Baidu: Why is the market still afraid when valuation is all about "cash"?

After the Hong Kong stock market closed on November 22, Baidu (9888.HK;$Baidu.US) released its third-quarter financial report for 2022. To sum up, " revenue is not so bad, and profits have collectively risen."

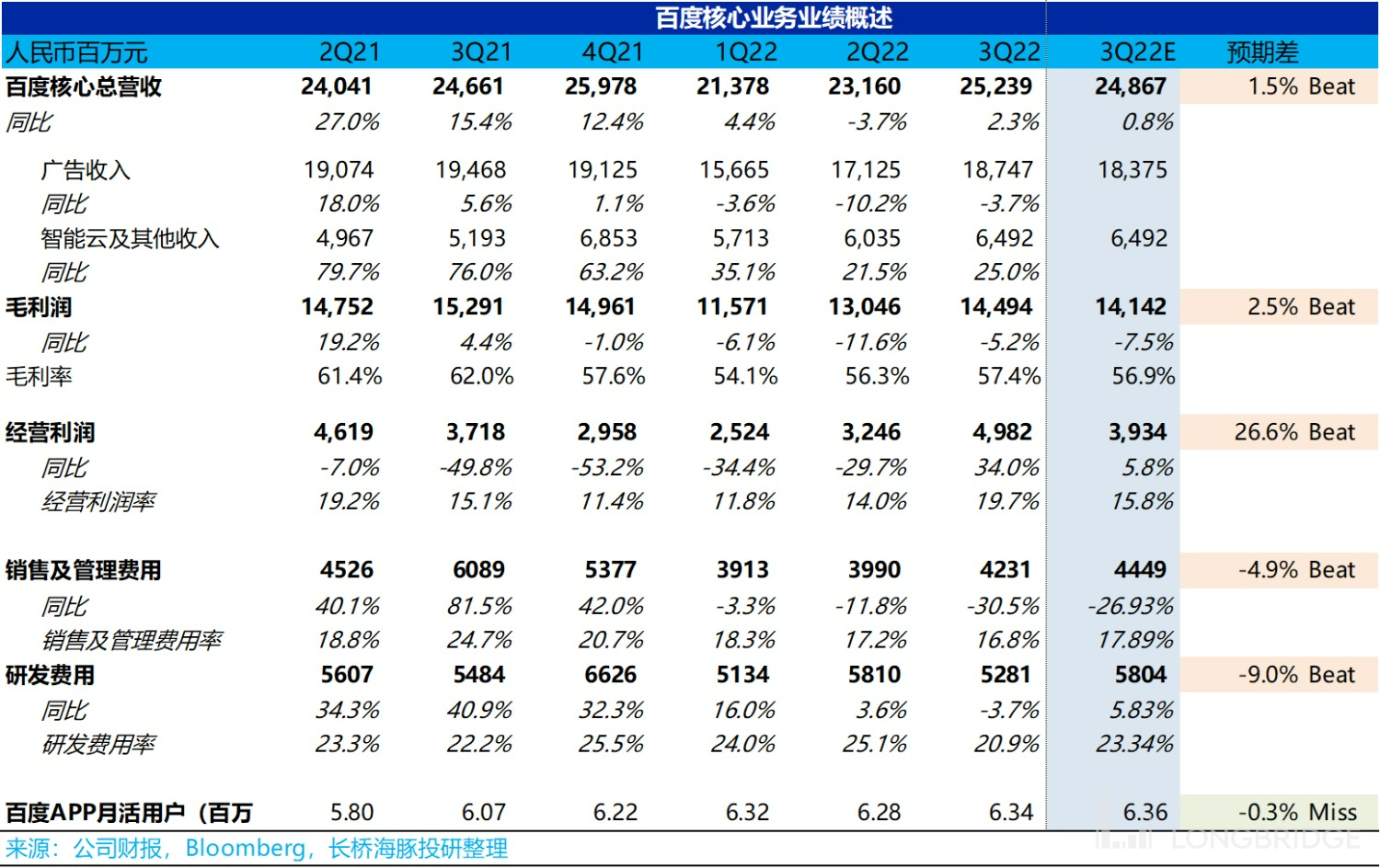

(1) This quarter, Baidu's revenue from the United States was RMB 32.5 billion, a small increase of 2% year-on-year, which slightly exceeded market expectations of RMB 31.8 billion; Aiqiyi's revenue and profits did not drag the core advertising revenue of Baidu, and Baidu's core advertising revenue was not as bad as expected.

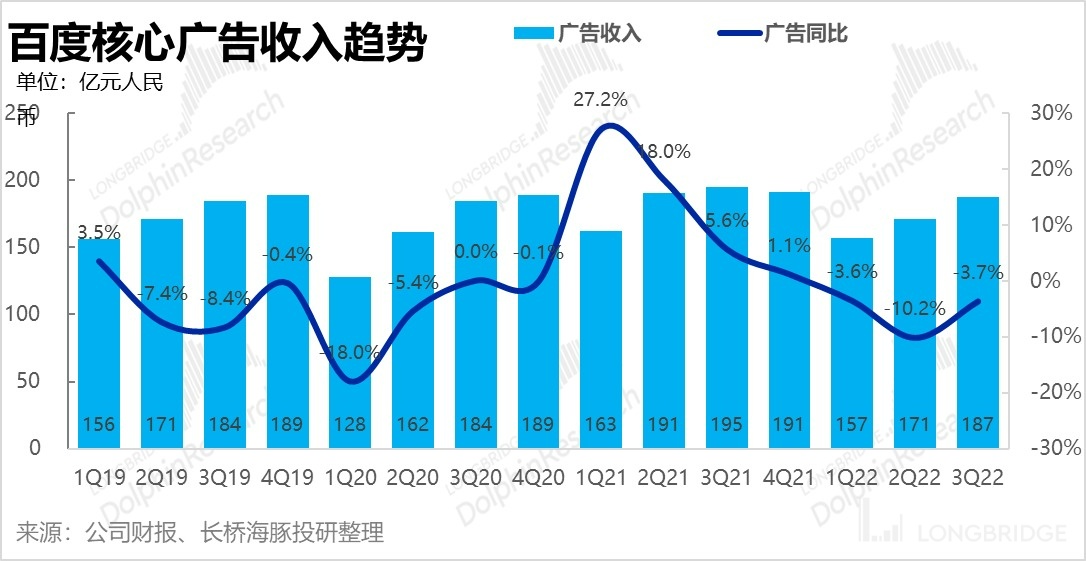

(2) Excluding Aiqiyi, the "profitability" that exceeded expectations this time is still relatively high: because the advertising business has actually shrunk by 3.7% year-on-year on a low base, which is better than -7%; however, peers such as Tencent and Kuaishou also have the same routine: After the market continuously lowers its psychological expectations, the actual situation is not as bad.

(3) The growth rate of the hosting page advertisement, which has a relatively high gross margin, in the third quarter increased by 13%, slightly recovering from the previous quarter's 10%, and contributed approximately 51% of Baidu's core advertising volume.

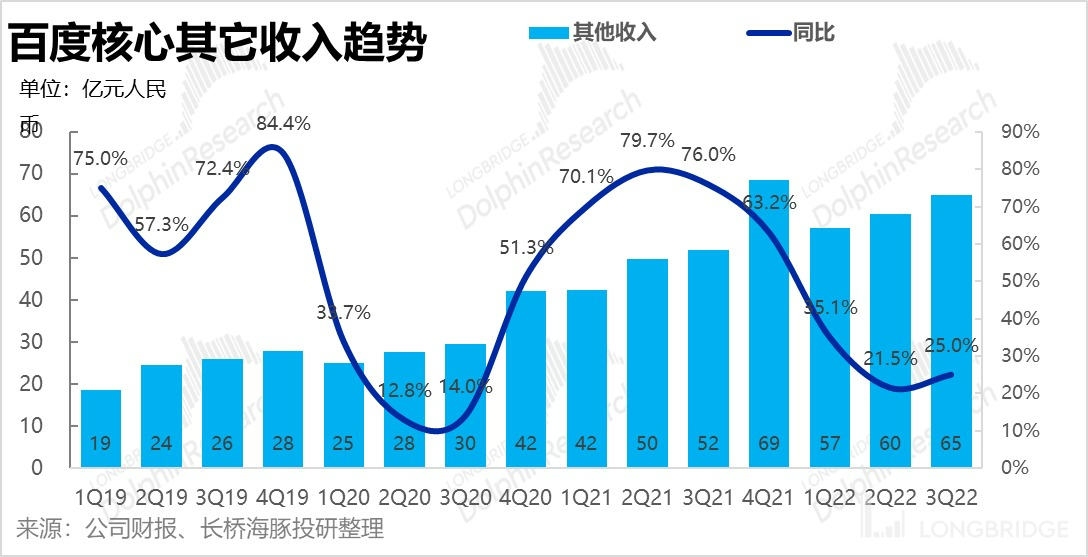

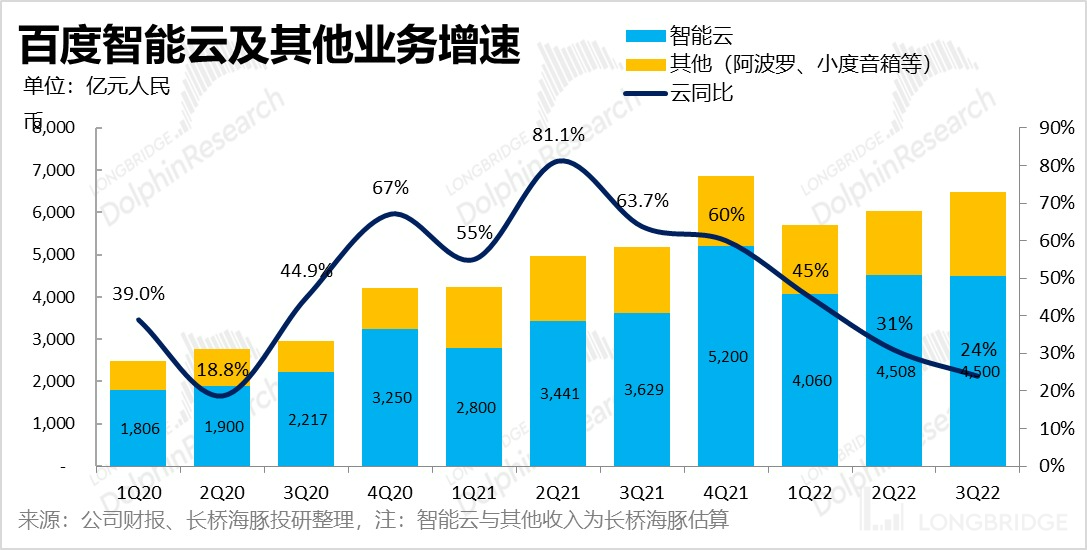

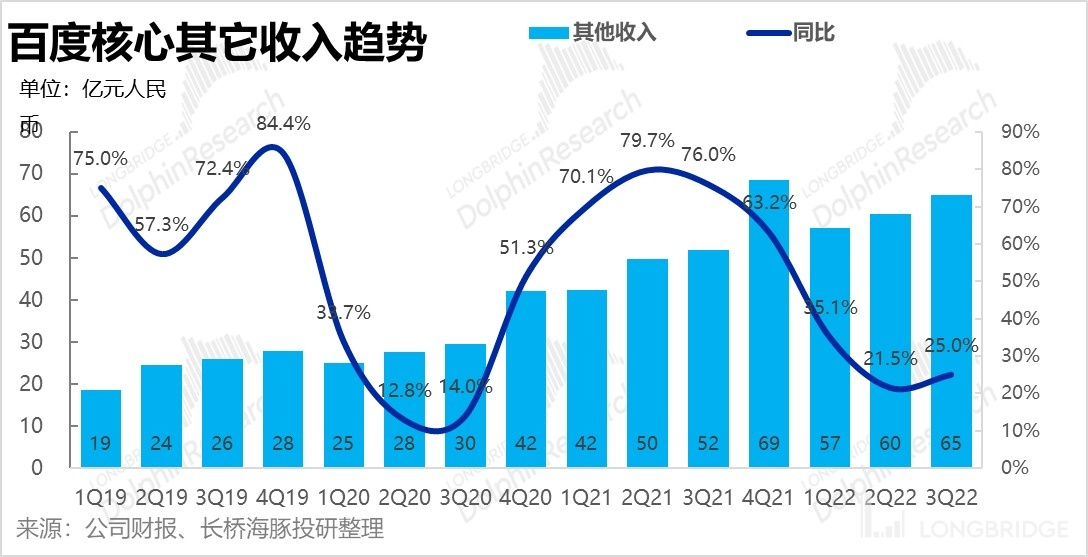

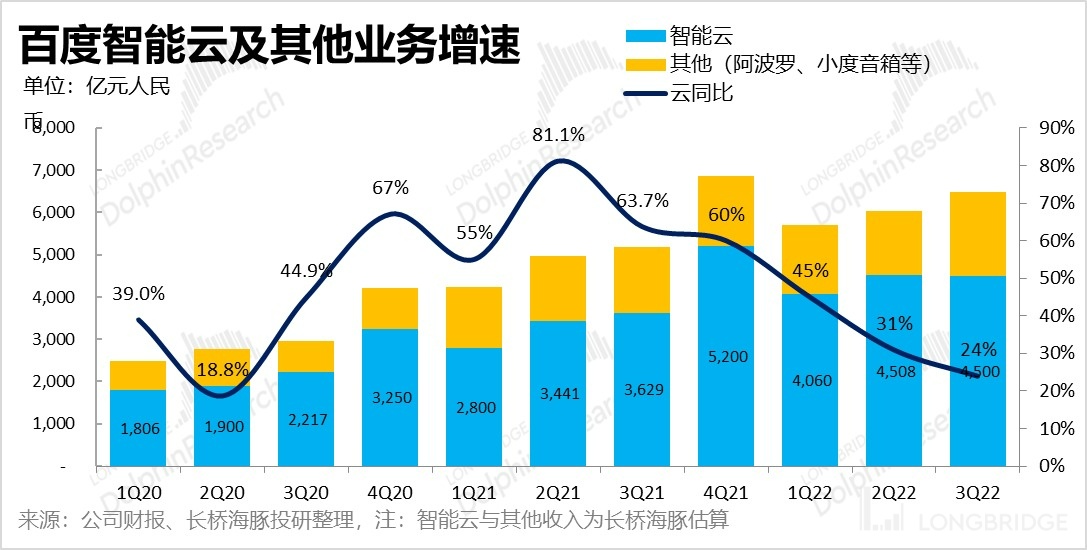

(4) Baidu Group-SW.HK's core non-advertising business, mainly intelligent cloud, increased by 25% year-on-year, which is basically in line with market expectations. The combination of advertising and innovation drove Baidu's core revenue to reach RMB 25.2 billion, a year-on-year increase of 2.3%, which is slightly better than the estimated 0.8% growth rate.

(5) Baidu Intelligent Cloud: After Baidu Intelligent Cloud emerged from the epidemic, its growth did not recover, but instead further slowed down from 31% in the second quarter to 25%. The slowed growth rate is probably due to the elimination of projects with poor efficiency.

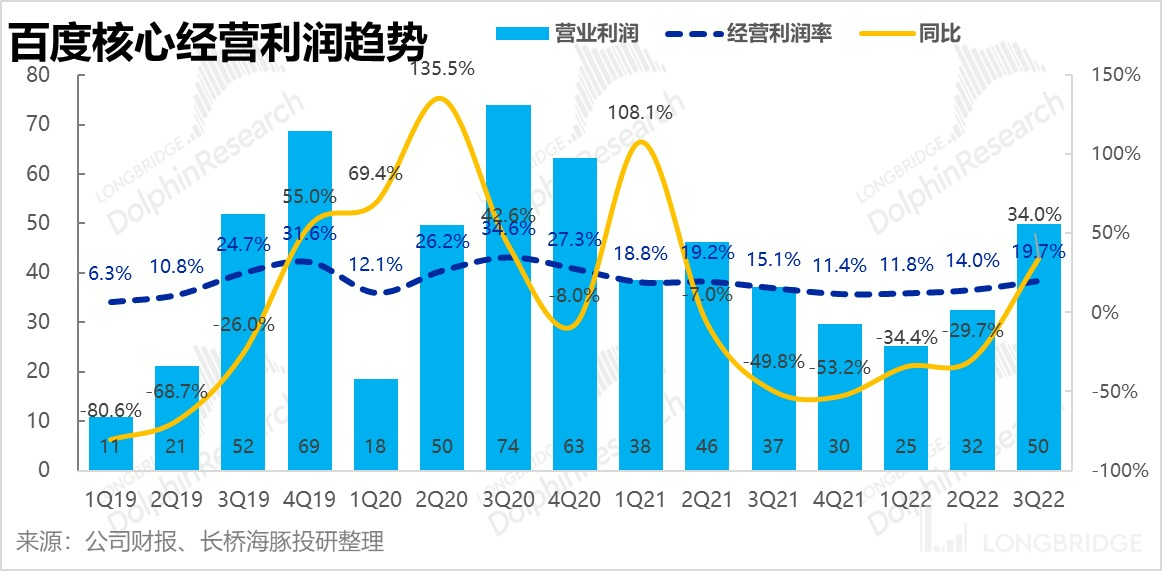

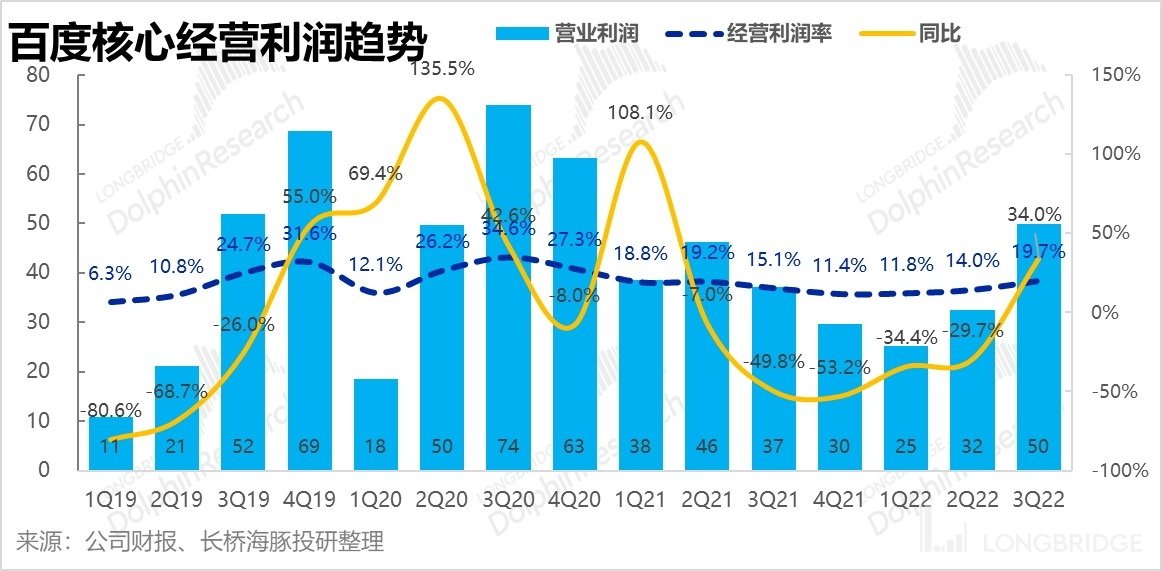

(6) Baidu's core operating profit was up to RMB 5 billion, which is ten billion higher than the market's expected RMB 4 billion. Unlike its peers, besides reducing customer acquisition costs and sales expenses, Baidu's research and development costs are in the negative growth range in order to squeeze out profits.

Dolphin Analyst's point of view:

Baidu's "cheapness" currently does not require any complex valuation calculations: After excluding Aiqiyi, Baidu holds cash, short-term investment and other assets with a total value of RMB 180 billion, and Baidu's market value is less than RMB 240 billion. Cash-type assets have already contributed 75% of the valuation; the remaining actual operational business is valued at RMB 60 billion, according to the current free cash flow earned by Baidu of over RMB 6 billion per quarter and Baidu's "tightfisted" management style, it will take just over two years for the cash flow to reach the market value, and all kinds of main businesses and equity investments are actually given away for free.

Beneath the visible cheapness, there still seems to be hesitation when it comes to buying Baidu with funds. Dolphin Analyst's conclusion is nothing more than the following: (1) The advertising business is under pressure; (2) Intelligent Cloud has revenue but no profits; and (3) for autonomous driving and assisted driving, the funds have already been exhausted. When Jidu Auto starts delivery from 2023, electric vehicles will already be in a state of fierce battle, which will be an absolute drag on net profit. Especially as currently advertising is facing a headwind: apart from macro differences, WeChat is continuously releasing advertising inventory - for Baidu, apart from video numbers, there is WeChat's same image and text search "Search" (in the fourth quarter, we can clearly see the release of advertising inventory). During this industry advertising inventory release cycle, it is necessary to observe if Cash Cow business will further deteriorate.

Therefore, in the opinion of Dolphin Analyst, the undervalued Baidu valuation system needs a systematic correction, aside from the marginal improvement of advertising, market demand needs to see Baidu's ability to achieve commercialisation of innovative businesses on a large scale, truly support Baidu's second leg for the next decade.

Before this perception changes, Baidu's investment value should be considered more of a certain investment opportunity that is below the extreme level of cash, apart from rising and falling with macro beta and market sentiment changes. For example, at a market value of USD 70-75/ADS (which basically corresponds to a 1800-2000 CNY Baidu account payable cash inventory), and around this bottom line, combined with macro beta progress, the risk-return ratio of how much it rises is still within their acceptable range.

In the fourth quarter of the epidemic, due to the poor consumption, outbreak, and inventory release by peers, how should the company judge its short- and medium-term prospects? It is recommended to pay attention to the management's telephone conference on future prospects and guidance. Dolphin will release the minutes of Baidu's meetings to the Longbridge app and user investment group for the first time. If you are interested, you can add WeChat "dolphinR123" to obtain them.

Interpretation of this season's financial report

Baidu is an internet company that is rare in dividing its performance in detail into:

- Baidu core: covering traditional advertising businesses (search/information flow advertising) and innovative businesses (intelligent cloud/DuerOS Xiaodu speakers/Apollo, etc.);

- iQiyi business: members, advertising, and copyright transfer licenses.

The division of the two businesses is clear, and iQiyi has detailed independent data as a listed company. Dolphin Research will also analyze the two businesses in detail. Due to approximately 1% (between 200 million and 400 million) of offset items in the two major businesses, the Dolphin Analyst's detailed Baidu core's segmented data may have slight differences from the actual reports, but it does not affect trend analysis.

This financial report focuses on the performance of Baidu's core business, and Dolphin will provide separate feedback on the performance of IQiyi. It will be released for the first time on the Longbridge app. If interested, download and read the app.

1. Advertising is not that bad

As various regions had scattered outbreaks of the epidemic in August and September, consumers tightened their purse strings. Each company was cutting costs. If internal employees had already started to cut off, the elastic advertising budget for external grants can only be described as fewer and fewer, except for direct linkage and good cost-effectiveness. Also because of this, the market has already placed very low expectations on advertising platforms, with most companies expecting negative growth, especially considering that this negative growth was caused by the thunderous rollout of industry regulation in the second half of last year, which caused revenue from internet advertising platforms to plummet.

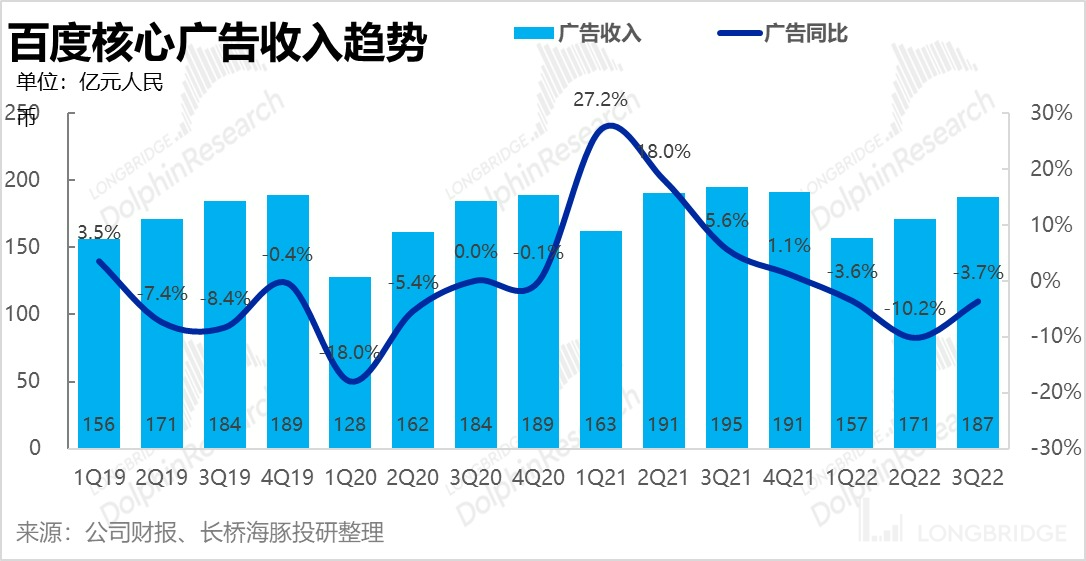

Because market expectations are low enough and last year's base is relatively friendly, Baidu's core advertising revenue is not that bad in reality. Dolphin Analyst calculated that Baidu's core advertising revenue was 18.7 billion yuan, a year-on-year decrease of 3.7%, while most expectations are for a contraction of 6% to 7%.

In fact, among the advertising platforms that Dolphin Analyst is paying attention to, with the exception of media advertising such as Focus Media and iQiyi, which are still in a significant decline, Tencent's social advertising (even if video number increments are excluded) has seen the most obvious marginal improvement, and even the slowing down of advertising on Kuaishou is not as bad as market expectations, and they are basically all doing the same thing: under the guidance of macro trends and company, they are constantly lowering expectations, but the actual results are slightly better than pessimistic expectations.

Furthermore, in order to increase the stickiness of advertisers and the user experience, "Marketing + Operation" SaaS advertising solutions, which were launched in the second half of 2019, have a relatively high gross margin. Among Baidu's sluggish advertising revenue, there are still relatively positively growing forms of advertising.

In the third quarter, managed page marketing revenue accounted for 51% of overall core advertising revenue (up two percentage points), with a year-on-year growth rate of 13%, a slight improvement over the 10% in the second quarter.

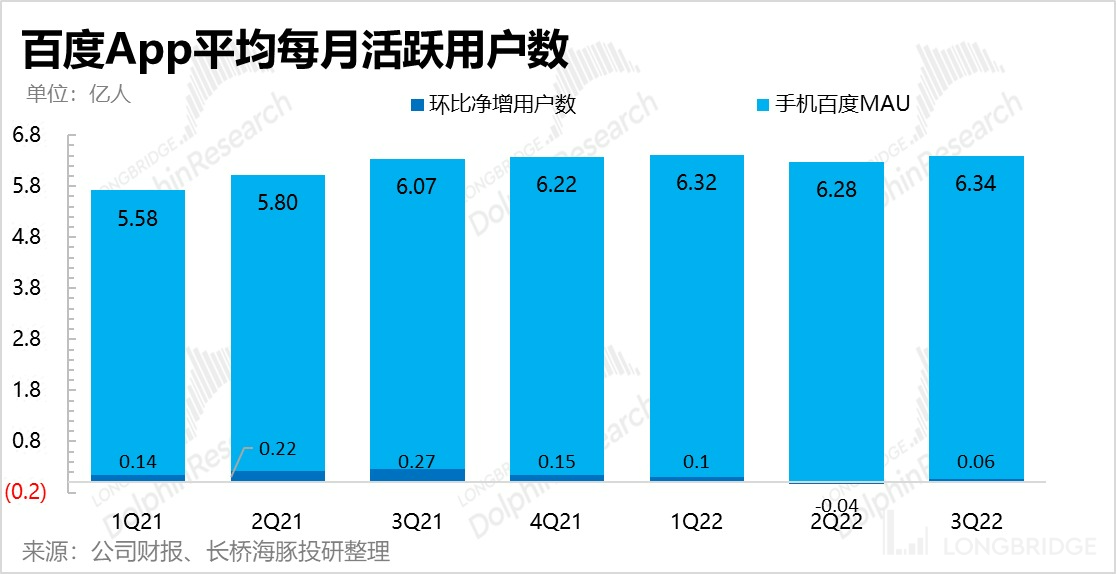

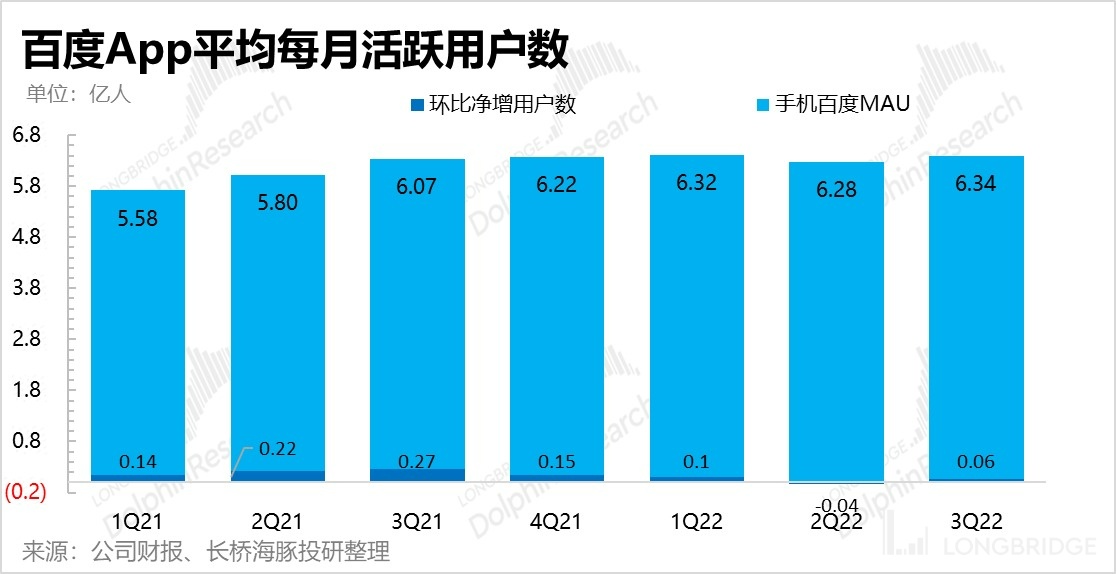

In the third quarter, the average monthly active users of Baidu APP was 634 million, and the user pool of Baidu's mobile app, despite a decrease in customer acquisition, remained basically stagnant.

- Innovative businesses: Intelligent cloud slows down, repair efforts are inadequate

Advertising did not perform as poorly this quarter as expected, but Baidu has been calling for AI+ technology businesses for many years and this quarter's performance was not that impressive.

All of Baidu's non-advertising, core-related revenues are included in other core revenues, which contribute to less than 30% of Baidu's core revenues, with the main contributor being its intelligent cloud business.

Specifically, this includes software/hardware-integrated, intelligent business, intelligent cloud (covering more than 70% of both to B and to C ends), intelligent speakers, Apollo self-driving, and non-advertising revenue from the mobile business. Baidu's core other revenue in the third quarter was about 6.5 billion yuan, a year-on-year growth of nearly 25%, which is slightly better than the 22% in the second quarter during the peak of the pandemic, mainly due to non-cloud business growth.

1. Smart Cloud Computing "Losing Fat"

Under the strong supervision of the internet in the past two years, compared to Tencent Cloud's general entertainment-centered customers and Alibaba Cloud's internet-centered customers, Baidu itself has been slowing down a bit due to the more balanced distribution of customers in industries, coupled with a lower base.

But this quarter, innovative business income support-the growth rate of Smart Cloud Computing business is still further slowing down after the Shanghai epidemic, with only a 24% growth rate. The revenue of Smart Cloud Computing business this quarter is about RMB 4.5 billion, which should be the same as Tencent and Alibaba to cut the "fat" and stop some poorly performing projects.

2. Intelligent Driving

Compared to the cloud business that has been initially scaled, Baidu's intelligent vehicle segment is still a long-term story that requires imagination. Although the dream is ambitious, it is more important to gradually implement it step by step.

1) Assisted Driving: is a product of Baidu, who sells automated driving solutions to vehicle manufacturers along the way of fully automated driving. ANP (Road Automatic Driving), AVP (Automated Parking), and High-precision maps: AVP has been installed in models such as WM W6, GAC AION S, Great Wall Haval Shenshou, Tank 500, and Ola Flash Cat. ANP 2 has already been mass-produced in the WM W6 model. The total order amount of this part of the business has exceeded 10 billion yuan, mainly requiring slow delivery and effectiveness.

2 ) Automatic Driving Fleet Service, Carrots: In the third quarter, the Carrot has provided 474,000 ride-hailing services, an increase of 311% YoY and 65% MoM. As of the end of the third quarter of 2022, Carrot has provided a cumulative total of 1.4 million ride-hailing services to the public.

3) Automatic Driving License: Baidu has obtained 718 Chinese automatic driving test licenses, including 571 for passenger qualifications and 194 for commercial pilots.

Three, Advertising Repair + Reduced Investment, Gross Margin Continues to Improve

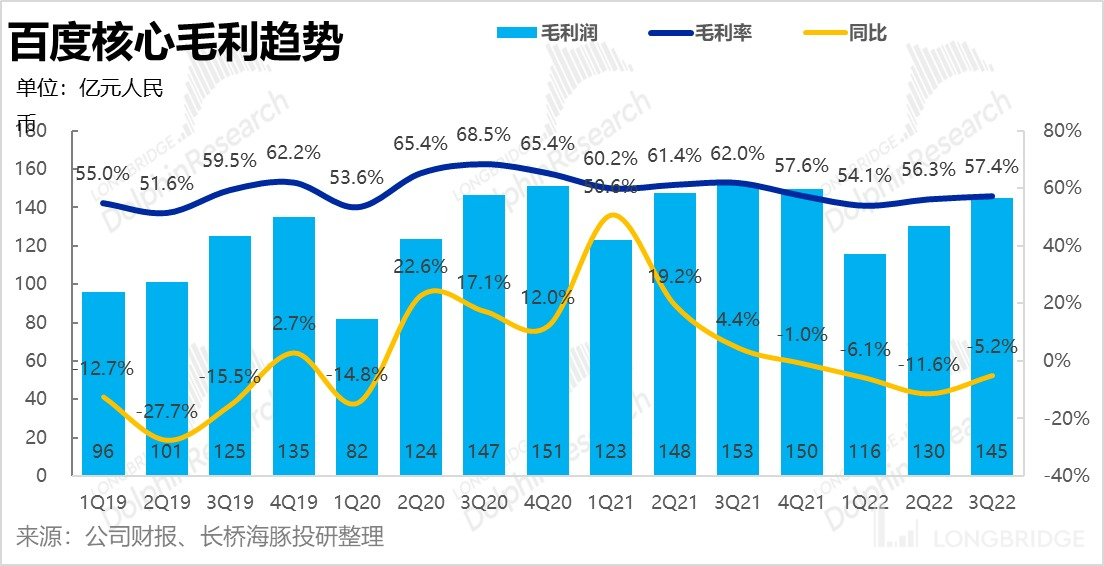

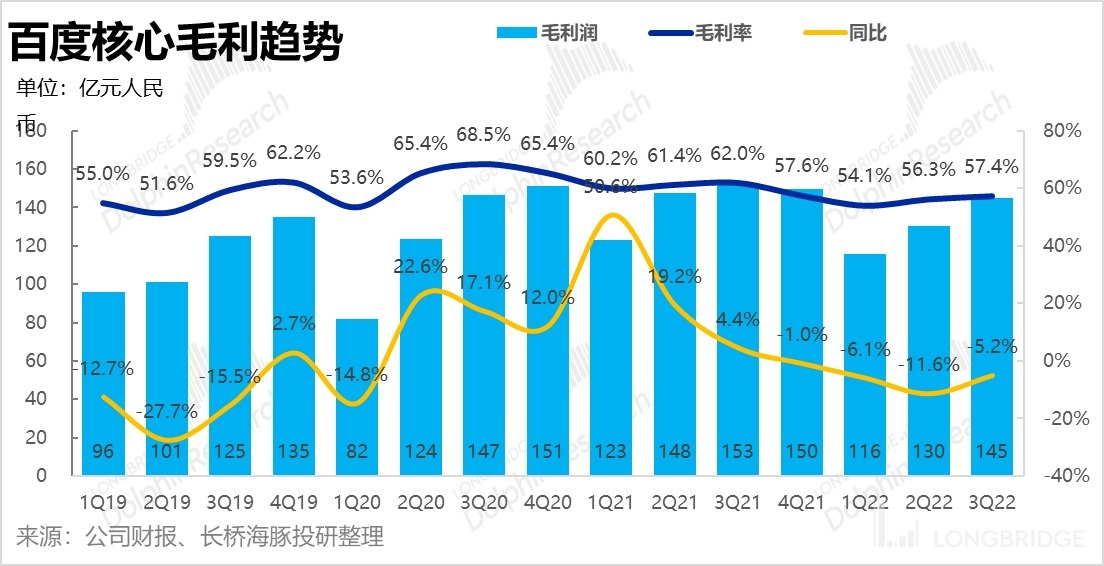

Due to a certain degree of repair on the advertising margin compared to the previous quarter and the restraint of customer acquisition investment, the single-quarter gross margin decreased by 5.2%, but the contraction range was reduced, and the improvement of core gross margin was relatively obvious. The gross profit margin this quarter was 57.4%, and the market expectation is less than 57%.

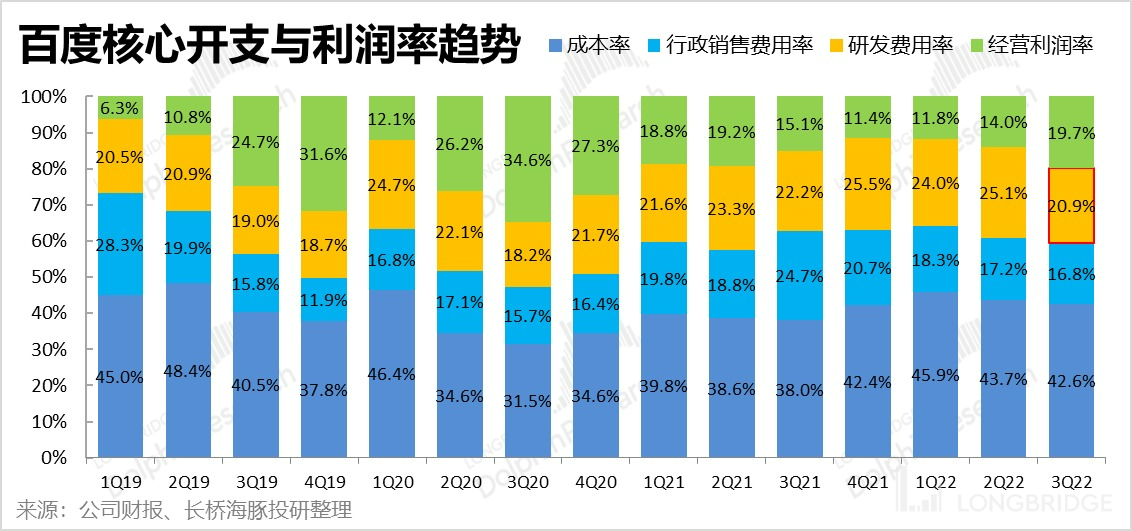

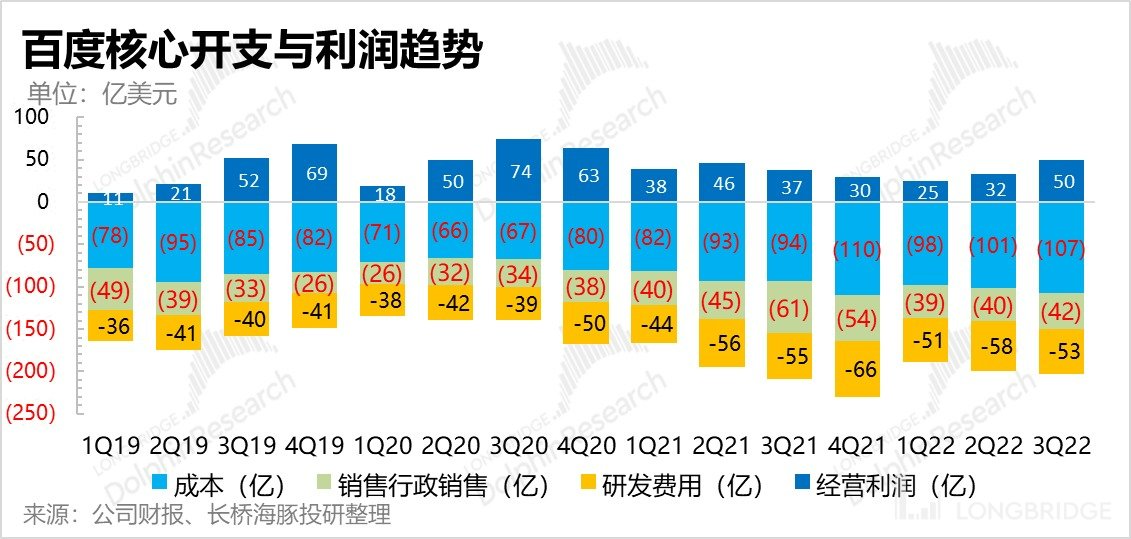

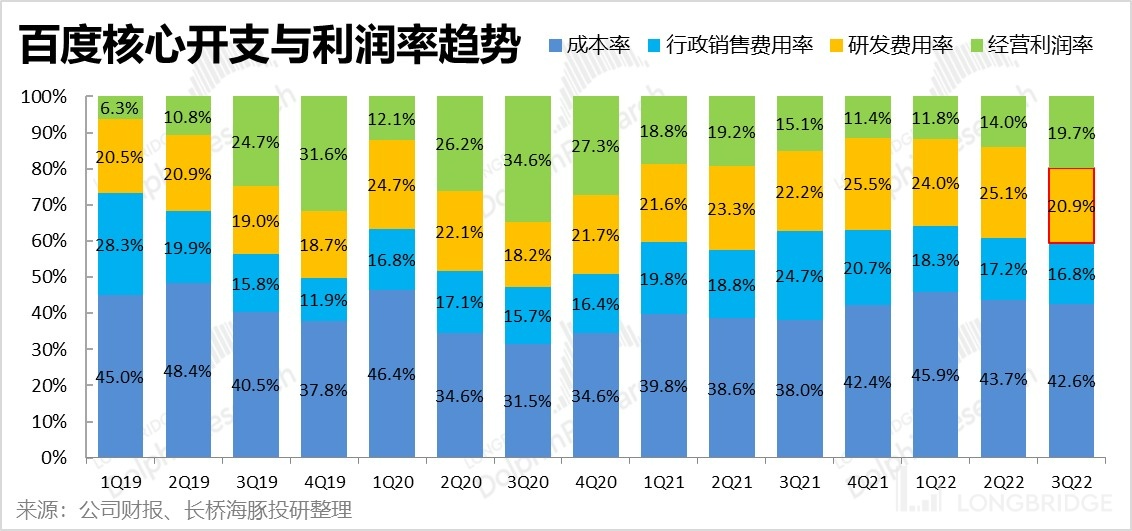

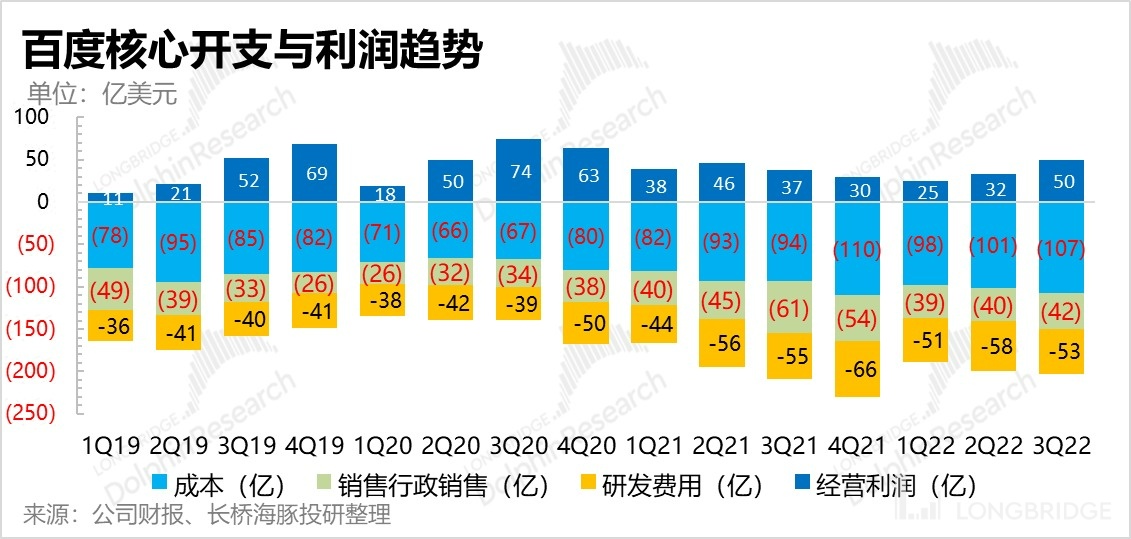

Four, Even R&D expenses have been directly reduced

In terms of operating expenses, Baidu has entered a clearly reducing costs and increasing efficiency cycle in 2022. The sales expense ratio has been continuously shrinking. This year's third quarter is less than one year, so sales and administrative expenses are still shrinking, and the third quarter has decreased by 31% compared to the same period last year. And the real surprise this quarter is that Baidu's R&D expenses have actually decreased in absolute value compared to the same period last year, especially since Baidu will continue to invest in manpower and resources in its autonomous driving business, which is relatively rare in this cost-cutting and efficiency-increasing cycle of the internet. Baidu's R&D personnel have also been streamlined.

Finally, due to slightly higher advertising revenue, some savings in various investments, continued cost savings in sales, and an unexpected direct reduction in R&D expenses, the operating profit of Baidu's core business reached ¥5 billion, exceeding market expectations by a full ¥1 billion.

Year-on-year profit growth has gone from a decline of 29% to a positive growth of 34%, and operating profit margins have reached a peak value of 19.7% in four quarters, three to four percentage points higher than market expectations.

Dolphin Analyst "Baidu" Historical Articles:

Earnings season

August 30, 2022, earnings review "Relying on Clouds to Reverse Advertising's Fortunes"

August 31, 2022, "Cost Cutting and Efficiency Increasing, Paving the Way for AI Cloud and Autonomous Driving"

May 26, 2022, conference call "Baidu's Intelligent Cloud and Autonomous Driving Business Return to Market Focus (1Q22 Conference Call Summary)"

May 26, 2022, earnings review "From Rags to Riches, Baidu's Turnaround is Not Far Away?"

March 1, 2022, conference call "Advertising Depends on Heaven, Baidu's Bold New Business Plan"

March 1, 2022, earnings review "Advertising is Still in Hell, but Baidu's "Change of Heart" is Promising" 2021 年 11 月 18 日电话会议《广告凉凉,百度的未来只能靠 "自动驾驶 + 云"(纪要)》

2021 年 11 月 18 日财务报告点评《现实太残酷、梦想太遥远,百度太难了》

2021 年 8 月 13 日电话会议《加税、监管、自动驾驶…,百度电话会很 "有料"》

2021 年 8 月 12 日财务报告点评《追百度财报有感:讲故事不是重点,落地才是!》

2021 年 5 月 18 日财务报告点评《百度接近腰斩?基本面没问题!》

2021 年 2 月 18 日电话会议《三句不离智能驾驶,阿波罗依然是香饽饽「百度电话会议」》

2021 年 2 月 18 日财务报告点评《Dolphin Analyst | 从广告到 AI 云 + 驾驶,百度逐步 "换心"》

** 深度 **

2022 年 5 月 7 日《跌得够惨,常识就够》

2021 年 3 月 17 日《认真扒一下百度的家底:“港股版” 百度还剩多少重估空间?》

** 本文的风险披露与声明:** Dolphin Analyst Disclaimer and General Disclosure