NetEase: Where does the confidence to break up with Blizzard come from while safeguarding the growth of the product life cycle?

Hello everyone, I am the Dolphin Analyst!

After the Hong Kong stock market closed on November 17th, Beijing time, NetEase released its Q3 2022 financial report. Compared to the report itself, the news that "Blizzard and NetEase Officially Announce Breakup" announced during trading hours may be of greater market attention. I will discuss this in the following paragraphs.

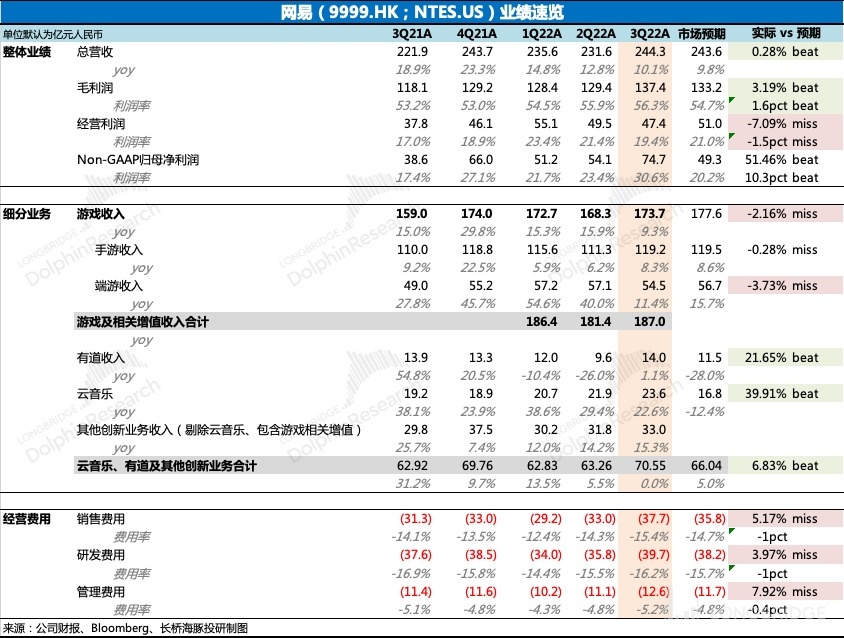

But before that, let's take a look at the Q3 operating performance:

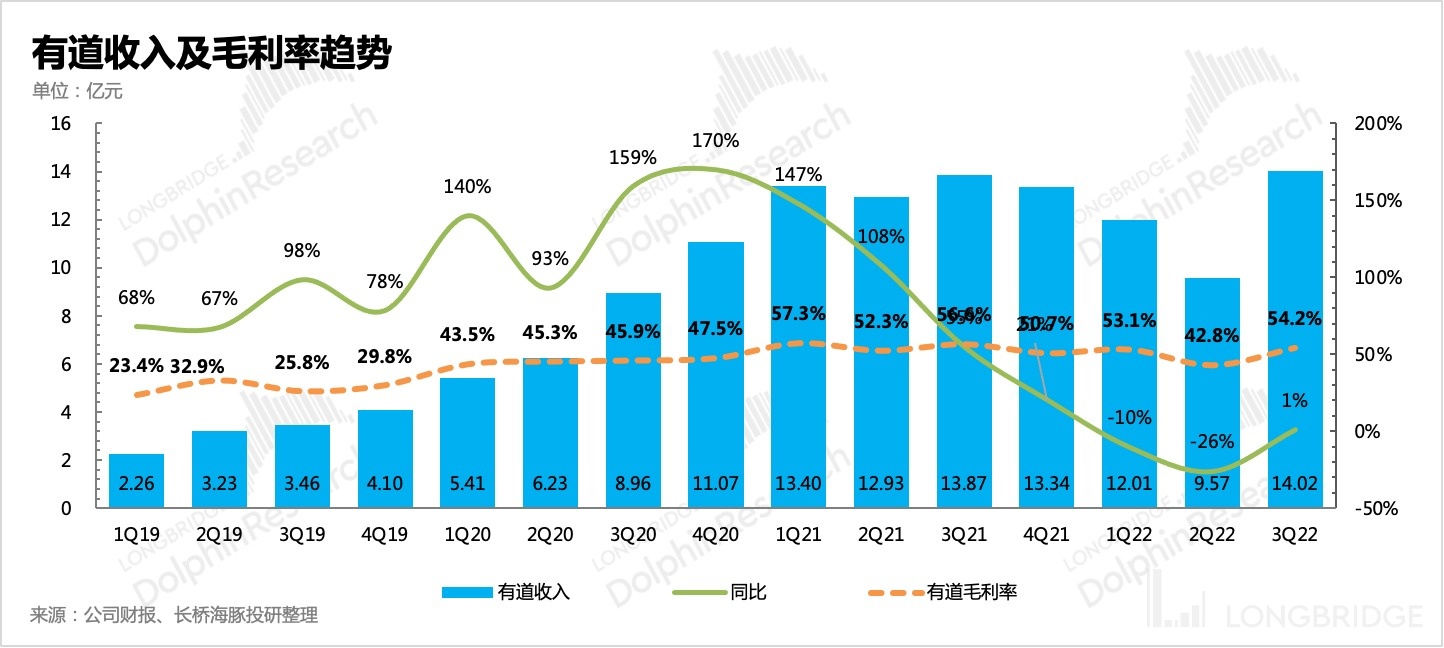

1. Total revenue was 24.4 billion, a year-on-year increase of 10%, which is in line with market expectations overall. Among them, the most exceeded expectation was the Youdao business, which recovered from the impact of the epidemic and grew by over 40% year-on-year, boosted by new products such as the Youdao Dictionary Pen X5 and the Youdao Learning Tablet.

However, the pressure from the gaming business, which accounts for the largest proportion, is also very obvious. Despite the launch of "Diablo Immortal" in Q3, the two factors of the Harry Potter and the Eternal Life series increasing the base of mobile games and PC games respectively still somewhat dragged down the growth. As most of the revenue from Harry Potter will be confirmed in Q4, Dolphin Analyst expects that the pressure on the gaming business will be even more evident in Q4.

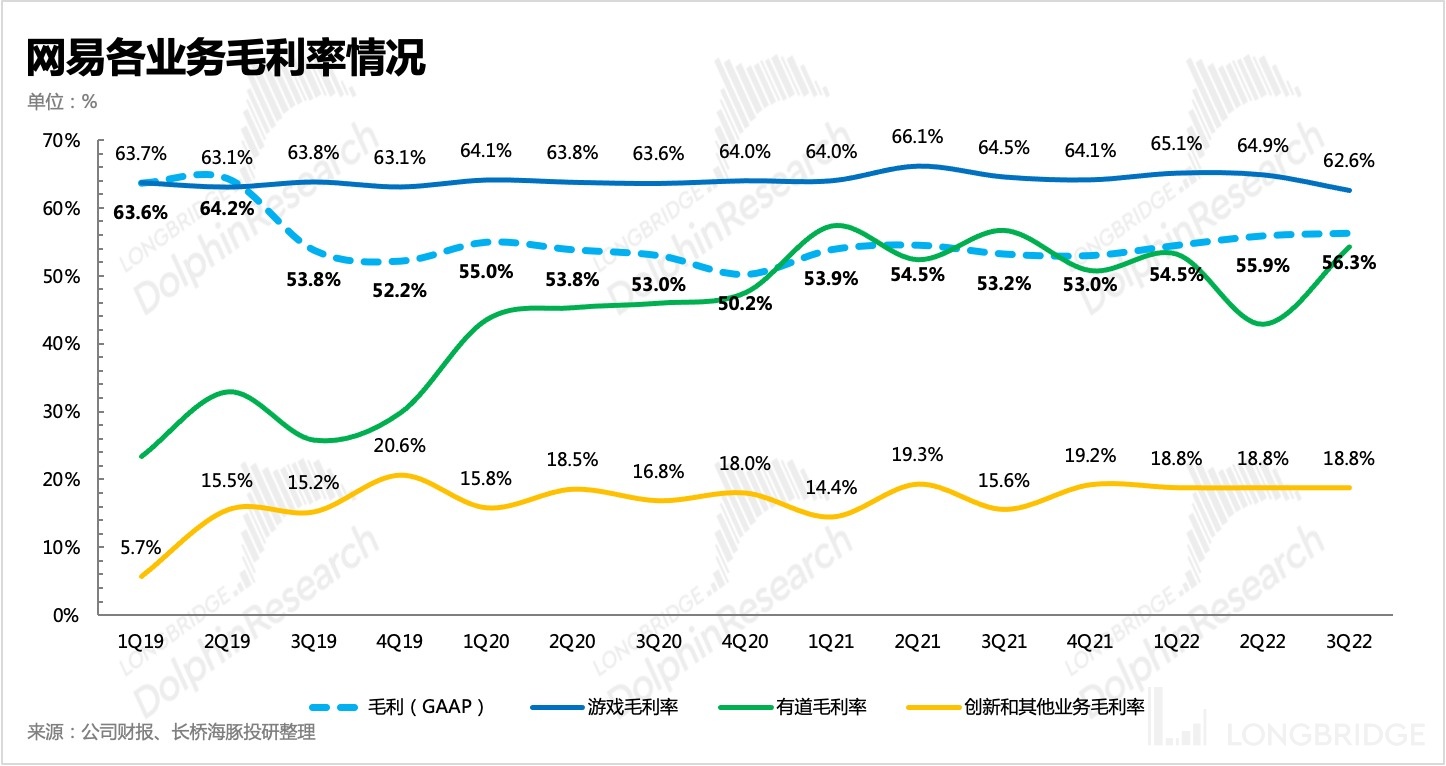

2. Gross profit margin remained stable overall from the previous quarter, but improved significantly year-on-year due to the higher proportion of high-gross-margin PC games and the optimization of cloud music copyright costs.

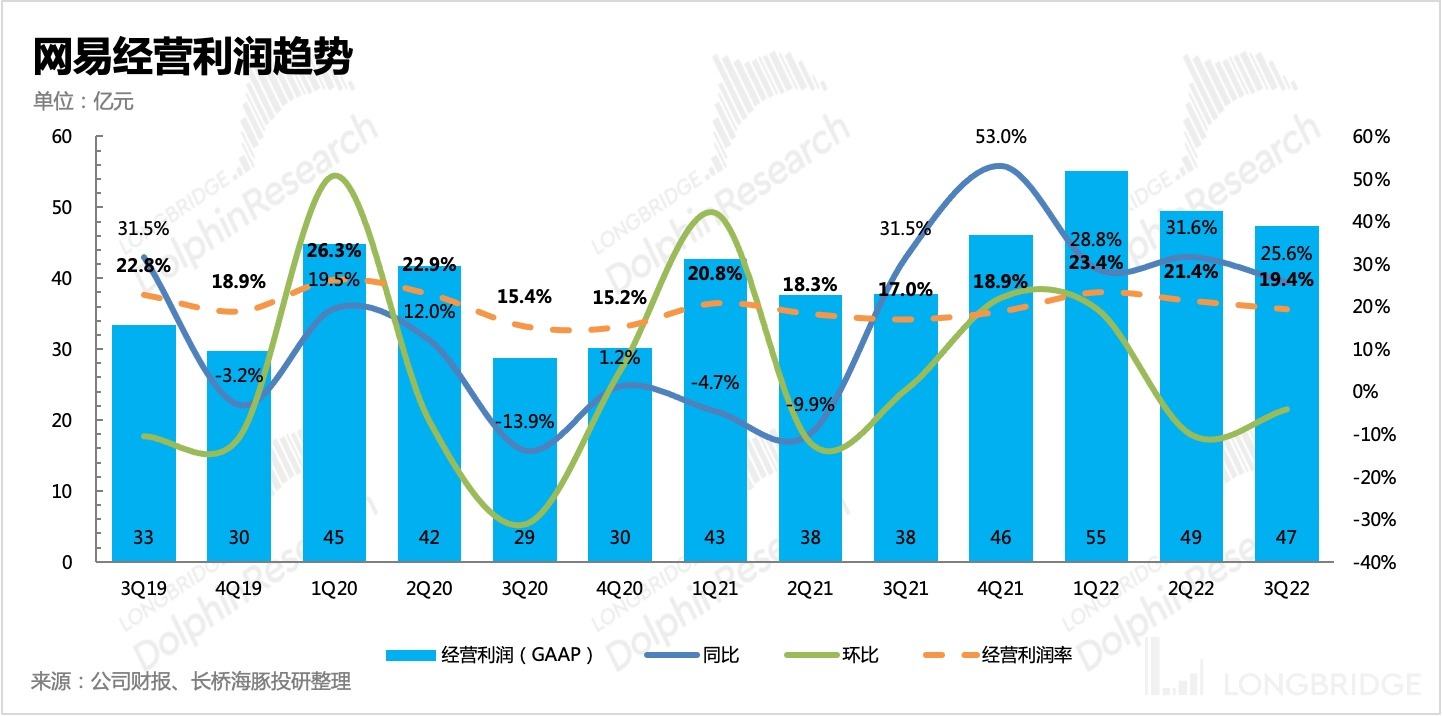

3. The core operating profit margin decreased slightly from the previous quarter. NetEase achieved a core operating profit of 4.7 billion in Q3, a year-on-year increase of 25.6%, and a profit margin of 19%. This was mainly due to the demand for investment and promotion of new games after their launch, resulting in relatively higher marketing expenses.

4. Regarding share buybacks, in addition to the 2-year buyback plan in 2021 still being in progress, NetEase announced a new buyback plan: repurchasing an amount not exceeding 5 billion US dollars within 36 months. This quarter, 3.4 million ADR shares were newly repurchased, and a total of 27 million shares were repurchased, consuming a total of 2.5 billion US dollars.

5. Cash flow has always been healthy. As of the end of Q3, Netease had 100 million yuan in cash and cash equivalents, and a net cash of 94.6 billion yuan after deducting short and long-term borrowings. The net cash flow from operating activities in Q3 was 7.5 billion, with both year-on-year and quarter-on-quarter increases, mainly due to increased profits from core business.

I will release the summary of the conference call on the Longbridge app and the user research group as soon as possible. Friends interested in investing in NetEase can add the WeChat account "dolphinR123" to join the group and get the summary.

Dolphin Analyst's Opinion

Overall, Q3 was decent. Although there is still a gap between gaming revenue and market expectations, it is already enviable among peers in the current environment.

However, the uncertainty of game approvals has disrupted NetEase's product cycle, and the quantity of new games with approved licenses and good revenue expectations in the current gaming reserves is low. Therefore, for NetEase, the greatest growth pressure is probably in the next quarter, which may even continue into the first half of next year if luck is bad. This is mainly due to the extremely high base, as well as the small number of new games with approved licenses and good expected revenue in NetEase's gaming reserves. Except for "Hidden World Record" with a license to go online, the two modified IPs, "Eternal Prison" and "Nishuishan", that have high hopes have not yet obtained a license and are still in the numerical debugging stage. The international service of "Harry Potter" has been postponed again and again from Q3 to Q4, and the third-quarter report has directly changed to 2023.

The international service does not have a license issue, but because the uncertainty of domestic license is too high, opponents will be very cautious about the existing reserve games, especially large IP games, and will optimize the data to the highest possible level. Of course, this is not only NetEase, the entire game industry is in a relatively awkward period--resuming license, long-term confidence is restored, but short-term investment is still cautious.

In this situation, for Blizzard's harsh new contract terms, NetEase's painful abandonment of this 14-year friendship is also a manifestation of a cautious investment attitude. As early as the beginning of the year, NetEase had already shut down multiple research and development projects with low investment returns and old games that had been launched internally, and focused resources on the most promising projects.

This strategic adjustment, when reflected in the indicators that investors care about, manifests as: the R&D cycle of products is longer, and the income release rate slows down in the long run, and the composite growth rate decreases, which affects the growth premium that the market is willing to offer. Pulling the valuation requires more reliance on short-term performance.

Dolphin Analyst believes that if the general R&D progress and possible approval progress of the license are followed, with the weakening of the base effect in the second half of next year and the expected launch of several highly anticipated games, NetEase may once again usher in a period of explosive performance.

In the short term, the potential positive signal brought about by the marginal changes in the domestic gaming environment may have a greater impact on the market valuation performance. The termination of cooperation with Blizzard alone has limited impact on the performance itself, and the market sentiment is more concerned about the interruption of NetEase's deep excavation of Blizzard IP, which raises concerns about NetEase's future internationalization slowdown.

Detailed interpretation of this quarter's financial report

- Online games: The hand tour of "Diablo" ignites and contributes to steady growth under a high base.

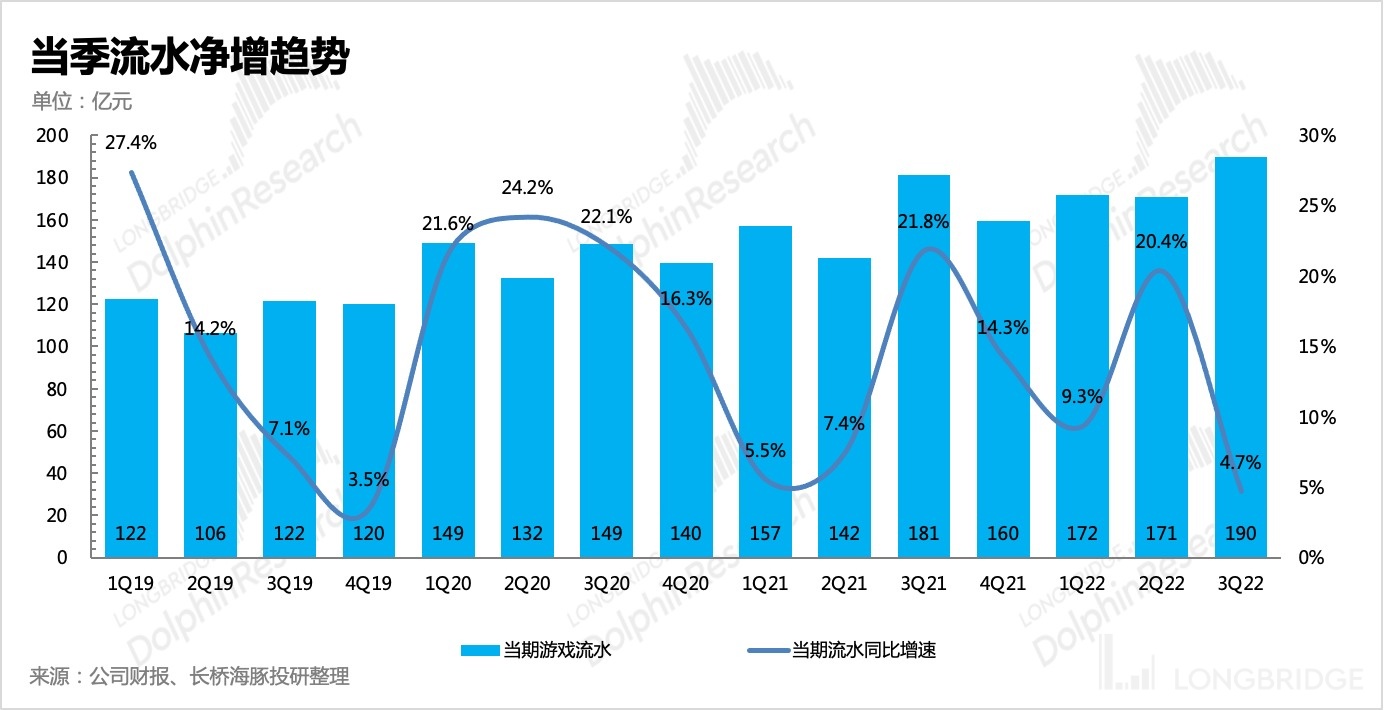

In the third quarter, NetEase Games' (excluding related value-added) revenue was 17.7 billion yuan, a year-on-year increase of 9.3%. Although there was the blessing of the annual game "Diablo Immortal", the base was relatively high due to the large sales of "Eternal Prison" and "Harry Potter" last year, so the growth rate slowed down compared to the previous quarter. In the global industry headwinds, obtaining nearly 10% growth is relatively difficult.

(1) In the third quarter, the year-on-year growth of mobile games was 8.3%, and "Diablo" was the largest contributor to the increment. According to Qimai data, the water flow of "Diablo" is expected to exceed 1.5 billion. In addition, "Endless Lagrange" continues to exert efforts and its water flow continues to set new highs in the third quarter. However, the water flow of "The Legend of Sword and Fairy" and "Yin and Yang Division" in the third quarter has obvious decline, and the overall head old games have declined. (2) The Q3 revenue of PC games increased by 11%. "Eternal Crusade" still ranks 6th in the popular games list on Steam, and players have remained active since its release. The long-life classic game "Fantasy Westward Journey" achieved record-high revenue in Q2 and continues to perform strongly in Q3.

Results speak for themselves. NetEase Games is undoubtedly an outstanding player in the industry, whether it comes to domestic games, Chinese game companies going global, or global games, all of which are in a strong headwind in Q3.

Looking ahead to Q4, the high base effect and lack of new games may put some pressure on NetEase's revenue growth rate. Although there are not many games with licenses, the company has a considerable inventory and some potential products that can attract gold, but the problem still lies in the lack of game licenses.

(1) On the mobile games side, the period when "Harry Potter" achieved excellent revenue was mainly in Q4 2020, Q1 2021, and in the first half of this year, "Endless Lagrange" also performed well. Although this year's "Diablo Immortal" performed well after its global launch, NetEase can only receive 10% of overseas revenue, which has limited contribution to the company's performance.

Currently, the domestic revenue performance of "Harry Potter" is inferior to that of its launch period, and its revenue has been continuously declining since Q2. Several factors have contributed to the greater growth pressure in Q4.

However, compared with "Harry Potter", NetEase, which is better at operating MMO games, does not need to be too pessimistic about the mid- to long-term operating effect of "Diablo Immortal". After all, on NetEase's products, there are too many experiences of old games opening up new opportunities.

On PC games, "Eternal Crusade," which was launched in late August last year, continues to break record-high revenue in Q4, putting pressure on Q4 revenue.

According to the stable ratio of deferred revenue and current revenue recognition, Q4's revenue growth rate is likely to continue to fall to zero growth.

In the game reserve, there is a rich product line with many potential stocks, but there are not many high-heat IP mobile games with a number of version licenses. Among them, the international version of "Harry Potter" is still being postponed, and the latest plan is scheduled for next year. The mobile game "Eternal Prison" is still in the environment of final numerical tuning, but it doesn't have a version license, so even if it is done well, it still has to wait. The same problem applies to the mobile game "Jian Nu You Hun Yin Shi Lu". Although it has a version license, it may also need to wait for the right time to be taken out due to the lack of inventory in hand.

A sports game, "All-Star Streetball Party", is expected to be launched in December of the fourth quarter, and Dolphin Analyst will continue to pay attention to its performance after it goes live.

Let's talk about the "breakup" between NetEase and Blizzard again.

The breakup between the two sides was expected early on, from the suspension of cooperation in developing the mobile game "World of Warcraft" by both parties in August, to the recent publication of Activision Blizzard's earnings report, which expressed an ambiguously uncertain tone about whether or not to renew its contract with NetEase upon its expiration, completely different from the "sweet past" in which it renewed its contract half a year earlier than necessary on previous occasions.

Especially when Blizzard announced the breakup unilaterally before NetEase's earnings report was even made public and while it was still being traded in the market, it gave a faint sense of arrogance regardless of the old relationship. NetEase's subsequent response, "We sincerely negotiate for the renewal of the contract, but there are irreconcilable conflicts in the agreement and we have to regretfully accept the termination of cooperation", is also an expression of the grievances and anger it has suffered.

As a result, the market cannot help but be curious about 1) why, after 14 years of love, did they suddenly break up? 2) how much influence does this have on NetEase? Is there any room for a turnabout between the two sides? 3) After the breakup, who will take over the operation of Blizzard's games in China? And so on.

At the performance conference call in the evening, NetEase's management will definitely continue to give some responses to this issue, but since it is a public conference call, the official response may still be the main one.

Here, Dolphin Analyst tries to do some extended discussion:

1. From industry rumors, the main points of conflict are:

(1) Blizzard has requested a higher revenue share ratio in the renewal contract (now 50%), and in subsequent IP mobile game development, only allows NetEase to receive revenue from China but requires NetEase to bear most of the R&D work. For example, in the mobile game "Diablo Immortal," NetEase is only responsible for publishing in China, giving Blizzard 50% of the revenue share, while Blizzard is the leading distributor in the international market, and NetEase is responsible for most of the R&D work but only receives less than 10% of the revenue share. This not only undermines NetEase's profitability but also is unfavorable to NetEase's internationalization strategy - the goal of the proportion of overseas income reaching 50% in the medium to long term. (2) Due to the uncertain increase in the issuance time of domestic market versions, Blizzard hopes to avoid this part of the risk. Therefore, in terms of guaranteeing the expected revenue, more stringent standards have been set. If the requirements are not met, a high amount of liquidated damages will need to be paid. This is equivalent to allowing NetEase to bear the risk of the version, while Blizzard still wants to take away a higher profit-sharing ratio than 50%.

NetEase has no channels, so all traffic can only be monetized through the game itself. Unlike channel providers with strong traffic, such as Tencent and ByteDance, they can make up for the losses caused by agent games through other monetization methods. Therefore, NetEase decided to give up.

- How much impact does the loss of Blizzard's game agency right have on NetEase?

It can only be said that the short-term impact is limited, limited to the impact of the income from the agency on NetEase's revenue. Blizzard said that the agency income in the Chinese market accounts for only 15% of their income, that is, 3% of the entire Activision Blizzard. According to the total revenue of Blizzard in 2021 ($1.83 billion), the 50% profit-sharing ratio corresponds to the more than RMB 4 billion revenue from Blizzard games that NetEase needs to confirm in the financial report, accounting for 8% of game revenue, and less than 5% of total revenue.

In addition, looking at NetEase's financial report, the income from agency all external games in 2021 accounted for 13.3% of NetEase's total revenue, and the income from agency Blizzard accounted for 50% of the entire agency income.

However, the profit margin of the revenue from agency Blizzard itself is lower than that of self-developed end games because Blizzard has to give 50% of its profit-sharing. Coupled with NetEase's own investment in operation, server bandwidth costs, and some expenses, the profit margin may be similar to the overall level of NetEase. Therefore, losing the operation of Blizzard games by agency may have an impact of less than 5% on the overall profit.

But if asked whether there will be any impact on long-term IP cooperation, it is difficult to say. For NetEase, the significance of maintaining long-term cooperation with Blizzard lies in continuing to prioritize the use of Blizzard's IP to explore its value and help itself move towards internationalization, and the minor profit brought by the agency of old games is not the main purpose.

After the cancellation of this agency authorization, it does not necessarily mean that NetEase will have no chance of cooperation with Blizzard's IP in the future. Perhaps NetEase and Blizzard will cooperate through the most direct IP authorization method. For example, the cooperation method of "Diablo: Immortal" is a separately signed agreement.

But precisely because of this uncertainty, the market is prone to excessive imagination, and short-term emotions need to be vented. However, Dolphin Analyst believes that China's policy environment is improving (official media's positive attitude towards the gaming industry), which is the biggest marginal change. 1

Just recently, the November issue numbers were announced and totaled 70, an increase compared to the previous numbers. NetEase also obtained a game license for "The Return of the Condor Heroes". During yesterday's Tencent conference call, the management team expressed relatively optimistic views on short-term game license issuance, despite the risks involved.

Therefore, I, Dolphin Analyst, believe that as game license regulations gradually ease up, there may also be opportunities for the conflict between NetEase and Blizzard to be resolved. Over a decade of collaboration cannot be replaced overnight and NetEase's operating capabilities have always been recognized, so we suggest continuing to monitor developments.

2

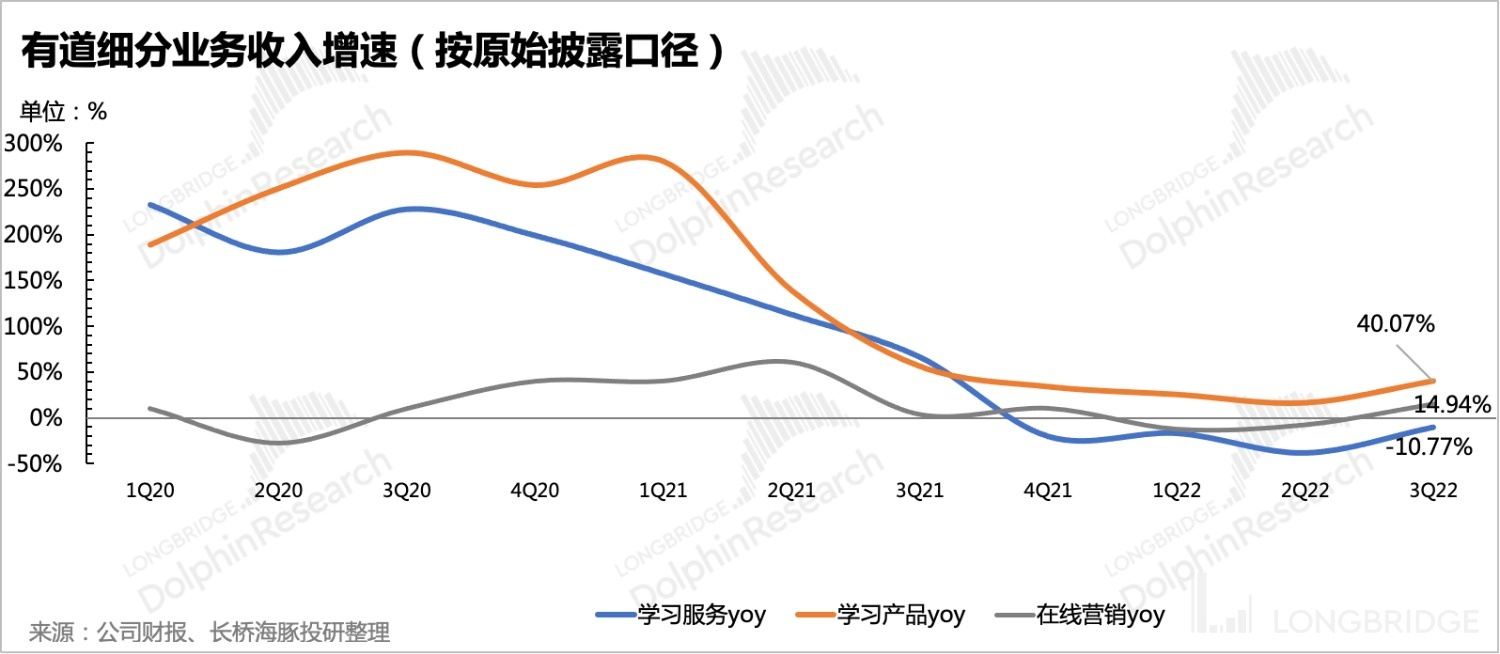

Youdao Education: Smart hardware devices are selling well, emerging from the shadow of the pandemic.

Due to the COVID-19 lockdown last quarter, Youdao faced considerable impacts on its smart hardware sales and supply chain logistics. However, this quarter's release of its new product, the Youdao Pen X5, coupled with the lifting of lockdowns in Shanghai, led to a rebound in smart hardware revenues, with a YoY increase of 40%. Additionally, online course services have also shown signs of recovery.

Furthermore, despite the current headwinds in advertising, Youdao's marketing business has returned to positive growth. This is likely due to the impact of education regulation reforms last year, which led to the rapid withdrawal of advertisements in the education sector and lowered the base.

3

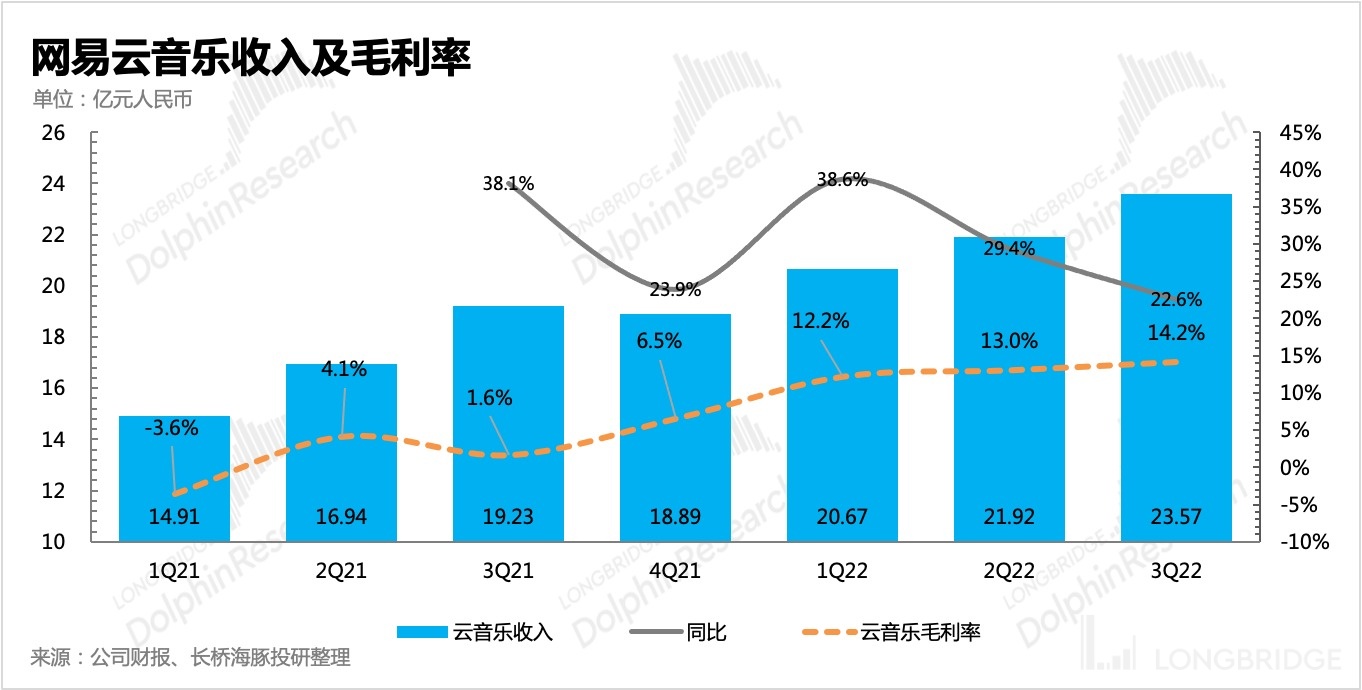

NetEase Cloud Music: Steady growth with slowly climbing gross margins.

NetEase Cloud Music did not disclose its Q3 operating figures. However, based on net income growth, it appears to have maintained steady growth. Q3 saw a YoY increase of 22.6%.

Similar to Tencent Music, the main driving force behind growth is expected to be subscription member fees, but social entertainment is still affected by short video platforms.

As gross margins gradually improve with monetization expansion and loosening of exclusive copyright regulations, label negotiations are weakened, bringing about improvement. However, the pace of improvement is slow and the gap with Tencent Music's gross margin level of above 30% is still significant.

4

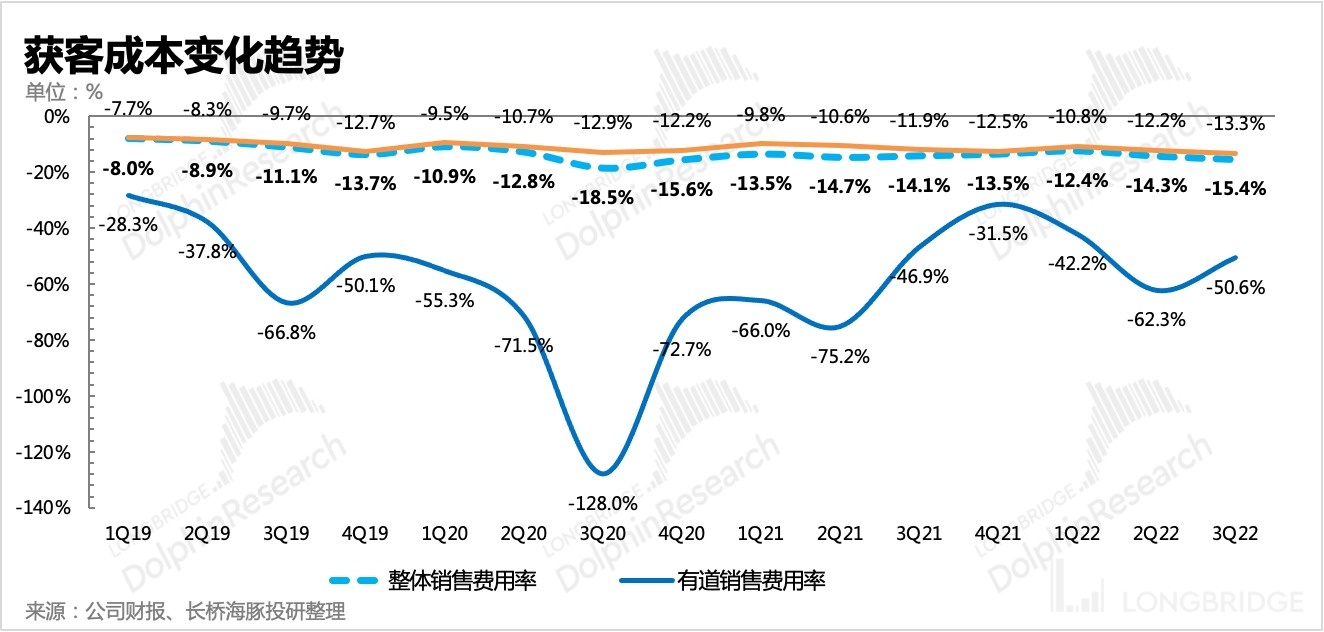

Profit margins declined MoM due to increased marketing costs from heavy promotions of new games.

Similar to last quarter, Q3 also saw a weakened profit margin level due to rapid increases in sales and marketing expenses. Seasonal increases in promotional expenses accompanied the release of new games, such as "Diablo" at the end of July, "Green Faith" at the end of September, and the Youdao Pen X5.

In the third quarter, the Non-GAAP net profit attributable to shareholders reached RMB 7.5 billion, doubling YoY. However, RMB 1.3 billion of it came from the disposal of equity assets, and another RMB 1.4 billion was due to the appreciation of the US dollar against the RMB. These were one-time non-operating gains and losses and do not reflect the true operating performance.

In order to purely evaluate the actual profit-making ability of the main business, we still need to look at the operating profit indicator, which was RMB 4.74 billion in the third quarter, an increase of 25.6% YoY. The YoY improvement in gross margin and a mere 5% YoY growth in R&D expenses all contributed to the release of profits.

Dolphin "NetEase" historical articles:

Earnings Season

August 18, 2022, conference call: "NetEase: Focusing on overseas is a strategic choice that must be made (2Q22 conference call summary)"

August 18, 2022, earnings review: "NetEase opened with a gloomy face? It's not really about performance"

May 25, 2022, conference call: "No obvious benefit from pandemic control, income from old client games exceeds records (NetEase conference call summary)"

May 25, 2022, earnings review: "[The "pig" cycle continues, and NetEase once again harvests "solid happiness"] (https://longbridgeapp.com/topics/2660304)" 2022 February 24 Telephone Conference "NetEase Future Focus: Overseas Markets, Overseas Talents, and Collaboration with Overseas Teams (Telephone Conference Summary)".

2022 February 24 Financial Report Review "Surviving Winter Together, Can NetEase's Spring continue for how long?".

2021 November 16 Telephone Conference "Metaverse? Management: Don't say much, NetEase's figure will appear at ease (NetEase telephone conference)".

2021 November 16 Financial Report Review "After "Harry Potter" King, what other cards does NetEase have?".

2021 August 31 Telephone Conference "NetEase Second Quarter Telephone Conference Summary: Underage flow accounted for less than 1%, looking forward to "Harry Potter"".

2021 August 31 Financial Report Review "NetEase: Will the regulatory landing drag down the "Super Pig Cycle" of pig farms?".

2021 May 18 Financial Report Review "NetEase Games finally outperformed the market, and Youdao Online Education is also about to emerge?".

2021 February 26 Telephone Conference "NetEase Telephone Conference Transcript: The IP value of "Yin Yang Master" has reached 10 billion U.S. dollars".

2021 February 25 Financial Report Review "Dolphin Investment Research|Veteran game factory is not afraid of the storm, NetEase Education's track is growing rapidly".

Depth

2021 June 25 "NetEase: The Super "Pig Cycle" of Pig Farms I Dolphin Investment Research".

Hotspot

2021 July 27 "NetEase maintains a long-term target price of 115-141 US dollars". This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure