BOE: Three Signals of Bottoming Out and Recovery

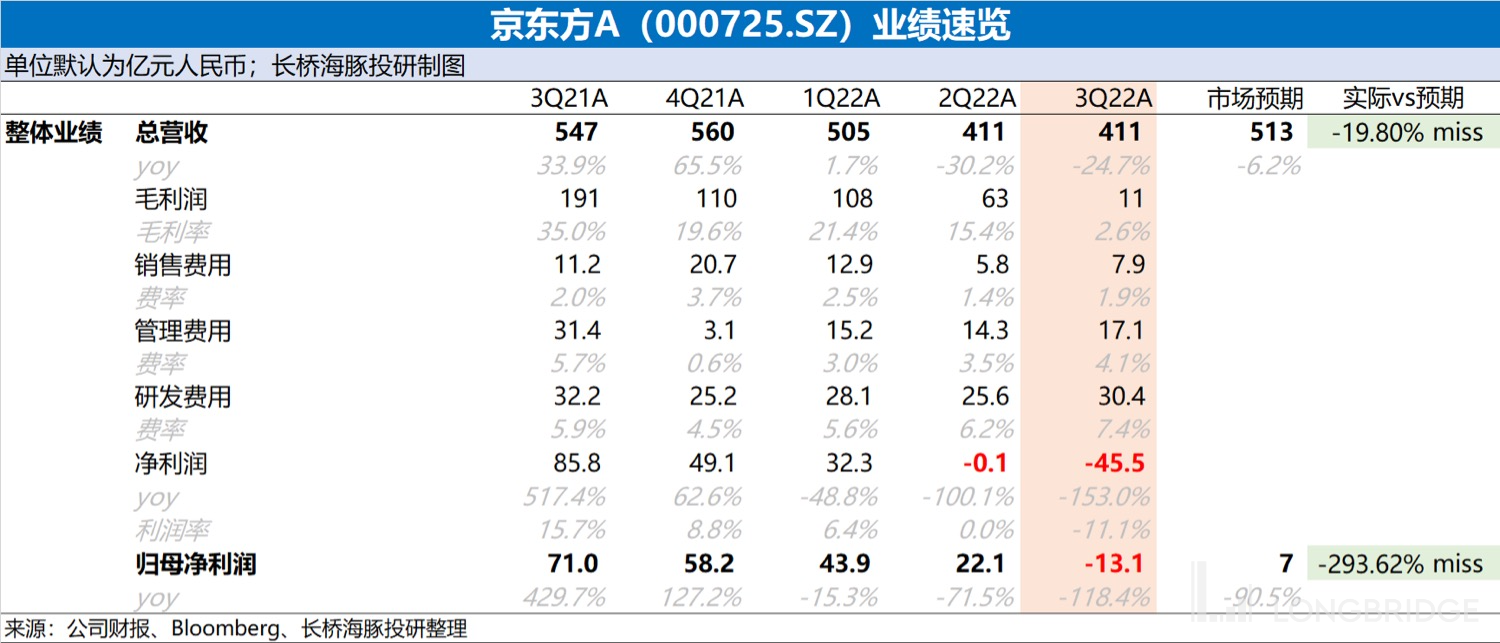

Longbridge (000725.SZ) released its third-quarter financial report for 2022 (ended September 2022) after the Longbridge A-share market on the evening of October 30, 2022. The main points are as follows:

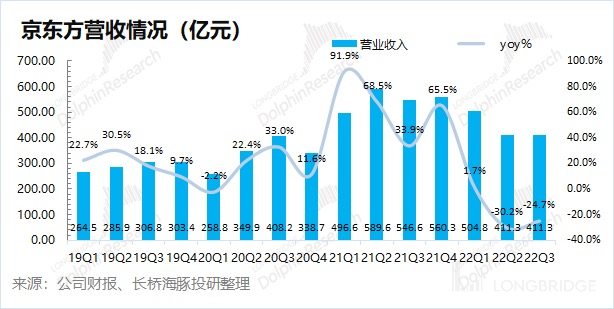

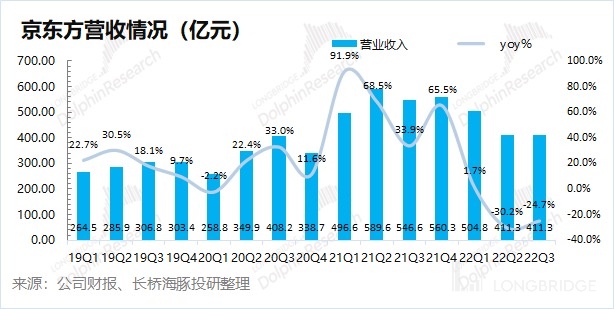

1. Revenue: Weak demand results in a significant decline in performance. Longbridge A.SZ's total revenue for the third quarter of 2022 was CNY 41.13 billion, a year-on-year decrease of 24.7%, which was lower than Bloomberg's consensus forecast (CNY 51.3 billion). The main reason for the significant decline in the company's revenue is the continued downward trend of panel prices and the adjustment of capacity utilization rate in the third quarter. As the downstream of the panel industry is mainly televisions, PCs and other displays, the weak downstream has a direct impact on the shipment of industry panels.

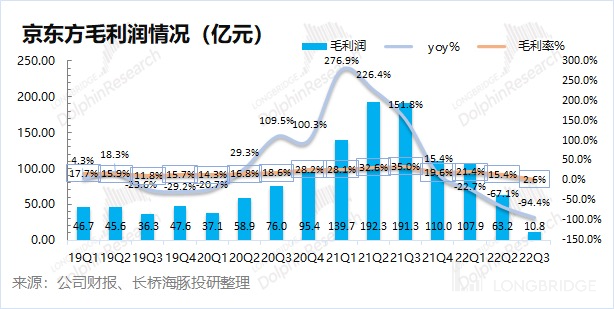

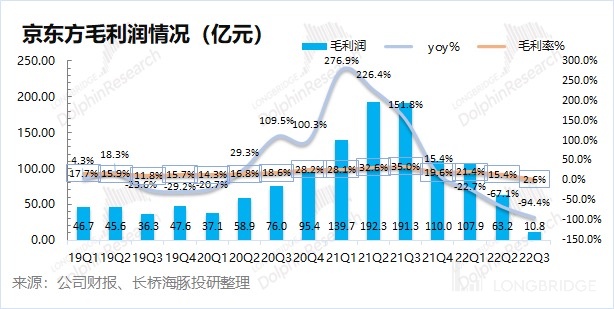

2. Gross margin: Prices and capacity utilization rates drive down profit margins. The company's gross margin for the third quarter was only 2.6%, a new low in recent years. The main reason is that the continuous downward trend of panel prices has squeezed the company's profit margins. At the same time, as prices have broken the cash cost, the company reduced the capacity utilization rate in the third quarter, further exacerbating the decline in gross margin. Although the panel prices continued to decline in the third quarter, there are signs of rebound in panel prices recently. As panel prices rebound, the gross margin for the fourth quarter is expected to increase compared to the third quarter.

3. Financial indicators: inventory begins to decrease, cost control is effective. The company's operating indicators for the third quarter began to improve as inventory decreased by CNY 4.5 billion compared to the second quarter, indicating that the company's inventory began to decrease. At the same time, the company's operating expense ratio decreased in the third quarter, benefiting from the company's cost control measures.

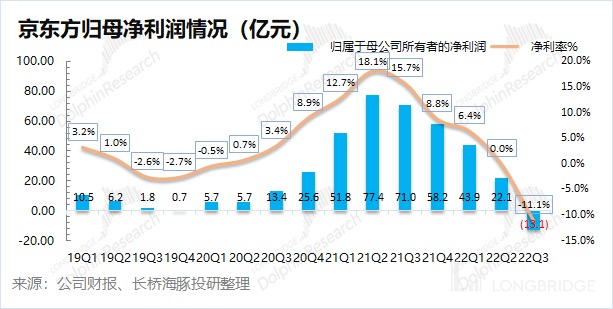

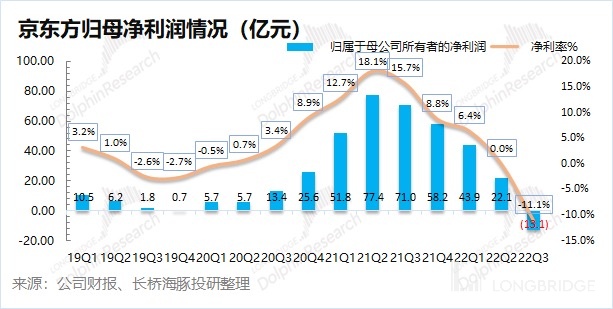

4. Net profit attributable to shareholders of the parent company: Quarterly loss for the first time in 6 years. The company's net profit attributable to shareholders of the parent company for the third quarter was a loss of CNY 1.3 billion, lower than Bloomberg's consensus forecast (CNY 0.7 billion), which was the first quarterly loss for the company in 6 years. The panel prices have broken the cash cost this quarter, directly leading to the company's loss this quarter.

Overall, Longbridge's performance this quarter was very poor, recording Longbridge's worst quarterly performance in 6 years. From the surface data, both revenue and profit this quarter were below market expectations.

However, Dolphin Analyst believes that this Bloomberg consensus forecast is not referenceable:

1) Revenue falling short of expectations: If we have been tracking the panel industry, Longbridge achieved revenue of CNY 41.1 billion in the second quarter, while panel prices continued to decline in the third quarter, and capacity utilization rate was reduced. In this case, providing a quarterly forecast of more than CNY 50 billion is a bit unreasonable.

2) Falling short of expectations on the profit side: The panel industry has broken the cash cost in the third quarter, and the consensus forecast provides a quarterly forecast of CNY 0.7 billion, which is not reasonable. Dolphin Analyst already mentioned in the previous quarter's financial report commentary《Longbridge: Buying not just performance, but also a cycle reversal》that "as the panel prices continue to fall in the third quarter, the company may experience losses in the third quarter." On BOE's poor performance this quarter, the decline in panel prices has been expected. However, for investors, the focus is on the company's future. The Dolphin Analyst believes that there are multiple signals demonstrating signs of a bottom-out recovery for BOE.

Signal 1 (Bottom-out Signal): This quarter, BOE's net profit attributable to shareholders was negative for the first time in six years, even though it was positive even before the last cycle started in 2020. This time BOE's performance was lower than the previous cycle's bottom.

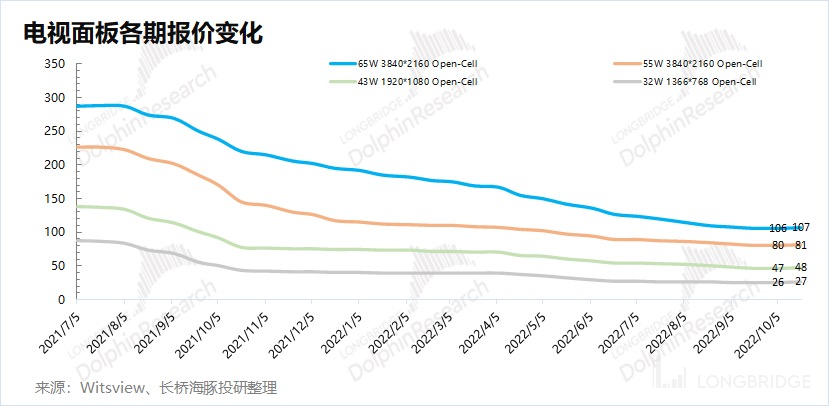

Signal 2 (Recovery Signal): In the third quarter, panel prices continued to decline, but in late October, panel prices rose for the first time in 14 months, with all products increasing in price. The rebound in prices will help improve the company's revenue and gross margin. With the recovery in prices, BOE's performance in the fourth quarter is expected to be better than in the third quarter, which could become the bottom of the performance.

Signal 3 (Inventory Digestion): BOE's inventory at the end of the third quarter was nearly 4.5 billion yuan less than at the end of the second quarter. The accelerated digestion of inventory is benefiting from increased downstream demand for replenishing warehouses, and the industry is expected to return to supply-demand balance.

"Performance Bottoming-out + Price Turning-up + Accelerated Inventory Digestion," from multiple perspectives, demonstrates that BOE and the panel industry are bottoming out. With the rebound in panel prices, the industry is expected to achieve supply-demand balance, and the company will also turn losses into gains. The Dolphin Analyst also pointed out in the previous quarter's review that "BOE has long-term investment value in the middle and long terms, but it is still in the left area, where exploratory left opening is viable. Poor performance may continue to appear in the short term, but this does not affect the company's long-term value and may provide more underestimated buying opportunities."

However, at the current node, the Dolphin Analyst would also like to remind investors that, although the panel industry is expected to bottom out and rebound, this may very likely be due to the rebound of the supply side. In fact, there is no sign of a surge in demand in downstream products such as TVs and PCs. The Dolphin Analyst believes that this time the panel price adjustment is mostly a correction after a sharp decline, aiming to return to the supply-demand balance point, which will have a positive impact on BOE and the industry's performance. However, since there is no obvious demand surge at present, panel prices are unlikely to quickly return to their previous high levels. Based on the current situation, investors have the opportunity to enjoy the benefits of the excessive decline, but it is difficult to return to the high point of the past in the short term without seeing a surge in demand.

The following is Dolphin Analyst's specific analysis of BOE:

Revenue End: Weak demand leads to a significant decline in performance.

BOE's total revenue in the third quarter of 2022 was 41.13 billion yuan, a year-on-year decrease of 24.7%, lower than market expectations (51.3 billion yuan). The company's revenue has fallen sharply for two consecutive quarters, mainly due to weak downstream demand for displays, which has caused product prices to fall.

2. Gross Profit End: Price and Capacity Utilization Rate Lead to Gross Margin Collapse

In Q3 2022, BOE achieved a gross profit of 1.08 billion yuan, which decreased by 94.4% YoY. The continued sharp decline in gross profit was mainly due to the sharp drop in gross profit margin.

The company's gross profit margin for the quarter was 2.6%, a YoY decrease of 32.4pct. The significant drop in gross profit margin was mainly due to the "collapsing" decline in panel prices and the company's adjustment of the capacity utilization rate of some production lines starting from Q3.

3. Panel Prices: Signs of Bottoming Out and Rebounding

Given BOE's significant decline in revenue and gross profit margin, the main reason is the significant drop in panel prices. So, let's take a look at the current situation of panel prices.

According to Witsview's October-end price list, the prices for 65-inch/55-inch/43-inch/32-inch panels were $107/$81/$48/$27, respectively. The prices are still at the bottom of the panel cycle, but this period's panel prices have seen a full-line increase for the first time in 14 months of decline.

Given that the price of TV panels broke the cash cost since Q2 and panel manufacturers are under pressure to sell only at or above cash cost, panel prices began to rebound in October.

As Dolphin Analyst pointed out in the Q2 evaluation of " BOE: Buying Not Performance, Cycle Reversal ," "In Q2, the company's net profit margin has fallen to the breakeven line, and other industry players have shown signs of losses. The industry entered a state of "more production, more losses," so the industry's capacity began to contract in Q2. With the breaking of cash costs, the contraction of capacity is expected to accelerate the digestion of inventory, and panel prices are expected to bottom out more quickly."

The rebound in panel prices is mainly due to the unsustainable phenomenon of panel manufacturers selling at prices lower than the cost. It is inevitable for prices to rise. However, at the same time, downstream products such as TVs and PCs as optional consumables have not shown obvious signs of demand recovery in the macroeconomic background.

Dolphin Analyst believes that the current price rebound is mainly due to the cost pressure on the supply side, while also noting that there is no sign of demand driving up prices in the current cycle. The current price rebound only returns to the supply-demand relative balance from below the cost price and has not seen the demand-driven rises in the past cycle. Four. Financial Indicators: Inventory Turnover and Cost Control have Achieved Some Results

4.1 Operating Indicators: When the industry is in a downturn, it is more important to focus on a company's inventory and operating indicators.

- Inventory situation: RMB 28.5 billion this quarter, a decrease of 0.1% YoY. JD's ongoing high inventory has finally declined this quarter, and the inventory/revenue ratio has dropped to 0.69. This also confirms Dolphin Analyst's previous forecast that "the company lowered its capacity utilization rate in the second quarter to digest inventory", and has achieved significant results in the third quarter.

- Accounts receivable: RMB 27.7 billion this quarter, a decrease of 22.2% YoY. The ratio of accounts receivable to revenue is 0.67, which is at a relatively reasonable level.

4.2 Cost Control: Control Expenses

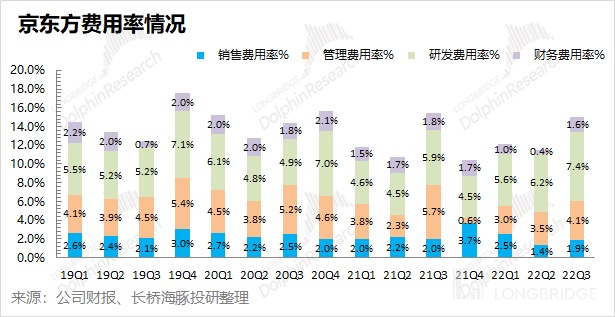

In the third quarter of 2022, BOE's four expense items totaled RMB 6.18 billion, a decrease of 26.8% YoY. The total four cost ratio is 15%, with a slight decrease, mainly due to the company's cost control measures.

1) Sales expenses: RMB 0.79 billion this quarter, a YoY decrease of 28.8%, and a sales expense ratio of 1.9%. The company's sales expenses and revenue changes have a certain correlation. The decline in revenue this quarter also reduces the company's sales expense expenditures.

2) Management expenses: RMB 1.70 billion this quarter, a YoY decrease of 45.6%, and a management expense ratio of 4.1%. The company has properly controlled its management expenses, and the management expense ratio has decreased.

3) R&D expenses: RMB 3.038 billion this quarter, a YoY decrease of 5.7%, and an R&D expense ratio of 7.4%. R&D expenses are still the largest proportion of the four expenses. The company has properly controlled R&D expenditures while still maintaining high R&D investment, indicating that the company still values R&D.

4) Financial expenses: RMB 0.643 billion this quarter, a YoY decrease of 34.1%, and a financial expense ratio of 1.6%. The change in the company's financial expenses is mainly due to a reduction in net interest expenses.

Five, Net Profit Attributable to Parent Company: Quarterly Loss for the First Time in 6 Years

BOE's net profit attributable to the parent company in the third quarter of 2022 was negative RMB 1.3 billion, a YoY decrease of 118.5%, which was lower than market expectations (RMB 0.7 billion). The company's net profit attributable to the parent company this quarter is the first quarterly negative number in six years, even before and after the start of the last cycle in 2020, it still achieved a positive profit. And the main reason for the significant drop in net profit attributable to shareholders this time is that the decline in panel prices directly affected the company's revenue and gross profit margin.

In Q3 2022, the company's net profit margin decreased to -11.1%, which is in line with Dolphin Analyst's expectation in the previous quarter report that "as panel prices continue to decline in Q3, the company may face losses in this quarter."

In Q3, it was a "very tough" time for BOE and the entire panel industry, and industry leader BOE also experienced a loss of 1.3 billion yuan in this quarter. This also forced the entire industry to adopt the strategy of "not taking orders at cost price". Dolphin Analyst believes that with the recovery of panel supply-side prices, the profitability of BOE and the industry as a whole will also be restored. With the entry of Q4, the replenishment of customers such as Samsung, etc., both prices and production capacity utilization rate are expected to rebound, and Q3 may be the worst time for the company and the industry.

Dolphin's historical articles on BOE:

On October 20, 2022, "The First Overall Price Increase of TV Panels in 14 Months, Focus on Industry Reversal Opportunities" was analyzed and judged. (https://longbridgeapp.com/topics/3554944)

August 31, 2022 financial report review "BOE: Buying is not performance, but cycle reversal" (https://longbridgeapp.com/topics/3392508)

Deep analysis of the company on July 26, 2022 "360-degree dismantling of BOE: Why short-term mines do not affect long-term value?" (https://longbridgeapp.com/topics/3198941)

Industry in-depth analysis on July 5, 2022 "From Double "Mighty" to Double "Bear": Is the Cycle of BOE and TCL over?" (https://longbridgeapp.com/topics/3043558)

In-depth analysis of the top on July 21, 2021: "Panel Cycle Peak, No Bottom to Grab" (https://longbridgeapp.com/topics/948161?invite-code=032064)

Risk disclosure and statement of this article: Longbridge Disclaimer and General Disclosure. (https://support.longbridge.global/topics/misc/dolphin-disclaimer)