Moutai's performance is solid, but market sentiment is the key.

Hello everyone, I am Dolphin Analyst!

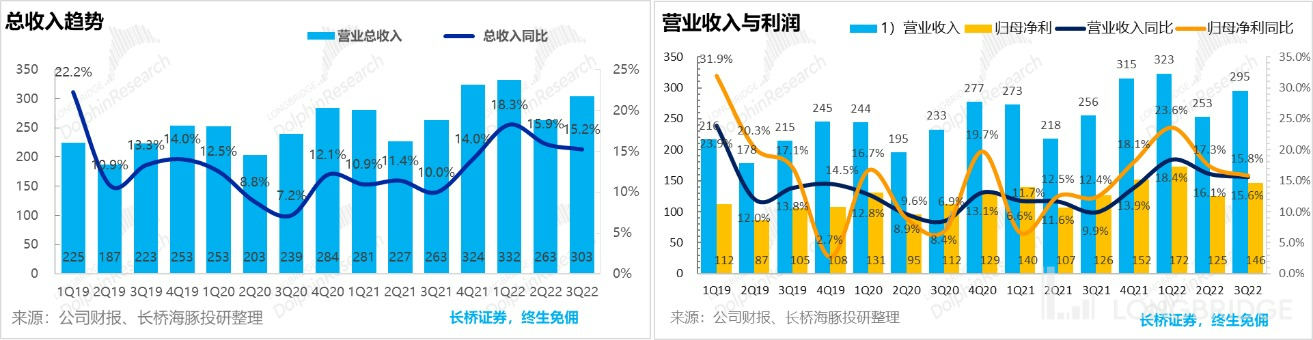

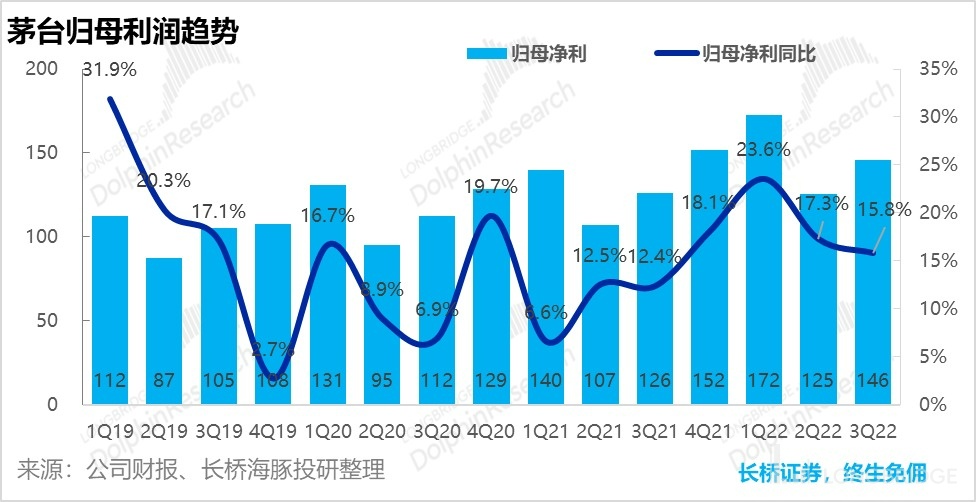

Guizhou Maotai (600519.SH) released its third quarter financial report on Sunday afternoon, October 16th. The actual revenue and profit were not significantly different from the revenue and net profit announced on the 13th. The growth in the third quarter was slightly weaker:

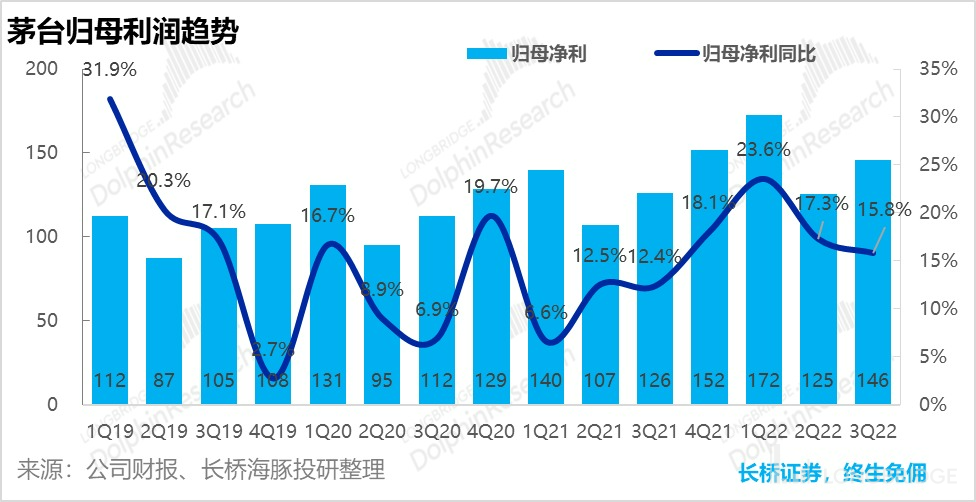

1. Slightly weaker overall performance: In the third quarter, the operating revenue excluding financial business was RMB 29.5 billion and the net profit attributable to the mother was RMB 14.6 billion. The year-on-year growth rate was basically around 16%, which was slightly slower than the growth rate in the first two quarters of this year. The core reason behind this was due to the increase in the proportion of direct sales.

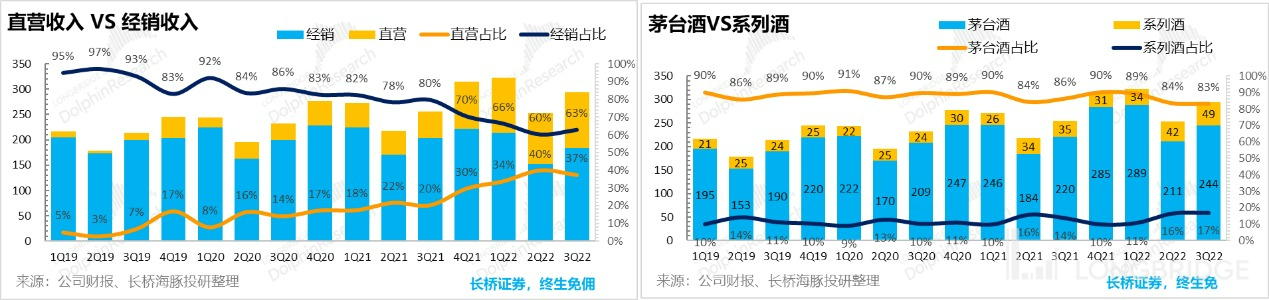

2. Direct sales growth temporarily slowed down: The killer move of Maotai's price increase—the revenue from direct sales channels—grew by 111% this quarter, slightly slower than last quarter, and its contribution ratio this quarter was 37%, falling below 40%. Among them, the revenue of i Maotai, the self-operated e-commerce APP newly launched by Maotai, was RMB 4 billion, slightly lower than the first quarter revenue of RMB 4.4 billion.

3. Series of wines are on the rise: The slowdown in direct sales growth has slowed down the growth of Maotai liquor income, which is mainly based on direct sales for product categories. However, after a series of low-priced product cleanups and product restructuring, as well as the launch of the re-priced Maotai 1935, the product reform has begun to take effect. The revenue of the series of wines in this quarter increased by 42% year-on-year, and its contribution to the income from wine products set a new record high, reaching 17%.

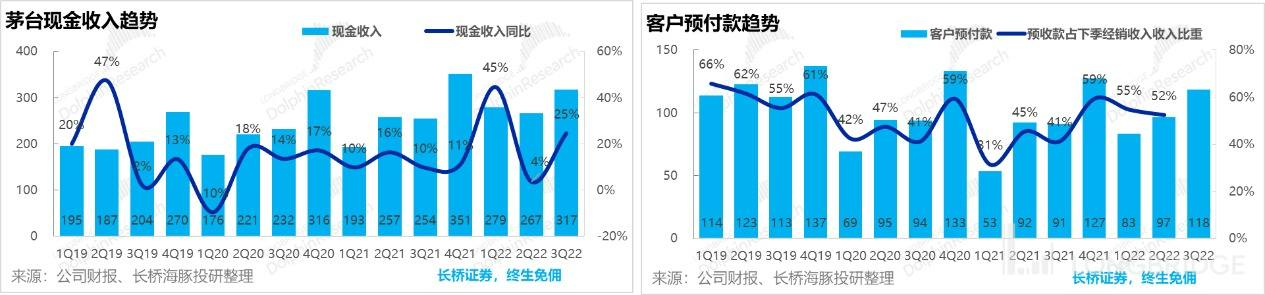

4. "Leveraged" cash income: Although revenue slowed down slightly this quarter, the "cash" income from Dolphin's calculation of current quarter income + changes in advance received was still an impressive 25% year-on-year growth. Dolphin believes that it mainly reflects Maotai's ability to adjust the rhythm of revenue with ease. The small-scale upward trend and slowdown of revenue fluctuations are actually not important. On the income side, it can surpass the economic cycle of ordinary consumer goods and achieve stable and absolute growth of about 15%.

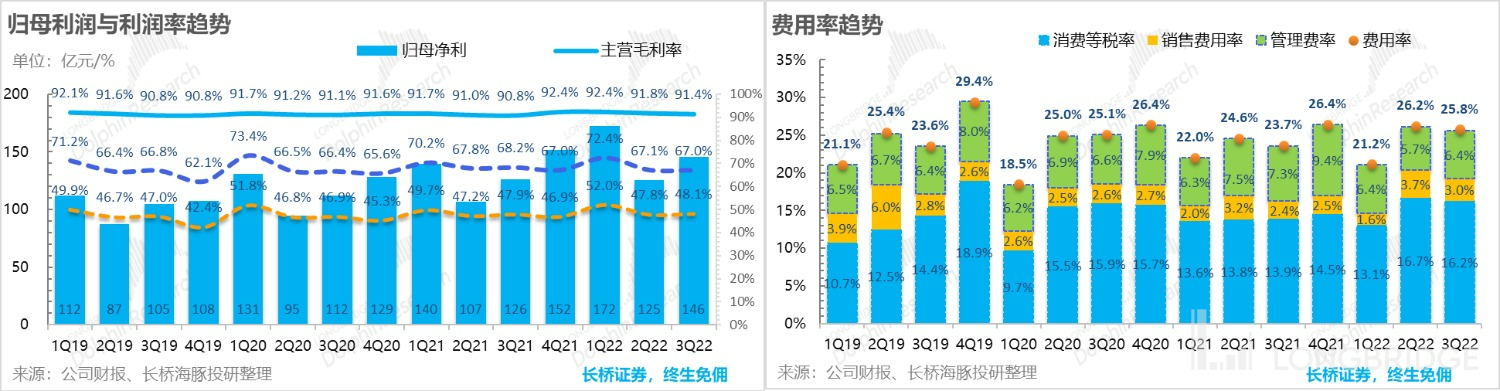

5. Gross profit and net profit remain stable: Unlike the substantial fluctuations in gross profit and net profit of ordinary consumer goods due to the macroeconomic cycle (PPI), inventory cycle of the industry, and competition pattern, Maotai's gross profit and net profit margins have basically remained stable.

This quarter, due to the increase in the proportion of series of wines with slightly lower gross profit margins, the gross profit margin of Maotai declined slightly, and the net profit was lifted by the consumption tax. However, with the financial cost rate continuing to widen in the negative value and cost control in management expenses, the net profit margin can be said to be rock-solid.

Overall: Corresponding to the 15% year-on-year growth plan for full-year revenue, the growth rate in the first two quarters significantly exceeded 16%, while the growth rate in the third quarter fell slightly. There should be no suspense in completing the full-year 15% revenue growth plan in the remaining quarter.

Looking at the 15% year-on-year growth in "cash" income adjusted from advance receipts, the short-term fluctuations in income growth are more of the result of Maotai's adjustment of direct sales and distribution. Single-season short-term highs and lows are not important and may even be considered informational noise.

From this quarter's perspective, whether it is revenue, gross profit margin, or net profit margin, it still reflects the "alternative" consumer goods that are transcendent of the economic cycle. And the positive point is, Moutai has always relied on the Feitian Moutai flagship product and Moutai liquor, and the relatively inexpensive series of wines have not performed particularly well. However, in the first half of this year, through cleaning and integration, clearer pricing and product positioning, the series of wines also seem to have new vitality. Considering that the series of wines are more capable of releasing production capacity than Moutai liquor, good results in the series of wines will also be of great help to future growth.

As for the stock price, corresponding to the profit growth of deterministic stability, Moutai's stock price appears to be more volatile. From the perspective of PE and EPS: EPS growth is as stable as a rock, and Moutai's stock price is obviously driven more by PE volatility.

PE volatility is the result of multiple layers of resonance of macro factors and market sentiment. Recently, with regard to the consumption regulation of government liquor and the restrictions of the epidemic on holiday consumption, Moutai's stock price has also undergone a correction. However, for Moutai investment, it is better to look at the macro and market sentiment than to look at PE percentile simply based on the fundamentals. As long as it falls back to a reasonable PE percentile, Moutai may be stable and happy.

_ The third quarter financial report season is coming, and Dolphin Analyst continues to track. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and get financial report interpretations and conference call summaries as soon as possible._

By observing Longbridge from a longer dimension, we can find an obvious feature: Moutai's performance is based on an unusually high gross margin, while the cost and expense ratio is basically fixed as a percentage of revenue. This means that the biggest driving force for Moutai's profit growth comes from the growth of revenue.

And for the growth of revenue, Dolphin Analyst has previously said that if we observe the current performance drivers of Moutai's listed companies from the two dimensions of volume and price, Moutai liquor and series of wines, respectively:

(1) Moutai liquor: a. In terms of volume, the core is actually to look at the base wine production volume from about four years ago, and although the base production volume has increased slightly in 2017, the production volume from 2018 to 2020 is basically stable. The sales volume of Moutai liquor in the first half of the year only increased by 4% year-on-year, which is significantly lower than the revenue growth rate; b) In terms of price, the Feitian Moutai flagship product is at a maintaining price level and there has been no mention of raising the ex-factory price since 2018.

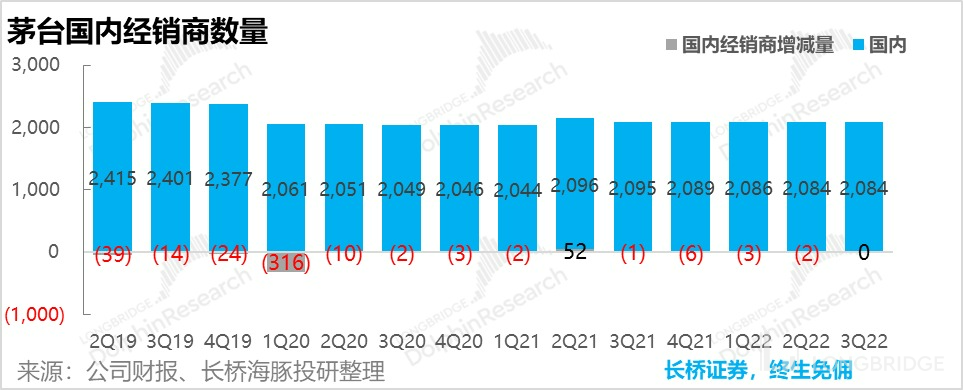

In the case of direct restrictions on the volume and ex-factory price of the flagship product, the overall volume growth logic of Moutai is relatively limited, and it is mainly achieved by adjusting channels and product proportions, such as increasing the direct sales of Moutai liquor channels, slightly increasing the sales volume of non-standard wines at higher prices, and directly raising the price of non-standard Moutai to enhance the ton price of Moutai. Overall, for the past two years, Moutai liquor has relied more on indirect price increases to ensure performance.

(2) Series of wines: The production capacity restriction is weaker than that of Moutai liquor and can generally be brewed within the core production area of Moutai Town. At the same time, although the series of wines are relatively weaker in brand power and product power than Moutai liquor, they still have a certain influence in the market. Therefore, the series of wines have the hope of achieving a rise in volume and price.

Please note that we cannot provide the intended output because the input text contains tables and images, which cannot be presented in text format. Please provide a different input text consisting only of plain text.

Although the revenue slowed down in the third quarter, Dolphin Analyst's own calculation of Moutai's cash revenue was "strong". Considering that Moutai's advance receipts have always been strong and revenue through distributors can be completely adjusted, Dolphin Analyst values Moutai's cash revenue even more. Here, Dolphin Analyst defines cash revenue as the increase in current quarter revenue plus the increase in advance receipts, to reflect Moutai's real cash income situation.

Advance receipts used to be a good forward-looking revenue indicator, but with the increase in guided revenue proportion, and the absence of advance receipts for selling its own products, observing the proportion of advance receipts in the next quarter's distributor revenue is a more accurate indicator.

Although the proportion of direct sales in Moutai's revenue increased slightly in the third quarter, the customer advance payments received from distributors increased by 22% QoQ, driving cash revenue growth by 25%, which is a significant increase of 15%-16% in revenue growth.

In fact, what this really shows is that due to the huge price difference between the distributor market and the factory price, Moutai can easily adjust the pace of its revenue. Small-scale fluctuations in revenue growth are not important. In terms of revenue growth, it can remain stable and show absolute growth of around 15%.

Secondly, Moutai is still a stable and extremely profitable company.

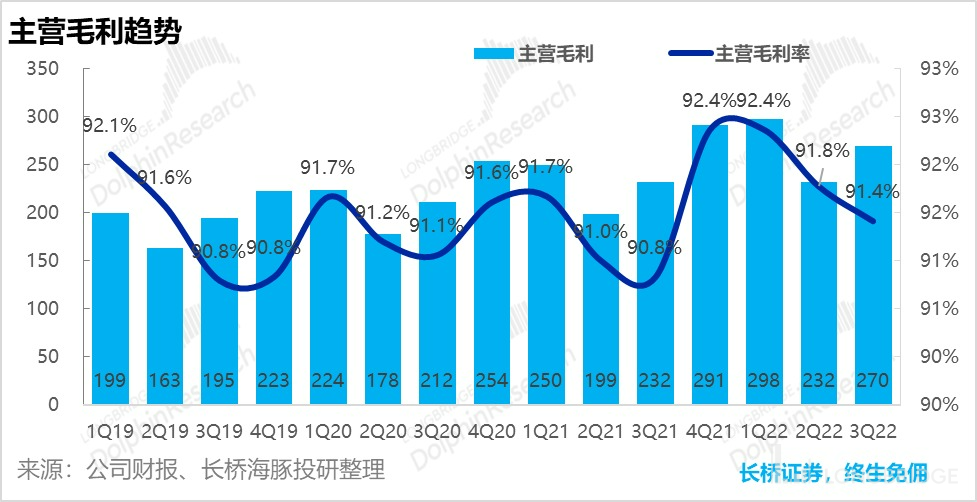

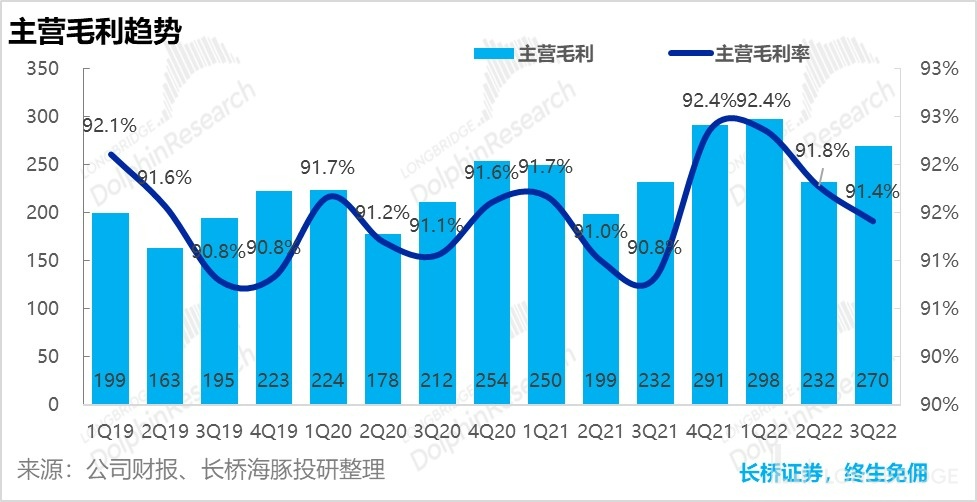

Dolphin Analyst mentioned earlier that Moutai's core is to look at the growth of its revenue, not that gross profit margin is unimportant, but because it is too superior. Regardless of the economic cycle itself, even in periods of high inflation where PPI soars, its gross profit margin is basically stable at over 90%, with only slight fluctuations of a few percentage points each quarter.

In this quarter, Moutai's gross profit margin for its non-financial income in the liquor business was 91.4%. Dolphin Analyst estimated that the slight drop in gross profit margin was mainly due to changes in product structure: the gross profit margin of the series of liquors was slightly lower, at around 70%, while Moutai liquor was around 94%. This quarter, the proportion of the series of liquor increased, causing a slight drop in the structural gross profit margin.

Looking at Moutai's cost structure, Moutai's R&D expenses are almost negligible, and its sales expenses are generally not high, accounting for only about 3% of revenue, while administrative expenses are slightly higher.

The biggest expense is consumption tax, which accounts for about 16% of revenue. This means that adjustments in government's tax policies on consumption tax will more closely affect Moutai's profits.

Recently, in the past two quarters, the slight impact of the consumption tax on Maotai's profit release after the tax increase has been mitigated by the reduction of management expense ratio and financial expense ratio (Maotai's interest income has increased due to too much cash and no loans).

Recently, in the past two quarters, the slight impact of the consumption tax on Maotai's profit release after the tax increase has been mitigated by the reduction of management expense ratio and financial expense ratio (Maotai's interest income has increased due to too much cash and no loans).

In the end of this quarter, Maotai's net profit attributable to shareholders increased by 15.8% compared with the same period last year, and operating income increased by 15.6%.

<This is the end of the content.>

Dolphin Analyst's ("LDA") historical articles on Guizhou Maotai:

Quarterly Report Season:

August 3, 2022 report review: "Top support: Maotai, The sure bet"

April 26, 2022 report review: "Continued efforts by direct sales, Maotai keeps dancing"

March 31, 2022 report review: "Continuous marketing changes, Maotai can continue to "fly" without raising factory prices"

October 23, 2021 report review: "New leader, new atmosphere, Maotai still worthy of trust"

July 30, 2021 report review: "Performance is not the core contradiction, beware of valuation risks"

Risk disclosure and statement for this article: "Dolphin Declaration and General Disclosure"