"Crappy" Behind Amazon: "Two Crimes" and "One Pot"

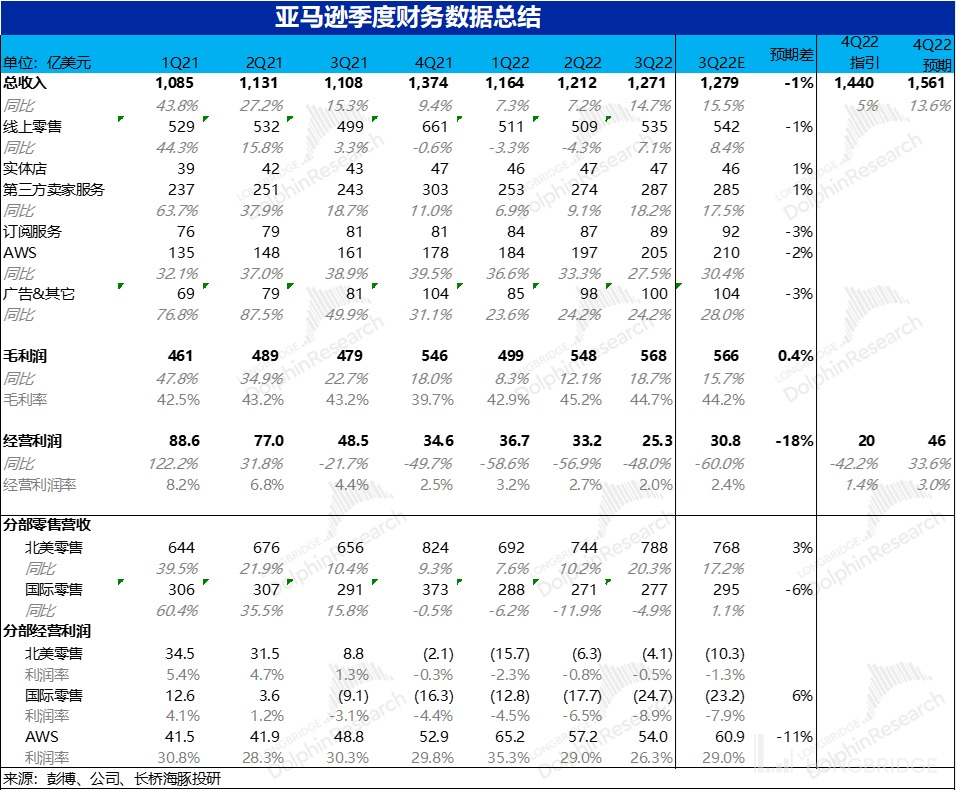

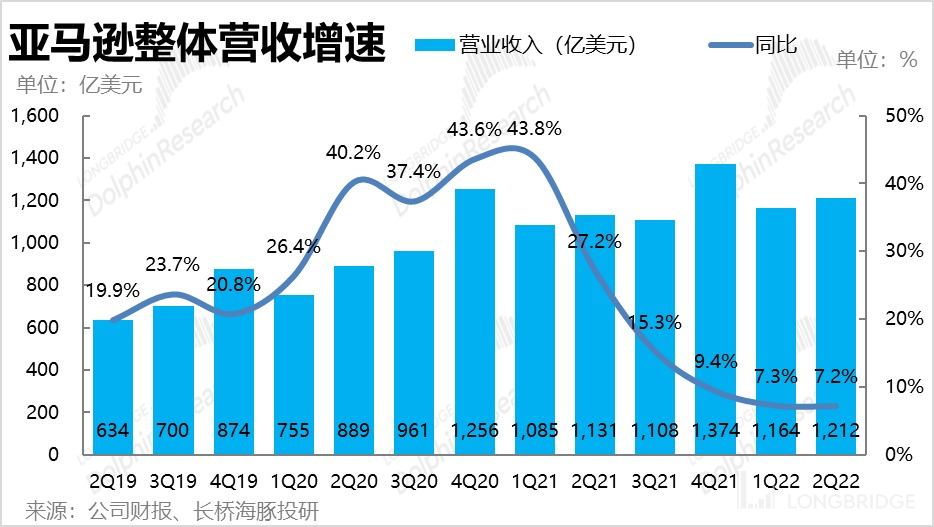

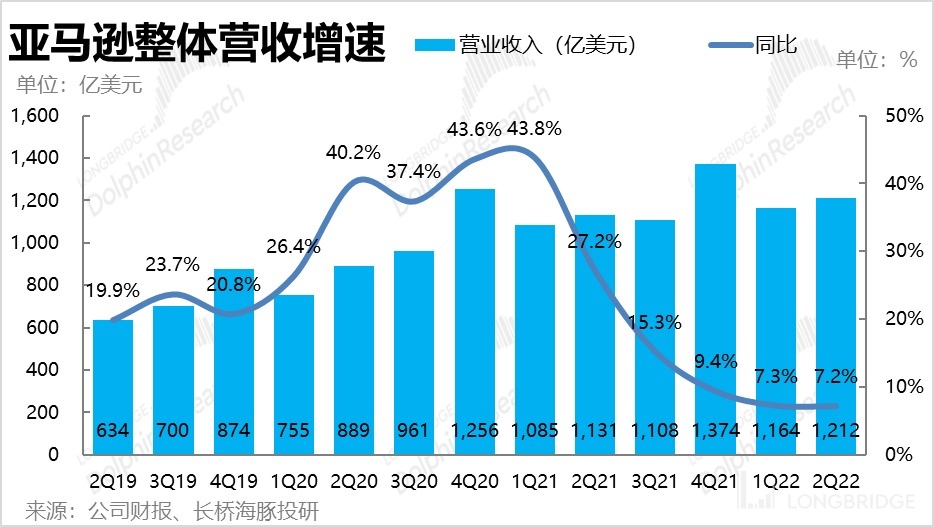

After the US stock market closed on October 27th Beijing time, Amazon released its Q3 2022 financial report. Dolphin Analyst expected poor performance after Microsoft's financial report, but did not expect Amazon's performance to be so disappointing. Let's take a closer look at Amazon's "two crimes" and "one problem":

- The first crime: Comprehensive collapse of guidance. Amazon's investment has always been more important than its quarterly performance. However, Amazon completely missed the mark on this key indicator. The company estimates revenue of 144-148 billion, which is far below the market expectation of 156+ billion US dollars.

Due to such a huge gap, Dolphin Analyst traced the reasons back based on the guidance. This guidance basically means that Amazon's large-scale retail business will not exceed single-digit growth on a low base last year, but it almost reached 12% in the third quarter. Considering that the weakness of overseas retail caused by exchange rates in the third quarter, the retail business in North America still remains strong. However, the revenue growth rate in the fourth quarter slowed down again, indicating that the recovery of Amazon's North American retail business in the third quarter was short-lived and the fourth quarter immediately declined.

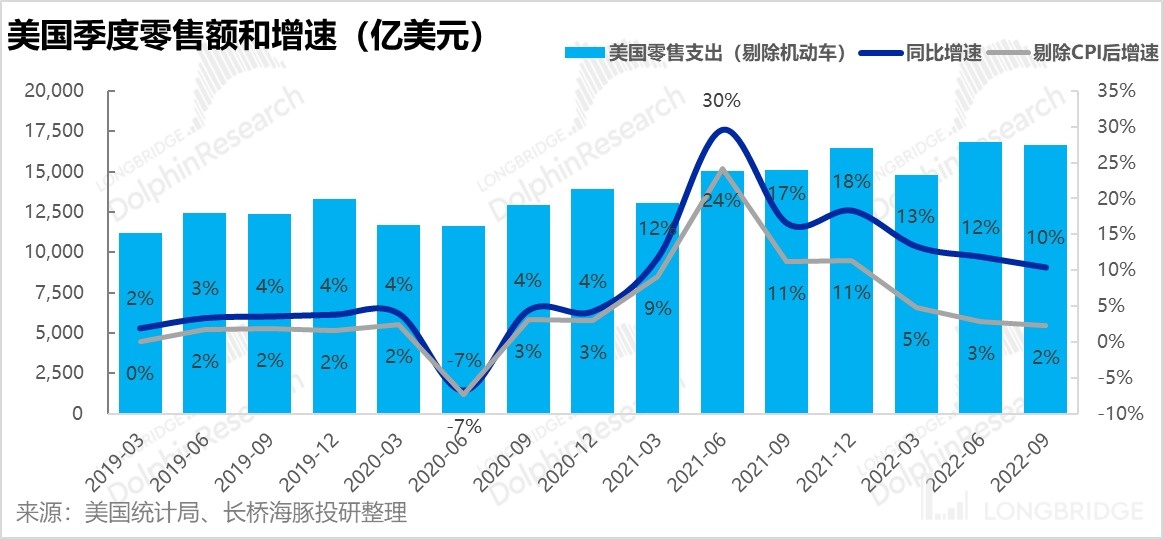

Considering Amazon's dominant position in the US retail market and the current situation where online retail is still better than the retail market, and there is no obvious decline in North American social retail until September. If Amazon's poor guidance regarding the fourth quarter is realized, it could lead to a US consumer market in comprehensive decline, which would be a blow to the entire US stock market.

-

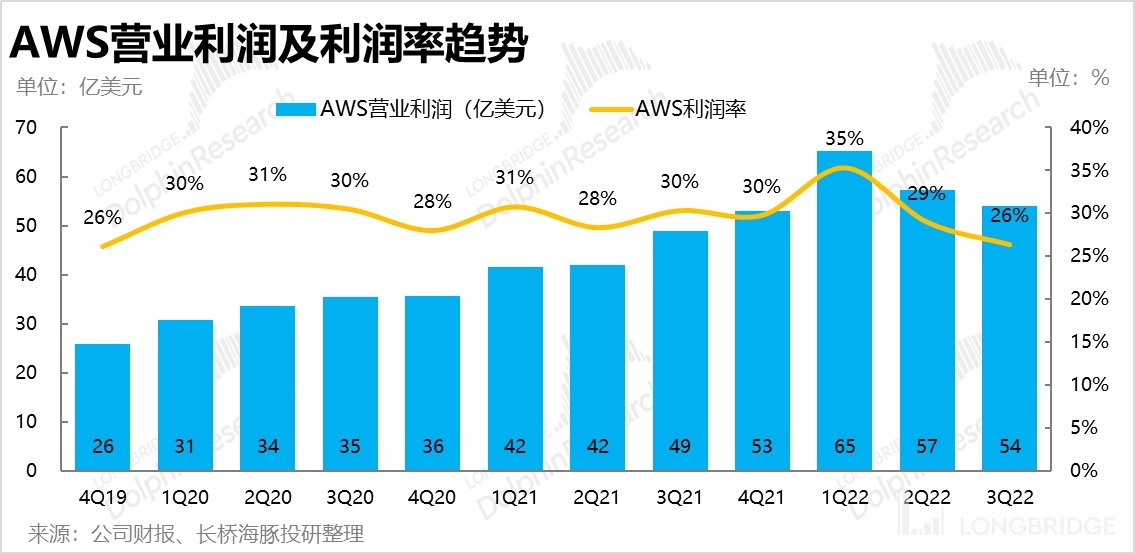

The second crime: AWS completely collapses. As Amazon's profit center and the third largest source of revenue after self-operated retail and 3P retail, AWS's revenue and profit performance were both disappointing. The revenue growth rate is fast falling to 30%, and the operating profit margin, even with the favorable adjustment of the depreciation policy, directly fell back to 26%. If it is combined with the high and stubborn R&D expense ratio and the seriously sluggish guidance for the fourth quarter, the performance of both revenue growth rate and profit margin falling below the "30%" watermark seems to be pointing to the intensified competition in cloud business.

-

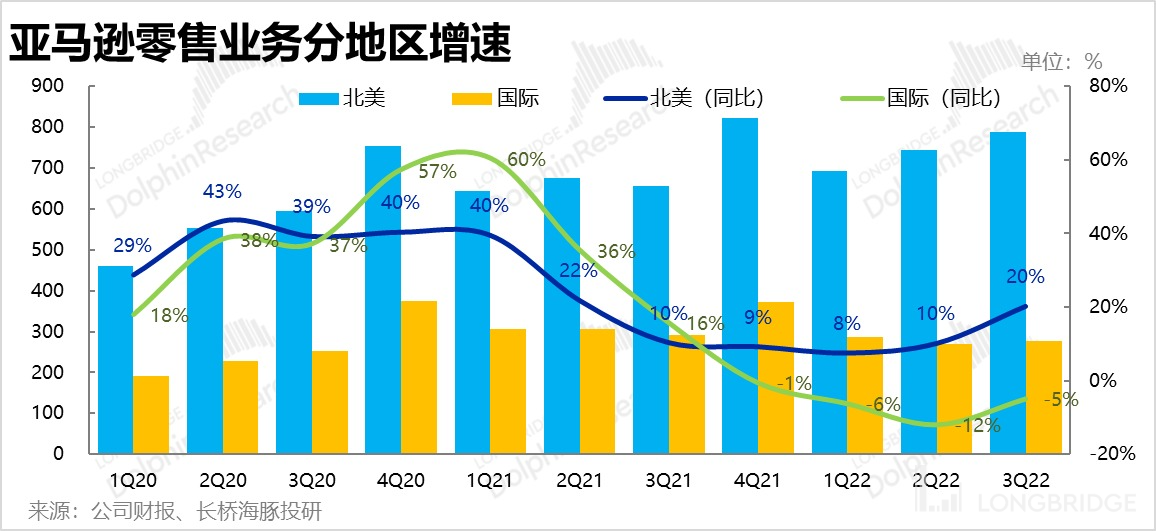

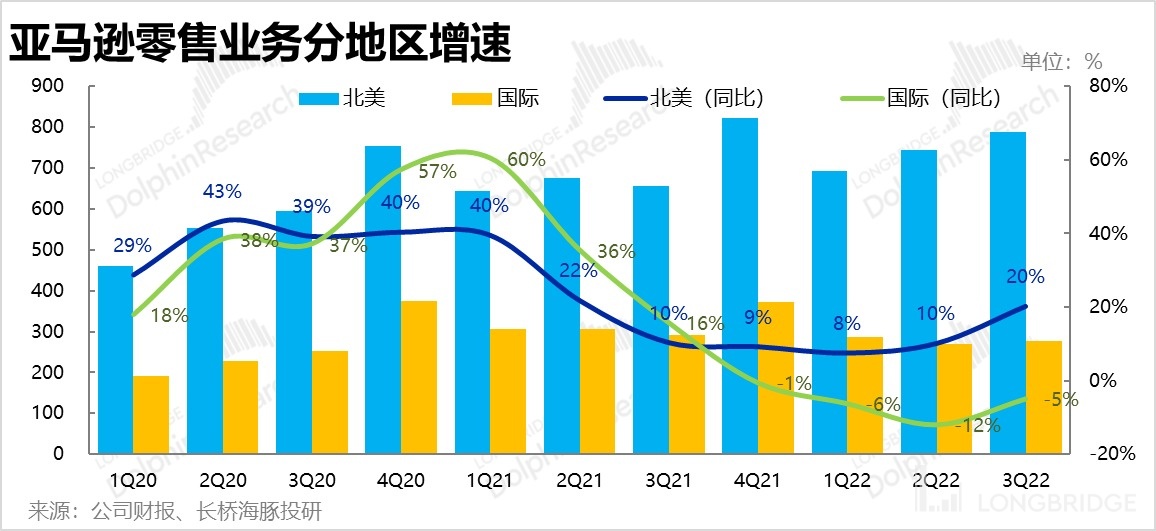

Retail in the third quarter may not be as good? It's all due to exchange rates. If there is anything else to say about Q3 performance, it is that retail is not particularly bad: The growth of North American retail business is actually quite good- up to 20% YoY - which is in line with the performance of the North American online retail market that Dolphin Analyst observed in July to September. The 5% negative growth of international retail is mainly due to exchange rate issues, and it actually grew by 12% when the exchange rate factor was excluded.

The problem is that although there was good growth in retail revenue in the third quarter, the guidance for the fourth quarter extinguishes the signs of continued recovery in the retail sector, and may even be detrimental to the market's overall assessment of the US consumer market.

Moreover, the exchange rate is also a big problem: The comparatively robust performance of this season's retail business, including other US internet giants that Dolphin Analyst observed in Q3, are all pointing to a common problem: in the strong US dollar cycle since the beginning of the year, with the US dollar index rising more than 15%, US mega-cap giants investing in internationalization business may not perform as well as US domestic verticals. Against the backdrop of overseas decline, few companies can withstand 15% currency erosion in their overseas operations.

Dolphin Analyst’s Perspective: While Microsoft was reporting its results, Dolphin had already estimated that Amazon had lost the cloud segment, as the general slowdown in Microsoft Azure is usually attributed to a worse performance by Amazon AWS. Dolphin had already lowered its expectations for Amazon’s performance, so it was no surprise that the actual results were even worse than expected.

Although Amazon maintained its retail performance in the third quarter, and the online retail market in North America performed similarly, its position in the industry kept its gross profit margins stable. After improving logistics efficiency, it was able to maintain labor-intensive logistics distribution costs, but the constant competition in the cloud segment led to high R&D costs, eroding all of Amazon’s efforts to control its costs.

In the fourth quarter, market expectations for the deterioration of Amazon's AWS business were further strengthened, after it had already lost its position, which also implied that American retail was also struggling. Therefore, the market can only stay away from Amazon for now.

Dolphin Analyst will subsequently share the conference call summary with Longbridge App and the users in the Dolphin investment research group of WeChat which is open to those who are interested.

Detailed comments are as follows:

I. What Do We Need to Know About Amazon?

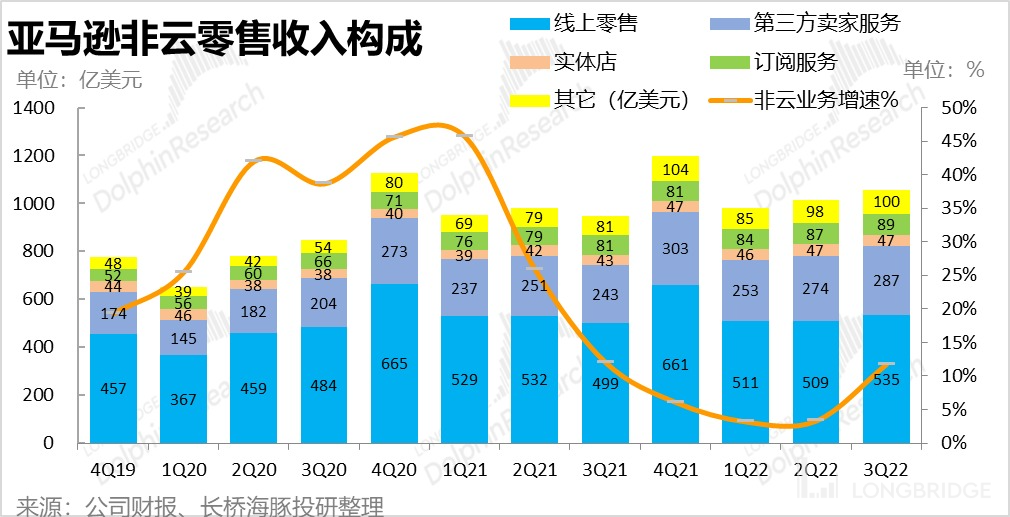

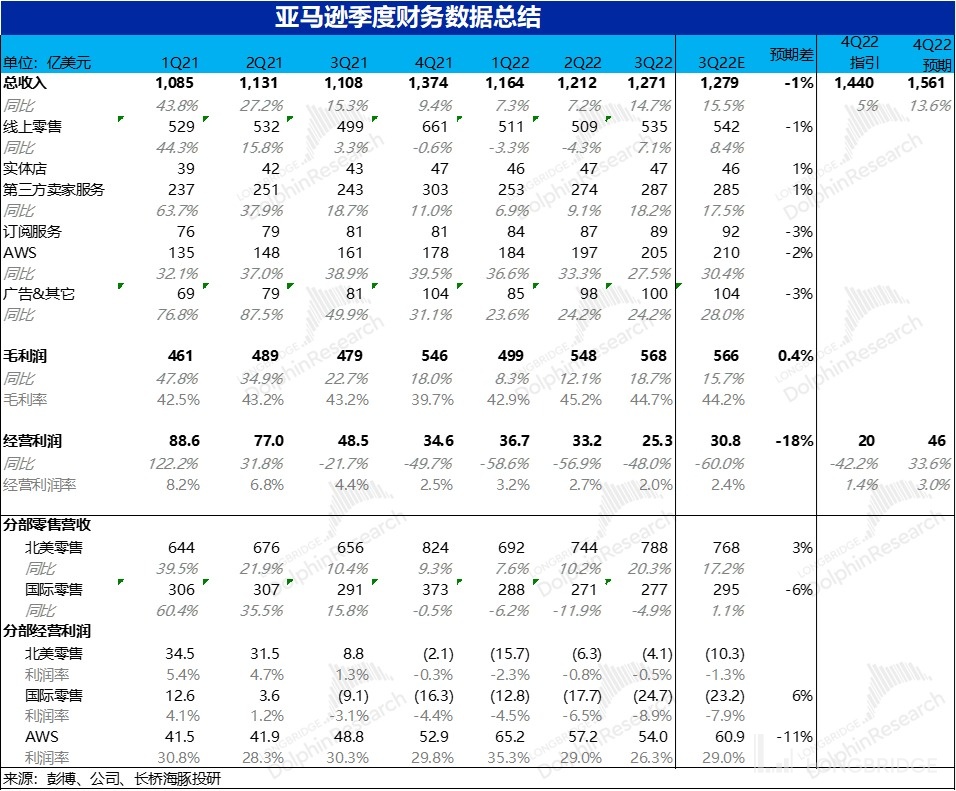

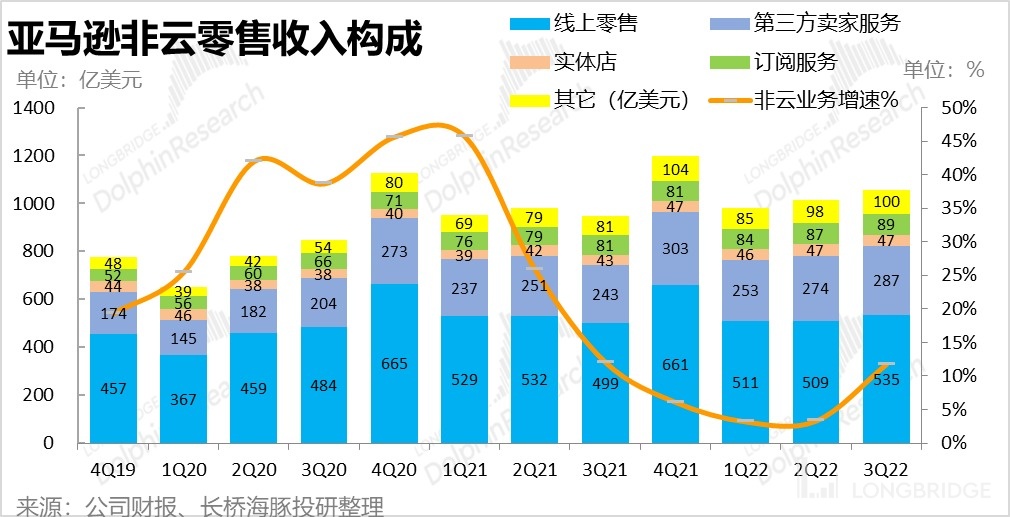

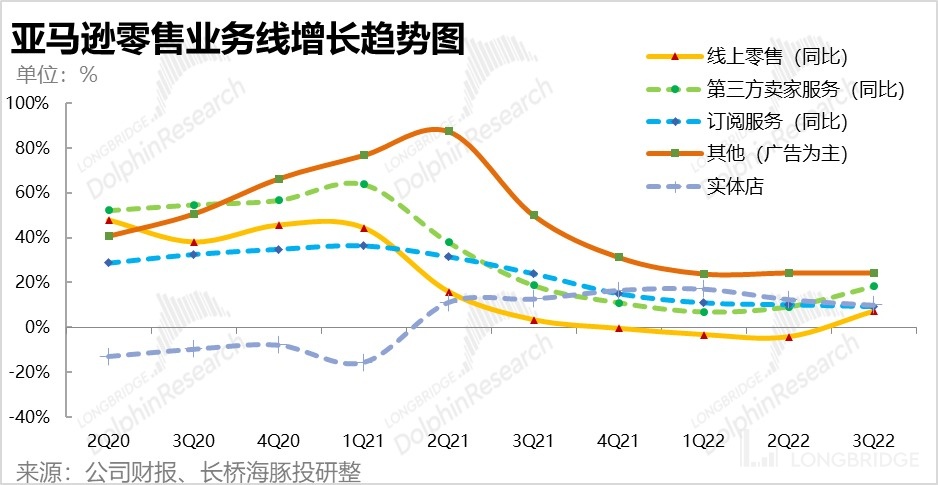

In terms of revenue structure, Amazon's business is mainly divided into two categories: retail-related business and cloud services. Among them, the retail industry can be further subdivided into online self-operated, online 3P seller services (commission and performance fees), online advertising, membership and subscription services, and offline retail.

From the revenue structure, Amazon's self-operated retail business still accounts for over half of the share, but the proportion is gradually decreasing. From the perspective of operating profit, the company's AWS cloud service business accounts for about 15% of its revenue share and contributes the majority of its profits. Therefore, although Amazon is still mainly engaged in retail business, with the gradual increase of high-profit income such as cloud services, advertising, and merchant platform services, the nature of the company has changed from a "retailer" to a "technology company" that provides online services as its main focus.

Source: Dolphin Investor Research

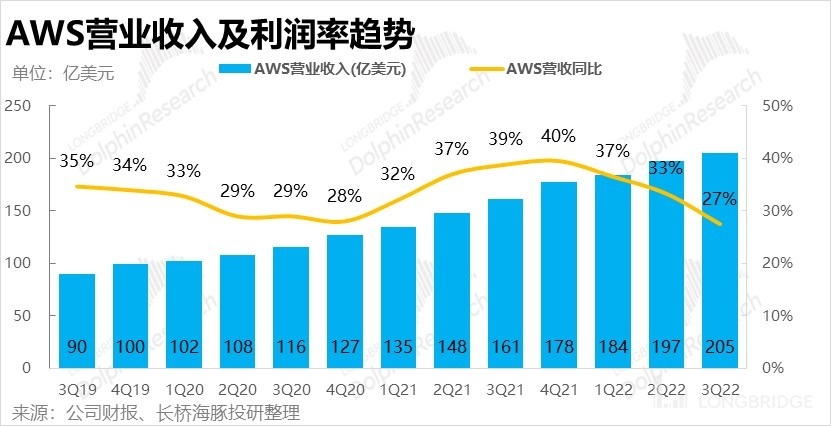

II. The Bastion of Amazon's AWS Cloud Services Has Collapsed

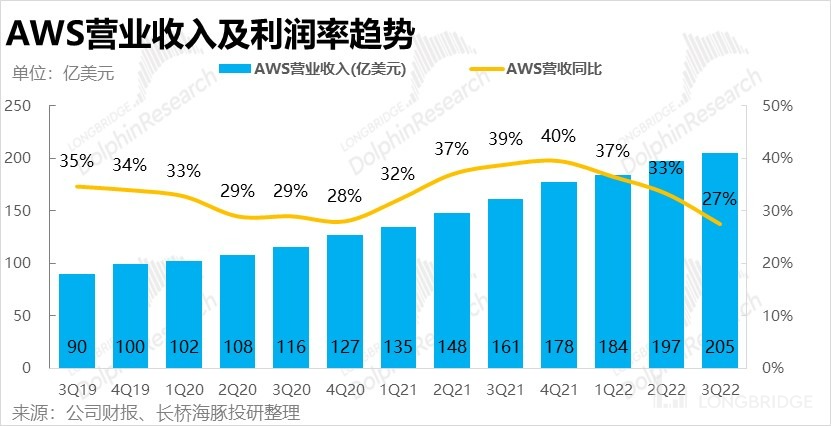

Due to the post-epidemic era, Amazon's traditional retail business has fallen into a continuous loss and slow growth dilemma, but its AWS cloud business, which targets enterprises, has been displaying robust performance, contributing to most of Amazon's growth and all of its profits. Therefore, the AWS cloud business is the core support of Amazon and the main factor affecting its valuation. However, AWS, which has been making up for the "hole" in its retail business all along, became the main drag on performance this quarter, missing market expectations. AWS revenue this quarter was $20.5 billion, up 27% from the previous quarter, a significant slowdown of 5pct, far below the market's expected year-on-year growth rate of about 30%. Moreover, exchange rate factors that have plagued multinational companies worldwide this quarter have only dragged down AWS business growth by 1pct, and exchange losses cannot fully bear the blame. The slowdown of AWS is real.

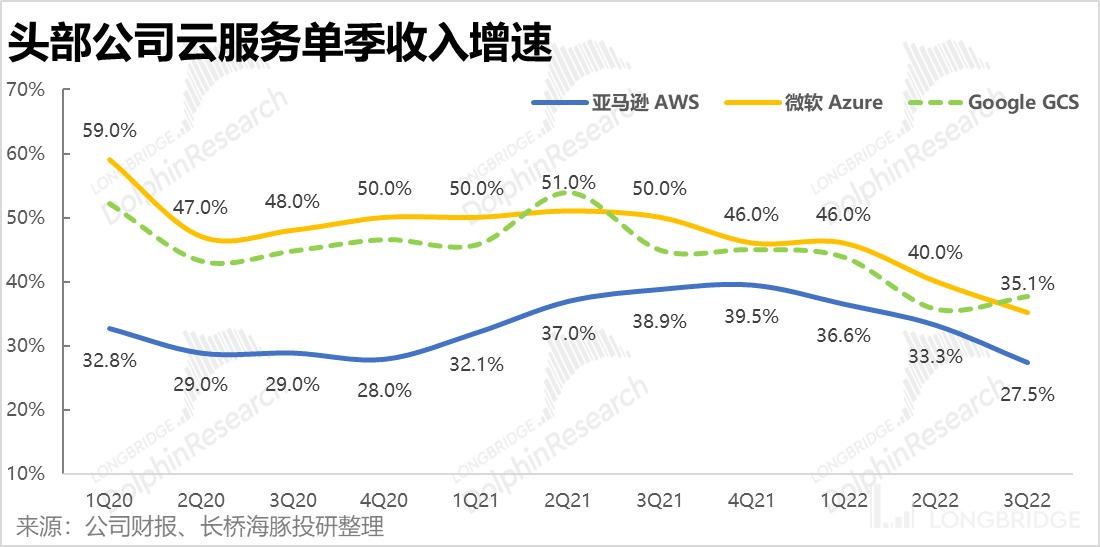

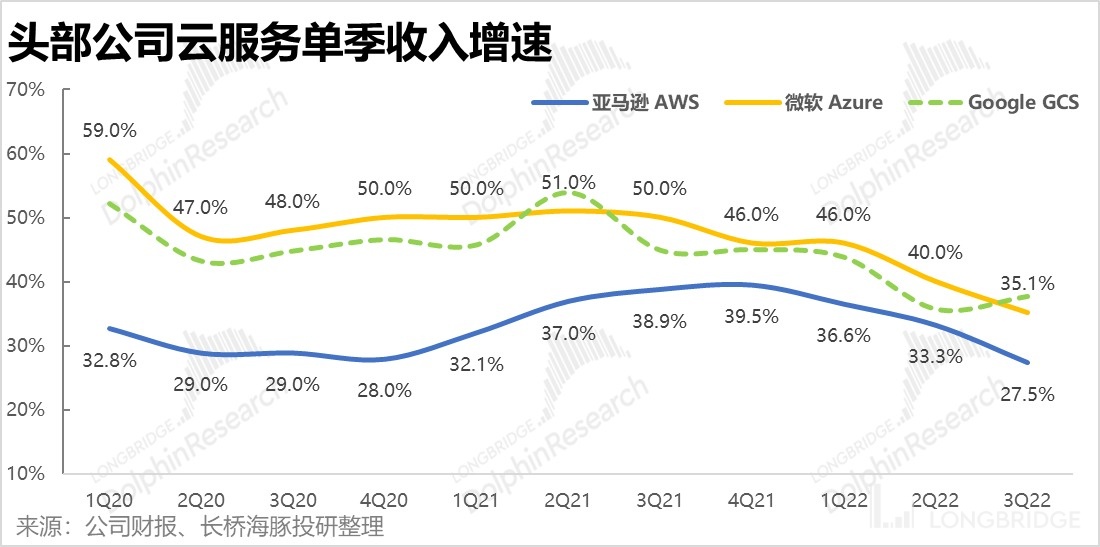

In fact, when Microsoft announced earlier that Azure's cloud service growth had unexpectedly slowed down, Dolphin Analyst had already expected AWS's poor performance. As can be seen from the chart below, except for the relatively small-scale Google Cloud Service, whose growth rate has fluctuated up and down in recent quarters, the growth rates of industry leaders AWS and Azure are consistently downward. The degree to which AWS and Azure's growth slowed down this quarter was about 5%, which is consistent. Therefore, Dolphin Analyst believes that the macro factors expressed in Microsoft's conference call, which caused corporate users to reduce IT spending, should also be the main reason for AWS's slowdown. It remains to be seen whether Amazon's management will have new explanations in the future.

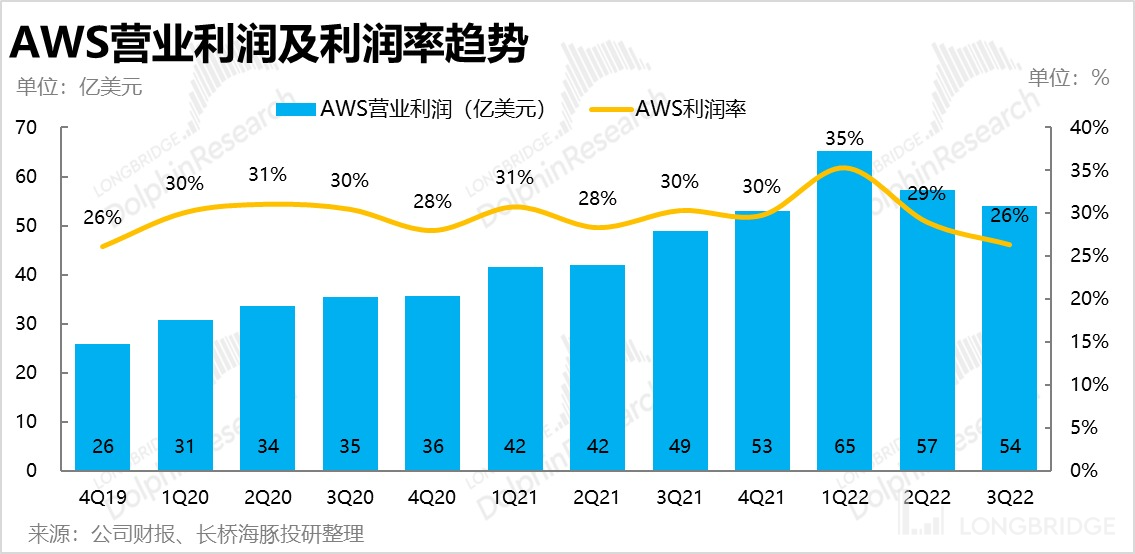

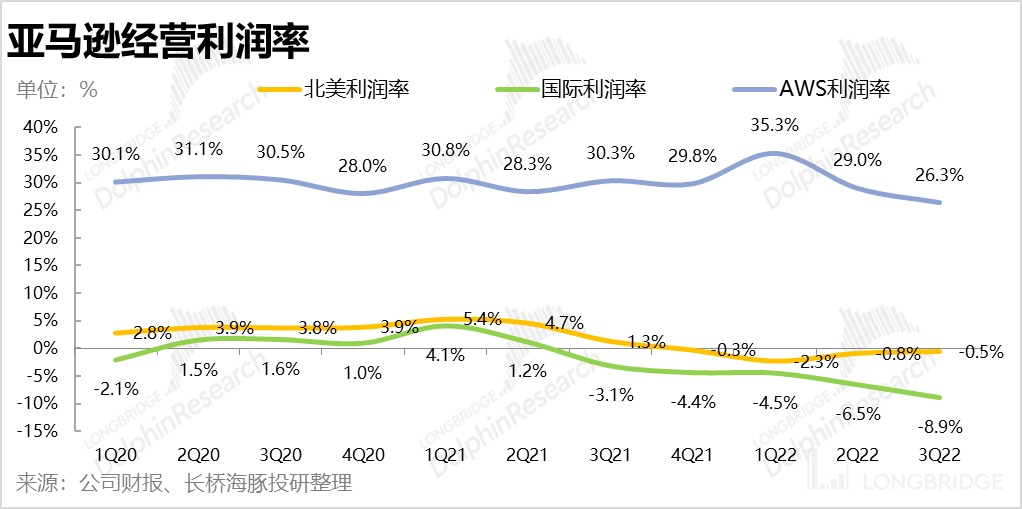

In addition to the slower-than-expected revenue growth, the profit release of AWS business this quarter is even more disappointing. AWS business achieved an operating profit of $5.4 billion this quarter, significantly lower than the market's expected $6.09 billion. And the operating profit margin this quarter was only 26.3%, a significant decline in both year-on-year and quarter-on-quarter, and lower than the market's expected level of 29%.

As can be seen, since 2020, the profit margin of AWS business has never fallen below 28%, and this quarter's profit level has directly fallen below it. It is also necessary to pay attention to the management's explanation in the conference call about why the profit margin of the cloud business has dropped significantly. Referring to Microsoft's financial report, the "downgrade in consumer consumption" of enterprise users and the rising energy costs of server centers may be the main reasons.

Overall, the lower-than-expected revenue and profit of AWS business this quarter have dealt a significant blow to the company's overall performance and market valuation. If the company's management does not improve the outlook for AWS business in the next few quarters in the conference call, it will be difficult for the company's stock price to rebound in the near future.

三、Overall sluggishness is hard to conceal, but the backbone of the pan-retail business remains strong

Although AWS, the backbone of the past, has performed poorly, the retail business that has been dragging down for the past few quarters has shown higher than expected resilience. Overall, Amazon's non-cloud business revenue for this quarter reached USD 106.5 billion, an increase of 11.7% year-on-year, a significant increase compared to the 3.3% growth rate in the previous quarter.

Looking at the regions, the pan-retail business in North America this quarter has a year-on-year growth rate of up to 20%, driven by the stimulus of Prime Day, a major promotion held in July (similar to China's Double Eleven). However, such growth can also be considered strong, almost reaching the lower limit of the growth rate during the online retail boom during the epidemic and we cannot help but marvel at the resilience of American consumers.

In contrast, revenue from the international retail business declined by 5% year-on-year this quarter. Although it seems weaker, the revenue growth rate of fixed exchange rate reached 12% after excluding the adverse effects of exchange rate, a 13 percentage point increase from the previous quarter. Therefore, the retail sector, which has been a "minor player" for the past few quarters, has officially straightened its backbone this quarter.

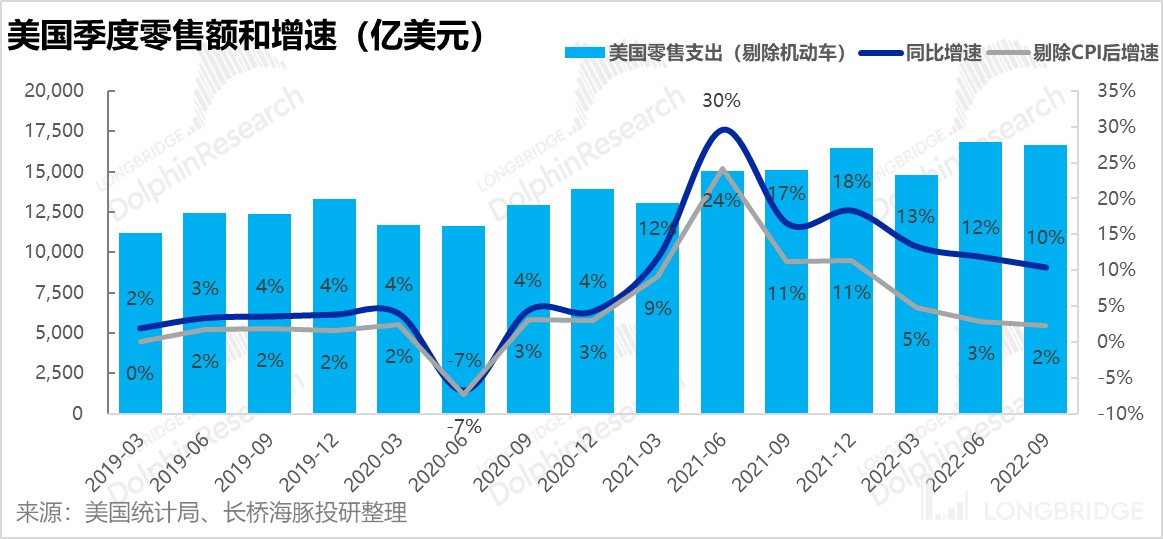

At the macro level, the growth rate of total US commodity retail sales in the third quarter was 10%, which is still falling. But as Dolphin Analyst previously predicted, the decline in the online retail penetration rate in the post-epidemic era in the United States has ended as early as the second quarter of this year, and due to the erosion of income by inflation, residents' preference for more affordable online shopping will increase again.

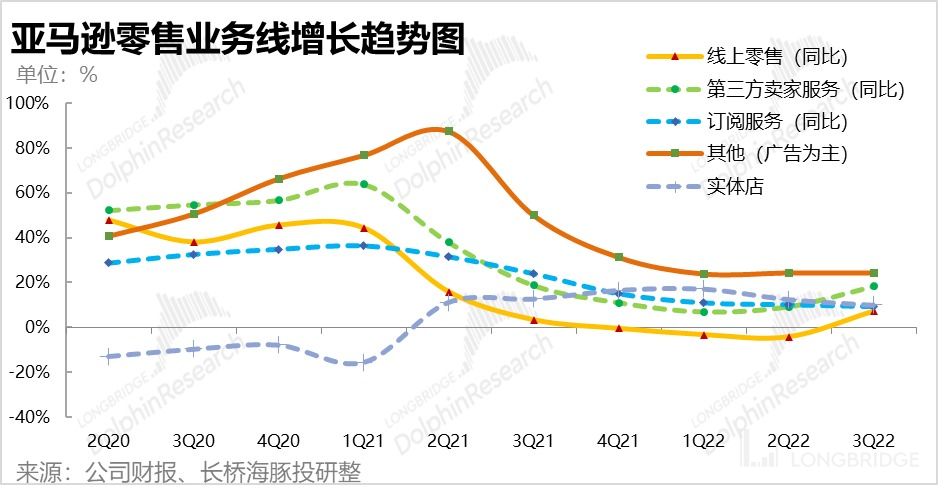

Looking at the various sub-sectors under the retail sector, except for the declining growth rate of offline store retail and optional consumption properties of subscription services, the growth rates of other sub-sectors have shown a turning point upward, as detailed below:

①The growth rate of online self-operated retail has turned around from a poor decline of -4.3% in the previous quarter to a growth of 7.1%, although there was promotion from Prime Day, the improvement was quite significant.

②Like self-operated retail, the growth rate of third-party seller services has also increased significantly from 9% to 18.2%, indicating that the sales heat of the entire platform is improving.

③The growth rate of subscription service revenue continued to decline this season, to 9.3%. As Amazon's Prime membership service has evolved from a simple shopping website member to an entertainment member including online streaming, sports events, cloud games and other optional entertainment consumption, the decline of optional entertainment consumption in a macroeconomic downturn is also reasonable. ④ Among the other 10 billion USD revenues of this season, 9.5 billion come from merchant advertising services, with a year-on-year growth rate of 25.4%, which significantly improved. Dolphin Analyst believes that the rebound in advertising growth is due to the overall sales recovery on the platform. In addition, e-commerce advertising, which can be directly converted into revenue during economic downturns, is more attractive to merchants than brand advertising on other platforms.

Overall, the company's retail sector performed well this quarter.

Adding together the Cloud Business and the Retail Business, Amazon achieved a total revenue of 127.1 billion USD this season, a year-on-year growth of 15%, which significantly rebounded. However, although the retail business has shown a clear improvement trend, and the improvement of the retail sector has been expected by the market, the poor performance of the cloud business was unexpected. From the perspective of the expected difference, Amazon's overall revenue of 127.9 billion USD was still lower than the market expectation, and the performance was not good.

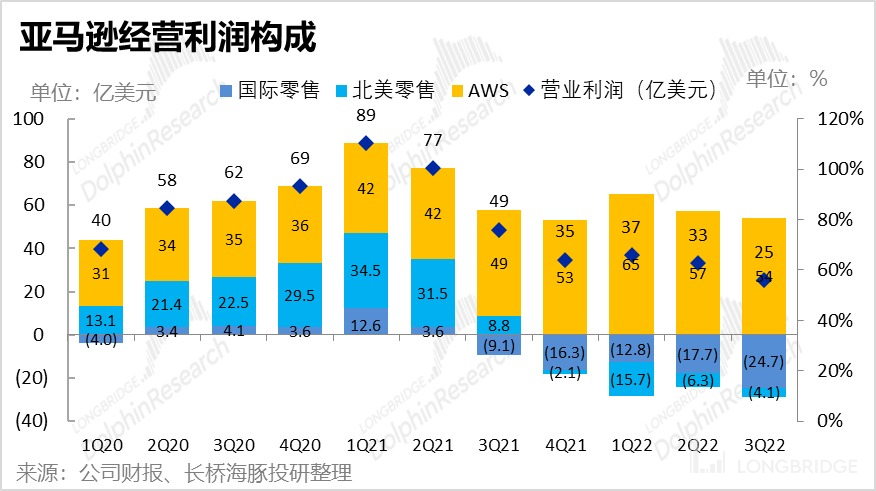

4. AWS and international business are dragging profits down.

If the rebound of the General Retail Business in terms of revenue offset the poor performance of AWS, the overall performance of the company this quarter is still acceptable, but the profit situation of the company is more disappointing. Last quarter, the actual profit of the company exceeded the upper limit of the guidance, and the company also raised the profit guidance for this quarter. The market expected a surprise in profit this quarter, but the actual operating profit not only did not reach the upper limit of the guidance, but was significantly lower than expected, giving a poor market impression.

Specifically, the company achieved an overall operating profit of 2.5 billion USD this quarter, significantly lower than the market expectation of 3.08 billion USD. The operating profit margin also fell from 2.7% in the previous quarter to 2.0%.

Looking at each section, besides the AWS cloud business whose profit exceeded expectations and declined, it can be seen that although the revenue growth of international retail business has rebounded, it is still in a low-efficiency operation state where the more income it generates, the bigger the losses. The operating loss reached 2.47 billion this quarter, a significant increase from the previous quarter.

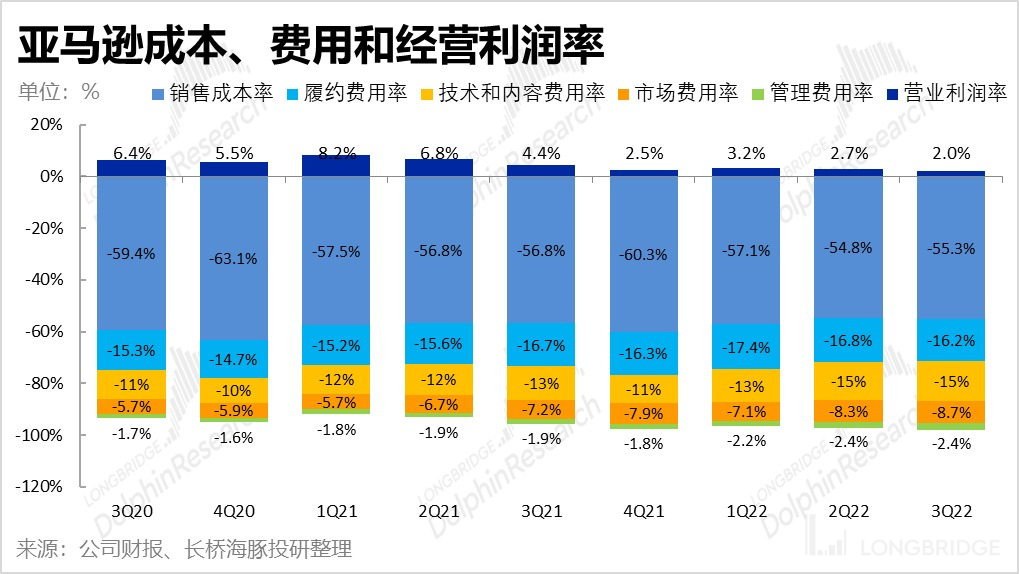

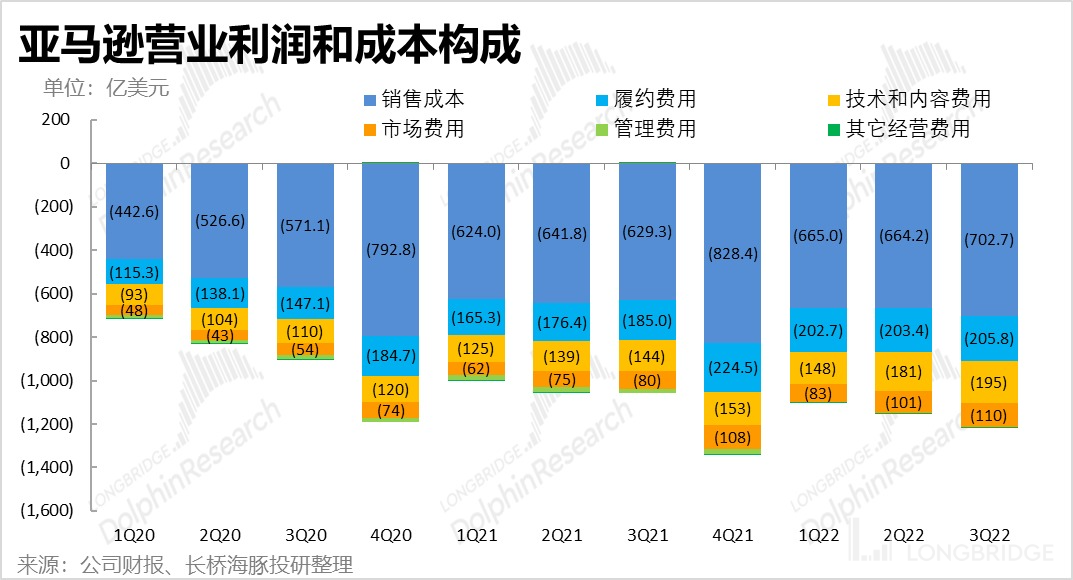

Only the North American retail which has shown strong consumption beyond expectation achieved better-than-expected performance in terms of profit. While the revenue growth of North American retail sector rebounded significantly this quarter, the operating loss narrowed from 630 million in the previous quarter to 410 million this quarter. It was much better than the expected loss of about 1 billion by the market. Cost and expense perspective, First of all, the gross profit margin of this season has decreased by about 0.7pct to 44.7% on a month-on-month basis. Dolphin Analyst believes that the reason is that the operating costs of cloud business have increased, and the gross profit margin of self-operated retail business will generally decrease during Prime Day.

From the perspective of expenses, because the company has slowed down its investment in logistics capacity, and the scale of retail revenue has improved this season, the utilization rate of capacity has also been improved. The proportion of performance-related fees to revenue has improved this quarter, decreasing by 0.6pct. However, during the promotion season, the company's marketing and promotion expenses still increased, and the expense ratio increased by 0.4pct.

In contrast, research and development expenditures and management costs are relatively rigid and basically unchanged from the previous quarter in terms of revenue level. Therefore, it can be seen that the company's expense level is basically consistent with that of the previous quarter, and the decline in profit margin is mainly attributed to the gross profit margin.

Dolphin Analyst's previous Amazon research:

Financial report review

July 29, 2022 conference call "Capital investment will continue to grow, but Amazon will be more cautious (conference call summary)"

July 29, 2022 financial report review "Ten thousand troops with iron fists have been laid off, and Amazon finally 'recovers'"

April 29, 2022 conference call "US giants also talk about reducing costs and increasing efficiency, Amazon conference call minutes"

April 29, 2022 financial report review "Inflation 'eats up' profits, this time AWS cannot save Amazon"

February 4, 2022 conference call "Market ups and downs, Amazon on its own way (conference call summary)" 2022 February 4 Review of financial reports - "AWS turns the tide, Amazon is spared"

In-Depth Analysis

2022 May 30 - "Macro headwinds are too strong, Amazon's cloud cannot escape"

2021 December 3 - "Why Amazon is more popular than Alibaba despite both not making money?"

Risk Disclosure and Statement for this Article: Disclaimer and General Disclosures by Dolphin Analyst