Today's Key News Review | Dolphin Research

09/16 Dolphin Analyst Focus:

🐬Macro/Industry

1. China's retail sales of consumer goods in August increased by 5.4% year-on-year, exceeding expectations of 3.2% and previous value of 2.7%. Among them, the growth rate of basic living consumption has accelerated, the elasticity of service consumption has increased, and online retail has remained stable.

2. Yesterday, the General Office of the State Council issued the "Opinions on Further Optimizing the Business Environment and Reducing the System Transaction Costs of Market Entities", which proposed to encourage securities, funds, guarantees and other institutions to further reduce service fees. The market interpreted this as a bearish news, and the securities sector fell by more than 4% today. Chinese broker, 'east money' fell by 10.78%.

🐬Individual stocks

1. $Macys.USicrosoft.US

On Thursday, the UK CMA announced that due to Microsoft's refusal to compromise, it has decided to conduct a comprehensive anti-monopoly investigation into Microsoft's acquisition of Activision Blizzard. After the news broke, Microsoft's stock price fell, closing down 2.71% last night. Microsoft announced the acquisition of Activision Blizzard in January this year, with a total transaction value of approximately US$69 billion—the largest acquisition in Microsoft's history. After the completion of the transaction, Microsoft will become the world's third highest-grossing gaming company, second only to Tencent and Sony. If Microsoft persists in the acquisition, it will also face investigations by regulatory agencies in multiple countries and regions, including New Zealand and the United States.

2. $Agilent Tech.USdobe.US

Adobe announced that it will acquire the online design collaboration tool platform Figma for approximately $20 billion in cash and stock. The transaction is expected to be completed in 2023, subject to the required regulatory approvals and approvals, and the approval of Figma shareholders, among other delivery conditions. In addition, Adobe's net profit in Q3 was down 5.8% year-on-year, and Q4's revenue guidance was below expectations.

🐬Leading sectors

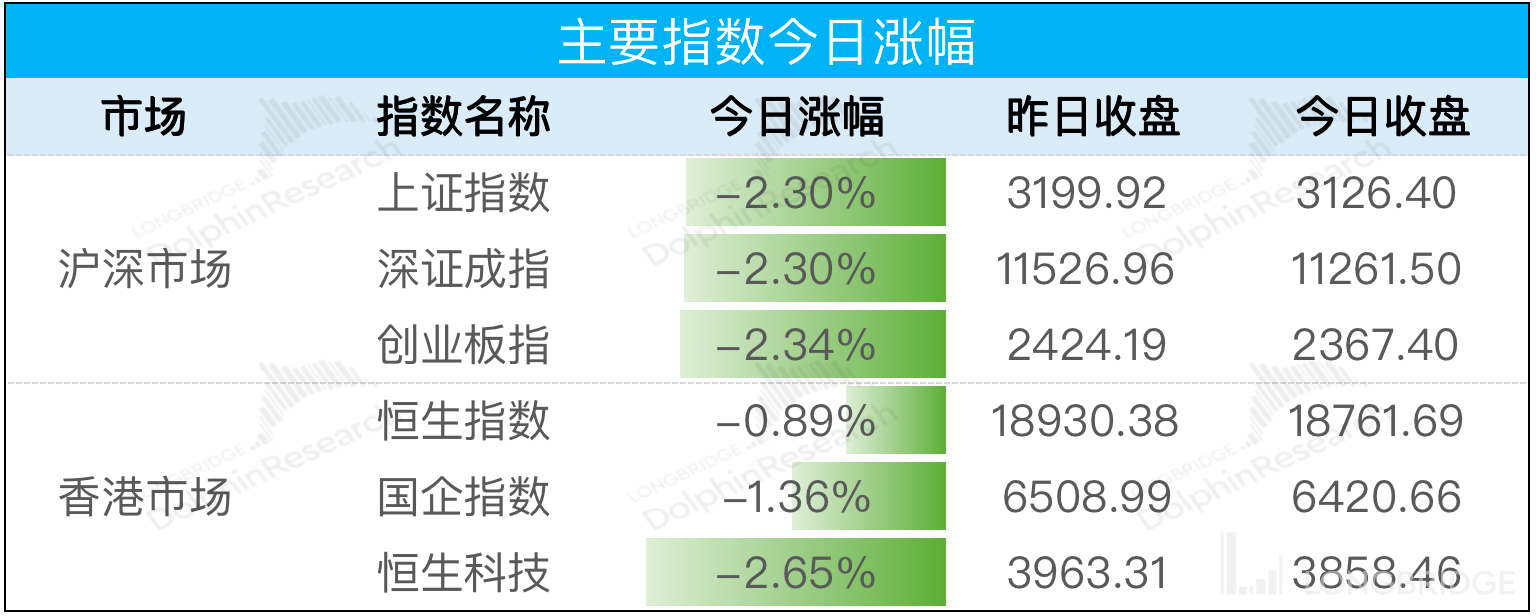

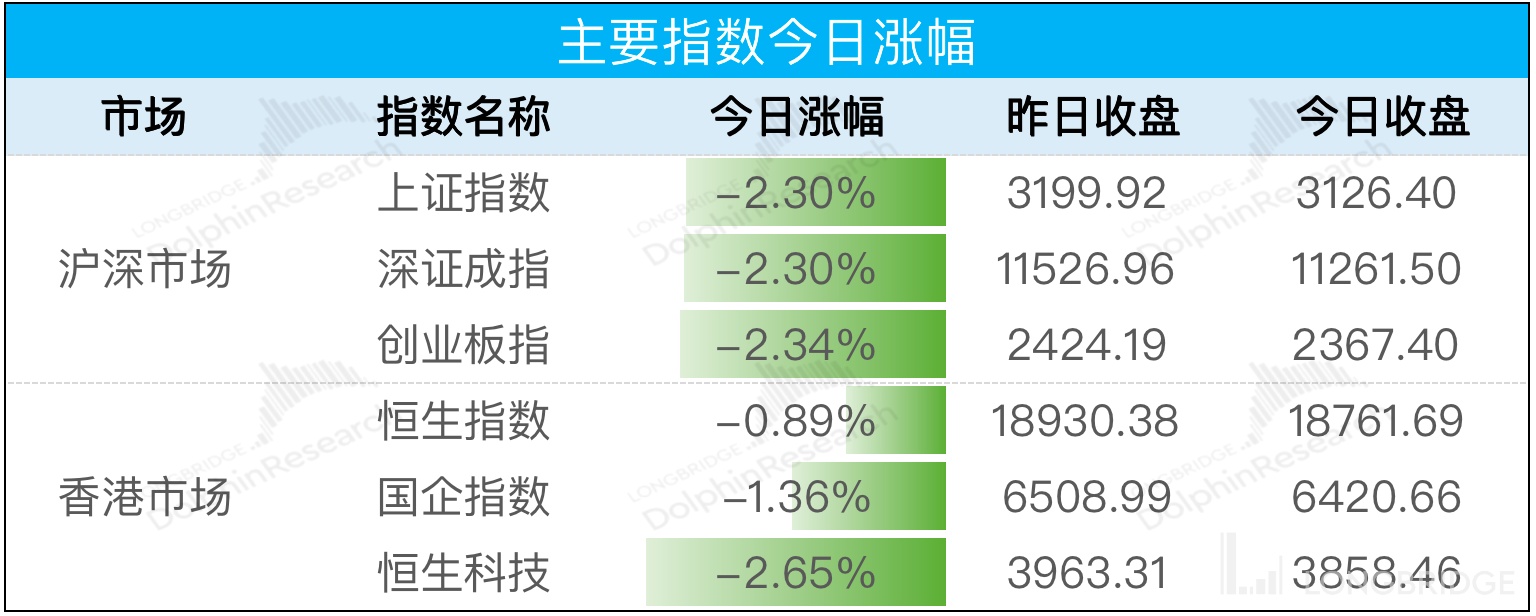

Shanghai and Shenzhen: Motorcycle and other vehicles, computer equipment, military electronic equipment;

Hong Kong Stock Exchange: Casinos and gambling, other fashion accessories, air freight and logistics;

US Stock Exchange: Healthcare plans, resorts and casinos, education and training services.

🐬Focus on next Monday

1. US NAHB Housing Market Index.

⚠️ The companies covered in this Dolphin report are marked in red and can be searched on the Longbridge App (click here to download). Enter "Dolphin Research" on the home page to search for the corresponding company name and obtain the company's entire research collection (including the minutes of the company's past performance meetings).

Risk Disclosure and Statement for this report: Dolphin Disclaimer and General Disclosure