Don't be deceived by the impressive growth rate, social retail is only experiencing a "weak" recovery.

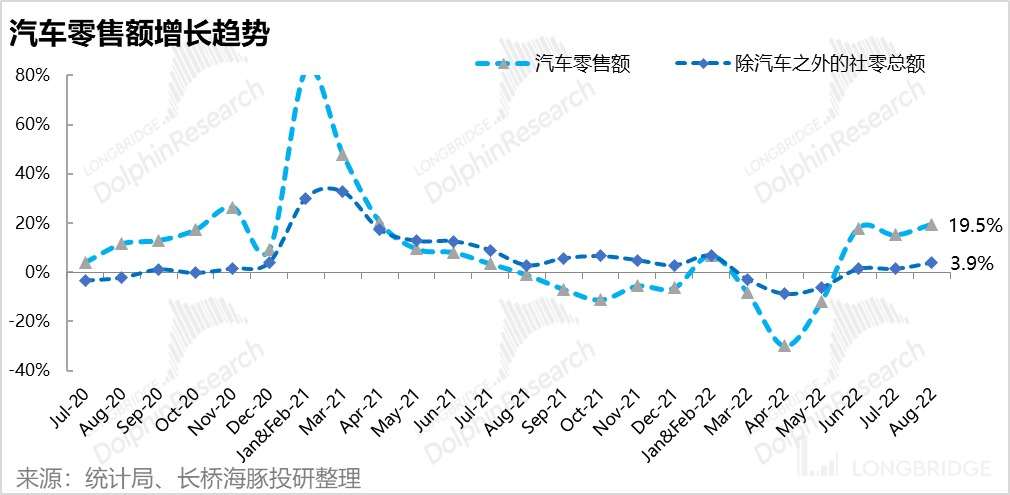

The Bureau of Statistics today released the latest social retail data: From January to August, the total retail sales of consumer goods in China was CNY 28.256 trillion, an increase of 0.5% year-on-year. Among them, the retail sales of consumer goods excluding automobiles was CNY 25.366 trillion, an increase of 0.7%.

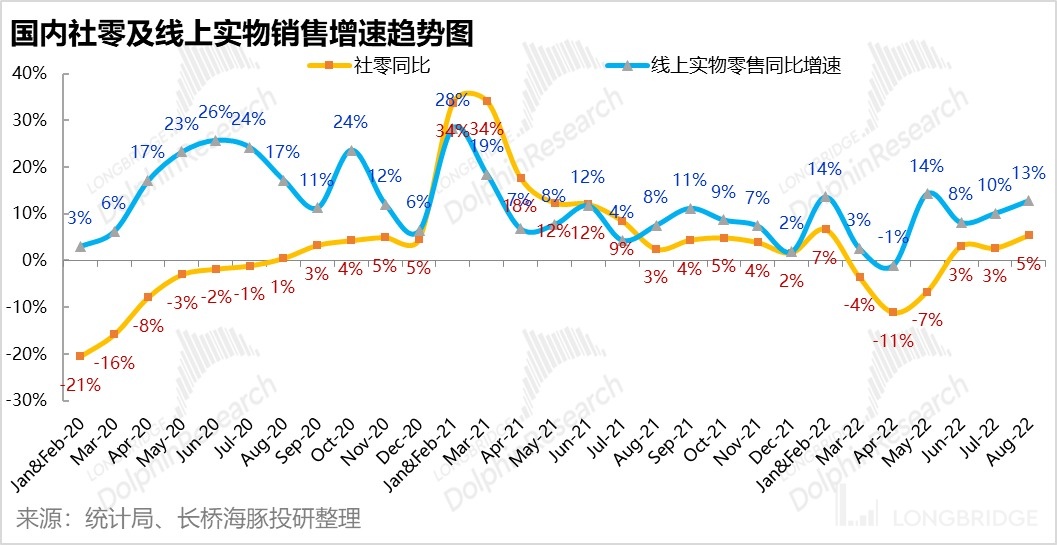

The national online retail sales totaled CNY 8.4295 trillion, an increase of 3.7% year-on-year. Physical goods online retail sales reached CNY 7.2414 trillion, an increase of 5.8%, accounting for 25.6% of the total retail sales of consumer goods; among them, food, clothing and daily-use commodities increased by 16.5%, 4.0% and 4.8%, respectively.

In terms of a single month, the total retail sales of consumer goods was CNY 3.6258 trillion, a year-on-year increase of 5.4%, and the online physical retail sales increased by 12.8% year-on-year.

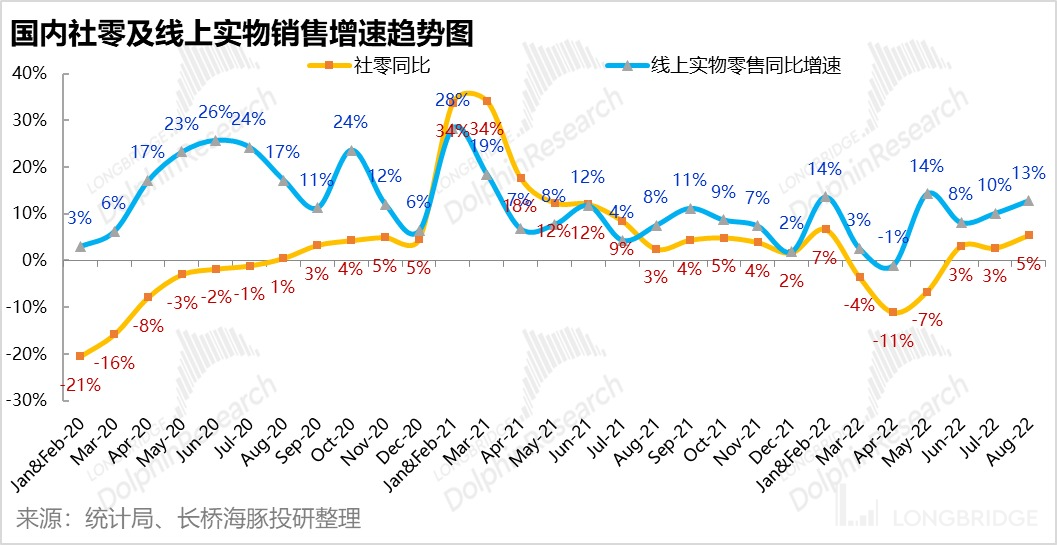

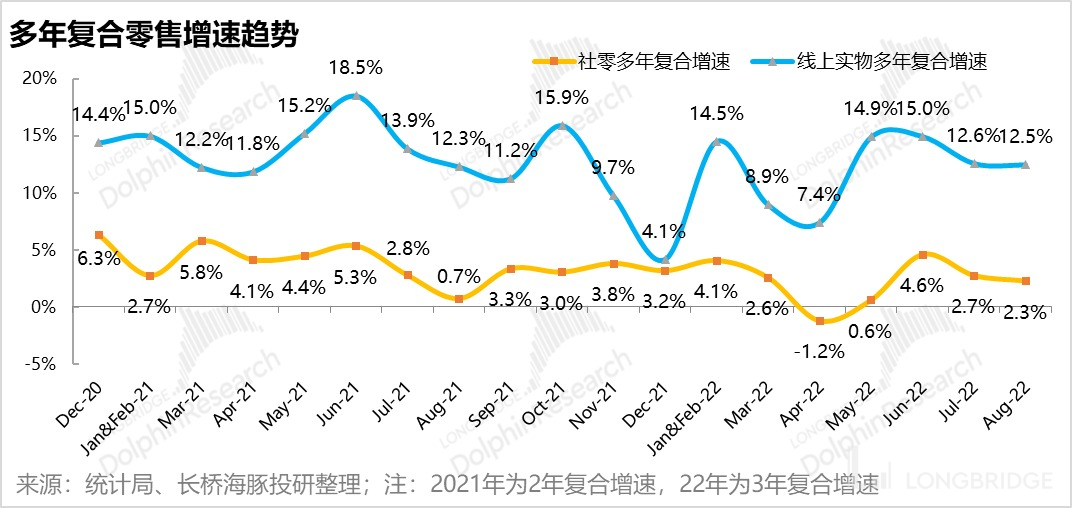

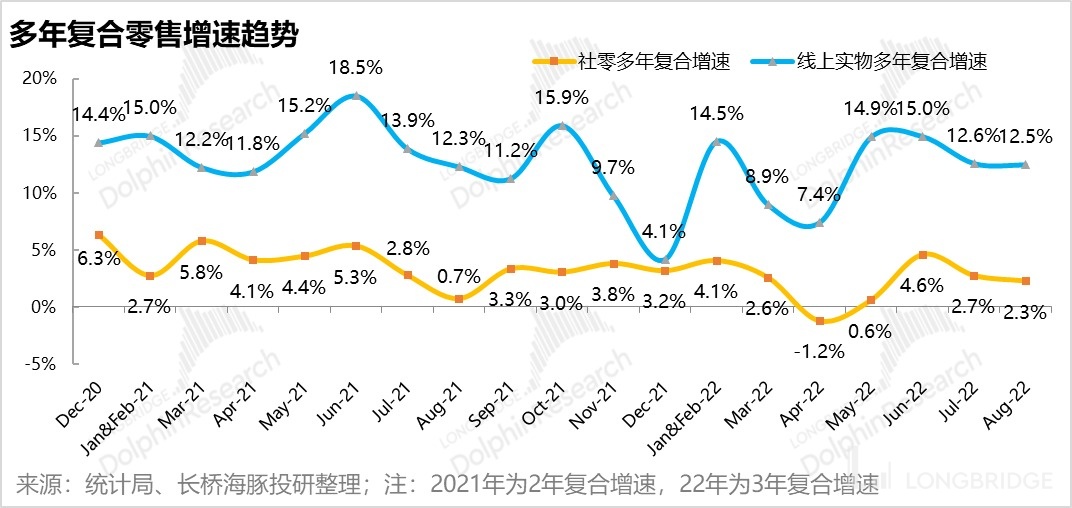

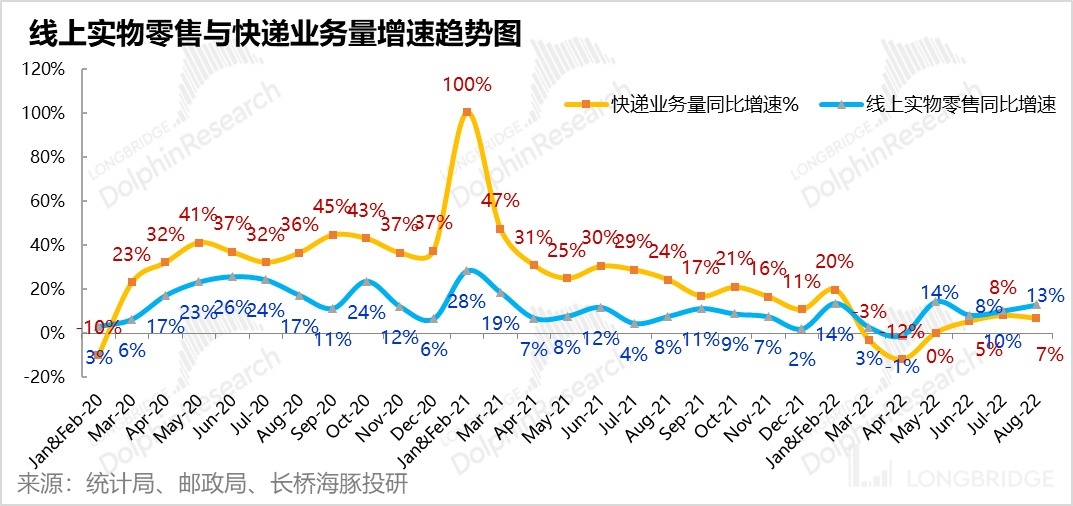

①Overall, regardless of social retail or online physical retail, the month-on-month growth rate has increased significantly, seeming to perform well. However, the widespread rebound of the domestic epidemic last August also had a very low base effect. After removing the low base effect, the overall social retail sales in August were still in a relatively weak state. The online physical retail sales were relatively strong, and even if the base effect was removed, the compound growth rate remained at a high speed of 12.5%.

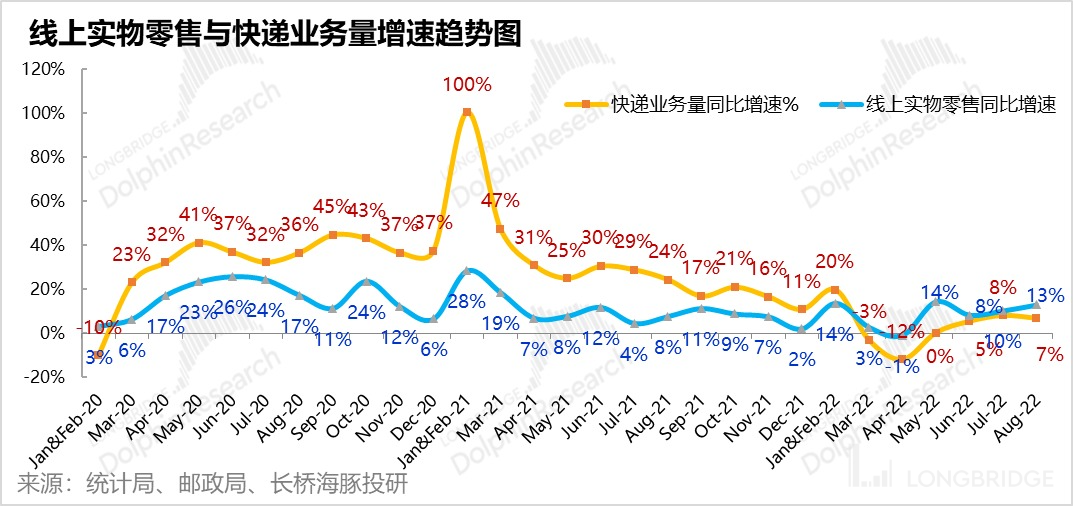

②Combining with the growth rate of express delivery volume this month, which is about 7%, lower than the growth rate of online retail sales, Dolphin Analyst believes that after consumption activities become normalized, the category structure will also change from mainly daily necessities and food during the epidemic situation to a more diverse and higher-priced category structure.

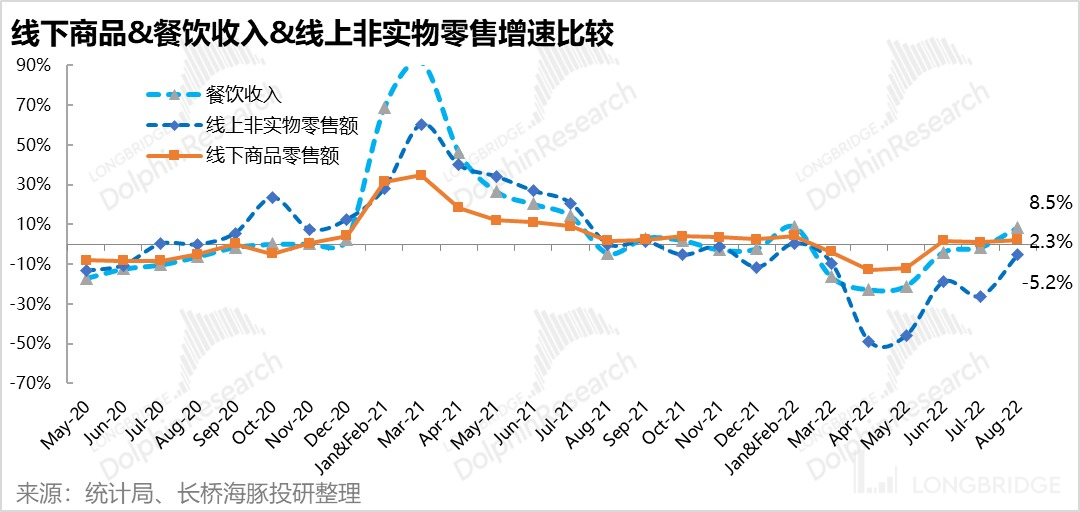

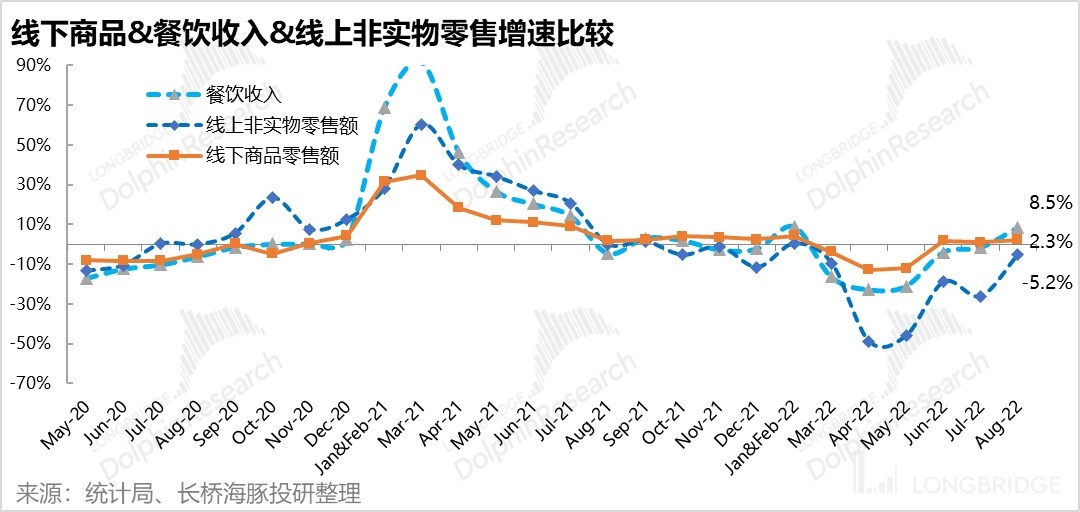

③From the channel growth situation, online physical> catering> offline physical> online non-physical. Among them, the online non-physical retail is on the rise, with a year-on-year decrease of only 5%, and the recovery strength is strong. Dolphin Analyst believes that after the unblocking, the demand for travel services such as tickets, hotels, etc. will rebound with a retaliatory effect.

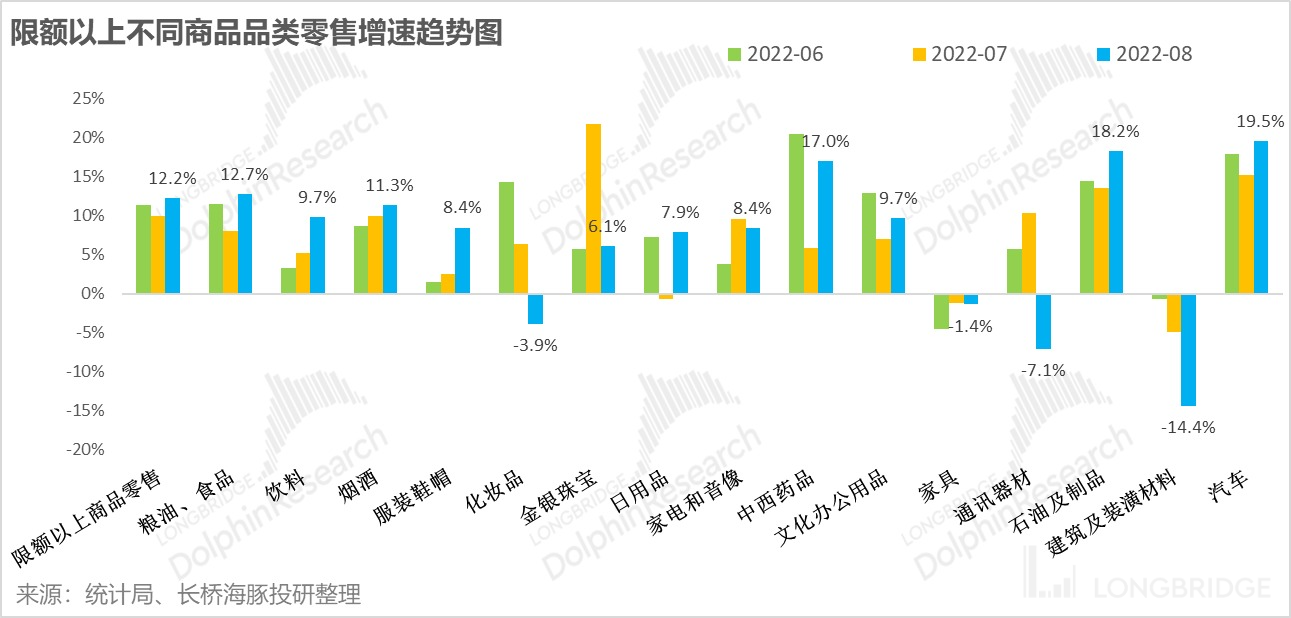

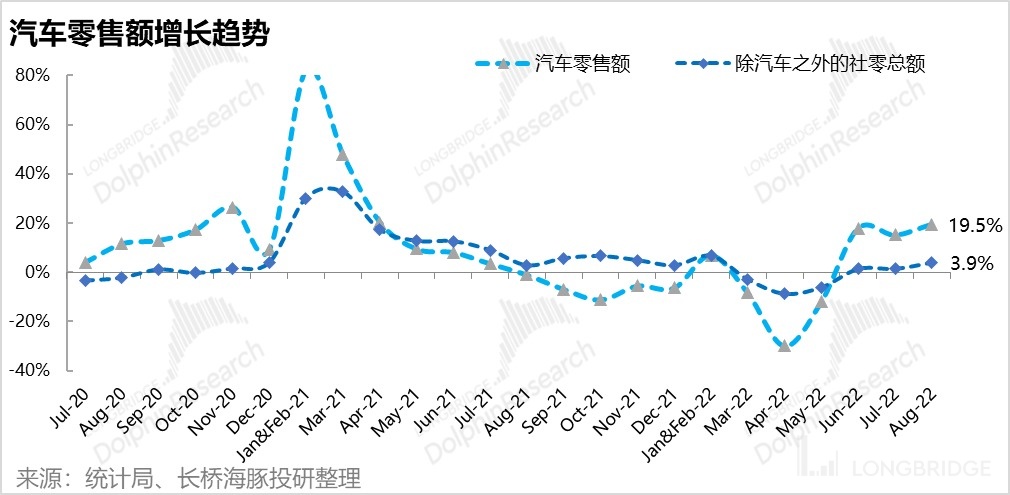

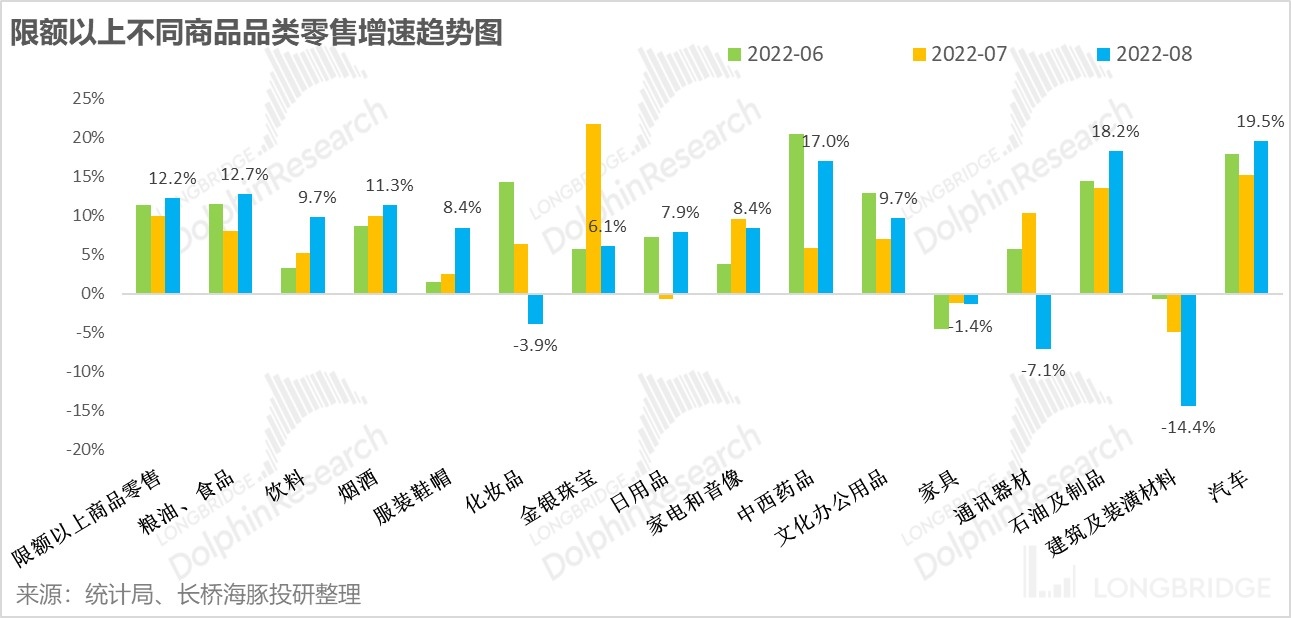

④Regarding the types of commodities, automobiles and petroleum products still have the highest growth rate, and the food, oil, and beverages which are bare necessities also perform strongly. However, furniture and building materials related to the real estate chain still have poor performance. At the same time, the clothing category increased by 8.4% this month due to the extremely low base, and it is worth paying attention to whether the recovery can continue.

Detailed Analysis:

1. After exclusing the low base, the overall social retail market is weak in its recovery, while online consumption remains robust.

As China's major cities gradually emerge from the impact of the last epidemic situation and consumption activities become normalized, the year-on-year growth rates of the overall social retail market and the online physical retail sales have continued to rise since June. By August, the year-on-year growth rate of social retailing surged to 5.4%, and the year-on-year growth rate of online physical retail sales increased to 12.8%. However, in August last year, the country also experienced a widespread outbreak of the epidemic situation, and consumer data was in a low point. Therefore, the low base effect played a role.

Therefore, a large part of the good growth in the social and retail market in August is due to the low base effect from last year. From the perspective of the compound annual growth rate based on 2019, the compound growth rate of social and retail sales in August decreased compared to July, while the compound growth rate of online physical retail sales remained unchanged, showing relative resilience.

Therefore, a large part of the good growth in the social and retail market in August is due to the low base effect from last year. From the perspective of the compound annual growth rate based on 2019, the compound growth rate of social and retail sales in August decreased compared to July, while the compound growth rate of online physical retail sales remained unchanged, showing relative resilience.

From the perspective of compound growth rate, except for the sharp rebound in June driven by retaliatory consumption just out of the epidemic, the consumption in July and August is actually in a relatively weak state. It can be seen that the problem of domestic consumption is not only the impact of the epidemic, but also the lack of internal growth momentum in the economy and consumption.

Although the official express delivery data for August has not been released yet, according to initial data, the year-on-year growth rate of express delivery volume in August was 6.8%, which is also lower than the 8% growth rate in July. The Dolphin Analyst believes that the structural shift in consumer goods from daily food during the epidemic to normalcy has led to a slower growth rate of express delivery than online consumption.

2. Degree of recovery, online physical > offline physical > catering > online non-physical

Under the dual impact of offline recovery and low base effect, catering, offline physical retail, and online virtual retail have all rebounded to varying degrees. In terms of sales growth rate of each channel, online physical> catering > offline physical> online non-physical. Among them, catering revenue in August increased by 8.5% year-on-year, showing a quite strong rebound (mainly due to the low base effect of last year), and offline catering companies and Meituan should benefit.

Online physical retail is still not stable, and the year-on-year growth rate in August was only 2.3%. Although the growth rate of online non-physical goods is still at the bottom, under the circumstance that the base is not low on a year-on-year basis, this month's year-on-year decline has narrowed significantly from -26.1% to -5.2%, showing a considerable improvement. Since non-physical goods mainly include license plates, tickets, hotels, and service consumption, it can be seen that residents' demand for travel has rebounded with retaliatory consumption after the epidemic.

3. Cars and necessities are still the main drivers of growth, and the real estate chain continues to be miserable

Viewed from different product categories, under a series of policy stimuli, automobile consumption in August was still in a period of high-speed growth, with a year-on-year growth rate of 19.5%. If automobile consumption is excluded, the growth rate of social and retail sales this month will drop to 3.9%. In addition, driven by the surge in energy prices, the consumption of petroleum products is also quite strong.

In the state of weak consumer demand, the sales of essential categories remain relatively robust, with high growth rates in food, oil, tobacco, daily necessities, and medicines. However, with the significant decrease in real estate sales, furniture and building materials related to the real estate chain and communication equipment related to mobile phones have shown weak performance.

In the state of weak consumer demand, the sales of essential categories remain relatively robust, with high growth rates in food, oil, tobacco, daily necessities, and medicines. However, with the significant decrease in real estate sales, furniture and building materials related to the real estate chain and communication equipment related to mobile phones have shown weak performance.

However, the category with the worst performance, clothing and footwear, saw a significant increase of 8.4% in retail sales this month. Nevertheless, the impact of the extremely low base from last year should be taken into account, and compared to the same period in 2019, the sales of clothing are still down by 10%. Therefore, the trend of clothing sales recovery still needs to be observed.

Risk disclosure and statement of this article: Dolphin Analyst Disclaimer and General Disclosure