Without the "pumping" from Shanghai factory, what can Tesla expect?

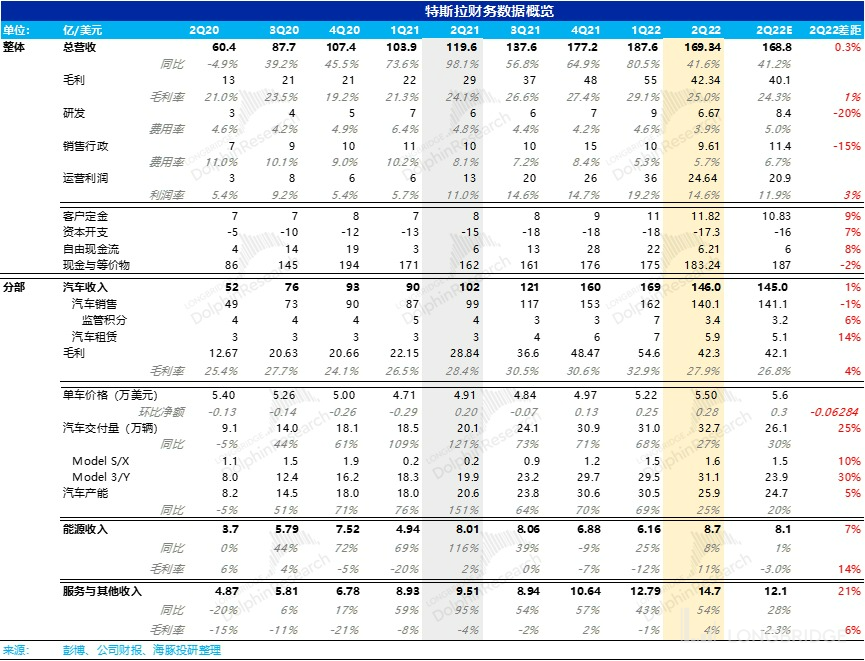

$ Tesla.US released its comprehensive and exceeding expectations report for the second quarter of 2022 after-hours on the evening of July 21st, Beijing time, with the following highlights:

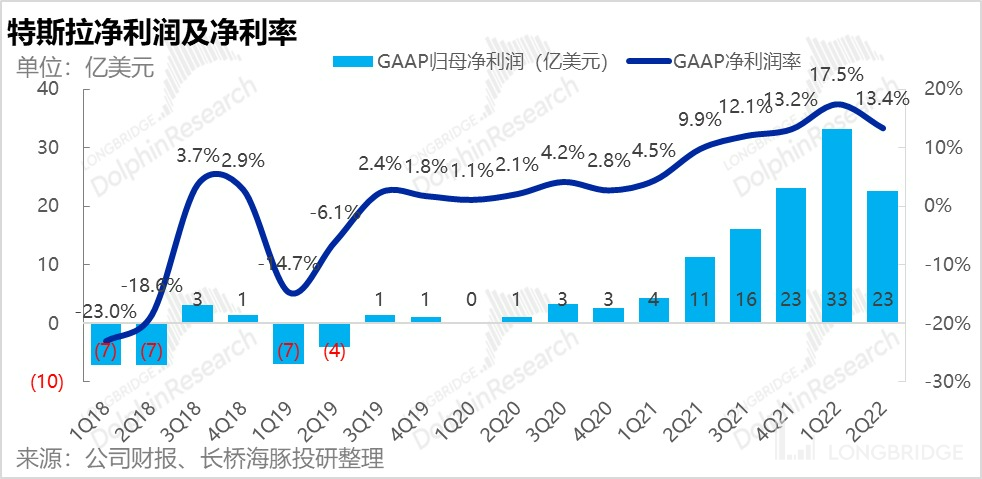

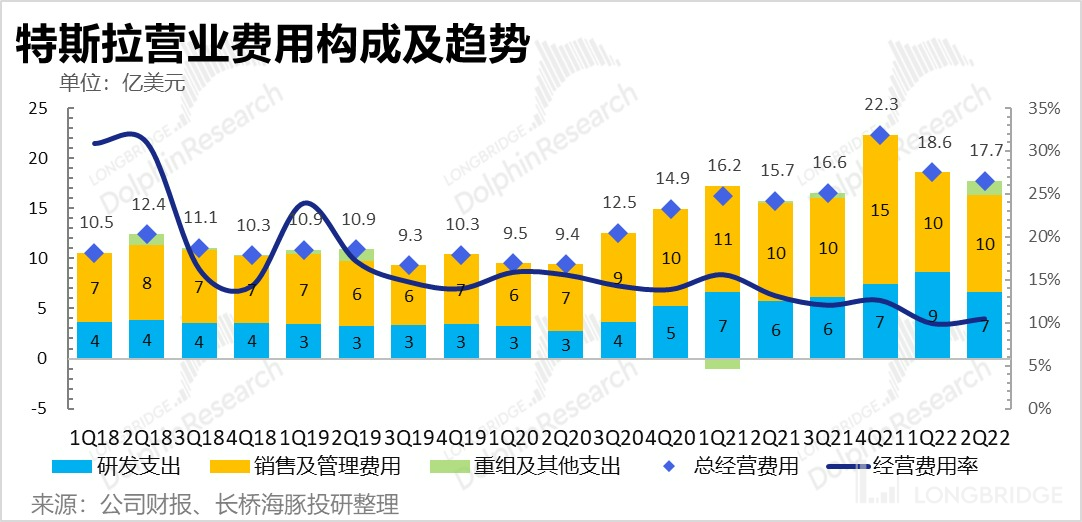

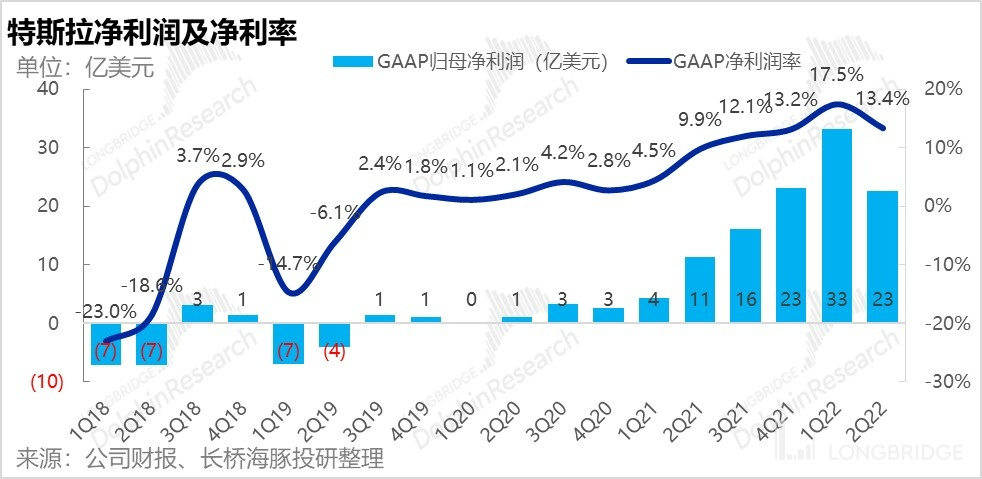

1. Tesla's performance was basically in line with expectations in the second quarter: Overall revenue was within the expected range, and the slightly lower revenue from automotive sales was due to a small decrease in the unit price of vehicles. However, service revenue increased slightly, and the overall revenue stayed relatively stable. Tesla's final profit of USD 2.3 billion was much higher than the market expectation of USD 1.7 billion. However, the main factor behind the cost savings was that both sales and R&D were relatively low, and the reduction in expenses was similar to that of the first quarter, mainly due to a significant decrease in stock incentives.

Considering that Tesla has always beaten expectations by a large margin, this time can only be considered as "okay."

2. Automotive sales business: The focus of this information is on the unit price and gross profit of cars. After a round of price increases, the actual price increase on a per-vehicle basis driven by the price increase of each car and the overall improvement of model mix was slightly lower than expected.

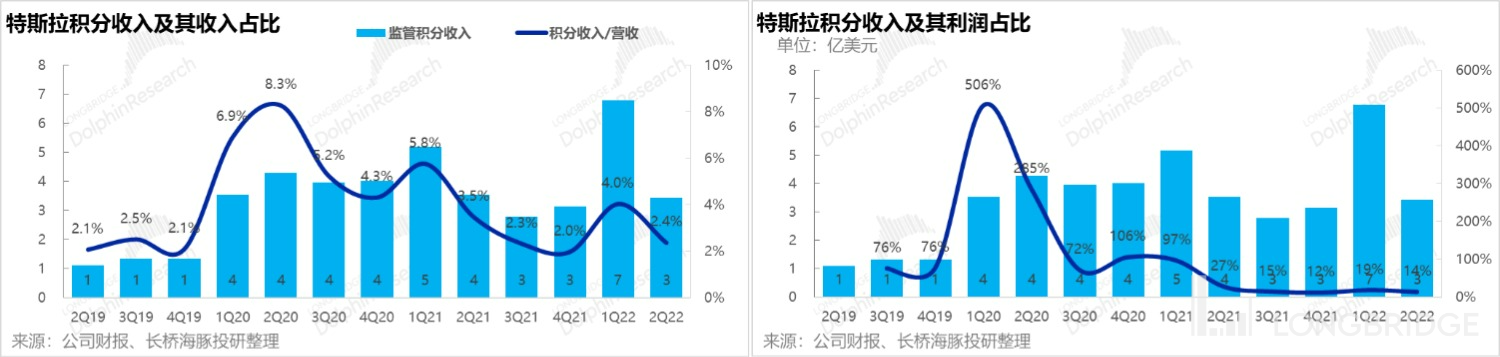

However, to Dolphin Analyst, this is not a big problem. Considering that orders from users who paid a deposit are still backloged, it shows that the price increase did not dampen users' enthusiasm for buying Teslas. Moreover, the price increase only applies to new orders, and the sales volume of high-priced new models such as Model S/X is still being released. The real effect of price increases is estimated to be seen in the third quarter financial report.

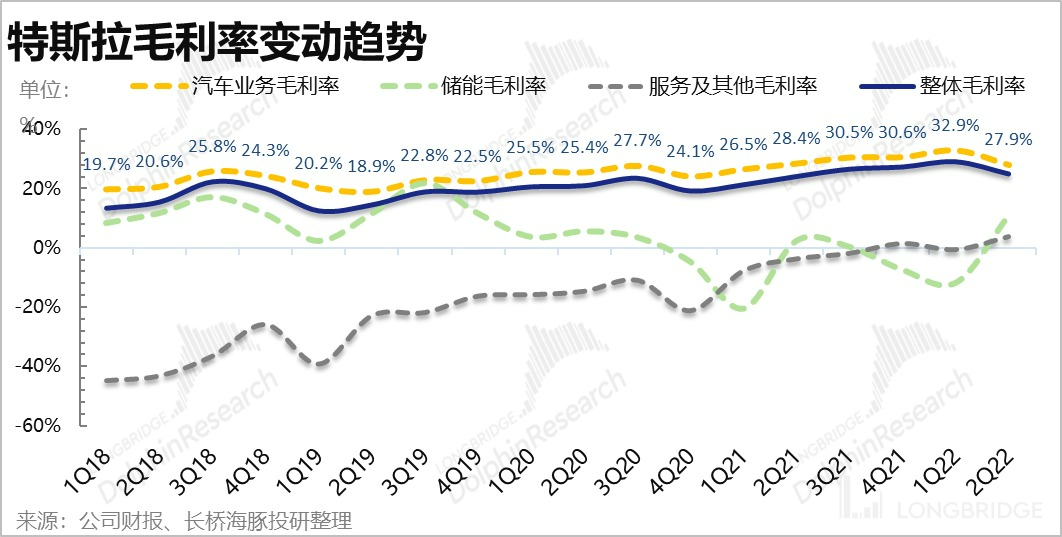

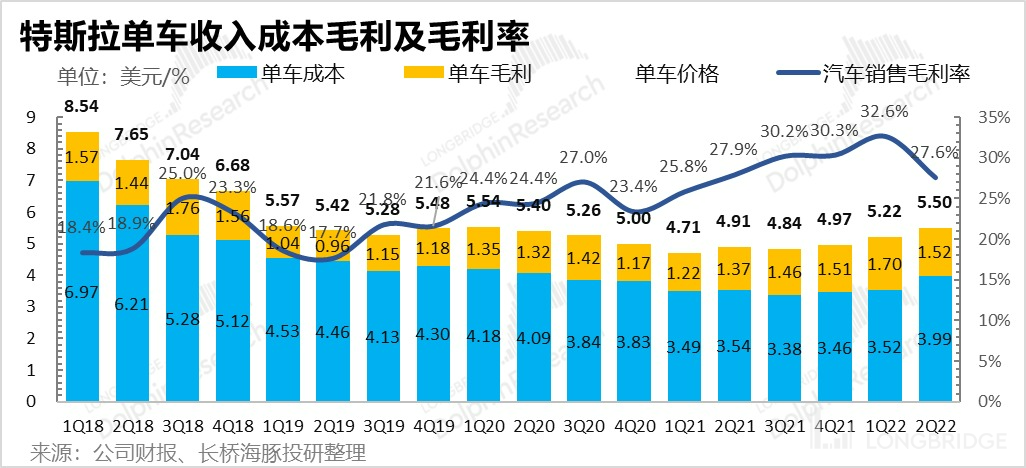

In terms of unit gross profit, the pump-priming factory stopped operating, and Tesla's unit gross profit fell to below 30% on schedule, but it was slightly better than expected, mostly due to the improvement of the model mix. In the third quarter, with the resumption of work in the Shanghai factory, and the reduction of some costs such as raw materials and logistics, as well as the increase in the proportion of high-priced cars (S, X, Y), the unit gross profit margin should be able to return to above 30%, so there should not be any significant problem.

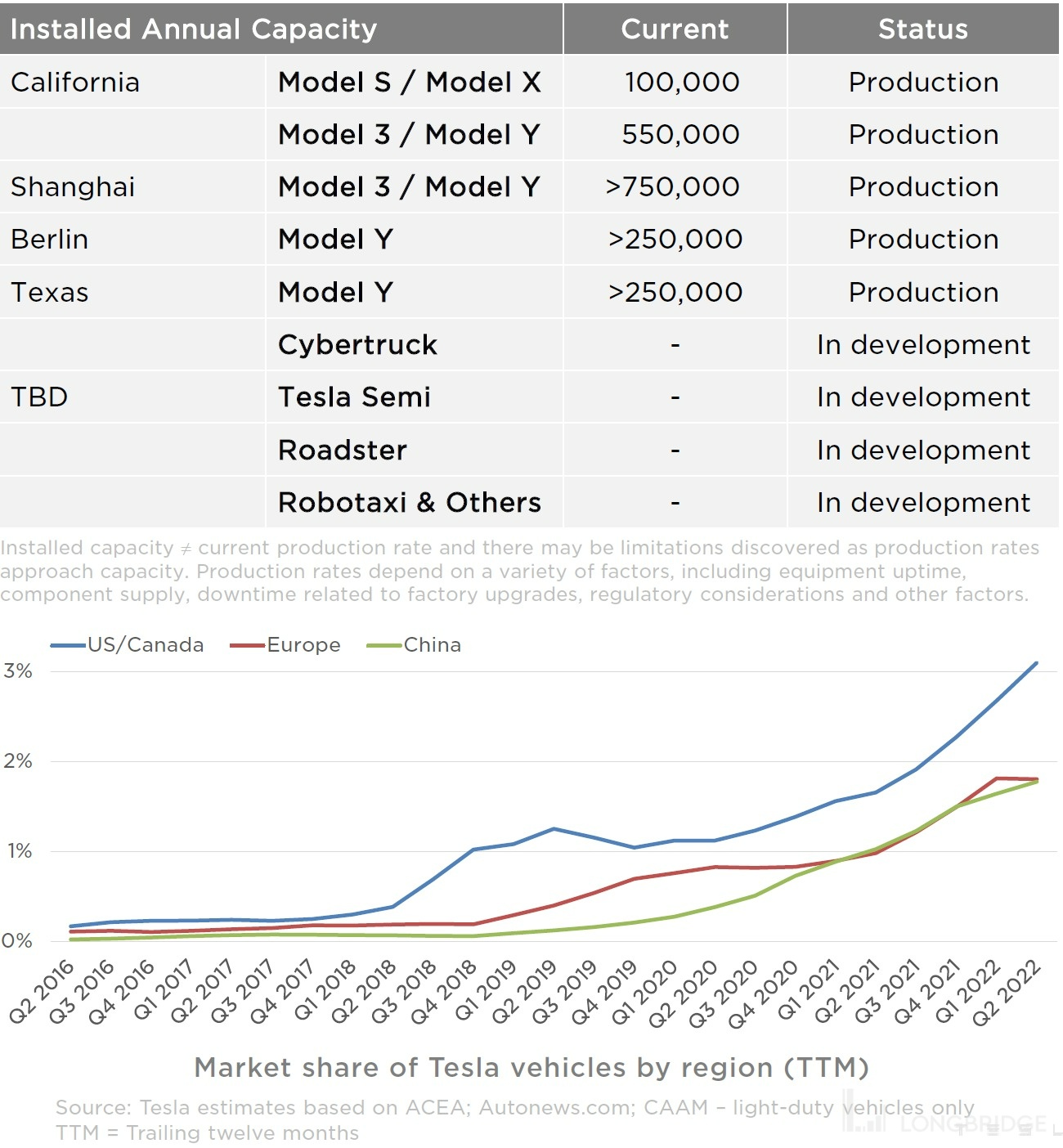

3. Production Capacity: By the end of June, the Shanghai factory had resumed full production, but the new factories are slowly ramping up. Among them, the Berlin factory delivered 1,000 Model Ys in a single week by the end of June. It was previously announced that the weekly output was supposed to reach thousands in April, yet the ramp-up of the new factories is still relatively slow. In addition, the 4680 battery capacity is still under construction, and there have been no significant new developments.

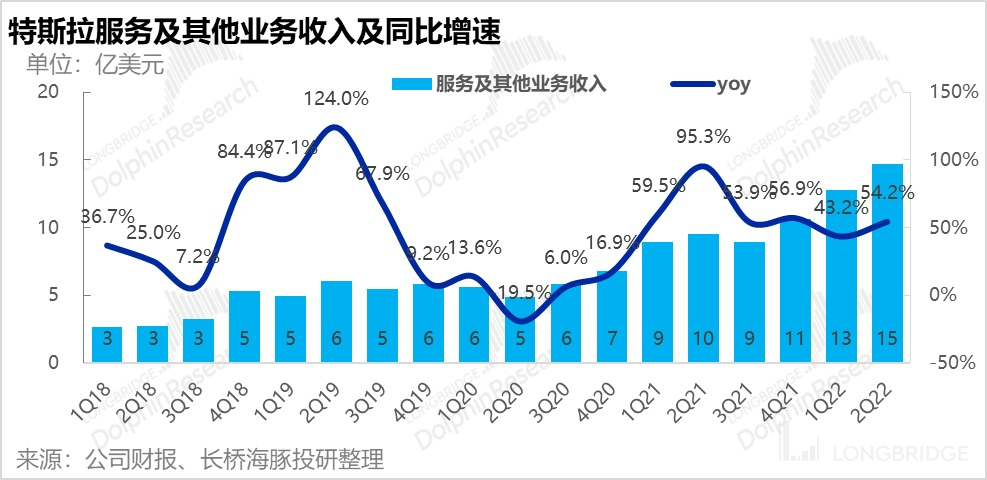

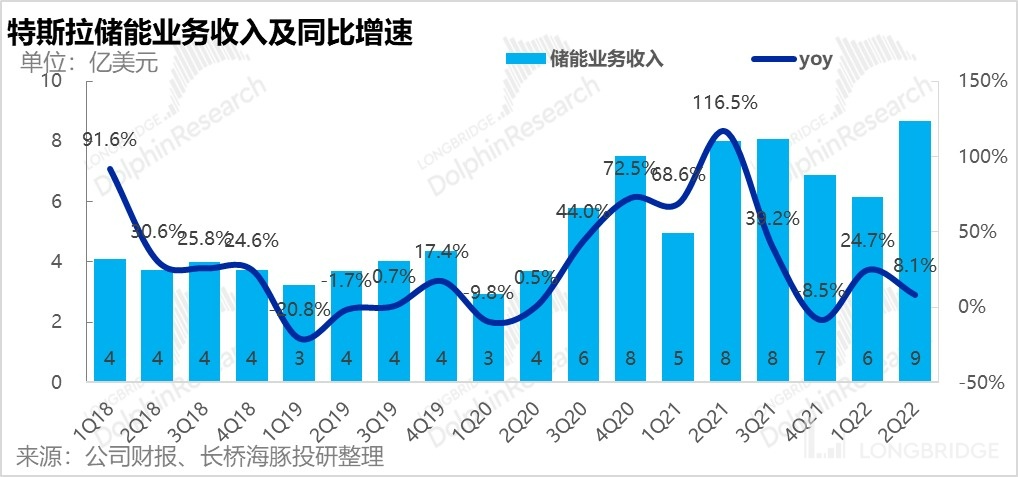

6. Energy storage supply shortage, increased service income: The degree of chip shortage for energy storage is worse than for cars, and the new factories are still ramping up, resulting in a large supply-demand gap and insufficient installation during peak season.

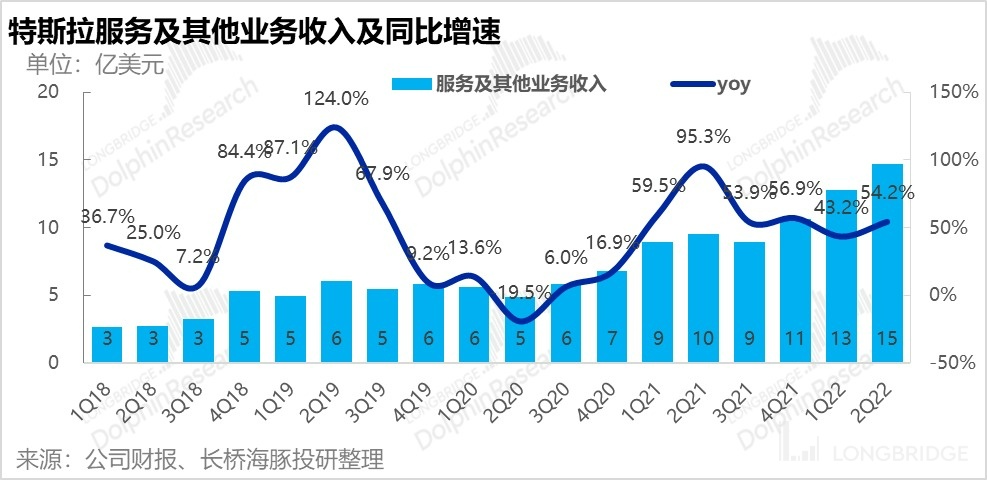

As for service and other matters, after the surge in oil prices, the demand for second-hand new energy vehicles is still high, and service business revenue has increased significantly, with a positive gross profit margin. However, these two businesses have a relatively minor impact compared to the company's automotive business.

Overall view in one sentence: Performance was average, faith was unbroken, the only way to resolve anxiety is through production capacity.

(1) Performance was average: After the small drop in sales volume below market expectations, revenue performance did not exceed expectations together. The part of profits that exceeded expectations was primarily achieved through expense control, and the contribution of automotive gross profit to this quarter was not high, which is the real high-quality profit source. Compared to the previous Beats which were arbitrarily large, there was no impact on the quarter after the shutdown of the Shanghai factory.

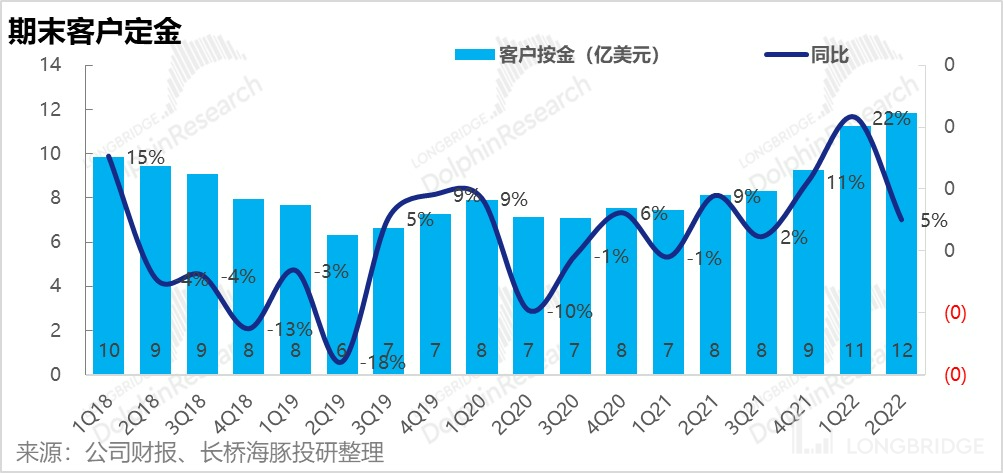

(2) Faith Unbroken: After the continuous price increase, the backlog of user deposits continued to rise, and the price increase did not affect demand. The core is product strength and brand strength, and behind that, Tesla has 4680 type battery which acts as a branded assist. The future is without worry.

(3) Capacity Solves the Worries: The new factories in Texas and Berlin once again illustrate that new factories in places other than China must go through production capacity refineries at the beginning. This time, the Texas factory only said that the production capacity is still climbing and did not say how much. The Berlin factory produced over a thousand vehicles in a single week at the end of the month, which is a lot of vehicles later than the original plan for the single week in late April.

Looking slightly further ahead, the production capacity of these factories resolves the issue of delivery and raises the gross profit margin. Under the guarantee of order stability, releasing production capacity is the real cure for Tesla.

From an investment value perspective, Tesla is still a target worth long-term participation and tracking. This type of company will only have opportunities that are slightly more cost-effective in terms of sex ratio in a callback. Subsequently, the Dolphin Analyst will focus on new factory production capacity utilization rate and vehicle price increase trend to seek possible investment opportunities in Tesla.

This article is an original article by the Dolphin Research Institute. It may not be reproduced without authorization. It is recommended that interested users add the WeChat ID "dolphinR123" to join the Dolphin Research Circle to discuss global asset investment views together!

The following is a detailed analysis of the financial report:

I. Overall Performance: Everything is as Expected

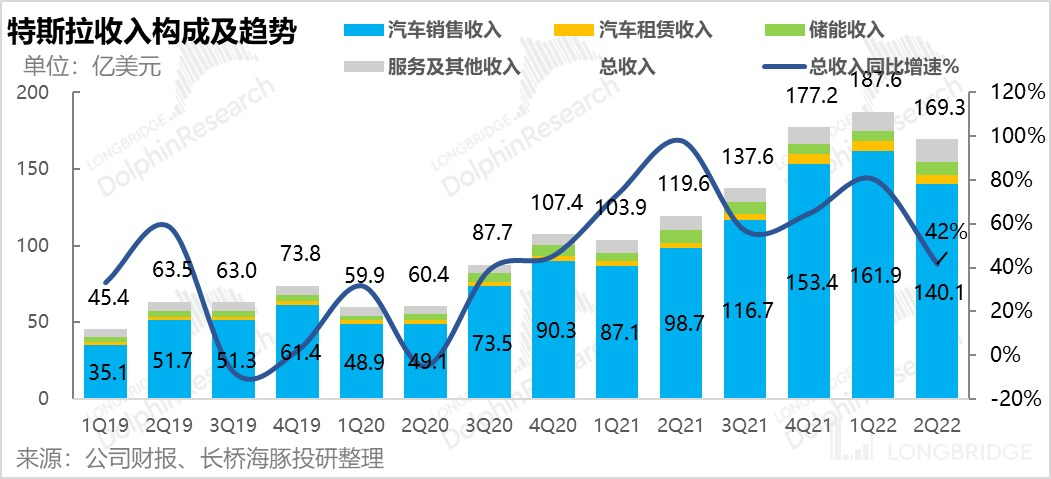

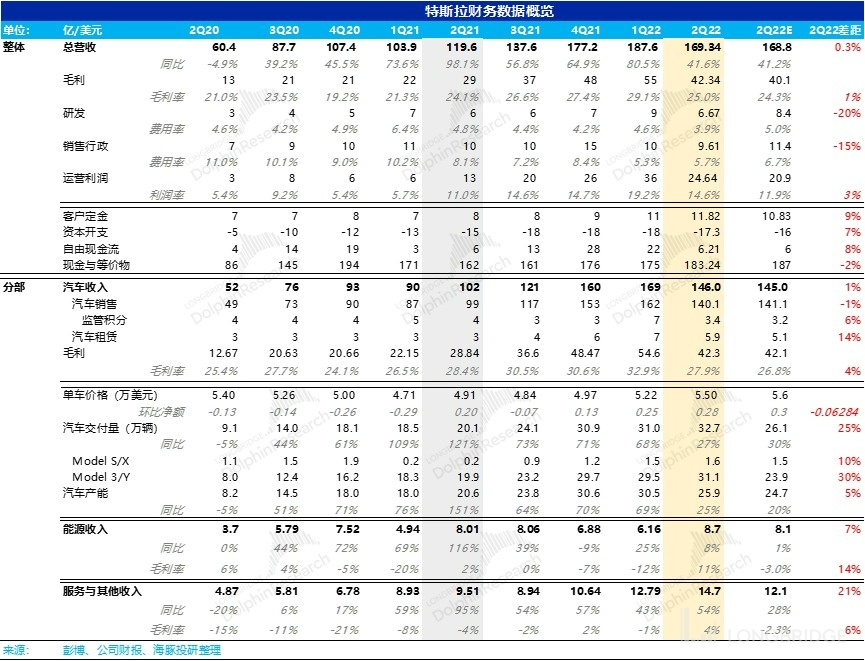

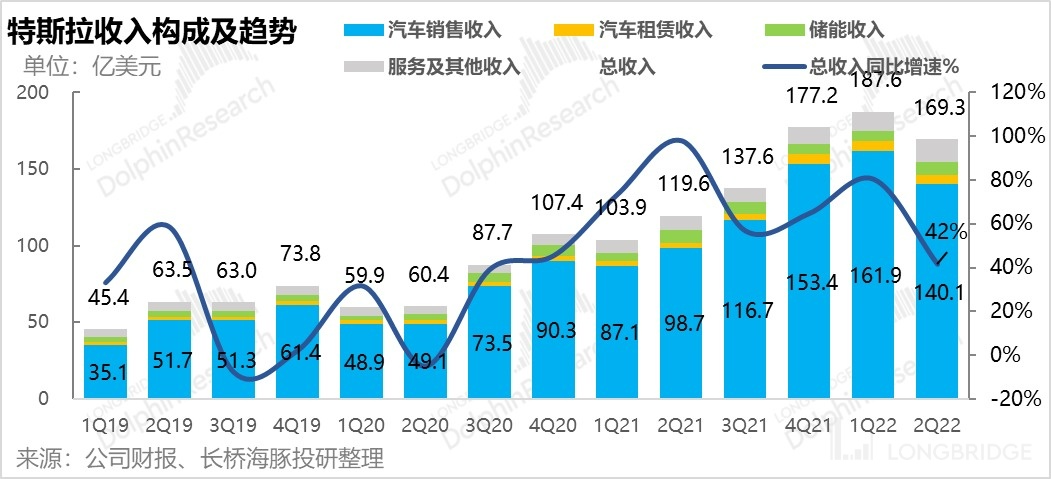

1.1 Revenue is basically the same as expected. In the second quarter of 2022, Tesla achieved revenue of 16.9 billion US dollars, a year-on-year increase of 42%, which is basically the same as Bloomberg's expectations.

Although the total difference is not big, because the increase in car unit price is slightly lower than expected, the revenue from car sales is slightly lower than expected. However, due to the good growth of vehicle after-sales service and other businesses this quarter, the final revenue is basically consistent with expectations.

1.2 Sales, R&D efficiency has been improved, and profits slightly exceeded the market expectation. In the second quarter of 2022, the operating profit was 2.3 billion US dollars, which exceeded the market expectation of 1.8 billion US dollars, and the year-on-year growth was 98%.

Previously, the core reason for the better profit was generally due to the better performance of automobile gross profit margin, but this time it was mainly due to the relatively restrained sales and administrative expenses, while the automobile gross profit margin performance was still acceptable. However, considering the eye-catching gross profit margin performance of automobiles in the past, it can only be said to be generally good this time.

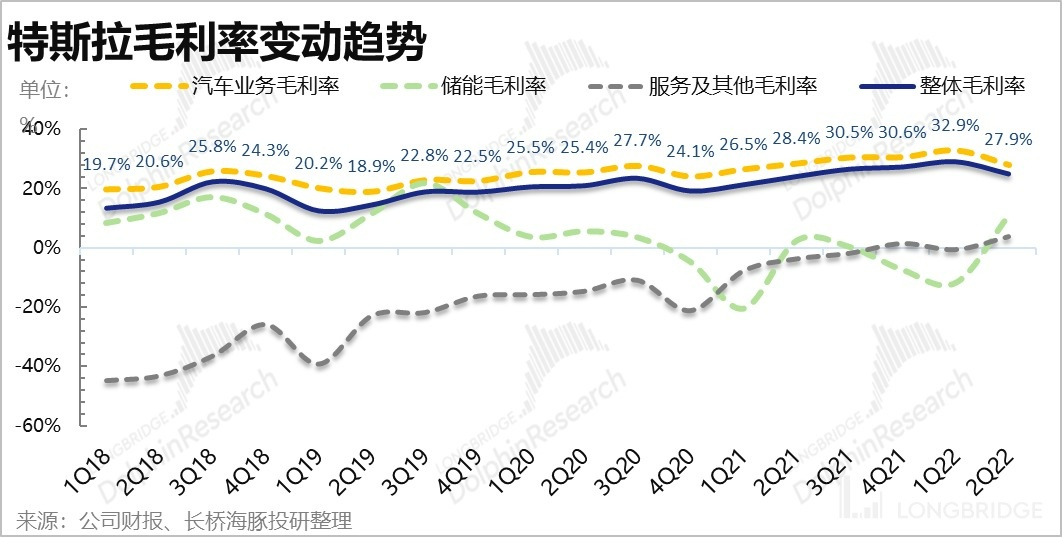

1.3 Raw materials, logistics, and Shanghai shutdowns have dragged down gross profit release. As the most important observation indicator for each quarter, the company achieved an overall gross margin of 25% in the second quarter of 2022, with a slower year-on-year growth rate, and a natural decline in the quarter-on-quarter due to the release of gross margin, with key Shanghai factories closed for most of the time. However, this performance is still slightly better than Bloomberg's consensus forecast of 24.3%, mainly because the market estimates of the gross profit for automobiles are even weaker, coupled with the fact that this quarter's investment-type businesses such as energy storage and service/other businesses have all turned from gross loss to positive gross profit, exceeding market expectations and making a certain contribution to the overall gross profit.

1.3 Raw materials, logistics, and Shanghai shutdowns have dragged down gross profit release. As the most important observation indicator for each quarter, the company achieved an overall gross margin of 25% in the second quarter of 2022, with a slower year-on-year growth rate, and a natural decline in the quarter-on-quarter due to the release of gross margin, with key Shanghai factories closed for most of the time. However, this performance is still slightly better than Bloomberg's consensus forecast of 24.3%, mainly because the market estimates of the gross profit for automobiles are even weaker, coupled with the fact that this quarter's investment-type businesses such as energy storage and service/other businesses have all turned from gross loss to positive gross profit, exceeding market expectations and making a certain contribution to the overall gross profit.

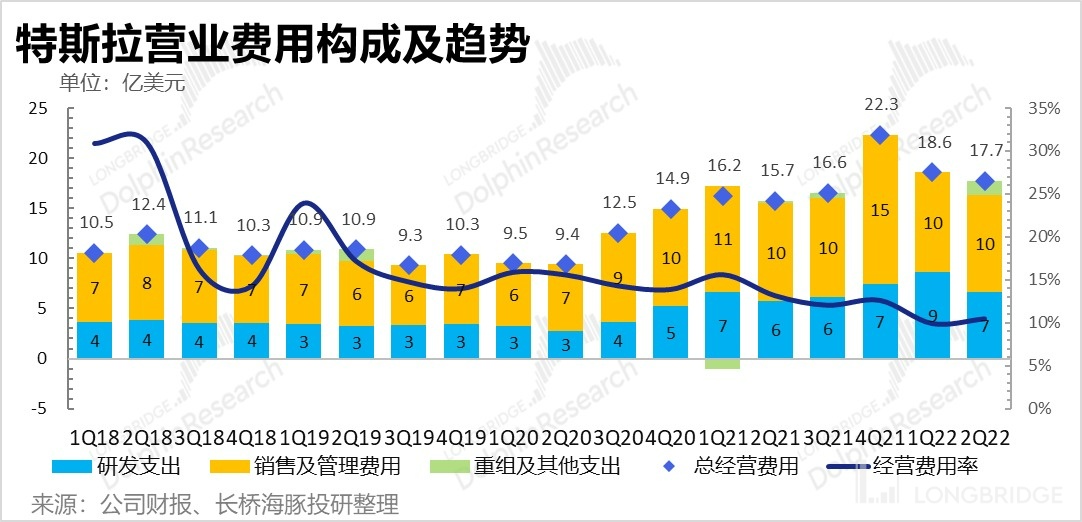

1.4 The company's R&D expenses in the second quarter of 2022 were 670 million yuan, and sales and administrative expenses were 960 million yuan, both significantly lower, maintaining the frugality of the previous quarter. However, there were more temporary restructuring and other expenses of 140 million yuan this quarter, which resulted in an overall operating expense ratio of 10.5%, still at a relatively low level.

The excellent performance in expenses this quarter is still related to equity incentives. The equity expenditure of 360 million yuan is down year-on-year and quarter-on-quarter, with a year-on-year decrease of 24%, mainly due to the decrease in executive incentives.

2.0 Automobile Business: Strong Demand, But Gross Margin Declines

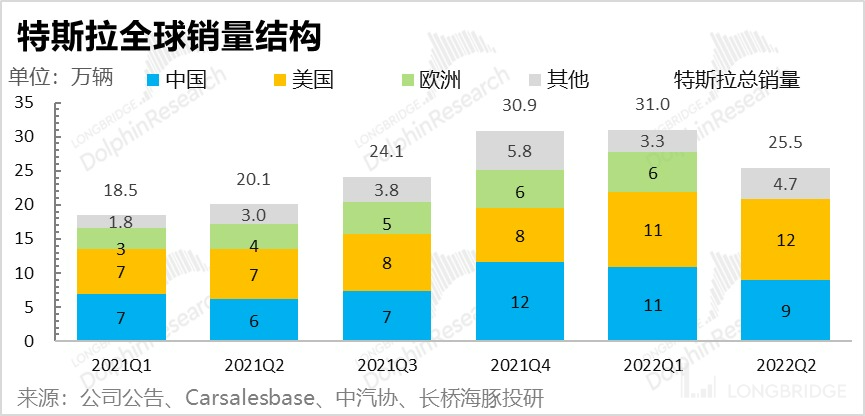

2.1 Strong performance in June, but the second quarter achieved only 258,600 sales.

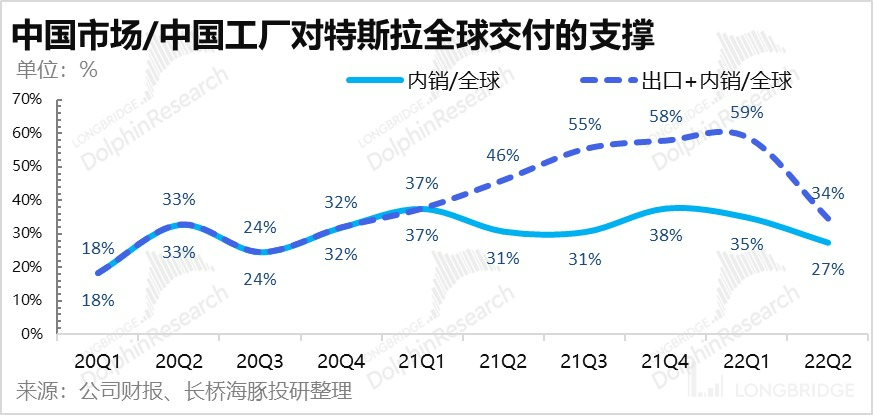

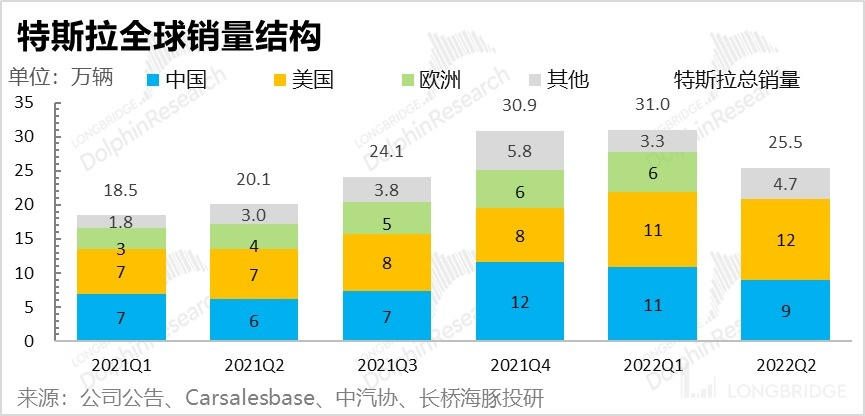

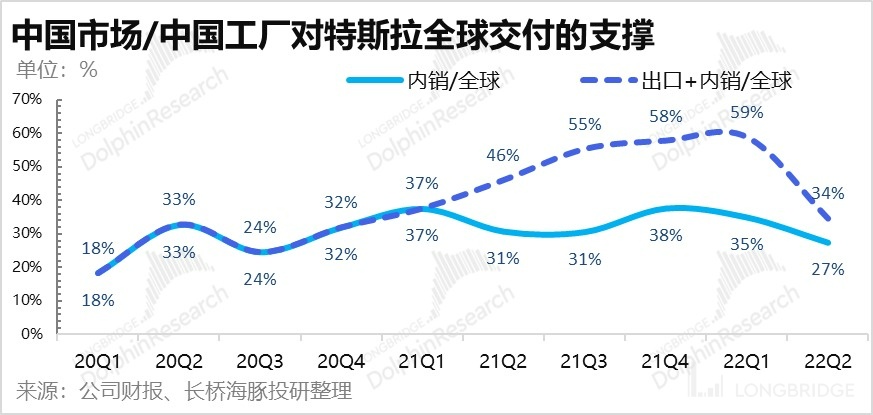

As the super factory in Shanghai that contributes to nearly 60% of global production, due to the epidemic in Shanghai in April and May, logistics and personnel were frozen, which affected Tesla's sales greatly.

From Dolphin Analyst's data, in the domestic market, deliveries were stagnant in April and slightly recovered in May, while the European market supplied by the Shanghai factory had only 1,700+ deliveries of Model Y and 3 in April, compared to 42,000 in March. The shutdown of Shanghai's logistics also had a major impact on European sales.

With no hope from the two new factories in Texas and Berlin, Shanghai was at a standstill as the main factory, and the California factory in the United States was basically at full capacity. The final sales in the second quarter were just enough to meet market expectations.

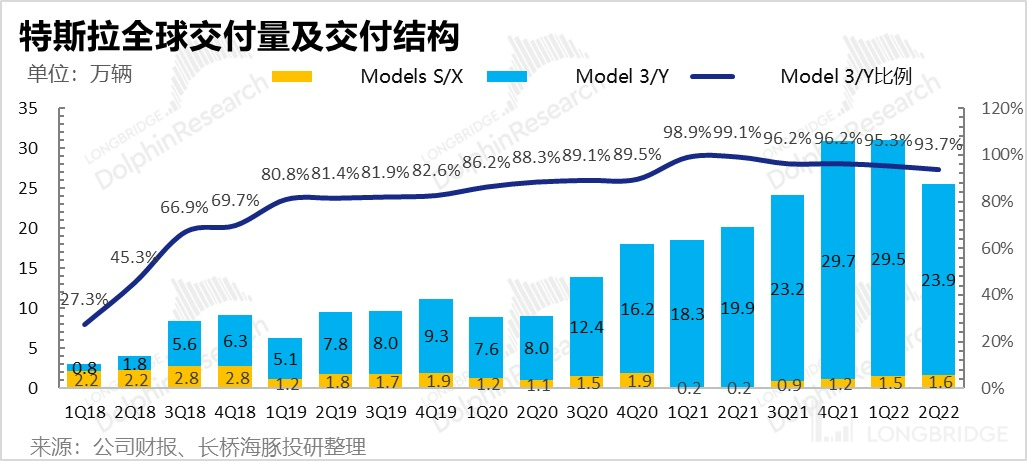

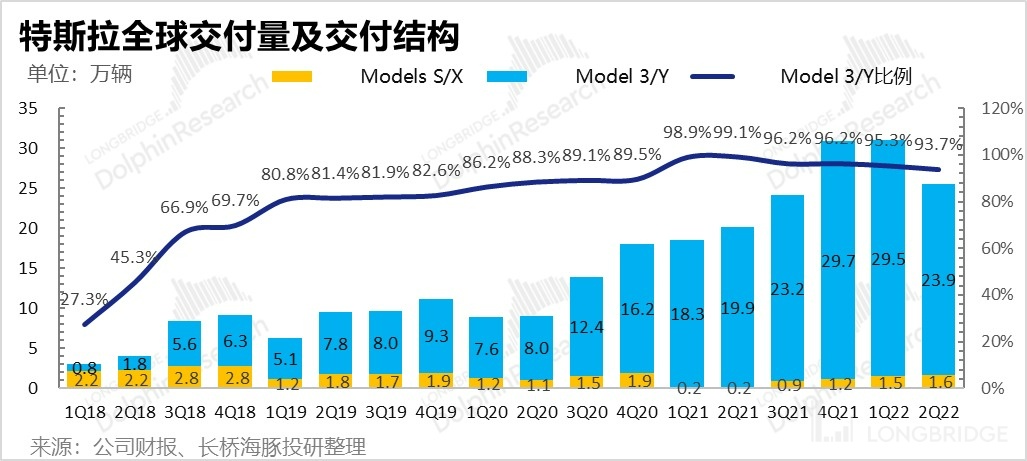

In terms of delivery structure, the new Model S/X, which started delivering in the second/fourth quarter of 2021, sold 16,000 units this quarter, slightly more than 15,000 units in the previous quarter. Model 3 and Y are relying on the California factory due to the shutdown in Shanghai, and the new Berlin factory only produced just over 1,000 Model Y vehicles per week at the end of the second quarter.

The proportion of Model 3/Y decreased slightly, according to Dolphin Analyst's estimate, and if the production capacity lost in Shanghai (70,000 vehicles +) is taken into account, the proportion should have been at least equal to that of the previous quarter.

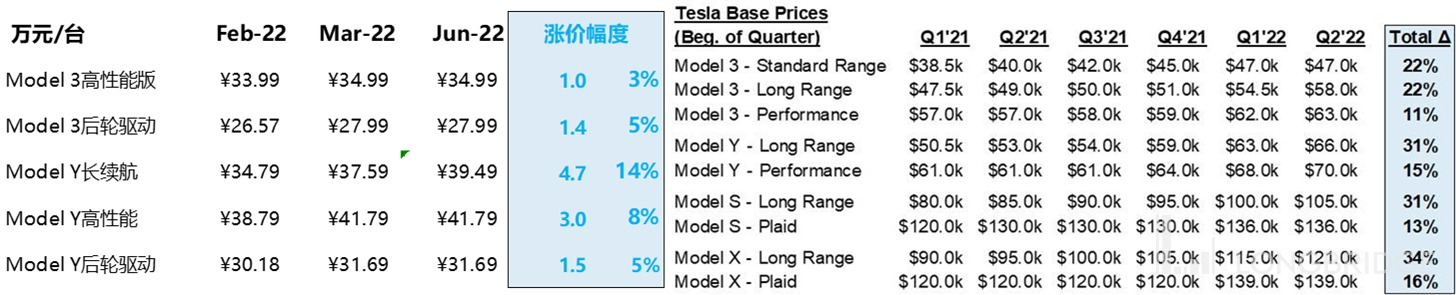

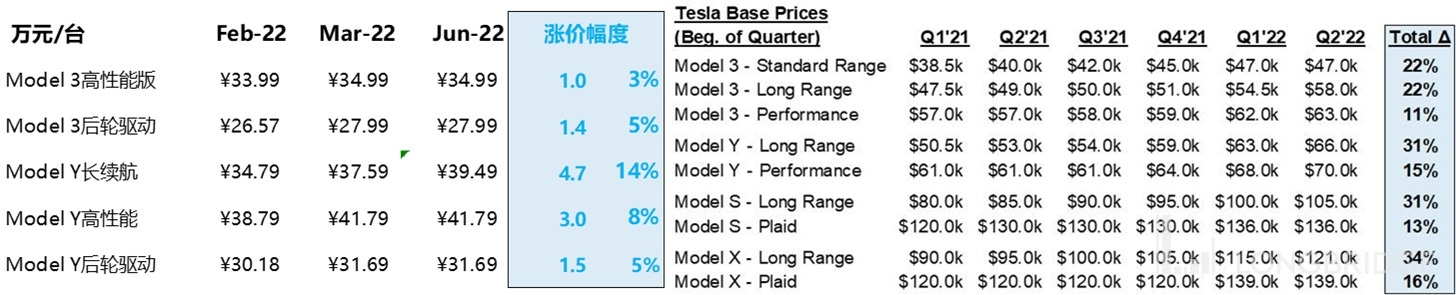

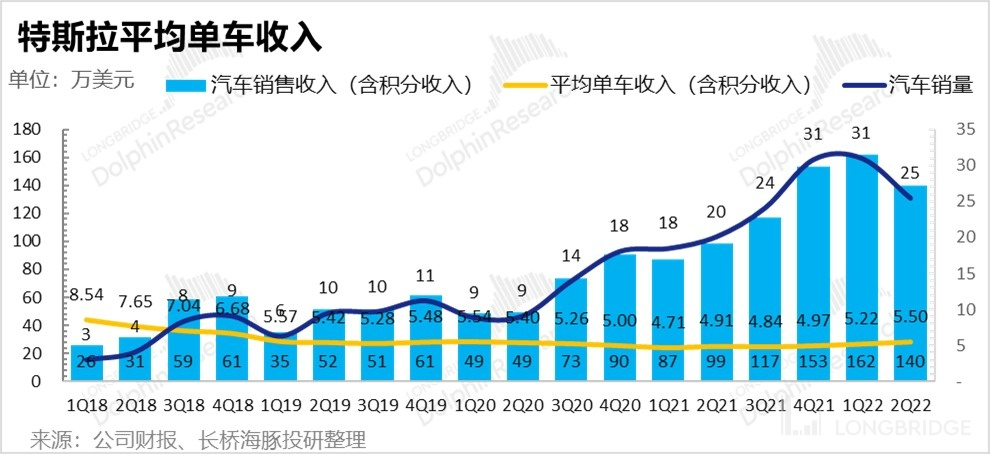

2.2 Prices Keep Going Up, and Tesla's average price per vehicle increased by $4,000. Tesla is still raising prices around the world in the second quarter. Except for a series of price increases in China in March, price increases in the United States in the second quarter were even more exaggerated, with an average increase of more than 15%.

In addition, in the second quarter, the proportion of more expensive Model S/X deliveries slightly increased, while the proportion of Model Y/3 decreased due to the shutdown of the Shanghai factory. As a result, the non-subsidy-included price per vehicle increased by $3,600 in the second quarter, compared to an average increase of only $1,300 in the first quarter.

The average price per vehicle including subsidy is 55,000 yuan, up $2,800. However, the expected increase in the market was over $3,000, so the increase was lower than the market expected.

Looking forward in the short term, automotive battery material costs have already started to decline in the third quarter, but the price increase in the second quarter was mainly for new orders. Combined with the increase in the proportion of Model Y production and sales, the increase in delivery volume in the third quarter may be more fully reflected, so the lower-than-expected price per vehicle in the second quarter is not a problem.

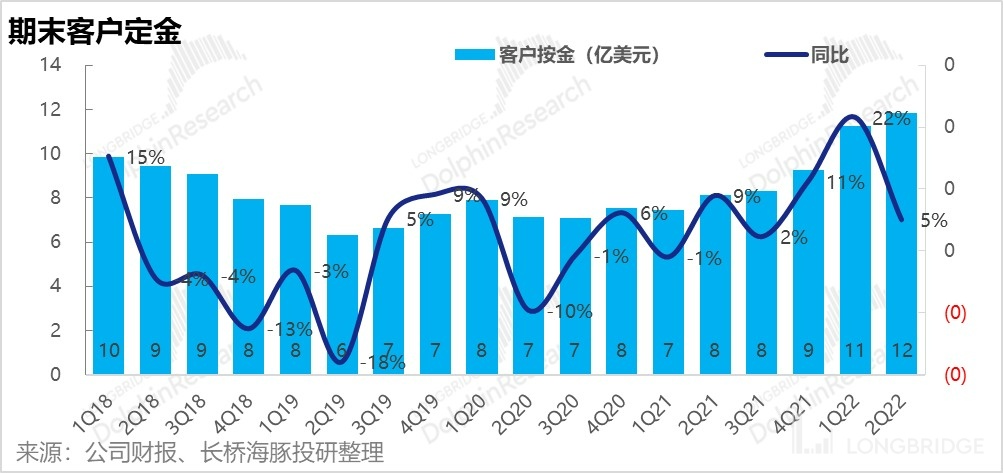

Moreover, Tesla's receivable deposits are still accumulating, with almost $1.2 billion received in this quarter. Dolphin Analyst estimates that this is equivalent to 470,000 vehicles in hand, based on a rough estimate of $2,500 per deposit, whereas Tesla's peak quarterly production capacity in the past was less than 310,000 vehicles.

In addition, Tesla's inventory turnover days are only 4 days, indicating that the demand for Tesla's vehicles is still strong despite the price increases. Factory efficiency and production capacity are the main bottlenecks.

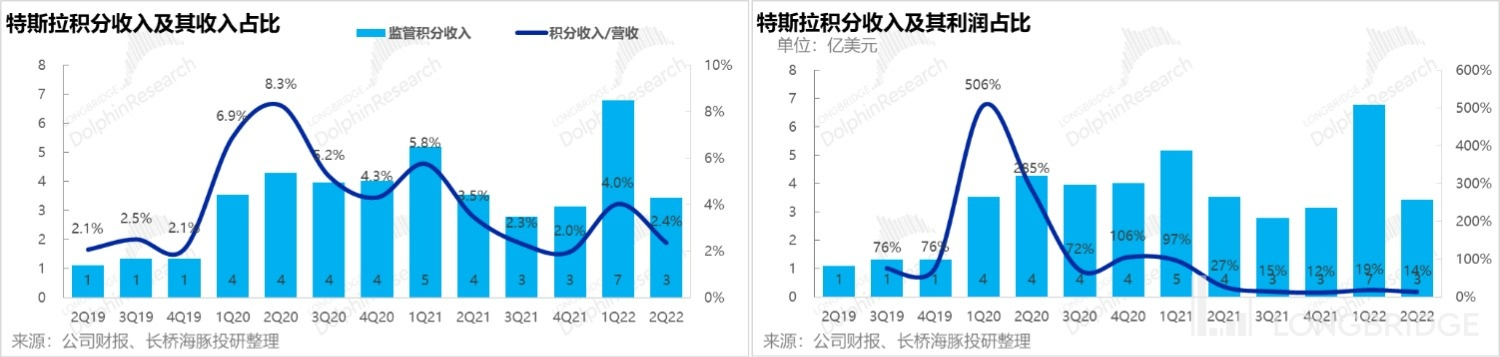

2.3 Revenue is in line with expectations: In the second quarter, the total revenue from sales of automobiles and credits reached $14 billion, a year-on-year increase of 42%. Revenues from automotive leasing business were $590 million, a year-on-year increase of 77%, slightly slower than in the previous quarter. After an abnormal high point of regulatory point income for a quarter, this quarter's revenue contribution of $340 million accounted for 2.4% of the total revenue and 14% of the pre-tax profit, basically returning to normal.

2.4 The price increase under cost pressure continues to push up gross profit margin:

After last quarter's automobile sales gross profit margin hit a new historical high, the costs of battery materials, logistics, and even labor have reached their peak. The fixed cost of per unit production has increased due to the shutdown of the Shanghai factory, and the appreciation of the dollar also has a negative impact while automobile gross profit margin fell to 27.9% and dropped below 30% after standing at 30% for three consecutive quarters.

However, looking ahead, there is a high likelihood that the trend of gross profit margin will continue to rise. Among the factors that affect automobile gross profit margin, even if Tesla does not raise prices in the third quarter, the previous price increases mainly targeted new orders, which should be more fully reflected in the third quarter.

Meanwhile, raw material prices, logistics costs, and other factors are all falling, especially the Shanghai factory as Tesla's capacity and the source of profit improvement. Production capacity will be restored, and according to Tesla's latest calculation, the annual production capacity has reached 750,000 units+, equivalent to producing 2,100 units per day.

It is almost a certainty that the profit will be restored to over 30% as the price of a single car may increase, while the cost of a single car may decrease.

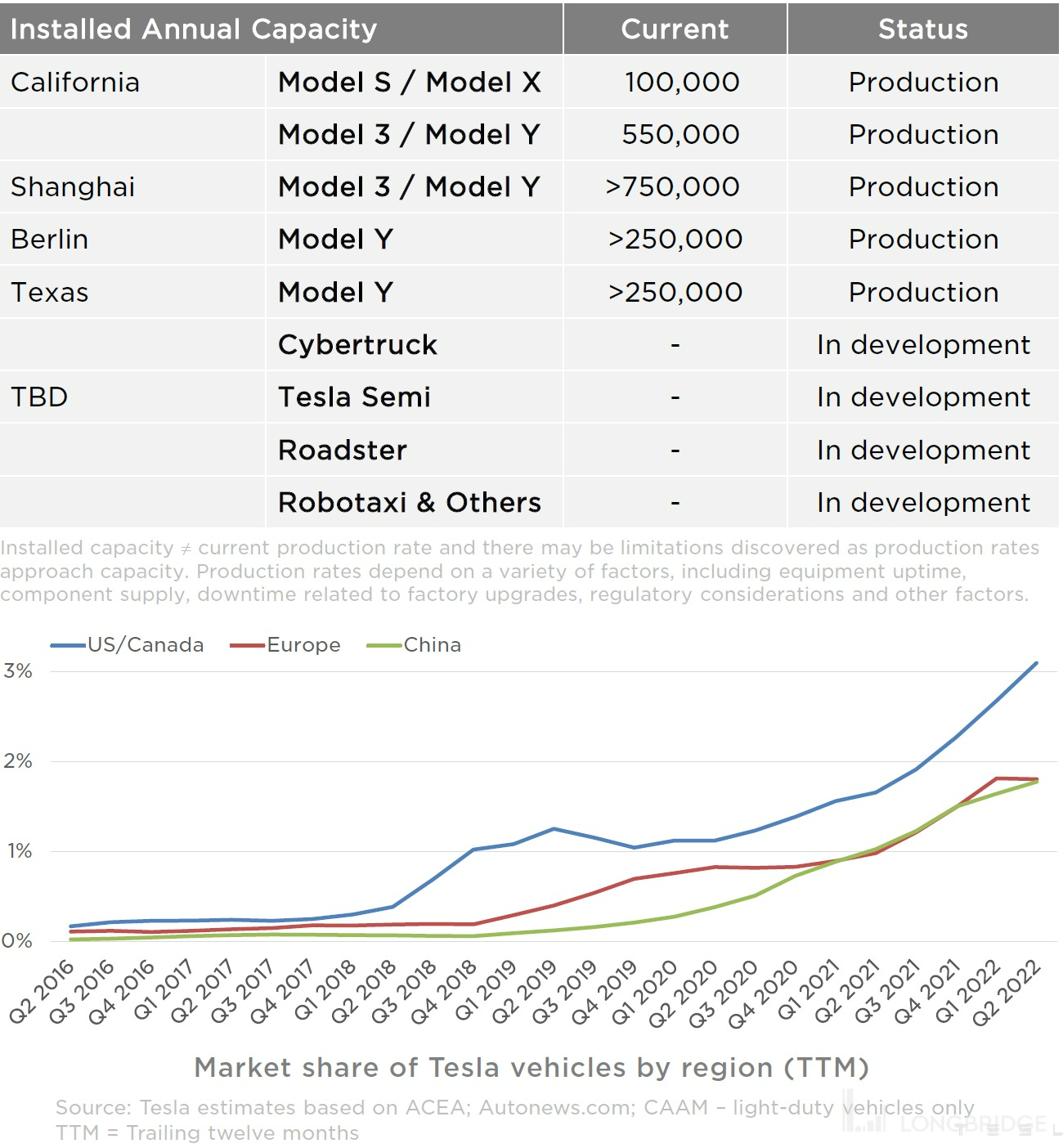

III. Production Side: Berlin and Texas Factories are mass producing, and the Shanghai Factory aims for a million units capacity

From the customer deposits and inventory days after the price increase, it can be seen that Tesla's capacity release is the core issue now. Only the capacity release can solve the backlog of orders and release the group's level of gross profit.

At present, looking at the four factories around the world, the old factory in California has basically no problems. The Shanghai factory will be the mainstay of production capacity without epidemics, while the factories in Texas and Berlin are the key variables for Tesla to climb stairs.

3.1 New factories: "Large furnace of burning money," Berlin factory's weekly production just passed 1,000

When Musk said at the end of May that the Berlin and Texas-Austin factories were "large furnaces of burning money" and "roaring factories with a burning sound," it was clear that the capacity of these two new factories was not progressing smoothly.

The German Berlin factory achieved mass production at the end of March, with a planned production capacity of 500,000 units, but as of the end of the second quarter, it had only produced just over 1,000 units of the Model Y with a 2170 battery per week. The production target was supposed to be 1,000 vehicles per week (50,000 vehicles per year) at the end of April, all of which were Model Y models. And the new factory in Texas, USA, is not releasing production capacity smoothly. This time, the company simply said "production capacity is ramping up."

3.2 Shanghai Factory: Planned capacity of 500,000 vehicles, but expected to reach 1 million in 2022

After the unblocking, the output of the Shanghai factory reached a new monthly high. Recently, equipment updates have been made, and the production capacity can be improved again. The current annual production capacity is 750,000 vehicles, which is significantly higher than the previous 500,000 vehicles.

Moreover, according to Tesla's statement, there is still room for improvement in the production capacity of this factory, and it is very likely to reach a production capacity of one million at the end of the year.

Data source: Tesla financial report

IV. Technology: FSD has always been prophesied, and the 4680 battery has been delayed

4.1 Autonomous driving has always been Tesla's core technology, but its progress has been prophesied

-Tesla has always valued the value of FSD. FSD can not only promote the world's energy transformation, enhance the safety of electric vehicles, but also enhance profitability for the company, which is a win-win situation. However, the actual progress has not reached the true FSD. The market has been accustomed to Tesla's prophesying that "FSD will be achieved next year";

- In terms of business model, a step forward has been taken, and the subscription mode of intelligent driving FSD has been launched. The subscription mode is more in line with the capital market's imagination of Tesla's business model, but its effect on improving FSD loading rate is minimal. The number of FSD North American users exceeds 100,000, while the cumulative sales in North America since 2016 have exceeded more than 1.2 million units.

4.2 Construction of new 4680 battery production capacity

- The 4680 battery enhances product competitiveness and reduces production costs. The company has successfully verified the performance of the 4680 battery and stated at the Berlin factory's open display that the Model Y produced at the Berlin factory will use the 4680 battery, effectively increasing the driving range by 16%. The 4680 battery is also a key factor for the company to further reduce costs;

- In April 2022, Tesla's new factory in Texas, USA, unveiled the Model Y model with a 4680 battery pack and delivered a small batch to some employees. The subsequent large-scale production still needs to be tracked. Earlier, the market expected the mass production of the 4680 battery to be in 2023.

- In addition to the plan for the 4680 battery production at the Texas factory in the United States, the equipment is currently still under construction; the 4680 battery production line at the German factory is also under construction, and Panasonic invested US$700 million in a Japanese factory to produce 4680 batteries for the company, adopting a self-made +OEM model;

V. Energy storage: a long way to go

5.1 Plain energy storage: Tesla's energy storage business includes selling solar systems and energy storage systems to residential, small commercial, large commercial, and utility-level customers. In the second quarter of 2022, revenue was US$860 million. It should have been a relatively busy installation season in the summer and only increased by 8.1% year-on-year, but the gross profit margin has obviously recovered to 11%. Capacity is the bottleneck for performance growth: The company claims that the shortage of energy storage semiconductors is more severe than that of cars, resulting in a relatively large supply gap in energy storage business, while the new Megapack plant capacity is still climbing.

5.2 Service business revenue grows rapidly, gross profit margin turns positive: In the second quarter of 2022, Tesla's service business achieved revenue of 1.5 billion US dollars, an increase of 54% year-on-year, with a gross profit margin of 3.8%, and gross profit turned positive.

This business is based on stock cars, and as Tesla's stock cars on the road become more and more, this business growth should continue to increase rapidly. Especially after the recent rise in oil prices, the market demand for Tesla and other new energy used cars is very strong, and the used car business is very good.

< End of content >

For Dolphin Analyst's historical articles, please refer to: May 21, 2021's Longbridge Deep Dive: "10 Years, 300 Times, How Long Will the "Magic" Tesla Last?"

June 3, 2021's Longbridge Deep Dive: "Tesla (Part II): Did We Miss the Shot or Overestimate? Where is the Story of Tesla At?"

April 27, 2021's Financial Report Review: "After Tesla's Unsurprising First-Quarter Report, What Else Can We Look Forward To?"

April 27, 2021's Conference Call: "Tesla 2021 Q1 Performance Conference Call Summary"

July 27, 2021's Financial Report Review: "Tesla: No One Is the Best, Only Better!"

July 27, 2021's Conference Call: "Tesla 21Q2 Earnings Conference Call Summary"

October 21, 2021's Financial Report Review: "Tesla: Can Musk Make $3,000 Happen? What Is the Sky High?" 2021 October 21 Telephone Conference: "Tesla: The Sale of One Million Units is Coming, Will Musk Let Go?"

2021 December 6 Opinion Update: "Musk Sells Tickets to Pay Taxes, What Will Happen to Tesla's Stock Price?"

2022 January 27 Financial Report Review: "Tesla, the Unbeatable Leader, Will Take a Break?"

2022 January 27 Telephone Conference: "Tesla: Musk Reiterates the Importance and Potential Value of FSD (Summary of Call)"

2022 February 28 Opinion Update: "Invest in Tesla with 'Safety First' Mentality, As Chaos Reigns Supreme" (https://longbridgeapp.com/topics/1988501?invite-code=032064)"

2022 April 21 "New Factory Capacity Increases, Tesla to Deliver 1.5 Million Vehicles in 2022 (Meeting Summary)"

2022 April 21 "New Energy Booming, Tesla Continues to Excel"

Risk disclosure in this article: Dolphin Analyst Disclaimer and General Disclosure