Tsingtao Beer "depends on the weather" to gain popularity? It may not necessarily cool down in the fourth quarter either.

Hello everyone, I am Dolphin Analyst!

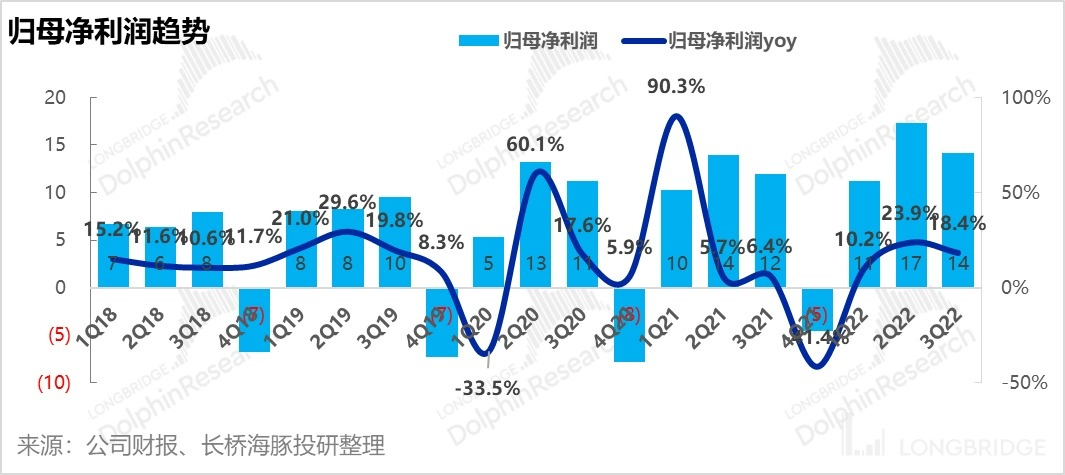

$Qingdao Beer.HK Beijing time Wednesday afternoon released its third-quarter financial report. Actual revenue was in line with market expectations, and profit growth was slightly faster than revenue, with overall stability and growth:

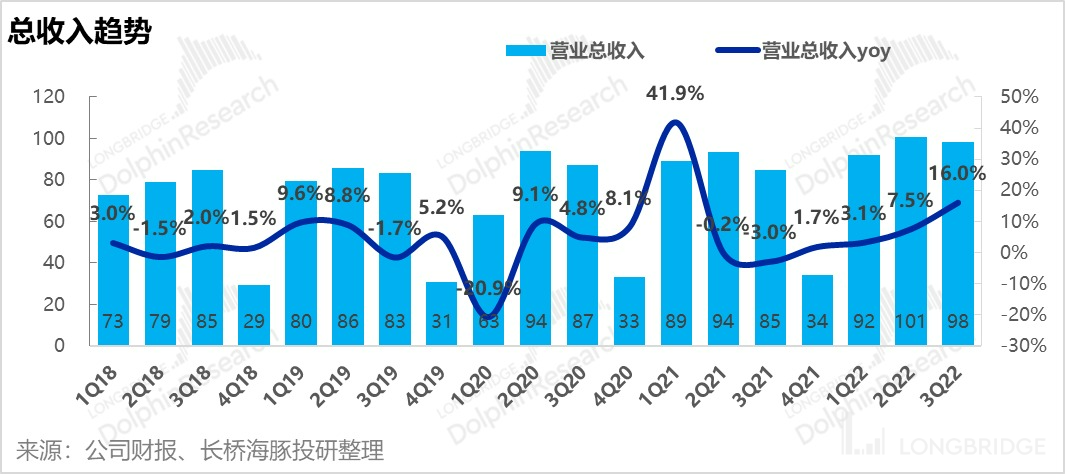

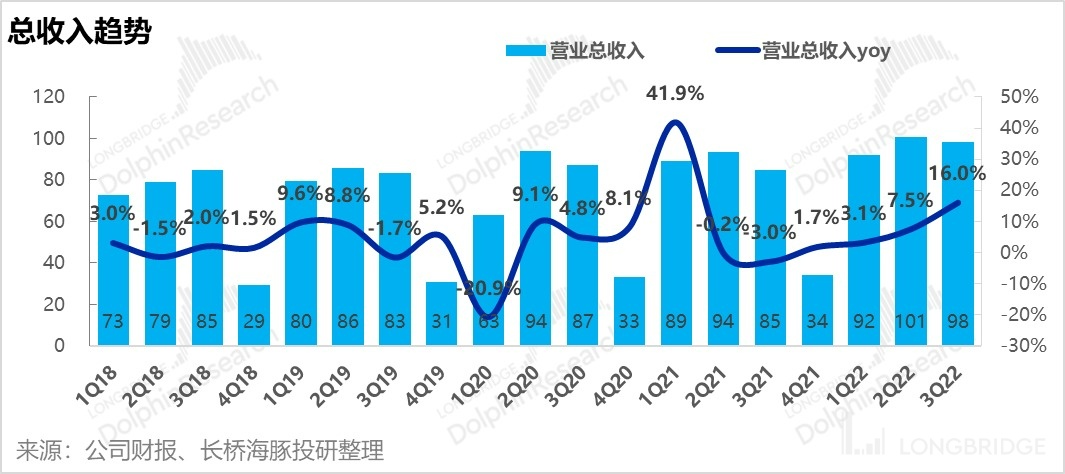

1. There are bright spots in Q3 revenue: Qingdao Beer's operating revenue for Q3 2022 was CNY 9.837 billion, the highest for a Q3 operating revenue for Qingdao Beer in the past few years, surpassing the CNY 9.221 billion for Q3 operating revenue in 2013. This year's hot summer has already contributed to Qingdao Beer's CNY 10 billion in revenue for 2Q, and as the high temperatures continue, the company's growth remains steady.

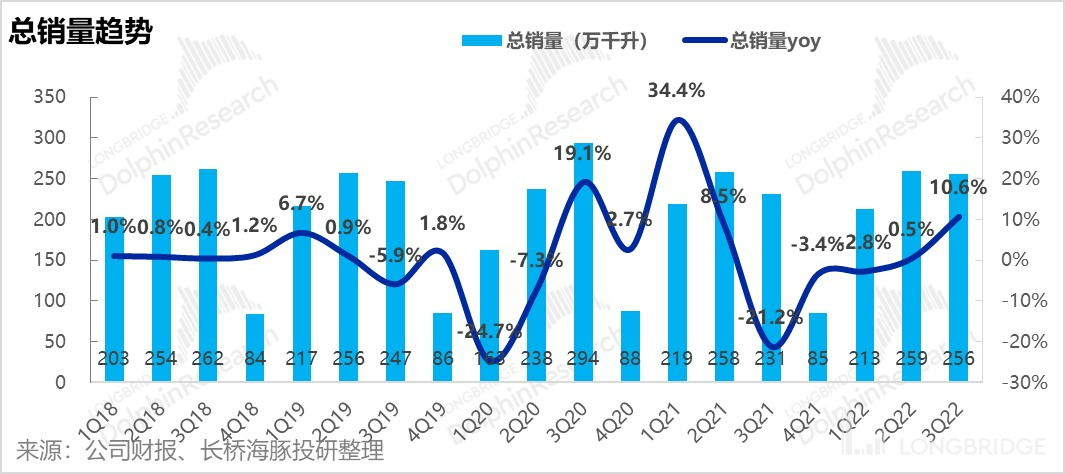

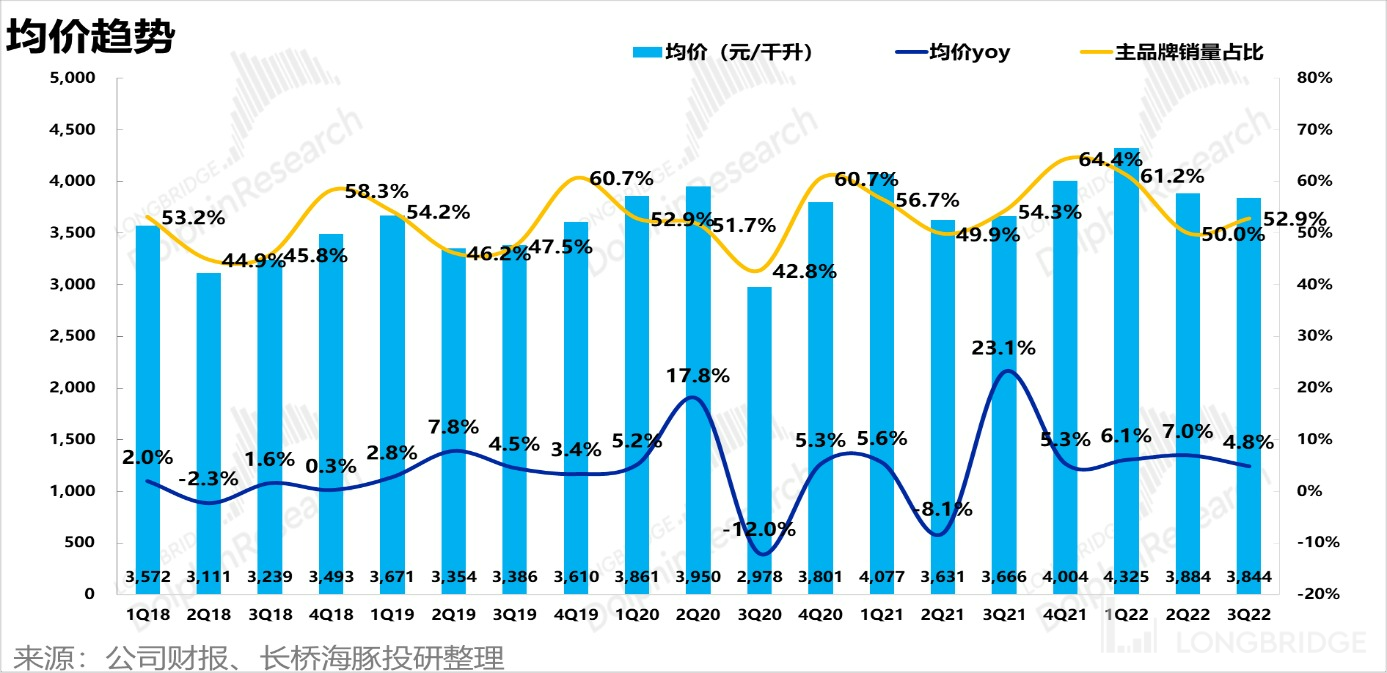

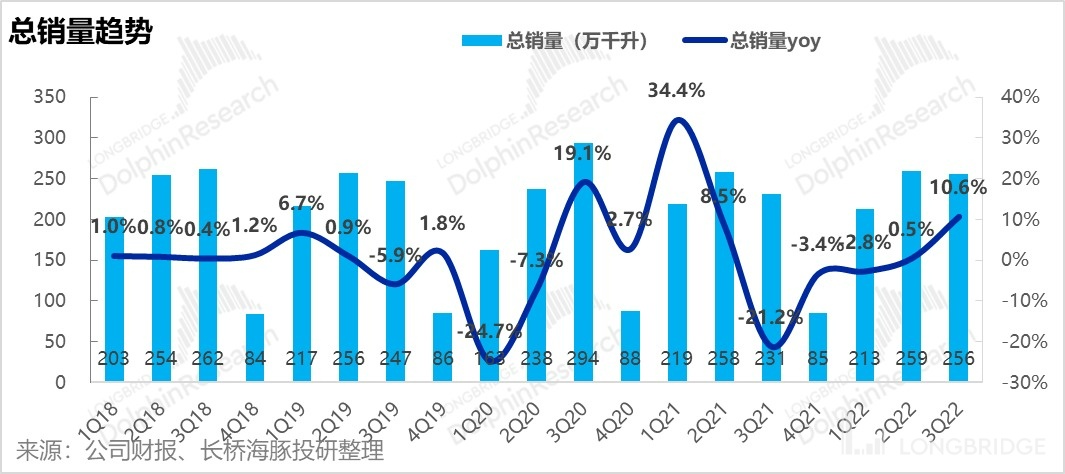

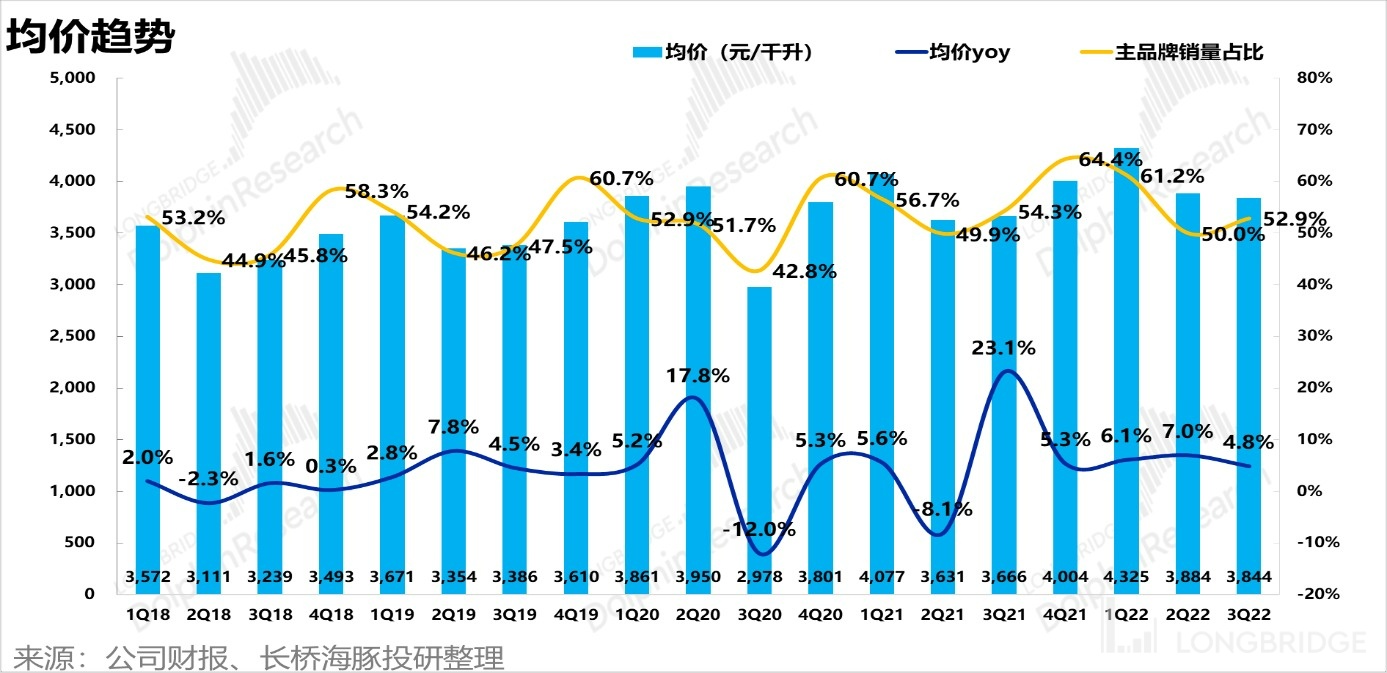

2. The trend of average price improvement continues, with sales volume growth outpacing the industry average: In Q3 2022, the ton price increased by 4.8%, which has remained consistent with the trend of structural upgrades from the 6.1% of Q1 and 7.0% of Q2. Sales volume in Q3 increased by 10.6%, with an obvious growth rate higher than the industry average. Both the main and sub-brands made certain contributions, with growth rates of 7.7% and 14.1%, respectively.

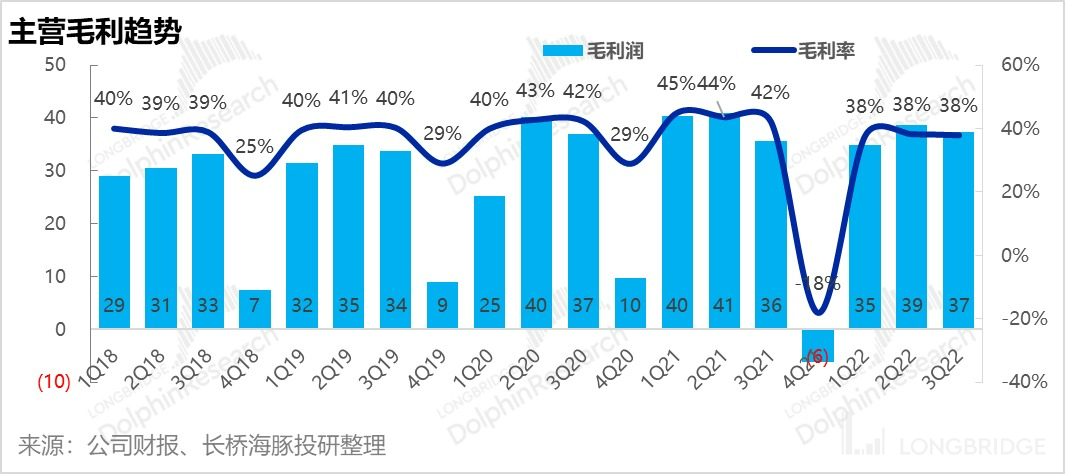

3. The benefits of cost remain promising: The company is still in a high-cost position for the first three quarters. The gross profit margin is still somewhat suppressed compared to previous years (excluding the impact of freight). However, the gap has started to converge on a quarterly basis. The gross profit margin for Q3 this year was 38%, indicating signs of loosening pressure on raw material costs. Benefits from control of cost and a rise in single-ton profitability are expected to become more pronounced starting in Q4, and even more so in 2023.

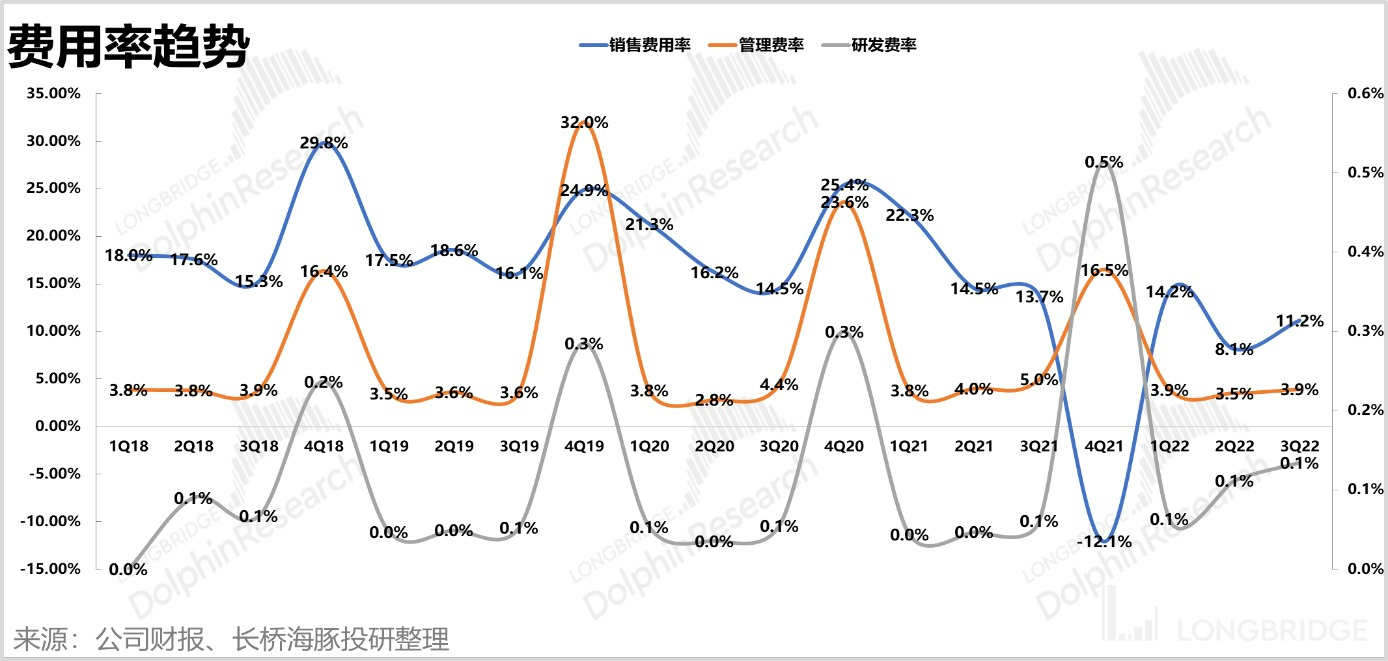

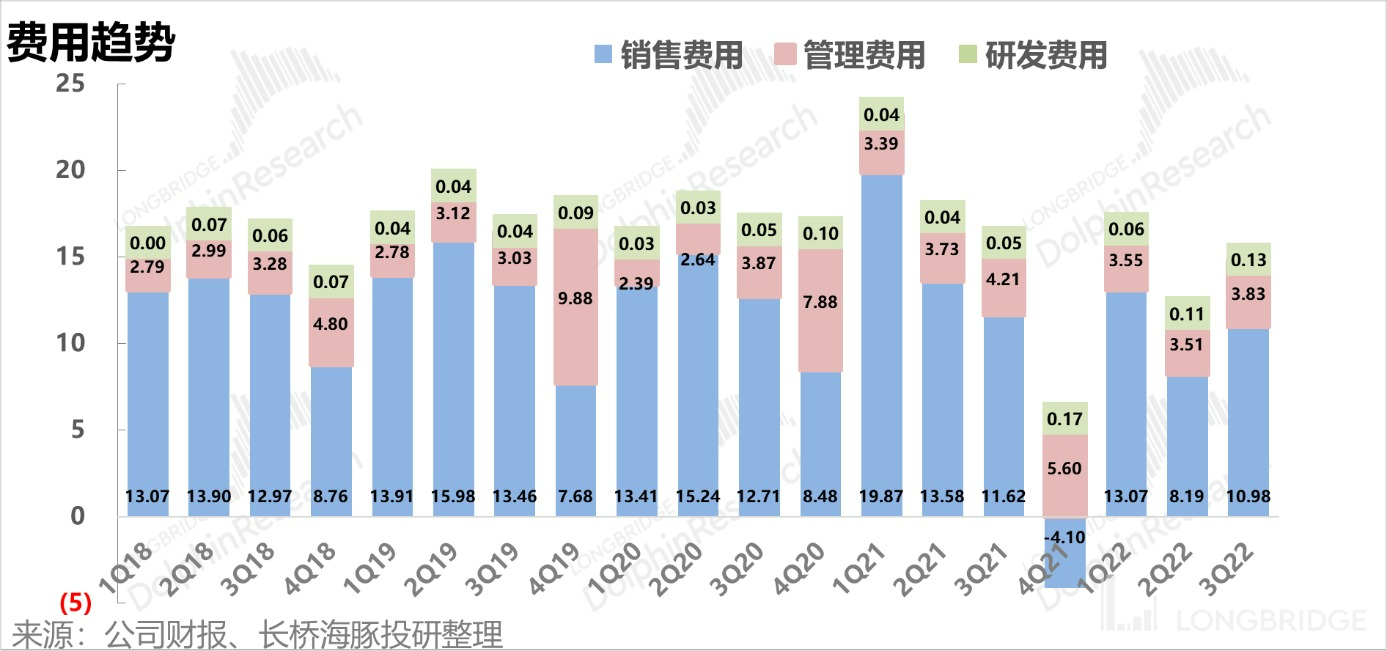

4. Each province has its own customs, each flower its own fragrance: In terms of expenses, sales expenses increased month-on-month. To motivate sales and promote channel deployment, the company is very willing to invest. According to grassroots research, the company's channel expenditure is higher than that of competitors, vigorously developing the market and stimulating channel energy. Management expenses remain stable, the company is cash-rich, and provides additional interest income.

Dolphin Analyst's Insight:

In 2022, the entire consumer goods industry has come under certain pressure, especially based on the high base of previous revenue, continuous upward pressure on raw materials costs, and repeated partial outbreaks in the first half of the year. Many major consumer goods companies are showing signs of fatigue.

According to data from the National Bureau of Statistics, in August 2022, the production of beer by Chinese enterprises above a certain scale was 3.933 million kiloliters, an increase of 12.0% year-on-year. Taking May as the turning point, the monthly output in the first five months was negative growth. From June until now, the cumulative year-on-year growth has gradually caught up. The consumer goods sector's performance was particularly difficult this year, with the ability to maintain simultaneous growth in quantity and price being especially commendable.

For the company's performance for the first three quarters, the market has already had certain expectations, and many investors are concerned about Qingdao Beer's sustained losses in Q4. However, this year's particular situation is that the World Cup is imminent, which will repair the business climate in the beer industry in the months of August and September. In addition, the Spring Festival in 2023 is earlier, coupled with the two major catalytic factors of beer stocking as the Spring Festival approaches, making it highly probable that Qingdao Beer will reduce losses in Q4 this year. Of course, more flexibility lies in the contribution of cost reduction to profit release from next year onwards, achieving a double increase in gross and net profit margins based on stable revenue growth.

In the third-quarter financial report season, a wave of leading heavyweights is approaching. Dolphin Analyst has been keeping track of the news. Interested readers are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and get the latest financial report interpretation and conference call summary.

Below, Dolphin Analyst will focus on the revenue growth situation (contribution of sales volume and average price), cost trends, expense situation and net profit attributable to shareholders, and take a look at Qingdao Beer's actual operating data in the third quarter and the potential changes in the future:

I. Rising sales volume and price, continuous contribution to revenue growth

The company's single-quarter revenue growth rate for the first three quarters was 3.1%, 7.5%, and 16.0%, respectively. From the analysis of the relationship between sales volume and price, Dolphin Analyst found that the vast majority of the contribution came from the increase in sales volume. The sales volume for the first three quarters was 2.8%, 0.5%, and 10.6% respectively.

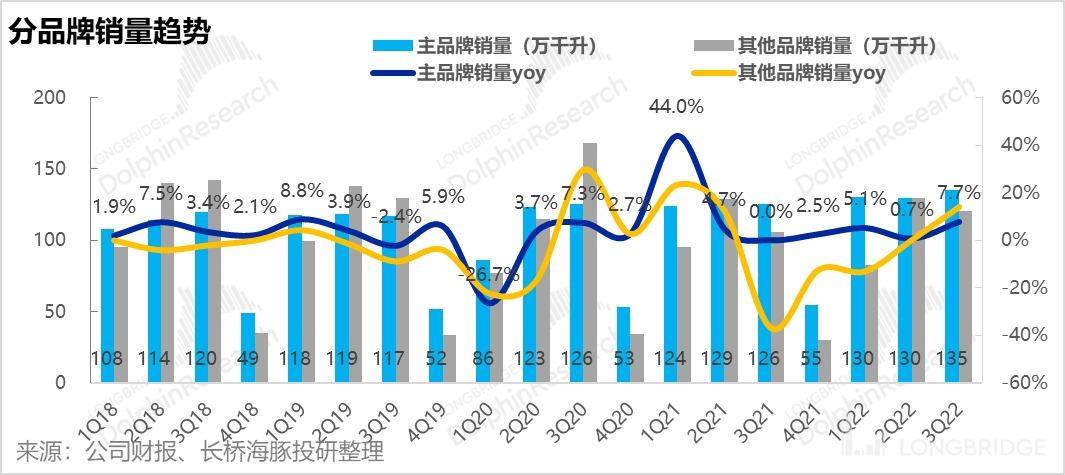

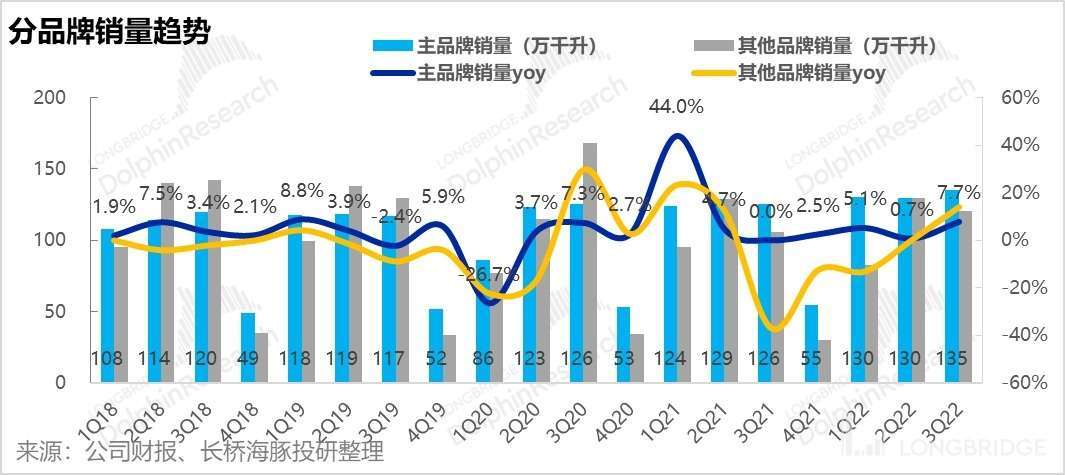

By splitting the sales volume trend by brand, it can be found that, unlike the first two quarters of this year, the sales growth of the "main brand" represented by "Qingdao Beer" in the third quarter of this year was slightly lower than that of the "other brands" represented by "Laoshan Beer". This is mainly due to the sporadic outbreaks of domestic epidemics in some areas in August and September, which have had a certain negative impact on the mainstream products of Qingdao Beer.

However, because Qingdao Beer sells nearly half of its volume in Shandong Province and is less affected by the epidemic, it is expected that the sales growth of the high-end products, Tsingtao Pure Draft and Tsingtao Classic, in the third quarter in the province will both exceed 15%, and the average price will increase by a small two-digit percentage. The trend of structural upgrading can already be seen.

In the future, with the company's continuous promotion of canning rate increase, sales growth of main brands will gradually return to normal, and the long-term trend of structural upgrading will not change.

In terms of price, the average price increase for the first three quarters was 6.1%, 7.0%, and 4.8% respectively. The stable sales volume of the main brands, which accounted for over 50%, has also contributed to the steadily rising average price of the company. In addition, with the ongoing World Cup in November, the expected price increase is expected to further boost the high-endization of the company's products.

II. Contribution of cost reduction to profit elasticity

II. Contribution of cost reduction to profit elasticity

Despite cost pressure, the gross margin of Tsingtao Brewery in the first three quarters of the year still maintained a relatively high level. Excluding the impact of transportation costs (the proportion of transportation costs in sales expenses is about 5% of revenue in previous years), although there is still a small gap compared with last year, the gap has been narrowing quarter by quarter.

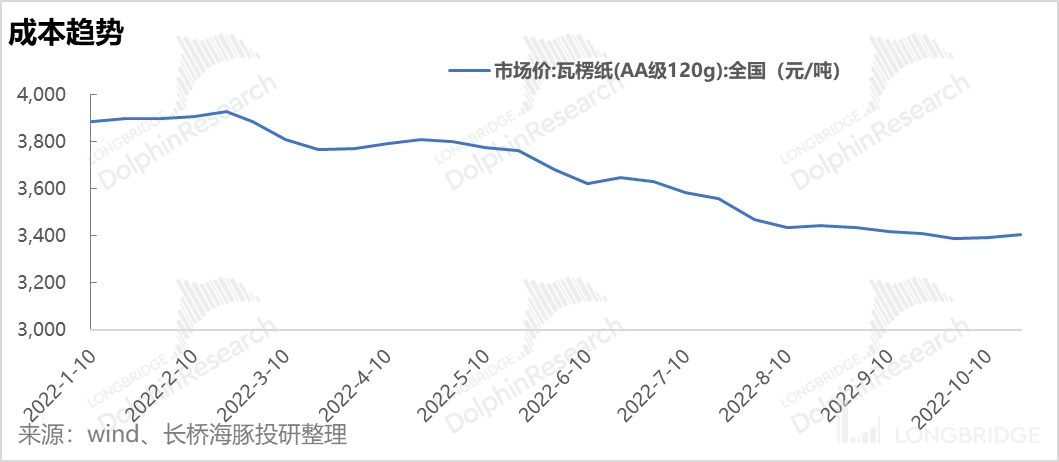

Dolphin Analyst has previously popularized that about 50% of the cost of beer packaging is the cost of packaging, of which glass bottles account for 35%, aluminum cans account for 10%, and cardboard boxes account for 5%. However, the prices of packaging materials such as aluminum, glass bottles, and corrugated paper have gradually fallen since March.

However, from the perspective of the procurement cycle, it takes a certain amount of time for the downward price of raw materials to be implemented into costs. Tsingtao Brewery is affected by the procurement cycle, and the cost in the third quarter of this year still remains high. The gross profit margin in the third quarter was 38.0%, a slight decrease of 0.2pct compared to the same period last year (excluding the impact of transportation costs). It is expected that the cost reduction situation will be very obvious starting from the fourth quarter.

In addition, barley, which accounts for 15% of the cost of beer, is also a major material cost. However, leading beer companies usually lock in prices to control the uncertainty of barley costs.

III. Have expenses where it matters

In the third quarter, Tsingtao Brewery's sales expense ratio/management expense ratio were 11.16%/3.89%, a year-on-year decrease of 2.54% and 1.07%, respectively. Dolphin Analyst previously mentioned that about 5 percentage points of transportation costs are classified as cost, affecting sales expenses. Excluding this factor, the company has made real efforts in cost control. In addition, this year's first three quarters were affected differently by the epidemic. The company also timely increased promotion and channel investment in the third quarter to support revenue growth. IV. Q4 Losses Expected to Decrease, with More Anticipation Next Year

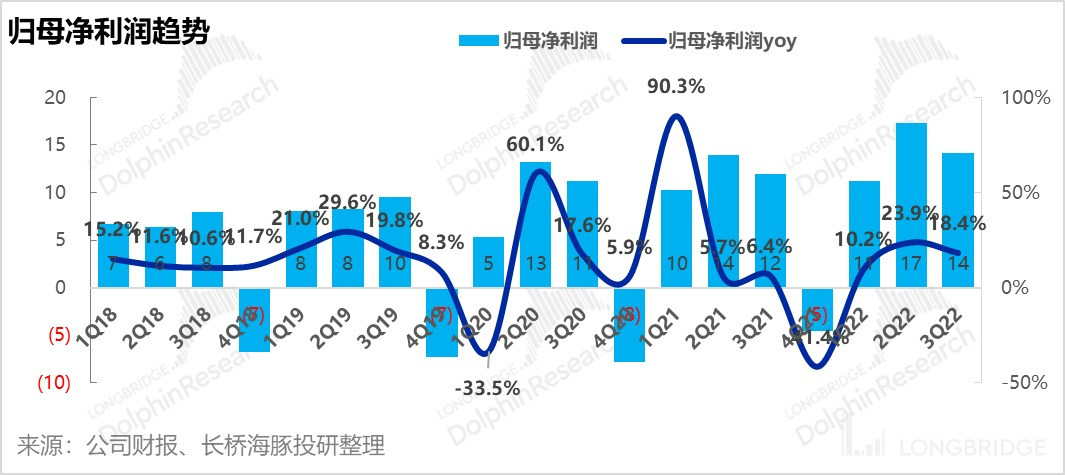

Whether it is revenue or sales volume, the company has achieved relatively good results in the first three quarters. The company achieved a net profit of 1.4 billion in Q3 this year, an increase of 18.4% YoY, exceeding the revenue growth rate of the same period (16%). However, the market is currently worried that beer sales will enter an overall downward trend in Q4. Usually, Q4 is the time of the year with the lowest performance due to the end of the peak sales season and the higher proportion of sales expenses carried throughout the year. For instance, Qingdao Beer has often experienced losses in the fourth quarter in history. However, it can be seen that the company will benefit from cost declines starting from October this year, and Q4 is expected to decrease losses compared to previous years.

Dolphin Analyst "Qingdao Beer" Historical Articles:

Earnings Season

August 26, 2022 Qingdao Beer: Raising prices Is The Way to Go (Chinese article)

April 28, 2022 Qingdao Beer: Price per ton continues to rise, cost pressures ease (Chinese article)

March 28, 2022 Qingdao Beer: Sales growth slows down and won't change premium strategy (Chinese article)

October 28, 2021 Qingdao Beer: Slowing sales has become a foregone conclusion, high-end market needs more effort (Chinese article)

In-depth Analysis

February 10, 2022 Qingdao Beer (Part Two): After Fosun's Reduction, How to Evaluate Qingdao Beer's Current Valuation (Chinese article)

January 25, 2022 Qingdao Beer (Part One): Unlocking the Ultra-high-end, Is Qingdao Beer's "Maotai-ification" a Transient Phenomenon or an Ultimate Fate (Chinese article) Risk Disclosure and Statement for this Article: Dolphin Investment Research Disclaimer and General Disclosure