South taking over while North is fleeing, it's once again a test of "composure".

Hello everyone, I'm Dolphin Analyst.

Last week, China and the US officially entered the third quarter earnings season, but given the macroeconomic expectations, Dolphin Analyst observed that only a very small number of individual stocks based on their own performance have shown outstanding results, such as Netflix with its short-term turnaround, whereas most companies are still affected by macroeconomic expectations.

And the biggest expectation is the Fed's policy turning point: after being frightened by the resolute inflation and consumption data in the United States, the media began to introduce voices of slowing down interest rate hikes, such as a Federal Reserve official in San Francisco saying that "we need to start discussing slowing down the pace of rate hikes," and a Federal Reserve official in Chicago saying that after reaching 4.6%, we should stop and evaluate the damage to the economy.

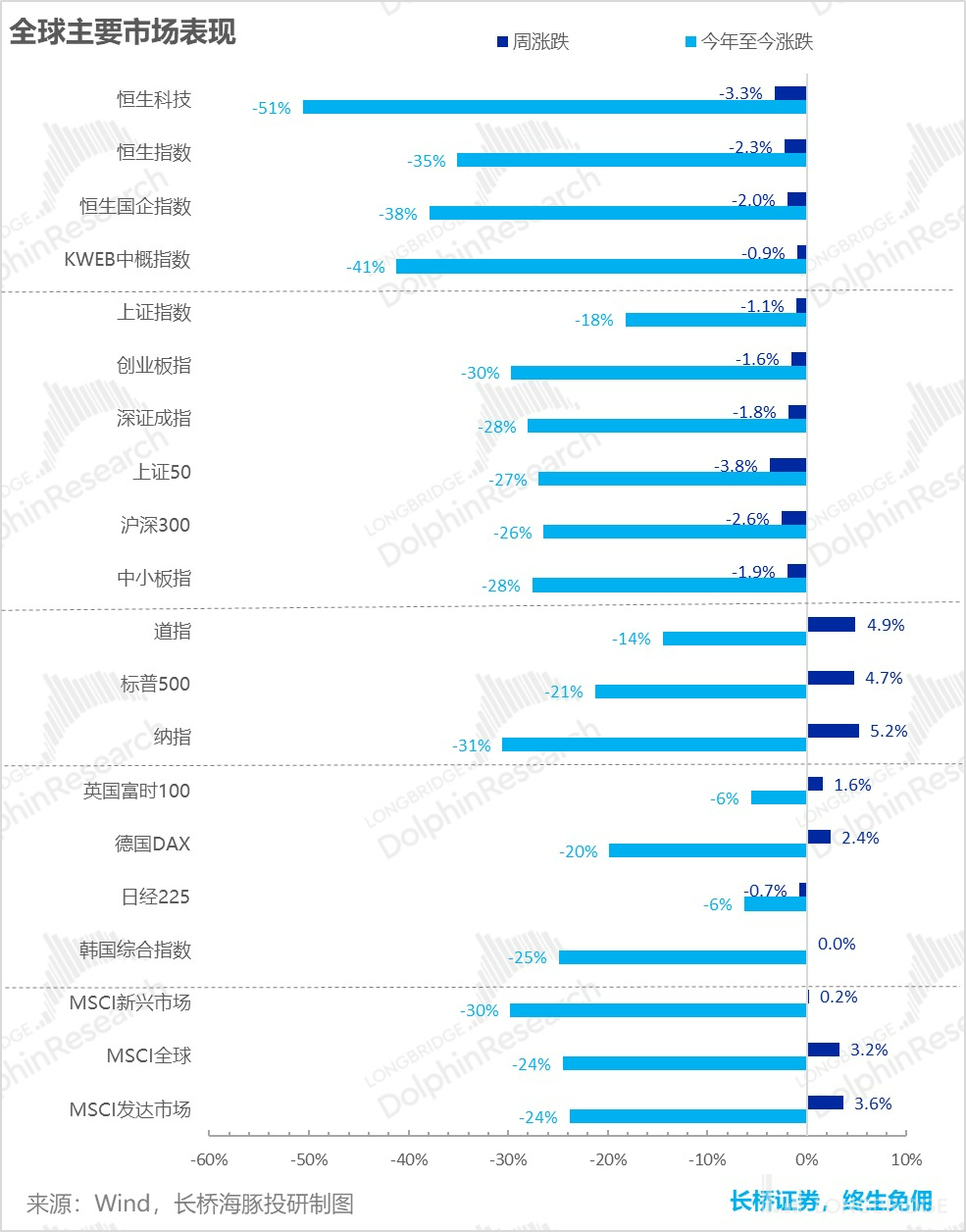

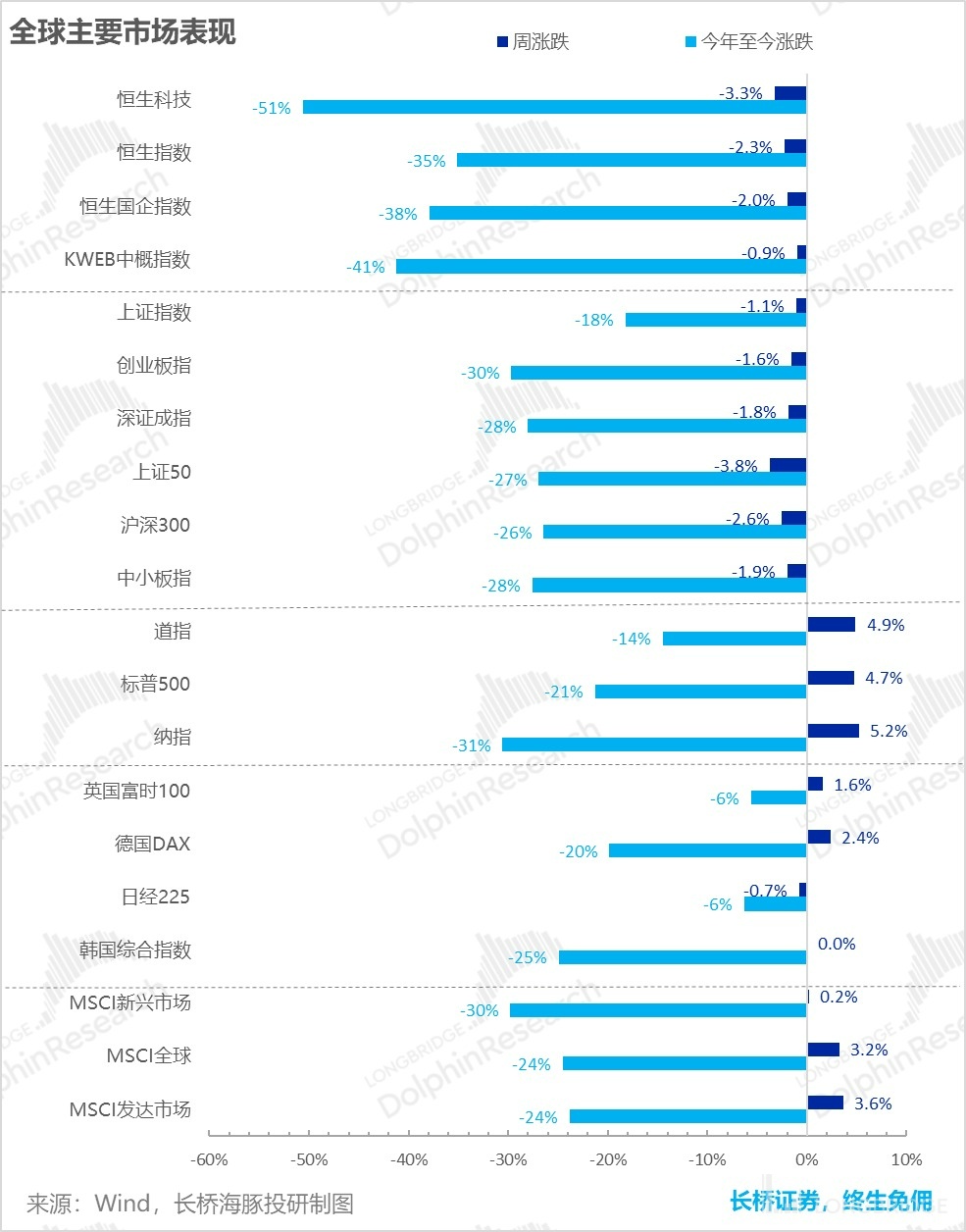

This kind of attitude coincides with the rebound of the US stock market and even the global market in the situation of interest rate hike desires under repair after being frightened:

However, in the absence of major macroeconomic data releases and the delay of domestic data releases last week, Hong Kong and Mainland China A-shares have once again demonstrated their "independence": with the leading of core assets such as the SSE 50, the CSI 300, and the Hang Seng Tech Index, the decline was generally around 2%.

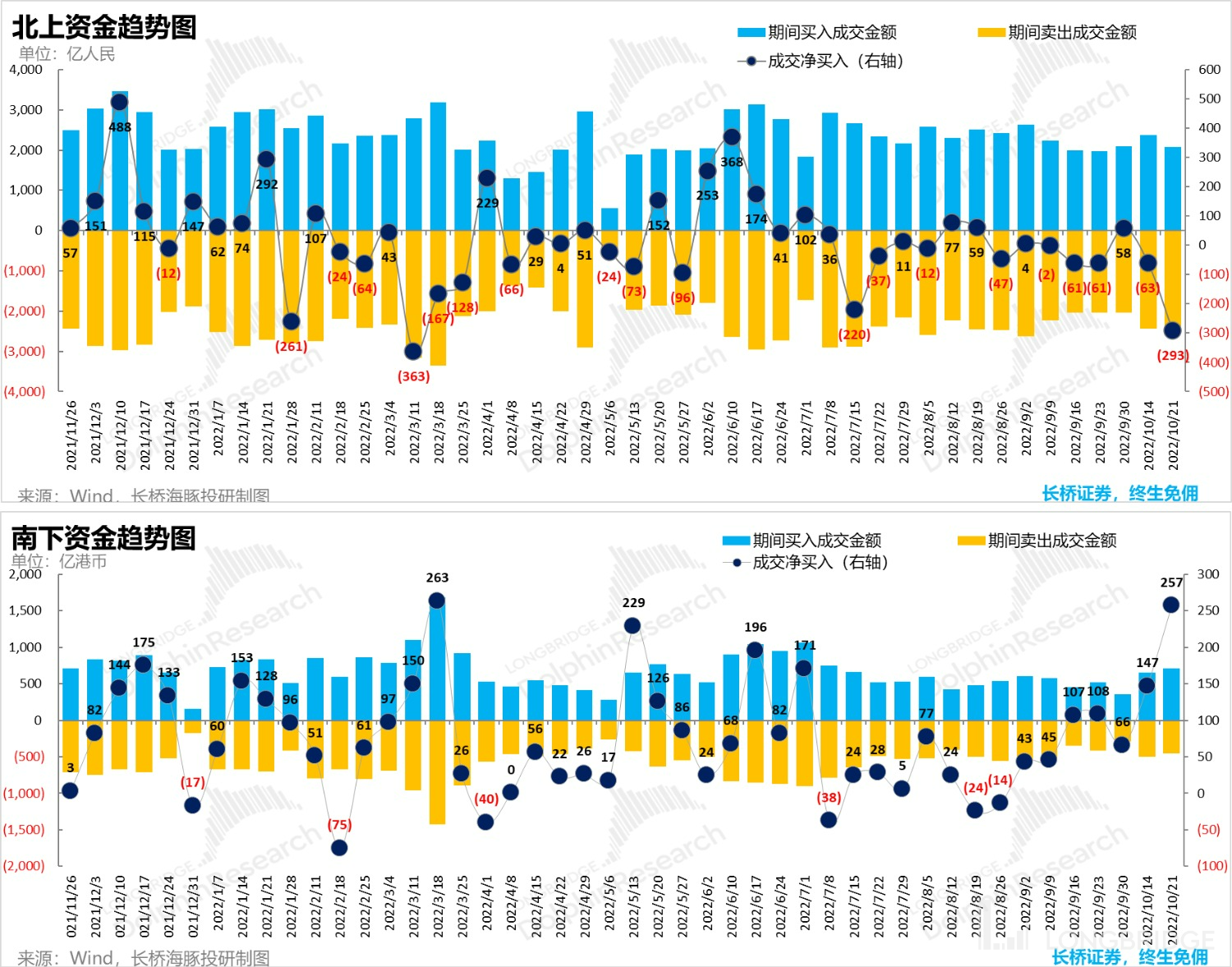

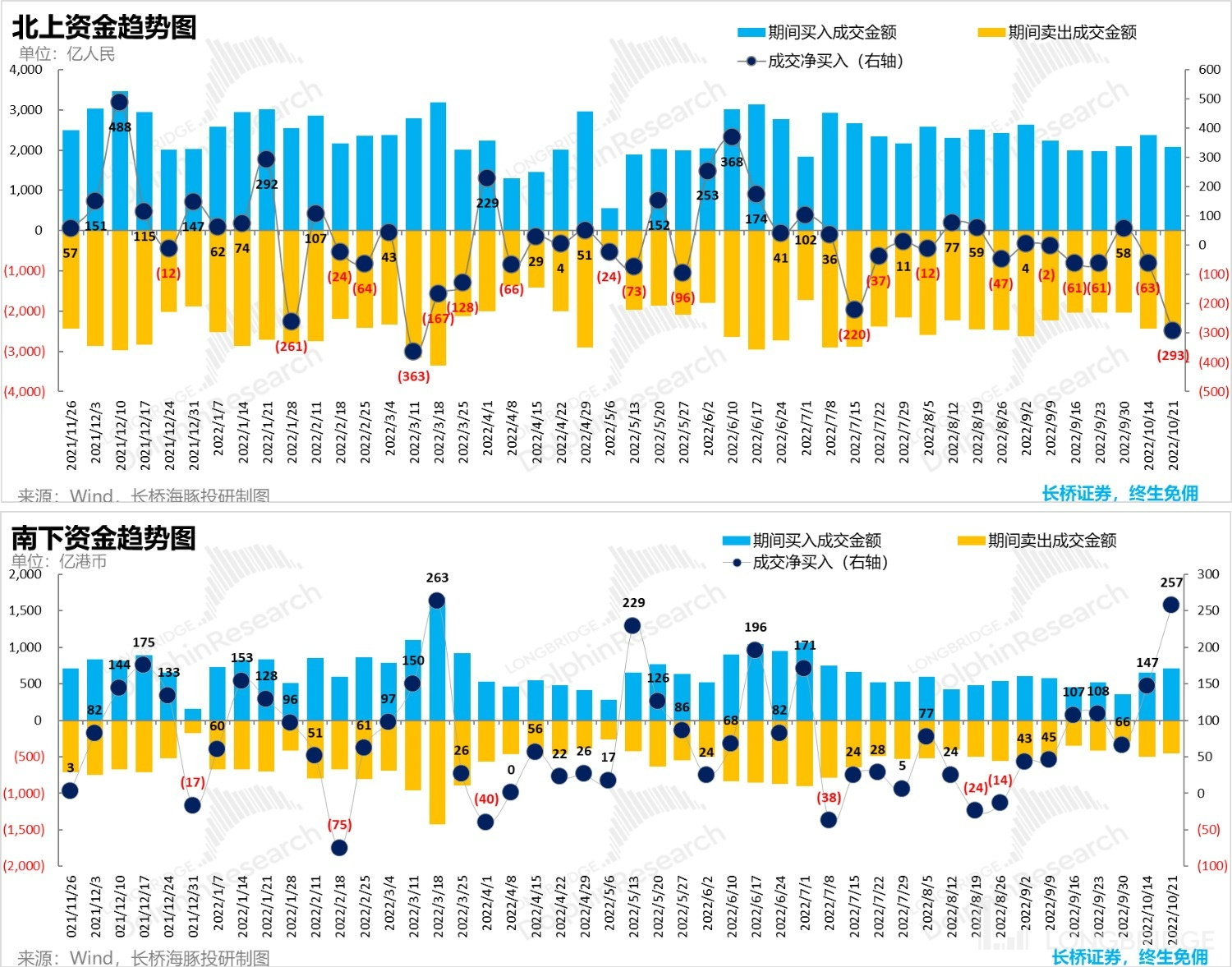

This process was accompanied by the diametrically opposed judgments of two sources of funds: Northbound capital fled in panic, while Southbound capital poured in fightingly. Furthermore, the directions of the two sources of capital's net inflows and net outflows last week were completely in line with those in mid-March, at the beginning of the Russo-Ukrainian War, and the scale was also close. The biggest difference was that the transaction volume of Northbound capital this time, although less than last time, was still not small, while the Southbound capital shrunk significantly.

In addition to this, with the Hong Kong stock market opening with a "limit-down" style, the sharp drop in A-shares, and the net outflow of Northbound capital reaching RMB 17.9 billion in a single day, today's announcement of the third-quarter GDP growth rate, industrial added value to PMI, all of which were satisfactory. All of these factors combined means that the key point has come for different funds to be tested in terms of their divergence.

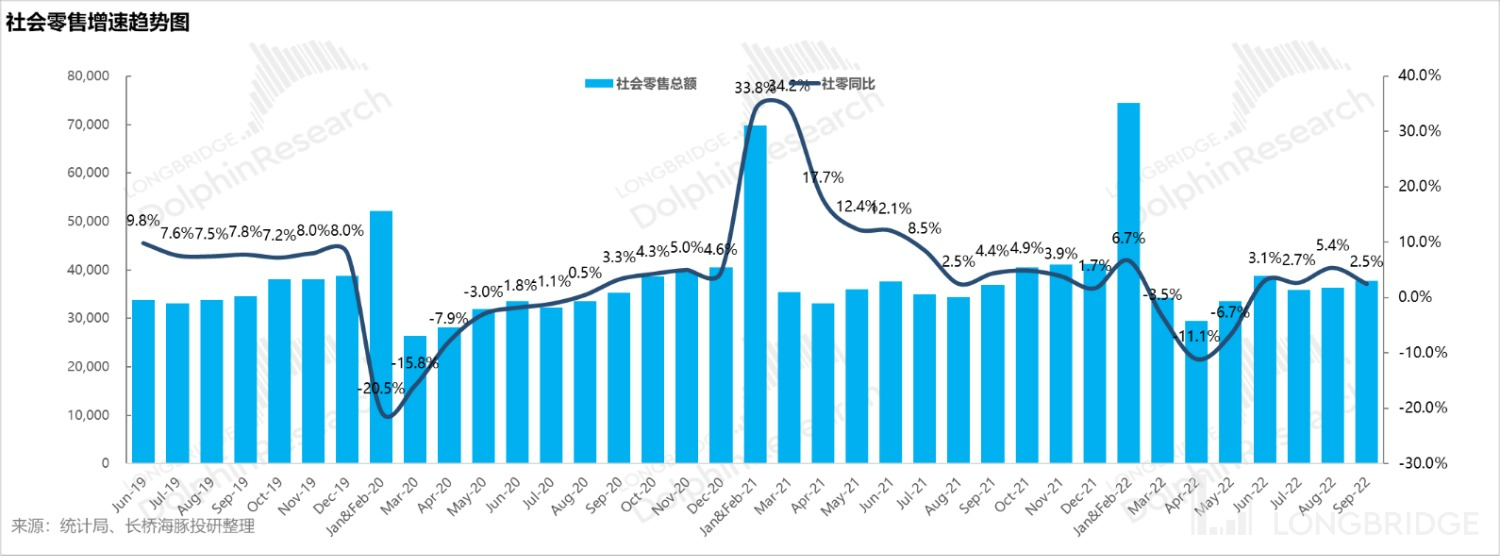

Of course, the two major sectors that the market is most concerned about —— social retail and real estate data —— are still in a gloomy state.

Second, retail: Online sales alone support the scene

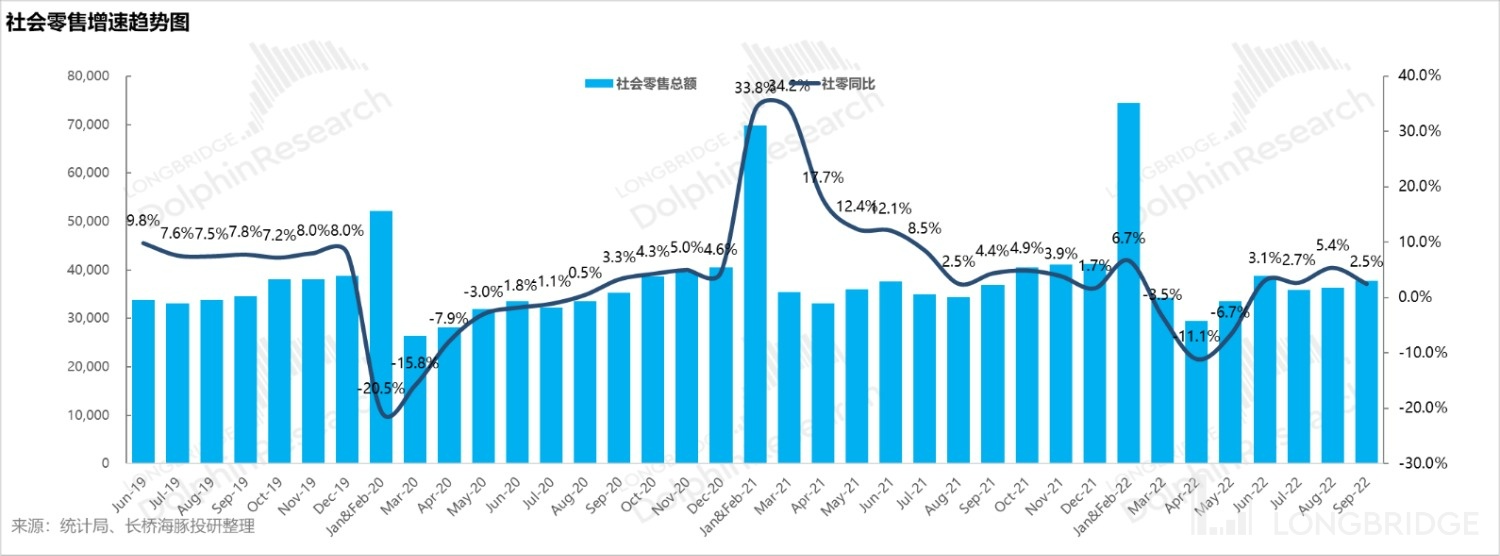

Social retail represents the consumption status of government and residents at both ends of the household consumption in GDP branch. In September, under repeated lockdowns of epidemics in various places, social retail once again showed weakness with year-on-year growth of only 2.5%, lower than the data for the three months from June to August.

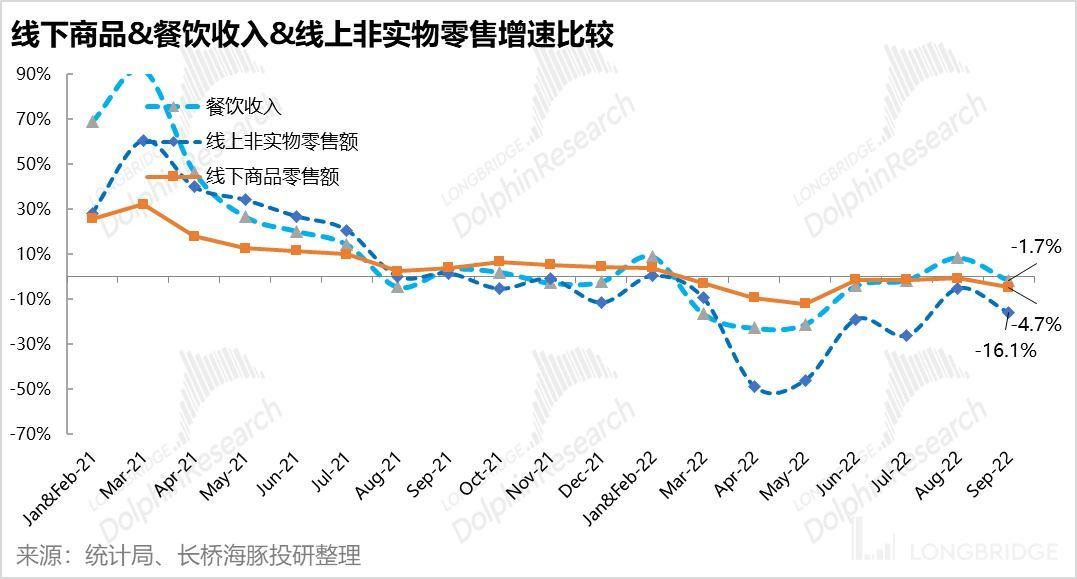

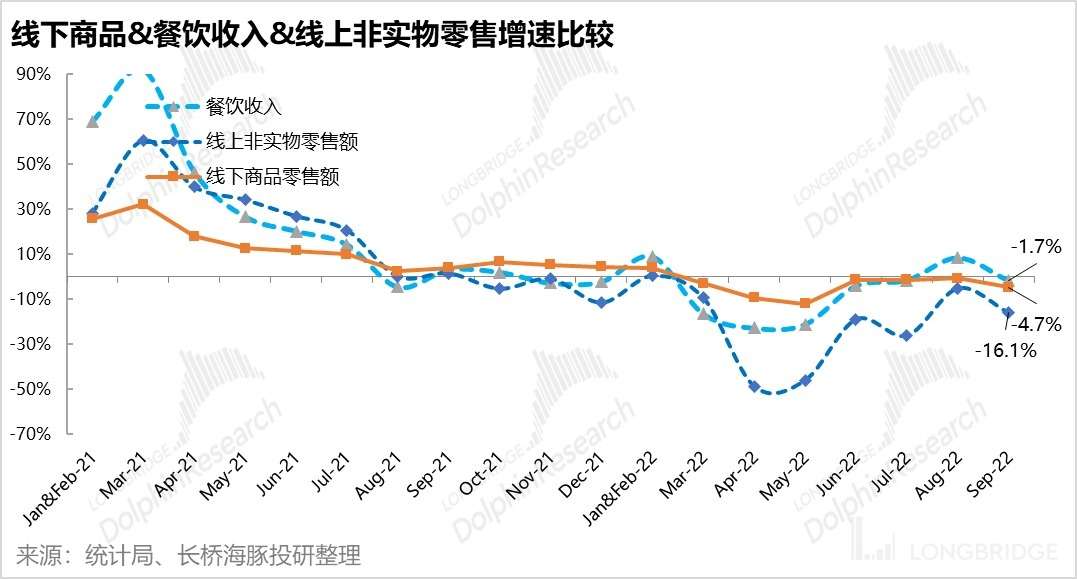

The 'Three Brothers' Ravaged by Pandemic: Offline Retail (Excluding Food and Automobile), Online Non-Physical and Offline Food and Beverage are still three 'difficult brothers' under the pandemic outbreak, and all turned towards a worse direction in September.

The 'Three Brothers' Ravaged by Pandemic: Offline Retail (Excluding Food and Automobile), Online Non-Physical and Offline Food and Beverage are still three 'difficult brothers' under the pandemic outbreak, and all turned towards a worse direction in September.

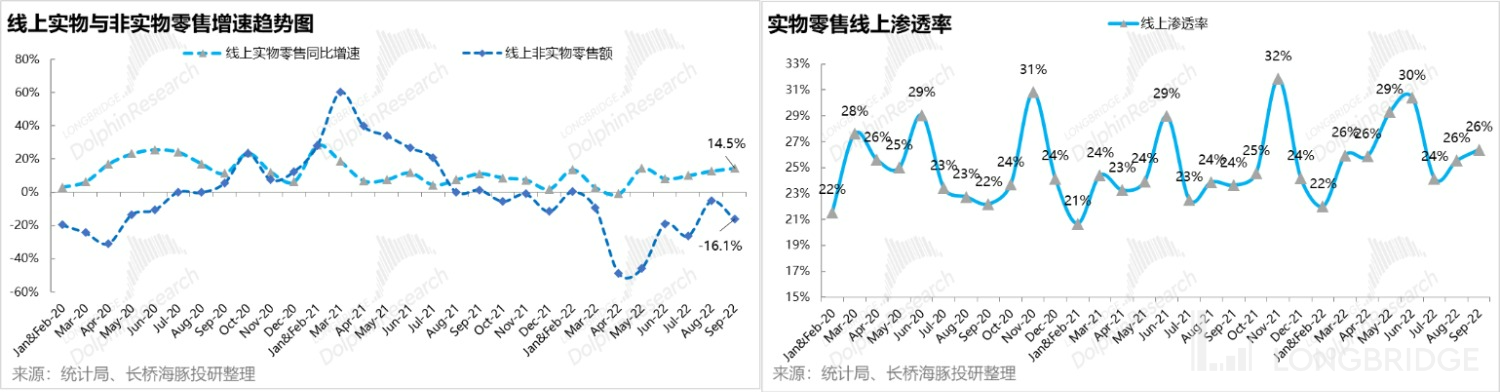

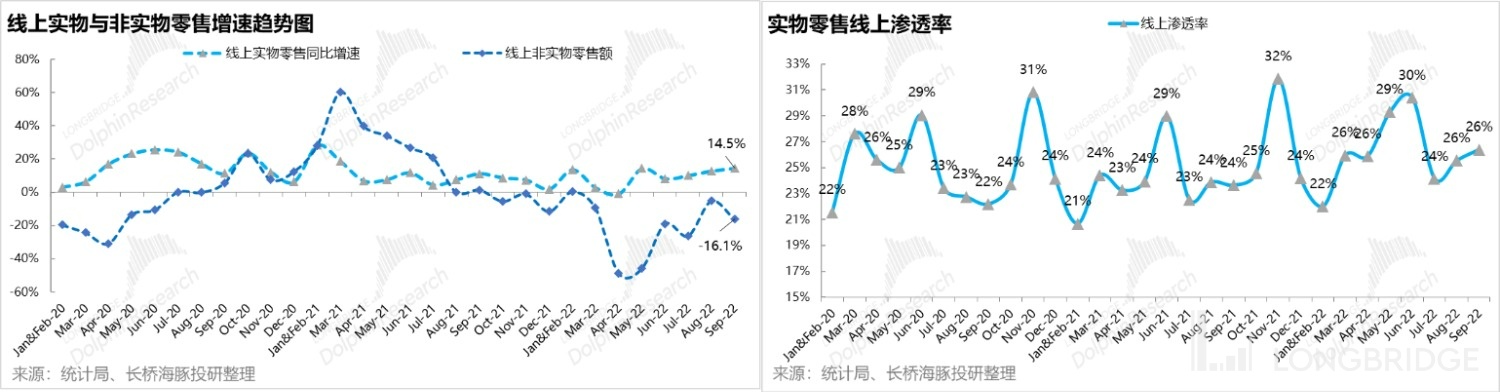

Therefore, apart from automobile retail that still maintains high growth in September, only online physical retail is left to sustain the overall retail data. Only online physical retail is accelerating growth, with a year-on-year growth rate of 14% in this quarter.

Note that this year, due to the readjustment of the statistical caliber for online retail, the growth rate of online physical retail calculated based on the readjusted criteria is 8.3% year-on-year, which is significantly faster than the previous two months' growth rates of 6.3% and 6.5%.

III. Marginal Improvement in Real Estate, but Still Far from Recovery

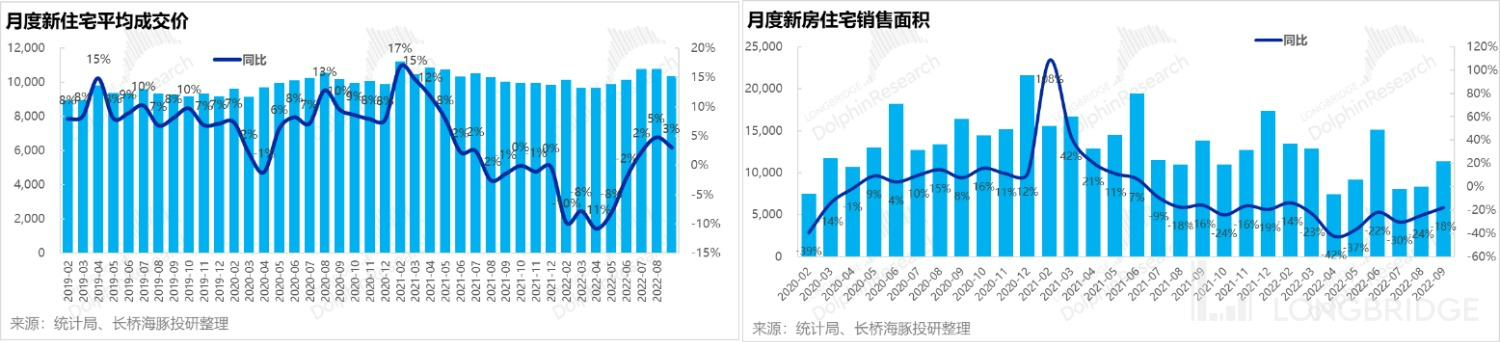

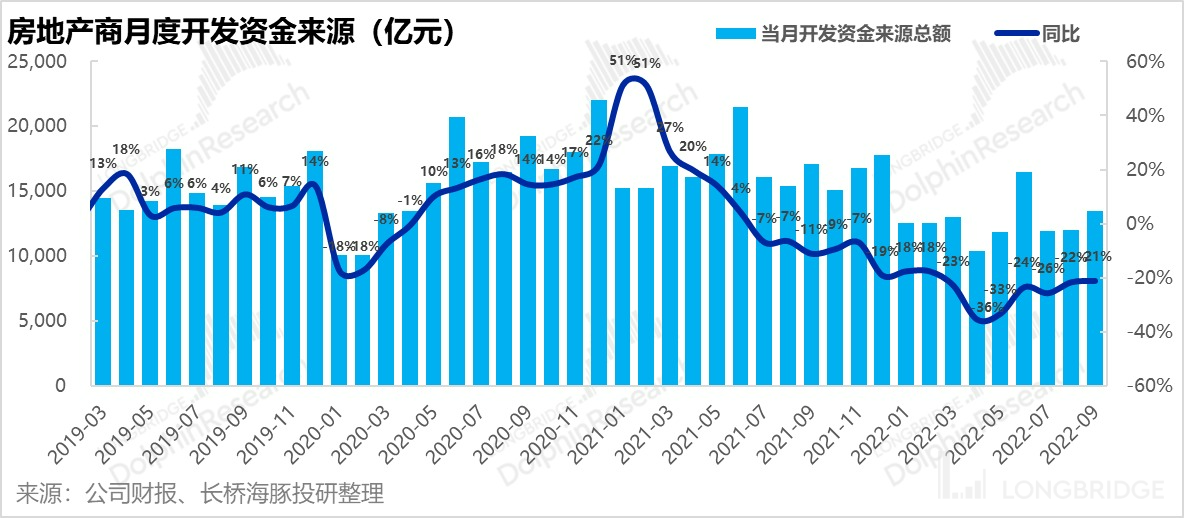

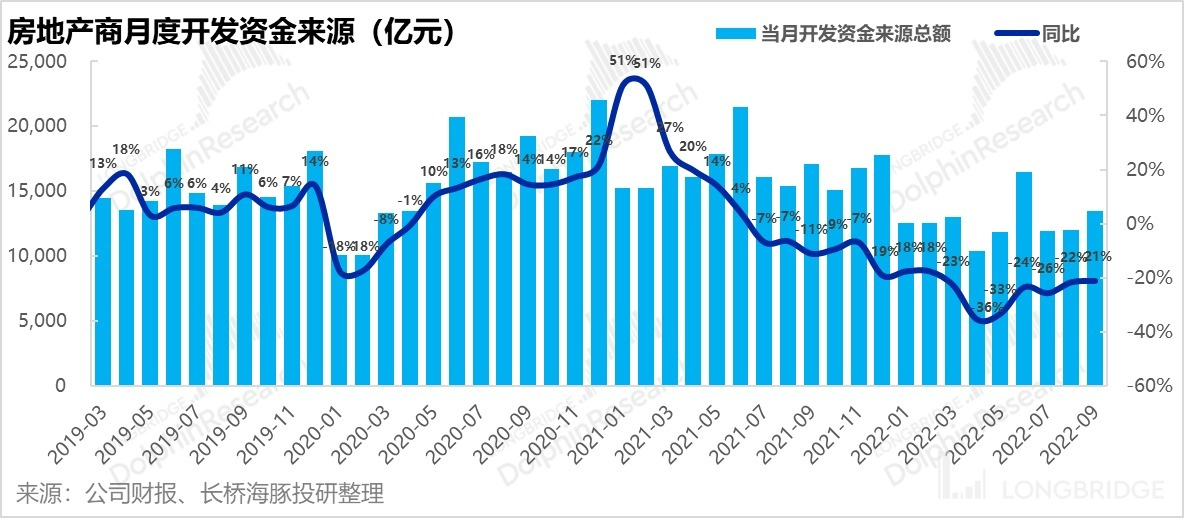

In September, the year-on-year decline in sales of commercial housing was 15%, which can only be said to be a slight improvement compared to the 21% decline in the previous quarter, but it is still in a double-digit decline. Behind this, residential sales area is still in double-digit decline, while the average price has been in positive growth for three consecutive months. Especially, the decline in deposits/prepayments and mortgage loans, which are the main sources of funds, was close to 20% year-on-year.

This also indicates a continuous shrinkage of developers' funding situation: this month, the funds collected by developers from various channels still shrank by more than 20% year-on-year.

Under such circumstances, new development projects and project completion have shown completely opposite trends: new construction area has decreased by more than 40% on the basis of a low base period, while the shrinkage rate of project completion has continued to narrow for two consecutive months. In September, the completion area decreased by 6% year-on-year, reflecting the priority of completion in the limited funding situation.

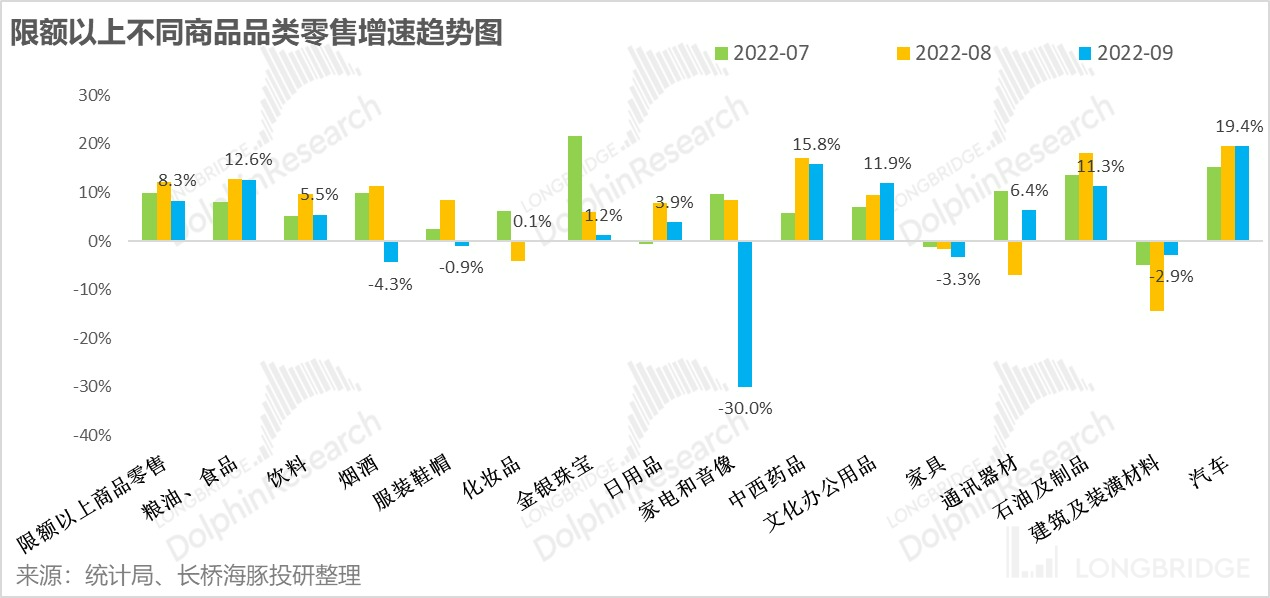

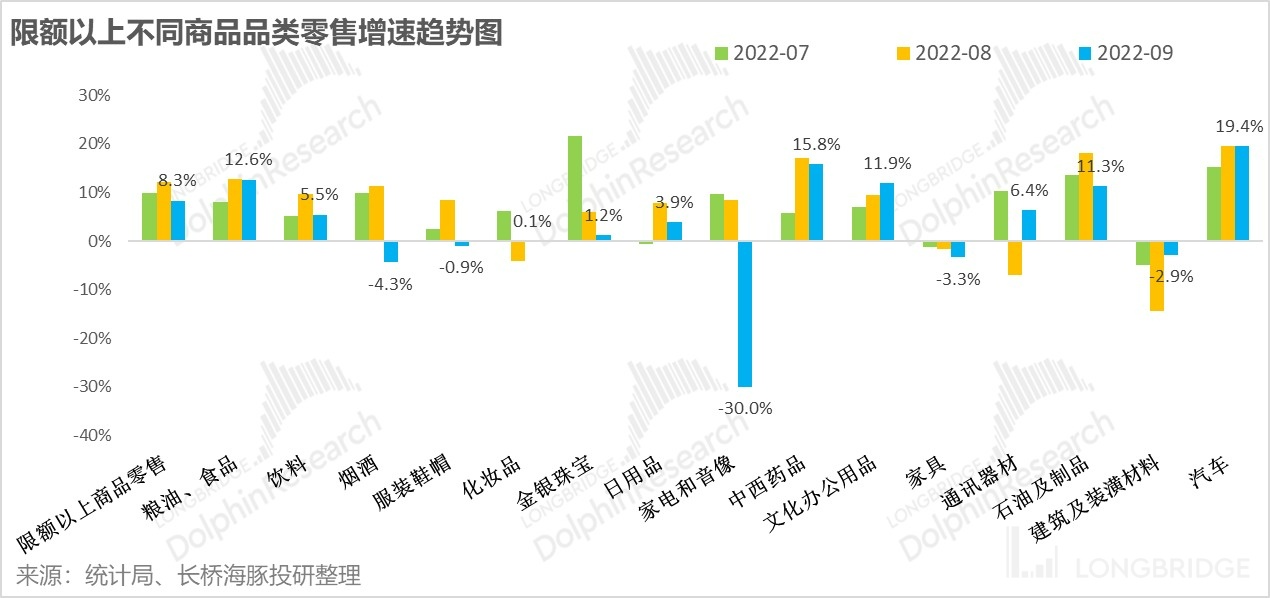

The continued bleakness in real estate echoes the unusually bleak consumption of post-real estate in September: home appliances, furniture, and building decoration all showed negative growth.

Overall retail still performs relatively well in grain and oil food, beverages, daily necessities, and drugs, while optional categories such as clothing, shoes, caps, cosmetics, and jewelry perform relatively poorly. Additionally, a surprising aspect in September was that the performance of tobacco and liquor was relatively poor, and we will need to observe whether this continues in the following months. **

**IV. Hong Kong and A-shares that "stand out"

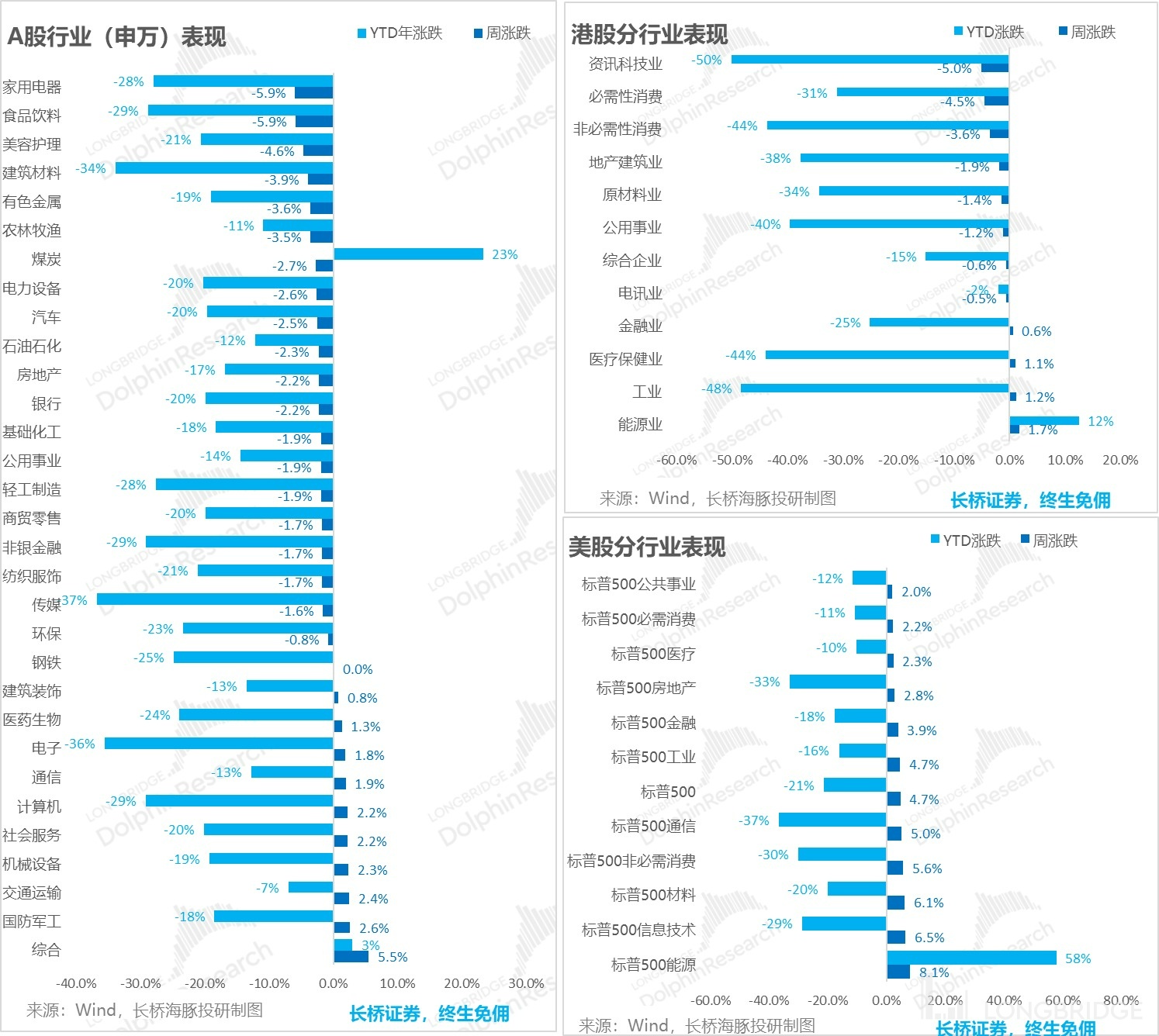

Under the effects of a weak domestic consumption, overseas gambling interest rates, and major events leading to the rise of stocks, the fall of Chinese assets and the outflow of foreign funds:

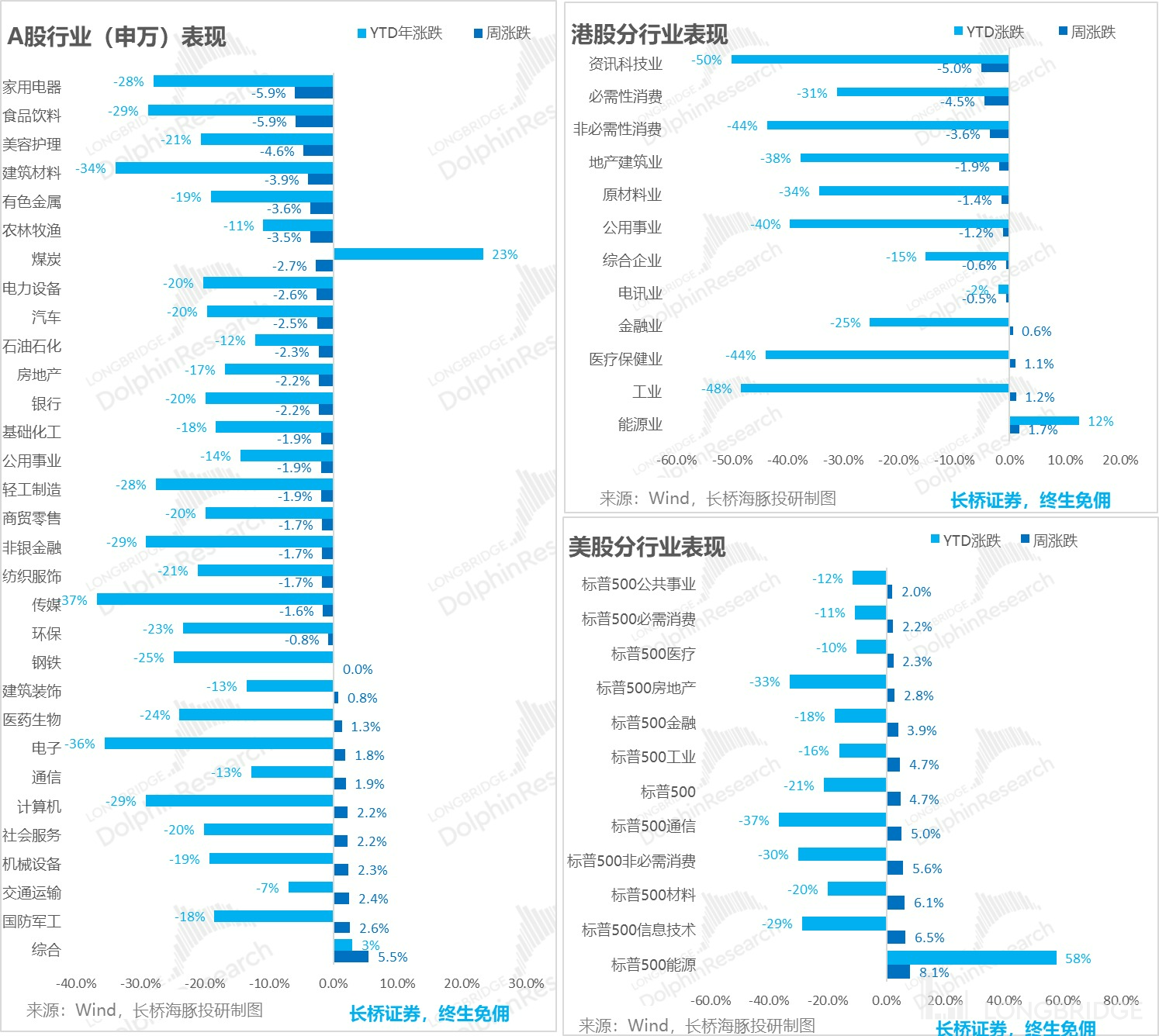

The hardest hit domestically was still consumer products; home appliances and food and beverage were the hardest hit, while military and aerospace were the top gainers. In Hong Kong, the technology and information industry, which is still despised by people, continued to fall, while in the US, there was a comprehensive rebound, but the highest gainer, energy, still had an explanation for the logic of stagnant growth.

V. Alpha Dolphin Portfolio Performance

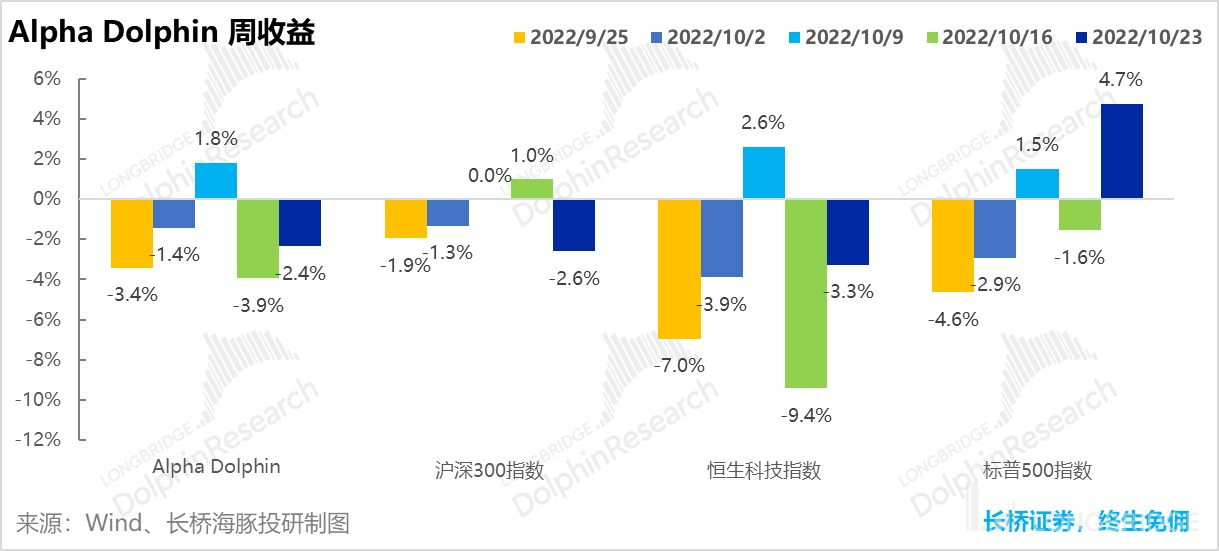

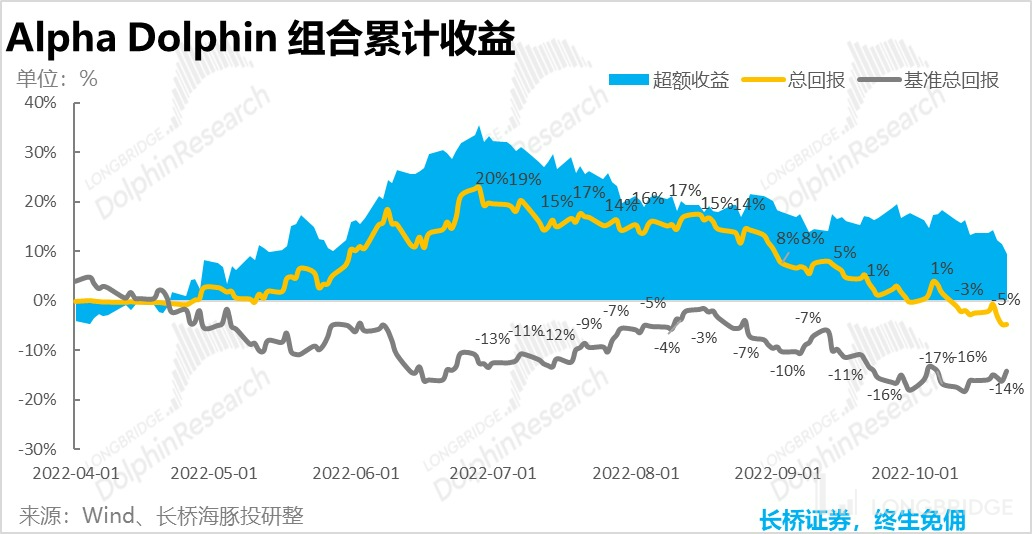

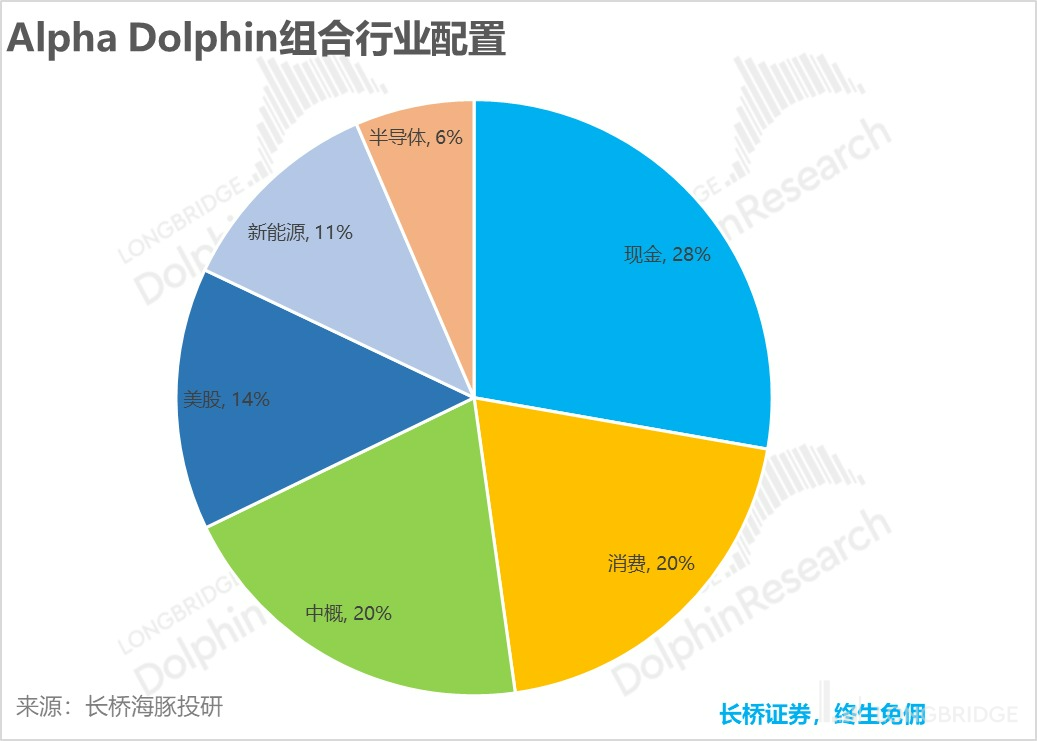

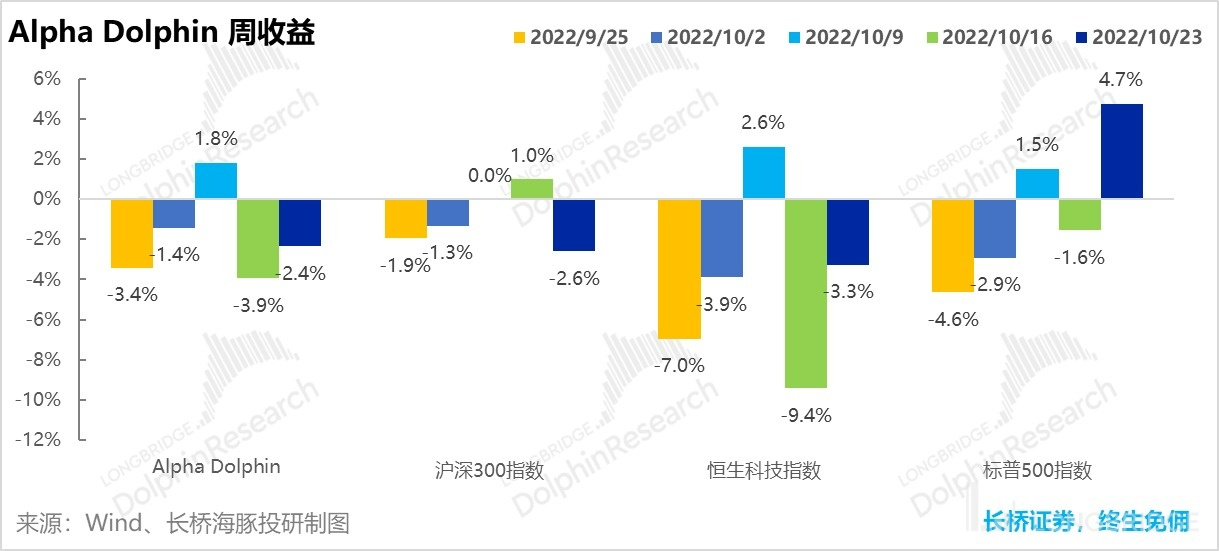

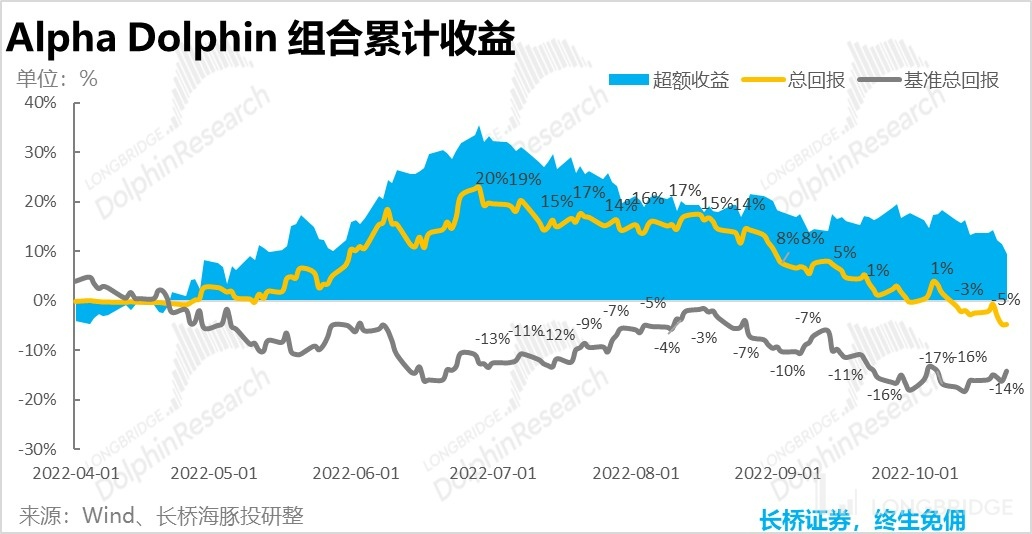

Although there is a relatively high cash weighting in Dolphin's portfolio to avoid risk, and a small amount of US stock holdings, the equity portion has a high consumption weighting. As a result, the portfolio has performed poorly amidst sustained consumption declines. As of Week 10/21, the Alpha Dolphin portfolio fell by 2.4%, performing slightly better than the CSI 300 (-2.6%), but significantly worse than the S&P 500 (+4.7%).

From the start of the portfolio's testing to last weekend, the absolute return of the portfolio was -4.8%, and the excess return compared to the benchmark S&P 500 index was 9.4%.

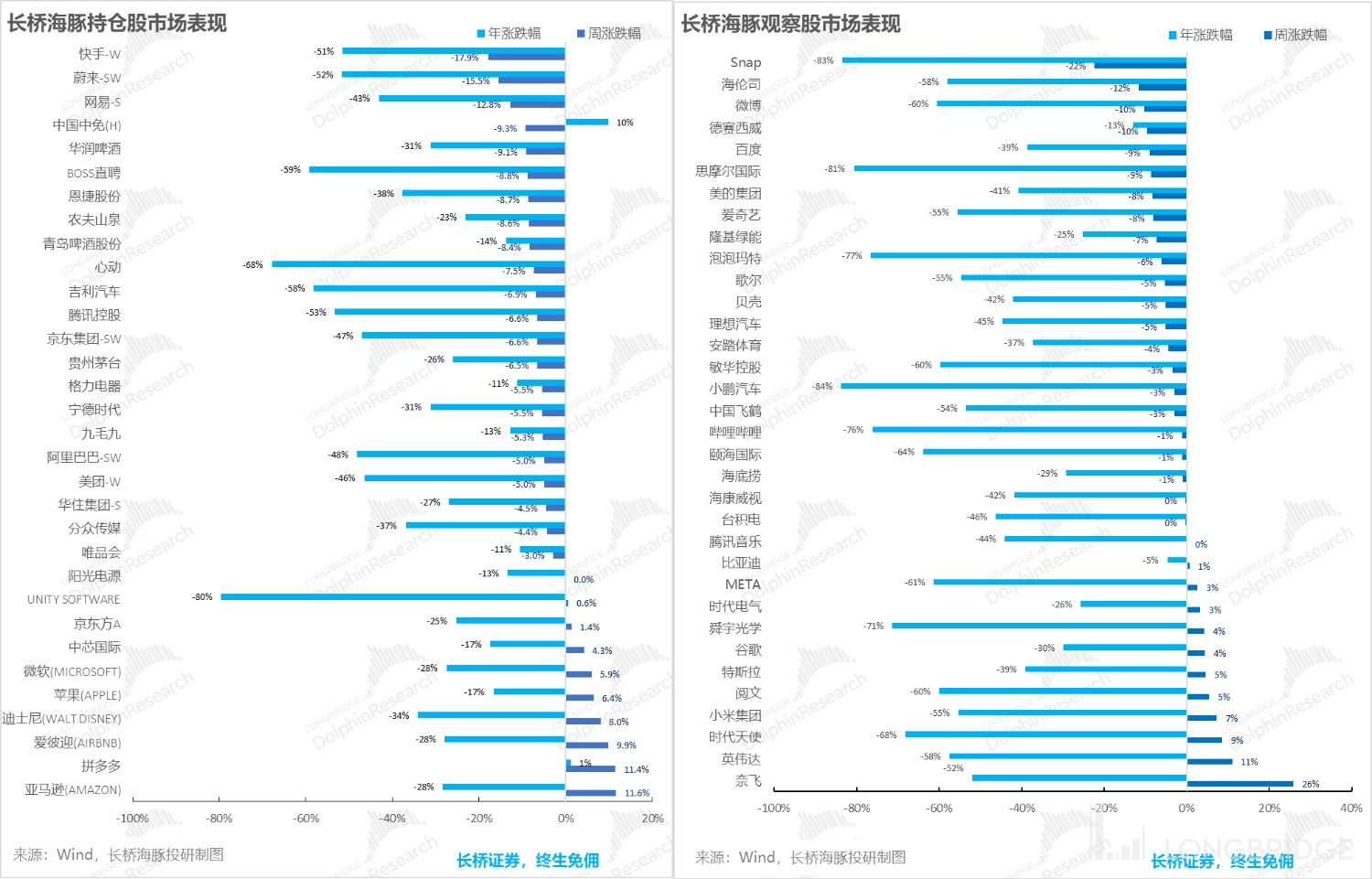

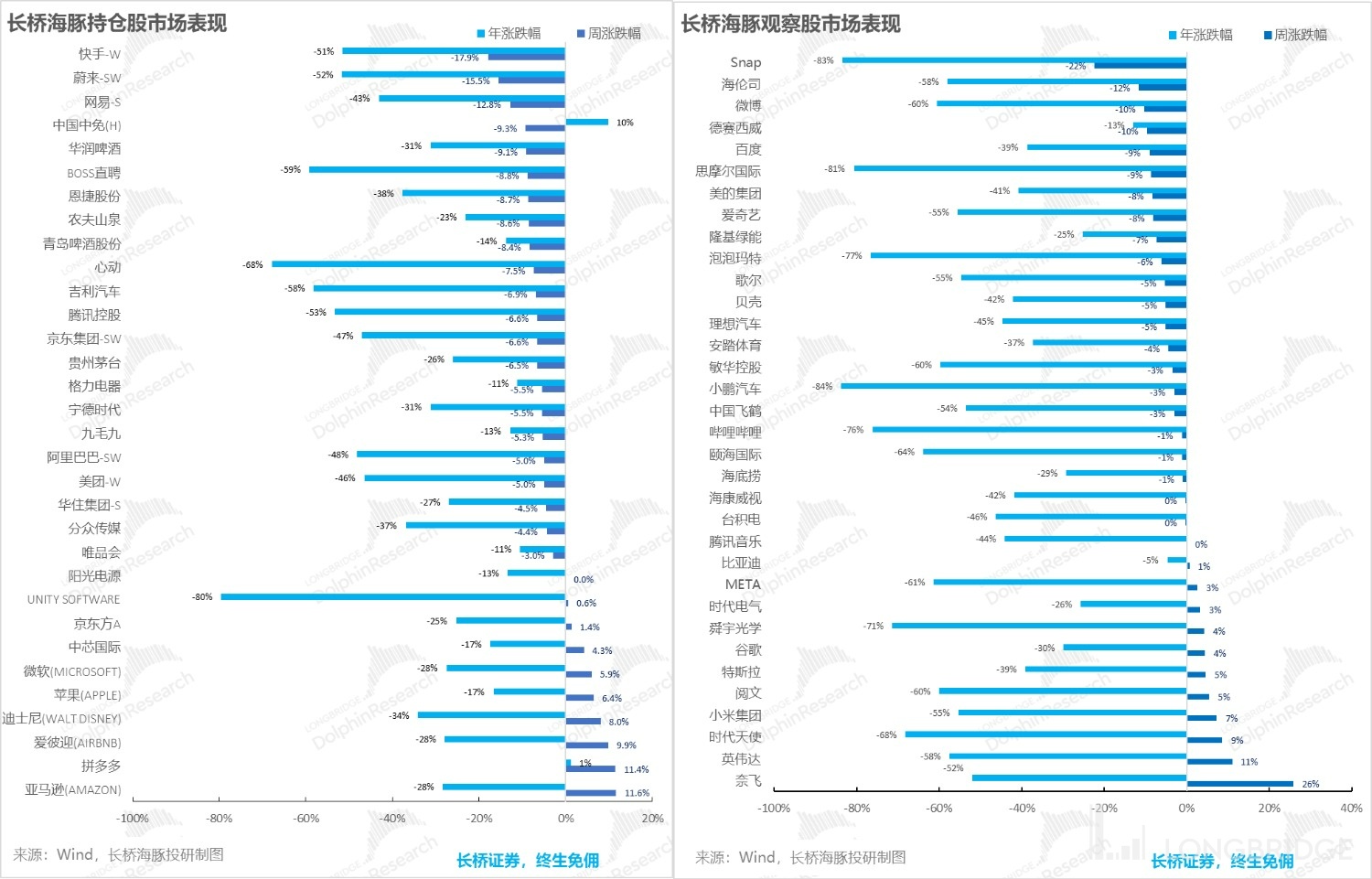

VI. Individual Stock Performance: US stocks rebound, and Chinese stocks bleed

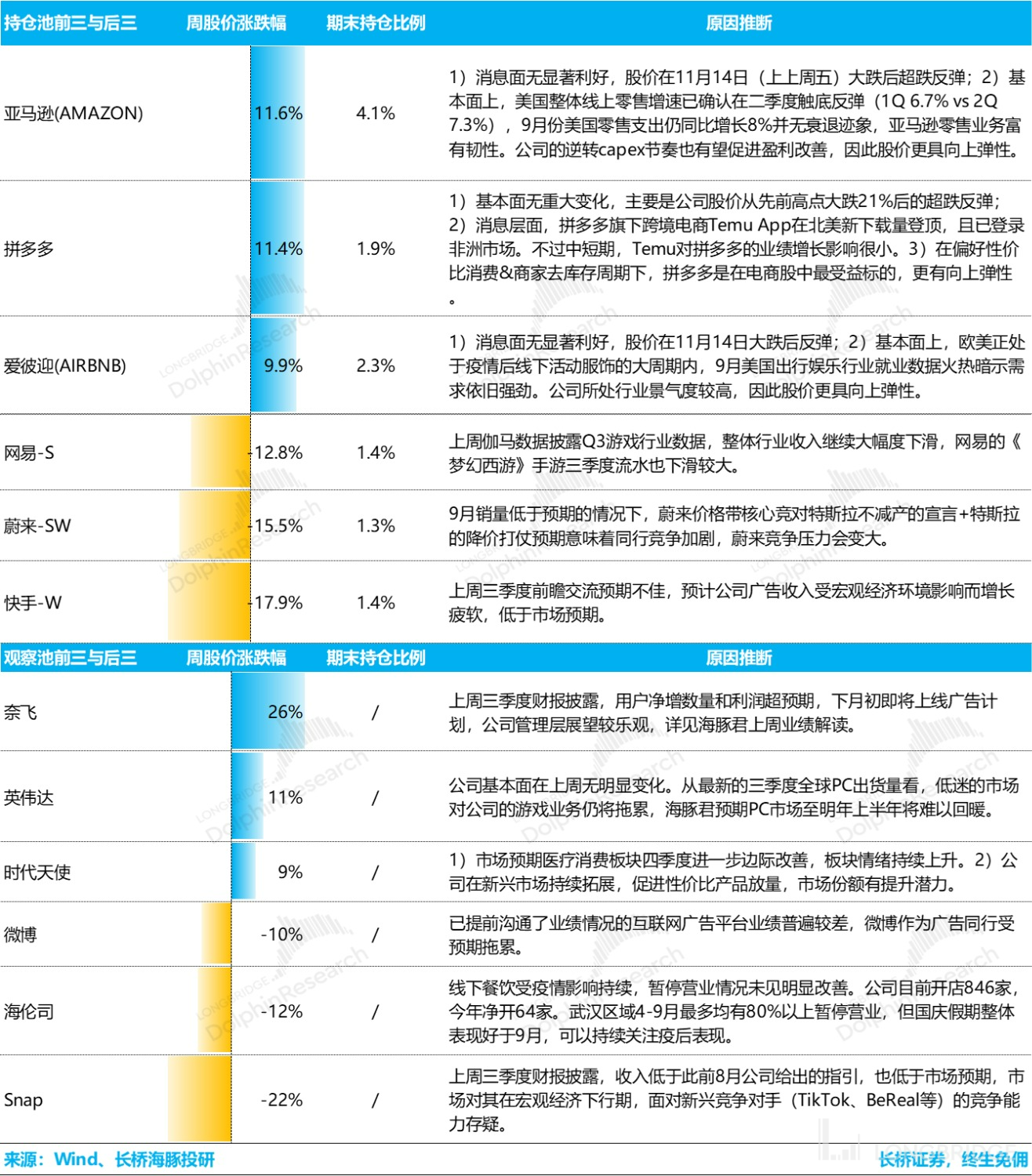

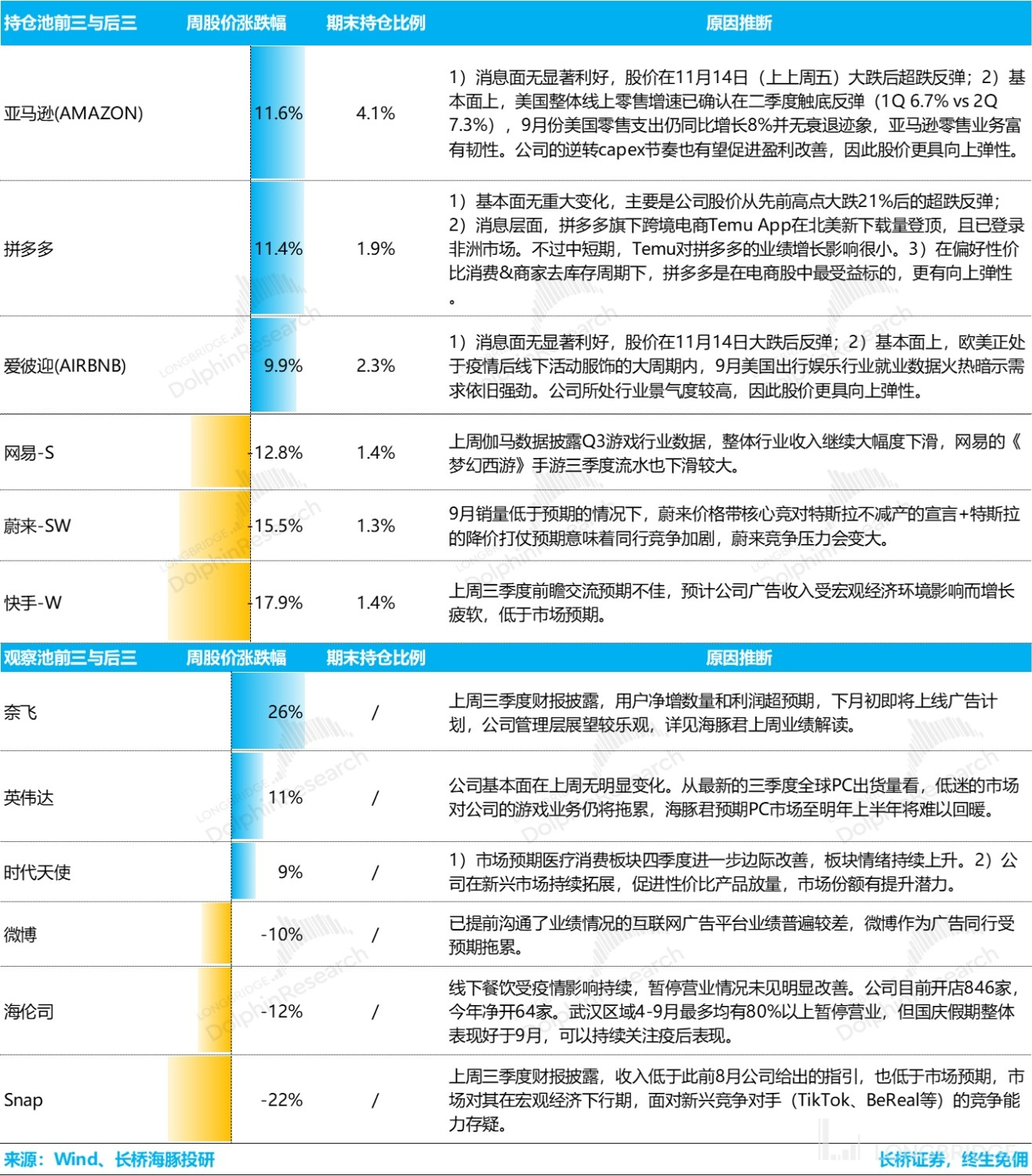

Last week, Dolphin Analyst's portfolio was mainly supported by US assets, with all gainers other than Pinduoduo being US assets, with SMIC and BOE A being more resistant to the downturn in domestic assets. Other sectors such as advertising, pan-consumption, social services, and new energy were all in decline, and the observation stock pool of Dolphin Analyst had similar features.

Regarding companies with large fluctuations in gains and losses, the driving reasons collated by Dolphin Analyst are as follows, for reference:

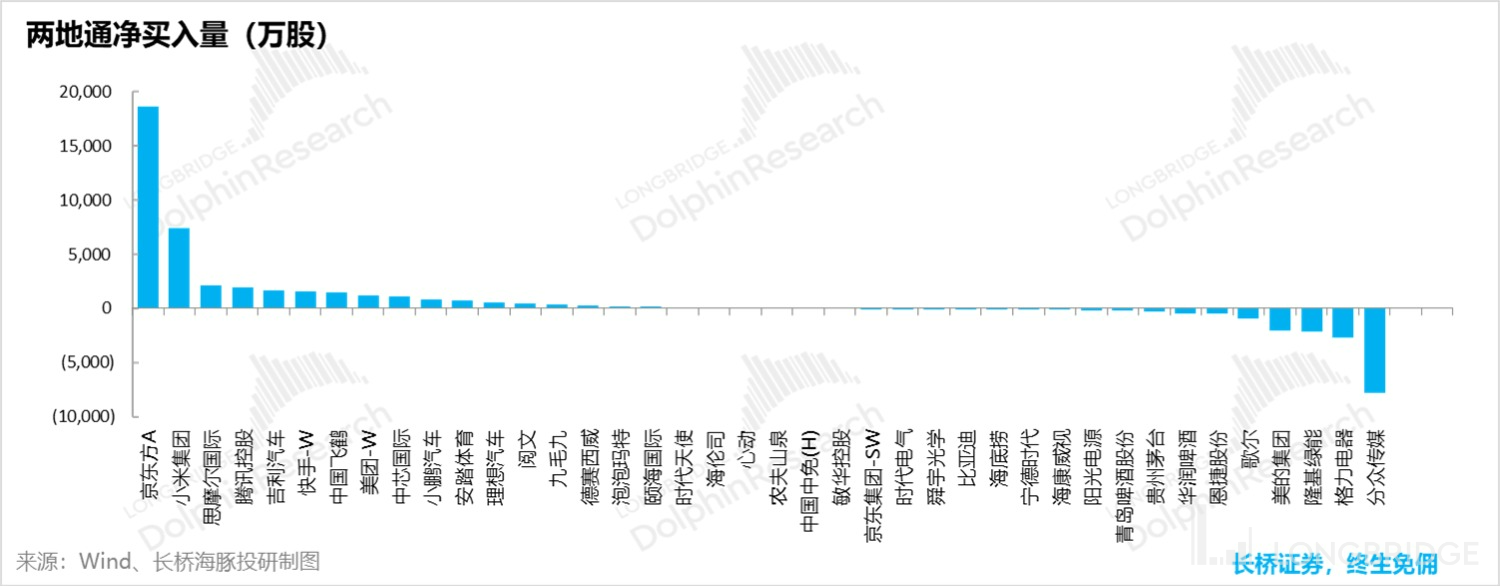

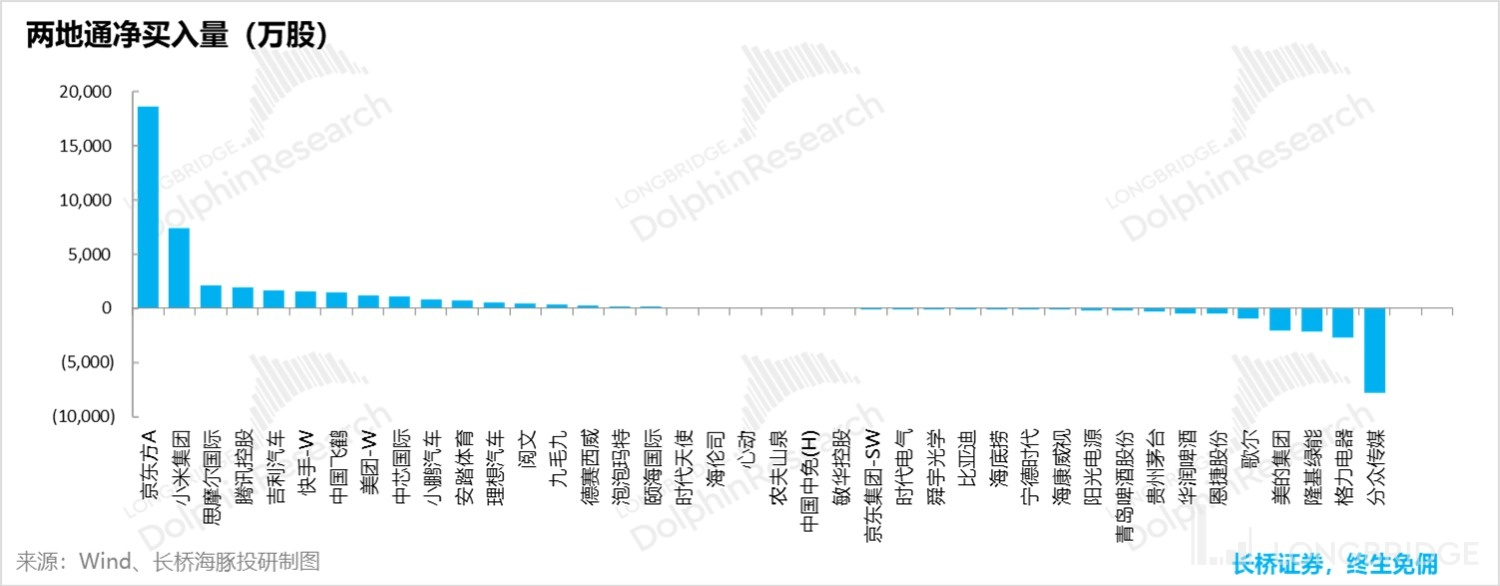

Judging from the north-south capital flows of Dolphin Analyst's stock pool, JD.com, which was bought in by capital, has the logic of having a roll-over under undervaluation, and Xiaomi, Tencent, and Kwai as well as all extremely undervalued. The net selling of Focus Media is from the advertising platform for the third quarter performance preview that has been communicated. The bleakness of the advertising industry in the third quarter exceeded market expectations. Gree and Midea were affected due to poor industry shipment data.

VII. Portfolio adjustment and focus

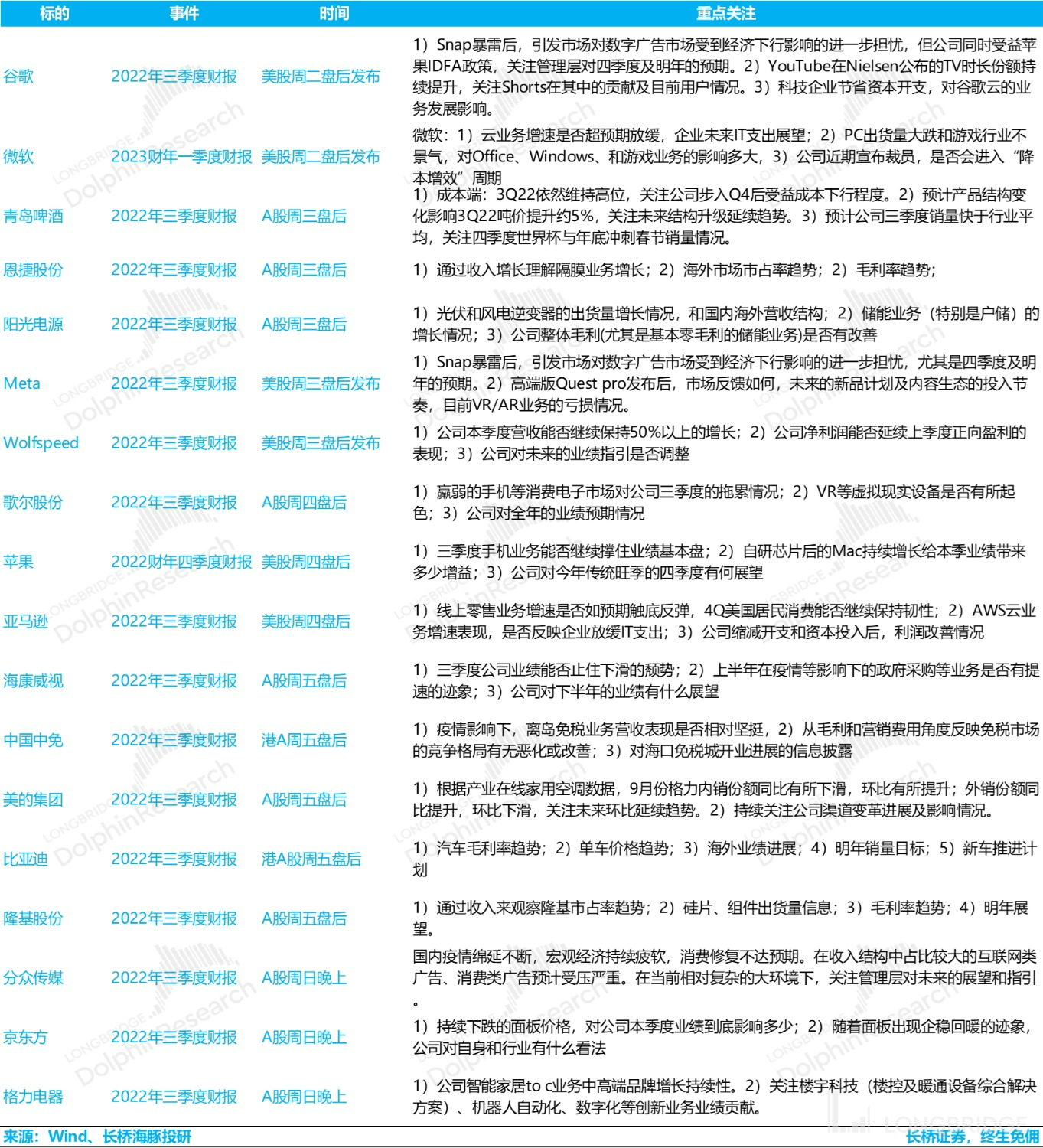

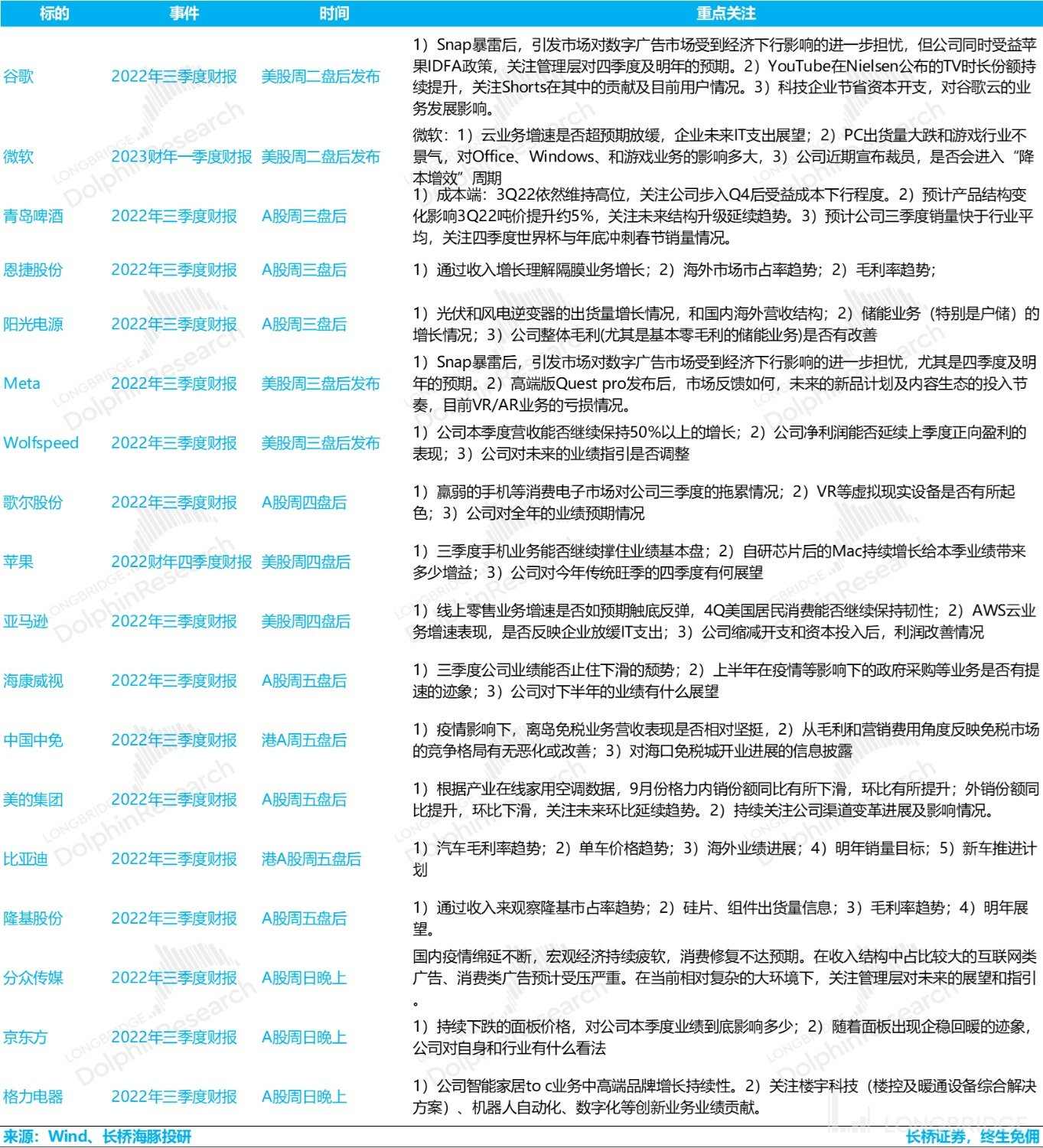

This week, both the US and A-share markets entered the intensive earnings season, with many companies reporting. The companies that Dolphin Analyst pay attention to, their earnings release times and Dolphin Analyst focus are as follows:

VIII. Portfolio asset distribution

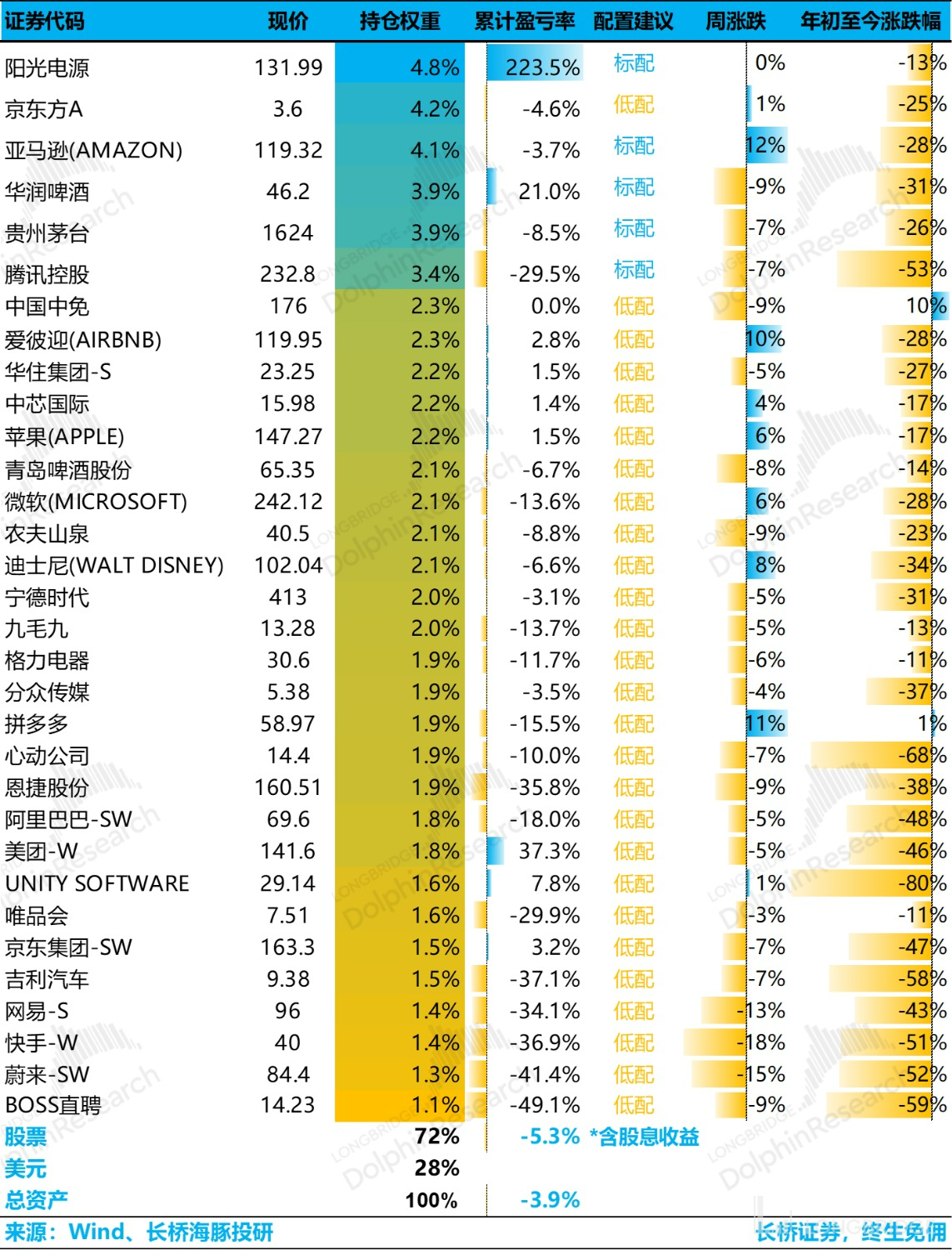

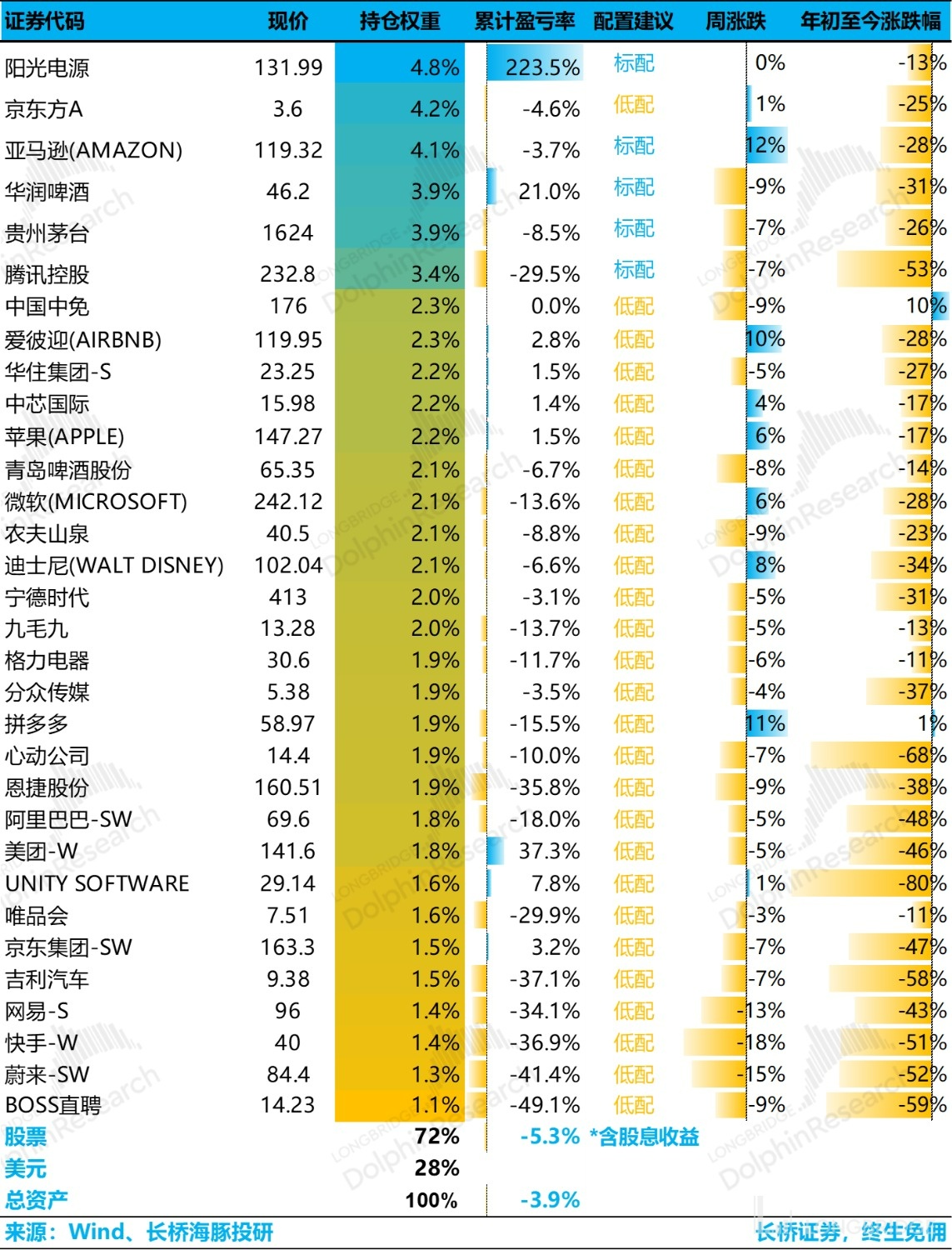

From the start of testing on March 1st to last week, Alpha Dolphin's portfolio overall income was -3.9% (including dividend income), and the stock asset income was -5.3%.

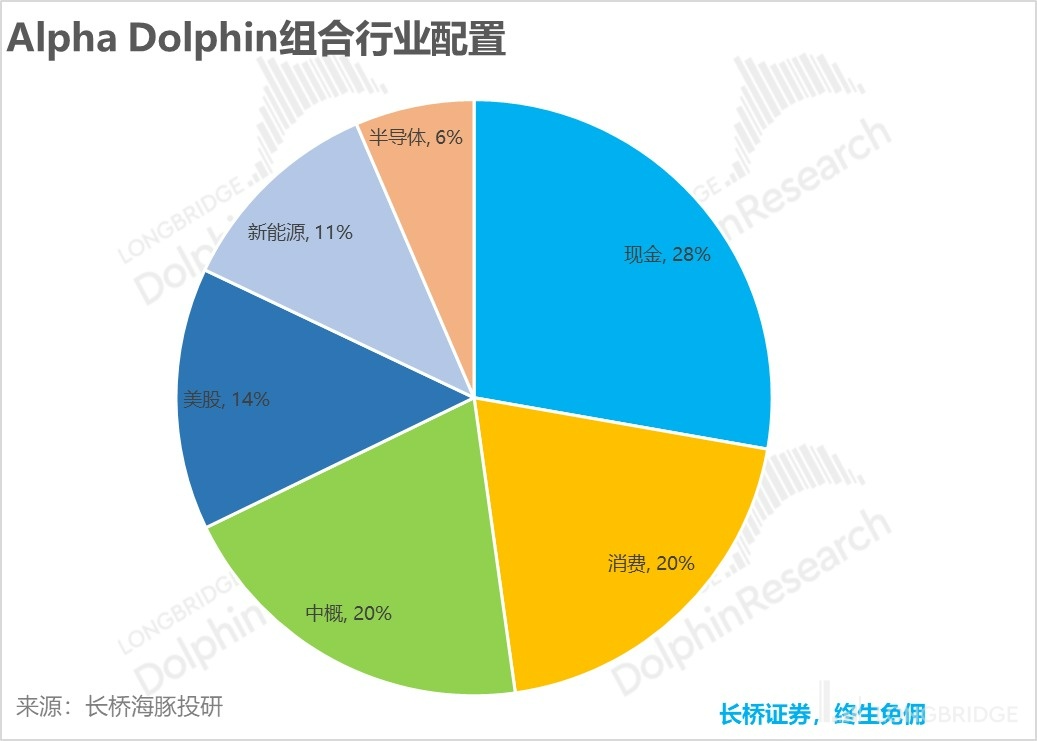

Currently, Alpha Dolphin's portfolio has a total of 32 stocks, of which only five are standard and the rest are low allocation stocks.

As of last weekend, Alpha Dolphin's asset allocation distribution and equity asset holdings are as follows:

Please refer to the following recently published reports from Longbridge Research Team:

"The East is not bright and the West is bright, and the A-share scenery is good"

"Slow down the rate hike? The American dream is shattered again"

"Reacquaintance with a 'Iron-blooded' US Federal Reserve"

"Doubting life when it falls, is there still hope for reversal?"

- Violent Inflation from the Fed, Domestic Consumption Opportunities Instead?

- Global Markets Crash Again, Shortage of Workers is Root Cause in the US

- Fed Becomes the No.1 Bear, Global Markets Collapse

- A Bloodbath Triggered by Rumors: Risks Remain,Finding Sugar in Glass Shards

- US Goes Left, China Goes Right, Cost-Effectiveness of US Assets Returns

- Layoffs are Too Slow to Pick Up, the US Must Continue to Decline

- US Stocks' Celebration of "Funerals": Recession is Good, the Strongest Interest Rate Hike Brings Out the Bearish News

- Interest Rate Hike Enters the Second Half, the Opening of the "Performance Thunder"

- The pandemic Will Strike Back, the US Will Recede, and the Funds Will Change

- Current Chinese Assets: "No News is Good News" for US Stocks

- Growth is Already a Carnival, but is the US Definitely in Recession? 《2023 年的美国,是衰退还是滞涨?》

Risk Disclosure and Disclaimer of This Article: Dolphin Investment Research Disclaimer and General Disclosure