Alibaba, Meituan, JD.com, Pinduoduo: Have they all given up? Still have to strive for "the big game".

Last week, in Dolphin's "Will Chinese stocks have a 'rebirth' this time?" article (https://longbridgeapp.com/topics/3444421), the main issue of delisting risk was addressed. The core judgment is that although the risk seems to have reduced, the fundamental problem has not been solved yet. Chinese stocks are still a "gunpoint" in the battle and game between major powers.

Delisting risk is still a sharp blade that hangs over the valuation of Chinese stocks and suppresses their upward potential.

In this case, Chinese stocks should focus more on short-term stock price recovery opportunities through value decline and fundamental recovery resonance. This article focuses on the e-commerce sector among the retail sector, by reviewing the industry and competition, to help you understand the potential for high market value e-commerce giants to emerge:

-

Does cyclical e-commerce still have any opportunities?

-

Can companies with relative advantages still emerge?

For friends who are interested in Chinese stock research reports, please add WeChat ID "dolphinR123" to join the investment research group and get Dolphin's in-depth research reports and discuss investment opportunities with experienced investors.

Dolphin mentioned in its Internet sector summary of the first half of this year in the article "How Much Value Do Alibaba and Tencent Have in the Era of Decaying Cycles?" (https://longbridgeapp.com/topics/2317128?invite-code=032064) that the entire Internet industry, including e-commerce, is undergoing a declining cycle. Under the overall environment of "low stock prices, strong regulation, and weak consumption," the industry as a whole has entered the first curve of "building internal strength" and the second curve of "restructuring." Let's take a look at the new changes in the industry six months later:

1. Has the penetration rate increased again? Actually, it's still "cooling down."

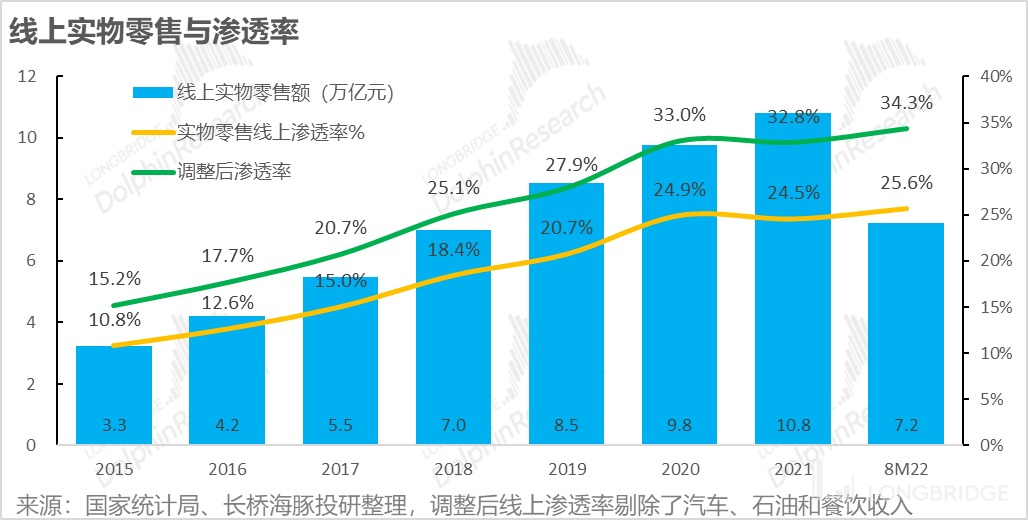

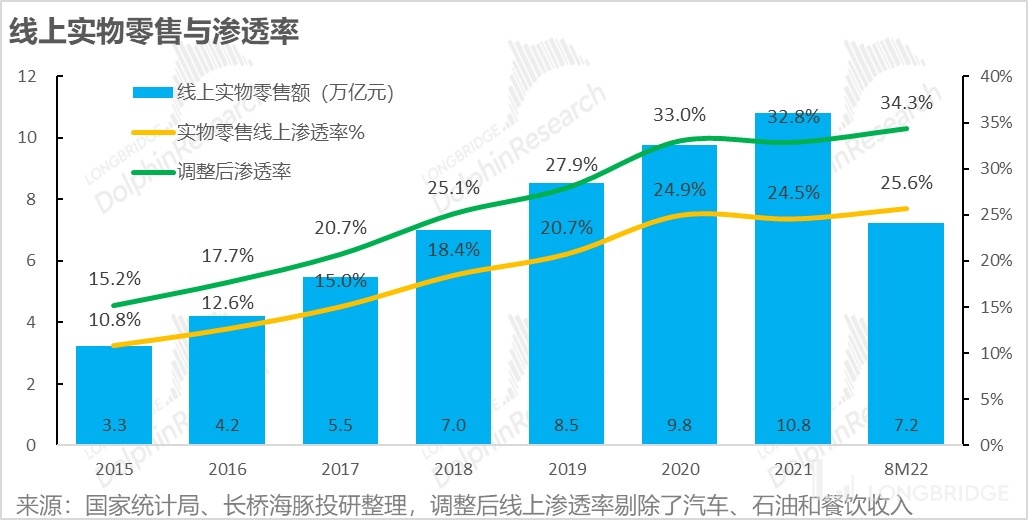

Dolphin previously mentioned the e-commerce penetration rate in 2020, the year when the pandemic surged, experienced a "big leap forward," but in 2021, the market encountered a "counterattack" to the logic of the penetration rate story. In 2022, it seems that this trend is back again.

As of August 2022, adjusted online retail penetration rate, excluding categories such as catering and automotive petroleum, has reached 34.3%, slightly higher than the peak of 33% in 2020.

However, in fact, in the first half of this year, stringent and normalized epidemic prevention and control measures were implemented, and the increase in online penetration rate came at the cost of continuous shrinkage of offline retail, and this was not a natural state of penetration. Thus, it is not very referential.

If we look at the categories, Dolphin classifies penetration rates above 40% as zero-penetration opportunity categories, 30% as slow-penetration categories, and below 20% as "opportunity" penetration categories-dining and beverage and furniture. It can be clearly seen that the main way to increase the penetration rate on the food and beverage line is to approach the community retail, especially through community group buying. Currently, in the words of insiders in the industry, community group buying is already "not based on order quantity".

Although now e-commerce platforms are starting to use 3D modeling and virtual scene display to promote furniture, as an optional consumption in the real estate cycle chain, the overall contraction of furniture sales is quite serious.

II. Standing under the "Social Retail Market," we face cloudy skies

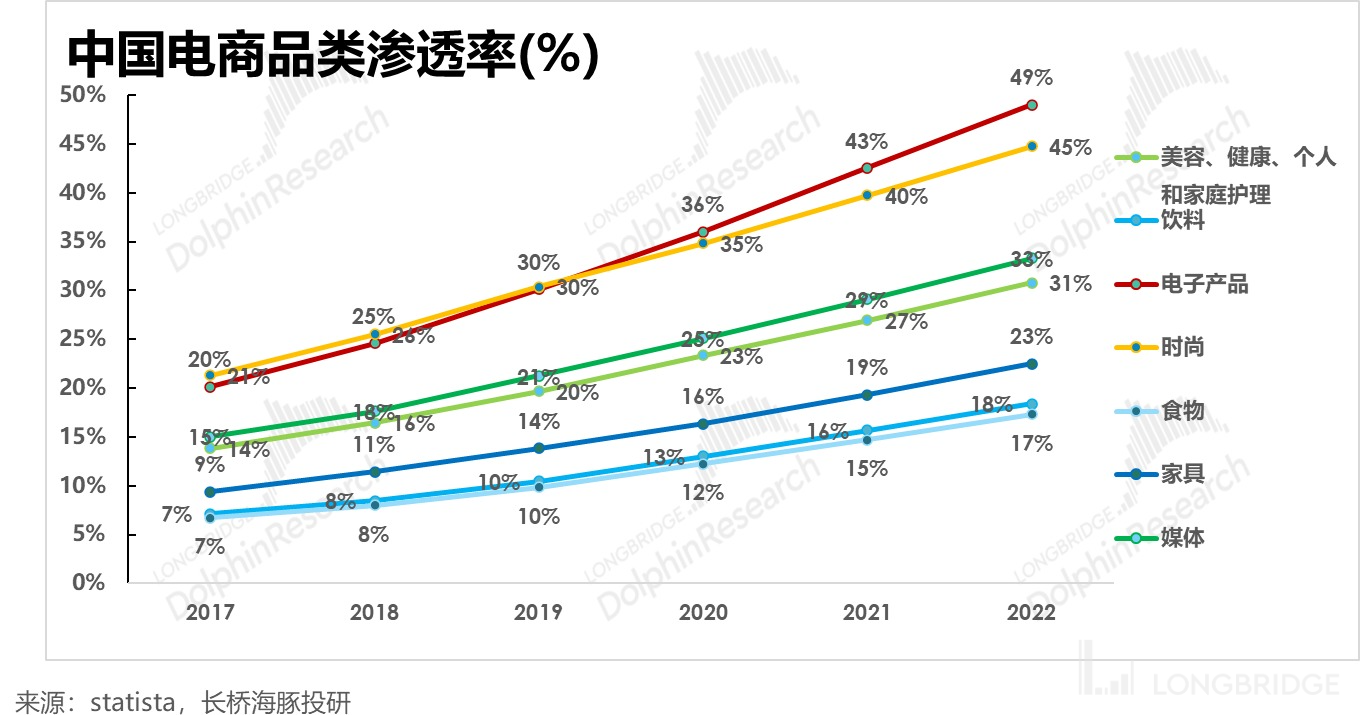

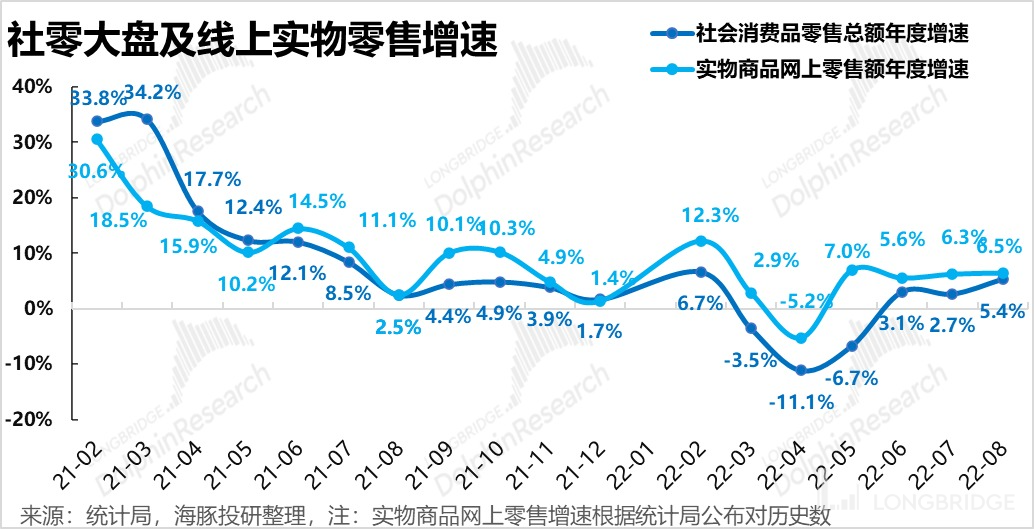

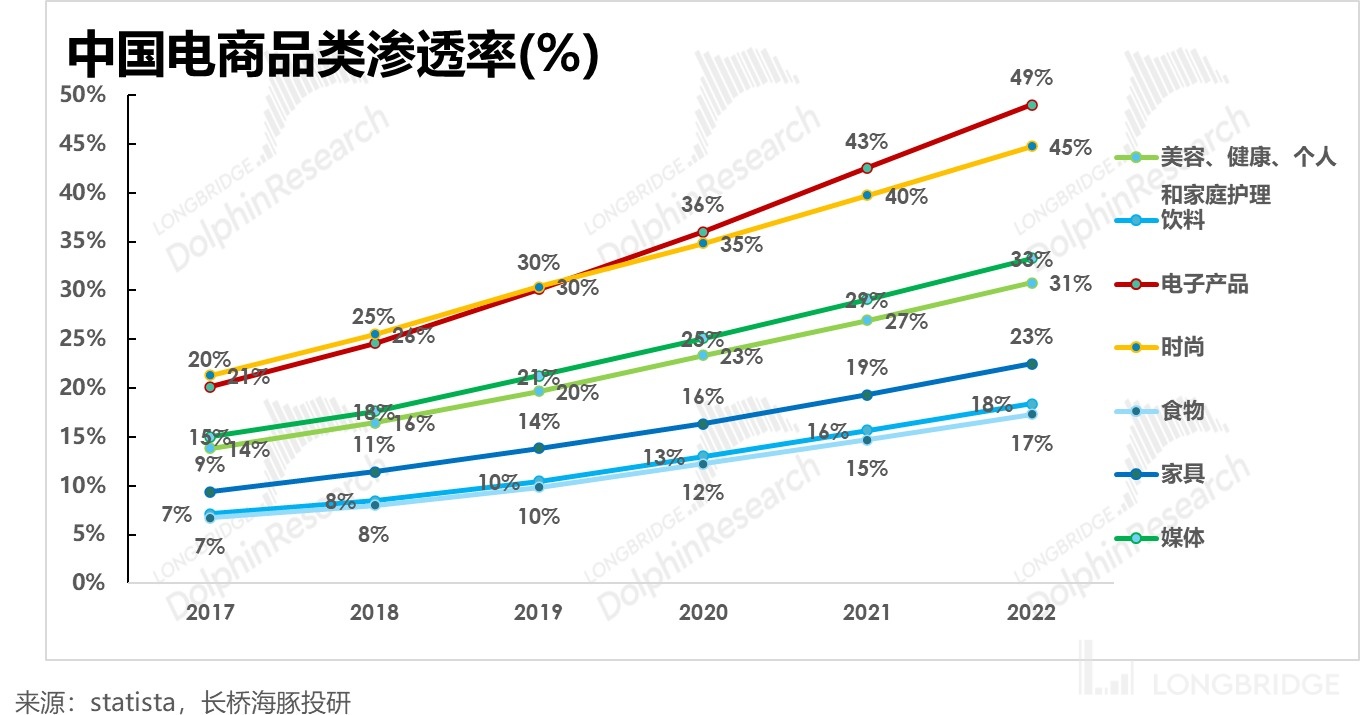

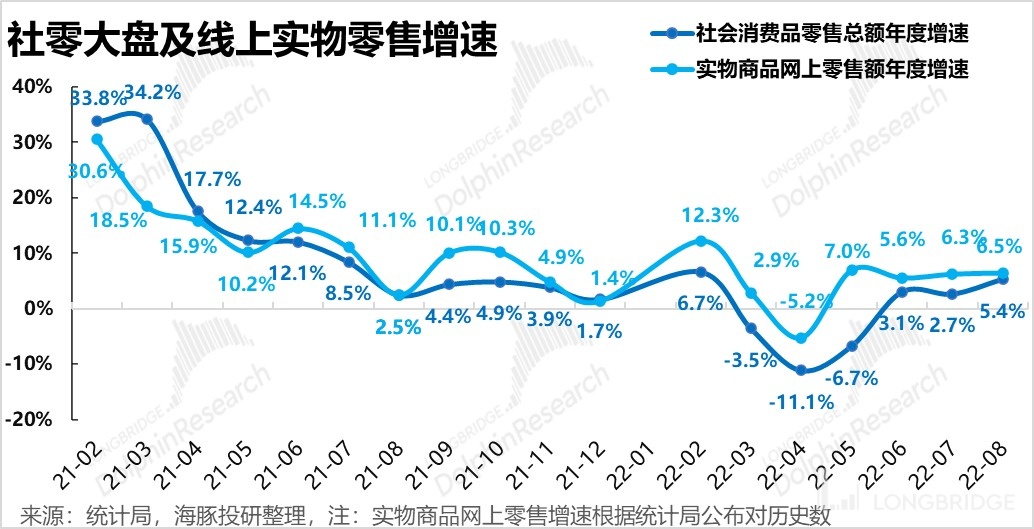

In the absence of online dividends, e-commerce is essentially a sector that is "eating off the land," relying on the social retail market. However, under the "fully-static" and "strictly-defended" anti-epidemic approaches during the pandemic's peak and valley periods, the overall social retail market remains in a "draw-a-line-in-the-sand" state.

Looking at the latest data from August, once the benefits of the epidemic on online retail recede, the growth of online retail will return to the level of the entire social retail market. It can be seen that the impact of macroeconomic consumption on online retail is becoming more obvious, and there is no real improvement in the logic of penetration rate, making it difficult for online retail to break out of the independent market. Although there is still relatively more robust advantage online, the trend of the industry shifting from a growth industry to a cycle is continuing. The growth of the consumer market itself will be the dominant factor affecting the growth of online retail.

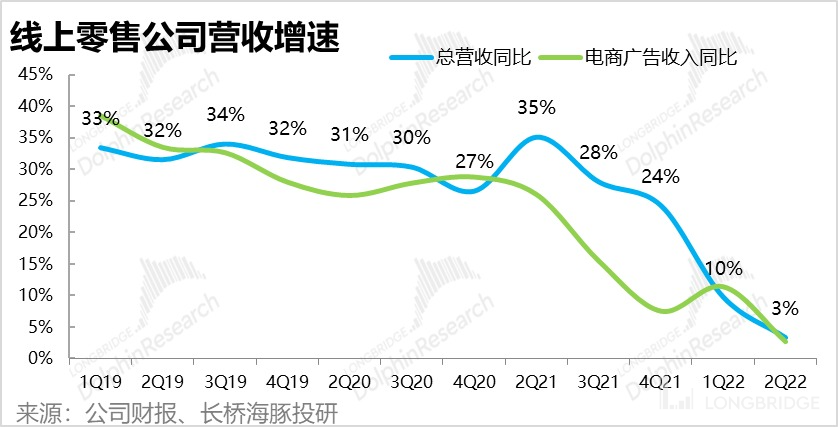

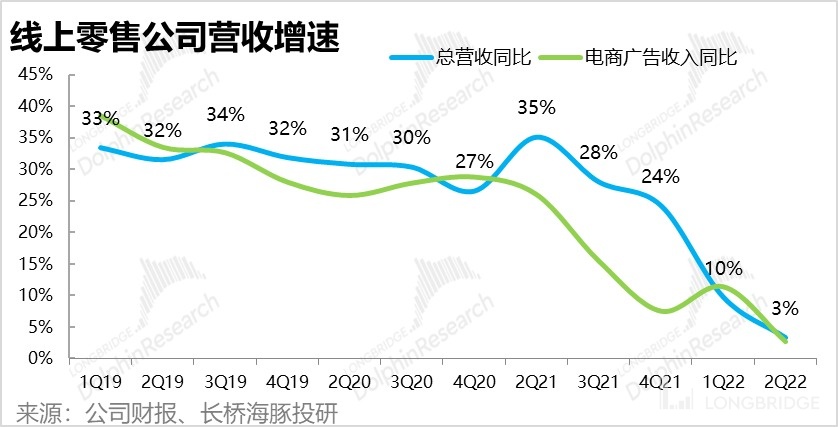

We are all under the same "social retail market," and have entered a period of relying on the market. It is not easy for e-commerce platforms overall, and the overall result of the industry reflected is that Q2 2022 online retail companies, especially after the shrinkage of community group buying, showed a overall revenue growth rate of only 3%.

III. Relying on the Market Is Difficult, Only by Cutting Costs and Surviving

In the past year, strong regulatory policies have blocked the capital-driven "burning money" and opening up a second front business model. Under the circumstances that e-commerce's main track is dependent on the market where the sky is cloudy, e-commerce platforms have only two options: training their internal skills, or even breaking their arms and saving themselves. In terms of corresponding financial reports and operating performance in the second quarter, there are three major points:

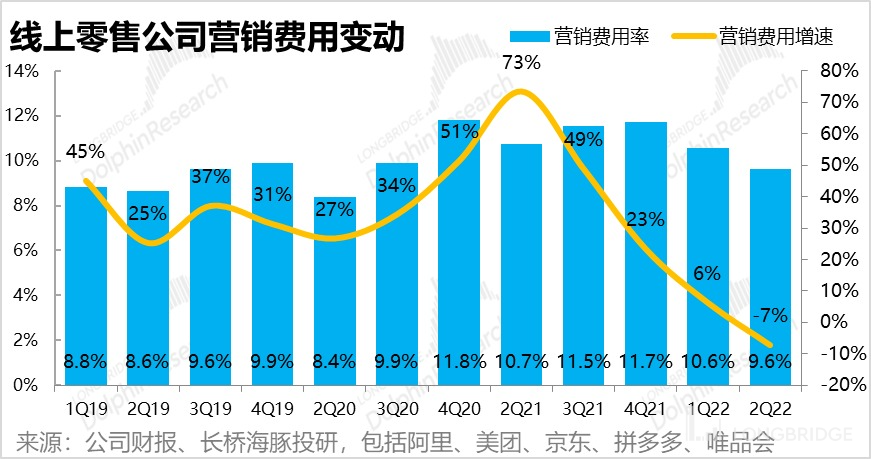

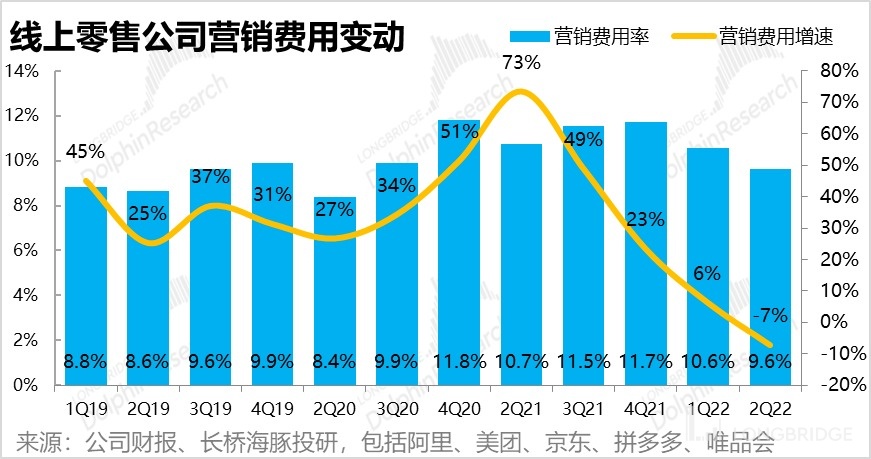

1. Negative growth in marketing expenses that was unprecedented

After experiencing an accelerated investment period between 20Q3 to 21Q3 (corresponding to the e-commerce period of internal competition), sales growth rates have continued to slow down since the fourth quarter of last year, and have even declined by 7% year-on-year in the second quarter of this year; after the sales expense ratio reached its peak in 4Q21, it has continued to decline, and in the second quarter, a negative growth of industry marketing expenses appeared for the first time. As Dolphin Analyst who has been tracking the e-commerce sector for a long time and looking at the interchange between investment and contraction periods each time, It is a situation that has never happened before.

In terms of marketing strategies represented by negative growth, in addition to cutting down on new businesses, e-commerce platforms are no longer focused on acquiring new customers. This is also why Pinduoduo and Alibaba have both chosen not to disclose their annual number of active buyers.

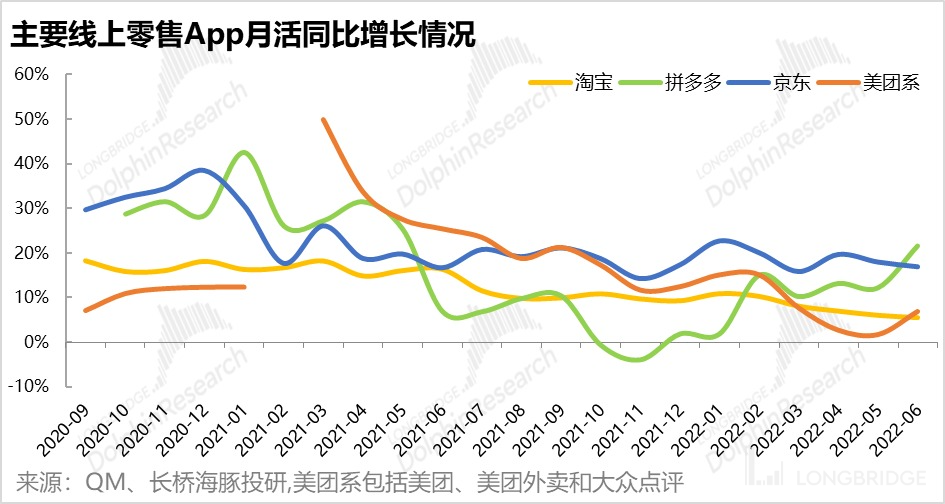

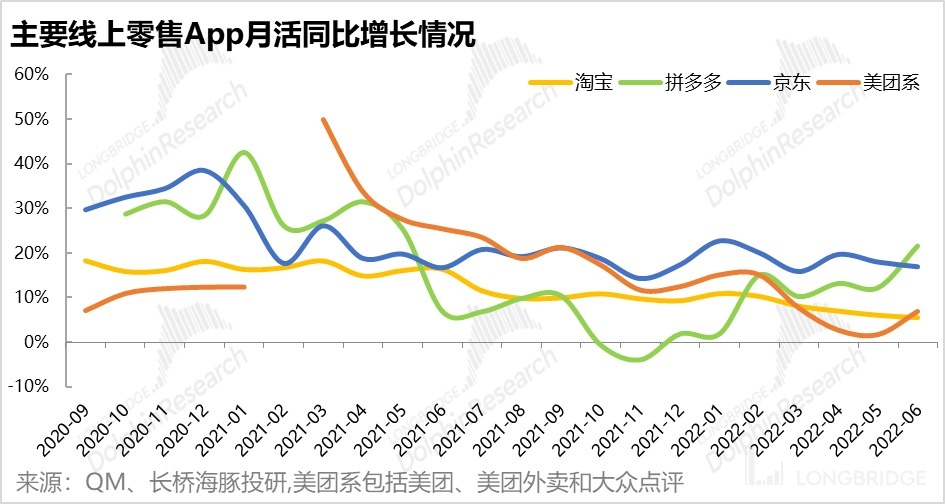

According to QuestMobile, with the decrease in investment, the monthly active users of Taobao, Jingdong, and Meituan have been gradually slowing down since 2022, and only Pinduoduo has seen a relatively significant increase in monthly active users, with marketing expenses increasing at the same time.

2. When targeting user stickiness, high DAU and duration are even more important.

In addition to an overall decrease in marketing budget, the structure has shifted from customer acquisition and new users to user stickiness and single-user wallet share: Pinduoduo, Meituan, Alipay and other apps are all promoting similar gift programs that can be redeemed for free, but require long and regular operations for users to promote app usage frequency and habits.

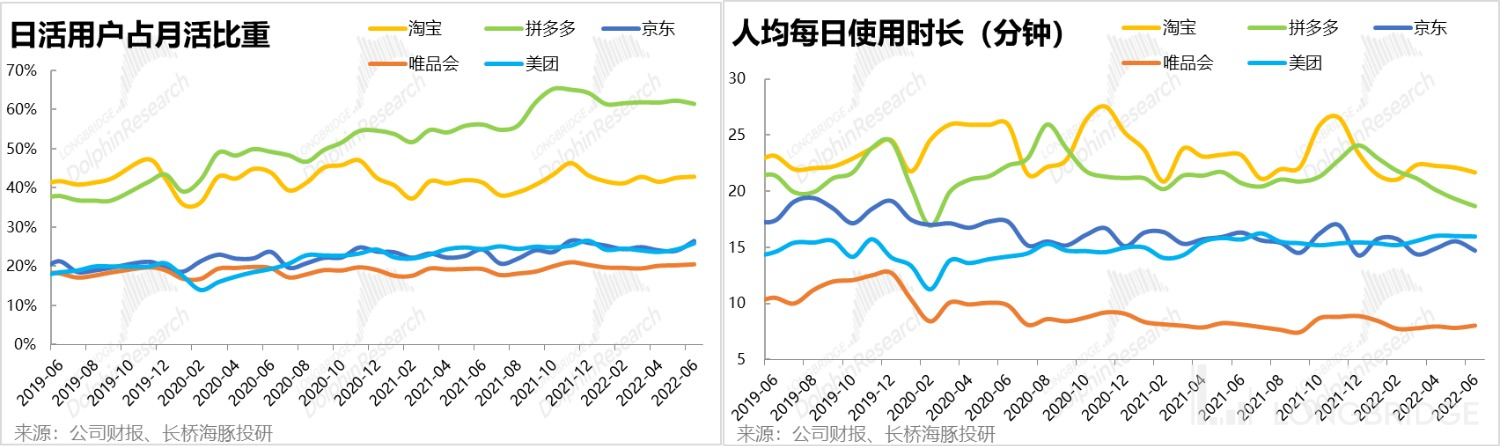

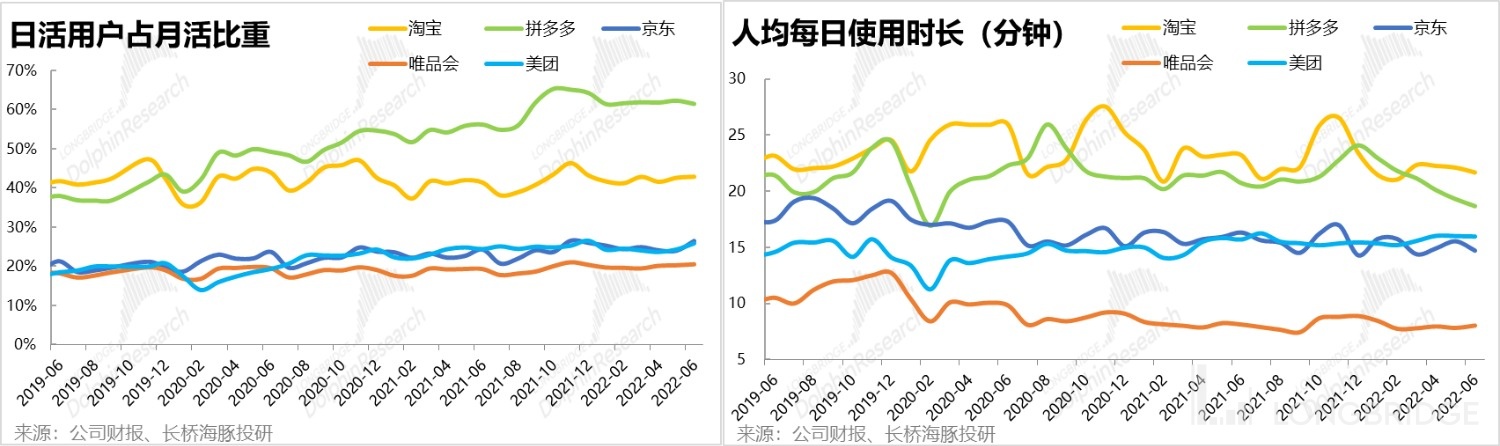

As for the comparison of user stickiness (DAU/MAU and single-user duration):

(1) According to QM data, in terms of the proportion of daily/monthly activities, Pinduoduo has gradually surpassed Taobao and is in the lead, with a daily activity ratio of over 60%; Taobao ranks second, with a daily activity ratio of over 40%; and Jingdong and Meituan are basically the same, currently at around 26%.

(2) In terms of the daily usage time per capita. Taobao and Pinduoduo are in the first tier, with an average daily usage time of about 20 minutes; Jingdong and Meituan are basically the same, in the second tier, with an average daily usage time of around 15 minutes; while Vipshop's average daily usage time is only about 8 minutes.

Overall, the ranking of user stickiness among various platform apps are: Pinduoduo > Taobao > Meituan~Jingdong > Vipshop.

3. Even without income, one can still make "profits" after starting from scratch.

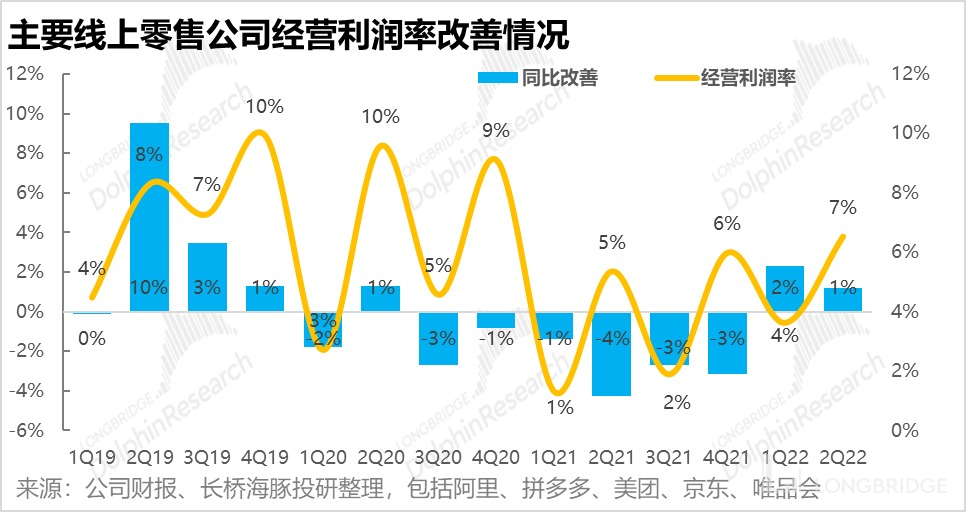

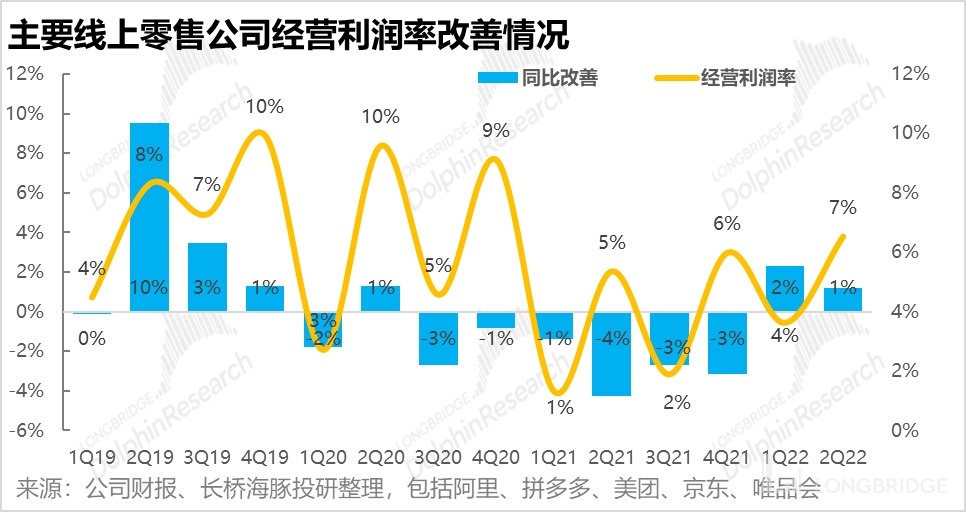

As "weak consumption, strong regulation, and low stock prices" have caused internet companies to get stuck in the money-burning mode, and main electronic business platforms have reached their peak, a major manifestation of improving self-discipline is to reduce costs and increase efficiency: ①Externally - reducing marketing investment and user subsidies. ②Internally: Cut business and cut personnel. As a result, the profit margins of various companies have been continuously improving since entering 2022.

As shown in the figure below, the operating profit margin of major online retail companies continued to decline for 6 consecutive quarters on a YoY basis from 3Q20 to 4Q21. Finally, the profit margin returned to an upward trend in the first two quarters of 2022.

In this way, when the industry growth rate is gone and everyone's competition has settled down, the customer acquisition with low input and output ratio gradually slowed down, and each company accepted their fate without making trouble. The industry competition eased, so the profits were generally released. Therefore, the industry is probably just a logic of profit release. This is the logic, but it is not the whole story.

四、There is a big dark cloud above, but is your "sky" necessarily the same as mine?

Although everyone is turning from scale and market share to profits in tough times, each company has stopped injecting chicken blood and turned to natural strength of the platform to compete. Due to the relatively differentiated positioning of each e-commerce platform, the thickness of the "dark cloud" on each company's head actually varies greatly. Here's a detailed explanation of Dolphin Analyst's analytical thinking. If the core participation factors of e-commerce business are divided into:

(1) Supply-side commercial flow: brands, commodities, SKUs;

(2) Supply-side logistics: express delivery, immediate delivery;

(3) Demand side: total number of users and the purchasing power of a single user;

(4) Platform side: competition, regulatory environment.

And currently, from the overall environment perspective: in the physical e-commerce field, unlike the strong control of immediate delivery in the service e-commerce, most warehousing and transportation capabilities in the logistics industry are not e-commerce platforms' own assets except for JD, the competition between platforms has eased, and regulation has broke the substantial monopoly of goods by platforms.

And the current core is to see the platform's ability to meet the demands of merchants and users. And if we look at the biggest characteristics of these three at the current stage:

(1) Merchants: clearing inventory - in most consumer goods seen by Dolphin Analyst, the inventory turnover days of most consumer goods industries are relatively high, and high-efficiency inventory clearing is the most prominent demand of merchants in the core links of the entire lifecycle of goods - new product development, new product launch, explosive sales, and inventory clearance.

(2) Users: extreme thrifty - under the situation of rising unemployment rate of the main consumer group and uncertain income prospects, saving money is the top priority.

(3) Platforms: in the big environment where the merchants are clearing inventory and the users are thrifty, the leading platforms are no longer pumping chicken blood, and do not want to let users make profits anymore.

And these elements put together is probably such a combination: users want cost-effectiveness, merchants want to clear inventory, and platforms do not want to let users make profits anymore. Without being "pumped with chicken blood," users will return to the cost-effective platform in their mental perception and the inventory-clearing platform in the minds of merchants. Currently, the platform for clearing inventory can be roughly divided into vertical category clearance-Vipshop, live-streaming e-commerce clearance-Kuaishou, and comprehensive clearance platforms/price-performance ratio platforms in user's minds-Pinduoduo.

After resigning oneself to fate, who will perform better? Based on <1-3> above, in the context of "weak consumption, strong regulation, and low stock prices", each company has resigned themselves to short-term difficulties. No longer are they fiercely competing in community group buying. Meituan has returned to local services, JD.com is doing quality e-commerce, Pinduoduo is doing agricultural products and cost-effectiveness, and Alibaba is doing a comprehensive e-commerce platform for "everything can be bought". Because of this, Dolphin Analyst made an overall configuration for e-commerce based on the logic of profit release.

However, after resigning themselves to fate, on top of the accumulation of differences in commercial barriers and organizational response speed, each e-commerce platform is not in the same position within this cycle. In this cycle:

(1) When the merchant clears inventory and users want a cheaper option, an e-commerce platform established with the benefits of clearance and cost-effectiveness will have more advantages.

(2) Platforms with high user stickiness: i.e., e-commerce platforms with high DAU and user duration.

During the period of overall slowdown in the competition and the release of profits, the ability of an e-commerce platform that meets the demand for clearing inventory with merchants/price-performance ratio and a platform with high stickiness will be stronger against the pressure brought on by the industry's slowdown in growth.

Based on this, Dolphin Analyst, on the basis of the previous e-commerce inventory competition "barrier theory" (as discussed in "Crushing Alibaba, Meituan, and Pinduoduo. Are There Real Barriers to Traffic Wars in the E-commerce Industry?" (https://longbridgeapp.com/topics/1159514?invite-code=032064)), added a judgment of the e-commerce stage "cycle theory" and pointed to the core company under this logic, which is Pinduoduo.

(6) After resigning themselves to fate, who will perform better? When it comes to the overall investment strategy of the e-commerce sector, the scope must be broader, and here, Dolphin Analyst reiterates the overall summary of the first half of this year in "As the Cycle Declines, What Value Do Alibaba and Tencent Have Left?" (https://longbridgeapp.com/topics/2317128?invite-code=032064):

1. China-under the background of strong epidemic prevention measures, weak consumption, strong regulation, and low stock prices.

a. Low stock prices combined with strong regulatory measures mean that the mode of financing-driven burning of money to grab market share cannot be sustained. No one is willing to pay for the "imaginary" second-line story, and the new business development model based on Internet methods is impeded.

b. Weak consumption means that under the circumstances of blocked new business development paths, the basic e-commerce foundation is facing the awkward challenge of rapid "decreased growth," and the overall e-commerce sector has entered the "platform" phase.

c. With the first-line growth lost and the imaginary second-line story difficult to achieve, all that is left to do is to work on improving the infrastructure and release profits.

2. Overseas-under the background of the aftermath of the epidemic, the strengthening of the currency dominated by the US dollar, and the competition between major powers. a. E-commerce companies are denominated in RMB assets but listed completely outside the mainland and priced in USD. During the period of the US market rebound and USD appreciation, their valuations will continue to be suppressed.

b. As long as the risk of Chinese concept stocks delisting due to financial decoupling caused by the competition between major powers is not fundamentally resolved, the overall Chinese concept stock market will only have a chance for a rebound under extremely low valuations. It is difficult to truly open up upward space.

The result of the resonance of these two major factors happens to correspond to: the overall Chinese concept stock market has no upward space but has bottom-line value. As the competition in the e-commerce sector slows down and profits are released in the second half of the year, when it falls to the bottom, the value of its sectoral overall configuration will become more obvious. In terms of choices, the companies with higher priority barriers, such as Meituan, are preferred, followed by companies with not so clear barriers but with phase-specific benefits, such as Pinduoduo.

Of course, any company must be comprehensively evaluated from the three dimensions of "good company, good management, and good price" from the perspective of cycle or barrier. Appropriate cost performance is the top priority. Dolphin Analyst will focus more on the specific value judgment and analysis of each e-commerce platform in the next article. Please stay tuned.

Dolphin Research Institute's relevant research in the past:

April 27, 2022, "Alibaba vs. Pinduoduo: After the Bloody Battle, Will Only Coexistence Remain?"

April 22, 2022, "Meituan, JD, Why Are They in Outstanding Positions in the Stockpile Battle?"

April 13, 2022, "As the Cycle "Decays", How Much Value Do Alibaba and Tencent Have Left?"

Risk Disclosure and Statement for this article: Dolphin Disclaimer and General Disclosures