Can the continuously rising inventory be digested in the next quarter? (NVIDIA FY2023Q3 earnings call)

NVIDIA (NVDA.O) On the morning of November 17th, Beijing time, the US stock market released its Q3 FY2023 financial report (end of October 2022) after hours:

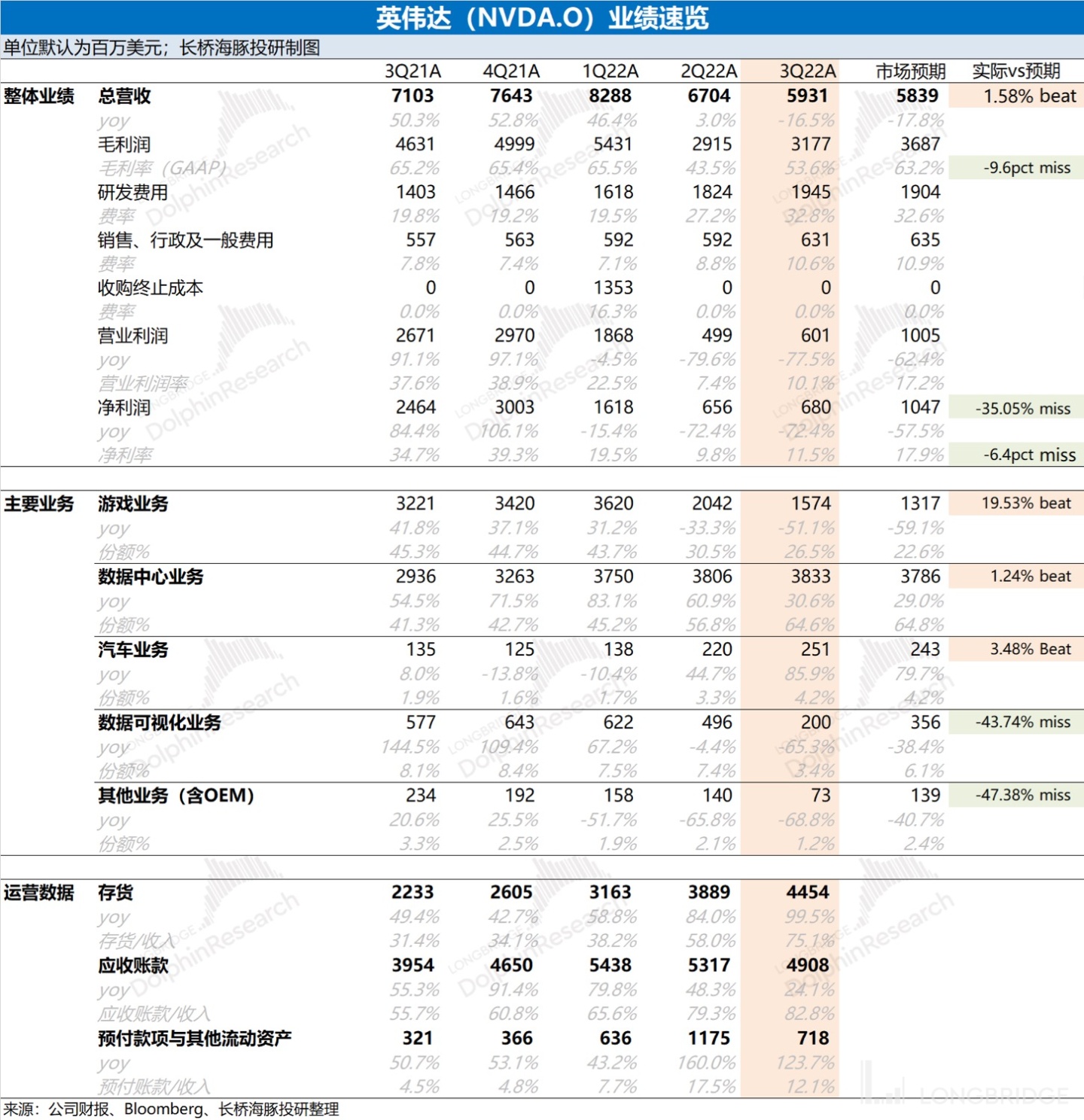

Summary of Core Data vs Market Expectations:

1) Revenue: Quarterly revenue reached $5.93 billion, a YoY decrease of 16.5%, which is in line with the company's previous guidance ($5.9 billion);

2) Gross margin: Quarterly gross margin was 53.6%, a YoY decrease of 11.6 ct, far below the guidance expectation (62.4%, positive/negative 0.5%);

3) Net profit: Quarterly net profit was $680 million, a YoY decrease of 72.4%, far below the market expectation ($1.05 billion).

4) Segment business situation: ① Gaming business: Realized revenue of $1.574 billion, a YoY decrease of 51.1%; ② Data center business: Quarterly revenue of RMB3.833 billion, a YoY increase of 30.6%; ③ Automotive business: Quarterly revenue of RMB0.251 billion, a YoY increase of 85.9%.

5) Guided for next quarter: ① The expected revenue of NVIDIA.US is $6 billion (±2%); ② GAAP gross margin is expected to be 63.2%-66%, returning to the normal level; ③ GAAP operating expenses are expected to be approximately $2.56 billion, and non-GAAP operating expenses are expected to be approximately $1.78 billion; ④ Capital expenditure is expected to be approximately $500 million to $550 million.

[Dolphin Analyst's specific financial report analysis on NVIDIA this time, will be cooperated with Youtube Top Blogger, and will be presented in a video version in "Longbridge Investment Research" later. Welcome to join the group, Dolphin will share it after the video is produced]

1. Incremental information from conference call:

[1] Gaming business: It is expected that Q4's gaming business will have higher demand, mainly stimulated by factors such as holidays and ADA architecture;

[2] Data center business: ① H100: Due to IDC power consumption regulations and the development needs of AI models, deep recommendations and other applications, the A100 product based on Ampere cannot meet customers' current needs. Therefore, the demand for Hopper architecture products is strong, and the company tries its best to meet these needs. The company expects H100 to have a certain shipment volume in Q4, and will be extensively shipped in 23Q1. ② A800: It was launched for compliance, and the product prevents reprogramming at the hardware level, so there is no risk of export control.

[3] Inventory situation: The company established a provision for inventory reserves of $702 million this quarter, most of which are related to the data center business, and mainly affected by changes in demand expectations. Some A100 products in the Chinese market were also included in the inventory reserves (Note: On 8/26, NVIDIA received a notice from the US government, A100 and H100 chips cannot be exported to the Chinese market. The company announced on 9/21 that it will release a product called A800 with the same architecture and compliance with export controls. This product was already put into production in Q3.

[4] Q4 Performance: According to the guidance, revenue in Q4 will increase by $100 million QoQ, and there will be small growth in gaming, data center, and automotive businesses, with high growth expected in the visualization business.

2.1 Management Remarks

Overall Performance

Revenue in Q3 was $5.93 billion, down 12% QoQ and 17% YoY. Among the businesses, data centers and automotive revenue reached record highs, but gaming and visualization revenues declined due to challenging external conditions and channel inventory adjustments.

1. Data Center

Despite macroeconomic weakness, new export controls, and supply chain disruptions, the data center business has shown resilience in Q3, achieving revenue of $3.83 billion, up 1% QoQ and 31% YoY.

(1) YoY Growth is mainly due to two factors:

Firstly, the number and scale of U.S. cloud service providers and consumer Internet companies deploying NVIDIA AI have increased, whose demand includes large language models, recommendation systems, and generative AI. As a result, the company's traditional large-scale definitions will be expanded to cover different terminal market use cases.

Secondly, other vertical industries such as automobiles and energy are driving growth in autonomous driving, high-performance computing simulation and analysis, and so on.

(2) Impact of Export Restrictions to China

In addition, because chips such as A100 and H100 have been listed on the export control list by the U.S. Department of Commerce, alternative products can only be sold to China, which has caused a certain impact on Q3 revenue. At the same time, demand in the Chinese market is still weak, and the company expects this trend to continue in Q4.

(3) H100

Starting in Q3, the flagship product "H100 Tensor Core GPU" based on the new Hopper architecture began shipping , and starting from November, H100 will be supplied to major server manufacturers such as Dell, HP, Lenovo, and Supermicro. In early 2023, the first batch of H100 will be used in Amazon Cloud, Google Cloud, Microsoft Cloud, and Oracle Cloud.

In the latest MLPerf industry benchmark test, H100 provides the highest performance and workload versatility for AI training and inference. Compared to products with the same AI performance as the previous generation, its purchasing cost has been reduced by three times, and the number of server nodes used has been reduced by five times, while energy consumption has been reduced by 3.5 times.

Today, the company announced a multi-year collaboration with Microsoft to build an advanced cloud-based AI supercomputer to help enterprises train, deploy, and expand AI, including large and state-of-the-art models. Microsoft Azure will be included in the company's complete AI stack, adding tens of thousands of A100 and H100 GPUs. Quantum-2, 400-gigabit for second InfiniBand network, and NVIDIA AI enterprise software are well-adapted to its platform. The company is also working with Oracle to expand AI training and inference to thousands of businesses. This includes bringing the complete NVIDIA accelerated computing stack to Oracle Cloud infrastructure and increasing the number of NVIDIA A100 and H100 GPUs by tens of thousands.

Cloud-based high-performance companies are adopting NVIDIA AI enterprise and other software on a large scale to meet the growing demand for cloud-based AI in the industrial science community. NVIDIA AI will bring new capabilities to the reconstruction of high-performance computing services, such as simulation and engineering software used in various industries. Driven by the relief of large-scale customers and supply tensions, network businesses have achieved strong growth.

(4) Bluefield DPU

The newly introduced Quantum 2, 400-gigabit per second InfiniBand, and Spectrum Ethernet network platforms are gaining momentum. In Q3, the company achieved a technological breakthrough by partnering with leading server virtualization platform VMware. VMware vSphere Distributed Services Engine (VMware Project Monterey) is closely integrated with NVIDIA BlueField DPU, providing an evolutionary architecture approach for data centers, clouds, and edges, and is first deployed on Dell PowerEdge servers. Bluefield DPU was designed with infrastructure software partners in mind, including checkpoint Juniper, Palo alto networks, and RedHat.

(5) Performance Ranking

In the latest Top500 supercomputer list released this week, the number of systems powered by the company has reached a historic high, accounting for 72% of the total and 90% of new systems.

In addition, 23 of the top 30 systems in the latest Green500 list use NVIDIA technology, demonstrating the energy efficiency of acceleration computing. The air-cooled ThinkSystem, also known as Henri, from the Flatiron Institute, tops the Green500 list and is the first 500-strong system to feature NVIDIA Hopper H100 GPUs.

(6) NVIDIA Omniverse

At GTC, the NVIDIA Omniverse computing system OVX reference design was released, which uses a new L40 GPU based on the Ada Lovelace architecture and is designed to leverage the NVIDIA Omniverse enterprise to build and run 3D virtual worlds. The Nvidia OVX system will be offered by Inspur, Lenovo, and Supermicro in early 2023, with Lockheed Martin and Jaguar Land Rover being the first customers to receive the OVX system. The company is expanding AI software and services through video and large language model services, both of which entered the early trial phase this month. These services enable developers to easily adapt to large language models and deploy custom AI applications for content generation, text summarization, chat boxes, code development, protein structure, and biological molecule attribute prediction.

2. Gaming

Q3 achieved revenue of 1.57 billion US dollars, QoQ-23%, YoY-51%, reflecting a decrease in sales to both partners to help adjust channel inventory levels to current demand expectations. The company expects Q4 channel inventory to approach normal levels. Currently, the sales of game products in the Americas, Europe, the Middle East, and Africa are relatively stable, but in the Asia-Pacific region, they are weaker, mainly due to the weakness of the macro economy and the impact of China’s epidemic blockade on consumer demand.

The first GPU "GeForce RTX 4090" based on the newly launched Ada Lovelace GPU architecture was launched in mid-October and sold out quickly in many places, and is currently striving to meet demand. The next member of the Ada family, RTX 4080, went on sale today. The RTX 40 series GPU has DLSS 3, which uses AI to generate neural rendering technology for entire frames to speed up game progress. The company's third-generation RTX technology has raised the standard for computer graphics and helped powerful games. For example, the classic game "Portal" with a 15-year history has now been reshaped using ray tracing technology ("Portal RTX"), and DLSS 3 has put it into the top 100 list of Stream. The total number of RTX games and applications now exceeds 350. The game industry has huge potential and will continue to drive the company's strong fundamentals in the long run. The real-time user count on Steam has just set a record of 30 million, surpassing the previous peak of 28 million in January. Activision's "Call of Duty: Modern Warfare 2" set a series record with over 800 million in first-weekend sales, surpassing the total box office of the blockbuster movies "Breaking Bad" and "Doctor Strange" in a crazy multiverse. And this month's League of Legends World Championships in San Francisco sold out in minutes, with 18,000 esports enthusiasts filling the venue for the Golden State Warriors game. The company will continue to expand the GeForce Now cloud gaming service. In Q3, the company added more than 85 games, bringing the total number of games to more than 1400; and launched GeForce Now on new gaming devices such as Logitech G Cloud and Razer 5G Edge.

3. Professional Visualization

Q3 achieved revenue of 200 million US dollars, QoQ-60%, YoY-65%, reflecting a decrease in sales to partners to help channel inventory levels meet current demand expectations. Despite facing short-term challenges, the company believes that there are long-term opportunities in driving artificial intelligence, simulation, compute-intensive design, and engineering. On GTC, the company announced the launch of the first software and infrastructure as a service product NVIDIA Omniverse Cloud, a comprehensive cloud service that provides artists, developers, and enterprise teams with the ability to design, publish, operate, and experience metaverse applications anytime, anywhere. Omniverse Cloud runs on the Omniverse cloud computer, a computing system composed of NVIDIA OVX for graphics and physics simulation, NVIDIA HGX for advanced AI workloads, and NVIDIA Graphics Delivery Network (GDN), a globally distributed data center network for delivering high-performance, low-latency metaverse graphics.

Home improvement retailer Lowe's is using it to help design, build, and operate digital twins of their stores; franchise communications and advanced analytics company, HEAVY.AI, is creating Omniverse-powered digital twins to optimize franchise communications' wireless networks; and German national railway operator is using Omniverse to create digital twins of their railway network and train AI models to monitor the network for improved safety and reliability.

4. Automotive

Q3 revenue was US$ 251 million, QoQ +14%, YoY +86%. The main growth driver was the increase in AI automotive solutions, as customers pushed for the production of Orin chips. The automotive industry has tremendous momentum and is becoming the company's next multibillion-dollar platform.

Volvo Cars has launched its new flagship model, the Volvo EX90 SUV, powered by the NVIDIA DRIVE platform. This is the first model to use Volvo's software-customized architecture, and the central core computer contains DRIVE Orin and DRIVE Xavier, as well as 30 other sensors.

At GTC, the company announced the NVIDIA DRIVE Thor superchip. This successor to the Orion in the automotive SOC roadmap provides performance up to 2,000 TFLOPS and utilizes technology introduced in the Grace, Hopper, and Data architectures. It can simultaneously run autonomous driving and in-car entertainment systems, achieving a performance leap while reducing costs and energy consumption. DRIVE Thor will be applied to cars starting in 2025, with Geek + being the first to adopt it under GAC's subsidiary E-Kua.

5. Other financial performance

Gross margin reflects an inventory cost of US$ 702 million, mainly related to the decrease in demand from data centers in China. This was partially offset by warranty costs of about US$ 70 million.

GAAP operating expenses increased by 31% YoY, and non-GAAP operating expenses increased by 30% YoY. The main reasons were an increase in employee headcount driving up compensation expense and an increase in data center infrastructure expenditure. On a quarterly basis, GAAP and non-GAAP operating expense growth rates were both in the single digits, and the company plans to maintain this level in the coming quarters. The company returned $3.75 billion to shareholders in the form of stock buybacks and cash dividends. Stock buybacks amounted to about $8.3 billion in the quarter ending in December 23.

6. Q4 Guidance

Revenue of $6 billion (+/-2%);

Data center revenue will reflect early H100 production shipments and ongoing weakness in China;

In gaming, we expect a sequential recovery in revenue as channel inventory corrections continue, but revenue is still below demand;

Expect continued growth of Orin-designed cars;

Overall, the company expects moderate sequential growth driven by auto, gaming, and data centers.

(2) GAAP and non-GAAP gross margins are expected to be 63.2/66.0% (+/-0.5%);

(3) GAAP and non-GAAP operating expenses are expected to be $2.56/1.78 billion;

(4) GAAP and non-GAAP other income and expenses are expected to be about $40 million, excluding gains and losses on non-affiliated investments;

(5) GAAP and non-GAAP tax rates are expected to be 9% (+/-1%), excluding any discrete items;

(6) Capital expenditures are expected to be approximately $500 million to $550 million.

2.2 Analyst Q&A

Q: What is the latest guidance on gaming, and how much has the softness in the Chinese market affected it?

A: As previously guided by the company, gaming sales in Q2 and Q3 combined were approximately $5 billion, with the China market under pressure. Nevertheless, the business demonstrated resilience overall, and notebook partially exhibited demand resilience too, though slightly softer, especially in China and Asia Pacific. The company expects higher demand in the Q4 gaming division, mainly driven by factors such as holidays and ADA architecture.

Q: The market is concerned about downstream customers of data center business cutting back on their CAPEX plans. How does the company evaluate this impact?

A: There are three driving factors for the data center business. 1) General computing: Accelerating computation is essential for achieving economies of scale, increasing workloads, achieving energy efficiency, and saving money; 2) AI computing: The demand for AI is growing rapidly, including the demand for deep recommendations, which is related to the invention of Transformer models a few years ago, and this algorithm has also driven the development of other AI models, so people can model various languages such as human language, life science language, chemical language, and gene language; 3) Nvidia-developed generative AI, perceptual AI: The ultimate goal of AI is to generate images and other content through AI and help companies reduce costs, increase efficiency, and improve productivity. The company's expectation is that, in light of these driving factors, AI demand will continue to grow with strong downstream demand. Q: How is the monetization process of AI software services going?

A: In this quarter, the company announced several cloud-related actions and partnerships. Over the years, the company has accumulated a rich ecosystem and has already been integrated into various development teams and start-ups. If the company can integrate its structure and stack into every cloud, it is expected to reach more users faster and expand AI business to different enterprises and internet service providers. Today, the company announced a partnership with Microsoft. A month ago, similar partnerships also occurred between the company and Oracle, Rescale (a high-performance cloud service provider). MONAI (medical deep learning), NeMo (language processing), BioNeMo (biotechnology language processing), and Omniverse (real-time graphics processing platform) developed by the company have also been integrated into the cloud. These services will be profitable through software licensing and subscription fees, and the company's software stack is creating huge profits.

Q: How is the inventory reserve and inventory management situation in this quarter? How much impact does the Chinese market have?

A: The company made a provision of USD 702 million for inventory reserves in this quarter, most of which is related to data center business. It is mainly affected by changes in demand expectations. In the Chinese market, some A100 products are also included in inventory reserves. The company's current inventory structure mainly consists of new products, including ADA architecture and hopper architecture products, as well as inventory of network services that will be launched soon. The company continues to monitor the inventory level every quarter and adjust it according to demand expectations.

(Note: Nvidia received a notification from the US government on 8/26 that A100 and H100 chips cannot be exported to the Chinese market. The company announced on 9/21 that it will release A800 products that have the same architecture and comply with export controls. The product has been put into production in Q3)

Q: Considering that A800 is inferior in performance to A100, will customers hoard this product before A100 is completely prohibited from export, and does the guidance for data centers include this impact?

A: No, the company has not seen this situation.

Q: Regarding inventory costs, the company mentioned in the previous quarter that the cost was adjusted due to the sluggish Chinese market and the expected revenue decline. However, revenue in this quarter is slightly better than the guidance, and the Chinese market seems to be net-neutral, so can it be considered that inventory costs are only related to A100 products?

A: First of all, at the end of the previous quarter, the company paid attention to the sluggish Chinese market. This guidance is a judgment of long-term demand, rather than a statement on inventory for the current quarter only. The company's products usually take 2 to 3, 4 quarters to build products that meet future needs, and inventory is closely related to orders in hand. Currently, the company also sees challenges brought by the epidemic control and economic pressure in the Chinese market, and is more cautious about inventory management.

Q: What are the expectations for the growth of the gaming, data center, and automotive businesses?

A: According to the guidance, revenue in Q4 will increase by USD 100 million month-on-month. Gaming, data center, and automotive businesses will all have small growth, and the visual business is expected to have high growth. Q: How is Grace product doing compared to X86?

A: Grace will increase the GPU memory speed by 10 times. This goal cannot be reached without Hopper and Grace architecture. Grace is designed for big data processing and high-speed computing, such as data processing involved in deep recommendations. These types of applications have strict speed requirements; otherwise, they cannot meet the needs of recommending content to hundreds of millions of users within milliseconds. In addition, Grace also performs well in AI training and machine learning. The sample is expected to be released in Q1.

Q: The company's spending on network services and cloud and computing power are highly related. What is the visible growth prospect for network services in the coming quarters?

A: The company's network services are an important indicator of high-performance computing. The company's services are not mainly aimed at the consumer Internet but mainly at high-end customers and large data centers. If a customer has a hyperscale data center and plans to deploy a large number of AI applications, the network bandwidth configured for the data center will have a significant impact on the overall throughput of the center. Therefore, investing in a small amount of incremental investment in high-performance networks can save billions of dollars in service configuration costs or increase throughput by billions of dollars, bringing significant economic benefits. The advantage of the high-performance network is that it can quickly recover costs. For example, Microsoft is building one of the largest AI infrastructures in the world, which uses high-performance networks and quickly recovers costs. If such a large infrastructure investment is made, but slow network services are used, it will instead drag down efficiency. Therefore, although the company's network services are related to capital expenditures of enterprises and data centers, they have a more direct relationship with the penetration rate of AI.

Q: What is the relationship and competitiveness between the company and traditional data centers?

A: If a company spends $20 billion on infrastructure, the efficiency of the entire data center can be improved by 10%, which is huge. In the application of large language models and recommendation systems, if the workload is distributed among multiple GPUs and nodes, it will take a long time. Therefore, higher basic investment can bring significant efficiency improvements.

Q: Does A800 carry the risk of violating government export controls? How to evaluate the exposure of A100 product of about $400 million?

A: A800 was launched to comply with regulations, and the possibility of reprogramming was eliminated at the hardware level, so there is no risk of export control. The concern about A100's exposure of about $400 million is based on the assumption that the capacity of A800's supply is insufficient and that it has not been introduced to customers and shipped in time. The company team will try its best to ensure that customers and business are not affected.

Q: What is the expected growth of H100 next year? What is the production capacity planning of this product? Q: Due to the constraints of IDC energy consumption regulations and the development needs of AI models, deep recommendations and other applications, the A100 product based on Ampere cannot meet customer's current needs. Therefore, the demand for Hopper architecture products is strong, and the company is trying to meet these needs as much as possible. The company expects to have a certain amount of shipments in Q4 and will ship extensively in 23Q1.

(Note: A100 was released in 2020, adopting Ampere architecture, and H100 was released in 2022, adopting Hopper architecture)

Q: The company has decided to tilt its data center business toward hyperscale data centers. What is the basis for this decision and what changes have occurred in the company's hyperscale customer structure and industry demand combination?

A: With the development of the company's data center business, the downstream customer structure has become more complex. In cloud-related products, customers include enterprises, research institutions, and universities. **Currently, the company's business has two dynamic changes: 1) The number and scale of internet service companies using NVIDIA has grown significantly, most of which are XaaS rather than cloud-based; 2) Cloud computing is at an explosive inflection point and enterprise customers adopt cloud-first and multi-cloud strategies. Hyperscale products are products sold directly, but also become partners of public clouds by having rich ecosystem. For Hyperscale users, public clouds may account for the vast majority of their overall consumption. Therefore, in terms of structure, in addition to directly selling products to customers, cooperative sales of products combination with partners is also an important part.

Q: Considering the market changes of blockchain/virtual currency, will it have an impact on the second-hand graphics card market? What is the company's view on entering the blockchain field?

A: The company does not consider blockchain as an important part of future business. The second-hand market always exists. With the launch of 40 series products, 3090 and other products will naturally enter the second-hand circulation market and be sold at appropriate prices. Although the supply and demand relationship and pricing of the second-hand market may affect the terminal sales of game business, the sales of the ADA architecture products currently launched by the company are good compared to the old models. The gaming market still maintains health and vitality. The company believes that the ADA architecture products have potential and will also launch more series of products.

Q: Can you update the company's supply chain situation? Is it currently in a tense supply chain state?

A: The pressure on the supply chain is gradually easing quarter by quarter. A year ago, network problems with the supply chain became a major topic, which has continued until this quarter. It is expected that the substantial improvement of the problem will not be seen until next quarter.

Q: The compensation for equity incentives this quarter is 700 million U.S. dollars and the proportion has increased. How does the company evaluate this impact?

A: It is difficult for the company to estimate the timing of equity incentive compensation. When new employees join the company, the company will provide equity incentives. In addition, equity incentives will also be provided once a year, and pricing depends on the market environment at that time. This is why it is difficult to make effective predictions. Equity incentive is an important part of corporate governance system and will continue to be maintained. The company is currently focusing on reducing the cost of management personnel by reducing recruitment scale.

Closing Remarks

(1) In terms of export control, the company is rapidly adapting to the macro environment, correcting inventory levels, providing substitute products for Chinese data center customers, and maintaining operating expenses flat in the coming quarters.

(2) In terms of data centers, the new platform has started well, laying a foundation for the recovery of growth.

-

NVIDIA RTX is reshaping 3D graphics through ray tracing and AI; the launch of Ada Lovelace is extraordinary; global gamers are lining up, and the 4090 is selling out quickly; Hopper timely meets the surge in demand for recommender systems, large language models, and generative AI with its revolutionary Transformer engine.

-

NVIDIA Networking is synonymous with the highest data center throughput and record-breaking performance. Orin is the world's first computing platform designed for AI-driven autonomous driving cars and robots, and will drive cars onto the road and become the next billion-dollar platform.

-

These computing platforms run NVIDIA AI and NVIDIA Omniverse, helping the company build AI and deploy it to its software libraries and engines for products and services.

In addition, NVIDIA's pioneering work in acceleration computing is more important than ever from a cost or power perspective. It is no longer feasible to expand only through general-purpose purchased computing. Acceleration computing is the way forward.

Dolphin NVIDIA history retrospective:

Depth

June 6, 2022 "Did the U.S. stock market shakeup kill Apple, Tesla, and NVIDIA?"

February 28, 2022 "NVIDIA: Growth is high, but cost-effectiveness is not that great"

December 6, 2021 "NVIDIA: Valuation can't be propped up by imagination alone"

September 16, 2021 "NVIDIA (Part 1): How Did the Chip Giant with a Twentyfold Increase in Five Years Come Into Being?"

September 28, 2021 "NVIDIA (Part 2): No Longer Driven by Two Wheels, Is Davis Going to Double Kill?" Financial Report Season

August 25, 2022 Conference Call: "How does management explain the "flash crash" gross margin? (Nvidia FY2023Q2 conference call)"

August 25, 2022 Financial Report Review: "Is Nvidia Stuck in the Swamp and Reliving 2018?"

August 8, 2022 Performance Forecast Review: "Thunderbolts, Nvidia's Performance 'Free Fall'"

May 26, 2022 Conference Call: "Pandemic-led Lockdowns and Gaming Decline Crush Second Quarter Performance (Nvidia Conference Call)"

May 26, 2022 Financial Report Review: "Nvidia's Performance Looks Bleak After the End of the "Pandemic Gravy Train""

February 17, 2022 Conference Call: "Nvidia: Focusing on Multi-Chip Advancement, Data Center is the Company's Highlight (Conference Call Summary)"

February 17, 2022 Financial Report Review: "The Hidden Concerns Behind Nvidia's Super-Performance"

November 18, 2021 Conference Call: "How is Nvidia Building the Metaverse? Management: Focusing on Omniverse (Nvidia Conference Call)"

November 18, 2021 Financial Report Review: "Nvidia Making a Fortune from Computing Power while the Metaverse Gives a Boost; Will It Keep Winning?"

Live Broadcasts

May 26, 2022 "Nvidia Corporation (NVDA.US) FY2023 Q1 Results Conference Call"

February 17, 2022 "[Nvidia Corporation (NVDA.US) Q4 Results Conference Call for 2021](https://longbridgeapp.com/lives/7429? channel=n7429)》

November 18, 2021 - NVIDIA Corporation (NVDA.US) Q3 2022 Earnings Call

Risk disclosure and statement for this article: Dolphin Analyst Disclaimer and General Disclosure