Nine Plus Nine (Part 2): Can Tai Er Support the Soaring Stock Price of Nine Plus Nine?

Through the first part of "The Cultivation Method of 'Tai Er' Fatty Fish" on Jiuliujiu, it is discovered that Jiuliujiu has achieved remarkable internal strength after years of hard work. It has reached the standards in terms of brand matrix, supply chain, and store expansion mechanism.

From the current category matrix, Jiuliujiu's Northwestern cuisine, which has been flipped twice, has shrunk to only 80+ stores, and the new brand "Sōng Huǒ Guō" has only 10 stores. The single-store model has not yet been fully implemented and cannot support Jiuliujiu's market value.

The real value of Jiuliujiu lies in "Tai Er Pickled Fish". Therefore, this article downplays the estimation of investment-type and mature-type businesses. Instead, it focuses on the certainty support that the "Tai Er" business brings to Jiuliujiu from the perspectives of table turnover and store expansion, corresponding to three core questions:

-

How is the table turnover rate of "Tai Er"? How should we view its long-term potential?

-

Can "Tai Er" achieve the goal of opening a thousand stores in five years?

-

What is the true value of Jiuliujiu?

Let's start with the conclusions and key points:

-

The breakeven point for each store is between 2.0-2.1, and the estimated table turnover rate in the future will fluctuate between 3.5-4.0.

-

Doubling the number of stores is a high probability event, with an estimated total of 870 stores. New first-tier and second-tier cities are the core areas for expansion.

-

Under PE and DCF valuation, there is still room for growth, but it is shrinking.

I. Table Turnover Rate: Will excellence always continue?

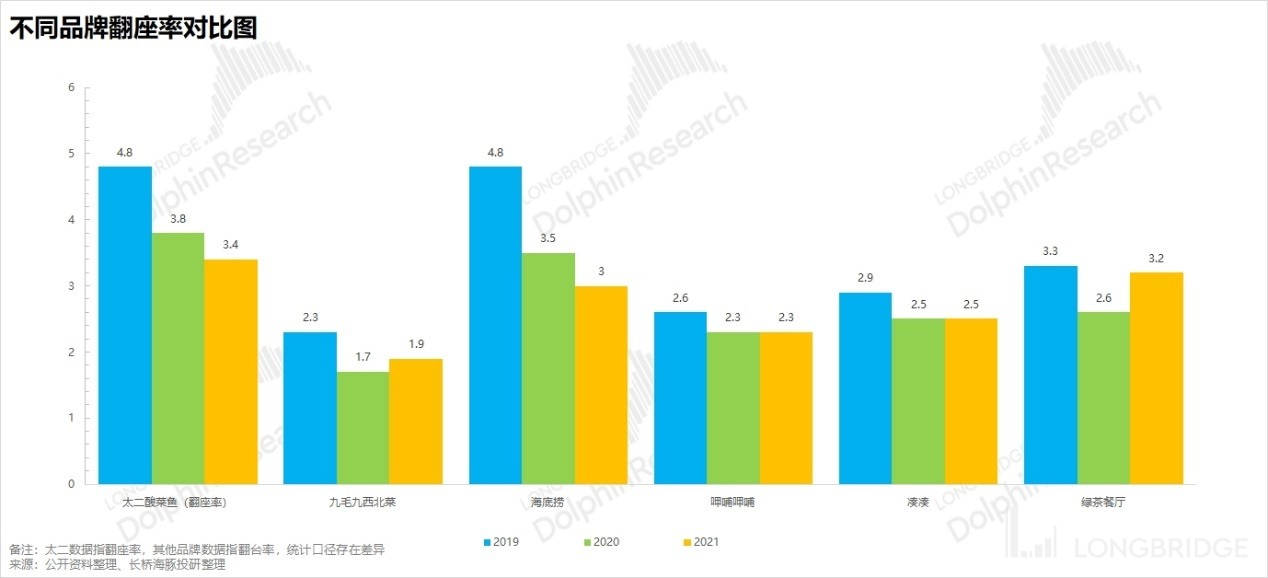

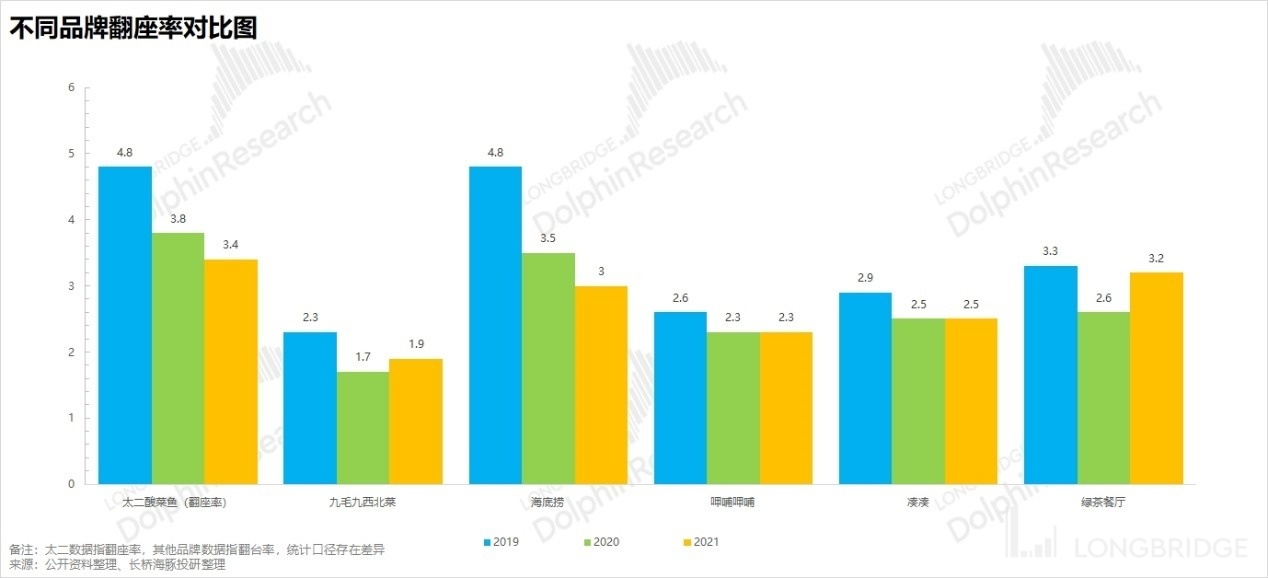

Among several leading catering brands observed by Dolphin, in terms of table turnover rate, "Tai Er Pickled Fish" is basically a leader in the industry, even considering the impact of the epidemic. Although the epidemic has affected customer flow, "Tai Er" still performs relatively well.

This is largely due to the "careful design" of "Tai Er":

-

No service for groups of four or more, which means rejecting customers who occupy tables and chat excessively. "Tai Er" aims to attract customers who simply want to eat.

-

Streamlined dishes and standardized processes, with a large portion of the work done in a central kitchen, resulting in fast serving.

It should be noted that the peak dining hours are only during lunch and dinner. During these peak times, time is precious. Serving the food quickly, focusing on eating, and leaving after finishing the meal is the key. With these two factors, a table of people can finish their meal in about 40 minutes.

Once a store is established, it means that fixed and semi-fixed costs such as decoration, rent, utilities, and even labor have been locked in. Only table turnover can influence profit generation. In other words, the catering industry is a business with a very strong operating leverage.

In order to clearly demonstrate the high sensitivity of single-store profitability to table turnover, Dolphin has carefully calculated every cost of single-store operations, taking into account the fixed and variable nature of each cost: a) Fixed Costs - Rent, Tables and Chairs, Depreciation of Decoration, etc.: Obviously, regardless of the number of customers, these costs need to be invested in advance. They can be understood as the sunk costs of opening the door to welcome guests.

b) Semi-Fixed Costs - Electricity, Labor: In terms of electricity, the decrease in the number of customers generally does not reduce the amount of electricity used by the store, but it may reduce the amount of water used in the kitchen. As for labor, in general, as the table turnover rate decreases, the store owner may lay off employees. However, when the table turnover rate increases, the store owner may not necessarily hire more workers because the number of tables served by a single waiter in a unit of time does not change.

c) Variable Costs: Variable costs mainly include ingredients and delivery fees, which are closely related to customer flow and revenue. Increases and decreases are roughly proportional. In addition, when Dolphin conducted sensitivity calculations for Too Er, it took into account the impact of Too Er's business strategy on delivery fees. As the table turnover rate increases, the proportion of delivery orders will gradually decrease.

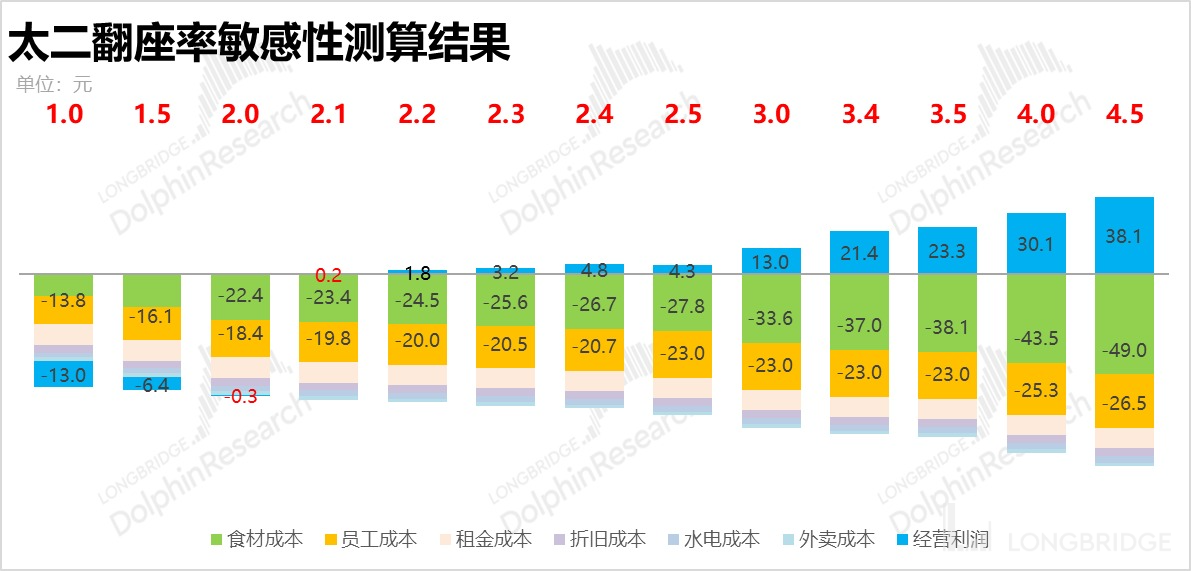

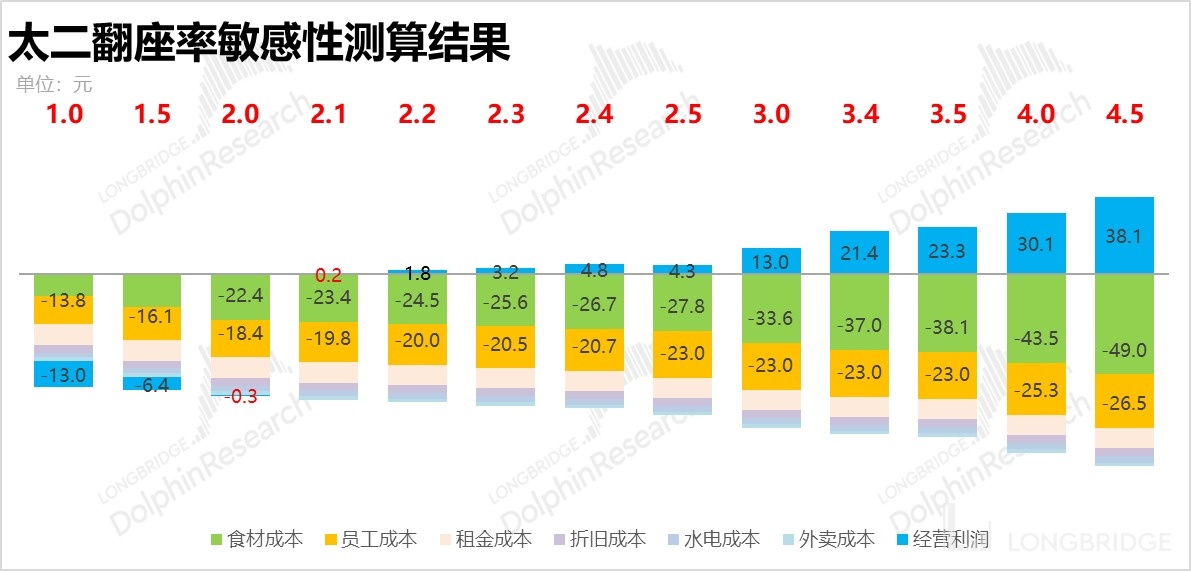

In specific calculations, for ease of understanding, based on the 2021 operating data, assuming that the restaurant earns 100 yuan per table per day, the corresponding cost situation is as follows:

In 2021, Too Er had a table turnover rate of 3.4, and a rough estimate corresponds to an operating profit of approximately 21.4% for a single store without allocating headquarters costs. Taking into account the headquarters costs to be borne (advertising, travel, transportation, dish development, and other miscellaneous expenses) of about 7.2%, the pre-tax net profit margin is about 14.2%.

Regarding the sensitivity of different costs to revenue and table turnover rate in a single store, based on 2021 as the basis, Dolphin adjusted the corresponding cost changes when the table turnover rate rises and falls using certain reasonable proportional coefficients.

The following are the results we have calculated, which can be seen as follows:

1) After the table turnover rate exceeds the threshold of 2.5-3, most of the seats that are turned over, except for the cost of ingredients, can be converted into actual profits that go into the store's pocket.

-

Too Er's single store must be able to survive on its own and needs to be turned over at least twice a day.

-

However, normal stores need to allocate headquarters expenses. Taking into account the allocation of headquarters costs, if you don't rely on others, you need to achieve a table turnover rate close to three times to be considered acceptable.

According to Dolphin's calculation model, with a table turnover rate of three times, the operating profit margin can reach 13%. After deducting the headquarters expenses, the actual pre-tax net profit margin is about 6%. In addition, for most restaurants, the actual income tax rate is very high (25%), so the after-tax net profit margin is only 4.5%.

-

To present an "attractive" business model to the capital market, a table turnover rate of 3.5 or above is needed, which is roughly the performance of Too Er's table turnover rate during the past two years under the suppression of the epidemic.

-

A table turnover rate of 4.5 or even higher is equivalent to serving two waves of customers at lunch and three waves of customers in the evening, and the tables must be fully occupied. Without complicated calculations, it can be judged that this is the performance of a super excellent restaurant. However, when Too Er went public, it achieved this.

But the newly listed Tai'er is very popular, and the stores are far from saturated. There are few queues and the turnover rate is close to 5 times in the short term. However, considering the saturation of store openings, it is difficult to achieve such a high turnover rate, even for excellent stores. When there are too many stores and a long time has passed, it will also become flat.

Turnover rate: When Dolphin estimated its valuation, considering its unique product positioning, it selected a turnover rate between 3.5 and 4 times, which was considered relatively reasonable.

If we take 4 times as the turnover rate, the corresponding operating profit for a single store is 30%. After deducting 7.2% of the headquarters' expenses and income tax, the net profit for a single store is approximately 23%.

Considering that everyone's judgment is not easy, different profit and valuation elasticities under different turnover scenarios are provided for reference, which will be explained in detail later.

2. Can we achieve the goal of opening a thousand stores in five years?

When Tai'er went public in 2019, it had less than 150 stores. Although it has been opening stores against the trend in the past two years, it reached 350 stores in 2021.

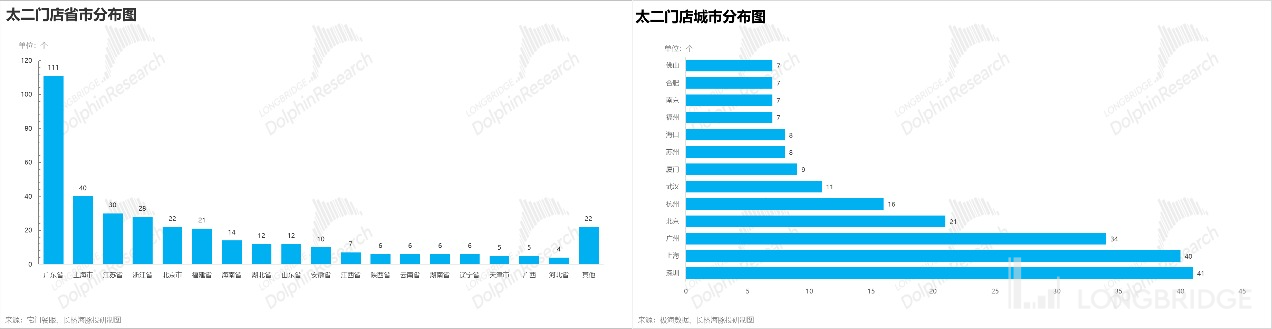

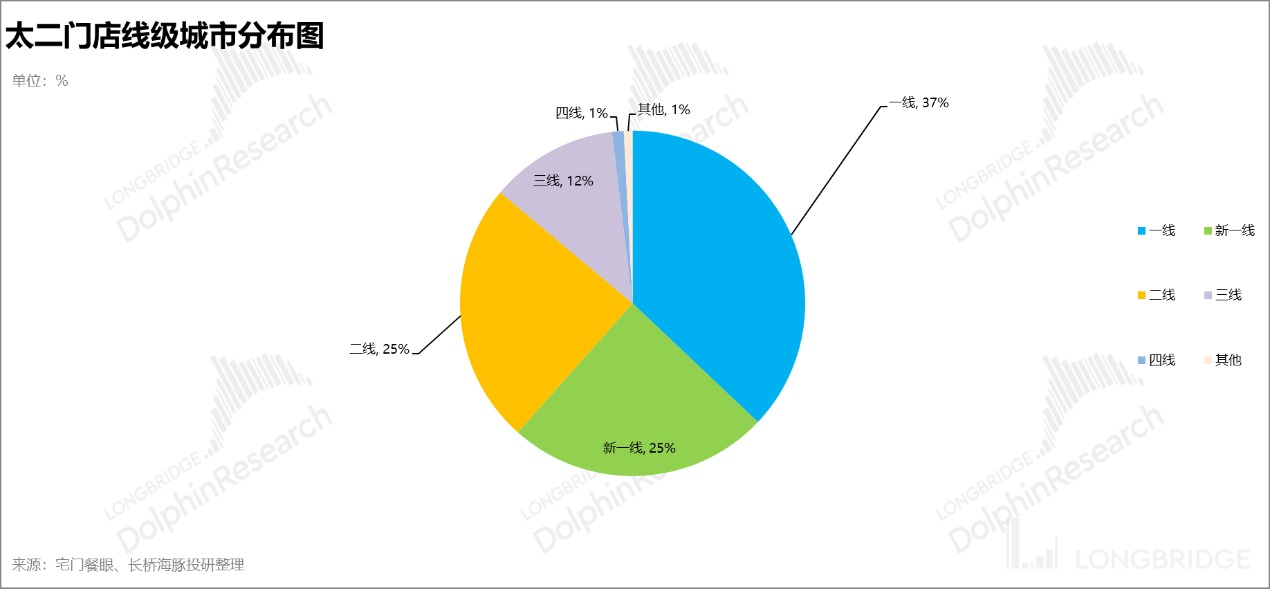

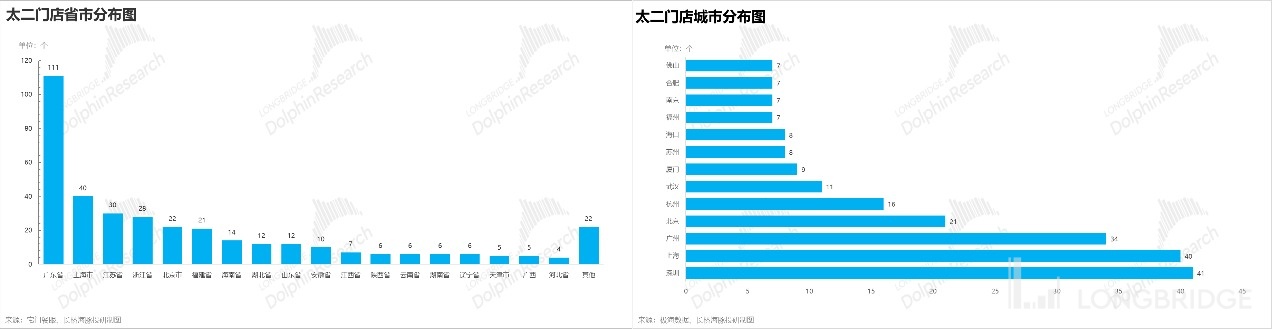

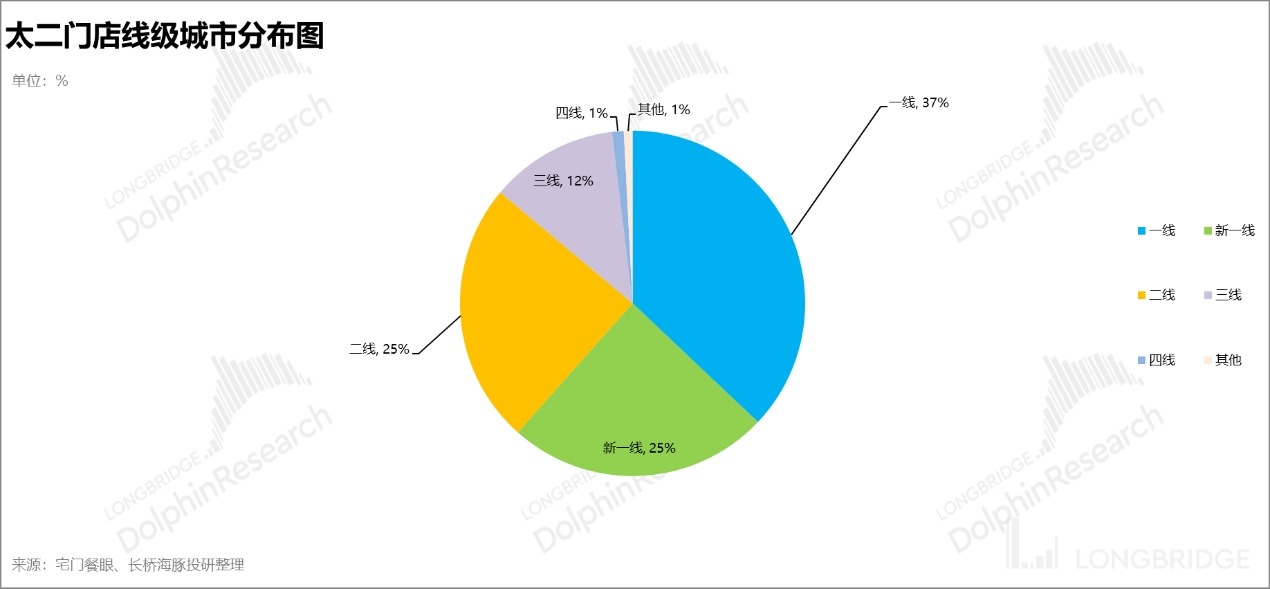

In addition, Dolphin referred to the data from Narrow Gate Restaurant Eye and sorted out the Tai'er stores as of June 2022: In the first half of the year, with high uncertainty in the anti-epidemic policies, Tai'er only opened 17 net new stores. The total number of stores is 367, and the proportion of stores in first-tier and new first-tier cities reached 62%. Guangdong and Shanghai have the most stores. It can be said that the performance in the first half of the year is not worth mentioning, after all, even dine-in service has not been opened in Shanghai until now (fortunately, it is said that dine-in service will gradually resume after June 29).

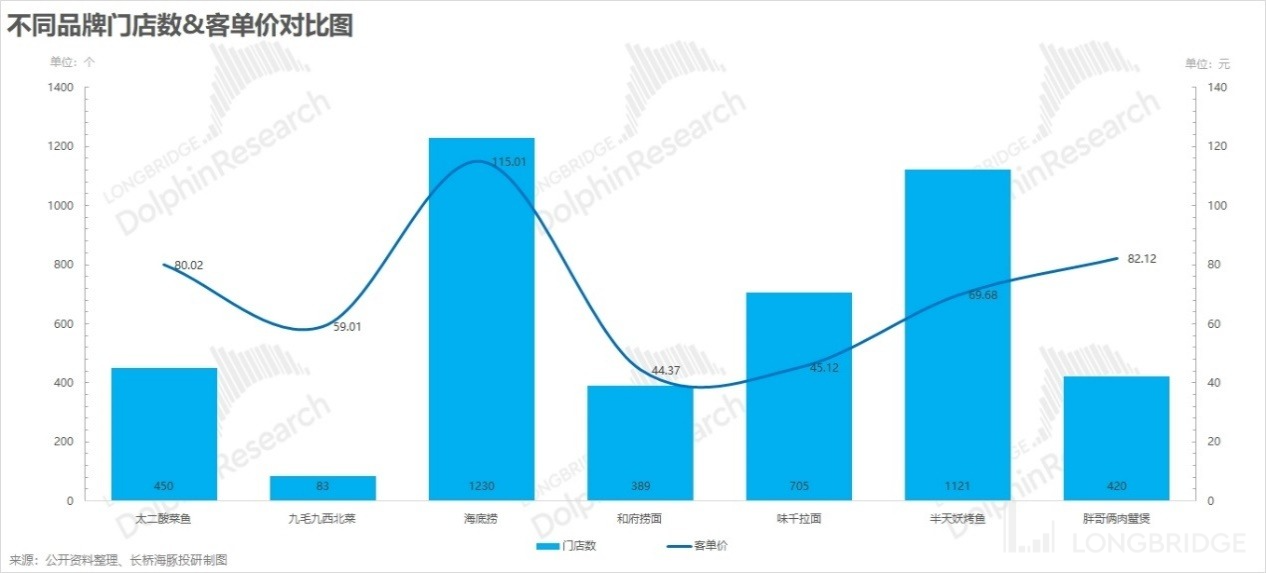

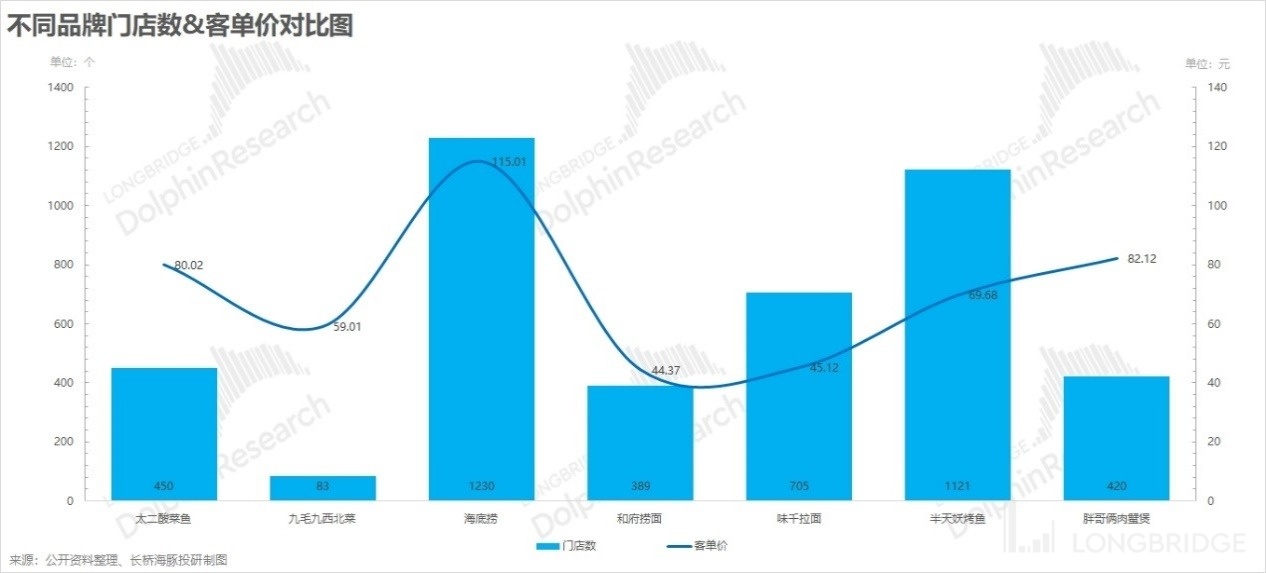

Compared with some similar chain restaurants that Dolphin has seen in terms of average customer spending or centralized kitchen model, the current number of stores is relatively low.

Calculation of future store space

Tai'er is currently in the stage of store expansion, focusing on shopping center scenes. At the same time, Tai'er's excellent single-store efficiency and profitability before the epidemic provide good support for expansion.

In order to determine the upper limit of Tai'er's store quantity, Dolphin has calculated the store space through two methods and referred to multiple public information. The final conclusion is that Tai'er's neutral to optimistic estimate is around 870 stores, and in a pessimistic scenario, it can reach around 700 stores. 1. Method 1: Store Expansion Strategy

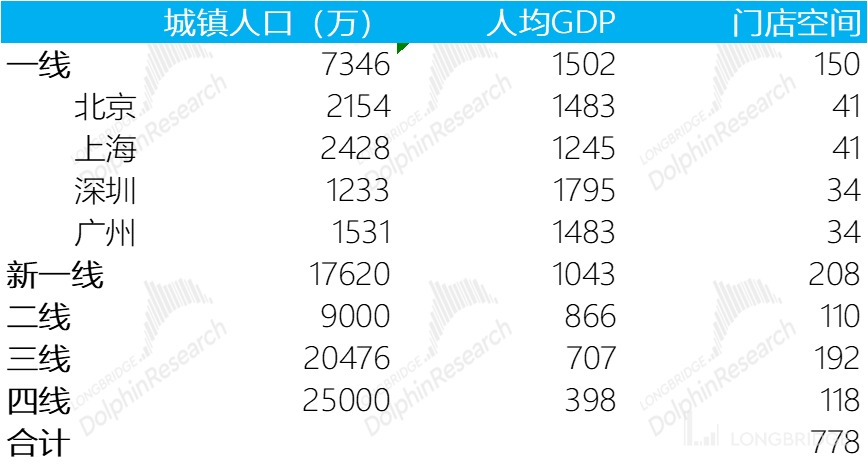

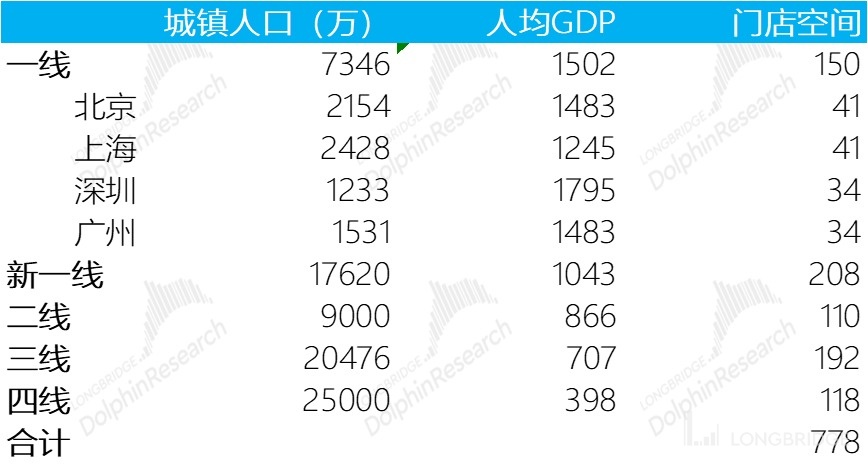

To begin with, let's analyze the store layout of Hai Di Lao, taking into consideration the current saturation level of their stores. We can use the population coverage and commercial center penetration rate of single stores in first-tier cities as a reference.

Next, we can adjust the penetration rate of different-tier cities based on the specific market segment and average customer spending of Tai Er (considering that hot pot has a broader audience and Hai Di Lao has higher brand recognition).

For first-tier cities, the penetration rate of Tai Er stores in shopping centers is similar to that of Hai Di Lao. However, when expanding to lower-tier cities, considering the higher popularity of hot pot compared to sour fish soup and the higher brand recognition of Hai Di Lao, we can lower the relative penetration rate of Tai Er stores. According to this method, the total number of Tai Er stores would be around 867.

2. Method 2: Benchmarking Guangzhou

In this method, we can use Guangzhou, the stronghold of Tai Er, as a sample city, and compare it with first-tier cities, new first-tier cities, and other lower-tier cities based on urban population and per capita GDP.

Considering that the number of Tai Er stores in Guangzhou has seen limited growth in the past two years and has reached a saturation point at 34 stores, we can assume that there won't be significant growth in the future.

Then, taking into account the service radius and average customer spending of Tai Er stores, we can estimate the potential market size of target cities by considering factors such as population density and consumer purchasing power.

According to this method, the reasonable number of stores would be around 778.

Additionally, from a qualitative perspective, Tai Er has the following advantages compared to its competitors when it comes to rapid store expansion while maintaining stability:

1) Standardized Production: Standardization reduces training costs and dependence on chefs, which is beneficial for store expansion.

The high degree of standardization in dish preparation allows Tai Er stores to operate with only 4-5 staff members in the kitchen. Specifically, the preparation process for sour fish soup involves slicing the fish, boiling the soup, adding ingredients, and pouring the oil. The entire process usually takes less than ten minutes, resulting in high efficiency.

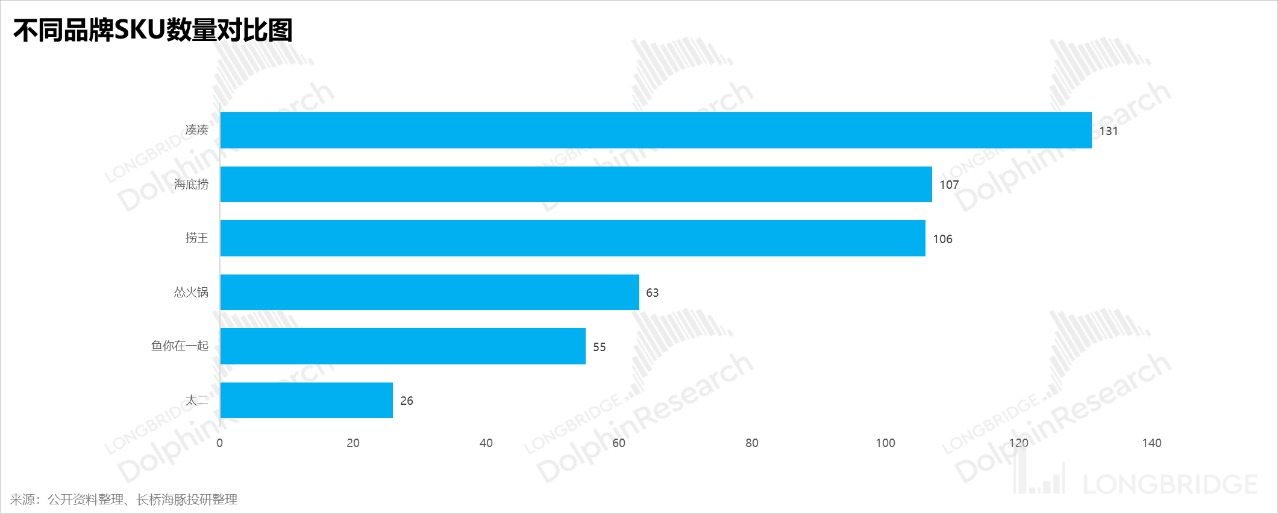

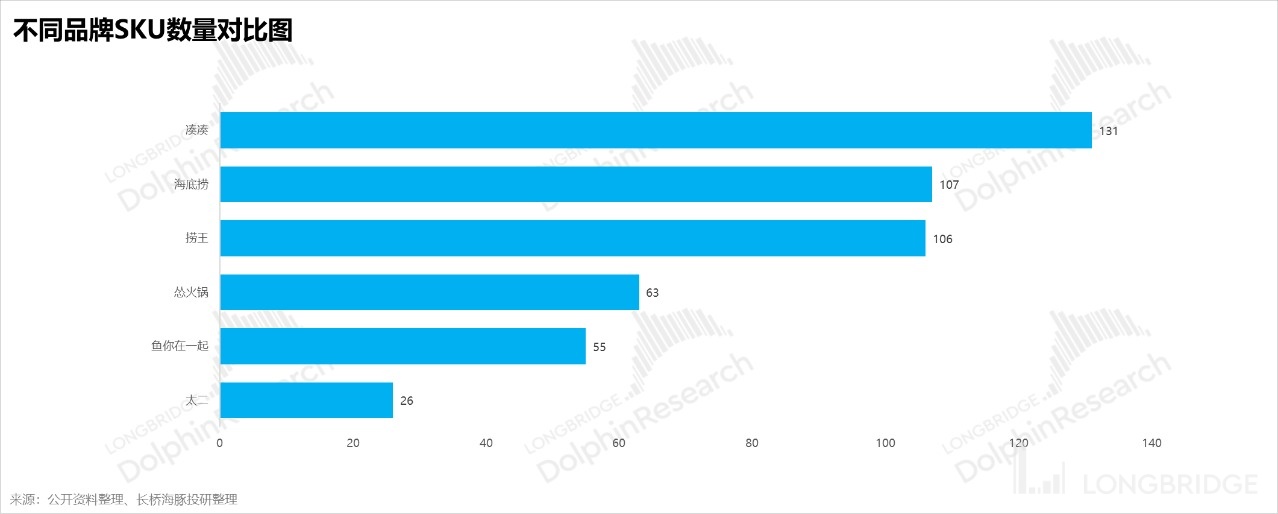

2) Streamlined SKU: Reducing the number of SKU (Stock Keeping Units) alleviates pressure on the supply chain and facilitates rapid expansion.

Tai Er stores offer only around 25 SKUs, with a core selection of one level of spiciness and one type of fish. In terms of portion size, they offer options for 2 people, 4 people, and a larger portion. The side dishes include 6 cold dishes, 6 beverages, 5 snacks, 3 noodle dishes, and 2 hot dishes. Therefore, Dolphin believes that having fewer SKUs reduces dependence on chefs, lowers the difficulty of supply chain management, ensures product stability, and supports store expansion.

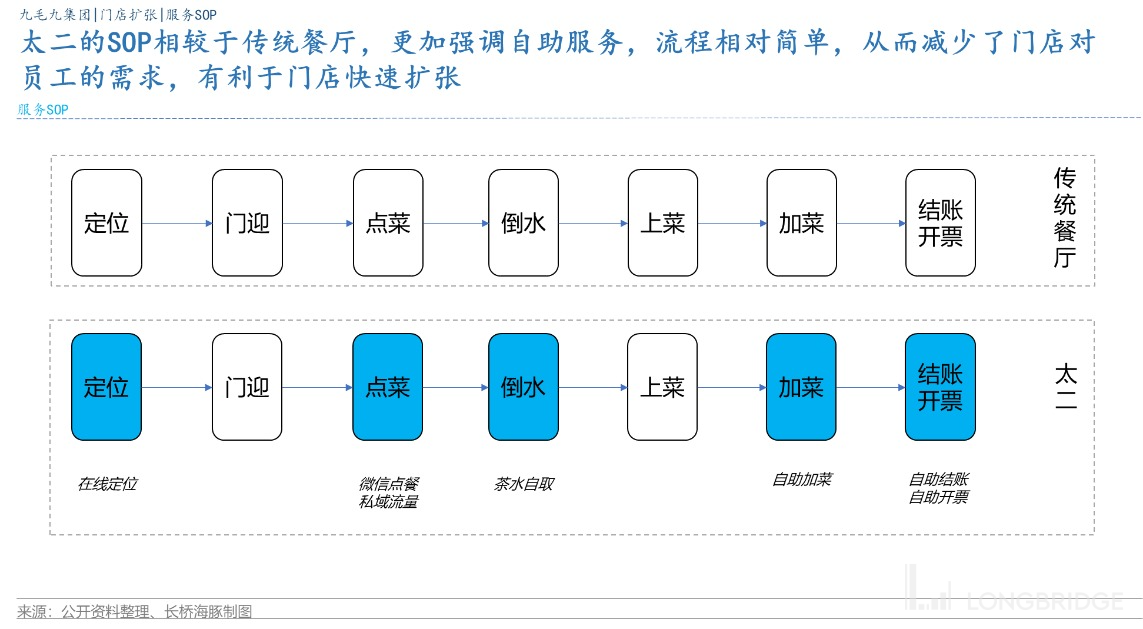

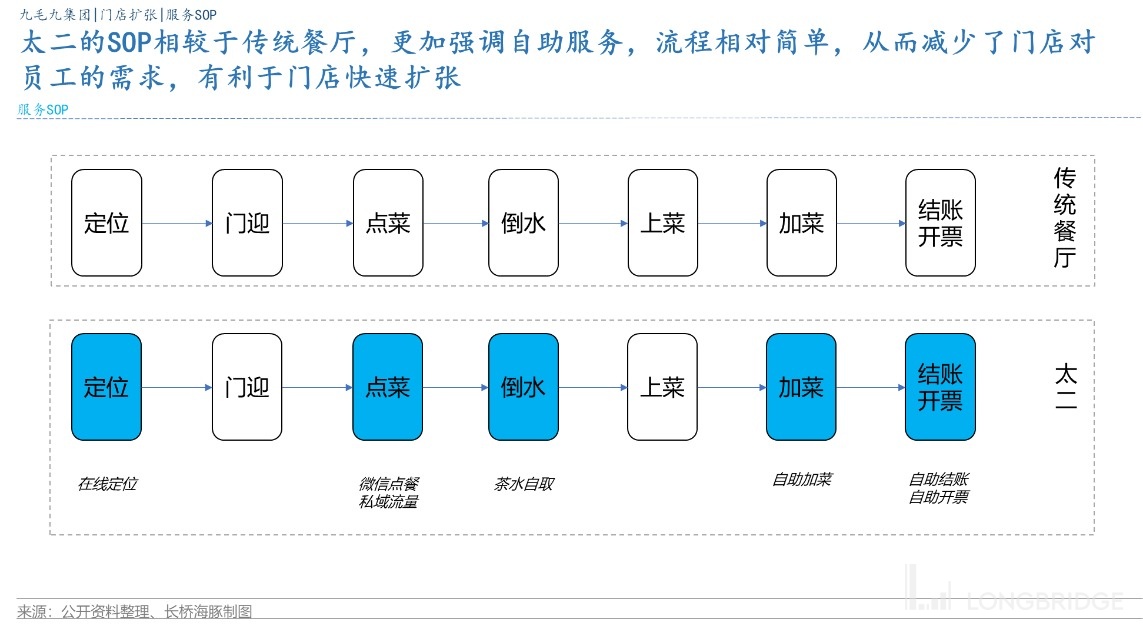

3). Service SOP: Actively guide diners to independently resolve their needs, reducing the demand for manpower and training during expansion.

3). Service SOP: Actively guide diners to independently resolve their needs, reducing the demand for manpower and training during expansion.

Dolphin believes that by analyzing Tai'er's service SOP, Tai'er has formed a closed loop of WeChat ordering and self-payment by abandoning reserved seating and strengthening self-service. The waiters only provide door greetings and serving, which greatly reduces the constraints of manpower on store expansion.

Summary:

Based on the third point, Dolphin takes the higher number of 870 stores as the saturation point for Tai'er, while the company's saturation store opening guideline is 1000 stores, and some sellers in the market even suggest 1200-1300 stores.

III. Valuation Space

In terms of valuation space, Dolphin calculates it from two dimensions: PE and DCF.

1. PE Valuation

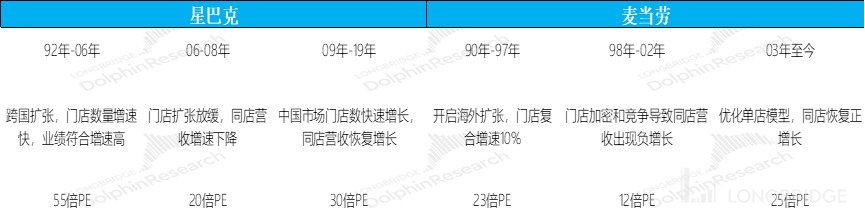

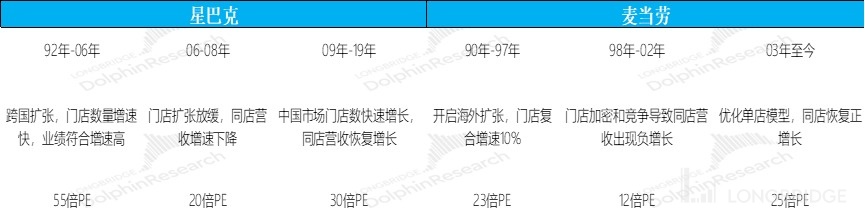

Let's start with PE: First, Dolphin needs to determine the PE valuation of Tai'er entering the mature stage.

In order to determine the PE valuation of Tai'er, Dolphin focuses on reviewing the valuations of Starbucks and McDonald's, and refers to the PE valuations of Xiabuxiabu, Haidilao, Parkson China, and Guangzhou Restaurant. Finally, Dolphin believes that the PE valuation of Tai'er after completing store layout in 2026 will remain at around 20 times.

a) Starbucks: Combining Starbucks' business situation, a review of Starbucks' PE valuation reveals that Starbucks' PE valuation can be roughly divided into three stages:

-

From 1992 to 2006, Starbucks expanded internationally, with an annualized store growth rate of 36.2% and a compound annual growth rate of about 52%. The PE valuation during this period was about 55 times.

-

From 2006 to 2008, the pace of store expansion slowed down, and at the same time, the growth rate of same-store revenue began to decline, with negative growth in 2007 and 2008. The PE valuation during this period was about 20 times.

-

From 2009 to 2019, the number of stores in the Chinese market grew rapidly, and same-store revenue recovered to single-digit growth. The PE valuation during this period was about 30 times.

b) McDonald's: Combining McDonald's business situation, a review of McDonald's PE valuation can be roughly divided into three stages:

-

From 1990 to 1997, McDonald's started overseas expansion, with a compound annual growth rate of stores of about 10%. The PE valuation during this period was about 23 times.

-

From 1998 to 2002, McDonald's was affected by the dual impact of store densification and competition, and same-store revenue experienced negative growth. The PE valuation during this period was about 12 times.

-

From 2003 to 2019, McDonald's continued to expand its store network in China, and same-store revenue maintained steady growth. The PE valuation during this period was about 20 times.

-

Since 2003, McDonald's has reduced the speed of store expansion, optimized the single-store model, and seen a recovery in same-store sales growth. The valuation during this period is estimated to be around 25 times.

Now let's take a look at Tai'er:

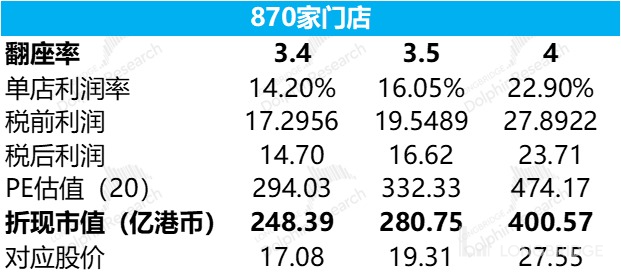

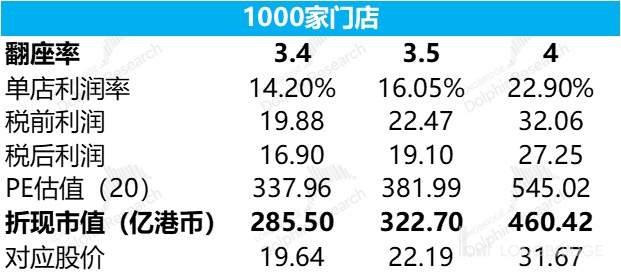

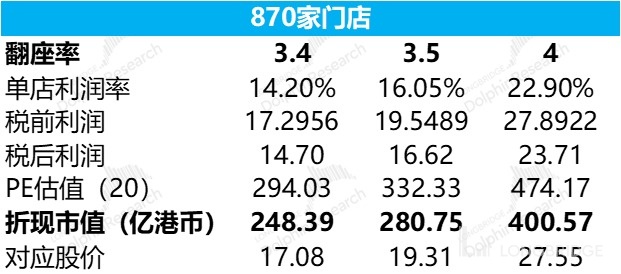

Based on the sensitivity calculation of occupancy rate and the estimation of store space, Tai'er is expected to complete the expansion of approximately 870 stores in 2026 and enter the mature stage. Then, using the determined mature stage PE ratio of 20 times, the market value of 2026 is calculated. Finally, discounting the market value at a rate of 10% to the present, the specific results are as follows:

Note: The PE valuation does not take into account the future success of other brands, such as the case of Sōng Hotpot. Here, the Dolphin sees it more as an upward option, and the value will be calculated seriously when it truly succeeds.

Combining Tai'er's store expansion plan and calculation results, the Dolphin believes that the current market valuation of Jiǔ Máo Jiǔ is based on Tai'er's low turnover rate and normal store expansion, which is a turnover rate of 3.5 and a valuation of HKD 32.27 billion based on 1,000 stores.

If the negative impact of the epidemic is alleviated, it is estimated that the valuation will be further increased. For example, if the turnover rate can recover to around 4.0, based on 1,000 stores, Tai'er's valuation can reach HKD 46.042 billion. Therefore, the Dolphin believes that Jiǔ Máo Jiǔ's opportunity lies in the alleviation of the epidemic, relying on the stomachs of young diners to save it, but at the same time, it is also necessary to be vigilant about the risk of store expansion not meeting expectations.

However, the Dolphin has a different view on store space. The Dolphin believes that the store space should be around 870 stores, with an estimated turnover rate of close to 4.0 and a valuation of approximately HKD 40 billion.

Regarding valuation, the Dolphin would like to elaborate here. It must be said that dining brands in the middle stage of store expansion have a relatively high level of certainty, mainly for the following two reasons: 1) After accumulating sufficient brand potential, it is relatively easy to attract customers when expanding into new markets, and it is also conducive to securing better store locations; 2) Once diners recognize a dining brand, their taste preferences will not change significantly in the short term, and positive word-of-mouth will facilitate store expansion.

The Dolphin believes that Jiǔ Máo Jiǔ is likely to enjoy the "Davis Double-Click" effect in the first half of the store expansion period, but caution is needed for the possibility of a "Double Kill" in the second half.

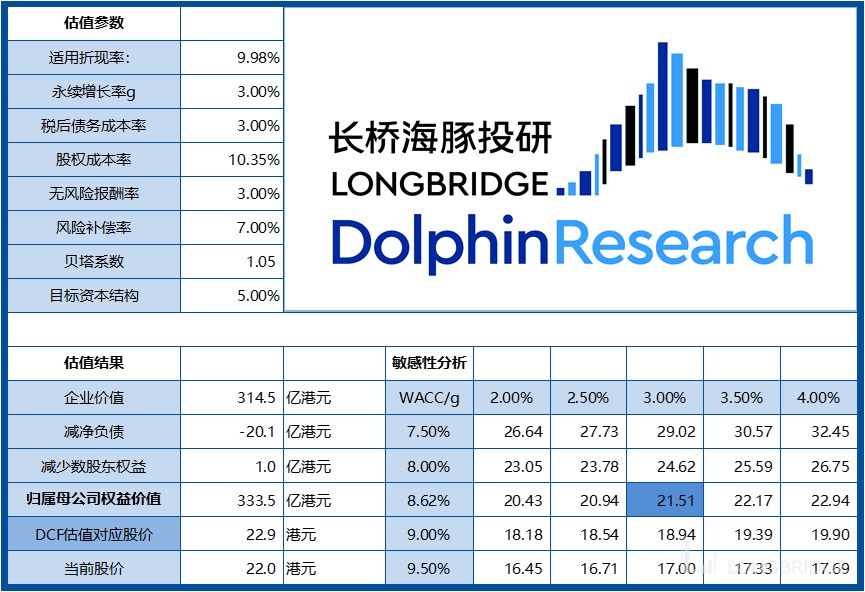

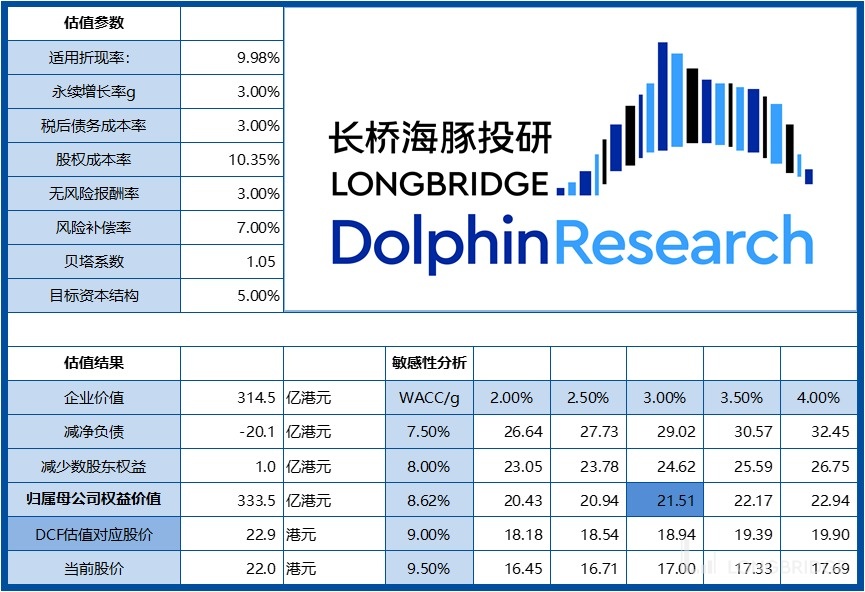

- DCF Valuation

Since high turnover rate usually corresponds to high store expansion and high PE ratio in the catering industry, and this trend usually lacks long-term sustainability, after opening many stores, it is highly likely that the turnover rate will decline and there will be a period of store adjustment, which will discount the reliability of the DCF valuation model for future sustainable and stable cash flow. If the final number of stores calculated by Dolphin is 800+ and the turnover rate is 4 times, with a perpetual growth rate of 3% and a discount rate of 10%, the corresponding price should be HKD 21.51.

The DCF mentioned here refers to the valuation of packaged assets, which includes the valuation of 80 Dolphin stores and a turnover rate of 2.4, as well as the valuation of 20 Longbridge stores and a turnover rate of 3.5 (without considering the success of Longbridge Hotpot).

The continuous rise in stock prices in the past few days has reduced the potential for further increases. However, if the epidemic improves in the future and Longbridge expands its stores and resumes normal operations, there will still be room for valuation to increase. Everyone can also pay attention to the situation of Longbridge.

Dolphin Research Report: "Jiu Mao Jiu" Historical Report

June 23, 2022 - "Jiu Mao Jiu: The Method of Raising a Big Fat Fish"

Risk disclosure and statement for this article: Dolphin Research Disclaimer and General Disclosure