Spring plowing and autumn harvest, the era of "core" for Era Electric

On the evening of August 26, 2022, Dolphin Analyst released the 2Q22 financial report (up to June 2022) after the Hong Kong stock market's close. Here are the highlights:

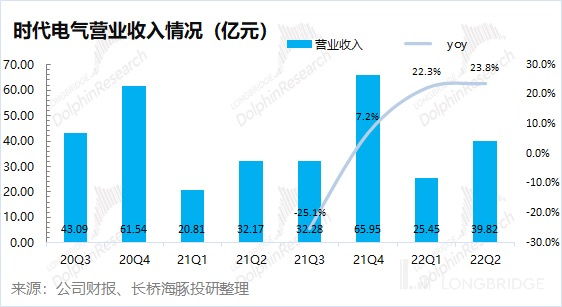

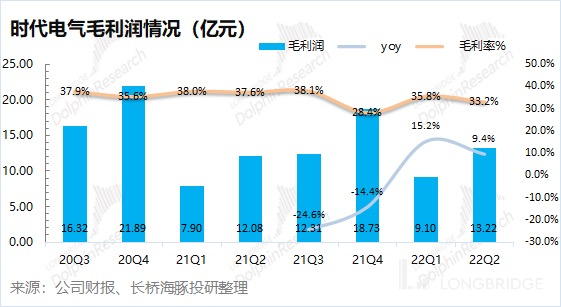

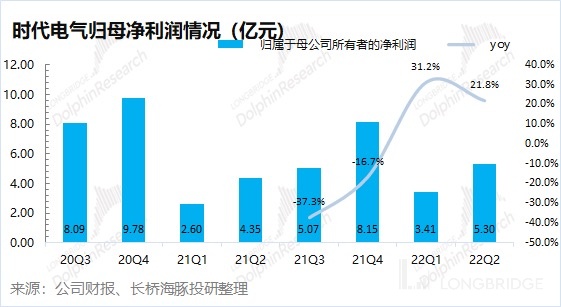

1. Overall Performance: CRRC Times Electric achieved revenue of RMB3.982 billion this quarter, a year-on-year increase of 23.8%, mainly driven by the emerging equipment business. The company's gross profit margin this quarter was 33.2%, which mainly due to the drop in traditional rail transit's gross profit margin and structural impact. The company's net profit attributable to the parent this quarter was RMB530 million, a year-on-year increase of 21.8%.

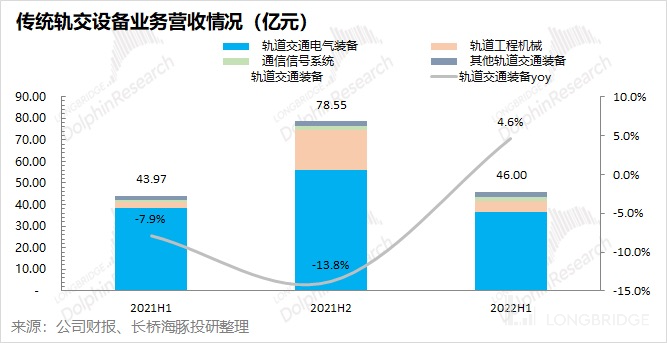

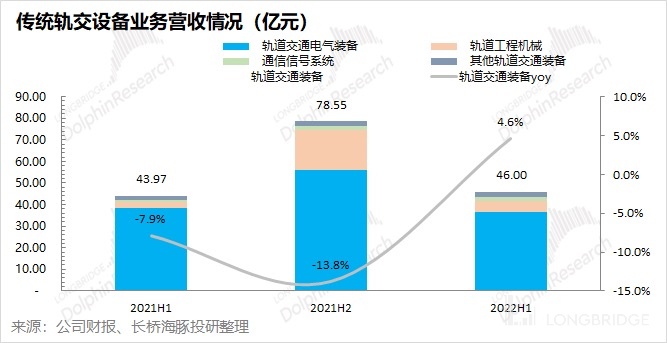

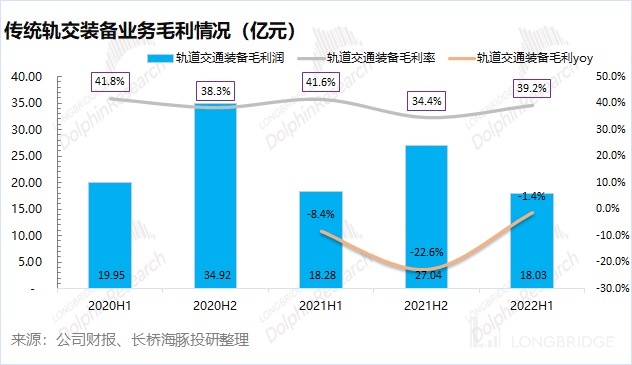

2. Traditional Rail Transit Business: In the first half of 2022, the revenue from traditional rail transit equipment business of CRRC Times Electric was RMB4.6 billion, a year-on-year increase of only 4.6%. In the first half of this year, due to the impact of the epidemic and other factors, governments and relevant units focused more on epidemic prevention and control, which affected the delivery of projects such as trains and urban rails. The gross profit margin of traditional rail transit business in the first half of the year also fell to 39.2%.

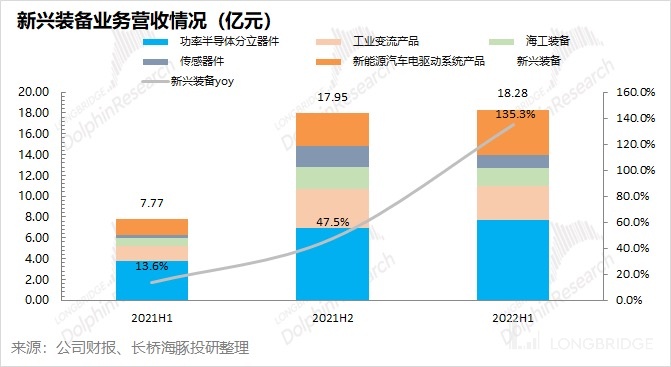

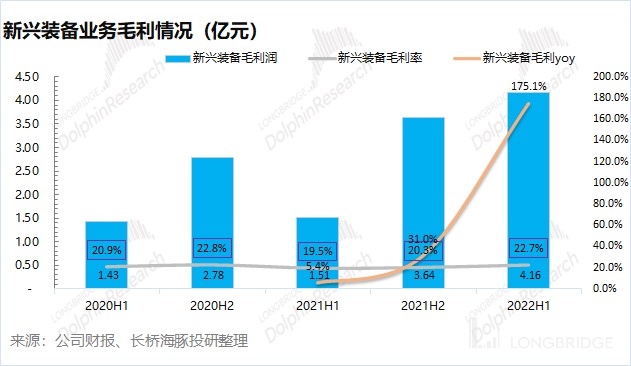

3. Emerging Equipment Business: In the first half of 2022, the revenue from emerging equipment business of CRRC Times Electric was RMB1.828 billion, a year-on-year increase of 135.3%, which was the main contribution to the company's growth in the first half of the year. In the first half of the year, power semiconductors, new energy electric drives, industrial rectification products, and other products all achieved doubled growth, mainly due to the strong demand in the new energy field.

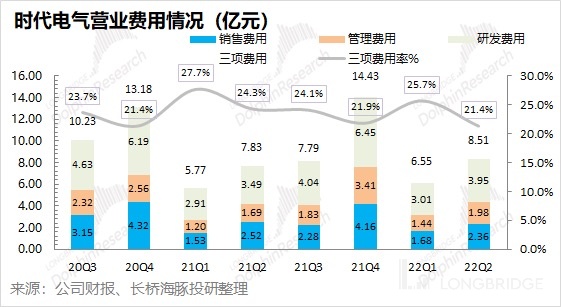

4. Expense Ratio: The proportion of various expenses of the company in the first half of the year has decreased, especially the sales expense ratio has shown a significant downward trend. The decline in expenses has helped to release the company's profit.

Overall, the financial report meets the market's expectations for the company. Although traditional rail transit business is the company's largest source of income, there is not much room for growth due to the business's excessive maturity. The market only hopes that this business can become the "basic plate" without dragging the company down, and the first-half financial report has achieved this. The market is more concerned about emerging equipment business. The first half of the year's financial report achieved growth of over 100% in the emerging equipment business, meeting the market's expectations for the company's new business growth.

Looking forward to the company's performance in the second half of the year, the basic plate is stable, and new businesses continue to grow.

- Traditional Rail Transit Business: As of the first half of 2022, high-speed railway, locomotive traction rectification system products, and urban rail continued to lead the domestic market. In the urban rail sector, the company's market share has remained first in the domestic market for ten consecutive years from 2012 to 2021. With the improvement of the epidemic control in the second half of the year, the demand for bullet trains and rail transit business in the second half of this year will be better than that in the first half of this year;

- Emerging Equipment Business: From the high growth in the first half of this year, the demand in the downstream of the overall new energy field is strong. The company's ability to achieve such high growth mainly comes from the release of production capacity. With the ramping up of production capacity in the second half of this year, the emerging equipment business will maintain high growth. For Zhongche Times Electric, if we consider it as a semiconductor company in the new energy field, it seems quite cheap with a PE ratio of only 20x and a 100%+ growth rate in emerging equipment business. However, its contribution to profits is still mainly from its traditional rail transit business. As this business has limited growth potential, it cannot provide a high valuation. Therefore, we need to look at Zhongche Times Electric from the perspective of its traditional and emerging businesses separately. Dolphin Analyst believes that under the current circumstances, the proportion of traditional business is still high, and there is limited room for growth and elasticity in the company's current position.

The following is a detailed analysis of Zhongche Times Electric's financial report by Dolphin Analyst:

I. Overall Performance: Emerging equipment leads the growth

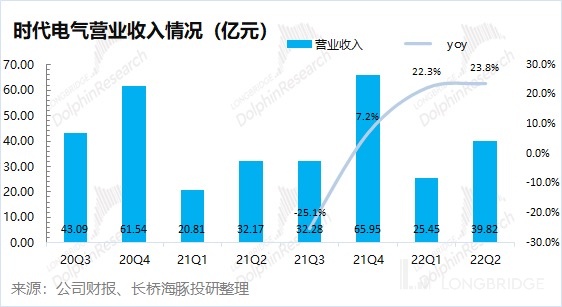

1.1 Revenue: In Q2 2022, the company achieved revenue of RMB 3.982 billion, a YoY increase of 23.8%. The company's revenue in the first half of the year increased by more than 20% YoY, mainly driven by the emerging equipment business, which saw a YoY growth rate of 135% in the first half of the year.

1.2 Gross Profit: In Q2 2022, the company achieved a gross profit of RMB 1.322 billion, a YoY increase of 9.4%. The company's gross profit increased by double digits YoY in the first half of the year, mainly due to the increase in revenue.

The company's gross profit margin in Q2 2022 was 33.2%, down 4.4pct YoY, mainly due to a decrease in the gross profit margin of the traditional rail transit equipment business and the lower gross profit margin of the emerging equipment business due to structural factors, whose proportion has increased in the first half of the year.

II. Operating Performance of Each Business Unit: Basic Business is Stable, New Business is Rapidly Increasing

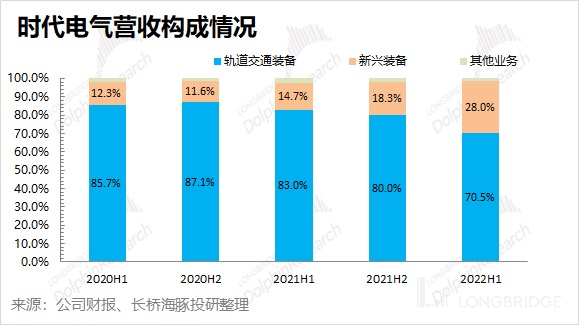

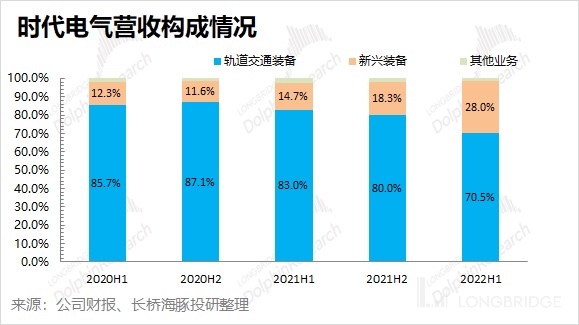

With Zhongche Times Electric's emphasis on the emerging equipment business, the proportion of this business in the company's revenue is gradually increasing. The revenue proportion of emerging equipment business reached 28% in the first half of 2022 and is expected to continue to increase.

2.1 Traditional Rail Transit Equipment Business

In the first half of 2022, the traditional rail transit equipment business achieved revenue of RMB 4.6 billion, a YoY increase of 4.6%. The low growth of traditional rail transit equipment business in the first half of the year was mainly affected by factors such as the pandemic and the slowdown in the delivery of company projects.

**In terms of sub-sectors: ① Rail Transit Electrical Equipment is the largest business unit with revenue of RMB 3.633 billion, a YoY decrease of 5% in the first half of the year. This is mainly due to the slowdown in the delivery of railway, urban rail and other projects due to the pandemic, and the government and related units focusing more on pandemic prevention and control in the first half of the year. ②Track engineering machinery achieved a revenue of RMB 535 million in the first half of the year, a year-on-year increase of 95.3%, and was the main growth point of traditional rail transit in the first half of the year; ③ Communication signaling system achieved a revenue of RMB 186 million in the first half of the year, a year-on-year increase of 42%.

In the first half of 2022, the company's gross profit from traditional rail transit equipment business was RMB 1.803 billion, a year-on-year decrease of 1.4%. The decline in the gross profit of traditional rail transit business was mainly due to the decrease in gross profit margin. The gross profit margin of the company's traditional rail transit business was 39.2% in the first half of the year, a year-on-year decrease of 2.4 percentage points.

2.2 Emerging equipment business

In the first half of 2022, the revenue of the emerging equipment business was RMB 1.828 billion, a year-on-year increase of 135.3%. The high growth of the emerging equipment business in the first half of the year was mainly driven by the strong demand for downstream new energy.

Specifically,① Power semiconductor discrete devices are still the largest item in the emerging equipment business, with revenue of RMB 772 million in the first half of the year, a year-on-year increase of 106.4%. The doubling growth rate of power semiconductors is much higher than that of traditional rail transit equipment (4.6%), indicating that the company's power semiconductors no longer rely too much on the company's original rail transit field and have demand release in downstream new energy and other areas.; ② New energy vehicle electric drive system products achieved a revenue of RMB 436 million in the first half of the year, a year-on-year increase of 196.6%, which has become the company's second largest source of revenue in the emerging equipment business; ③ Industrial inverter products achieved a revenue of RMB 326 million in the first half of the year, a year-on-year increase of 118.8%; ④Other marine equipment and sensor components achieved a revenue of RMB 169 million and RMB 125 million, respectively, in the first half of the year, both with year-on-year increases of more than 100%.

In the first half of 2022, the company's emerging equipment business achieved a gross profit of RMB 416 million, a year-on-year increase of 175.1%. The growth rate of gross profit from emerging equipment business exceeded the growth rate of revenue, and the gross profit margin of the company's emerging equipment business was 22.7% in the first half of the year, a year-on-year increase of 3.2 percentage points.

As the gross profit margin of emerging equipment is still lower than that of traditional rail transit, the overall gross profit margin of the company will have a structural downward trend with the rapid growth of emerging equipment business.

III. Expense and Profit Situation: Expense Side Shows a Downward Trend

III. Expense and Profit Situation: Expense Side Shows a Downward Trend

3.1 Operating Expenses: In Q2 2022, the company's total operating expenses amounted to 851 million yuan, an increase of 8.6% year-on-year. The three expense ratio stood at 21.4%, showing a downward trend, mainly due to the decrease in the sales expense ratio.

① Sales Expense: This quarter amounted to 236 million yuan, a decrease of 6.3% year-on-year. The sales expense ratio fell to 5.9%, mainly because the company has a leading advantage in the traditional rail transit field and the development of emerging equipment business is gradually recognized by the market, resulting in a decrease in overall sales expenses.

② Management Expense: This quarter amounted to 198 million yuan, an increase of 17.2% year-on-year. The management expense ratio stood at 5%. The growth mainly came from the increase in employee compensation and depreciation and amortization due to the company's business growth.

③ R&D Expense: This quarter amounted to 395 million yuan, an increase of 13.2% year-on-year. The R&D expense ratio stood at 5%. The number of R&D personnel decreased slightly, and the increase in R&D expenses mainly came from the year-on-year increase in employee compensation.

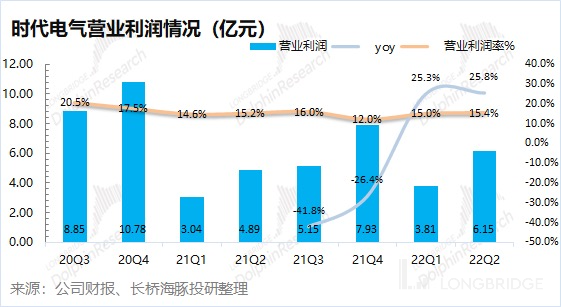

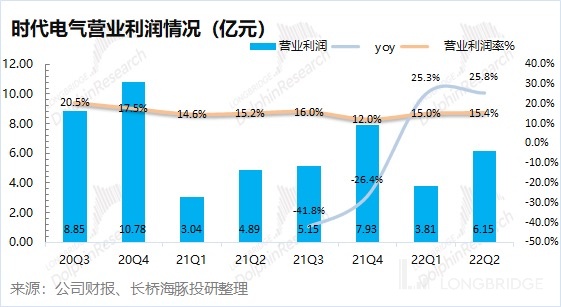

3.2 Operating Profit: In Q2 2022, the company achieved operating profit of 615 million yuan, an increase of 25.8% year-on-year. The growth in operating profit mainly came from the increase in revenue and the decrease in expense ratio.

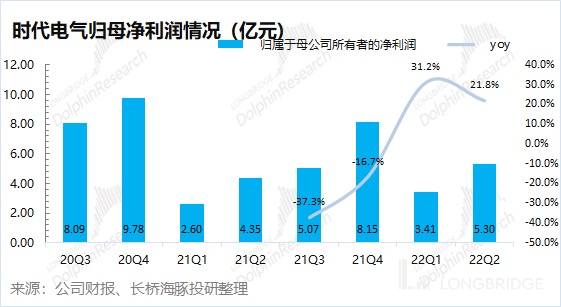

3.3 Net Profit Attributable to Equity Holders of the Company: In Q2 2022, the company achieved net profit attributable to equity holders of the company of 530 million yuan, an increase of 21.8% year-on-year.

Dolphin Zhongche Times Electric's Historical Article Review:

In-depth

On June 14, 2022, Longbridge published an in-depth article titled "Safely Bouncing on the Safety Mat: Does IGBT Create a New Era for Times Electric?".

On May 16, 2022, Longbridge published an in-depth article titled "Times Electric: Running on Rail Transit or Taking Another Ride with IGBT?".

Risk Disclosure and Statement for this article: Dolphin Analyst Disclaimer and General Disclosure