The input contains no unique terms to be translated

On the evening of October 21, 2022, Ningde Times released its third quarter report for 2022, with the following highlights:

-

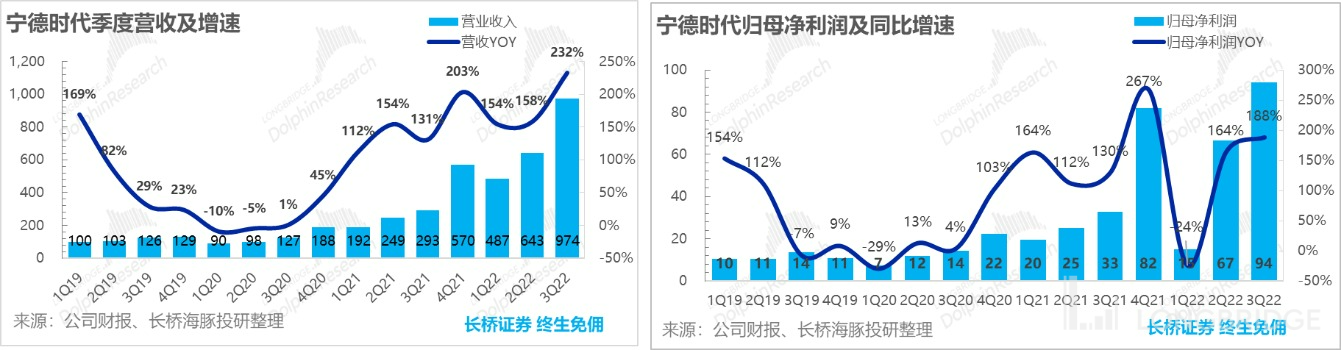

Revenue greatly exceeded expectations: The prosperity of power batteries continued and energy storage surged (the total shipment of 90GWh of energy storage accounted for 20% of the total), and Ning Wang's third quarter revenue exploded, with single-quarter revenue almost breaking through the trillion mark, reaching 97.4 billion yuan, a year-on-year increase of 232%, reaching a historical new high that can only be described as domineering.

-

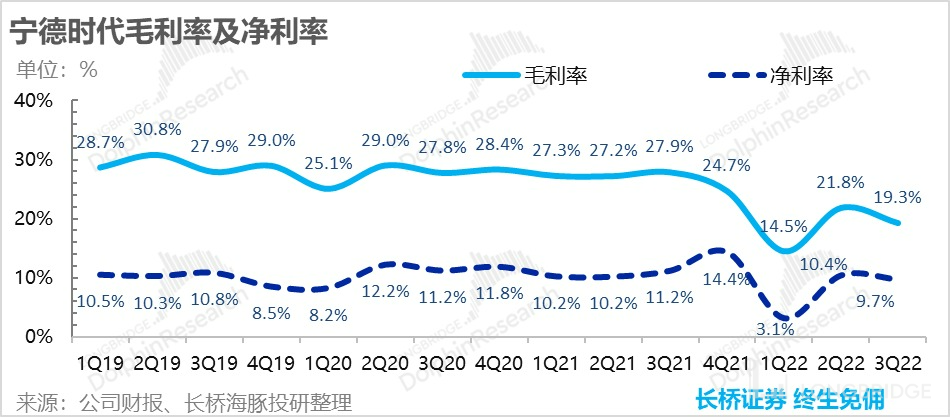

Gross margin isn't doing well again? Due to the previously announced high net profit, the actual revenue was even more domineering than the profit, so the deficit in the most concerning gross margin for the market this time lies in the fact that although the gross margin level of 19.3% in the third quarter was not worse than that of the second quarter due to the completion of price hikes in the third quarter and a slight price reduction of lithium, there was a noticeable drop in other non-lithium battery materials. However, Ning Wang explained that the main reason was that the gross margin of the second quarter was inflated due to price retracements, and the situation in the third quarter improved both in terms of power batteries and energy storage on a quarter-on-quarter basis.

-

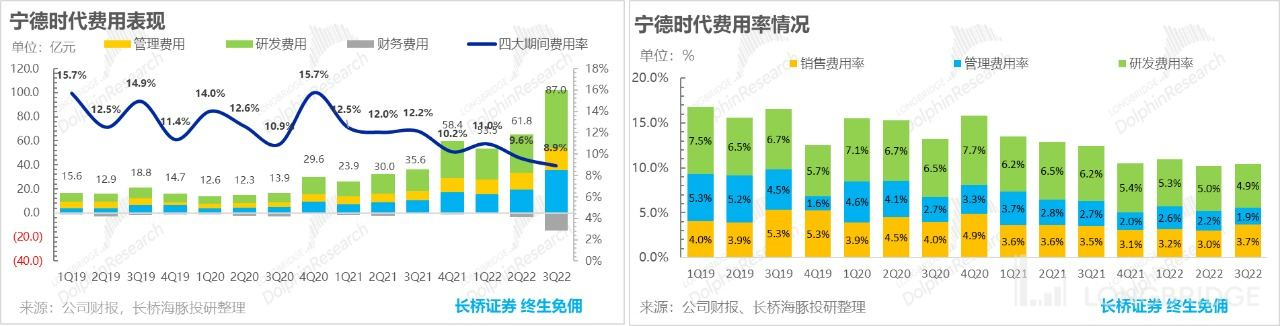

After-sales cost accrual hinders the release of operating leverage. In this quarter, the company’s R&D expenses, sales expenses, and management expenses totaled 10.5%, up 0.3 percentage points from the second quarter. While management expenses continue to be rapidly diluted, R&D expenses are a little slower to construct technological barriers. Despite the high revenue growth rate this quarter, the sales rate has increased, mainly due to the excessive accrual of comprehensive after-sales costs (mainly warranty fees) after project delivery. It's not a big problem overall, and the core issue is still the gross margin.

-

The high-value core operating profit that has not been reflected in net profit is not as good as expected: The net profit this quarter was 9.424 billion yuan, a year-on-year increase of 188%, which is basically consistent with the profit forecast that excited the market after the National Day holiday. However, due to the lower minority shareholder distribution rate and tax rate, as well as higher financial income from financing and receipt of financial management, etc., a part of the net profit was fictitiously inflated. The actual core operating profit of revenue - cost - taxes and surcharges - three fees that Dolphin Analyst paid particular attention to only increased by 87%, not as stunning as expected this quarter, with all the surprises coming primarily from the surge in revenue.

Dolphin Analyst's overall view:

Given the already known net profit for the third quarter, what the market is actually more concerned about is finding incremental information on the revenue and gross margin fronts through the financial report. The actual result was that revenue exploded, but the gross margin was still relatively weak, and the quality of net profit was not as impressive as it looks on paper, mainly due to the gross margin issue.

Regarding the most concerning indicator for the market currently, the company's explanation was that in the second quarter, there was a profit overstatement due to the retrospective price mechanism based on vehicle models, which was reduced in the third quarter. However, if this factor is excluded, the gross margin of both energy storage and power batteries in the third quarter compared to the second quarter is recovering. If this explanation is indeed true and reliable, it actually means that there is still a guarantee for Ning Wang's performance in the fourth quarter: first of all, the revenue will continue to explode, after all, the fourth quarter has entered the last quarter before the subsidy backtracking period, coupled with the continuous outbreak of energy storage, there will be no problem with revenue;

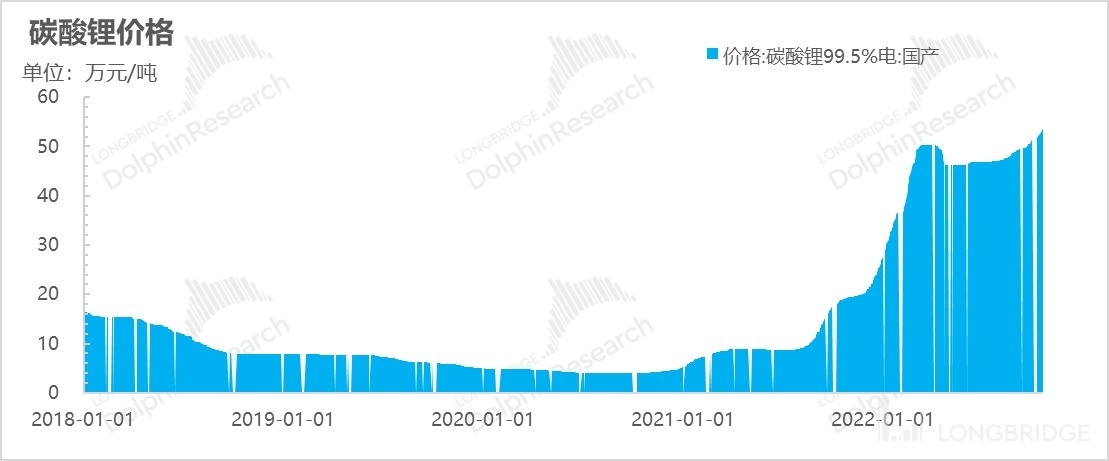

As for the gross profit end, the Dolphin Analyst noted that since October, the price of lithium carbonate has soared again, and it seems to be approaching the level of 550,000 yuan/ton. Some even shouted out a price of 600,000 yuan/ton by the end of the year. However, from the company's perspective, the good news is that the fourth quarter will walk out of the gross profit fluctuations caused by the retrospective price adjustment. If most of the price increase of lithium can be passed on, the gross profit margin will continue to rise in the fourth quarter, and the scale effect will continue to dilute the cost, and the profit may not necessarily be guaranteed.

But currently, the market is actually more concerned about the outlook for next year: as Tesla, the industry leader in new energy vehicles, vows never to reduce production, to a certain extent, it means that the new energy vehicle industry will enter a year dominated by demand from a supply-driven perspective.

In an environment where the growth rate of new energy vehicle penetration is slowing down and high interest rates are suppressing optional consumption, downstream companies with more fierce competition may alleviate the degree of penetration slowdown to a certain extent, thereby relatively benefiting companies with discourse power in the downstream lithium resource market chain, such as Ningde Times. Its situation may be better than that of vehicle companies, but at the same time, the high lithium price is like a sword, which will affect the investment logic of the downstream lithium resource market. Generally speaking, the Dolphin Analyst believes that in the automotive industry chain next year, the situation of battery factories may be a little better, but it is currently not too clear and should not be heavily invested.

For Ningde Times' third quarterly report, because the company had just passed a profit forecast of RMB 8.8 billion to RMB 9.4 billion for the third quarter as soon as the National Day holiday was over, it had already revealed the amazing performance of the company's third quarter profit. Therefore, the main observation of the third quarter's performance is:

1. Observe Ningde Times' growth rate through revenue: The high prosperity of power batteries and even higher prosperity of energy storage can be understood by the growth of revenue and the disclosure of shipment information of these two businesses.

2. Observe the cost transmission situation through changes in gross profit margin: Especially when capacity is not a problem and the utilization rate of capacity is high, the gross profit margin is more dependent on variable material costs: where did the price adjustment of Ningde Times go up to in the third quarter after the price of lithium stubbornly rose and fell?

3. Expense ratio: As far as the manufacturing industry is concerned, if revenue continues to soar, especially high-growth companies like Ning Wang with more than 200% growth, the release of operating expense leverage is almost natural and only requires a slight attention to expenses. The core is to look at the investment situation of R&D expenses.

- Other miscellaneous items: Other miscellaneous items before net profit, such as tax rates, minority shareholder profit sharing, financial expense ratios, investment income, etc., are only for observation and to some extent, noise for studying net profit quality. Observation is the main purpose.

With the above questions, let’s find answers in the financial report. The following is the content:

I. Revenue: Double-wheel drive speed up

Overall: In terms of revenue performance, Ning Wang's revenue can be described as more amazing than the previously announced profit: it soared to RMB 97.4 billion in a single quarter, and it seems to be about to break through the RMB 100 billion mark, with a year-on-year growth rate of as high as 232%, still in the range of 150%-160% in the first two quarters. This quarter, the actual attributable net profit was RMB 9.424 billion, which hit the upper limit of the forecast and increased by 188% year-on-year. However, the profit growth was not as exaggerated as the revenue growth.

Shipments: Power batteries perform well, but should we rebuild battery businesses for energy storage?

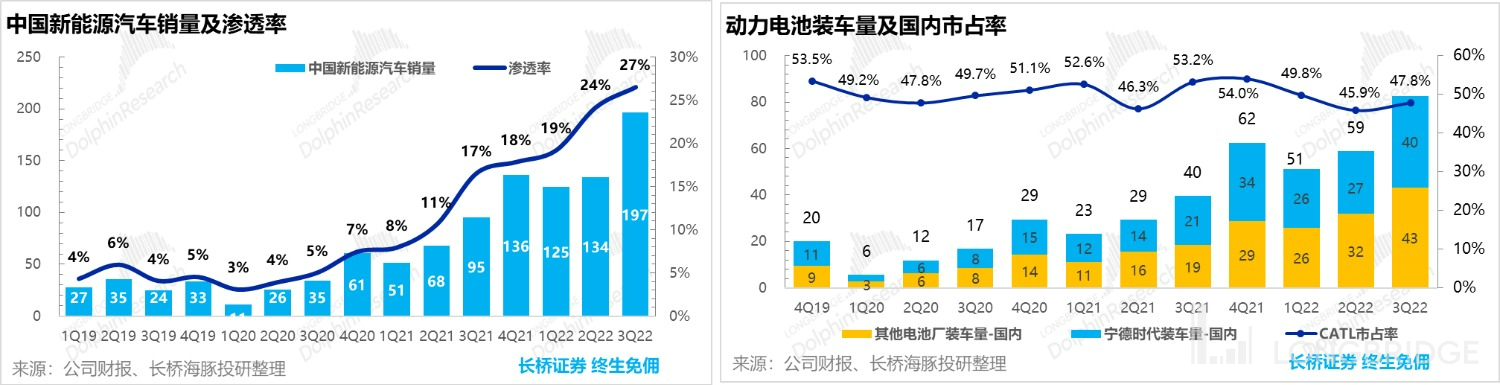

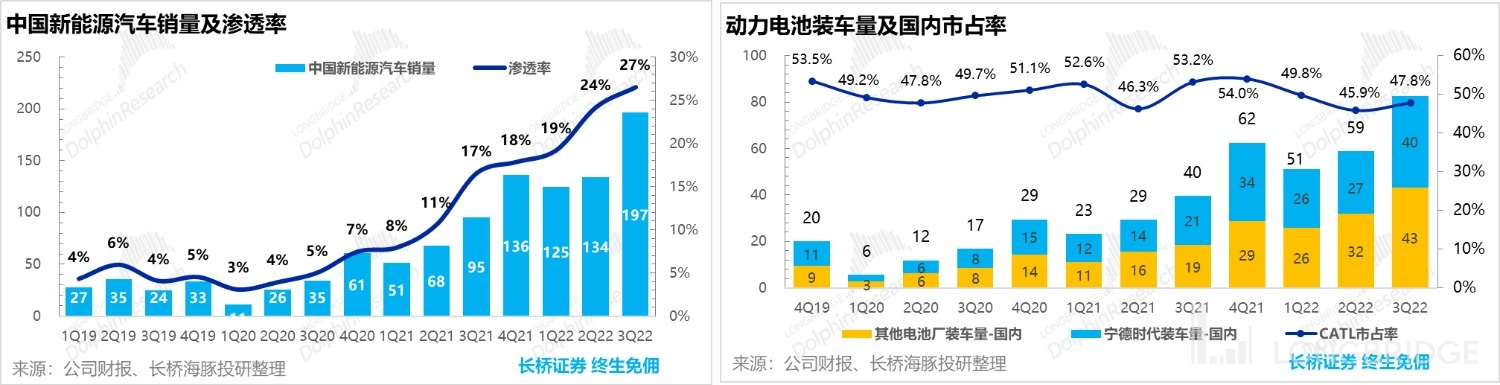

Power batteries: After a slight adjustment during the epidemic in the second quarter, the sales volume of new energy vehicles in China has reached 27% in the third quarter, and the single-month sales volume in August has exceeded 30%. Correspondingly, the domestic power battery installed capacity was 83GWh, up 109% year-on-year. Due to the large sales volume of BYD vehicles driving up the market share of BYD batteries, the growth rate of Ningwang power battery has been suppressed, and the growth rate of Ningwang installed capacity has slowed down slightly.

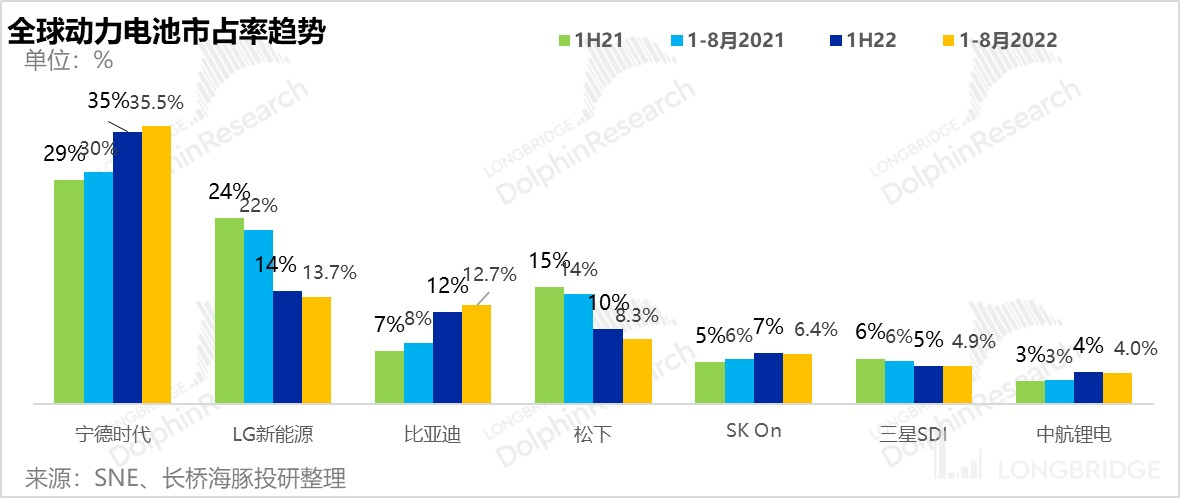

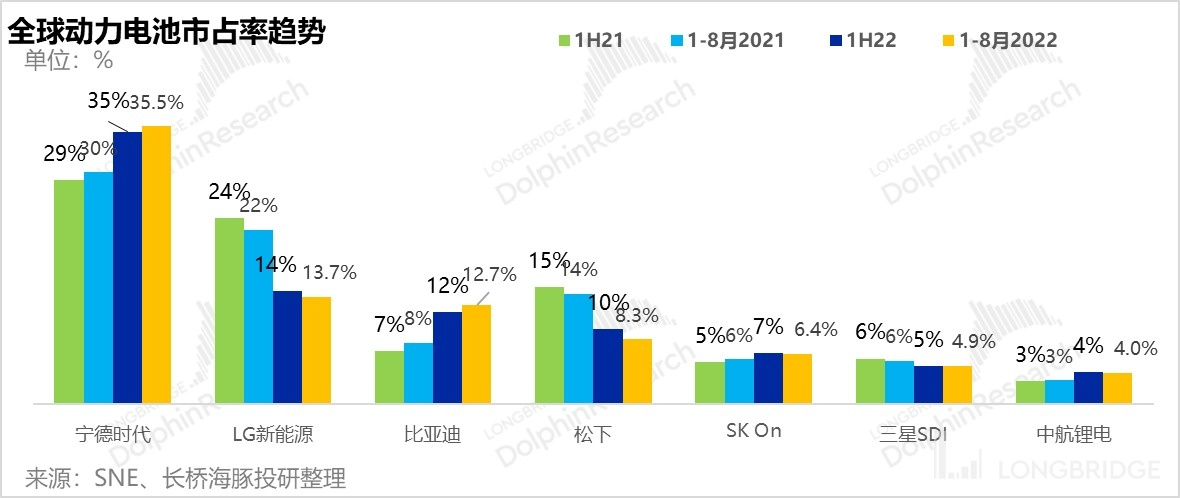

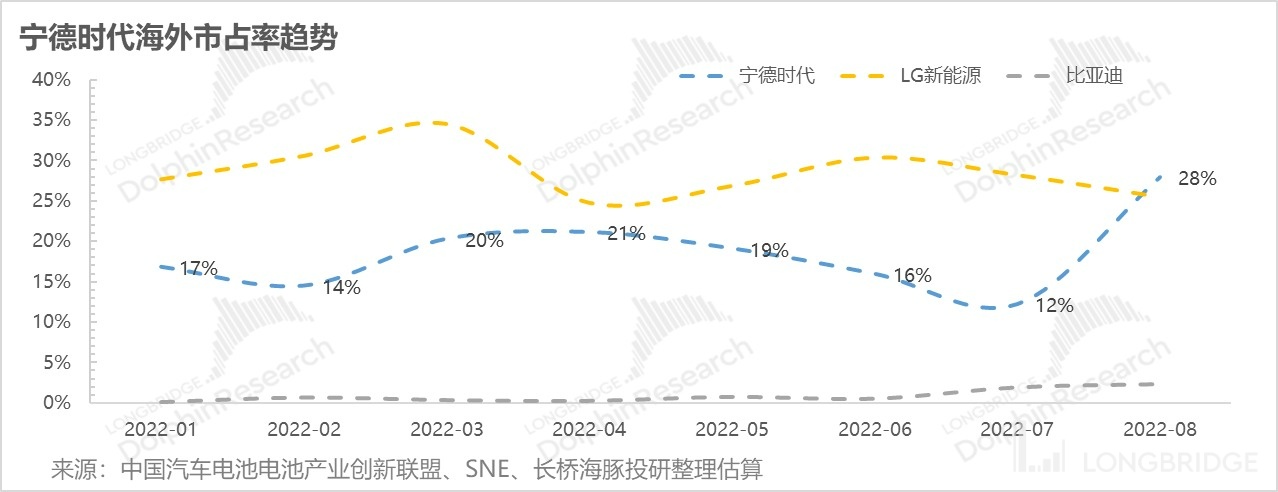

Looking at the global market, in July and August, Chinese battery manufacturers further eroded the market share of companies such as LG new energy and Panasonic. Contemporary Amperex Technology's market share from January to August this year was 35.5%, which further increased from 35% in the first half of the year.

According to information from the company’s conference, sales of power batteries exceeded 70GWh in the third quarter, while last year’s total annual sales were less than 120GWh. Moreover, according to the company, sodium-ion batteries will also be used for some small passenger cars in the future.

Energy storage: The company's total shipments in the third quarter were 90GWh, with an 8:2 ratio between batteries and energy storage, which means that energy storage shipments have reached 18GWh, which was less than 17GWh for the entire year in 2020. According to the latest projects disclosed in the media:

-

On October 18, the company announced that it had signed a large contract with US utilities and photovoltaic energy storage operator Primergy Solar, providing exclusive batteries for its Gemini photovoltaic and energy storage project, with a total investment of USD 1.2 billion, and deployment of 690 MWac/966 MWdc solar panels and 1.416GWh energy storage system.

-

On September 21, CATL announced that it had reached a cooperation agreement with US energy storage technology platform and solution provider FlexGen to supply advanced energy storage products totaling 10GWh to FlexGen in three years.

Obviously, under the background of dual carbon, whether it is domestic or foreign, the energy storage industry, although with a small base, will be significantly stronger than power batteries in terms of growth and outbreak.

Prospects: Under the expectation of subsidy decline, the sales volume of new energy vehicles will usher in a bigger peak in the fourth quarter, and the sustained outbreak of seasonality + energy storage means that CATL's revenue will still accelerate month-on-month growth in the fourth quarter, reaching a revenue of over CNY 100 billion in the next quarter. Actually, the key outlook for income expectations has moved into next year, and the key is three dimensions-the penetration rate of new energy vehicles + market share in Ningde, and judgment of new application scenarios:

-

Domestic: Currently, Ningde Times' domestic market share has reached 50%. Under the premise of accelerating the release of the power battery industry's production capacity, it is difficult to further increase the domestic market share. The key contradiction lies in whether the penetration rate of new energy vehicles will slow down when it already has a penetration rate of up to 30% or even 35%. Although Ningde Times stated that the growth rate of penetration rate will exceed market expectations, the market as a whole still remains cautious.

-

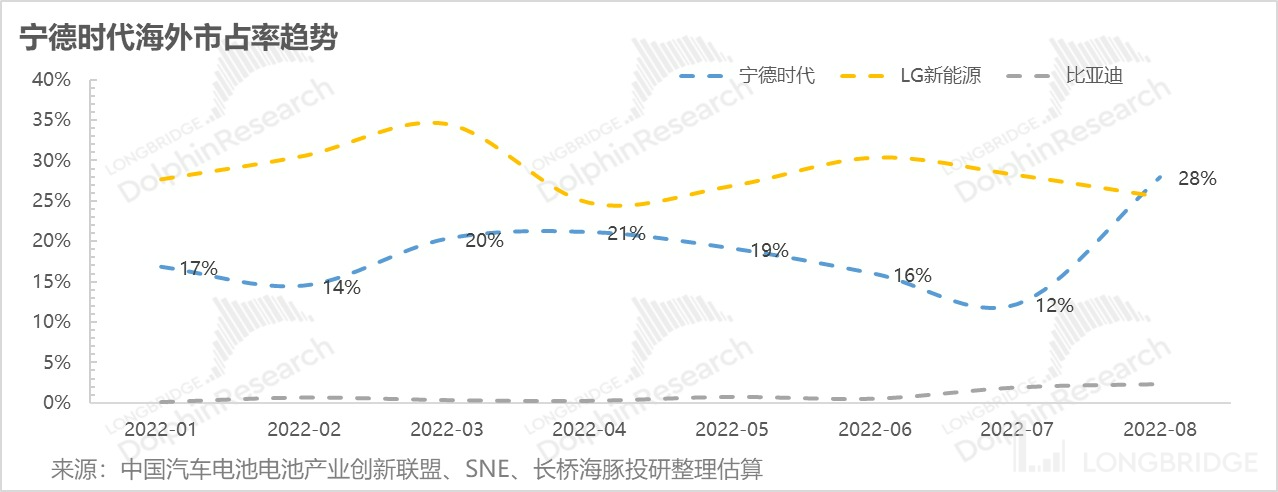

Overseas: The logic of the overall improvement in market share in Ningde Times' overseas market is quite clear, which is linked to the supply of overseas major customers, coupled with the approval of production of factories in overseas countries such as Germany and Hungary with planned production capacity of 100GWh. It is highly certain to increase rapidly in the range of 15-25%.

3) Regarding the expansion of application scenarios: According to Ningde Times' own judgment, in addition to new energy vehicles, energy storage, and consumer batteries, there is hope for incremental shipments in subsequent commercial vehicles such as heavy trucks, light trucks, buses, and ships, as well as motorcycles. However, taking commercial vehicles as an example, their sales in China are only about 10% of passenger cars, and there is no explosive growth. The real hope for high sequential growth should still be in the energy storage business.

Overall, regarding the judgment of next year's penetration rate of new energy vehicles, Dolphin Analyst tends to agree with Ningde Times' statement-that it will exceed market expectations. This is mainly based on Tesla's statement after intensified competition-" gasoline cars will disappear in the future, so we will not reduce production in any case"; this is basically a kind of industry declaration of war: as long as they have production capacity, they must sell it (even at reduced prices). After all, only when it cannot be sold out will there be a reduction in production.

As for the automotive industry chain, downstream companies compete on prices to eliminate old energy vehicles and seize market share in new energy vehicles, and certainty opportunities lie in upstream supply chains. After two years of capital investment upstream, production capacity is gradually released. The upstream companies with technological and scale advantages that have the certainty of increasing market share and improving cost margins can resist risks when the industry logic changes.

In Dolphin Analyst's view, the certainty of income for Ningde Times is not a big problem, so let's take a look at its gross profit performance.

II. Profit: Is there pressure on gross profit margin? It's due to price fluctuations

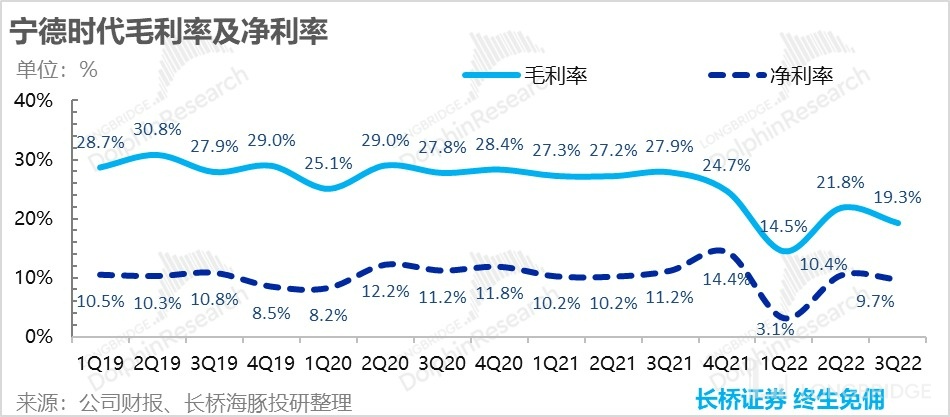

During the company's second quarter, the gross profit margin quickly recovered from the underestimation in the first quarter through the metal-linked pricing mechanism, but in the third quarter, it slipped back: the gross profit margin in the third quarter was only 19.3%, significantly lower than the 21.8% in the previous quarter, and it has been stable at more than 25% before.

Actually, during this period, the certainty of the company's income has always been relatively assured, and what has been worrying is the gross profit margin. The company's stock price also fell sharply due to rumors about its gross profit margin, but the company subsequently held an emergency clarification meeting to explain that the gross profit margin for both power batteries and energy storage would improve in the third quarter. However, judging from the results of the third quarter, the intuitive results did not seem to be the case. However, the company provided a specific explanation: In the cost linkage mechanism, the power battery business is generally based on the vehicle model. After the cost adjustment, it can be traced back according to the vehicle model. When the overall sequential pricing mechanism was adopted in the previous quarter, the additional rebound of the gross profit margin brought by the traceability was eliminated in this quarter, so it appears that the gross profit margin has declined.

Therefore, although the gross profit margin appears to have declined in the third quarter, the gross profit margins of Ning Wang's power battery and energy storage businesses have actually increased when the price regression factor is excluded. In other words, the gross profit margin in the third quarter does not reflect the actual trend.

In addition, energy storage is a project-based negotiation. If the upstream costs change significantly during project implementation, it is necessary to renegotiate one by one if you want to trace back. Therefore, pricing is less smooth than power batteries. As a result, the gross profit margin of energy storage in the first half of the year has dropped to single digits.

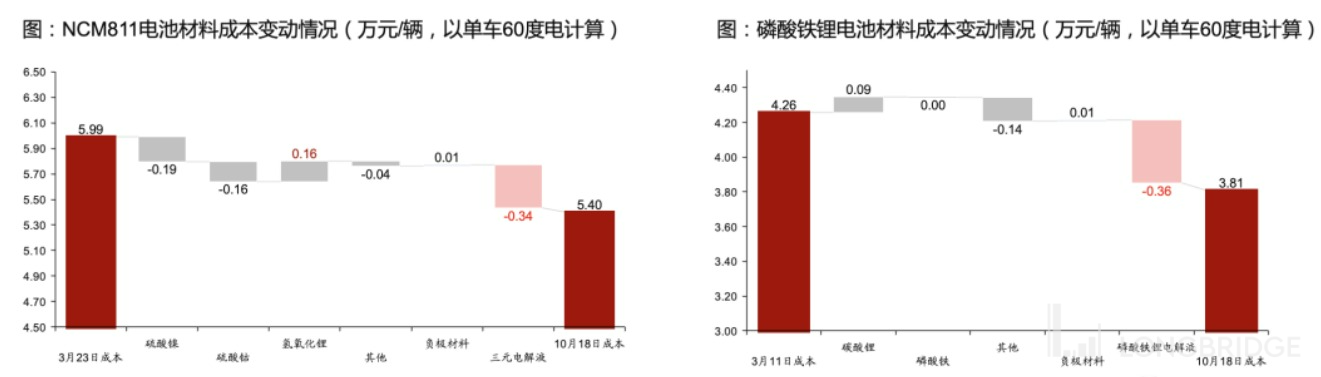

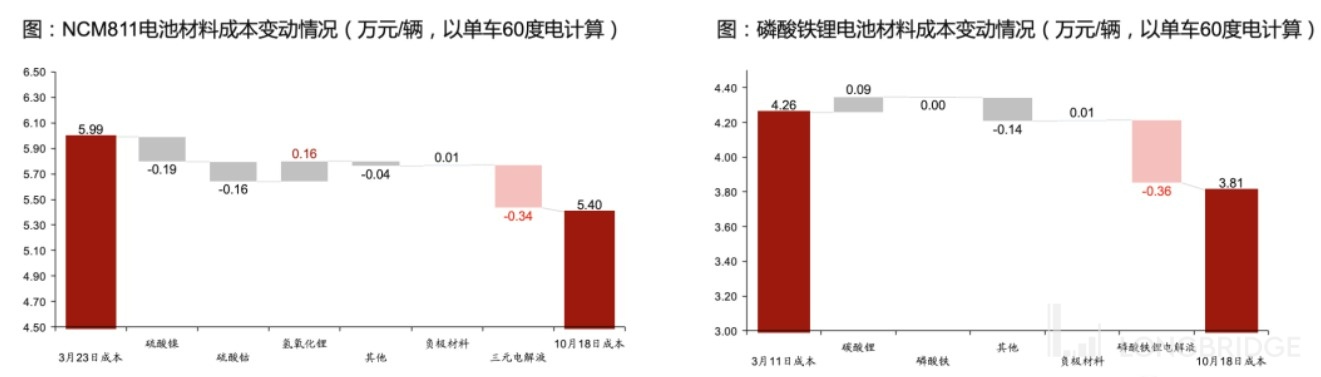

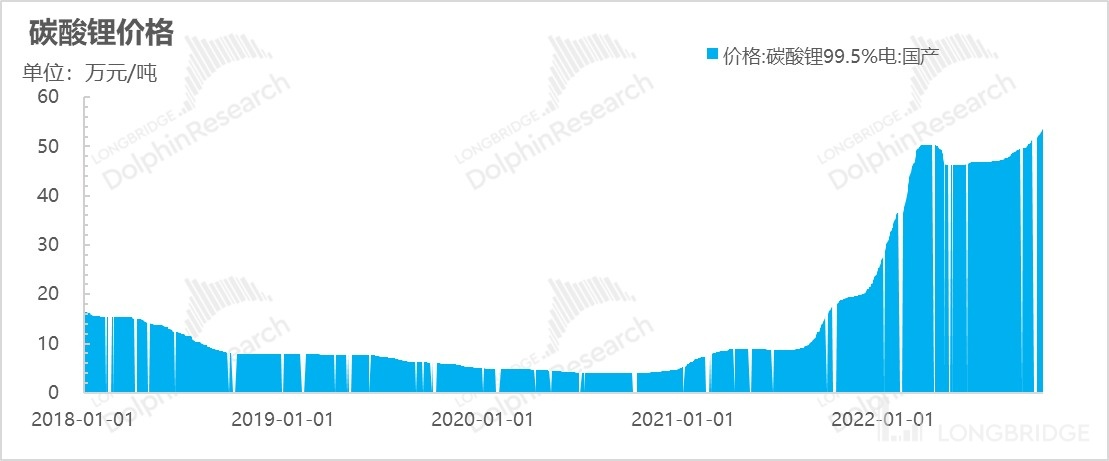

However, in the short term, cost pressure still seems to be significant: The most important raw material cost, lithium price, has again shown an upward trend-high-grade lithium carbonate prices for batteries have just entered the peak season of vehicle sales in the fourth quarter, and have risen to nearly 540,000 yuan/ton.

Although other materials, such as ternary precursors, electrolytes, and lithium hexafluorophosphates, have dropped by -20% to -50% compared to the previous price peaks, the high lithium price even negates the effect of other price cuts.

Source: Asian Metal Network, Wind, Zhejiang Securities

According to Ning Wang's statement, the lithium price has been operating at a high level for two years, and it is not yet in the 3-4 year mining cycle. However, by the time next year comes, the tight supply situation of lithium carbonate will have hope to ease.

3. Costs: The benefit of soaring revenue is the ultimate release of operating leverage.

Research and development expenses: In the third quarter of 2022, research and development expenses were 4.8 billion yuan, and the research and development expense ratio was 4.9%. The industry's leading position needs to be maintained by continuous technology investment. Now, whether it is sodium-ion batteries or the Kirin battery, continuous technological research and development is needed for promotion and iteration. However, due to the company's rapid income growth, the R&D expense rate is still down in a trend even with high growth of nearly 170%.

Sales expenses: In the third quarter, the sales expenses were 3.56 billion yuan, and the sales expense ratio was 3.7%. There was no significant leverage effect, mainly due to the comprehensive after-sales service fees accrued after the delivery of the main project, mainly because there were more warranty fees, which are not easy to reduce. Management expenses: In the third quarter, the company's management expenses were RMB 1.82 billion, with a management expense ratio of 1.9%, which is the most severely diluted expenditure category among the three expenses due to the sharp increase in income.

In addition, in terms of financial expenses, due to the company's 45 billion yuan issuance and cash management, interest income soared and the financial expense ratio dropped to -1.5%.

4. When revenue is rapidly released, the profit performance will depend on the gross profit margin

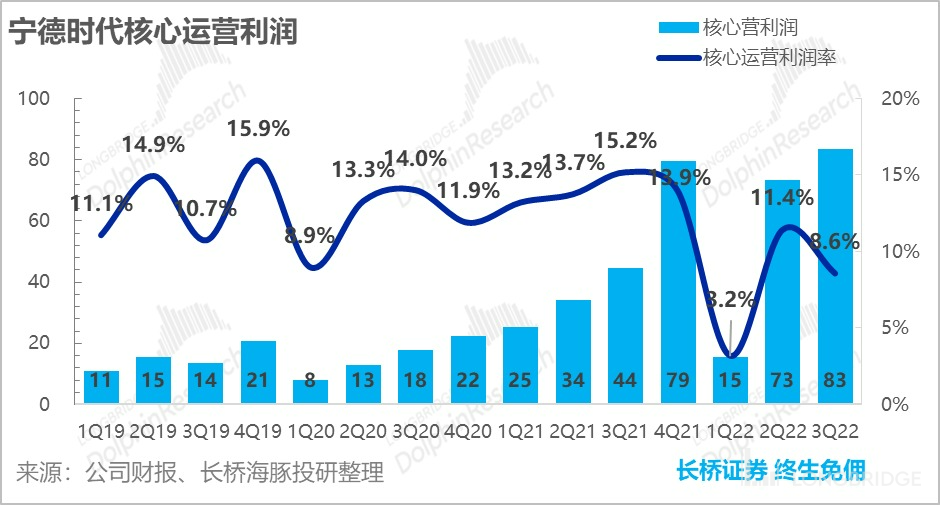

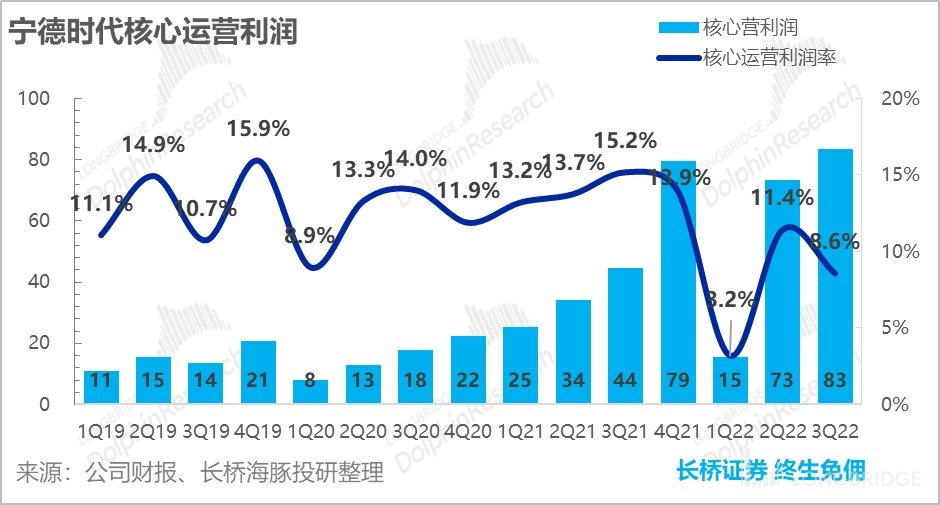

Financial expenses are more determined by the structure of the company's use of funds. The Dolphin Analyst focuses on observing the pure operating profit of the company before the structure of fund use-the core operating profit (revenue - costs - three fees - business taxes and levies).

The core operating profit for this quarter was RMB 8.3 billion, a year-on-year increase of 87%, which is still far lower than the year-on-year increase of 188% for the equity holders (due to high interest income, low tax rate, and low minority shareholder profit sharing rate) and the year-on-year increase of 232% for revenue.

The significant slowdown in the growth of operating profit from main business operations is mainly due to the decline in gross profit margin and the abnormally high increase in sales expense ratio this quarter, and the decline in gross profit margin is the most critical factor.

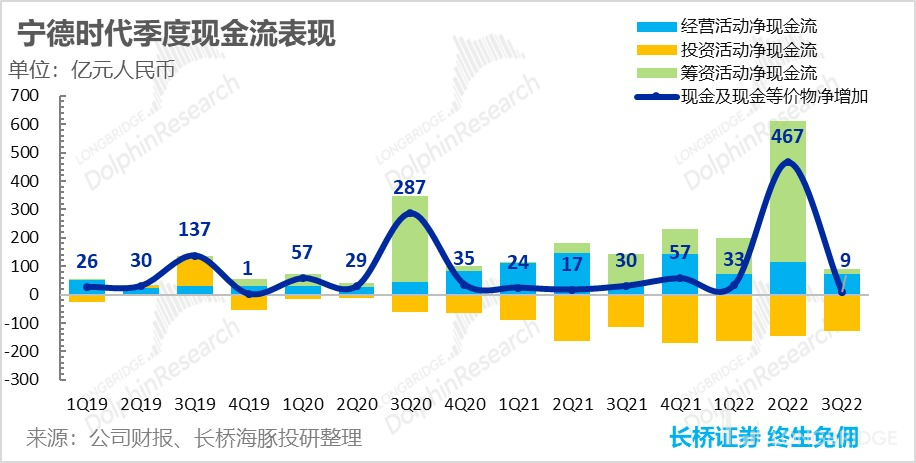

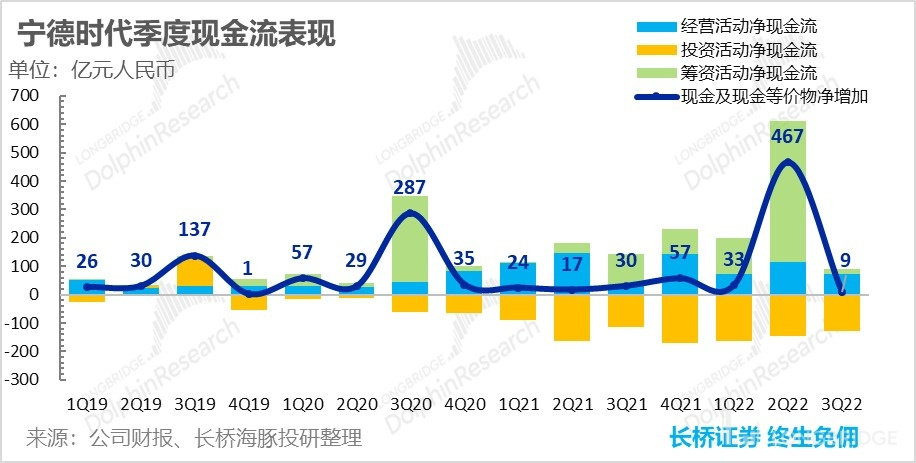

5. As peak season stocking approaches, cash flow declines

The cash flow was not particularly good in the third quarter, with an increase in cash and cash equivalents of only RMB 900 million. Excluding the impact of financing timing, the main reason was that the cash flow from operating activities did not match the revenue growth, mainly because the company stockpiled in advance for the peak season in the fourth quarter.

Summary of the power battery sector on May 20, 2022: "Collapsed New Energy, Investment Differences Reached?"

Commentary on the financial report on April 30, 2022: "As expected, the performance thundered, is it the end of the Ningwang era?"

Financial report conference call on April 30, 2022: "Ningwang is not concerned about performance thunder, market share and customer structure are the core observation indicators" On April 22nd, 2022, Commentary on Financial Reports: "Ningde Times Welcomes Dual Considerations of Profit and Confidence in the Face of Valuation Risks" (https://longbridgeapp.com/topics/2386142)

On October 28th, 2021, Commentary on Financial Reports: "Should We Still Respect Valuations When Facing the Extraordinary Ningde Times?" (https://longbridgeapp.com/topics/1259347)

On August 25th, 2021, Commentary on Financial Reports: "Ningde Times: Investment Goes Beyond Future Prospects and Extends to Performance" (https://longbridgeapp.com/topics/1079806)

On July 14th, 2021, In-Depth Company Analysis: "Ningde Times (Part 2): Building a 'Rigid Bubble' on Faith?" (https://longbridgeapp.com/topics/925062)

On July 7th, 2021, In-Depth Company Analysis: "Ningde Times (Part 1): Where Does Confidence for a Trillion Dollar Market Value Come From?" (https://longbridgeapp.com/topics/913915)

Risk Disclosure and Statement for this Article: Dolphin Analyst Disclaimer and General Disclosures (https://support.longbridge.global/topics/misc/dolphin-disclaimer)