The real estate market has come alive, can Beike take big strides again?

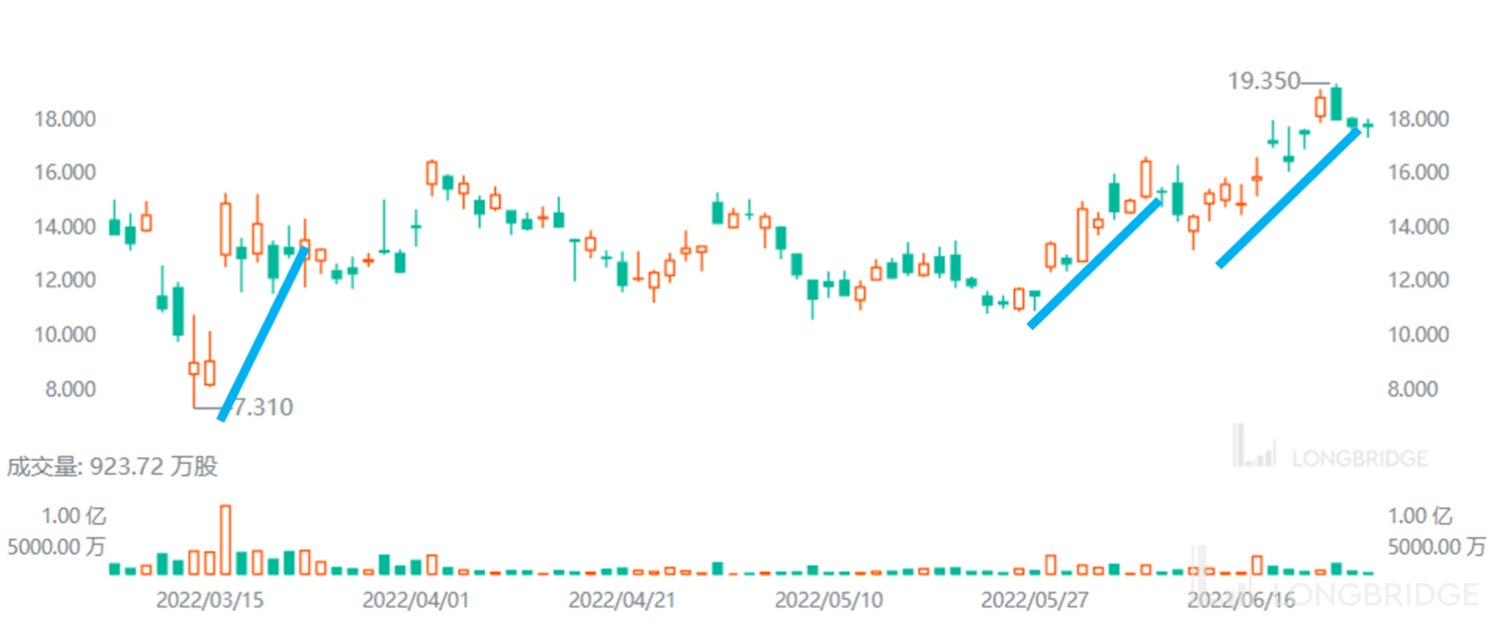

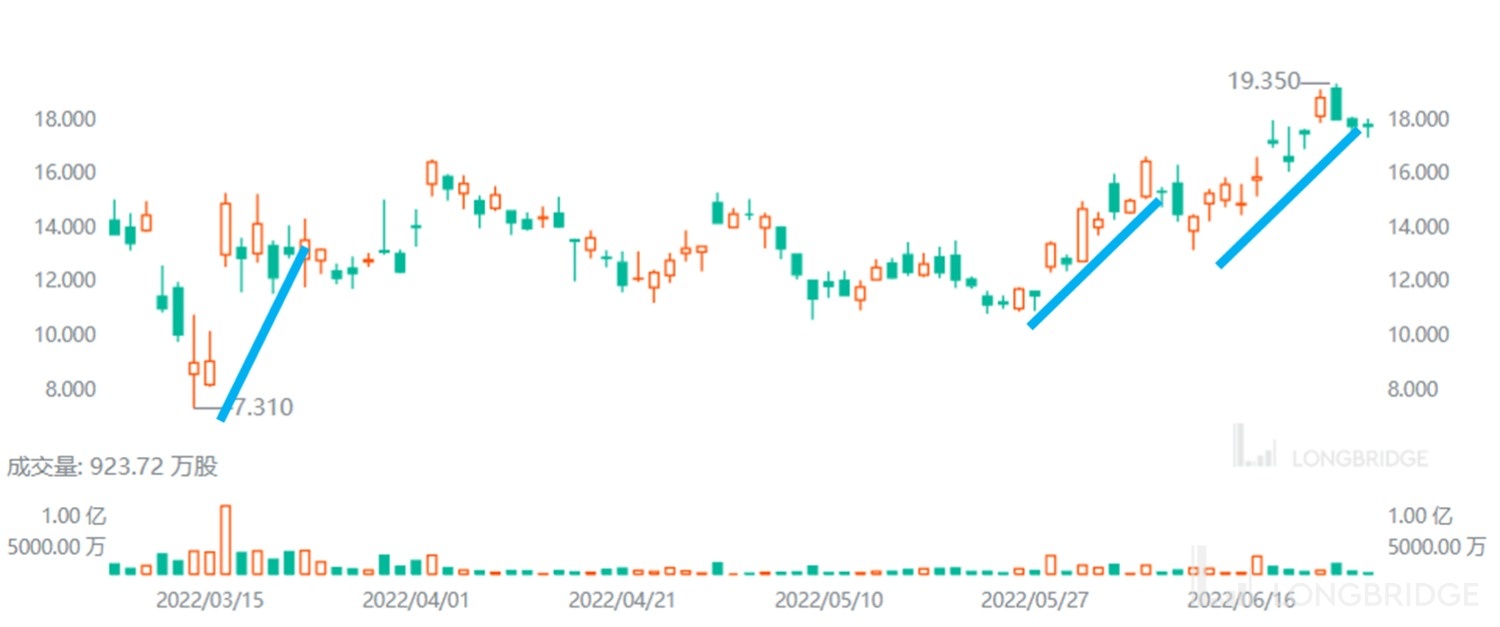

Since the "golden pit" caused by the suspicion of delisting of Chinese concept stocks in mid-March, Beike's stock price has rebounded from its lowest point of $7.3 to a high of $19.35, an increase of up to 165%. Specifically, the rise in Beike's stock price can be attributed to three main factors: first, the extreme pessimism and subsequent oversold rebound in the mid-March market under the risk of Chinese concept stock delisting; second, the announcement of the lifting of restrictions in Shanghai at the end of May, which allowed real estate transactions to resume and created anticipation of an early market recovery; third, the significant improvement in actual transaction data in some cities' real estate markets in mid-June, which began to fulfill market expectations.

Source: Longbridge Securities

At this point, Dolphin believes that there are two core issues that need attention: first, is the rebound in real estate transactions since late June temporary or trend-driven, and looking ahead to the full year of 2022 and beyond, can the scale of new and second-hand housing transactions continue to grow? Second, after the continuous rally since the end of May, does Beike's current stock price reasonably reflect its future performance potential, and does Beike still offer investment value?

This article will provide Dolphin's analysis and judgment on the above two core issues. The following is the detailed content.

Dolphin Research focuses on providing users with cross-market interpretations of global core assets, grasping deep value of enterprises and investment opportunities. Interested users can add the WeChat account "dolphinR123" to join the Dolphin Research community and discuss global asset investment perspectives together!

I. Post-pandemic surge in real estate transactions: revenge consumption or the return of the real estate market's spring?

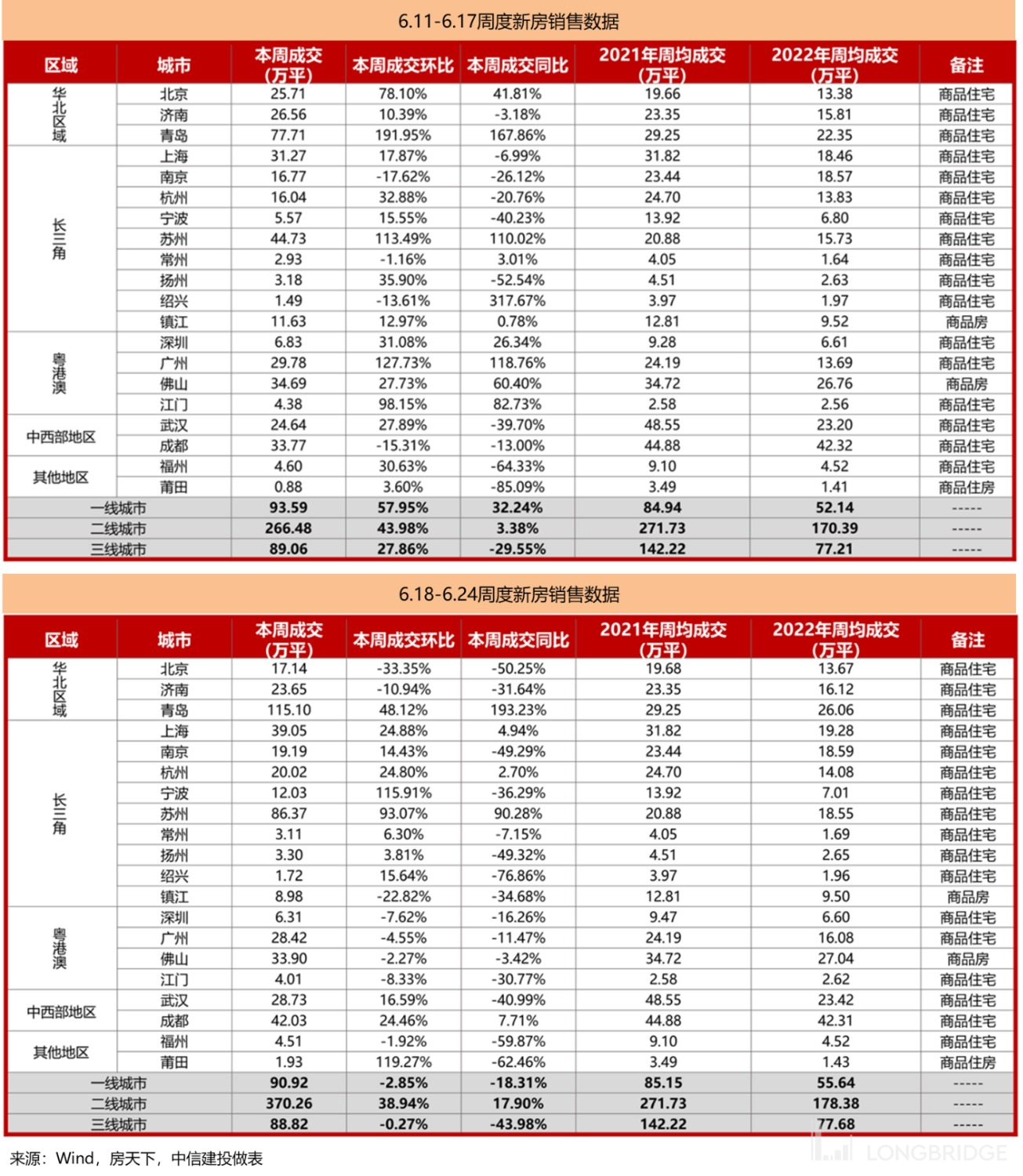

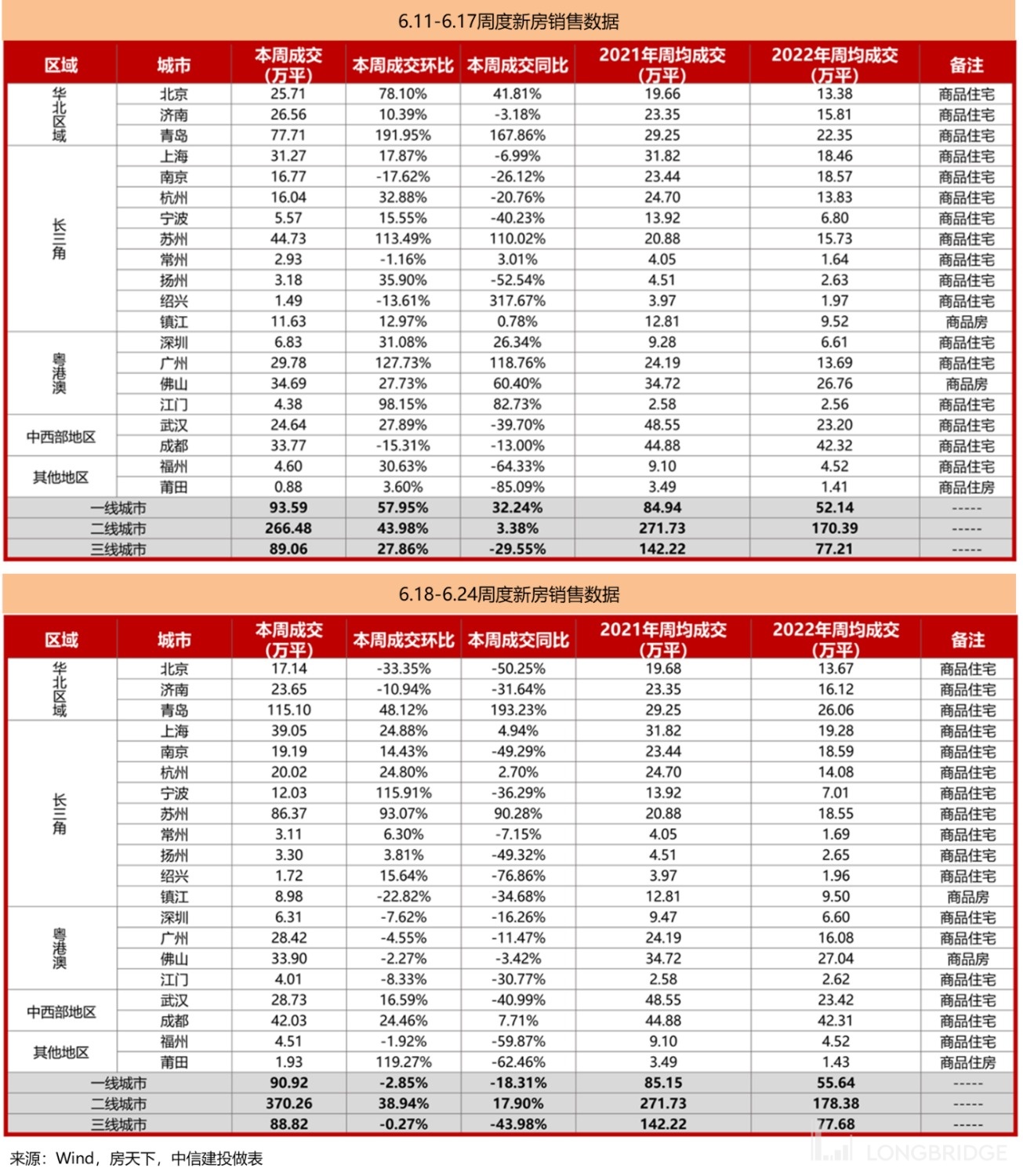

First of all, regarding Beike's strong rebound in stock price since mid-June (from a low of $13 to a high of $19), Dolphin believes that this is in line with the violent rebound in real estate market transactions since the second week of June. By observing the new housing transaction data for the weeks of June 11-17 and June 18-24 in the table below, we can see that first-tier and second-tier cities have experienced a rapid rebound in the real estate market after the pandemic, with transaction areas returning to positive year-on-year growth. In contrast, the rebound in third-tier cities has been relatively weak, with a year-on-year decline of around 30-40% compared to previous years. It can be seen that the housing demand in high-tier cities is much more resilient than in low-tier cities.

However, when these two hot transaction data were released, the "cautious" capital market had two concerns:

- In June 2021, the same period coincided with the Dragon Boat Festival, so the market was concerned that the sharp year-on-year increase in the past two weeks was due to the low base in the same period of the previous year. However, if we overlook the year-on-year performance and focus only on the absolute transaction volume, we can see that the new housing transaction area in first-tier and second-tier cities in the past two weeks has exceeded the weekly average of June 2021 and the annual average of 2021, indicating that the recent rebound in the real estate market is real and not solely due to the low base.

- During the period of epidemic control and lockdown, real estate transactions in cities such as Shanghai, Beijing, and Shenzhen were basically suspended. Therefore, the market was concerned that the current rebound in transactions was a result of pent-up demand being released after the epidemic period, and thus the rebound might not be sustainable. However, the impact of the epidemic was mainly on first-tier cities, while the strongest rebound this time occurred in second-tier cities, which were not subject to widespread lockdown measures.

Therefore, Dolphin believes that this rebound is mainly driven by a reversal of sentiment and various stimulating policies that have accumulated previously.

Overall, Dolphin believes that under the dual benefits of policy stimulus and the lifting of COVID-19 restrictions, the real estate market experienced a substantial rebound in transactions in late June. The market had high expectations following the shift in real estate policies, but there were concerns about the effectiveness of these policies. However, the "hot" transaction data in the past two weeks has validated the previous expectations. With expectations and data resonating, it is only natural for the stock prices of real estate-related companies such as Beike to rise.

However, despite the reasonable and well-founded rebound in the real estate market and stock prices, there are still two questions that need to be answered:

-

How long can the rebound in the real estate market last?

-

After a significant rebound, does Beike's stock price still have room to rise, or has it already priced in the expectations of a real estate rebound?

First, let's address the first question: How long can the recent strong performance of the real estate market continue?

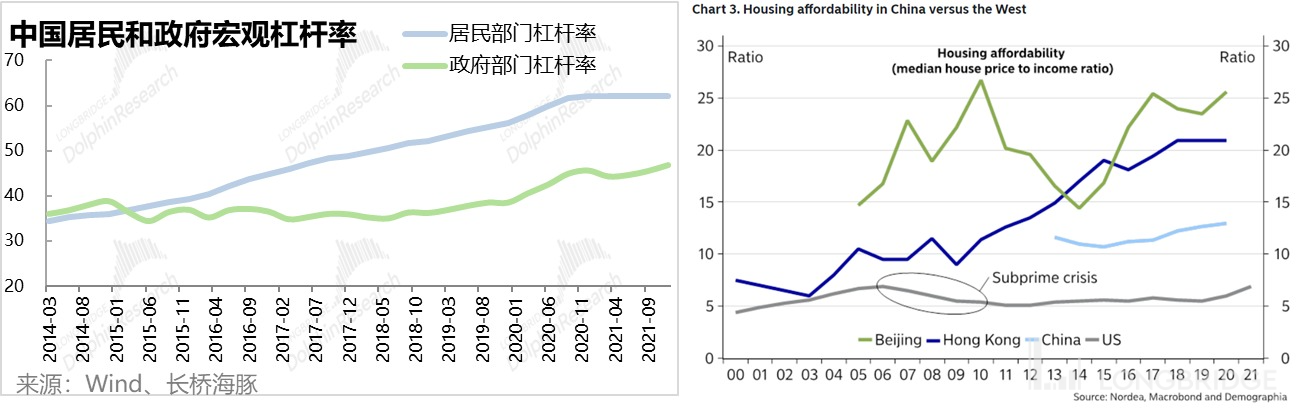

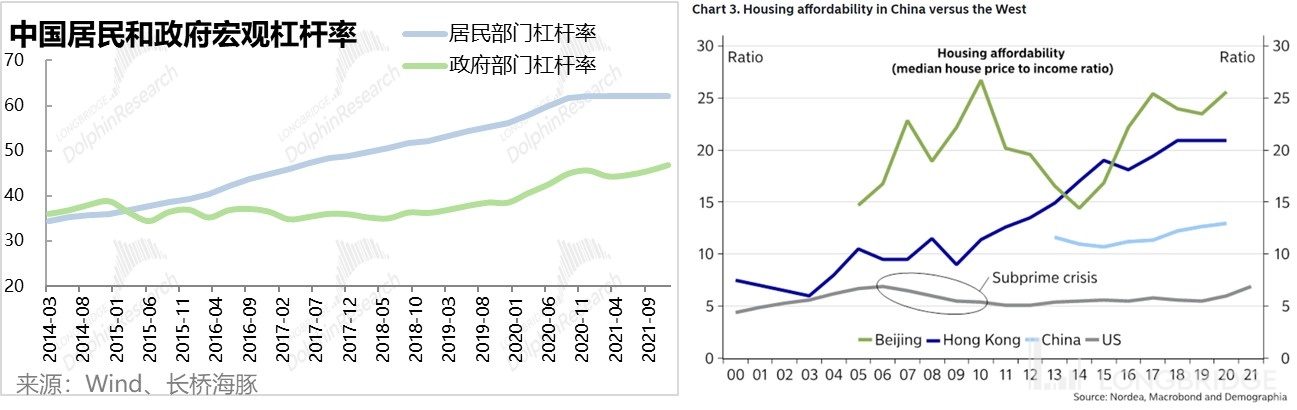

From a long-term perspective, considering our previous in-depth analysis, Dolphin believes that it is a consensus that housing demand will trend downward in the long run, given the slowing population growth and the nearing completion of the urbanization process in China.

From a medium-term perspective, whether the real estate market can continue to be hot largely depends on when or if the real estate policies will shift. Dolphin believes that the central government's attitude towards real estate is to "support without excessive stimulation." Due to the high household debt-to-income ratio and the high price-to-income ratio in China, the possibility of maintaining comprehensive and long-term stimulating real estate policies is low.

The recent policy relaxation is more due to the fact that the real estate market has been stagnant for a long time and there is downward pressure on the macroeconomy. The government is more concerned about avoiding systemic risks in the real estate market and stimulating economic consumption. Therefore, Dolphin believes that once the real estate market stabilizes, it is highly probable that the policies will shift back to a neutral stance rather than a stimulating one.

In fact, these judgments can also be inferred from recent policies. As shown in the figure below, a notable feature of this round of policy relaxation is that many of them have set expiration dates (highlighted in red). For example, the preferential housing loan and provident fund policies in Wenzhou will only last until the end of the third quarter of this year, the relaxation of home purchase restrictions in Wuhan will only be effective until the end of the year, and the housing ticket resettlement policy in Yixing is valid for only one year.

In other words, the government has made it clear in advance that the relaxation of certain policies in this round is temporary. Even if the government does not actively tighten policies, some stimulus measures will automatically become ineffective and return to the original principle of "housing is for living, not for speculation." Therefore, the duration of stimulus policies is likely to be negatively correlated with the recovery of the real estate market and the macro economy. Once the real estate market stabilizes, policies are likely to shift towards neutrality, and the long-term development of the real estate market still depends on the core factor of population mobility.

In other words, the government has made it clear in advance that the relaxation of certain policies in this round is temporary. Even if the government does not actively tighten policies, some stimulus measures will automatically become ineffective and return to the original principle of "housing is for living, not for speculation." Therefore, the duration of stimulus policies is likely to be negatively correlated with the recovery of the real estate market and the macro economy. Once the real estate market stabilizes, policies are likely to shift towards neutrality, and the long-term development of the real estate market still depends on the core factor of population mobility.

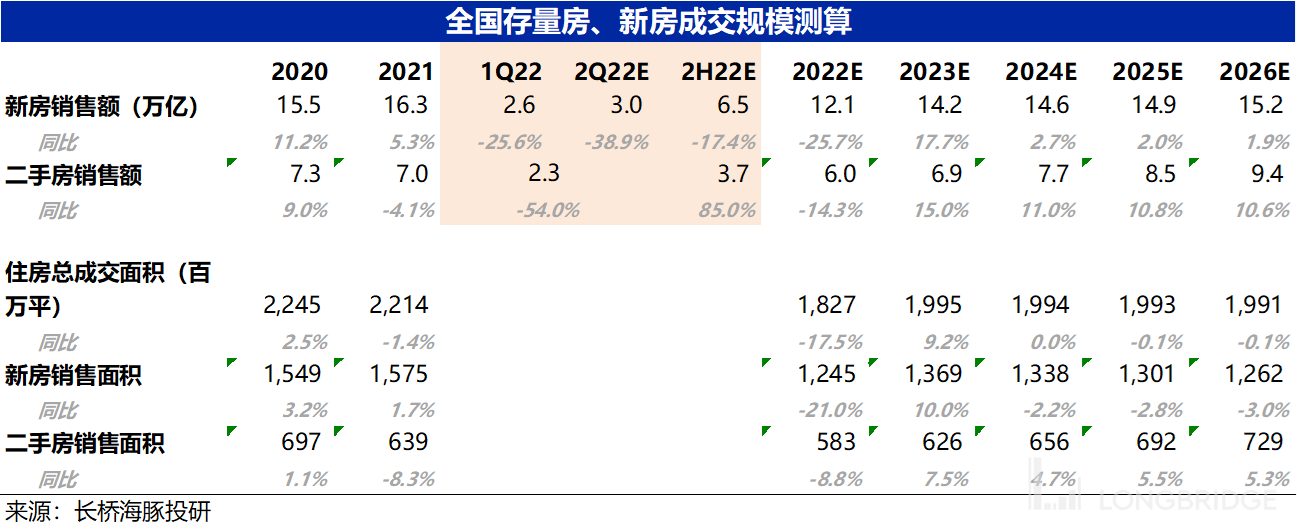

Based on the above judgments of the short-term and long-term prospects of the real estate market, we optimistically assume that in the second half of 2022, the transaction volume of new houses and existing houses will experience a violent rebound (with a year-on-year growth of over 80%). By 2023, when the market stabilizes, the overall transaction volume of first-hand and second-hand housing will rebound to around 21 trillion yuan, close to the level of 2021. After that, it will gradually return to a trend of slow decline in transaction area. The detailed forecast is as follows.

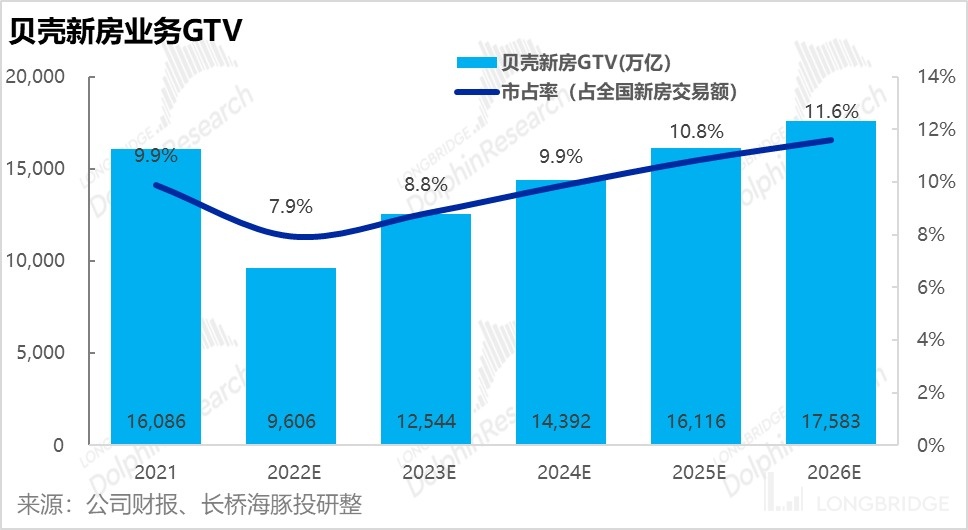

2. Can safety and growth coexist? How much room is there for Beike's new home sales business?

The ups and downs of the real estate market not only affect the scale of Beike's topline, but also influence the company's strategic choices. Against the backdrop of a sharp decline in housing transactions, as some highly leveraged private enterprises go bankrupt and clear out during the cold winter, state-owned real estate companies with more stable strategies and healthier balance sheets are gradually increasing their weight in both the real estate market and the land market. At the same time, since 2022, Beike has actively concentrated its cooperation with leading state-owned real estate companies in the new home sales business, considering the reliability of cooperation and payment guarantee from these companies.

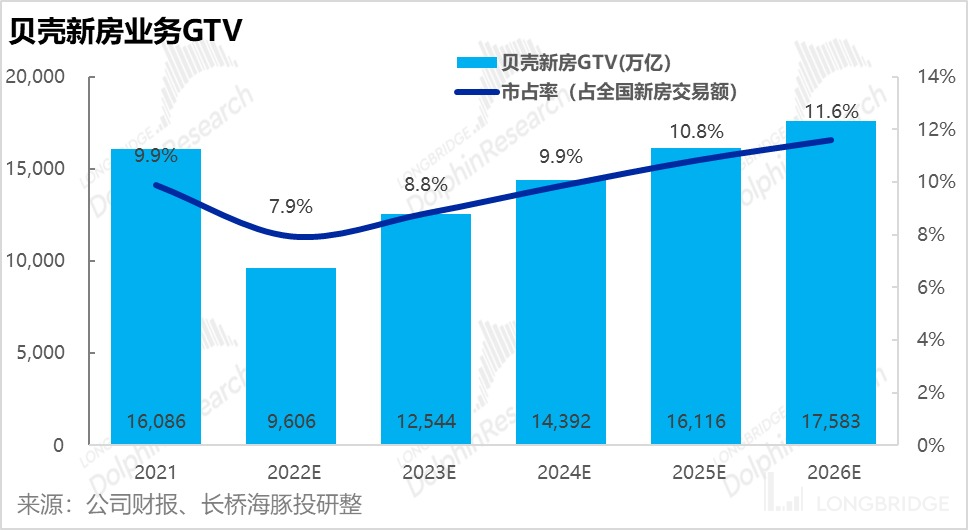

However, the selective cooperation with leading state-owned real estate companies comes at the cost of a decline in Beike's market share and commission rate in the new home sales business. Due to the lower funding costs of state-owned real estate companies and their lower demand for quick sales to generate cash flow, they are willing to pay lower commission rates to third-party sales channels compared to private enterprises. Therefore, Beike's ability to monetize its new home business will decrease. According to the company's communication, the monetization rate of Beike's new home business in the second half of 2022 may decrease from 3.1% in the first quarter to around 2.7%-2.8%.

Therefore, it is believed that although the year-on-year decline in national new home sales in the second half of the year will narrow significantly, under the influence of the decline in market share and monetization rate, Beike's revenue from new home transaction services may be higher than the industry's decline.

In the medium to long term, it is believed that after overcoming the epidemic and stabilizing the real estate market, the trend of further concentration of new home sales towards leading real estate companies, especially state-owned ones, will continue. After the market stabilizes, the demand for payment from real estate companies will not be as urgent as during the epidemic period. Therefore, it is expected that the commission rates paid by real estate companies to third-party sales channels will also decrease in the medium to long term. Even if we expect Beike's market share in third-party channels to increase, we believe that the growth rate of Beike's new home business revenue will gradually slow down due to the expected annual decline in national new home transactions. III. Fake Platform or True Self-operation? Where Does Beike's Profit Come From?

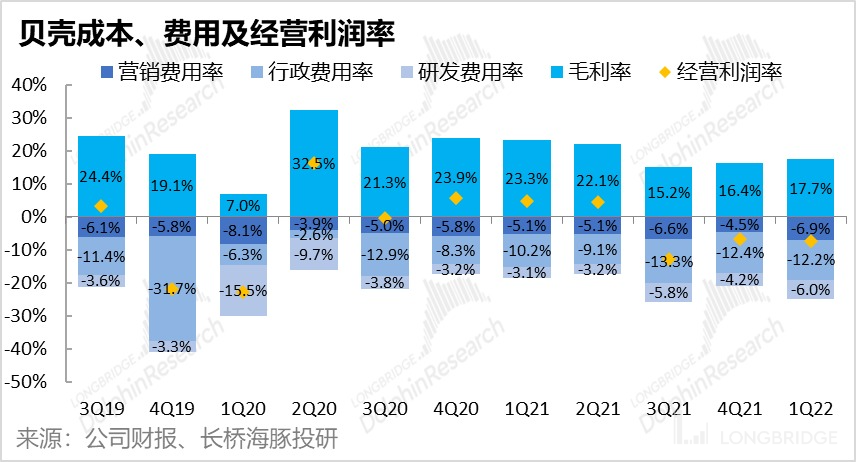

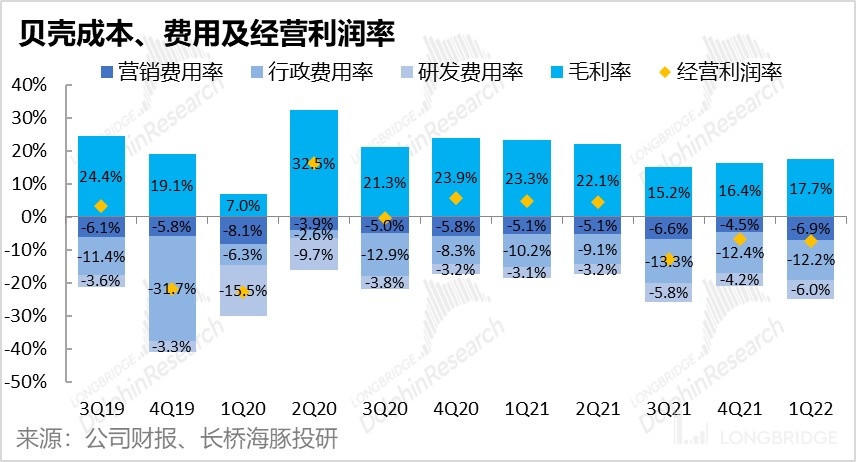

In addition to the future growth potential of the new and existing housing transaction market, another key concern in the market is the potential for Beike to release its profits. Looking back, it can be seen that Beike incurred losses during the downturn in the real estate market. Even during periods of high prosperity, it could only achieve an operating profit margin of around 5%, and the profit margin has been unable to break through and reach a stable level of profitability.

So, does Beike have room to increase its profits? If so, where can it be released? If it is difficult, what factors limit Beike's profit potential?

As can be seen from the above chart, even during periods of industry prosperity, Beike's gross profit margin is only slightly above 20%. After deducting management expenses of around 10%, as well as sales expenses and research and development expenses of around 5% each, only a single-digit profit margin remains.

Since marketing expenses and research and development expenses are not high in proportion, and even if they are reduced, they cannot release much profit. Therefore, it seems intuitive that Beike's profit potential mainly depends on whether the gross profit margin can be improved, as well as how much room there is to reduce the high management expenses of over 10%.

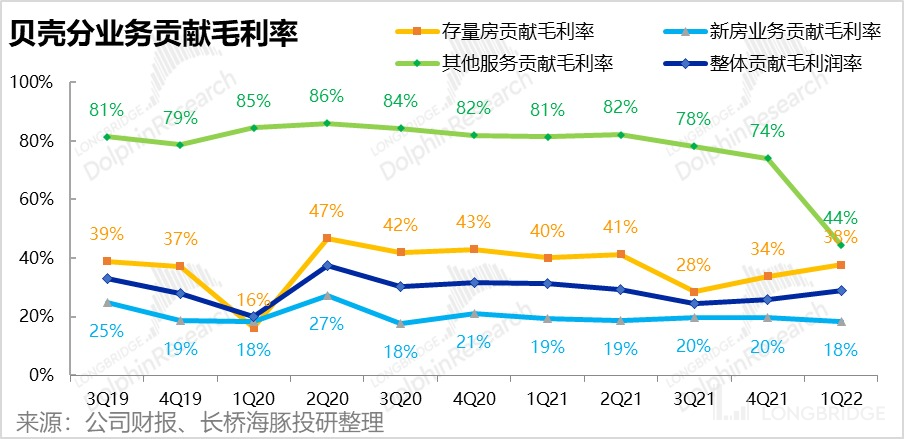

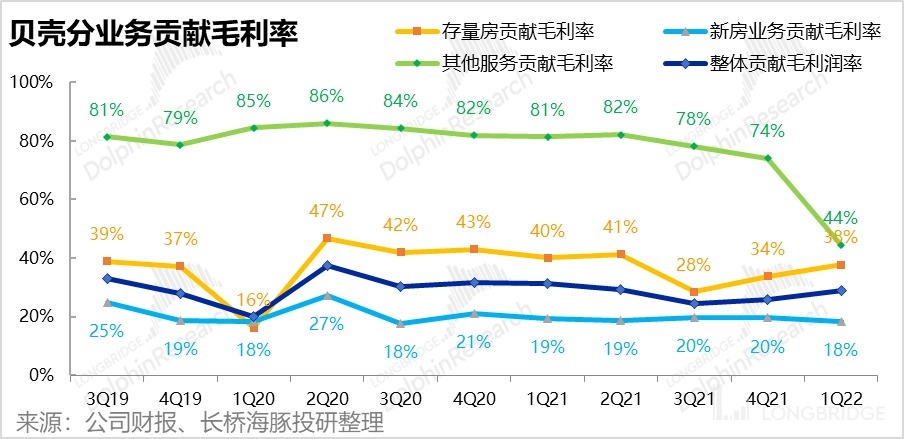

Starting with the gross profit margin, looking at Beike's three major business lines: new housing, existing housing, and innovative businesses, based on past data, only the gross profit margin contribution of the existing housing business has an upward trend, while the other two are in a downward trend. Looking ahead, as the realization rate of the new housing business has a downward trend, the gross profit margin will also follow suit.

In the innovative business, due to the shift in revenue structure from financial services to home decoration services (the company expects a gross profit margin of around 30% for home decoration), the gross profit margin will continue to decline for some time in the future. Therefore, the overall increase in gross profit for the company can basically only rely on the existing housing business.

Recently, the company has indicated that the gross profit margin contribution of the existing housing business in the second half of 2022 and 2023 is expected to return to over 40%. However, this can only help Beike return to an operating profit margin of around 5%. So what factors limit the increase in Beike's profit margin? The Dolphin tends to believe it is the latter.

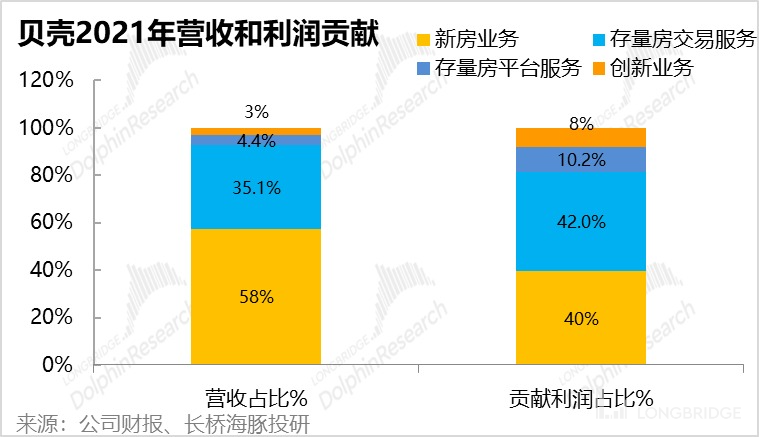

Although Beike has always promoted the ACN platform model, from the company's revenue and profit structure, the revenue contribution from the Beike platform business accounts for only 4.4%. Even if we assume that the gross profit margin of the platform business reaches 65%, it only accounts for about 10% of the company's total profit contribution. Therefore, Beike is essentially still a heavy-asset company with self-operated business as the main body and platform business as a supplement (similar to Amazon and JD.com).

And businesses with heavy assets and heavy performance have always been characterized by low-profit and high-sales (the operating profit of JD.com and Amazon's retail business has also been hovering in the single digits for a long time). Beike relies on numerous offline stores and brokers, and its business model with a long chain of performance commitments fundamentally determines that Beike's profit margin is difficult to increase. From this perspective, it becomes reasonable for Beike to have a management expense ratio of over 10%. As Beike needs to manage tens of thousands of intermediary stores and agents, this means a large number of stores, regions, cities, different levels of management personnel, and expense expenditures.

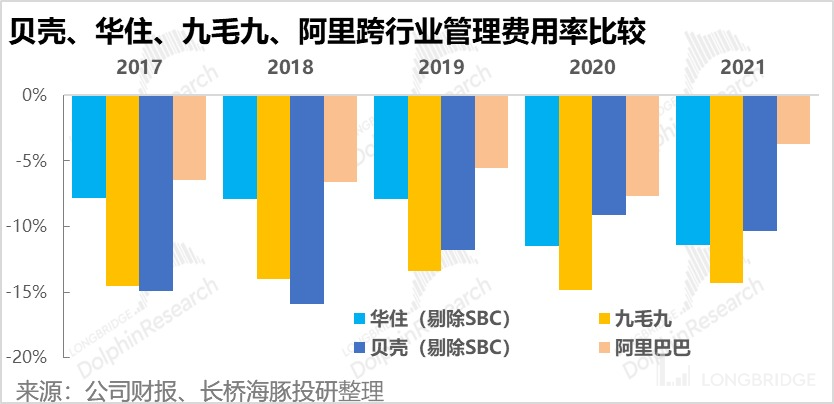

Therefore, Beike's management expenses should not be benchmarked against internet companies from the beginning, but should be compared to the hotel and catering industries that heavily rely on physical stores. From the figure below, it can be seen that Beike's management expense ratio is comparable to that of Huazhu, which operates through self-owned and franchised stores, and slightly lower than the fully self-owned Jiuxiaojiu.

In the short term, according to the company's recent communication, the number of Lianjia stores will continue to decline slightly compared to the same period last year, and a batch of back-office personnel will be downsized to reduce management expenses (saving about 400 million yuan per quarter). After Beike optimizes its cooperation with real estate developers, the provision for bad debts will also decrease by several hundred million yuan in the second half of the year. With these cost control measures, Dolphin optimistically predicts that the management expense ratio in 2023 can decrease significantly from 11.1% in 2021 to 8.6%.

However, referring to the chain store industry, Dolphin believes that there is limited room for Beike's management expense ratio to continue to decline from 8%. The second track of Beike, such as home decoration and home services, also relies heavily on manpower and contract fulfillment, and the operating costs will not be low. Therefore, the profit margin of Beike may only reach a high single-digit figure in the long term.

So where is the potential for Beike's profit improvement?

-

The commission rate of the company's existing housing business may still have some (limited) room for improvement, for example, from the current level of about 2.4% to above 2.5%. However, considering domestic regulations, it is difficult for the commission rate to increase significantly.

-

The gross profit of platform-based businesses far exceeds that of self-operated businesses. Therefore, if Beike's platform-based business can significantly expand in scale, it will significantly increase the overall profit of Beike.

In summary, if Beike continues to rely mainly on a self-operated model, the profit margin may remain in the single digits in the long term without much room for improvement. Only by truly transforming into an internet platform-based company can Beike unleash its profit potential.

After a strong rebound, does Beike's stock price still have room to rise?

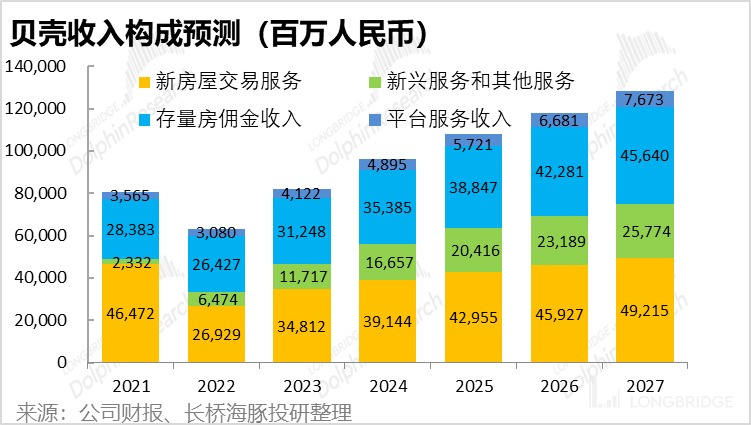

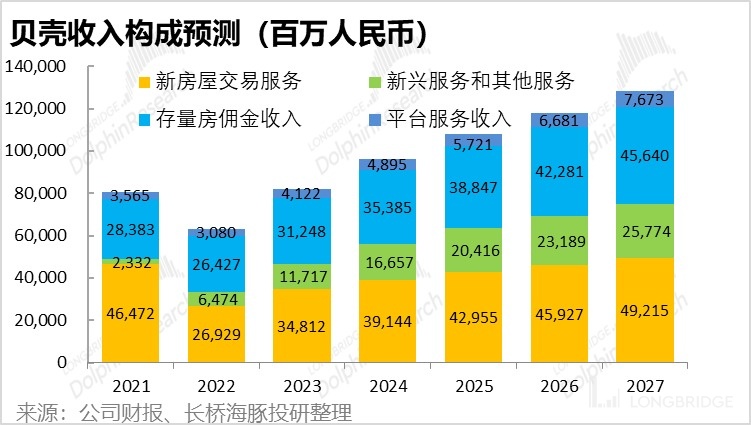

Based on the above analysis and recent guidance from the management, Dolphin makes the following assumptions about Beike's future performance:

- It is optimistically estimated that Beike's existing housing GTV will experience a strong rebound in the second half of the year, with a year-on-year growth of about 60%; returning to the level of the first half of 2021, it is optimistically predicted that the GTV of existing housing will continue to grow by 24% in 2023.

- The scale of new housing transactions nationwide in the second half of the year narrowed down to a decline of about -25%. However, due to the decrease in market share and realization rate, Beike's revenue decline will be even greater. It is expected that the revenue from new housing in 2023 will be 74% of that in 2021.

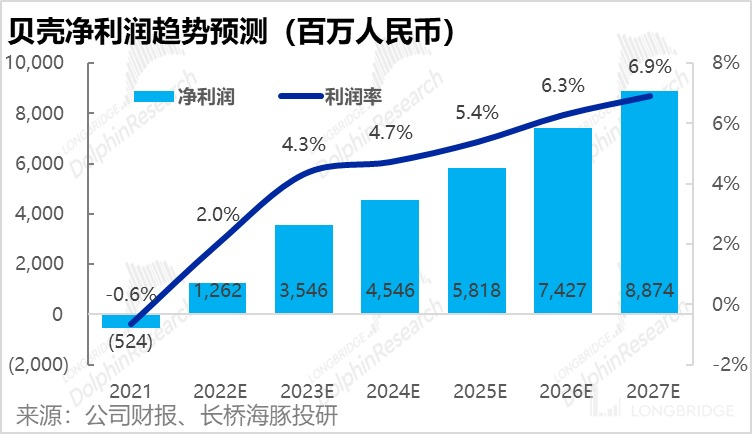

- Optimistically, the gross profit is expected to rebound rapidly, and operating expenses will remain at the level of 2022. It is estimated that the net profit will recover to 4.1% in 2023 and reach 9% by 2030.

- As for the home decoration business in the second track, Shengdu's revenue in 2021 was 4.1 billion yuan. The company's current guidance for the second half of 2022 is around 4 billion yuan. Therefore, it is estimated that the revenue of the home decoration business will reach 9-10 billion yuan in 2023, with a gross profit margin of about 30%. However, the strategy and prospects of Beike's home decoration business are not clear. Considering the conservative approach, it is expected that the growth rate of the home decoration business will decline rapidly after 2023.

The specific predictions for Beike's revenue and profit are as follows:

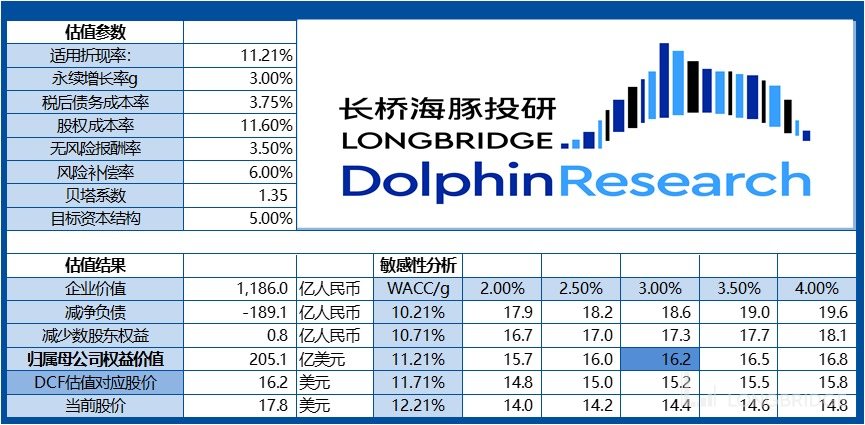

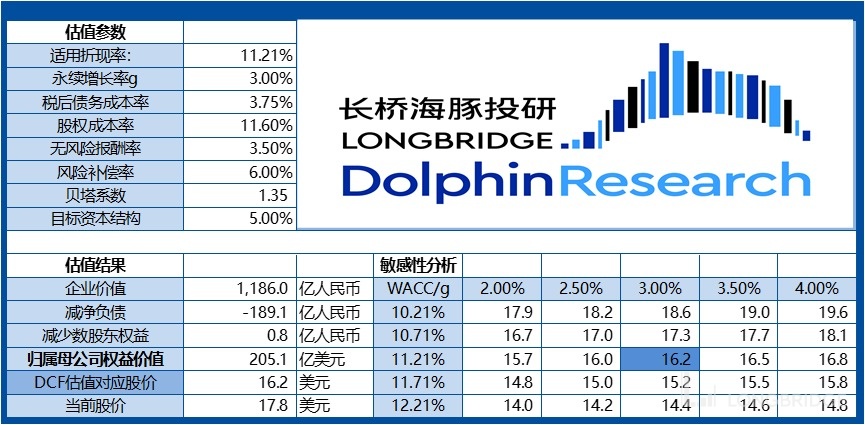

Based on the relatively optimistic predictions above, Dolphin has calculated that Beike's current fair stock price is $16.2 using the DCF model. Therefore, although there are strong expectations for the real estate market's recovery, we believe that Beike's stock price has already priced in the expectation of recovery, with a maximum of $19 and the current price of $17.8.

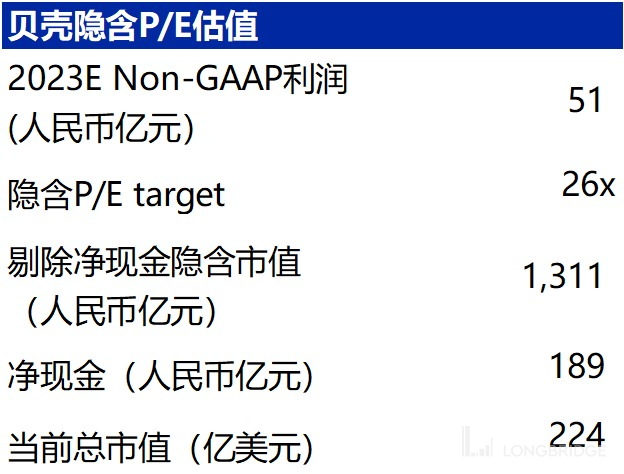

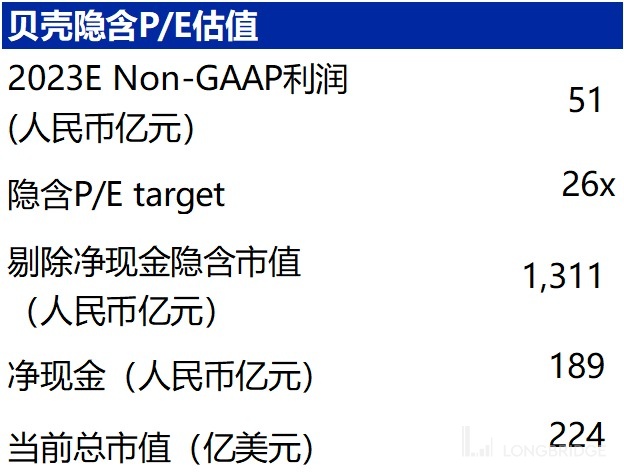

In addition to the DCF valuation, due to the significant uncertainty in Beike's long-term performance and the relatively optimistic market sentiment, Dolphin found that the market mostly uses the 2023 Non-GAAP profit (including stock-based compensation expenses and amortization of intangible assets) for valuation.

According to Dolphin's forecast, Beike's Non-GAAP net profit in 2023 is estimated to be approximately 5.1 billion RMB. Excluding net cash, the implied P/E valuation of the current stock price is around 26x (we expect a profit CAGR of 29% from 2022 to 2025). From this perspective, the current valuation is still reasonable. However, whether it is reasonable to ignore the incentive expenses that the company actually needs to pay is a matter of opinion. We expect the GAAP net profit in 2023 to be 3.5 billion yuan, and the implied P/E multiple corresponding to the current market value is as high as 37x.

Past Research:

Past Research:

Earnings Season

May 31, 2022 Conference Call: "Housing Transaction Business Suffers Huge Blow, Emerging Businesses Steadily Developing (1Q22 Shell Conference Call Summary)"

May 31, 2022 Earnings Review: "Real Estate Market Frozen, Shell Can Only Hold On"

March 10, 2022 Conference Call: "Beyond Brokerage Business, Shell is Focusing on Home Decoration and Home Services (Conference Call Summary)"

March 10, 2022 Earnings Review: "Escape from Real Estate? Shell Fights Against the Trend"

In-depth Analysis

December 27, 2021: "Real Estate Market Rebounding? Investing in Shell? Wait a Little Longer"

December 17, 2021: "Muddy Waters Shorting Shell? Superficial Analysis"

December 15, 2021: "From 'Revolutionary' to 'Revolutionized,' Can Shell Withstand?"

December 9, 2021: "Rebellious Shell: Whose Lives Did It Change and Who Is Its Savior?"

Risk Disclosure and Statement for this Article: Dolphin Research Disclaimer and General Disclosure