Wolfspeed: Is it short-term performance that's being sacrificed, or long-term faith in silicon carbide?

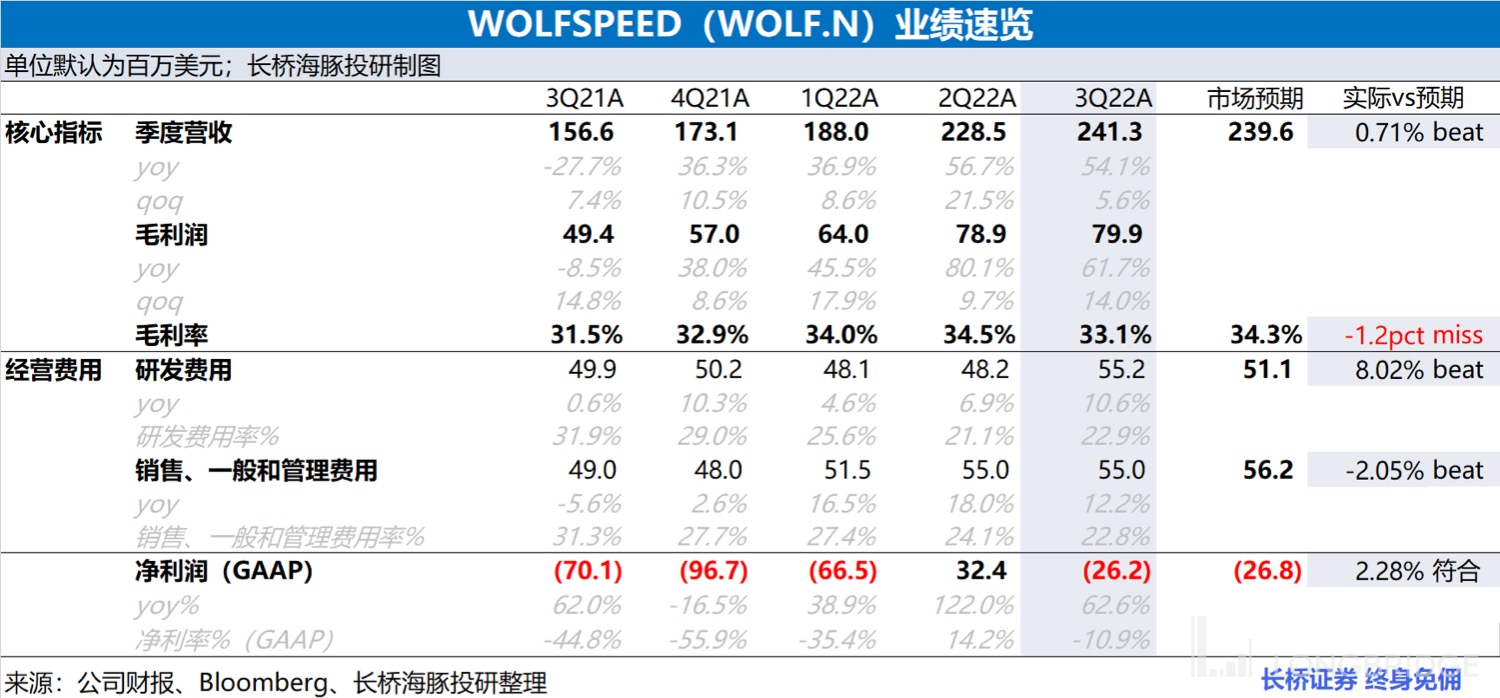

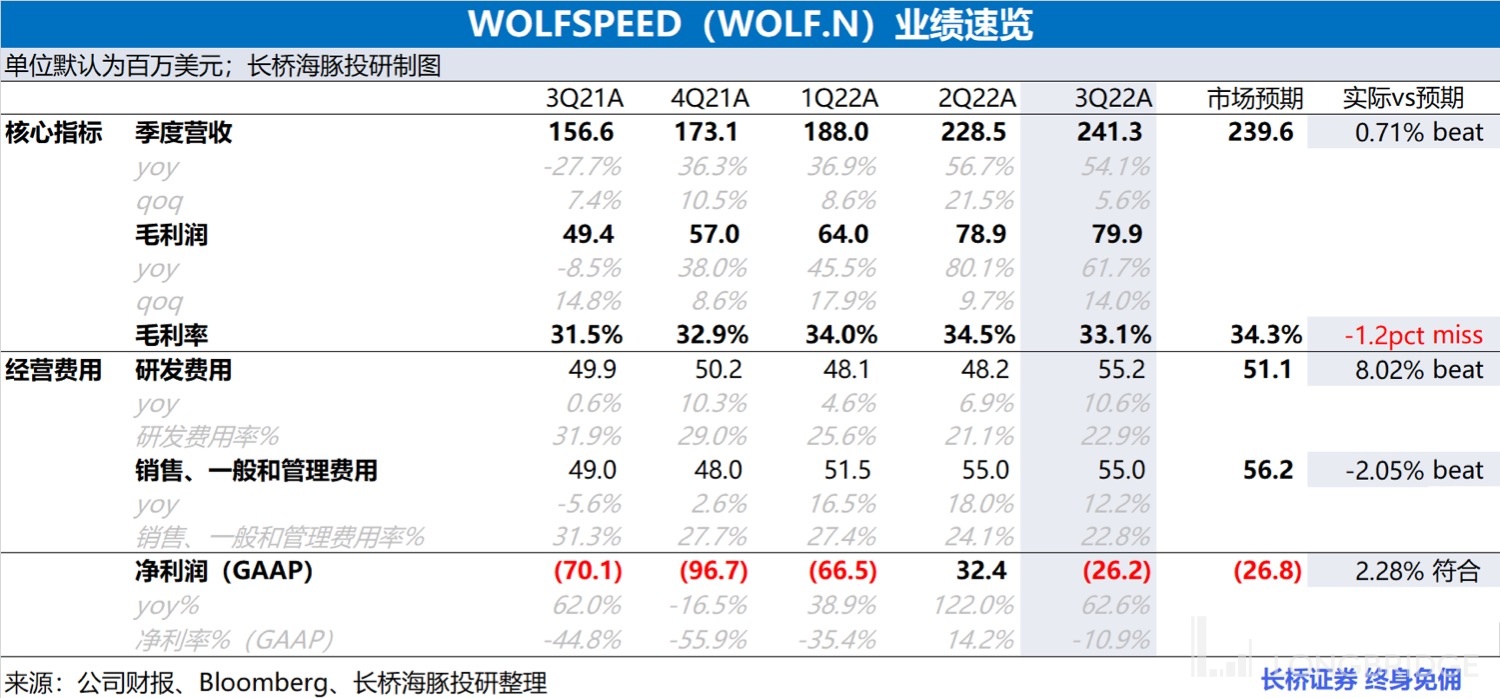

WOLFSPEED (WOLF.N) released its Q1 2023 earnings report (until September 2022) in after-hours trading on Longbridge on the morning of October 27th. Highlights are as follows:

1. Key Metrics: $Wayfair.USolfspeed.US achieved revenue of $241 million in Q1 of FY2023, slightly exceeding market expectations ($239 million). The company realized more than 50% YoY growth for two consecutive quarters, and the revenue growth in this quarter was mainly driven by the continued improvement of the power device business and the strong demand for the six-inch silicon carbide substrate in the material business. The gross margin for this quarter was only 33.1%, slightly lower than the market expectation (34.3%), mainly due to the increase in manufacturing-related expenses affected by inflation.

2. Operating Expenses: Wolfspeed's operating expenses reached $110 million in Q1 of FY2023, up 11.4% YoY, lower than the growth of the revenue side. Looking at specific operating expenses, the sales, general and administrative expense items have decreased, indicating that the company has started to control expenses, while the R&D expense still maintains a high proportion of over 20%.

3. Net Profit: Wolfspeed achieved a net loss (GAAP) of $26 million in Q1 of FY2023, with a significantly reduced YoY loss. While the company returned to a loss in this quarter after making a profit in the previous quarter, due to nearly $100 million of non-recurring changes last quarter. From an operational perspective, the operating loss for this quarter has significantly narrowed.

4. Q2 Guidance: Wolfspeed's revenue guidance for Q2 of FY2023 is $215-235 million, lower than the previous market expectation ($252 million). While the company's net loss (GAAP) target is $83-93 million, far lower than the market expectation (net loss of $35 million).

Overall, Wolfspeed's earnings report is in line with market expectations, and both the revenue and profit ultimately fall within the company's guidance range. From this earnings report, the company's revenue side still maintains high growth, and the expense side has been affected by cost growth, but the company has also begun to control expenses.

This earnings report alone will not have a significant impact on the market, but as a high-growth stock, market trades more on the company's future expectations. The quarterly guidance provided by the company is the main reason for the market's shock. Both the revenue and profit guidance for the next quarter has declined, significantly lower than market expectations.

Dolphin Analyst has also previously warned of the risks of Wolfspeed in the Silicon Carbide field in the article "Wolfspeed: The Hard Currency in Silicon Carbide, Expensive Is the Original Sin." In the medium-to-long term, Dolphin Analyst still believes that Wolfspeed will continue to lead the development of the silicon carbide industry, but in the short term, there may still be some upward pressure. If there is another opportunity for the stock price to drop significantly below the target range (such as the low point of $58 per share in June), this will provide investors with a better buying opportunity."

For high-growth stocks like Wolfspeed, the company's high valuation mainly comes from the market's expectations for the company's future, as the company has not yet made a profit. At the same time, any movements in the market will also bring significant fluctuations to the company's stock price. Dolphin Analyst believes that if the impact is only due to a shortage of spare parts for old equipment, the impact will only last for 1-2 quarters in the short term. As long as downstream demand remains tight, the company and its path still have long-term potential. As for the timing of buying, Dolphin Analyst believes that the company's performance will show signs of improvement or the stock price falls far below the target range.

In terms of specific financial report performance, Dolphin Analyst pays close attention to the following aspects:

- Can Wolfspeed's revenue continue to grow rapidly, benefiting from the high prosperity of the new energy downstream?

- Since the company has given a long-term gross profit margin guidance of 50%, can Wolfspeed's gross profit margin in this quarter be improved further?

- With major US factories starting to control costs, does Wolfspeed have a corresponding response, and can the company achieve positive profits again this quarter?

- What is Wolfspeed's outlook for the next quarter's operations?

Dolphin Analyst looks for answers to these questions in the financial report:

I. Revenue end: High growth expectations fell short

Wolfspeed achieved revenue of $241 million in the first quarter of fiscal year 2023, a year-on-year increase of 54.1%, slightly higher than the market's expected $239 million.

Combined with the company's financial report communication in the previous quarter, the company completed revenue targets of $232-247 million in this quarter. The company achieved growth of more than 50% again this quarter, mainly driven by the continuous improvement of the power device business operation and the strong demand for 6-inch silicon carbide substrates in the material business. The strong demand in the new energy field has driven the company's revenue growth.

This quarter's revenue end still met expectations, but the market is more concerned about the company's situation next quarter. The company gave a revenue guidance of $215-$235 million for next quarter, with a year-on-year increase of 30%, but a decline on a quarter-on-quarter basis, and the company's explanation is that it has faced challenges in production and supply.

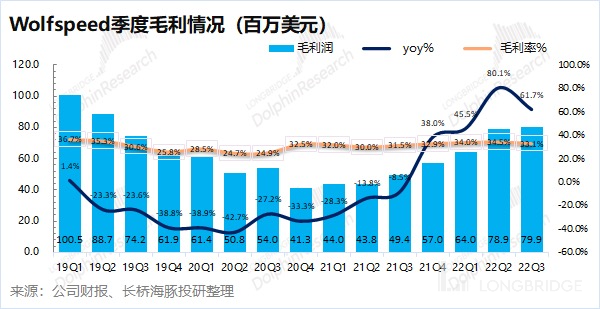

II. Gross Margin: Trending Upward but Short-term Pressure

II. Gross Margin: Trending Upward but Short-term Pressure

Wolfspeed's gross profit in the first quarter of the 2023 fiscal year was USD 80 million, a year-on-year increase of 61.7%. The growth was mainly due to the improvement in revenue and gross profit margin.

The company achieved a gross profit margin of 33.1% this quarter, a year-on-year increase of 1.8 percentage points. However, it was slightly lower than market expectations (34.3%). As the production capacity expands, the company's gross profit margin is showing an overall upward trend. However, due to inflation and other factors, the increase in manufacturing-related expenses caused the gross profit margin this quarter to be lower than market expectations.

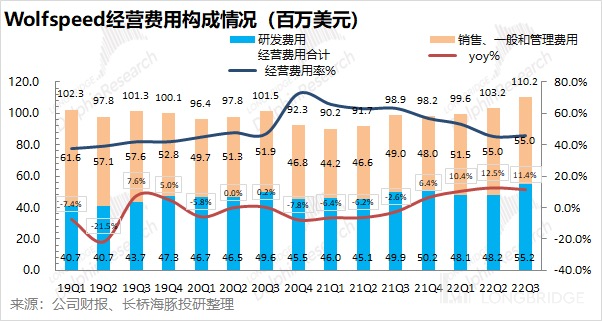

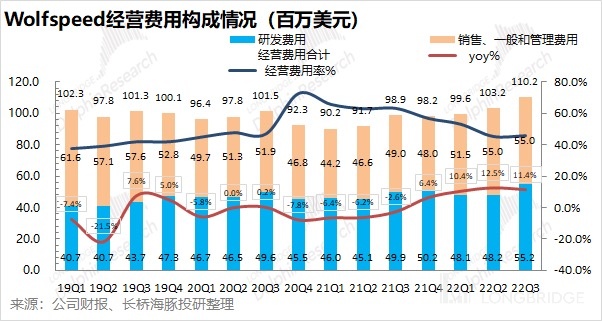

III. Operating Expenses: Cost Control, while R&D Invests heavily

Wolfspeed's operating expenses in the first quarter of the 2023 fiscal year were USD 110 million, a year-on-year increase of 11.4%. As the company is still in the early stage of high-growth, the operating expense ratio (especially on the R&D side) is close to 50%. After the asset divestiture, Wolfspeed's operating expense ratio is now back below 50%. The once 60% operating expense ratio was due to the sudden impact of asset disposal, and now Wolfspeed's operating expense ratio will maintain a reasonable level of 40-50%.

1) Research and Development Expenses: Expensed at USD 55 million this quarter, a year-on-year increase of 10.6%. After divesting assets such as LED, the company's increased investment in R&D is mainly focused on SiC. Dolphin Analyst expects that the company will continue to attach importance to R&D investment and R&D expense ratio will remain above 20%.

2) Sales, General, and Administrative Expenses: Expensed at USD 55 million this quarter, a year-on-year increase of 12.2%. The company has controlled this expense to a certain extent this quarter, which did not increase on a month-on-month basis.

Under the influence of recession expectations, the company has started to control its expenses this quarter, but it has not relaxed its investment in R&D. Dolphin Analyst expects that the company will continue to control sales and administrative expenses, while R&D expenses will still maintain growth.

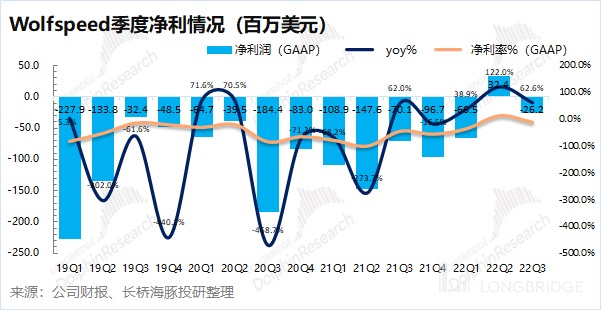

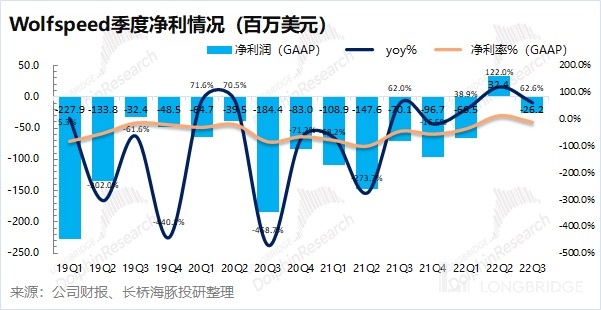

IV. Net Profit: Continues to be Loss-making

Wolfspeed's net loss (GAAP) in the first quarter of the 2023 fiscal year was USD 26 million, a significant reduction compared to the same period last year.

Compared with the positive profit in the previous quarter, the company returned to a loss this quarter. Did the company's performance deteriorate on a quarter-on-quarter basis? Not really. The positive profit in the previous quarter was mainly due to "profit from discontinuing operations," which brought about nearly USD 100 million of non-recurring changes. Excluding the impact of sudden changes, the company still had a loss of USD 61 million on an operational basis in the previous quarter. ** 而单从经营面看,公司本季度的业绩尚可,亏损又是进一步收窄的 **。

Based on Wolfspeed's quarterly report, the company's revenue and profits in this quarter are basically in line with market expectations. However, the market's biggest concern is the next quarter. According to Wolfspeed's guidance for the next quarter, the quarterly loss is expected to be between 83-93 million US dollars, a further widening of the loss. Dolphin Analyst believes that the loss in the next quarter will widen again, partly due to challenges in production and supply, and partly due to cost increases caused by inflation and other factors, affecting the company's profit release.

Dolphin Analyst's research on WOLFSPEED and SiC industry

September 23, 2022, in-depth analysis by the company: "Wolfspeed: Hard Currency in Silicon Carbide, Being Too Expensive is the 'Original Sin'"

September 15, 2022, in-depth analysis by the company: "Wolfspeed: The Hidden 'Hard Currency' Ignited by Tesla"

June 14, 2022, "Bouncing on the Safety Mat, Does IGBT Create a New Era of Power Electronics?"

May 16, 2022, "Times Electric: Running on the Rail Transit, or Riding IGBTs to a New Era?"

March 7, 2022, "Behind the New Energy Race, Who will be the Next King of the Silicon Carbide Track?"

January 18, 2022, "The Double Play of New Energy and Photovoltaics, How Attractive is IGBT?"

January 6, 2022, "Riding the New Energy Express, Does IGBT Become a Core Player in the Automotive Semiconductor Race?"

Risk Disclosure and Statement for this Article: Dolphin Investment Research Disclaimer and General Disclosure