A series of troubles send Vipshop plummeting, is it doomed to be a "cigarette butt stock"?

Before the U.S. stock market opened on November 22, Vipshop released its Q3 2022 financial report. Here are the key points:

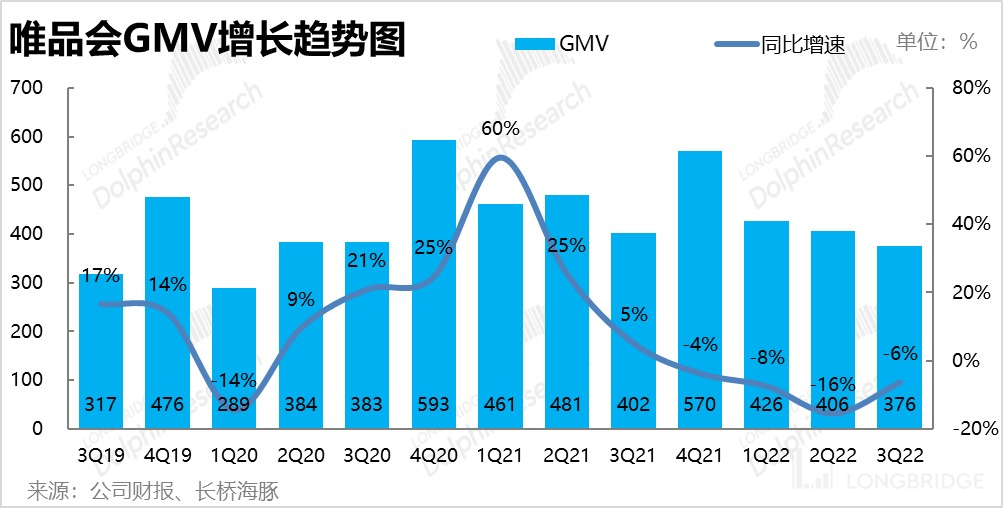

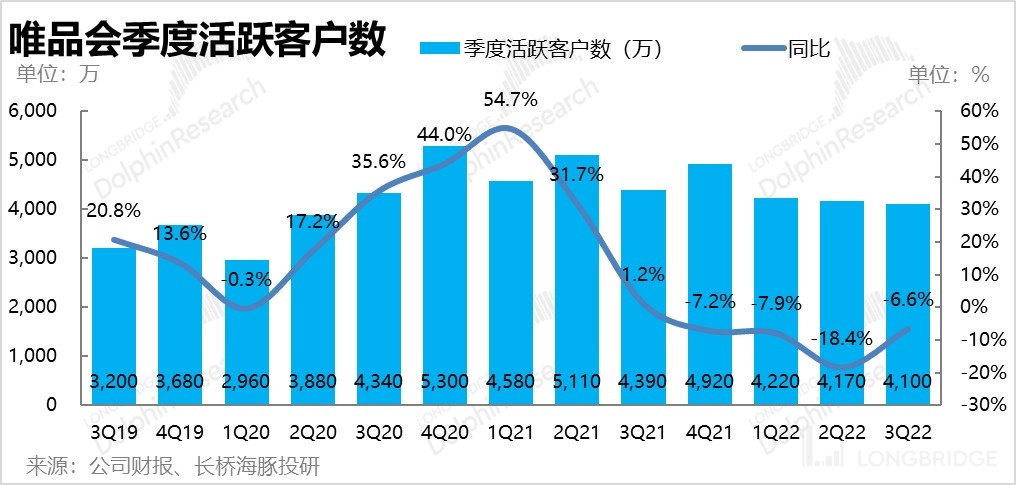

- Vipshop's active users this quarter were 41 million, with a YoY decrease of around 7%, which was lower than the company's previous guidance of YoY parity and lower than market expectations. However, the fact that the company didn't increase marketing expenditures was good news, resulting in marketing costs lower than market expectations. Although the number of users has decreased, the average consumer spending per customer has remained stable, and GMV has also decreased by about 6%, which is better than the market's expected 12% decline.

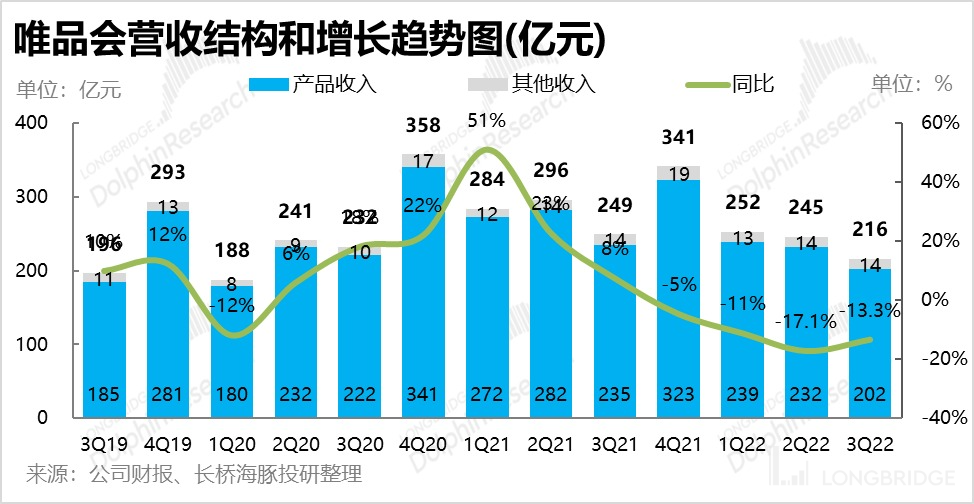

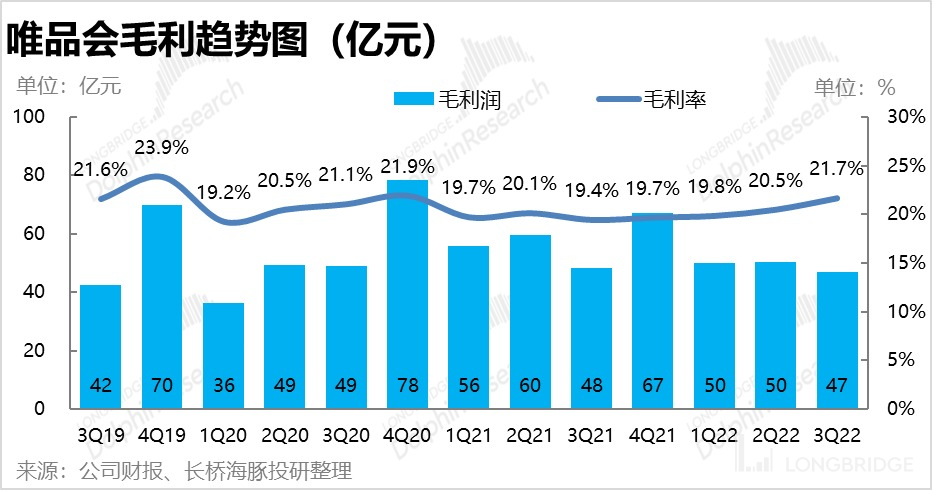

- Although the company's revenue seems to be lower than expected with a YoY decline of 14%, it is actually a bit of a smokescreen for the market. In fact, the inconsistency between GMV and income performance may be due to the company's rescheduling of traffic; 3P business is strong while 1P self-operated business relatively weaker, resulting in seemingly lower revenue scale. However, the proportion of high gross profit 3P business has increased, and the actual gross profit margin of the company is more resilient, only a 3% YoY dip.

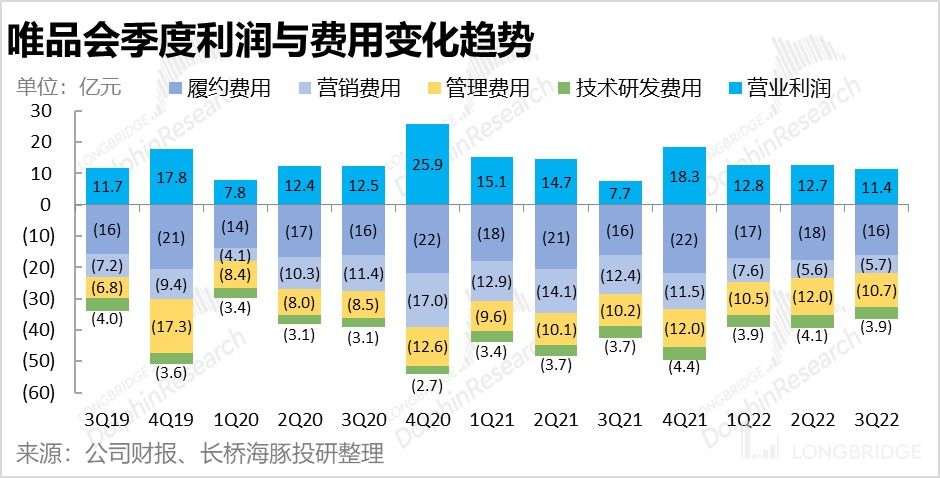

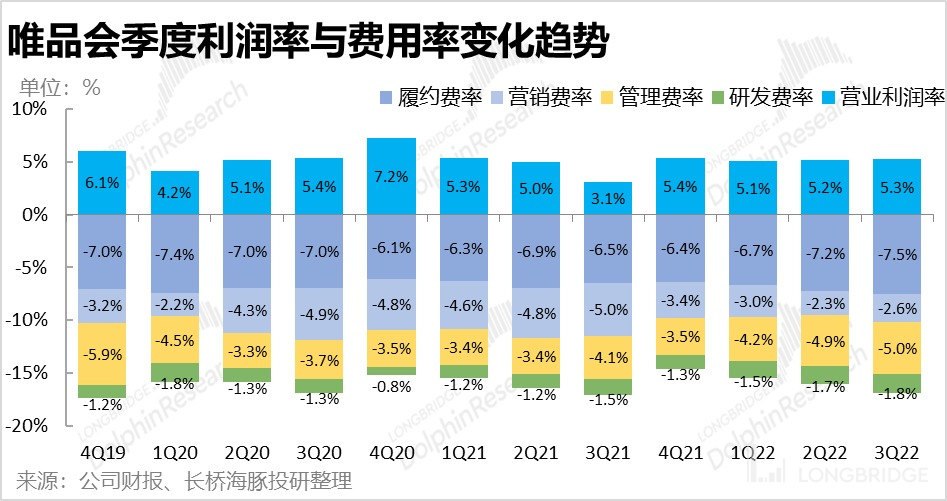

- However, despite the improvement in gross profit, Vipshop's cost reduction this quarter was slightly slower. Although it has also decreased month-on-month, the decline is lower than the income decline, resulting in a passive expansion of the cost rate, eroding profits. The most noteworthy thing is that the marketing investment this quarter did increase slightly by 3% MoM, indicating that the company did try to increase its investment to retain customers, but wisely did not over-invest after seeing that customer attrition was hard to reverse.

- Looking ahead to Q4, the company guidance states that revenue will decrease by 5%-10% YoY, which is less than this quarter's decline, but market expectations for Q4 revenue are only a 4.2% YoY drop. Therefore, although the trend of decline has narrowed, the degree of improvement is not as good as the market originally expected. However, it is also important to note that the current market expectations for Q4 are based on assumptions that the company will reinvest to achieve growth, and the increase in the proportion of 3P business will also have an impact on revenue scale (but not on profits). Therefore, further explanations of revenue details from senior management during the conference call are needed for more clarity.

Dolphin Analyst's View:

Overall, although Vipshop's financial report for this quarter seems to have good and bad news compared to market expectations, the only difference is that the growth of 3P business has exceeded expectations, resulting in higher than expected GMV growth. The overall revenue and profit performance of the company is basically in line with expectations or slightly better. Management claimed with great ambition to increase investment and regain users in the second quarter. However, ultimately they were forced to face a harsh reality and had to lie flat again, with users continuing to drain away, without sacrificing profits to invest heavily.

At the same time, Dolphin Analyst believes that after briefly fluctuating this quarter, Vipshop is unlikely to try to be unique and sacrifice profits for growth again. The market expects winter clothing sales to help Vipshop recover growth after the weather turns cold, but as the temperature does not drop, this prospect is basically dashed.

Therefore, Dolphin Analyst believes that Vipshop has basically returned to its original state, with users and revenue expected to continue to decline, but the company will not lose profits due to excessive investment, and will return to its "cigarette butt stock" positioning - no growth but with profits. We shouldn't expect much upward elasticity in Vipshop's stock price, but it will be a good opportunity for value rebound whenever the company's valuation is severely undervalued (such as approaching the company's net cash).

Later, Dolphin Analyst will share telephone conference summaries with the dolphin user community through the Longbridge App. Interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin investment research group and get telephone conference summaries first.

The following are the detailed financial reports:

- Users are still declining, but their consumption capabilities remain

By the third quarter, Vipshop's quarterly active users were 41 million, although still decreasing by 700,000 compared to the previous quarter. However, the third quarter has always been a low season for e-commerce, and the year-on-year decline in active users this quarter is actually narrowing. However, in the telephone conference in the second quarter, management had expressed the hope that the number of users would remain steady year-on-year this quarter, so the actual number of users was about 1.1 million less than the market had expected.

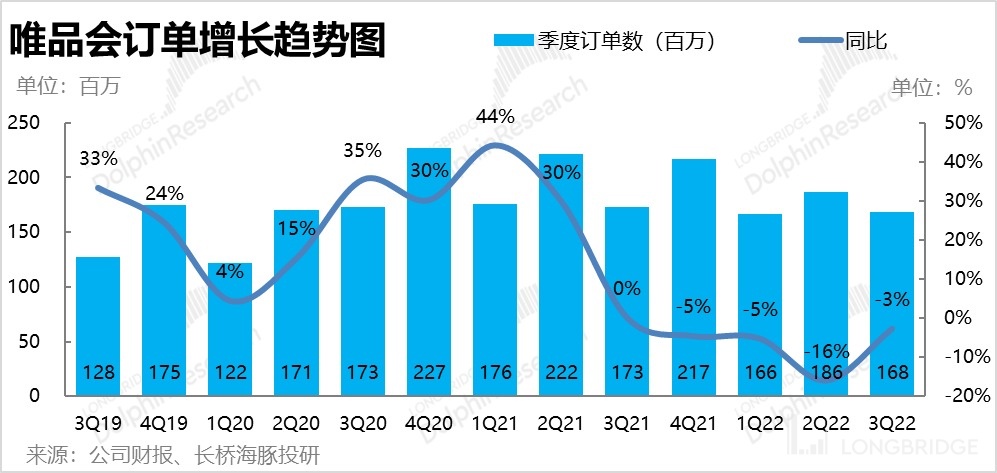

As the decrease in the number of users narrowed, the total number of orders placed by the company this quarter also declined by a significantly smaller percentage, at 3%, better than the market's expected 6% decrease in order volume. The main reason for the order volume exceeding expectations was that the average order frequency per customer was higher than expected, and this season increased by 4% year-on-year.

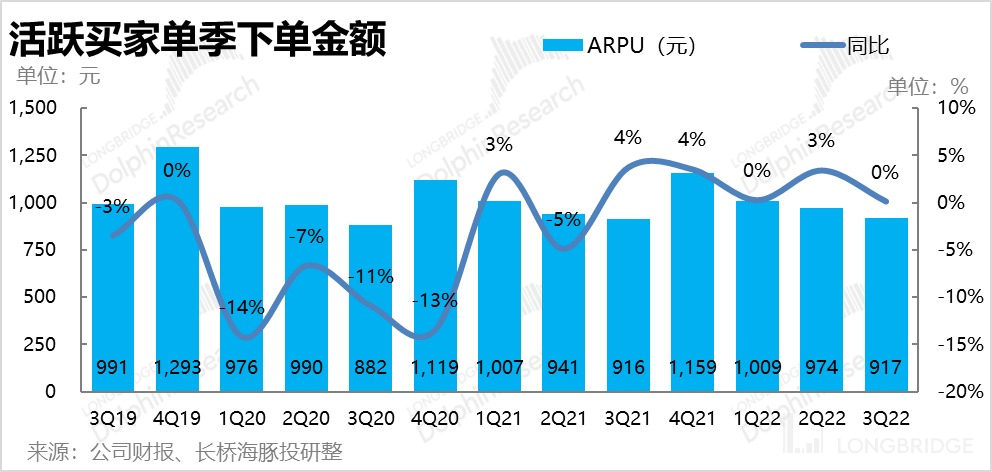

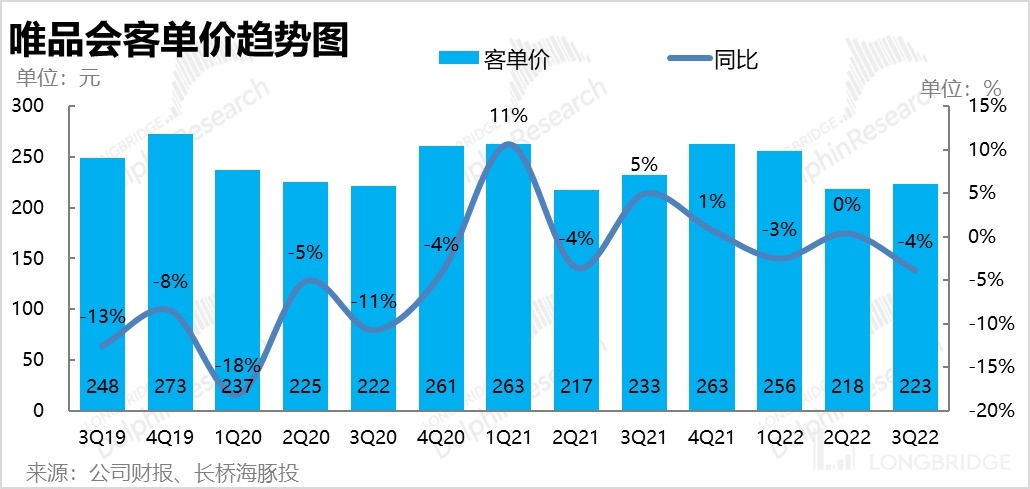

In contrast to the increase in order frequency, the average customer order value this quarter decreased by 4% year-on-year. Taken together, this suggests that products purchased by Vipshop consumers this third quarter were cheaper on average, but with higher consumption frequency, perhaps reflecting a trend of consumption downgrading?

In the end, after the ups and downs of average customer spending and consumer frequency offset each other, Vipshop's GMV growth rate in the third quarter was basically consistent with the change in the number of users, and fell by 6% to 37.6 billion yuan. However, the single-season order amount per active user remained flat at 917 yuan YoY.

In the end, after the ups and downs of average customer spending and consumer frequency offset each other, Vipshop's GMV growth rate in the third quarter was basically consistent with the change in the number of users, and fell by 6% to 37.6 billion yuan. However, the single-season order amount per active user remained flat at 917 yuan YoY.

Overall, although users did not stop flowing away as expected by management, it is fortunate that the average per capita consumption of users remained unchanged YoY. Therefore, the total GMV was 7% higher than expected.

- Strengthening of the 3P business, with poor revenue but good gross profit

While GMV exceeded expectations, the total revenue for this quarter seemed to be less than expected, decreasing by 13.3% to 21.6 billion yuan, and it also fell below the company's revenue guidance of a 10-15% decline. In terms of revenue types, Vipshop's revenue from self-operated products decreased by 14% YoY, while revenue from services provided to third-party sellers decreased by almost 2% YoY.

However, the main reason why the revenue seems to be lower than expected is that the GMV growth rate of Vipshop's 3P business in this quarter should have been significantly better than that of the 1P business.

Therefore, even though the 3P business recorded net commissions into revenue, making the revenue scale appear lower, it was not a bad thing in terms of gross profit margin. With the increase in the proportion of high-gross-margin 3P business (or the reduction of user subsidies), Vipshop's gross profit margin in this quarter increased significantly by 1.2pct to 21.7%. Therefore, the YoY decrease in the company's gross profit margin was only 3%, which was even lower than the decrease in GMV.

Therefore, the ups and downs of GMV that exceeded expectations, revenue that was lower than expected, and gross profit that exceeded expectations were actually only three manifestations of the stronger growth of the 3P business. And the actual quality of revenue growth is also better than expected.

Looking ahead to the next quarter, the company expects revenue to decrease YoY by about 5-10%, which is a narrower decline compared with this quarter. However, the market originally expected a YoY revenue decline of only 4.2% in the fourth quarter. Therefore, although the trend of decline has narrowed, the degree of improvement is not as optimistic as the market had expected. Dolphin Analyst believes that the market originally expected the company's users to stop declining in the fourth quarter, and that winter clothing consumption would drive the company's revenue growth as the weather turns colder, but at present, the probability of these two improvements seems to be small. The Profit Margin has only Slightly Improved Though the Gross Profit is Good, due to the Passive Expansion of Expenses

First of all, it is expected that the logistics performance will not be smooth under the influence of the epidemic. Therefore, while self-operated revenue decreased by 13% YoY this quarter, the performance-related expenses actually remained the same YoY. As a result, the proportion of expenses to revenue has expanded slightly.

As for the management expenses and R&D expenses of the back office, they actually decreased by 4% and 10% respectively on a QoQ basis this quarter. However, since the decline in revenue was even greater, the expense ratio was also passively expanded.

The most noteworthy thing is that Vipshop's marketing investment in this quarter has increased slightly by 3% QoQ, which is consistent with the management's previous guidance to increase marketing promotion to stabilize user numbers. However, after seeing that user loss cannot be stopped, the management did not over-invest. The market's expectation that the marketing investment in this quarter will reach 650 million yuan should also be a "false belief" in the management's guidance.

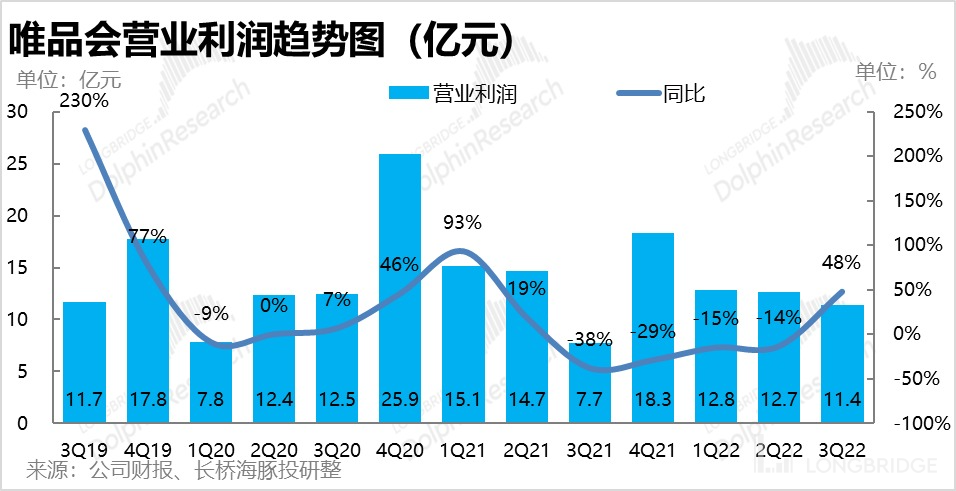

Therefore, although the gross profit margin has improved slightly due to changes in revenue structure, the company's overall operating profit margin has only improved slightly from 5.2% to 5.3% QoQ under the passive expansion of the proportion of operating expenses to revenue. Eventually, the operating profit margin achieved 1.14 billion yuan, which seems to be a skyrocketing YoY growth of 48%, but it is more of a problem of a lower YoY base. Actually, it decreased by 10% QoQ and the profit improvement performance was only mediocre.

In addition, although the profit seems to be about 1.4% higher than expected, the main reason is that the market was "misled" by the management and overestimated the marketing expenses. Therefore, the actual profit is basically in line with expectations.

(Dolphin Analyst has conducted research on Vipshop in the past:

August 19, 2022 Telephone Meeting "Increase Investment and Strive for 3Q User Growth and 4Q Revenue Growth (Vipshop Telephone Summary)"

August 19, 2022 Financial Report Comment "Give Up! Vipshop's Countercyclical Strategy Is Just a Story Without Substance"

May 19, 2022 Telephone Meeting "Can Vipshop Break Through Non-Clothing Categories to Redeem Itself? (Telephone Summary)")

(The End) On May 19, 2022, financial report review "Vipshop's dim performance, dawn hard to find".

On February 23, 2022, financial report review "With deepening performance decline, is there any room for Vipshop's survival under the competition of giants?".

On November 18, 2021, financial report review "What is the latest situation of Vipshop? Ten charts explain everything".

On August 19, 2021, telephone meeting summary "Keeping a low profile, acknowledging weakness - Summary of Vipshop's meeting".

On August 18, 2021, financial report review "Vipshop that doesn't grow, is there any value left?".

Risk disclosure and statement for this article: Dolphin Investment Research disclaimer and general disclosure.