"How can the struggling Kwai, Xindong, iQiyi, and Tencent Music overcome their disappearance?"

Hi everyone, I'm Dolphin Analyst!

From the "Thousand Broadcast Battle" to audio books, from music K-song to video dominance, what used to be a flourishing Internet entertainment industry now seems to be withering away, with constantly shrinking valuations, disappearing into the landscape of the capital market just like media stocks in the A-share market. Many have questioned whether they still have investment value when their market cap is cut to their knees.

In the previous article "Different Paths Taken, Tencent, Kuaishou, and Bilibili Have Different Fates," we made judgments on the short- to medium-term changes and trends of the overall industry. Under the expectation of slow consumer recovery in the near future, the pan-entertainment industry, classified as optional, will also be dragged down in its overall recovery process. "Going abroad" is a way to open up new markets for growth, but at present, the main battlefield of the pan-entertainment companies is still in mainland China. Going abroad requires investment and it is difficult to quickly make up for the gap caused by the sluggish domestic consumption.

However, Dolphin Analyst also said that although the industry is temporarily mired in the mud, differentiation is deepening, and some individual stocks have begun to show turning points.

Therefore, on the occasion of the pan-entertainment giant Tencent breaking a new low, Dolphin Analyst chose to open a section on individual stocks after the previous industry overview to re-evaluate the investment value of pan-entertainment individual stocks.

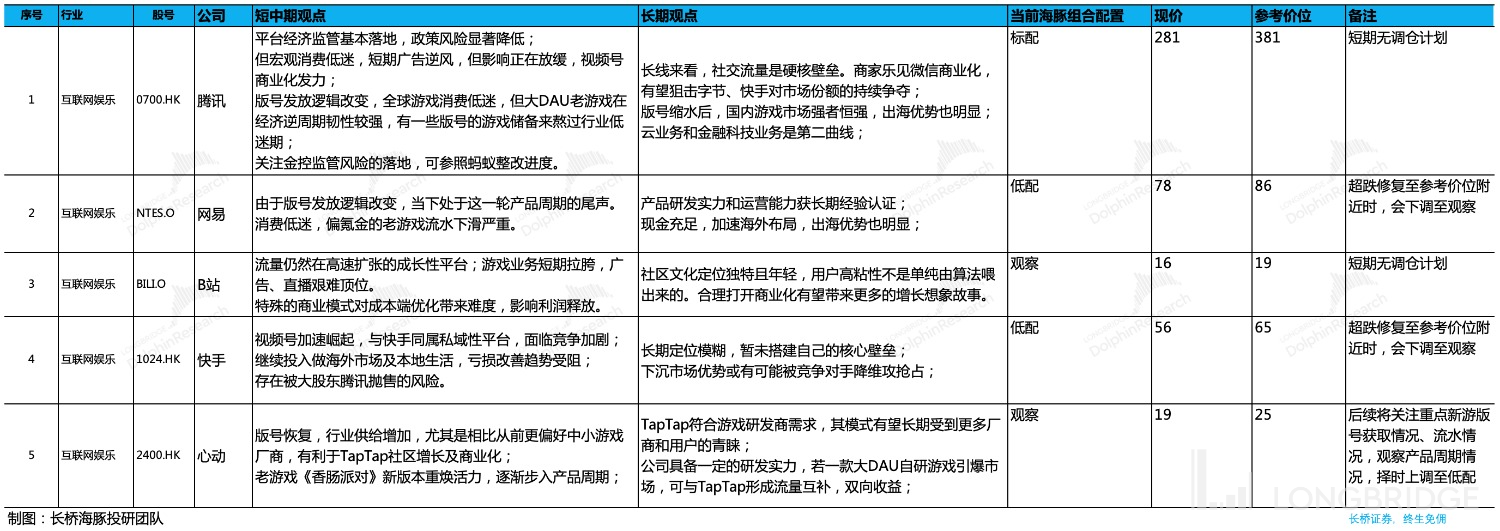

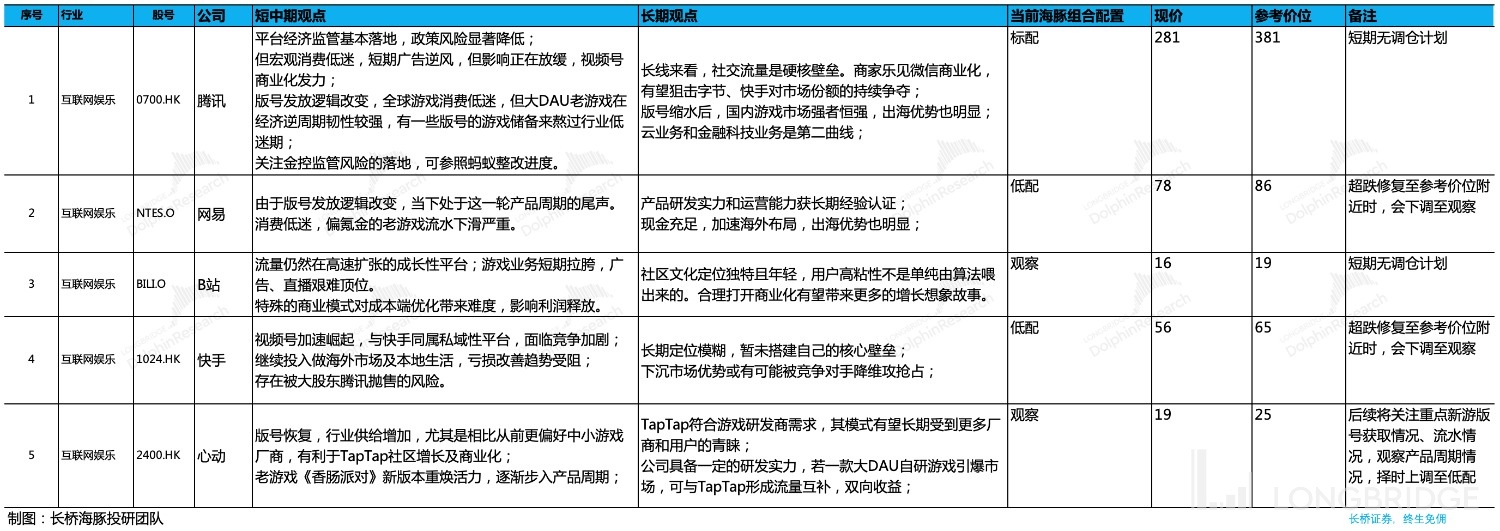

First, Dolphin Analyst presents a summary of the judgment on key pan-entertainment individual stocks:

Dolphin Research focuses on interpreting global core assets across markets and grasping the depth of corporate value and investment opportunities for users. Interested users can add the WeChat account "dolphinR123" to join the Dolphin Research community and discuss global asset investment views together!

In order to better reflect the trend of individual stock differentiation, Dolphin Analyst has classified the main pan-entertainment stocks covered according to factors such as competition stage and content cycle:

1. Lie-flat stocks: Better to be down-to-earth than to look up at the stars

These companies refer to fields where the core user market space is too small, and most of their past expansion was based on spending money. After continuous market validation, it was found that natural growth had already reached its peak. "Lie-flat" behind the class is the helplessness after there is no growth expectation.

Among the pan-entertainment companies covered by Dolphin Analyst, iQiyi, Tencent Music, and Yuewen are such companies. The expected market space has changed from "wide category" to "narrow category". This is mainly because funds have gradually realized that there are too few loyal users who are willing to pay high prices for domestic film and television, music, and online literature content over the long term, not because of their consumption willingness, but because of the limitation of per capita income.

Without imagination, does it mean there is no value? In Dolphin Analyst's view, although the category space has become narrow, they are still irreplaceable leaders in their respective categories. Coupled with positive cash flow after cost reduction and efficiency increase, along with profit release brought about by business streamlining and the most vigorous cost reduction and efficiency increase before exploring new business lines in the restricted market space, the investment opportunities lie more in the bottom value during the pessimistic and oversold process, rather than after the valuation has recovered to neutral space. Their continued position value will also reduce rapidly.

Second, downhill category: after the peak, it falls into silence.

This includes:

-

A downward cycle in product/content. That is, the company's content reserves cycle has passed, and it needs to return to a new round of investment.

-

Cross-border encroachment by competitors, and the relative advantage of the company declines. That is, the industry competition pattern in which the company is located deteriorates, and more new players join. Old players are faced with the situation of long-term potential market space being compressed, and at the same time, they need to spend more costs to maintain the previous scale.

-

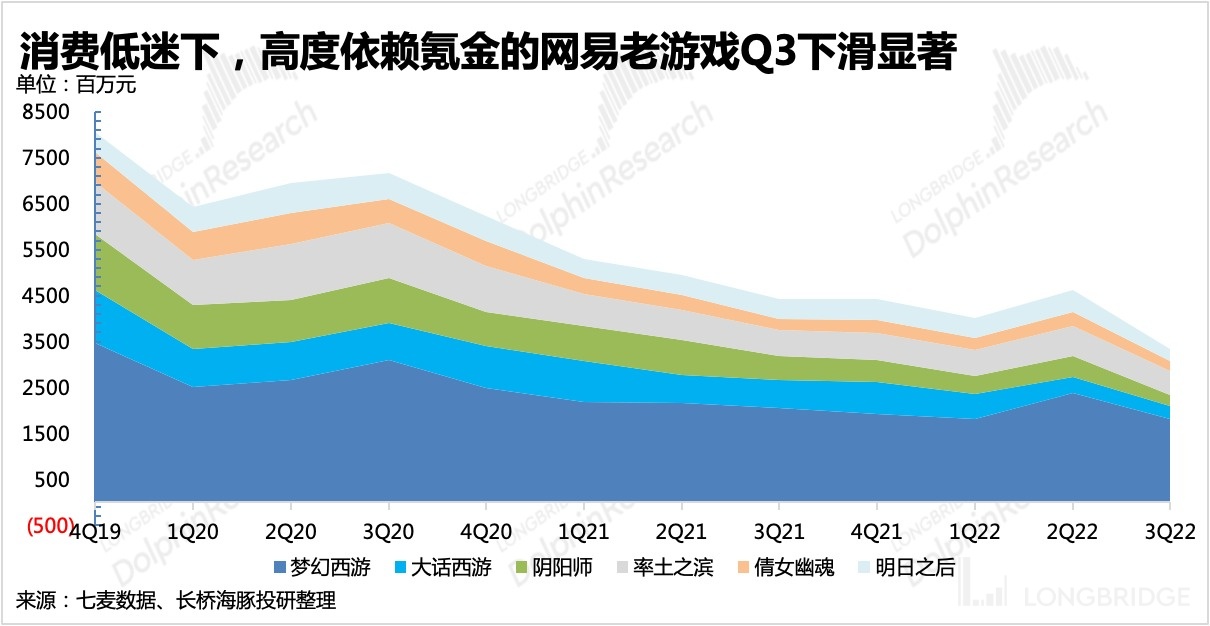

A typical example of the first type is NetEase. When Dolphin Analyst first covered NetEase last year ("NetEase: The "Pig Cycle" of Pig Farms"), he repeatedly emphasized that he was in a relatively strong content cycle. But as the "Ace" (high-heat game) in his hand was played one by one, and in the foreseeable future, the supply of edition numbers would no longer favor large factories like before, the play of NetEase's usual "product matrix"-continuously completing high-growth revenue scale by stacking "small cards" (ordinary games)-was difficult to work at this time.

-

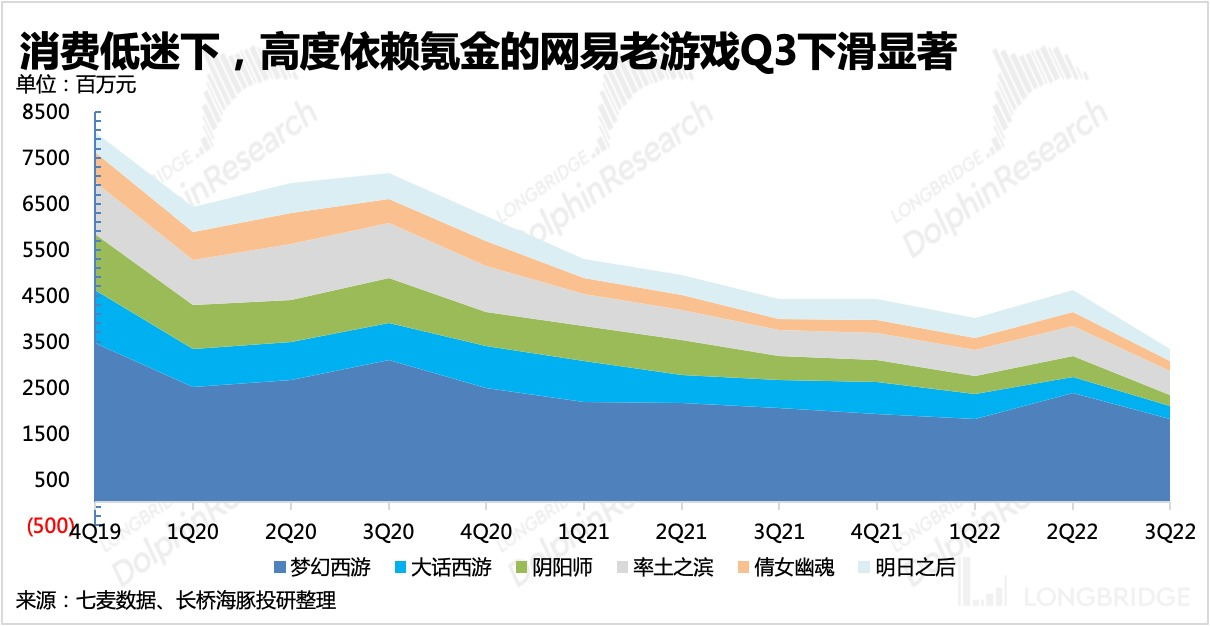

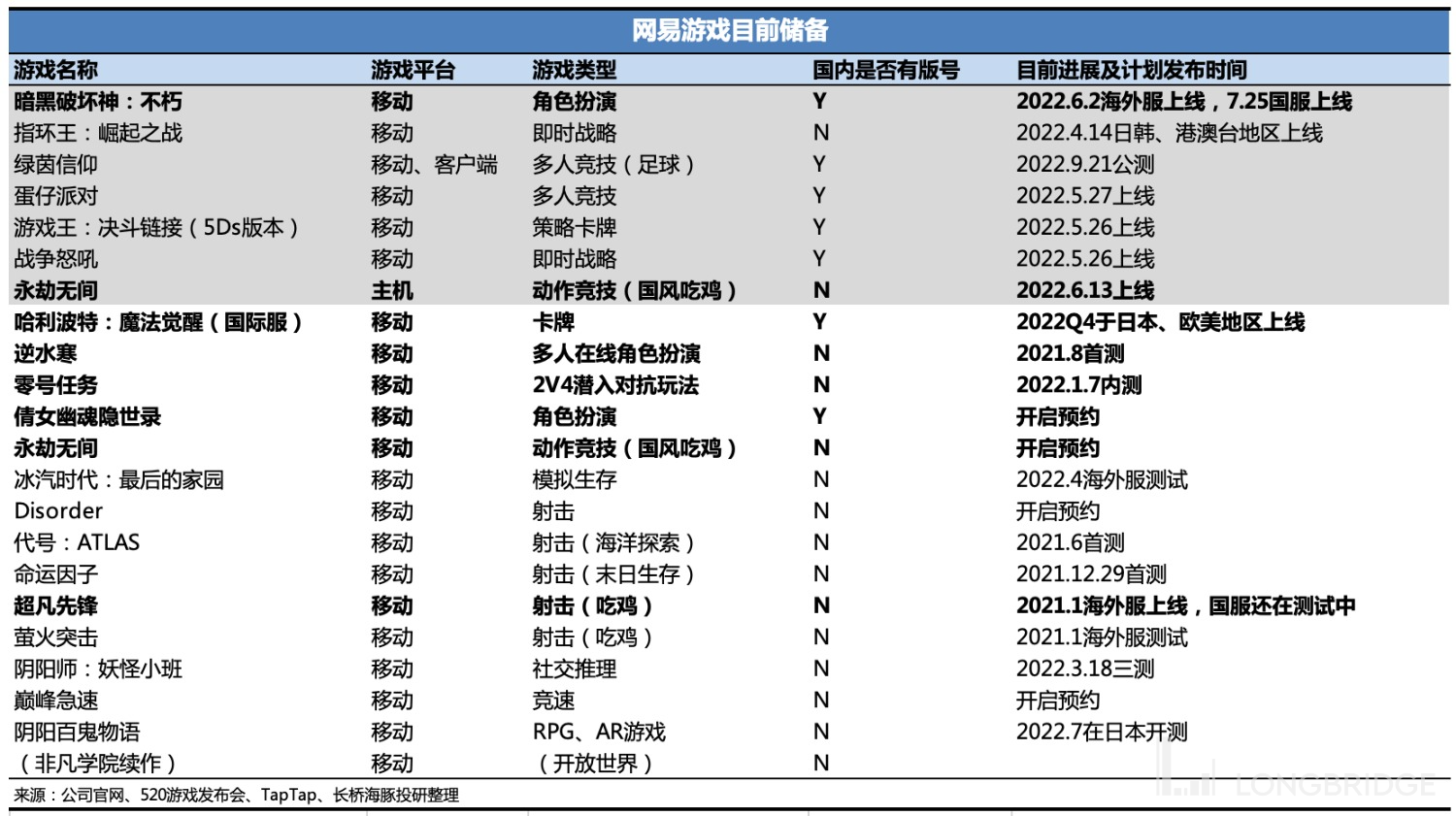

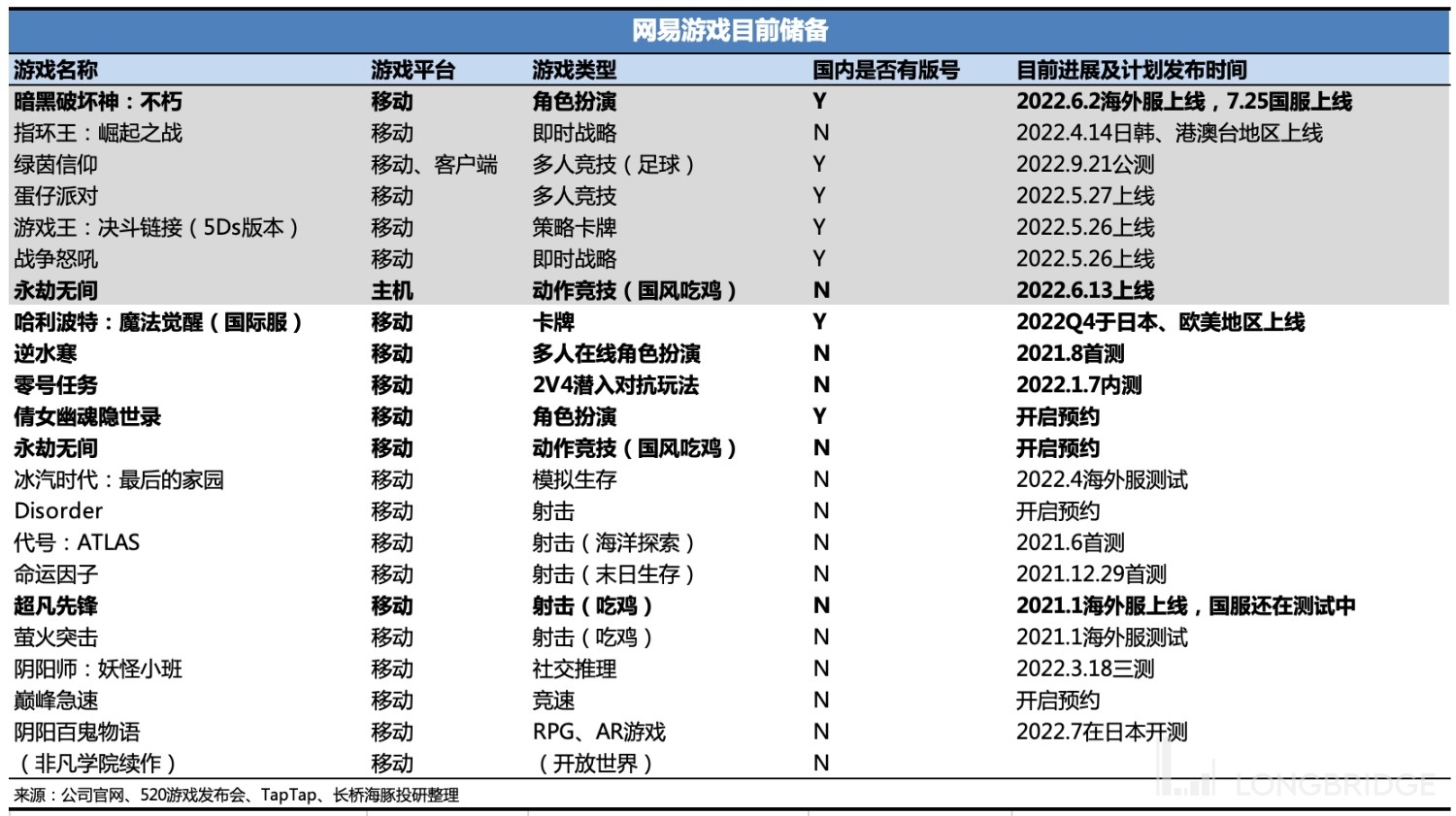

Since the third quarter, NetEase's revenue from old games has dropped too fast. It is true that it is related to the overall decline in game consumption power, but it falls on NetEase itself. On the one hand, the company's games rely more on paid users. They are more affected when consumption is weak. On the other hand, the operating years of these old games have exceeded the life expectancy of ordinary mobile games. Even if the operation is vigorously salvaged, it is difficult to reverse the trend of lightness. Therefore, NetEase is very eager to make up for a new product, but we all know that the problem is not the R&D progress of NetEase, but edition numbers. The more critical problem is that most of the potential "explosive models" in their self-developed mobile game reserves have not yet obtained edition numbers.

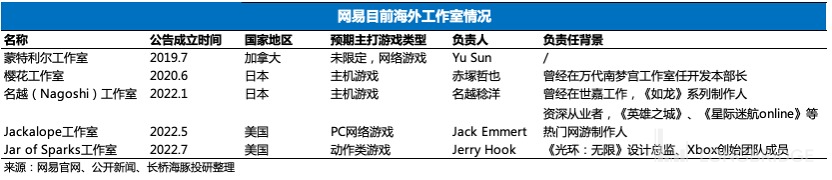

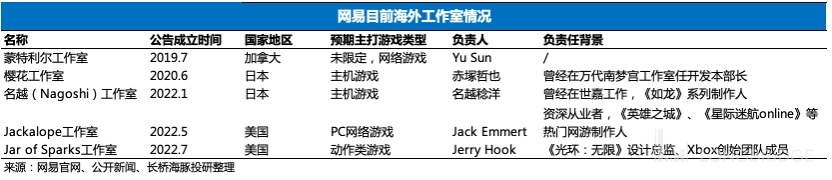

In terms of overseas layout, although NetEase is also stepping up its layout in overseas markets without edition number problems, overseas studios are mainly PC and console games, skewing towards mid-to-heavy games, with a longer R&D cycle for new products that may take 3 to 5 years since Canadian studios were established in 2019.

Therefore, in the short term, NetEase is in the stage of downward cycle of content from 2020 to 2022. Judging from the current reserves, edition number issuance rhythm, and the possible R&D progress of overseas studios (after the establishment of Canadian studios in 2019, the R&D cycle may take 3-5 years), it is estimated that at least it will have to wait until the middle or second half of 2023 for the next cycle to begin.

2. The second type is the long-term logic weakening caused by the downward trend of competitive advantages. For cross-industry competitors such as iQiyi, Tencent Music, Yuewen, and Bilibili, they have been struggling with short videos for a long time. But they have felt the chill since 2018 and 2019, and the impact of competition is still ongoing, rather than just beginning.

2. The second type is the long-term logic weakening caused by the downward trend of competitive advantages. For cross-industry competitors such as iQiyi, Tencent Music, Yuewen, and Bilibili, they have been struggling with short videos for a long time. But they have felt the chill since 2018 and 2019, and the impact of competition is still ongoing, rather than just beginning.

However, among these four small declining categories, when they encounter a decline in valuation and performance at the same time, their outcomes are not the same, and the difference depends mainly on who has sufficient cash in hand. In " Will Chinese Concept Stocks Have A Resurgence After Experiencing Another Crisis?", the Dolphin Analyst calculated in detail the current net cash situation of Chinese concept stocks, and it is clear whether they have money or not.

a. Tencent Music and Yuewen, which have significant monopolistic advantages in their main business and are already profitable with sufficient cash on hand. In the process of market value shrinking, the more sufficient the cash holding amount, the harder the bottom value. When the proportion of cash in market value is too high, there will be funds willing to participate in the rebound.

b. iQiyi and Bilibili, whose main business models are yet to be verified and have high debt levels, and operate by "borrowing money". They are relatively miserable. As long as their business models are not proven, it is difficult for them to usher in a decent rebound. Moreover, their debts are mainly convertible bonds issued when their stock price was high, and in the short term, there is no hope for conversion. All of them will become heavy interest-bearing debts.

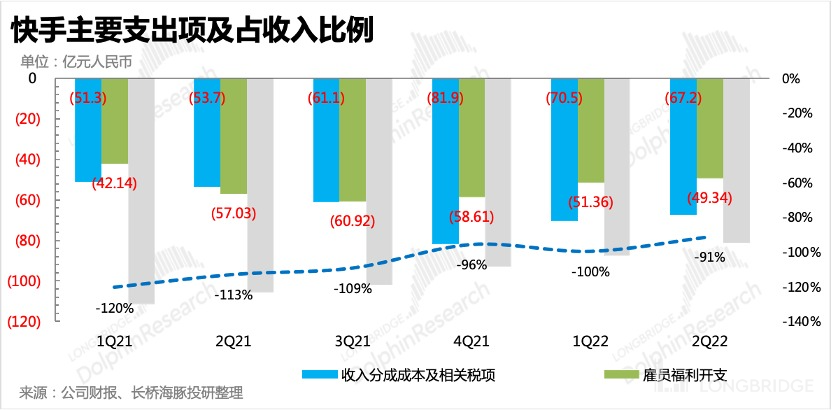

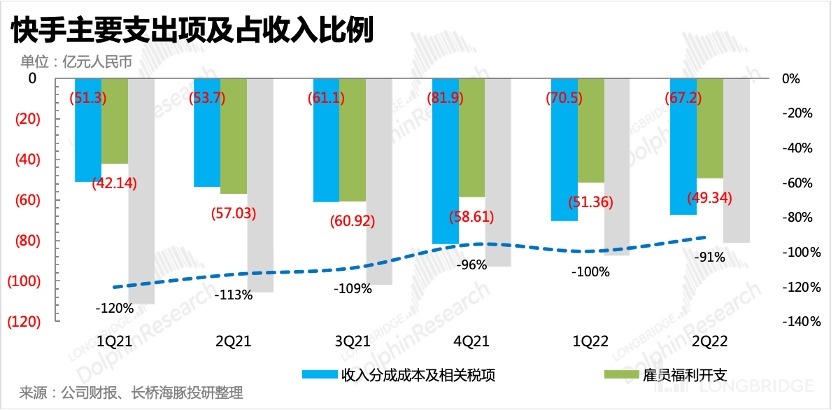

But if we have to discuss who faced deteriorating competition at the beginning, KuaiShou may be one of them. Although the data of KuaiShou's Q2 report is very good, especially the user indicator data, the growth prospects of various businesses for the next quarter are also relatively healthy.

However, the problem lies in the reduction pace of losses. The guidance given by the management regarding the high cost expenditure cannot satisfy the market. Coupled with the recent adjustments made by the company to the organizational structure and business strategy, on the basis of expanding overseas layout, it also targeted the "local life" market. This means that the costs and expenses that were originally shrinking will re-emerge.

What the current market hopes to see is a money-making company that has completed the battlefield occupation phase and begins to steadily generate income, instead of a company that needs to re-enter the "continuous investment, various disruptive" phase and fall into a loss spiral.

In addition, for the promotion of Video Number next year, although the company believes that it will not have a significant impact, it is still difficult to convince the market. Or, KuaiShou has to increase more costs to resist the threat of competition. Growth achieved by high investment without considering costs can no longer be recognized by the market at present.

NetEase and KuaiShou, both of which belong to this category, have had their respective peak moments. Although their revenue growth rate is still far ahead of their peers in terms of horizontal comparison, it is undeniable that their peak period has passed. Compared with Kuaishou, Dolphin believes that, from a mid-term perspective, although the content cycle of NetEase is longer, its competitive advantage in influencing long-term logic is relatively smaller and therefore faces less competition threats.

3. Expected improvement category: there is no room for the worst, and repair is imminent.

Under the pressure of macro, regulation and the exhaustion of traffic dividends in the overall entertainment industry, there are not many companies that truly have a long-term upward trend, and more are breathing opportunities after passing through the darkness.

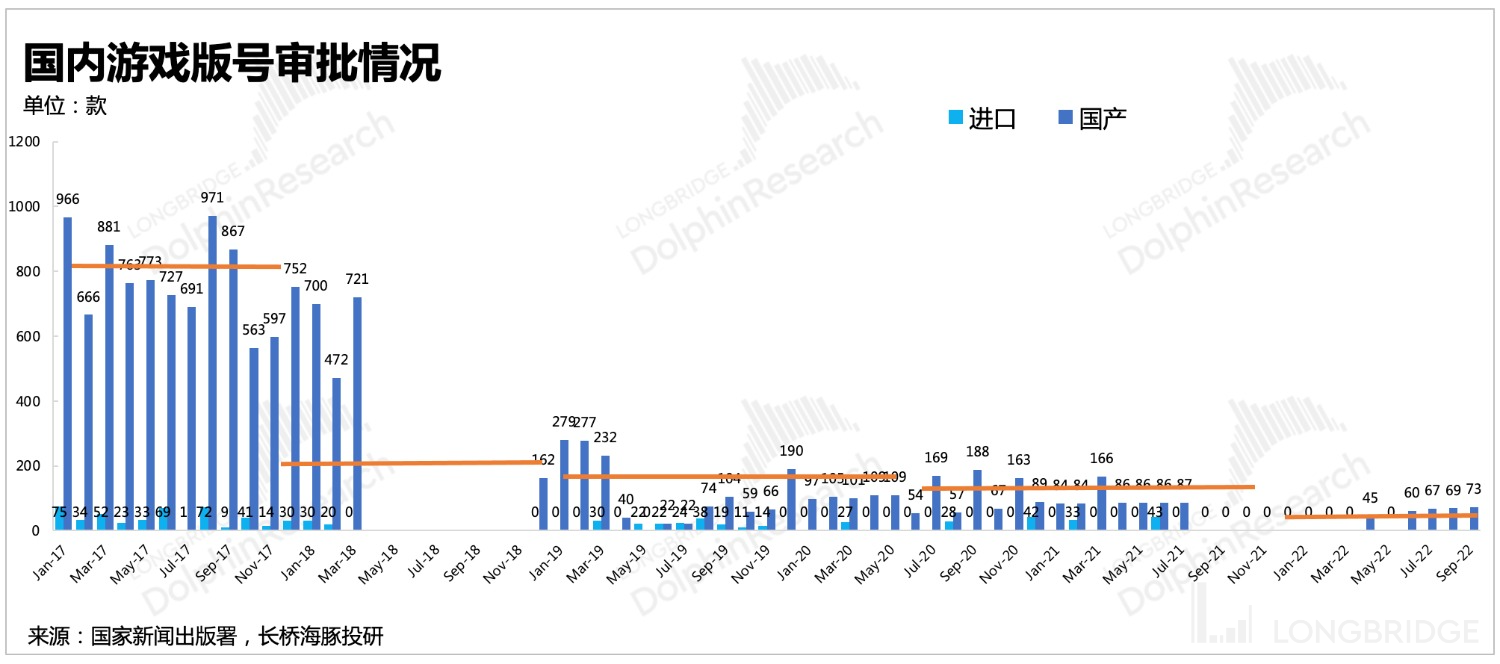

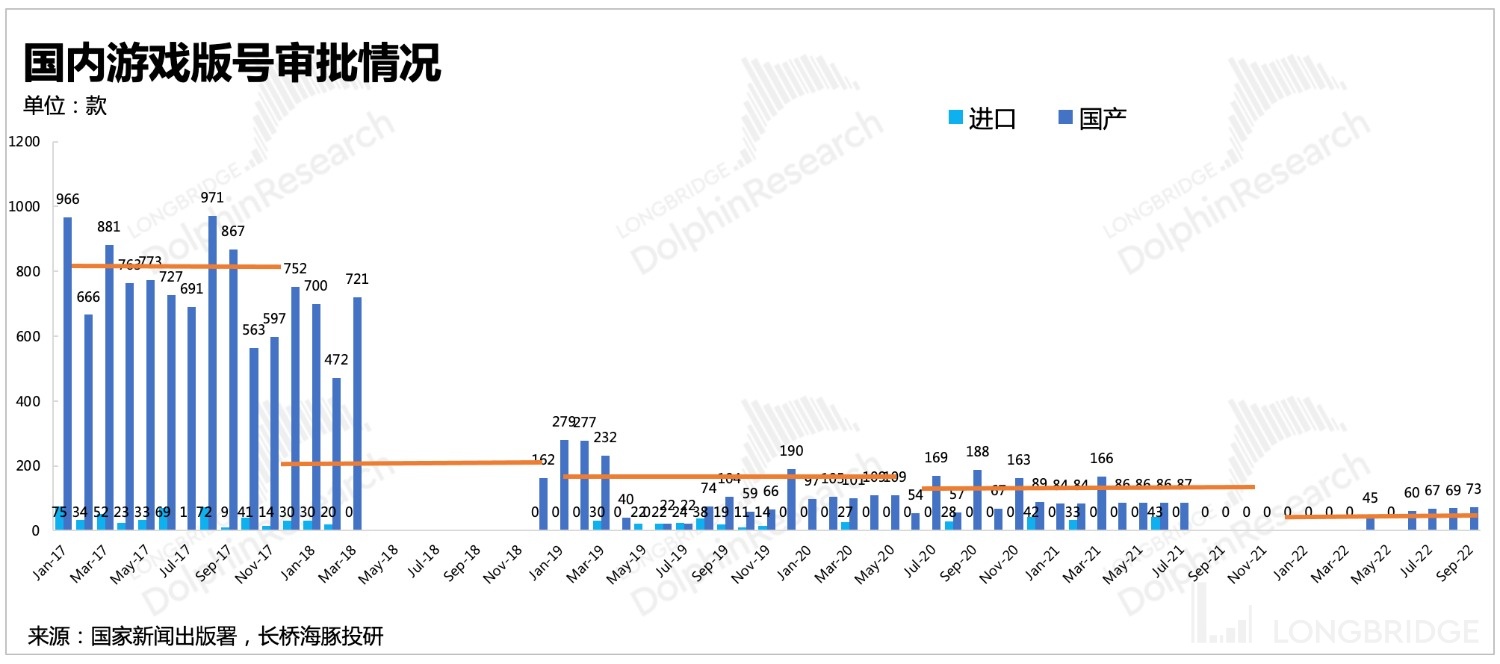

In the past two years, the pan-entertainment industry has been under high-pressure regulation. Among them, the gaming industry with a better business model has suffered the most from regulatory pressure, and the issuance of permits that influence the industry's business climate has been halted for nearly a year. However, with the restart of those permits, industry vitality is starting to reignite. Therefore, the game has the most improvement expectation in the entire pan-entertainment sector.

Currently, the game industry is in the final stage of strong regulation. After the third quarter, the base effect caused by the minor protection policy will be completely digested. In terms of the number of permits issued, it has gradually improved since the restart. Tencent, NetEase and other large factories also obtained permits in the batch issued in September.

Will games return to high-pressure periods in the future? I'm afraid this is the issue that the market is paying close attention to. Dolphin Analyst tends to believe, based on the expert research from JP Morgan last month, that regulatory pressure will gradually relax in the future, but several directions are worth noting:

(1) It is expected that the new "Interim Measures for the Management of Online Games" will be released within 1-2 years in the future. Since the Propaganda Department replaced the Ministry of Culture for the administration of the gaming industry, a series of measures has been successively released, mainly focusing on the protection and guidance of minors in the gaming content. As many new policy regulations have been added, the 2010 version of the "Interim Measures for the Administration of Online Games" needs to be significantly revised.

Dolphin Analyst's interpretation: To a certain extent, the landing of the new regulations means that game regulation will gradually finish its upgrade and move towards more normalization.

(2) The core of regulation still focuses on content control, especially encouraging content containing Chinese culture. However, it cannot violate history; unreasonable violence confrontation (reasonable storyline required); unhealthy polyamorous relationships.

Dolphin Analyst's interpretation: In the short term, the enterprise side may face some frictional costs. For example, the previously developed game content needs to be extensively adjusted, or new projects must be started directly. Both large and small enterprises will be affected, but this influence is fatal for some small enterprises. That means, although the issuance of permits has been relaxed, we will still see more and more gaming companies close their doors in the short term.

(3) With regard to the approval of permissions, previously, they were mainly considering the multiple factors of small enterprises facing the pressure of stopping the issuance of permits, economic pressure and competition from large enterprises, so the operational pressure was greater, and therefore selected to give priority to the permit issuance of small enterprises, which also complies with the principle of "common prosperity".

(4) There will be multiple local approval agencies involved in the review process to speed up the approval process.

(5) Although the license for imported games has not been issued this year, the approval work has not stopped, and it is expected that a batch of licenses will be issued in the second half of the year.

Dolphin Analyst's interpretation: The number of licenses in the future may continue to improve, but in terms of specific allocation, the advantage of the large factories may weaken or even disappear. "Everyone gets a share" should be the trend.

(6) Experts believe that there is a high probability that there will be no further restrictions on the consumption of adult players. Instead, the previous regulations will be followed, such as the number of daily treasure box openings, but the limit for in-game purchases will not be further reduced.

Dolphin Analyst's interpretation: It is somewhat contrary to human nature to impose strong restrictions on adult consumption. Moreover, there has been a clear limit in 2018, so the possibility of further reducing the limit for in-game purchases is low.

Overall, the regulatory intensity has relaxed significantly compared to a year ago, and the likelihood of a return to high pressure is low. However, at the same time, in the short term, the game is still in the stage of overall consumption weakness due to the global economic downturn, the impact of protection of minors in mainland China, and the release of international epidemics.

Except for the policy impact and the impact of the unblocking of the international epidemic, these factors may gradually be digested in the first half of next year. However, the economic slump's impact on consumption needs to be further observed, but due to the low base, the rate of decline will slow down.

Therefore, the Dolphin Analyst believes that although the game is currently at a turning point from the bottom, it is still in a weak rebound after passing through the darkest period in the short term due to the global economic downturn in consumption.

According to the standards of "increased number of licenses and both large and small factories getting a share" and "less affected by consumption weakness," we tend to pay attention to Xindong and Tencent in the short term.

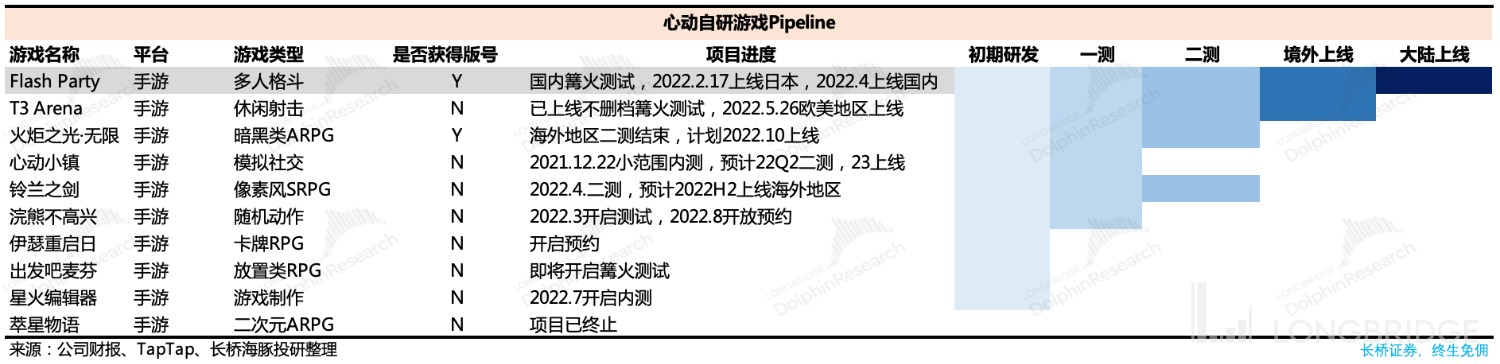

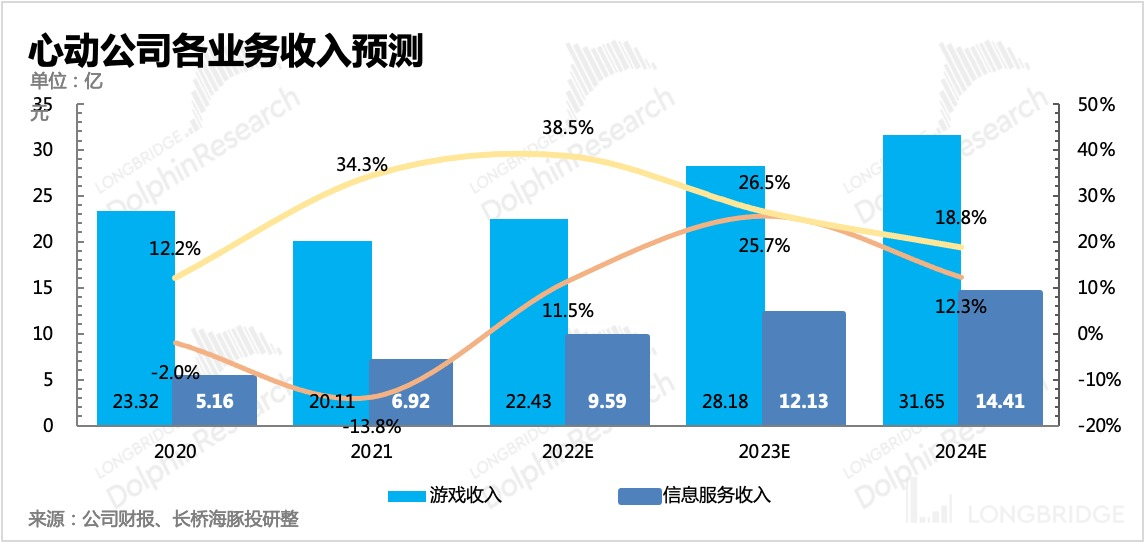

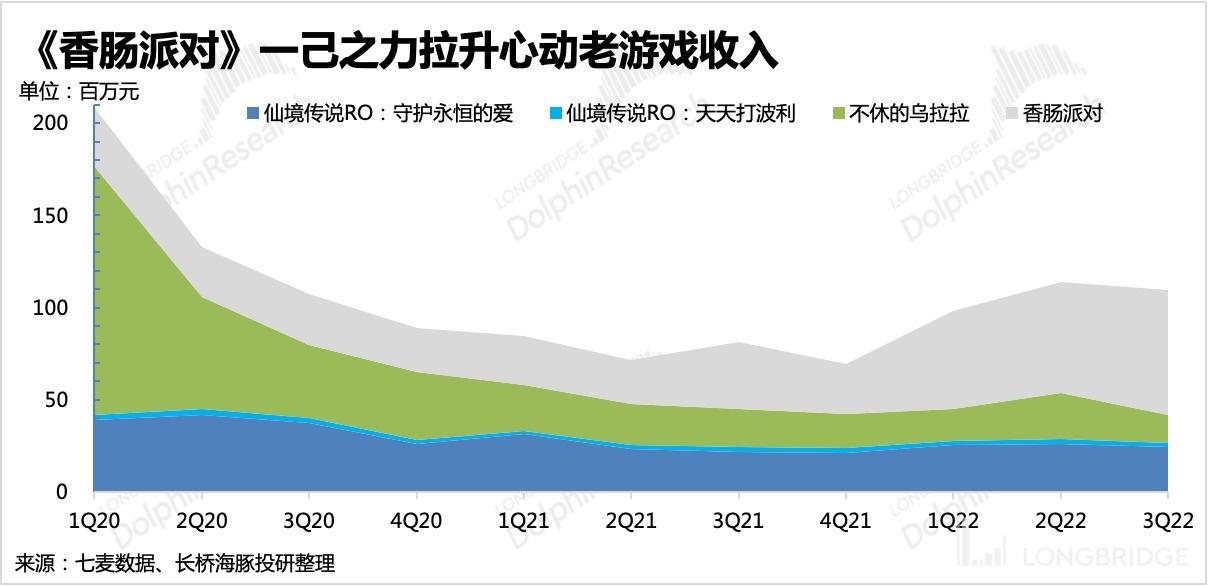

a. First of all, Xindong has greater upward momentum. On the one hand, the increase in industry supply is conducive to TapTap's accelerated ecological expansion and commercial rhythm. On the other hand, Xindong itself has gradually ushered in a product cycle that has been silent for nearly three years.

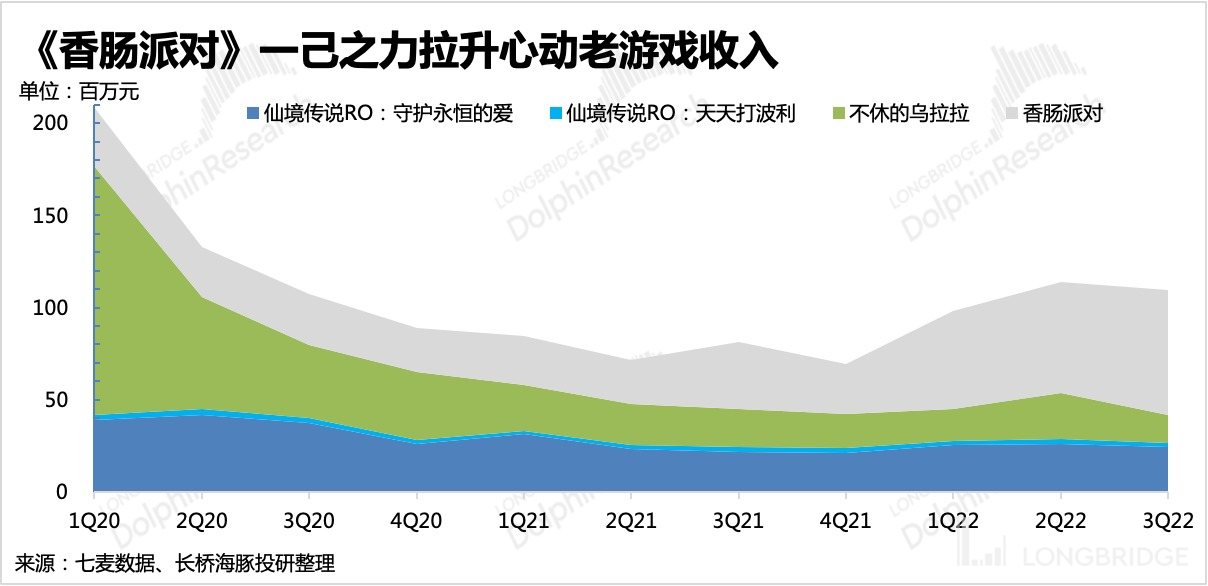

In addition, the old game "Sausage Party" has achieved great success in the first half of this year, making up for the poor performance of the new game "Flash Party." From the revenue data in the third quarter, "Sausage Party" is still continuing to perform well, which can temporarily relieve Xindong's anxiety about the urgent need for new games.

Among the upcoming games, "T3" has been launched in the Japanese market and performed well, and the Chinese domestic market is waiting for the license. If "Township of Animedream" can obtain a license next year, it is also expected to be launched quickly. "Torchlight" has already obtained a license and is in the final polishing stage.

The Dolphin Analyst believes that, like "Sausage Party," "Torchlight," also a shooting game, should not perform poorly after launch like "Flash Party."

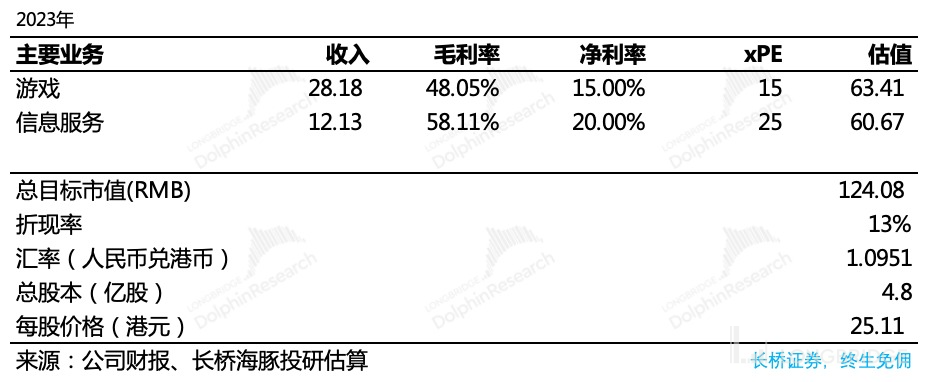

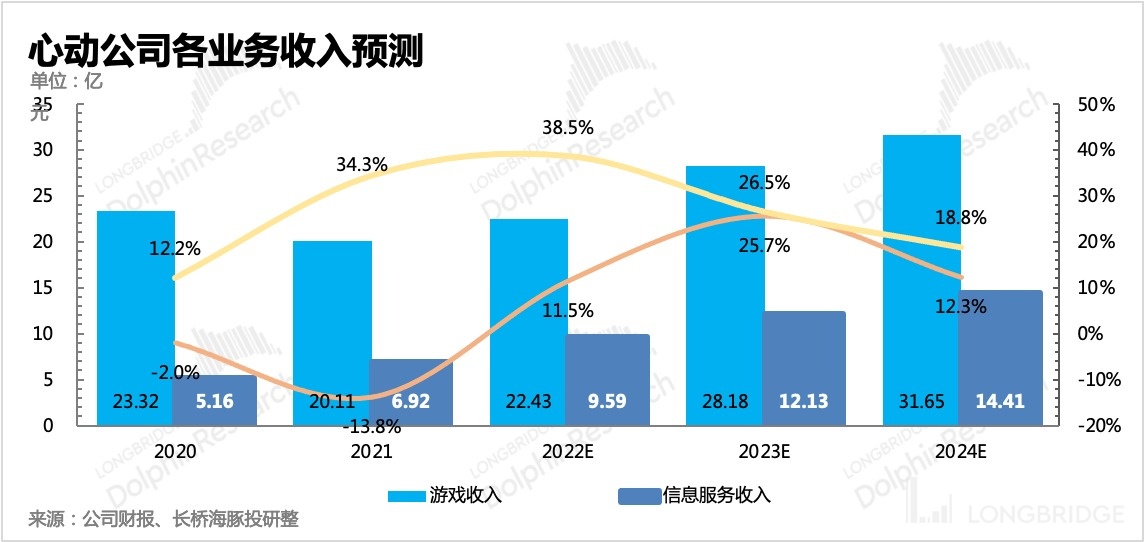

Here Dolphin Analyst made a simple update to the valuations based on the above analysis:

Here Dolphin Analyst made a simple update to the valuations based on the above analysis:

-

Assuming that the pay-to-play test of "Torch Light" runs smoothly in the second half of the year, according to the current version policy and management expectations, "T3" and "Mirage Town" will enter the public beta testing phase next year. The product cycle of Mirage will then begin.

-

While the number of game versions is increasing in China, the monthly active users of TapTap continue to grow rapidly, and is expected to reach nearly 50 million in 2023. At the same time, as the industry's prosperity continues to increase, the ecological expansion and commercialization are also on the rise.

-

The gross profit margin of games and TapTap continues to recover due to the release of self-developed game revenue and expansion of advertising revenue. However, as the international version of TapTap is still in the investment phase, it is difficult to recover to the level before 2022 in the short term.

-

Research and development costs will reflect the effect of optimization through layoffs in the second half of the year, and so maintain a steady growth rate in accordance with the product cycle.

Under the above assumptions, the revenue growth rates of Mirage and TapTap are as follows:

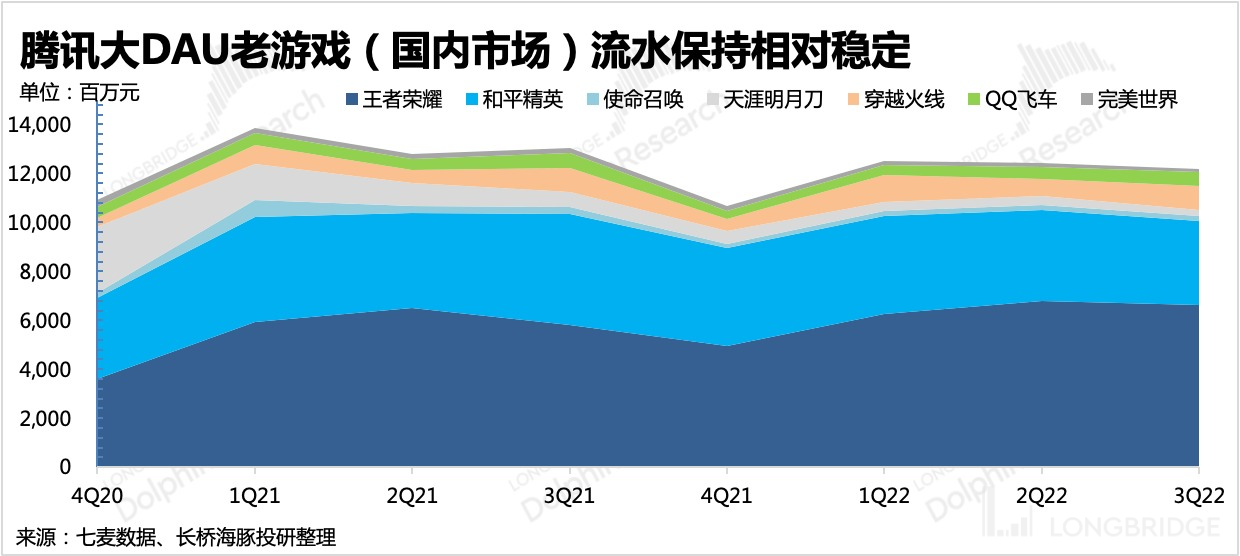

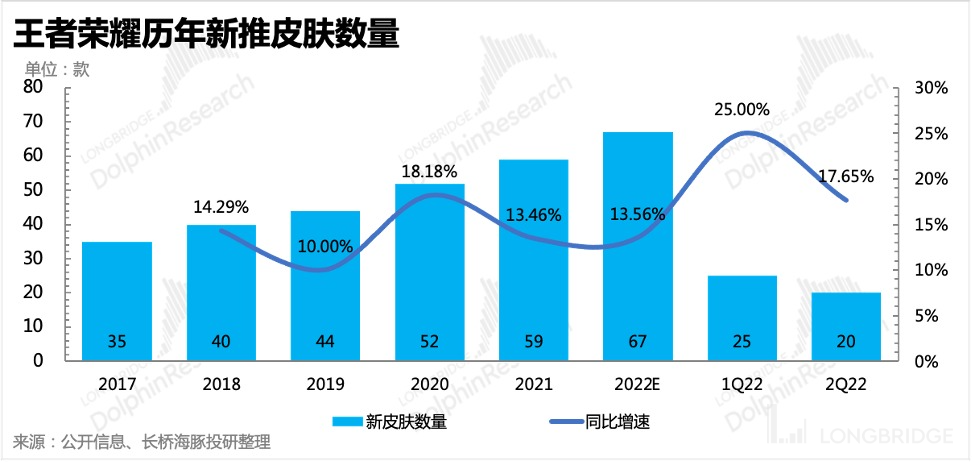

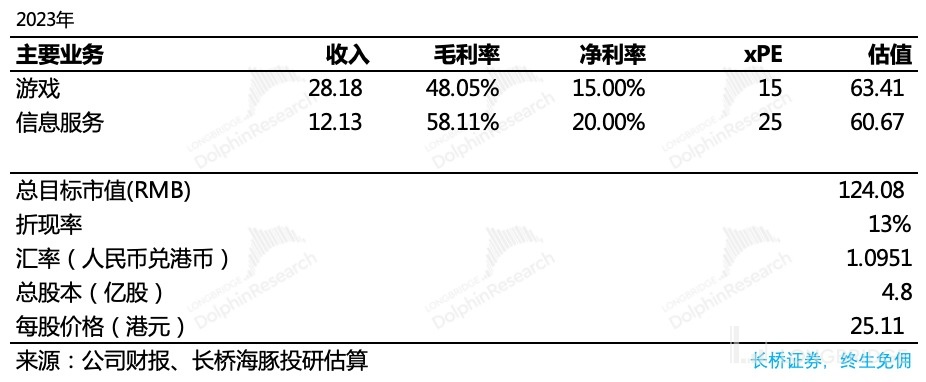

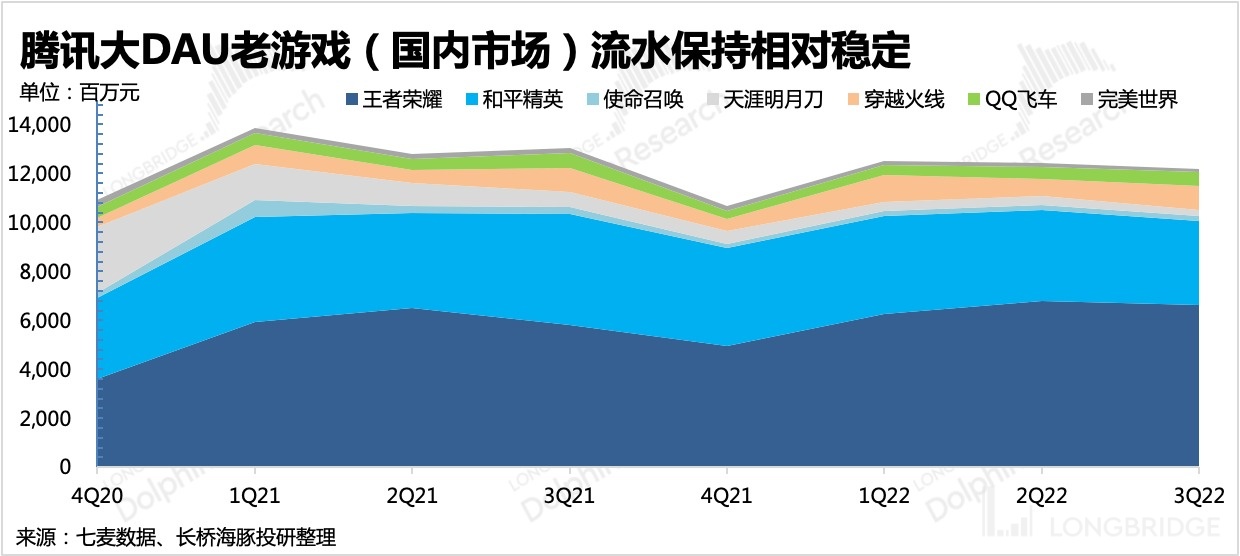

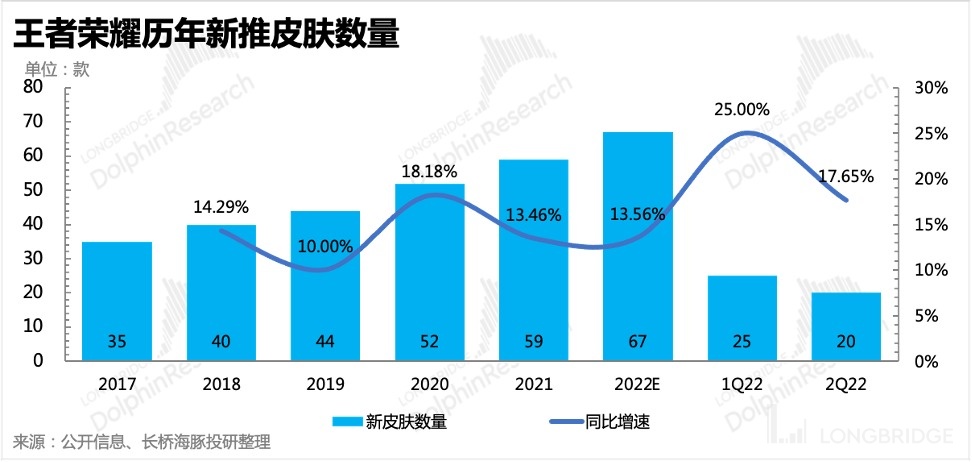

b. Secondly, there is Tencent. Although Tencent has not obtained version numbers for its self-developed games recently, it is fortunate that it still has a rich reserve of games. In addition, unlike NetEase, Tencent's top games rely on large DAUs to generate revenue. According to Qimai data, Tencent's old games do not decline as much as NetEase.

In addition to the rapid decline in revenue of "Tian Ya Ming Yue Dao," Tencent is more adept at operating competitive games such as "Honour of Kings," "Peace Elite," and "CrossFire," although their revenue may fluctuate, their overall performance is relatively stable.

In addition, Tencent's upward inflection point includes non-gaming businesses, cost-saving opportunities, and potential shareholder gains from selling investment equity.

Due to its high investment faith in Tencent's social foundation, Tencent carries high market expectations. As the trend of the industry leaders largely affects the overall industry sentiment and given the self-inflicted divergence signal of its strong fundamentals, and multiple factors affecting short-term stock price trend from large shareholders' pressures, we still consider Tencent as a BUY. Therefore, Dolphin Analyst will single out Tencent for a detailed analysis and valuation judgment in this entertainment series overview, focusing on the bottom value under conservative expectations. The next part will be released soon, please stay tuned!

Related Articles by Dolphin of Longbridge Entertainment:

September 16th, 2022 "Different life paths, same fate for Tencent, Kuaishou, and Bilibili"

July 1st, 2022 "TikTok wants to teach the "big brothers" how to work, Google and Meta are about to change"

June 15th, 2022 "Both are "deficit" giant baby diseases, Kuaishou and Bilibili, who can recover?"

May 5th, 2022 "Breaking through the entertainment ecosystem: Re-exploring Tencent and Bilibili's vast ocean"

April 15th, 2022 "The restart of game approvals caused no splashes?"

February 17th, 2022 "US streaming media overview-Netflix and Disney's "love you win" battle"

February 16th, 2022 "Consumer Internet "Roll King" competition, Meta, Google, Netflix fighting with bayonet"

December 3rd, 2021 "Is the second half still coming for Google, Facebook, Netflix as "big floods" are coming to an end?"

September 15th, 2021 "Retrospective on entertainment ecosystem: Another round of winter, how far are Tencent and Kuaishou from their spring? (Part 2)"

September 13th, 2021 "Retrospective on entertainment ecosystem (Part 1): Another round of winter, how far are Tencent and Kuaishou from their spring?"

Risk Disclosure and Disclaimer for this article: Dolphin Research is not responsible and disclaims any liability whatsoever for any direct, indirect or consequential loss or damage arising from the use of this article or its contents. (https://support.longbridge.global/topics/misc/dolphin-disclaimer)