Midea Group: Overcoming Difficulties in a Cooling Industry

Hello everyone, I am Dolphin Analyst!

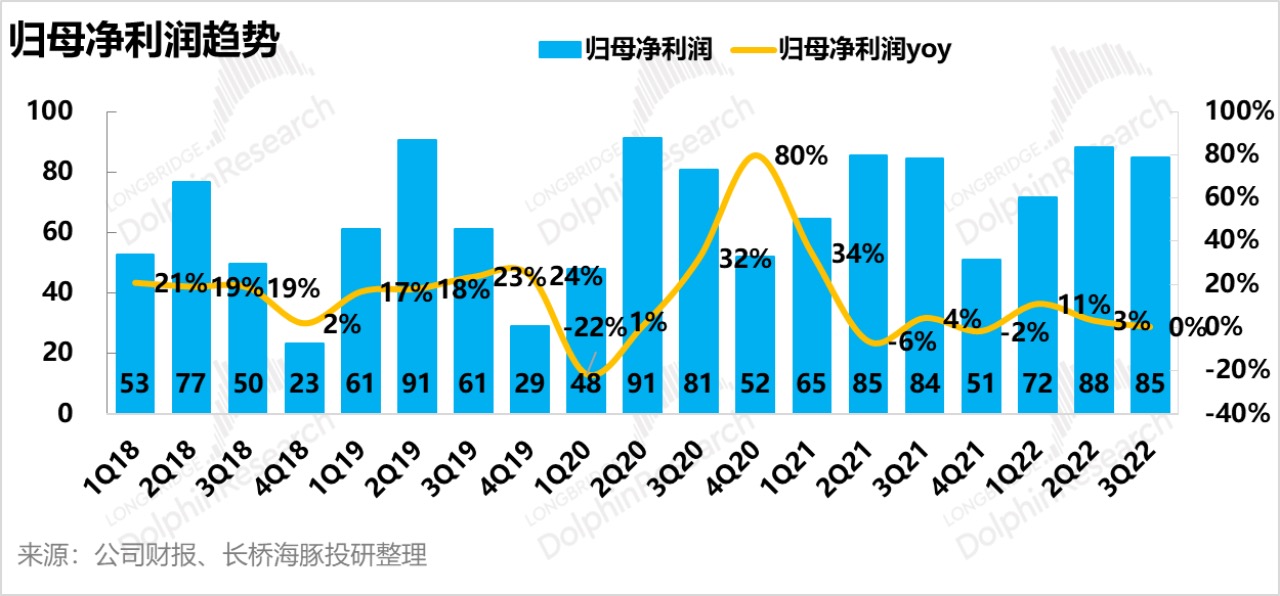

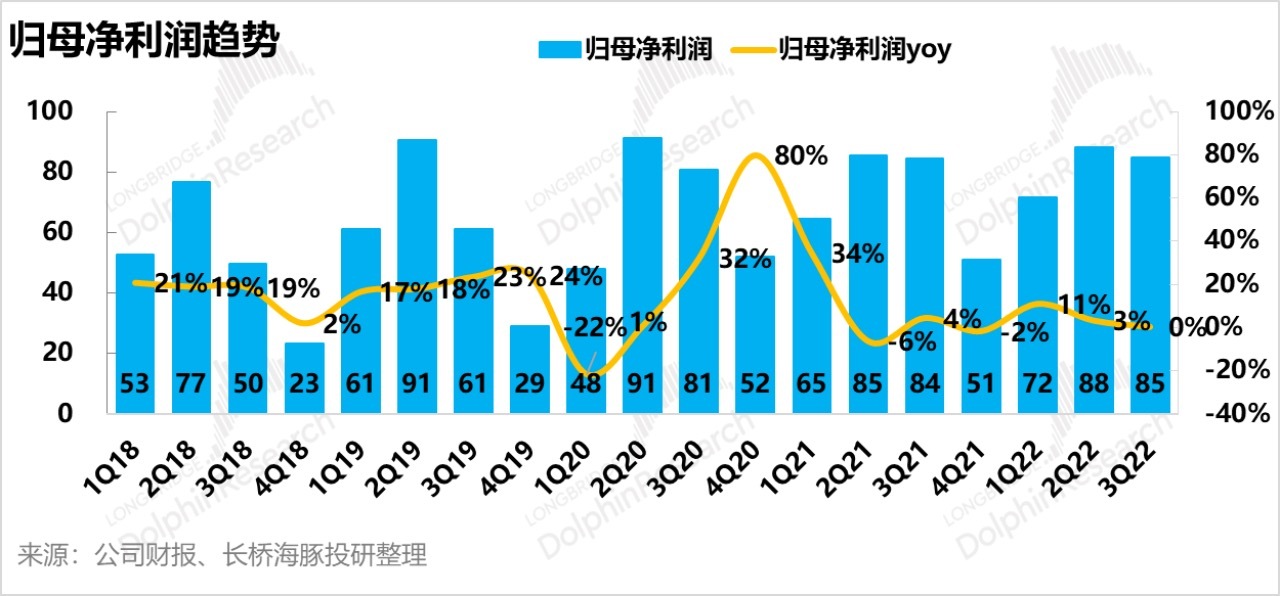

Midea Group [$ Midea Group.SZ] released its Q3 financial report on Friday, October 28th Beijing time. In Q1-Q3 2022, the revenue was RMB 271.78 billion, a YoY increase of 3.4%, and the net profit attributable to the parent company was RMB 24.47 billion, a YoY increase of 4.3%, which is consistent with the market expectations.

1. Industry is in a downturn, Dolphin Analyst keeps shares through conscientious work

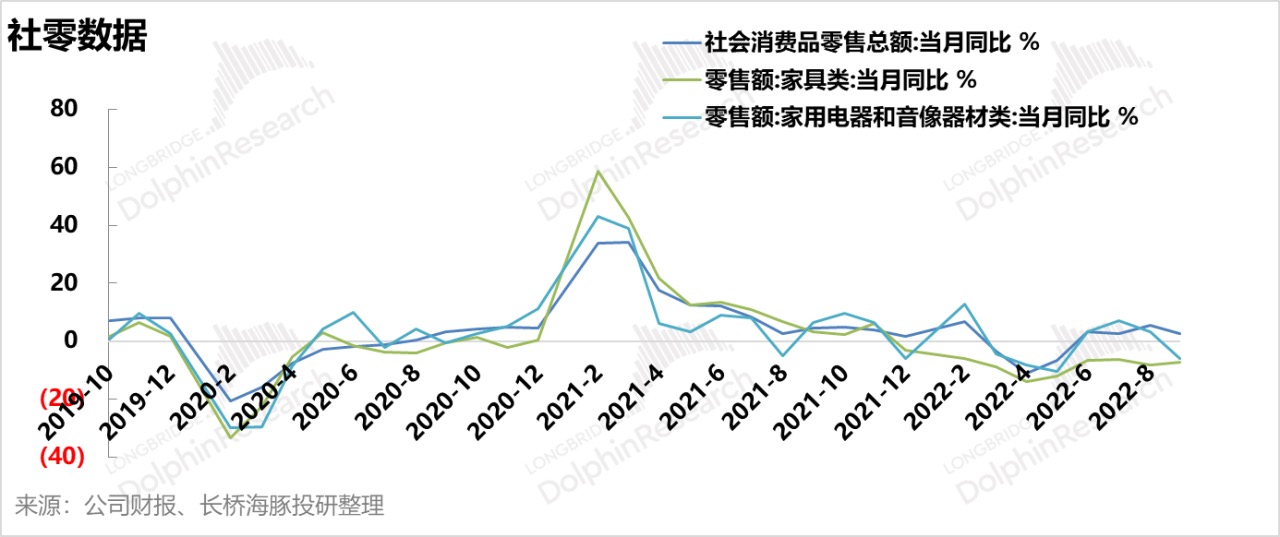

As the real estate cycle declines and the negative impact of the pandemic on demand, sales of refrigerators and air conditioners have decreased to varying degrees from January to September this year. Although some categories seemed to have confidence in boosting production in August, the growth rate in September remained in a downward trend. The revenue growth rate of Midea Group's Intelligent Home Appliances segment in Q1-Q3 2022 was only 1.70%, accounting for 77%. Dolphin Analyst believes that it is not only due to the gradual saturation of domestic demand, but also the significant pressure caused by overseas high inflation in recent years on leading enterprises' deployment of overseas markets. A closer look at the air conditioner data shows that as of September this year, the domestic sales volume was 68.77 million units, a YoY increase of 0.5%, and the export volume was 51.88 million units, a YoY decrease of 3.5%. (For other white goods, please refer to specific industry data in the text below.) Under such circumstances, the +1.70% revenue growth rate of Midea Group's To C business can be considered a decent achievement.

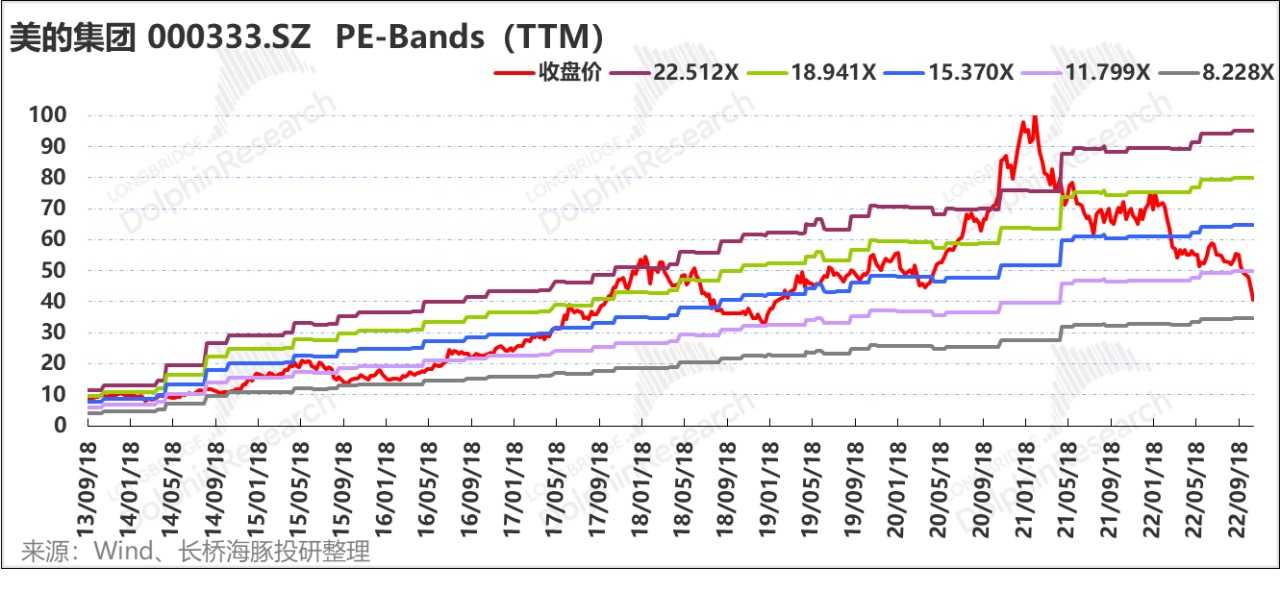

2. Patient waiting still needed for the valuation downturn process

The weakening demand has indeed become a weapon for leading home appliance companies to continuously lower their valuations. The Intelligent Home Appliances segment, which has the highest business proportion, is currently emphasized by Midea as adhering to profitability as the core, reducing non-core businesses to some extent, and reducing some small home appliance businesses with weak profit-making abilities. However, Dolphin Analyst believes that although the profit-making ability of small home appliances is weak, many segmented categories still have high growth potential due to a low market penetration rate, and small appliances are easy to produce explosive models, so there is room for further growth in profit-making ability. Whether Midea's approach can achieve better improvement effects still needs further observation. Going global is still an irreversible trend in the long run, but the cooling in the past two years has indeed put significant pressure on leading enterprises. At present, Midea's valuation has almost dropped to the lowest level in the past decade. However, in the capital market, the sharp reversal of confidence often occurs suddenly without any forewarning. Therefore, Dolphin Analyst believes that patience is still needed until the darkest hour.

![Financial report season Q3 2022, Dolphin Analyst continues to follow up. Interested users are welcome to add WeChat "dolphinR123" to join the Dolphin investment research group and get financial report interpretation and conference call minutes in real-time.]

Below, Dolphin Analyst will analyze Midea Group's revenue growth, cost trend, and expense situation respectively:

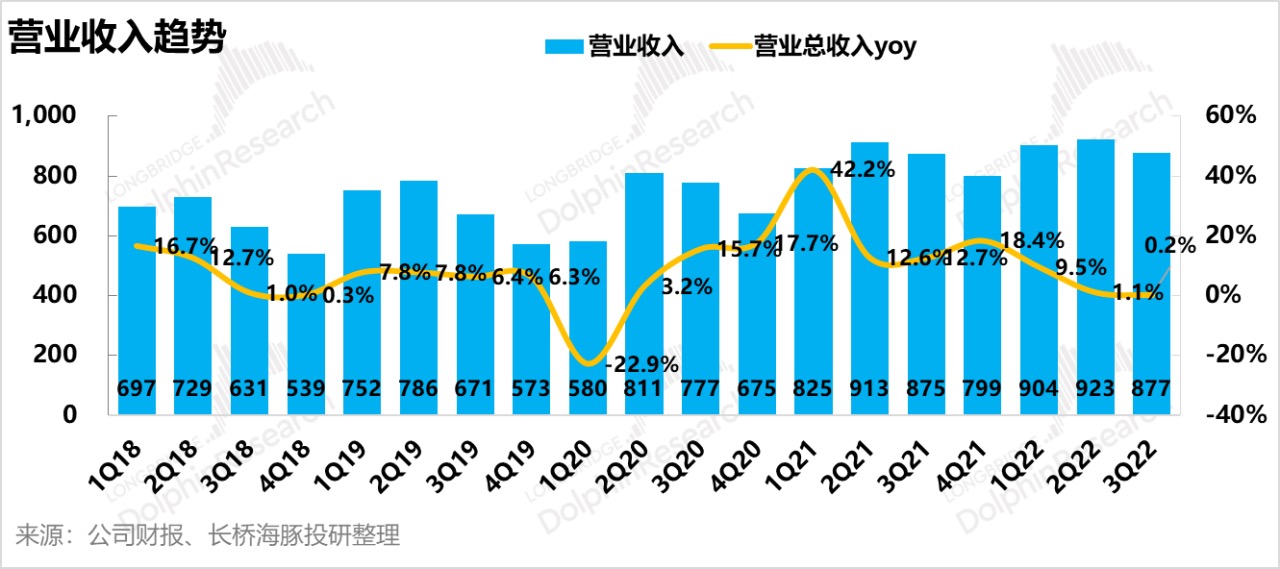

- Slowdown in demand, stronger domestic sales than exports The company's revenue increased by 3.5% from January to September 2022, with growth rates of 9.5%, 1.1%, and 0.2% in the first three quarters, showing a trend of high growth followed by low growth. The Dolphin Analyst believes that on the one hand, this is somewhat related to the slowdown in demand in the overall home appliance industry, with updates and replacements gradually becoming the main demand, and on the other hand, the disturbance of the epidemic in the second and third quarters of this year has also had a certain impact on domestic demand.

Overall, domestic sales revenue grew by 6.7% and overseas sales revenue grew by 3.0%. The company's performance in the first three quarters is relatively similar to that of the industry as a whole, with domestic sales performing slightly better than exports. The ToC business, which accounts for a large proportion (77%), only grew by 1.7% in the first three quarters, which also determines the company's overall growth rate at a low single-digit level. However, compared to the development trend of the industry in the first three quarters of this year, the performance of Midea Group is already remarkable. First of all, this week's social and retail data, whether it is the total retail sales or the furniture and home appliance industries related to the post-real estate cycle, are not ideal.

Dolphin Analyst will now sort out the industry data of the refrigeration, air conditioning, and washing machine industries up until September this year. According to the online industry data, in September 2022, the air conditioning production volume was 10.15 million units, up 1.5% year-on-year, and the sales volume was 10.38 million units, up 1.1% year-on-year. The domestic sales were 6.95 million units, an increase of 4.5% year-on-year, while the export volume was 3.44 million units, a decrease of 5.1% year-on-year. Air-conditioning domestic sales were boosted significantly in August (up 20.03% year-on-year), and stabilized in September. From January to September, air conditioning domestic sales totaled 68.77 million units, up 0.5% year-on-year, while exports totaled 51.88 million units, down 3.5%.

In September, the washing machine production volume was 6.58 million units, down 2.0% year-on-year, and the sales volume was 6.55 million units, down 2.3% year-on-year. Domestic sales were 4.01 million units, down 6.7% year-on-year, while overseas sales were 2.54 million units, up 5.5% year-on-year. The situation for washing machine exports improved, with exports outpacing domestic sales. What may worry investors slightly is that compared to August, both domestic and overseas sales growth rates continued to decline in September. From January to September, washing machine domestic sales totaled 29.57 million units, down 6.5% year-on-year, while exports totaled 20.96 million units, down 7.9% year-on-year.

In August, the refrigerator production volume was 6.3 million units, down 8.7% year-on-year, and the sales volume was 6.13 million units, down 14.0% year-on-year. Domestic sales were 3.49 million units, down 0.6% year-on-year, while overseas sales were 2.64 million units, down 27.0% year-on-year. Compared with domestic sales, the pressure on exports is not small. From January to August, refrigerator domestic sales totaled 26.42 million units, down 5.0% year-on-year, while exports totaled 25.06 million units, down 14.3% year-on-year. The domestic white goods industry has reached a relatively high level of per capita ownership after 20-30 years of development, and as industry demand shifts from the promotion of commodity housing to the replacement of old products, the overall industry growth rate has gradually slowed down. So the Dolphin Analyst believes that it is not newsworthy that the revenue growth rate of some listed companies related to it has gradually declined, such as Midea Group's core home business group. I believe that after understanding this year's data on white goods, everyone will have a deeper understanding and feeling about Midea Group or Gree Electric.

2. ToB business is doing well and has many highlights

Worth mentioning is the company's stable development of ToB business, with industrial technology/building technology/robot automation/digital innovation increasing by 14.8%/22.6%/5.7%/37.3%. Although the overall proportion of ToB business is not yet too high at present, it still has many bright spots.

- Building technology: The Midea Industrial City West project has won two international authoritative building standards, LEED and WELL, at the same time. The water dispenser brand "Kunyu" has been officially released, and a new technology achievement has been launched - magnetic levitation ice storage and cooling dual working condition unit, gas levitation centrifugal unit and levitation technology platform. The European heat pump production and R&D base officially started construction in Feltre, northeastern Italy, with an expected investment of 60 million euros and an annual heat pump capacity of 300,000 units, and is expected to start production in the second quarter of 2024. After completion, the key materials of heat pump products will be made and sold in Europe, and the order-to-delivery cycle of heat pump products will be shortened from the original 5 months to 1 month.

- Industrial technology: Weiling's "ultra-high-pressure fast charging" vehicle electric compression machine has a 800V high-voltage platform, 12000rpm high-speed rotation plus silicon carbide semiconductor application technology, which is now in mass production; the 2.54MW roof distributed photovoltaic power generation phase one project of Kuka (Guangdong) has been officially connected to the grid, and the project is expected to have a total installed capacity of 18.7MW, providing 20 million kWh of "green power" annually.

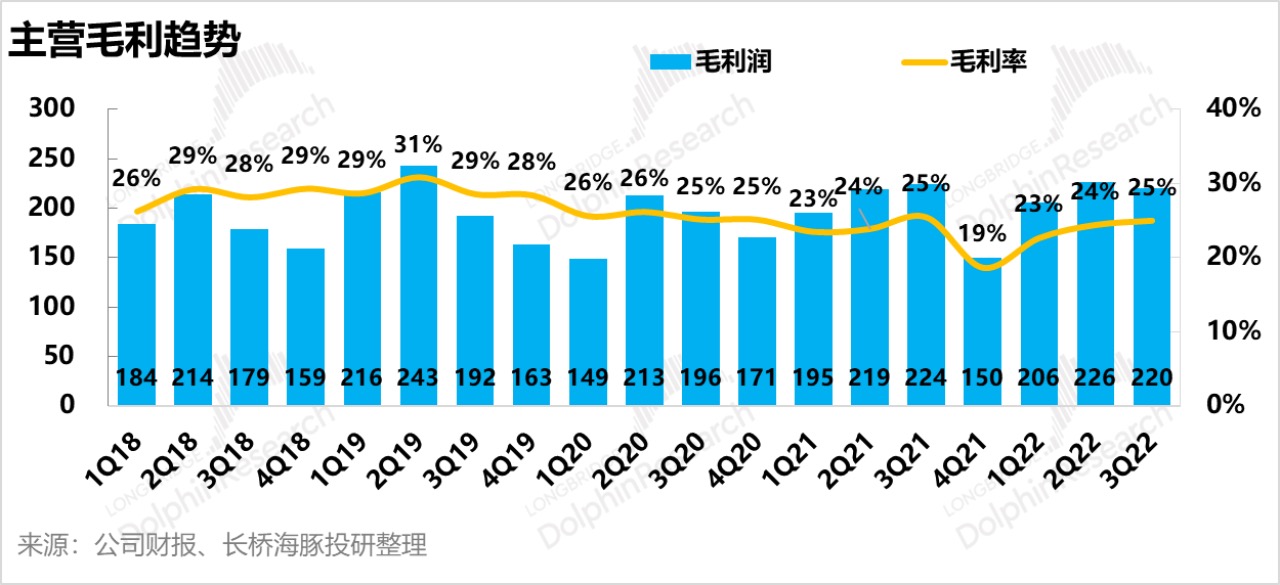

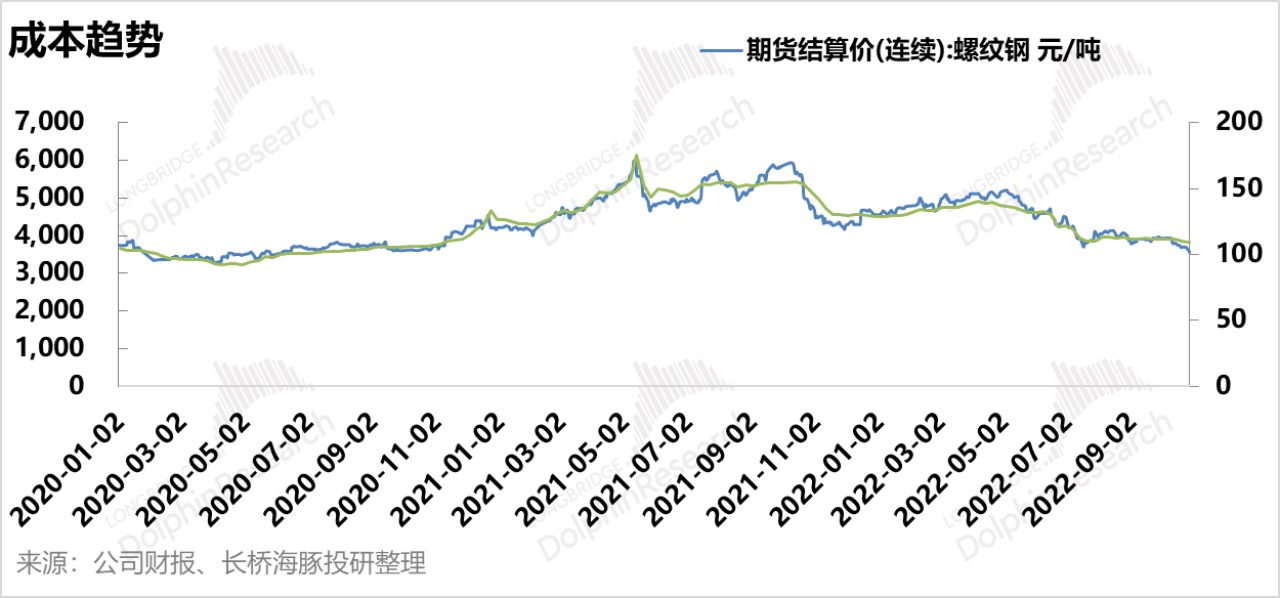

3. Cost is expected to decline, and gross margin pressure will be reduced

The company's gross margin for the first three quarters was 23.61%, a year-on-year decrease of only 0.19 percentage points, and the gross margin for Q3 alone was 23.63%, a year-on-year decrease of 0.31 percentage points. Compared with the continuously rising raw materials last year, Dolphin Analyst finally breathed a sigh of relief in the second half of the year when it saw that the cost of several major raw materials was finally easing, and there will be some room for gross margin recovery in the future.

IV. Good Cost Control Leads to a Slight Increase in Net Profit Margin

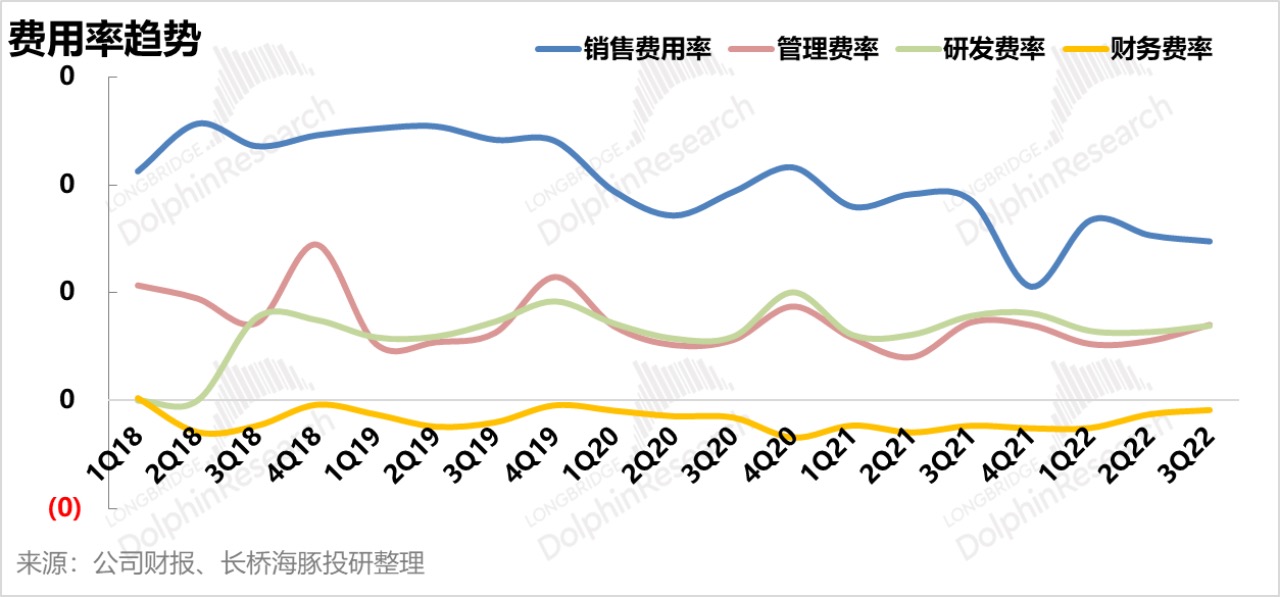

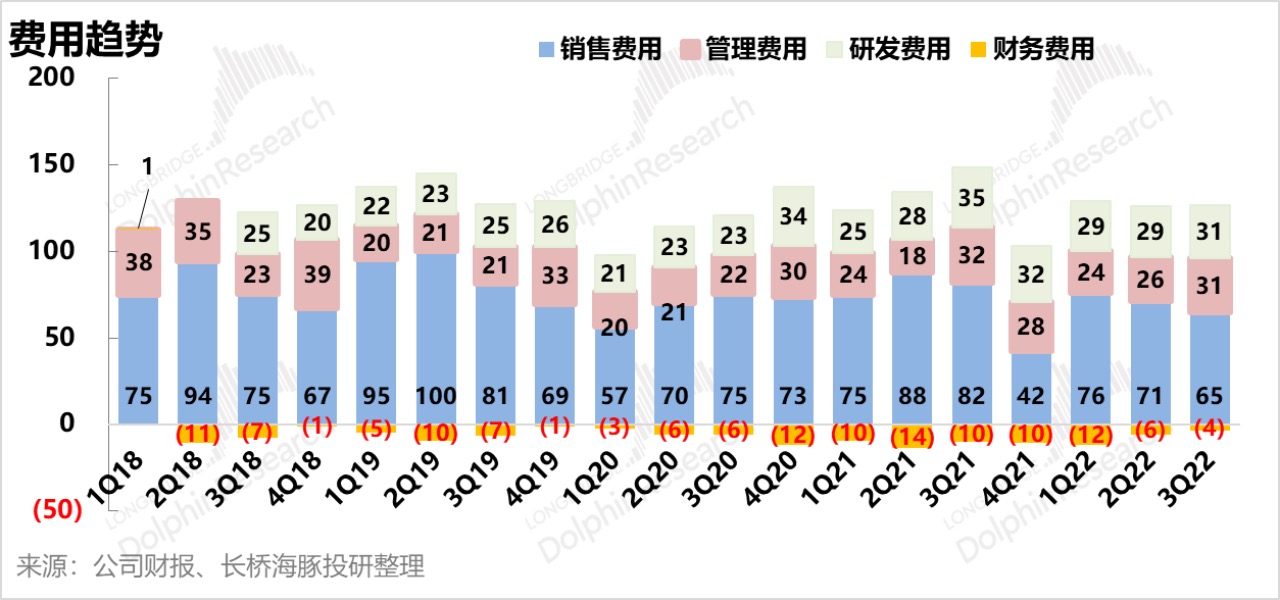

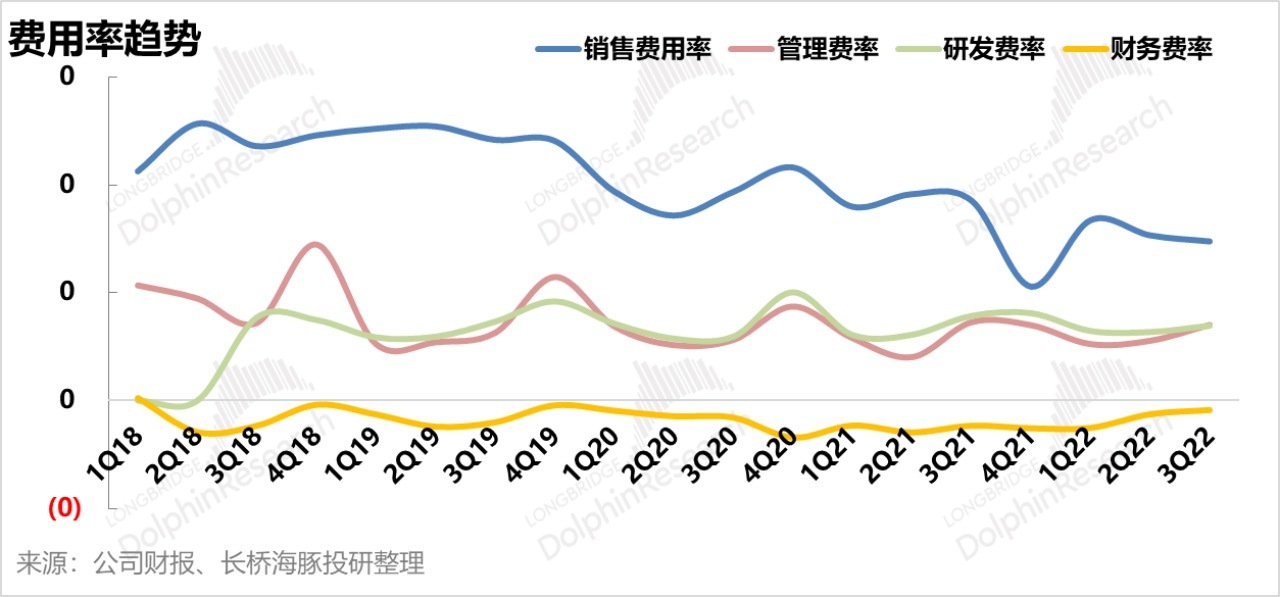

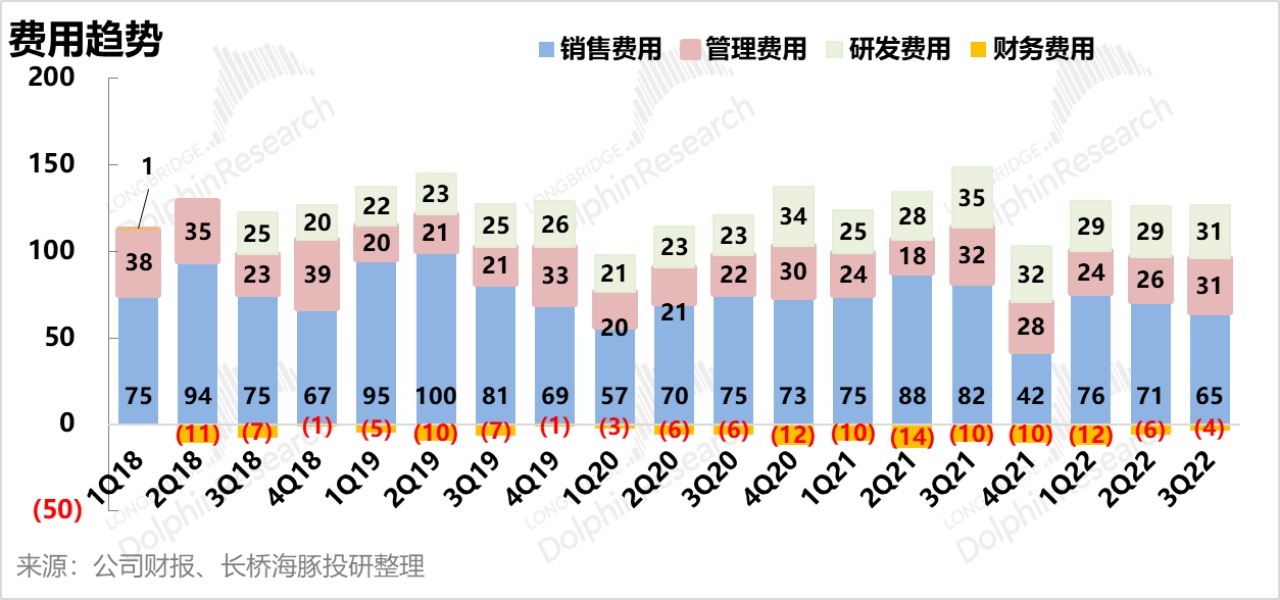

In the first nine months of 2022, the net profit attributable to the parent company of Midea Group was RMB 24.5 billion, a YoY increase of 4.3%, and the net profit attributable to the parent company after non-recurring gains and losses was RMB 24.1 billion, a YoY increase of 6.7%. Specifically, the net profit attributable to the parent company in the third quarter alone was about RMB 8.5 billion, a YoY increase of 0.3%, and the net profit attributable to the parent company after non-recurring gains and losses was RMB 8.4 billion, a YoY increase of 5.6%. It must be said that in such a severe environment, Midea Group still controls costs to the extreme. It is obvious that after excluding the impact of accounting changes, Midea Group reduced its sales expense input to significantly lower its sales expense ratio while its revenue slightly increased, thereby improving its net profit margin. At the same time, the R&D expenses that had to be spent did not decrease at all.

Dolphin Analyst's Historical Articles on "Midea Group":

Financial Reports Season

August 30, 2022, "Midea Group: Tightening Consumer End, Expanding Business End, Is Transformation Promising?"

April 30, 2022, "Consumer Promotion Policy Gets 'More aggressive,' Midea and Gree Are No Longer Pessimistic"

October 29, 2021, "Midea Outperforms Gree, Valuation Still Has Room to Grow"

August 31, 2021, "Midea Group: Air Conditioning Business Continues to Lead Gree, Waiting for the Turning Point of Domestic Sales and Shipments" On April 30th, 2021 "Midea Group: The Rationality behind "Double-Killing" Gree and "Being Expensive"".

Insightful.

On July 7th, 2021 "Midea Group (Part 2): Does Midea's Investment Value Begin to Emerge after the Decline?".

On June 29th, 2021 "Midea Group (Part 1): How to Look at the Future of Midea's Air Conditioning Business?".

Risk disclosure and statement of this article: Dolphin Analyst Investment Research Disclaimer and General Disclosure.