Gree Electric Appliances: Stable performance, not yet time to reverse

Hey everyone, I am Dolphin Analyst!

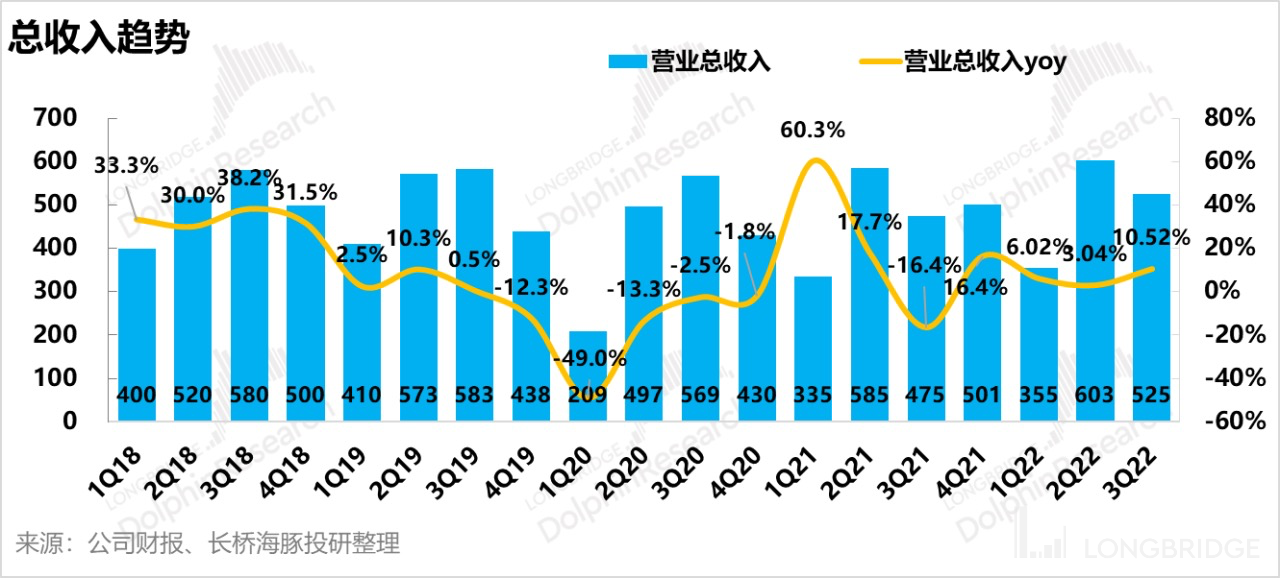

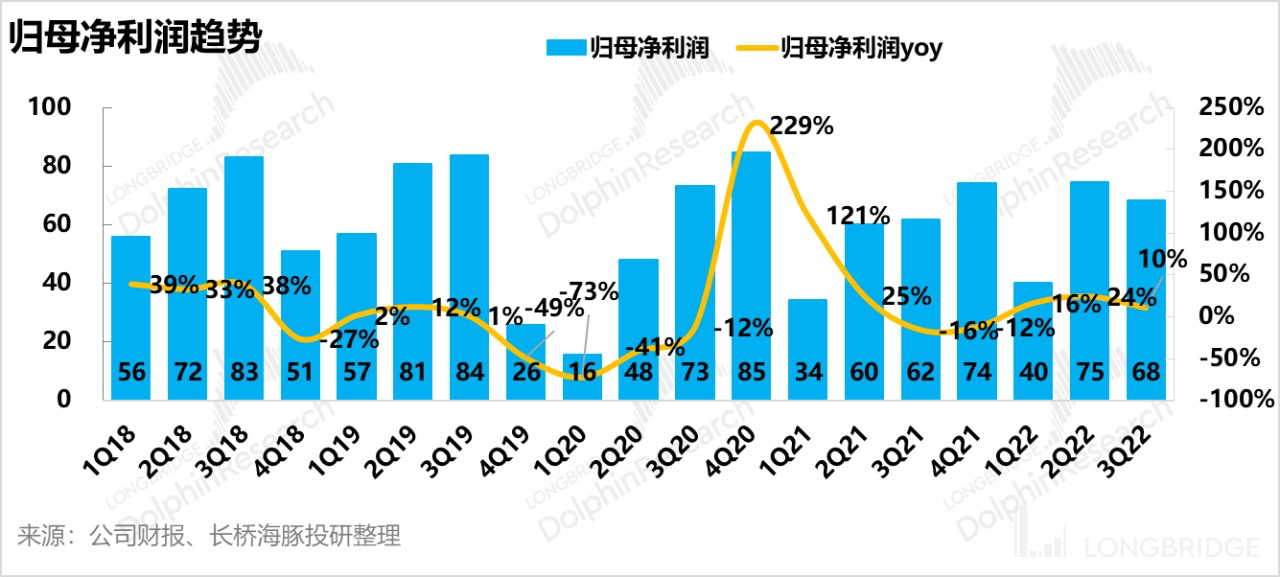

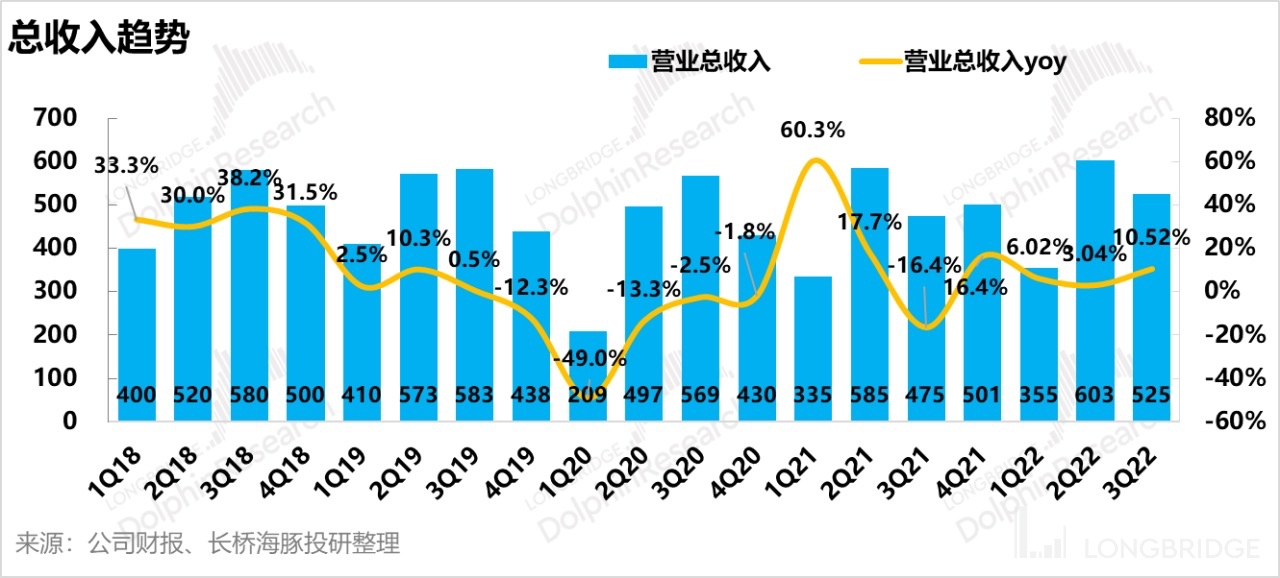

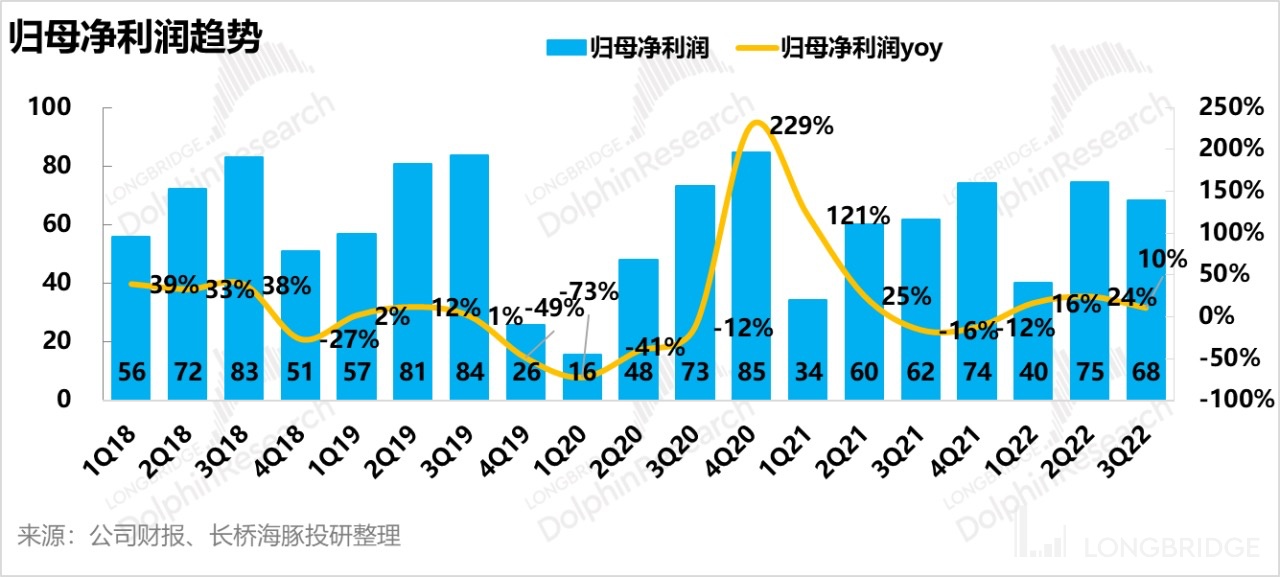

Gree Electric Appliances Inc. of Zhuhai (000651.SZ) released its Q3 financial report on Friday, October 30th. The company's total operating revenue for the first three quarters of 2022 was CNY 148.344 billion, a year-on-year increase of 6.30%. Net profit attributable to the parent company was CNY 18.304 billion, a year-on-year increase of 17.0%, and non-net profit attributable to the parent company was CNY 18.567 billion, a year-on-year increase of 25.77%. Revenue was in line with the market's expectations, however, it is noteworthy that the cumulative net profit growth rate in the first three quarters was faster than the revenue growth rate. This was mainly attributed to Q1 and Q2 of this year, with a slight increase in operating profit margin or net profit margin compared to the same period last year. In the third quarter, due to the increase in expense ratio, part of the impact of gross profit rate improvement was restricted, and the net profit growth rate was in line with revenue without showing any significant difference.

-

Stable leading market share: Benefiting from the hot weather in the Q3, air conditioning sales rebounded from the poor performance in the first half of the year. However, the overall data for household appliances in the first three quarters of this year was not ideal. (See detailed data in "Midea Group: Facing the Chill Together"). GREE Electric Appliances, which focuses on air conditioning, had a relatively good performance in the first three quarters of this year, aided by the weather and the industry's inventory clearing status over the past two years. According to AVCLOUD, online market share of GREE, Midea, and Haier were 31.6%, 27.0%, and 11.0% respectively, a year-on-year decrease of 1.6pct, 1.1pct, and an increase of 0.9pct. Meanwhile, offline market share were 34.3%, 34.2%, and 13.3% respectively, showing a year-on-year increase of 0.7pct, a decrease of 3.6pct and an increase of 1.2pct. GREE’s dominant position is solidified.

-

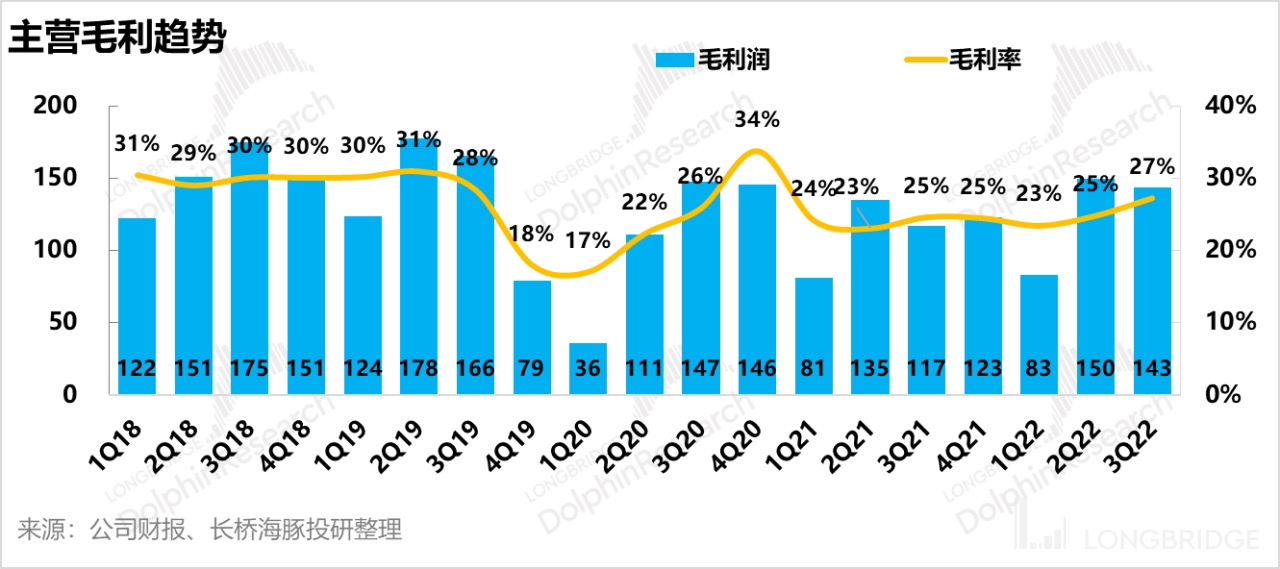

Direction of changes in the gross profit margin and expense ratio varies in the first three quarters: In contrast to the first half of the year, there was a significant improvement in the gross profit margin in Q3; however, part of the effect was offset by the increased expense ratio. As a result, the net profit growth rate was relatively in line with the revenue growth rate.

-

Wait for the results of the channel reform: With low inventory and good shipment volume during the peak season, distributors in some regions have shown a tendency to return. Since 2019, GREE has continued to carry out channel reforms, and the short-term pain brought by channel hierarchy reduction is inevitable. However, whether it will bring long-term development still needs to be observed for some time.

Dolphin Analyst's opinion:

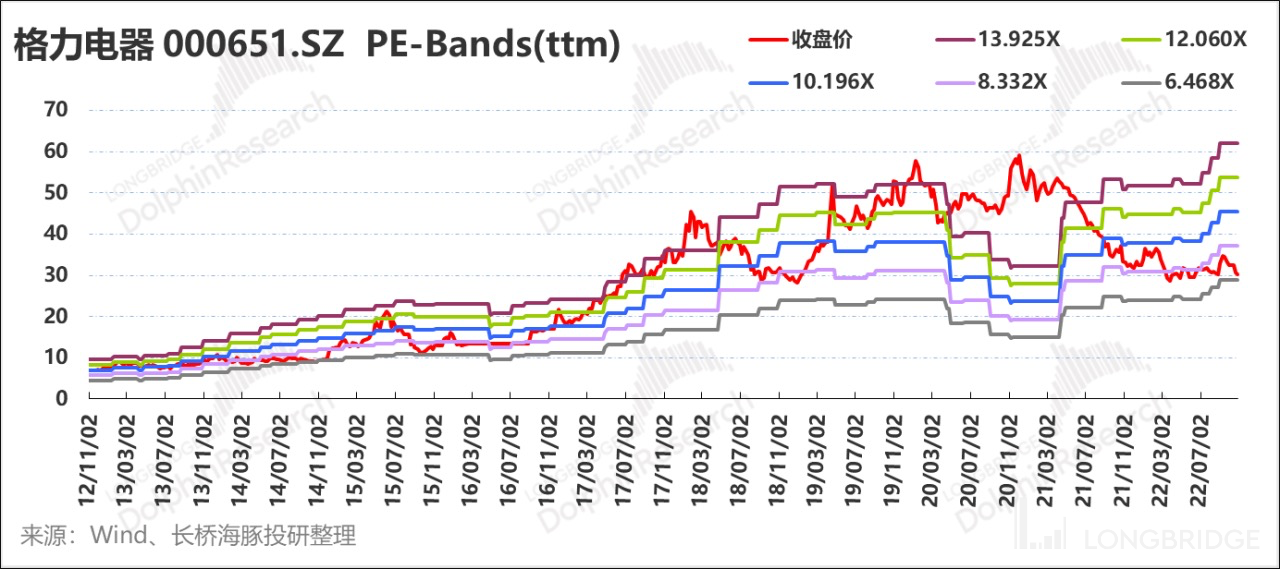

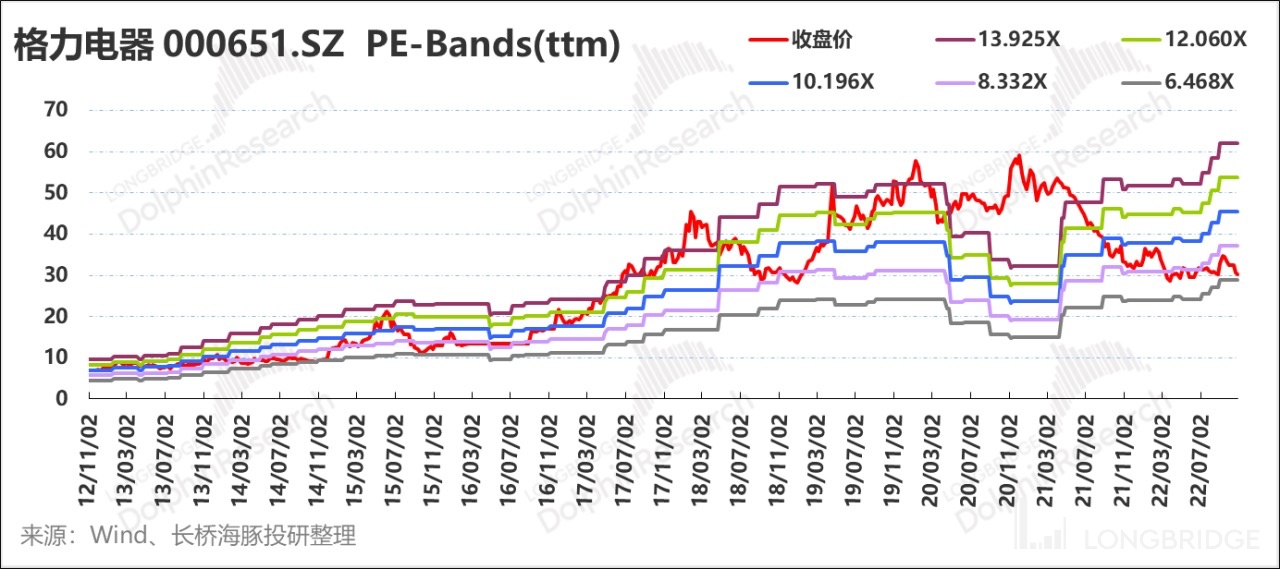

In the context of overall insufficient demand and industry pressure, GREE, which needs to carry out channel reforms, seems to have an extra challenge than its rivals. And currently, it still cannot make a definite conclusion on the results of its changes. Even if GREE can now achieve satisfactory results, it cannot prevent its valuation from nearing its historical low. From an investment perspective, Dolphin Analyst believes that now may not be the best time to enter the market. Compared to performance, the biggest factor affecting the stock price currently is the pessimistic expectation of future demand. As mentioned in "Midea Group: Industry Cold, Working Together in Difficulties", trust reversal always occurs suddenly, but more patience is needed before the reversal occurs.

During the third quarter earnings season, the Dolphin Analyst continued to follow up. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin Investment Research Group and get financial report interpretations and phone conference summaries in real time.

Below, the Dolphin Analyst will focus on further analyzing Gree Electric Appliance from the perspective of revenue growth, cost trends, and expense situation:

- Leading position is stable, sales data fell slightly in September

The company's cumulative operating income in the first three quarters of 2022 increased by 6.77%. Among them, the growth rates of operating income in the three quarters were 6.02%, 3.04%, and 10.52%, respectively. Compared to the previous two quarters, the third quarter revenue finally exceeded 10%. However, according to the latest retail data from Aowei Cloud Network, after the summer sales peak, the growth rates of online and offline sales of air conditioners have both declined. According to Aowei Cloud Network, the year-on-year online sales in September were -10.4%, while the year-on-year offline sales were -33.9%. In terms of splitting volume and price, online sales in September were down 9.4% in volume and 1.1% in price year-on-year; offline sales were down 39.8% in volume and up 9.9% in price year-on-year, with average offline prices rising. In terms of the retail market share, Gree, Midea, and Haier are still the leading players. Online: Gree, Midea, and Haier had market shares of 31.6%, 27.0%, and 11.0%, respectively, with year-on-year changes of -1.6pct, -1.1pct, and +0.9pct. Meanwhile, offline: Gree, Midea, and Haier had market shares of 34.3%, 34.2%, and 13.3%, respectively, with year-on-year changes of +0.7pct, -3.6pct, and +1.2pct.

Previously, the most concerned issue about Gree Electric Appliance was its channel reform. Based on grassroots research in September, although the company's offline dealers experienced some fluctuations in the first half of this year, some regional dealers exited the market, after a period of adjustment, a certain degree of recovery has appeared. For example, in Shandong province, a pioneer of Gree, some of the lost dealers have returned. The Dolphin Analyst believes that Gree has always performed relatively well in the offline market in the past, so its response to the rapid rise of online channels for air conditioners was not timely, which allowed competitors to take advantage for a period of time, leading to some slowdown later on. Therefore, even though the reform of offline channels may cause pain for the company, it is also imperative.

In addition, Gree has always focused on air conditioning in the past, so the continued high temperatures in the second quarter of this year naturally gave Gree more opportunities. According to grassroots research, after May of this year, the domestic epidemic has been alleviated to a certain extent, and the installation data of air conditioners has risen sharply with the hot weather. Moreover, because the industry has been clearing inventory for the past two years, the inventory in the market this year is not too high, which has greatly eased the cash pressure on dealers.

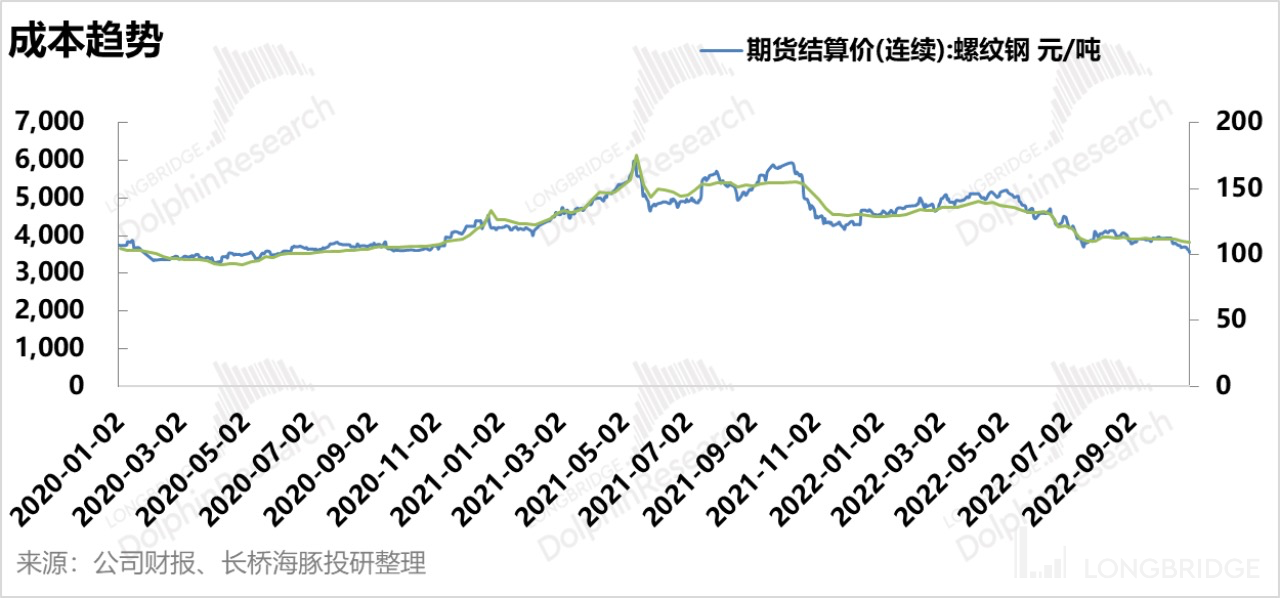

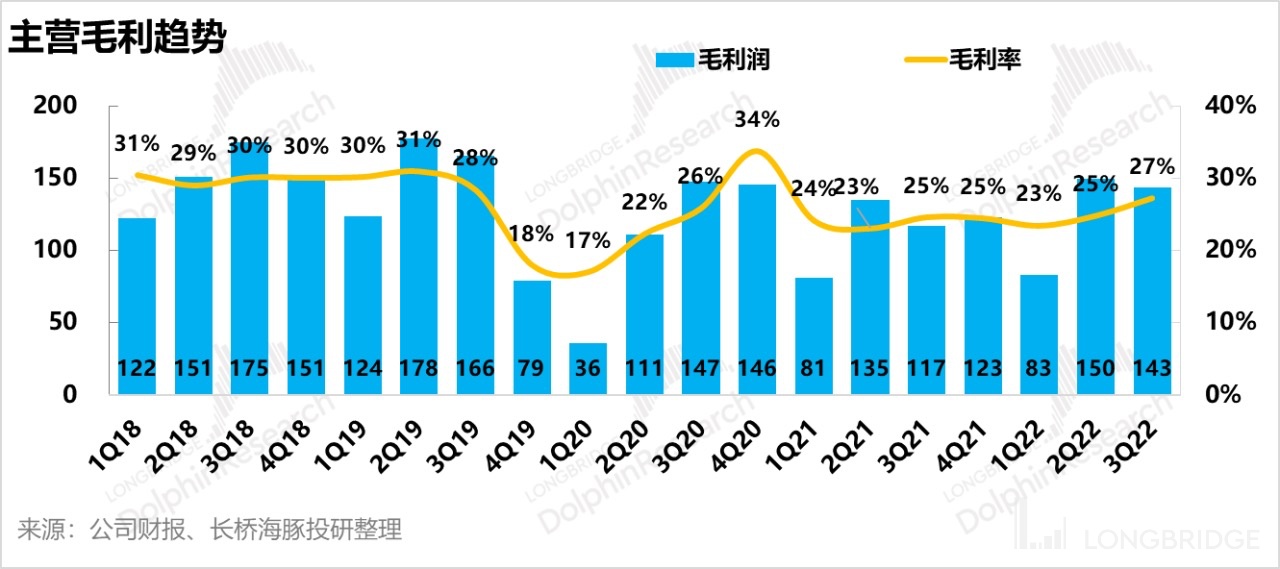

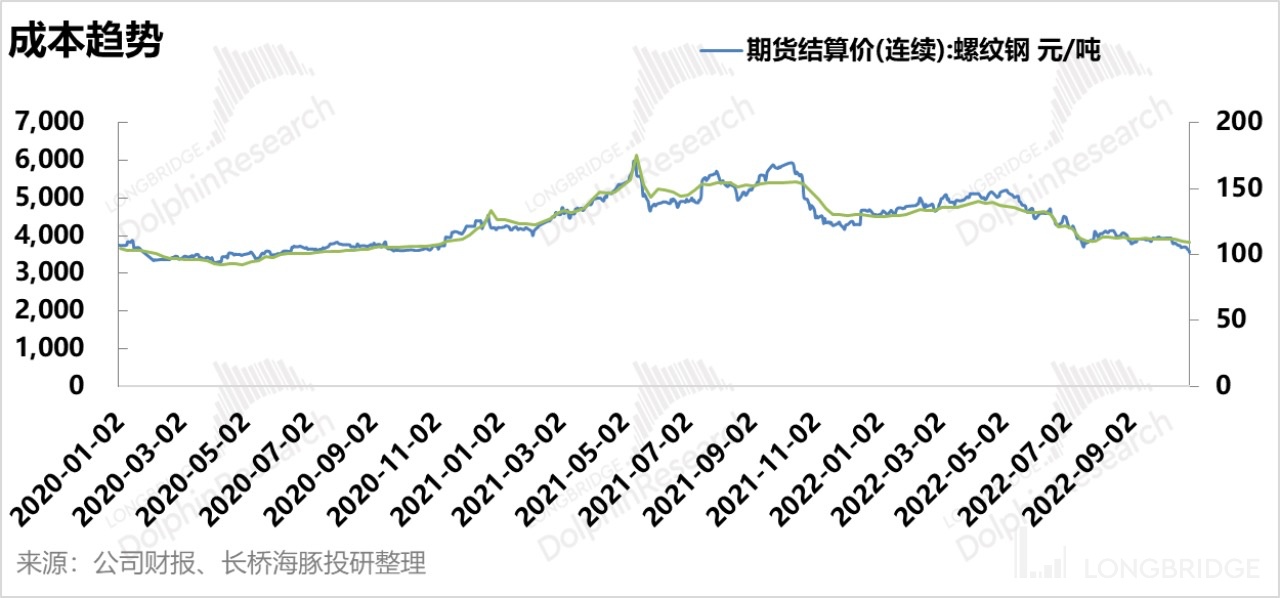

II. Gross Margin

The company's gross margin for the first three quarters was 25.54%, a year-on-year increase of 1.41 percentage points. The increase in gross margin is quite significant. Among them, the gross margins for the first three quarters were 23.66%/24.99%/27.44%, a year-on-year decrease of 0.77/+1.65/+2.55 percentage points. In the past two years (2020 and 2021), as raw material prices have risen sharply, various brands have basically raised product prices in 2021. Starting from March to May this year, the costs of various raw materials have fallen to varying degrees. Gree's gross margin has already seen a certain degree of improvement. However, Dolphin Analyst wants to remind everyone that the market itself has already had expectations for this event, including the logic of gross margin repair in the second half of the year, such as Midea Group we previously analyzed. When the gross margin really starts to change for the better, the market may not find it fresh. For example, the change in a single quarter of +2.55 percentage points now may not cause significant fluctuations.

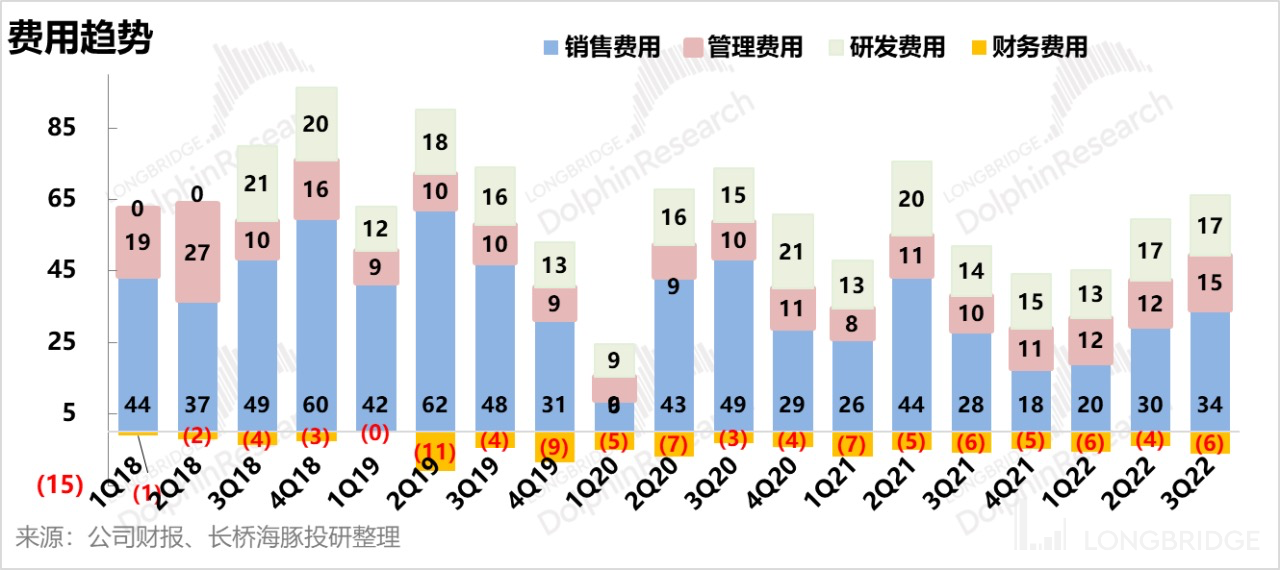

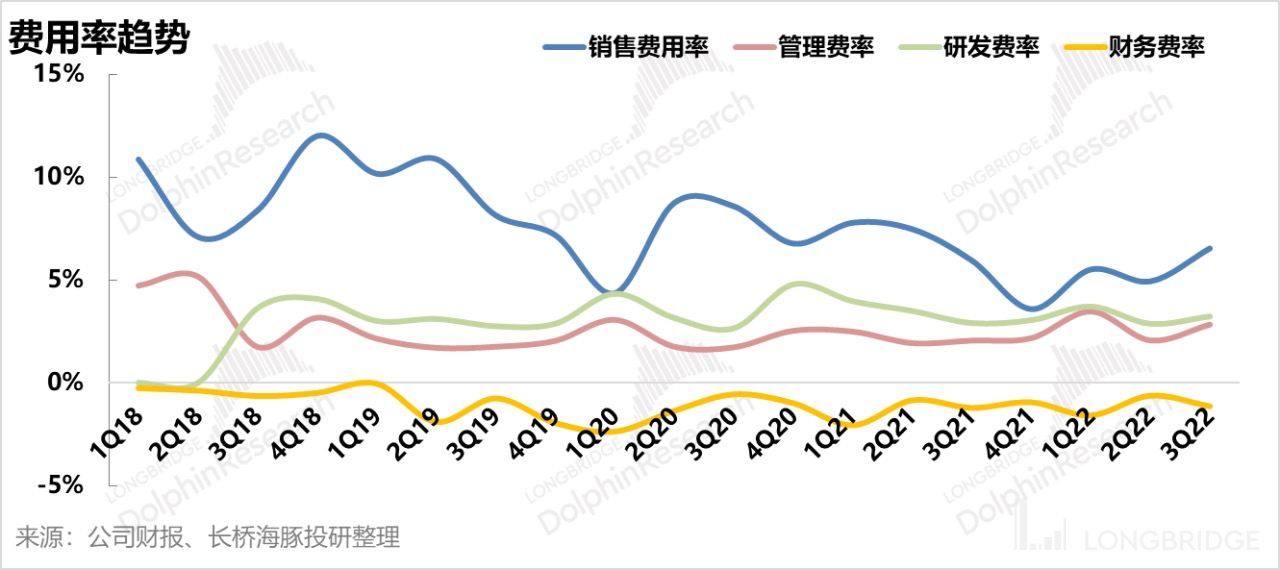

III. Expense Performance is Normal, Significant Changes Need Time

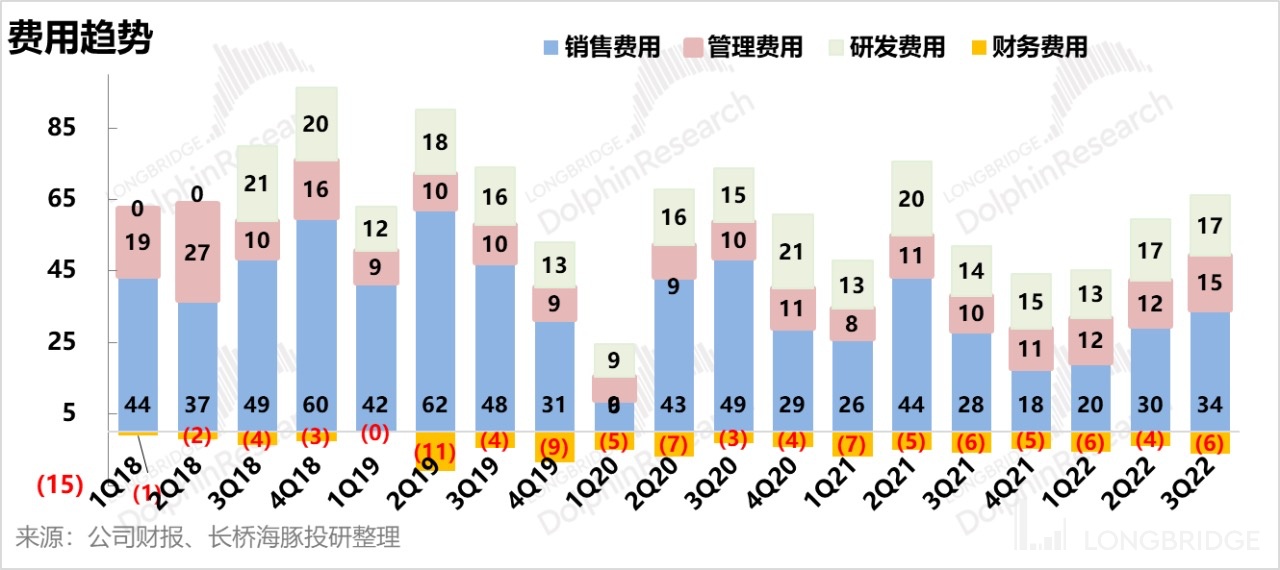

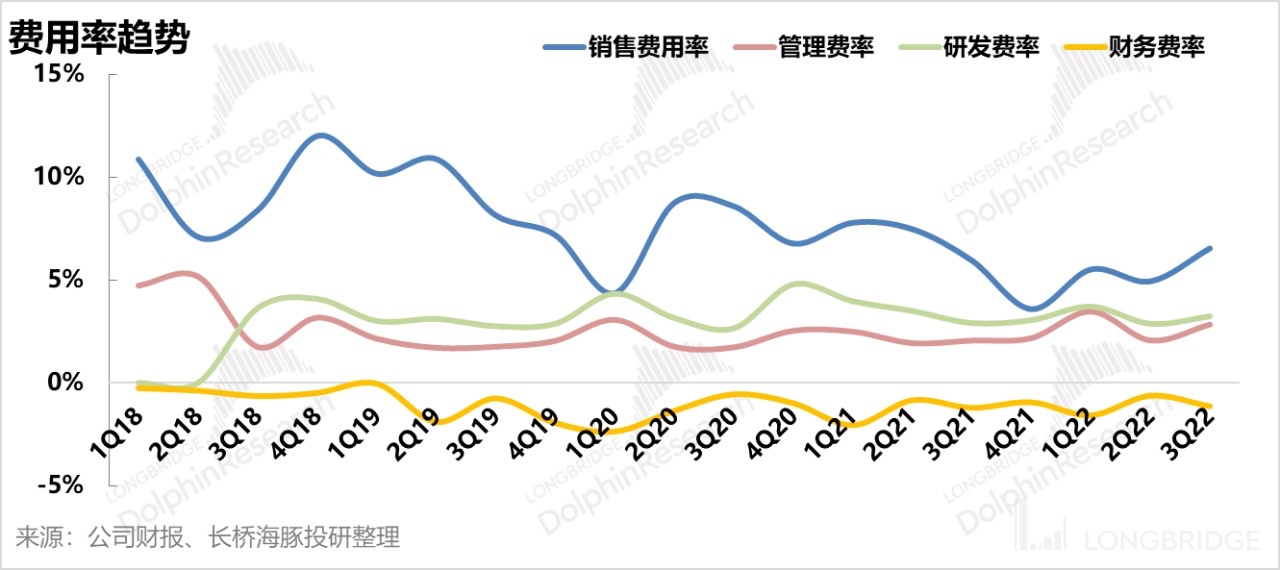

The company's net profit attributable to shareholders in the first nine months of 2022 was RMB 18.304 billion, a year-on-year increase of 17.00%, and the net profit attributable to shareholders after deducting non-recurring gains and losses was RMB 18.567 billion, a year-on-year increase of 25.77%. Among them, the net profit attributable to shareholders in a single quarter was about RMB 6.838 billion, a year-on-year increase of 10.50%, and the net profit attributable to shareholders after deducting non-recurring gains and losses was RMB 6.959 billion, a year-on-year increase of 16.56%. Sales expenses for the first three quarters decreased by 14.80% year-on-year, management expenses increased by 34.69% year-on-year, and sales expenses and management expenses for a single quarter increased by 21.50%/52.05% year-on-year, respectively. Gross profit margin optimization in the third quarter is relatively obvious, but the net profit margin has not changed much, mainly because the expense ratio in the third quarter has also increased to some extent.

As we all know, Gree's channel reform has been going on for more than two years, but the most obvious changes still began after the easing of the epidemic in the first half of this year. Currently, we can see that the sales expense ratio has a certain trend of convergence, and the net profit margin has also been improved to some extent. However, Dolphin Analyst believes that it is necessary to observe for a period of time to see how long this trend can last and how much the improvement in the sales expense ratio can be.

Dolphin Research "Gree Electric" historical articles:

Earnings season

April 30, 2022 " Consumer policy "upgrade", Midea and Gree are no longer pessimistic"

October 26, 2021 "Is there still a story to tell about the air conditioning race of Gree Electric?](https://longbridgeapp.com/topics/1254109)"

August 22, 2021 "Gree's 2021 interim report: It has not yet returned to normal levels!](https://longbridgeapp.com/topics/1070625)"

April 29, 2021 "Gree Electric: gradually emerging from the painful period of reform, when will Gree make a comeback as the king?](https://longbridgeapp.com/topics/780768)"

Risk disclosure and statement for this article: Dolphin Research Disclaimer and General Disclosure