Give up! The anti-cyclical of Vipshop is just a story without any ability.

On the morning of August 19th, US stock market, Vipshop released its financial report for Q2 2022. Overall, this quarter has exceeded the relatively pessimistic market expectations in terms of revenue and profit despite the impact of the pandemic. However, from the company’s own operating situation, the trend of comprehensive decline of all indicators is still continuing. The key points are as follows:

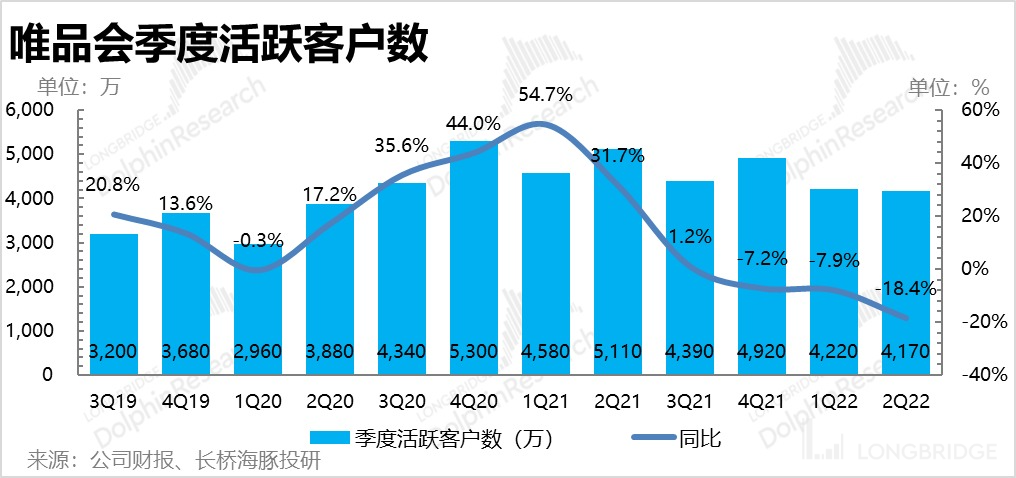

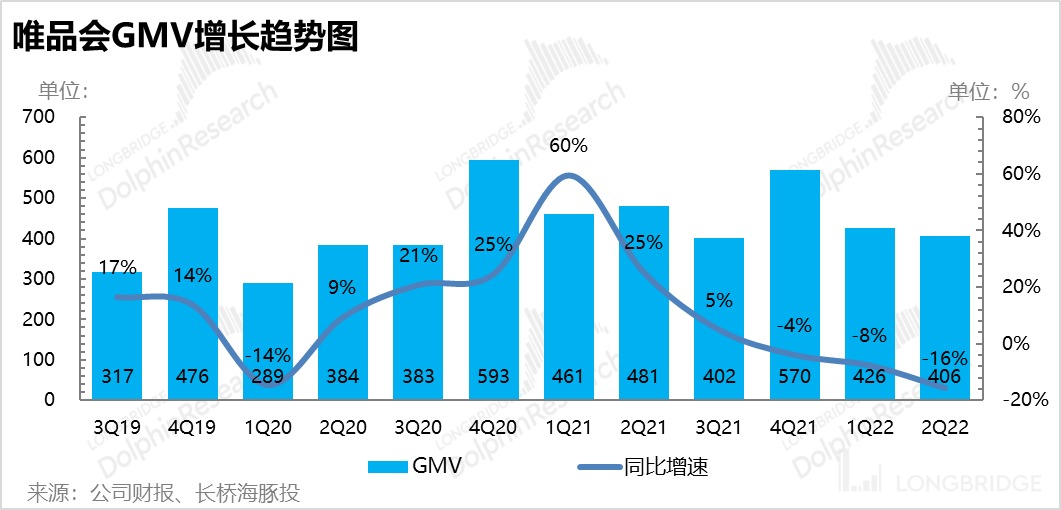

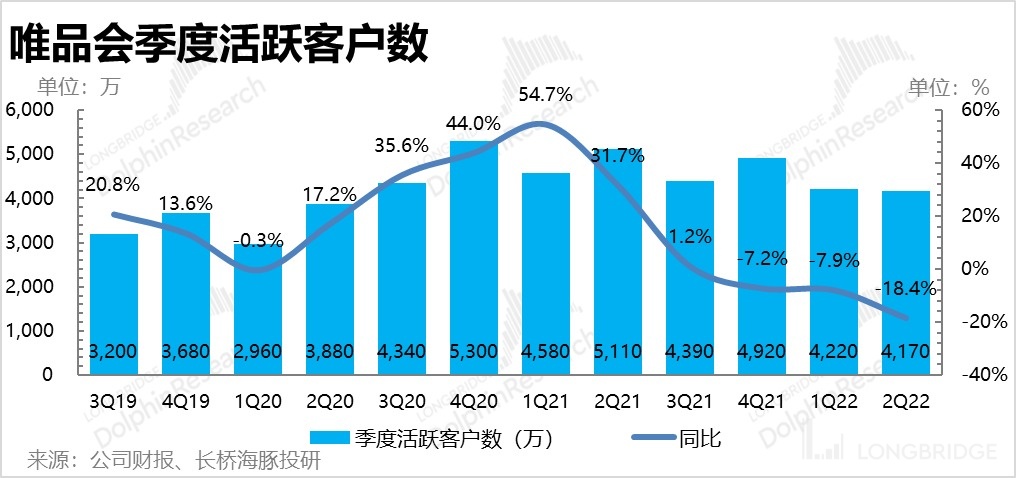

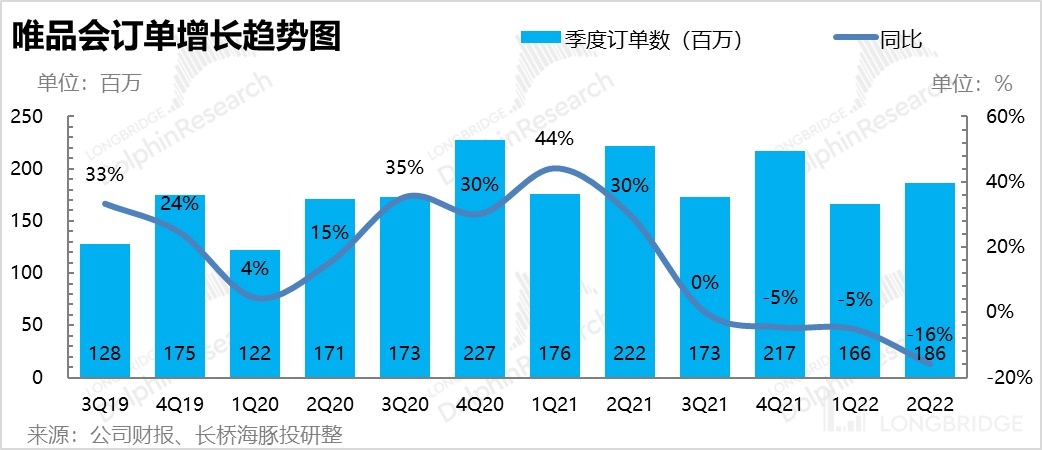

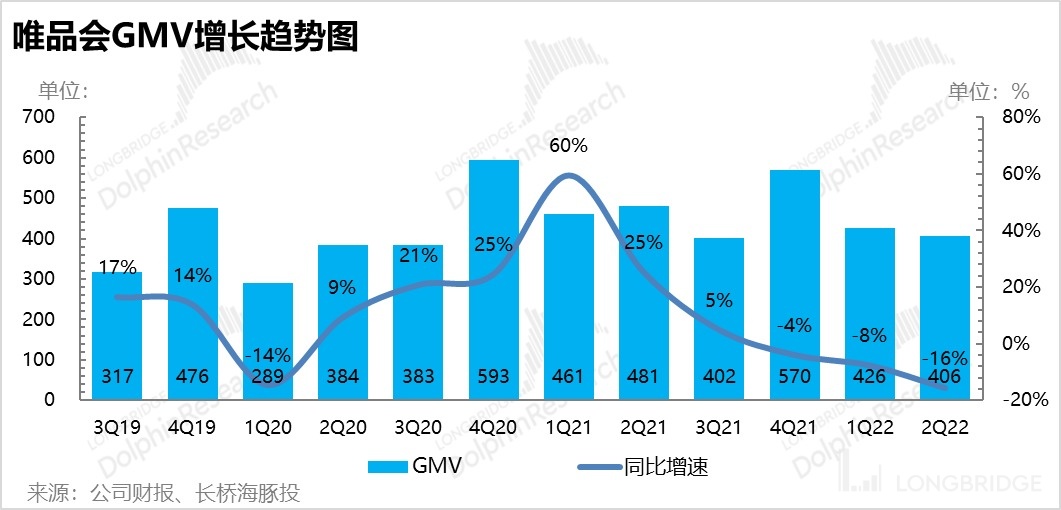

- Under the impact of the pandemic, the number of Vipshop’s users and GMV continue to decline rapidly. Among them, the number of active users in this quarter decreased by 18% year-on-year to 41.7 million, and GMV also decreased by 16% to 40.6 billion. However, the market expectation was not high under the epidemic, so the actual GMV performance exceeded expectations by 8%.

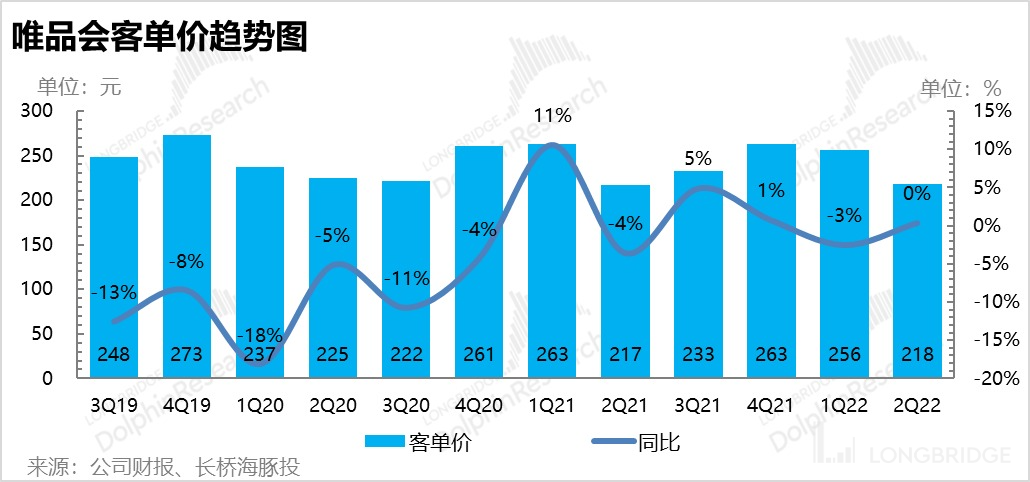

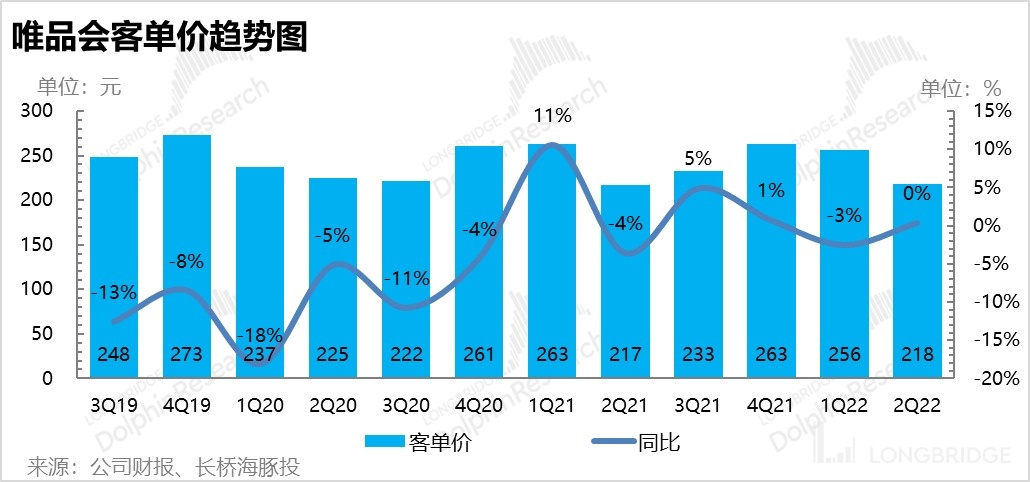

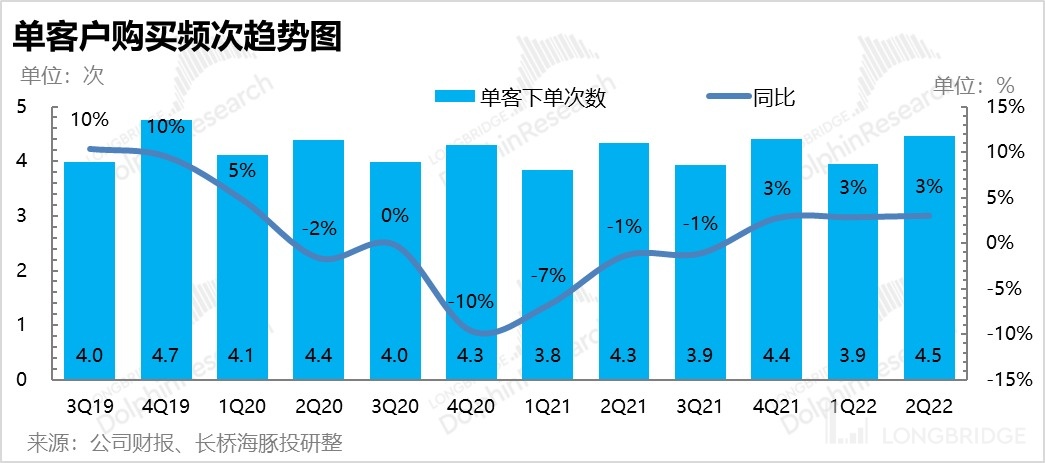

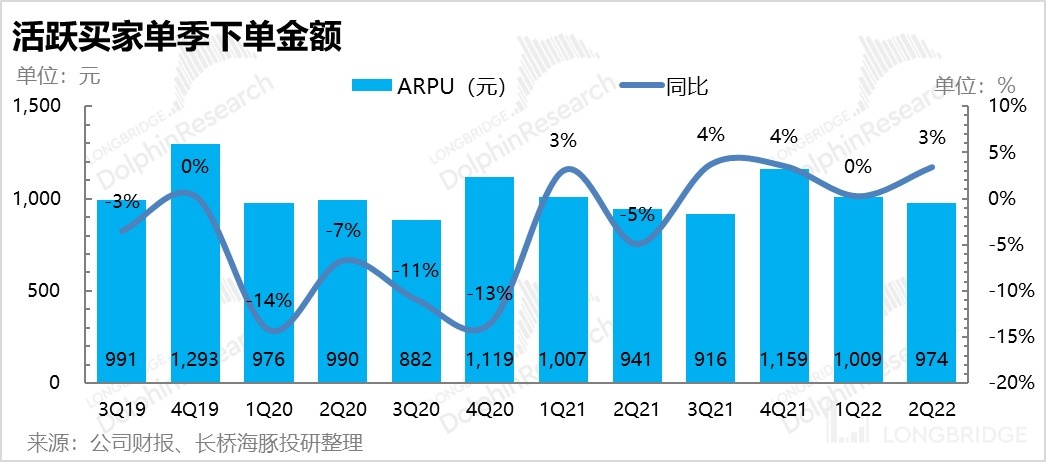

- Although the number of users continues to decrease, from the perspective of a single user, the frequency of placing orders and the per capita consumption amount have stabilized, indicating that the remaining users are loyal users. In addition, the per capita consumption amount for SVIP users, who spend eight times more than regular users, continued to increase year-on-year by 21% this quarter. Vipshop's future will depend on the stickiness and consumption ability of these core users.

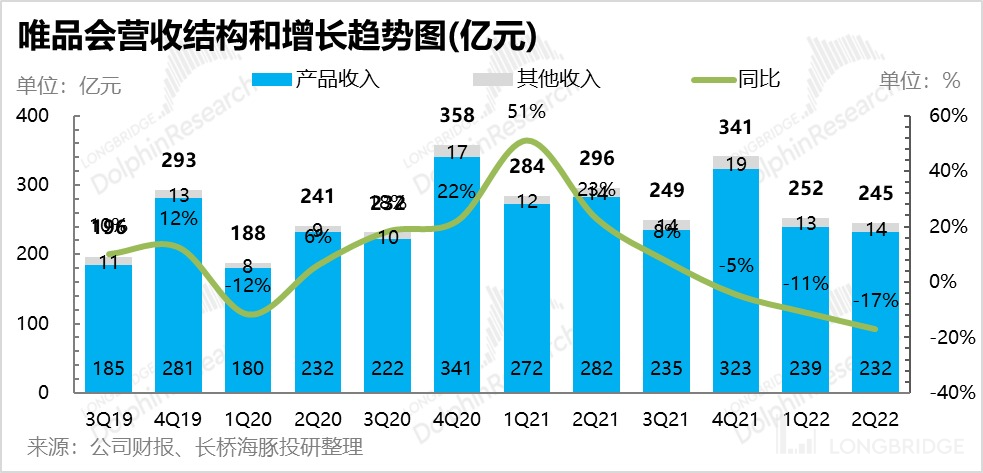

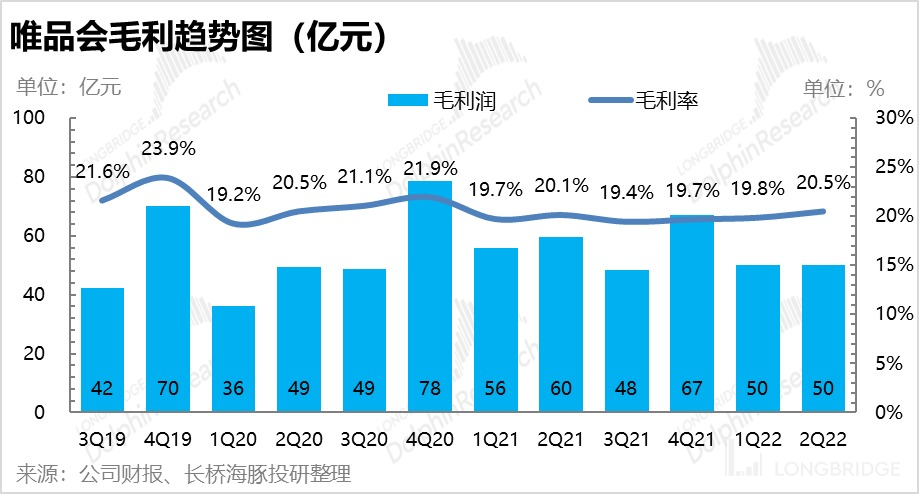

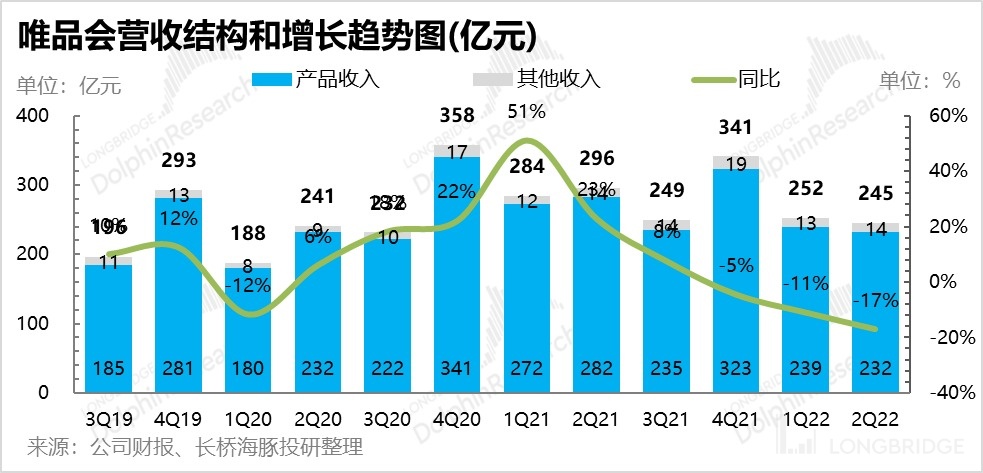

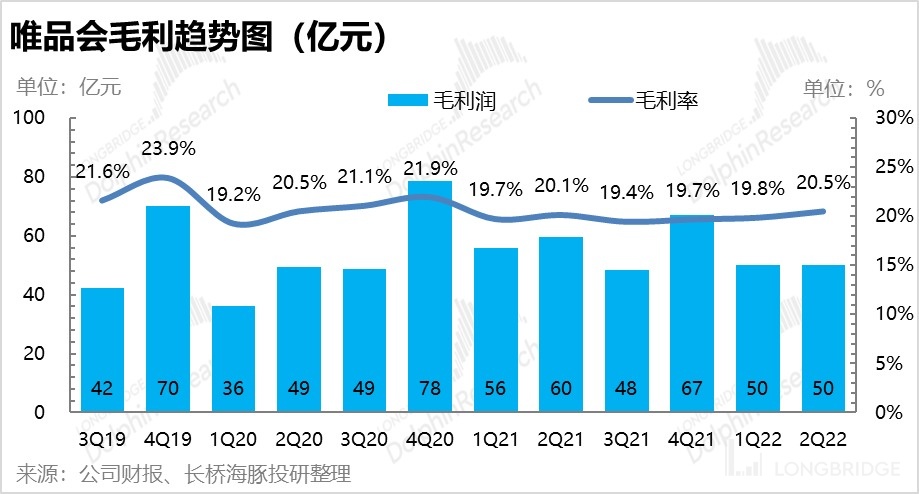

- Consistent with GMV performance, Vipshop's revenue also decreased by 18% year-on-year to 24.5 billion this quarter, which was also 8% higher than market expectations and better than the company's guidance of a 20%-25% year-on-year decline. In addition, the interest rate improved from 19.8% to 20.5% on a month-on-month basis, slightly better than expected. Combined with the reduced impact cost, Dolphin Analyst guessed that the company reduced its discount efforts this quarter.

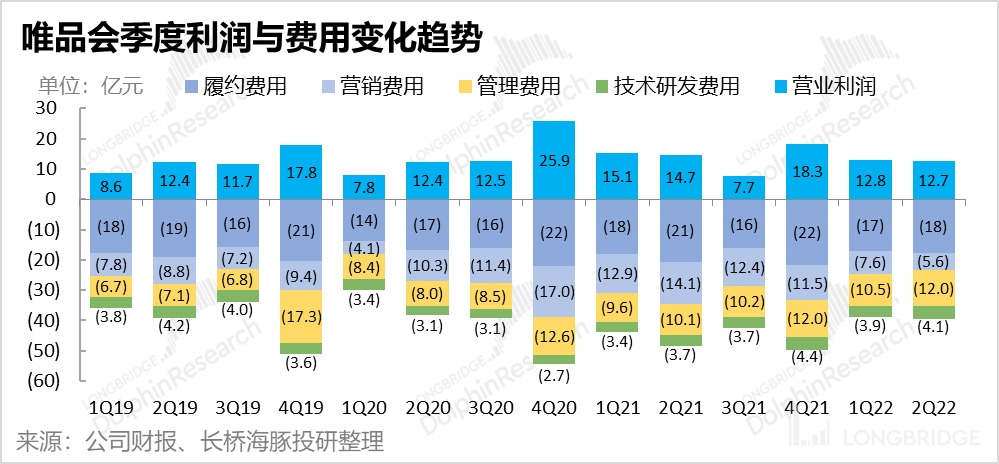

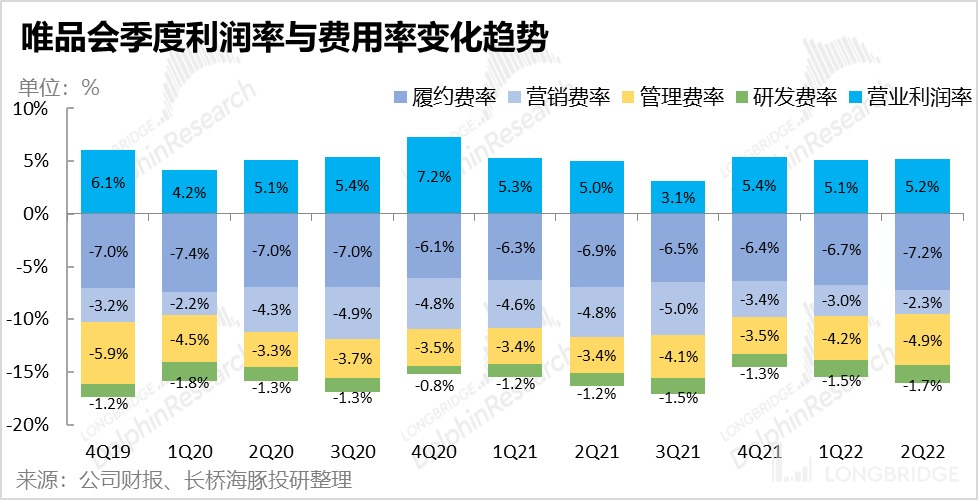

- However, costs were mixed. Although external costs were significantly reduced, the surge in performance-related expenses under pandemic was offset by reduced marketing expenses. Unexpectedly, internal R&D and management expenses continued to grow under the background of shrinking revenue, leading to no change in the company's operating profit and profit margin on a month-on-month basis. Although the operating profit did not fall under the impact of the pandemic and exceeded market expectations, it was still slightly disappointing.

- Looking ahead to Q3, the company’s revenue guidance is between 21.2-22.4 billion. After getting rid of the impact of the pandemic, not only recovery could be seen, but revenue is expected to continue to decline. Therefore, Vipshop's own downward trend is likely to continue.

Dolphin Analyst's Opinion:

Overall, the impression from Vipshop's financial report this quarter can be described as mixed. From the perspective of expectation deviation, the company has performed well in terms of revenue and profit, both exceeding market expectations and management guidance. But from the trend of the company's performance itself, users, revenue, and profit are all still on a continuous decline track. Even after the epidemic, the company still guided revenue stagnation rather than rebounding.

Looking at the overall market environment, retail sales remained weak in July, with a bleak outlook for the future. As Vipshop's main business is fashion, which is one of the worst-performing categories during this round of downturn in consumption, its future performance visibility and certainty are still low in the medium term.

However, as a company that is profitable and "has no place to spend money" during a downturn, Vipshop is still able to generate nearly 10 billion in operating cash flow each year and had 16.9 billion in net cash at the end of this quarter. Therefore, growth or margin recovery are not the only investment logics for Vipshop, but rather absolute valuation safety margin. After deducting net cash, the company's current market value is only USD 3.7 billion. Assuming the company can maintain the current level of profits in the second half of the year, the current valuation corresponds to a PE of 7x-8x in 2022. Dolphin Analyst believes that considering the company's revenue scale will continue to shrink, the current valuation does not have an absolute safety margin. A better investment opportunity will come when the valuation rebounds or when the inflection point of clothing consumption can be reached.

Dolphin Investment Research focuses on interpreting global core assets across markets for users and seizing deep-value corporate investment opportunities. Interested users can add WeChat ID "dolphinR123" to join the Dolphin Investment Research community and exchange global asset investment views together!

The following are the details of the financial report:

I. Under the impact of the epidemic, the scale of users and transactions shrank rapidly, but it was better than expected.

Under the impact of the epidemic, Vipshop's quarterly active users in Q2 continued to decline by 500,000 to 41.7 million on a month-on-month basis, a year-on-year decrease of 18.4%, while the market expectation was 45.99 million, and the decline was not be said to be not drastic.

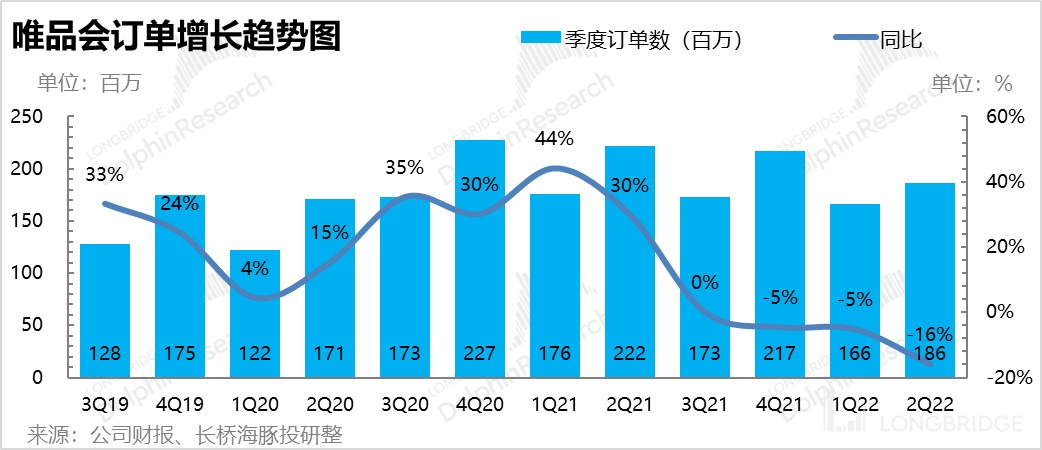

Due to the decrease in the number of users, the number of orders in this quarter also decreased by 16% to 186 million, but under the circumstances where logistics was most severely affected during Q2, the market's expectations for orders were relatively pessimistic, at only 177 million. Therefore, the actual number of orders was about 5% higher than expected.

At the same time, the previously declining year-on-year average customer unit price remained flat on a quarter-on-quarter basis. Therefore, besides the decrease in the number of orders, the average customer unit price did not further drag down GMV, which was beyond market expectations. Therefore, this quarter Vipshop achieved a GMV of CNY 40.6 billion, with a year-on-year decrease in the same range as the number of orders, and 8% higher than the market's expectation. However, from the company's own trend perspective, the absolute value of GMV is still shrinking continuously, and at best, it can only be said to make the best of a bad situation.

From the perspective of single-user data, after non-loyal users were lost, the remaining core users had a higher order frequency, which has been growing positively on a year-on-year basis for three consecutive quarters. And due to the fact that the average customer unit price did not continue to decline this quarter, the revenue generated by each user has stabilized from the perspective of a single user.

In addition, according to the company's disclosure, there are already over 6 million Super VIP users in 2021, accounting for only 6% of the company's annual active users, but contributing 36% of the actual GMV, with an average consumption 8 times higher than that of non-VIP users. It can be seen that after user "cleaning", the company's growth depends more on the contribution of core users. According to the disclosure, SVIP users increased by 21% year-on-year in the second quarter.

II. Revenue has shrunk, gross profit has improved, but expense control is a catch, and profit performance is mediocre

Due to the 16% decline in GMV, Vipshop's total revenue also decreased by 17% to 24.5 billion yuan this quarter, also 8% higher than market expectations. However, from the trend of the company's own revenue, the scale is still continuously declining. According to the company's guidance, the company's revenue in the third quarter will be between 21.2 billion and 22.4 billion yuan, further shrinking from the impact of the epidemic in the second quarter, a year-on-year decrease of 12.5% (median). After surviving the impact of the epidemic, Vipshop's revenue scale is still expected to further shrink. In this case, no matter how good the second-quarter performance is compared to pessimistic expectations, the market is afraid that it will be difficult to "buy in."

At the gross profit level, the gross profit margin stabilized and rebounded to 20.5% this quarter. Along with the reduction in marketing expenses, Dolphin Analyst believes that the company has reduced the price discounts given to customers, thereby maintaining the gross profit margin flat in the case of revenue shrinkage.

In terms of business-related expenses, although the delivery cost-to-revenue ratio increased from 6.7% to 7.2% due to difficult delivery during the epidemic. Fortunately, the company reduced marketing expenses from 760 million to 560 million MoM, and the expense ratio decreased from 3% to 2.3%, completely offsetting the growth in delivery expenses.

However, Vipshop did not control its internal expenses well. In the case of revenue shrinkage, the absolute value of R&D and management expenses continues to increase. Among them, management expenses increased from 1.05 billion to 1.2 billion, and R&D expenses increased from 390 million to 410 million. Therefore, while the company's gross profit margin improved by 0.7% QoQ and business-related expenses were well controlled, the operating profit margin remained flat QoQ due to internal expenses dragging down. The final operating profit for this quarter was CNY 1.27 billion, a slight decrease of only CNY 0.1 billion from the previous quarter. Being able to maintain a steady profit under the impact of the pandemic exceeded the market's expectations of CNY 0.99 billion.

However, from a cash flow perspective, even under the impact of the pandemic, the company achieved CNY 4.5 billion in net operating cash flow this quarter, and a net cash inflow of CNY 3.3 billion in the first half of the year. As of the end of this quarter, the net cash balance was as high as CNY 16.9 billion. Therefore, although the company's performance continues to decline, as a "fallen aristocrat" with a huge capital base, the company has the confidence and ability to reward shareholders through share buybacks, dividends, and other means.

2021 August 18th Financial Report Review "What value does Vipshop have if it can't grow up?"

2021 May 19th Financial Report Review "Vipshop: Guiding the Thunder, the Just Lit Hope is Extinguished Like This? | Dolphin Analyst"

2021 February 26th Conference Call "After Listening to Vipshop's Conference Call, It's Also Good News"

2021 February 25th Financial Report Review "Dolphin Research | Active Buyers Surprisingly Increased, Vipshop Strongly Grows in a Pinch"

Risk Disclosure and Statement for this article: Dolphin Analyst Disclaimer and General Disclosure