Crossing the pandemic and inflation, the killer behind Uber's luck

Hello everyone, in this article Dolphin Analyst will bring you a research analysis on the global "ride-hailing + food delivery" giant - Uber. The first question is, why would Dolphin Analyst choose Uber as a research subject worth attention in the current gloomy stock market and unfavorable macroeconomic prospects? Simply put, first, it has a relatively high beta advantage in the current prosperous US travel and entertainment industry. Second, with the general entry of US technology companies into the cost reduction and efficiency enhancement cycle, and the slowing of competition, Uber, which has been continuously losing money for more than ten years, will seize this time window and usher in its own profit release alpha period. It turned losses into profits for the first time in the second quarter of this year.

1) Strong offline service consumption and stronger commuting needs

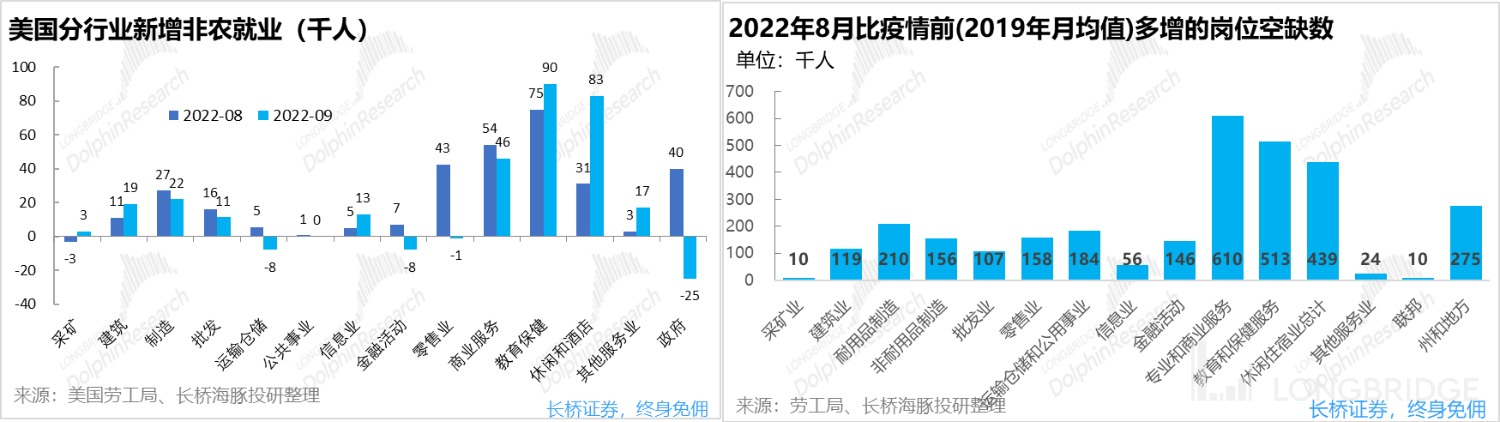

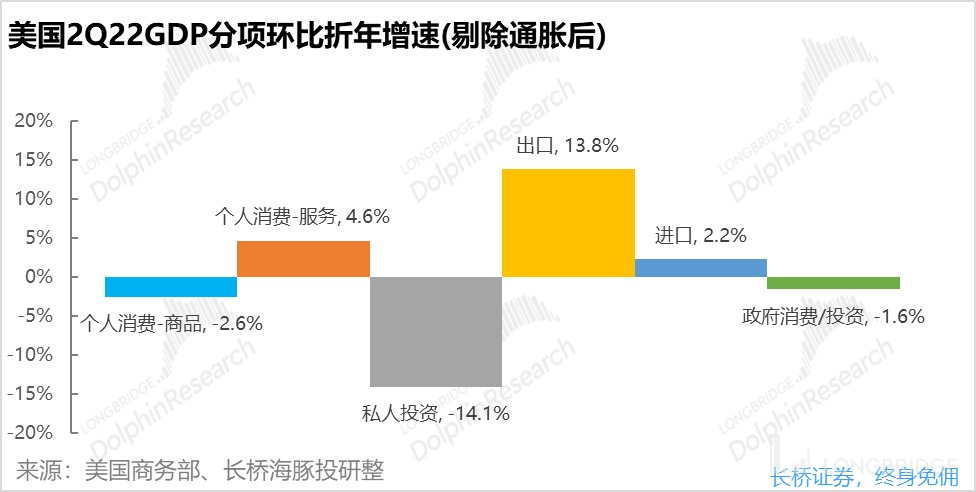

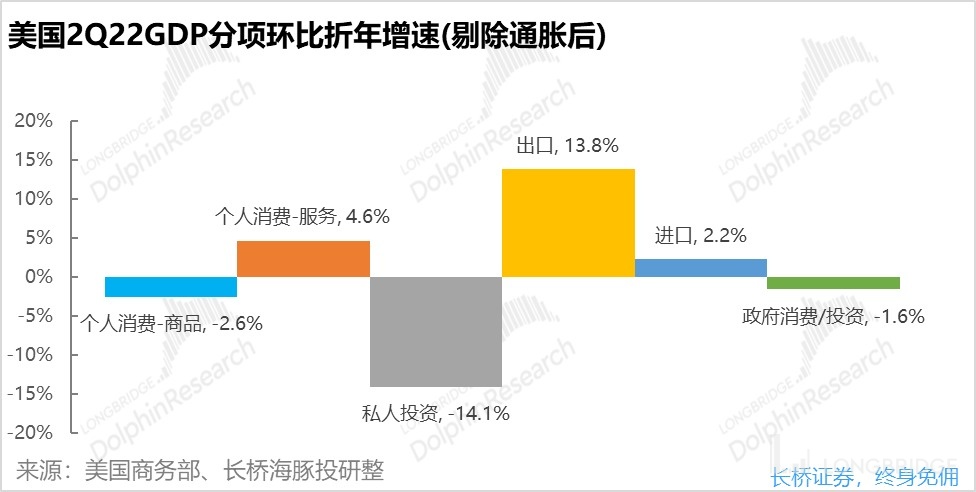

Since 2022, under the multiple blows of continuous high inflation, rising interest rates, and the cessation of government subsidies, consumer goods consumption by American residents has declined sharply, and enterprises with pessimistic economic prospects have also reduced their investments. Both the US economic outlook and the stock market performance, which are the barometers, can be described as bleak.

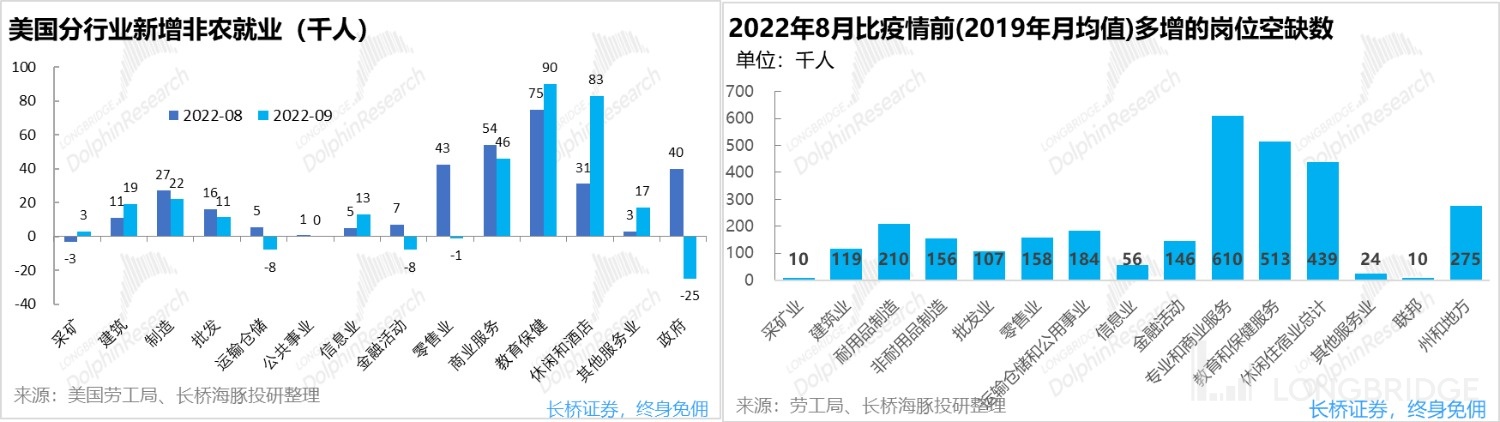

However, in the midst of the gloom, the service economy (mainly in healthcare and travel and entertainment) has shown different strong performance, and it is also the main reason why the overall US economy remains strong to this day. According to the latest employment data released in September, regardless of the newly added jobs or job vacancies, the demand for education and healthcare and leisure and entertainment industries is still strong, which is still in short supply. And in the previously released US GDP data for the second quarter, service consumption was the only one of the three drivers of domestic demand that achieved positive growth.

Therefore, Dolphin Analyst believes that companies related to offline travel and entertainment consumption have scarce relatively high prosperity, and they will have stronger performance resilience when most US stocks begin to slaughter performance in the third quarter.

Based on the above logic, Dolphin Analyst had already screened out Airbnb (ABNB) and Disney (DIS) as benefiting companies in the first quarter. Compared with the aforementioned two companies, Uber has a greater advantage in that Airbnb and Disney mainly correspond to optional consumption such as tourism and amusement parks, while Uber more satisfies the necessary service consumption of daily transportation and dining; even if the US economy weakens significantly in the future, the necessary transportation needs represented by Uber will still be equally resilient.

2) Not only the industry is booming, but the company itself also has Alpha Uber's financial performance in the second quarter is impressive. Its core ride-hailing business revenue reached $3.53 billion, an astonishing increase of 120% compared to the previous year, significantly surpassing market expectations of $2.95 billion. In addition to this rapid revenue growth, Uber's profitability improved significantly in the second quarter with an operating profit of $120 million after excluding non-recurring expenses, although the absolute value is small, this is the first time Uber has achieved profitability since its inception. In the current market environment where profit is preferred over growth, this significantly supports Uber's valuation.

Based on these two points, it can be seen that Uber, which combines beta (industry prosperity) and alpha (company profit release period), may contain considerable investment opportunities. This article by Dolphin Analyst will mainly focus on the above-mentioned logic, and quantitatively share Uber's ride-hailing business long-term revenue scale and market share, the steady-state profit-making ability of the delivery business after passing the high-growth period, and whether the company's stock price has a cost-effective valuation after a major decline, which will be discussed in the next article.

Dolphin Investment Research specializes in interpreting global core assets across markets for users to grasp the deep value and investment opportunities of enterprises. Interested users can add the WeChat account "dolphinR123" to join the Dolphin Investment Research community and discuss global asset investment perspectives together!

- What kind of company is Uber?

First of all, Dolphin Analyst will briefly introduce what kind of company Uber is, and its main business, so that everyone can better understand the analysis in the following text.

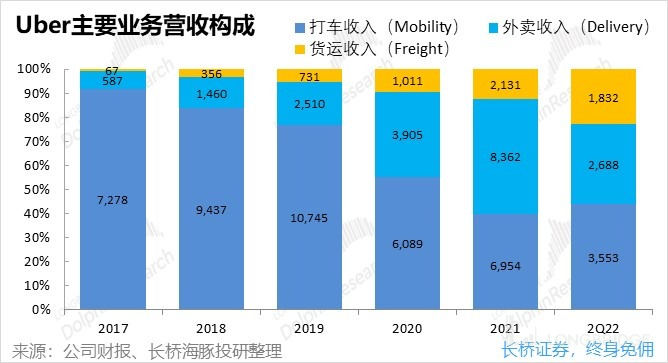

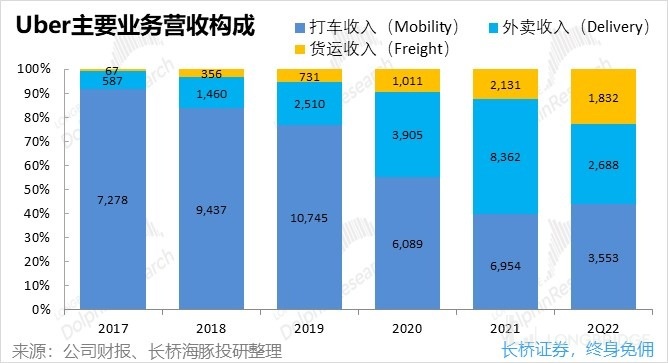

From the company's revenue composition in recent years, it can be seen that Uber's main business is composed of three major sectors: ride-hailing (Mobility), delivery, and freight.

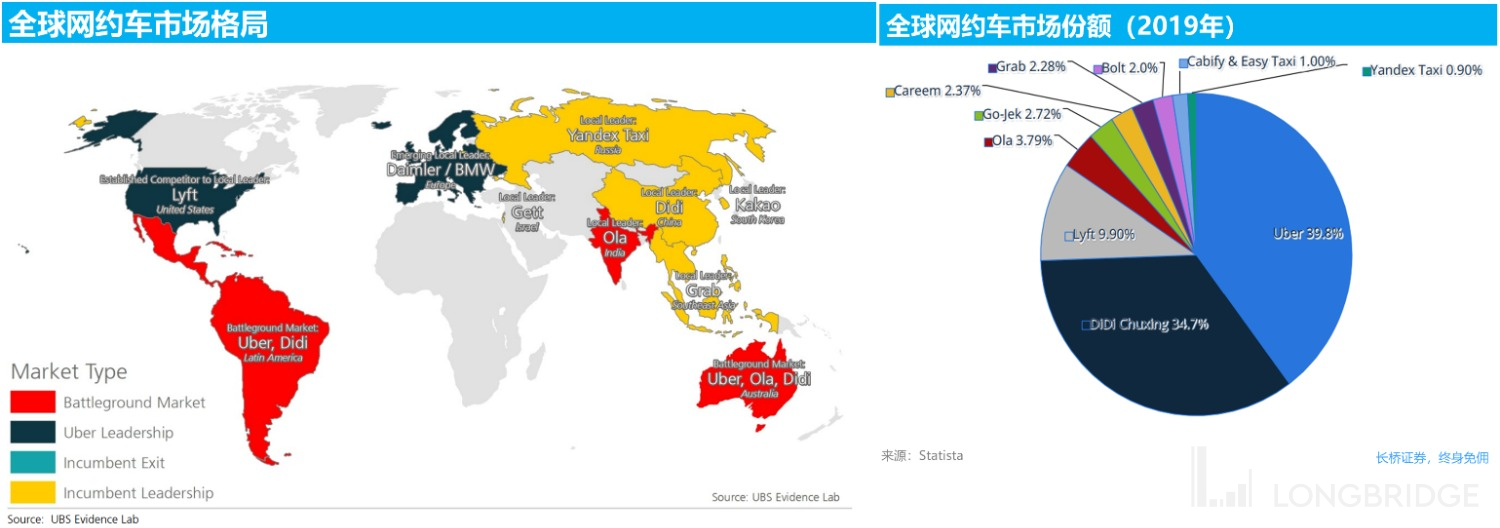

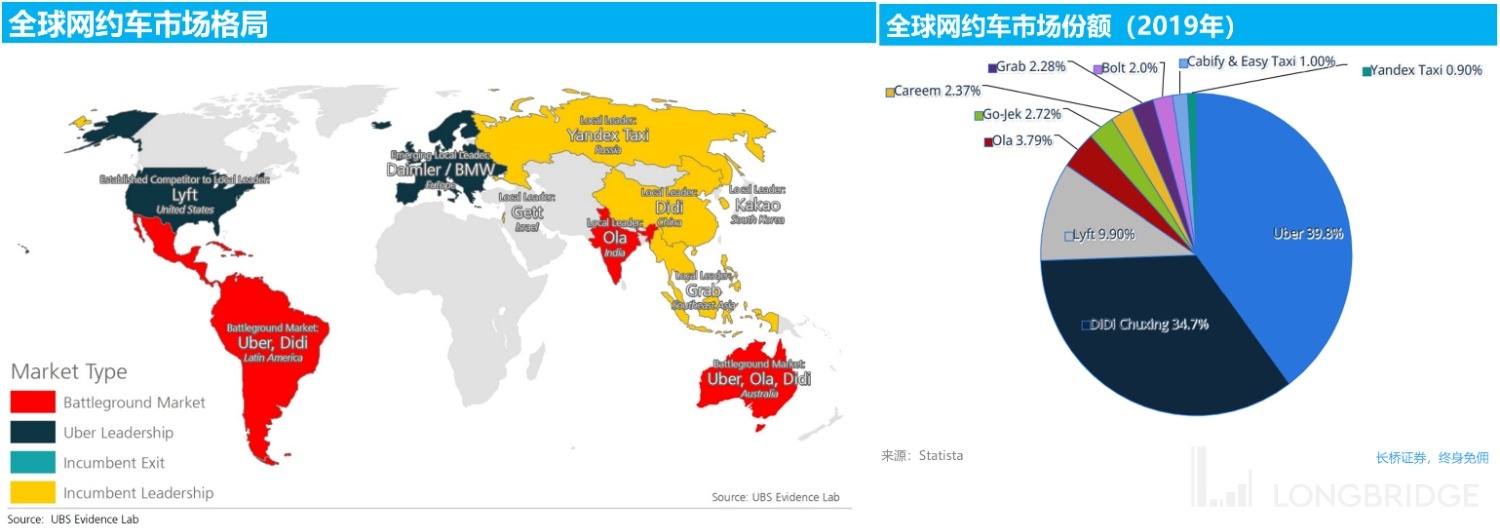

a) Ride-hailing: Since Uber was founded in 2009, it has always been the cornerstone of the company's business and still contributed more than 90% of the company's revenue in 2017. Looking at the global competition pattern of ride-hailing, Uber occupies the leading position in the industry in the United States, Canada, and Europe; it is in a fierce competition with local leaders for market share in South America, India, and Oceania; in China, Russia, and Southeast Asia, local leaders, Didi, Yandex Taxi, and Grab respectively occupy the top portion.

Globally, Uber firmly occupies the largest share and was close to 40% in 2019. In addition to Didi, which dominates the Chinese market and follows closely with approximately 35% market share, other players have less than 10% market share. Therefore, in the overseas ride-hailing market, Uber has an absolute leading market share and can be considered a dominant player.

2) Food Delivery Business (Uber Eats):

It's the company's second-line business launched in January 2016. During the COVID-19 pandemic, with the surge in online food ordering needs, the company's food delivery business revenue exploded. By 2021, the revenue scale had reached 3.3 times that of 2019, and food delivery revenue was once the largest board. However, since 2022, with the recovery of offline activities, the growth rate of the company's food delivery business revenue has quickly slowed down, and the revenue scale has also fallen below that of the ride-hailing business. However, in response to the slowdown in the growth of the food delivery business, the company has also selectively expanded from only delivering food to daily necessities, beverages, and other commodity categories to seek greater growth potential.

3) Freight Forwarding Business (Uber Freight):

Uber launched this business in 2017, mainly through an online platform to connect and assist in matching freight forwarding companies with transportation needs and truck drivers or businesses with idle carrying capacity. The nature of the freight forwarding business is a B-side business for freight forwarding companies. Although the bottom is the base of transportation capacity and people, it cannot share users with Uber's core C-side business. As of the end of 2021, the revenue scale of the freight forwarding business was only 2.13 billion US dollars, accounting for about 12%, of which about 680 million were still contributed by the acquisition of the freight forwarding company tupelo. In terms of profit caliber, in the second quarter of the previous year, only 0.05 billion of the company's 364 million in pre-tax income came from the freight forwarding business.

Overall, Uber started with the ride-hailing business and has firmly established its global leading position. Since 2016, the company has successfully developed the second-line food delivery business, and its revenue scale has reached nearly that of the first-line. The freight forwarding business is currently non-core from both a commercial and financial perspective. Therefore, the following analysis by Dolphin Analyst will mainly focus on the ride-hailing and food delivery business and will not elaborate on the freight forwarding business.

Second, the post-epidemic/commuter demand of "working people" strongly rebounds

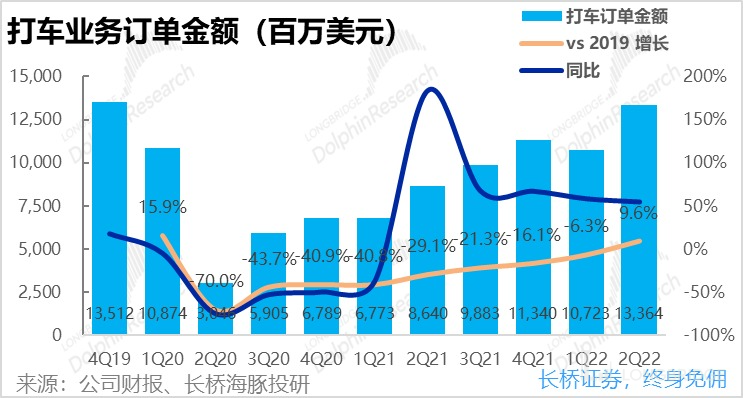

First, looking at Uber's second-quarter financial report previously released by the company, the total order amount of the ride-hailing business has not only returned to the level of the same period in 2019 after the epidemic but has also increased by nearly 10%. So, what prompted the violent rebound of overseas ride-hailing demand?

Combined with the communication of the management of Airbnb, a covered target in the same travel industry as Longbridge, and based on the safety needs of staying away from densely populated areas during the epidemic and the loose work-from-home policies of enterprises, a large number of people in Europe and the United States moved from metropolitan areas to the sparsely populated suburbs or rural areas. Therefore, commuters' demand for transportation has greatly reduced.

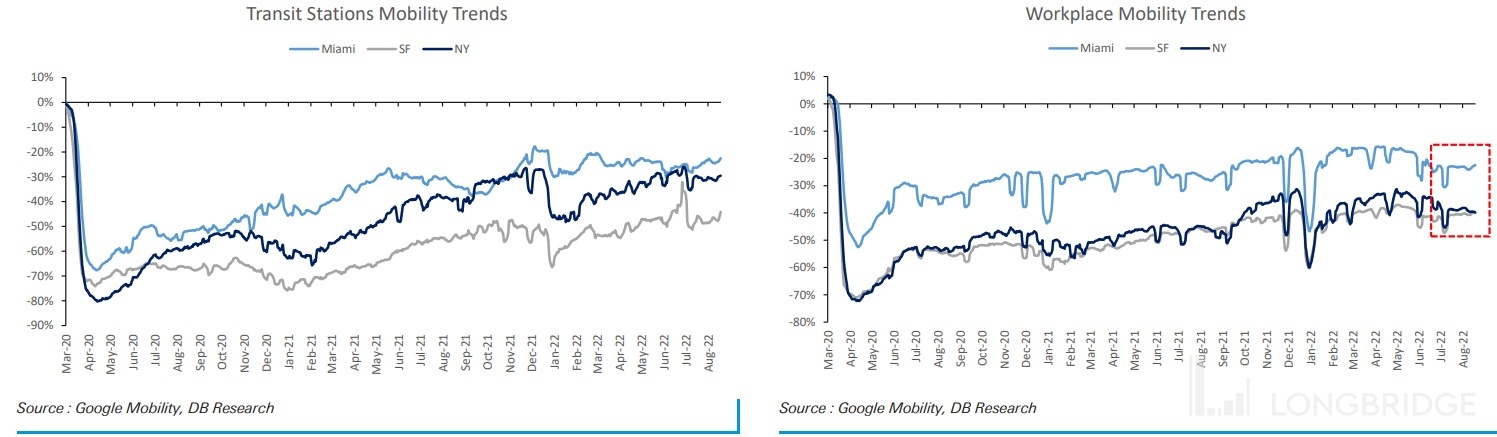

However, as European and American countries gradually passed the Omicron epidemic peak in the first quarter of this year and offline activities were fully open, and with the tightening of work-from-home policies by enterprises due to the surge in labor costs, residents have returned to big cities. With people flocking back to densely populated cities, the commuting demand of "workers" will also increase rapidly. Unlike the more convenient private cars in the outskirts of the city, public transportation and taxis (including ride-hailing) will account for a higher proportion in congested urban areas.

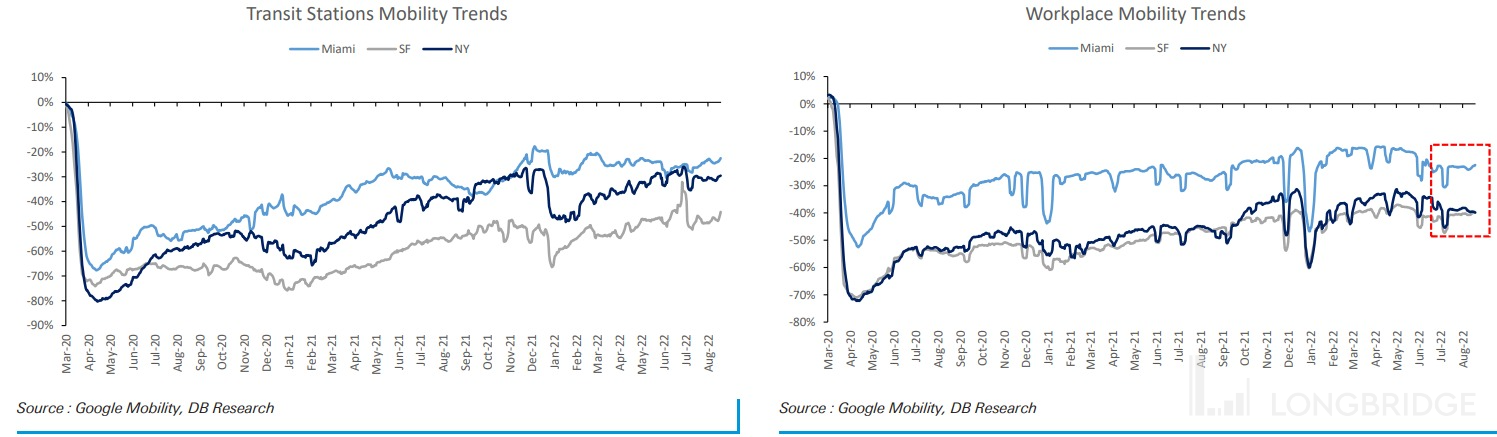

According to the traffic index statistics on Google in the figure below, the flow of people at transportation hubs and office areas in major cities such as New York, Miami, and San Francisco has been steadily increasing since the beginning of 2022, verifying the rapid recovery of traffic volume in major US cities.

As a bilateral platform connecting passengers and ride-hailing drivers, not only does this rebound in travel demand not solely promote the recovery of the ride-hailing industry, but it also requires enough ride-hailing drivers to meet the surge in demand.

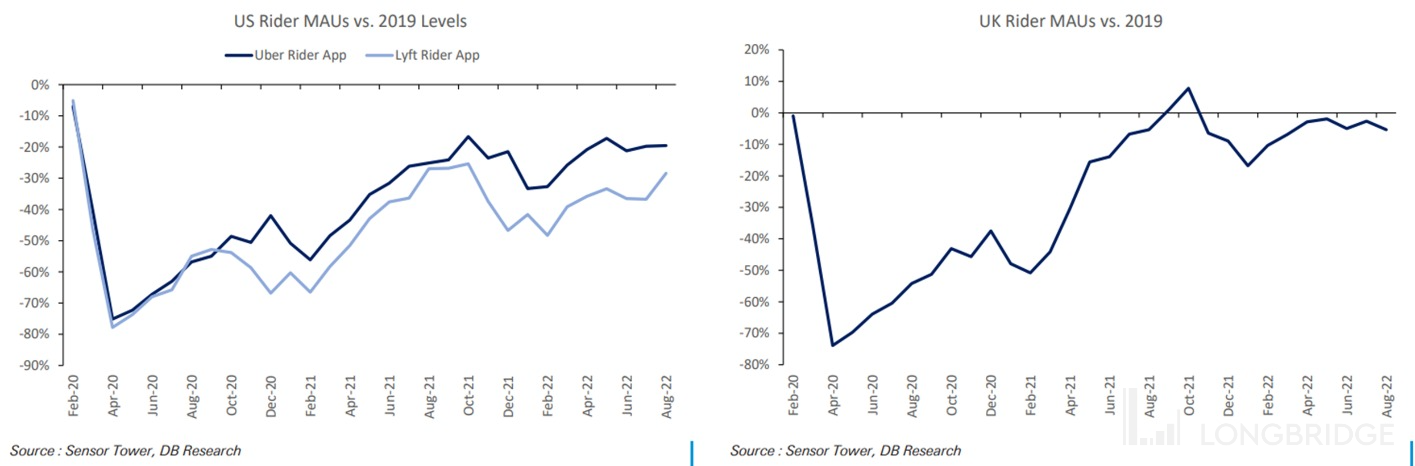

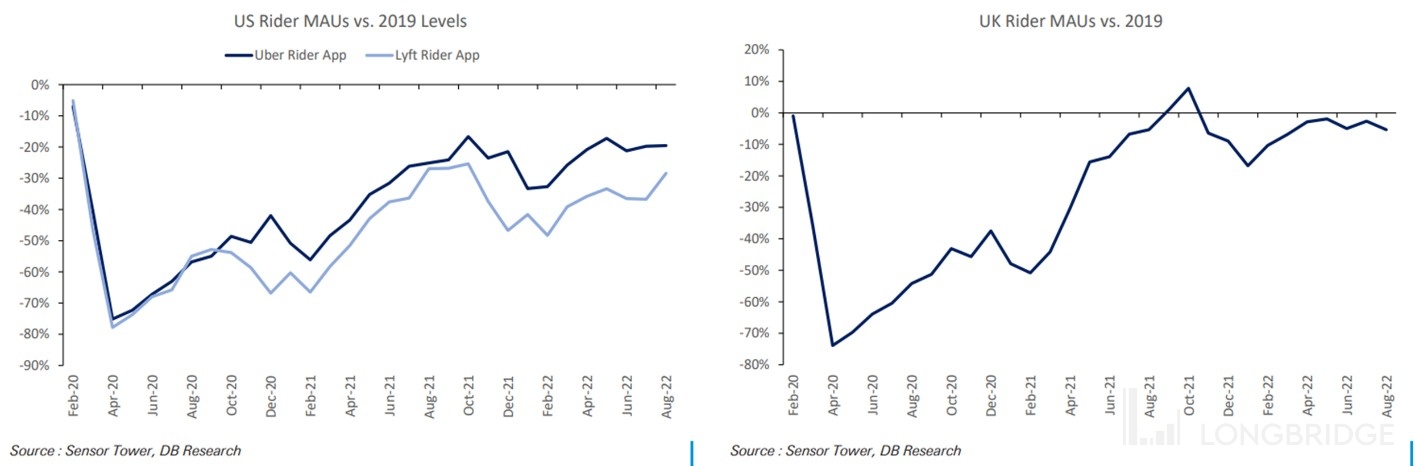

As shown in the figure below, whether in the United States or London, the monthly active users of ride-hailing driver apps are quickly bouncing back. The monthly active users of Uber drivers in the United States have recovered to about 80% of 2019, and the number of monthly active users of drivers in London has basically reached the level of 2019.

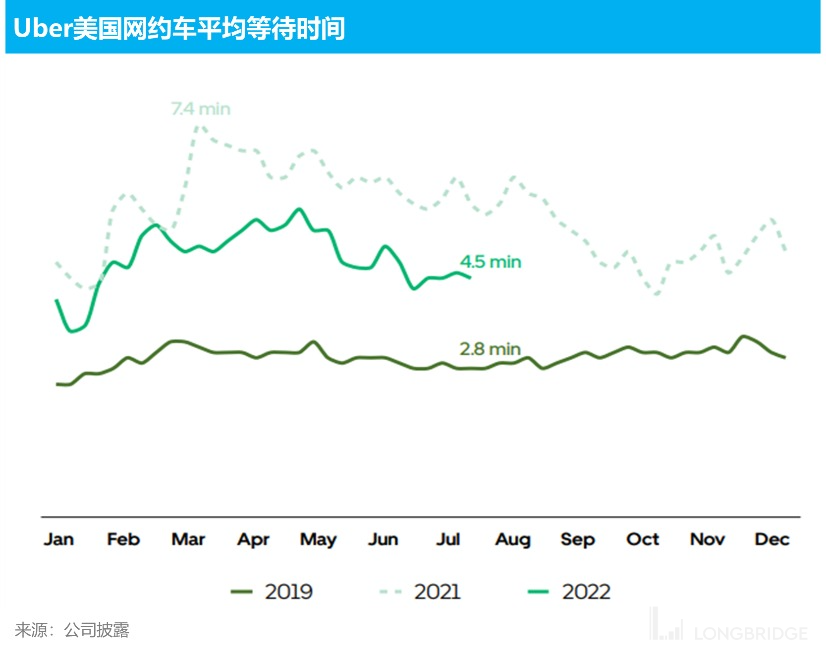

Therefore, although the demand for travel has surged, the average waiting time for US ride-hailing passengers has continued to decrease since the second quarter due to the large number of ride-hailing drivers returning. The sufficient order volume has raised the average income level of ride-hailing drivers, and the sufficient number of ride-hailing drivers has also improved the user experience for passengers, thereby enabling the supply and demand growth of ride-hailing to enter a virtuous cycle.

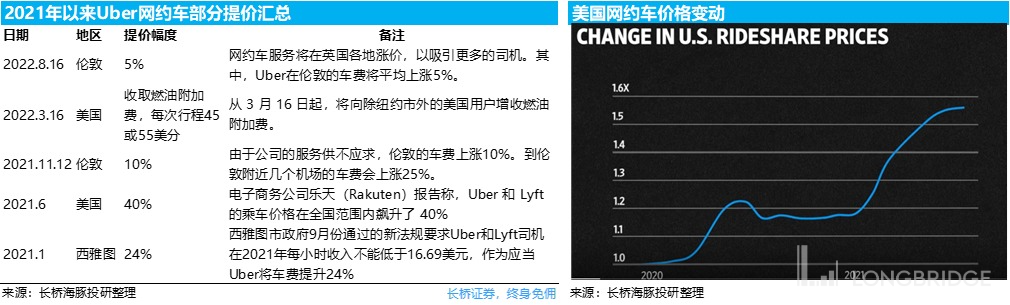

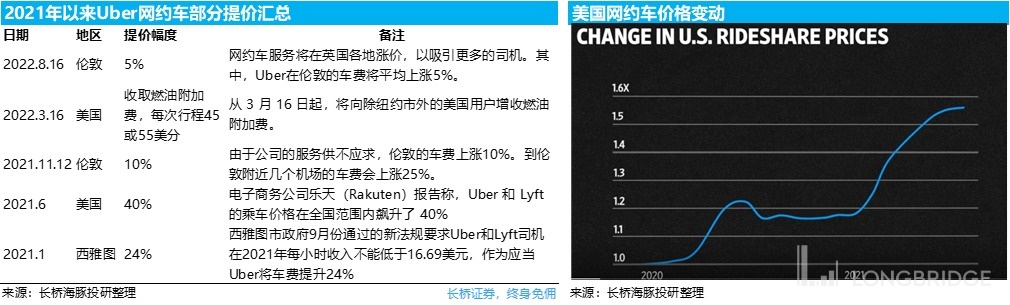

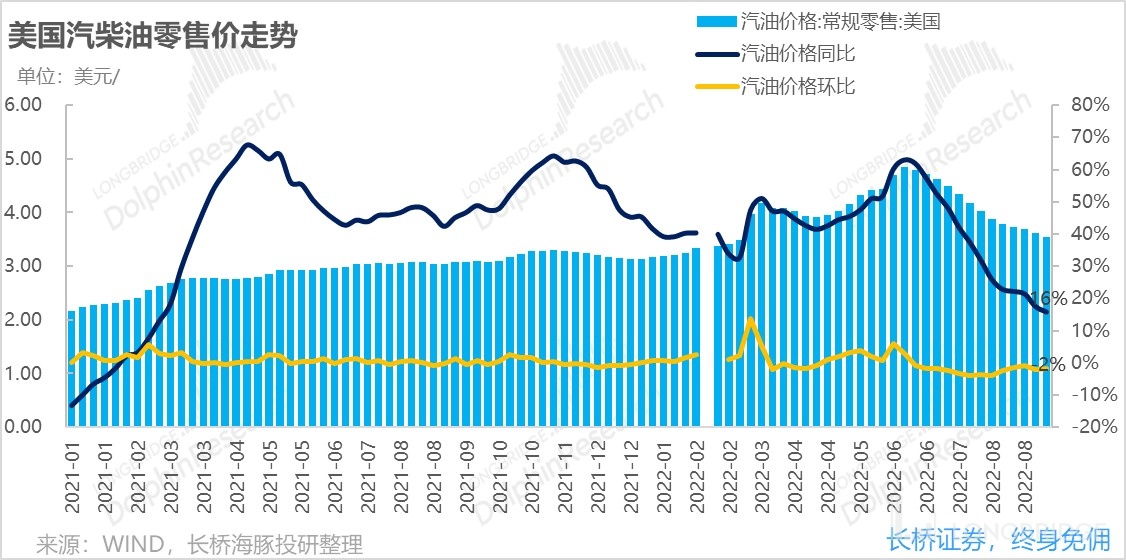

In addition to the growth in quantity mentioned above, from a price perspective, in the context of skyrocketing oil prices, travel prices have also risen sharply. As shown in the figure below, the average price of US ride-hailing had increased to more than 1.5 times the pre-epidemic level by the middle of 2021. In order to cope with the erosion of ride-hailing driver income caused by the rise in oil prices, Uber has also frequently and significantly raised ride-hailing prices in the United States, London, and other places since 2021. Ride-hailing price increases are not only beneficial to driver income, but assuming that the realization rate of the ride-hailing company remains unchanged, a higher unit price actually means that the ride-hailing company can obtain higher commissions.

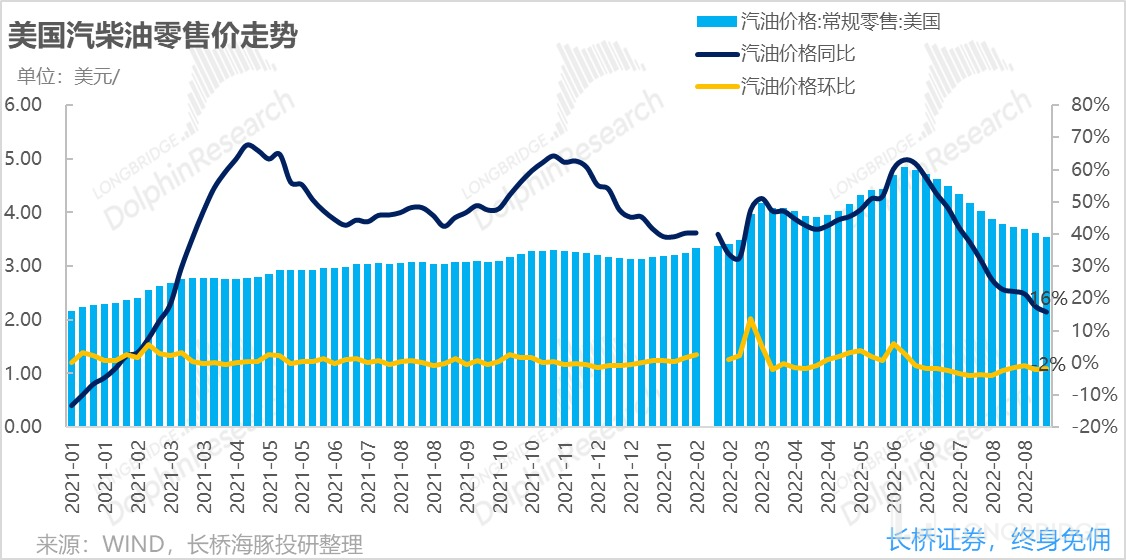

Overall, in the first half of 2022, the ride-hailing industry is in the best business cycle of rising prices and quantity. Since the end of June this year, the price of gasoline in the United States has been declining from its peak. So is the fluctuation of gasoline prices good or bad for the ride-hailing industry? Let's take a dialectical look at it:

-

When the price of oil rises, ride-hailing companies can raise prices, which can increase the incomes of drivers and companies but harm demand and prompt passengers to turn to public transportation. If the company does not raise prices, the income of drivers will be eroded, leading to the outflow of driver supply.

-

When the price of oil falls, if the company also reduces prices (but to a lesser extent), not only will the net income of ride-hailing drivers (passenger payment - company commission - gasoline and other costs) increase, but the cheaper prices will also stimulate demand. Therefore, a reasonable decline in oil prices is a healthier and more sustainable growth model for the ride-hailing industry.

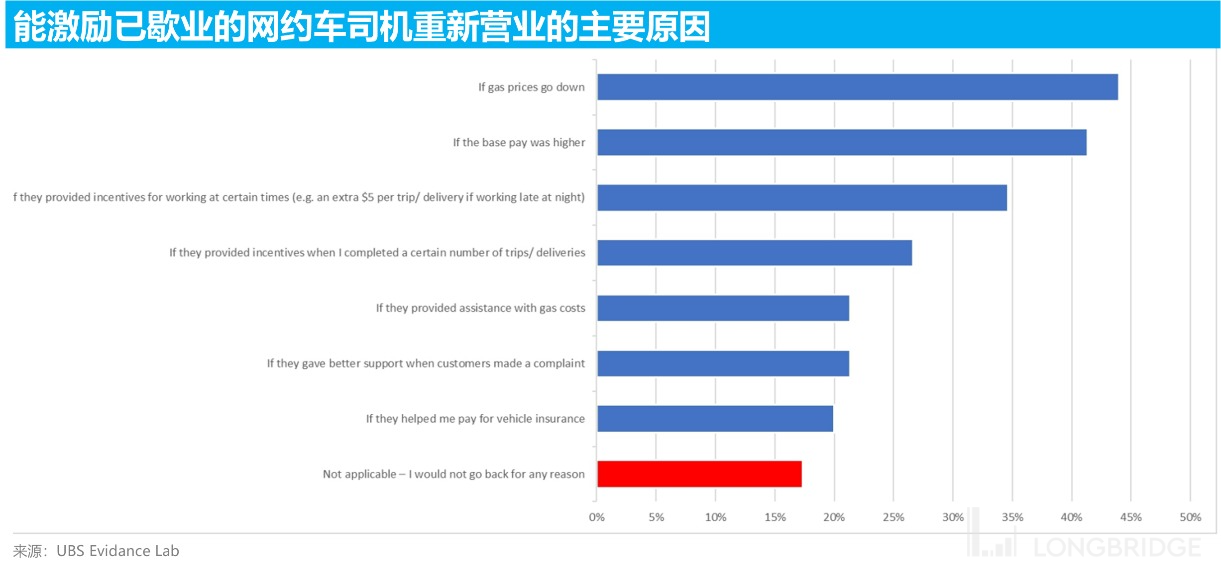

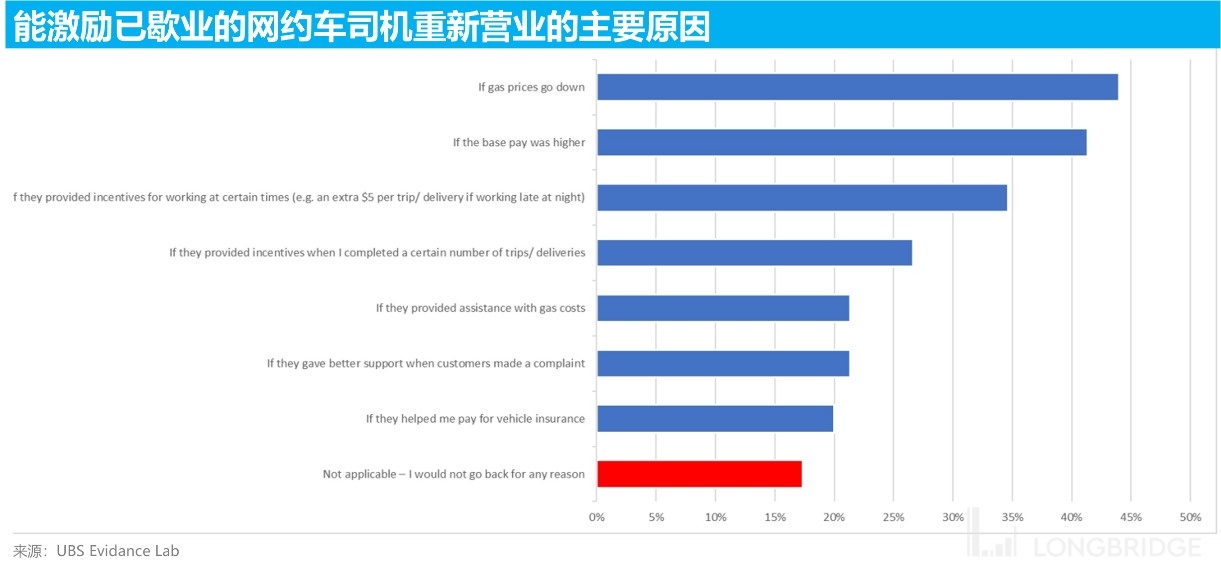

According to UBS's survey of U.S. ride-hailing drivers, the most effective factor in stimulating drivers' return to the ride-hailing industry is a decrease in gasoline prices. Therefore, the recent continuous return of ride-hailing drivers can be explained by the decline in gasoline prices since the second quarter.

Looking ahead to the second half of the year, as offline activities in the United States continue to normalize and the job market remains hot, as long as there are no enormous systemic risks or mass unemployment in the U.S. economy, the relatively mandatory commuting demand will also become more robust. Even if gasoline prices continue to decline in the future, more passenger demand and driver supply will help make up for the losses from price from a quantitative standpoint. Therefore, in the medium term, the ride-hailing business of companies will probably continue to be prosperous.

3. Not just the second curve, the food delivery business is also driving the company's "flywheel"

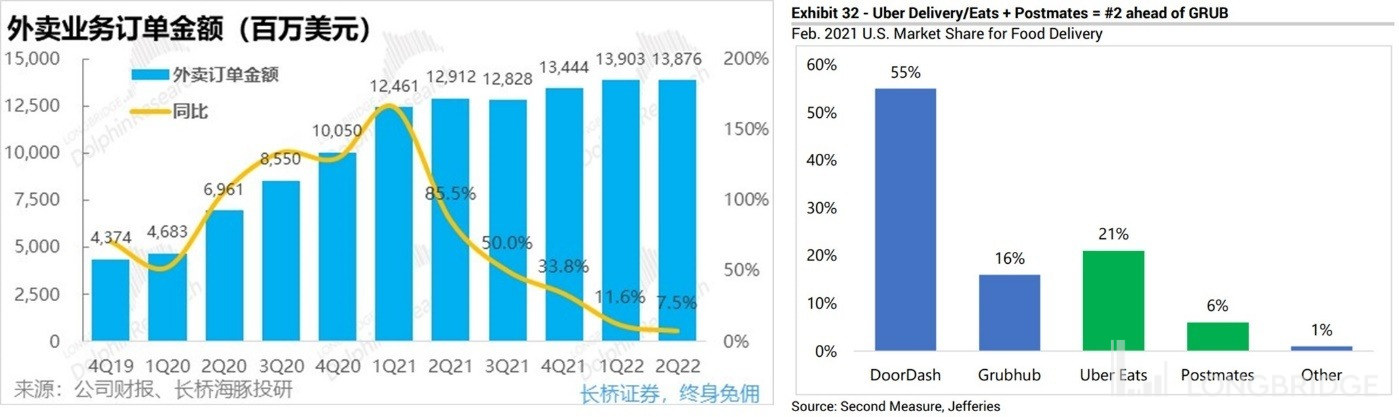

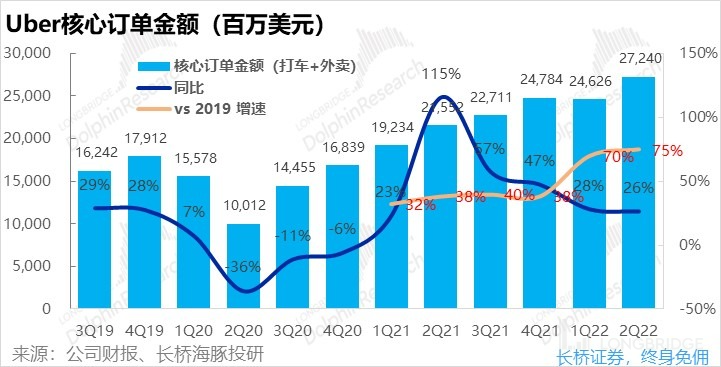

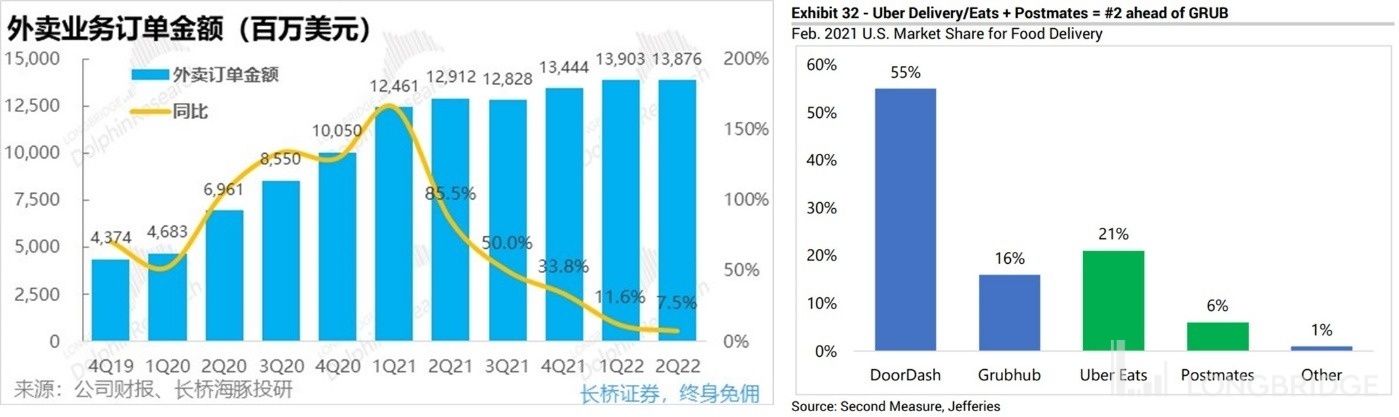

With the wind during the pandemic, the company's second curve - the food delivery business - has also achieved an order scale of over tens of billions of dollars per quarter and is close to the ride-hailing business in terms of order amount. From this perspective, the food delivery business as the second curve is quite impressive.

However, "profit and loss are linked." The impact of the pandemic has promoted the doubling of the food delivery business (Uber Eats), and after the pandemic bonus period is over, the growth of the food delivery business is also rapidly declining, with a year-on-year growth rate of only 7.5% in the second quarter of this year.

At the same time, unlike Uber's ride-hailing business, which generally dominates the European and American markets, the food delivery business does not have such a strong market position.

Even in the US market alone, the market share of Uber Eats and its acquired food delivery platform Postmates is less than 30%, far behind the industry leader DoorDash with a 55% market share.

Therefore, if we look at Uber Eats alone, as a business with stagnant order growth, bleak future growth prospects, an unideal industry structure, and unclear long-term profitability from the perspective of the stock market, it is not an attractive target.

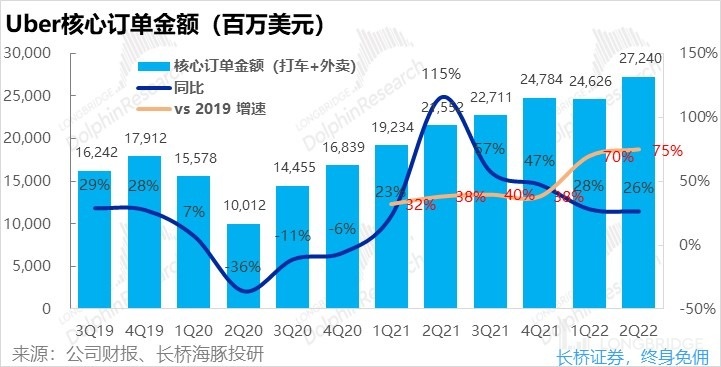

In fact, if we look at Uber's taxi business alone, from 2019 to present, the amount of taxi orders has just recovered to pre-epidemic levels, with zero growth over three years. From this perspective, Uber's taxi business is just a logical rebound and not an attractive proposition.

However, when Uber's taxi and delivery businesses are combined, during the epidemic period when the taxi business has significantly declined, the rapidly growing delivery business has filled the gap; and when the delivery business has suffered a stagnation after the epidemic, the taxi business has taken on the growth relay once again. With mutual assistance, the total order amount of Uber's taxi + delivery has reached 175% in the second quarter of this year compared to the same period in 2019, and the year-on-year growth rate of the current order amount is still 26%.

Therefore, the combination of taxi + delivery has created a flywheel effect for Uber, making the company a rare target that can withstand risks and prosper cyclically.

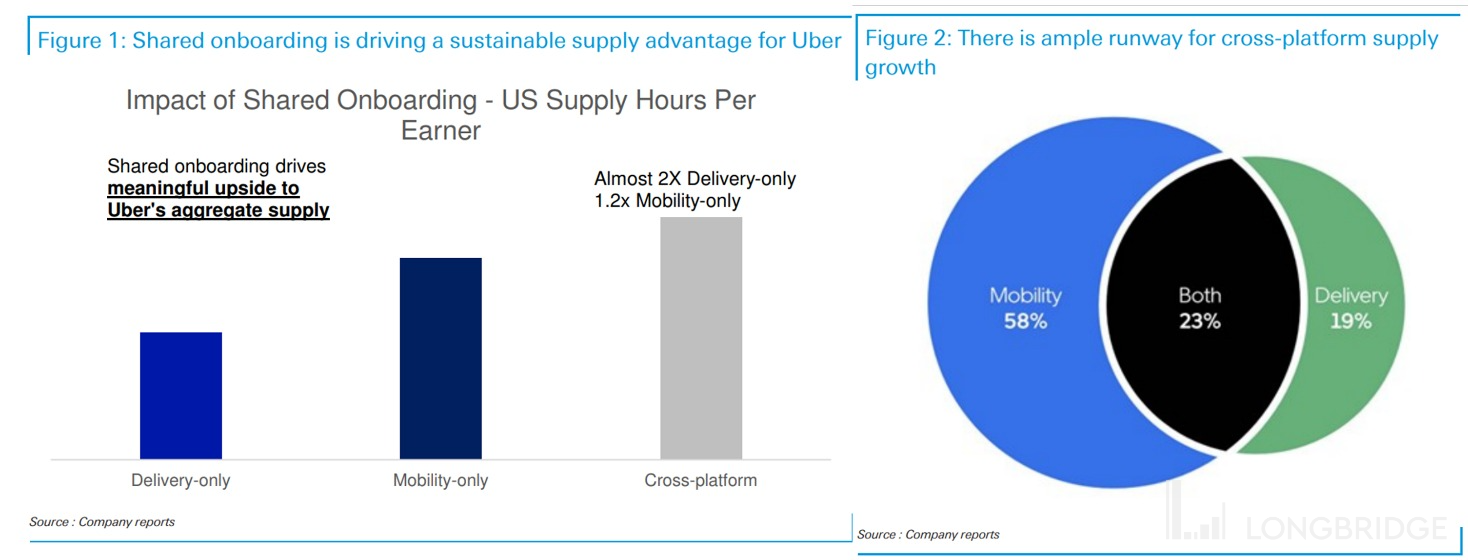

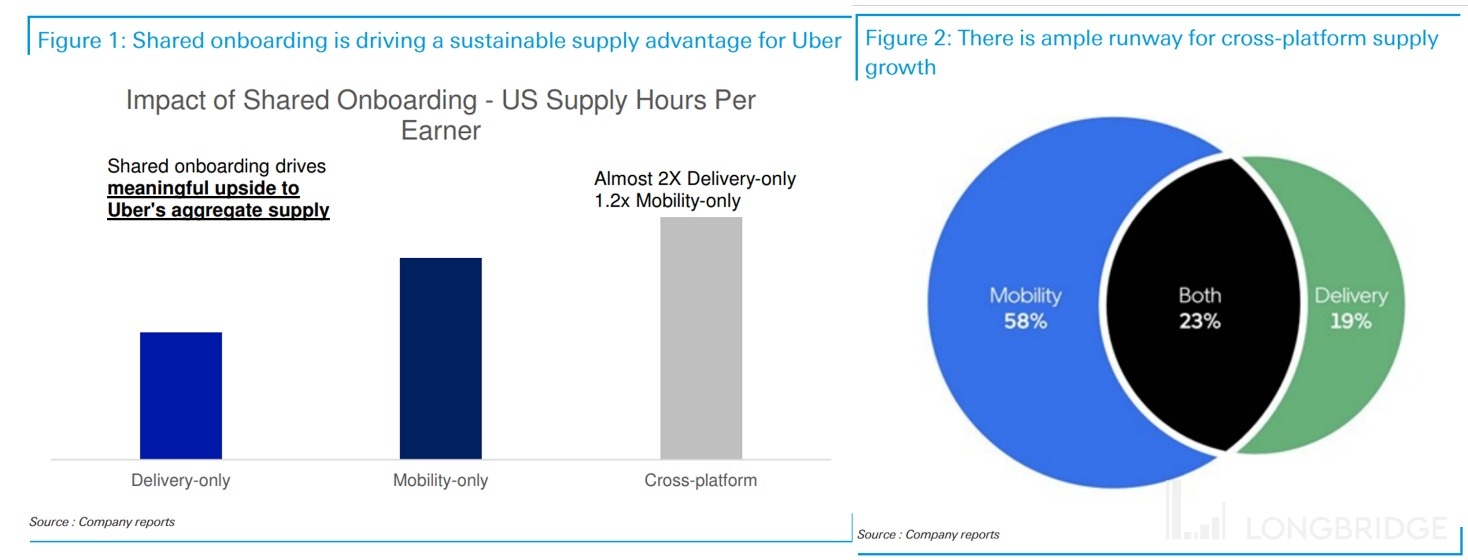

More importantly, the flywheel effect of Uber's taxi and delivery businesses is not only reflected in the financial aspect, but also in the fact that users and drivers can convert between delivery and taxi services on the platform.

In China, delivery services and taxi services are completely different forms: one is transporting people by car, and the other is delivering food in bulk by electric bike. However, in other countries, some delivery services are also completed by car (because the delivery distance can be longer, the delivery fee is higher, and the cost of car delivery can be borne). Therefore, drivers on the Uber platform can freely switch between driving people or delivering food, or work in both jobs in different time periods to earn more income.

Being able to help drivers earn more income also means that the Uber platform is more attractive to drivers than platforms with a single business. According to the company's survey, the amount of time drivers are willing to provide services on a platform with both taxi and delivery services is 1.2 times that of a platform with only taxi services and 2 times that of a platform with only delivery services.

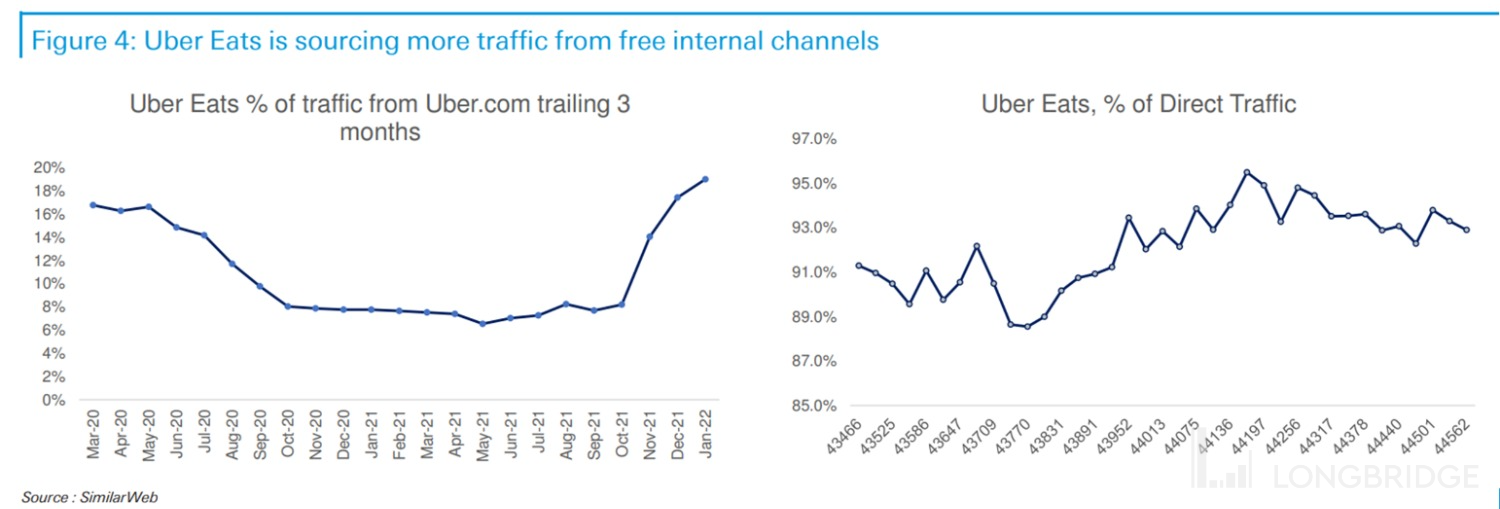

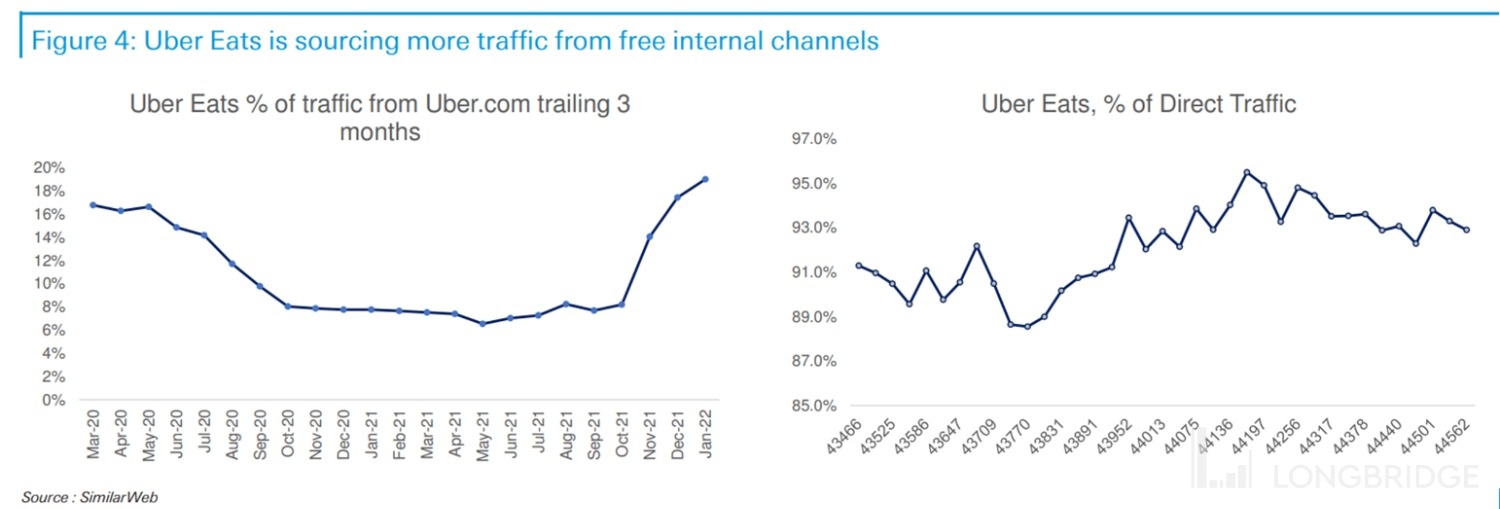

Increasing the supply of drivers also means that Uber can cover a wider range of areas, meet more customer needs, and provide more timely services. According to the company's disclosure, 23% of drivers on the Uber platform currently provide both taxi and delivery services, leaving room for further improvement. In addition, the more mature ride-hailing business has helped the take-out business to attract traffic for free. In 2022, the share of free traffic from the main site for take-out business (Uber Eats) accounted for nearly 20%.

In addition to allowing drivers to move flexibly between ride-hailing and take-out businesses, having both businesses increases the frequency of consumers using the Uber platform and increases user stickiness. According to the company, the monthly active consumers that use both services spend 6 times more on Uber than those who only use ride-hailing and 2 times more than those who only use take-out services.

Overall, the significance of the take-out business is not only to bring considerable incremental revenue to the company. From a more core business perspective, it provides higher order density to the ride-hailing or take-out platform with weaker bilateral effects, allowing drivers to earn more money, users to be more willing to use the service, and the company to obtain more revenue from limited consumers and drivers.

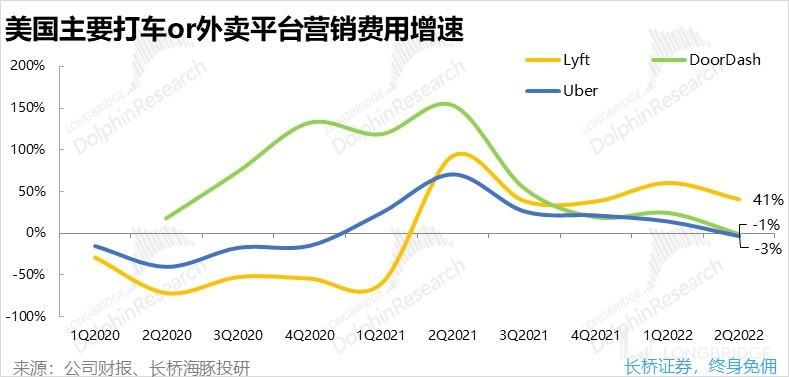

Fourth, the "lying flat" trend has spread to global tech companies, and Uber's profit cycle has also come.

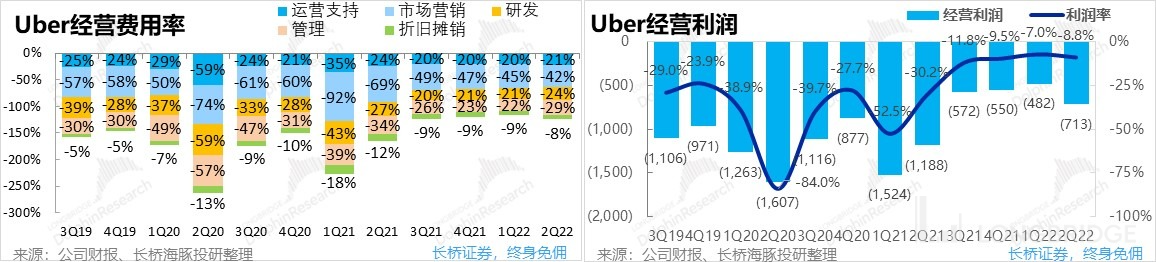

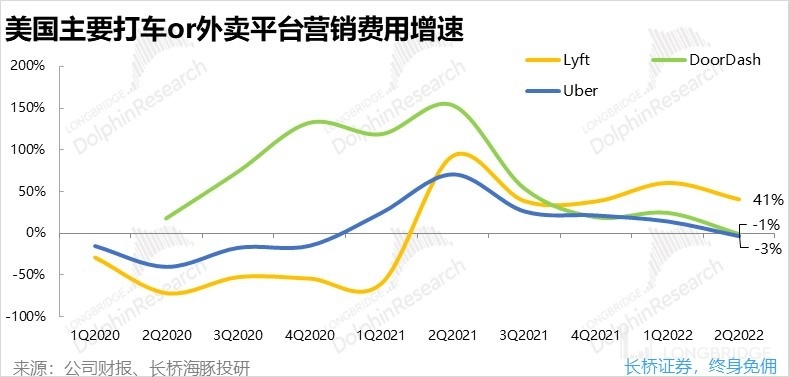

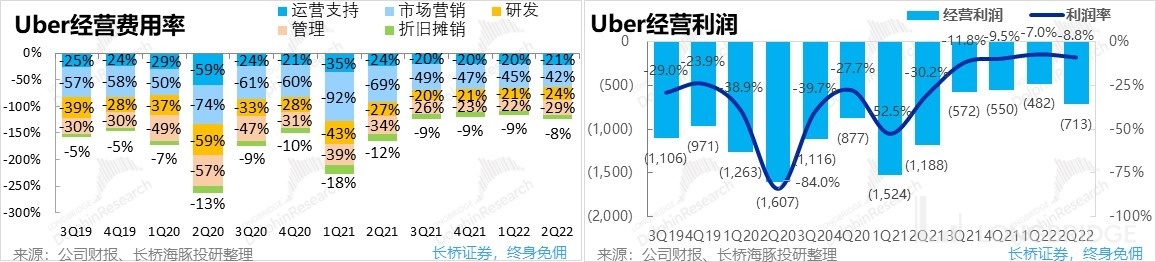

In addition to the flywheel effect brought to Uber by take-out + ride-hailing, online taxi or take-out platforms have also entered a period of reducing costs and increasing efficiency and releasing profits, coinciding with the backdrop of a major downturn in the US capital market and bleak economic prospects in the future. As can be seen from the following figure, whether it is Uber, the second-largest ride-hailing company Lyft, or the largest take-out company DoorDash, their marketing expenses have continued to decline, with Uber and DoorDash even entering the contraction phase. When companies reduce their investment and no longer compete for market share, the profits of each company in the industry will increase as a whole.

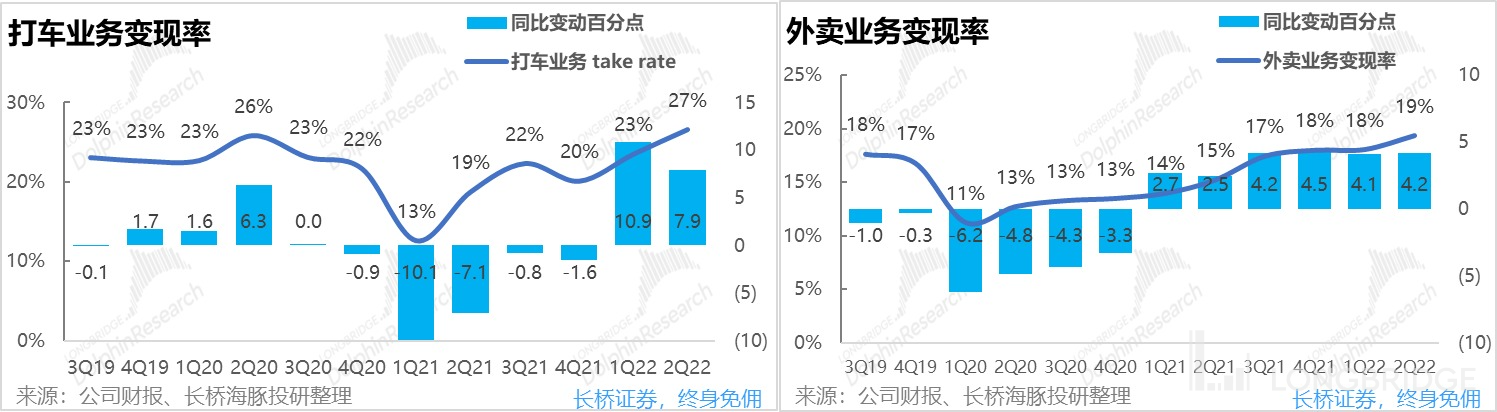

As for the ride-hailing business, since user demand and driver supply are quickly recovering, Uber and Lyft's need to heavily subsidies to attract users and keep drivers will decrease. Reflected in the financial report, the monetization rate of the company's ride-hailing business (revenue/order amount) has also continued to increase, reaching a historical high of 27% in the second quarter of this year. Since the company's order amount caliber does not exclude the total price before offering subsidies to drivers or users, one reason for the increase in monetization rate is the decrease in subsidies.

For the take-out business, when the revenue growth rate slows down to single digits, the company's sensible choice is to reduce investment and try to increase monetization. In reality, Uber's monetization rate for take-out business is indeed continuing to increase and has reached 19% in the second quarter.

With higher realization rates naturally comes greater profit margins. The company's unique dual-platform business of food delivery and ride hailing also provides a higher order density, resulting in lower average backend costs (such as operational support, etc.). Furthermore, the company is actively reducing marketing expenditures, and its operating losses are continuing to narrow. According to current trends, it is expected to achieve a turnaround from losses to profits at the operating profit level in the short and medium term.

With higher realization rates naturally comes greater profit margins. The company's unique dual-platform business of food delivery and ride hailing also provides a higher order density, resulting in lower average backend costs (such as operational support, etc.). Furthermore, the company is actively reducing marketing expenditures, and its operating losses are continuing to narrow. According to current trends, it is expected to achieve a turnaround from losses to profits at the operating profit level in the short and medium term.

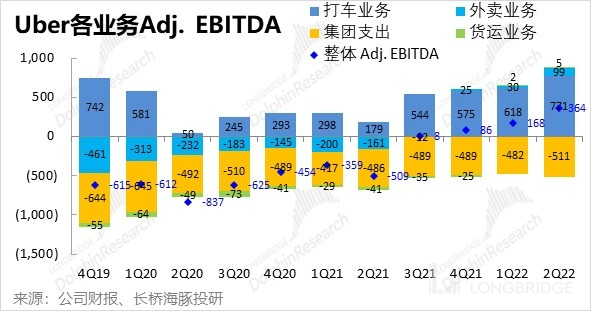

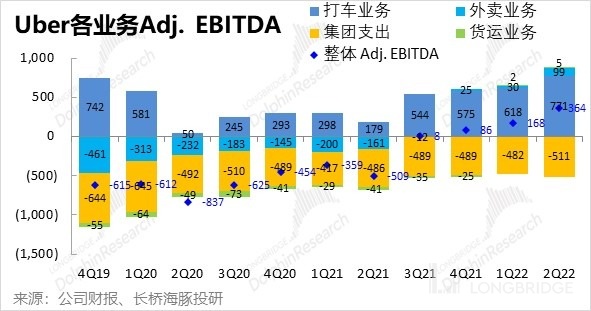

Therefore, when the United States raises interest rates and the market prefers profitability, Uber is also at a crucial point in its history of turning losses into profits. However, when it comes to individual sectors, only the ride hailing business currently contributes significant EBITDA. The profit from the food delivery business is still relatively thin, and the freight business can be ignored.

Despite Uber's current advantage in having relatively high business prosperity beta and its own profit-release alpha cycle, the question remains as to whether the company's current valuation is still cost-effective relative to its fundamentals, and whether the ride-hailing business can continue its current strong rebound. What will be the long-term profitability of the food delivery business? And whether the debate over whether ride-hail drivers should be classified as independent contractors or employees, and its impact on Uber, will have any effect remains to be seen. These issues will be the main focus of Dolphin Analyst in the next article.

Disclaimer and disclosure of risks for this article: Dolphin Disclaimer and General Disclosure for Longbridge Investment