360-Degree Analysis of JD.com: Why Short-Term Risk Doesn't Affect Long-Term Value?

Dolphin Analyst believed in the previous in-depth article titled "From Double 'Xiong' to Double 'Xiong': Is the Periodic Crisis of BOE and TCL Over?" that although the panel industry is still in the downward range on the left, the behavior of panel prices falling below cash costs and capacity contraction is expected to bring opportunities for the industry to quickly reach the bottom. This article focuses on the performance estimation and valuation of specific stocks in the panel industry.

The panel industry is cyclical. BOE A.SZ has become the global leader in LCD panels by expanding production in a counter-cyclical manner over the past decade. Today, in the overall decline of the panel industry, BOE has fallen from its high point of more than 7 yuan a year ago to below 4 yuan. With panel prices falling below cash costs, BOE's performance this year will move from high profitability to its low point. For investments in cyclical stocks, the low point of performance is often the focus of attention for turning points.

Since BOE's operating expense ratio is relatively stable, the core of BOE's performance estimation falls on revenue and gross profit rate. Dolphin Analyst estimated the revenue from the bottom up by estimating 15 production lines separately.

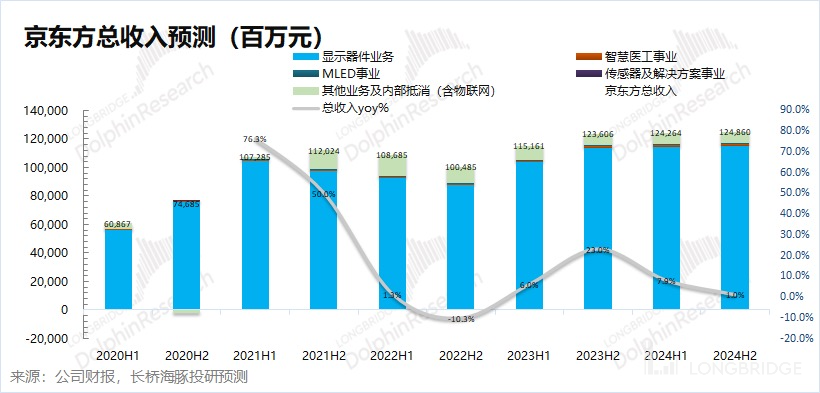

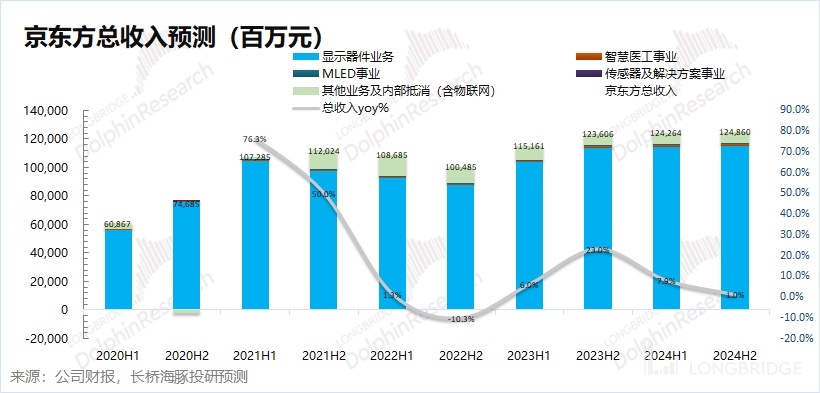

①. Dolphin Analyst expects BOE's revenue in 2022-2024 to be 209.2/238.8/249.1 billion yuan, with a year-on-year growth rate of -4.7%/14.2%/4.3%. With the continuous decline of panel prices, BOE's revenue this year may exhibit negative growth.

②. The estimation of BOE's gross profit rate is mainly based on the combination of product prices, fixed costs (depreciation and amortization), and variable costs (manufacturing expenses such as raw materials). Dolphin Analyst expects that the company's gross profit rate will be very poor in 2022, but it will rise with the recovery of the industry in 2023-2024.

After breaking the cost price in the second quarter, the panel price continued to decline in the third quarter. Dolphin Analyst expects BOE's performance in the third quarter to be even more "ugly".

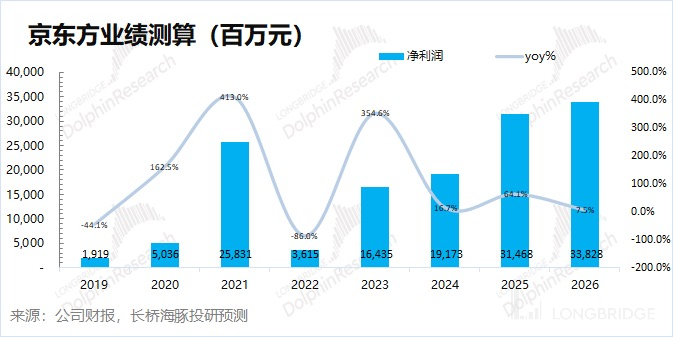

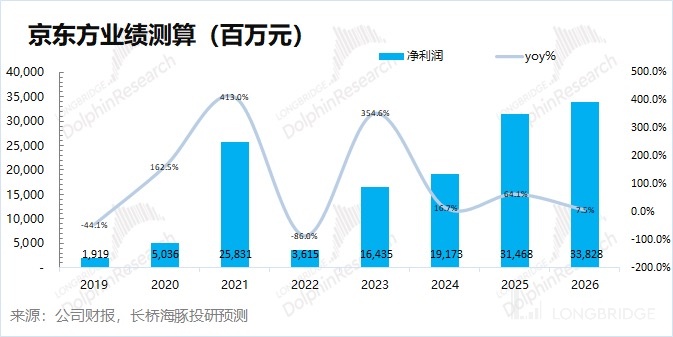

At the same time, Dolphin Analyst believes that BOE's profit in 2022 will be far lower than the market's consensus estimate of 18.5 billion yuan, only 3.6 billion yuan, a year-on-year decrease of nearly 90%. The net profit attributable to the mother for the two years after 2022 will be 16 billion yuan and 19 billion yuan, corresponding to a year-on-year increase of 354% and 17%.

In the short term, as the cycle declines, BOE's performance this year will be "disastrous". Indeed, BOE's performance this year is poor, but things often have two sides.

In the downward cycle, the company's performance is often difficult to stand alone, but how much worse can the panel that has already broken the cash cost price be? It is already expected in the market that the panel cycle will decline and the company's performance will be poor. However, as panel prices continue to fall, it will also accelerate the contraction of the supply side capacity of various manufacturers. Changes in the supply and demand relationship may bring opportunities for the bottoming out of panel prices.

It is true that panels are cyclical stocks, and their performance is good and bad. However, if we look at the long-term and flatten the profit, BOE is expected to achieve an average annual profit of 30 billion yuan after the release of OLED capacity and depreciation. In mature industries, giving a company a reference PE of 9 times discounted to today, there is a market value of 2008 billion yuan (5.23 yuan/share), which has an upward space of 34.4% compared to the current market value.

From a medium- to long-term perspective, panel prices, company performance, and share prices are all expected to rebound with the industry. However, an undeniable fact is that in the third quarter of continued price declines and capacity contraction, performance will only get worse. BOE's performance this year is likely to be significantly lower than the market's consensus expectations. "Performance bombshell" may bring negative impact to BOE in the short term, but in the medium and long-term dimensions, BOE will follow the industry to rebound.

Dolphin Analyst believes that BOE has investment value in the medium- to long-term dimensions and is still in the left interval, and can explore the left opening position tentatively. The "performance bombshell" may occur in the short term, and it does not affect the company's medium- and long-term value. It may provide a more undervalued buying point. At the same time, the "performance bombshell" in the second half of the year may also become a turning point for the industry cycle and company performance to bottom out.

Dolphin Analyst's BOE performance estimation and valuation pricing are detailed below:

In the estimation of BOE's performance, since the company's operating expense ratio and other aspects are relatively stable, the main focus of performance estimation is on the revenue side and gross profit margin.

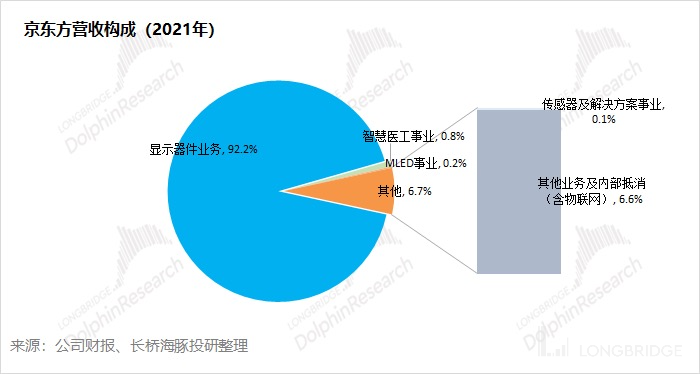

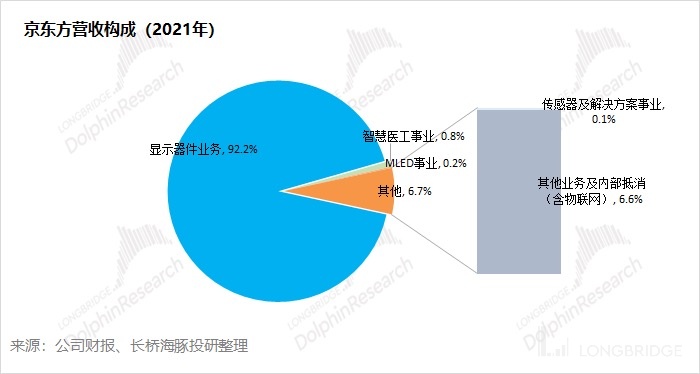

"1) When estimating the revenue side, we should start from the company's main business components." In BOE's 2021 financial report, the proportion of the display device business exceeded 90%, and the display device mainly includes smartphone LCD displays, tablet computer displays, laptop displays, monitor displays, television displays, and other displays. In other words, nearly 90% of the company's business revenue comes from panels, and the estimation of the company's revenue mainly focuses on the income performance of the panel business.

"2) The estimation of gross profit margin mainly involves the breakdown of cost items." The company's gross profit is derived from "product price - product cost item." Since the price of panel products has market data references, the estimation of gross profit margin mainly depends on the breakdown of cost items. Cost items can be divided into fixed costs and variable costs. Due to the characteristics of the company's heavy asset manufacturing industry, the expansion of production capacity input leads to an increase in depreciation and amortization, which constitutes fixed costs in the cost items. In the production and processing of products, the input of raw materials and other production factors constitutes variable costs in the cost items. The change in the company's profit-making ability is jointly affected by product prices and cost items.

"Estimation of the revenue side:"

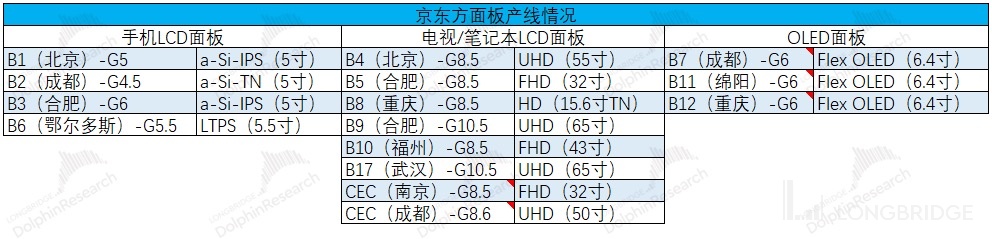

When estimating BOE's revenue, the company's financial report only discloses the display device business. In other words, "From the annual report, we can roughly only get the comprehensive income of LCD and OLED products, and cannot obtain the income of each sub-category. Therefore, it is difficult to estimate the revenue of BOE's panel business. Dolphin Analyst can only estimate the revenue of BOE's panel business from bottom to top, starting with each production line of the company." With continuous expansion and acquisition, BOE has 15 panel production lines covering mobile LCD, TV/laptop LCD, and OLED panels.

①In the mobile panel field, BOE's LCD panel production lines were mostly built and put into production before 2015, and then began to invest in new OLED production lines.

②In the TV/laptop panel field, BOE has achieved full coverage of its main products from 15.6 inches to 65 inches through self-construction and acquisition of existing production lines of CEC Panda, with a production capacity that ranks first in the world.

Source: Dolphin Investment Research

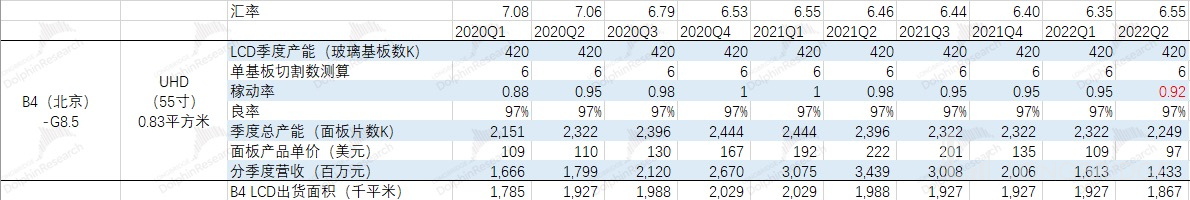

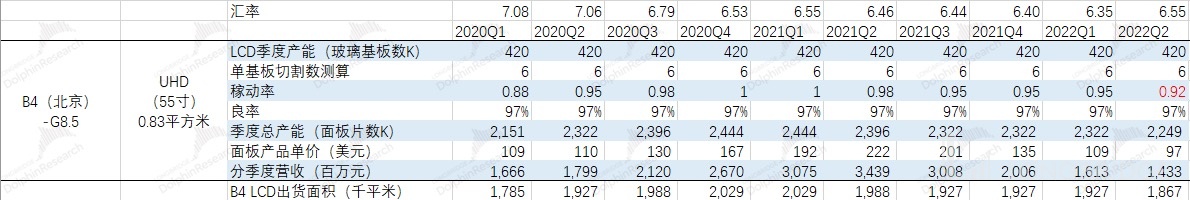

In the calculation of production line revenue, Dolphin Analyst calculates the quarterly income of the production line based on LCD quarterly capacity, utilization rate, yield, and other aspects.

Taking the B4 (Beijing) production line as an example, due to the glass substrate with an annual production capacity of 1680 thousand pieces, the single-quarter capacity is 420 thousand pieces. Because the B4 production line is an 8.5-generation line, its main product is 55-inch panel.

According to industry chain information, a single substrate can be cut into approximately 6 pieces of 55-inch panels. Because B4 is a mature old production line, both the utilization rate and yield have higher performance.

By "total quarterly panel capacity=quarterly number of glass substrates \ single substrate cutting number \ utilization rate \* yield**", the total quarterly panel capacity of the B4 (Beijing) production line can be calculated.

Based on the historical panel quotation of Witsview, the revenue of the panel of the production line can be calculated.

Since the area of a 55-inch panel is approximately 0.83 square meters, "total panel capacity \ single panel area*" can be used to calculate the quarterly LCD shipment area of the B4 (Beijing) production line.

Source: Industry chain research, Witsview, Dolphin Investment Research

Dolphin Analyst has calculated the revenue of BOE's panel business by measuring the 15 panel production lines separately. From the three types of panels:

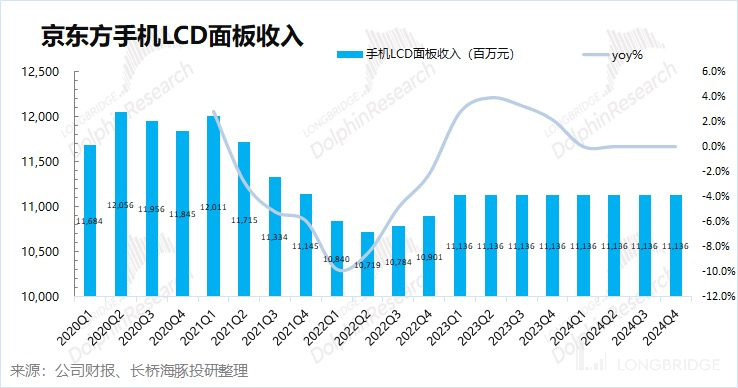

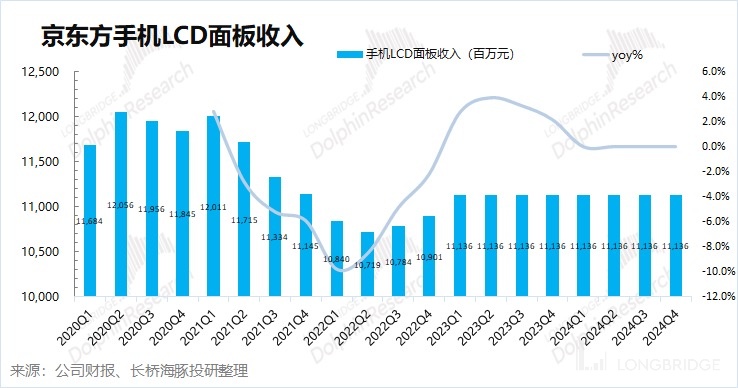

1) Mobile LCD panels:

BOE's mobile LCD panel production line has not changed much in terms of production capacity after 2015. The changes in the revenue of this business come more from changes in utilization and price.

Dolphin Analyst calculated that the unit price of BOE's mobile LCD panels had exceeded 8,000 yuan/square meter in the past, but in the second half of 2021, due to high inventory of mobile phone manufacturers, both the unit price and utilization rate of mobile LCD panels were affected by the decline. With the digestion of mobile phone inventory, the price of mobile phone LCD panels may also rebound to a certain extent. However, as the mobile phones that carry LCD panels are mainly mid-to-low-end machines and the entire market is in a relatively mature state, prices are gradually stabilizing.

Dolphin Analyst estimates that the four production lines of BOE's mobile phone LCD panels will bring the company about 11 billion yuan in revenue for a single quarter.

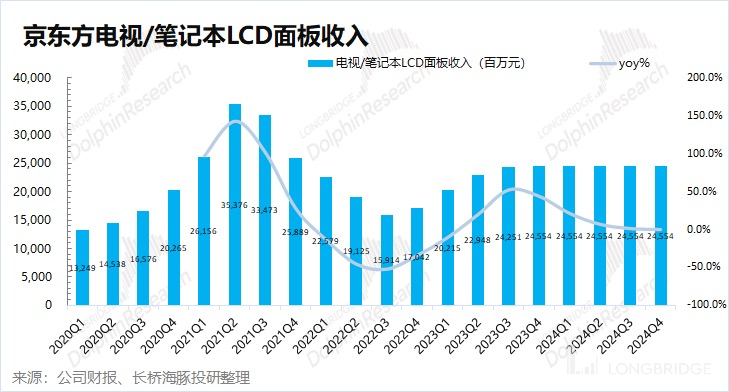

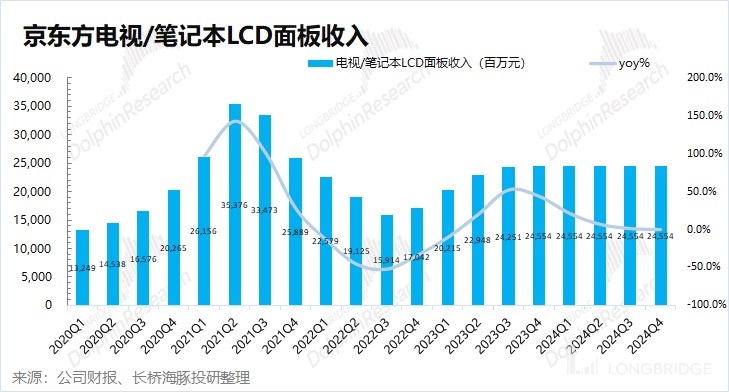

2) TV/laptop LCD panels:

BOE's TV/laptop LCD panel production line was the main profit growth point for the company in the previous upturn cycle. Due to the "same origin of profit and loss" characteristic, it is also the main drag on the company's performance in this cycle's downturn.

Unlike mobile phone LCD panels, there is still new capacity release for TV/laptop LCD panels. At the end of 2020, BOE acquired CEC Panda Nanjing's 8.5th generation line and Chengdu's 8.6th generation line **, and the acquisition of new production lines made BOE firmly occupy the position of the world's largest LCD market. Besides, the climbing of the 17th generation line in Wuhan has also brought capacity expansion to the company.

Admittedly, OLED has better display characteristics than LCD, but the cost of OLED on large screens such as TVs has remained high for many years. Therefore, LCD panels still account for most of the global demand for the TV market.

In 2021, the high-priced panel raised the price of terminal products, which in turn squeezed terminal demand. As we enter the second half of the year, the inventory of terminal manufacturers begins to rise, and the market gradually shifts to a situation of oversupply. Panel prices begin to fall. The drastic decline in panel prices has already broken the cash cost of panel manufacturers. Dolphin Analyst pointed out in the in-depth report "[From Double "Heroes" to Double "Pandas": Is BOE and TCL's Cycle Over?" that " since the panel price has fallen to the bottom range and has broken the cash cost, and the capacity side is also shrinking, the performance of the third quarter is most likely not good. However, the situation where the product price continues to fall below cash cost is unsustainable, and the price will definitely rebound."

As the current product price has broken the cash cost, industry manufacturers have successively begun to shrink capacity. The decline in cost provides downward price space for terminal products, and under the supply-side capacity contraction, the current oversupply situation in the panel industry is expected to improve.

Dolphin Analyst expects that the current situation where panel prices have broken the cash cost is unsustainable, and prices will definitely rebound. And the current panel prices are still continuing to fall, which will further accelerate the supply-side capacity contraction. The price of the panel industry may bottom out faster than expected, and signs of price stabilization are expected to be seen in the second half of this year. Dolphin Analyst estimates that the revenue from BOE's 8 production lines of TV/laptop LCD panels will bottom out in the second half of the year and then bring the company about 24 billion yuan in revenue for a single quarter. **

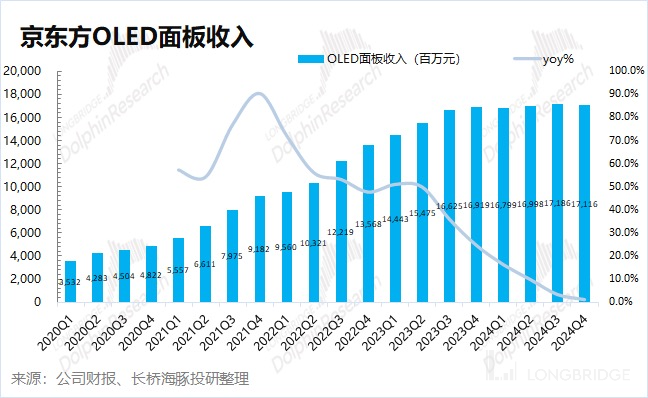

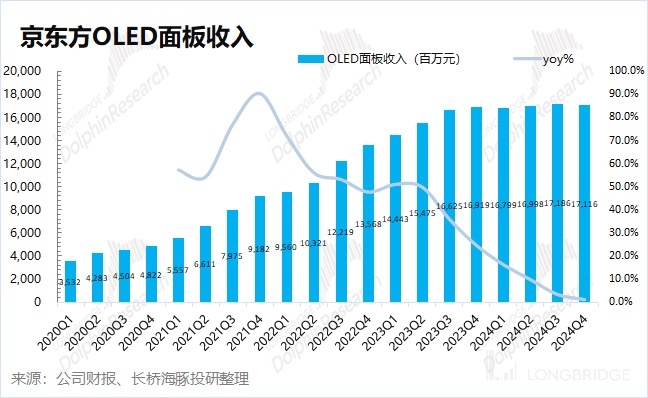

3) OLED Panel:

Different from the mature market of LCD panels, OLED panels bring growth opportunities to BOE. When seeing OLED screens gradually becoming standard options for mid-to-high-end phones, BOE stopped building new LCD phone display lines in 2015 and embarked on the journey of OLED.

Up to now, BOE has three OLED production lines: B7, B11, and B12. In the past two years, BOE has broken the monopoly of Korean plants and become the first Chinese supplier of Apple's OLED screens. With continuous investment in OLED production lines, BOE is expected to continue to improve its share of the US Apple market, bringing growth space to the company.

With the continuous release of BOE's OLED production capacity and the influence of scale effect, the cost of OLED may decrease. The Dolphin Analyst predicts that with the release of BOE's OLED production capacity, the price of OLED is expected to decrease, but it will still be higher than the price of LCD. According to calculations, the unit price of OLED panels for BOE's mobile phones is currently above 30,000 yuan/square meter, far higher than that of LCD at 8,000 yuan/square meter.

According to the Dolphin Analyst's calculation of BOE's three OLED production lines, the release of production capacity will bring growth to the company, and is expected to bring about 17 billion yuan of revenue to the company in a single quarter in the future.

4) Total Revenue:

Based on the revenue forecast of 15 production lines, the Dolphin Analyst believes that the company's panel revenue will continue to grow in 2023. If there are no new production lines built in the future, the company's capacity and revenue will tend to be relatively stable after 2024. Display components will continue to be the company's main source of revenue in the future.

The Dolphin Analyst predicts that BOE's revenue from 2022 to 2024 will be 209.2/238.8/249.1 billion yuan, with a year-on-year growth of -4.7%/14.2%/4.3%. As the panel price drops, the company's revenue may experience a decline in shipments in 2022, but it is expected to resume growth in 2023 and 2024.

**

二、Calculation of Gross Margin:

The above section has completed the revenue forecast for BOE, and the calculation of gross profit margin is "Revenue - Cost Item". Therefore, the calculation of gross profit margin mainly depends on the calculation of the company's cost items. Due to the fact that the company is in a capital-intensive industry, it has a significant amount of fixed costs resulting from depreciation and amortization. Therefore, the calculation of the company's cost items mainly involves the calculation of fixed and variable costs.

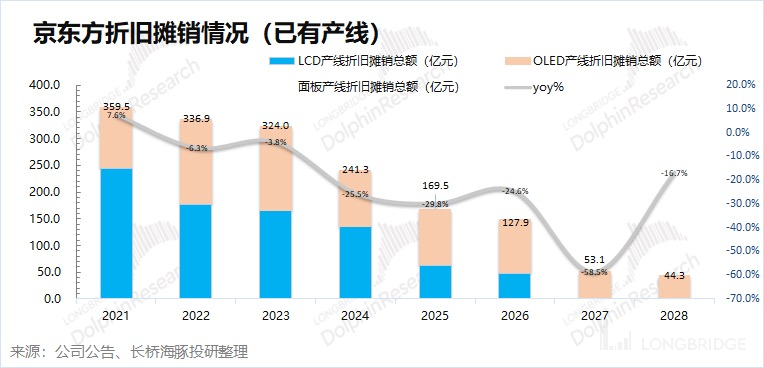

2.1 Fixed Cost Item: Depreciation and Amortization

The panel industry is a capital-intensive industry, with investments in production lines often reaching tens of billions. The significant amount of depreciation and amortization generated therefrom constitutes the company's fixed cost item for its products.

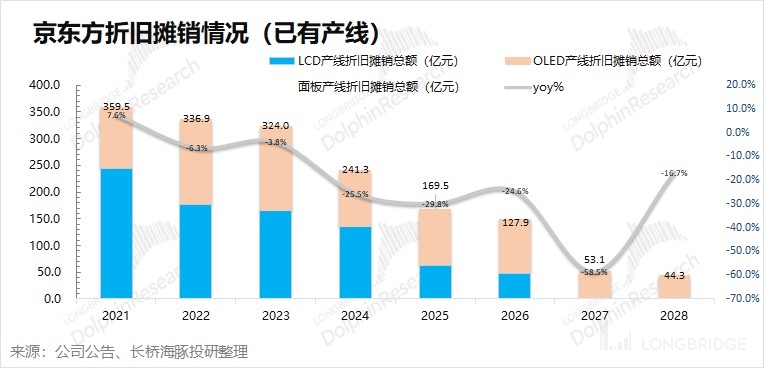

Dolphin Analyst has compiled the production status of 15 production lines of BOE Technology in operation according to linear depreciation and amortization over 7 years. B1/B2/B3/B4/B5/B6/B8/CEC (Nanjing) production lines of BOE Technology have already completed depreciation, while the main ones that are still in the process of depreciation are the TV/notebook LCD panel production lines and the OLED production lines.

Source: Dolphin Research and Analysis

Based on the assumption of linear depreciation over 7 years and BOE Technology's depreciation and amortization situation for each production line, Dolphin Analyst calculated the situation in which existing production lines bring depreciation and amortization to the company. With the advent of new production lines' mass production between 2015 and 2021, BOE Technology's depreciation and amortization has shown a yearly upward trend. However, after 2021, as the depreciation period expires, the company's depreciation and amortization situation shows a declining trend. If the company no longer builds new production lines, the depreciation and amortization amount will decrease year by year, providing an increase in gross profit margin and pricing room for the company.

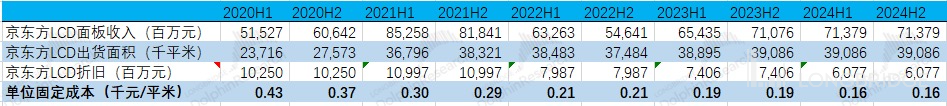

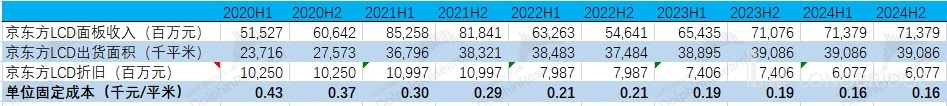

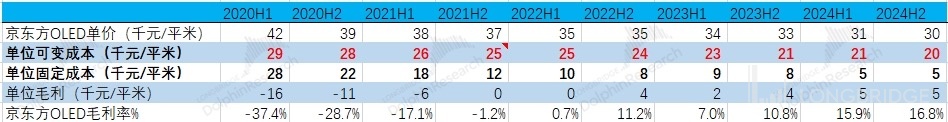

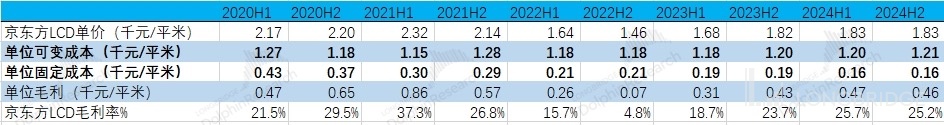

1) Unit Fixed Cost of LCD

Based on the prediction of LCD shipment area and the depreciation and amortization situation of related production lines, Dolphin Analyst expects the unit fixed cost of BOE Technology's LCD panels to decrease from 430 yuan/square meter to 160 yuan/square meter by 2024, as depreciation and amortization decrease.

Source: Dolphin Research and Analysis

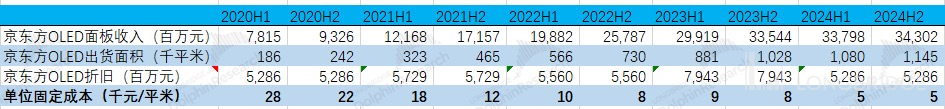

2) Unit Fixed Cost of OLED

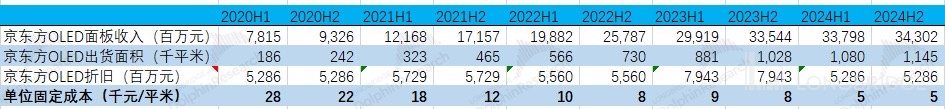

Based on the prediction of OLED shipment area and the depreciation and amortization situation of related production lines, Dolphin Analyst expects the unit fixed cost of BOE Technology's OLED panels to decrease from 280,000 yuan/square meter to 5,000 yuan/square meter by 2024, as capacity is released and depreciation and amortization decrease.

Source: Dolphin Research and Analysis 2.2 Variable Cost Item: Manufacturing Cost of Raw Materials and Others

As the company did not disclose the specific composition of manufacturing costs, Dolphin Analyst calculated the "unit manufacturing cost = product unit price - unit gross profit - unit fixed cost" backwards.

Regarding the breakdown of the cost items of BOE, it is mainly to observe the elasticity under the influence of various indicators. When calculating, Dolphin Analyst first assumed that the OLED business's gross margin in the second half of 2021 would be close to the level of about 0%.

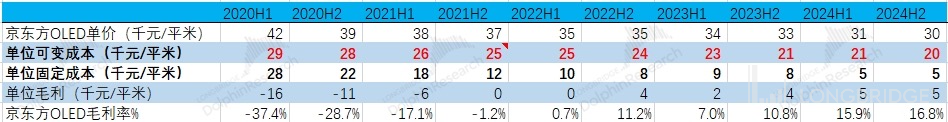

2) OLED Unit Variable Cost

After assuming the gross margin level of OLED in the second half of 2021, it was estimated that the unit manufacturing cost of BOE's OLED business was about 25,000 yuan/square meter.

It can be seen that BOE's past OLED business losses were mainly due to the lack of economies of scale when the production capacity was small, and the unit manufacturing cost was relatively high. At the same time, the mass production of the production line brought high depreciation and amortization expenses.

With the release of OLED production capacity, both unit manufacturing cost and unit fixed cost will decrease. The profit-making ability of OLED also begins to increase.

Source: Dolphin Research and Investment

2) LCD Unit Variable Cost

As the display device business is mainly the panel business of LCD and OLED, referring to the gross profit margin of the display device, the gross profit and cost of LCD and OLED are calculated. With the cost item of OLED determined, the cost item of LCD is calculated backward.

Combining the fixed costs brought by previous calculations of LCD's depreciation and amortization, the manufacturing cost of LCD is calculated.

Dolphin Analyst found through calculations that the proportion of fixed costs in the LCD business is relatively low, mainly affected by variable costs in manufacturing. As the LCD market is relatively mature, the company's motivation to expand production is not strong, Dolphin Analyst expects the company's unit fixed cost to continue to decline, and the unit manufacturing cost will not show a significant decline due to economies of scale, and the unit manufacturing cost tends to be stable.

Source: Dolphin Research and Investment

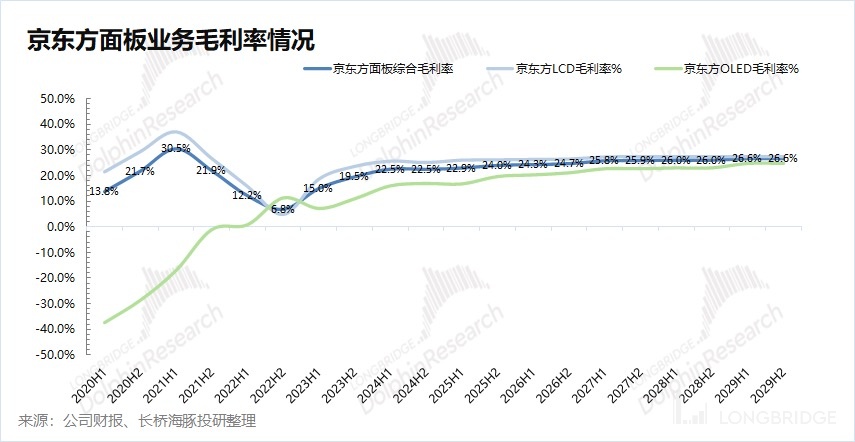

2.3 Gross Margin Situation: Profitability of Panels

Considering the gross profit margin of the LCD and OLED businesses, Dolphin Analyst expects that with the mass production of OLED, this loss-making business will also begin to prepare for profitability, and the comprehensive gross profit margin of BOE's overall panel business will return to the range of 20-30%.

Dolphin Analyst believes that although the depreciation and amortization of LCD will reduce fixed costs, due to the characteristics of the mature market of LCD, the reduced costs may not necessarily be reflected in the gross profit margin, and may ultimately be fully returned to downstream customers. The increase in the gross profit margin of LCD is only due to the product price returning to a reasonable level. One thing to note is that during the current downturn in the panel industry, BOE may experience a low point in profitability and performance in the second half of 2022, and once again touch the breakeven line.

III. Performance Calculation and Valuation

Through the above calculation of panels, the two core indicators of revenue and gross profit margin have basically been broken down. Combining the company's stable operating expense ratio, the company's future performance can be estimated.

According to Dolphin Analyst's calculation, BOE's net profit attributable to the parent company in 2022-2024 will be RMB 3.615 billion, RMB 16.435 billion, and RMB 19.173 billion, respectively, with a year-on-year growth rate of -86%, 354% and 17%. Dolphin Analyst believes that BOE's profits will be greatly eroded during the industry downturn, and 2022 will also be a year of poor performance for BOE. With inventory digestion, panel prices are expected to recover in 2023.

The panel industry will not lose its cyclicality due to the increase in concentration. Due to the low technical threshold of LCDs themselves, this industry will not have a long-term high gross profit due to market concentration. When prices rise and products are highly profitable, players will build and expand new production capacity due to high profits, and when prices fall and products lose money, there will also be a situation where production capacity shrinks and exits. Therefore, LCDs will still have cycles, but after optimizing the structure, the expansion of the market share of leading companies may allow them to enter a weak cycle from a strong cycle.

Due to BOE's operating expense ratio generally being 10-15%, when the gross profit margin is less than 10%, the company will definitely face losses. Looking at the industry in the long term, the gross margin is often between 20-30%, which means that the company can earn a profit margin of 10-15%. This level of profit margin will not arouse strong interest from other players in the panel industry, thereby intensifying competition.

Therefore, when valuing and pricing BOE, Dolphin Analyst believes that the profit should be viewed in a longer-term manner. According to the model, with the release of OLED capacity, the company's performance is expected to continue to grow. Assuming that the company's performance is relatively stable after 2026 (revenue of 240 billion yuan, gross margin of 26.5%), the corresponding net profit attributable to the parent company is 33.8 billion yuan.

After 2026, the depreciation of the company's existing production lines is also coming to an end. Depreciated production lines basically do not generate fixed costs but can still provide business income. Viewing the company as a stable cash flow company without growth potential, giving a reference PE of 9 times in 2026, the corresponding market value in 2026 is 304.2 billion yuan. Converted to a current valuation of 200.8 billion yuan (corresponding to 5.23 yuan / share), there is 34.4% room for increase compared to the current market value. **

Dolphin Analyst's Study on the Panel Industry

Panel Industry

In-depth report on July 5, 2022: "From Double "Males" to Double "Bears": Has the Cycle of BOE and TCL Come to an End?"

Panel industry review on June 15, 2022: "Panel Duopoly, Both Shutting Down"

Panel industry hot topic on July 21, 2021: "The Panel Cycle Has Peaked, with No Bottom to Buy"

Risk disclosure and statement for this article: Dolphin Research & Analysis Disclaimer and General Disclosure