Is the SEA region able to make a comeback with Shopee's version of PlayerUnknown's Battlegrounds despite the poor gaming experience? input: ====== 这个新产品非常酷,我认为会很受欢迎。 ====== output: This new product is so cool! I think it's going to be very popular. input: ====== 海豚君认为这款车性价比很高,而且动力很足。 ====== output: The Dolphin Analyst believes that this car offers great value for money and has ample power. input: ====== 有了新的管理团队,公司的发展前景非常光明。 ====== output: With the new management team in place, the company's prospects for development are very promising.

On the evening of November 15th, before the U.S. stock market opened, SEA Winter Seas Group released its Q3 2022 financial report. Here are the details:

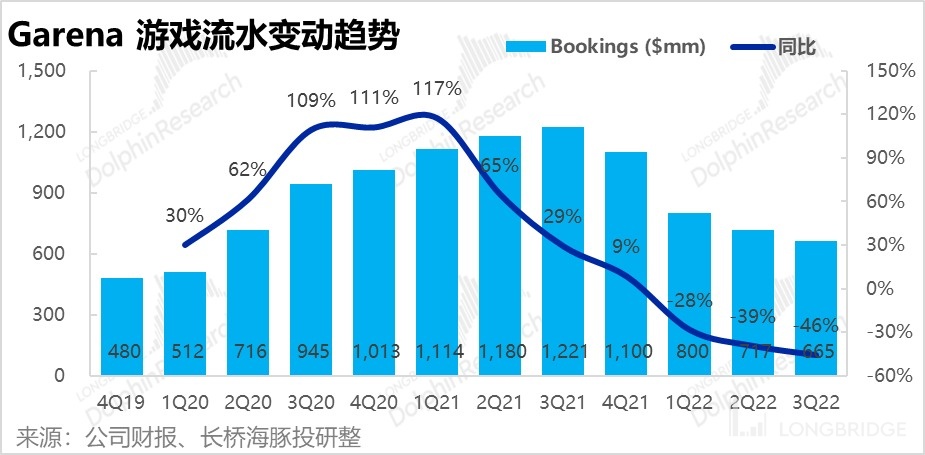

1. Garena's game business is still struggling: Active users, paying users, and game revenue are all still in a continuing state of loss this quarter, and the degree of loss has further increased with paying users and revenue declining by about 45% YoY. Although financial revenue only decreased by about 19% YoY, appearing to be better than the market's expected 24% decline, the reason is still due to eating 'stored food' deferred income. There are no substantial signs of improvement.

2. Shopee's e-commerce growth stagnates but exceeds expectations for reduced losses: Due to the company withdrawing from all markets outside Brazil and Southeast Asia and completely shifting focus to profit, this quarter's GMV for Shopee was 19.1 billion yuan, with virtually 0 growth QoQ. However, with the help of an increase in monetization from 7.8% to 8.7%, the e-commerce business's revenue still grew by 32%. Actual revenue of 1.92 billion was also better than the market's expected 1.87 billion. In addition, "effective monetization" mainly based on commission and advertising revenue grew by more than 50% this quarter, surpassing the growth rate of "ineffective monetization" logistics fees collected on behalf of others. The improvement in high-quality monetization also means that the profitability of the e-commerce sector will improve significantly.

3. SeaMoney digital finance: This quarter, the company no longer discloses the total payment value (TPV) and instead discloses three operating data related to lending business. Among them, the most important is the outstanding loan balance of USD 2.2 billion. The change in disclosure standards also means that the company's strategic focus has shifted from pure payment channel business to lending business with wider profit margins.

4. Overall revenue growth is stronger than expected, and gross profit has also significantly improved: Although revenue growth in all sectors has slowed down, the company's total revenue growth this quarter only appears to be 17%, a significant decline. However, compared with 2Q22, there is virtually no growth in the absolute value of revenue in 1Q22, so this quarter's revenue has increased significantly QoQ. From the perspective of expectation gap, the over-expectation performance of e-commerce and digital finance has helped the company's actual revenue of 3.16 billion exceed the expected 3 billion US dollars.

From a gross profit perspective, except for the "extremely poor" entertainment sector's gross profit margin, which still declined slightly by 1pct, the gross profit margin of the company's e-commerce and digital finance businesses this quarter has increased by 5pct to 29% QoQ, with significant improvement. Even the gross profit margin of the company's self-operated e-commerce sector has increased slightly from 8.5% to 10%. Therefore, the overall gross profit margin has increased from 37% to 39% this quarter, which is better than the market's expected 37.5%.

5. Marketing expenses have greatly reduced, and operating losses have finally narrowed: The most elastic marketing expenses were directly reduced by 19.1% YoY this quarter. After expanding in the previous quarter to retain player spending, the game sector has further reduced marketing expenses this quarter. The marketing expenses of the e-commerce and digital finance sectors have also been significantly reduced, with a reduction of around 10pct QoQ. Overall, the proportion of sales expenses to total revenue has significantly decreased by about 7pct to 25.9%. **

Therefore, despite the continuing expansion of R&D and management expenses, both have increased by more than 80% compared to the same period last year. The company's overall operating loss rate has significantly narrowed to 15.7%. Actual operating losses have also decreased sharply to CNY 496 million, significantly less than the expected CNY 580 million loss.

In terms of business units, the operating profit margin of the gaming unit finally stabilized at 51% and did not continue to decline. The operating loss rate of the e-commerce unit decreased from 42% to 31% month-on-month. Adjusted EBITDA loss was CNY 496 million, significantly less than the expected CNY 580 million loss. The adjusted EBITDA loss of the financial business was CNY 68 million, roughly half of the expected CNY 114 million loss.

Dolphin Analyst's viewpoint:

Overall, SEA's financial report for this quarter can be described as a bottom-turning rebound after reaching the ultimate low. Although the main indicators of the gaming unit, such as users and revenue, are still declining sharply, the market has no more expectations for the already rotten gaming unit. For e-commerce, although GMV growth has completely stalled, for SEA that wants to survive, the management and the market are more concerned about reducing losses than expanding the scale.

Therefore, although this quarter's revenue growth is weak, it is stronger than expected, and both the core e-commerce unit and the emerging financial unit are rapidly reducing losses. Although the absolute performance of this quarter's financial report is still unimpressive, it is indeed a signal of marginal improvement. Moreover, the company's stock price has been hovering around $50. In the context of such a low valuation and the overall valuation recovery of US stocks, any good news will be a significant positive.

Therefore, in the short term, the company's valuation should usher in a wave of recovery. However, in the long run, the future of the gaming unit is still bleak. After abandoning the scale and emphasizing profits, the revenue and profit scale of Shopee's endgame are not so clear, and the company's long-term fair value still needs time to observe and evaluate.

The following is a detailed interpretation of the financial report:

I. Garena games: Users and revenue continue to bleed, when can new game blood be injected?

Overall, the Garena gaming unit continued the trend of the past few quarters, "regardless of the number of active users, paid users, game revenue, or income, they are still declining, and the decline is further expanding," and the bleeding has not stopped.

First of all, in terms of user data, the number of Garena's quarterly active users dropped by 500,000 again this quarter after a brief rebound in the previous quarter due to increased marketing promotion. The number of paying players contributing to revenue also decreased again by 4.6 million to 51 million this quarter, a year-on-year decrease of nearly 45%.

However, the market expectation is that both active users and paying users will stop falling on a month-on-month basis, so this quarter's user loss situation is significantly worse than expected. However, corresponding to this, "this quarter's marketing expenses in the gaming business also decreased significantly," indicating that the company has completely shifted its strategic focus to profit and cash flow and is basically indifferent to the scale's shrinkage.

Actually, according to third-party data, Free Fire's monthly active users have basically stabilized since March this year, which is why sellers expect that users will stop losing. However, the possible reason for the result not matching expectations is that other major games of the company outside of Free Fire, such as Honor of Kings and Call of Duty Mobile, are also in the late stage of life, and are also likely losing users. At the same time, Tencent has announced that it will regain the operation rights of Garena Honor of Kings from 2023, which will be a big blow to Garena's user base.

The only silver lining is that the willingness of the remaining core players to spend remains. The average revenue per paying user is still stable at $12.9 per quarter, which is slightly higher than the previous quarter. Therefore, the decline in game revenue this quarter was also 46%, with a total of US$665 million, which is equivalent to the magnitude of user loss.

From a financial perspective, the confirmed revenue of the gaming sector this quarter was USD 893 million, a year-on-year decrease of 19%. Although the decline is obviously lower than the loss of users, the main reason is still that the company is consuming the previous loss reserves. The deferred revenue balance of the gaming sector in this quarter decreased by about USD 228 million. Since 4Q21, the accumulated decreased deferred revenue is about USD 1.05 billion, and the company's accumulated deferred revenue since 2017 is still as high as USD 3 billion. Although the company still has reserves to rely on, the time window for launching new revenue-generating games is still tight.

Secondly, regarding Shopee e-commerce: the effect of exchanging growth for profit is not satisfactory.

Due to the gaming sector of the group being completely rotten, the market has no hope for it anymore. Dolphin Analyst believes that the market's core concern now is only the speed of loss reduction in the e-commerce sector, and even the importance of GMV growth has declined. Therefore, the fact that the company has successively launched local markets in other South American countries outside Brazil (while retaining cross-border business), and has significantly reduced staff in the remaining Southeast Asian markets and significantly improved monetization rates, has completely stagnated the growth in GMV of Shopee this quarter, but the market will probably look through this issue, and the analysis of the profit situation below will be more important. Specifically, in this quarter, Shopee achieved a GMV of 19.1 billion, with a YoY growth rate further declining to 14%, showing no growth compared to last quarter's 19 billion GMV. However, the actual performance was consistent with expectations, indicating that the slowdown in growth was already anticipated by the market.

From a price-volume-driven perspective, as the company has largely withdrawn from all markets outside of its core Southeast Asian countries and Brazil, this quarter's order volume for Shopee remained unchanged at 2 billion, the same as last quarter. It can be seen that the main reason for the GMV's stagnant growth is order volume. In terms of price, after getting rid of the drag from low unit prices in emerging markets, Shopee's overall customer unit price continued to rise, reaching $9.6 this quarter, an increase of 50 cents from its lowest point. As Shopee continues to deepen its presence in its core markets, there should be room for continued improvement.

In terms of e-commerce revenue, this quarter's revenue was $1.92 billion, slightly higher than the market's expected $1.87 billion. Although its YoY growth rate has slowed, it is still at 32%. The reason for the revenue exceeding expectations is naturally due to the significant increase in monetization.

After the company's own e-commerce revenue was announced, calculated data showed that Shopee's monetization rate for 3P e-commerce in this quarter was 8.7%, a significant increase of 90 basis points compared to the previous quarter. At the same time, the company also disclosed the revenue breakdown of its 3P business. Of the approximately 1.6 billion 3P revenue, about 1 billion came from "effective monetization" such as commission and advertising fees, a YoY increase of 54%, which is significantly higher than the overall revenue growth rate. The revenue from "ineffective monetization" such as logistics services was around 600 million, a YoY increase of 20%. Since commission advertising and other effective monetization methods have higher gross margins, they will also promote profit improvement in this sector.

Third, SeaMoney digital finance: expanding beyond payment to lending business. For the digital finance sector with the greatest potential for growth among its subsidiaries, the company's disclosed operational data for this quarter has undergone major adjustments, demonstrating a shift in the company's strategic direction.

This quarter, the company no longer discloses TPV and SeaMoney user numbers that reflect payment scale. Instead, the company disclosed three data points related to its loan business: 1) The company's outstanding loan balance as of the end of this quarter was $2.2 billion; 2) The bad debt rate for loans overdue for more than 90 days is less than 4%; and 3) The average loan term for which the company has yet to collect payment is four months.

Although we cannot determine the development trend of SeaMoney's loan business due to lack of historical data, at least strategically, the company is no longer focusing on payment channel business with limited profit margins and has shifted toward higher-profit lending businesses. In comparison, whether it is Alipay and WeChat in China or Block, a U.S. payment company, all of them regard lending businesses as the focus of their development. Therefore, this change in disclosure at least reveals that the company's strategy is moving in the right direction.

In terms of financial performance, SeaMoney's digital finance business achieved revenue of RMB 330 million this quarter, which was higher than the market's expected RMB 310 million, and the year-on-year growth rate was still as high as 147%, continuing the high-speed growth in the early stages.

Overall performance: Revenue continues to decline but is stronger than expected, and profit release has improved significantly

Since the revenue growth rates of each segment are slowing down, the company's total revenue growth rate is only 17% visually, indicating a significant decline. However, in detail, the increase in revenue this quarter is significantly higher than that compared to 2Q22, and there was almost no increase in the absolute value of revenue compared to 1Q22, so the quarter-on-quarter revenue growth is apparent. In addition, from the perspective of the difference between actual performance and expectations, the better-than-expected performance of the e-commerce and digital finance sectors helped the company reach revenue of US$3.16 billion, which exceeded the expected US$3 billion. Although revenue growth has slowed down, it is still stronger than the market's expectations.

Furthermore, due to the fact that the main reason for the better-than-expected revenue is the increase in the conversion rate of e-commerce business (the loan business in digital finance business may also have made contributions), this quarter the company's gross profit margin has also significantly improved. Specifically, apart from the "rotten" entertainment segment, which has slightly slipped by 1 percentage point, the gross profit margin of the company's e-commerce and digital finance businesses have increased by 5 percentage points compared to last quarter to 29%, a significant improvement. Even the gross profit margin of the self-operated e-commerce segment has increased slightly from 8.5% to 10%.

Dolphin Analyst Therefore, the company's overall gross margin for the quarter increased from 37% to 39%, a better improvement than market expectations of 37.5%. Total gross profit also reached RMB 1.23 billion, a month-on-month rebound that exceeded market expectations of RMB 1.13 billion.

In terms of operating expenses, the most elastic marketing expenses turned from growth to decline this quarter, directly decreasing by 19.1% year-on-year instead of slowing down in growth rate. Specifically, after expanding marketing investment to retain players in the previous quarter, it was reduced again this quarter. Additionally, the marketing expenses of the e-commerce and digital financial sectors are shrinking at a considerable rate, with a month-on-month reduction of about 10 percentage points. Therefore, the overall sales expenses as a percentage of total revenue also significantly decreased by about 7 percentage points to 25.9%.

Apart from external marketing expenses being successfully controlled, internal administrative and research and development expenses continued to expand this quarter, as follows:

-

Administrative expenses continued to rise sharply by 87% year-on-year. According to the company's explanation, the increase in equity incentives (from RMB 120 million to RMB 196 million year-on-year) and the significant expansion of manpower and office expenses caused by the company's significant expansion from 2021 to the beginning of 2022 were the main reasons for the significant increase in administrative expenses. However, according to news disclosure, SEA has laid off nearly 7,000 people in the past six months and introduced many emerging markets, so the management expenses should also begin to shrink after the base period.

-

Research and development expenses also increased significantly by 81% year-on-year. However, for technology companies, research and development expenditure is arguably the most rigid expenditure and more like an investment in the future than an expense. Therefore, Dolphin Analyst has no objection to this expenditure, and it is unknown whether it will be reduced in the future.

Therefore, with a nearly 5 percentage point increase in gross margin, and a larger 7 percentage point reduction in sales expenses, although research and development and management expenses continued to expand, the company's overall operating loss rate still significantly shrank to 15.7%. The actual operating loss also declined significantly to RMB 496 million, significantly less than the market's expected loss of RMB 580 million.

V. Profit performance of departments: e-commerce and finance have significantly improved. 1. Game Segment: Although the user loss rate is still high, at least the user payment rate has stabilized, and marketing expenses have returned to a downward trend. This quarter, the operating profit margin of the gaming segment finally stabilized at 51% and did not continue to decline.

2. E-commerce Segment: The e-commerce segment's operating loss rate narrowed from 42% to 31% on a month-on-month basis due to better-than-expected monetization rates and a continued rapid slowdown in investment. Adjusted EBITDA loss was 496 million, significantly less than the market's expected 580 million.

3. Financial Segment: As the business shifted towards higher-profit lending business, the financial sector's adjusted EBITDA loss was 68 million, which was only about half of the market's expected 114 million in losses.

4. Group Level: In addition to the above segments, due to the company's significant reduction in new services such as takeaway and group-level expenses, undistributed operating losses have also been greatly reduced.

VI. Cash Flow

From the perspective of cash flow, the amount of operating cash outflow in this quarter has dropped to around USD 170 million, and the net cash balance has remained above USD 7 billion. Although it is still flowing out, the amount has greatly reduced.

Previous Research:

August 17, 2022 phone conference call: "SEA: Efficiency Comes First, Regardless of Size (Phone Conference Summary)"

August 17, 2022 financial report review: "Growth Disappeared, Severe Losses Persist, How Will Sea Save Its Valuation?"

May 17, 2022 phone conference call: "Diversification for Gaming Business, Profitability for E-commerce Business (SEA Phone Conference Summary)"

May 17, 2022 financial report review: "SEA: Gaming 'Aging', E-commerce Supports Single-handedly" On March 2nd, 2022, 4Q21 Conference Call Summary "SEA Strategy Reversal, Gaming Entertainment Empowered to Diverse Developments, and E-commerce Needs to Increase Efficiency"

On March 2nd 2022, 4Q21 Financial Report Evaluation "SEA wants to “Split” : E-commerce and Gaming Markets are Like Fire and Ice"

January 5th, 2022 "“Little Tencent” Being Abandoned Panics Tencent Associates? The Significance Differs for Sea"

January 10th, 2021 "Is Southeast Asia still the "land of prosperity" for Sea?"

January 24th, 2021 "Integrating "Taobao + Tencent + Alipay", the Ultimate Form of the Internet - SEA's Journey To More Than $100 Billion"

Risk Disclosure and Statement of this Article: Dolphin Research Disclaimer and General Disclosure