BOE: You're Buying a Reversal in Cycles, Not Just Performance

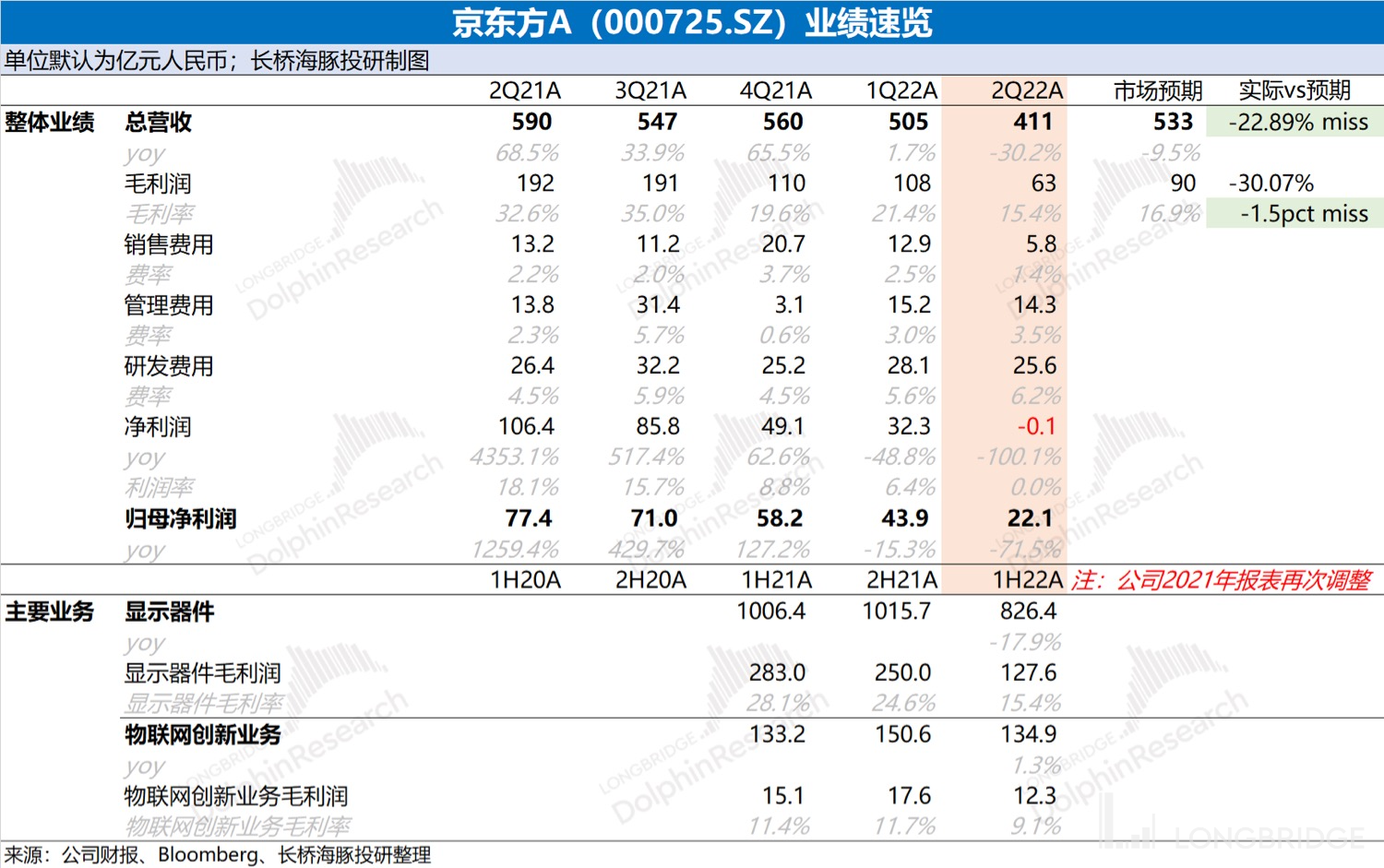

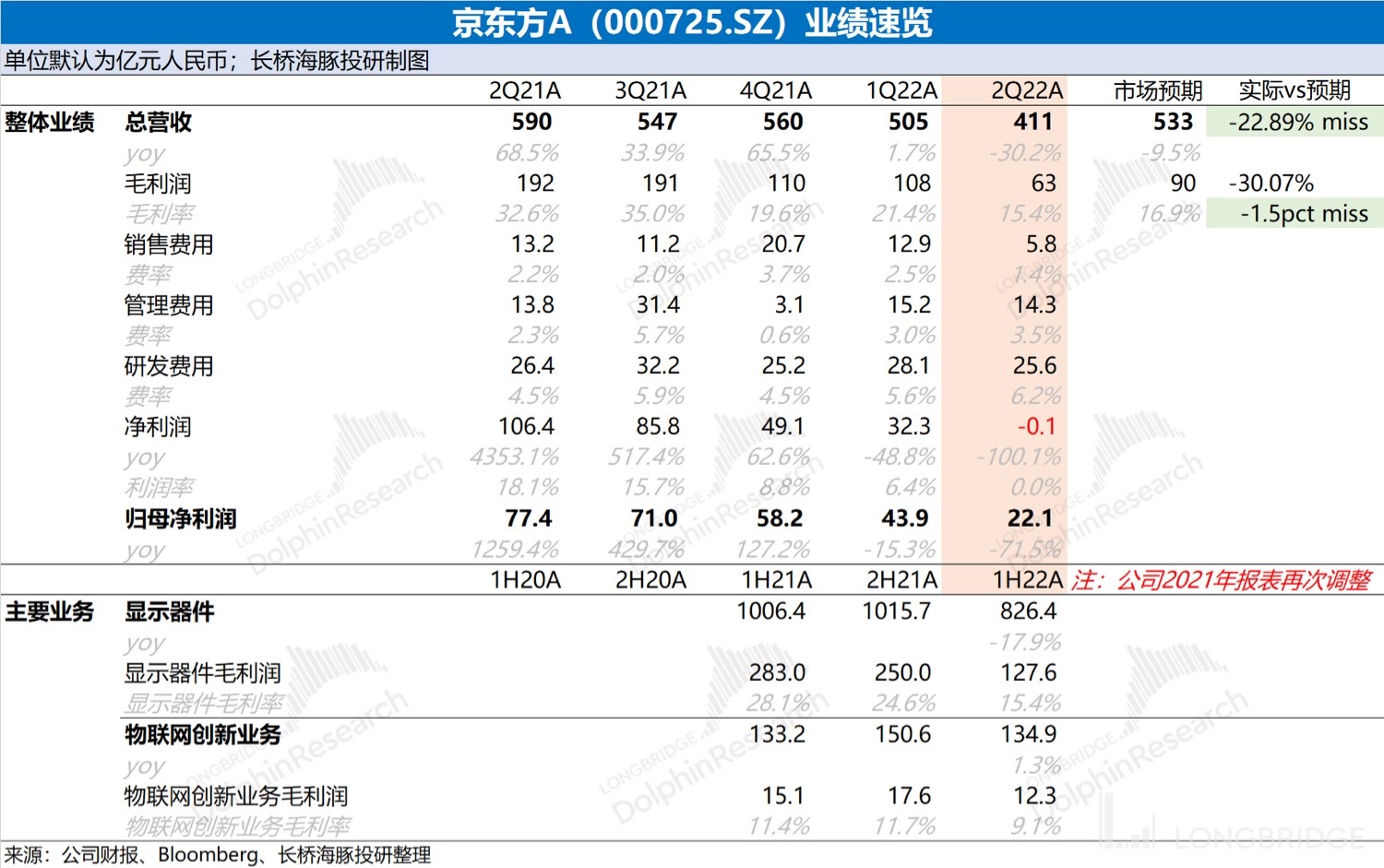

Longbridge A-share released its Q2 2022 financial report (as of June 2022) after the Longbridge market closed on the evening of August 29, 2022. The main points are as follows:

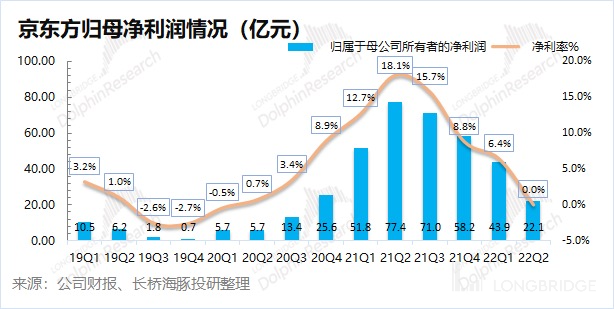

1. Overall performance: Poor performance due to significant price decline. Longbridge A.SZ's revenue this quarter was 41.13 billion yuan, a year-on-year decrease of 30.2%, lower than market expectations (53.3 billion yuan); this quarter's gross profit margin was 15.4%, a year-on-year decrease of 17.2 percentage points, lower than market expectations (16.9%). The decline in revenue and gross profit margin was mainly due to the significant decline in panel prices; the company's net profit attributable to shareholders this quarter was 2.21 billion yuan, a year-on-year decrease of 71.5%, and the net profit margin fell to the breakeven line.

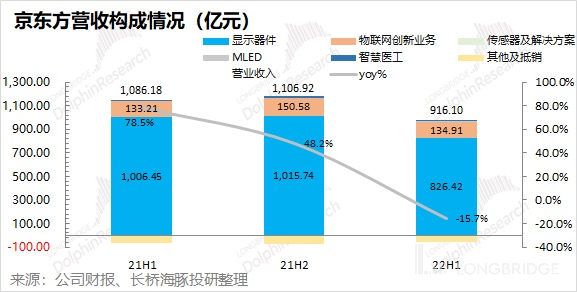

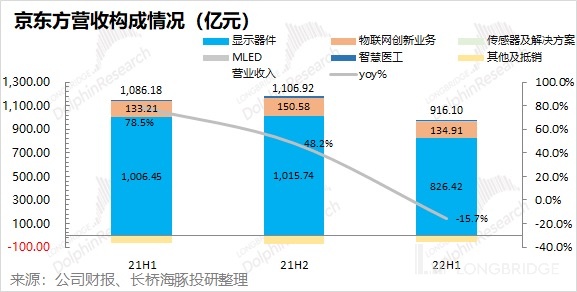

2. Business segment situation: Display components are the biggest drag. Display components are Longbridge's largest source of revenue, accounting for 90%. In the first half of the year, the display component business declined by 17.9% year-on-year, and the gross profit margin fell by 12.7 percentage points. This is the main reason for the company's performance decline, which is due to the sluggish demand for downstream displays such as televisions and mobile phones since the first half of the year.

3. Expenses and operating situation: Inventory is on the rise, returning to the breakeven point. The panel industry has entered a downward cycle since the second half of last year. Inventory indicators have become an important guide of the cycle. The company's inventory continued to rise this quarter, and there was no sign of the cycle bottoming out. Due to the high inventory and sluggish demand, the price decline caused the company's net profit margin this quarter to fall to around 0%.

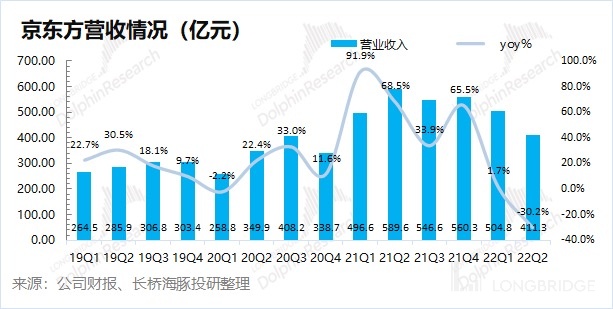

Overall, Longbridge's performance this quarter has significantly declined and will be worse in the next quarter. After panel prices reached the peak last year, the sluggish downstream demand caused the panel to enter a downward cycle. The poor performance this quarter can actually be anticipated from the decline in panel prices.

The performance in the second quarter was poor, and it will be worse in the third quarter. Inventory in the second quarter is still on the rise, and the oversupply market puts continuous pressure on panel prices in the third quarter. Since the second quarter, panel prices have already broken the cash cost, and both the company and the industry have lowered capacity utilization rates. Therefore, the performance in the third quarter will still be affected by the decline in both quantity and price, worse than the second quarter.

Longbridge's current poor performance is not important. Because the panel has a cyclical nature, and the performance during the bottoming phase of the cycle will inevitably be poor. The cycle goes down and it will go up again.

For Longbridge/panel investment, more attention should be paid to the bottoming and rebound of the cycle. In the second quarter, the company's net profit margin has fallen to the breakeven line, and other industry players are showing signs of losses. At that time, the industry will enter a "multi-production, multi-loss" stage, so the industry's capacity has begun to shrink in the second quarter. With the price breaking the cash cost, the shrinkage of production capacity is expected to accelerate inventory digestion, and panel prices are expected to bottom out.

With the digestion of inventory, panel prices are expected to see signs of bottoming and rebounding in the second half of the year. As a rule of thumb, the stock price will usually lead the industry. Dolphin Analyst has been covering Longbridge in depth since last month, mainly to seize the opportunity of the cycle bottoming and reversing. Dolphin Analyst still maintains the previous report points: ① Panel prices have fallen to the bottom range and have broken the cash cost, while capacity has also contracted, and the performance in the third quarter is probably not good; ② The situation where product prices continue to fall below cash costs is unsustainable, and prices will definitely rebound; ③ Longbridge believes that BOE has investment value in the medium-to-long term, and is currently still in the left zone, which can be explored by opening a left position. Poor performance will still occur in the short term, but this does not affect the long-term value of the company and may provide a more underestimated buying point.

Revenue" original-src="https://pub.lbkrs.com/cms/2022/0/T8AhFXZNBv7xGDfn5HnryHzeVyBCC4TP.jpg"/>

Revenue" original-src="https://pub.lbkrs.com/cms/2022/0/T8AhFXZNBv7xGDfn5HnryHzeVyBCC4TP.jpg"/>

The following is Dolphin's specific analysis of BOE:

I. Overall performance: Poor performance, mainly due to a sharp decline in prices

1.1 Revenue End

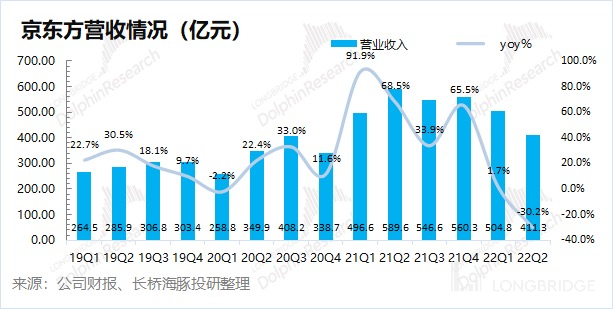

BOE's total revenue for Q2 2022 was 41.13 billion yuan, a year-on-year decrease of 30.2%, lower than the market expectations (53.3 billion yuan). Since the peak of the last cycle (Longbridge warned of the signal of the peak of the cycle in July last year), the company's revenue has experienced a sharp decline for the first time, mainly due to the weak downstream demand of displays, which led to a continuous drop in panel product prices.

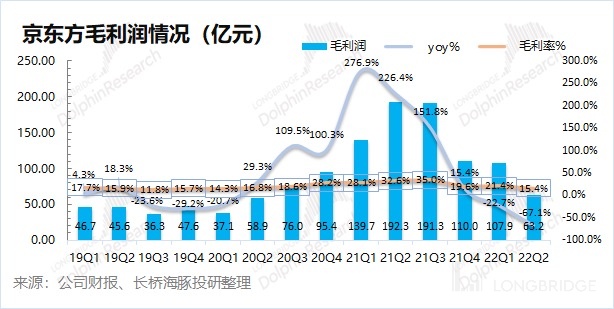

1.2 Gross Margin End

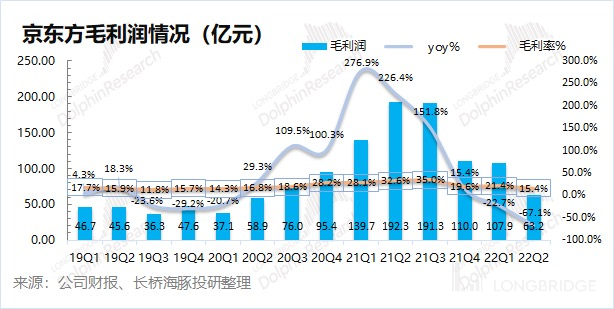

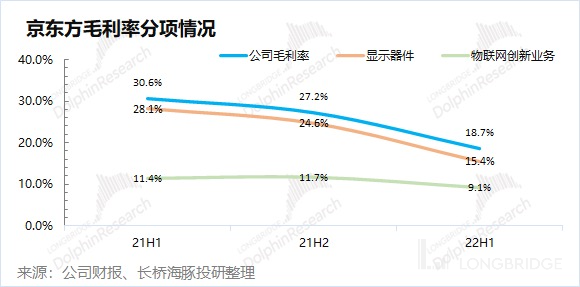

BOE achieved a gross profit of 6.32 billion yuan in Q2 2022, a year-on-year decrease of 67.1%, and the gross profit margin decreased sharply due to the decrease in revenue and gross profit margin.

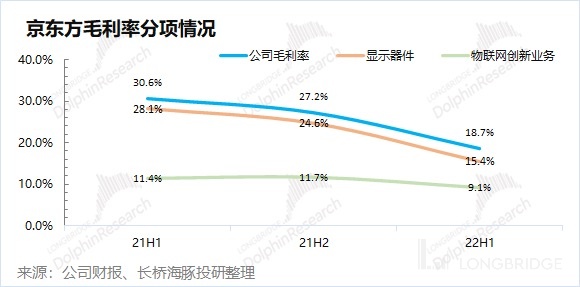

The company's gross profit margin this quarter was 15.4%, a year-on-year decrease of 17.2 percentage points, lower than the market expectations (16.9%). The sharp drop in gross profit margin was mainly due to the "meltdown-style" decline in panel prices.

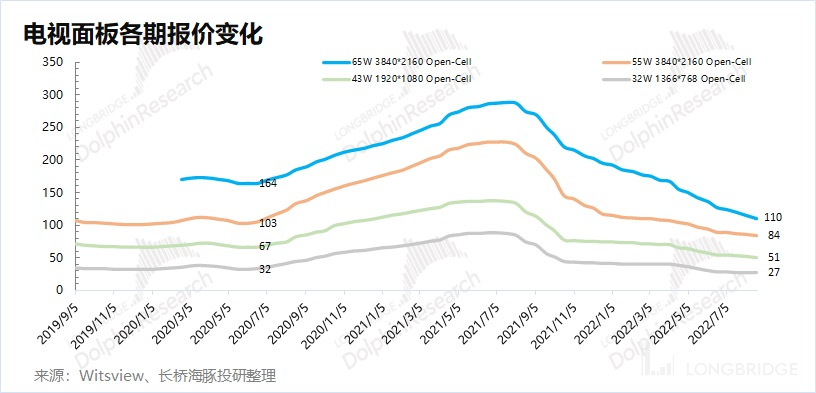

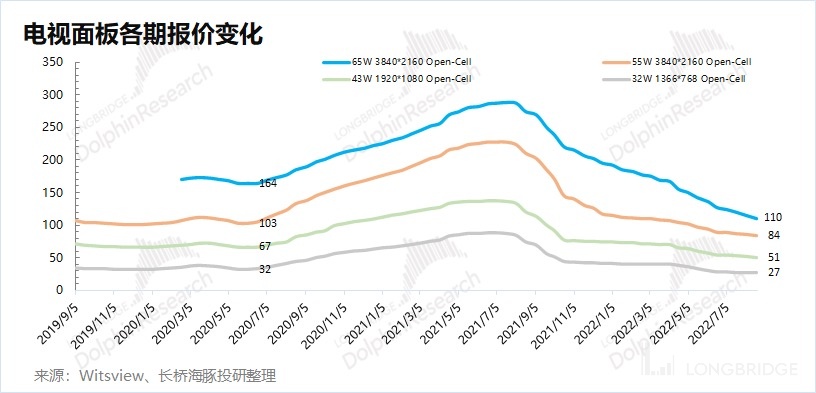

1.3 Panel Prices

BOE's sharp drop in revenue and gross profit margin this quarter is mainly due to the sharp fall in panel prices. According to data from Witsview, panel prices had already started to break the cash cost in the second quarter. Based on the prices in late August, the prices for 65-inch/55-inch/43-inch/32-inch were $110/$84/$51/$27 respectively, and the prices of all products were lower than the previous cycle's low.

With panel prices falling below the cash cost, companies began to shrink production capacity due to "producing more and losing more" situation. Dolphin Analyst expects that the industry and the company's performance in the third quarter will be worse than that in the second quarter, and the net profit margin will also be negative. From the perspective of supply and demand balance, due to the stable global demand for televisions of over 200 million units in the past decade and the tightening of supply starting in the second quarter, the industry will be able to accelerate inventory digestion while tending towards balance in the supply and demand.

II. Business Subdivision: Display Devices Are the Biggest Drag

2.1 Revenue Breakdown

BOE adjusted their report again in 2021. Currently, the two main businesses of the company are the display device business and the IoT innovation business.

1) Display Device Business: H1 Revenue of 82.642 billion yuan, a year-on-year decrease of 17.9%. The display device business is the company's traditional main business, mainly including TV, mobile phone, notebook and other display screen products. The decline in revenue in the first half of the year was mainly due to weak downstream demand and falling product prices;

2) IoT Innovation Business: H1 Revenue of 13.491 billion yuan, a year-on-year increase of 1.3%. Focusing on the ToB market, it mainly provides integrated solutions for IoT subdivision fields such as smart parks, smart finance, and smart transportation. This business is relatively stable;

3) Other Business: BOE's other businesses also include sensors and solutions, MLED, smart medical equipment, etc., but these businesses currently account for a small proportion and have little impact on the company's performance.

2.2 Gross Margin Breakdown

As the display device business accounts for 90%, the trend of BOE's gross profit margin is basically dependent on the display device business.

1) Display Device Business: H1 Gross margin of 15.4%, a year-on-year decrease of 12.7%, and the main reason for the decline in business gross margin was the decrease in downstream product prices;

2) IoT Innovation Business: H1 Gross margin of 9.1%, a year-on-year decrease of 2.3%, and the decline in business gross margin was due to the increase in cost.

III. Expense and Operating Status: Inventory Keeps Rising and Returns to Break-Even Point

3.1 Operating Index: Inventory Continues to Rise

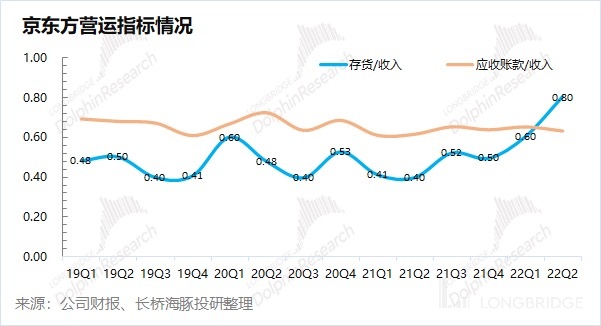

In a downturn in the industry cycle, it is more important to pay attention to a company's inventory and operating indicators.

- Inventory: 33 billion yuan this quarter, a year-on-year increase of 40%. In the situation of declining revenue, inventory increased instead of decreased. The inventory-to-revenue ratio reached a new high of 0.8 this quarter, prompting the company to adjust its capacity utilization rate from the second quarter. High inventory is difficult to digest in the short term, and panel prices continued to decline in the third quarter.

- Accounts Receivable: RMB 26 billion this quarter, a decrease of 28.4% YoY. The ratio of accounts receivable to revenue is 0.63, which is at a relatively reasonable level.

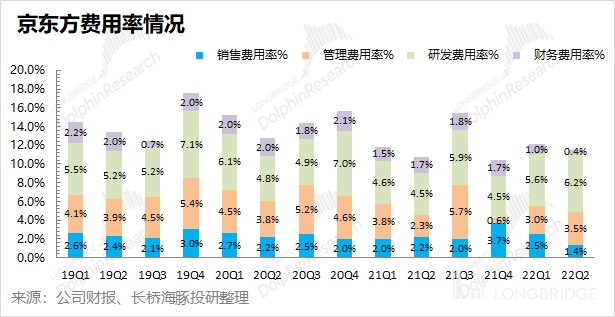

3.2 Expense Ratio: Increased

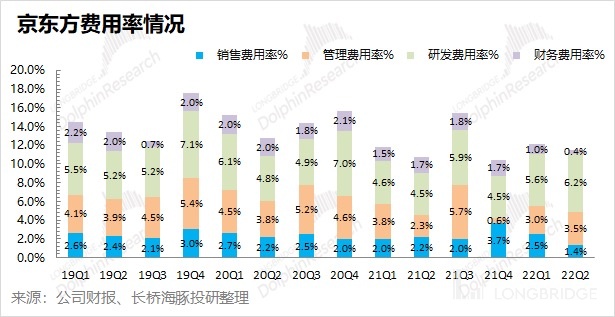

In Q2 2022, BOE's total expenses were RMB 4.727 billion, a decrease of 25.7% YoY. The expense ratio was 11.5%, and it increased due to some relatively rigid expenses, while revenue declined this quarter.

1) Sales Expenses: RMB 575 million this quarter, down by 56.3% YoY. The sales expense ratio was 1.4%. There is a certain correlation between the company's sales expenses and changes in revenue. The decline in revenue this quarter has also reduced the company's sales expenses.

2) Administrative Expenses: RMB 1.429 billion this quarter, up by 3.8% YoY. The administrative expense ratio was 3.5%. The company's administrative expenses are relatively rigid and are not greatly affected by revenue. The expense ratio increased this quarter due to the decline in income.

3) R&D Expenses: RMB 2.559 billion this quarter, down by 3.3% YoY. The R&D expense ratio was 6.2%. R&D expenses account for the largest proportion of the four expenses, and the company has appropriately controlled R&D expenses during the industry downturn.

4) Financial Expenses: RMB 167 million this quarter, down by 83.7% YoY. The financial expense ratio was 0.4%. The changes in the company's financial expenses are mainly due to the decrease in net interest expenses.

3.3 Net Profit: Significant Decline

BOE's net profit attributable to the parent company in Q2 2022 was RMB 2.21 billion, a decrease of 71.5% YoY. The decline in panel prices has affected the company's revenue and gross profit margin, which is the main reason for the significant decline in net profit attributable to the parent company this quarter.

In Q2 2022, the company's net profit margin fell to the break-even point. With the continued downward trend of panel prices in Q3, the company may face losses in Q3.

Historical articles of Dolphin Analyst about BOE:

On July 26, 2022, a deep dive on BOE was published on Longbridge. Read more in the article《360 Degree Analysis of BOE: Why Short-Term Risks Do Not Affect Long-Term Value?》. 2022 年 7 月 5 日行业深度 "From Double Champions to Double Bears: Has the Cycle Plunder of BOE and TCL Come to an End?"

July 21, 2021 Top Research: "No Bottom to Buy on as Panel Cycle Peaks"

Risk Disclosure and Statement of this article: Dolphin Research Disclaimer and General Disclosure.