In the midst of the pandemic, Huazhu is striving to grow against the odds.

Hi everyone, I'm Dolphin Analyst!

After the Hong Kong market closed and before the US market opened on November 28, 2022 Beijing time, Huazhu Group ($Hyatt Hotels.USyatt Hotels.USuazhu Group-S.HK/$Hyatt Hotels.USyatt Hotels.USuazhu Hotel.US) released its Q3 2022 financial report, with the highlights as follows:

-

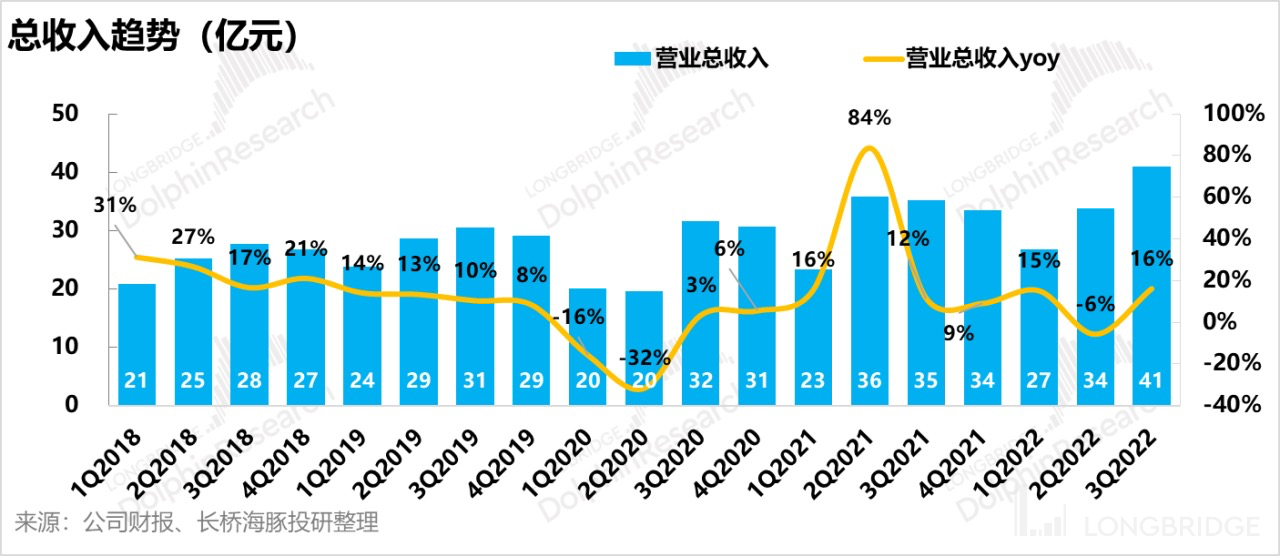

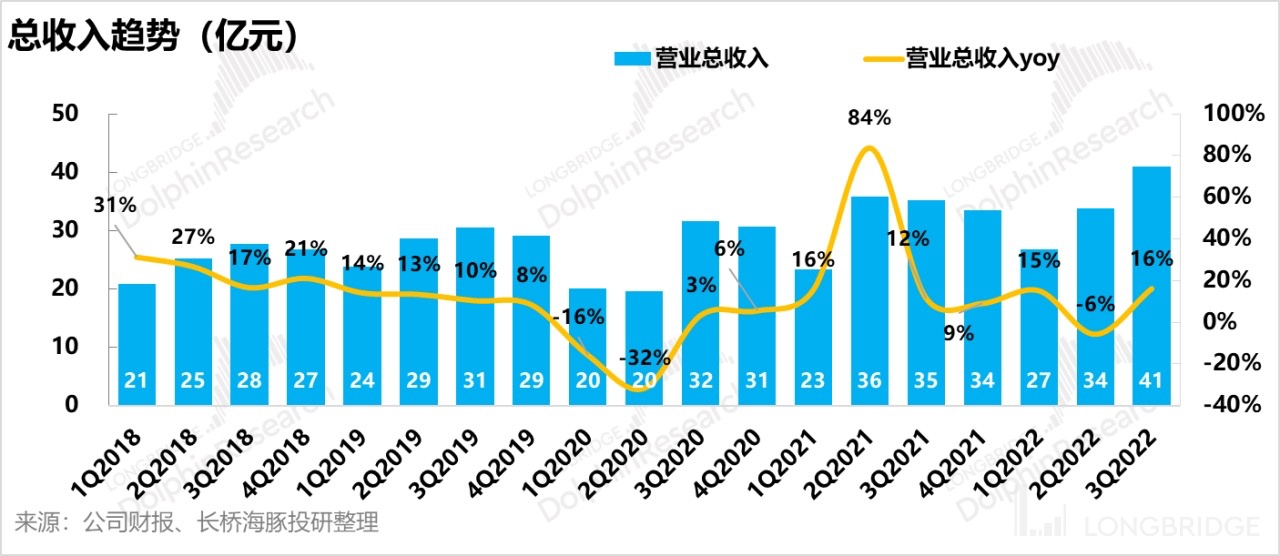

The revenue in Q3 alone is CNY 4.093 billion, a YoY increase of 16.2%, approaching the company's previous performance guidance, and an increase of 13% to 17% compared to Q3 2021. Although there were sporadic outbreaks of COVID-19 in some domestic cities in Q3, the group's overall operating profit reached CNY 500 million, showing a significant improvement both YoY and MoM.

-

The domestic hotel revenue of Huazhu Group in Q3 saw a YoY increase of 7.7% to CNY 3.20 billion, and a MoM increase of 28.4%, matching the previously announced guidance of revenue growth of 5% to 9%. The revenue from the Legacy-DH division was CNY 932 million, a YoY increase of 58.2% and an MoM increase of 1.2%. The increased revenue was mainly due to the strong recovery of the company's European business since mid-February when Europe began to open up to tourism.

-

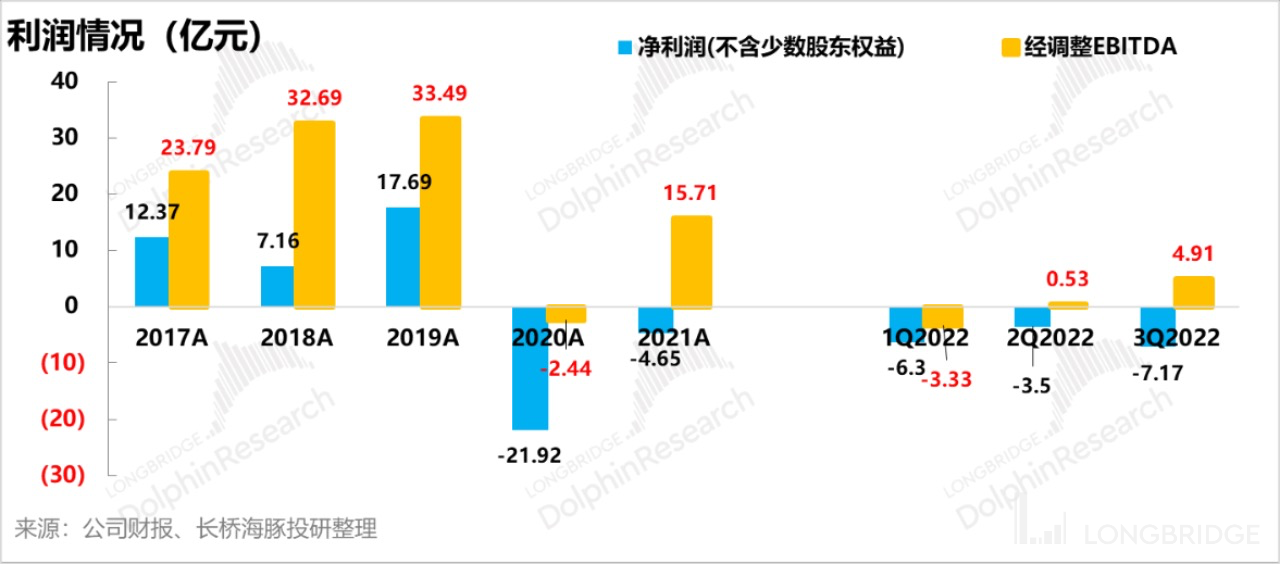

The company recorded a net loss of CNY 710 million in Q3 due mainly to the unrealized losses resulting from the fair value changes of securities held by the group, such as Accor Hotel, which amounted to CNY -313 million, and FX losses of CNY -359 million. Excluding stock-based compensation expenses and unrealized losses of securities held, the adjusted EBITDA for Q3 2022 was CNY 491 million, up 27.53% YoY, and the EBITDA margin was 12.0%, an increase of 1.07pct compared to the same period last year, showing a significant MoM improvement.

-

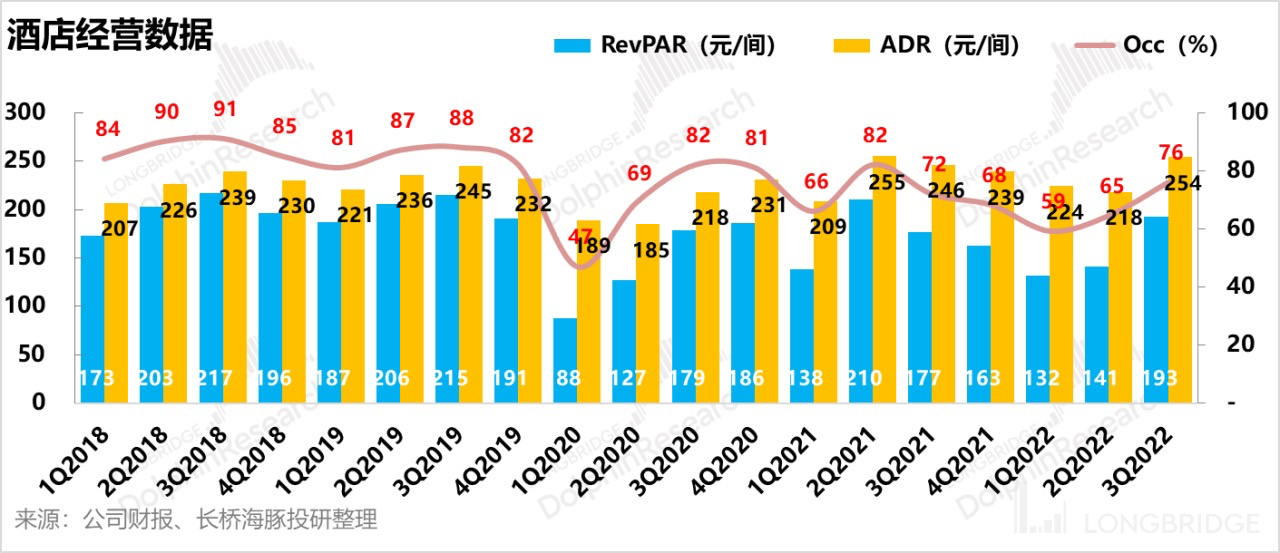

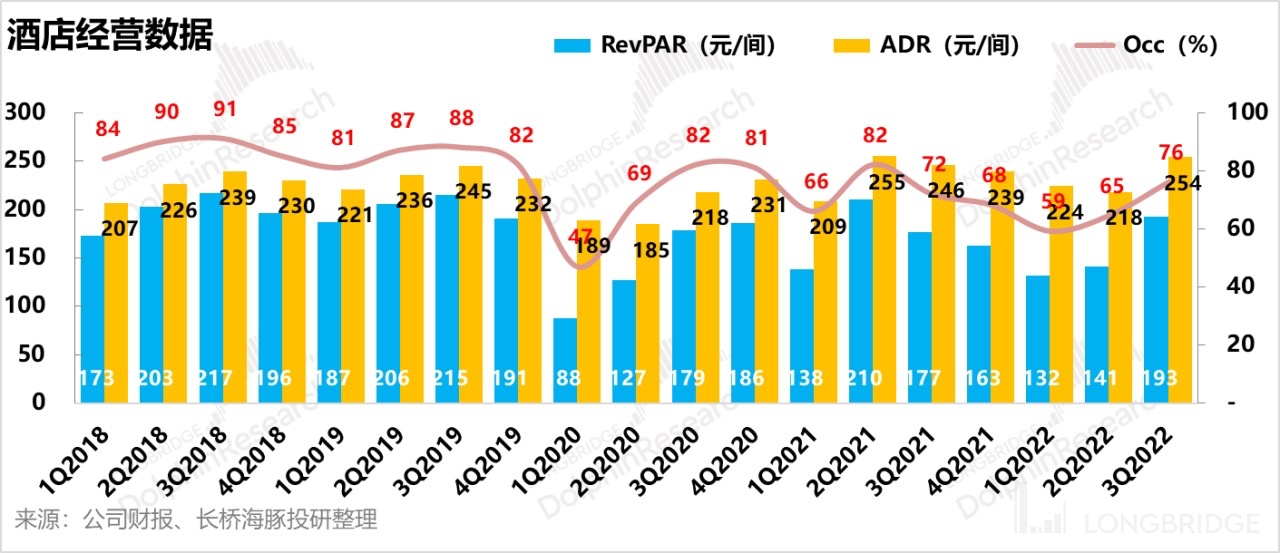

The ADR of Huazhu's domestic hotels in Q3 2022 exceeded the pre-pandemic level, up 2.1% YoY compared to the same period in 2019, but the Occ (occupancy rate) and RevPAR (revenue per available room) remained lower than those in the same period of 2019, and higher than those in Q3 2021. The RevPAR in Q3 2022 was about 90% of the level in 2019.

-

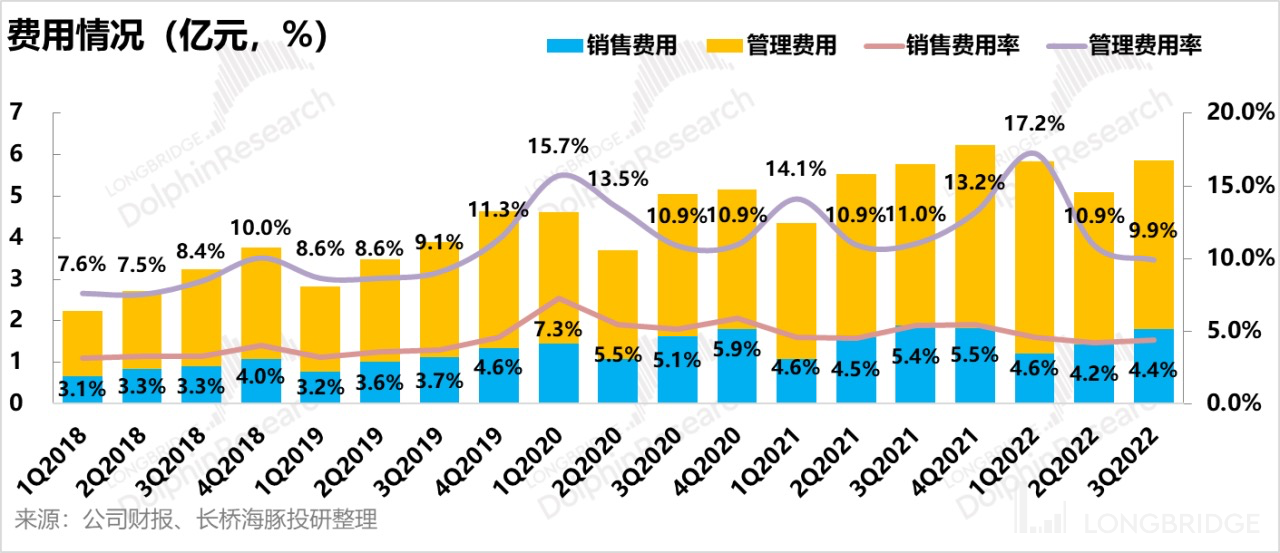

The sales expense of Huazhu in Q3 2022 was CNY 181 million, with a YoY decrease in expense ratio of 0.94pct and an MoM increase of 0.22pct, while the general and administrative expense was CNY 405 million, with a YoY decrease in expense ratio to 1.12pct and an MoM decrease of 0.99pct. The overall impact of Huazhu's sales expense ratio and general and administrative expense ratio in Q3 was not significant.

-

For Q4 2022, Huazhu expects revenue to grow by 7% to 11% compared to Q4 2021, or to decrease by 1% to 5% (excluding DH). Dolphin Analyst's View: The revenue and operating profit in Q3 were both good, and both directly-operated and franchised stores showed bright spots. The gross profit margin of the company in Q3 was also repaired well. However, from the company's expectation of Q4 performance and the partial spread of domestic epidemic in Q4, optimism about the sustainability of the performance recovery in the short term should not be too high. But in the medium to long term, with the continuous optimization of epidemic prevention, potential concerns of residents and travelers about business travel will gradually decrease, and the operating prosperity of domestic hotels still needs to continue to recover. At the present time point, attention can be properly paid.

This quarter's financial report is detailed below.

First, revenue in Q3 steadily increased, consistent with the company's guidance.

In Q3, Huazhu Group's hotel revenue (i.e., hotel turnover, referring to the total transaction value of room and non-room revenue from Huazhu hotels, including leased operations, managed franchising, and licensed hotels) increased by 24.4% YoY to RMB 15.2 billion, excluding Deutsche Hospitality (DH), and hotel revenue in Q3 increased by 21.6% YoY. In Q3, the company's operating revenue increased by 16.2% YoY to RMB 4.093 billion, and excluding DH, Q3 revenue increased by 7.7% YoY, consistent with the company's previous performance guidance.

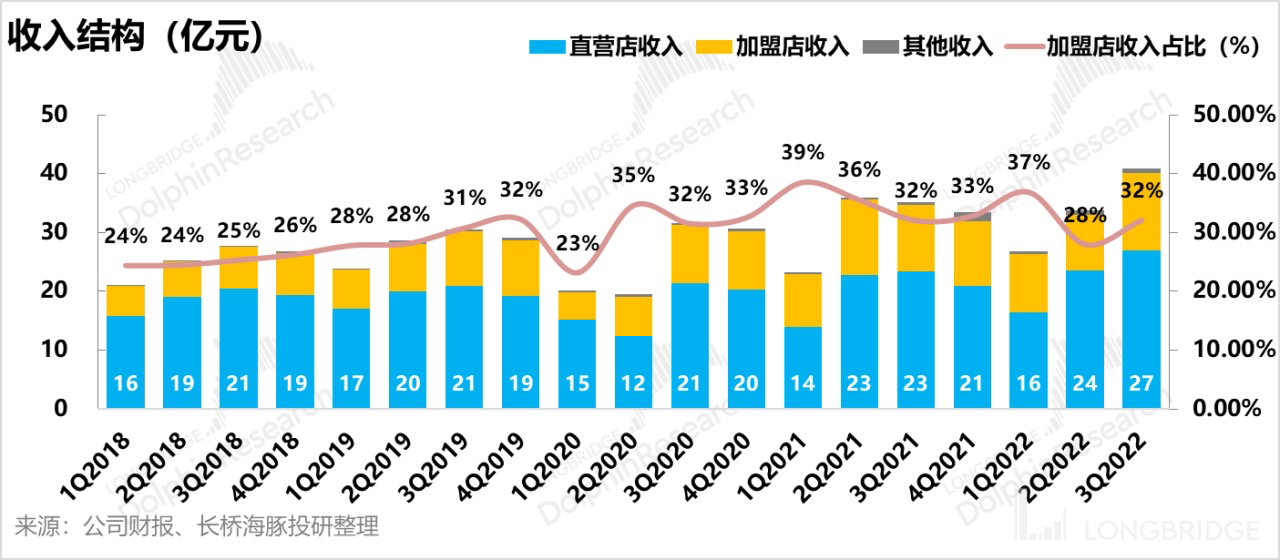

In Q4, the revenue of leased and self-owned hotels was RMB 2.695 billion, a YoY increase of 14.9% and an MoM increase of 14.15%. Among them, the revenue of leased and self-owned hotels from Legacy-Huazhu (only referring to Huazhu China) was RMB 1.8 billion, a YoY decrease of 0.5%, which had a very small overall impact. The revenue of leased and self-owned hotels from Legacy-DH was RMB 902 million, a YoY increase of 60.8%, which was the main source of revenue growth for directly-operated stores.

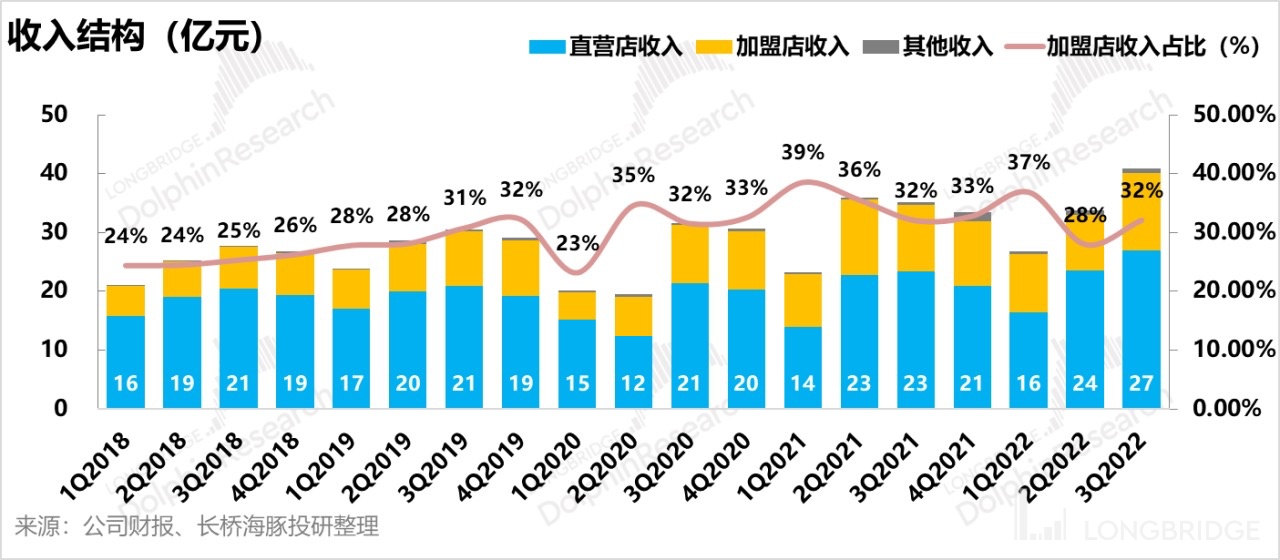

In terms of revenue from managed franchising and licensed hotels, the revenue of this business in Q4 was RMB 1.313 billion, a YoY increase of 16.4% and an MoM increase of 38.9%. It accounted for 32% of the overall revenue of the group in Q3. Among them, the revenue of Legacy-Huazhu was close to RMB 1.3 billion, accounting for the vast majority of the overall franchise revenue. The revenue growth of Legacy-DH was relatively fast, reaching 22.2%, but the absolute value was only RMB 22 million, and the impact was relatively limited.

In addition, other revenue (revenue generated by non-hotel businesses, mainly including revenue from information technology products and services, revenue from the Huazhu Mall, and other revenue from Legacy-DH branches) totaled RMB 85 million in Q3, making a small contribution to the overall revenue.

2. Franchise ratio continuously rises

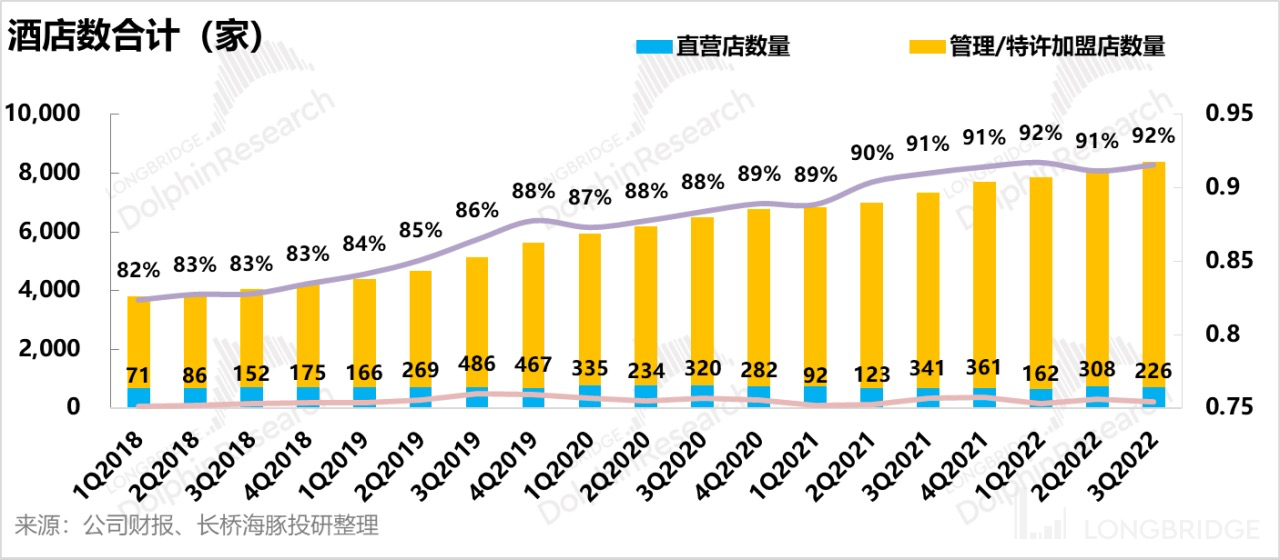

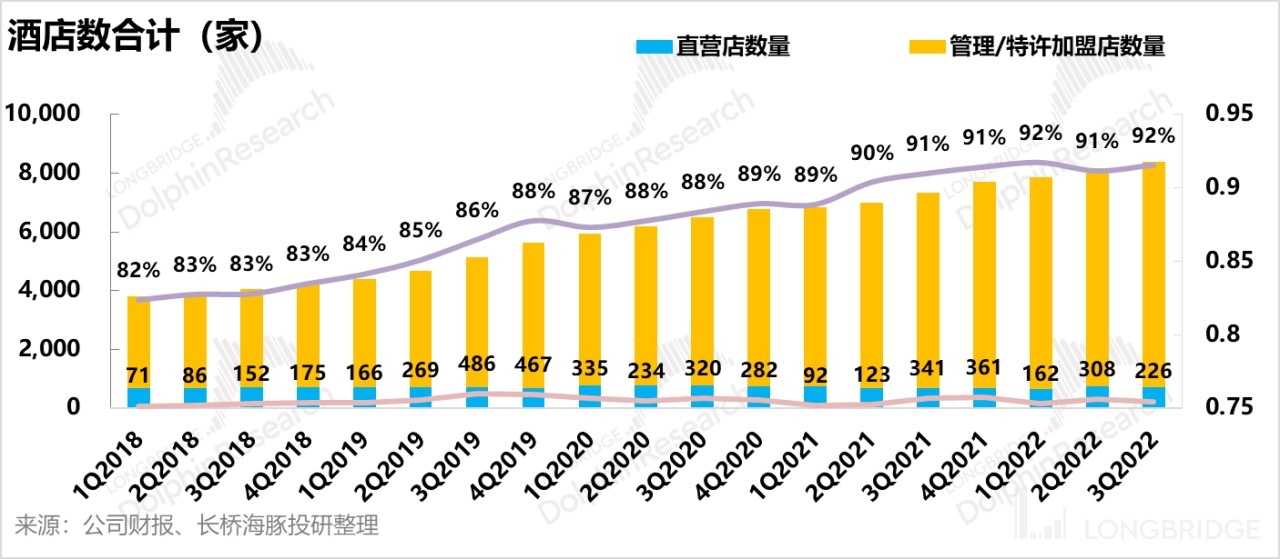

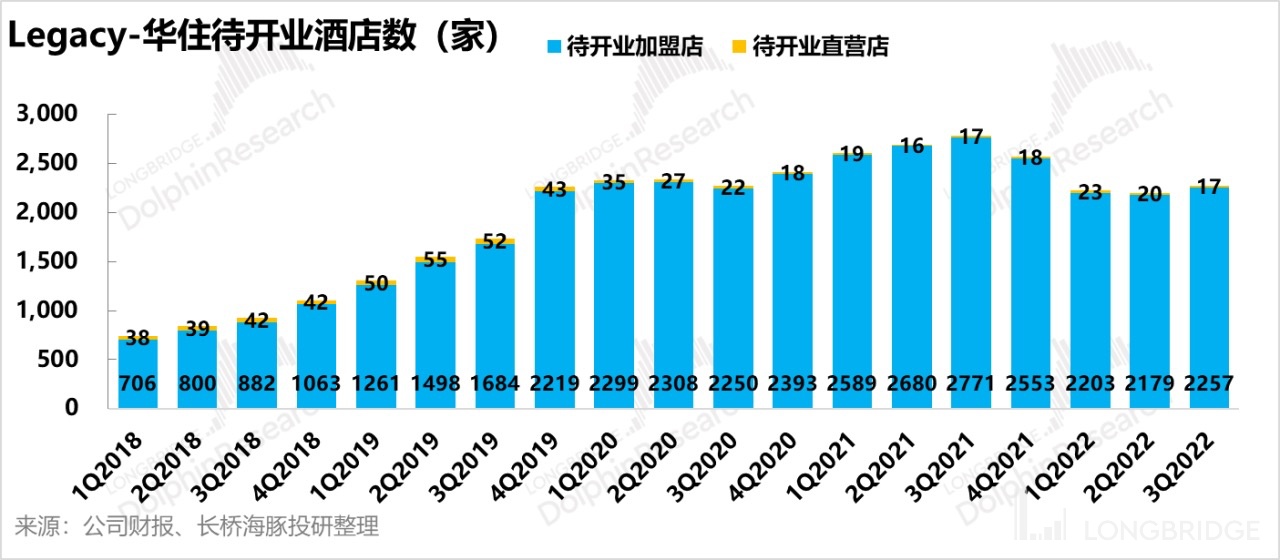

Huazhu Group has always been leading the industry in terms of the number and speed of new hotel openings. Especially as a light-asset operating model, the franchise ratio of Huazhu hotels has been continuously rising. As of September 30, 2022, Huazhu operates 8,402 hotels in 17 countries, with a total of 797,489 rooms in operation. Among all the hotels, 92% are operated under management franchise and franchised model. The ratio of franchise hotels is continuously rising, and the group has seized the opportunity to accelerate the pace of the hotel flipping under the impact of the epidemic.

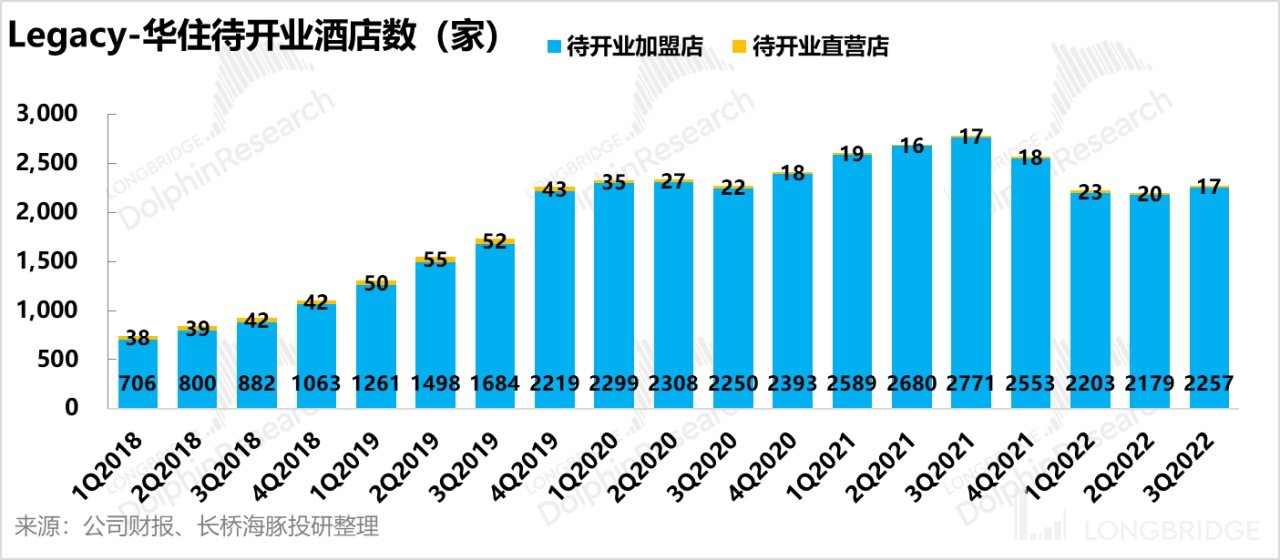

In the third quarter of 2022, a total of 226 net new hotels have been opened, and the pipeline of reserved hotels reached 2274, among which there are 17 self-operated hotels and 2257 franchise hotels. The franchise model accounts for 99.25%, which helps to further increase the overall ratio of franchise hotels in the future for the group. Dolphin Analyst believes that although Huazhu's expansion has been somewhat affected by the fluctuating epidemic, the company is steadily expanding by accelerating the closure of underperforming portfolio hotels and optimizing the quality of hotels. In the long run, the company's strong brand power and high operational efficiency will be the foundation of stable growth in performance.

3. Operating situation continues to improve in the third quarter, but not overly optimistic about the impact of the epidemic in the fourth quarter

Legacy-Huazhu part, ADR in the third quarter of 2022 was RMB 254, an increase of 3.25% over the third quarter of 2021, which was RMB 246. Compared with the pre-epidemic third quarter of 2019 with an ADR of RMB 245, it increased by 3.67%.

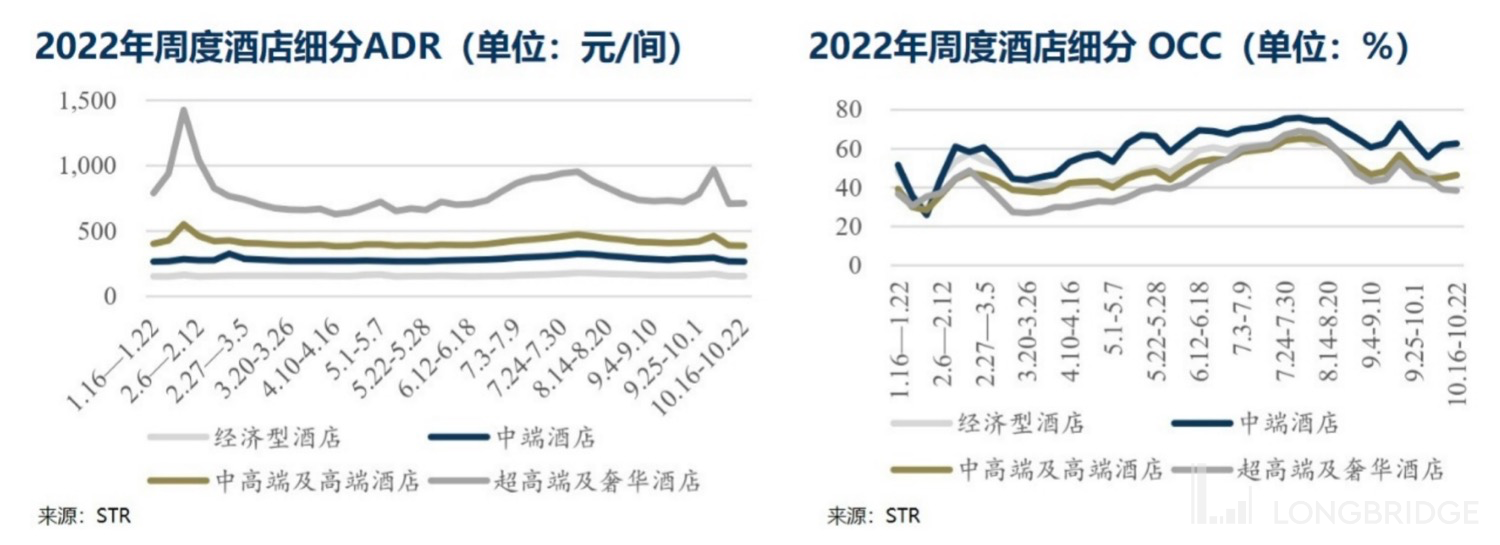

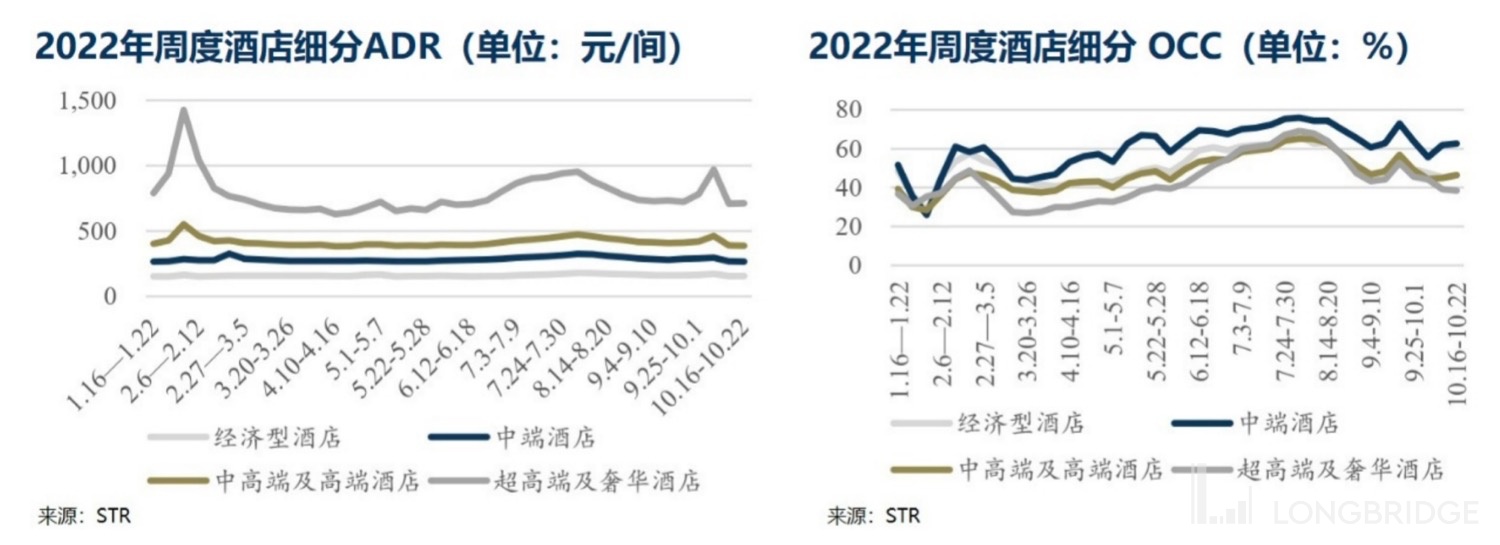

In the third quarter of 2022, the occupancy rate of all Legacy-Huazhu hotels in operation was 76.0%, which was an increase of 4.1pct over the same period of 2021. However, compared with the occupancy rate of 87.7% in the pre-epidemic third quarter of 2019, there is still a gap of 11.7pct. Nevertheless, compared with industry data, Huazhu's performance is already impressive.

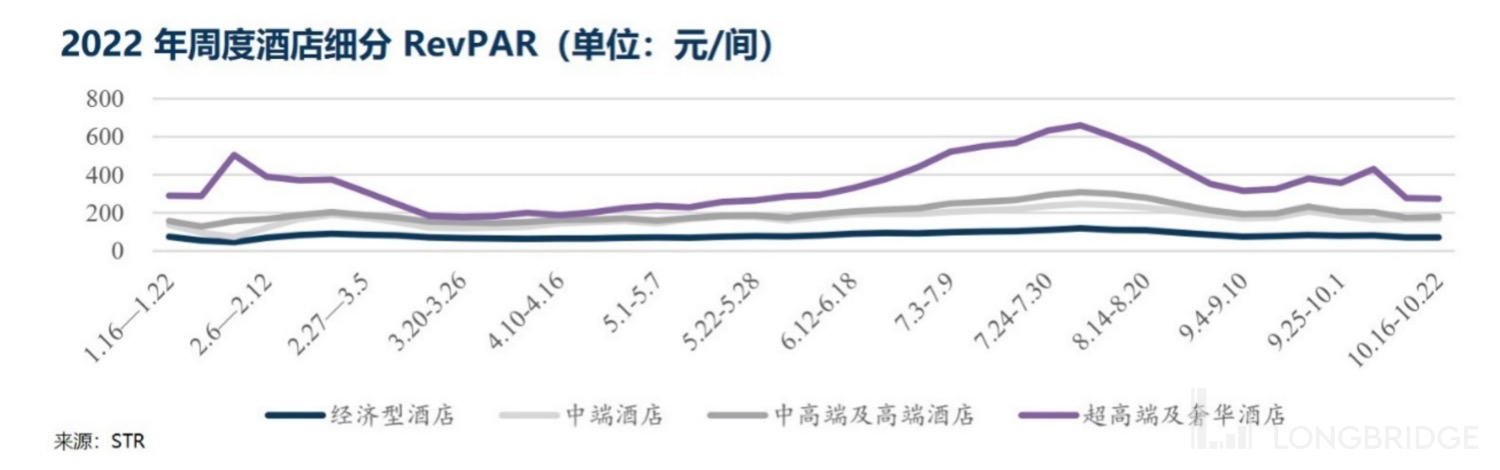

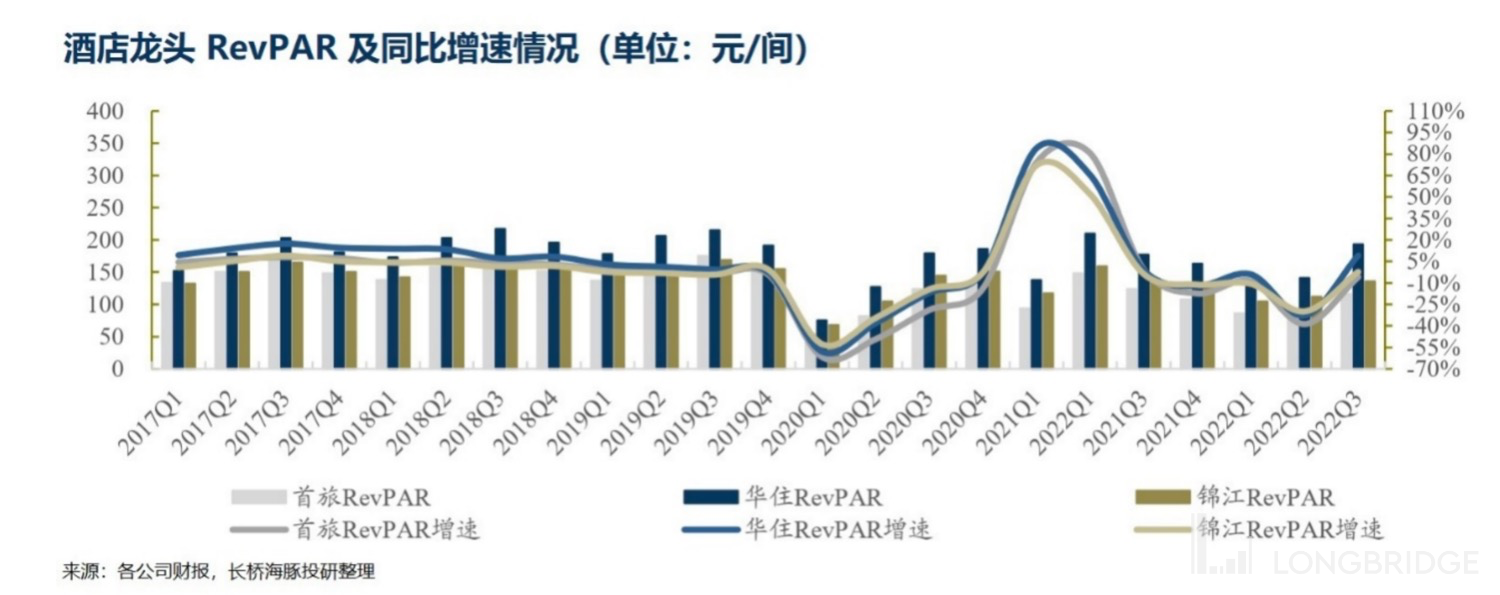

In terms of the mixed average rental room income, in the third quarter of 2022, the RevPAR has reached RMB 193, an increase of 9.04% compared with RMB 177 in the third quarter of 2021. However, compared with RMB 215 in the third quarter of 2019, it has decreased by 10.23%. From the overall industry situation, the prosperity in the third quarter has declined after the peak season in the summer. In addition to the sporadic outbreaks of the epidemic in the fourth quarter, the hotel business situation in the fourth quarter should not be overly optimistic.

Jin Hu, CEO of Huazhu, said that thanks to the pent-up demand for leisure travel during July and August, as well as the gradually recovering business travel in late September, the group's RevPAR in the third quarter of 2022 had recovered to 90% of the level in 2019. However, since early October, the multi-point outbreak of the epidemic has slowed down the group’s RevPAR recovery speed to 74% of the level in 2019. Therefore, the group still maintains a cautious attitude towards the recent business recovery situation.

For all Legacy-Hauzhu hotels that have been in operation for more than 18 months, the RevPAR in the third quarter of 2022 was RMB 190, an increase of 3.9% compared to RMB 183 in the third quarter of 2021. However, the ADR has decreased by 0.2% and the Occ has increased by 3.0pct. Compared with the third quarter of 2019 before the epidemic, the RevPAR in the third quarter of 2022 has decreased by 21.6% compared to RMB 230 in the third quarter of 2019, and the daily room rate and occupancy rate have decreased by 6.9% and 14.4pct, respectively. The improvement in the operation of existing hotels will be slightly slower, and consumers' preference for new hotels seems to be more apparent.

IV. Overseas recovery

In the third quarter, the Legacy-DH business continued to improve, and the RevPAR has recovered to 102% of the level in 2019 (recovered to 93% in the second quarter), mainly due to the impact of ADR growth of 17%. The group also indicated that ADR will continue to grow in October, but due to the change in the external situation in Europe at the beginning of the year, against the backdrop of the energy shortage causing inflation to soar, the group prioritizes the improvement of cash flow. In the future, Legacy-DH will continue to focus on improving efficiency and implementing cost optimization. Section 5. Continued Recovery of EBITDA

In Q3 2022, the adjusted EBITDA reached RMB 491 million, a YoY increase of 16.40%. The QoQ change was also significant (only RMB 53 million in Q2), mainly due to the recovery of revenue. The company's operating profit reached RMB 500 million, and the fluctuations in sales and management expenses were relatively normal, with a decrease of 0.94pct in sales expense rate and 1.12pct in management expense rate.

However, due to the impact of share-based incentives, fair value fluctuations of holding Accor Hotels' shares, and exchange losses, the net profit of the group in Q3 was only -RMB 703 million, and the net profit attributable to the parent was only -RMB 710 million. Among them, share-based incentives expenses were RMB 29 million, fair value change losses were RMB 313 million, and exchange losses were RMB 359 million, which had a relatively large impact on the net profit attributable to the parent.

Dolphin Analyst's historical articles on Huazhu Group-S:

Earnings Call

Mar 24, 2022 Conference Call "Focus on Lean Growth: Minutes of Huazhu Group's Q4 Conference Call"

Mar 23, 2022 "Huazhu: A Long Way to Recovery in the Fluctuating Pandemic"

Nov 25, 2021 Conference Call "How did Huazhu Reform under the Fluctuating Pandemic? (Minutes of Huazhu Conference Call)"

Nov 25, 2021 "Huazhu: Trying Hard to Survive"

In-depth

Oct 19, 2021 "Valuation Stubbornly High, Is Huazhu Really Reliable?"

Oct 11, 2021 "Huazhu Group (Part I): Rising of Domestic Brands in the Hotel Industry"

Risk Disclosure and Statement of this article: Dolphin Analyst's Disclaimer and General Disclosure