After seeking their own growth paths, Tencent, Kuaishou, and Bilibili have different fates in the same industry.

Hello everyone, I am Dolphin Analyst!

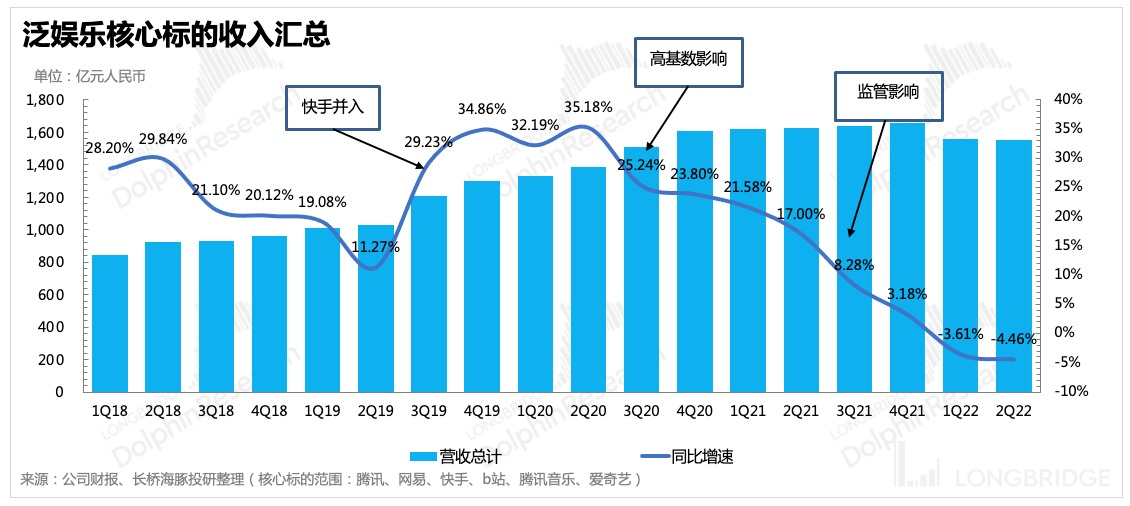

The interim financial report for the pan-entertainment industry has just ended and the second quarter report has become a big event amidst the macroeconomic environment dilemma. As a heavily-regulated industry and an optional consumer during the economic downturn, the entire industry is facing headwinds. However, as the saying goes, only when the tide goes out do you know who's been swimming naked.

Under the expectation of poor performance for all companies, some companies have brought some small surprises and signals of a turnaround in adversity, while others have revealed their own problems.

All in all, whether in the sub-sectors of the larger industry or among the various players in the industry, the performance of the interim report has further deepened the differentiation based on Dolphin's judgment at the end of last year (see “2021 Q4 Pan-Entertainment Overview”).

-

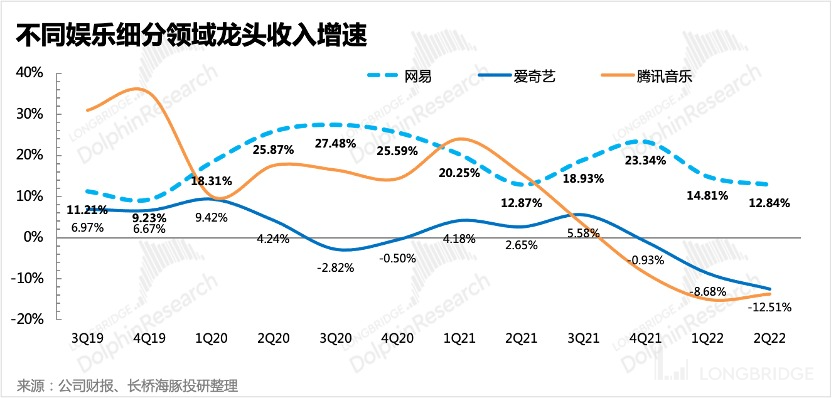

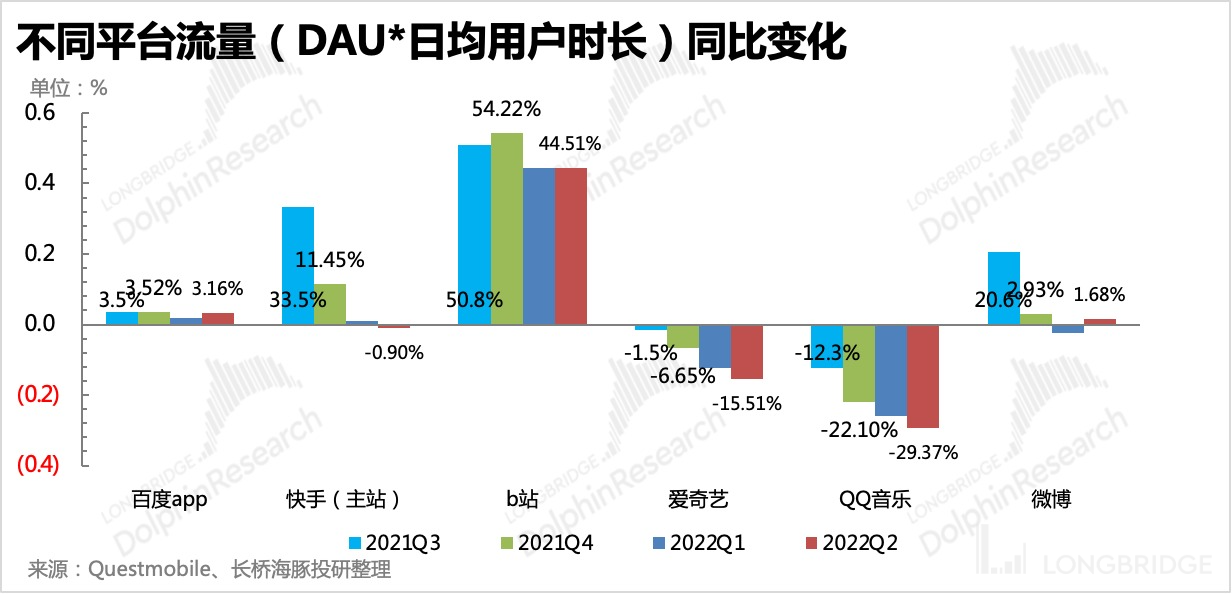

Peaking traffic is a big trend in the pan-entertainment and even the entire internet industry, but it does not mean that all companies do not have opportunities, just that the easy days when the industry was a free-for-all are over. The logic of quantity has weakened, and the logic of value is more influenced by the internal competition of content/platform operations, whether users are willing to pay for content and whether advertisers are willing to allocate more budget, which in the long run depends on the quality of each company's content and platform attractiveness.

-

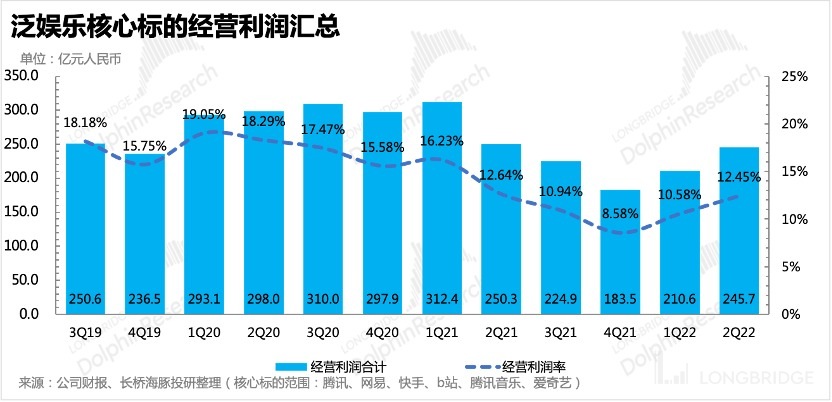

In addition, under the pressure of industry-wide revenue contraction, profitability has also become a key factor in investment decisions. Therefore, for pan-entertainment platforms that have always relied on "loss for scale" as their strategy, it is time to prove the effectiveness of their business models. It is also at this time that, despite huge losses, some companies have demonstrated their profit potential, while other companies have exposed the inherent flaws in their business models.

Although the logic of overall industry user growth has declined and there is a higher regulatory requirement for cultural content in national conditions, long-term space growth has encountered bottlenecks. However, in the short term, due to the gradual weakening of the regulatory impact at the national level, the positive signal of delisting risk of Chinese concept stocks, and the slow recovery of overall consumption, the downward trend of the pan-entertainment industry has begun to slow down, and some companies also have "small cycles in the big trend", especially in the second quarter, where profit improvement has exceeded expectations, and the fundamentals have been continuously consolidated.

Therefore, for the pan-entertainment industry, Dolphin Analyst is more inclined to focus on sub-sectors and key companies that have short-term turnaround points from the perspectives of opportunity certainty and profitability.

Following the evaluation of the risk of Chinese concept stock delisting in the previous article "Will Chinese Concept Stocks Have a "Rebirth" after the Delisting Crisis?", this article will focus on the marginal changes and trend judgments of the sub-industry logic. 1. Review of the First Half of the Year: Differences in Business Model Lie in Monetization Capabilities

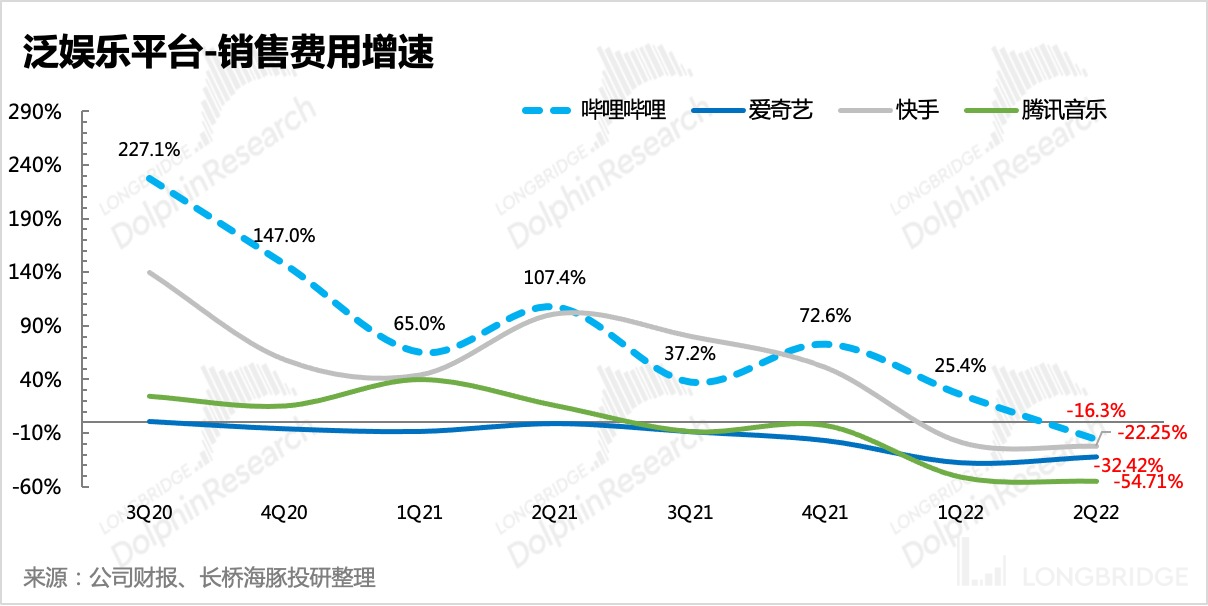

"Cost reduction and efficiency enhancement" were the key words of the first half of the year for Internet companies, especially prominent in entertainment platforms. Taking the sales cost, with the most flexible changes, as an example, iQiyi, Tencent Music, Kuaishou, and Bilibili all cut marketing budgets during the first half of the year.

Successful "cost reduction and efficiency enhancement" rely on expanding the monetization end to offset the cost and achieve an increase in profit margins. Secondly, it is to reduce the absolute value of cost and expenses to optimize profits under a stable income. The most failed "cost reduction and efficiency enhancement" is the typical "shortsightedness" approach, blindly reducing expenses that affect the normal operation of the business, resulting in profits but losing growth.

For example, among the entertainment companies, NetEase, which is in the product cycle, is undoubtedly in the first category, while iQiyi and Tencent Music are the worst third type.

Entertainment content has the advantage of natural inflow, and some e-commerce platforms often need to introduce entertainment content to obtain traffic. For entertainment platforms, content costs can be considered as "relatively fixed expenditures" similar to server bandwidth costs. Short videos that lean toward UGC and user-generated content have higher bargaining power in the upstream (ordinary creators) than long videos, which mainly serve PGC copyright content. However, the incentive splits used to drive content creation are still a "hard rock" that platforms find difficult to significantly reduce.

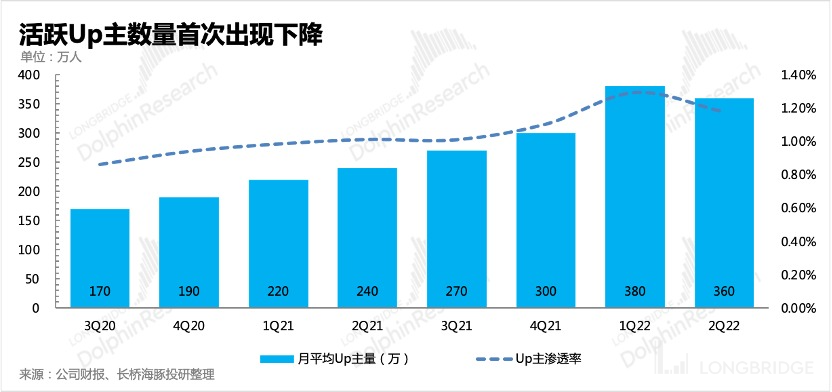

In the early part of the year, Bilibili adjusted the Upstream incentives splitting threshold, causing a significant drop in Upstream's revenue for most Upstreamers. As a result, the second-quarter financial report showed that Upstreamer participants appeared to be losing.

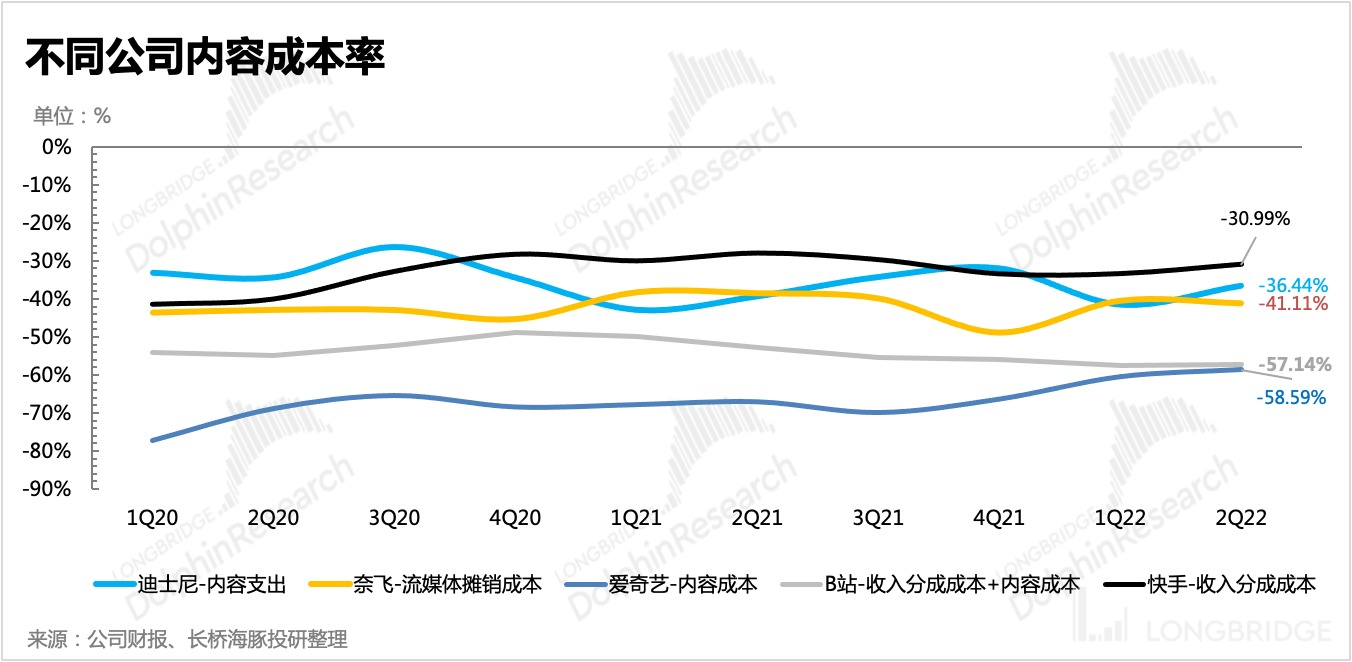

Dolphin Analyst believes that whether it is in China or overseas, the absolute value of content costs is not the most critical issue, but whether monetization revenue matches content costs, that is, the content cost ratio.

Taking a film and television content platform as an example, Disney's content cost is extremely high in absolute terms. In 2022, the total content investment exceeded 30 billion U.S. dollars, and the production cost of a Marvel movie was up to hundreds of millions of dollars. However, due to its very strong monetization ability, the proportion of content cost is not very high.

And as Disney has more monetization methods such as theme parks and cinemas compared to Netflix, Disney's content cost is also lower than Netflix's pure subscription model. This is also the reason why Netflix is investing in game companies everywhere and is eager to launch an advertising low-priced package next year.

1. Traditional Content Payment: After Synchronous "price Increase", Good Games are Still yyds (Awesome)

When Netflix surrendered to commercialization, it reflected to some extent the limitations of the pure content payment business model, especially the great relevance to user consumption willingness and purchasing power.

Because the content consumption consciousness of domestic users needs to be cultivated, the business model of content payment is also more difficult in the Chinese market.

Therefore, the thinking of domestic and foreign content platforms has been diametrically opposed since this year.

Overseas streaming media platforms expand monetization methods and attract more low-paying users through advertising, while domestic long videos are mainly shrinking painfully and precise harvesting loyal users through price increases.

For example, iQiyi has been cutting staff and content studios, closing small and medium projects and focusing on big projects since the end of last year, with high demands for loss reduction. However, the absolute value of content investment has decreased, and users and income have reached their peak.

The price increase of the terminal is limited by the purchasing power and consumption consciousness of the Chinese people, especially in the case of reduced content supply. Every time AYouTeng raises its membership fees in recent years, it will receive a lot of criticism from users.

Therefore, price increases only work for loyal users, and more room for loss reduction can only be hoped for by optimizing upstream supply costs.

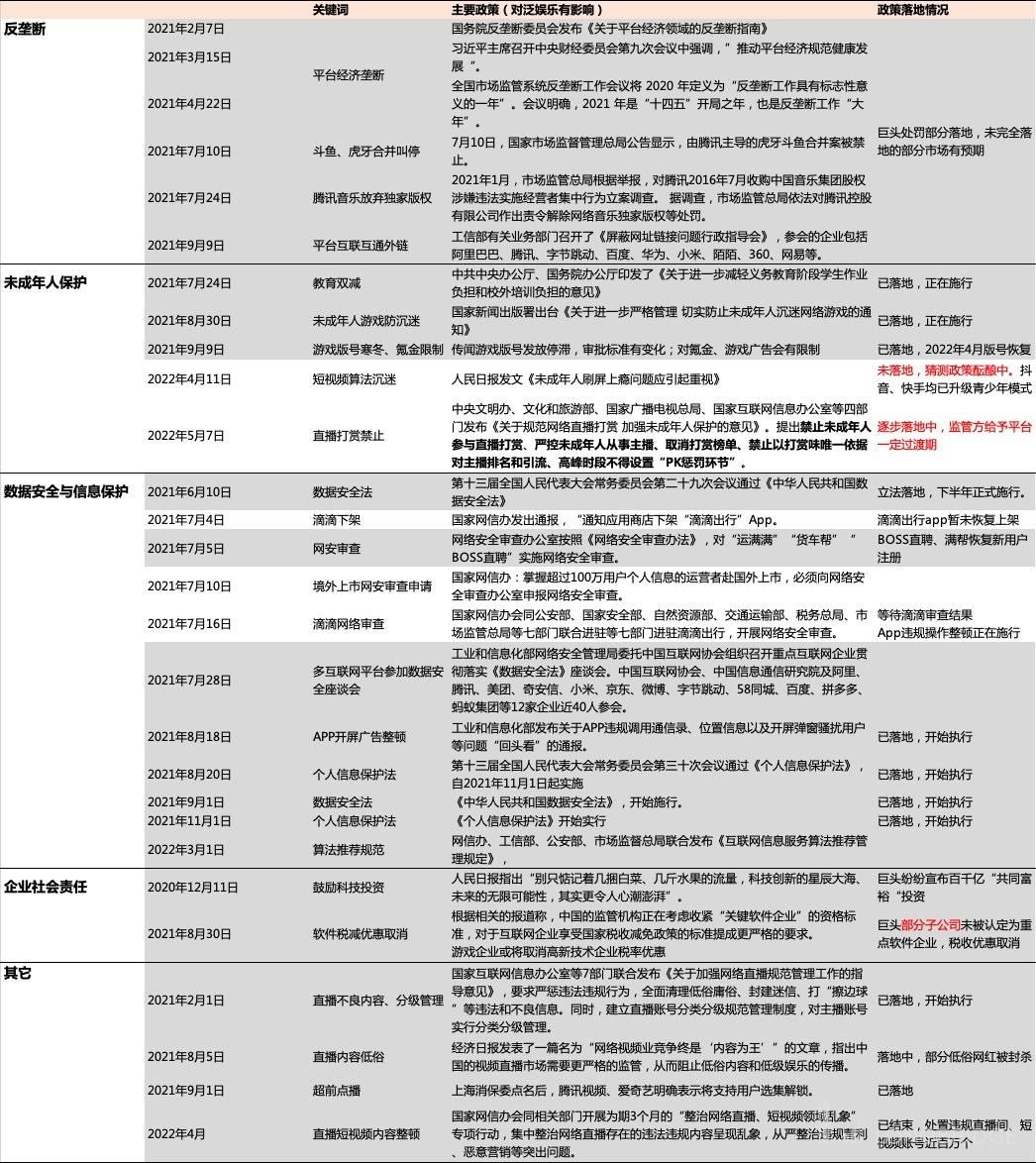

In recent years, under the pressure of regulation, "supply-side reform" is still advancing in the film and television circle. However, strong regulation has both advantages and disadvantages. Although the cost trend of high star pay and fan circle flow data has decreased, the quality of content in the medium and long term will continue to be limited due to the tendency of strict content review.

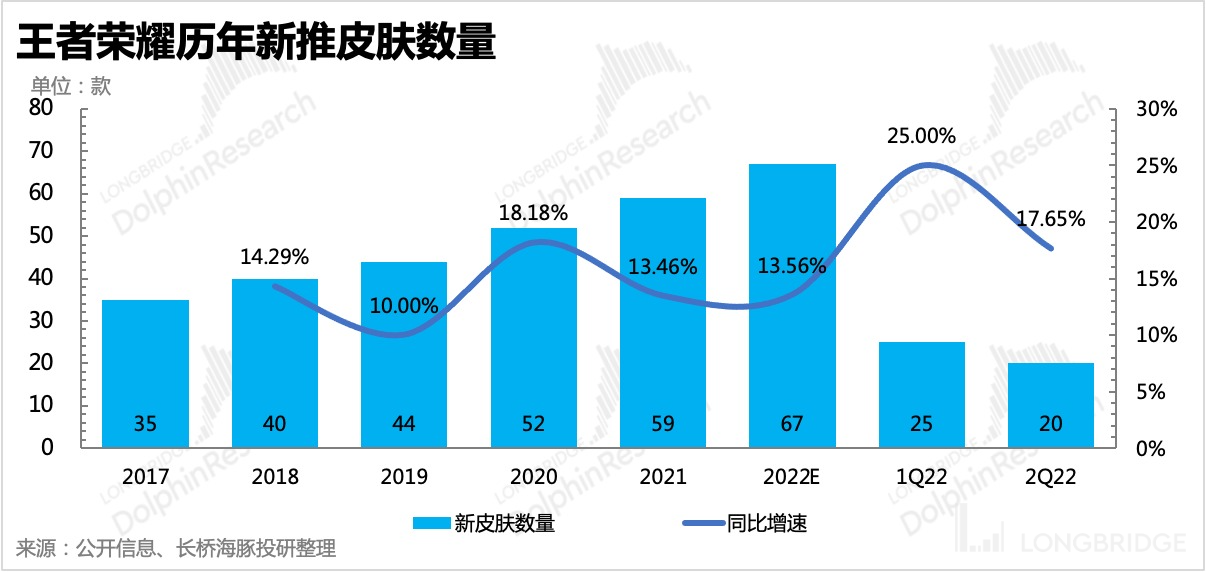

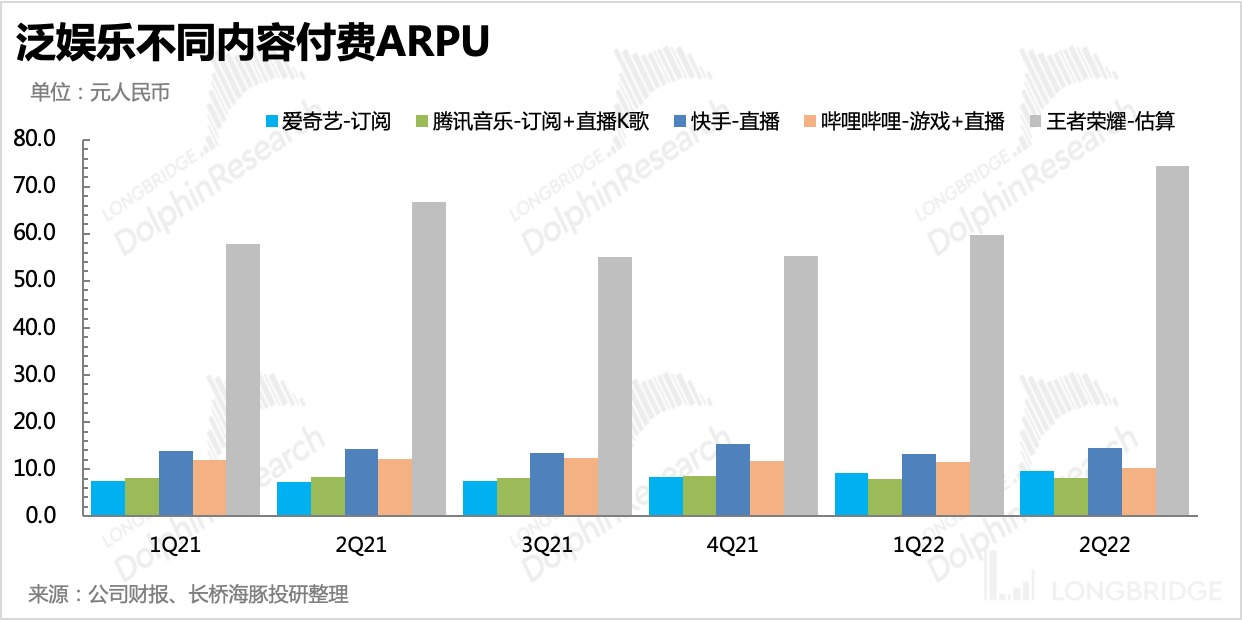

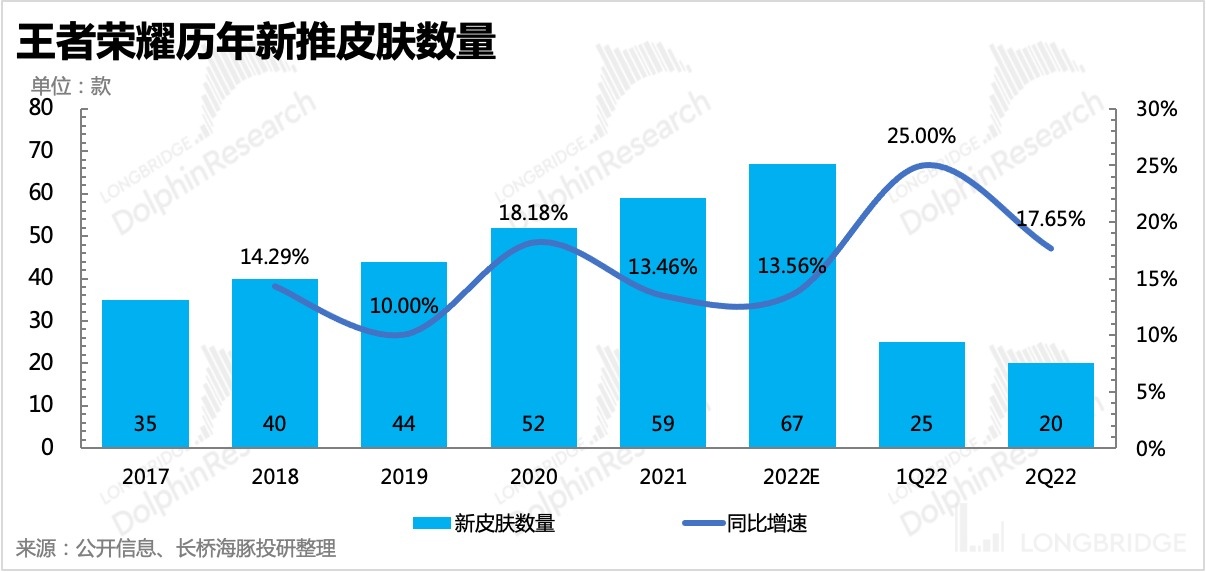

In the current economic environment (most people's demand for optional consumption is reduced), games are actually taking the route of indirectly increasing spending. Take the national game "Glory of Kings" as an example. In the past two years, the number and frequency of new skins launched by "Glory of Kings" have obviously increased, and the average single-user payment ARPU (income/MAU) has also continued to increase.

As "Glory of Kings" is a fair competitive game, buying skins does not necessarily increase much skill advantage. Therefore, unlike the compulsory price increase of long videos, the increase in ARPU of "Glory of Kings" comes more from users' active consumption power growth. That is to say, compared with other contents such as film and music, users are obviously more willing to pay for game content.

![The picture contains an automatically generated application description]

![The picture contains an automatically generated application description]

Games are a relatively alternative form of entertainment content. It does not belong to one-time consumption, but more like a continuous consumption process. In addition, the strong interactivity and sense of accomplishment of games can provide players with richer emotional value, so it is also easier to produce consumer impulse. The introduction of virtual props has further opened up the commercial space of games by adding more paid points in game content, compared to music and video content. A good game can create more value for a single user than a content platform.

While games are subject to censorship, Dolphin Analyst believes that the logic of raising prices under the peak flow is smoother in games than in other entertainment content.

- Advertising Marketing: Conversion rate demands reach their peak, and the budget of pan-entertainment platforms is being transferred.

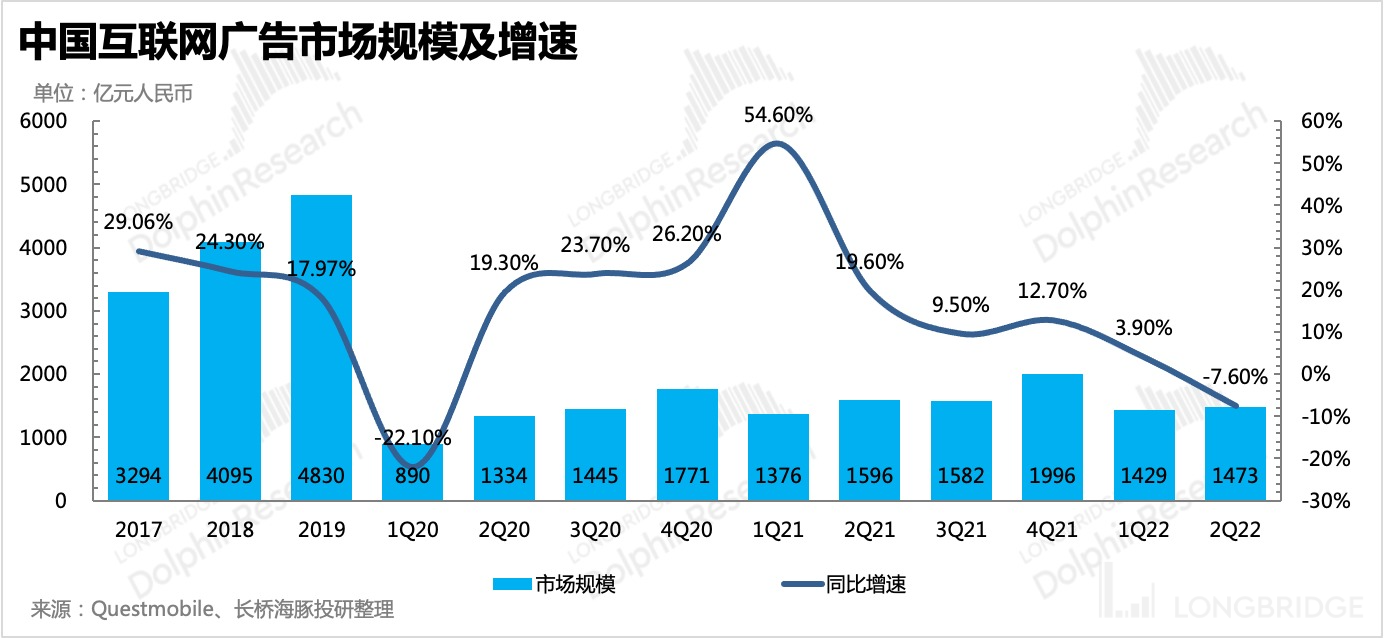

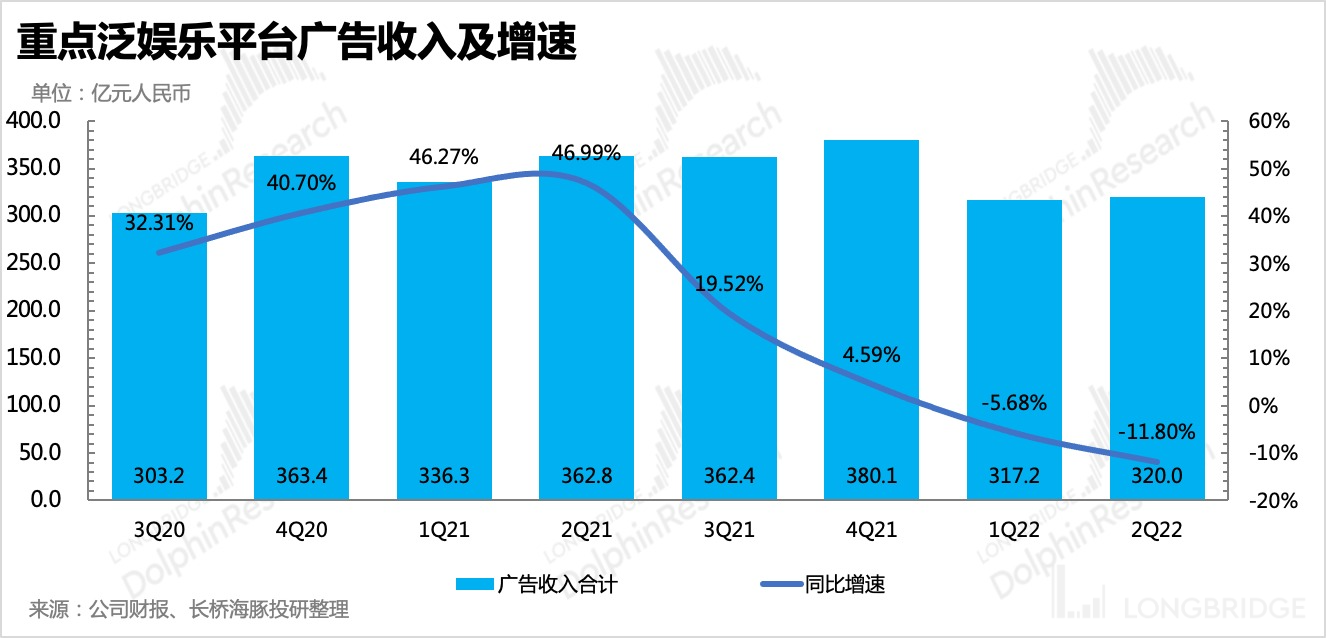

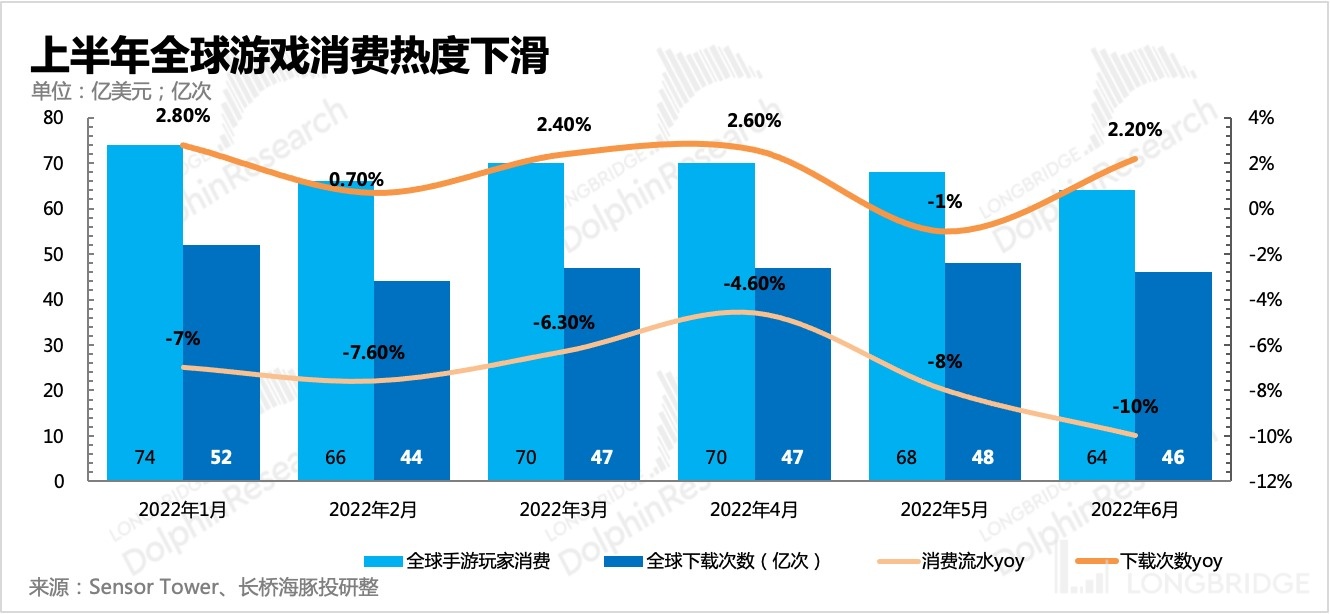

Since the outbreak of the pandemic this year, the economic growth rate has slowed down significantly. Advertisers' budgets have been greatly reduced and they strive to use every penny on cutting-edge activities. Online entertainment platforms face greater advertising headwinds than e-commerce as they are further away from the transaction.

According to several entertainment platform situations, the decline in pan-entertainment ad revenue far exceeds the overall industry level of Internet advertising.

If there is a loss in traffic, it will be even worse, such as with iQiyi and Tencent Music. Entertainment platforms with closed-loop transactions face less headwinds, such as Kuaishou.

In the short term, consumption recovery is relatively slow. Therefore, in the second half of this year, except for the need to attract specific target user groups, most merchants' marketing budgets will still tilt towards e-commerce platforms with transaction links.

This also means that the advertising revenue of pan-entertainment platforms will continue to be low in scale, but the rate of decline may slow down compared to the first half of this year due to the lower base in the second half of last year.

On the other hand, it also represents that once consumption recovers and merchants’ marketing budgets are sufficient, the advertising revenue of entertainment platforms with certain barriers will have relatively considerable growth elasticity.

Q2 reports are already past for the pan-entertainment industry, which has repeatedly fallen below the value of its stock price. Dolphin Analyst believes that the worst period for the industry is over, but differentiation will continue.

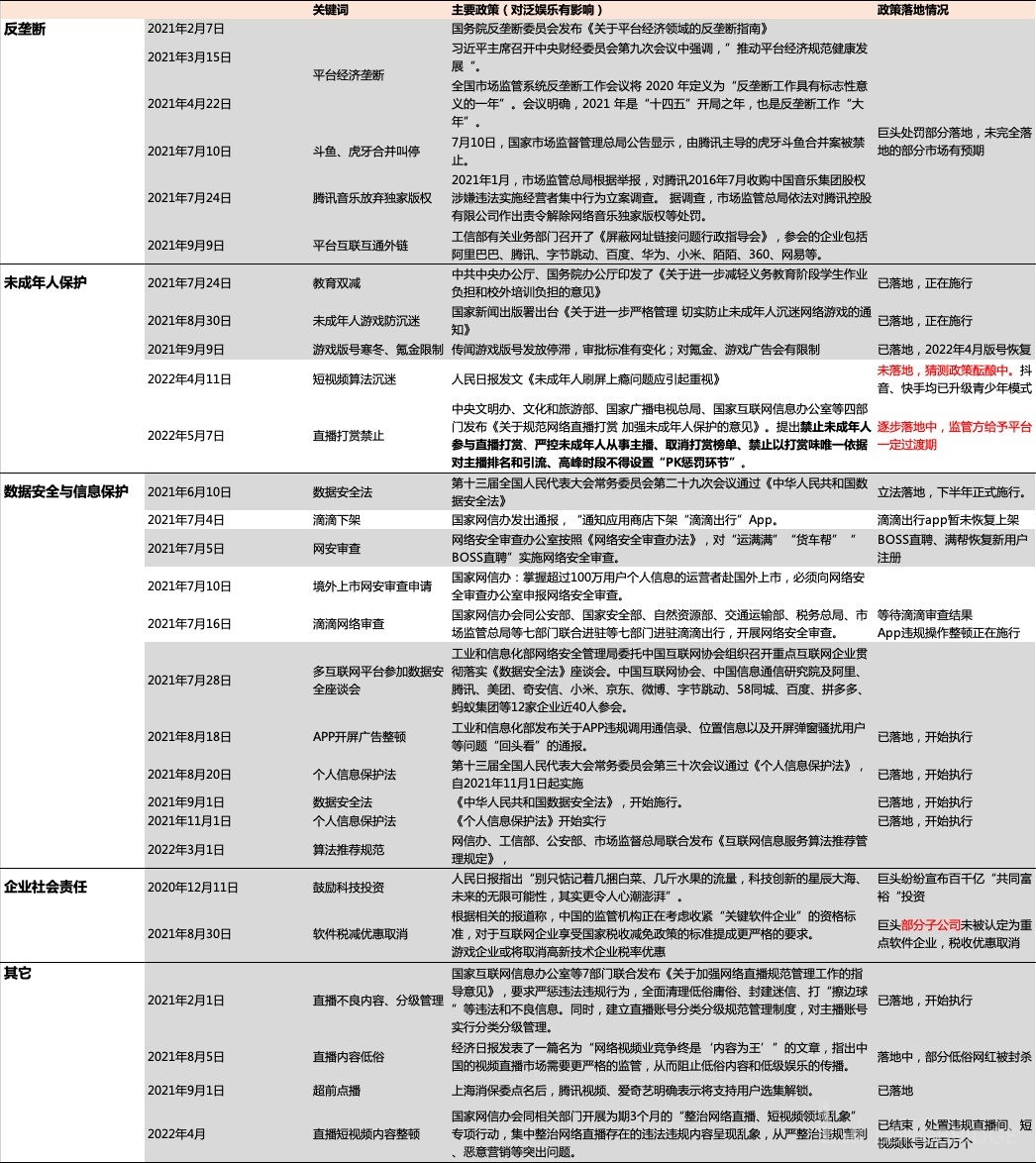

- First of all, from an emotional perspective, the industry regulation that has been ongoing for a year is entering its final stages (indicated by the gray background being implemented / market expectations are fully priced in). Currently, the focus is on live broadcast regulation, which is gradually being implemented. However, in the whole industry, especially in the second half of the year and the end of the year, the influence of regulation on the performance of various companies will gradually weaken.

- Under the pressure of the consumer environment, the overall growth resistance in the second half of the year, especially for entertainment channels that rely on advertising, is still not small, but differentiation will continue. Certain segments and specific companies have their own small content cycles, and the turning point will gradually come in the second half of the year.

(1) In traditional entertainment, such as long video and music streaming, growth has peaked, and the second half of the year will still focus on optimizing profit models. But due to the poor business model and limited optimization space, the market has to some extent tested the long-term ceiling of the industry. Only the emergence of new growth curves can regain the favor of the market, otherwise, only a valuation repair opportunity after a decline.

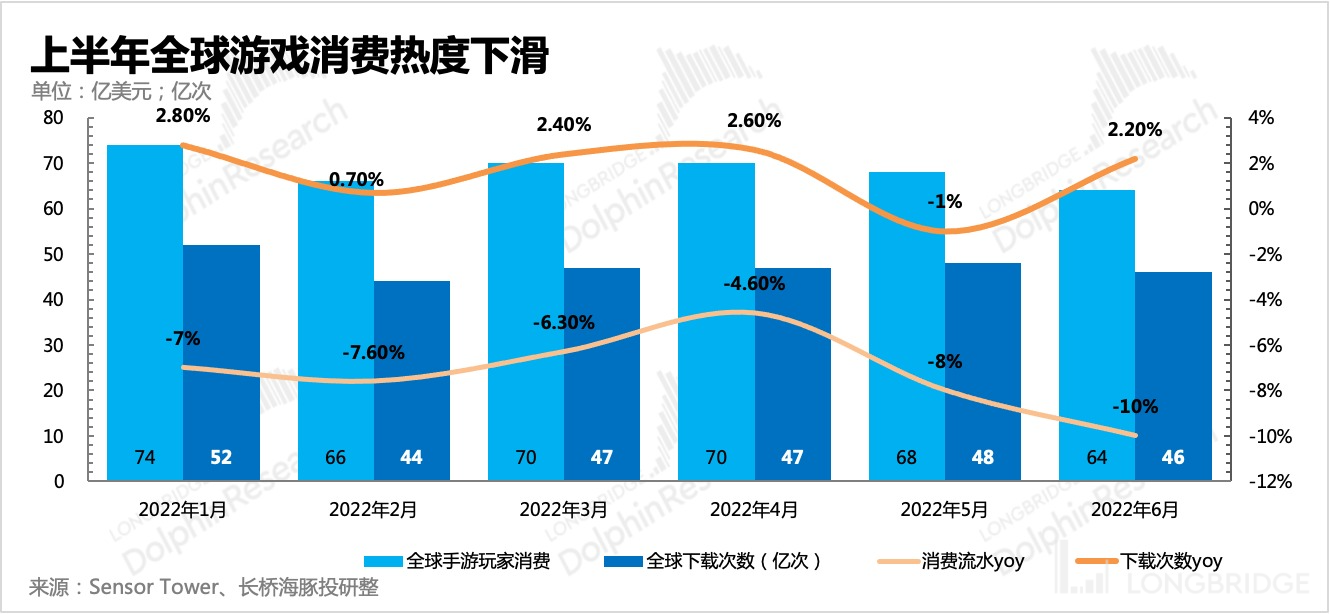

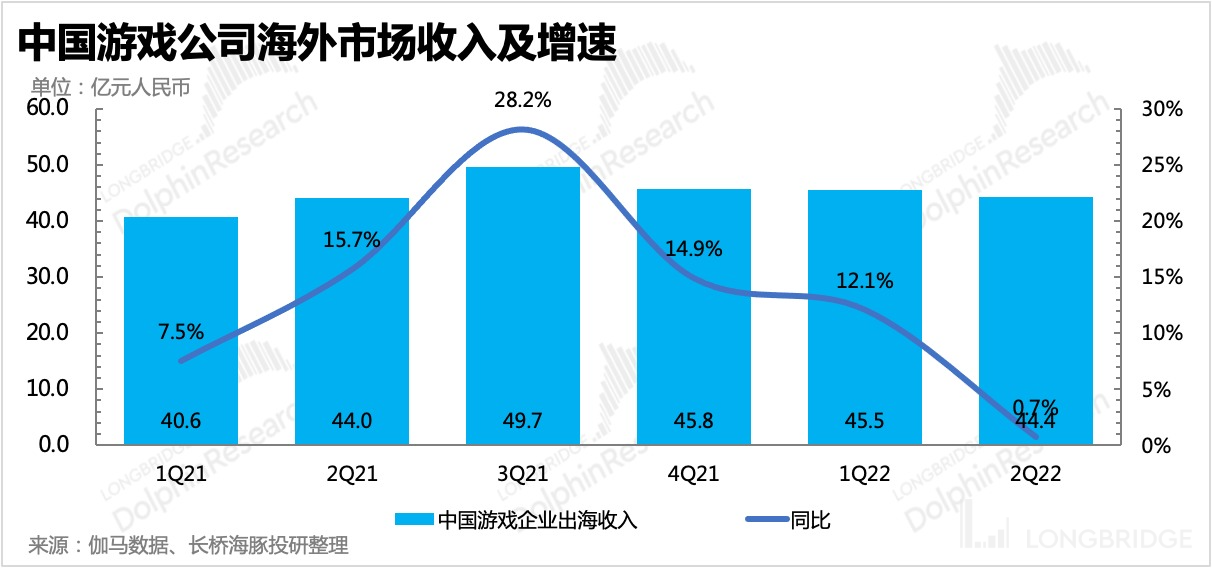

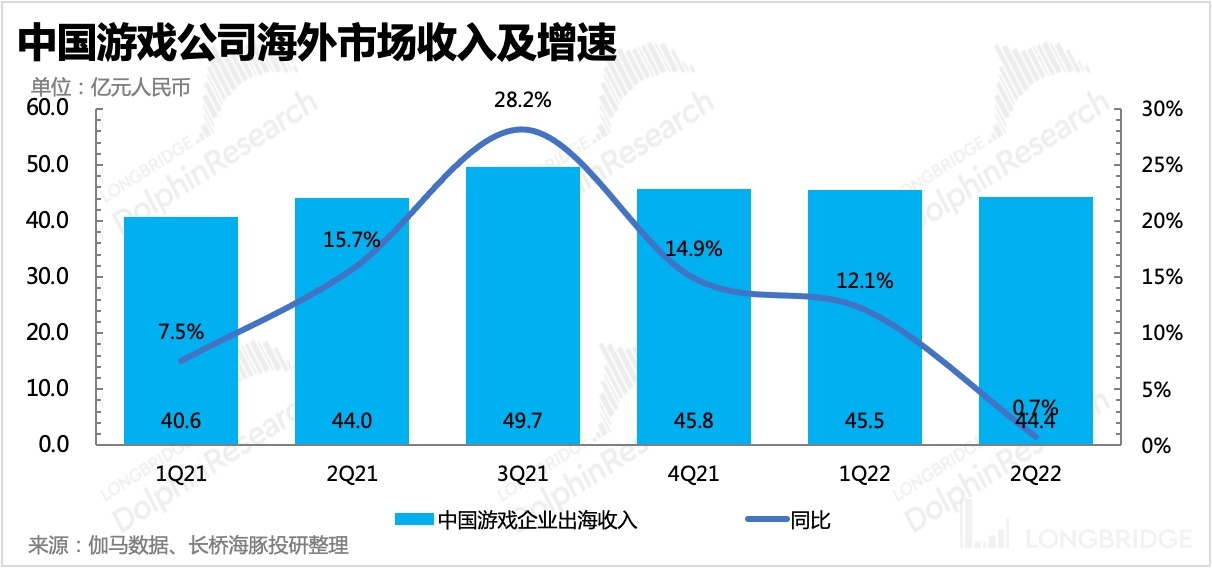

(2) In terms of games, the global growth rate declined in the first half of the year, which was used to digest the overdraft growth during the epidemic period, but the overseas revenue performance of Chinese game companies was better than the overall industry.

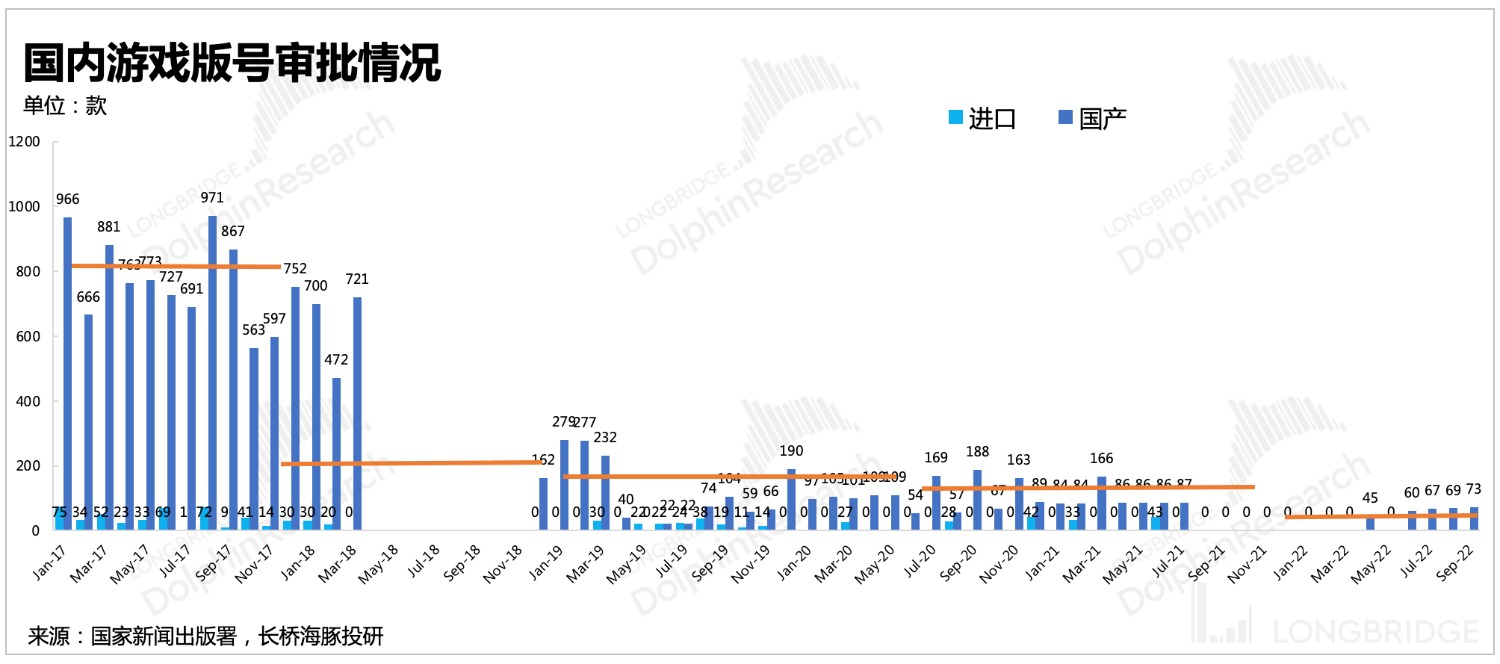

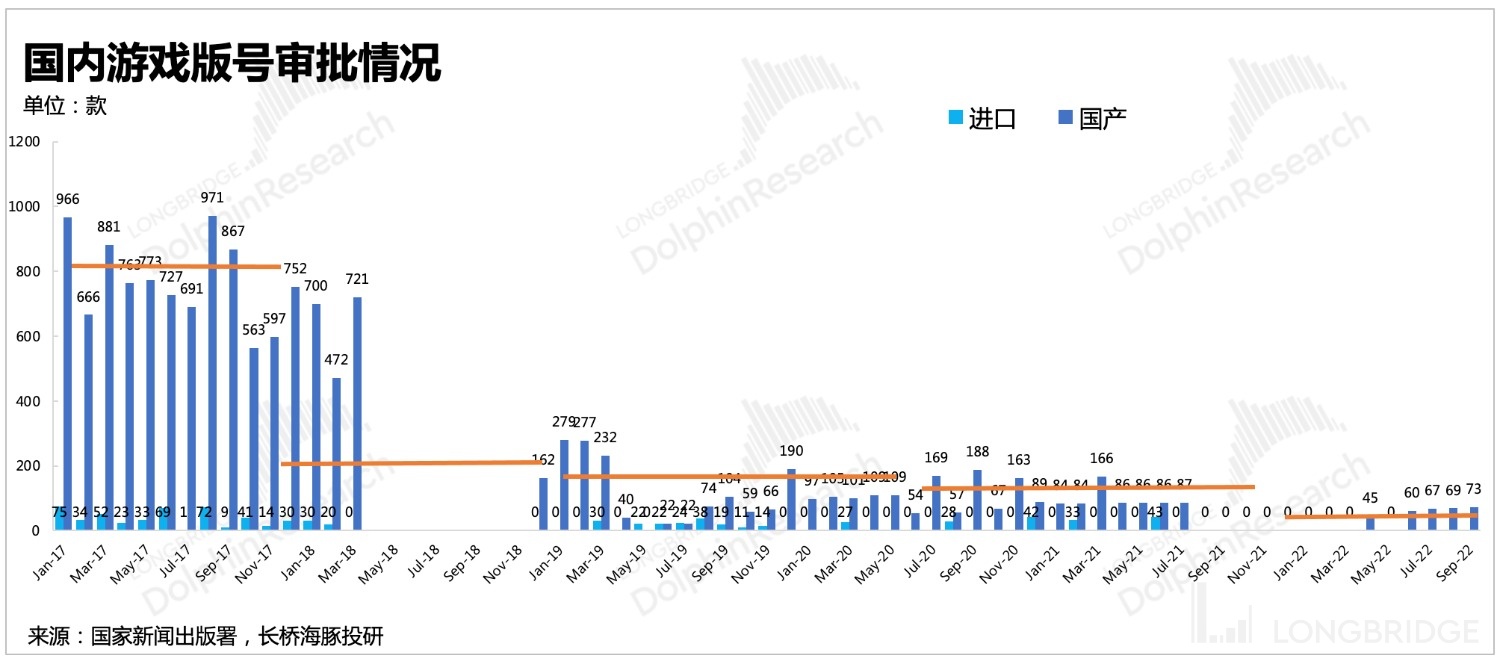

In the domestic game market, according to the approval situation of version numbers since April, the number of version numbers issued has increased sequentially, and the major game developers (Tencent, NetEase, 37 Interactive, Perfect World, G-Bits, etc.) are no longer "sealed." The overall industry confidence is constantly recovering, and its valuation is expected to improve before its performance.

However, the regulatory approach of version number approval has also changed from the natural advantage of major companies to the equal treatment of companies of all sizes. This change in thinking brings mainly two effects: On the one hand, it stimulates the creativity of small and medium-sized enterprises, and on the other hand, it enables the bankruptcies of major companies to develop towards a heavier emphasis on high-quality products and overseas expansion. Therefore, the recovery of version numbers this time is far better for small companies (such as Xindong) than for industry leaders (Tencent and NetEase).

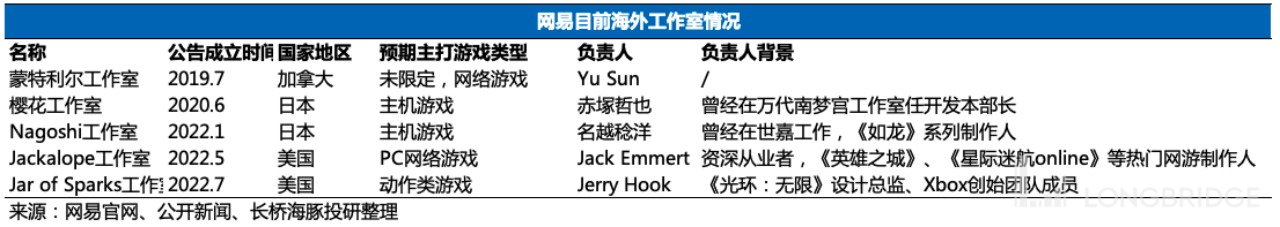

In the medium and long term, overseas expansion (competition for stock markets) and metaverse games (technological changes to open up new markets) are still the main directions.

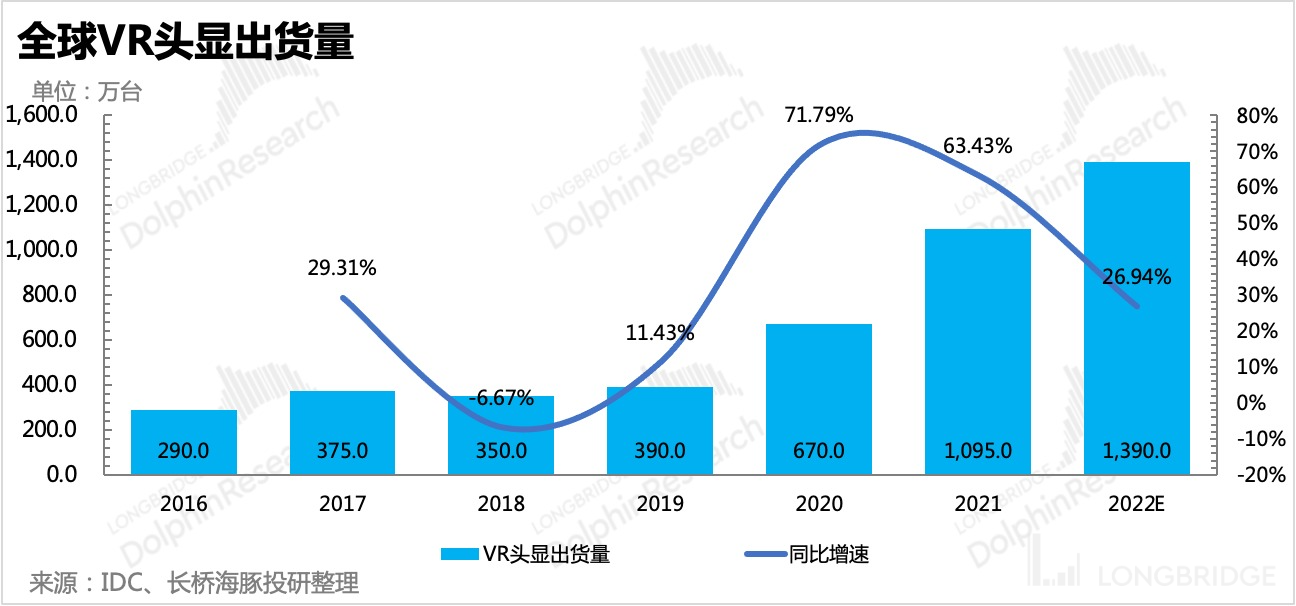

In terms of overseas game layout, Tencent's overseas game revenue has reached nearly 30% of total game revenue, and NetEase accounts for 10%. In addition to self-developed games going overseas, the two major leading companies have also frequently invested in overseas game studios during the first half of the year. For them, with ample cash in hand, investment can rapidly increase overseas game revenue and the global influence of the company. On the metaverse front, hardware is still rapidly penetrating the market. According to IDC, the global shipment is expected to reach 13.9 million units in 2022. Although Meta may have slowed down due to its restructuring in terms of business planning, other players like ByteDance's Pico are still expanding their investments. In the latter half of this year, Pico, Meta, and Oculus will release new models successively, and Apple will bring its MR device in early 2023, so investment in the metaverse industry remains enthusiastic.

In terms of channels, the competition in the short video market has deteriorated with Tencent's sudden assault. Despite the trend towards shorter video content, short videos are only a new technology, not a platform with exclusive access. Therefore, when various channels begin to value and invest heavily in short video functions, the competition in this field begins to visibly and steeply worsen.

When Tencent's Video Account reaches a larger number of daily users than TikTok and their usage time is approaching that of friends' circle, although some of the traffic is unmonetizable (forwarding on the chat page), the power that Tencent can unleash through its social ecosystem cannot be underestimated by any internet platform.

Tencent has always been restrained in the commercialization of WeChat. In the second quarter conference call, management also lowered market expectations, making it clear that the market's expectations were too high, and Video Account needed several quarters of polishing before it could achieve a revenue scale of CNY 1 billion for a single quarter.

Thus, compared to advertising monetization on Video Accounts, which has limited incremental revenue for Tencent, Dolphin Analyst is more looking forward to a 360-degree closed-loop sales solution for businesses that will be provided after bundling video accounts with mini programs, Tencent Work, WeChat groups, and other functions. For businesses, once users add their enterprise WeChat, this part of the traffic will completely transform from public domain traffic of the platform to private domain traffic of their own, and in terms of stimulating repeat purchases, the flow cost is close to zero. In April of last year, Dolphin Analyst emphasized this point in research conduct for businesses, thinking about flow property wars, when businesses begin to care about flow property rights, how should platform players balance their linguistic power? For existing players in the industry, Tencent's entry brings an all-round impact, which will intensify the share grabbing of short videos from other ad forms in the short term. However, in the medium to long term, growth space of both government-oriented Douyin and the privately-oriented Kuaishou, Bilibili, and Xiaohongshu will be significantly compressed.

Overall, Dolphin Analyst is cautiously optimistic about the pan-entertainment industry in the next six months and needs to "make the best of both worlds" by taking into account current valuations. The industry as a whole shows signs of slowing down against the wind, but growth is not yet recovered.

The channel side of the brawl continues to escalate, and although short videos are still growing, the competitive landscape is deteriorating, and old players will continue to be challenged by new players.

As for content, only games have a focus point. Since the regulatory turning point in April, the industry has revived with positive emotions, but valuation repairs caused by emotional changes will be ahead of performance, and different companies' performance will diverge due to their different product cycles.

In our next article, we will focus on specific individual stocks and elaborate on the investment logic and valuation of the important companies in this stage, including Tencent, NetEase, MitoQ, Kuaishou, and Bilibili.

〈End of Article〉

Dolphin's articles related to "Pan-Entertainment Overview":

May 5, 2022, "Breaking the Game in Pan-Entertainment: Re-exploring the Vast Ocean of Tencent and Bilibili."

April 15, 2022, "Big Movements, Small Splashes: Why Does the Resumption of Game Edition Numbers Fail to Boost Game Stocks?"

September 15, 2021, "Reviewing the Pan-Entertainment Industry (Part 2): Another Winter, How Far is the Spring of Tencent and Kuaishou?"

September 13, 2021, "Reviewing the Pan-Entertainment Industry (Part 1): Another Winter, How Far is the Spring of Tencent and Kuaishou?"

Risk Disclosure and Statement for this article: Dolphin Investment Research Disclaimer and General Disclosure