Get to Know a "Forceful" Federal Reserve

Hello everyone, I am Dolphin Analyst!

1. From the central bank annual meeting to the interest rate meeting, the "iron-blooded" Fed strikes back with a heavy blow

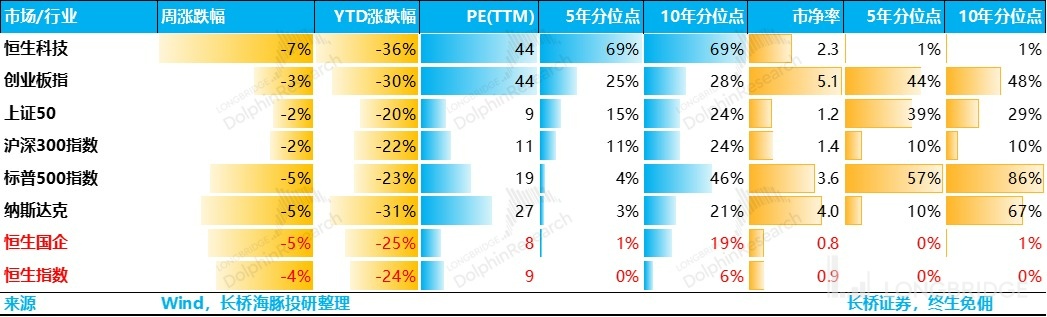

Except for July, interest rates have increased almost every month since these recent few months. However, this time the decline is particularly severe. In Dolphin Analyst's view, the background of this decline is the Fed's three watershed attitude changes throughout this interest rate hike cycle. The Fed has had three major changes:

① At the end of last year, abandon the "temporary" argument for inflation;

② In June of this year, speed up the rate hike;

③ This September, promote the idea of high interest rate environment's "long-lasting" effect.

In September, the biggest marginal change in interest rate hike was not how much the Fed raised the interest rate, but rather the Fed completely broke through the expectation guidance of raising the rate to suppress the economy, and then quickly entered a rate-cutting cycle to save the economy with "naive fantasies".

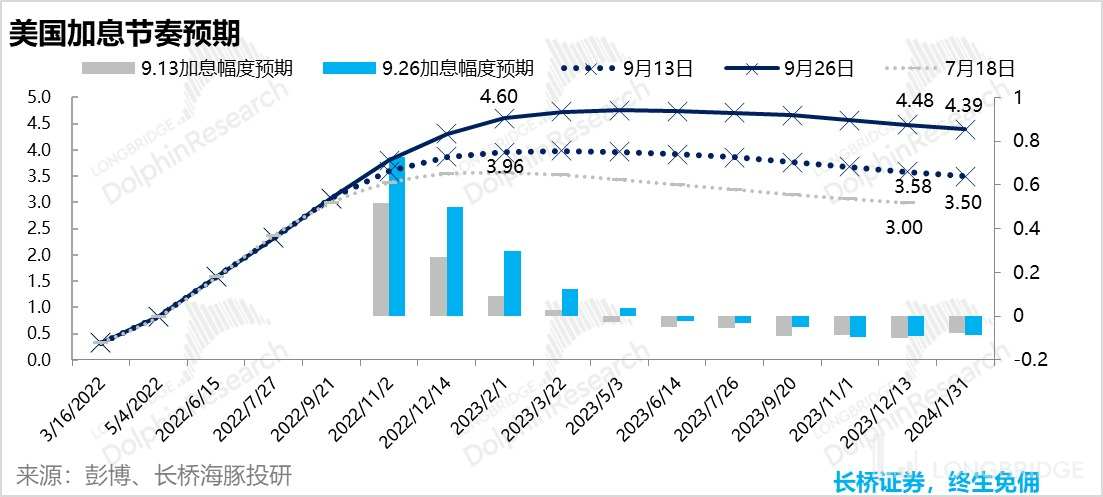

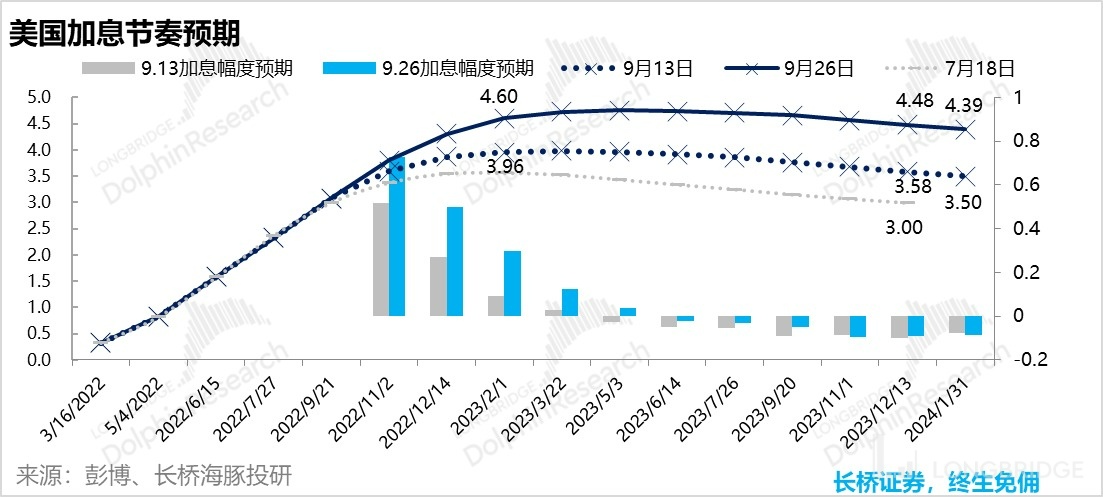

The corresponding chart below shows the expectations of the market for the Fed's interest rate hike at three different points in time captured by Dolphin from the Bloomberg system: July 18 (before July 26 interest rate hike), September 13 (before September 21 interest rate hike), and September 26 (after September 21 interest rate hike).

Especially before and after this interest rate hike, the biggest change in market expectations was that, in addition to the increase in the federal rate to the level projected for 2024, the number of people who expected a rate cut after the rate hit a high point decreased. This led to a further slowdown in the rate of decline in expected end-point rates.

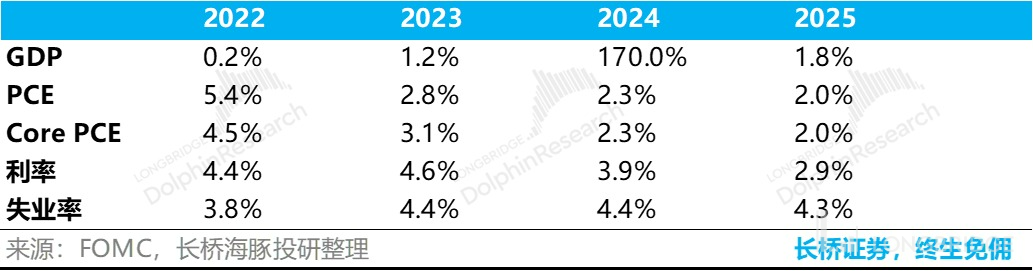

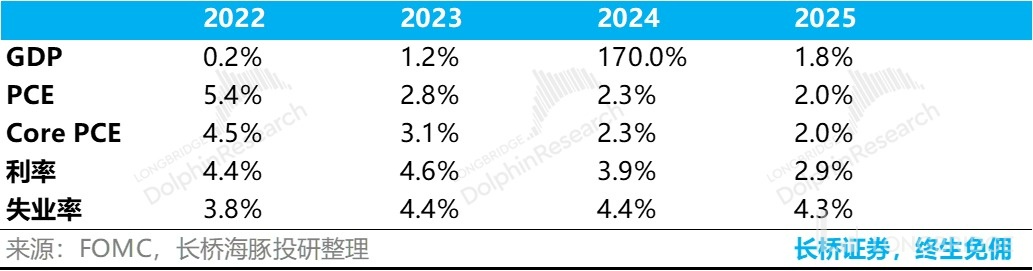

Behind this, it is precisely the result of the Fed's "strong" expectation guidance. According to the economic projections released by the Fed: After a total of 100 or 125 basis points of interest rate hikes in the remaining two months this year, rates will be maintained at around 4.6% after a slight increase next year. The corresponding macroeconomic figures are low growth of 1.2%, and an unemployment rate rising to around 4.4%.

In summary, the combination of a "high interest rate, low growth, and high unemployment" is clearly a "stagflation-style downturn".

This number reflects the Fed's anti-inflation strategy of maintaining the restrictive level of 4.6% that it has chosen by raising the interest rate for a long time. The Fed will endure on the contractionary interest rate level until prices itself no longer continue to deteriorate (natural rebound of high base effect of core inflation and supply-side inflation factors, including impacts of the pandemic on the supply chain and the impact of Russia-Ukraine conflict on energy) to gradually bring the full-term real interest rate into the positive range. For example, if it turns positive one percentage point, the current nominal interest rate of 3% vs. the year-on-year CPI of 8% is still in the severely negative range.

Iron-blooded Federal Reserve and Active Fiscal Policy: The Key to the Resilient US Economy

Iron-blooded Federal Reserve and Active Fiscal Policy: The Key to the Resilient US Economy

If we combine Federal Reserve Chairman Jerome Powell's remarks at the press conference, "We don't want to ease policy too early and swing back and forth between tightening against inflation and easing to support the economy, ultimately paying a higher price," the Fed's attitude reflects that it would rather "go overboard" than "fall short," eradicate inflation risk with a short-term recession over one or two years, and exchange 10-20 years of sustained economic prosperity. Under such an "iron-blooded anti-inflation attitude," it is not difficult to understand why the resources that previously led the inflation trend have once again fallen significantly.

Second, the "iron-blooded" Federal Reserve: in addition to its iron-blooded attitude, it has iron-blooded confidence.

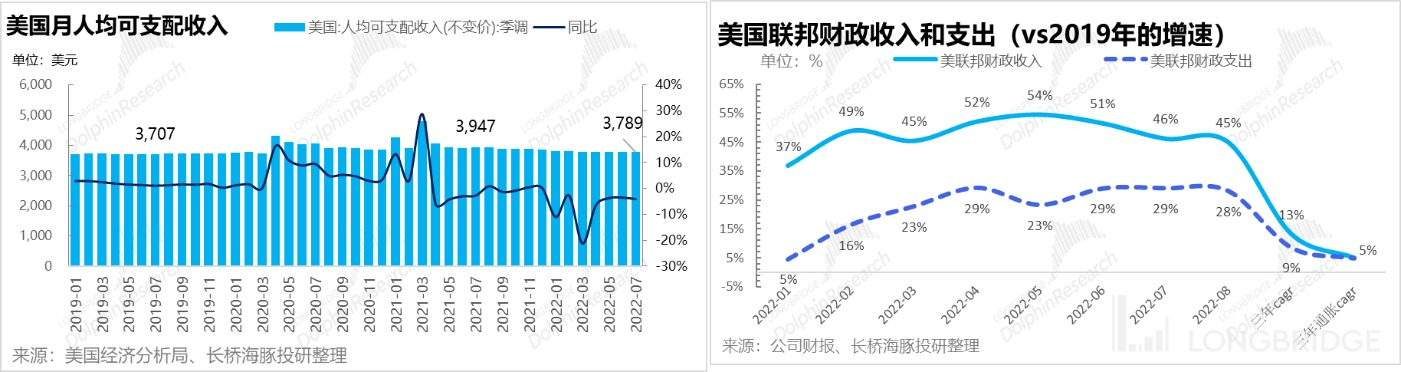

Unlike the overseas markets where the pandemic and inflation have caused a mess, the US economy is actually very robust. In addition to the visible strength of the US dollar, the continuous improvement of Americans’ purchasing power and the shortage of labor supply in the US labor market contribute to its robustness.

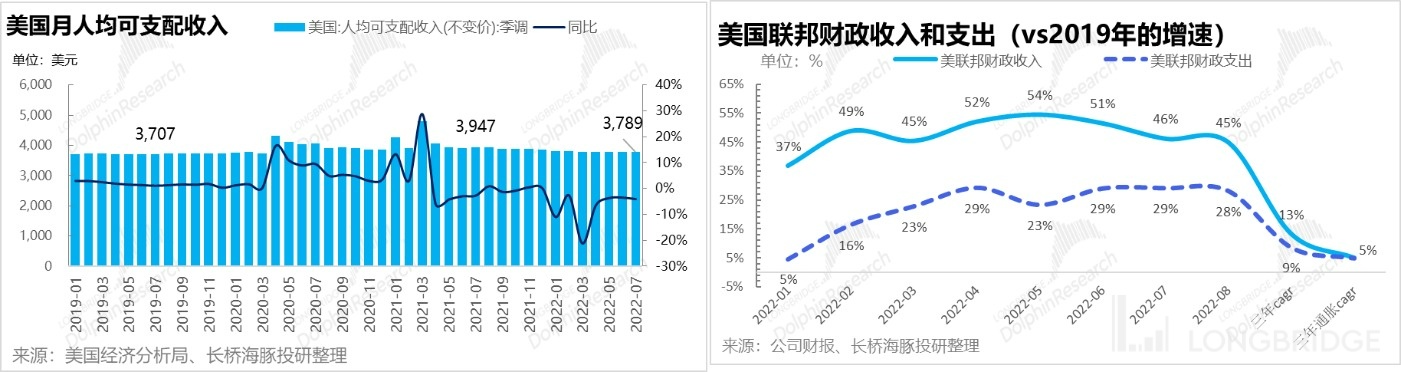

After the pandemic and inflation, ①the actual per capita disposable income of US residents affected by inflation has basically maintained the level of 2019; ②the income and expenditure levels of the US federal government in the past three years (even after excluding inflation) still far exceed that before the pandemic, and the state governments are even more impressive--with the help of federal transfer payments and taxes, the state governments with annual deficits due to recurrent income are now in a secure surplus, and from a subdivision of expenditures, the interest expenditures of the federal and state governments are not high, while their government consumptive expenditures are increasing rapidly.

All of these point to a fiscally active government policy under a tightening environment.

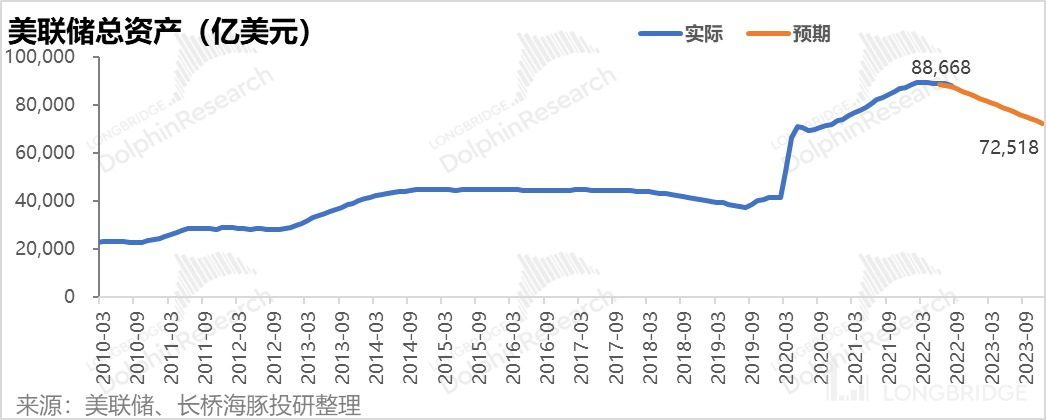

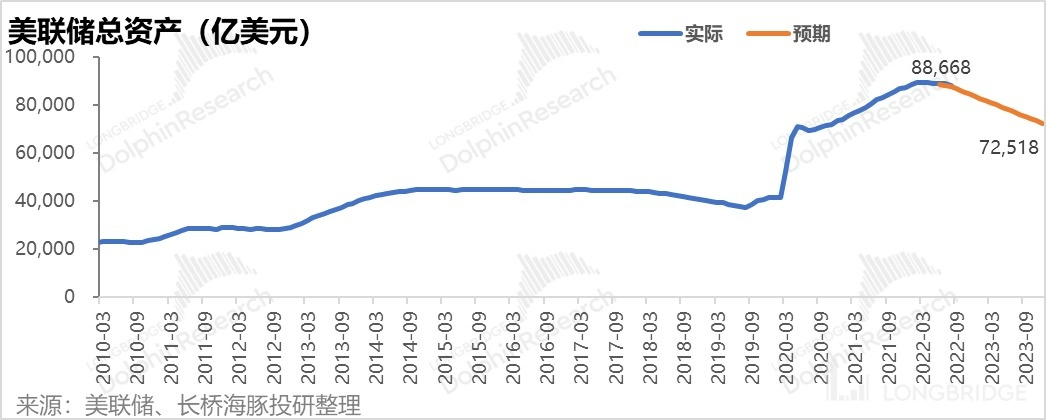

Behind the fiscally active behavior of the federal and state governments is the Federal Reserve, which is tightening under the current "slow and orderly, limited" conditions compared to the "instantaneous and unlimited" quantitative easing during the pandemic.

Overall, although the price-end of monetary policy-the current 3% federal fund rate is significantly higher than the pre-pandemic rate of around 1.6%, the Fed's total assets remain far above the pre-pandemic levels.

Although the Fed has left itself some room to accelerate its liquidity recovery through selling Treasury bonds and mortgage-backed securities, Powell made it clear in the meeting that, "Although we have not ruled out this operation, it is not under consideration at the moment and will not be considered in the near future."

Overall, it is still possible to see that in the post-pandemic era, the combination of "thick wallets" of US residents, especially the government, and the US's absolutely tight monetary policy and relatively "fiscally active" fiscal policy may have suppressed equity assets during the tightening process, but the US's economic resilience is surprisingly strong. It is imaginable that after this period of tightening, regardless of the uniqueness of the epidemic policies in the A-share market, US equity assets are highly likely to be the first to rebound. **

Although the expected interest rate for next year has been raised to 4.6% and will continue for a period of time, and from temporary inflation to raising interest rates, to the current high interest rate persistence, in the opinion of Dolphin Analyst, the policy turning point negative impact from the US Federal Reserve's monetary price end has basically been in place.

What needs to be further observed is whether the actual inflation under the interwoven international situation can fall back on schedule, and if inflation remains high in the future,will the US Federal Reserve begin actively selling treasury bonds and MBS.

3, Interest rate market= bear market

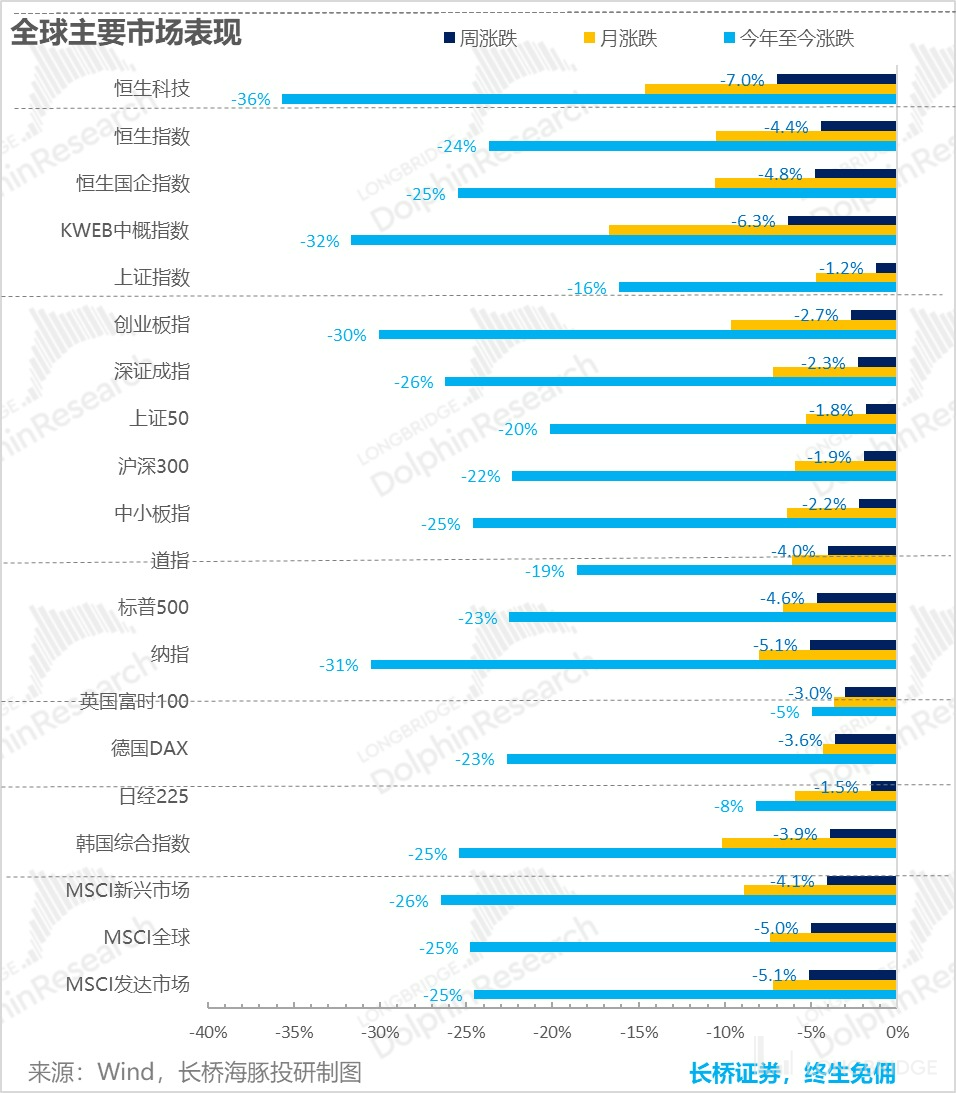

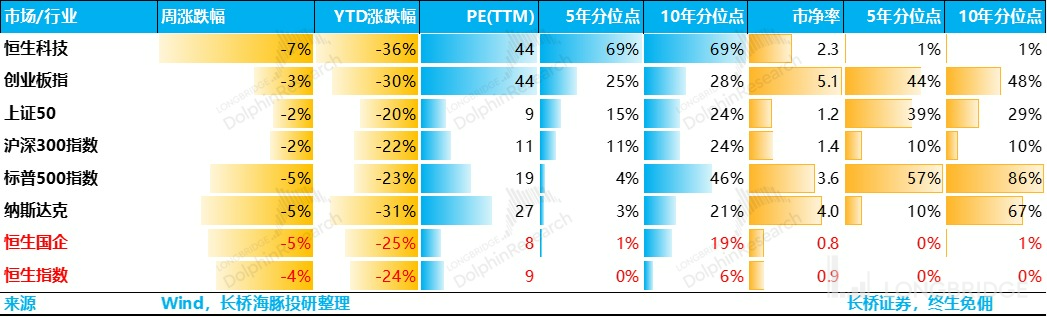

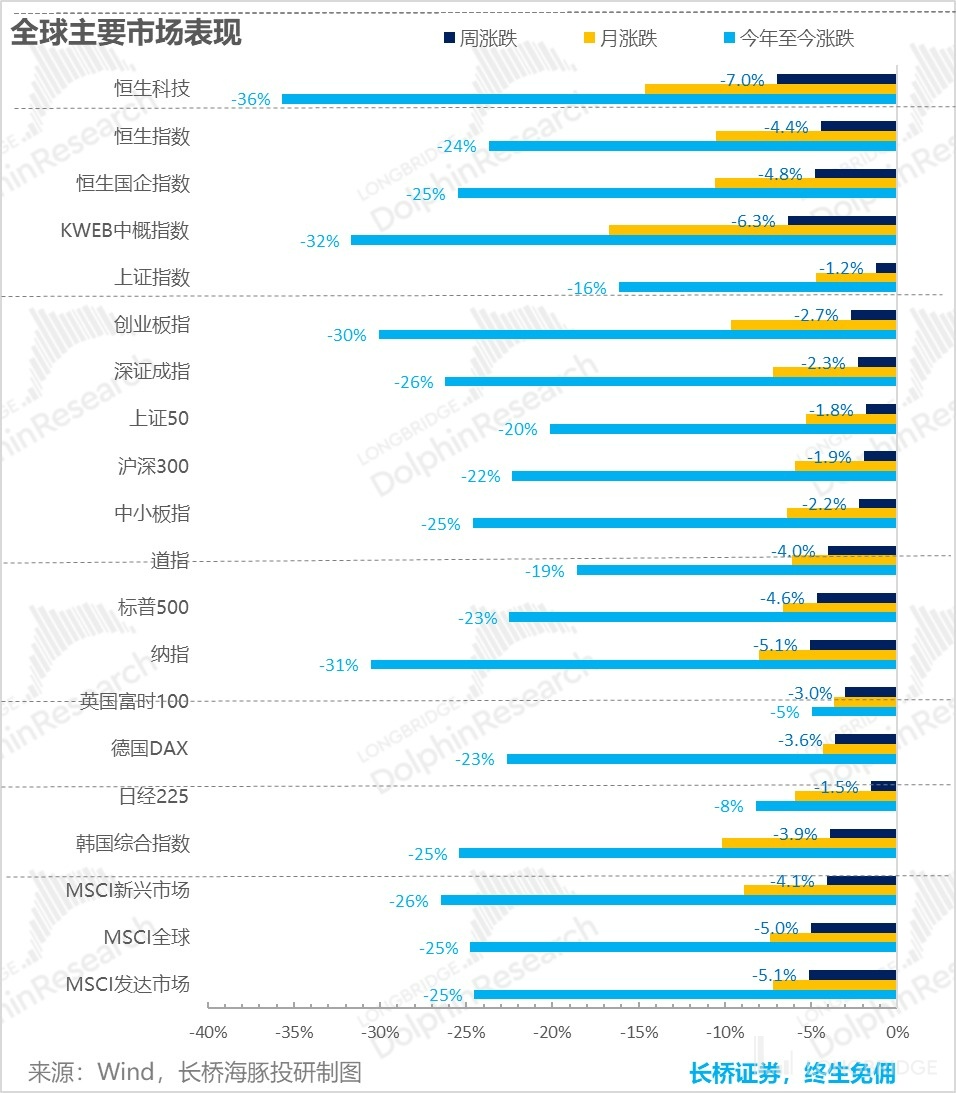

Also because of the Federal Reserve's iron-blooded attitude, during the Federal Reserve's interest rate week, the market once again saw an immense amount of bloodshed. Dolphin Analyst is concerned that the average decline of major global stock indices last week was close to 4%, and the monthly decline as of last week was close to 8%.

This month basically corresponds to the time from the global central bank annual meeting held in Jackson Hole on August 26 to the landing of the Federal Reserve's interest rate boots last week, with an unexpected CPI in August driven by rising housing costs in the United States in between.

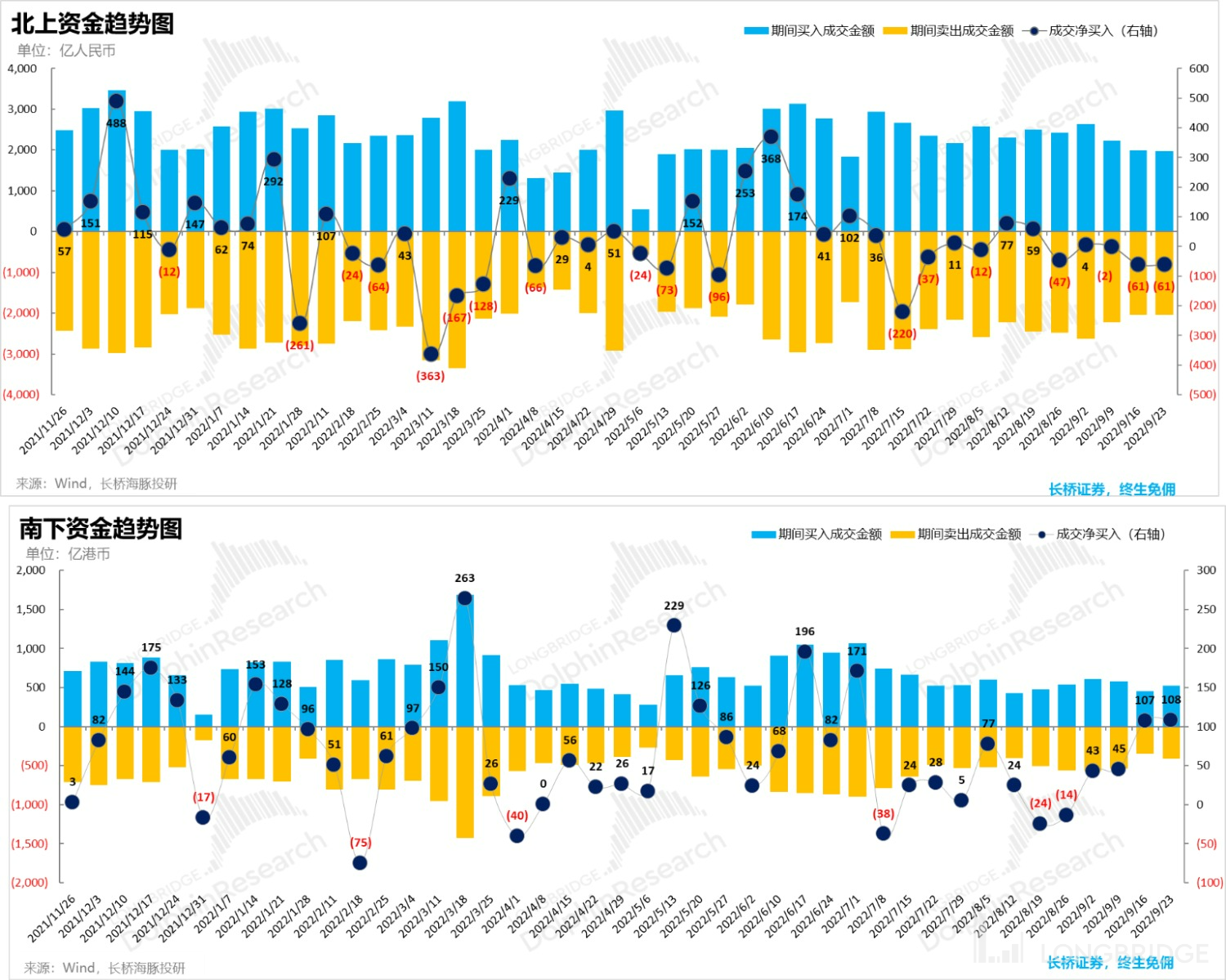

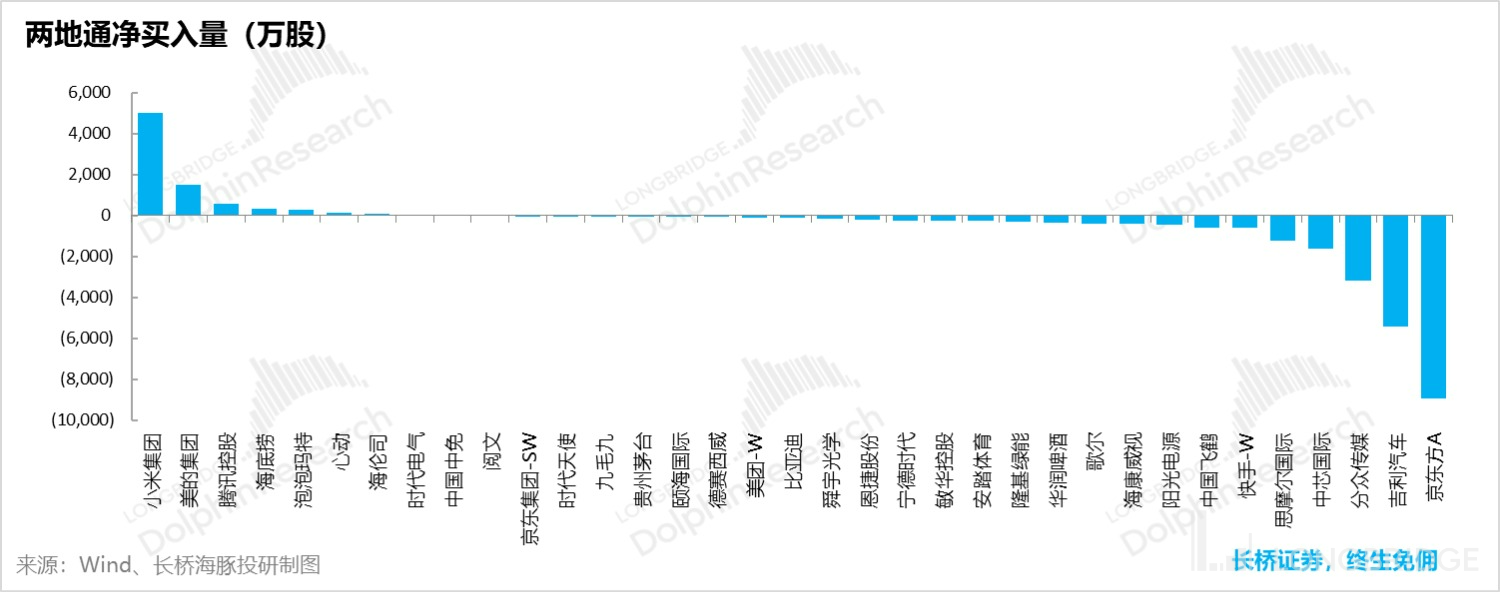

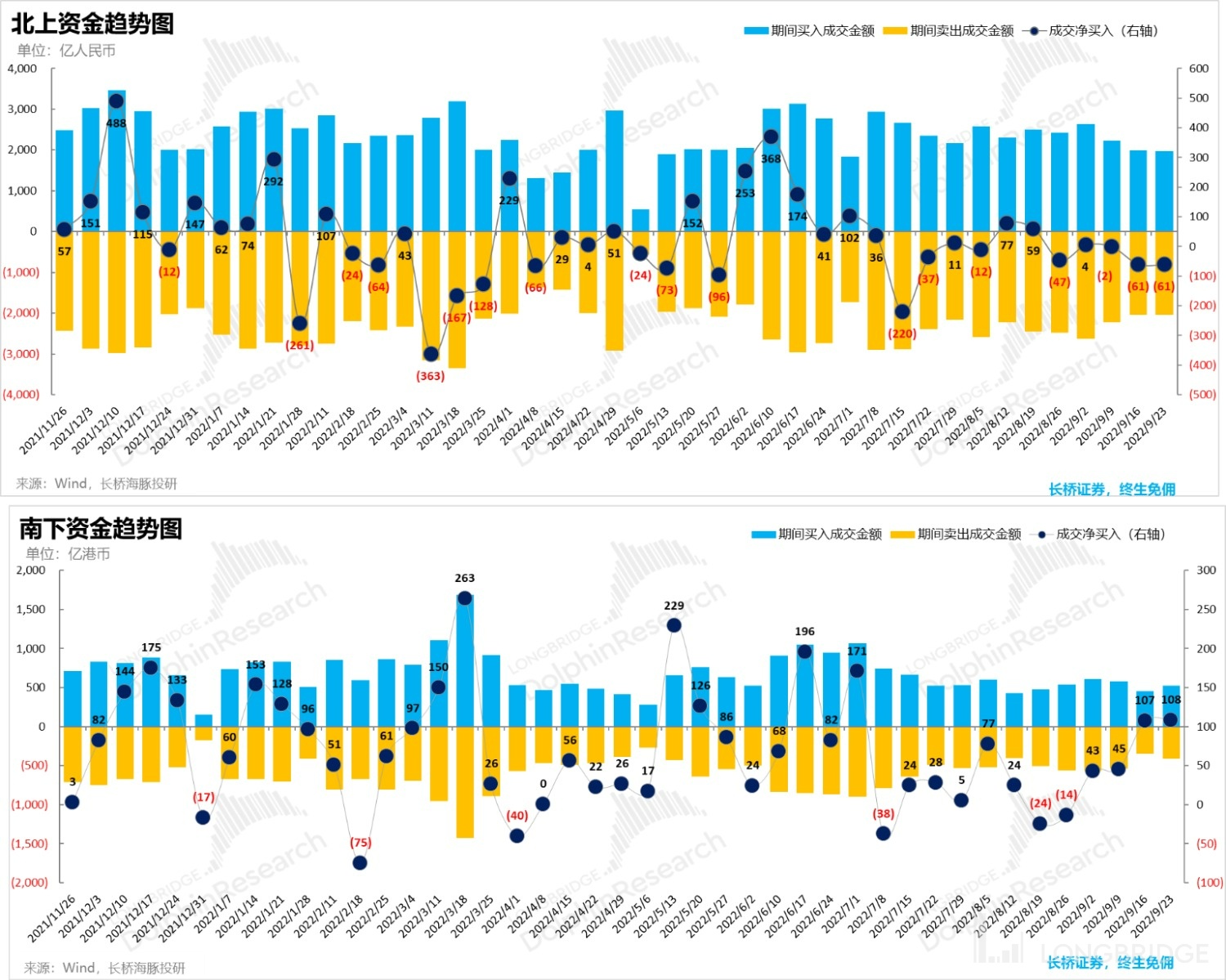

In response to this tightening policy that surpassed expectations, corresponding to this is the continued outflow of northbound funds, and as Hong Kong as a forefront market in terms of extracting US dollar liquidity was severely undervalued, southbound funds began to flow continuously. In addition, due to the relaxation of entry and exit restrictions in Hong Kong, the economic fundamentals are generally trending positively.

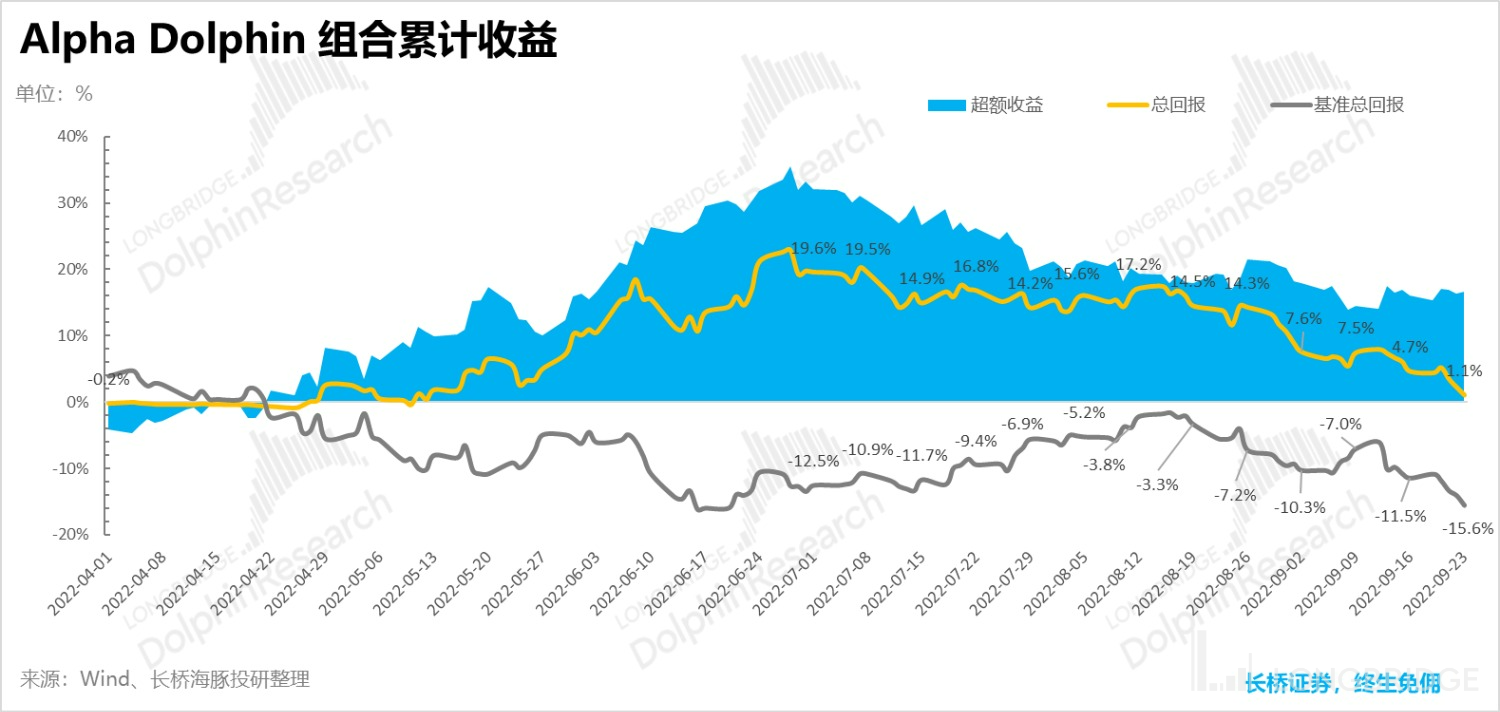

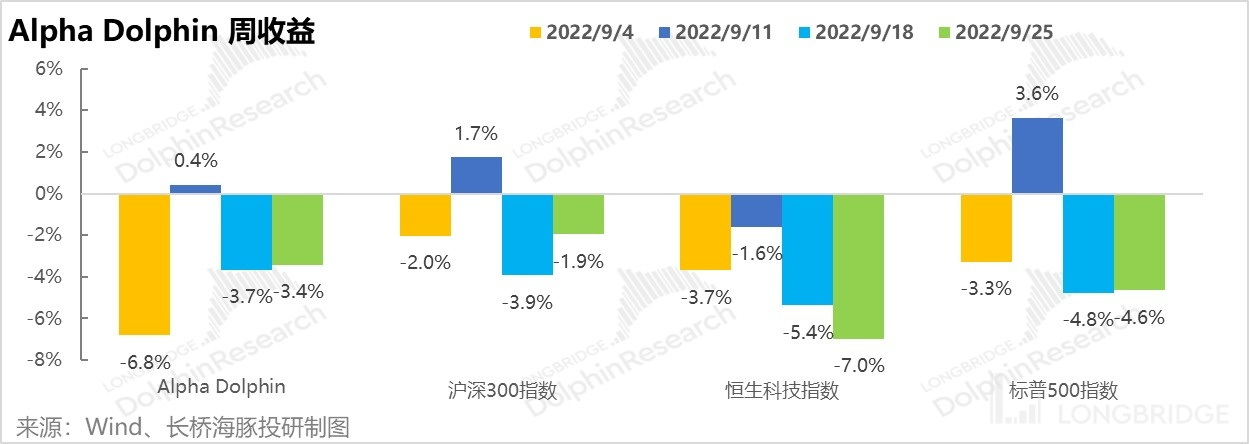

4, Alpha Dolphin Portfolio Returns

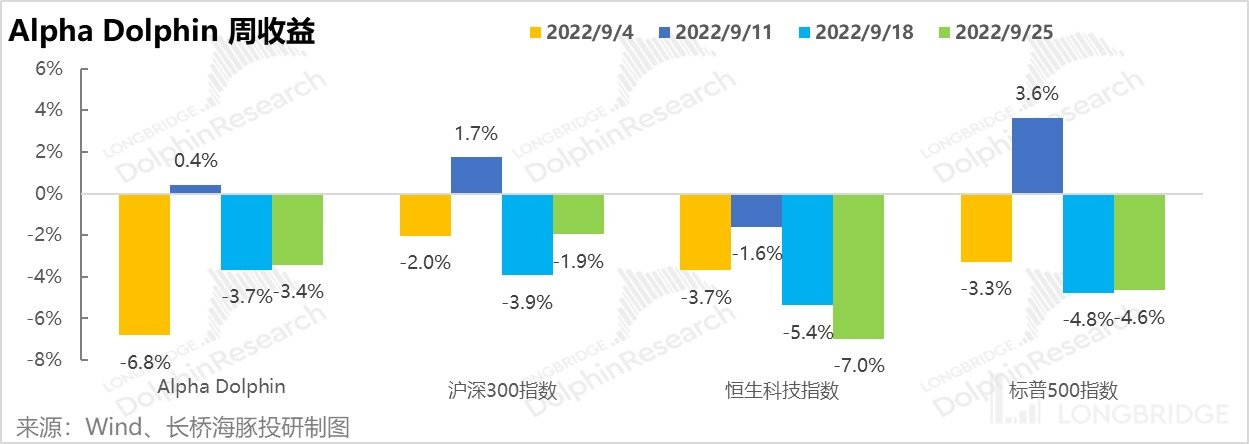

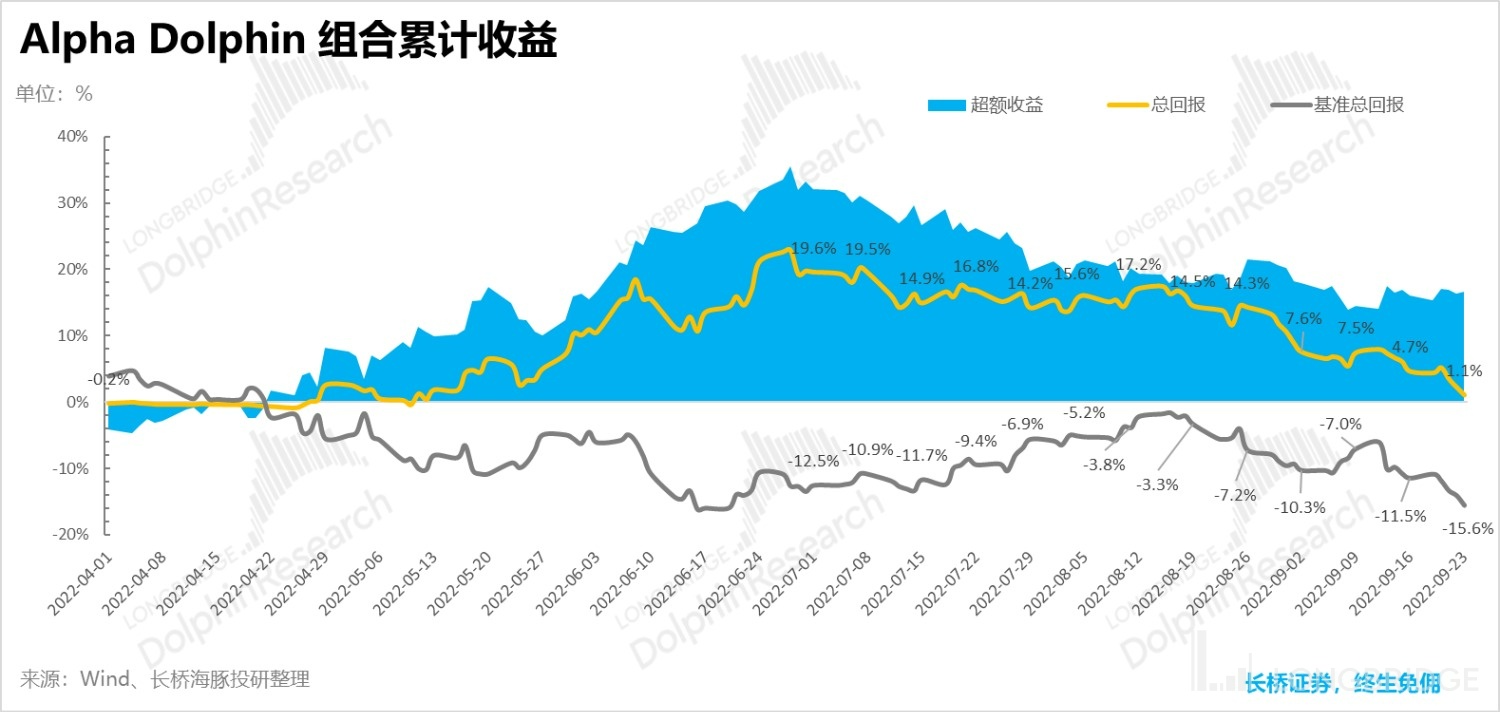

Affected by the weighting of Chinese and American stock assets, but due to Dolphin Analyst's previous reduction in position ahead of time and increased cash proportion, the portfolio's equity decline was relatively large last week, but the overall return was -3.4%, less than the Shanghai and Shenzhen 300 Index (-1.9%), but significantly better than Hong Kong's Hang Seng Technology Index (-7%) and the S&P 500 (-4.6%).

From the beginning of the portfolio's testing to last weekend, the absolute return of the portfolio was 4.7%, and the relative return compared to the S&P 500 was 16.1%.

**

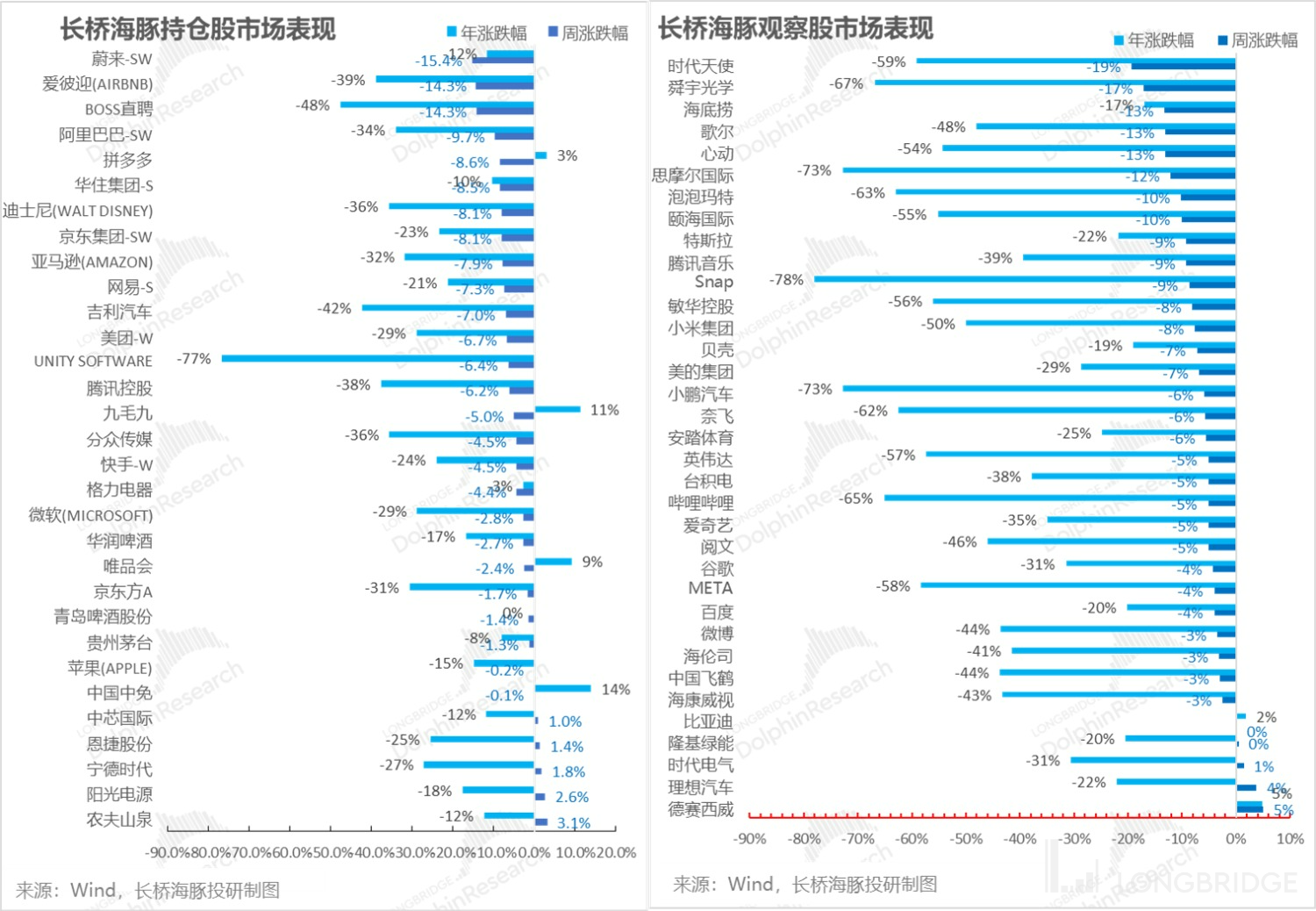

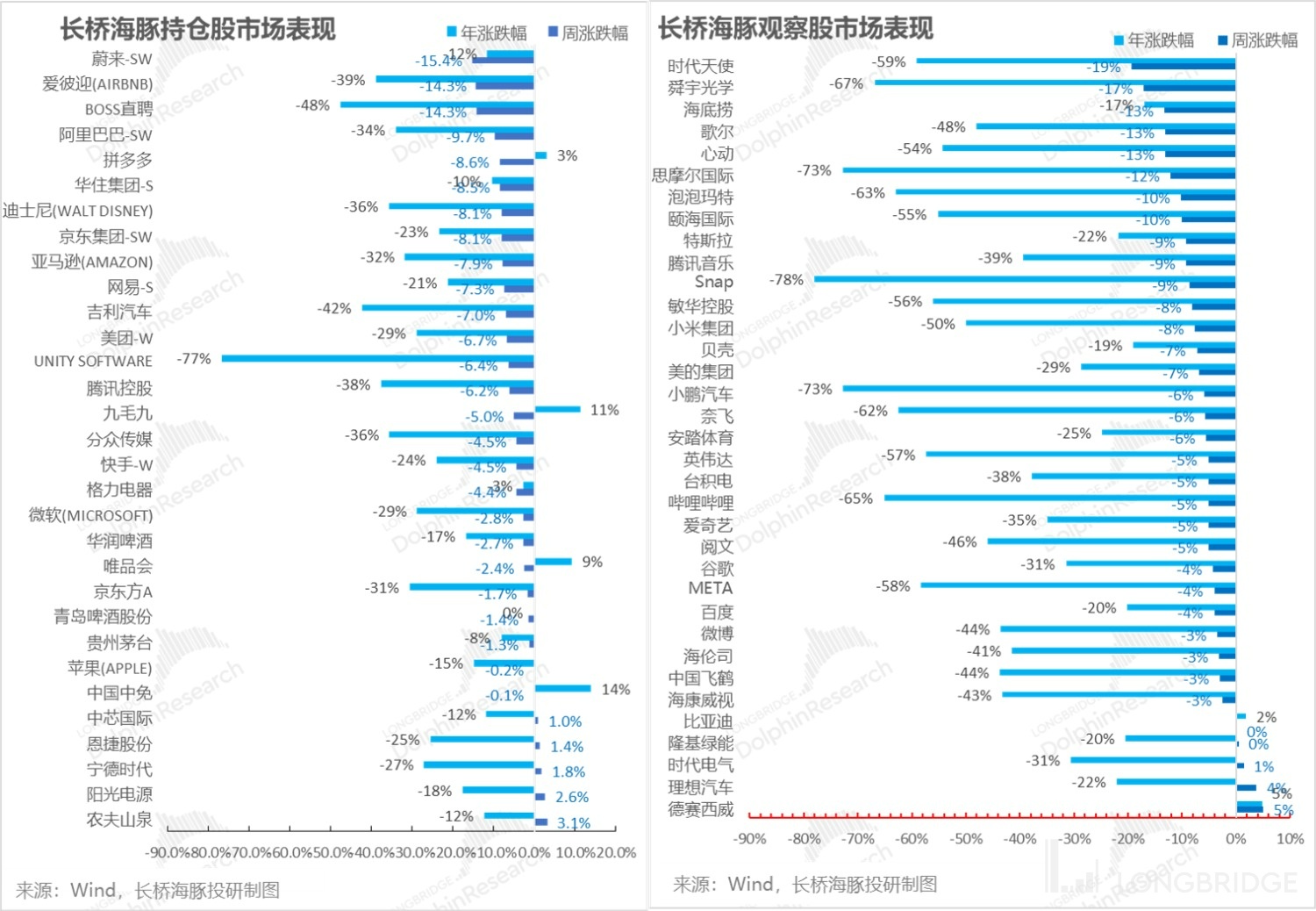

五、Relying on Consumption and Cash to Support

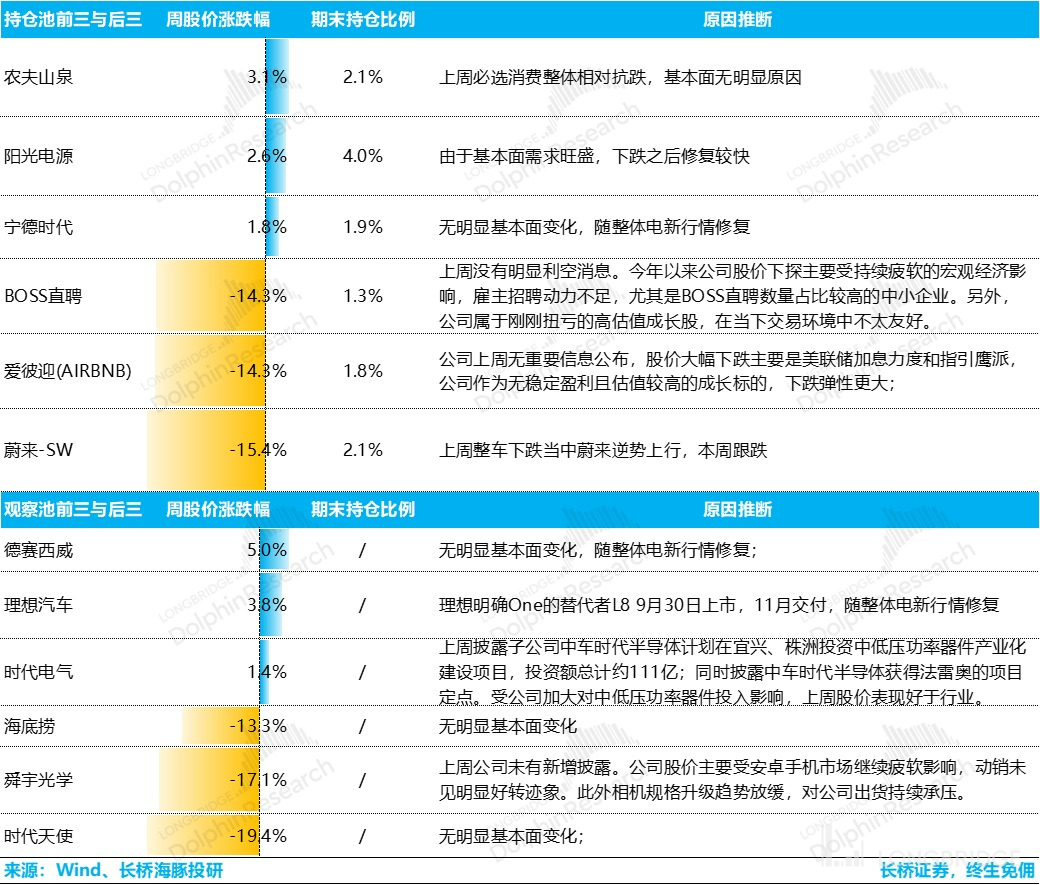

Last week, the entire electric vehicle sector began to recover, and consumption, especially essential consumer goods, still showed strong resistance to decline. However, the electric vehicle proportion in Dolphin Analyst's portfolio is not currently high. Last week, mainly consumption and cash were used to maintain the index from falling too much.

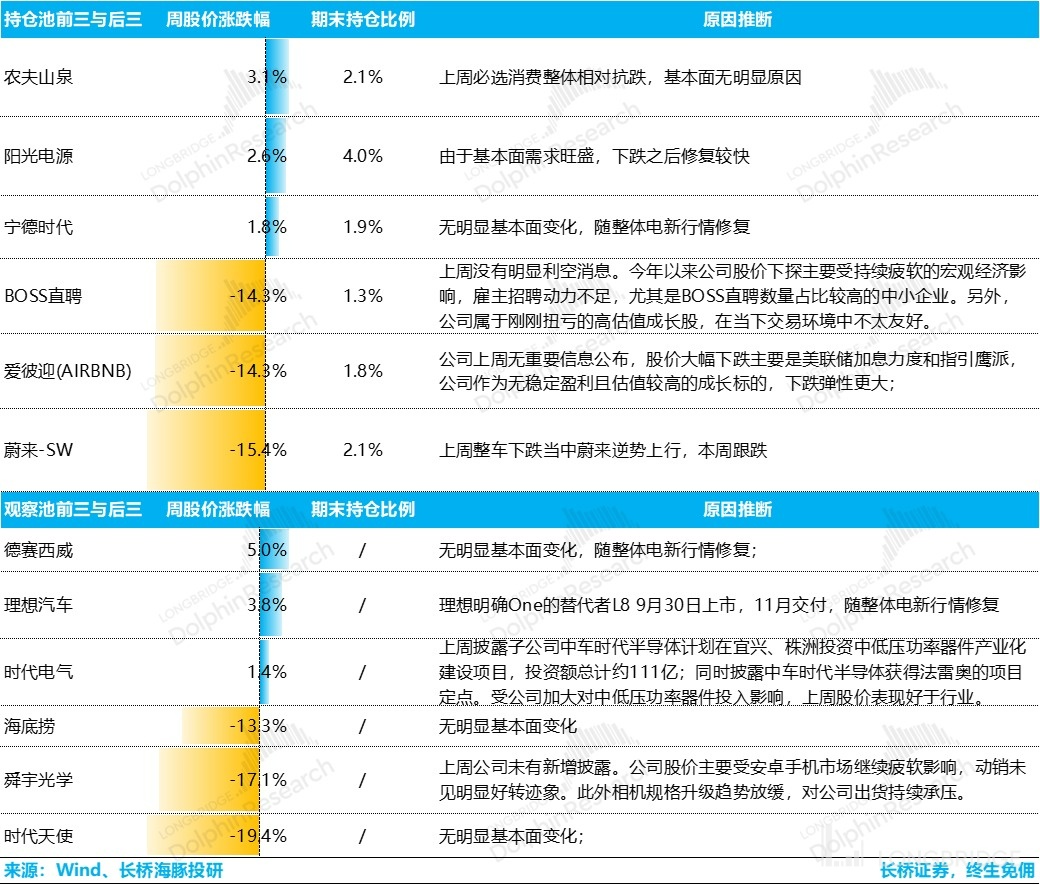

For companies with large fluctuations in their rise and fall last week, the reasons for the analysis and arrangement by Dolphin Analyst are as follows, for reference:

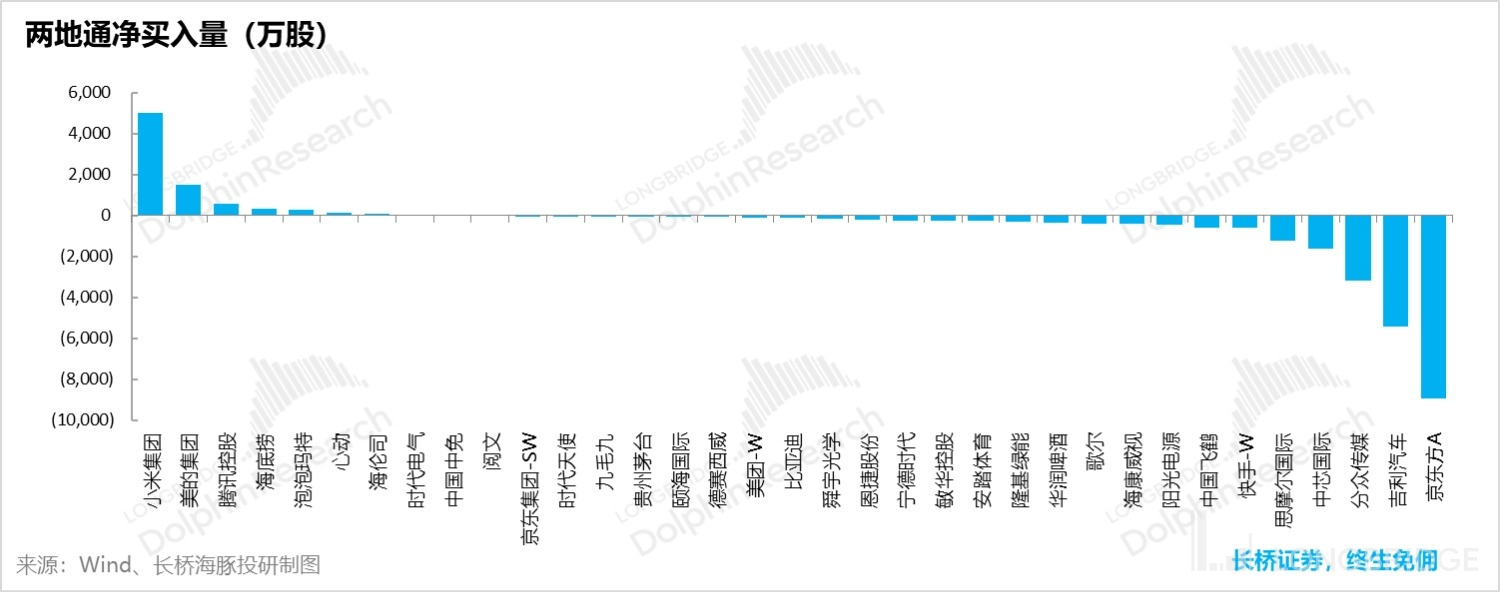

As for the South-North capital flow of Dolphin Analyst's holdings and observational positions, after the continuous plunge of technology stocks, funds began to buy Xiaomi and Tencent, and after the plunge, catering and social services also became objects for funds to pick up. The assets without any cyclicality, such as BOE and SMIC were still abandoned. Additionally, Geely Automobile was continuously discarded.

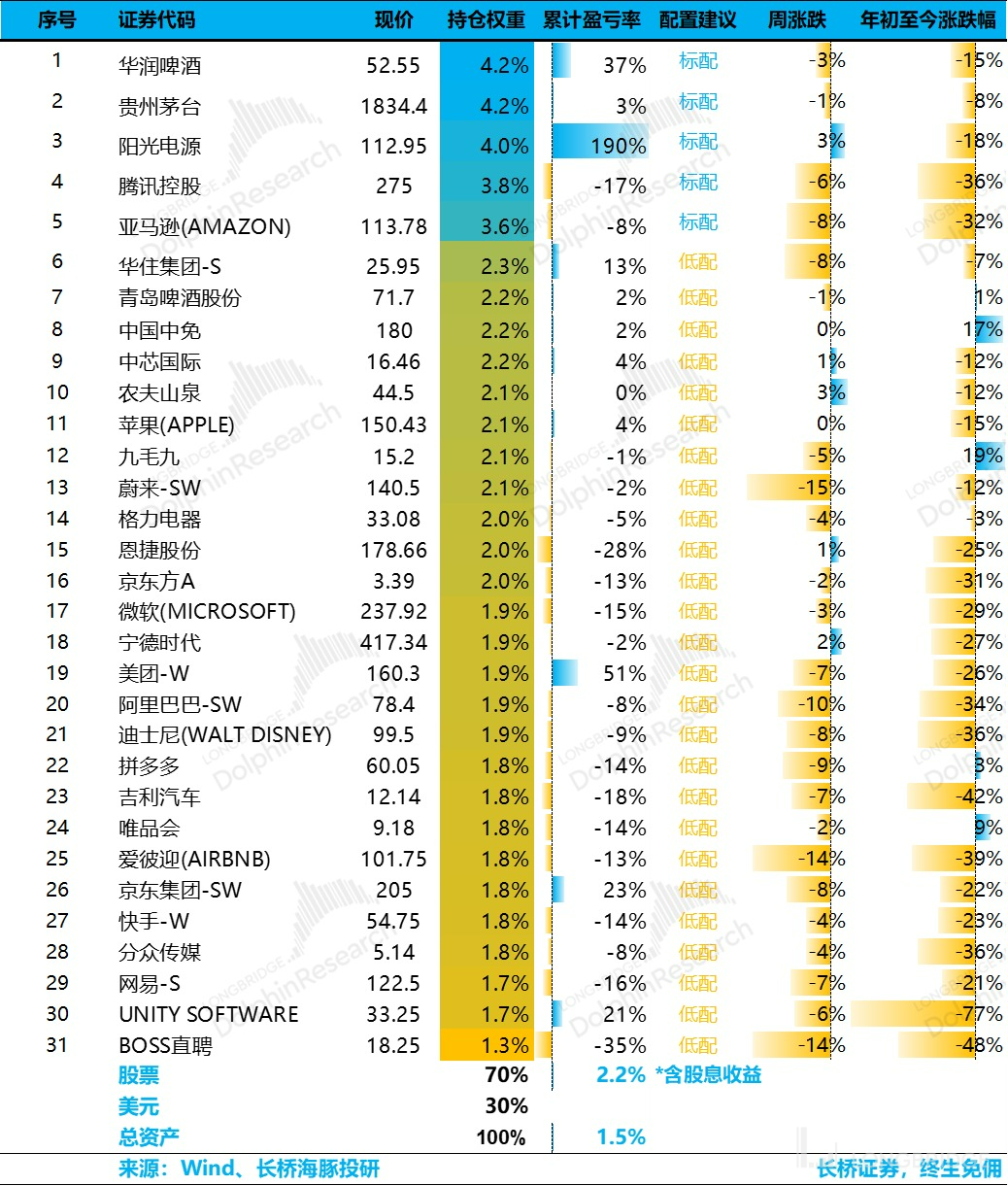

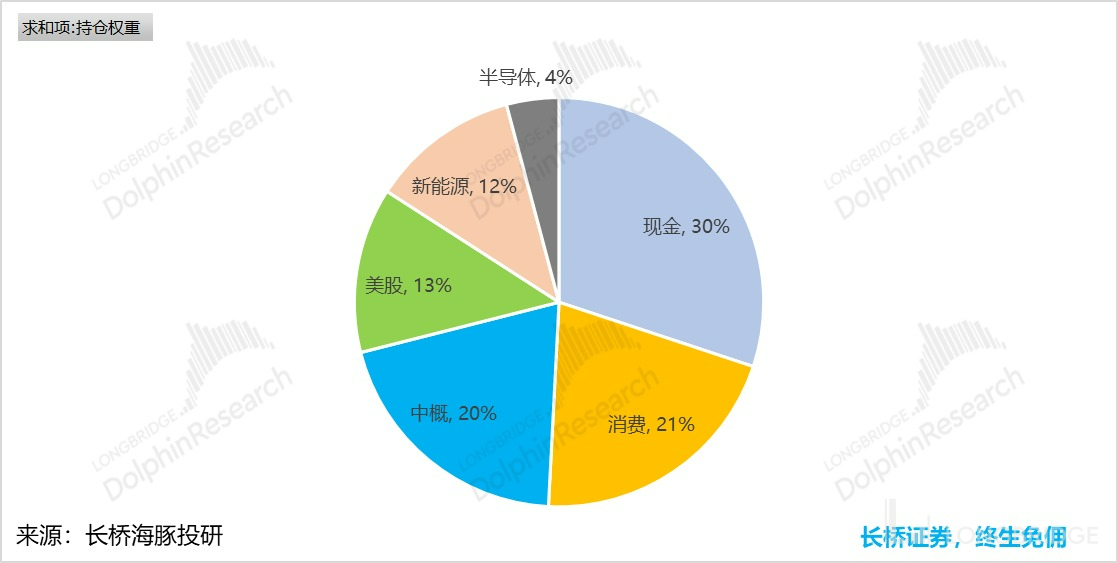

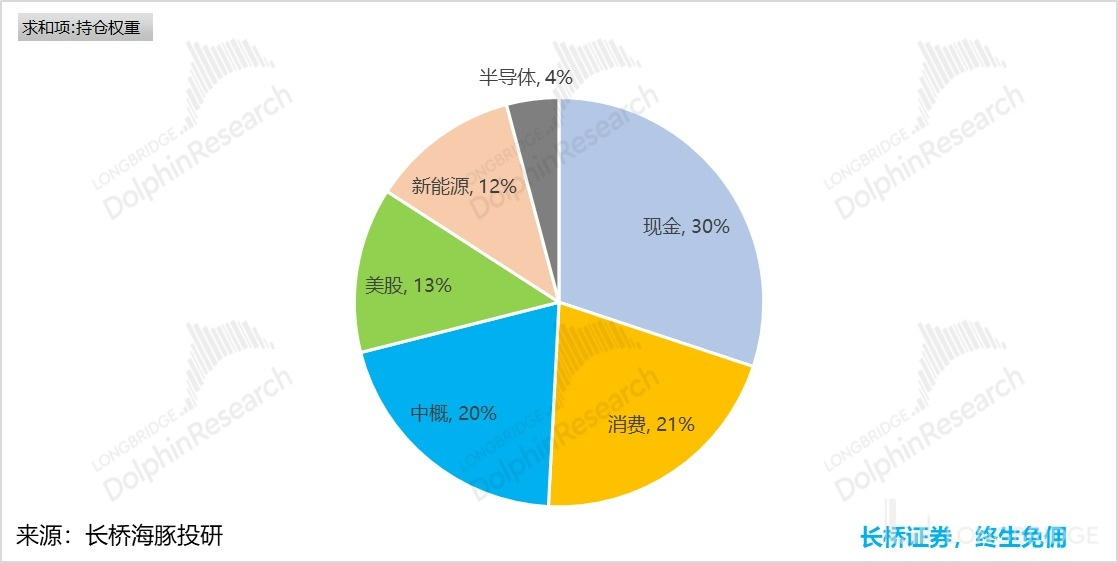

六、Portfolio Asset Allocation

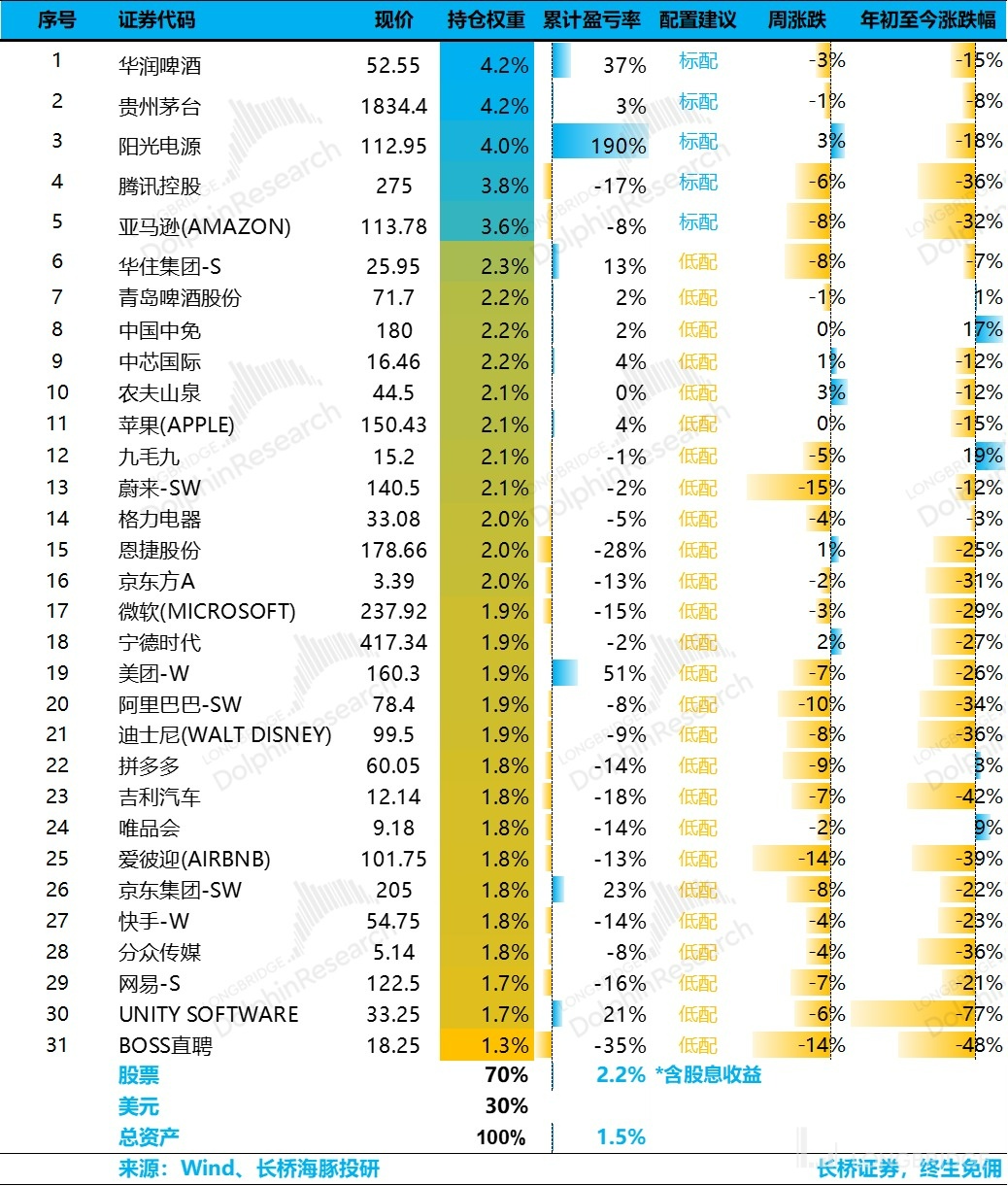

As of March 1st, the start of the internal testing, the overall return of Longbridge Alpha Dolphin's portfolio until last Friday was 1.5% (including dividend income), and the stock asset return was close to 2.2%.

Currently, Alpha Dolphin portfolio has allocated 31 stocks, including only five standard stocks, and 26 low-end stocks.

As of last weekend, the asset allocation and equity asset holding weights of Alpha Dolphin portfolio are as follows:

《Global Falls Again, US Labor Shortage is the Root of the Problem》

《Global Falls Again, US Labor Shortage is the Root of the Problem》

《The Federal Reserve is the Top Bear, and Global Markets are Falling Down》

《A Bloodbath Triggered by a Rumor: Risks Have Never Been Cleared, and Sugar is Found in the Broken Glass》

《The US is Moving Left, China is Moving Right, and the Cost Performance of US Assets is Back Again》

《Layoffs are Too Slow and Not Enough to Pick Up the Pieces. The US Must Continue to "Decline"》

《US Stocks Celebrate "Funeral" Style: Recession is Good News, and Raising Interest Rates the Most Fiercely is Called Negative》

《The Interest Rate Enters the Second Half, and the "Performance Thunder" Opens》

《The Epidemic Will Fight Back, the US Will Decline, and Funds Will Change》

《China's Assets Now: "No News is Good News" for US Stocks》

《Growth is Already in a Carnival, But Will the US Definitely Decline?》

《Will the US in 2023 Experience Recession or Stagnation?》 《Will the US oil inflation benefit China's new energy vehicles?》

《As the Federal Reserve Raises Interest Rates Quickly, China's Asset Opportunities Have Blossomed》

《As US Stock Inflation Explodes Again, How Far Can We Expect A Rebound?》

《The Dolphin Investment Portfolio Gets Underway In The Most Down-to-Earth Way》

Risk Disclosure and Disclaimer in this article: Dolphin Analyst Disclaimer and General Disclosure