The ideal lightning has a loud sound, L9 cannot support the "collapsed ideal"

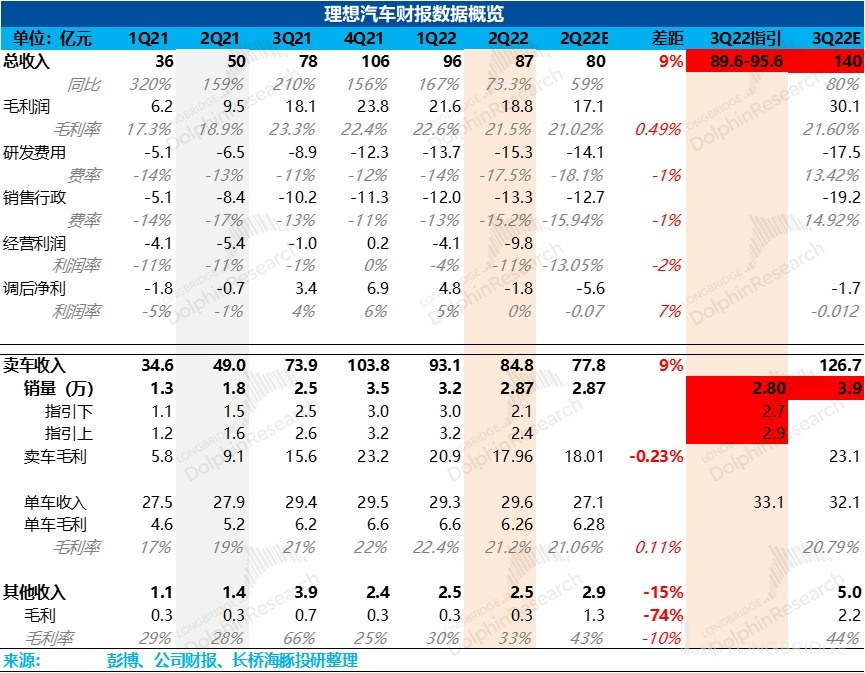

$ Ideal car-W.HK released its second quarter financial report after-hours in Longbridge on the evening of August 15th, Beijing time, before the opening of the U.S. stock market. Dolphin Analyst expected a profit that exceeded expectations, but the company unexpectedly hit a big snag:

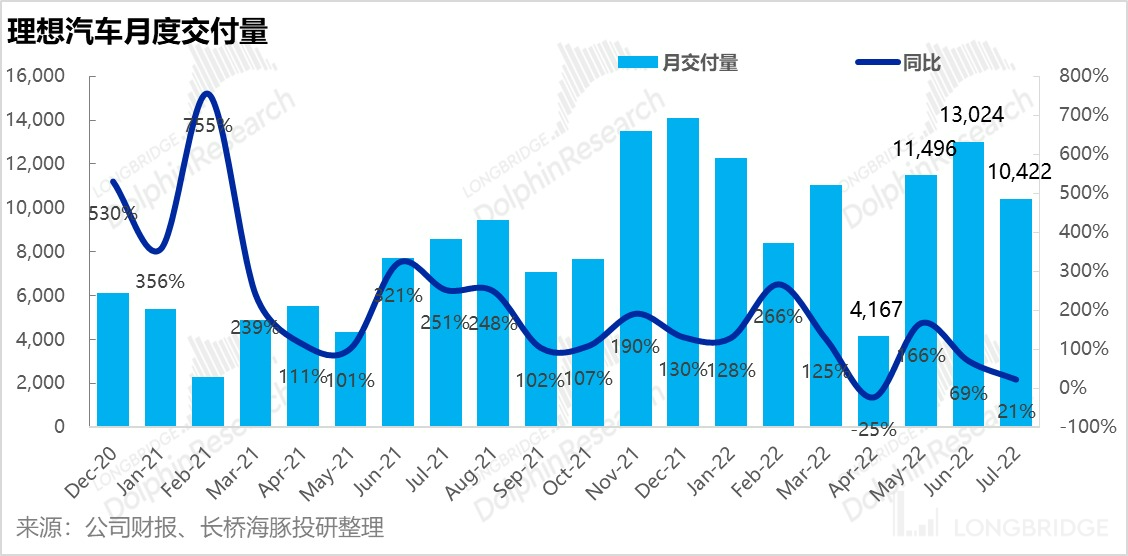

1. The third quarter guidance for car sales is 27,000 to 29,000 units, and more than 10,000 units have already been delivered in July. Even if calculated according to the highest guidance of 29,000 units, the delivery volume in August and September would barely exceed 9,000 units. When the market had become accustomed to Ideal delivering more than 10,000 units per month, the guidance missed expectations by a full 10,000 units, this deviation will make Ideal's market performance worse.

It is important to note that Ideal's stock price was priced too early based on future performance, and stock price can only be verified by monthly delivery data. The market was already dissatisfied with the July delivery, and the guidance for delivery in August and September was even worse, which shook the market faith.

2. The effect of the sales guidance miss: The third-quarter revenue guidance is only 8.96 billion to 9.56 billion, which is nearly 5 billion yuan lower than the market expectation, and for a company whose 97% of revenue comes from selling cars, if sales guidance falters, revenue wouldn't perform well either.

3. Is Ideal ONE outdated? Combining the Company's Data for L9 and the gap in market expectations, as well as the company's statement that L9's supply chain is more stable, the real problem in the third quarter may have been Ideal ONE's sales lagging behind. Whether it is the competition between ONE and L9 or the multitude of flagship models released this year, which has stifled the competition of Ideal, the sales expectations of Ideal are not good, with neither model holding their own, and this is a serious problem.

4. The weakness in guidance does not seem to be a supply problem: Previously, media reported that the operating Changzhou factory has a production target of 180,000 units in 2022, and the Dolphin conservatively estimates a delivery of 150,000 units to be possible.

In the first half of the year, the company delivered over 60,000 vehicles. Assuming that 30,000 units would be delivered in the third quarter, the production capacity would be sufficient for Ideal to deliver 60,000 units in the fourth quarter. However, from the third quarter guidance, it seems that the target of selling 20,000 units per month in the fourth quarter will be difficult to achieve, which means that production capacity is not the problem.

5. The second quarter's over-expectations are no longer important: Stock price lives in the future business performance, therefore, the market's attention is already mostly focused on the third quarter's performance rather than the second quarter. However, the actual second-quarter performance was quite good.

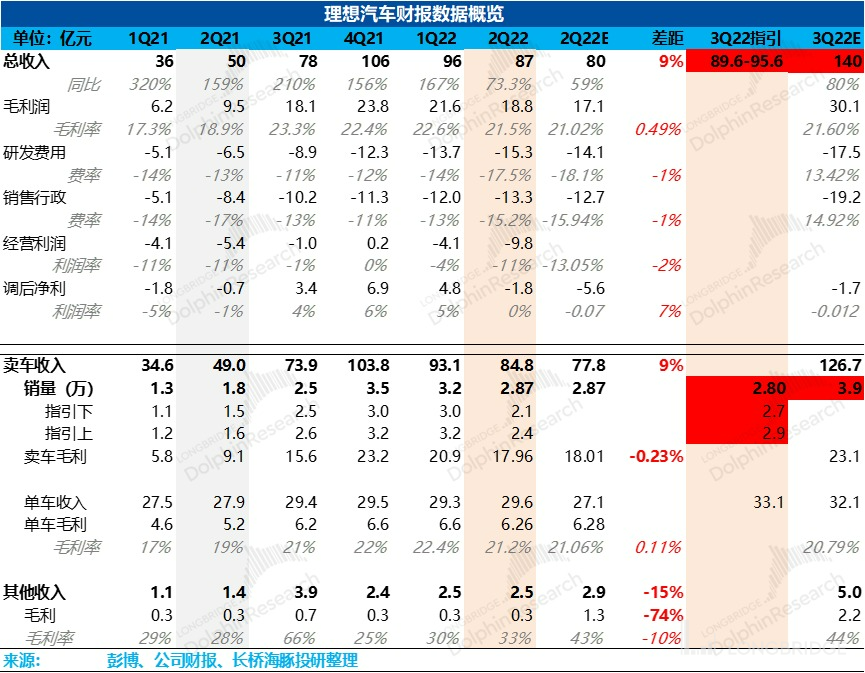

a. The price increase offset some of the pressure on material cost increases, and the revenue per vehicle was 2,200 yuan higher than the previous quarter, with second-quarter revenue performance being 7 billion yuan higher than the market expectation, actual revenue is 87 billion yuan;

b. As the revenue per vehicle was higher than expected, Ideal's net loss in the second quarter, excluding its equity incentive plan, was less than 200 million yuan, whereas the market had expected a net loss of nearly 600 million yuan.

Overall point of view: Ideal Auto.US has always been the most capable new force in car-making, but in the age where sales determine valuation, as long as there is sufficient cash flow, profitability is only an added bonus. However, this quarter, when Ideal's sales guidance was questioned, especially when the guidance pointed more towards demand rather than supply issues, Ideal's sales issue became more worrying.

Overall point of view: Ideal Auto.US has always been the most capable new force in car-making, but in the age where sales determine valuation, as long as there is sufficient cash flow, profitability is only an added bonus. However, this quarter, when Ideal's sales guidance was questioned, especially when the guidance pointed more towards demand rather than supply issues, Ideal's sales issue became more worrying.

Especially in China's new energy vehicle market, after two or three years of rapid new players, this year, various companies have begun to compete with flagship models. For new forces like Ideal, transitioning from an early-mover advantage to a long-term advantage seems like an extraordinarily difficult obstacle, and perhaps it is the second major challenge for Ideal as a new force in car-making.

The question now is, after the pandemic and the launch of new cars, why has Ideal's sales outlook shrunk? We will need to listen to the company's conference call to get more information on this point. The Dolphin Analyst will search for and put together incremental information from the call, please stay tuned.

The Dolphin Analyst will subsequently share a summary of the conference call with Longbridge users through the Longbridge App, and interested users are welcome to join the Dolphin Investment Research Group by adding the WeChat ID "dolphinR123" to get the conference call summary in real-time.

The following is a detailed analysis:

I. Sales guidance crisis: Is Ideal ONE outdated? Is L9 faltering? How long can Ideal's popular marketing strategy last?

After some extensive digging, the Dolphin Analyst has found that Ideal's Q2 results were flawless, and all problems came from Ideal's performance evaluation in the third quarter.

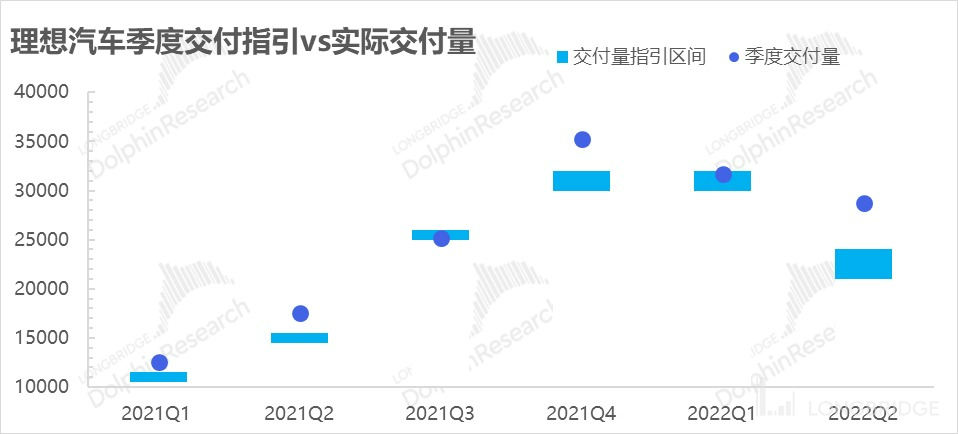

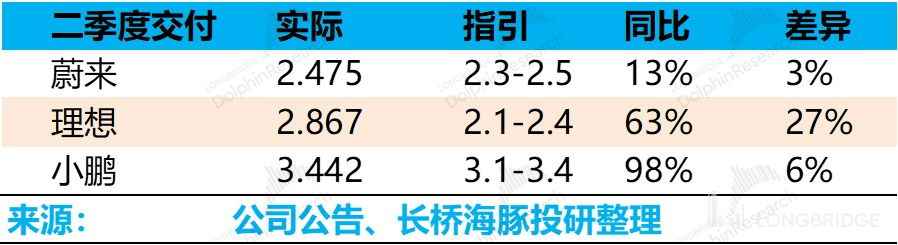

Unfortunately, as a new brand that is closely watched by the stock market in terms of auto sales, Ideal's sales guidance for Q3 this year was only 27,000 to 29,000 units, which is a far cry from the market estimate of 39,000 units.

Let's take a look at the recent storylines:

(1) Ideal released the L9, and product and delivery details can be found by clicking here. After that, the product was in high demand, and the stock price rose sharply, and Ideal leveraged this opportunity to raise funds.

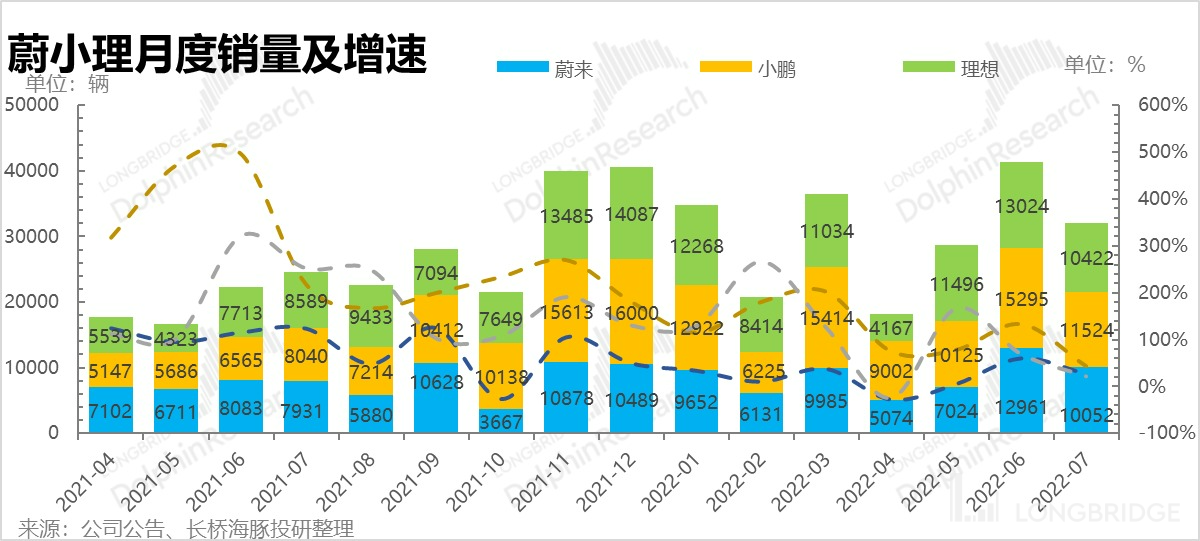

(2) Shortly after that, Ideal's sales fell by 20% in July, based on the 13,000 units sold in June, just barely reaching 10,000 units, and the stock price fell all the way.

(3) Although Ideal ONE's sales declined, Ideal painted a picture of the great supply and demand scene for the new car L9:

a. Starting from the end of August, the newly released L9 will start delivering, with a monthly delivery volume of over ten thousand units starting from September. As of August 1st, there have been 50,000 orders for the L9, of which more than 30,000 are large deposits that are not refundable.

b. The supply of new vehicles is better guaranteed: the supply chain situation for the L9 has improved a lot compared to the ONE, and many key supplies use a vertically integrated "joint venture" approach: the L9 car engine is provided by Sichuan Xinchen Power (51% equity ownership), the battery is provided by a joint venture with CATL, and the five-in-one power system is provided by a joint venture with HC (49% equity ownership).

(4) Fatal Bug: Will the new and old models cannibalize each other in the light of the fierce competition?

The sales guidance for Q3 is currently 27,000 to 29,000 vehicles, implying an average monthly sales of less than 9,000 vehicles for August and September, which is below the ten thousand mark.

It's time to solve the mystery: Ideal has already stated that the supply of the L9 is more guaranteed, and there are already over 30,000 definite orders for the L9, which started delivering at the end of August. Ideal also stated that once the L9 is delivered, the monthly sales will surpass ten thousand. Therefore, is it reasonable to speculate that:

a. The sales expectations for the Ideal ONE were very low in August. If 10,000 L9s are delivered in September, the Ideal ONE can only deliver less than 9,000 vehicles in the two months of August and September combined?

Note: This is probably not a capacity issue, because the Changzhou factory's production capacity for the Ideal ONE is 15,000 vehicles per month. Furthermore, recent visits to Ideal’s stores have shown that the delivery time for the ONE has been greatly reduced and cars can be delivered within a month.

b. The demand for the L9 in the market is not high, as market expectations are that two cars can compete better than one. However, after the new car was launched, sales were even worse than before.

Of course, it is also reasonable to question: July and August may have been the transitional period for Ideal, as the new cars can only be mass delivered in September. The weather in July and August was too hot, which affected the car-buying pace due to decreased in-store traffic.

But in reality, other new energy car startups such as Leapmotor and NIO exceeded expectations and have set new records. Is it possible that Chinese new energy car players, after investing in the capital market for several years, have now entered the "flower blooming" and "fierce competition" era, with various flagship models vying for attention?

In other words, competition is intensifying (In the case of the L9, the pre-order volume was similarly high when the competing product Huawei Wanjie M7 was launched). And the advantage of being ahead for Ideal is slowly disappearing. The next step is likely to be the era of intense competition for new energy car companies.

II. The accompanying effect of the sales guidance collapse: The income guidance is far below expectations

The current income of new energy vehicles depends entirely on car sales. When car sales fall below expectations, income guidance is also significantly lower than expected, which is just an accompanying problem.

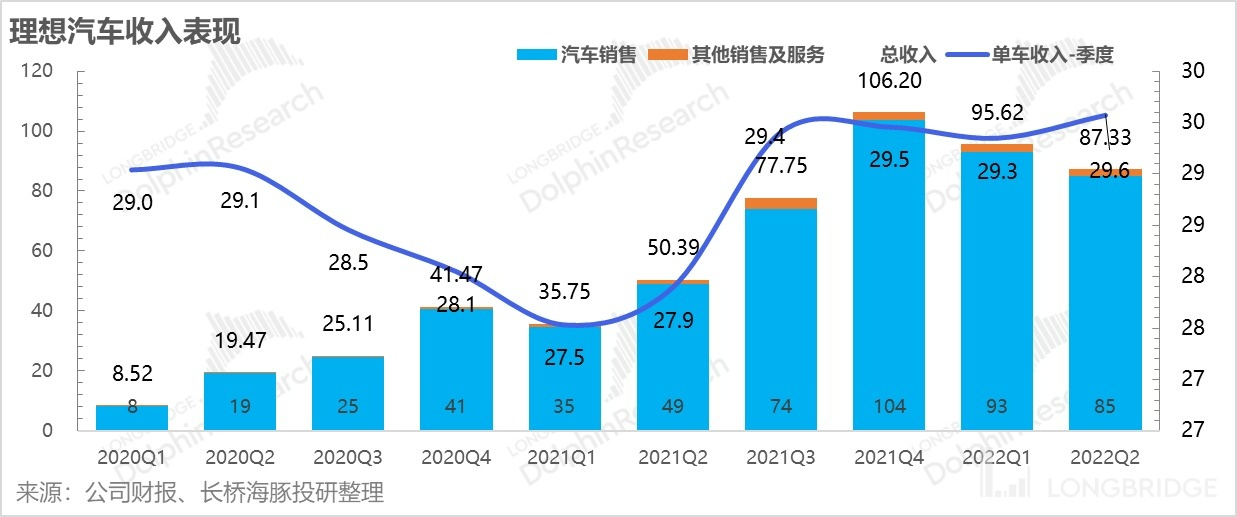

Ideal has given itself revenue guidance of 8.96 to 9.56 billion yuan for Q3, while the market expects up to 14 billion yuan, which is almost a difference of 5 billion yuan. Judging from the difference between the guidance and the market expectations, the main reason is that the sales of the Ideal ONE are behind schedule because the single vehicle's price is higher, and the starting price of the L9 is 460,000 yuan, which is higher than that of the Ideal ONE.

Three. After the Shrinking Guidance, How to Achieve the 2022 Delivery Expectations?

Dolphin Analyst originally gave an expected sales volume of 150,000 for the whole year. Based on the estimated volume of nearly 100,000 in the second half of the year, I noticed that many market expectations have given volume predictions of around 100,000 for the second half of the year, with around 40,000 vehicles in the third quarter and 60,000 vehicles in the fourth quarter.

Now, the company's direct guidance for the third quarter is less than 30,000 vehicles.

Even if the ideal can exceed its guidance for the majority of the time, the guidance this time is too low. Even if it does exceed, it is still difficult to catch up with the market's close to 40,000 vehicles guidance.

Looking at it from the perspective of production capacity, the company's current productive factory is Changzhou factory, which has an annual production capacity of 100,000 vehicles. Phase II is currently under expansion, and the annual production capacity will reach 200,000 vehicles after completion. According to the person in charge of the Changzhou base, the production target of Changzhou plant in 2022 is 180,000 vehicles. Based on the delivery in the second quarter, it should be no problem to achieve the delivery volume of 150,000 vehicles per year through overtime.

The company has delivered over 60,000 vehicles in the first half of the year. Assuming a delivery of 30,000 in the third quarter, the production capacity can deliver 60,000 vehicles in the fourth quarter.

But there seems to be a problem with ideal ONE's sales volume behind the third quarter's guidance, and the new car is still out of favor. It is difficult to achieve a monthly sales volume of 20,000 in the fourth quarter. In other words, depending solely on Changzhou's production capacity is enough.

In terms of planning, Ideal still has two planned factories:

(1) Beijing factory: Ideal acquired Beijing Hyundai's Beijing factory in 2021, and plans to start production at the end of 2023. The annual production capacity of phase one is 100,000 vehicles, used to produce pure electric vehicle models;

(2) Chongqing factory: In 2022, the company will build a Chongqing manufacturing base in Liangjiang New Area in Chongqing, and the official production time is yet to be determined.

Therefore, it seems that the problem is not on the supply side, but more on the demand side from the perspective of production capacity planning and the supply chain security of Ideal L9.

As for the sales outlook after the outbreak and the new car release, the sales expectation seems to have decreased. More explanations still need to be heard from the company at the conference call. We will look for incremental information from the conference call and organize it later.

For an industry with a significantly pre-evaluated valuation like new energy vehicles, when the guidance is not good, whether the quarterly performance is good or not is not so important.

However, if we take a closer look at Ideal's performance in the second quarter, it is actually very good. Whether in terms of revenue or gross profit, it is obvious that sales volume is still the key.

Four. Q2: Sales Support, Price Increases, and Ideal Revenue Looks Good

Ideal's sales guidance for the second quarter was still cautious during the Shanghai lockdown period. After the epidemic, the company worked overtime and delivered far more than the original guidance.

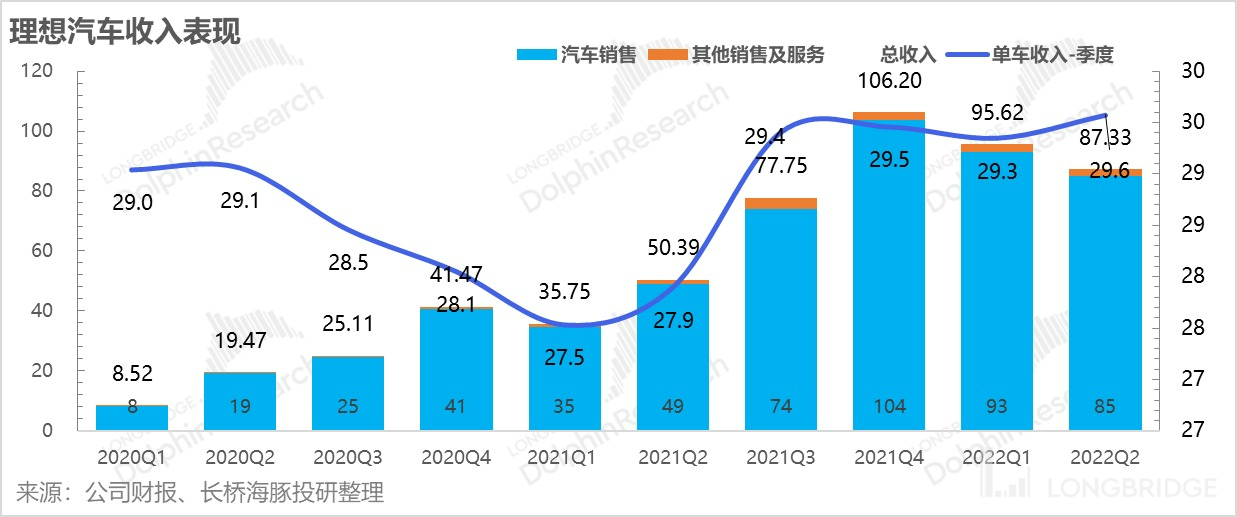

As the monthly sales figures have been announced, the market has long been aware that Ideal's Q2 revenue of 8.7 billion exceeded market expectations by 700 million, mainly due to the contribution of bicycle prices.

Average bicycle price:

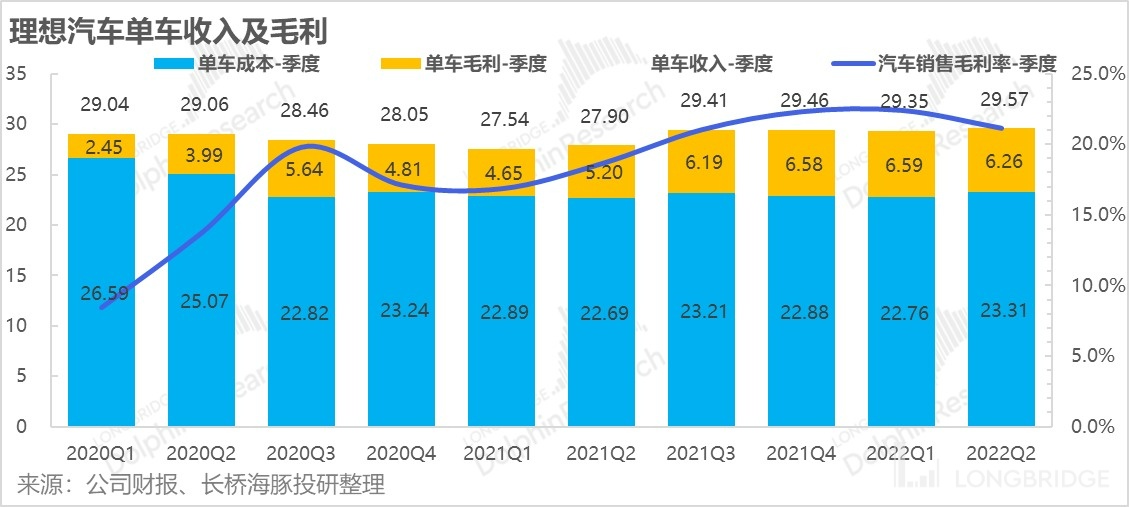

Ideal's Q2 bicycle revenue was 296,000 yuan, which is 2,200 yuan higher than the previous quarter. On March 23, 2022, the national unified retail price of the Ideal One was raised from the current 338,000 yuan to 349,800 yuan, an increase of 118,000 yuan (effective from April 1, 2022). And the company's overall bicycle revenue is almost certain to rise, with the L9 starting price at 460,000 yuan.

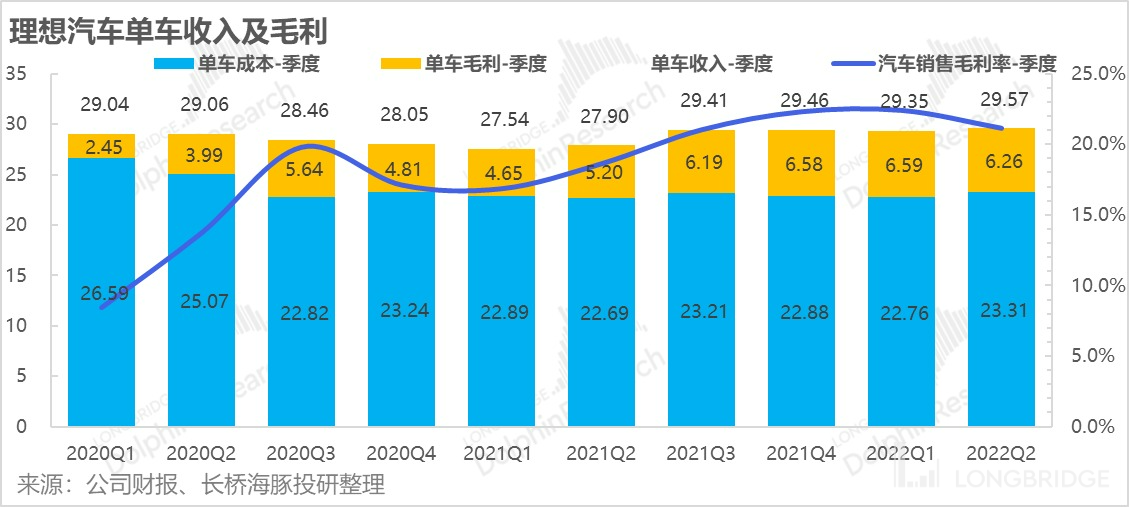

4. Under the pressure of the epidemic, bicycle profitability has held up

In Q2 2022, the company's automobile sales gross margin was 21.2%, and the overall gross margin was 21.5%, both better than market expectations. According to Dolphin's calculation, the company's Q2 bicycle price was 295,700 yuan, an increase of 2,200 yuan from the previous quarter. The bicycle cost was 233,100 yuan, an increase of 5,500 yuan. Finally, the bicycle gross profit was 62,600 yuan, which is 3,200 yuan less than before.

If the automobile cost is divided into fixed costs mainly amortization and depreciation, and variable costs mainly based on materials, the 3,200 yuan less profit should be related to the small quarter-on-quarter decline in sales and the increase in battery material costs. Of course, the Ideal One is also raising prices, but the extent of the increase may not cover the rise in material costs.

However, from the perspective of expectations difference, due to the epidemic, the market did not hold unrealistic expectations for Q2 gross profit, but the results were not bad, and the bicycle gross profit exceeded the market expectations by 0.11 percentage points.

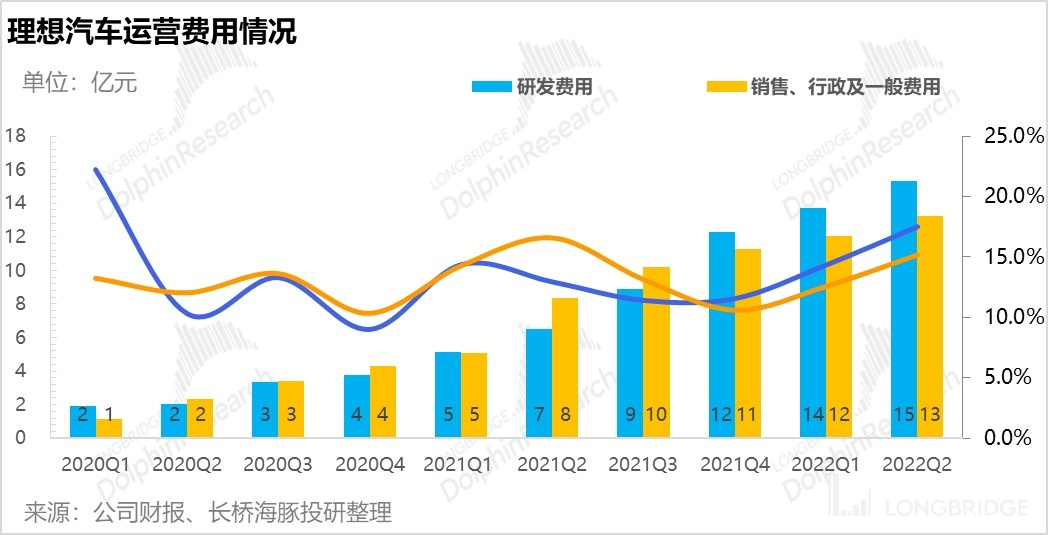

5. Overall controllable expense performance

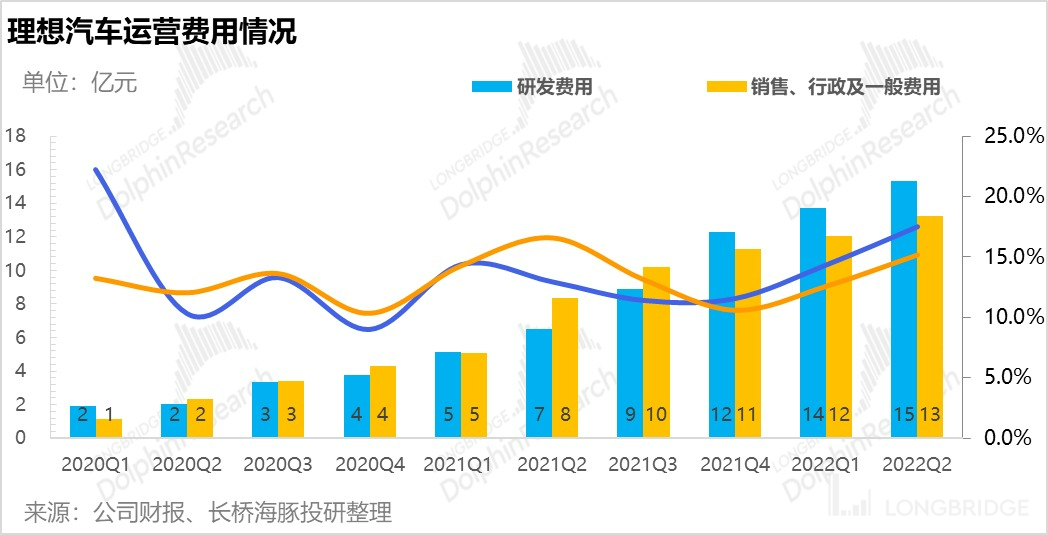

(1) As a company with only one type of car, the main internal expenses that Ideal earns are research and development investment, aimed at enhancing the certainty of later product lines.

Ideal's R&D guidance for the full year of 2022 is 6-7 billion yuan, which spent 1.53 billion yuan in Q2, and the expense ratio was 17.5%, which increased compared to the previous quarters. However, now that the R&D investment guidance for 2022 of 6-7 billion yuan needs to control the expense ratio, only by increasing revenue can this be achieved.

According to the company's plan, three new cars, including the first pure electric car, will be launched in 2023, and there are too many places to invest in, such as promoting high voltage fast charging and investing in the development of 4C charging batteries, etc. (2) The investment in sales and administrative expenses was RMB1.33 billion, with an expense ratio of 15.2%, and the overall situation was basically controllable.

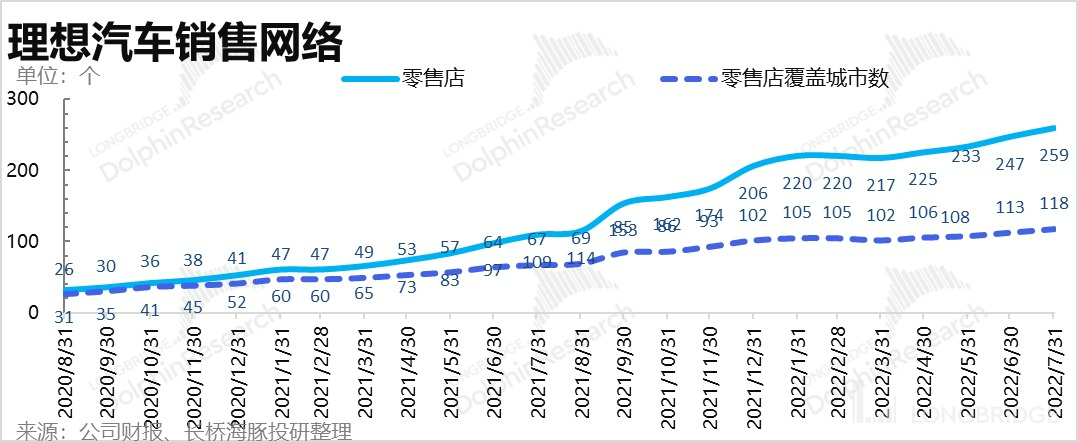

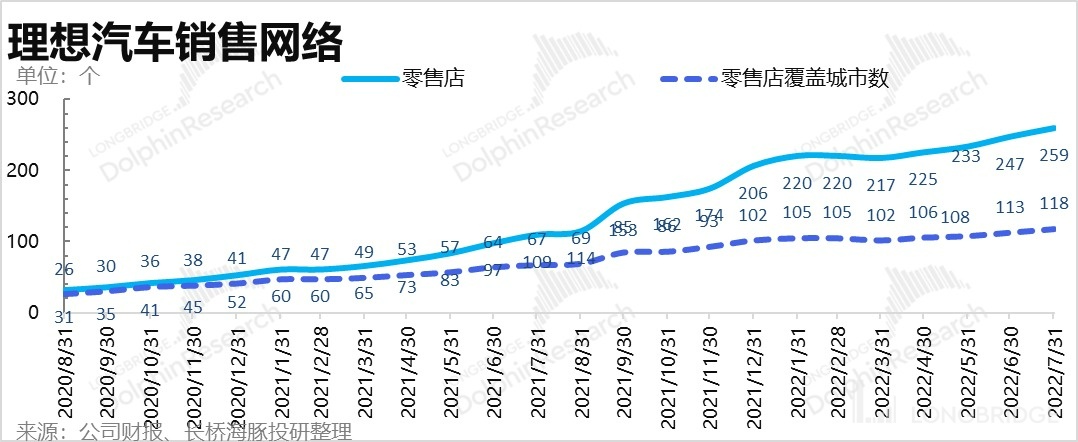

As of the end of July 2022, the company has 259 retail stores covering 118 cities. In the first half of the year, due to the slow pace of new store openings during the Chinese New Year in the first quarter, and the fact that store openings did not pick up significantly in the second quarter due to the pandemic, the number of new stores opened at the end of July still fell short of the target of 400 set for 2022.

VI. Despite losing, it is still the "most frugal" new force

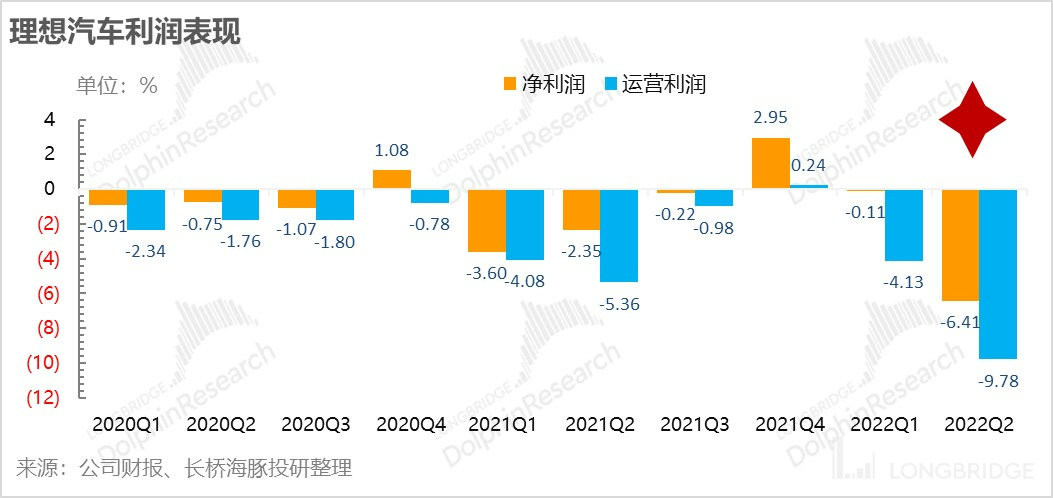

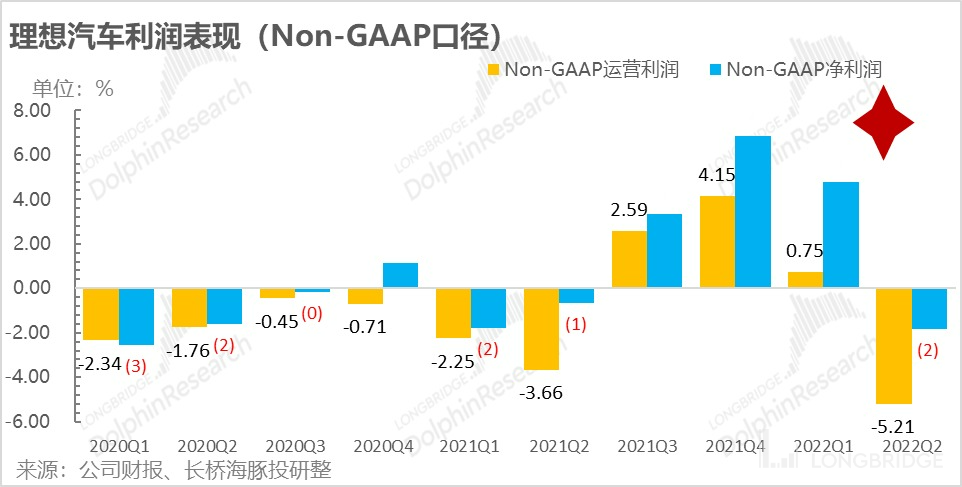

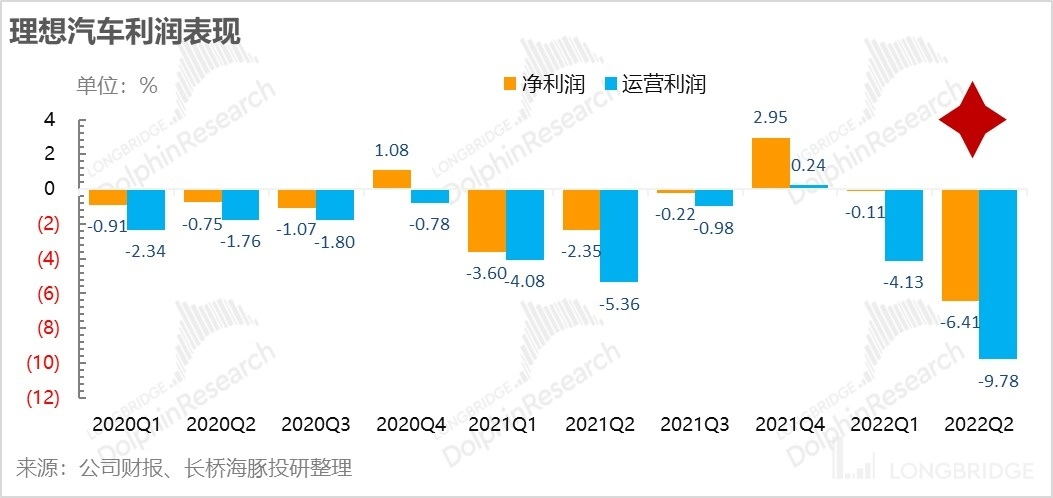

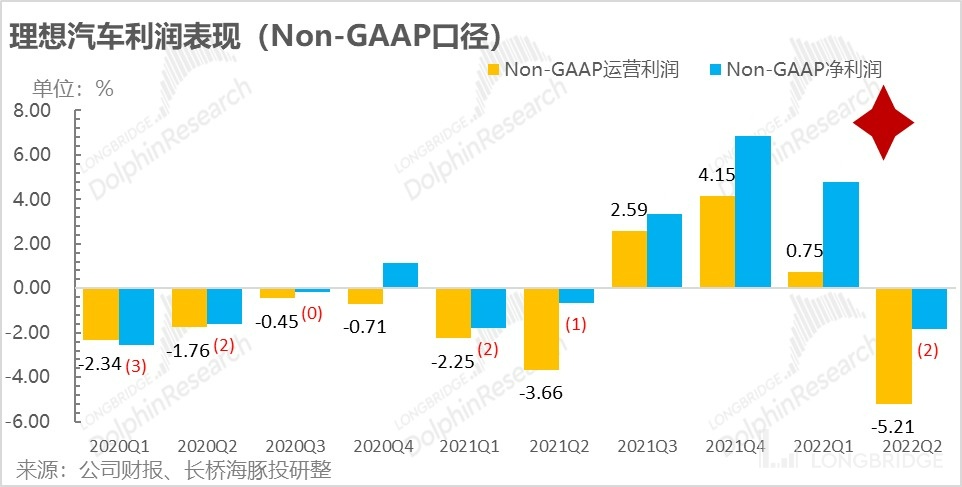

In the second quarter, Ideal achieved an operating loss of nearly RMB1 billion, which was better than market expectations. The key reason is still the better-than-expected revenue performance, especially the decent increase in the price of single-car contributions to revenue.

Excluding the cost of equity incentives, Ideal Auto's Non-GAAP operating profit and net profit in the second quarter were -RMB183 million and -RMB521 million, respectively. After three consecutive profitable quarters, the company returned to a loss due to the pressure of rising raw material prices and epidemic control measures.

For previous articles by Dolphin Analyst, please refer to:

On June 22, 2022, product release summary L9, the new "Ideal" of Ideal Auto

On May 10, 2022, meeting minutes Ideal: Three new products will be launched in 2023 to embrace a big product cycle year

On May 10, 2022, financial report review "Ideal's Ideal, is Everything Hopes Pinned on the Second Half of the Year?"

On February 26, 2022, meeting minutes "Completing the 0-1 verification phase: How Ideal Auto Achieves 1-10 Growth" On February 25, 2022, Performance Briefing live broadcast "LI.US Ideal Automobile 2021 Q4 earnings conference".

On February 25, 2022, Financial Report Comment "Pull-up 'Cash' Ability, Idealism Comes to Reality With Li Xiang".

On November 30, 2021, Meeting Minutes "How does Ideal Auto compete with Xiaomi in the pure electric vehicle market? (Meeting Minutes)".

On November 29, 2021, the Performance Briefing live broadcast "LI.US Ideal Automobile 2021 Q3 Earnings Conference".

On November 29, 2021, Financial Report Comment "Is Ideality Opportunism or Long-Termism? It Earns More Than Xpeng and NIO".

On August 31, 2021, Meeting Minutes "Ideal Automobile: The third quarter exceeded Xpeng and NIO, will surpass 150,000 units next year (Meeting Minutes)".

On August 30, 2021, Performance Briefing live broadcast "LI.US Ideal Automobile 2021 Q2 earnings conference".

On August 30, 2021, Financial Report Comment "Ideal Automobile: Steady performance and strong momentum?".

On June 30, 2021, Three Stupids Comparative Study - Part II "New Forces of Car-making (II): Market Enthusiasm Wanes, What Will Three Stupids Rely on to Consolidate Their Position?".

On June 23, 2021, Three Stupids Comparative Study - Part III "New forces of car-making (III): fifty days of doubling, can Three Stupids keep running wild?". On June 9, 2021, a Three Stooges comparative study - Part One, "New Forces in Car Making (Part 1): Invest in the right people, do the right things, and take a look at the people and events behind the new forces in the industry."

Risk disclosure and statement for this article: Dolphin Investment Research Disclaimer and General Disclosure