The output is hidden because it exceeds the character limit.

Hello everyone, I am Dolphin Analyst!

1. US stocks: further growth is short-lived

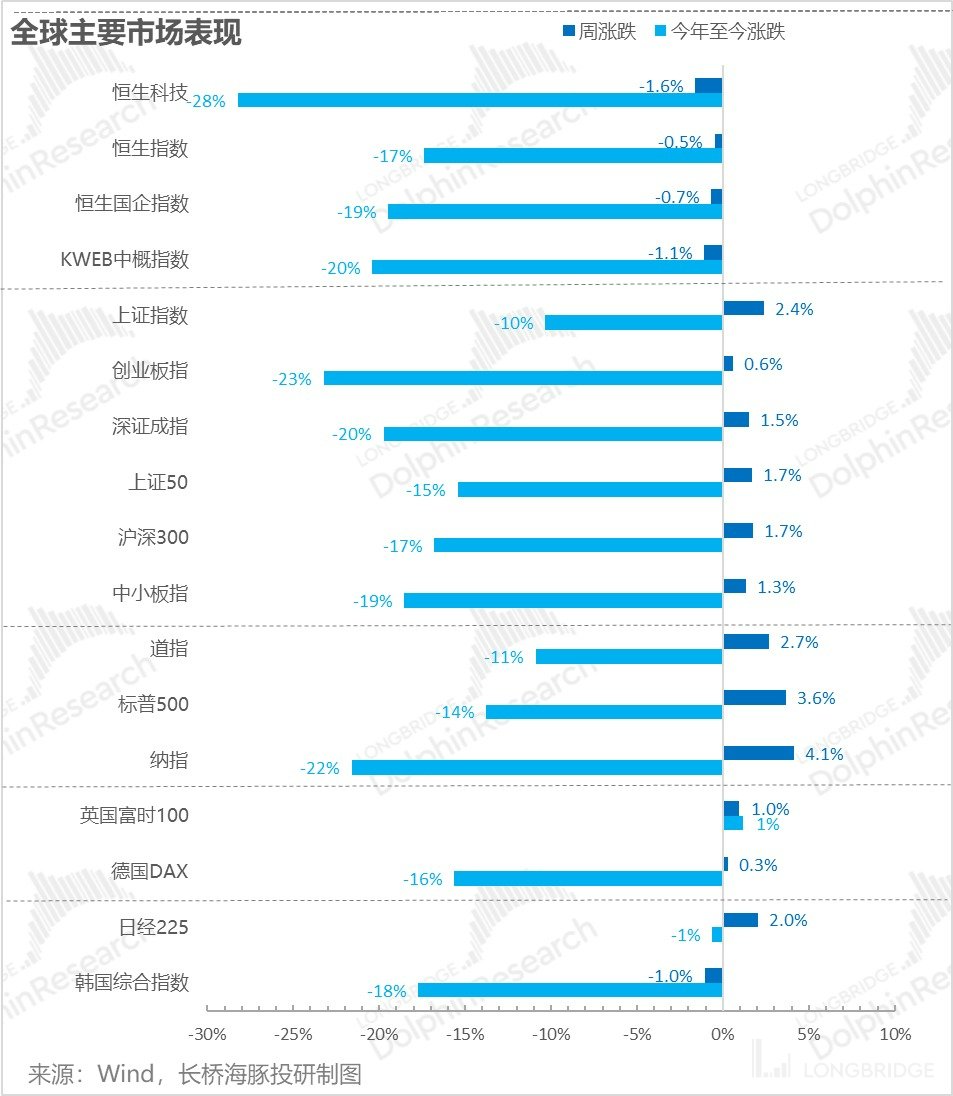

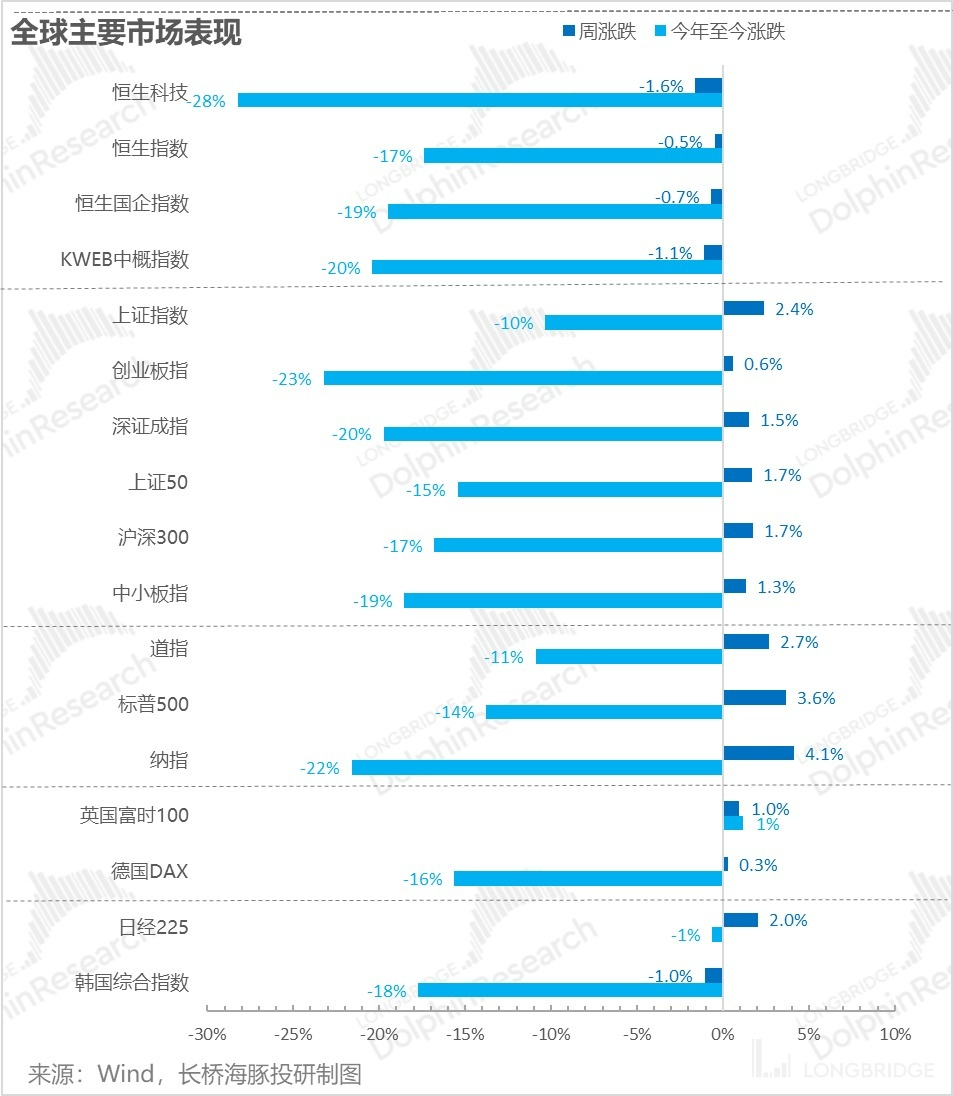

Looking at the global markets last week, since the Federal Reserve put out tough words and "reset" market rate hike expectations, US stocks have been falling continuously for three weeks. However, last week can be considered a brief respite as the rebound intensity was the largest among major global markets.

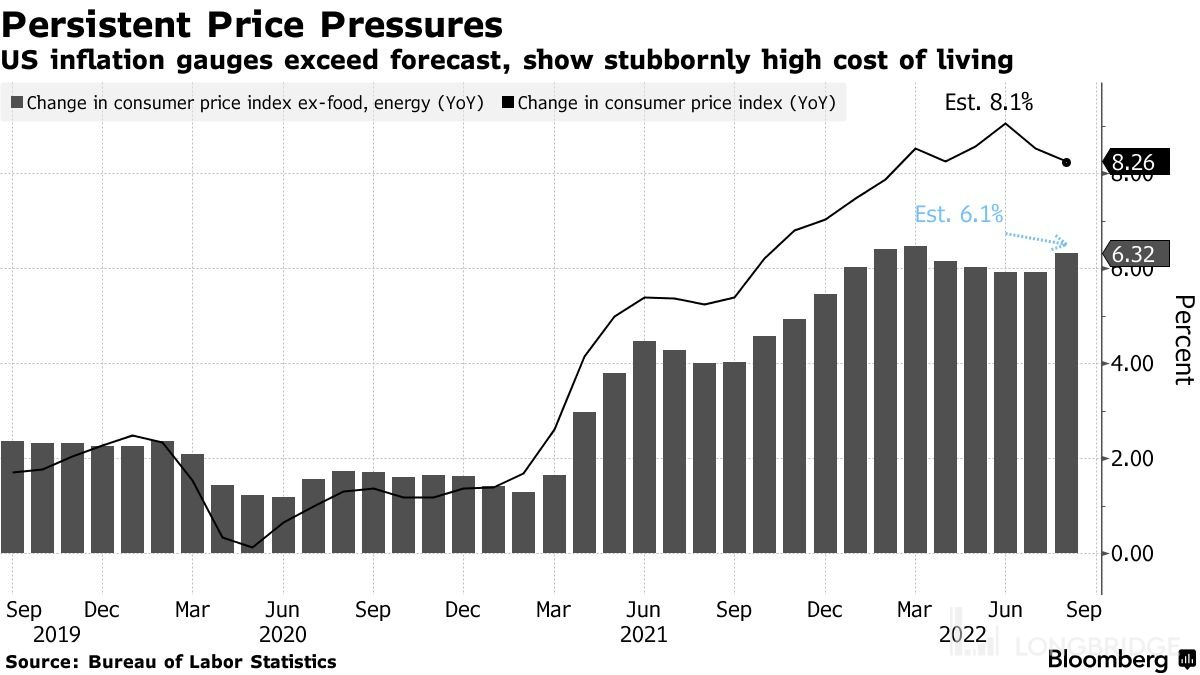

But, in my opinion, this may be just a brief respite in the midst of a decline, as an important expectation repair is about to be released, with August CPI expected to see a cooling of inflation that exceeds expectations.

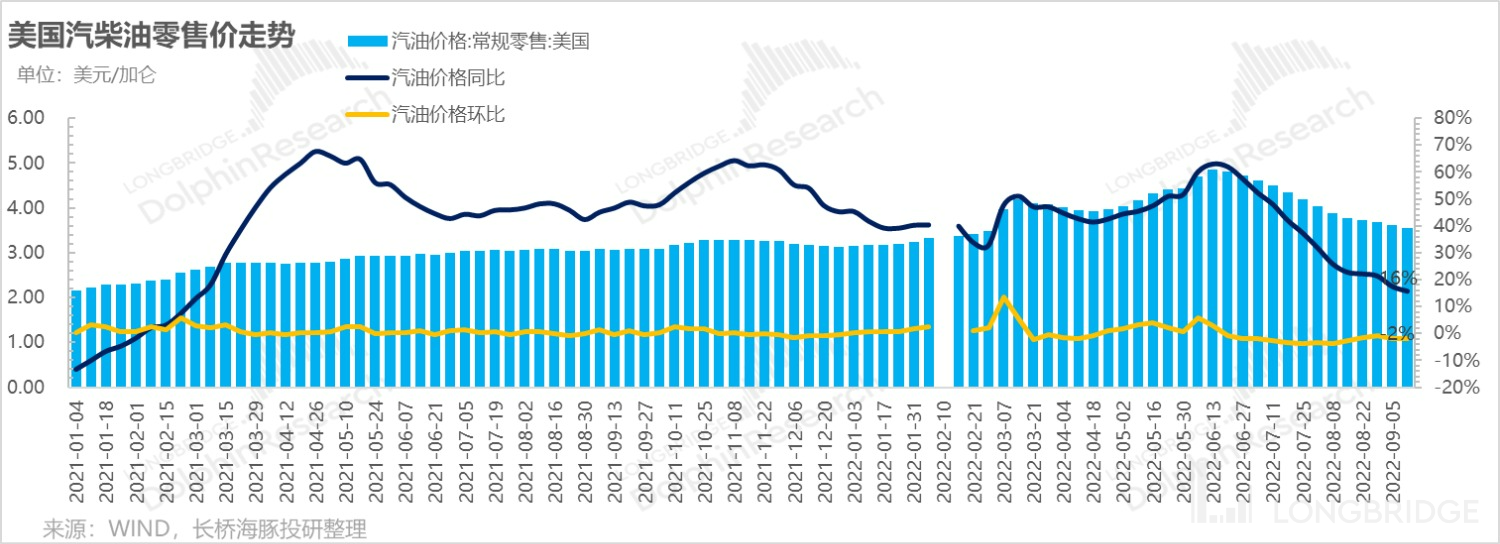

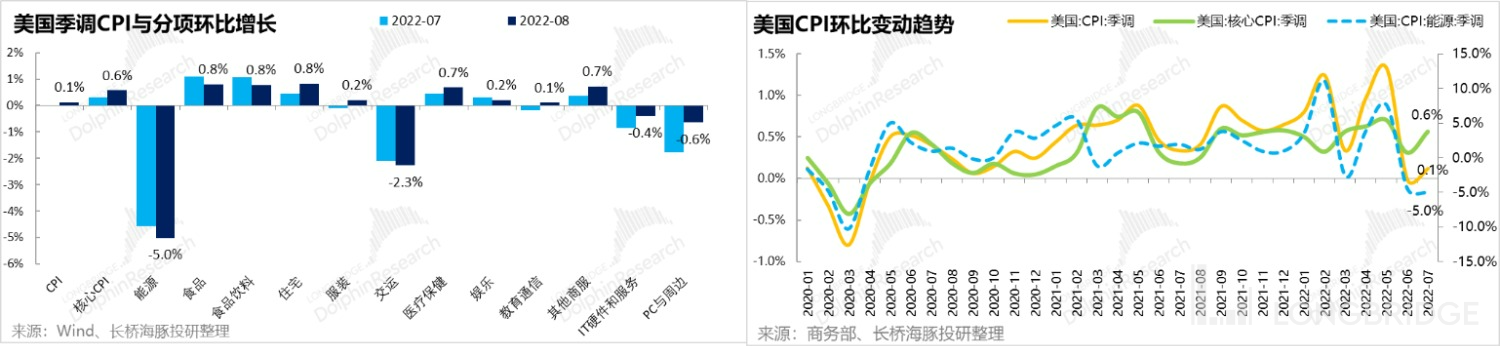

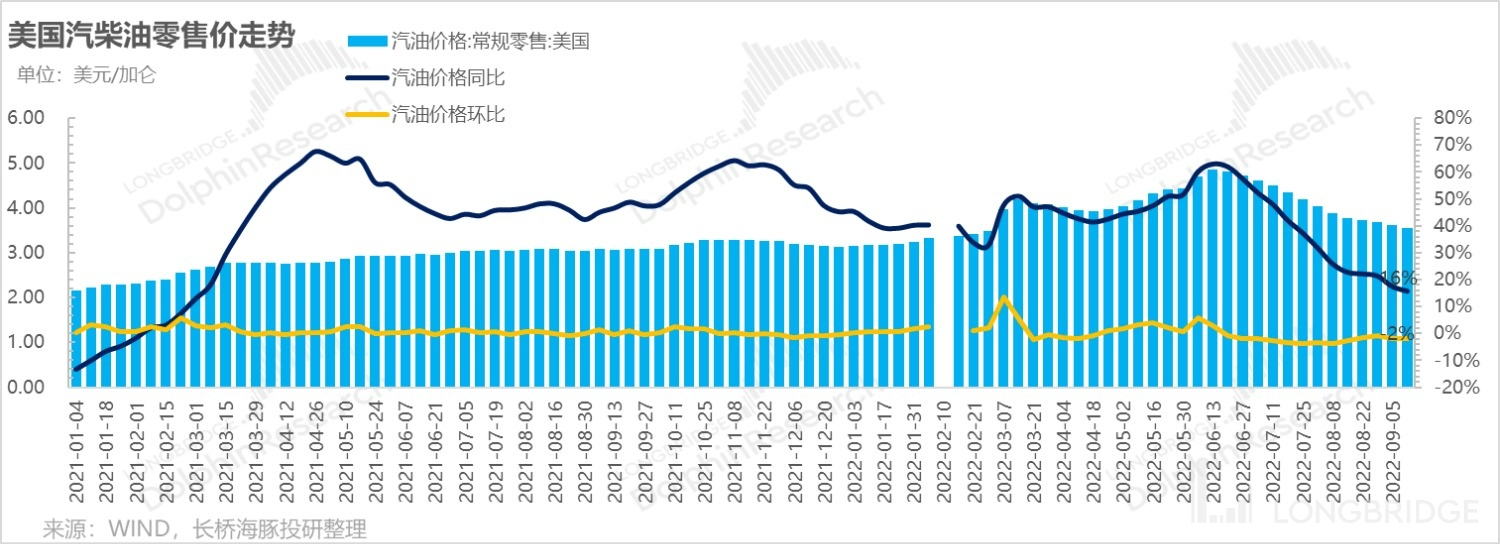

Especially in the case of rapidly falling oil prices, items related to energy in the CPI, such as transportation, may also decline, leading to a greater-than-expected decline in core CPI.

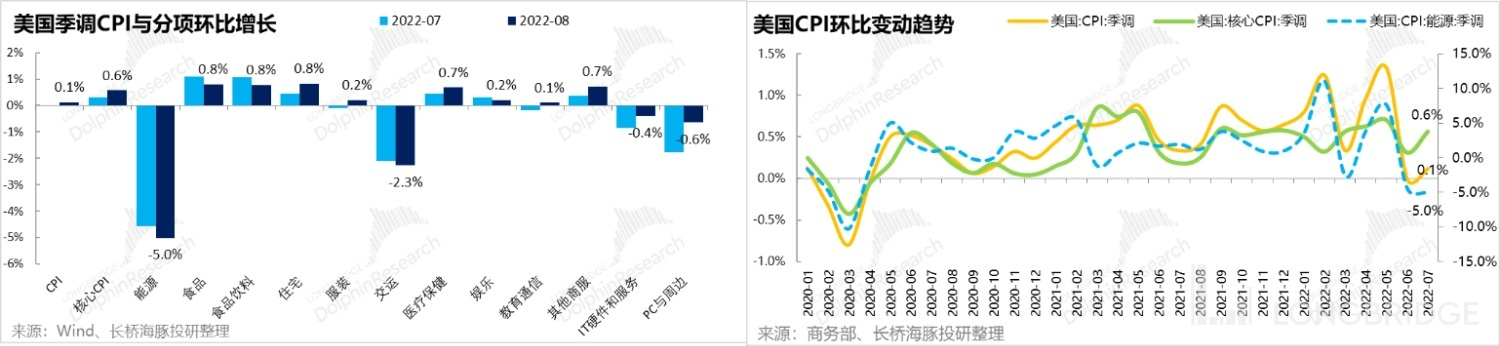

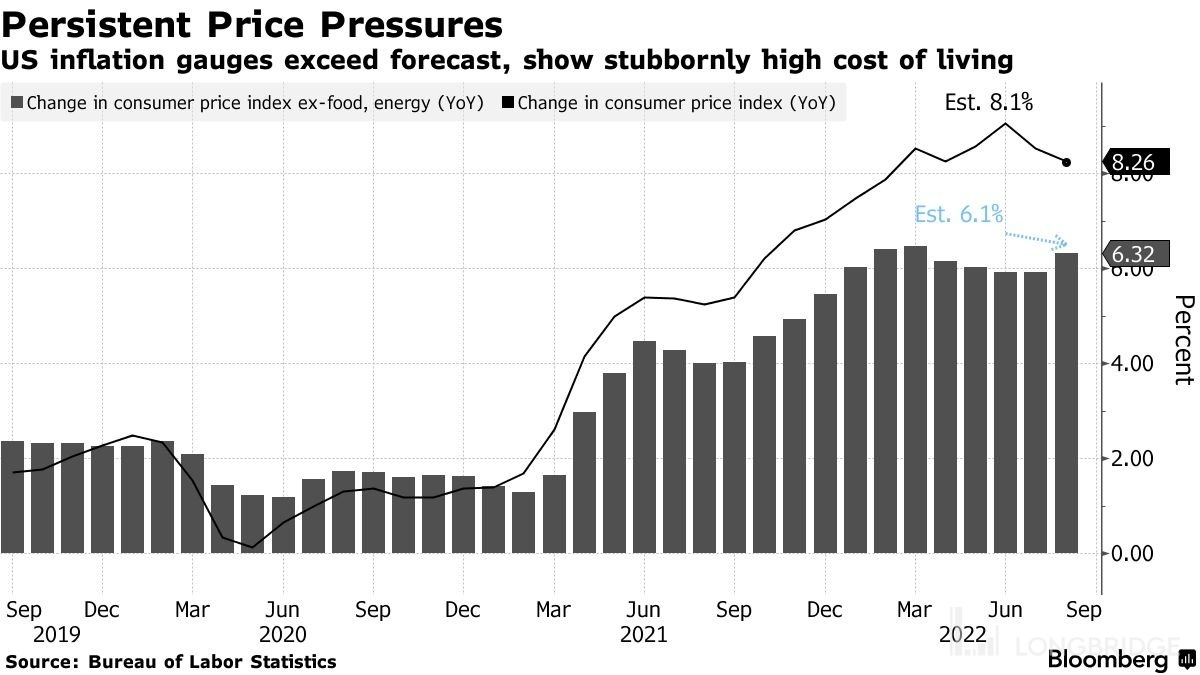

In fact, the data I just saw is that US CPI increased by 0.1% month-on-month, and core CPI increased by 0.6% month-on-month, with core CPI still accelerating.

Moreover, it is evident that, besides residential services surging prices, services related to human resources are in a state of generalized inflation - healthcare, commercial services, and so on.

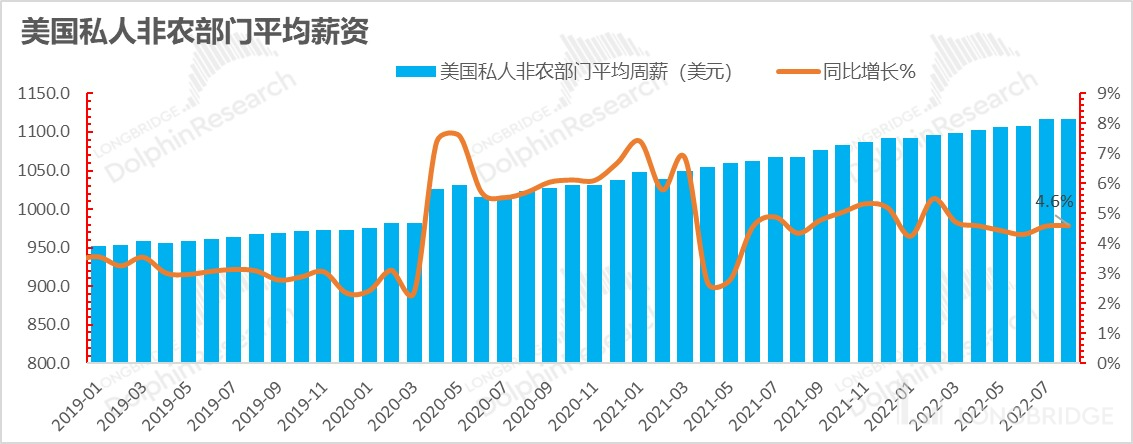

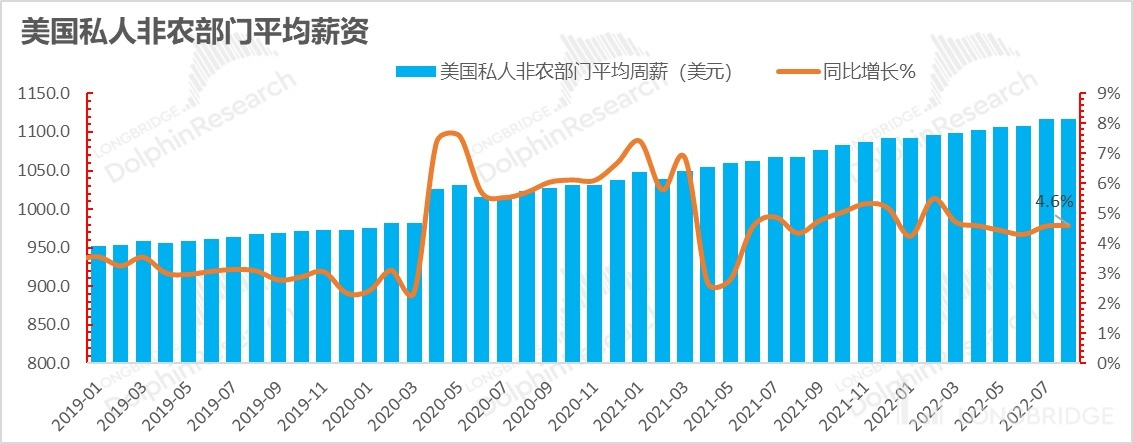

What is even more important, besides this CPI pouring cold water on the market, behind the sticky inflation causing the current labor shortage is the rise in wages, and the current situation of the labor market still has a long way to go to meet the demand (see "The world has fallen significantly again, and labor shortage is the root of the problem in the United States"). Labor compensation is still steadily rising, and there are at least 4-5 months to go until the supply and demand of labor balance.

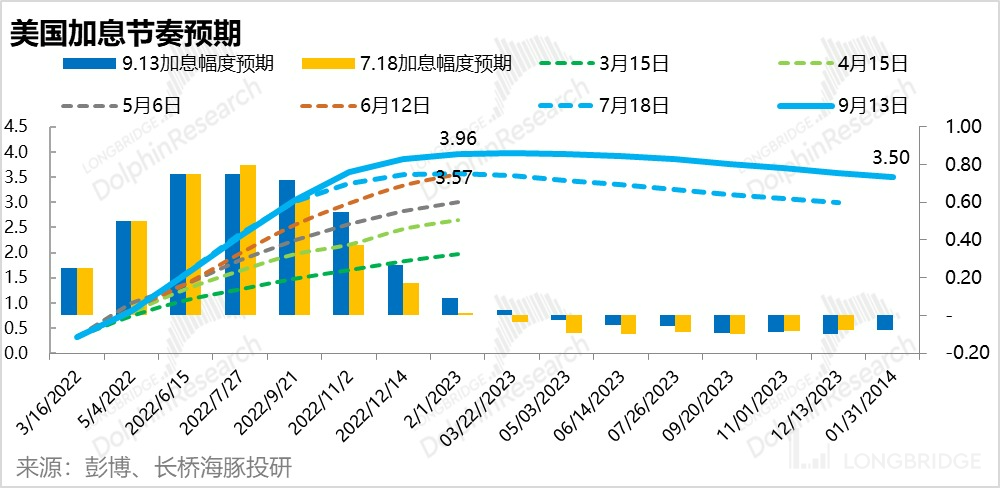

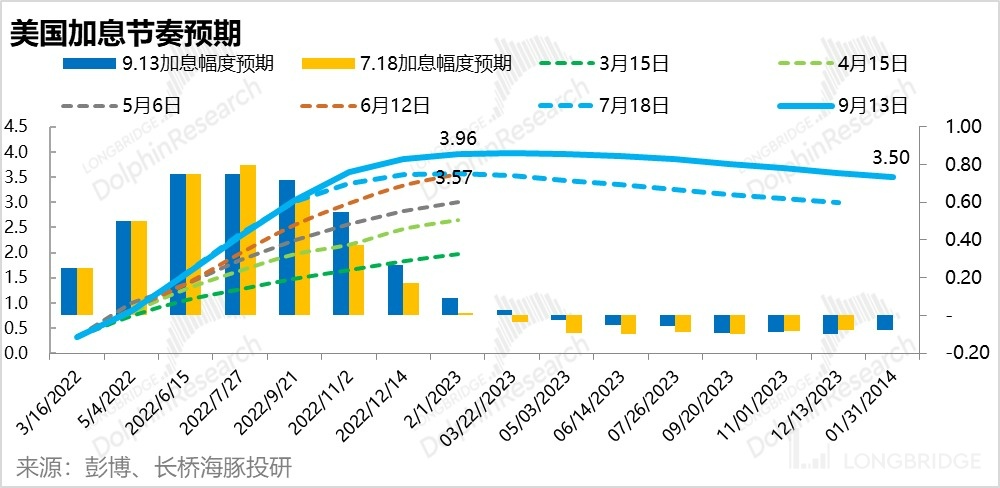

In the current situation where contractionary policies "continue" to exist, it is difficult for the Federal Reserve to quickly turn with market expectations, especially since Dolphin Analyst noticed that the latest market expectations (September 13) still tend towards maintaining a contractionary interest rate policy until after the first quarter of next year. The interest rate meeting in March will gradually begin to cut rates, implying an expectation that the supply and demand of labor will rapidly move towards balance next year, which in my opinion, is unlikely. Still too optimistic, very likely to be slapped by the Federal Reserve.

Since this year, the market has been continuously raising expectations of interest rate hikes. The trend of the US stock market's downward trend shows that in the process of the market's continuous adjustment of the Fed's tightening policy, the US stock market is likely to continue to be under pressure and is unlikely to make a big impact.

The rebound in the US stock market is estimated to be short-lived.

II. Domestic: After the interest rate cut, can we really welcome the truly broad credit in the second half of the year?

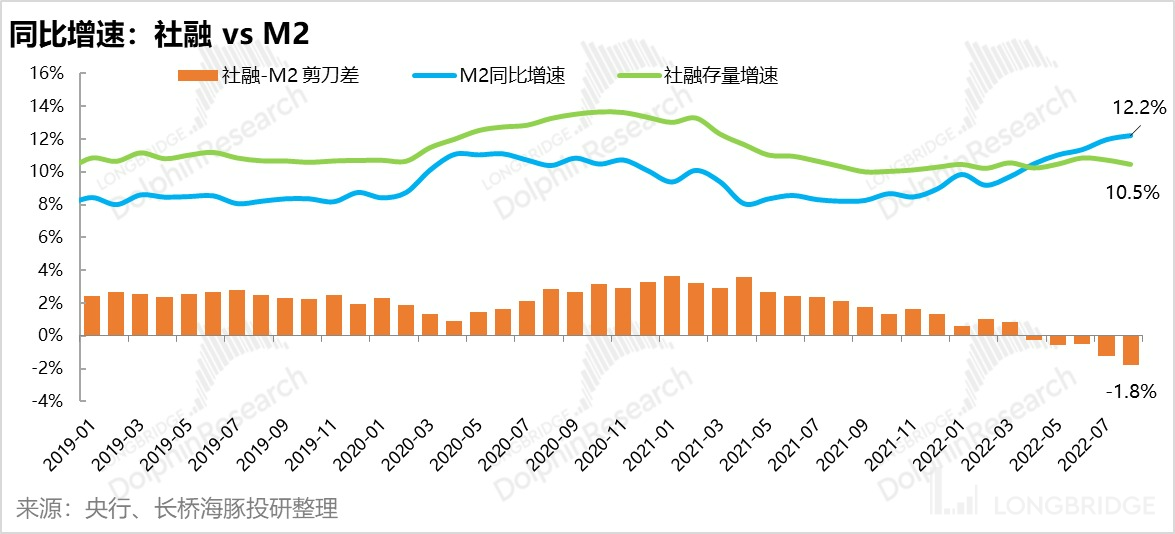

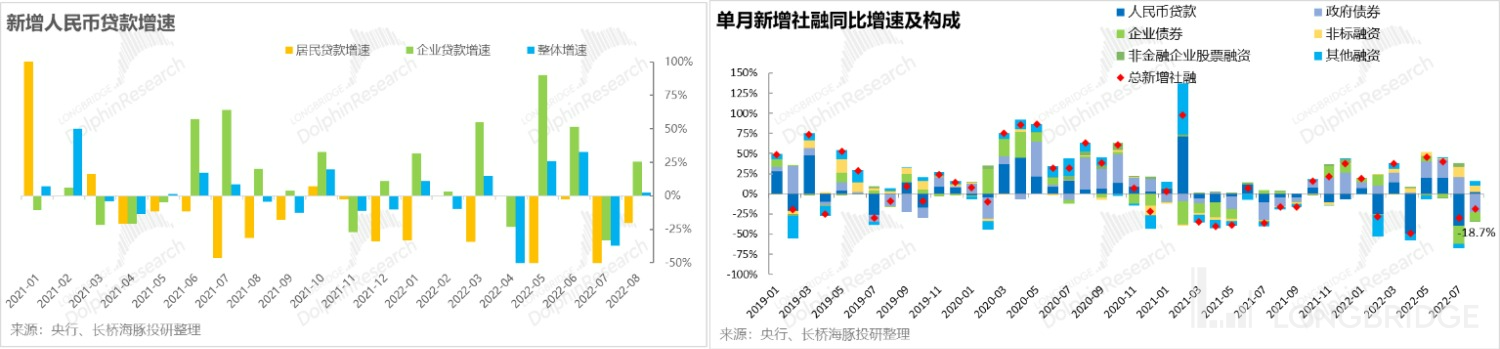

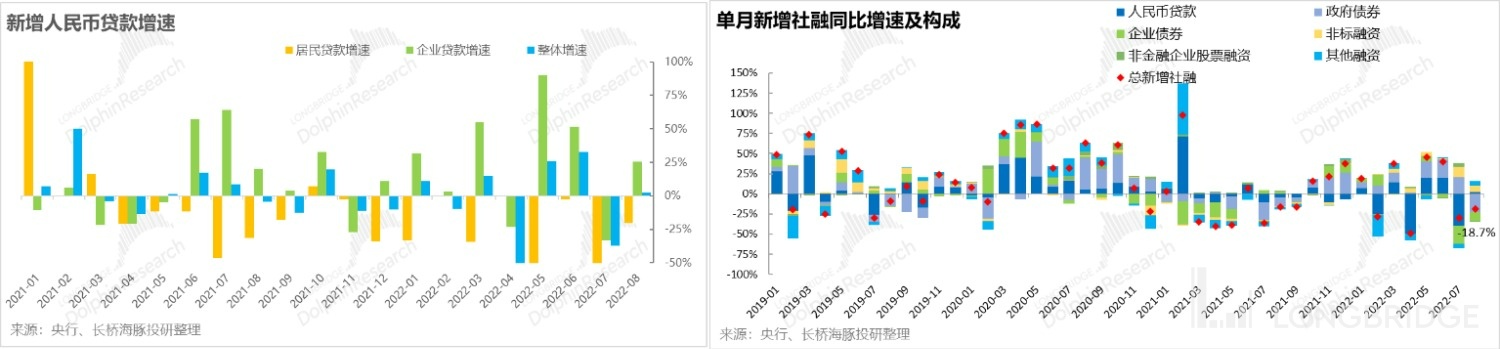

If we take M2 growth rate as the speed of money supply and social financing as the growth rate of the whole society's demand for money, the core problem in the first half of this year is that the liquidity is released but it has not been transformed into truly effective credit lending.

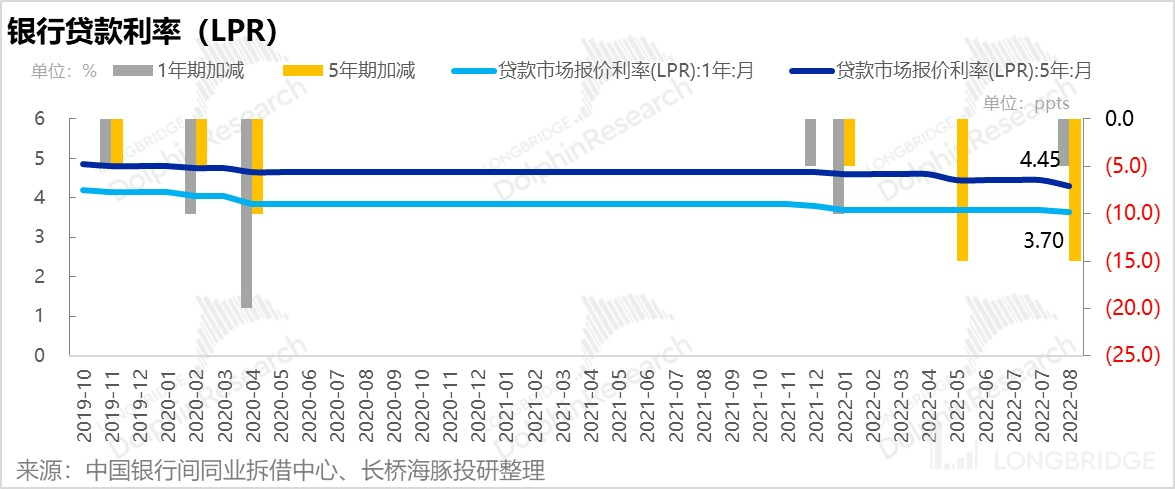

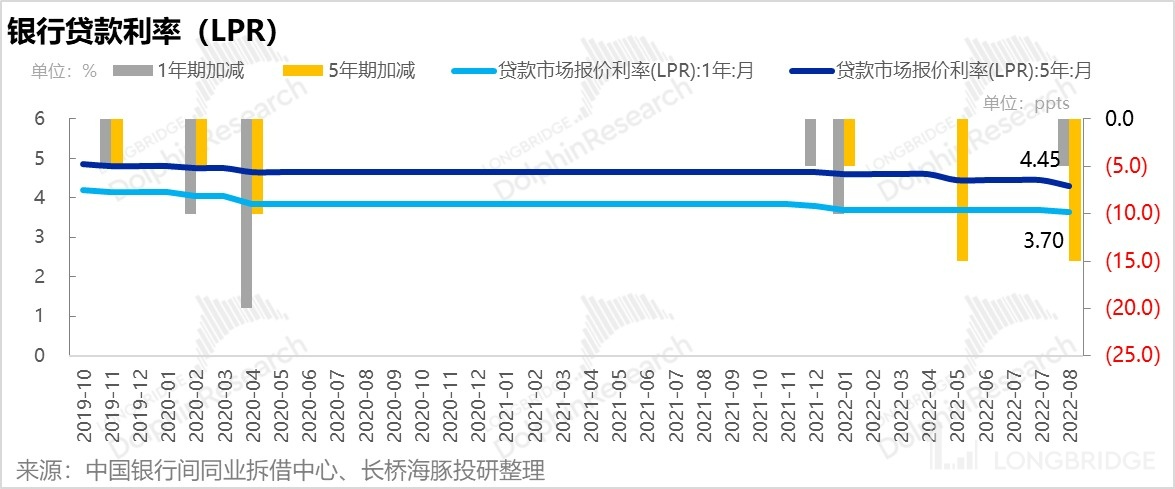

The release of liquidity by the central bank in the first half of the year, and the precise irrigation of the real economy through the banking system, has not been effective. One important reason is that although there is sufficient liquidity between the quantity and price of loans, the overall loan interest rate is still relatively high. In the case of residents' inability to increase leverage, is it possible to further reduce the cost of borrowing (asymmetric interest rate cuts for short-term and long-term loans) to guide enterprises to increase long-term leverage, while easing non-standard financing on social financing to promote gradual improvement in its structure?

From the data in August, it seems that there is this trend: the growth rate of long-term loans for enterprises and institutions is still good. Of course, it is difficult to say how much of this is state-owned enterprises and institutions and how much is private enterprises. At the same time, for seven or eight consecutive months, non-standard financing such as entrusted loans and trust loans has been transitioning from contraction to expansion.

From the current relative macro environment of China's assets and US assets, the Dolphin Analyst believes that the overall environment in the US stock market is still in a downward trend of marginal tightening, while China may have a "not worse than worst" situation.

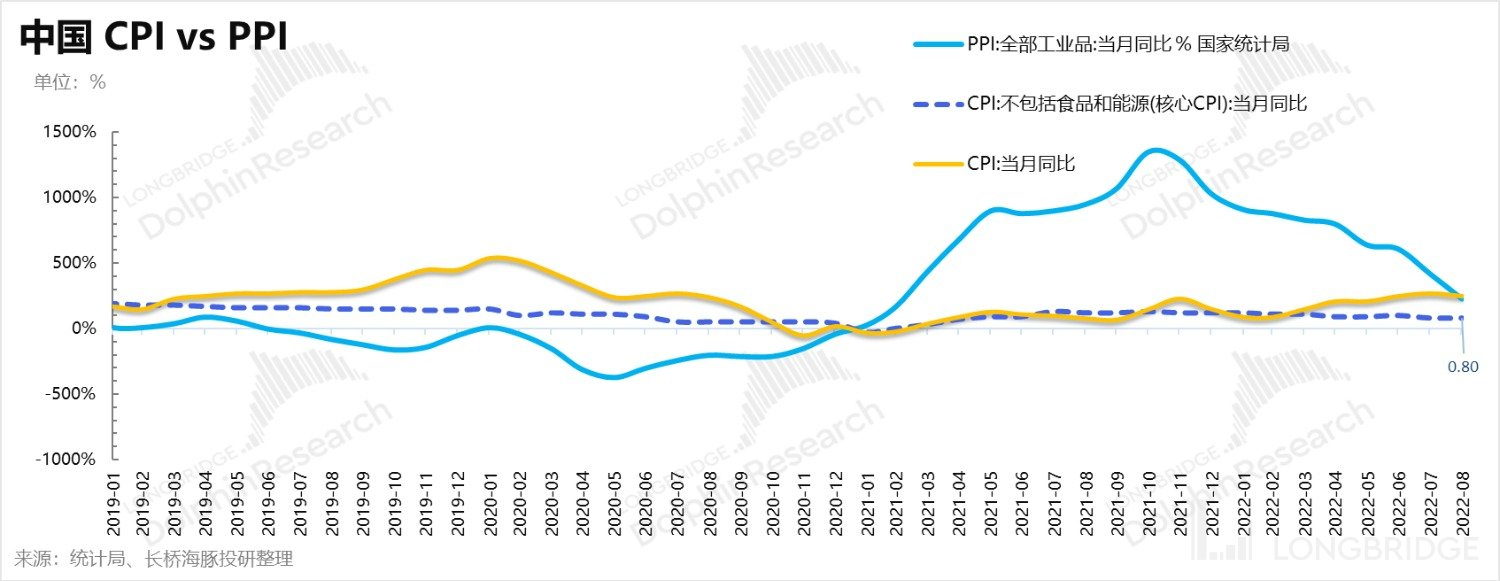

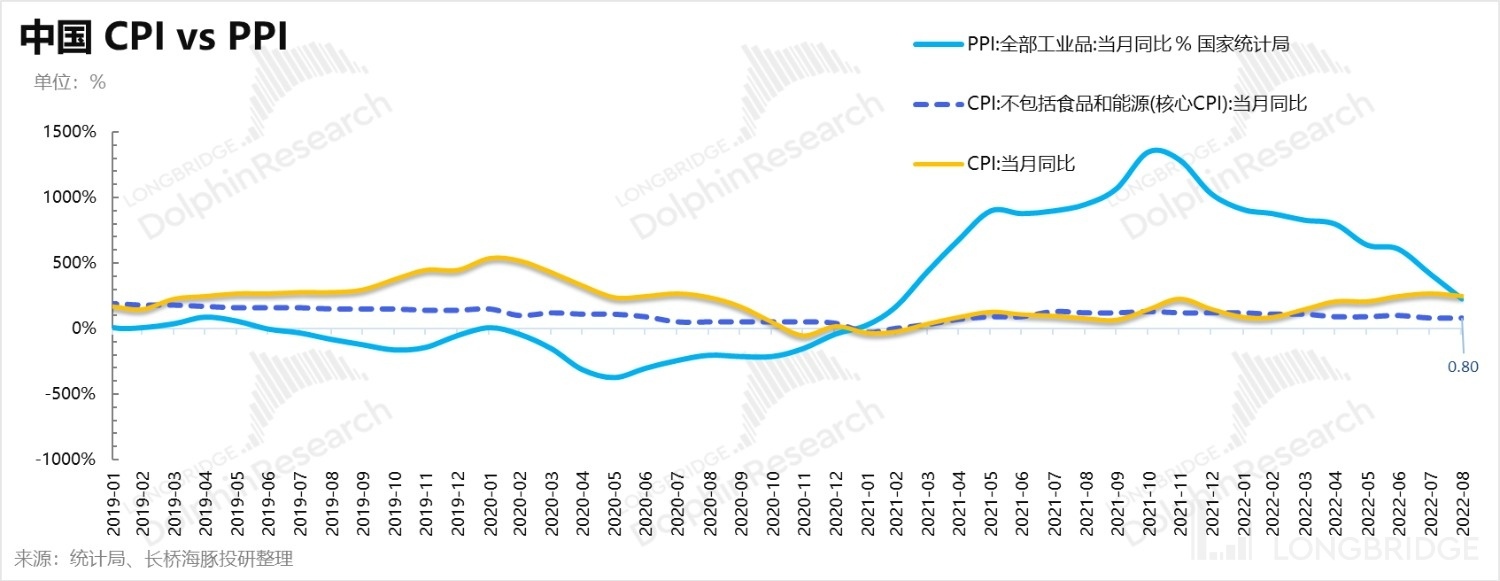

On the other hand, from another perspective, in August, the inflation on the production side and the consumption side in China intersected for the first time since 2021, and the year-on-year growth rate of PPI was lower than that of CPI for the first time.

Especially, if the Federal Reserve further violently hammers inflation, the input inflation pressure of China's PPI will be further reduced, and the moderate upward trend of CPI superimposed on the rapid downward trend of PPI will bring more opportunities for the repair of domestic consumption, especially the good news of easing the cost pressure, which will come faster.

Core CPI after excluding energy and food remains low, indicating low demand and a sluggish consumption. However, the second half of the year is entering a relatively strong season for consumption. If credit can really penetrate the real economy, then the pan-consumption should be at the bottom of its income.

The greater certainty here comes from the rapid decline of PPI, which means that the pressure on raw materials will gradually ease for many manufacturing and consumer goods.

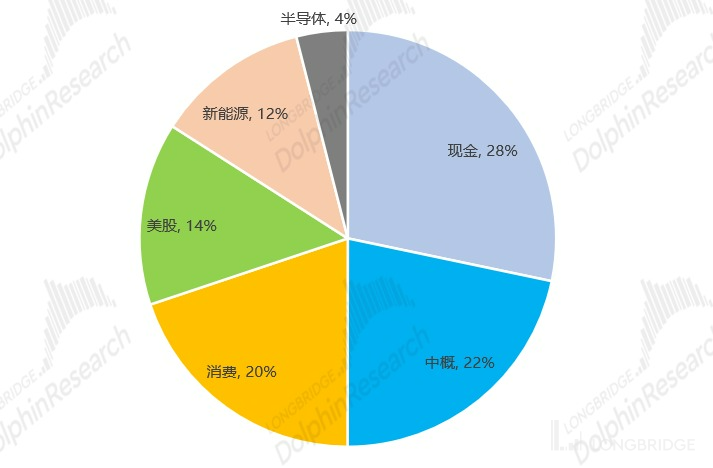

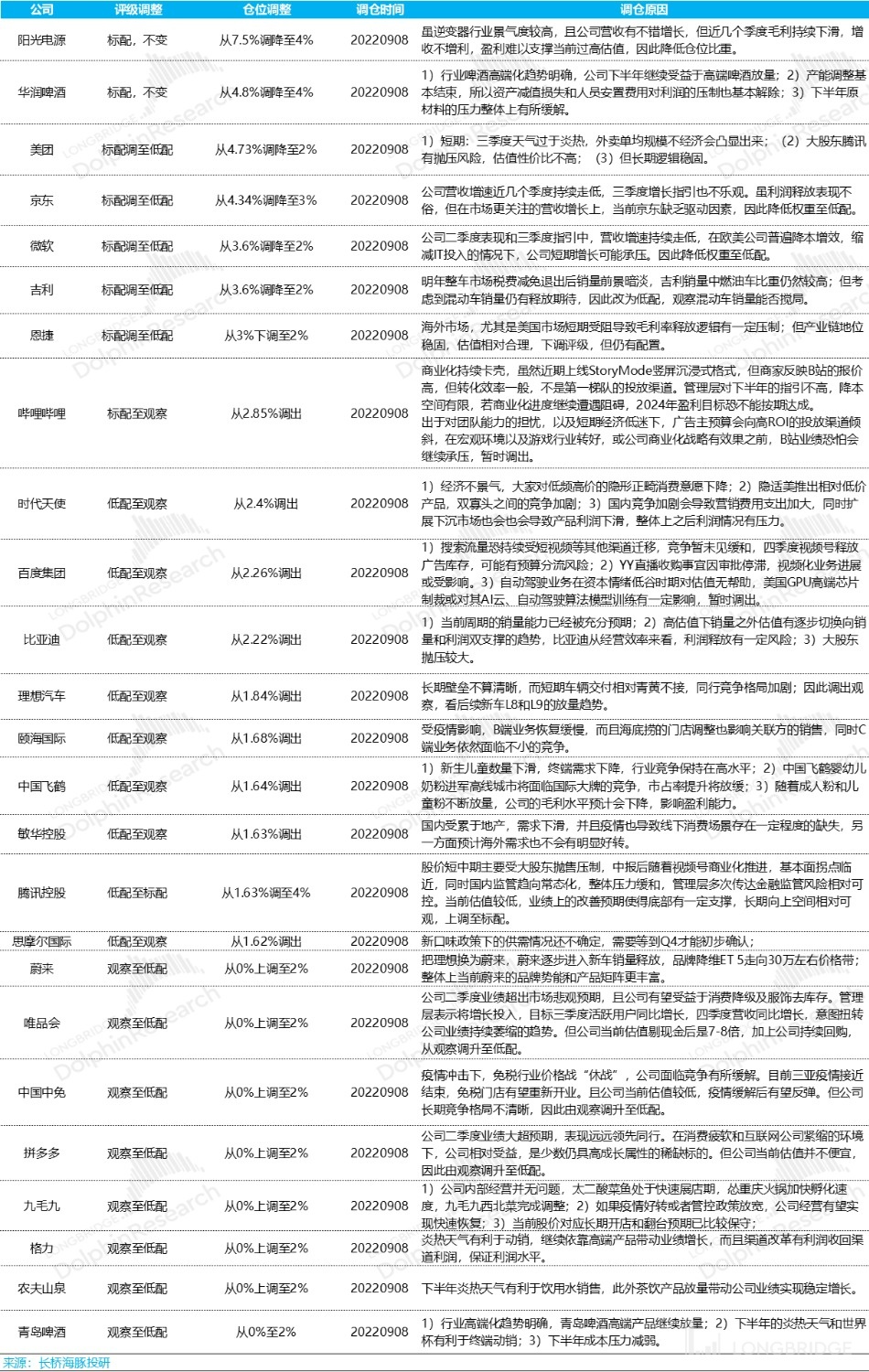

3. Alpha Dolphin's major adjustment: reducing new energy holdings, increasing consumption holdings, and leaving enough cash

After the interim report, Dolphin Analyst significantly adjusted the Alpha Dolphin portfolio last week, mainly reducing the new energy sector with high growth uncertainty after the withdrawal of next year's auto consumption stimulus policy and subsidy decline with relatively high valuation. Based on the expectation of turning around the dilemma, Dolphin Analyst maintained even slightly increased the pan-consumption sector, including e-commerce and consumer goods in the retail channel. With the easing competition in the industry, the e-commerce platform was reconfigured as a sector as a whole, while the consumer goods focused on the compulsory consumption and part of the dilemma reversal logic under the pressure of material costs.

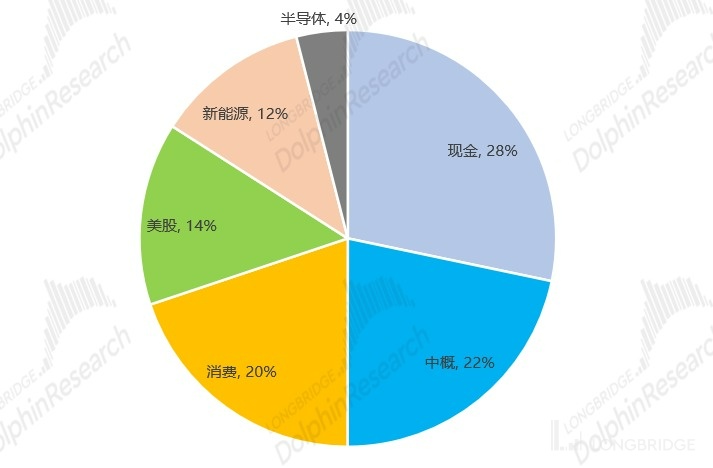

During the domestic policy vacuum period in the second half of the year, the equity holding was generally reduced and a relatively large cash position was retained. Structurally, due to the increase in the weight of pan-consumption, and the scattered outbreaks of the epidemic, the overall strategy is biased to the left, with possibly low short-term elasticity. The adjustment strategy is for reference only. The overall sector configuration is as follows:

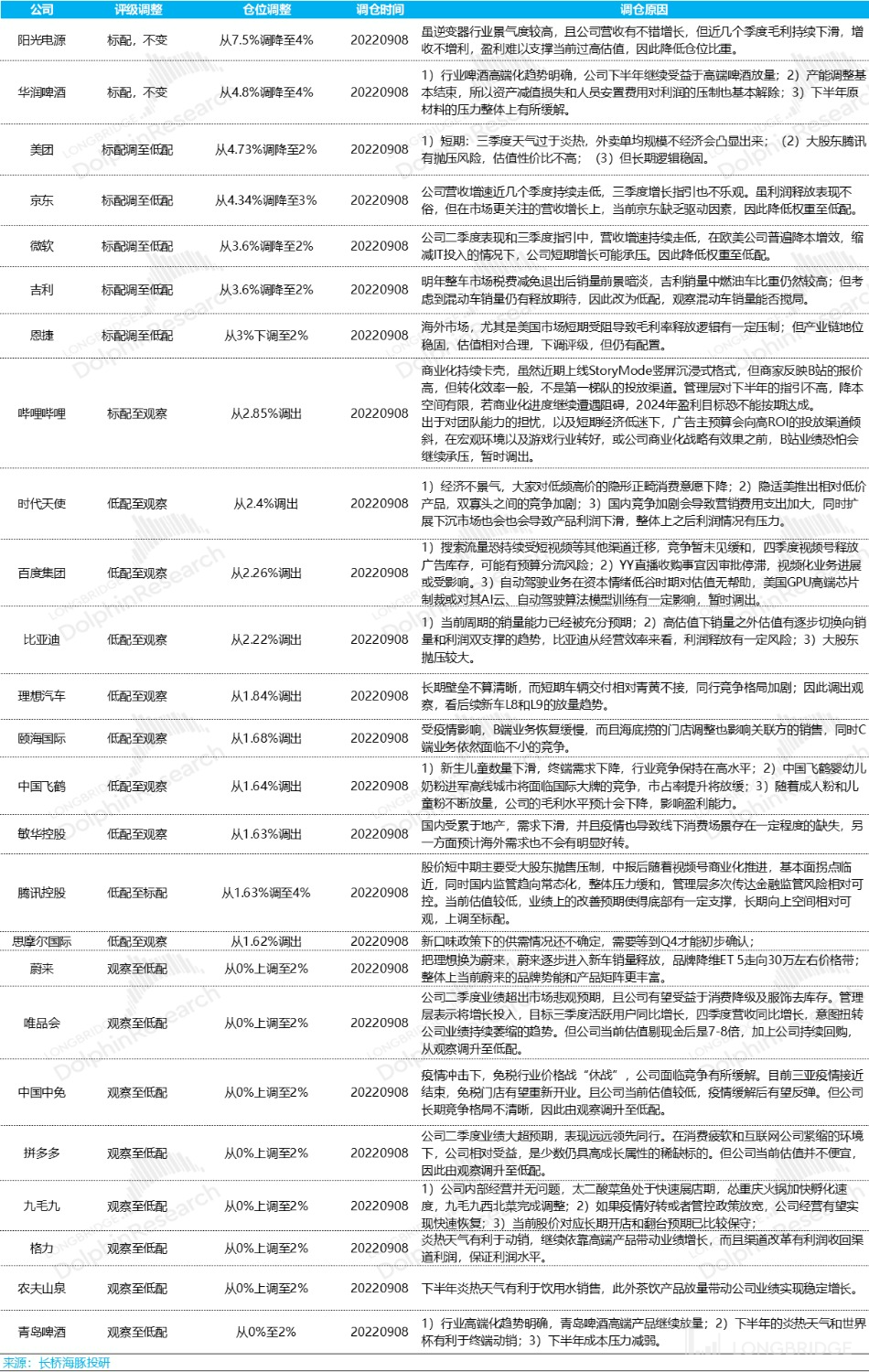

The specific adjustment situation of Dolphin Analyst is detailed below:

Special Reminder: The above is only a brief explanation. Dolphin Analyst will give more detailed investment value judgments through valuation estimates in the subsequent overall review, so stay tuned.

4. Alpha Dolphin Portfolio Returns

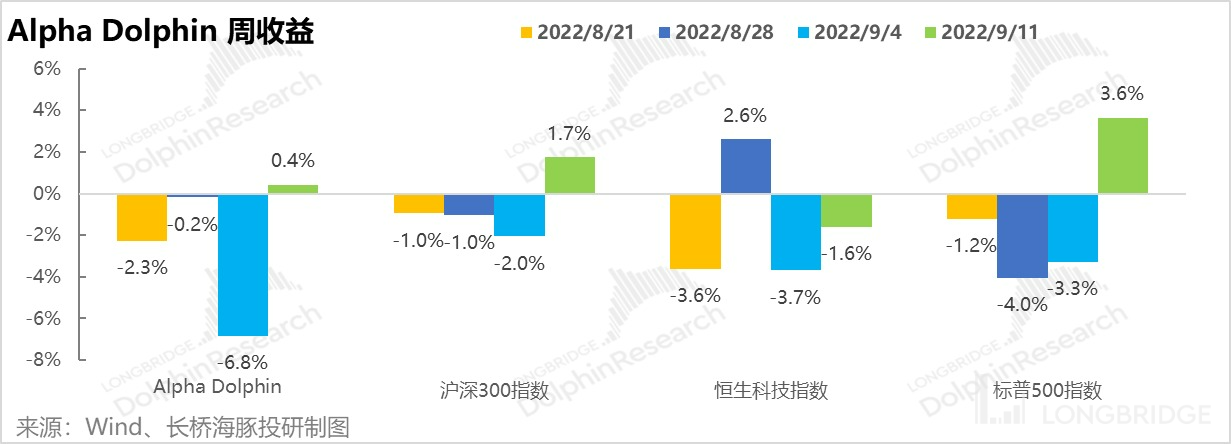

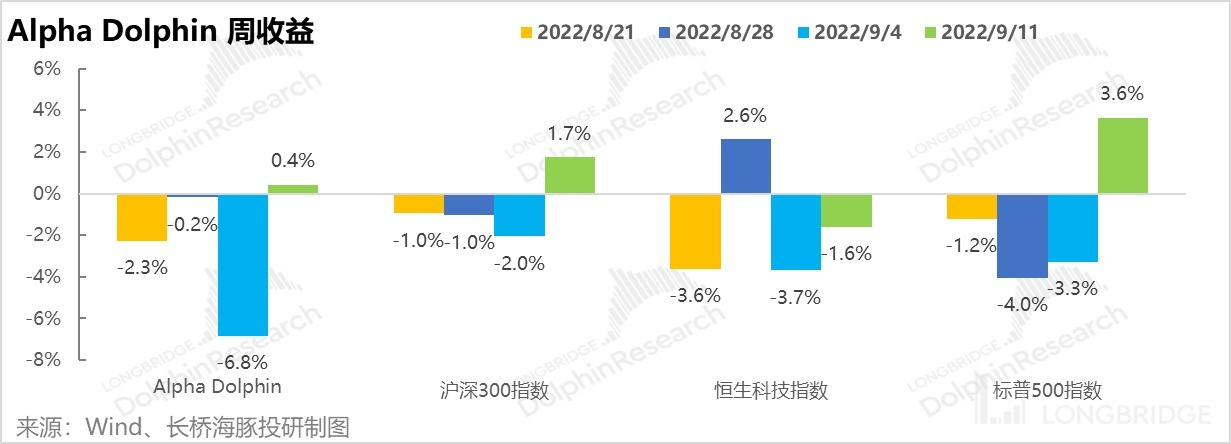

Due to the sharp decline in Chinese concept stocks last week and the suppression of consumption stocks due to the rebound of the epidemic, the portfolio's return last week was only 0.4%, significantly underperforming the same period of the Shanghai and Shenzhen 300 and S&P 500.

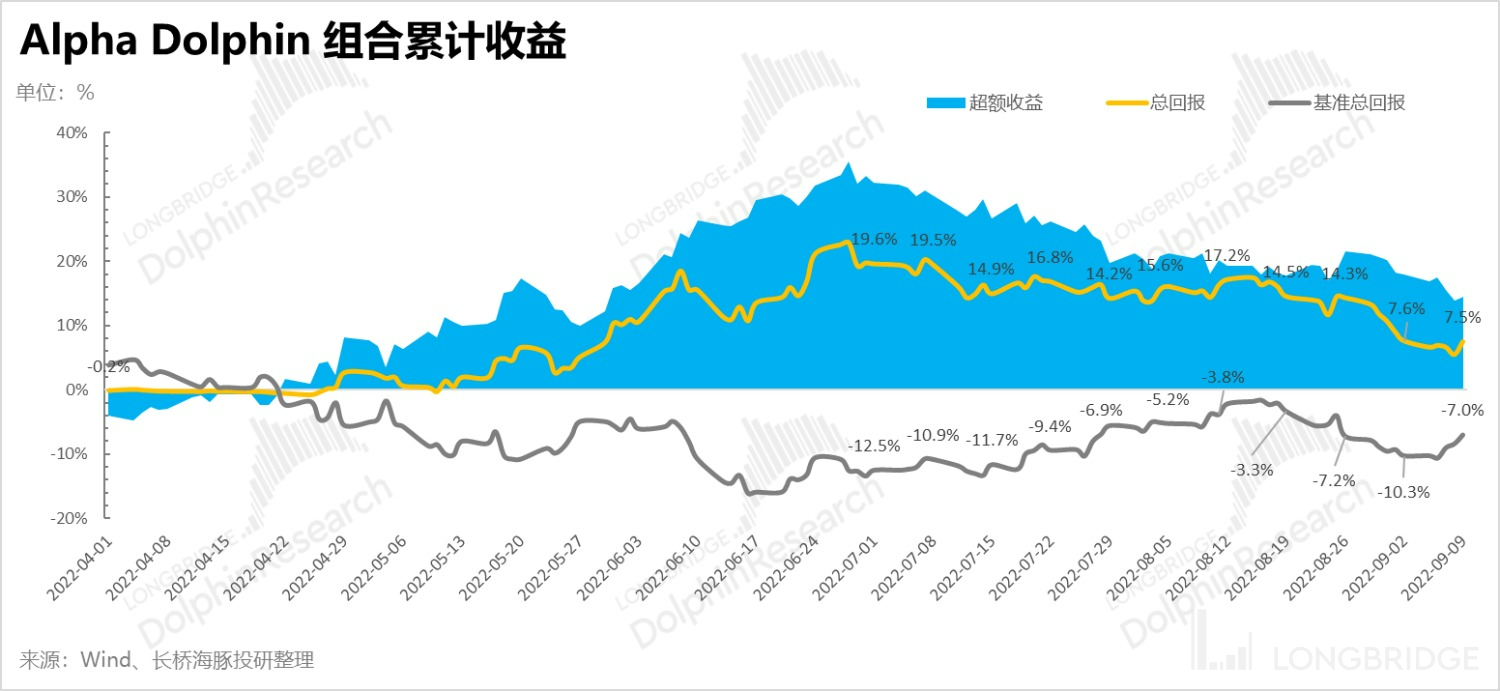

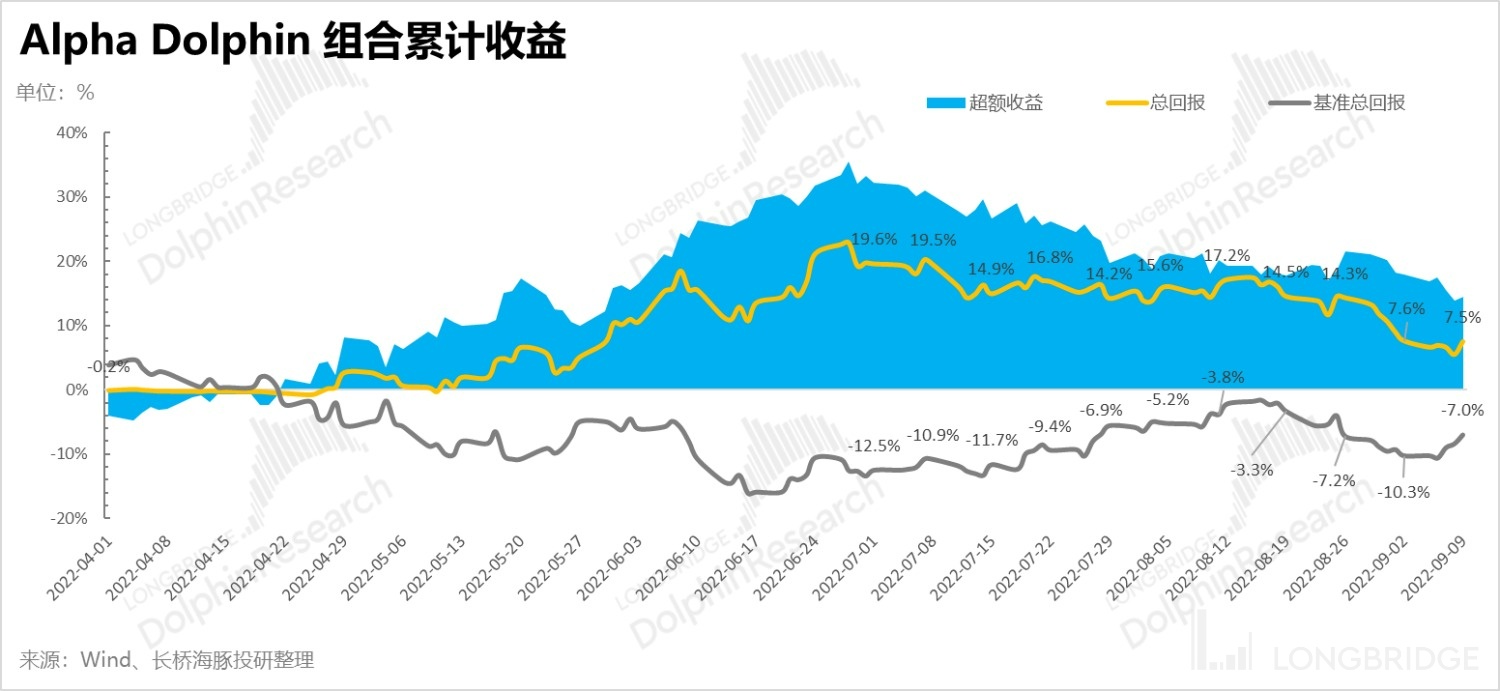

Since the start of the portfolio test to last weekend, the absolute return of the portfolio is 7.6%, and the relative return compared to the S&P 500 is 15%.

6. Pandemic and US Stock Market Rebound

Last week, the overall feature of Alpha Dolphin portfolio was pandemic hitting consumption, entertainment sector being bleak and US stock market rebounding, while some renewable energy stocks were recovering.

7. Distribution of portfolio assets and portfolio adjustment

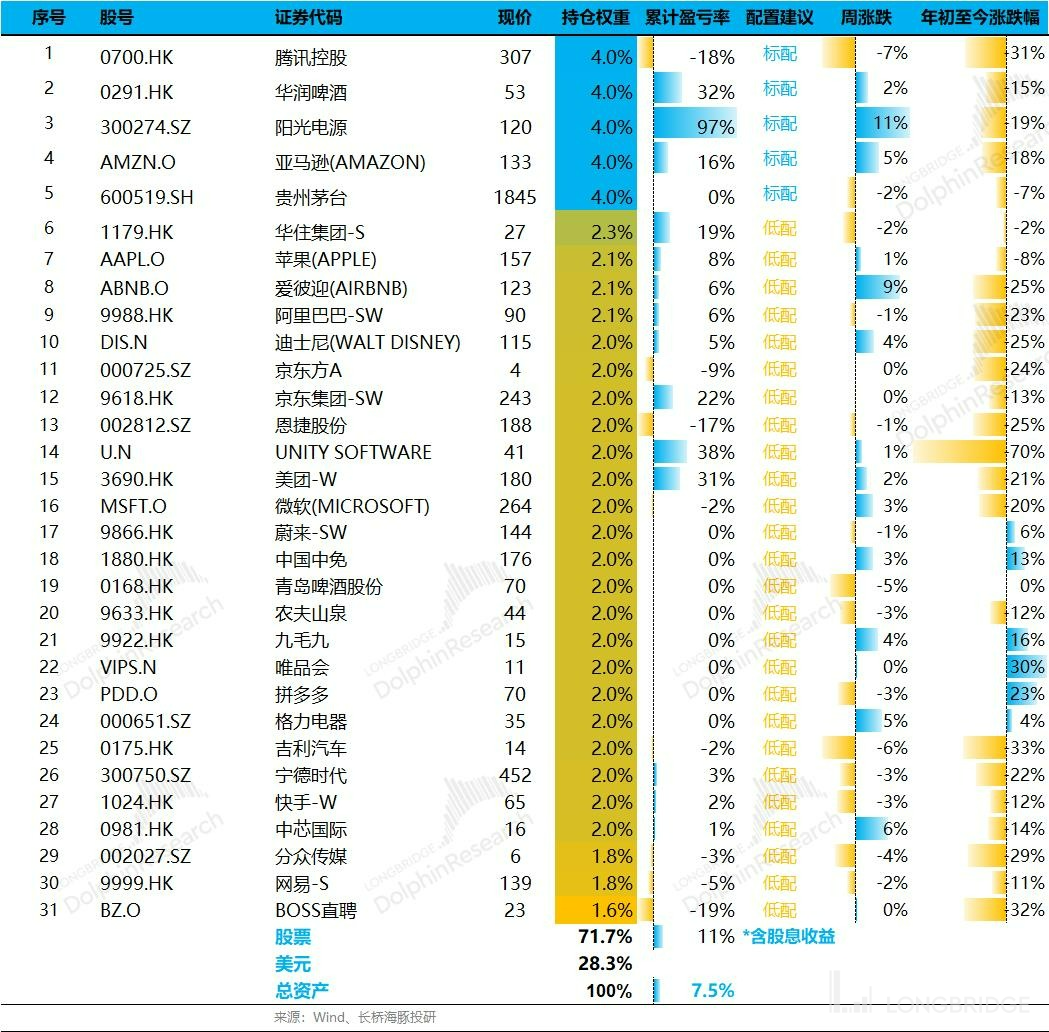

From the beginning of the internal testing on March 1st, the overall profit of Longbridge Alpha Dolphin portfolio is close to 7.5% (including dividend income), and the profit of stock assets is close to 11% as of last Friday.

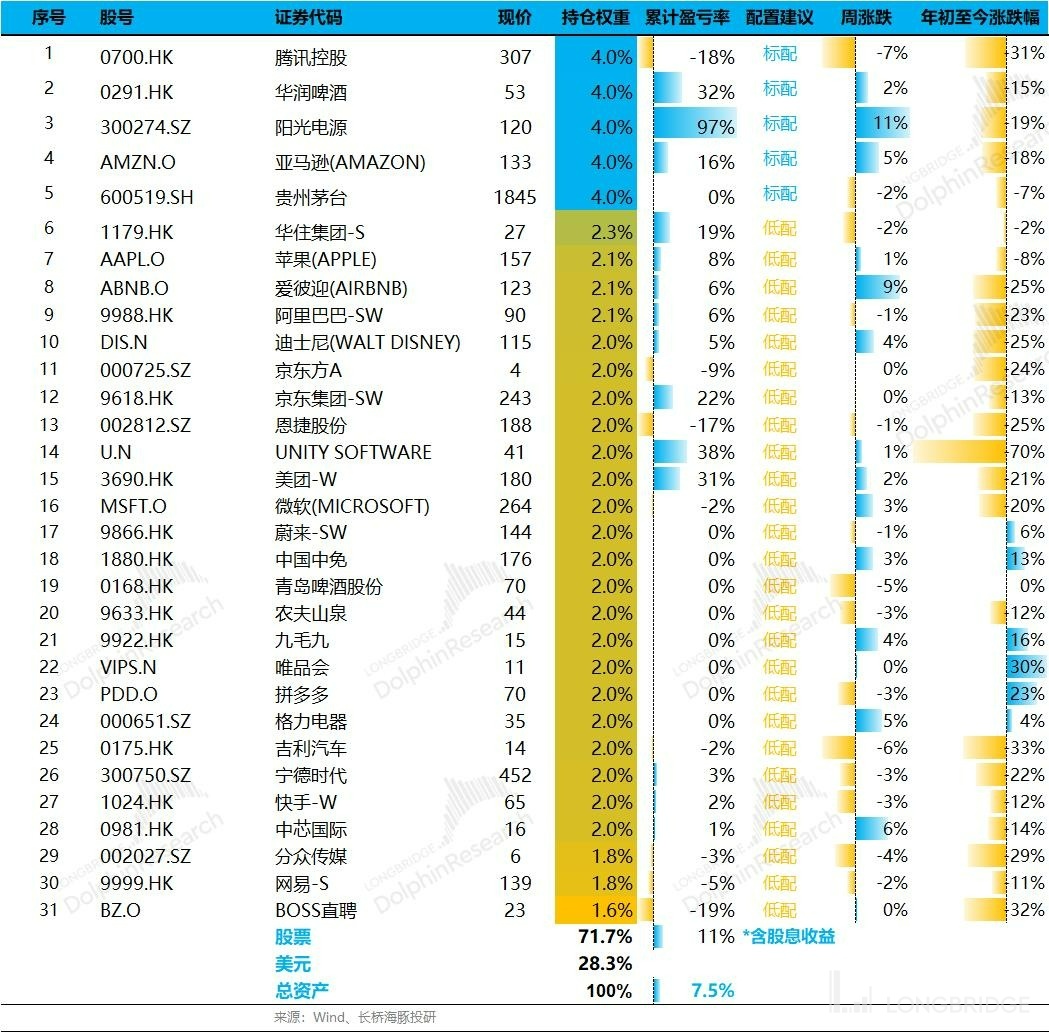

After substantial portfolio adjustment last week, a total of 31 stocks were allocated, among which only five stocks were standard allocation while the rest 26 were low allocation.

As of last weekend, Dolphin Analyst's asset allocation distribution and equity asset holding weights were as follows:

Please refer to the following Longbridge weekly reports of Alpha Dolphin portfolio:

Global Market Plunge Again, Labor Shortage in USA is Root Cause

The Fed becomes the major bear, Global Market Collapses

Slow Layoffs and Not Enough Bargain Hunting, USA Has to Continue to Decline The US stock market style of "funeral celebrations": Recession is a good thing, and the strongest interest rate hike is bearish.

Interest rate hikes enter the second half, and the "performance thunder" opens.

Current Chinese assets: "No news is good news" for US stocks.

Has growth already gone crazy, but will the United States always be in recession?

Will the United States experience a recession or a stagnation in 2023?

US oil inflation, can China's new energy vehicles grow and strengthen?

As the Federal Reserve increases interest rates, opportunities in Chinese assets have emerged.

The US stock market's inflation has once again exploded, how far can the expected rebound go?

This is the most grounded way, the Dolphin investment portfolio is launched.

Risk disclosure and statement of this article: Dolphin Analyst Disclaimer and General Disclosure