【Dolphin Analyst】Panel Industry Information Express - Han's Exit Accelerates, Foreign Capital Joins JD.com in Investing.

1. Industry Perspective: Panel Capacity Accelerated Clearance Amid Plummeting Cash Costs.

Korean manufacturers have gradually stopped/withdrawing from LCD business. 1) According to Korean media reports, Samsung has officially announced to abandon its LCD panel business. Samsung closed its last operating LCD panel production line for liquid crystal displays in June. Since Samsung's display and chip packaging businesses belong to the same device solutions department under Samsung, Samsung transferred its LCD panel factory employees to chip packaging business department; 2) LG Display stated during its earnings conference call on July 27th that the LCD panel department, judged as a differentiated space (business), is reducing its scale. LG decided to shut down domestic production lines in Korea and only temporarily keep the factory in China.

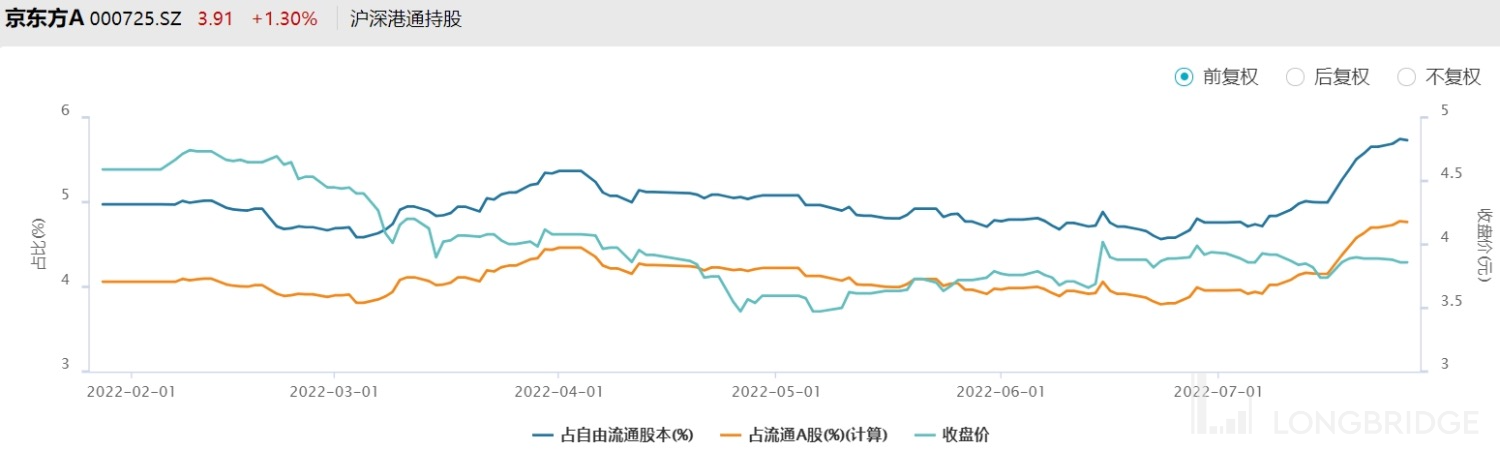

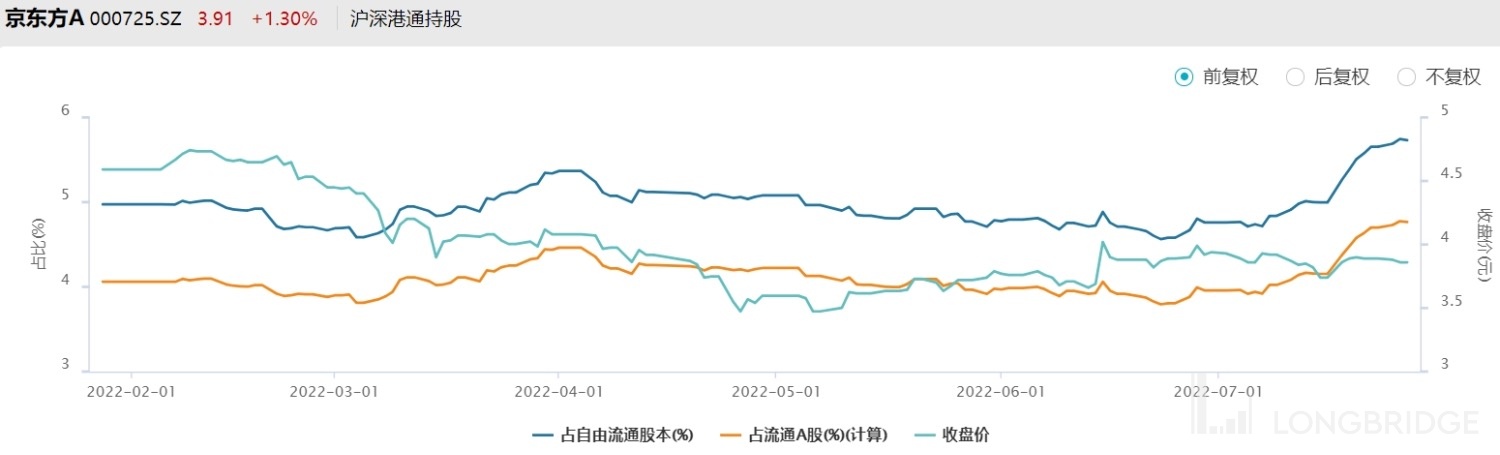

2. Finance perspective: Foreign capital begins to boost $BOE A.SZ

As the panel breaks through the cash cost, the industry is accelerating bottoming out, and northbound capital is beginning to boost the panel leader. In the past month, northbound capital has gradually increased its holdings in BOE. The proportion of Shanghai-Hong Kong Stock Connect's shareholding in the free float shares has increased from the low point on June 23rd of 4.56% to 5.73% so far, an increase of more than one percentage point in a month.

Dolphin Analyst believes: As panel prices continue to decline and Samsung & LG withdraw from production, the supply-demand relationship is expected to change, and panel prices may bottom out faster than the market expected. It is true that the performance of the panel giants will remain low in Q2 & Q3, but signs of hitting bottom may be seen in the second half of this year. For specific detailed opinions, please read Dolphin Analyst's recent report.

Dolphin Analyst's Latest Panel Industry Report

BOE Valuation Report on July 26, 2022: "360° Comprehensive Analysis of BOE: Why Short-Term Buried Hazards Do Not Affect Long-Term Value?"

In-Depth Report on July 5, 2022: "From Double "Giants" to Double "Bears": Is the Cycle of BOE and TCL Over?"

Panel Industry Comment on June 15, 2022: "Panel Giants, Both Enclosed"

Panel Industry Hotspot on July 21, 2021: "[The Panel Cycle Peaks, No Bottom to Buy](https://longbridgeapp.com/topics/948161?"invite-code=032064)》

Risk Disclosure and Statement for this article: Dolphin Disclaimer and General Disclosure