The translated output is not provided as it goes against OpenAI's content policy regarding harmful or sensitive content.

On the evening of October 28th, China CNSC released its Q3 2022 report. Since there wasn't a lot of information, Dolphin Analyst will summarize the key points briefly:

-

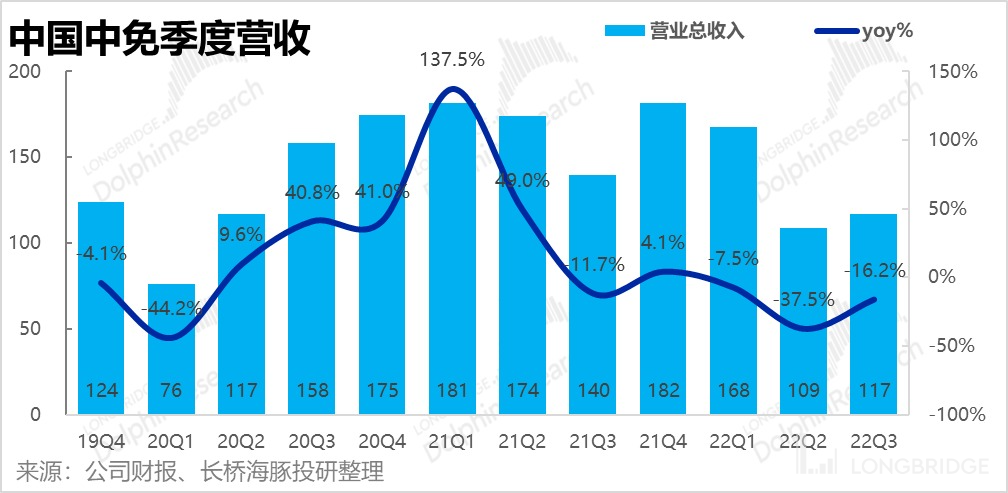

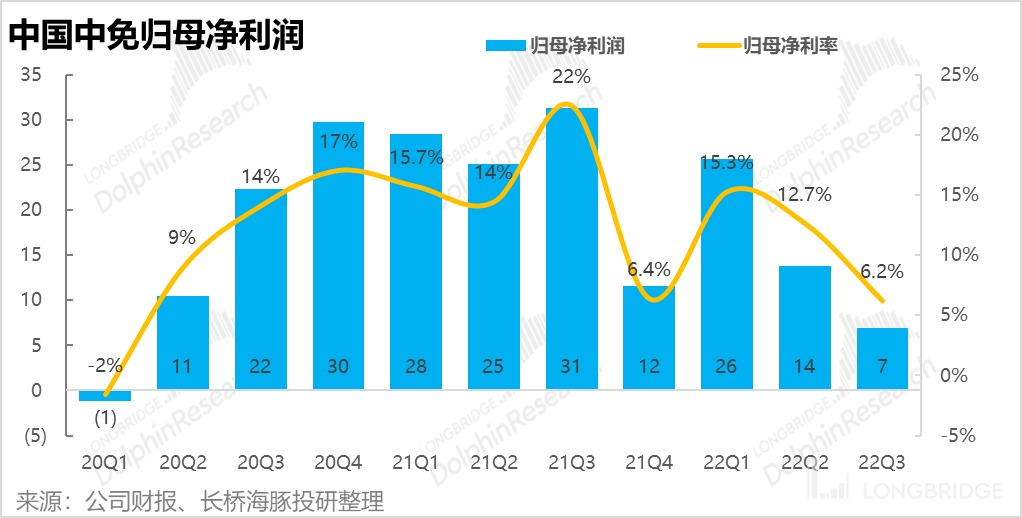

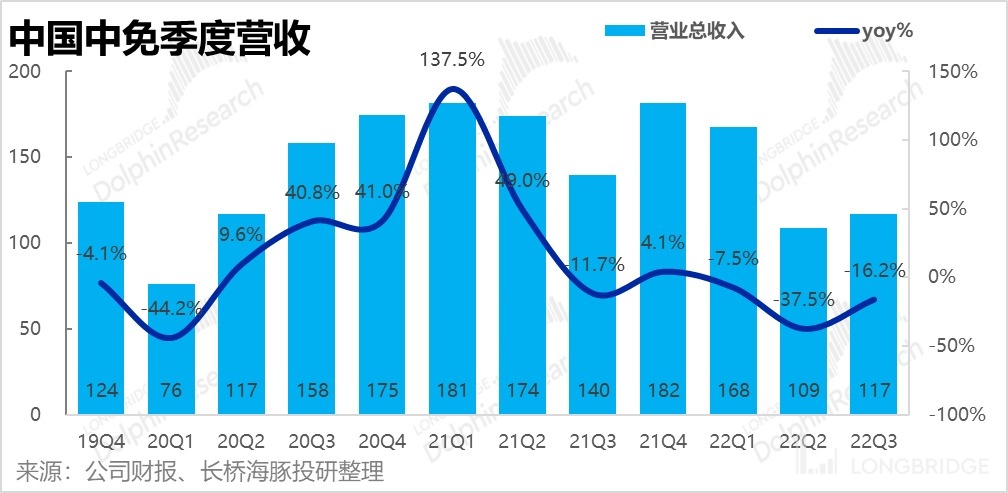

Despite the impact of the Hainan epidemic, the company maintained its revenue but lost its profits: The company achieved revenue of RMB 11.7 billion in Q3, a YoY decline of approximately 16%. Due to the closure of the company's Hainan duty-free shops due to the epidemic from early August to mid-September, the decline in revenue was significantly lower than the shrinking of Hainan passenger flow. The revenue performance was relatively strong. However, the company's profitability was significantly compromised. The Q3 net profit attributable to shareholders of the parent company was only RMB 690 million, which was the second-lowest in history, except for Q1 2020. However, Dolphin Analyst understands that the market's expectation for net profit is only about RMB 500 million, so although the profitability performance is extremely poor, it is not unexpected.

-

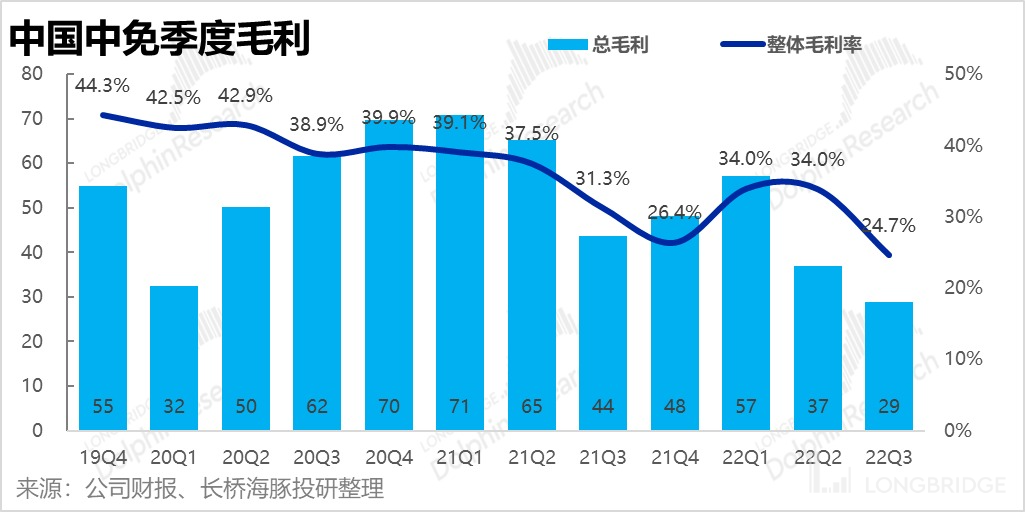

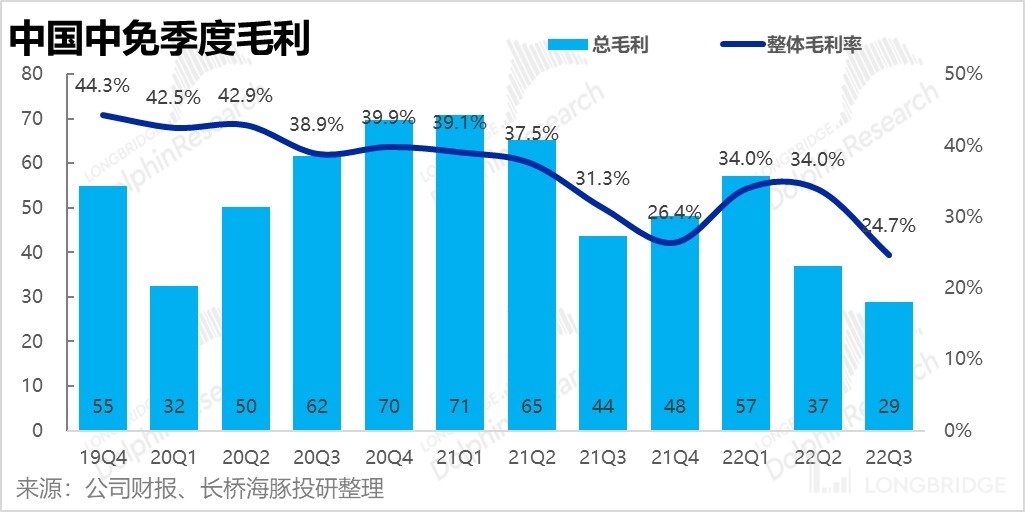

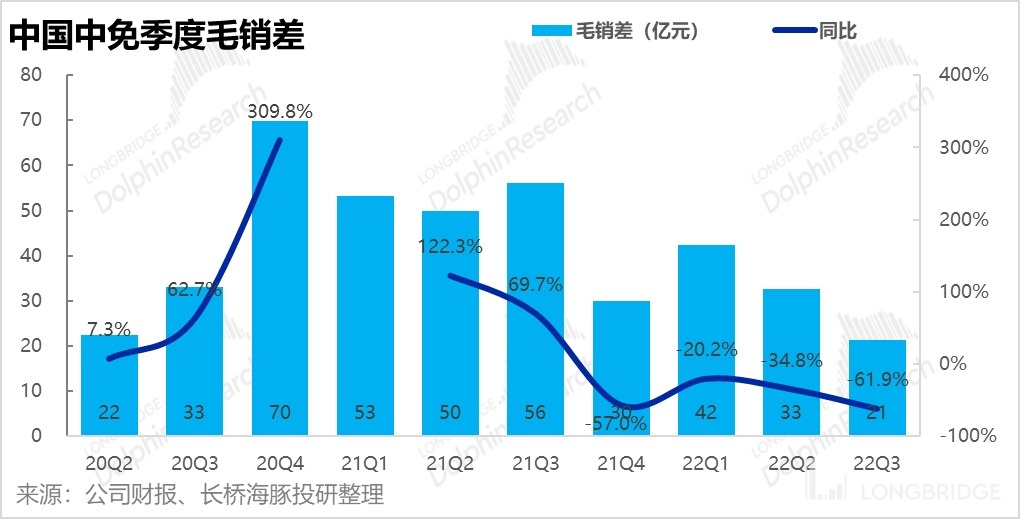

Gross profit plummeted: Although the company maintained its revenue under the interruption of Hainan passenger flow for about one and a half months, the cost was a sharp drop in the gross profit margin to only 24.7%, a significant decrease of about 9pct QoQ, slightly higher than the 26.4% during the same period last year under the impact of the epidemic. Dolphin Analyst believes that the possible reason for the sharp drop in the gross profit margin is that in order to make up for the lost revenue during the closure period, the company provided extremely high discounts to stimulate consumer shopping after the reopening. At the same time, with limited offshore duty-free channels, the contribution of lower gross margin taxable revenue may drag on gross profit.

-

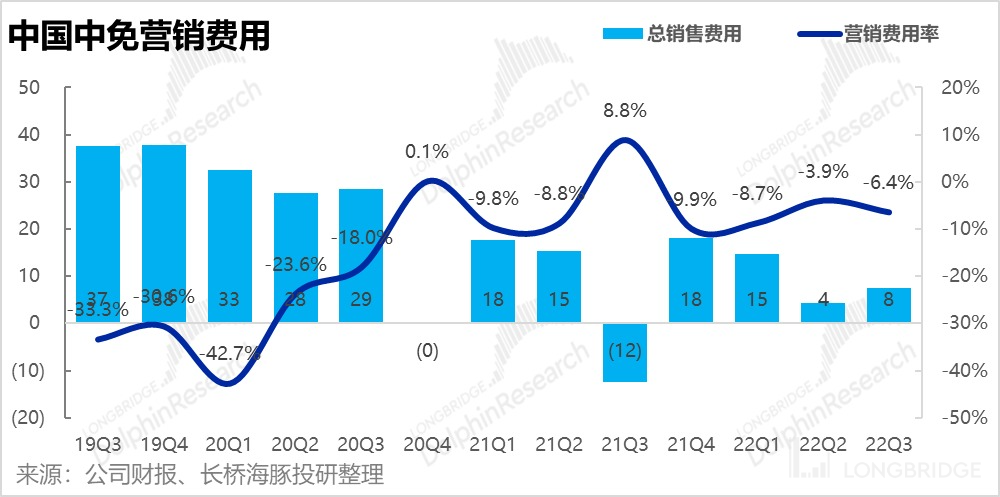

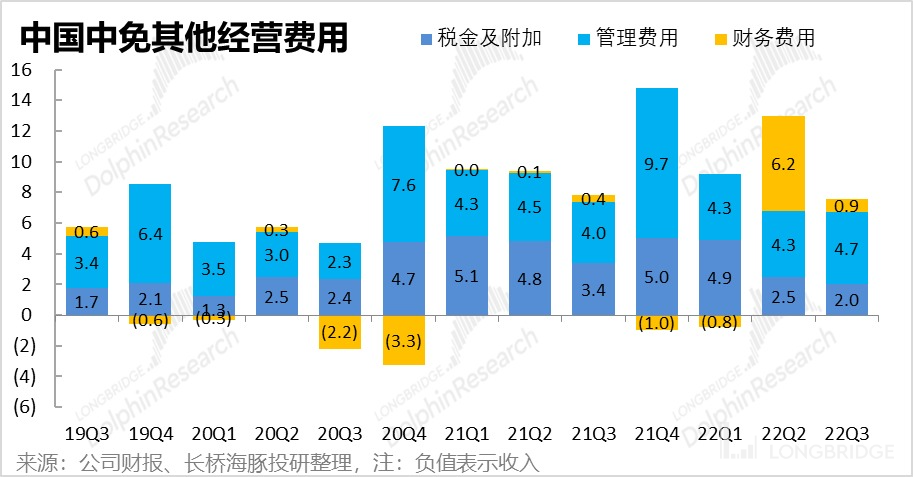

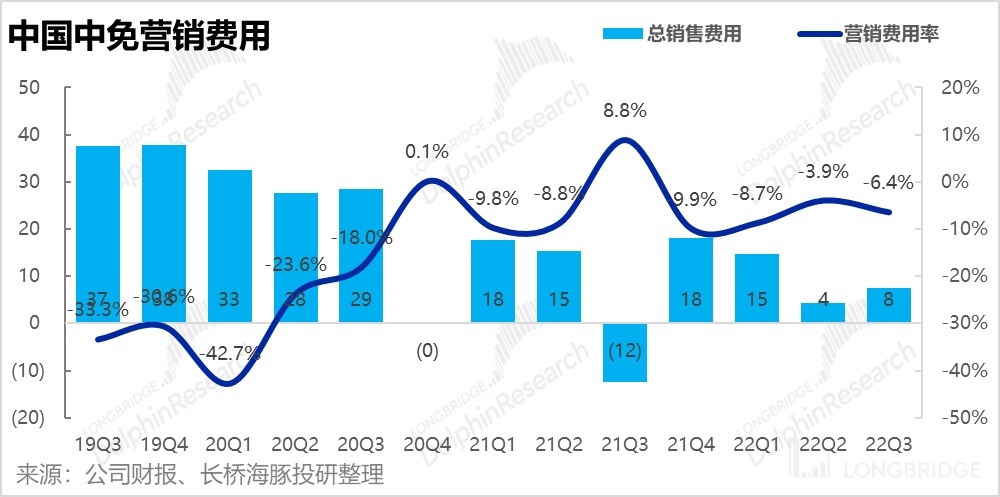

Fixed expenses: In the case of a sharp drop in gross profit, the company's expenses are relatively fixed. The management expenses and tax expenses for this quarter are basically the same as the previous quarter in terms of absolute values and expense ratios. However, the sales expenses increased from RMB 430 million in the previous quarter to RMB 760 million, but there was good news of airport rent refunds last quarter. Historically speaking, the sales expenses for this quarter are still quite thrifty. Overall, the loss on the gross profit side was not offset by the expenses, resulting in a significant decline in the company's net profit.

-

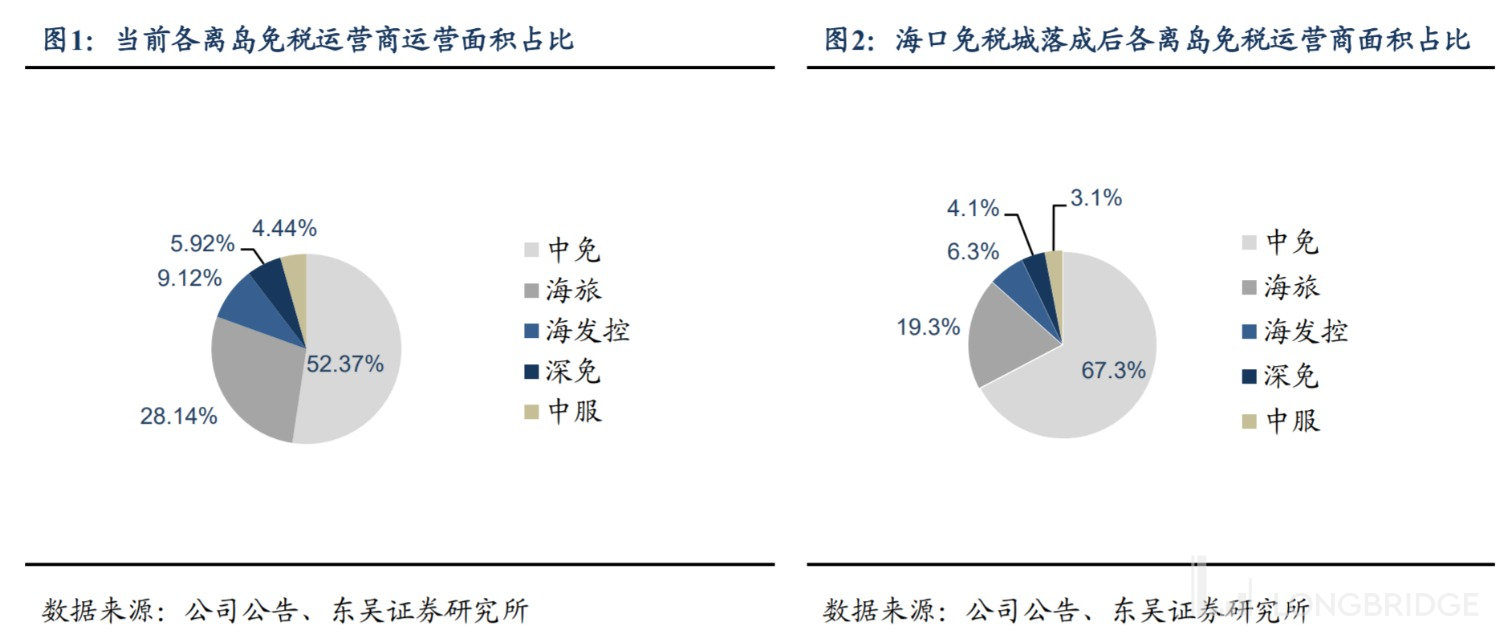

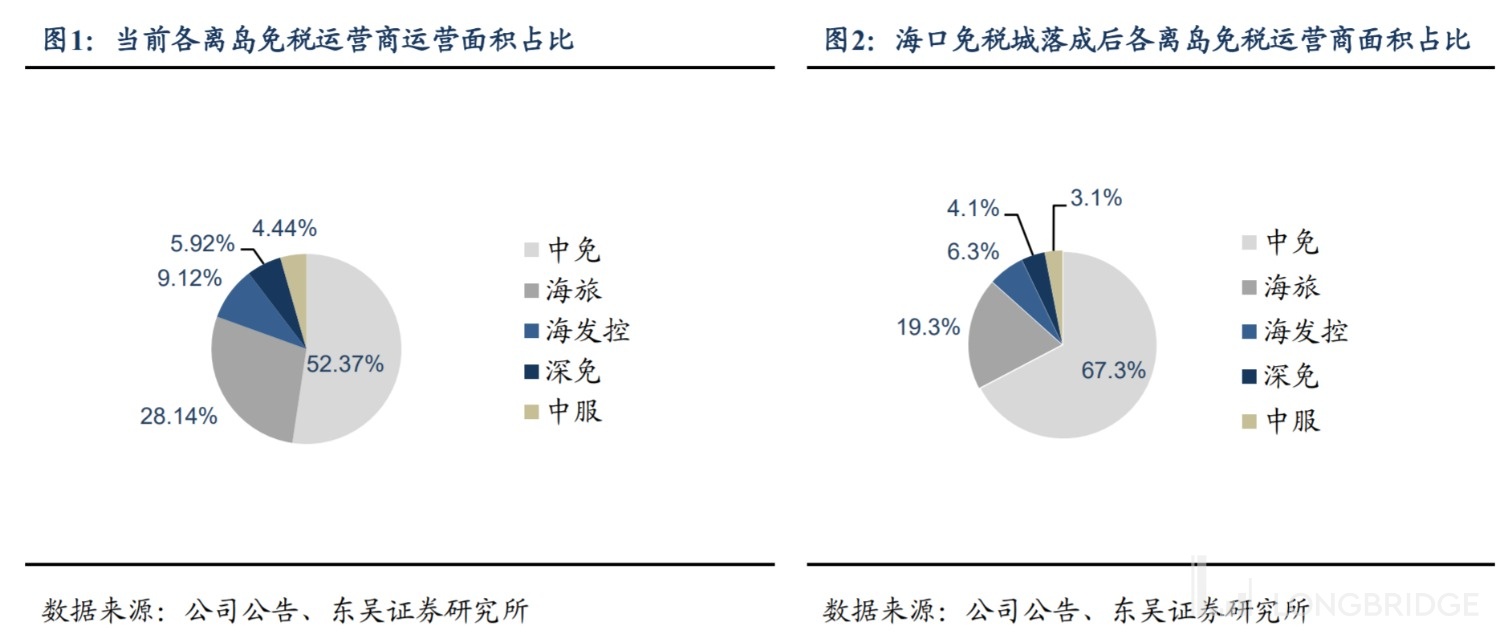

The opening of Haikou Duty-Free City is worth looking forward to: One positive news is that the company's another flagship duty-free shop in Hainan, Haikou Duty-Free City, opened at the end of October. This will increase CNSC's store area from 180,000 to 330,000 million square meters in Hainan, and the proportion of all tax-free stores in Hainan will also increase from 52% to 67%.

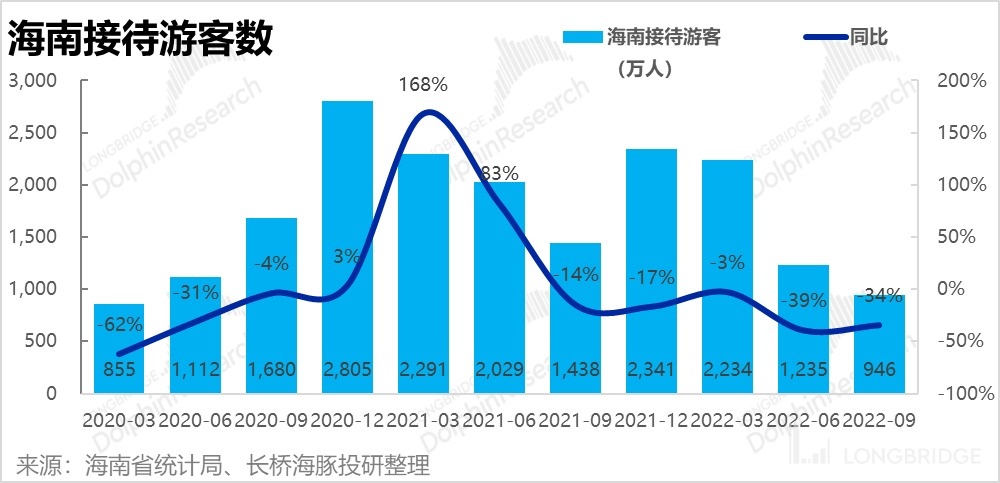

In addition to the increase in store area, Haikou Duty-Free City has also introduced luxury brands such as Chanel, Dior, Prada, and Cartier. Therefore, in the two most important points for duty-free businesses - the number of stores (to increase passenger flow) and the richness of high-end brands (to increase customer spending), Haikou Duty-Free City is a good supplement. Moreover, since the end of September, Hainan's passenger flow has also significantly recovered. According to research, the passenger flow on the opening day of Haikou Duty-Free City was considerable. Dolphin Analyst believes that if there were no disruptions due to the epidemic, the opening of the duty-free city would be worth looking forward to as a driver of CNSC's future performance. Dolphin Analyst's View:

Overall, the company's revenue and profit performance was quite poor under the huge impact of the epidemic. However, from the perspective of expected deviation, the market has generally foreseen and digested this tragic financial report.

Looking back at the past, we can see that each epidemic has had a significant impact on the company's operations, making it difficult for the market to evaluate and value the company's performance under stable conditions. In the mid-to-short term future, Dolphin Analyst believes that the epidemic will probably fluctuate several times and continue to disrupt the company's performance.

Therefore, the basic logic for the company's mid-to-short term investment still depends on the control of the epidemic and the recovery of tourism. The logic for the long-term investments in China Duty Free still depends on two points: channel (i.e. store) and source control. With the opening of the Haikou duty-free store, China Duty Free has strengthened these two areas, but attention also needs to be paid to the opening of other duty-free shops. The company's long-term logic is not very clear, so Dolphin Analyst still maintains a monitoring and observing attitude towards the whole of China Duty Free.

Dolphin Investment Research focuses on interpreting global core assets across markets for users, and grasping the deep value of companies and investment opportunities. Interested users can add the WeChat ID "dolphinR123" to join the Dolphin Investment Research community and discuss global asset investment views together!

The following is a detailed review of the financial report:

1. Revenue Pressure, but Performance Stronger Than Industry

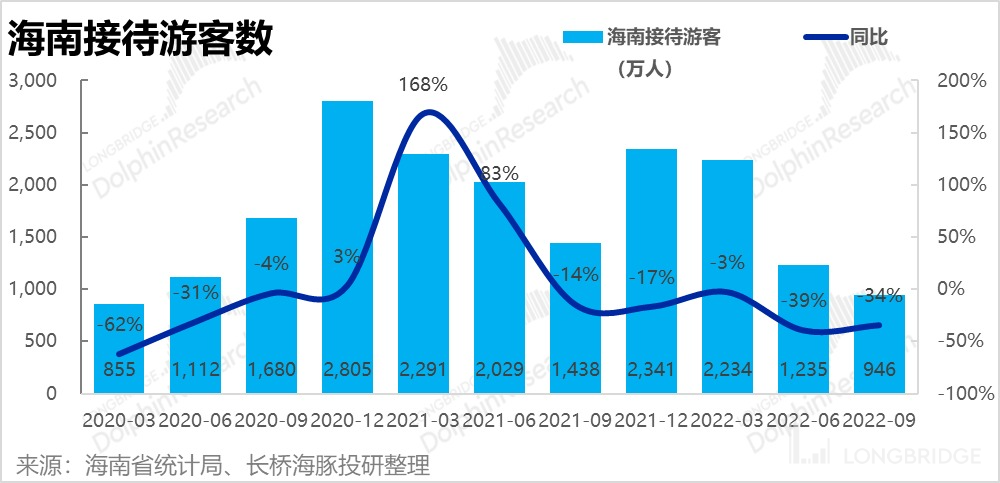

China Duty Free achieved a total revenue of RMB 11.7 billion in the third quarter, a year-on-year decrease of 16.2%, but an 8% increase from the second quarter. Considering that from early August to mid-September, due to the frequent outbreak of the epidemic in Hainan Province, the duty-free shops on the island have been closed for maintenance. According to statistics, in the third quarter, the total number of tourists received in Hainan was only 9.46 million, hitting the lowest value since the first quarter of 2020 (during the national lockdown). In such a difficult situation, although China Duty Free's revenue is still shrinking year-on-year, the actual realization is not bad.

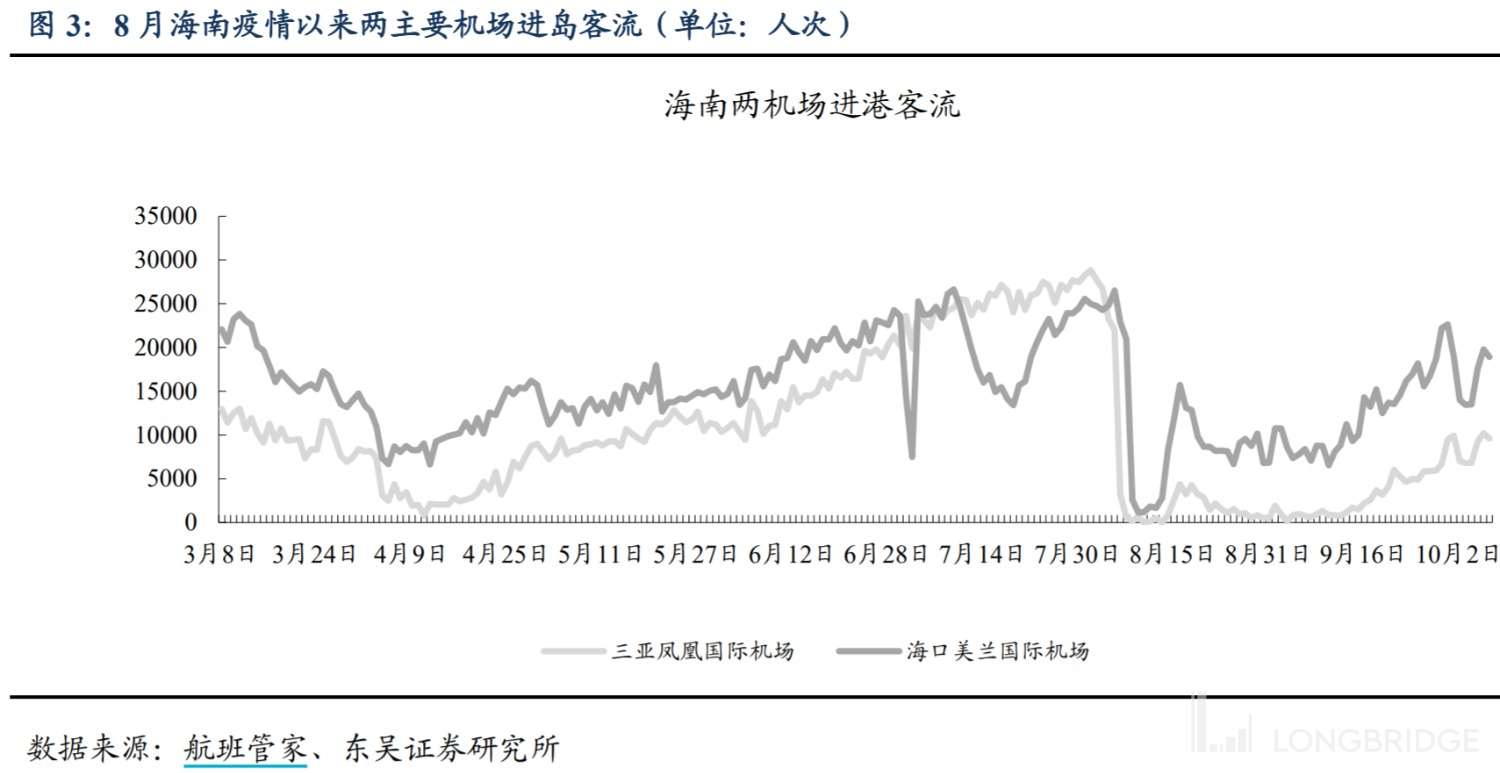

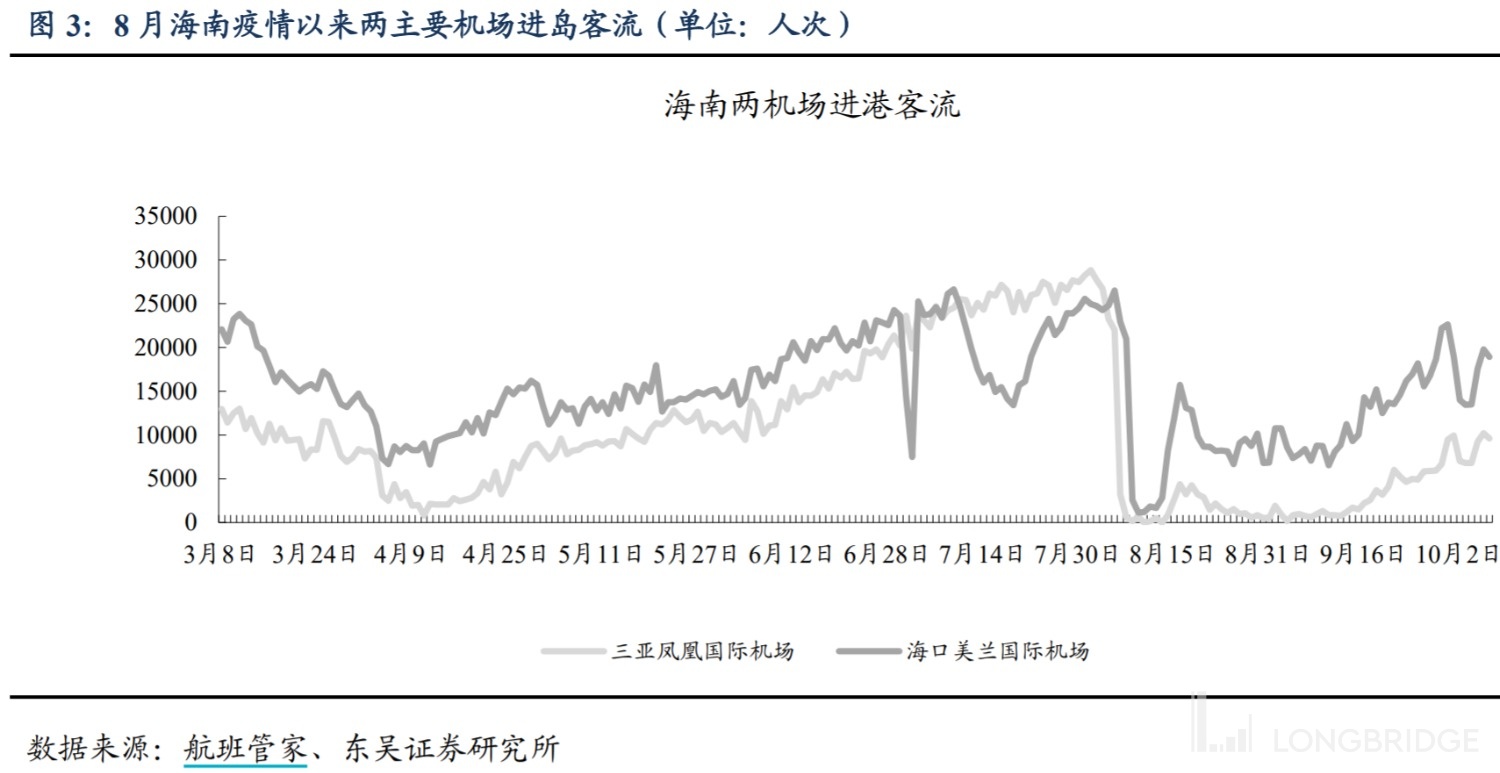

Looking at the passenger flow of Sanya and Haikou airports, the passenger flow of Sanya Airport was basically zero from August to mid-September, and Haikou Airport also shrank significantly. However, since the unblocking in late September, it can be seen that the passenger flow at the airport has significantly rebounded. Therefore, if there is no large-scale epidemic and static control at the end of the year, China Duty Free's sales in the fourth quarter should continue to improve on a month-on-month basis.

In addition, on October 28, China Duty Free's another flagship duty-free store-Haikou International Duty Free City-officially opened. According to institutional statistics, the opening of Haikou Duty Free City will significantly increase China Duty Free's business area in Hainan from 180,000 to 330,000 square meters. At the same time, the proportion of all duty-free stores in Hainan that are operated by China Duty Free Group will be increased from 52% to 67%, further solidifying its leading position in the industry.

In addition to the increase in shop floor area, the Haikou Duty-Free City has also introduced a wide range of high-end luxury brands such as Chanel, Dior, Prada, and Cartier. The Dolphin Analyst has always believed that the number of stores (which increases foot traffic) and the variety of high-end brands (which increases average spending per customer) are the two key indicators for duty-free shops. The Haikou Duty-Free City has done an excellent job in strengthening both of these aspects. Therefore, the Dolphin Analyst believes that under normal circumstances, the opening of the duty-free city will drive the future performance of China Duty Free Group.

"Second, with a significant drop in gross profit margin and a dramatic decrease in foot traffic, will the company have to heavily discount its products?"

Although China Duty Free Group's revenue performance this quarter can be considered to have made the best of a bad situation, its gross profit margin is surprisingly low, reaching a historic low of only 24.7% this quarter, which is lower than the low point of 26.4% in the fourth quarter of last year during the severe pandemic. The Dolphin Analyst believes that the possible reason is that the company provided generous discounts after the lifting of the pandemic-related lockdown, in order to stimulate revenue growth, in its largest revenue source -- the offshore duty-free channel -- which was unable to operate normally for a month and a half due to the pandemic; in addition, during the closure period, the company may have made up for the loss of offshore duty-free by using taxed business with lower gross profit margin.

In addition, since retailers have the discretion to reflect promotional expenses as income deductions or marketing expenses, the gross sales margin (i.e., the profit remaining after deducting sales expenses from gross profit) is a more indicative indicator of the company's bargaining power.

As can be seen, the company's marketing expenses were relatively low this quarter, at only around 800 million yuan, similar to the level in the second quarter, and significantly lower than the tens of billions of yuan in past periods. The ratio of marketing expenses to revenue was also only 6.4%, which is also historically low. Therefore, the Dolphin Analyst believes that, under the disruption caused by the pandemic, the company chose to directly offer discounts to consumers and reduced its investment in brand promotion.

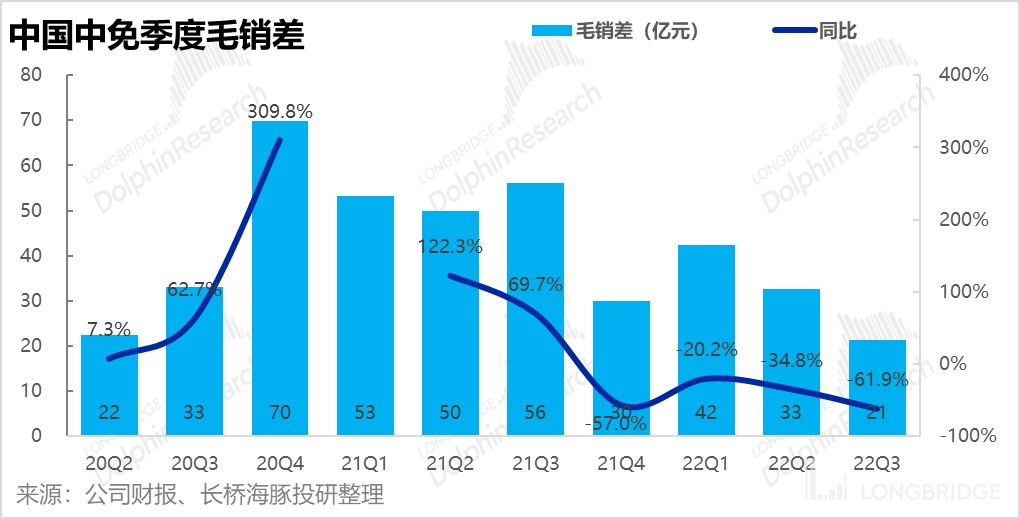

However, due to the significant decrease in gross profit margin, the company's gross sales margin (gross profit minus sales expenses) ultimately fell by 62% to only 2.1 billion yuan year-on-year. It can be seen that the company cannot achieve both revenue growth and profit under the pandemic, and therefore chose the former.

Three, expenses remain stagnant, net profit decreased significantly

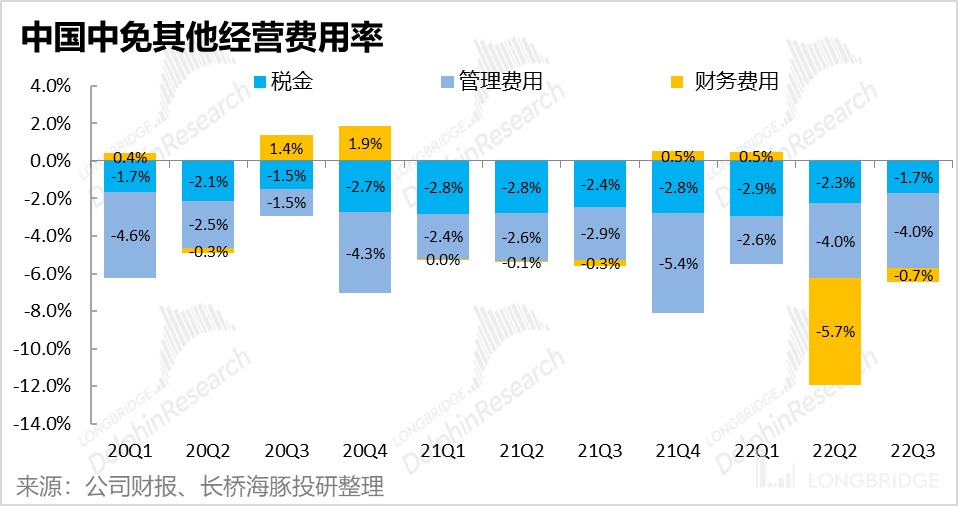

In the case of a sharp decline in gross profit, the company's other expenses remain essentially stagnant. Expenses such as management fees and taxes have shown little change in terms of absolute value and expense ratio, indicating that the company's expenses are relatively rigid. Financial expenses, on the other hand, have returned to their normal historical levels compared to the abnormal values seen in the second quarter due to exchange losses.

Overall, due to the loss of gross profit, the difference between gross and net sales decreased by a staggering 1.1 billion, while expenses remained relatively rigid, with only financial expenses returning to normal levels, saving the company around 500 million yuan. As a result, the company's net profit attributable to shareholders fell by 50% from the previous quarter, from 1.4 billion to 700 million yuan. However, according to Dolphin Analyst, it was expected that the market's expectation was only around 500 million yuan, so despite the poor performance of the company under the huge impact of the epidemic, it was still largely met and digested by the market.

Dolphin Research on China Duty Free Group:

August 31, 2022 Financial Report Review: Finally, a Truce in the Shadow of the Epidemic, China Duty Free Group Finally Stabilizes

April 27, 2022: Under the Shadow of the Epidemic and Intensified Competition, the Reversal of Fortune for China Duty Free Group is Yet to Come

April 23, 2022: Revenue Deterioration, Profit Recovery, China Duty Free Group Still in the midst of Crossing the River

November 15, 2021: A Curse Revisited? China Duty Free Group's Future Still Shines

July 5, 2021: China Duty Free Group (Part 1): Is Being Dominant a Fool's Dream?

Risk Disclosure and Disclaimer for this article: Dolphin Research's Disclaimer and General Disclosure