NetEase turns black at market opening? It's really not because of poor performance

Hello everyone, I am Dolphin Analyst!

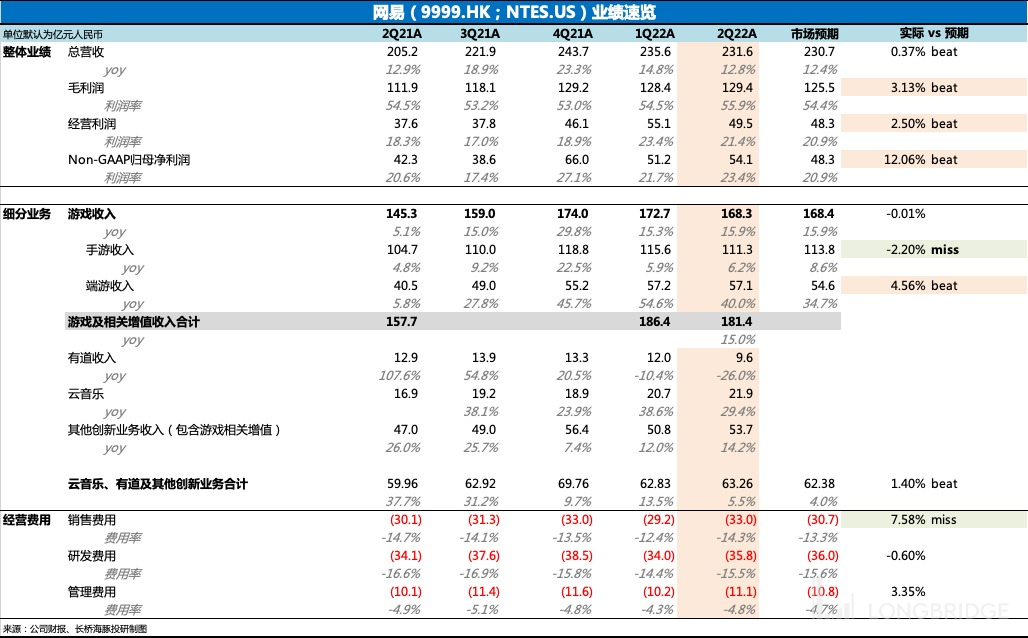

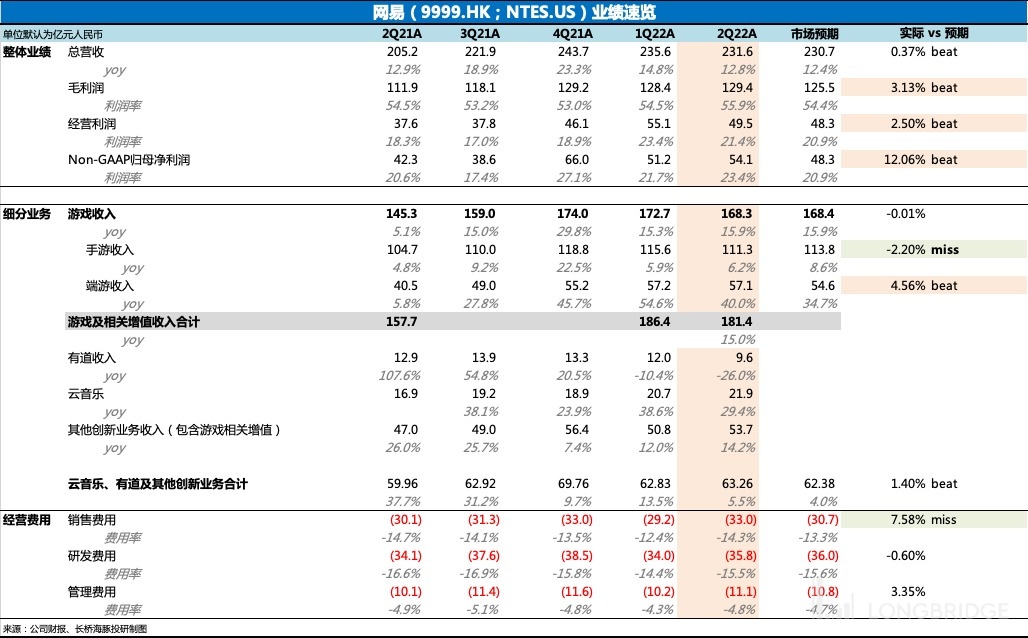

Tonight (August 18th Beijing time), NetEase (NETS; 999.HK) released its Q2 2022 financial report. Compared with market expectations, revenue was in line and profits exceeded expectations. The good performance of profits mainly comes from the improvement of gross profit, mainly due to the increase in the proportion of high gross margin end games in the gaming business.

Overall, NetEase's performance is still stable, and although the third quarter is the first summer vacation to face the impact of protection policies for minors, the launch of the "Diablo" mobile game can still help NetEase resist some industry headwinds.

Short-term growth expectations still need to focus on NetEase's product pipeline and management guidance. However, Dolphin Analyst noticed that NetEase turned from rise to fall after opening**, but neither Q2 performance itself nor the forward-looking indicators of liquidity can see the cause of its big fall. We are more inclined to communicate some negative information on the trading side, NetEase's phone calls or subsequent group communications. If there is any information update, Dolphin Analyst will update it first**.

Dolphin Analyst will release the summary of the performance conference call to the Longbridge app and user research group for the first time, and friends who are interested in NetEase investment can add the WeChat ID "dolphinR123" to join the group to get the summary.

Core points of Q2 financial report are:

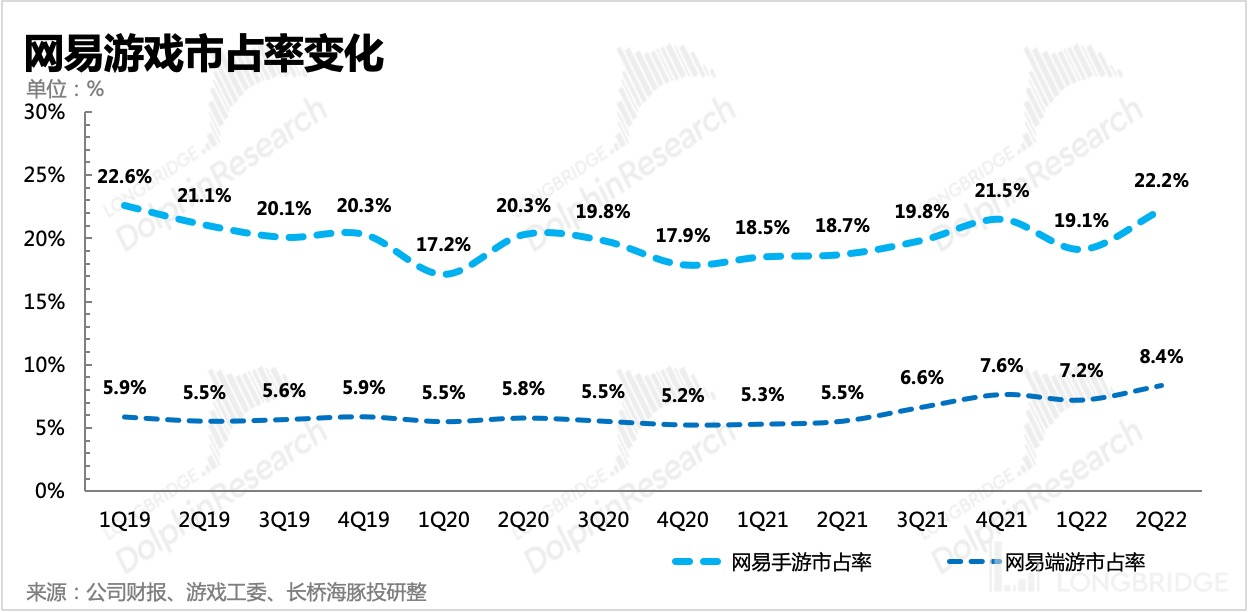

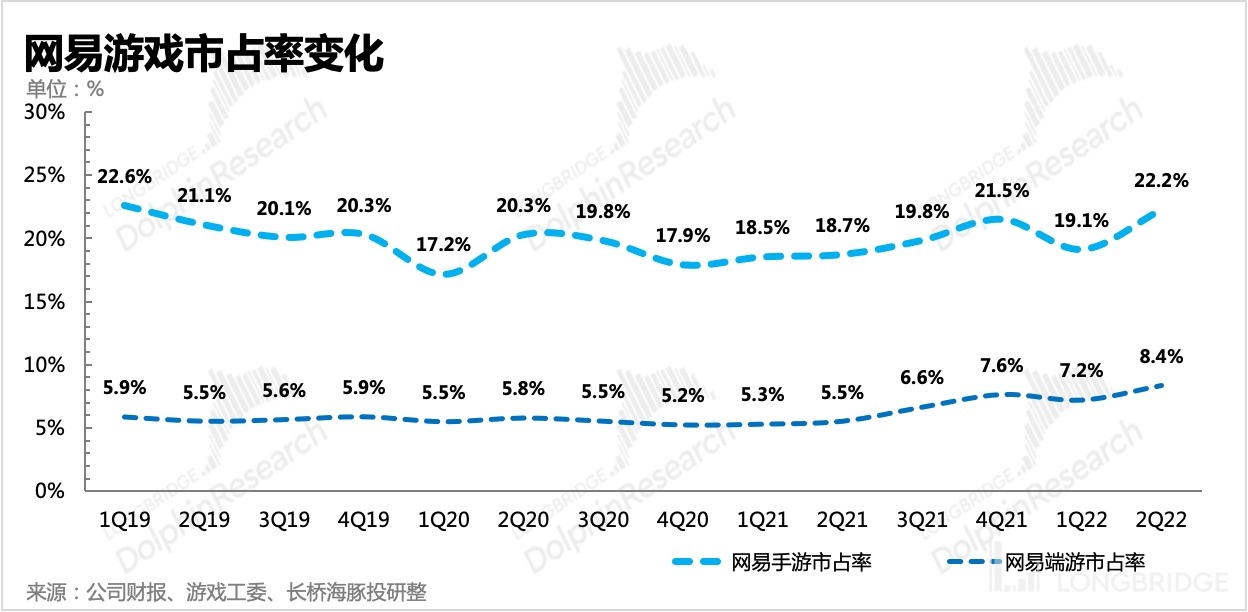

(1) The total revenue basically met expectations, of which end games continued to exceed expectations, and mobile games performed slightly worse, but compared with the industry, the pressure resistance during the headwind period was already quite good.

(2) The gross profit margin is up, the same as the previous quarter, mainly due to the increase in revenue from end games with higher gross profit margins.

(3) NetEase launched many new games this quarter, especially "Diablo Immortal" mobile game, and the preheating promotion costs cannot be reduced. In addition, the marketing expenses of cloud music also doubled this quarter, mainly used for promotion of live streaming business.

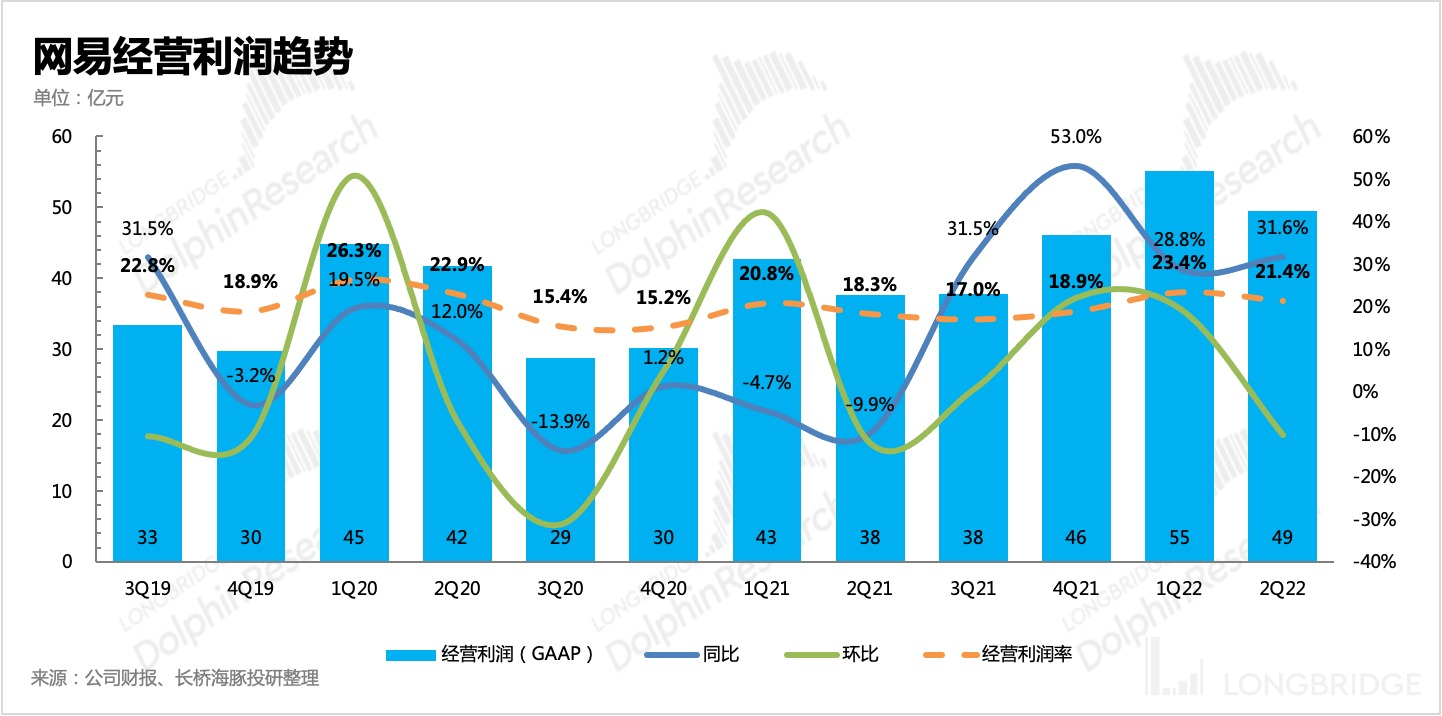

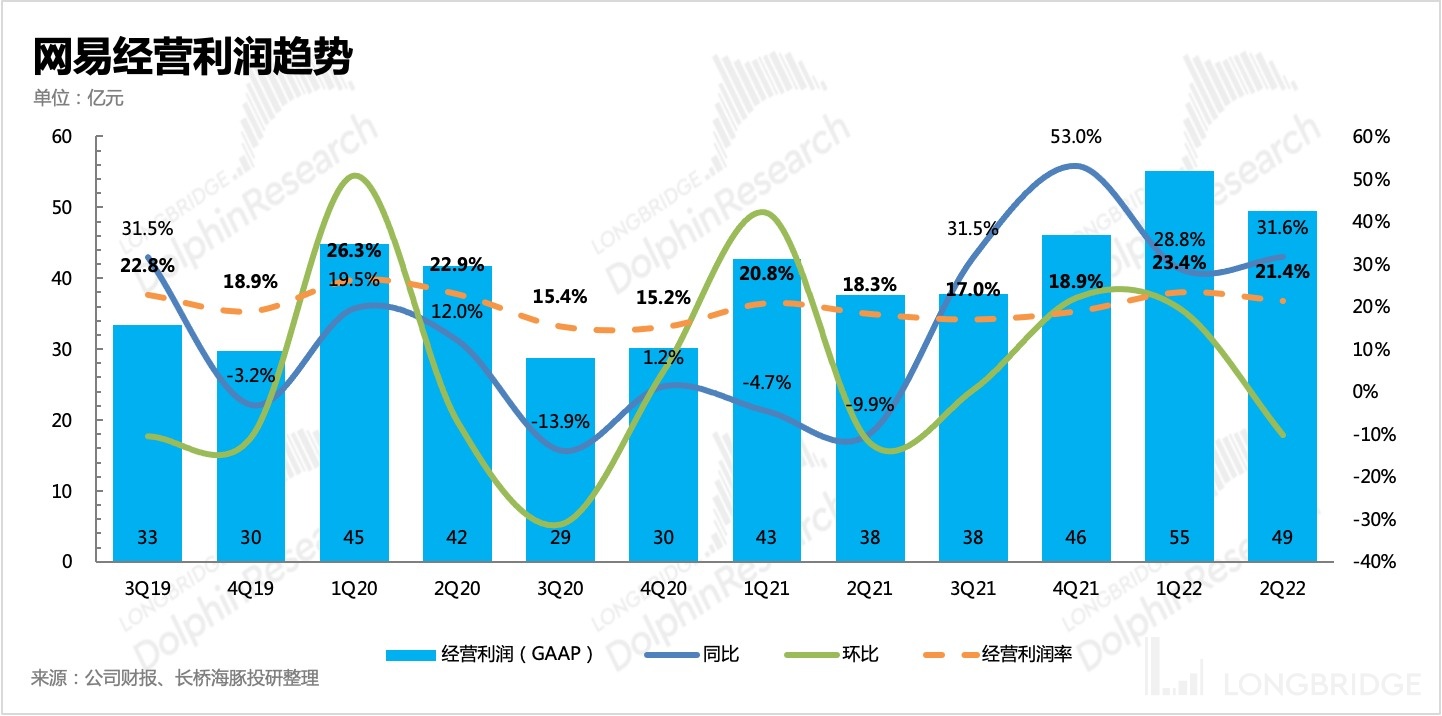

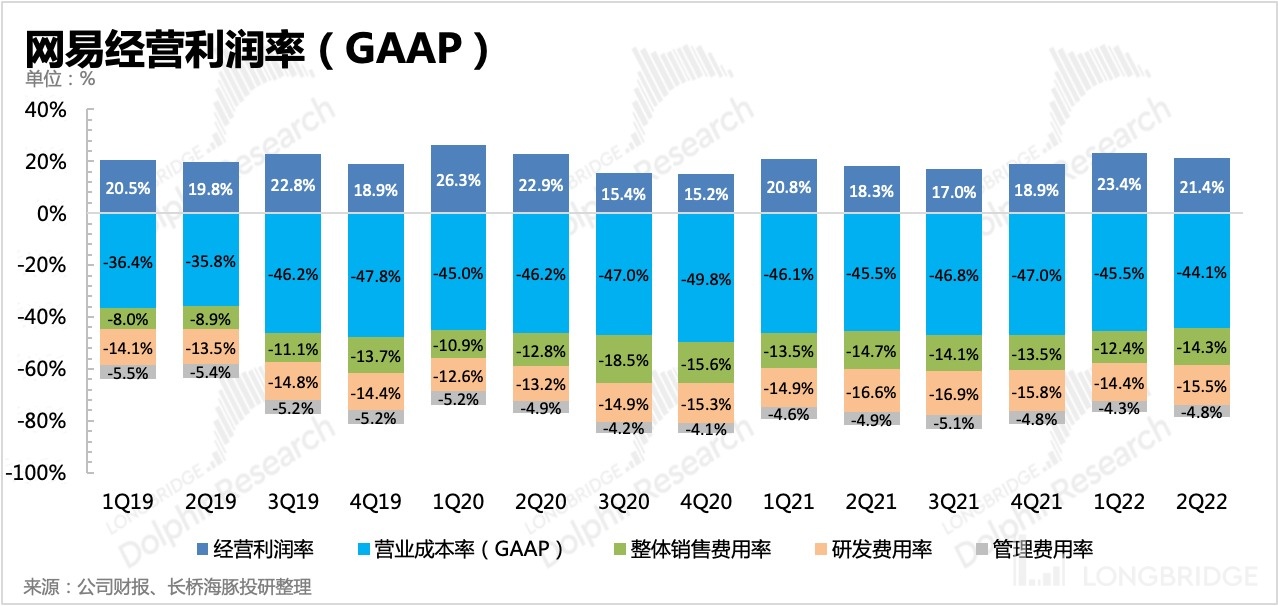

(4) The final profit also exceeded market expectations, the GAAP operating profit margin increased by 3 percentage points year-on-year, and the operating profit in Q2 increased by 32% year-on-year on a low base last year.

(5) In terms of repurchase, the previous repurchase quota of 3 billion US dollars, as of the end of Q2, has been used 2.3 billion, repurchasing about 23.6 million American depositary shares, with an average repurchase price of 97.5 US dollars per share.

In addition, in terms of subsidiary repurchase plans, Youdao has repurchased 1.7 million shares, costing 17.7 million US dollars, and there is still more repurchase quota; in Q2, the company publicly purchased 800,000 cloud music shares, costing 8.3 million US dollars.

(6) As of the end of Q2, the net cash assets on the account, after deducting short-term and long-term borrowings, totaled RMB 87.7 billion (USD 13.1 billion), with abundant cash flow, and can continue to support the company's active expansion strategy to go global. Compared with Tencent, overseas game revenue has accounted for 30%, while NetEase only had 10% in the previous quarter. With the launch of "Diablo" mobile game and "Harry Potter" overseas, there may be some increase. However, Dolphin Analyst believes that in overseas expansion, NetEase can and has the ability to be more aggressive. Analyst View of Dolphin

Amid the overall downturn in the internet industry, NetEase seems more like an outsider, living alone in its own product cycle. With rich and competent content reserves, it not only withstands the pressure of the counter-cycle for NetEase, but also leads NetEase out of a unique line of sight.

Revenue cuts are not related to it, and big moves to cut costs and increase efficiency do not seem to have been reflected in it. Although overseas games have overdrawn the growth during the digestion of the epidemic period and gradually faded as the offline restrictions have been lifted, NetEase has chosen to bet against the trend, accelerate investment, and lay the line for the next product cycle.

Since Dolphin Analyst included NetEase in the key monitoring pool in the middle of last year, NetEase has steadily and stunningly performed for several consecutive quarters. As an old internet company that once dominated the PC era, NetEase used one year to showcase a perfect case of relying on content cycles to overcome industry cycles to peers.

Detailed interpretation of this quarter's financial report

I. Online games: The off-season is not off, and the stand-alone game continues to carry the banner of growth

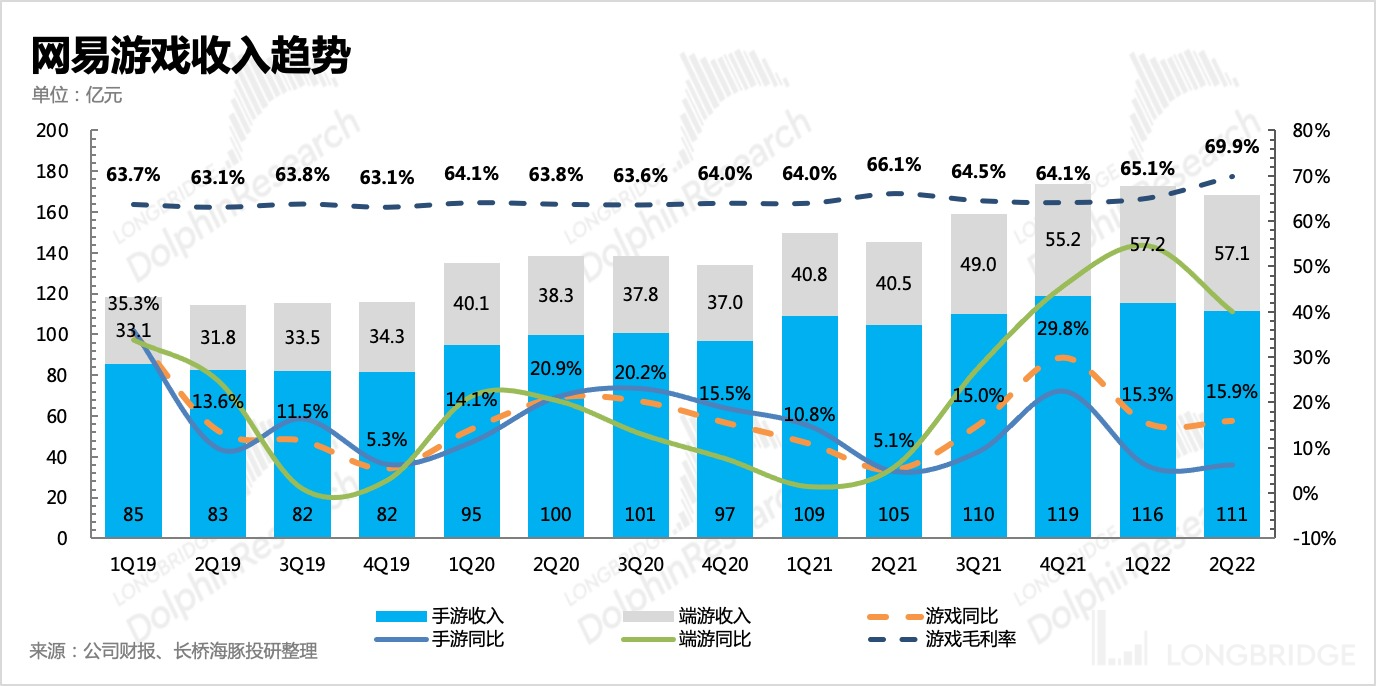

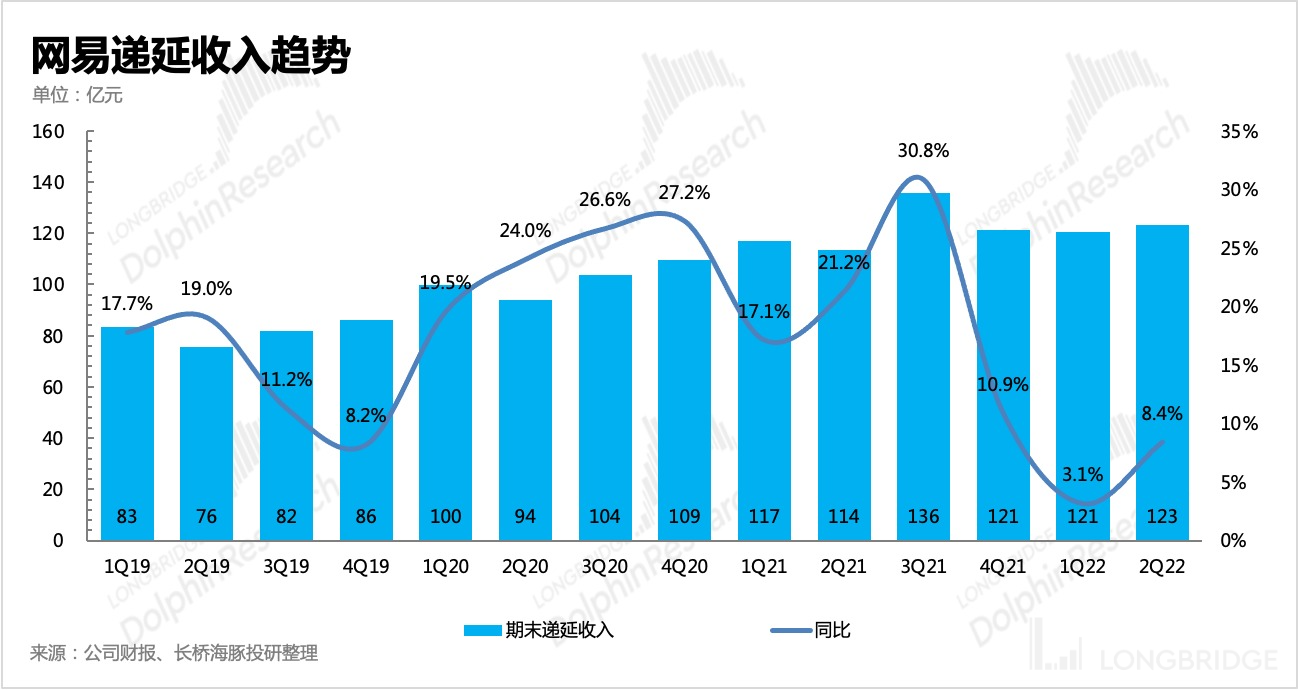

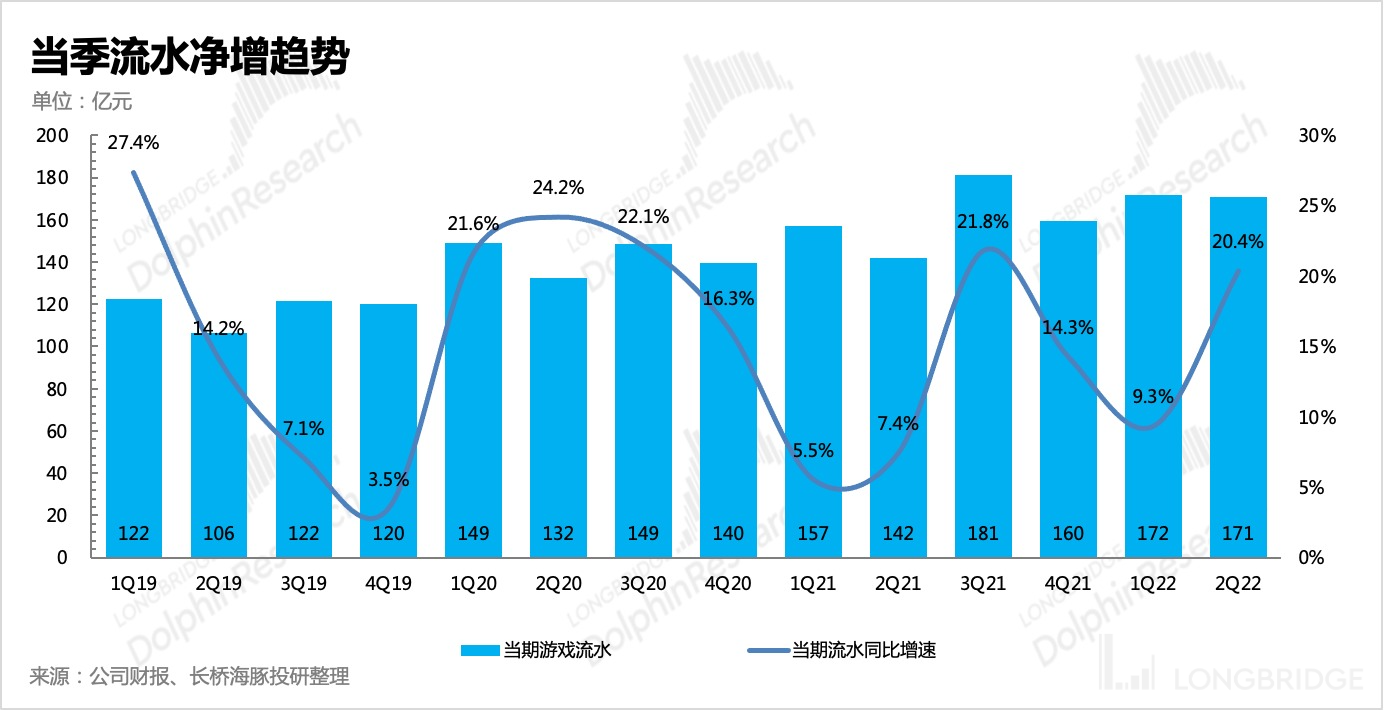

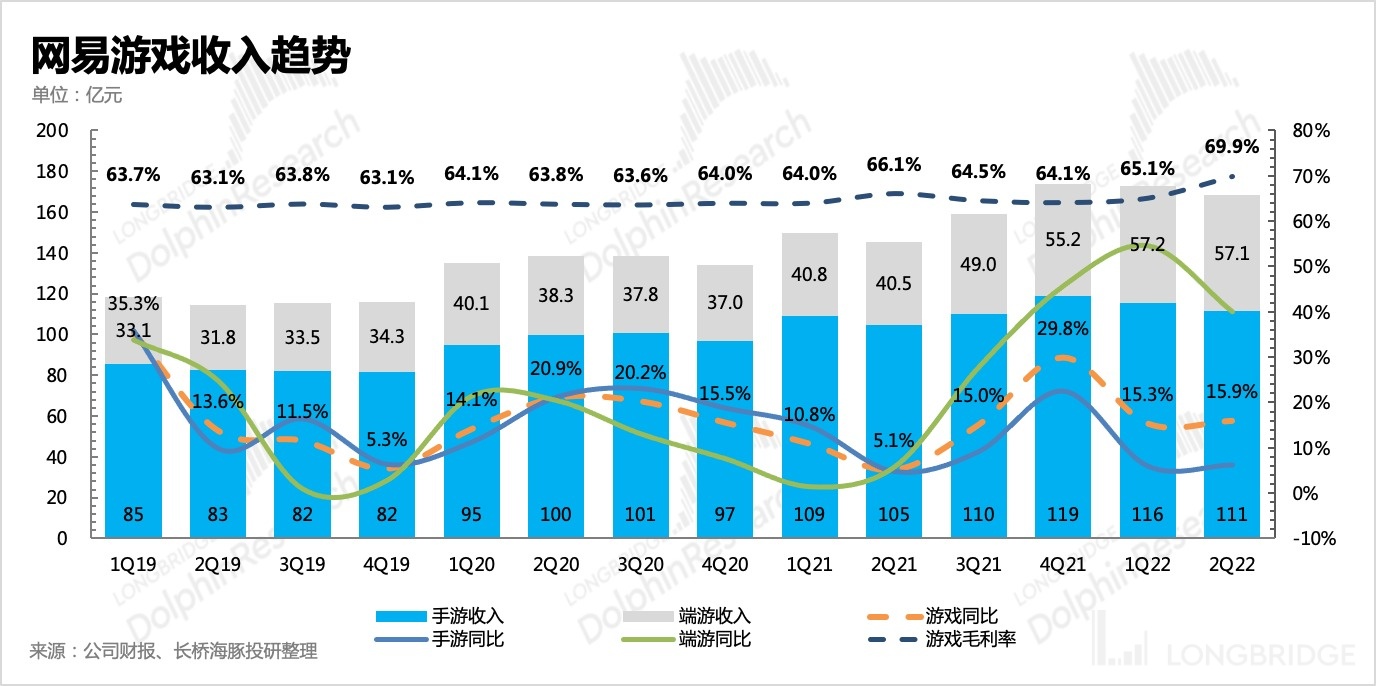

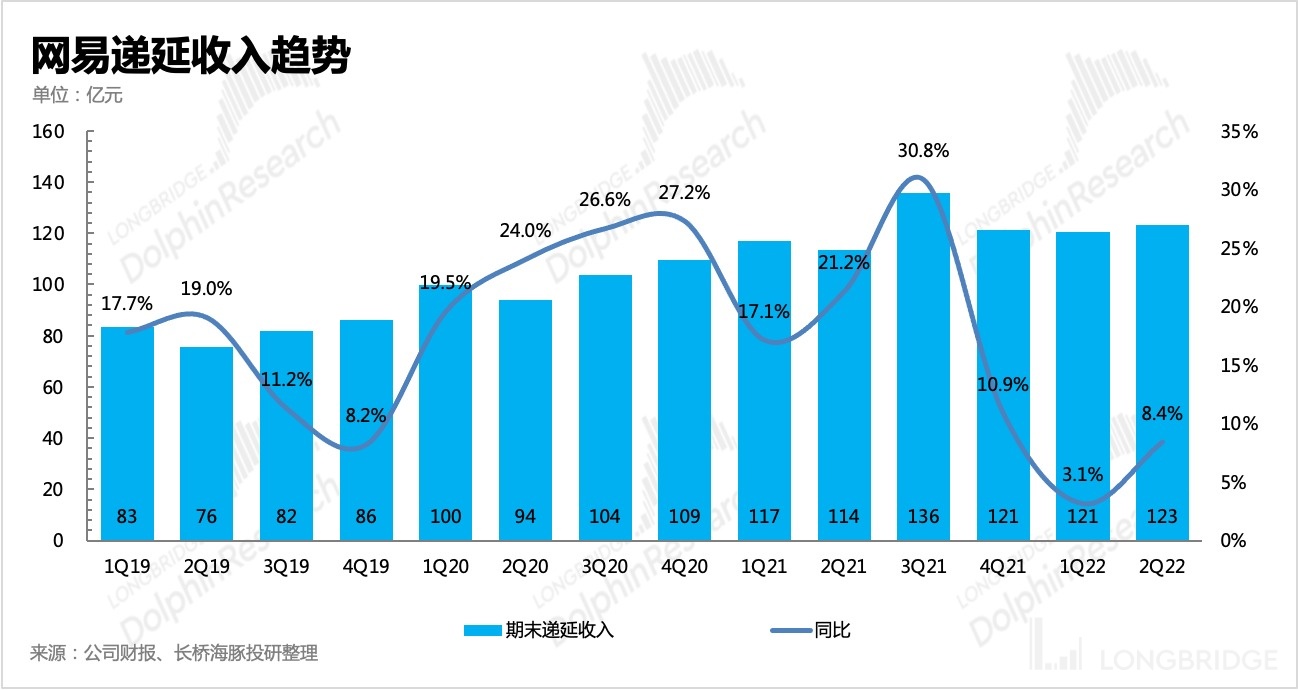

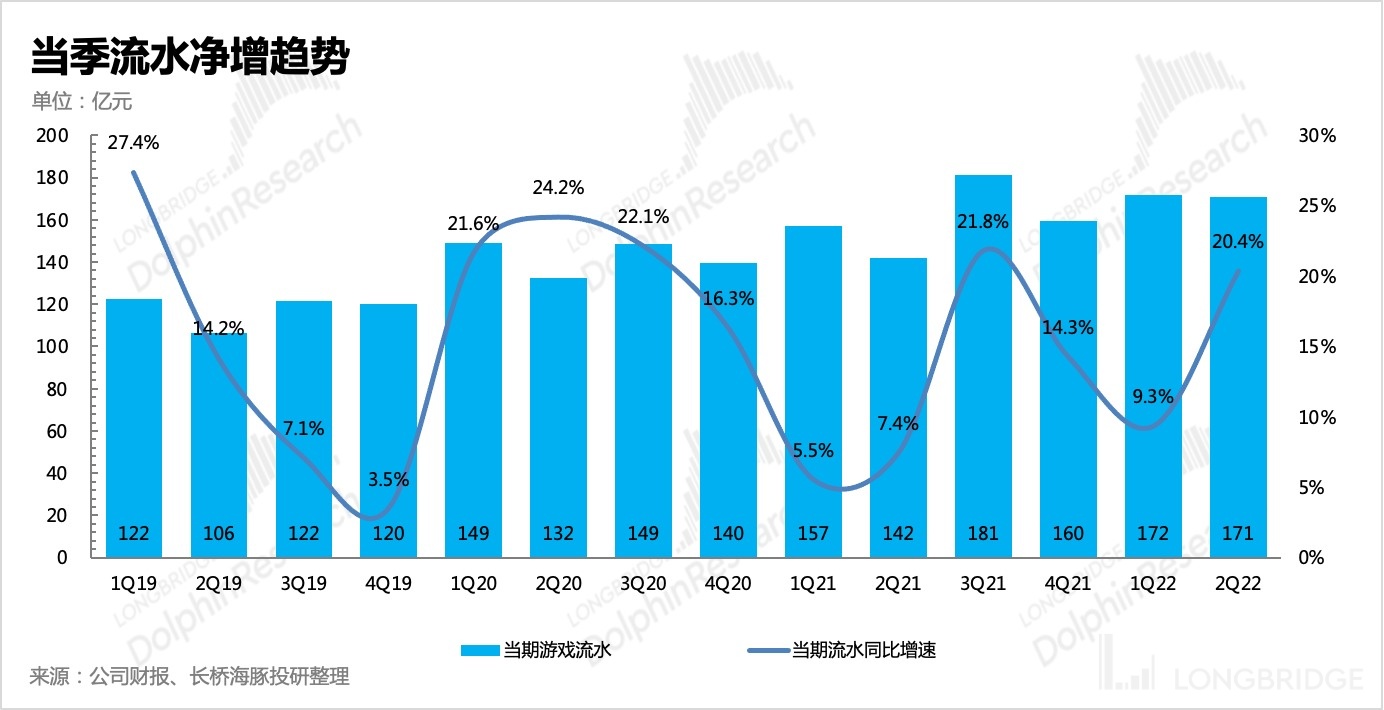

In the second quarter, NetEase game revenue was RMB 16.8 billion, a year-on-year increase of 15.9%, slightly accelerating compared to the previous quarter.

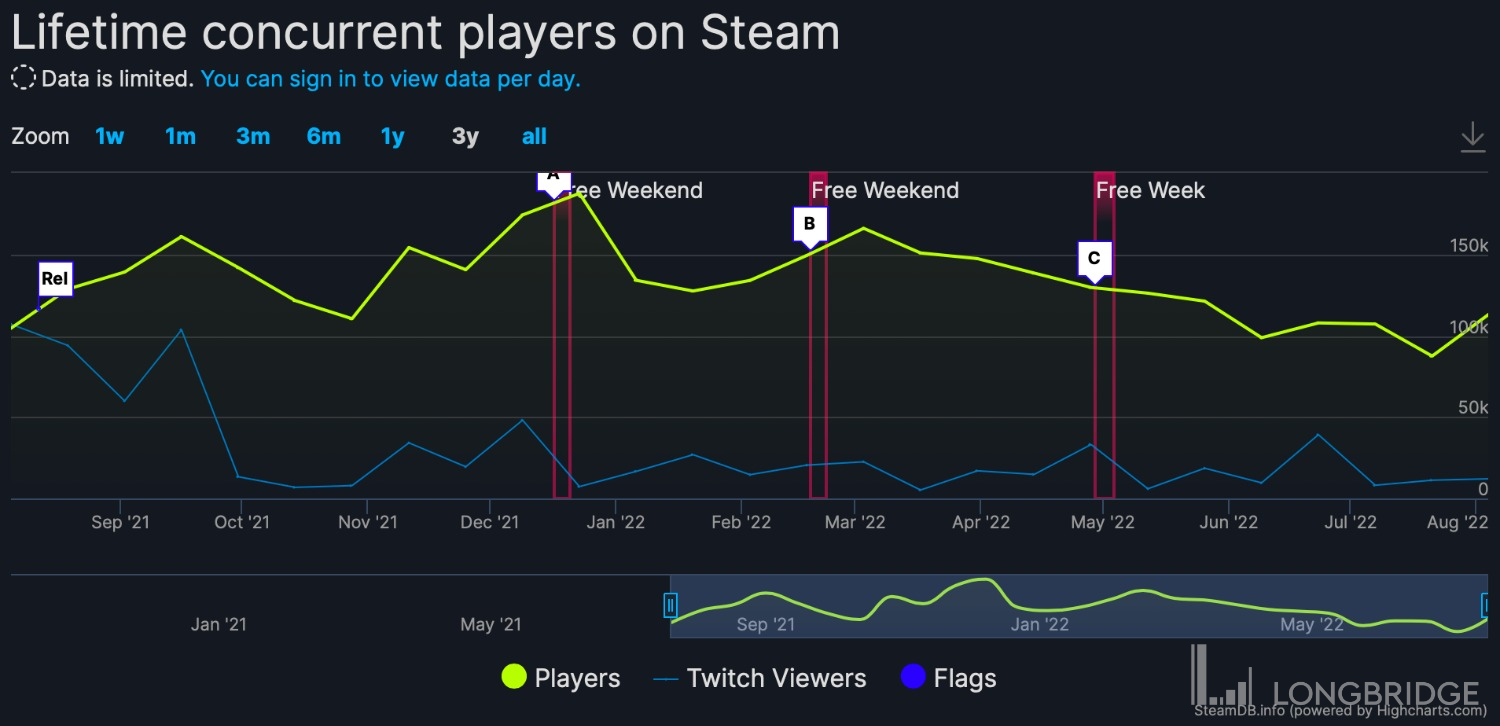

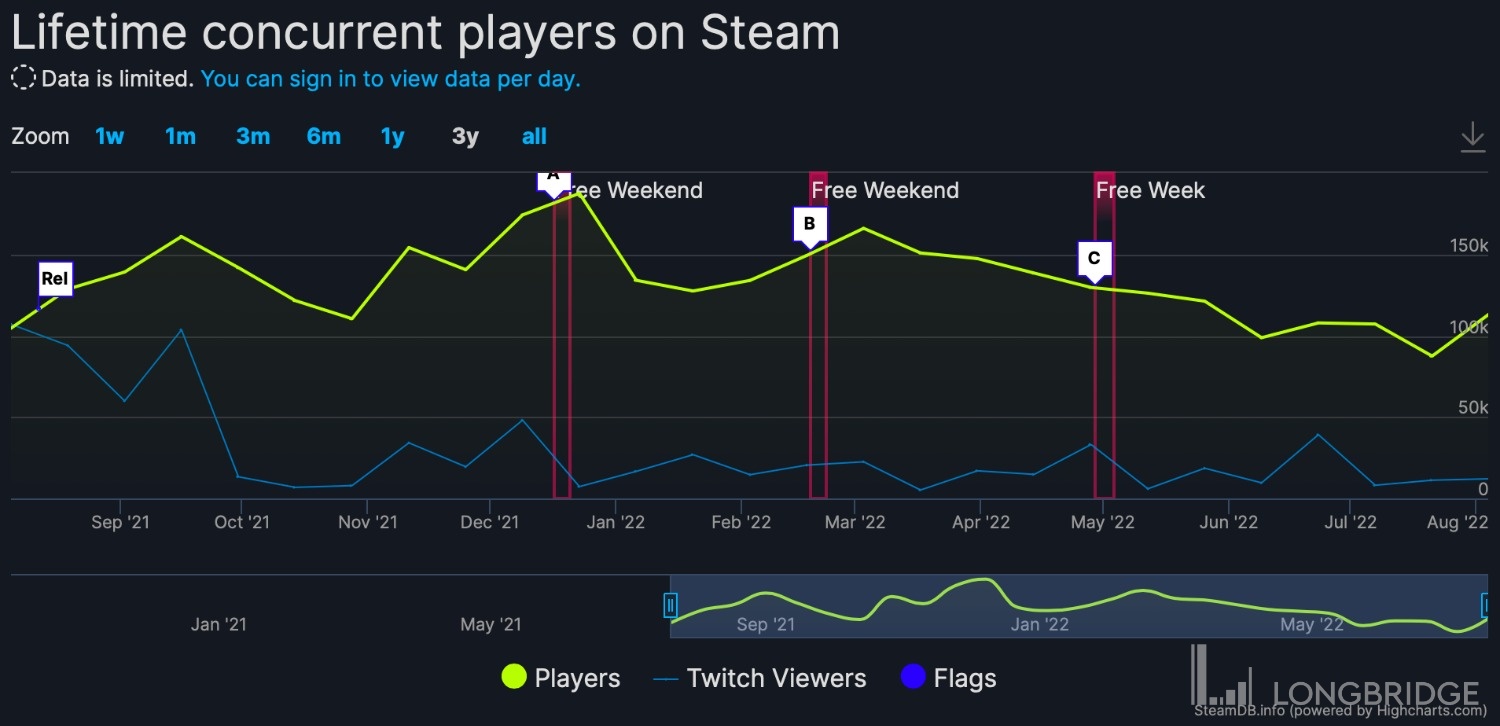

(1) Among them, the performance of stand-alone games continues to be better than expected, with a 40% high growth rate. Among them, the popular game "Endless Awakening", which has been popular for almost a year, has slightly declined in popularity this quarter due to seasonal effects (Steam daily online numbers), but it will be further boosted in the third quarter by the heavy update launched in June and the release of Xbox version during the summer vacation.

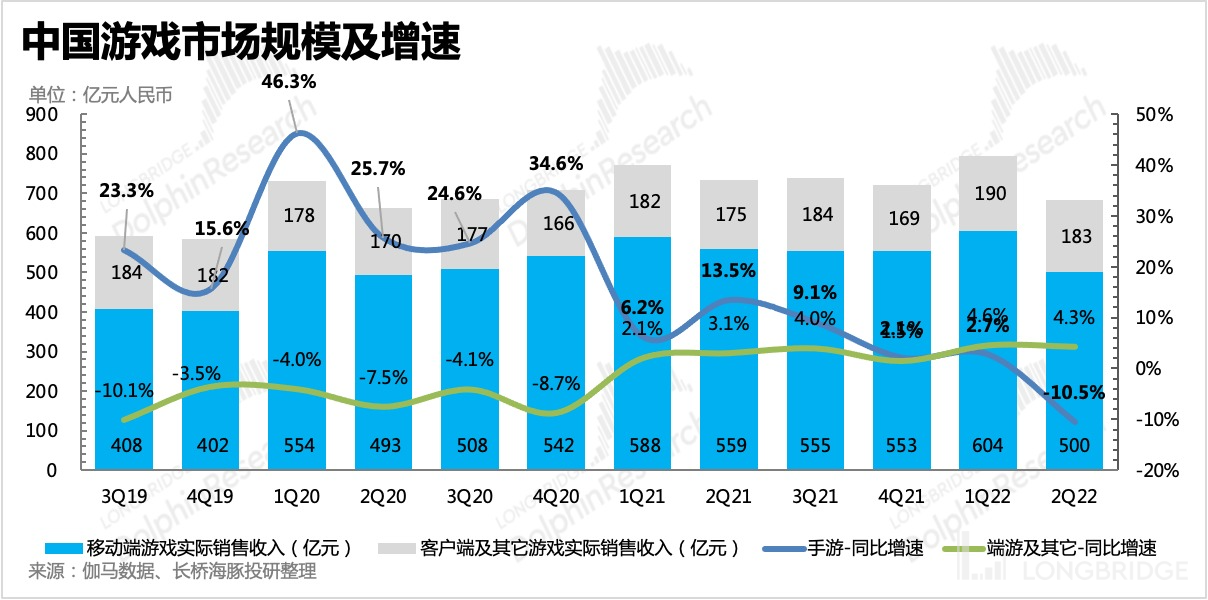

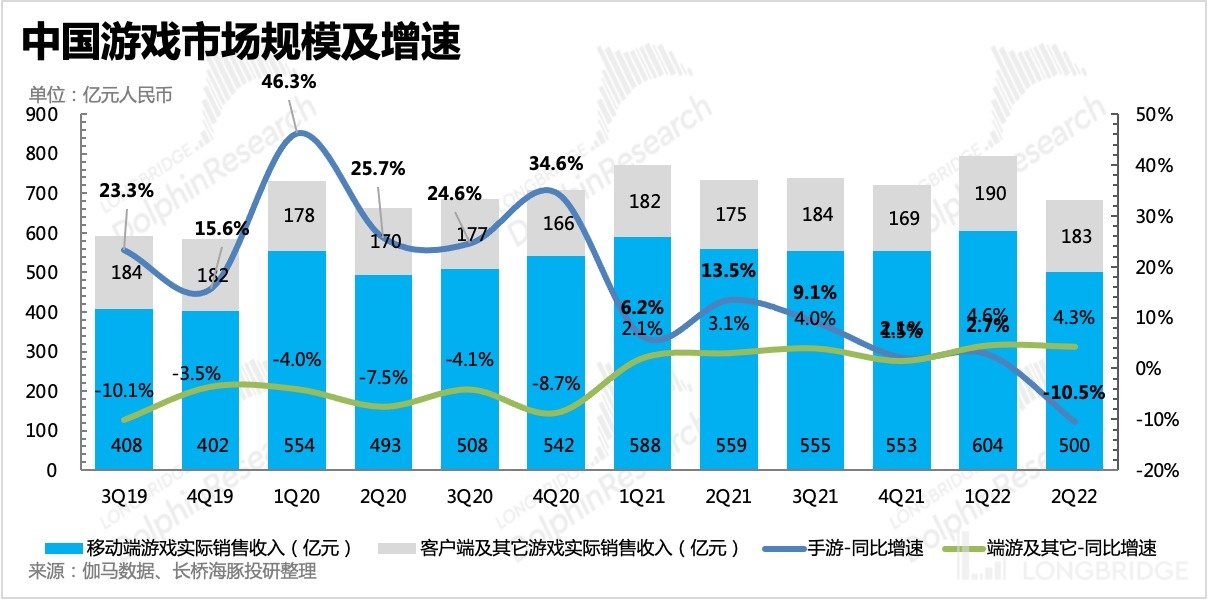

(2) Although the performance of mobile games is lower than market expectations, it reflects the strong counter-current of the industry. However, with the steady operation of old games such as "Fantasy Westward Journey" and "Journey to the West", the launch of the new game "Darkness" mobile game overseas, and the launch of multiple games of different types in the domestic market, the income of mobile games still achieved a growth of 6%, which is enough to see its resilience compared to the industry's year-on-year growth rate of -10%.

The outstanding game revenue performance in the second quarter has also led to a significant increase in NetEase's market share.

Looking ahead to the second half of the year, although the industry will still be affected by factors such as regulation and weak consumption, Dolphin Analyst believes that compared with other peers, there is still a bit more confidence in NetEase.

Looking ahead to the second half of the year, although the industry will still be affected by factors such as regulation and weak consumption, Dolphin Analyst believes that compared with other peers, there is still a bit more confidence in NetEase.

1) In the short term, big IP games bring stronger resistance to pressure.

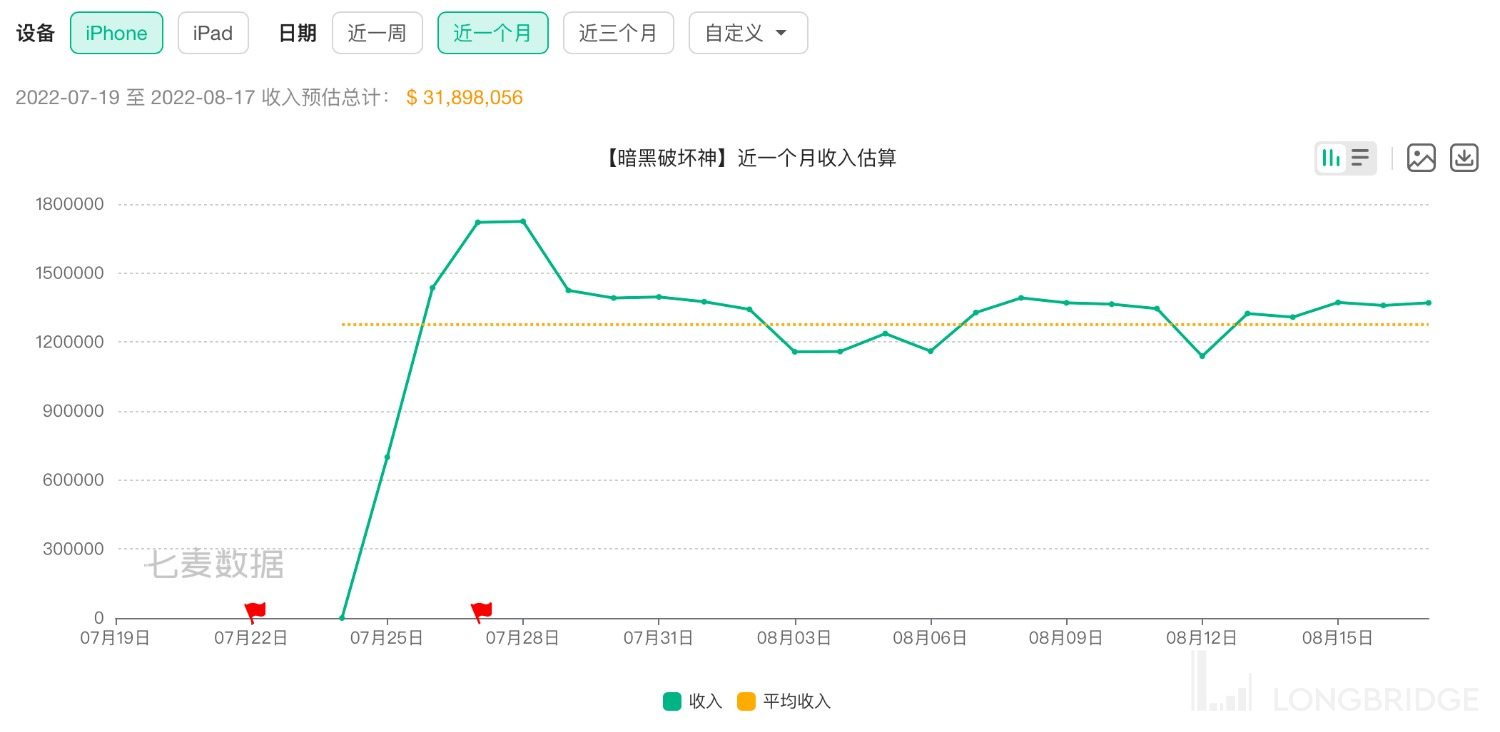

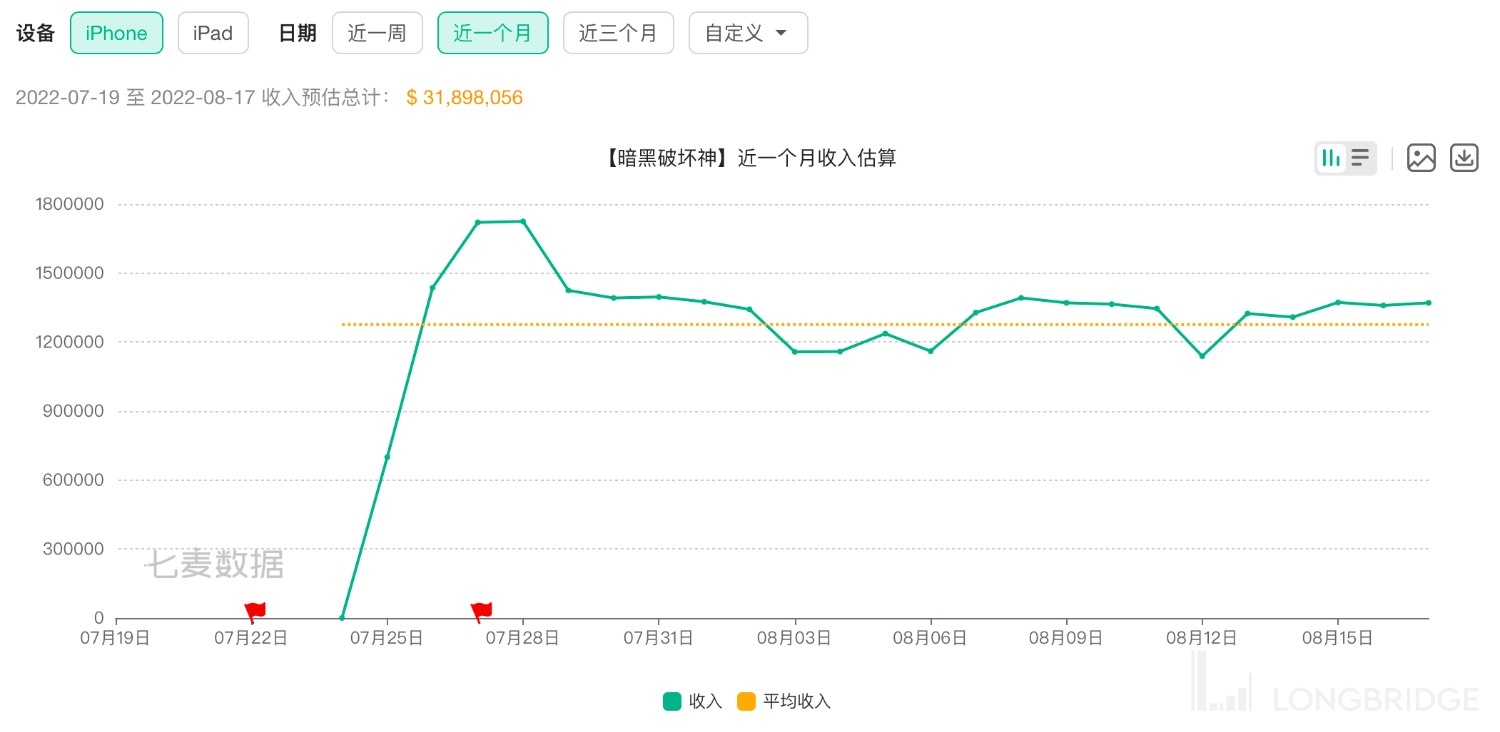

The Chinese version of Diablo Immortal finally went live in July. Although there were complaints about pay-to-win in the international version, the revenue data predicted by third-party data platforms is still relatively stable. NetEase has rich experience in MMORPG game operation. Although it is not as good as big DAU games in terms of user penetration rate and activity level, it is still quite significant from the perspective of revenue contribution.

From Dolphin Analyst's personal experience, the quality of Diablo Immortal mobile game is still good, and with its own IP, although it is in a period of user fatigue towards MMO, the revenue performance is still good so far.

Although there is a certain gap with our previous optimistic expectations, considering the current consumption environment and the ups and downs of the launch process, Dolphin Analyst believes that the smooth launch of such a strong game like Diablo Immortal, will still contribute significantly to NetEase's steady passage through the industry's headwinds.

If we look at financial indicators, deferred revenue and computed current period revenues, NetEase's short-term growth resilience can also be seen. Although there will be new impacts from the protection of minors policy next quarter compared with the same period last year, with the advantage of its own product cycle, the revenue is relatively secure.

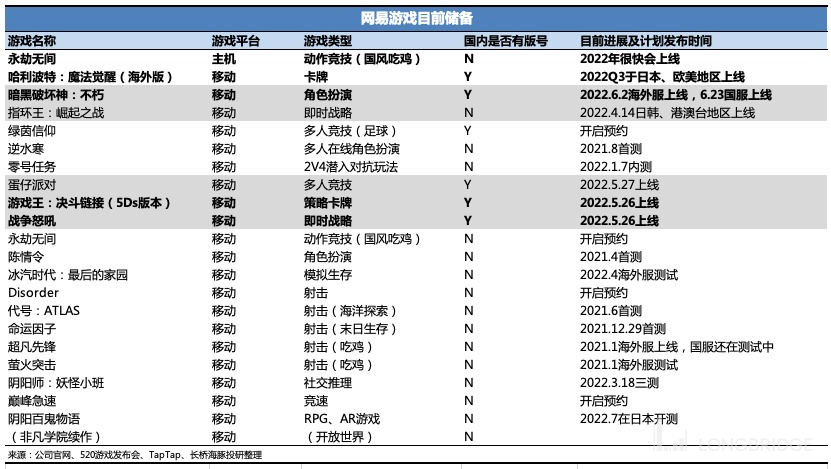

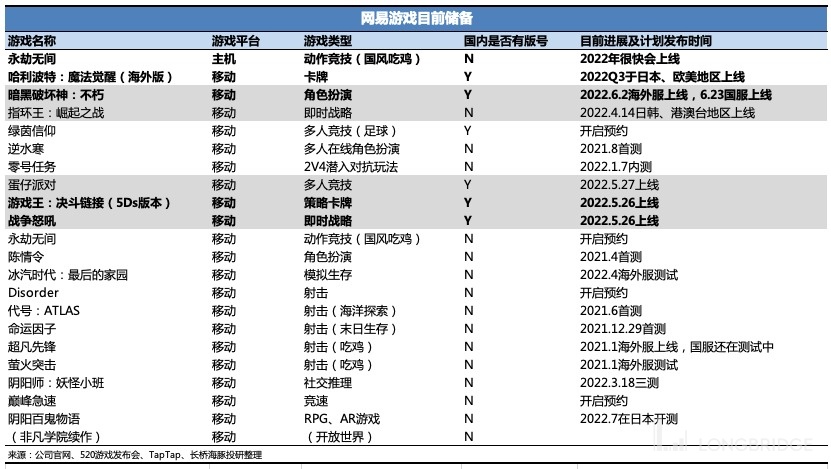

2) Secondly, there are many products in the company's game reserves that have potential to bring in revenue. Like Tencent, after the restart of the license review process, there is not yet a single game under NetEase that has obtained a new license. However, the game reserves still have a lot of games with potential to bring in revenue, such as Eternal Return mobile game, Mission Zero, Nishuihan mobile game, and so on. If some core products can obtain licenses smoothly in the later license review process, then for NetEase, it can expect more opportunities to shine in the headwind in the second half of the year.

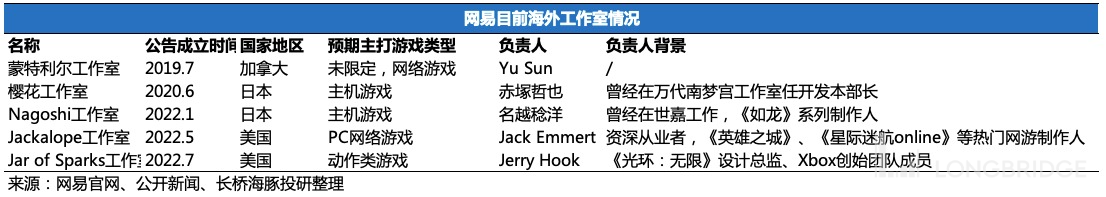

3) Proactively gather overseas, NetEase makes continuous moves for mid-to-long-term growth preparation. From the above key game reserves, it is not difficult to see that in the absence of new licenses, NetEase's overseas moves are more frequent. Because many games have not yet obtained a domestic license, they have eagerly launched internal tests or officially went live in overseas markets. At the same time, Netease announced the establishment of two subsidiaries in the US in the second quarter. So far, Netease has a total of 5 overseas studios.

As we all know, although Netease is the second in the domestic game industry, its overseas game investment moves are obviously lagging behind Tencent. This aggressive investment in the second quarter can be expected to accelerate Netease's efforts to achieve its goal of 50% of future overseas revenue.

After all, as of the end of the second quarter, Netease still had US$13 billion in cash that could be used, which would be a waste if it were not invested and solely relied on bank interest.

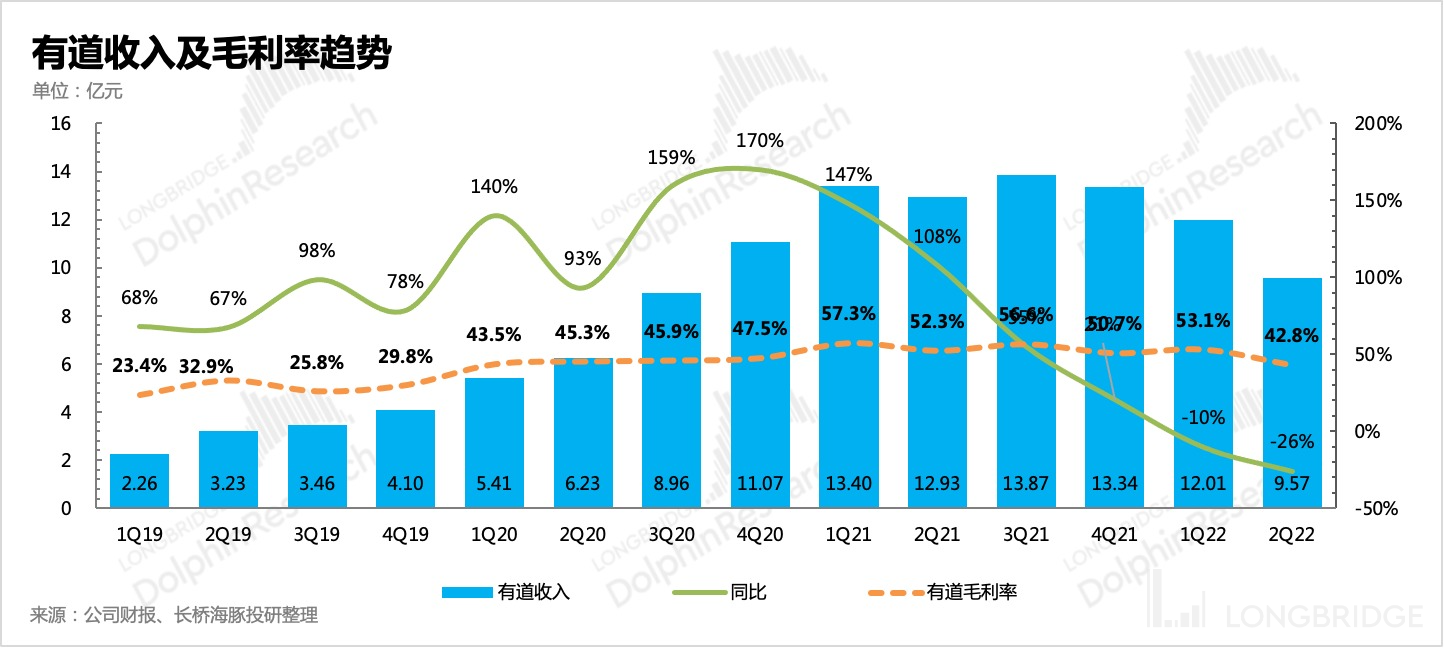

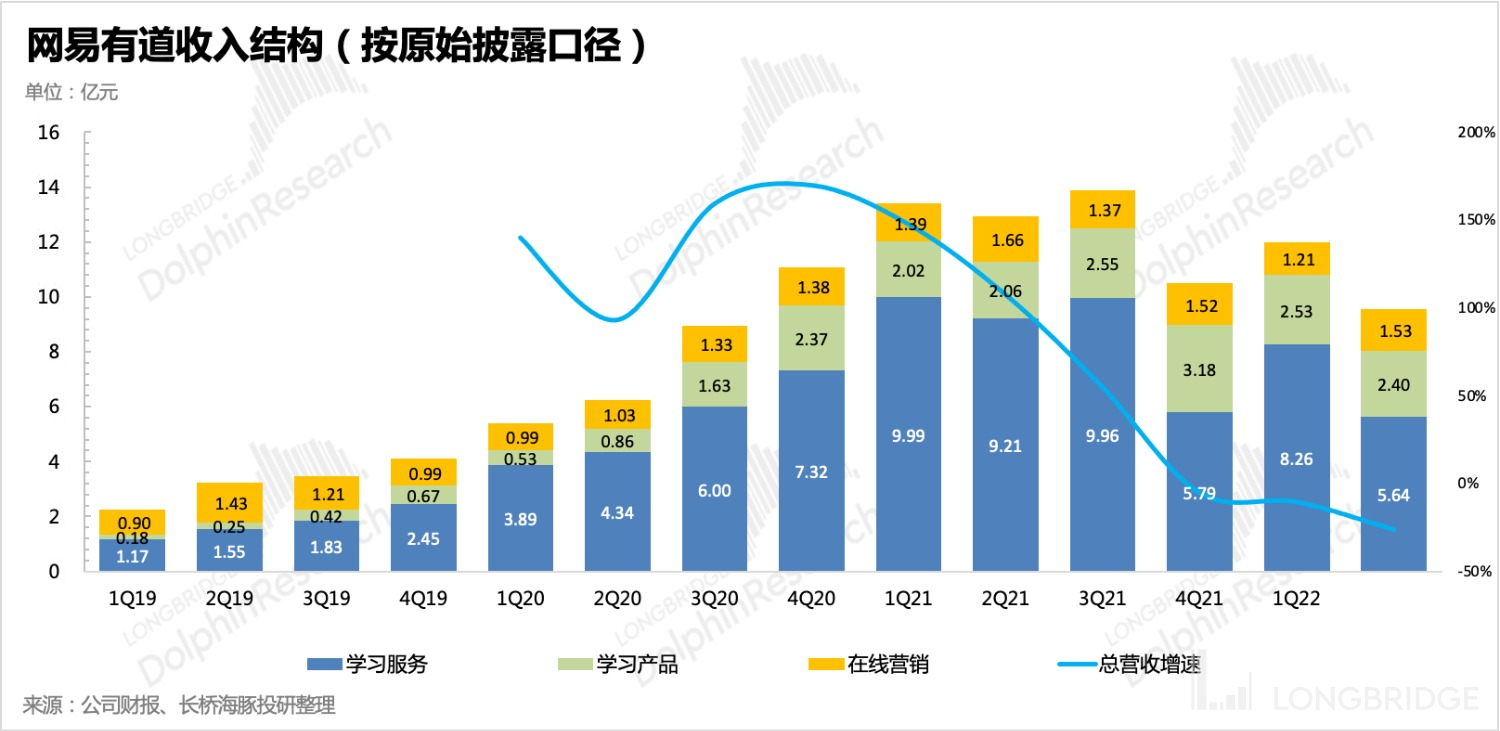

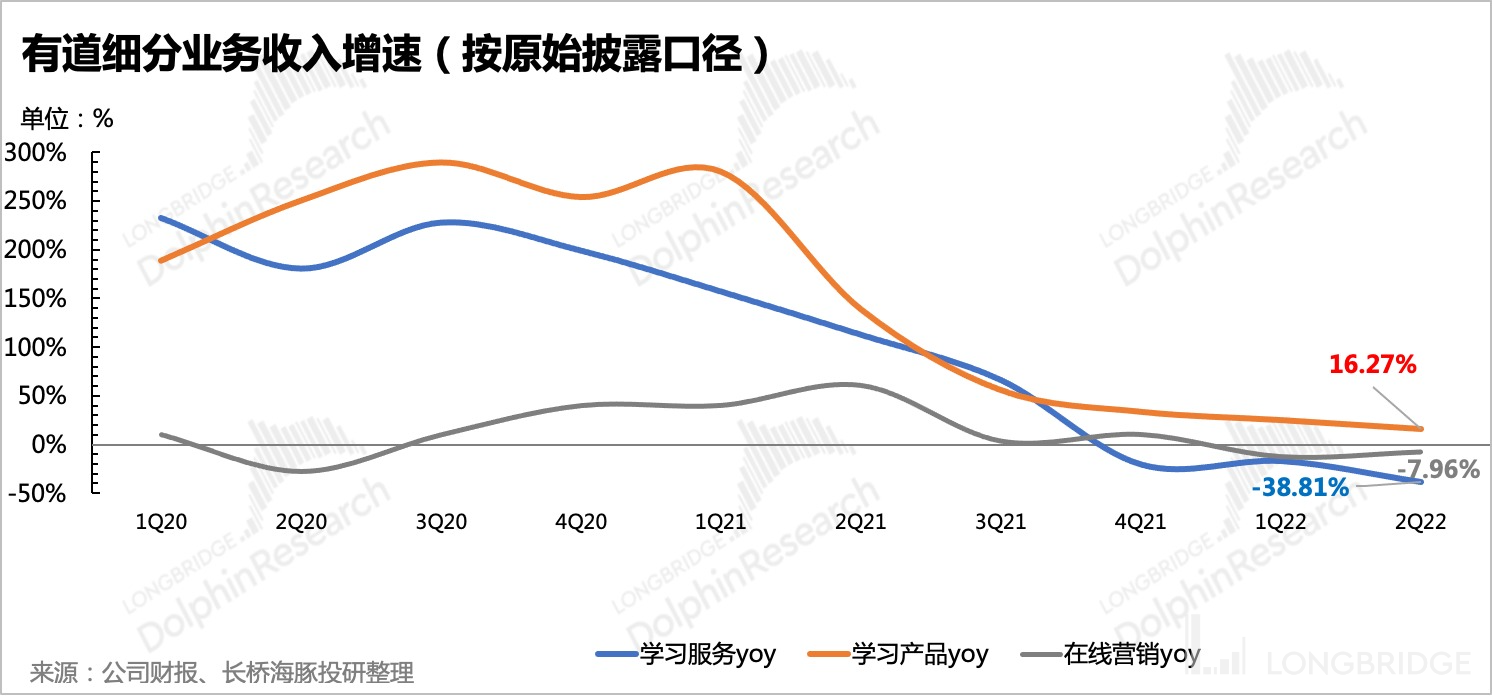

In the second quarter, Youdao Education faced many challenges:

(1) On the one hand, the base effect of K12 subject education, which was only closed at the end of last year, still has an impact.

(2) On the other hand, due to the large-scale lockdown of key cities in the first and second tiers in April and May, which seriously disrupted the production and supply chain of intelligent hardware, the goods were squeezed in the warehouse and could not be sold.

(3) In addition, the headwind of advertising has an impact on all channels, and Youdao naturally cannot stay out of it and continues to decline year-on-year.

Finally, overall revenue of Youdao was only 960 million, showing significant year-on-year and quarter-on-quarter declines. As the high-margin online course business declines in proportion due to the closure of subject education, Youdao's comprehensive gross profit margin has also weakened.

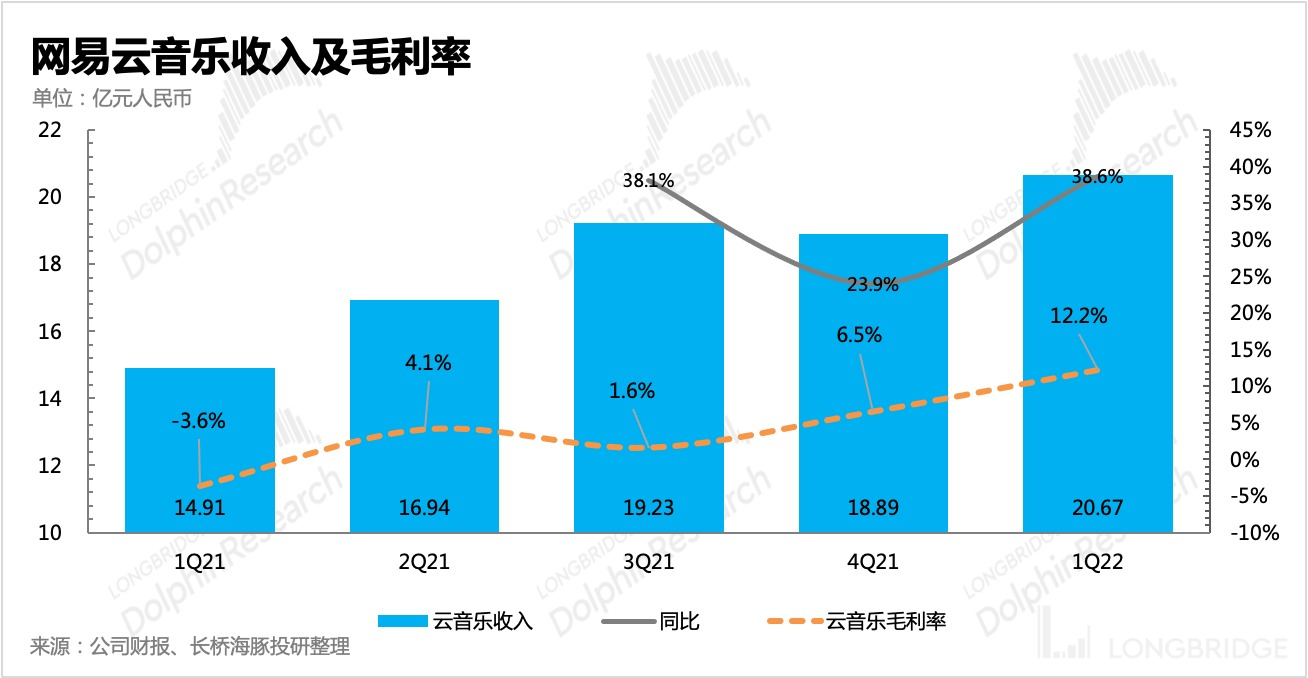

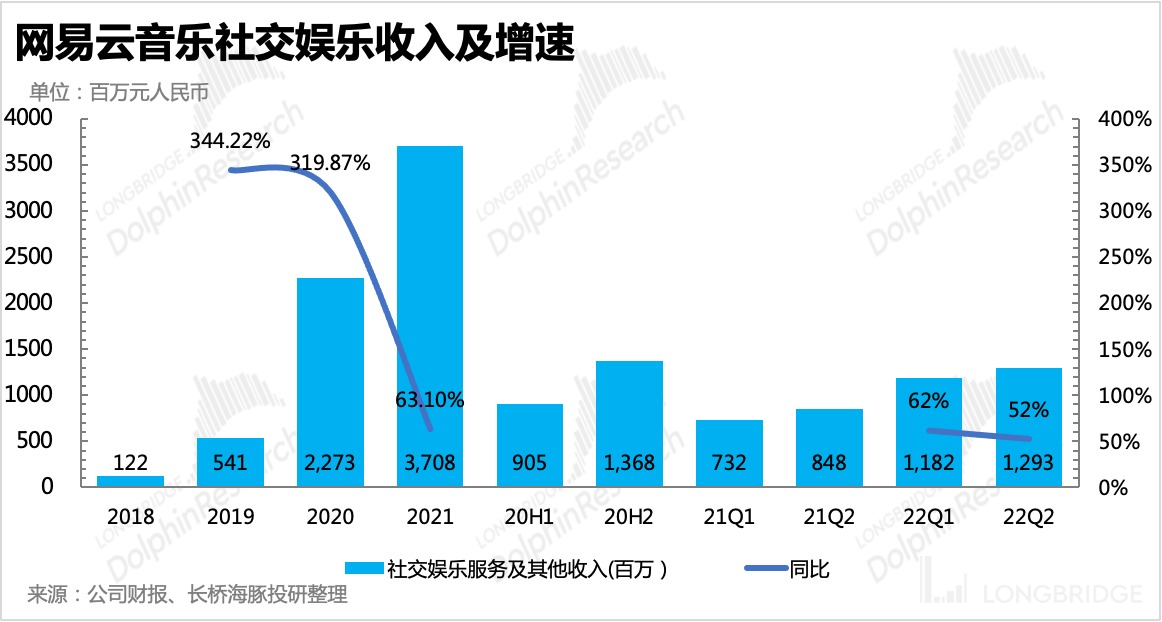

The performance of Netease Cloud Music is somewhat different from that of its peer Tencent Music. Unlike Tencent Music, whose live broadcast business is more severely damaged, Netease Cloud Music's social and entertainment services such as live broadcast revenue are still growing rapidly. Of course, this is also related to the fact that Netease Cloud Music started broadcasting relatively late and is still in the early stage of development.

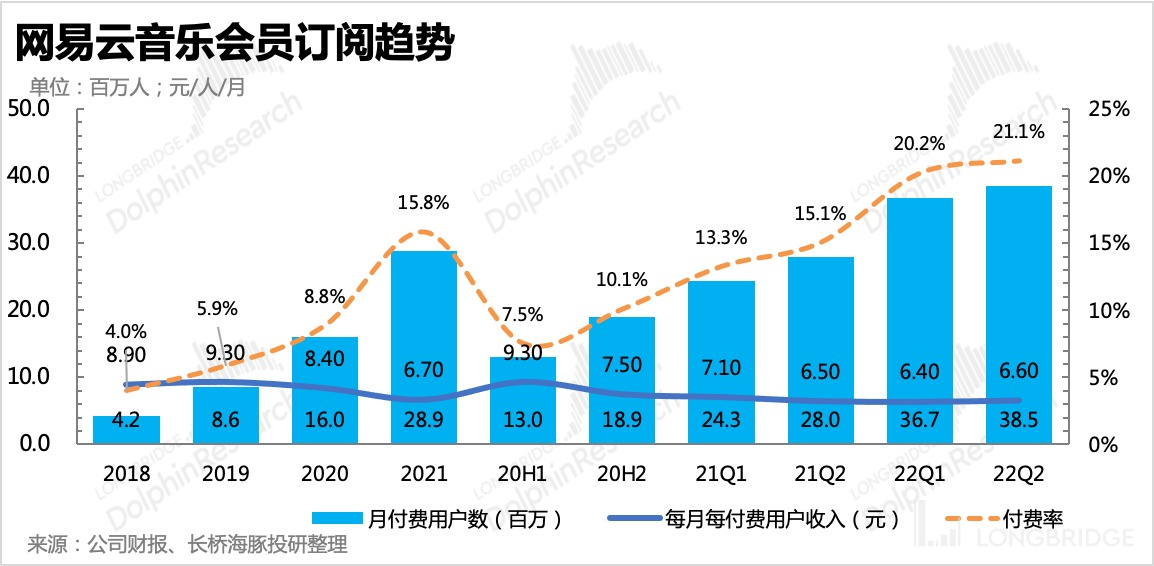

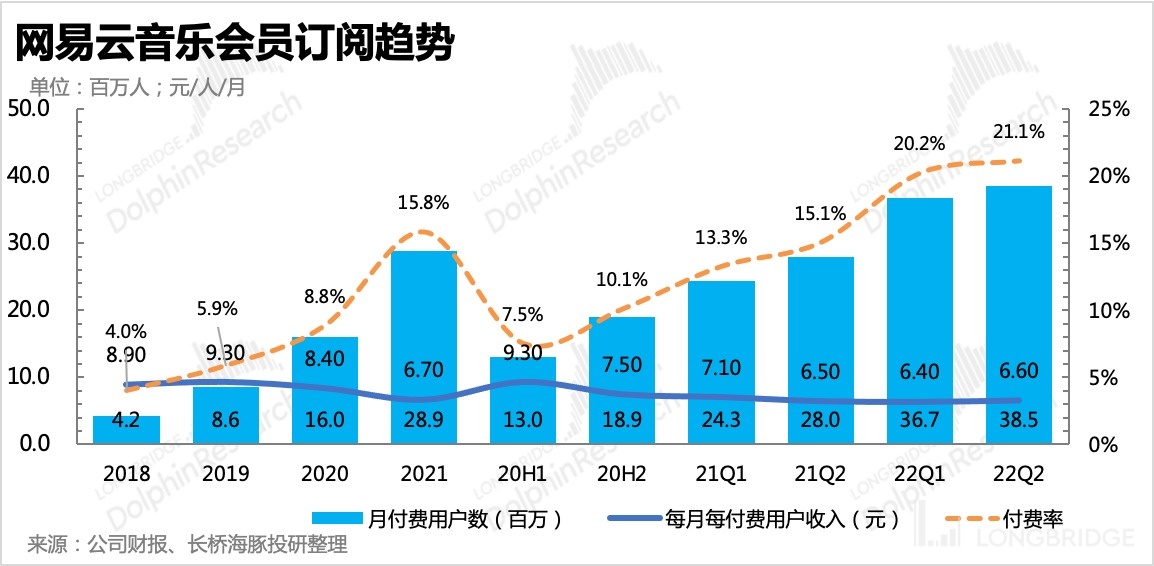

(1) In the second quarter, Netease Cloud Music achieved a total revenue of 2.2 billion yuan, a year-on-year increase of 29%, of which social and entertainment revenue increased by 52% year-on-year. Although the growth rate has slowed down compared with the first quarter, it is still in a growth trend. (2) The net increase in music subscription users was 1.74 million, a significant slowdown from the 8.76 million net increase last quarter.

However, considering that the average single-user payment in the second quarter increased compared to the previous quarter, Dolphin Analyst speculated that the slowdown in net increase in paid users may be related to the reduction in member promotion activities in the second quarter. Here, we can pay attention to how the management team explains this during the conference call.

"Worth mentioning is that in terms of the payment rate, Cloud Music has higher user loyalty (20% for Cloud Music VS 13% for Tencent Music). In other words, those who still choose to use Cloud Music, despite Tencent Music's channel and copyright advantages, are already loyal fans, so their willingness to pay is relatively higher."

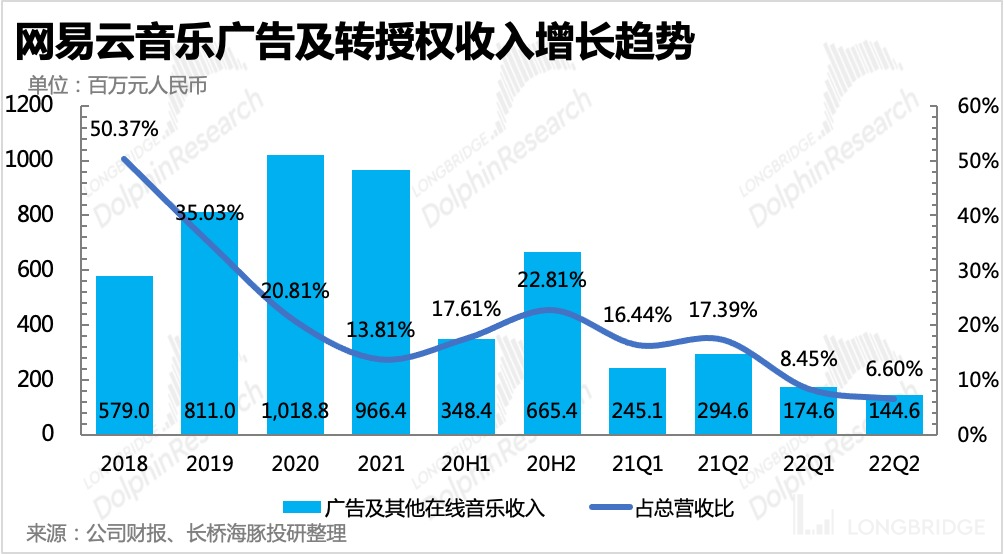

(3) Other businesses, such as advertising and copyright transfer authorization, are similar to Tencent Music, as it is difficult to escape counter-cyclical growth under the industry trend of attention and exclusive copyright being released.

(4) In addition, some operational indicators of Cloud Music have changed: a. The user duration for the first half of the year was 80.6 minutes per day, while the first quarter disclosed 82 minutes; therefore, there may have been a decline in the second quarter. b. Cloud Music's high adhesion and interactive community atmosphere have also attracted more independent musicians to join, which has always been a place where Cloud Music has an advantage over Tencent Music. As of the end of the second quarter, the cumulative registration of independent musicians reached 529,000, a net increase of about 80,000 month-over-month. There are currently 2.3 million songs in the database from registered independent musicians.

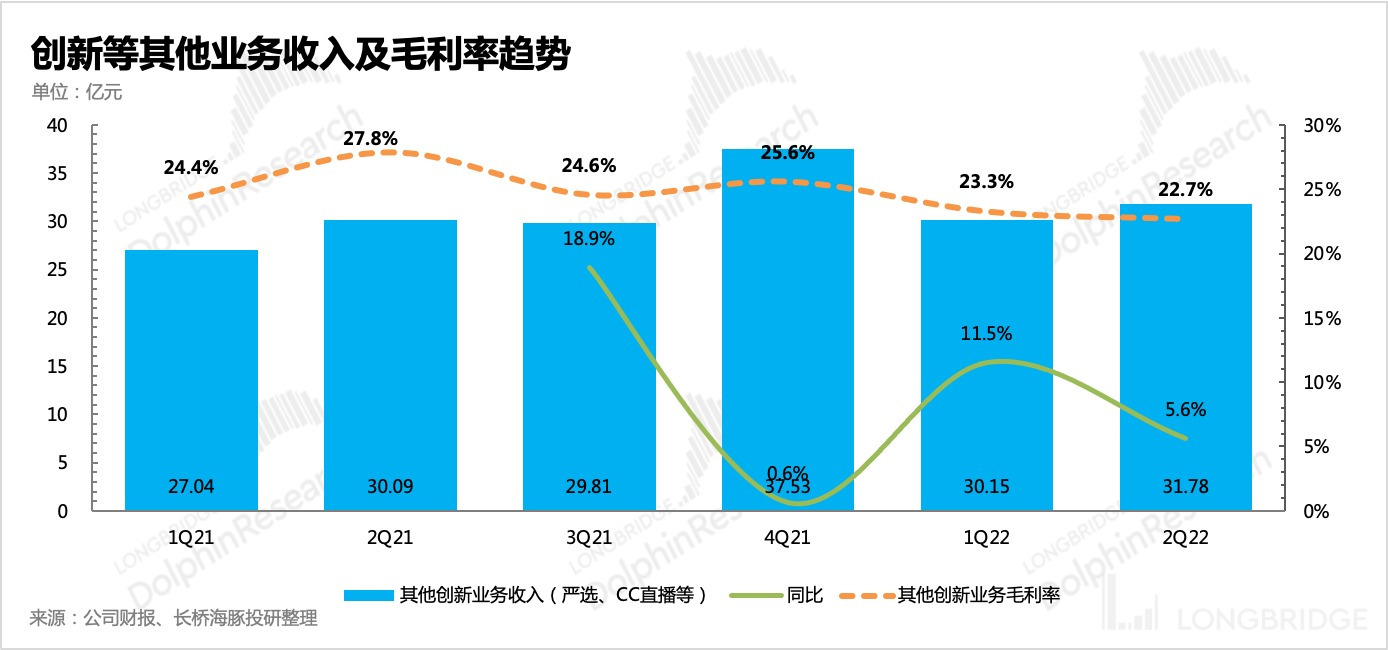

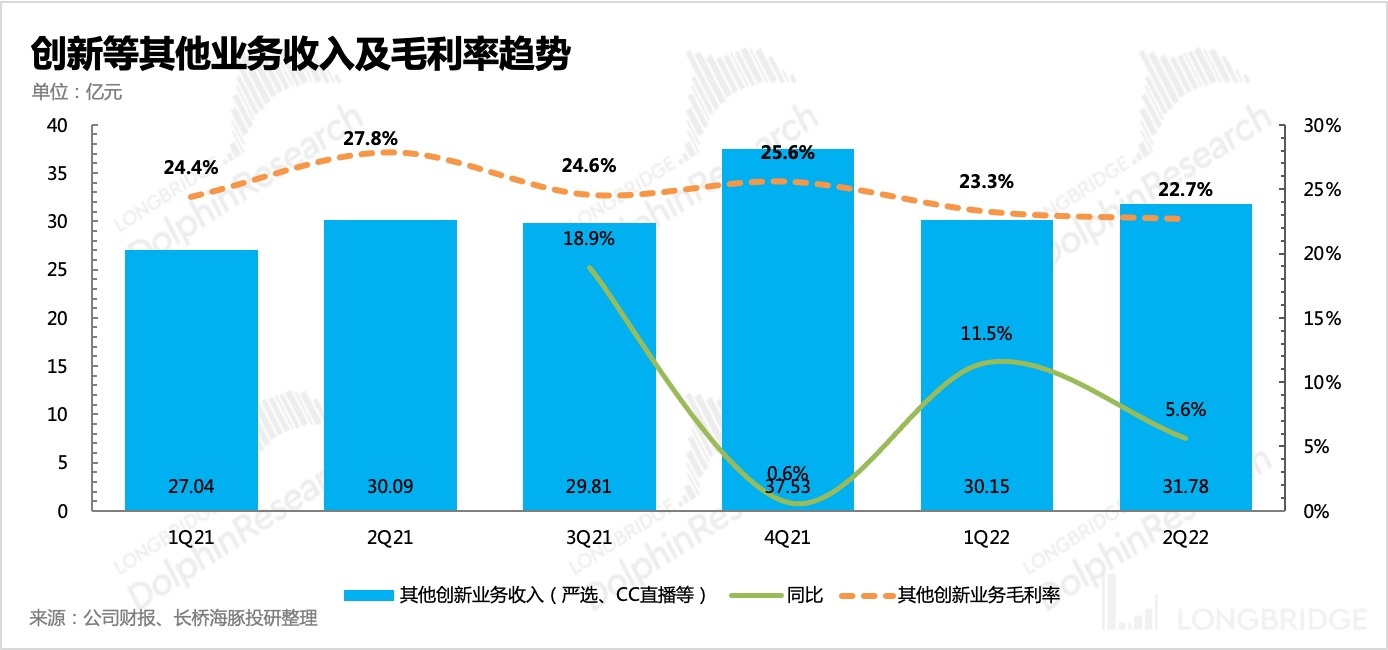

(5) Other innovative businesses: impact is not as big as imagined. The original innovative business metrics, after removing Cloud Music, mainly include NetEase strict selection and CC live broadcast. Even in the macro environment as bad as the second quarter, there was still a 6% growth, which can also reflect the resilience of their own business.

(6) Gross profit margin was optimized due to changes in the business structure, and the launch of new products led to a slight expansion of costs. Finally, let's take a look at cost and profit situation. In the second quarter, NetEase achieved a GAAP operating profit of 4.95 billion, a year-on-year increase of 32%, with a slight decrease in profit margin compared to the previous quarter, mainly due to the expansion of costs.

If we look at the Non-GAAP net profit attributable to shareholders, excluding equity incentives, it was 5.4 billion yuan, an increase of 28% year-on-year, and the profit margin also increased compared to the previous quarter. The difference between the decline in operating profit margin and the increase in net profit is mainly due to the exchange gains and losses included in net profit, but this is not related to the main business situation. Therefore, Dolphin Analyst suggests paying more attention to the changes in operating profit, excluding investment and exchange gains and losses.

Breaking it down:

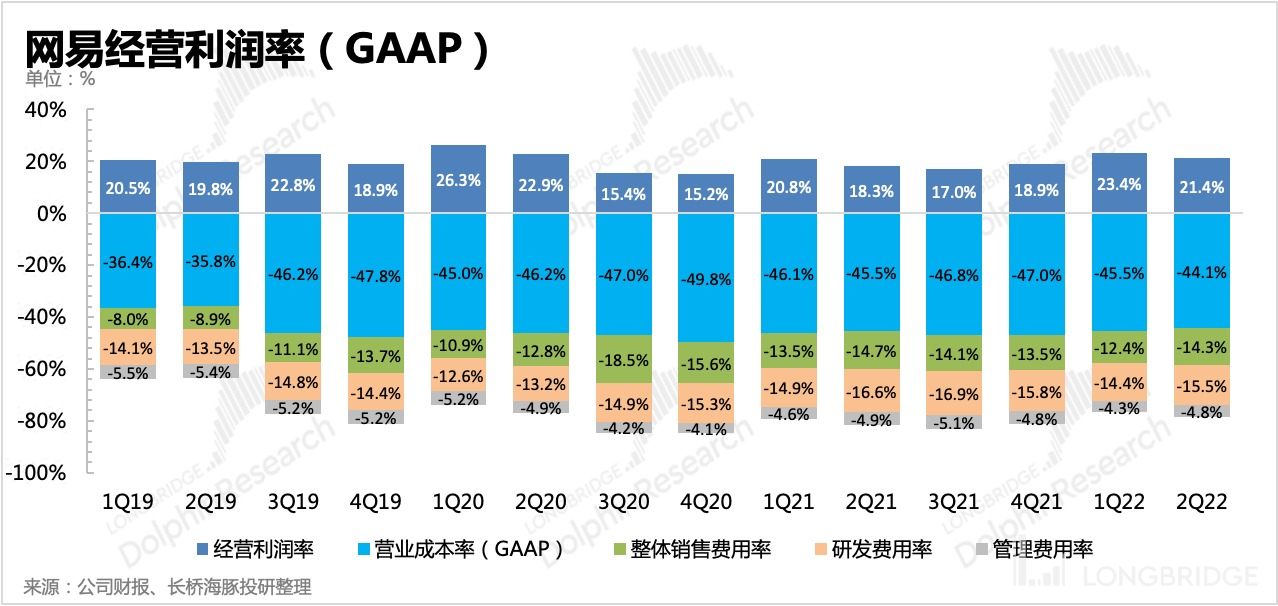

(1) In terms of gross profit margin, there was a slight improvement in Q2, with game gross profit margin showing a significant increase from 65% to 70%, mainly due to the increase in the proportion of high-grossing end-game revenue. In addition, although the gross profit margin of Cloud Music also increased slightly, it still made a relatively small contribution to the overall gross profit margin optimization.

(2) NetEase released several new games in Q2, particularly the highly anticipated blockbuster mobile game "Diablo," which undoubtedly incurred high marketing expenses in the early stages. Cloud music's marketing expenses this quarter were also relatively high, mainly focused on promoting social entertainment platforms such as live streaming.

In addition, R&D and management expenses did not follow the trend of "reducing costs and increasing efficiency" in the Internet industry this quarter, but showed a slight increase, which is probably related to NetEase's recent continuous expansion of its overseas game research and development team.

Dolphin Analyst believes that the current investment in overseas teams can be seen as "laying a foundation for future growth" from a long-term perspective, although there may be a period of mismatch between income and expenditure in the short term, and the profitability will be somewhat suppressed. Nevertheless, such investment is necessary at present.

In terms of the numbers, the expenses this quarter did not continue the trend of optimization, but overall, due to NetEase's restrained and stable expense outlay, it remained within a normal fluctuation range.

Longbridge NetEase Research "Historical Articles":

Earnings season

May 25, 2022 Telephone meeting "No obvious benefit from epidemic lockdown, record-breaking revenue from old end-games (NetEase telephone meeting summary)"

May 25, 2022 Earnings review "The "pig" cycle continues, and NetEase once again "steadily happy""

February 24, 2022 Telephone meeting "NetEase's future focus: overseas markets, overseas talent, and cooperation with overseas teams (telephone meeting summary)"

February 24, 2022 Earnings review "Surviving the winter, how long can NetEase's spring last?""

November 16, 2021 Telephone meeting "[Metaverse? Management: We won't say much, but rest assured that NetEase will make its presence felt (NetEase telephone meeting)](https://longbridgeapp.com/topics/1323764? input:

invite-code=032064)》

2021 年 11 月 16 日财报点评《 After the "Harry Potter" Bombshell, What Cards Does NetEase Still Have?》

2021 年 8 月 31 日电话会《 Minutes of NetEase's Second Quarter Telephone Conference: Underage Water Revenue Accounts for Less Than 1%, Looking Forward to "Harry Potter"》

2021 年 8 月 31 日财报点评《 NetEase: Will Regulatory Implementation Drag Down the "Super Pig Cycle" of Pig Farms?》

2021 年 5 月 18 日财报点评《 NetEase Games Finally Outperforms the Market, and Youdao Online Education Is Also on the Rise?》

2021 年 2 月 26 日电话会《 NetEase Telephone Conference Record: The IP Value of "Onmyoji" Reaches 10 Billion US Dollars》

2021 年 2 月 25 日财报点评《 Dolphin Research | Old-School Game Giants Brave the Wind and Waves, NetEase Education Track Surges Strongly》

Depth

2021 年 6 月 25 日《 NetEase: Super "Pig Cycle" of Pig Farms I Dolphin Research》

Hot Topics

2021 年 7 月 27 日《 NetEase Maintains Long-Term Target Price of $115-$141》

Risk Disclosure and Disclaimer for this Article: Dolphin Research Disclaimer and General Disclosure

output:

invite-code=032064)》

November 16, 2021 Financial Report Review "[After the "Harry Potter" Bombshell, What Cards Does NetEase Still Have?](https://longbridgeapp.com/topics/1323418?invite-code=032064)"

August 31, 2021 Telephone Conference "Minutes of NetEase's Second Quarter Telephone Conference: Underage Water Revenue Accounts for Less Than 1%, Looking Forward to "Harry Potter" (https://longbridgeapp.com/topics/1101849?invite-code=032064)"

August 31, 2021 Financial Report Review "[NetEase: Will Regulatory Implementation Drag Down the "Super Pig Cycle" of Pig Farms?](https://longbridgeapp.com/topics/1101487?invite-code=032064)"

May 18, 2021 Financial Report Review "[NetEase Games Finally Outperforms the Market, and Youdao Online Education Is Also on the Rise?](https://longbridgeapp.com/news/36019485)"

February 26, 2021 Telephone Conference "[NetEase Telephone Conference Record: The IP Value of "Onmyoji" Reaches 10 Billion US Dollars](https://longbridgeapp.com/news/30074642)"

February 25, 2021 Financial Report Review "[Dolphin Research \| Old-School Game Giants Brave the Wind and Waves, NetEase Education Track Surges Strongly](https://longbridgeapp.com/news/29949147)"

**Depth**

June 25, 2021 "[NetEase: Super "Pig Cycle" of Pig Farms I Dolphin Research](https://longbridgeapp.com/news/38807638)"

**Hot Topics**

July 27, 2021 "[NetEase Maintains Long-Term Target Price of $115-$141](https://longbridgeapp.com/topics/974467?invite-code=032064)"

Risk Disclosure and Disclaimer for this Article: [Dolphin Research Disclaimer and General Disclosure](https://support.longbridge.global/topics/misc/dolphin-disclaimer)