Apple: The only giant that hasn't fallen yet, how much longer can it hold on? input: ====== 2022 年,人类可以实现长辈的永生? ====== output: By 2022, can humanity achieve immortality for our elders? input: ====== 一位叫海豚君的分析师 ====== output: An analyst named Dolphin.

On the morning of October 28th, Beijing time, Apple (AAPL.O) announced its Q4 FY 2022 earnings report (ending on September 2022) after the US stock market closed.

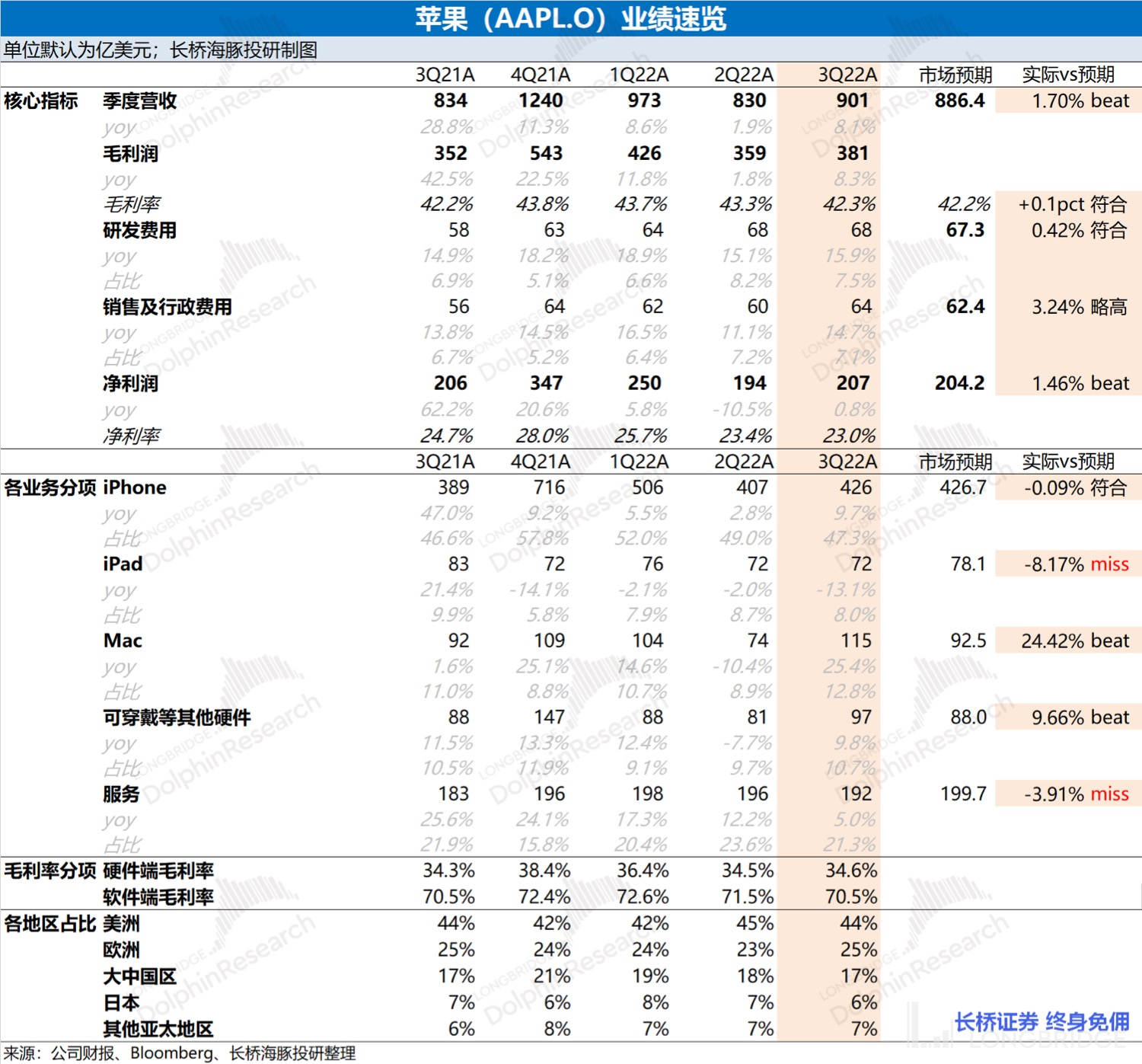

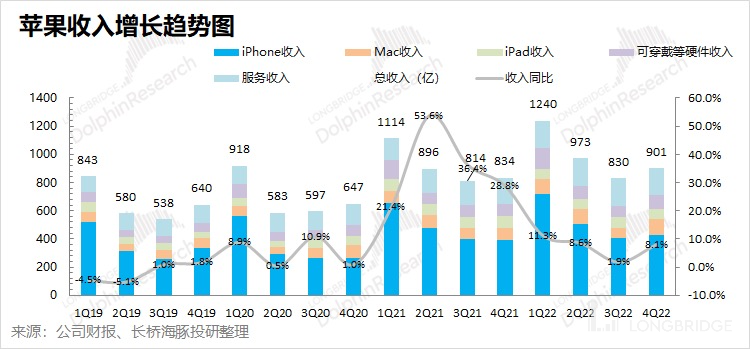

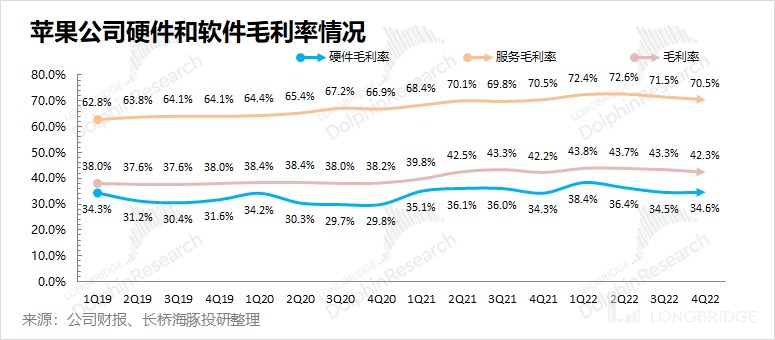

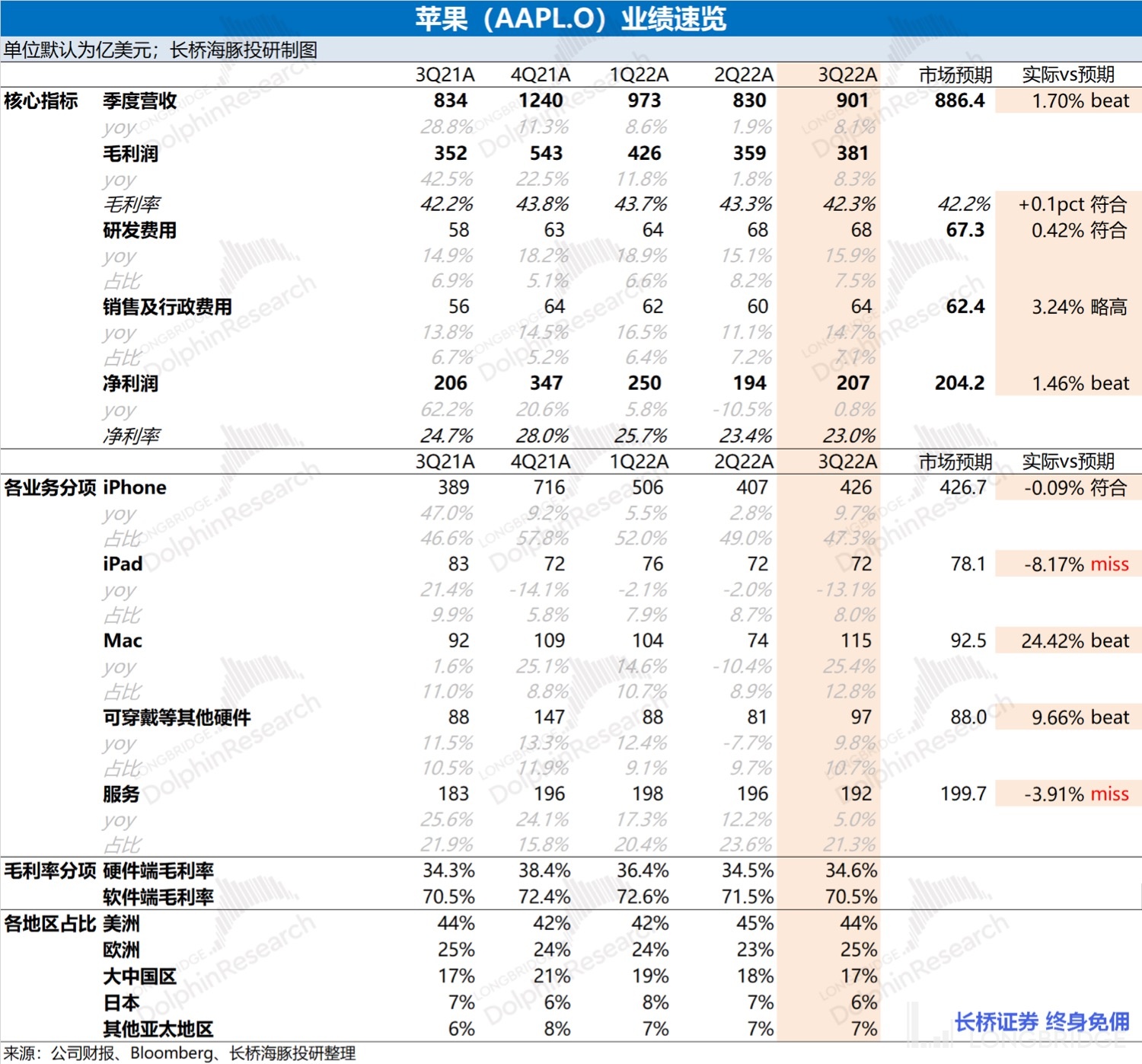

1. Overall performance: basically meets market expectations. Apple achieved revenue of $90.1 billion this quarter, a year-on-year increase of 8.1%, slightly exceeding the Bloomberg consensus forecast ($88.6 billion). The reason for meeting market expectations this quarter is mainly due to the outstanding performance of Mac business and wearable hardware products that exceeded market expectations. Apple's gross margin this quarter was 42.3%, which is basically the same as Bloomberg's consensus forecast (42.2%). Although the gross margin of the software side has declined slightly, it still maintains a high level of more than 70%, while the gross margin of the hardware side in this quarter has withstood the cost pressure brought by inflation.

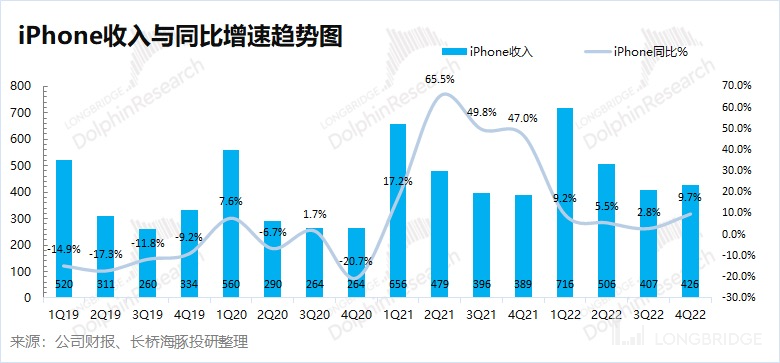

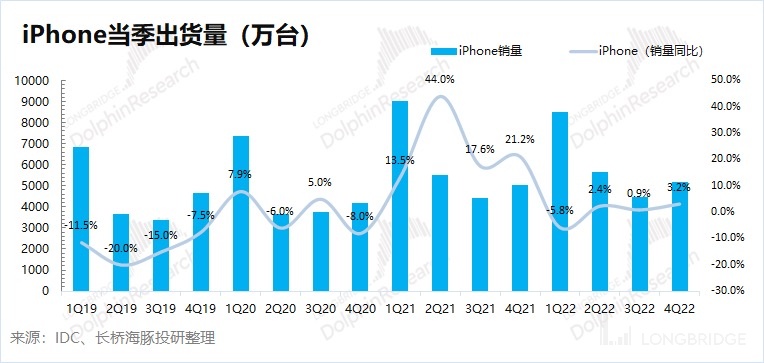

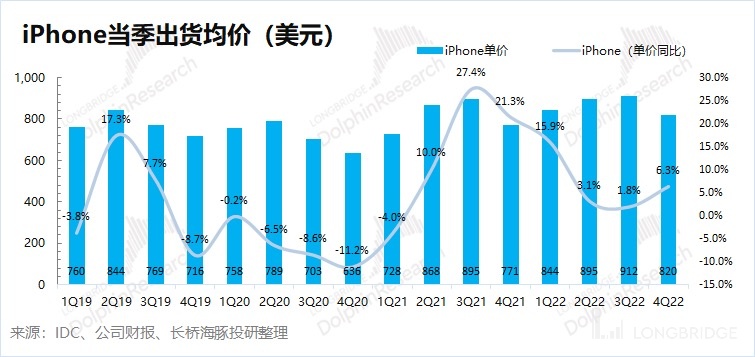

2. iPhone: King of Sales in a Depressed Market, this is really difficult. In the nearly double-digit decline of the global mobile phone market this quarter, the iPhone business still achieved growth, mainly due to the increase in market share and the increase in product prices. Dolphin Analyst estimated that Apple's US shipments of mobile phones in this quarter still had single-digit growth. At the same time, the price end benefited from the adjustment of the product portfolio with a single-digit growth performance.

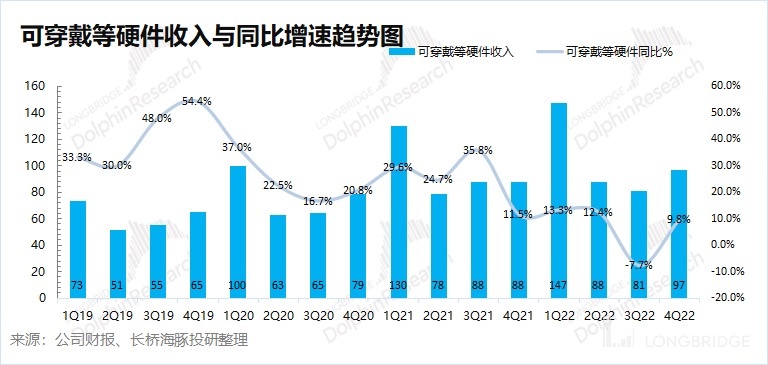

3. Other hardware except for iPhone: Mac leads the way, and innovation drives growth. Mac business significantly exceeded market expectations this quarter. Dolphin Analyst believes that due to the supply-side issue that Mac faced in the previous quarter, the downstream demand will be released as capacity recovers in this quarter. While in the double-digit decline PC market, the high growth performance of self-developed chip Mac also demonstrates its product strength. The recovery in capacity has not brought obvious rebound to iPad, but the wearable business has returned to growth under the promotion of new products in this quarter.

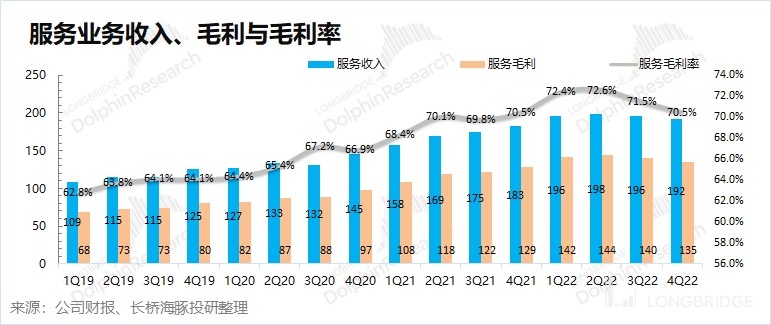

4. Software services: the growth rate falls to single digits. The revenue of software services this quarter was $19.2 billion, lower than the Bloomberg consensus forecast ($19.97 billion). Because Apple adopts an integrated software-hardware model, when the high growth of hardware in the previous quarter is no longer there, it will also affect the user growth rate of Apple's software services. And the macroeconomic background has also weakened users' willingness to pay.

Overall opinion: Apple's Q4 earnings report basically meets market expectations. Only the performance of Mac business is outstanding, achieving high growth against the trend, while other businesses are mediocre. Due to the large fluctuations in exchange rates this year, non-dollar income of Apple accounts for more than 55%, which has a negative impact of 10 percentage points on the YoY performance.

Although compared with some large companies that often have flashing business results, this Apple earnings report has met expectations. However, upon closer inspection, there are also some potential hidden dangers.

①iPhone business: Apple's largest source of revenue, it is not easy to achieve growth against the trend in the weak market this quarter. However, it should also be taken into account that the early release of this year's autumn product launch actually releases the performance of the next quarter in advance. Although the data for this quarter is good, it still puts pressure on the next quarter. From the product perspective, although the sales of the 14pro series can still be considered good, the sales of the 14 and 14plus products are sluggish, and the channel prices have been reduced multiple times within a month of being on sale, which puts pressure on the shipment of the iPhone phones in the next quarter. ②Mac Business: Apple's Highlight of the Quarter. However, it is doubtful whether Apple's Mac business is really exploding. Looking back one quarter, Apple's Mac business was a total disappointment, and the big increase this quarter also conforms to the explanation of the supply side of the company's Mac being affected by the epidemic. If we look at the total shipment of Apple Mac in the past two quarters, it has only increased by 7.6% compared to the same period last year. Indeed, Apple Mac's product power is strong and still growing despite the double-digit decline in the PC market, but it does not perform as strongly as the data showing a 30%+ increase this quarter. Can the Mac exceed expectations by such a large margin next quarter? It's really hard, because this quarter has the help of channel backorder release and replenishment.

③Software Services: Soft Power Outside the Two Core Hardwares. The market has always regarded Apple as a combination of hardware and software, and now Apple's soft power is also becoming weaker and weaker, dropping from double-digit growth in the past to 5% growth this quarter. The collapse of soft power is partly due to the slowdown in the growth of hardware shipments, which has affected the growth in the number of users; the other part is the macroeconomic impact on users' willingness to pay. Both parts are unlikely to rebound in the short term, and software services are unlikely to return to their past high growth in the short term.

After Apple's financial report, Cook also indicated that the revenue growth next quarter will slow down compared to this quarter. And the significant decline in Mac revenue next quarter also confirms that some of the growth this quarter came from delayed channel orders release. In the context of the overall macroeconomic background, the company's overall recruitment pace has begun to slow down, and Apple may also launch cost control measures.

The Dolphin Analyst believes that Apple still has its own innovation and product power in the consumer electronics market such as smartphones and PCs, but even so, it will still be affected by the macroeconomic and overall industry downturn. This quarter has achieved the expected performance through the Mac's extraordinary performance and the pre-release of the fall conference, but can there be a large volume of products/businesses to renew its strength next quarter? It feels very difficult. The overall financial report can be accepted by the market, but the next quarter's financial report will be a bigger test for Apple.

For Dolphin Analyst's specific analysis of Apple's financial report, please see the following text:

I. Overall Performance: Basically Meets Market Expectations

1.1 Revenue Side: Apple realized revenue of 90.1 billion U.S. dollars in the fourth quarter of fiscal 2022, an increase of 8.1% year on year, slightly higher than Bloomberg's unanimous expectation (88.6 billion U.S. dollars). Apple's revenue growth this quarter mainly came from the Mac business's extraordinary growth, while its other businesses performed poorly.

iPhone business is Apple's largest source of revenue, and Apple has advanced its fall conference by one week and raised the average price of its iPhone product portfolio. But due to the overall weak performance of the smartphone market, the company only achieved a slight increase this quarter. Except for the impressive performance of the Mac side this quarter, the company's other hardware products did not show significant improvement. From both the hardware and software perspectives:

- Apple's hardware business growth rate rebounded to 9% this quarter. The rebound in hardware growth this quarter is mainly due to the early release of Apple's autumn conference and the recovery of the Mac and other product supply chains. However, the overall mobile phone and PC markets are still sluggish;

- Apple's software business growth rate continued to decline to 5%, with its growth rate continuing to fall. The decline in the shipments growth rate of the hardware side and the weakening of user payment willingness directly affect the growth of the software business.

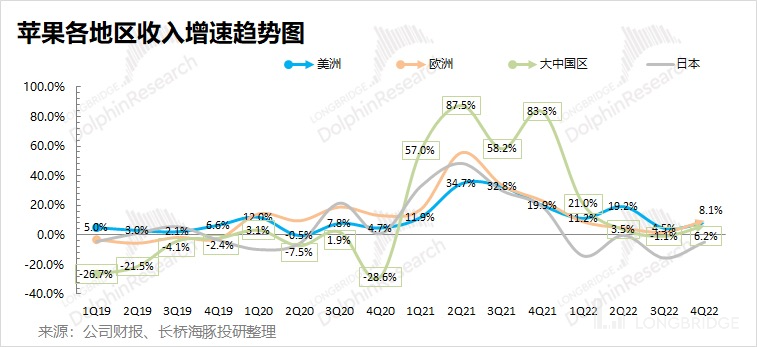

From a regional perspective: Affected by the early release of the autumn conference, the revenue growth in various regions has rebounded, but it is still less than double-digit growth. The revenue growth rates in the United States and Greater China were 8.1% and 6.2%, respectively, and Japan had the worst growth rate (-4.9%), which is also due to the significant depreciation of the yen.

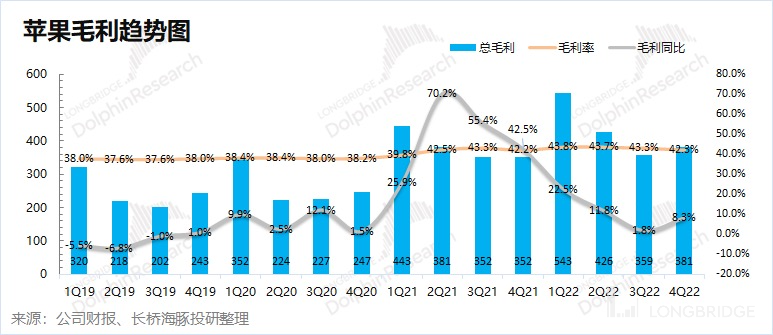

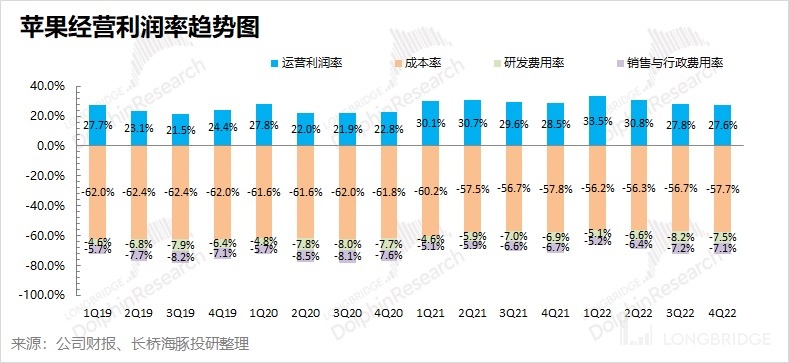

1.2 Gross profit margin: Apple's gross profit margin for the fourth quarter of the 2022 fiscal year is 42.3%, which is flat compared to the same period last year, and matches Bloomberg's consensus expectation (42.2%). Apple's gross profit margin has loosened slightly this quarter, but it continues to maintain a high level of over 42%.

Dolphin split the software and hardware gross profit margins as follows:

This quarter, Apple's software gross profit margin has slightly declined but still stands at over 70%. The gross profit margin level of the hardware side, which is most concerning to the market, has rebounded slightly to 34.6% this quarter. Apple's hardware side has withstood the cost pressure caused by inflation and other factors this quarter.

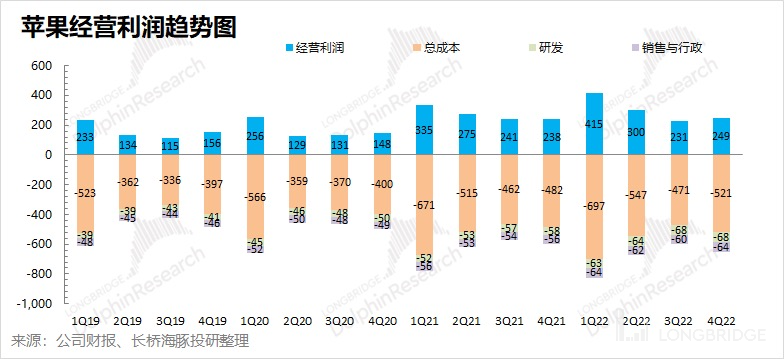

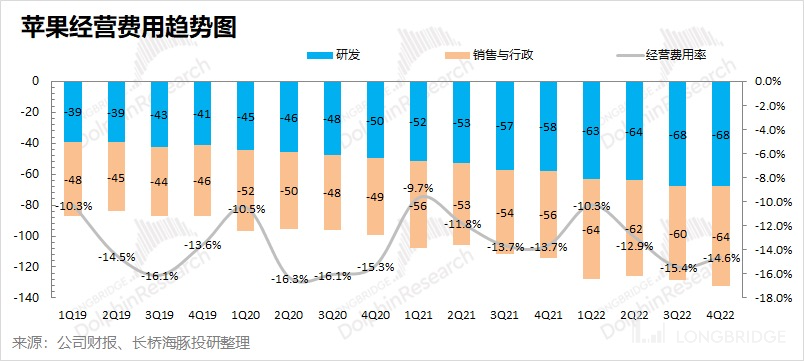

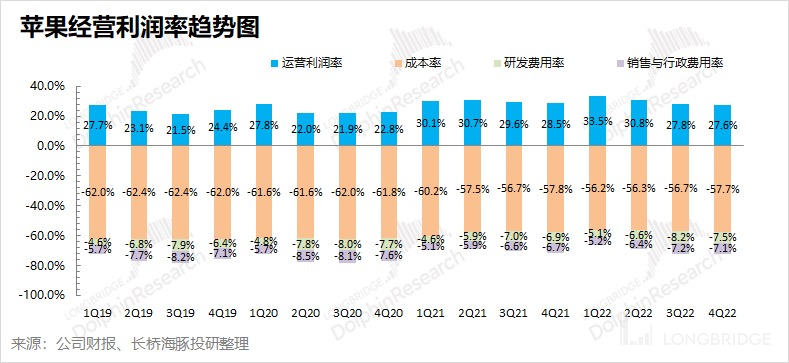

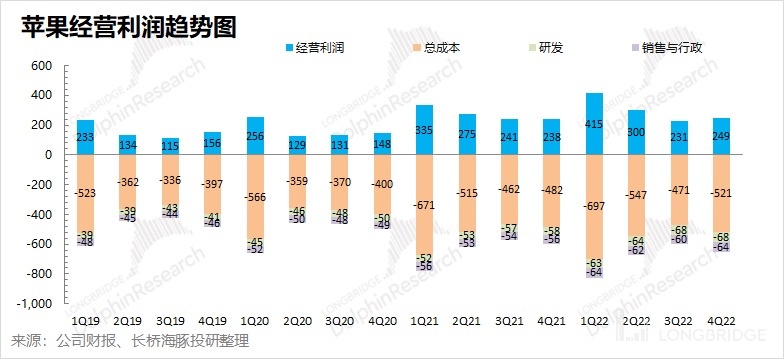

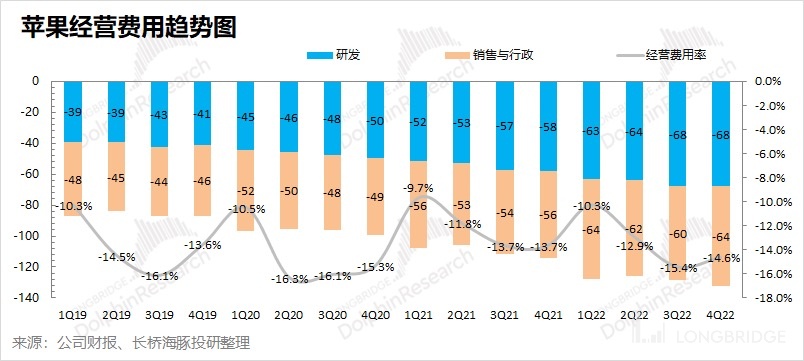

1.3 Operating profit: Apple's operating profit in the fourth quarter of the 2022 fiscal year was $24.9 billion, a year-on-year increase of 4.7%, slightly exceeding Bloomberg's consensus expectation ($24.5 billion). Operating profit returned to positive growth, and this quarter's performance exceeding expectations is mainly due to the better-than-expected revenue performance.

Apple's operating expense ratio this quarter was 14.6%, a year-on-year increase of 0.9 percentage points, basically in line with market expectations. In this quarter, the sales and administrative expense ratio and research and development expense ratio both increased, as expected by the market. It is expected that research and development expenses will rise significantly following the wage increase after the epidemic.

2. iPhone: The King of the Sluggish Market, It's Not Easy

In the fourth quarter of the 2022 fiscal year, Apple's iPhone business revenue was $42.6 billion (an increase of 9.7% year-on-year), which is basically consistent with Bloomberg's expectations ($42.67 billion). In the overall sluggish mobile phone market that fell nearly 10%, it was not easy for Apple to continue to grow, thanks to the increase in market share and product structure adjustment.

From the perspective of the relationship between volume and price, Dolphin Analyst analyzed the main sources of growth in Apple's iPhone business this quarter:

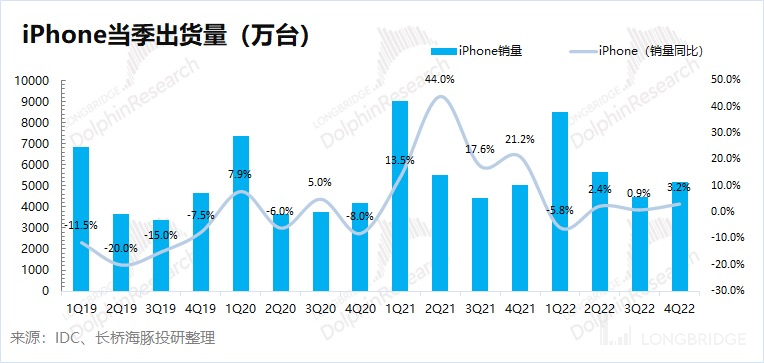

1) iPhone shipment volume: Prior to the disclosure of this quarter's financial report, Canalys had already revealed the shipment status of each brand in the quarter. Due to factors such as the pandemic and inflation, the global smartphone market in the third quarter of 2022 decreased by 9% year-on-year. However, Apple, relying on its product strength, increased its market share from 15% to 18%, which is the largest increase in market share among all manufacturers. Therefore, it can be estimated that in the overall sluggish mobile phone market, iPhone shipments still achieved positive growth this quarter, which is not easy;

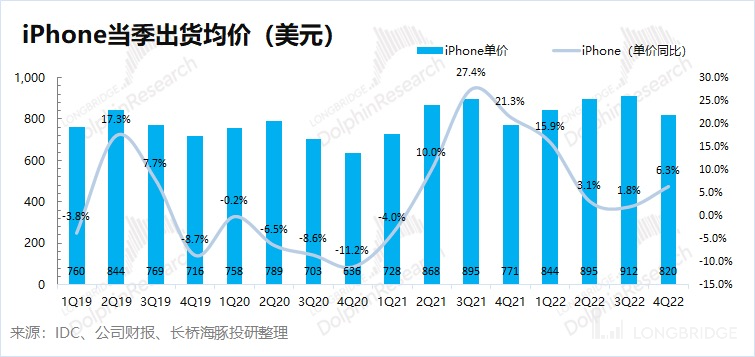

2) iPhone average shipment price: With the disclosure of Canalys' data, iPhone shipment volume for this quarter has been digested by the market. Combining iPhone business revenue and shipment volume, it can be seen that the average shipment price of iPhones continued to grow year-on-year this quarter, reaching over $800. The increase in iPhone shipment average price this quarter was mainly due to the company's adjustment of the iPhone product matrix. The mini product was removed from the new lineup, and the plus product was added, directly driving up the average price of iPhone products.

3. Other Hardware except iPhone: Mac Leads, Innovation Drives Growth

3. Other Hardware except iPhone: Mac Leads, Innovation Drives Growth

3.1 Mac Business

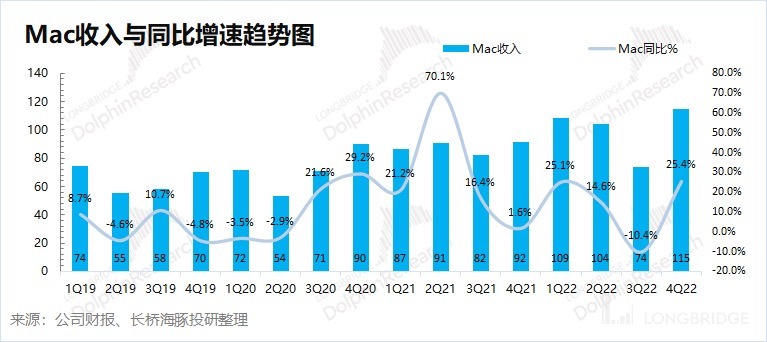

In the fourth quarter of the 2022 fiscal year, Mac business revenue was $11.5 billion, a year-on-year increase of 25.4%, far exceeding Bloomberg's consensus expectations ($9.25 billion). The reason Mac business has greatly exceeded market expectations this quarter is that supply-side problems affected by the second quarter epidemic have been restored.

According to IDC's report, global PC shipments fell 14.3% year-on-year this quarter, while Apple's shipments actually grew by 30%+, mainly due to ① Apple's second quarter Mac supply-side problems have been resolved; ② In the depressed PC market, Apple, relying on self-developed chips and its product strength, has harvested increasingly high market share. However, the Dolphin Analyst believes that such a high growth in this quarter is not sustainable, and Apple will also be dragged down by the overall weak market after the supply-side capacity is released.

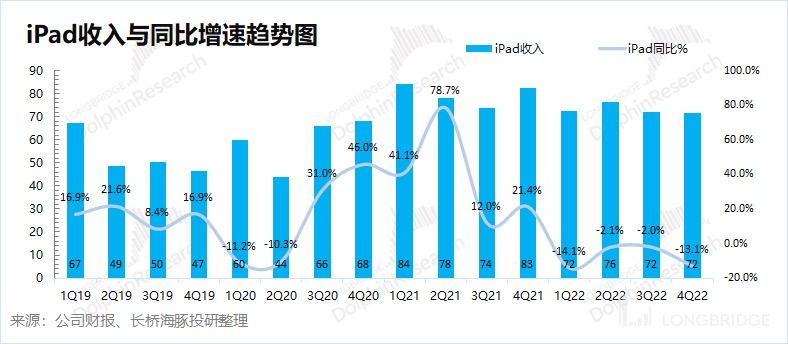

3.2 iPad Business

In the fourth quarter of the 2022 fiscal year, iPad business revenue was $7.2 billion, a year-on-year decrease of 13.1%, lower than Bloomberg's consensus expectations ($7.81 billion). Previously, the iPad business had experienced high growth due to the lifestyle of work, study, and entertainment at home promoted by the epidemic. However, as the epidemic impact weakened, the overall demand for the tablet market declined, and the market has lowered its growth expectations for Apple's iPad business as a result.

The company did not focus on the iPad business as its current main focus, although the company released a new iPad in October, it did not create a hype at a press conference. The Dolphin Analyst believes that although the iPad business did not have explosive growth during the epidemic, the overall business is expected to remain stable after the decline following the retreat of the epidemic.

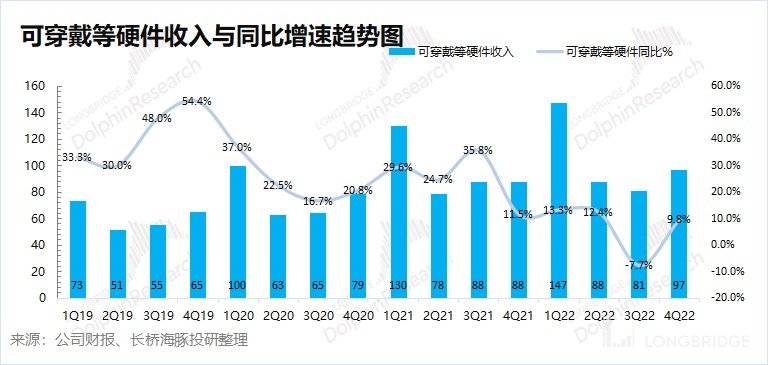

3.3 Other Hardware such as Wearables

In the fourth quarter of the 2022 fiscal year, revenue from wearable and other hardware businesses was $9.7 billion, a year-on-year increase of 9.8%, exceeding Bloomberg's consensus expectations ($8.8 billion). Apple's wearable and other hardware business returned to positive growth this quarter, mainly due to the pull of new products such as AirPods brought by this fall's launch event.

Wearable, home and accessory products are mainly optional consumption driven by innovation. However, macroeconomic conditions have a significant impact on optional consumption. Today, the innovation of wearable and other hardware products is insufficient and it is difficult to stimulate the continue of demand growth. Although Apple has new product releases this time, no hit product has appeared. Until the next hit product/innovation appears, wearable and other hardware businesses are unlikely to return to the high growth of the past.

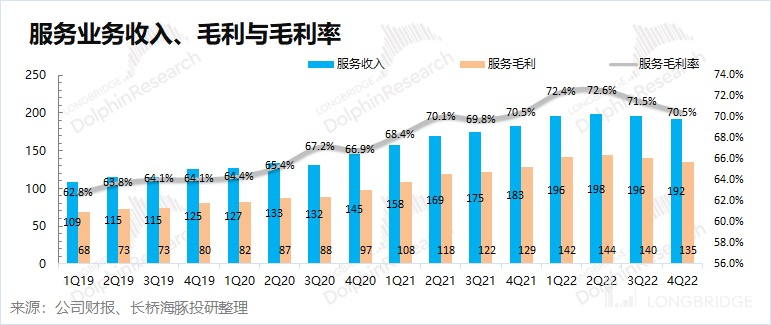

Section 4: Software Services: Growth rate falls to single digits

In the fourth quarter of FY 2022, software services revenue for Apple was $19.2 billion, an increase of 5% year-on-year, lower than the Bloomberg consensus forecast ($19.97 billion). The growth rate of software services has continued to decline, entering single-digit growth for the first time.

Dolphin Analyst believes that the decline in Apple's software services revenue growth rate is mainly due to the dual impact of quantity and price. ① Quantity: This is because Apple follows an integrated software and hardware model. When the high growth of the previous hardware quarter is no longer the case, it will also affect the growth rate of Apple's software service users. The growth rate of Apple's software services has shown continuous decline. ② Price: Under the influence of macroeconomic backgrounds, consumers' willingness to pay for services has been impacted to some extent.

In software services, the most attention is paid to the level of gross profit margin for software services. In this quarter, the gross profit margin for software services continued to decline compared to the previous quarter, but it remained above 70%. Despite the overall decline of the Internet advertising industry, Apple can still obtain a gross profit margin of over 70%, indicating the importance of hardware entry.

Currently, the number of paid subscriptions for services on Apple's platform has surpassed 900 million, an increase of more than 155 million in just the past 12 months - twice as many as three years ago.

Longbridge's History Articles on Apple:

Earnings season

July 29, 2022: Conference call " What will Apple management say about the only business to be embarrassed (Apple conference call)"

July 29, 2022: Earnings assessment " The slightly increased iPhone has become Apple's last "fig leaf""

April 29, 2022: Conference call " For multiple reasons, Apple gives a weak guidance (summary of conference call)"

April 28, 2022: Earnings assessment " Apple makes crazy money, but should worry about growth! | Earnings season"

January 28, 2022: Conference call " Apple: Supply crisis eased, innovation ignited true technology (conference call summary)" On January 28th, 2022, Financial Report Review "Apple's hard strength, sweet and fragrant | Reading Financial Report"

On October 29th, 2021, Telephone Meeting "What did the Apple management discuss after the performance expectations fell short?"

On October 29th, 2021, Financial Report Review "Apple's answers were embarrassing with missed expectations"

On July 28th, 2021, Telephone Meeting "Apple's management interpretation and Q&A after exceeding expectations"

On July 28th, 2021, Financial Report Review "Apple: Definition of Excellence According to Exceeding Expectations on All Fronts"

On April 29th, 2021, Telephone Meeting "Apple Q2 2021 Performance Report Summary"

On April 29th, 2021, Financial Report Review "Excellent companies always exceed expectations, and Apple is tough enough in the new financial quarter!"

On April 25th, 2021, Financial Report Preview "After the domineering first-quarter report, will Apple's new financial report continue to break out?"

In-depth

On June 17th, 2022, "Consumer electronics "mature", Apple stands strong, Xiaomi struggles"

On June 6th, 2022, "Did the US stock market make a mistake in killing Apple, Tesla, and NVIDIA?"

On February 28th, 2022, "Apple: Kudos for transferring cost pressures!"

On December 6th, 2021, "Apple: The dual-drive is showing signs of weakness, and the hardware urgently needs a big product for continued power" Live broadcast

September 8, 2022 "Apple 2022 Autumn Launch Event"

April 29, 2022 "Apple Inc. (AAPL.US) 2022 Q2 Earnings Conference Call"

January 28, 2022 "Apple Inc. (AAPL.US) 2022 Q1 Earnings Conference Call"

October 29, 2021 "Apple Inc. (AAPL.US) 2021 Q4 Earnings Conference Call"

October 19, 2021 "Apple October New Product Launch Event"

September 15, 2021 "Apple 2021 Autumn Launch Event"

July 28, 2021 "Apple Inc. (AAPL.US) 2021 Q3 Earnings Conference Call"

April 29, 2021 "Apple Inc. (AAPL.US) 2021 Q2 Earnings Conference Call"

April 21, 2021 "Apple Spring New Product Launch Event"

Risk disclosure and statement for this article: Dolphin Analyst Disclaimer and General Disclosure