Wolfspeed: The hard currency in silicon carbide, being too expensive is the "original sin".

After Tesla brought silicon carbide to the forefront, various automakers and investors began to pay attention to this niche field, and Wolfspeed is a company that cannot be ignored in this field.

In the previous article "Wolfspeed: Tesla's Secret 'Hard Currency'" by Dolphin Analyst, the high growth of silicon carbide and Wolfspeed's absolute leading position were mainly explained. However, when it comes to thinking about public companies, the ultimate focus is still on investment and whether or not to buy.

This article mainly focuses on two aspects: Firstly, what is the core barrier of silicon carbide? Secondly, can Wolfspeed be bought now? Here are the core conclusions:

①What is the core barrier of silicon carbide?

Dolphin Analyst believes that the substrate is the most valuable and difficult part of the silicon carbide production process. Due to the difficulty of controlling crystal growth, good control of thermal field, crystal type, doping and other aspects is required, which also leads to low yield in substrate production. As a pioneer, Wolfspeed has accumulated process capabilities, which is its core barrier, making it generally ahead of foreign counterparts in the core wafer size by about 3 years, and ahead of domestic counterparts by about 8 years.

②Can Wolfspeed be bought now?

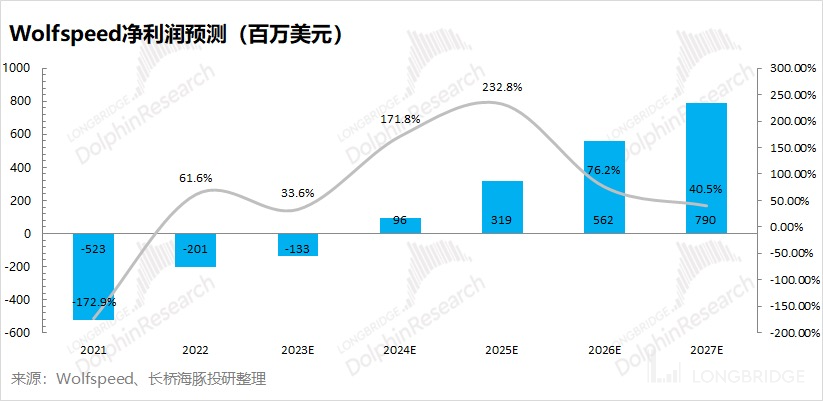

Although Wolfspeed has raised its mid-to-long-term revenue expectations in recent communications, the company has not yet achieved profitability. Although the company's revenue has achieved high growth of more than 30% in recent quarters, Dolphin Analyst expects that the company's profit will not turn positive until the 2023-2024 fiscal year.

In the context of the continuous rise in US bond yields, Wolfspeed, as a growth stock, is obviously under pressure. Dolphin Analyst used both PE and DCF perspectives to estimate the company's valuation, expecting the target price range to be between 89-113 US dollars per share, which corresponds to the current price running in a reasonable space. However, the macroeconomic contraction has a heavier impact on its stock price, and the current price is not suitable for intervention. Specifically:

①In the short term: In the context of the rising yield of US Treasury bonds, the current stock price of 109.84 US dollars will have great upward pressure;

②In the mid-to-long term: As the leading player in the booming silicon carbide track with demand certainty, it is more important to squat a high-performance price. When the company's stock price is significantly lower than the target range in the fluctuation (such as the 58 yuan price in the end of June), it will provide better buying opportunities for investors.

I. Where is Wolfspeed's strength? Production process is the core

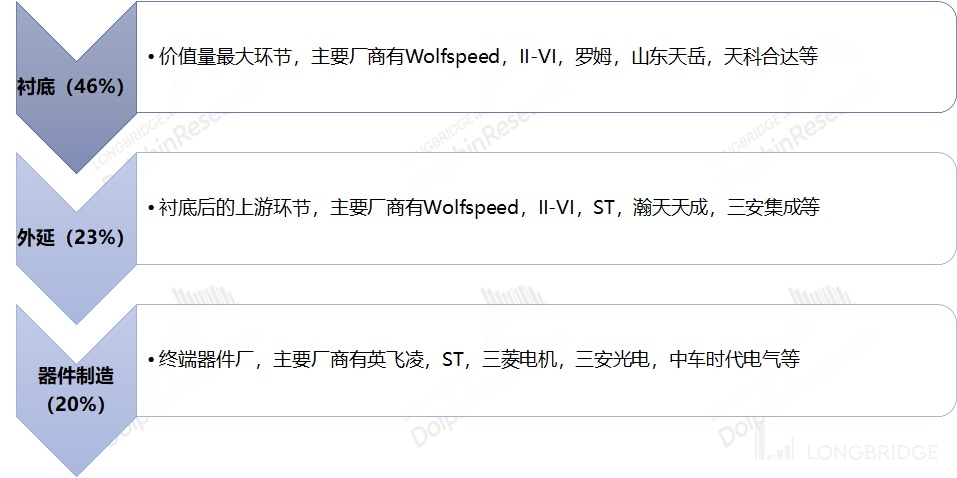

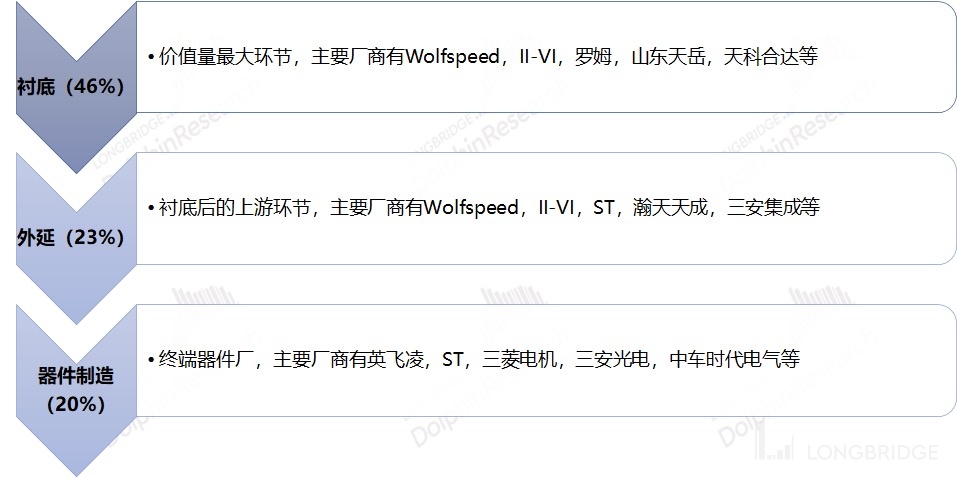

The production of silicon carbide mainly involves three links: "substrate-epitaxy-device manufacturing", among which the substrate is the most valuable part of the industrial chain (46%). Although Wolfspeed has the production capacity of the entire industrial chain, the company still focuses mainly on the substrate business. As Dolphin Analyst mentioned in "Wolfspeed: Tesla's Secret 'Hard Currency'", "The most anticipated material in the new energy field is conductive materials, which can be used in new energy vehicles, rail transit, as well as high-power transmission and distribution." Currently, there are some manufacturers engaged in silicon carbide substrates, but Wolfspeed has an absolute leading position in the field of conductive substrates for new energy. In other words, Wolfspeed is the core target in the field of silicon carbide, and cannot be bypassed in related research.

Source: Dolphin Investment Research

Since it is so critical in the industrial chain, what is the process of the entire product, especially how is the substrate made?

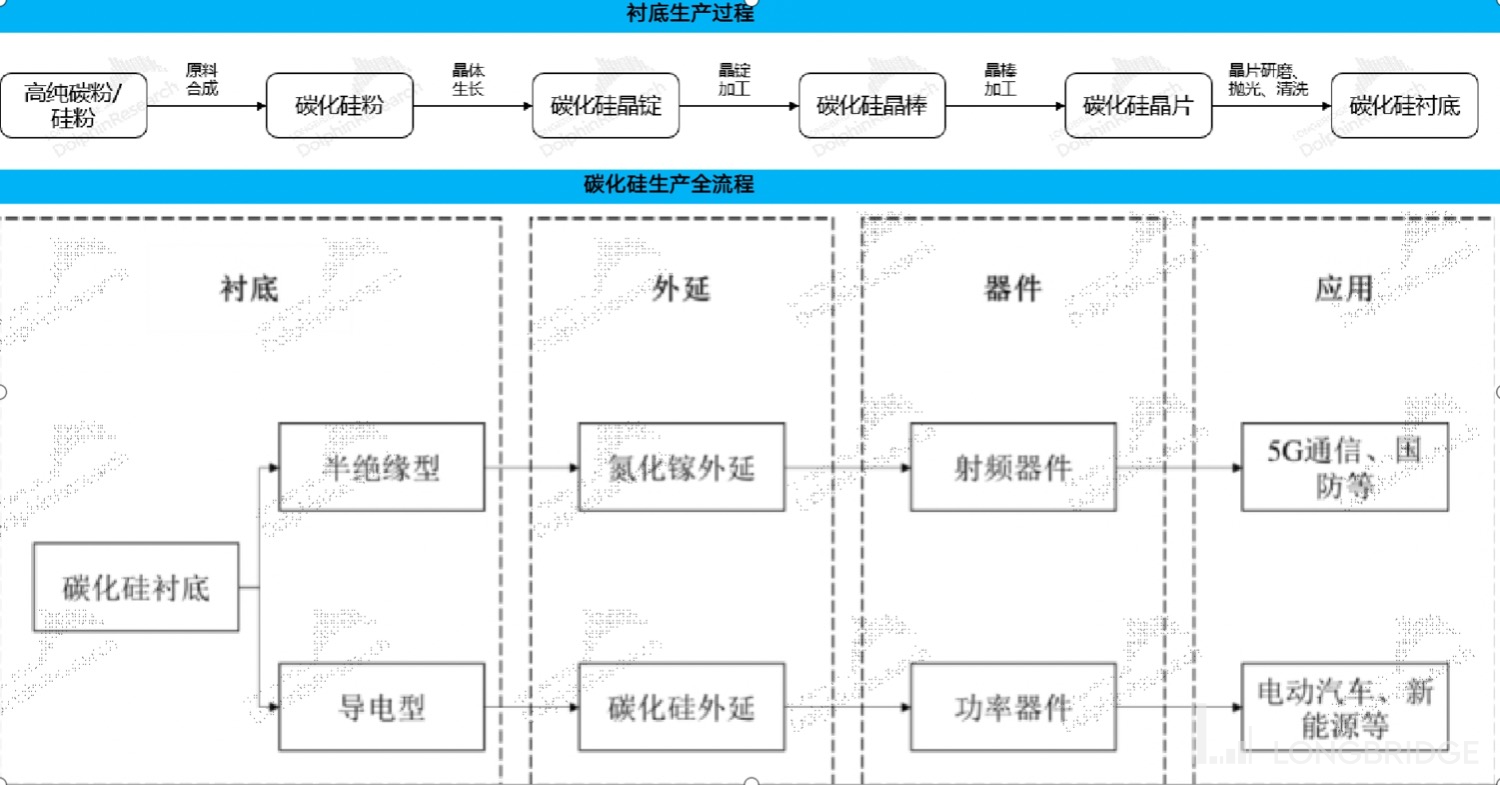

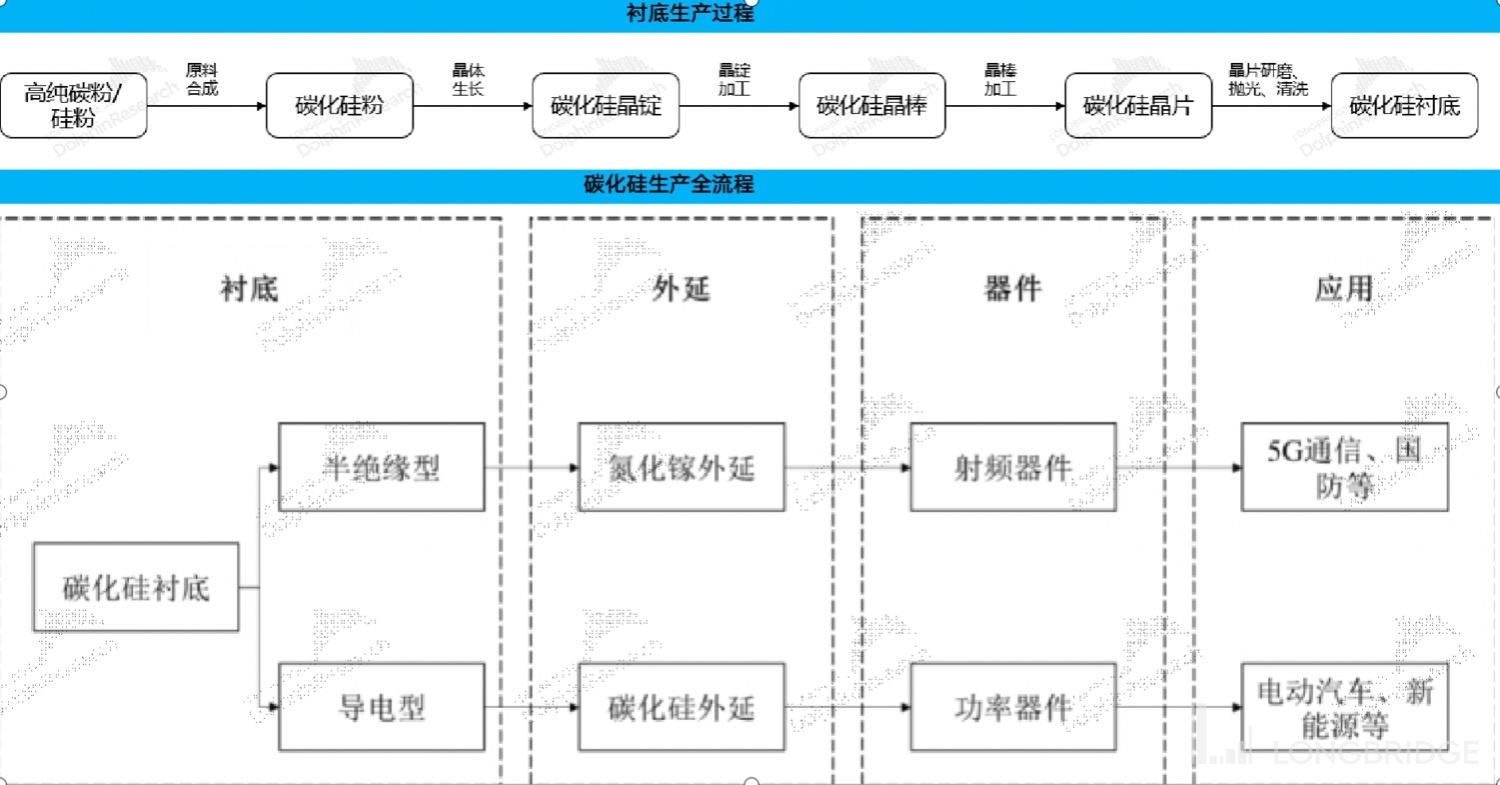

The preparation of silicon carbide substrates requires the process of "raw material powder-crystal growth-crystal/ingot processing-wafer grinding/polishing/cleaning".

Among them, in the process of crystal production, impurities doped with different elements are used to finally produce conductive and semi-insulating silicon carbide wafers. The power devices made from conductive ones are applied in the field of new energy and power systems; semi-insulating ones are made into radio frequency devices, which are applied in the field of 5G communication.

Source: Tianke Heda, Dolphin Investment Research

Combining relevant information, Dolphin Analyst found that although the preparation process of silicon carbide substrates is similar to that of silicon materials, the difficulty of preparing silicon carbide is significantly higher than that of silicon-based materials. Due to factors such as higher required working temperature, longer crystal growth cycle, higher crystal type requirements, and greater cutting difficulty in the preparation of silicon carbide substrates, the high-difficulty preparation process directly limits the rapid production of silicon carbide substrates.

In the specific production of silicon carbide substrates, the most important core link is in the "crystal growth process from silicon carbide powder-silicon carbide ingot". The main barrier in the crystal growth process is the control of the production process.

There are several methods for growing silicon carbide single crystals: physical vapor transport (PVT), liquid phase epitaxy (LPE), and high-temperature chemical vapor deposition (HT-CVD). At present, the most mainstream choice for commercial applications is PVT.

The main difficulties in the preparation of silicon carbide substrates are:

- Thermal field control: it is prone to crystal layer misalignment and defects such as misalignment in an environment above 2000 degrees.

- Crystal Phase Control: There are more than 200 types of silicon carbide crystals, and it is difficult for the company to produce a specific type steadily;

- Doping Control: Accurate doping is required during the manufacturing process to prepare the desired conductive crystal (Wolfspeed makes few insulated chips);

- Surface Control: The technology of cutting and polishing directly affects whether the product will crack and other issues.

Moreover, the larger the chip size, the greater the difficulty of growing and processing the corresponding crystals, but larger chips can increase downstream device manufacturing efficiency and reduce unit costs. Currently, only WolfSpeed is capable of producing 8-inch substrates the earliest, while its peers will be about two to three years behind.

As WolfSpeed has accumulated long experience in preparing silicon carbide substrates, in terms of R&D and precipitation of process technology, the company has a clear first-mover advantage in the substrate field. At present, the company is more than three years ahead of its peers in both 6-inch and 8-inch products.

II. Wolfspeed's Production Capacity Planning and Revenue Expectations

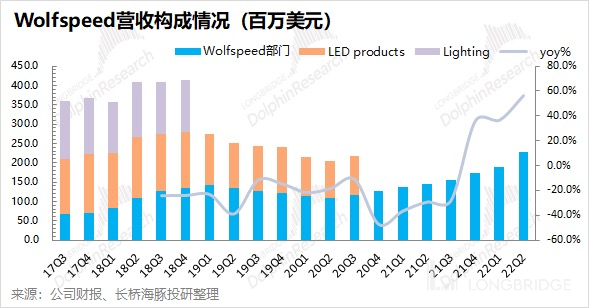

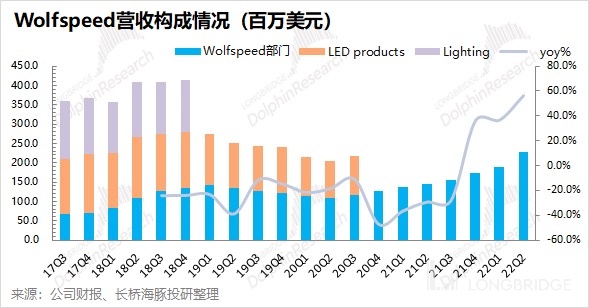

Since we are looking at Wolfspeed, let's start with the company's revenue stream. Wolfspeed's predecessor was the Cree Group, with a business covering three major segments: LED, lighting, and Wolfspeed. As the company foresaw that LED lighting had already entered the "Red Sea" market, it took the initiative to divest its Lighting and LED businesses and now focuses on Wolfspeed's revenue stream, mainly on silicon carbide.

Wolfspeed's silicon carbide business started from substrates and is now also penetrating downstream devices. Currently, Wolfspeed still occupies more than half of the global conductive silicon carbide substrate market share. When the company decided to abandon its traditional business in "Lighting" and "LED", it had already regarded silicon carbide business as the company's future main direction for development.

①Production Capacity Planning: In May 2019, the company announced a $1 billion investment in expanding SiC capacity over the next five years. Its conductive silicon carbide power devices, insulated RF devices, and SiC substrate capacity will each be expanded up to 30 times the first quarter of fiscal year 2017;

②Mohawk Valley Fab in New York State: It is expected to begin volume production at the end of 2022 or the beginning of 2023, and will be the first to achieve 8-inch wafer production;

③Durham Fab in North Carolina State: As the company's main production base for silicon carbide substrates, it already contributes half of the global conductive substrate production capacity. Now, the company plans to expand its secondary plant to support the needs of Mohawk Valley Fab. At present, the revenue of Wolfspeed's SiC business can mainly be divided into two parts: the SiC core business and the RF business:

1) RF business: mainly comes from the acquisition of Infineon's RF business in 2018. At that time, Wolfspeed originally intended to sell its own power and RF divisions, but the US government rejected the sale citing national security risks. The company then turned to acquire Infineon's RF business.

The RF business mainly provides transistors and MMICs (monolithic microwave integrated circuits) for wireless infrastructure RF power amplifiers, based on GaN-SiC technology for RF chips (LDMOS and Gallium Nitride). This business is relatively mature and stable as a whole, and the Dolphin Analyst expects a growth of 10-20% in the medium and long term revenue forecast.

2) SiC core business: it is the largest source of company revenue, including substrate epitaxy and devices. The company's current substrate materials are mainly concentrated in North Carolina factories, and the main production capacity of 8-inch substrates and devices is in New York factories.

SiC core business is mainly used in the new energy field, with conductive type products mainly applied to power devices in new energy vehicles, photovoltaic industrial control and other fields.

The core value judgment of the company depends on the growth judgment of the SiC core business revenue. Moreover, in the current situation of explosive demand, supply is the core bottleneck, which means that there will be as much sales as there is production. Therefore, the company's growth prediction comes from its production capacity and production plan.

However, from the perspective of the Dolphin Analyst's research information and the company's publicly disclosed information, although the company has mentioned factory and production capacity investment plans, the specific production capacity release is unclear.

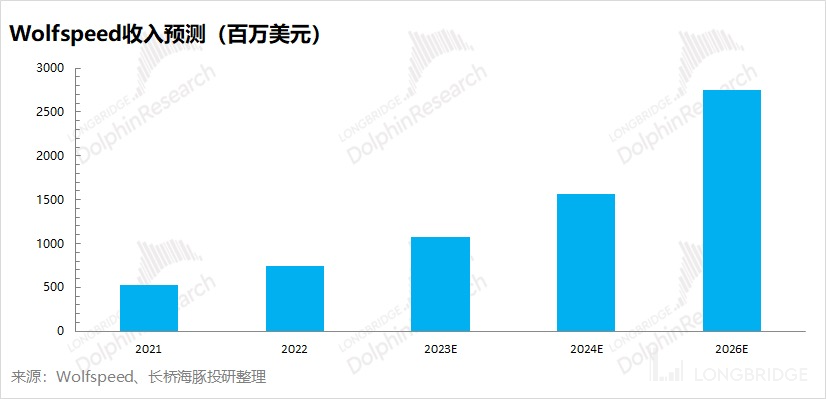

In fact, the Dolphin Analyst has seen that the revenue assessments of various entities for WolfSpeed rely more on the company's guidance for revenue. The stock price rose after the second quarter financial report because the company raised its long-term revenue guidance for 2026. Therefore, the Dolphin Analyst's revenue assessment for Wolfspeed's SiC core business is mostly based on the company's guidance for future revenue expectations.

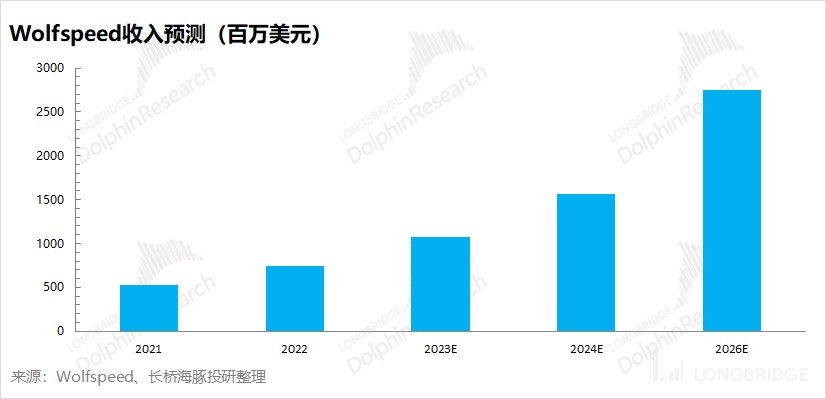

Combining with the company's communication, the Dolphin Analyst expects that Wolfspeed's revenue is expected to surpass $1 billion in fiscal year 2023, reach $1.5 billion in fiscal year 2024, and achieve more than $2.7 billion by 2026, which is basically consistent with the company's guidance. In other words, Wolfspeed's revenue is expected to double in 2 years and double again in 5 years.

Three, Wolfspeed performance estimation and valuation considerations

3.1 Performance Estimation: After analyzing the revenue estimates, Dolphin Analyst looked into Wolfspeed's profit situation, focusing mainly on the gross profit margin and expense ratio.

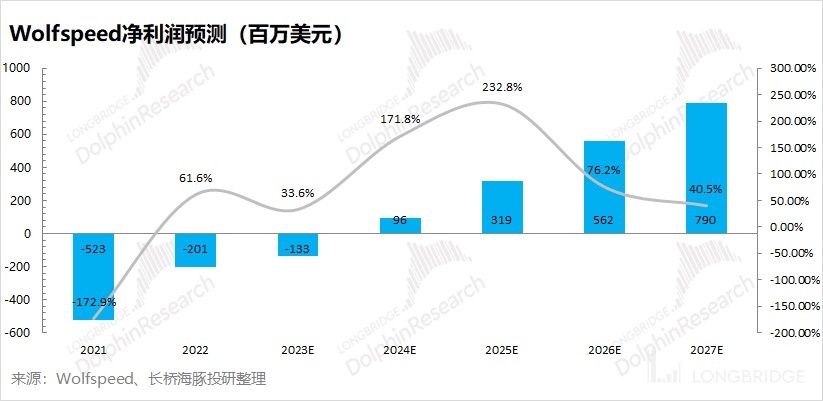

① Gross profit margin: Wolfspeed's gross profit margin fluctuated significantly before due to the cyclical changes in the LED/lighting business. However, now that the two businesses have been divested, the company's gross profit margin has returned to the range of 30% to 35%. With the future production of 8-inch substrates and the growth of device business, the company's gross profit margin is expected to rebound. Based on the company's communication, Dolphin believes that the company's gross profit margin is expected to return to a level of around 50% in the medium to long term.

② Expense ratio: Wolfspeed's operating expenses mainly come from two items: "research and development expenses" and "sales, general, and administrative expenses." Research and development expenses will still account for a larger proportion, while sales expenses can enjoy economies of scale with revenue growth. Dolphin believes that the company's operating expense ratio will decrease in the medium to long term.

③ Net profit (GAAP): After forecasting the expense ratio, Dolphin expects that Wolfspeed will achieve a positive net profit in the 2023-2024 fiscal year on the operating side, and expects that the company's net profit in the 2026 fiscal year will reach $560 million.

3.2 Valuation considerations:

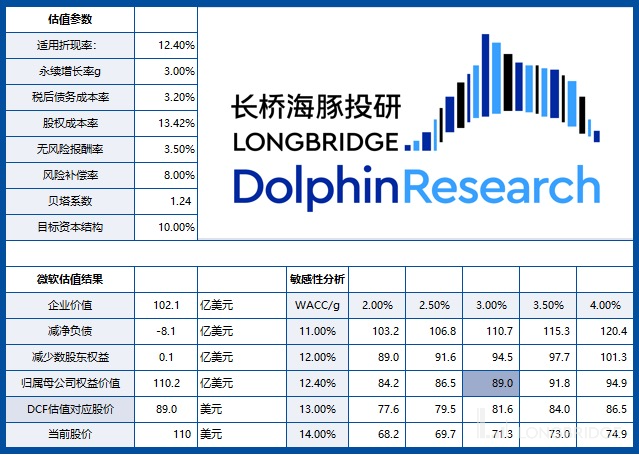

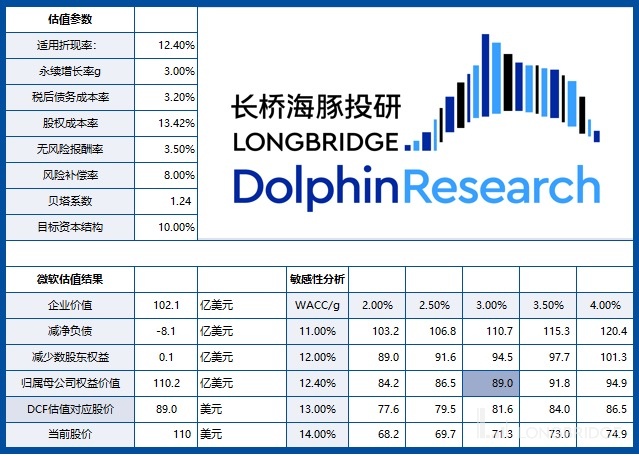

Dolphin's valuation considerations for Wolfspeed mainly come from two aspects: PE and DCF:

- PE perspective: Since the company's current profits have not yet turned positive, the current PE ratio cannot be used for estimation. Dolphin predicts that the company will have positive earnings after the 2023 fiscal year based on performance estimates. After some time, the growth rate of the silicon carbide market will slow down, but the company still has the potential to become a leading growth stock. Considering the company's relatively high growth potential afterward, using a PE ratio of 40 times for the 2026 fiscal year, corresponding to a valuation of $22.4 billion in 2026, and discounted at a rate of 12.4% to a current value of $14.1 billion, corresponding to $113.8 per share (note: if a conservative PE ratio of 30 times is used, it corresponds to $86 per share);

- DCF perspective: mainly from the perspective of the company's future cash flow. Under the assumption of WACC=12.4% and perpetual growth rate g=3%, through sensitivity analysis, Wolfspeed corresponds to a valuation of $89 per share under DCF valuation.

3) Taking into account both PE and DCF valuation perspectives, Dolphin believes that based on Wolfspeed's current business progress and expectations, the reasonable market value space is between $85 and $110 per share, and the current stock price has already reached $110 per share. Against the backdrop of rising US Treasury yields, Wolfspeed, as a growth stock, faces significant pressure at its current position.

In the mid to long term, Dolphin Analyst still believes that Wolfspeed will continue to lead the development of the silicon carbide industry, but in the short term it may still face some upward pressure. If the stock price falls significantly below the target range again (such as the low point of $58/share in June), this will provide investors with a better buying opportunity.

Dolphin's in-depth research on SiC and power semiconductors includes:

- September 15, 2022, "Wolfspeed: Tesla's Hidden 'Hard Currency' on Fire"

- June 14, 2022, "Dancing on a Safety Mat, IGBT Creates a New Era of Electricity?"

- May 16, 2022, "Riding on Railway Transportation with IGBT or Something Else?"

- March 7, 2022, "Behind the Rapid Development of New Energy, Who Will Be the Next King of the Silicon Carbide Race?"

- January 18, 2022, "The Dual Role of IGBT in New Energy and Photovoltaics: How Sweet It Is?"

- January 6, 2022, "Joining the High-Speed Train of New Energy, IGBT Becomes the Hard Core of the Automotive Semiconductor Race?"

Risk Disclosure and Statement: Longbridge Research Disclaimer and General Disclosures