iQIYI: Mediocre performance with hidden concerns? The only advantage lies in cost-effectiveness.

$ iQIYI.US @ Earnings Report # Crazy Earnings Season

iQIYI released its second-quarter earnings report before the US stock market opened on August 12th:

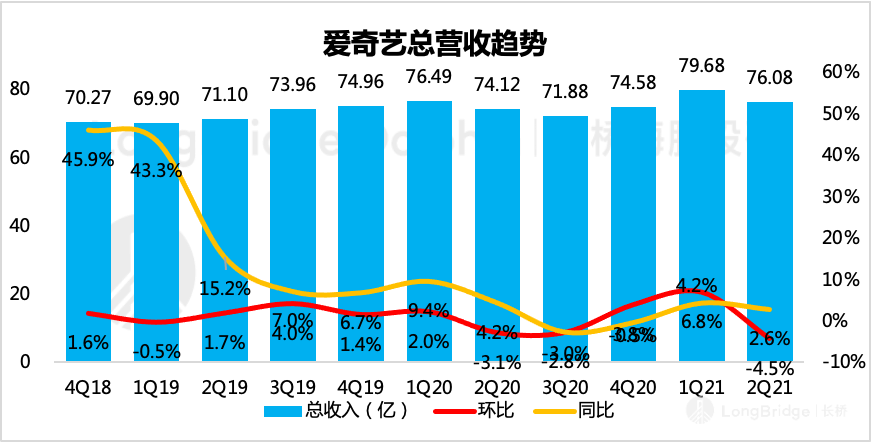

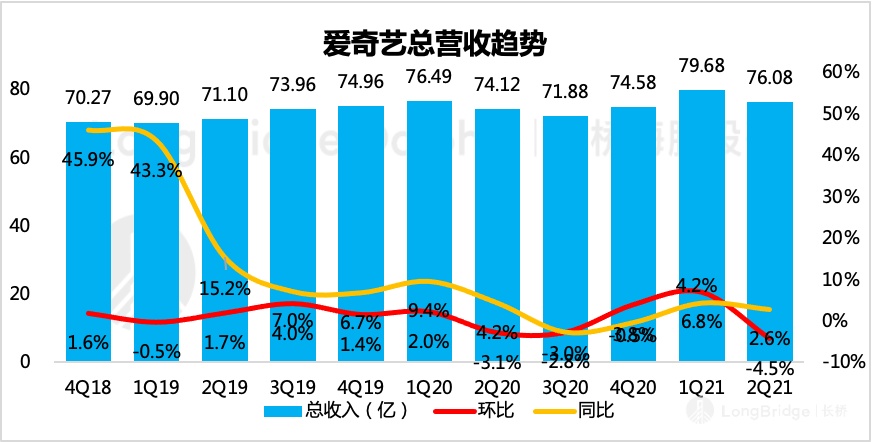

(1) The company achieved a total revenue of RMB 7.6 billion this quarter, a year-on-year increase of 2.6%. It slightly exceeded the market's consensus expectation of RMB 7.47 billion and fell within the company's guidance range for the previous quarter (RMB 7.25-7.65 billion). In the third quarter, during the summer peak season, with a low base from last year, the revenue guidance growth rate is 6% to 12%. However, compared to market expectations, it is slightly conservative. Bloomberg's consensus expectation for third-quarter revenue is RMB 8.03 billion, which is close to the upper limit of the guidance.

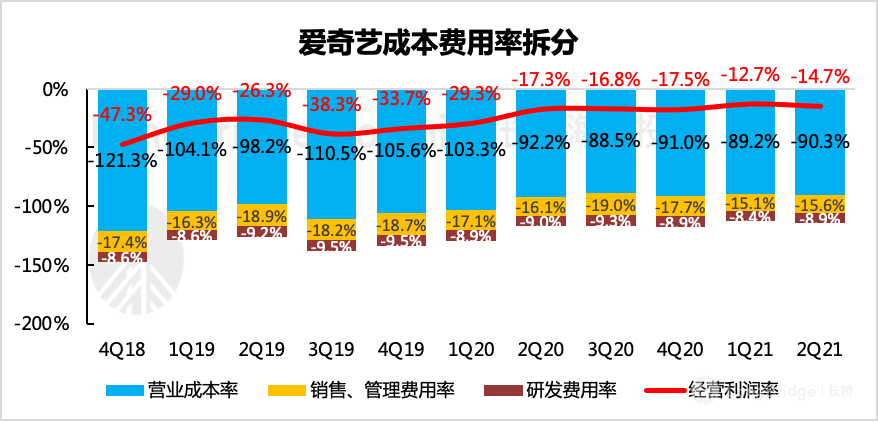

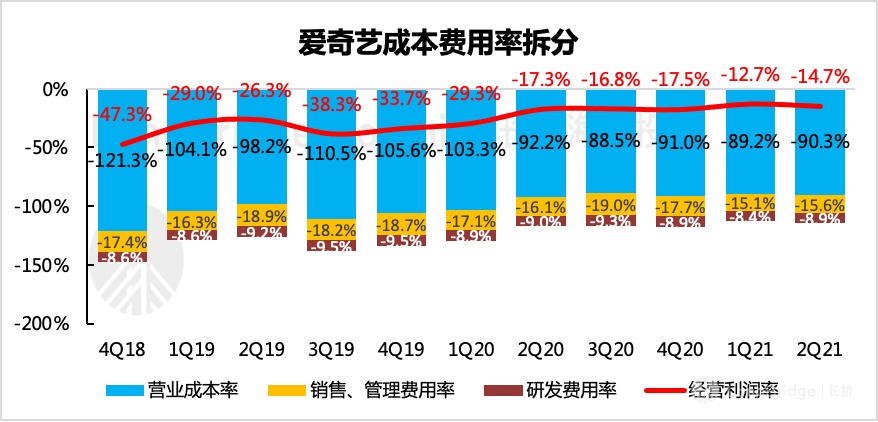

(2) In terms of operating losses, although the MoM loss continued to expand, it was better than market expectations. The operating loss in the first quarter was RMB 1.12 billion, a year-on-year decrease of 12.5%, mainly due to increased server costs and operating expenses. The MoM operating loss rate increased to 14.7%, significantly better than the market's expected 18%.

Overall, the second quarter is a slow season for long videos, and iQIYI's development is stable. However, the third quarter, which was originally the "peak season" for sales, may experience a slight cooling in performance compared to previous forecasts due to the consecutive introduction of education regulation, app advertising regulation, internet content regulation policies, and the outstanding performance of competitors in the long video industry.

In addition, Chinese concept stocks are generally affected by the supervision of the US Securities and Exchange Commission and the risk of foreign capital selling off. Especially for iQIYI, whose free cash flow has not shown significant improvement in the short term, the impact on trading needs to be taken seriously.

From Dolphin Research's long-term value judgment on the company, the current stock price is not high, basically corresponding to the bottom range of historical valuation (corresponding to only 1.6 times PS based on the 2021 performance expectations). Considering that many high-quality content will be launched in the fourth quarter, it is advisable to enter at an appropriate price after the short-term regulatory risks gradually dissipate.

On other key operating indicators:

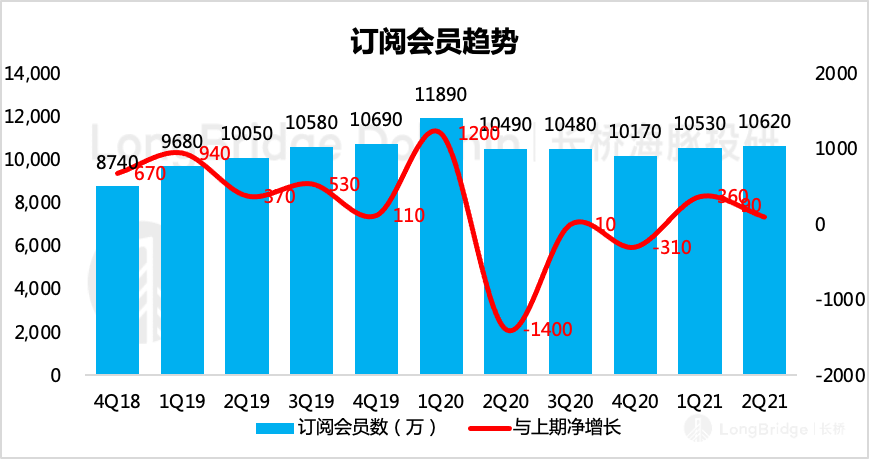

1. Steady growth of members in the off-season, slightly lower than market expectations

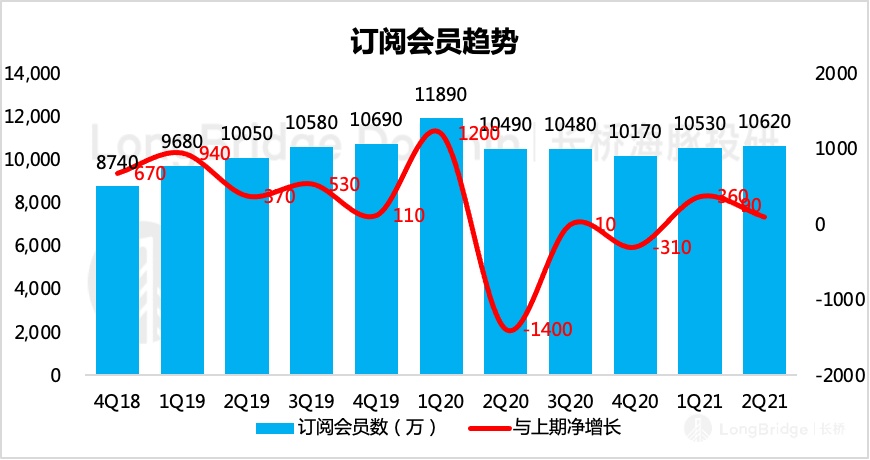

Do you remember the impressive growth of iQIYI's members in the first quarter? Although there were also some popular dramas in the second quarter, such as "The Rebel," "Falling in Love with Special Forces," and "Little Accomplishments" that gained popularity due to the "double reduction in education" trend, the increase in users was slightly lower than the expectations of major banks and Dolphin Research (+1.1-1.5 million). The net increase in members was 900,000, and the overall membership reached 106.2 million at the end of the quarter.

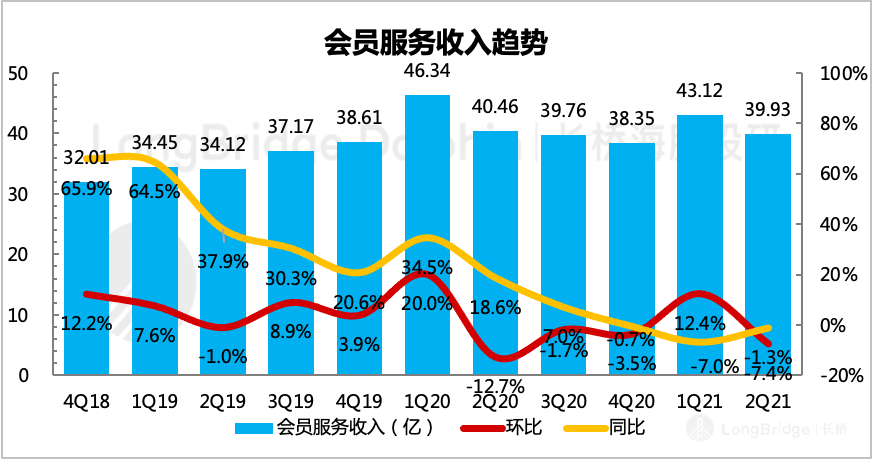

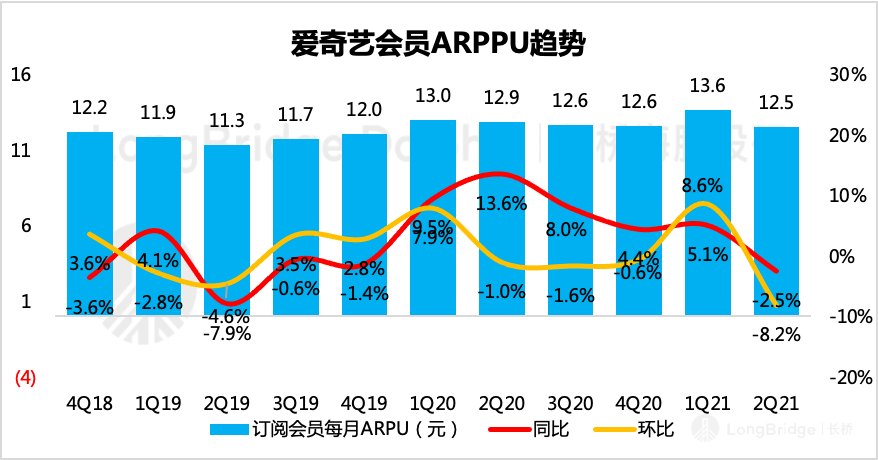

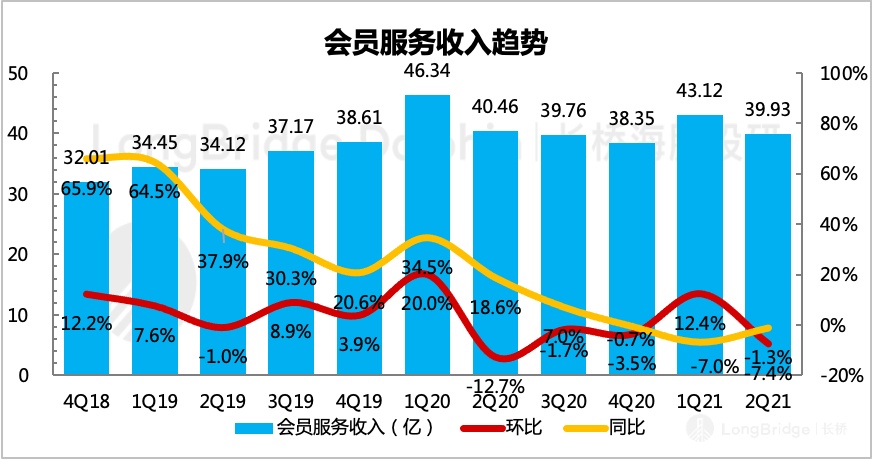

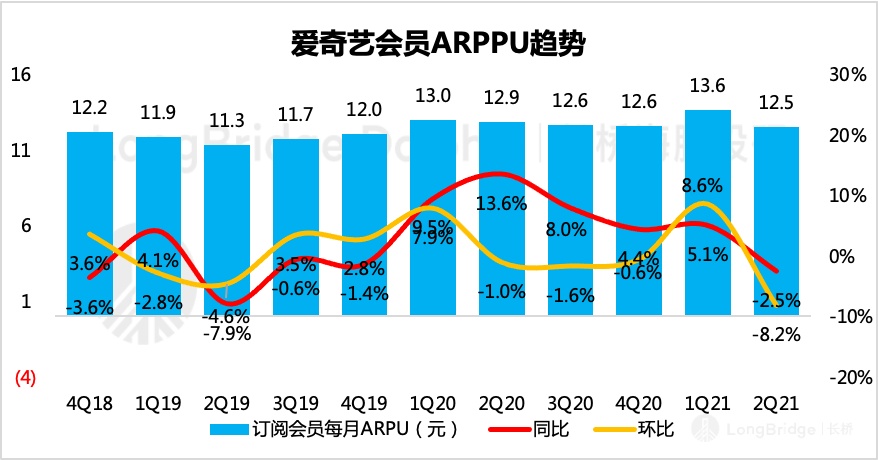

Possibly influenced by promotional activities, the ARPU of members declined MoM this quarter, offsetting some of the growth in members. The overall subscription revenue was RMB 4 billion, a year-on-year decrease of 1.3%. Looking ahead to the third quarter, although it is the peak season for summer vacations, the performance of competitors in the industry has been good based on the current viewership data, especially Tencent Video, which may put some pressure on iQIYI's membership growth in the third quarter.

- Advertising continues to recover, but be cautious about the impact of regulatory environment on the effectiveness of recovery.

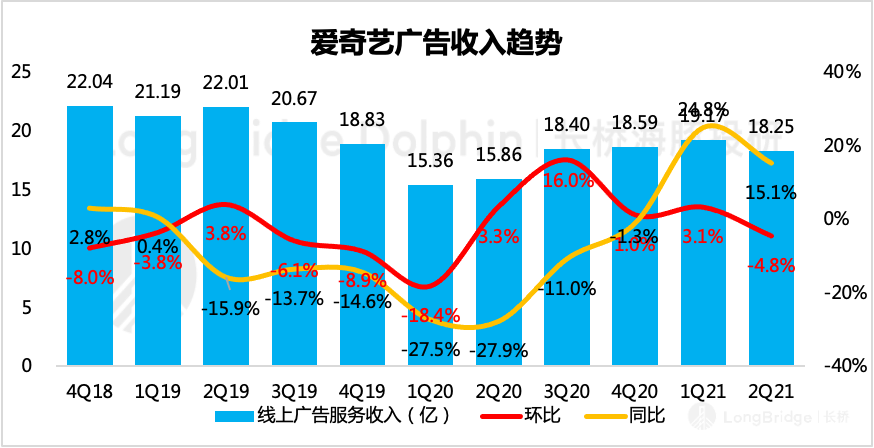

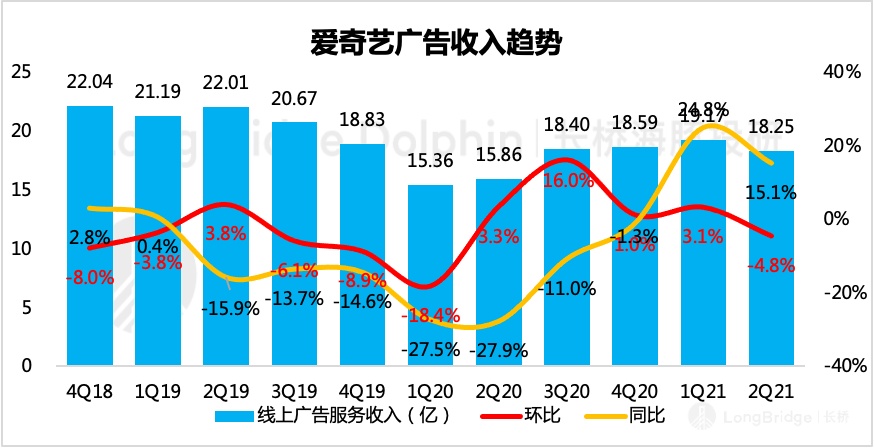

Benefiting from the economic recovery, the progress of content production, supply, and scheduling in the film and television industry has caught up one after another. Regardless, advertisers' willingness to invest has rebounded compared to the same period last year. In the second quarter, iQIYI achieved advertising revenue of CNY 1.8 billion, a year-on-year increase of 15%.

However, due to the lack of educational advertisements and the continued strengthening of Internet advertising regulation guidance by the Ministry of Industry and Information Technology, Dolphin Research will adjust its optimistic expectations for advertising growth in the second half of the year.

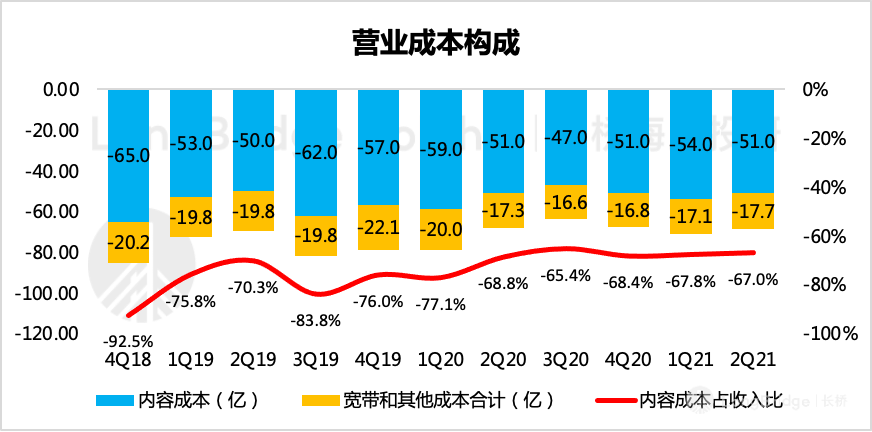

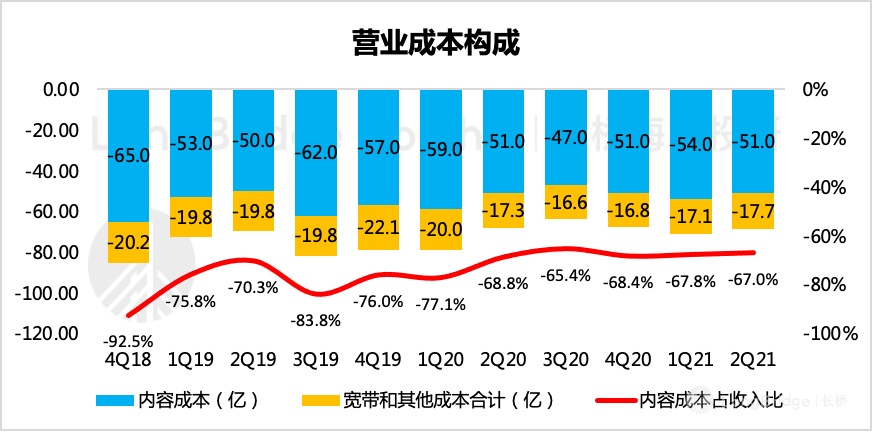

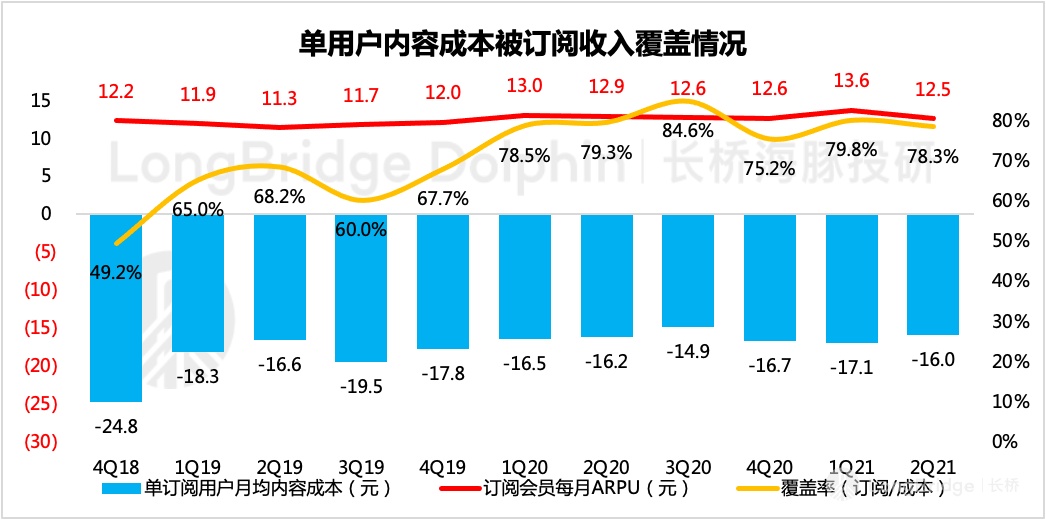

- Continuous optimization of content cost ratio, with an increase in research and development expenses compared to the same period last year.

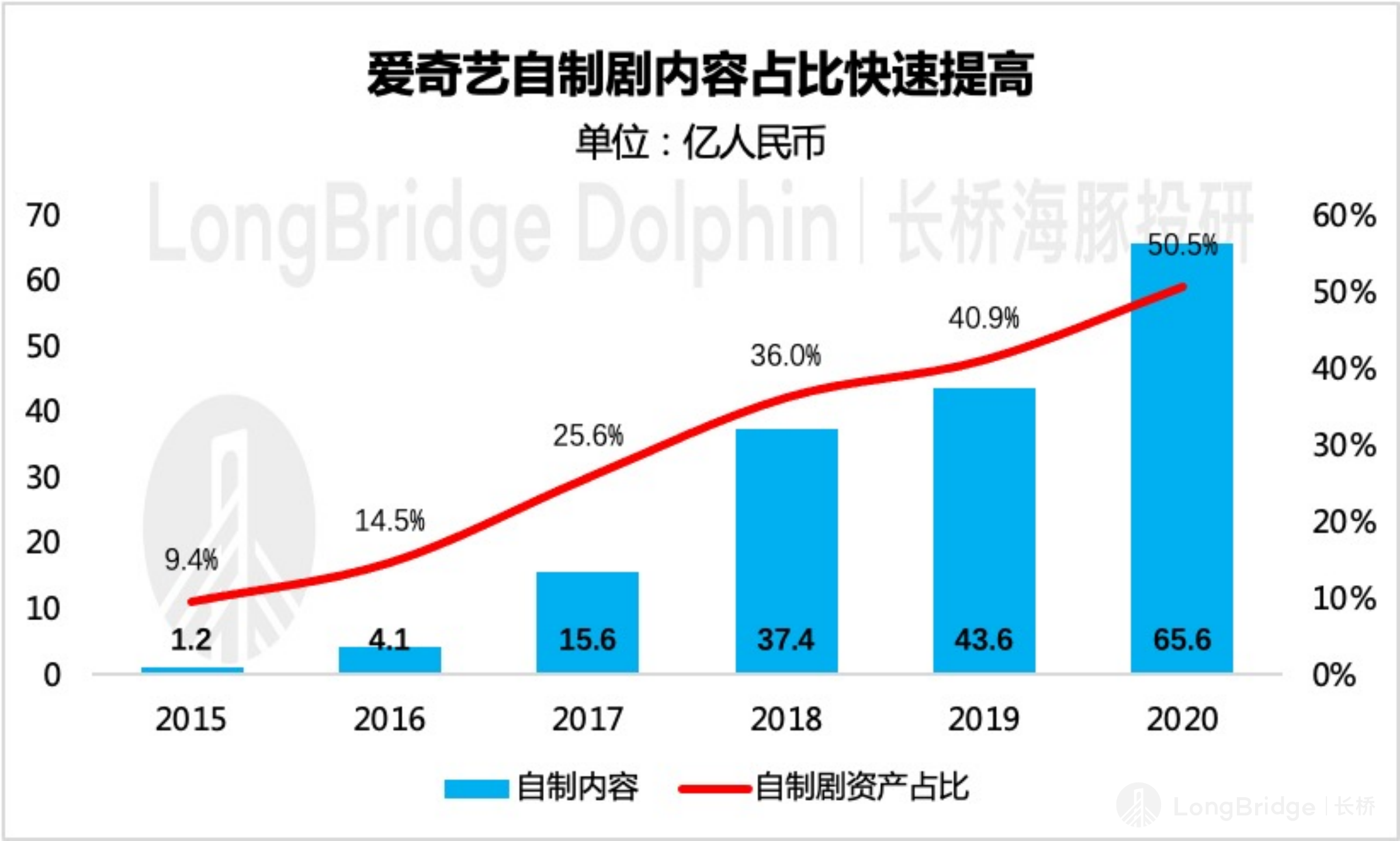

The content cost ratio continues to improve due to the increase in the proportion of self-produced content. The overall content cost in the second quarter remained the same as the previous period, but the content cost ratio continued to decrease on a MoM basis, showing a positive trend.

Sales and management expenses remained basically the same as last year at CNY 1.185 billion, a decrease of less than 1% YoY, while research and development expenses increased by 2%. Dolphin Research expects that the increase in research and development expenses may be due to iQIYI's increased investment in intelligent film and television production. From iQIYI's 2B strategy, it is expected that research and development expenses may continue to increase in the future.

Specific content of this earnings report analysis:

- Overall performance: slightly better than market expectations, adjustment of performance expectations needed due to regulatory pressure in the education sector in the second half of the year.

(1) Revenue:

Total revenue in this quarter reached CNY 7.6 billion, a year-on-year increase of 2.6%. The revenue slightly exceeded the market's expectation of CNY 7.5 billion, but it basically fell within the upper limit of the company's previous guidance.

The management's revenue guidance for the third quarter of 2021 is in the range of CNY 7.65-8.05 billion, with a year-on-year growth of 6%/12% respectively. However, the base of the same period last year was relatively low, so this guidance is still relatively conservative, especially considering that the market's consensus expectation is CNY 8.03 billion, which is close to the upper limit of the management's guidance. From a historical perspective, compared to market expectations, this guidance is not particularly optimistic.

Data source: iQIYI Earnings Report, Dolphin Research

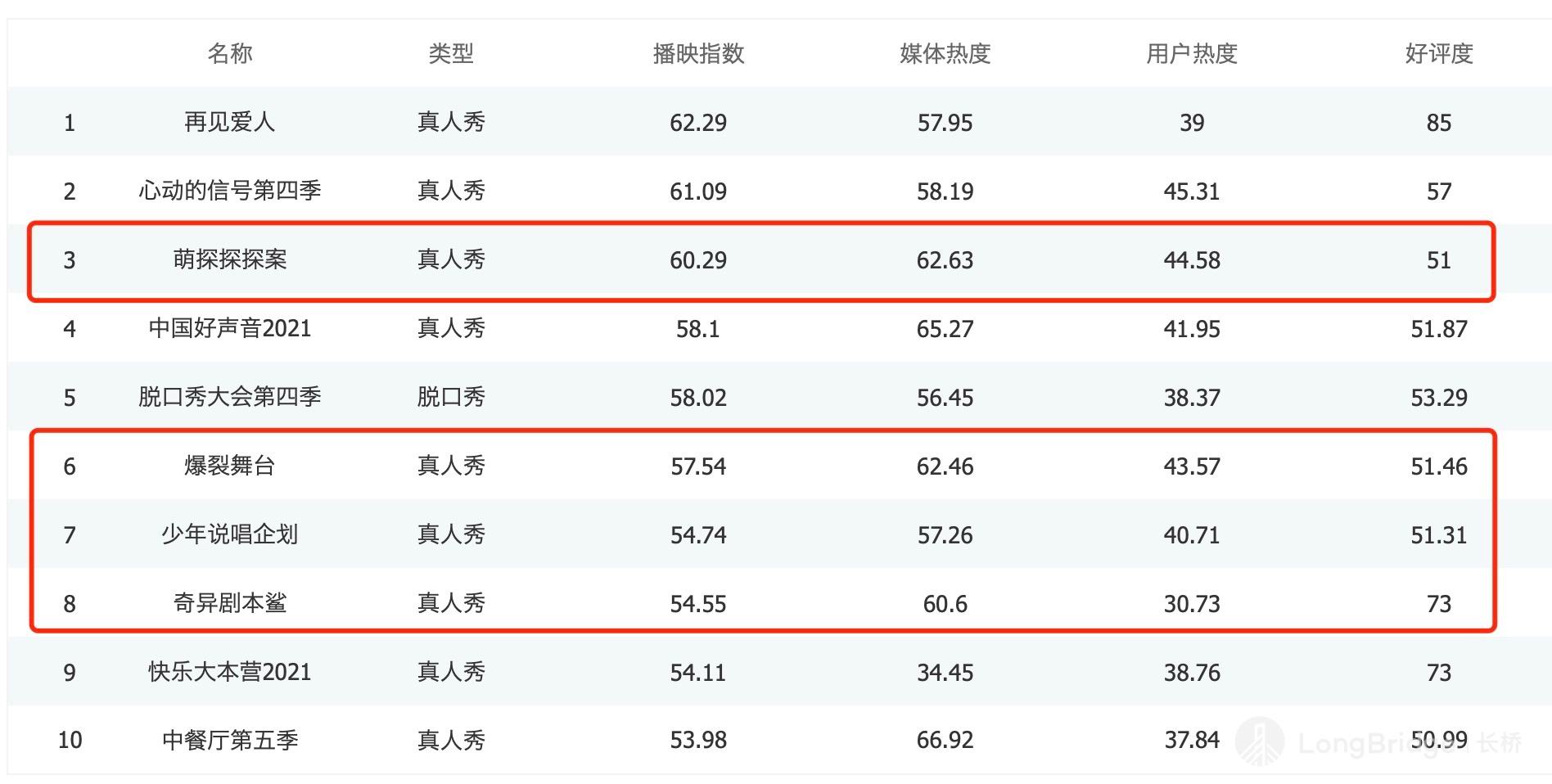

For long video platforms, adjustments in film and television scheduling are an unavoidable risk, especially for popular films and variety shows that have received high attention in the market. In the second quarter, iQIYI had delays in the release of many originally planned content, such as the mystery series "Meng Tan Tan Tan An", "Strange Script Shark", "Explosive Stage", and the TV drama "North-South Diversion", which were all postponed until the end of the second quarter or even the beginning of the third quarter. Dolphin Research speculates that the reason for the decline in the release of films on iQIYI in the first and second quarters is due to the strict regulation of the education industry, which has essentially cut off the source of education-related advertising sponsorships for TV dramas. In order to attract other advertisers to fill the sponsorship slots, the platform needs to carry out new promotional activities, which in turn affects the release of films.

In addition, the adjustment of film schedules also affects revenue from content distribution.

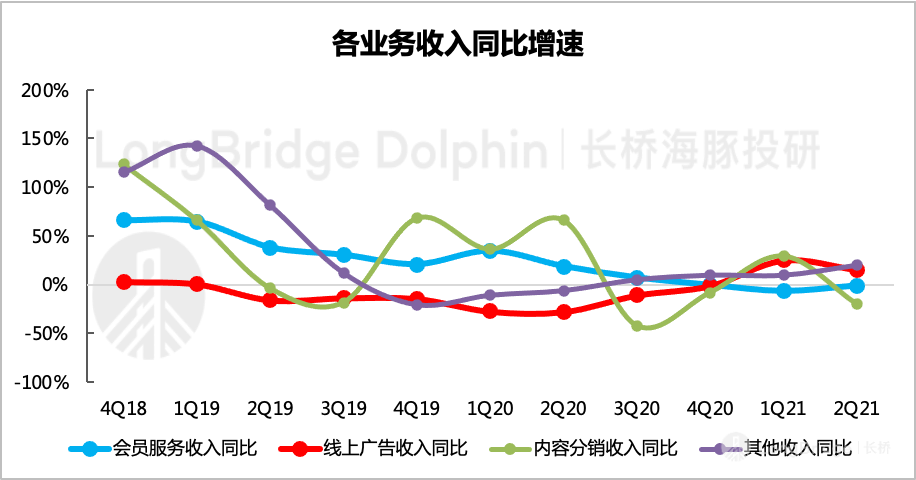

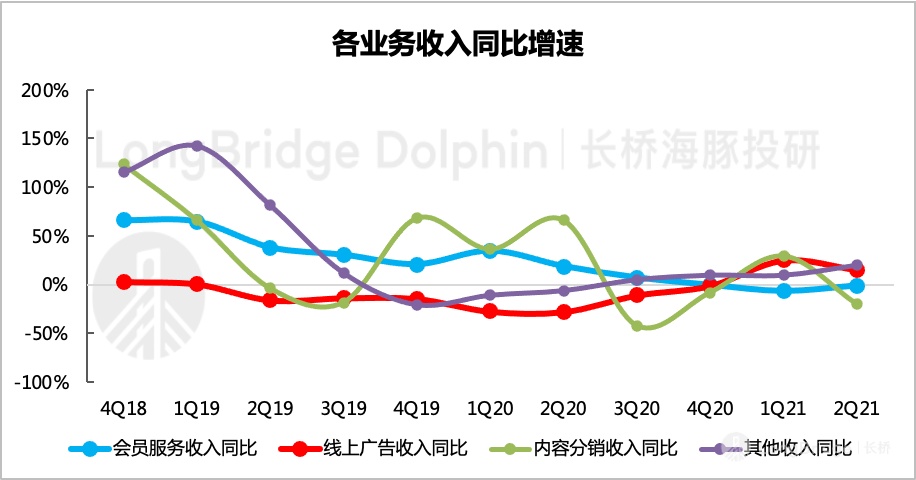

This can also be seen from the growth situation after the business split. In the second quarter, despite the low base of last year, both advertising revenue and content distribution revenue still showed a year-on-year decline.

Data source: iQIYI earnings report, Dolphin Research compilation

(2) Profitability

iQIYI's content cost ratio continues to improve due to the increasing proportion of self-produced content. In the second quarter, the overall content costs remained the same as the previous period, but the content cost ratio continued to decrease compared to the previous quarter. Broadband and other costs in the second quarter increased compared to the same period last year, resulting in a total cost of 6.9 billion, which is nearly 1 percentage point higher than the previous quarter in terms of revenue share.

Data source: iQIYI earnings report, Dolphin Research compilation

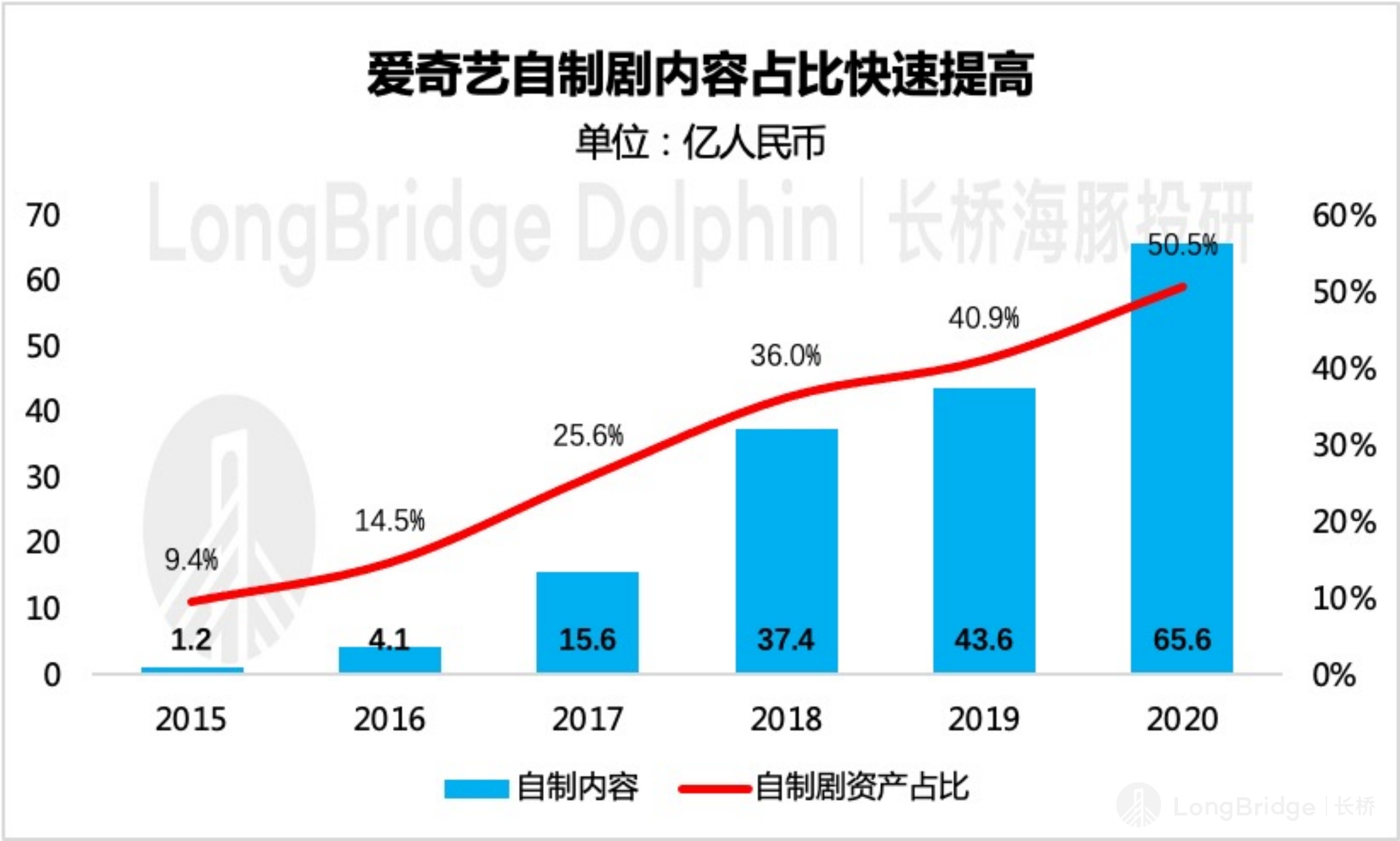

Currently, iQIYI's self-produced drama assets account for 50% of its content. In the 2021 World Conference held in May, nearly 200 works were announced, of which nearly 60% were self-produced content. CEO Gong Yu stated that the company's goal in the next one to two years is to increase the proportion of top self-produced dramas to 60% to 70%.

Data source: iQIYI earnings report, Dolphin Research compilation

On the expense side, sales and management expenses remained basically the same as last year, at 1.185 billion, a decrease of less than 1% year-on-year, while research and development expenses increased by 2%.

Considering the new strategy proposed at the iQIYI World Conference, Dolphin Research predicts that the increase in research and development expenses may be due to iQIYI's increased investment in intelligent film production.

At the iQIYI World Conference, the management pointed out that in the future, they will promote the industrialization of the film and television industry through the development of intelligent production tools and co-production of films with suppliers in the industry chain. The ToB intelligent production tools and solutions will help iQIYI open up new business growth models. Of course, this is a long-term logic that needs continuous confirmation, and in the short term, iQIYI's performance is still mainly driven by high-quality content. In the second quarter, the MoM expense ratio slightly increased. Based on historical development experience, expenses in the second quarter tend to expand compared to the first quarter. Dolphin Research speculates that considering the peak season in the third quarter, the platform will conduct marketing activities one quarter in advance. However, at this time, there is no subscription and advertising revenue from film and television works, so the sales expense ratio in the second quarter will be relatively high.

Data source: iQIYI earnings report, Dolphin Research compilation

2. Subscription Members: Steady user growth, outstanding performance in the third quarter may increase growth pressure

In the first quarter, driven by the hit drama "The Blooms at Ruyi Pavilion," there was a net increase of 3.6 million subscription members, which surprised the market when the financial report was released. Although there were also some popular dramas in the second quarter, such as "The Rebel," "Falling in Love with Special Forces," and "Little Accomplishments" that rode the wave of "reducing education burden," they generated high discussion on Weibo and frequently trended.

However, due to sufficient screening volume, the user growth in the second quarter was slightly lower than the expectations of major institutions and Dolphin Research (+1.1-1.5 million), with a net increase of only 900,000 members. The overall membership reached 106.2 million at the end of the quarter.

Data source: iQIYI earnings report, Dolphin Research compilation

Data source: iQIYI earnings report, Dolphin Research compilation

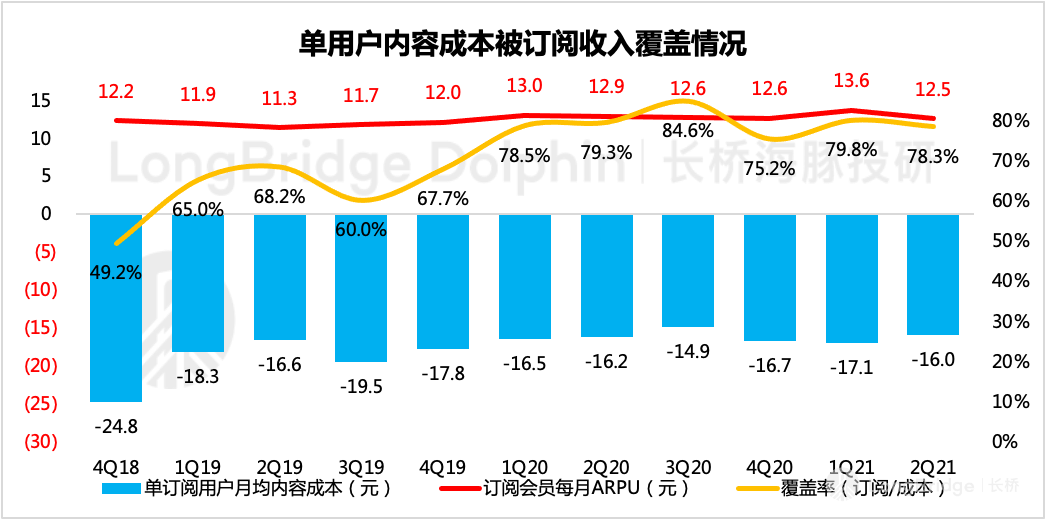

Furthermore, the ARPU per member decreased slightly QoQ in the second quarter, which may be related to the numerous iQIYI membership promotions and joint membership activities during that period. As the decrease in ARPU per user exceeded the optimization effect of content costs, the improvement in subscription revenue covering costs did not materialize as expected in the second quarter. However, occasional short-term disturbances cannot be ruled out.

However, based on the current situation in the third quarter, iQIYI's membership promotion activities are still ongoing, and the market's expectation of simultaneous increase in quantity and price in the first quarter may need to be adjusted.

Data source: iQIYI earnings report, Dolphin Research compilation

Source: iQIYI Earnings Report, Dolphin Research Compilation

Source: iQIYI Earnings Report, Dolphin Research Compilation

It is worth mentioning that the peak season of the summer vacation in the third quarter is already halfway through. From the performance of TV dramas and variety shows on various platforms, Tencent Video stands out. Although the Wu Yifan incident affected the scheduled broadcast of the popular drama "The Long Ballad," the highly anticipated dramas "You Are My Glory" and "Storm Eye" have achieved remarkable results.

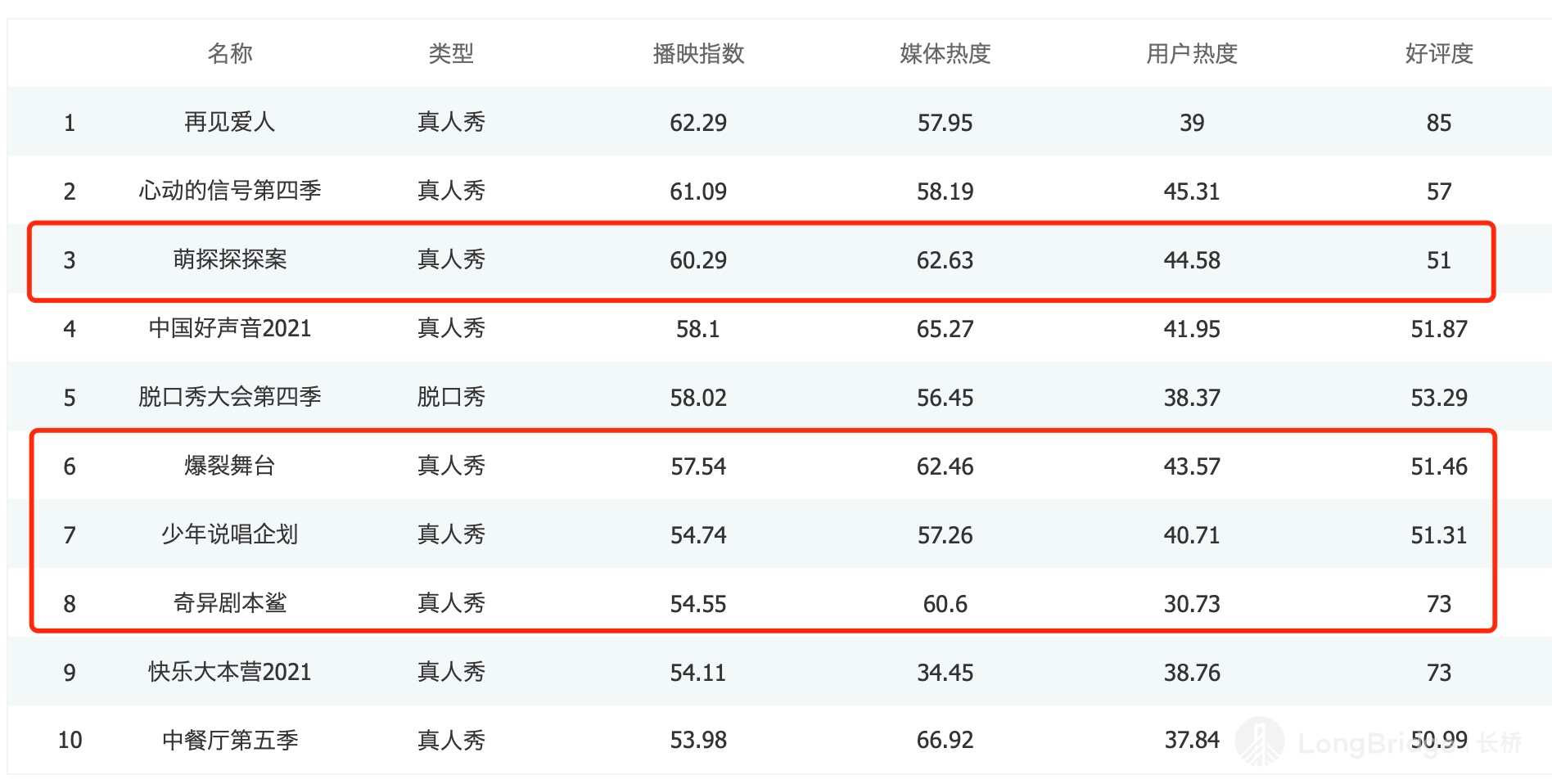

In terms of variety shows, the popular shows that were originally scheduled to air in the second quarter were broadcasted in the third quarter. According to the popularity rankings, iQIYI is relatively leading, but the advantage is not significantly widened, with Mango TV and Tencent Video closely following.

Therefore, in addition to the pressure from the industry's overall environment, the competition among peers remains intense.

Image source: Guduo Film and Television

Image source: Ent Group Data

3. Online Advertising: "Economic Recovery + Increased Screenings YoY" Continues to Recover, Beware of Cooling Advertising Environment due to Regulatory Measures

Benefiting from the economic recovery, the progress of content production, supply, and scheduling in the film and television industry has caught up. Regardless, the advertising demand from advertisers has rebounded compared to the same period last year. In the second quarter, iQIYI achieved advertising revenue of CNY 1.8 billion, a YoY growth of 15%, which is basically within market expectations, mainly due to the recovery of brand advertising.

Data source: iQIYI Earnings Report, Dolphin Research Compilation

However, due to the restrictions on app advertising by education regulators and the Ministry of Industry and Information Technology, as well as the delay in iQIYI's variety shows, the market has already lowered its expectations. Therefore, the performance of advertising revenue in the second quarter can only be described as not disappointing. But for the second half of this year:

(1) Considering that this year is a special year for party building, content regulation has not been significantly relaxed, which affects film review and platform scheduling.

(2) The absence of educational advertisements, which used to occupy a considerable share.

(3) Restrictions on app advertising by the Ministry of Industry and Information Technology.

(4) Advertisers are cautious due to the impact of regulatory environment.

Based on the above short-term risk factors, Dolphin Research will make certain adjustments to its originally optimistic expectations for advertising revenue this year.

Finally, here is a summary of iQIYI's high-quality content reserves for the second half of 2021. Dolphin Research has marked the highly anticipated dramas.

Dolphin Research [iQIYI] Historical Report Review

Dolphin Research [iQIYI] Historical Report Review

Earnings Season

May 19, 2021 Conference Call: "iQIYI Q1 Conference Call Summary: What Future Moves Will Follow the Recovery?"

May 18, 2021 Earnings Review: "Dolphin Research | iQIYI Finally Recovers, Discussing Rebirth through Transformation?"

February 19, 2021 Conference Call: "Optimism for the Medium to Long Term, Content Quality over Quantity: iQIYI Conference Call"

February 18, 2021 Earnings Review: "Dolphin Research | User Base Continues to Decline, What's Next for iQIYI?"

Research

June 1, 2021: "Learning from History: Unraveling the Logic behind iQIYI's Version of Industrialization in the Film and Television Industry"

In-depth Analysis

April 13, 2021: "The Complicated Story of iQIYI and Netflix"

Live Broadcasts

May 18, 2021: "iQIYI (IQ.US) Q1 2021 Earnings Conference Call"

August 12, 2021: "iQIYI (IQ.US) Q2 2021 Earnings Conference Call"