First-quarter profit, Dingdong Maicai becomes the "last lone hero of pre-warehouse"

Hello everyone, I am Dolphin Analyst!

Last night (August 11th Beijing time), Dingdong Maicai released the Q2 financial report for 2022 before the US stock market opened.

As a company that was recently picked up by the Dolphin Analyst and included in the watchlist, Dingdong Maicai's stock price has returned to the initial point when the Dolphin Analyst first started paying attention to it, after experiencing the early delisting of Chinese concept stocks and the recent Meituan incident.

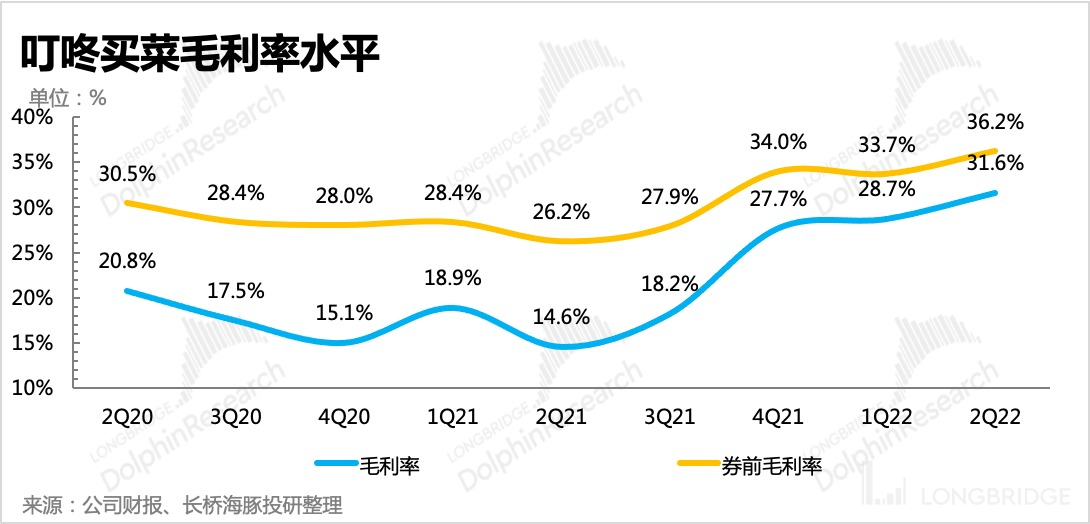

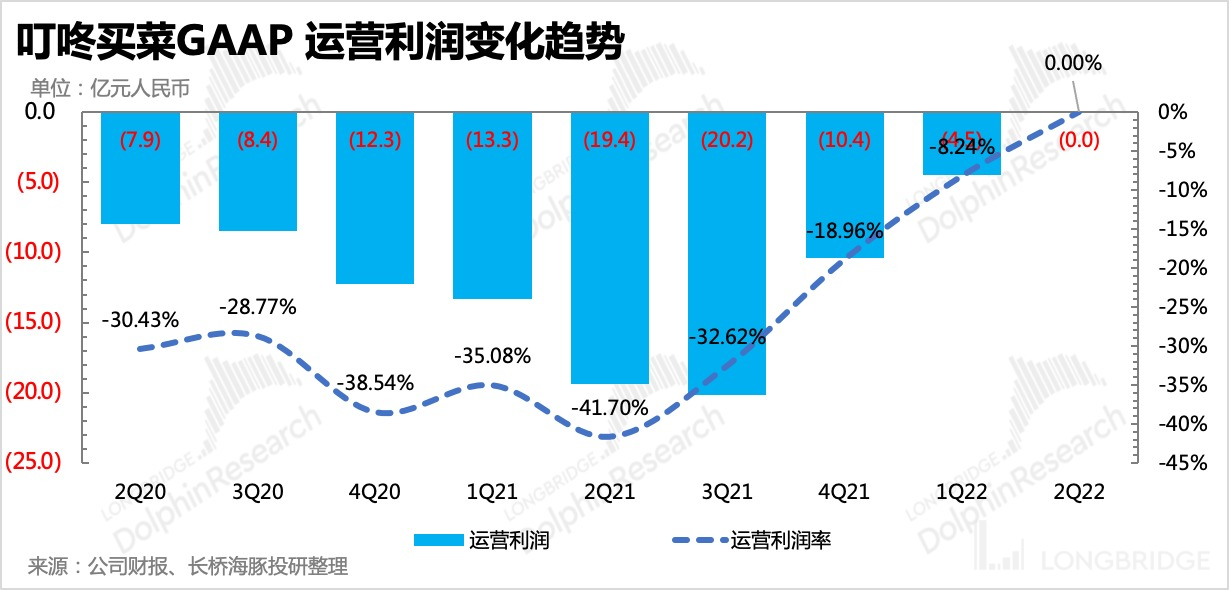

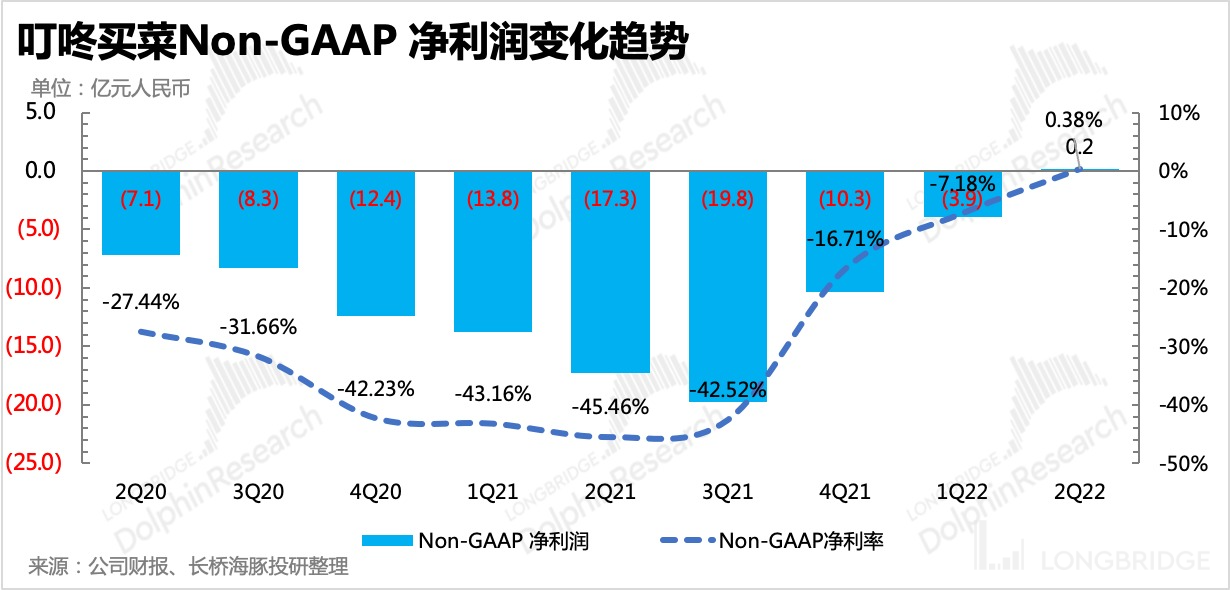

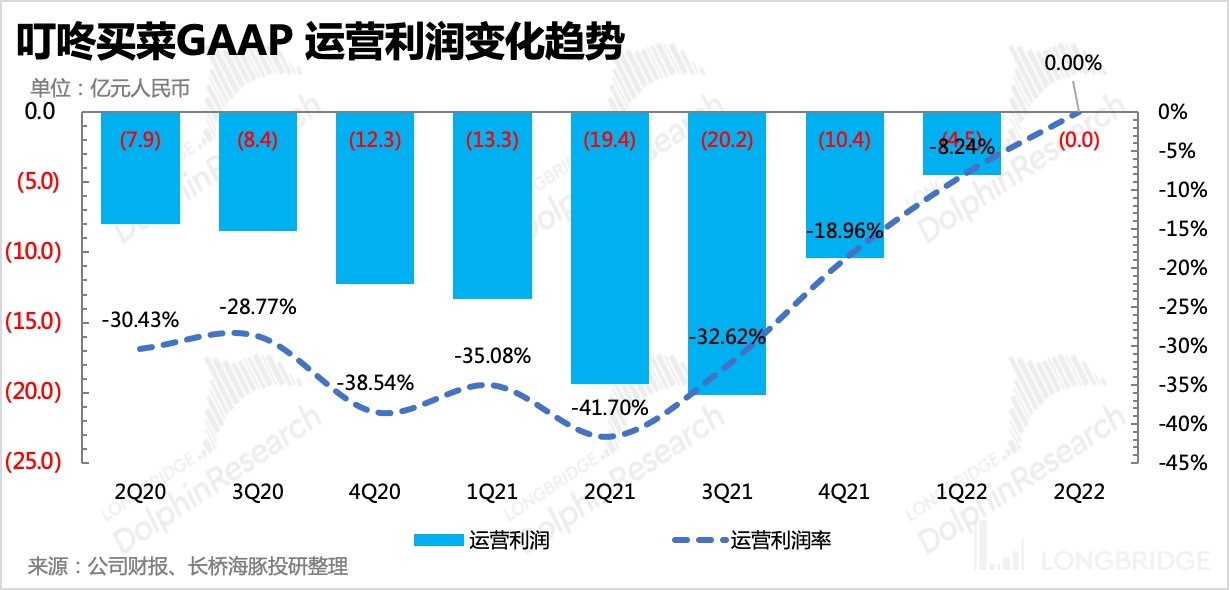

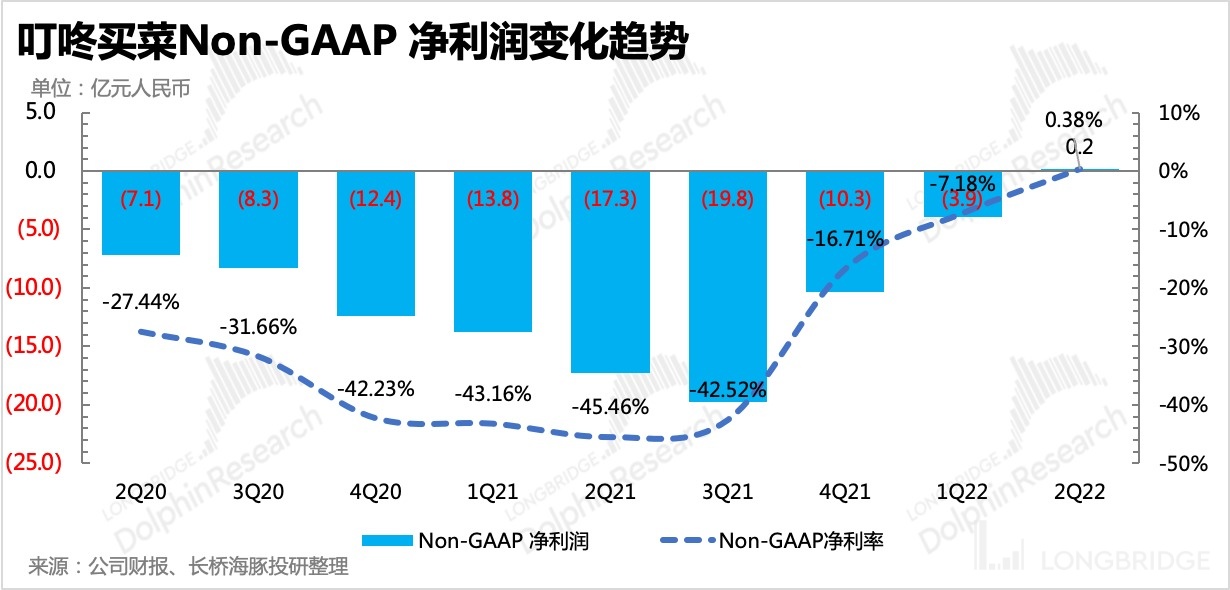

In terms of this financial report, the most eye-catching aspect is the positive GAAP operating profit this quarter, and the Non-GAAP net profit that excludes share-based compensation expenses has actually turned a profit. A higher gross profit margin and a year-on-year decrease in all expenses except research and development costs are the key factors in squeezing out profits.

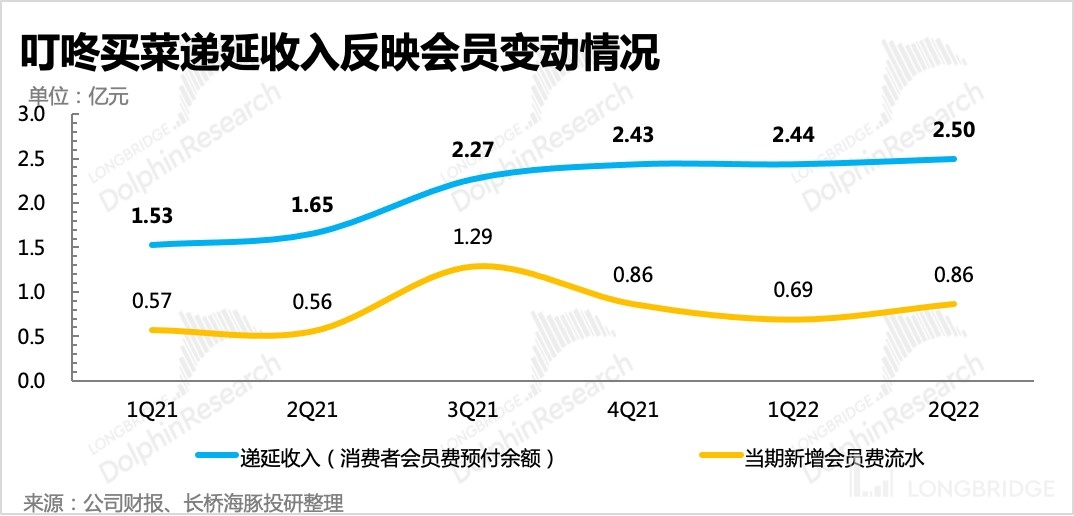

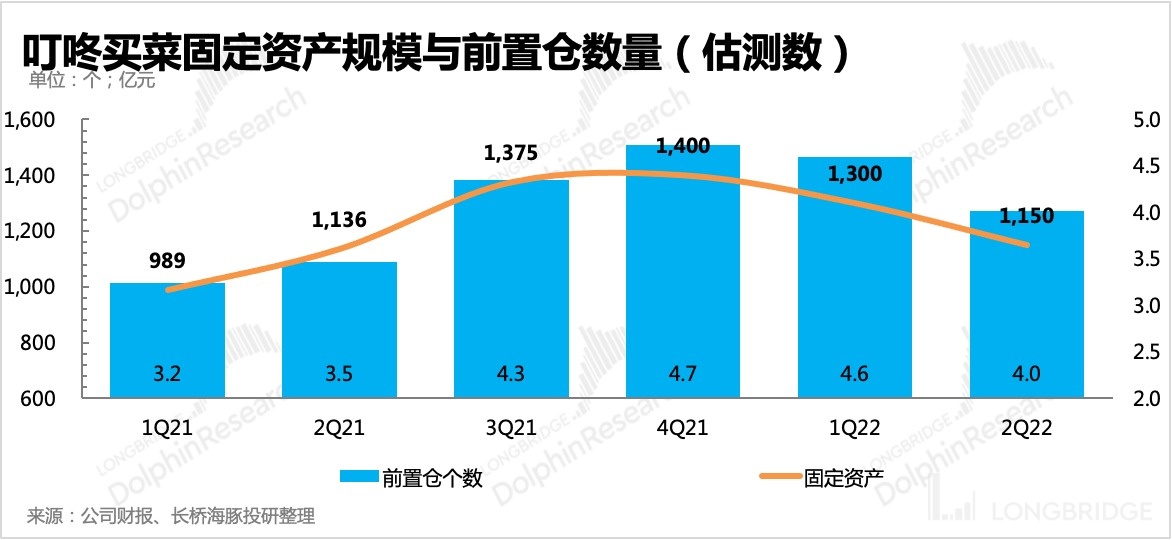

Although Dingdong Maicai did not disclose the operational data that the Dolphin Analyst was most concerned about (such as the number of front-end warehouses, order frequency, and number of trading users), from the changes in deferred revenue and the scale of factory equipment assets, it is still possible to find some clues that membership fees have increased and the current number of normal front-end warehouses has decreased.

The optimization of expenses further reflects the management's reform achievements in improving operational efficiency, which is also a scenario that the Dolphin Analyst would prefer to see. Perhaps many investors will question its growth after seeing the decrease in the number of Dingdong Maicai's front-end warehouses and choose to leave. But in the two articles "Dingdong Maicai (Part 2): Valuation Depends Entirely on Imagination, and Now is Not a Good Opportunity" and "The Turning Point of Profitability is Near, Dingdong Maicai is Not So Desperate", we explained in detail the key role of "efficiency first" in ensuring that fresh food e-commerce can continue to operate.

In this year of great macro pressure, the less well-off wallets of consumers will bring more headwinds to Dingdong Maicai's growth, but Dingdong Maicai, which has continuously optimized its operating performance in the first two quarters, has already shown us its confidence in withstanding resistance.

Perhaps when short-term emotional influences dissipate, Dingdong Maicai will once again prove its long-term value to the market.

Detailed Interpretation of this Quarter's Financial Report

I. Revenue Growth Remains Steady, "Epidemic Price Increases + Self-Owned Brands" Are the Main Reasons for Gross Margin Improvement

Dingdong Maicai's Q2 revenue was RMB 6.634 billion, a year-on-year increase of 43%, with a growth rate that has not slowed down compared to the previous quarter, and higher than the market's unanimous expectations. However, the expectations of core investment banks were originally higher, mainly due to some expectations of relative benefits from the epidemic.

In terms of segmental revenue:

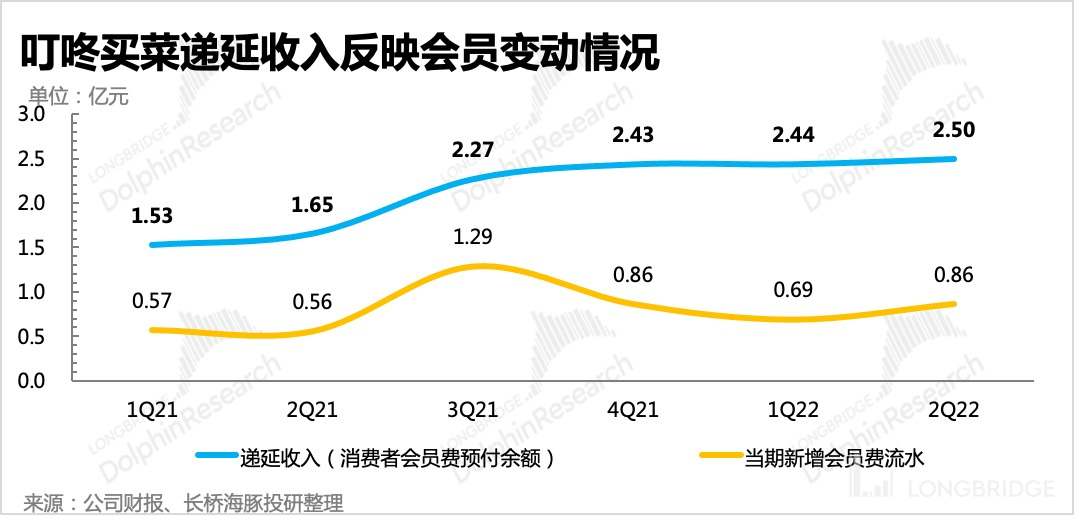

- The service revenue (membership fee) this time had a year-on-year growth rate of 88%, mainly due to the increase in the number of members. From the deferred income, it can be seen that the membership fee has not increased, but the year-on-year increase in deferred income for consumers who have prepaid membership fees can only indicate that more users have become members.

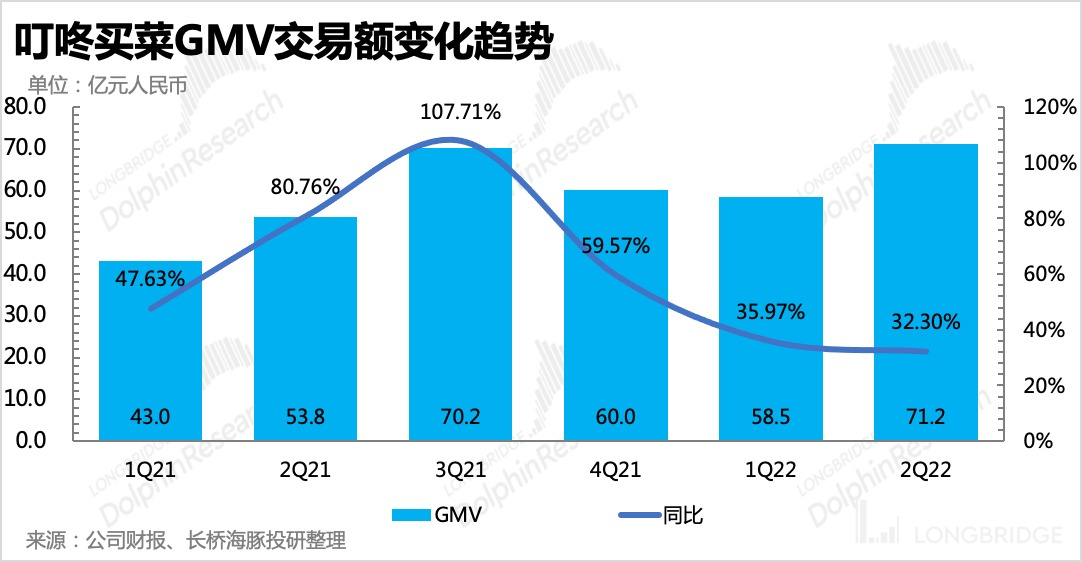

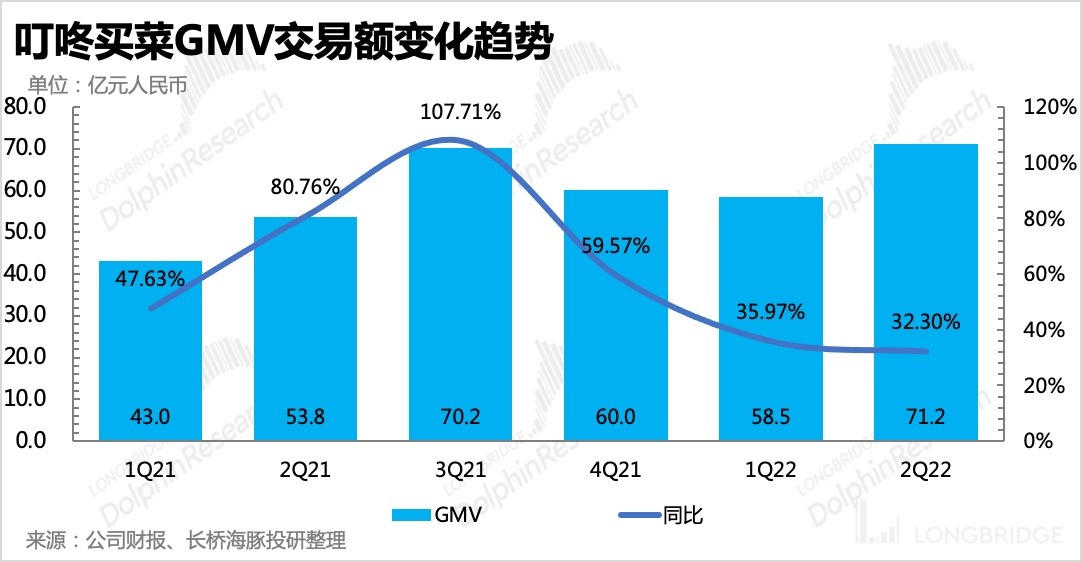

2)Product sales revenue was RMB 6.55 billion, a YoY increase 42%. This quarter's GMV reached RMB 7.1 billion, a YoY increase of 32%, with a slightly slower growth rate compared to the first quarter.

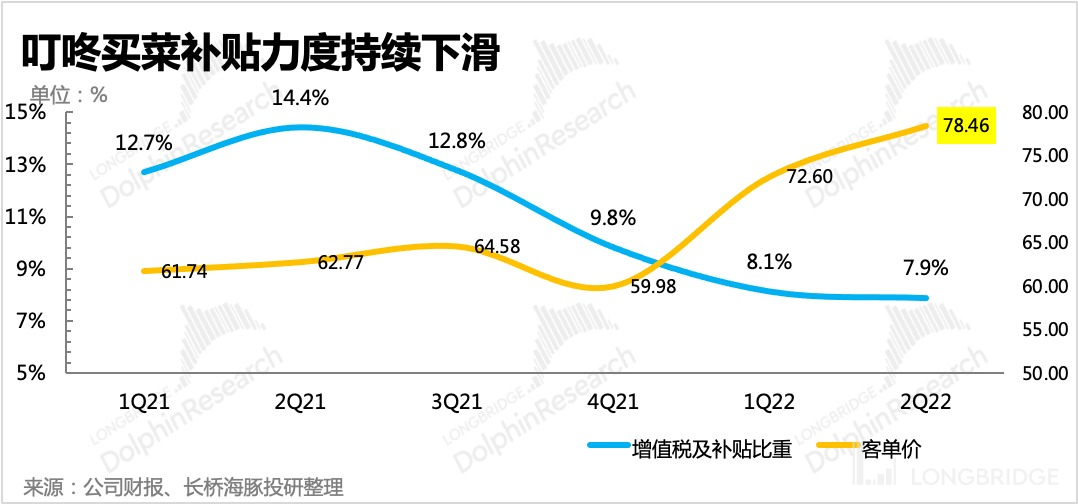

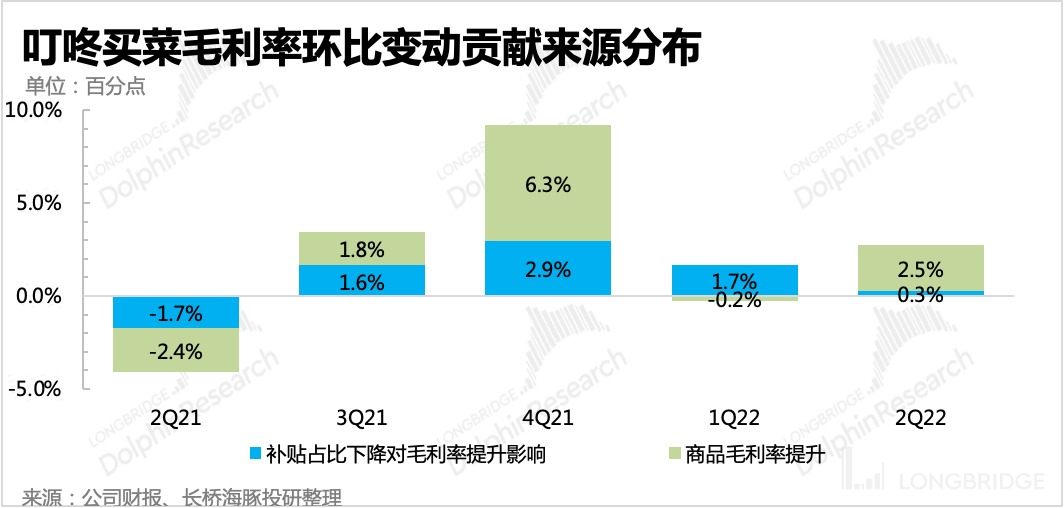

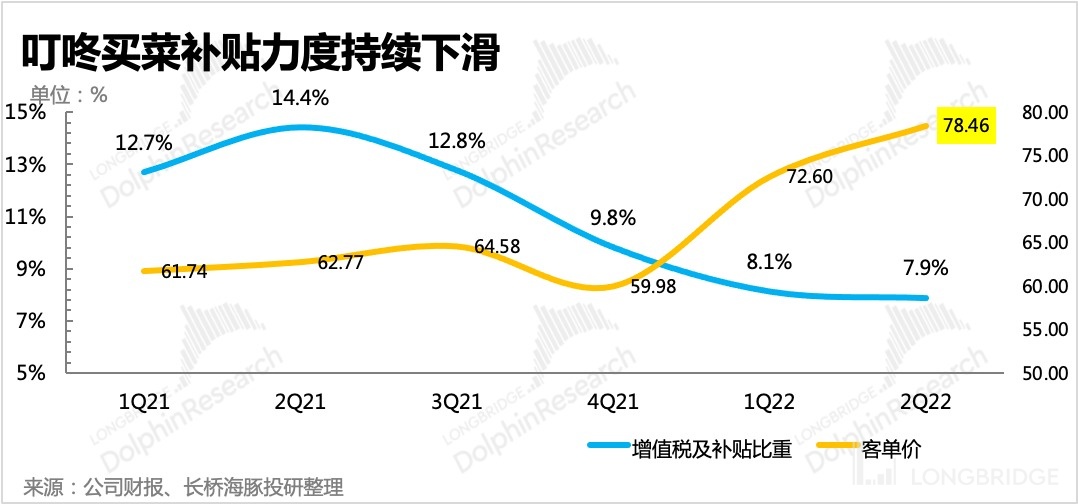

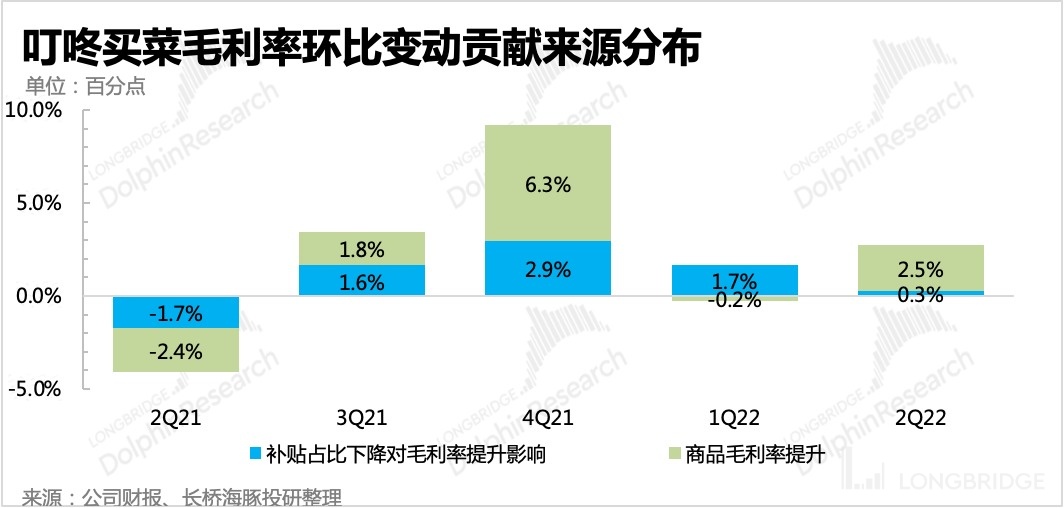

Looking at the subsidy situation from "GMV-revenue", although the proportion of value-added tax and subsidies continued to decline to 7.9%, the downward trend has basically stabilized, reaching a relatively balanced state. Reflected in the reason for the increase in gross profit margin this quarter, the impact brought by the decrease in subsidies is diminishing.

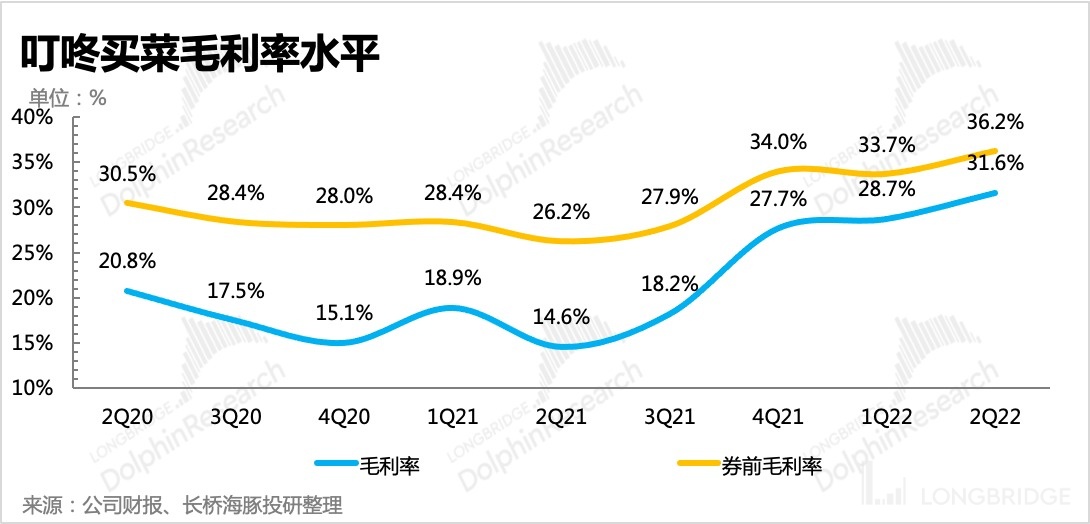

That is to say, the improvement in the gross profit margin of the products this quarter is the main reason for the continuous optimization of the overall gross profit margin.

(Note: The yellow data in 2Q22 is the Dolphin Analyst's forecast)

Dolphin Analyst believes that the improvement in the product gross profit margin is due to the shortage of living materials during the epidemic period and the rise in prices due to supply shortages. In addition, the sales volume of Dingdong Maicai's self-owned brand products with higher profit margins has also reached a new high. According to the financial report, the GMV of Dingdong Maicai's self-owned brand reached 17.5% of the overall GMV in the second quarter, a substantial increase from 7% in the first quarter.

Second, operating expenses have been comprehensively optimized, and Non-GAAP losses have turned into profits for the first time.

After continuously optimizing the expense end for two consecutive quarters, Dingdong Maicai achieved a beautiful result of turning its GAAP operating profit positive and Non-GAAP net profit into profit by continuing to close front storage points with lower operational efficiency.

Behind the drive, in addition to the improvement of gross profit margin mentioned above, comprehensive optimization of the cost side is also a major contributor.

Behind the drive, in addition to the improvement of gross profit margin mentioned above, comprehensive optimization of the cost side is also a major contributor.

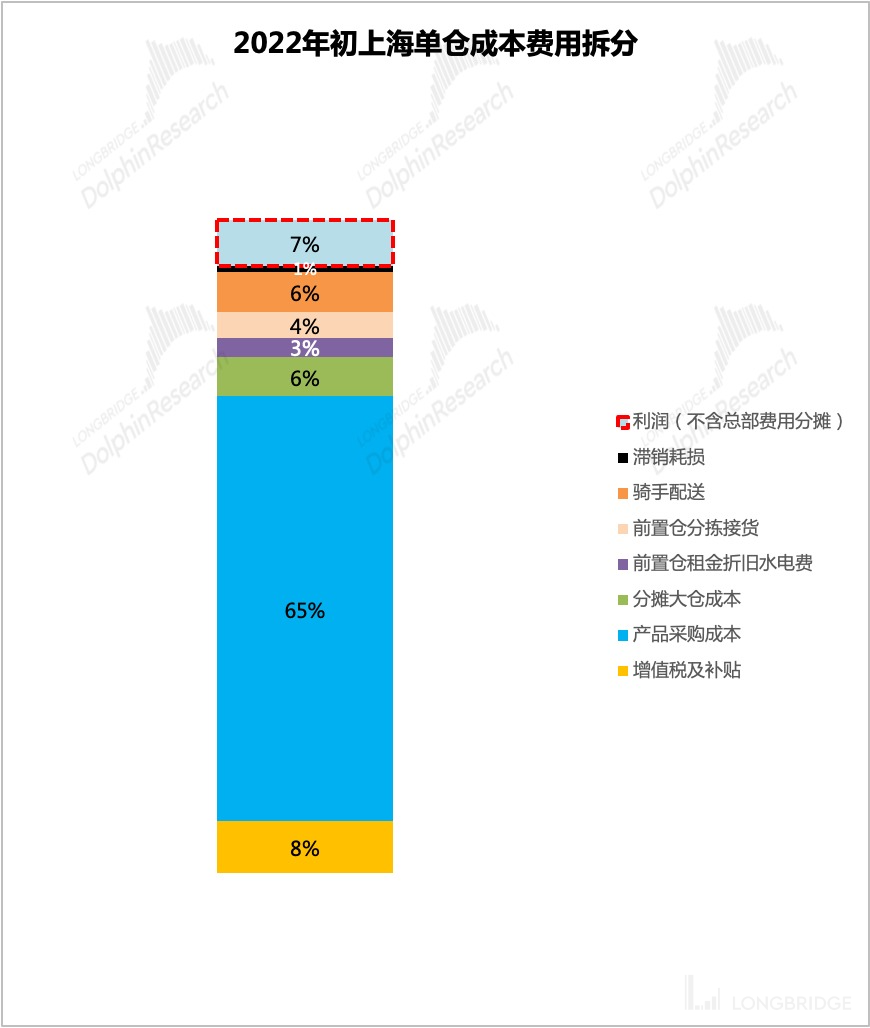

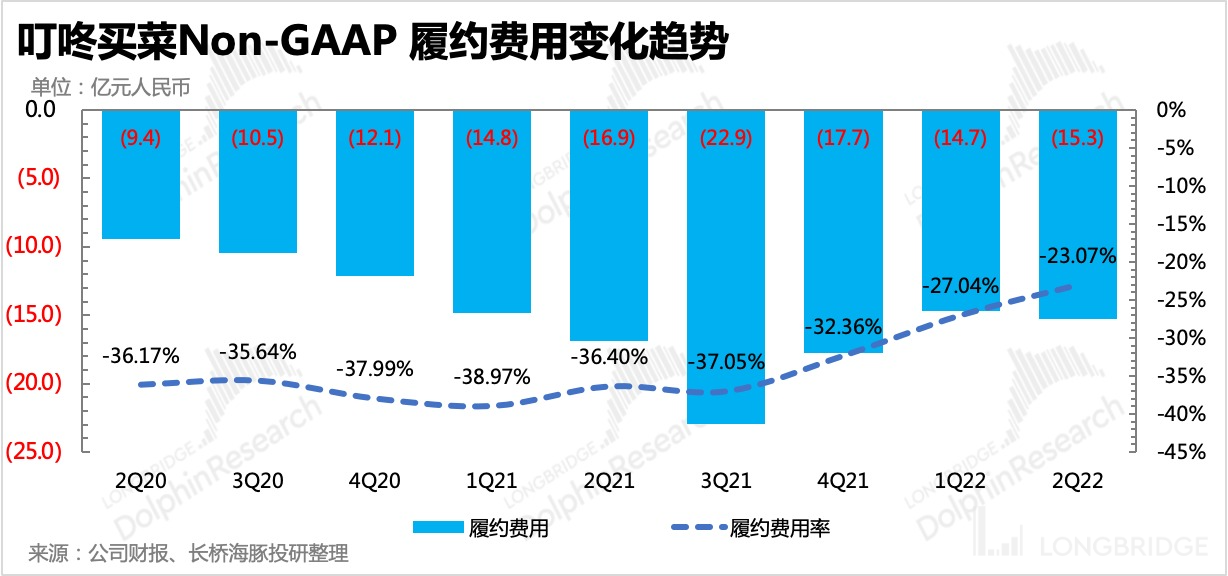

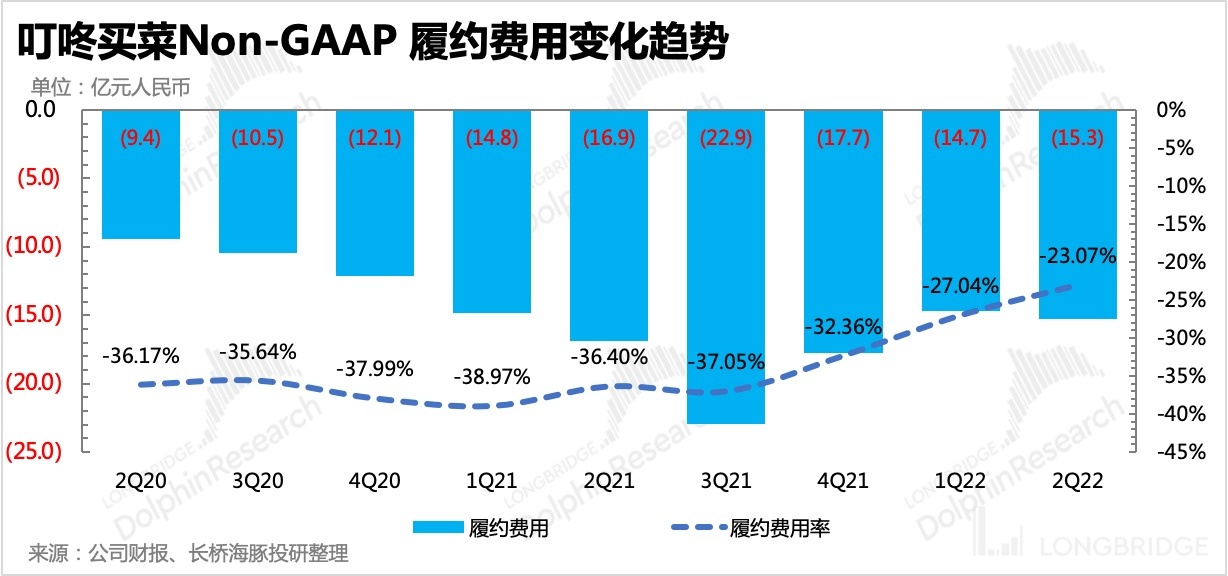

1. Among them, the highest proportion of performance-related expenses has been continuously optimized for three consecutive quarters, with an absolute value decline on a year-on-year basis and a faster decline in expense ratio due to the expansion of total revenue.

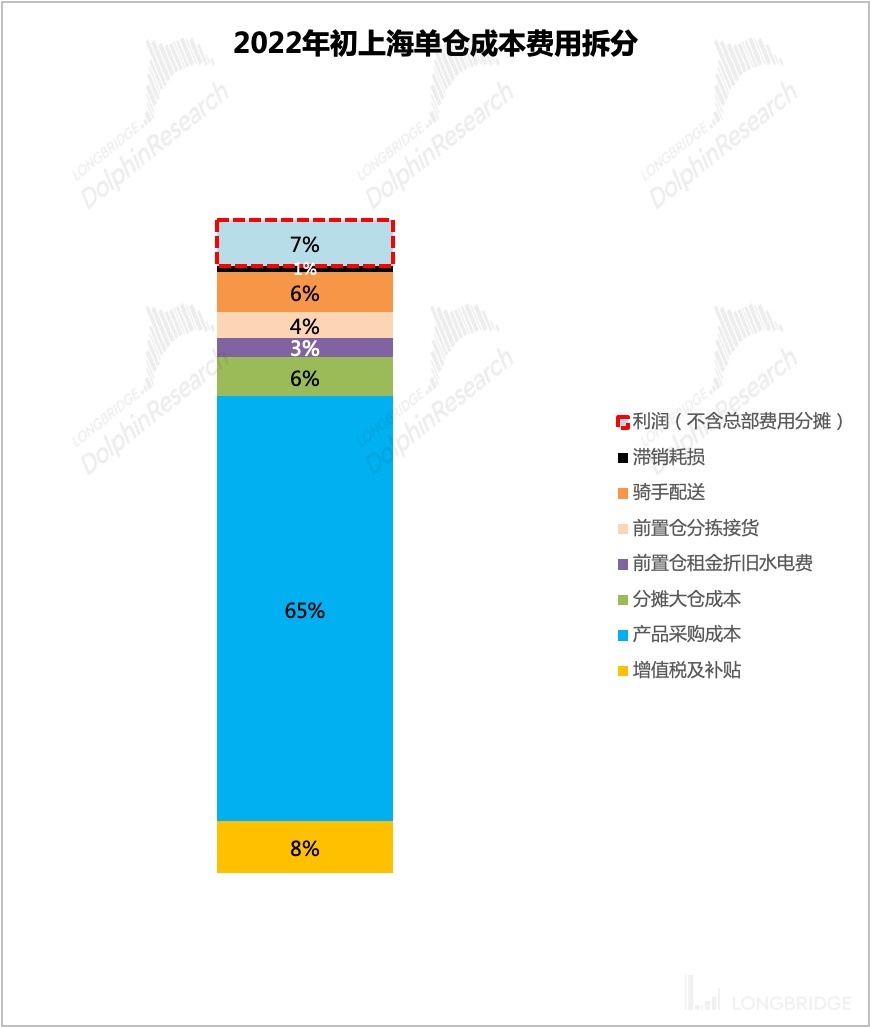

Dolphin Analyst believes that, from the analysis of performance-related expenses, the reason for the absolute value decline may come from the closure of some pre-warehouses, the decrease in overall rental costs and water and electricity costs, as well as the reduction of corresponding configured riders and sorting teams.

At the same time, GMV is still on the rise, which makes the performance-related expense ratio increase. The logic behind this is that with the increase in order density in the same range, the delivery efficiency of individual riders can be improved without the need to add additional riders to meet the increased user order demand.

The overall performance-related expense ratio for the second quarter was optimized to the level of 23%, which is already very close to the profit level of the Shanghai front warehouse before the end of last year (excluding headquarters expense allocation).

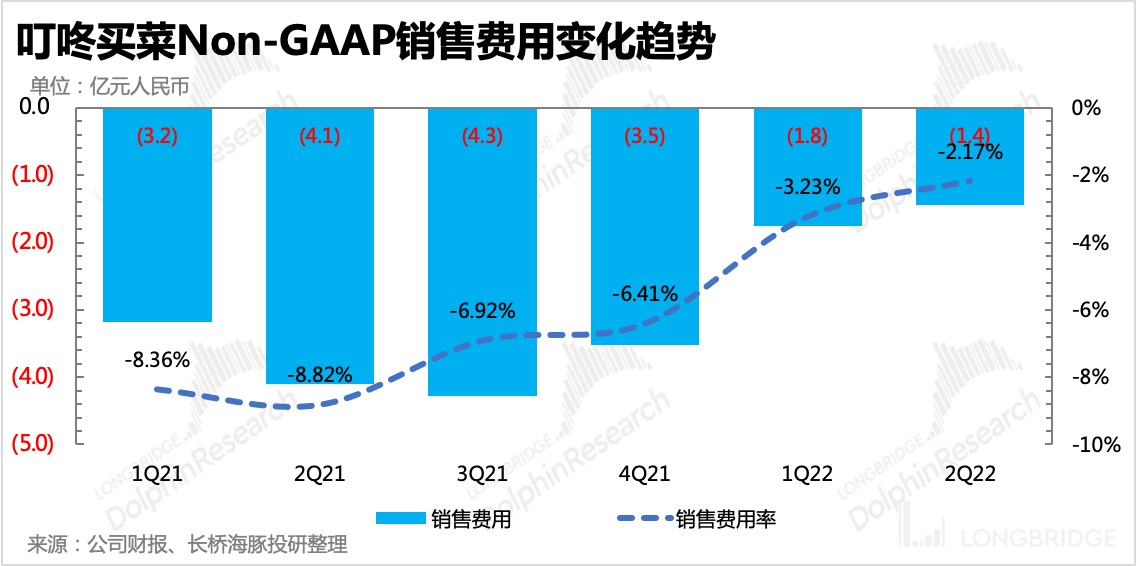

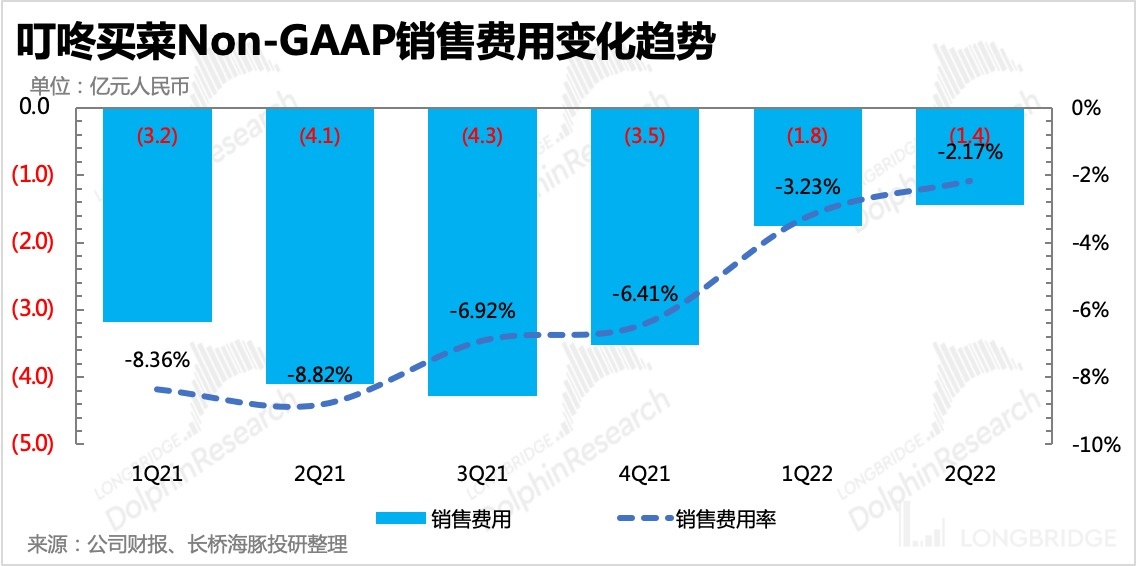

2. Sales expenses continued to decline year-on-year, reflecting the company's own brand effect

In the second quarter, the sales expenses of Dingdong Maicai once again saw a significant year-on-year decline, not to mention the degree of optimization of the sales expense ratio under the increase in income.

Under the shrinking of sales expenses and the expansion of income, it shows that the company's normal operation no longer needs to carry out aggressive marketing activities to attract and promote customers, such as the marketing techniques used by early fresh e-commerce companies - downloading apps to send rice, eggs and so on. More importantly, it relies on the natural increase of customer unit price after the usage habits of stock users, or the effect of new customer acquisition through word-of-mouth between users. Whichever case, it can demonstrate the brand influence of Dingdong Maicai and the word-of-mouth that has gradually occupied users' minds.

Of course, the Daily Freshness's retreat during the epidemic also gave Dingdong Maicai an opportunity to gain more market share and users without much effort. Although there are still many competitors for Dingdong Maicai in the entire fresh e-commerce market, such as Meituan Maicai and Hema, there is almost only Dingdong Maicai left as a "lone ranger" in the entire front warehouse e-commerce segment.

Three, trying to uncover the undisclosed official operating data

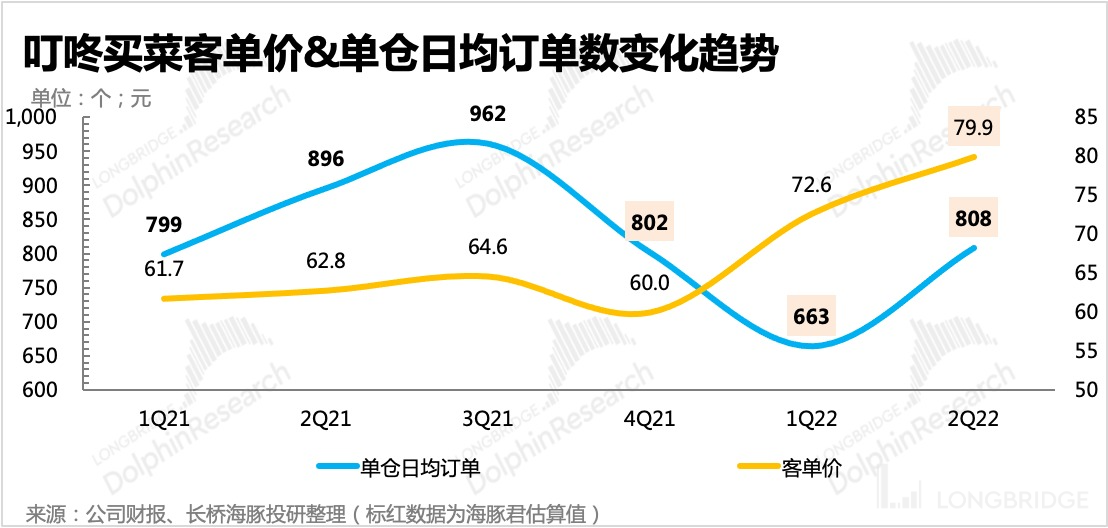

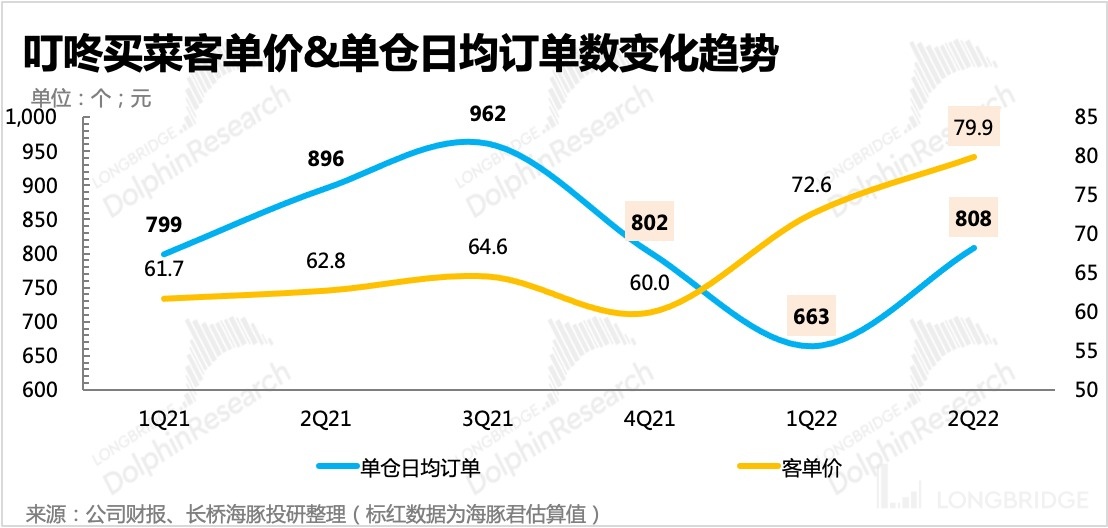

This time, Dingdong Maicai's financial report did not disclose the operating data that Dolphin Analyst is most concerned about - front warehouse quantity, ordering times, ordering user scale, average customer unit price and other indicators. Although these indicators have not been fully disclosed before, some information will always be disclosed. We can calculate the remaining operating indicators through other data. In " Profit Turning Point is Near, No Need to Despair About Dingdong Maicai", Dolphin Analyst is excited about the improving trend of Dingdong Maicai's losses, but at the same time, is also skeptical and cautious about the declining trend of daily orders per warehouse (order density) shown in the operating data. Therefore, the focus is on the order situation for the second quarter. After all, in Dolphin Analyst's profit assumption model, order density is the key to the success of the pre-warehouse model. Although the increase in average customer unit price can also drive profits, from both a macro perspective—the current "per capita consumption level"—and a micro perspective—user "usage stickiness" for the platform—increasing order density is easier to achieve, and is more beneficial for Dingdong Maicai to maintain its competitiveness and long-term business vision.

Therefore, even though the company has not disclosed it, Dolphin Analyst still tries to assume and estimate the current operating situation of Dingdong Maicai, and the trend of the key indicator reflecting the order density, "daily orders per warehouse".

- Core Assumption 1: The average customer unit price increased by 10% quarter-on-quarter

This assumption is more of Dolphin Analyst's personal feeling as someone who lives in Shanghai and has been using Dingdong Maicai for a long time. There may be individual items with higher price increases, but there are also items that have remained the same. In addition, in areas without epidemic situations, the average customer unit price has been slipping normally. Finally, on the whole, the estimated average increase during the winter months, which has a relatively higher average customer unit price than in the first quarter, is around 10% (the impact of the epidemic on prices has already been observed), which is basically reasonable.

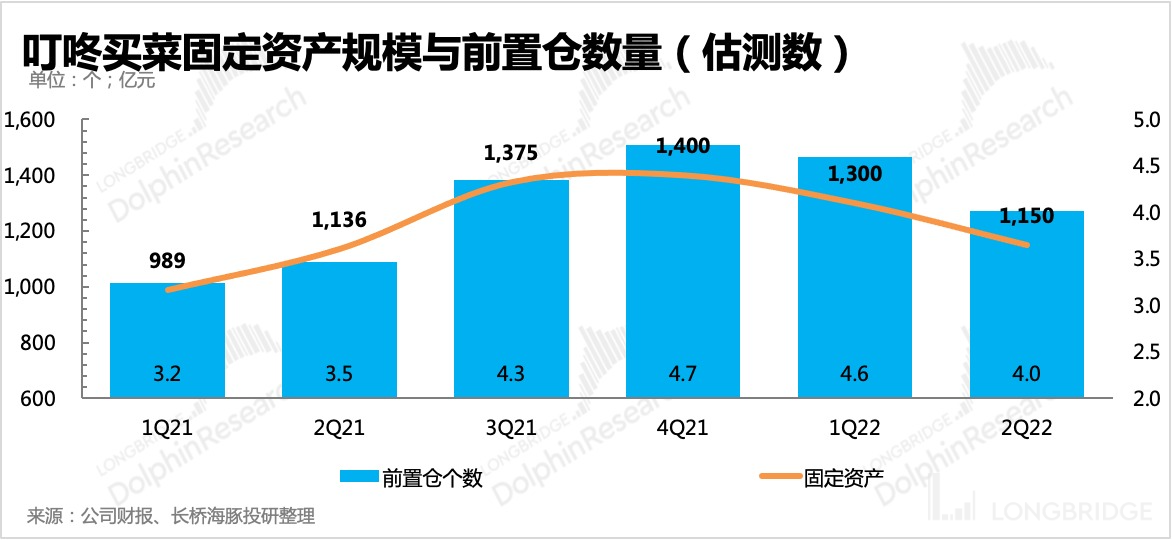

- Core Assumption 2: The number of pre-warehouses has decreased from 1,400 at the end of last year to 1,150

As for the number of pre-warehouses, the company's financial reports have not been disclosed for three or four consecutive quarters. Dolphin Analyst estimated the number of pre-warehouses for the third and fourth quarters of last year, and the first quarter of this year based on some expert research and news reports (10 city stations were closed in the second quarter, mostly in northern and third and fourth-tier cities, reducing an average of 10-15 pre-warehouses per city). As for the changes in the number of pre-warehouses in the second quarter, we mainly look at the trend of Dingdong Maicai's fixed asset scale change - the closure of city warehouses is still ongoing.

- Calculate the overall order volume for the second quarter to be 89 million orders by GMV/average customer unit price.

This is higher than the 81 million orders in the first quarter, but it has not reached the level of 100 million orders in the fourth quarter of last year. This data is basically consistent with the result of the combined positive and negative factors of "Shanghai pre-warehouses are frequently over-ordered in the second quarter + closure of some inefficient pre-warehouses and exit from some third and fourth-tier cities".

- Calculate the daily orders per warehouse by total order volume/pre-warehouse number/90 days, which is 808 orders/warehouse/day. From our assumptions and calculations, the average daily order volume of a single warehouse in the second quarter was much higher than that in the first quarter (663 orders).

This is also what Dolphin Analyst hopes to see. There are only two ways to turn a single warehouse from a loss to a profit: increasing the unit price of orders or increasing the order volume. However, as we have analyzed in previous articles, an increase in order density is a better choice. Therefore, although the first quarter showed signs of Dingdong Maicai approaching profitability, there were still some shortcomings -- the order density was actually quite low, although it can be explained that many new warehouses were in the ramp-up period, the gap is still significant compared to previous situations.

This also indirectly illustrates that Dingdong Maicai's warehouse opening speed was indeed too aggressive last year.

Combining <1-4>, we not only see a trend that is becoming closer to true profitability, but also a successful model of achieving benign development through order density - the single warehouse UE model.

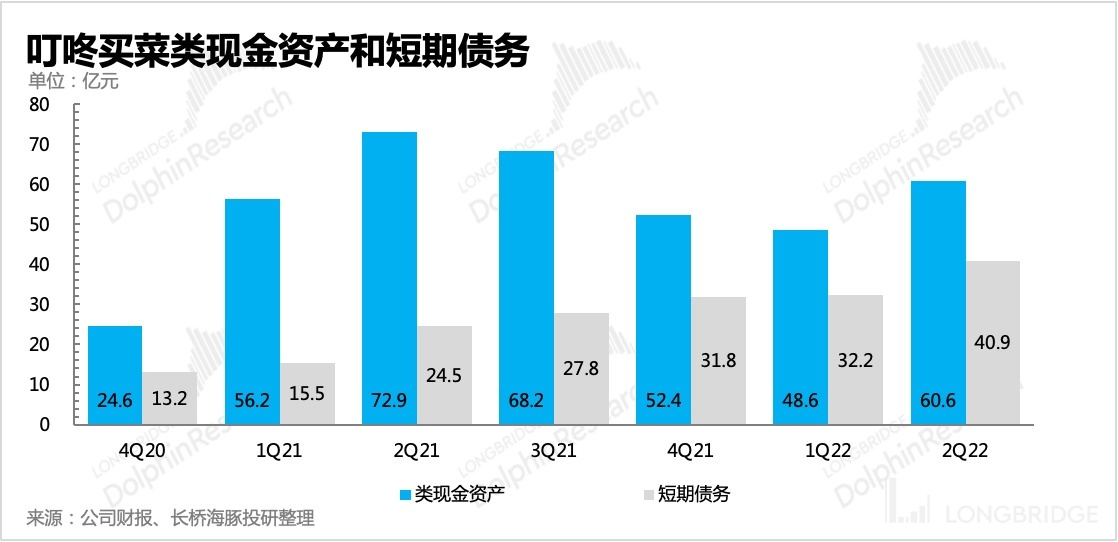

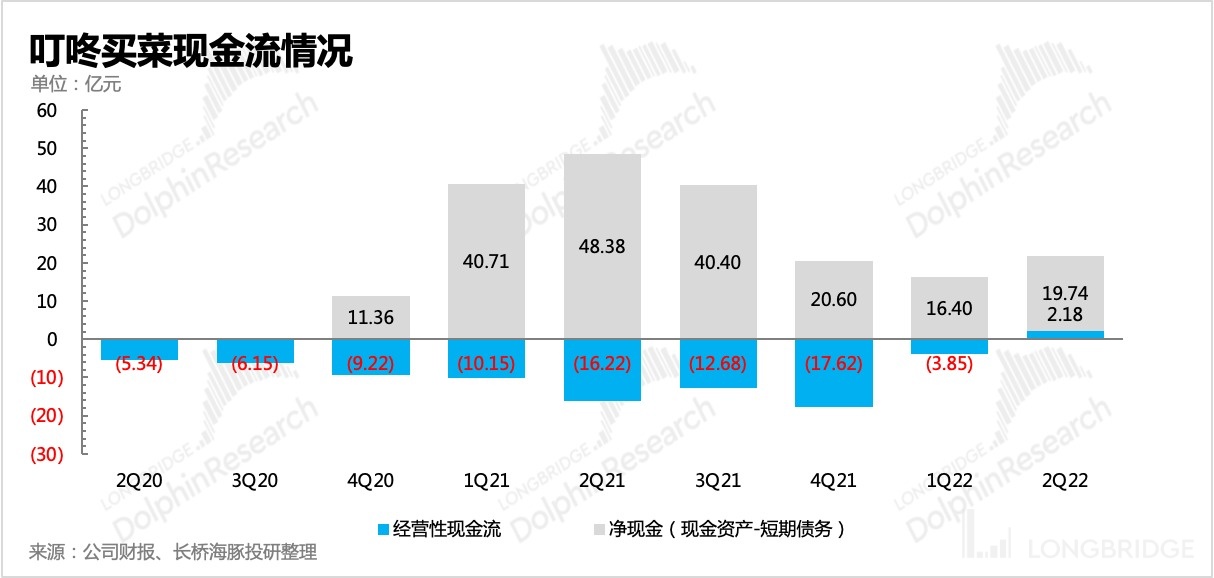

4. Finally, let's take a look at whether Dingdong Maicai has enough cash to spend?

As we all know, fresh e-commerce requires burning money, at least until users habitually use it, also known as the "ramp-up phase". Although the single warehouse model has been successful, the focus is still on efficiency for now, rather than expansion, in order to get through the short-term environmental crisis. If Dingdong Maicai hopes to continue its growth in the future, it must accumulate some funds to get through the "ramp-up period" of each pre-warehouse when it continues to expand in the future.

Management also knows that the market is concerned about the issue of cash flow, especially in the face of the risk of bankruptcy and liquidation of daily turnover optimization. Therefore, it has emphasized that its cash reserves are sufficient and its bank borrowing limit has been increased.

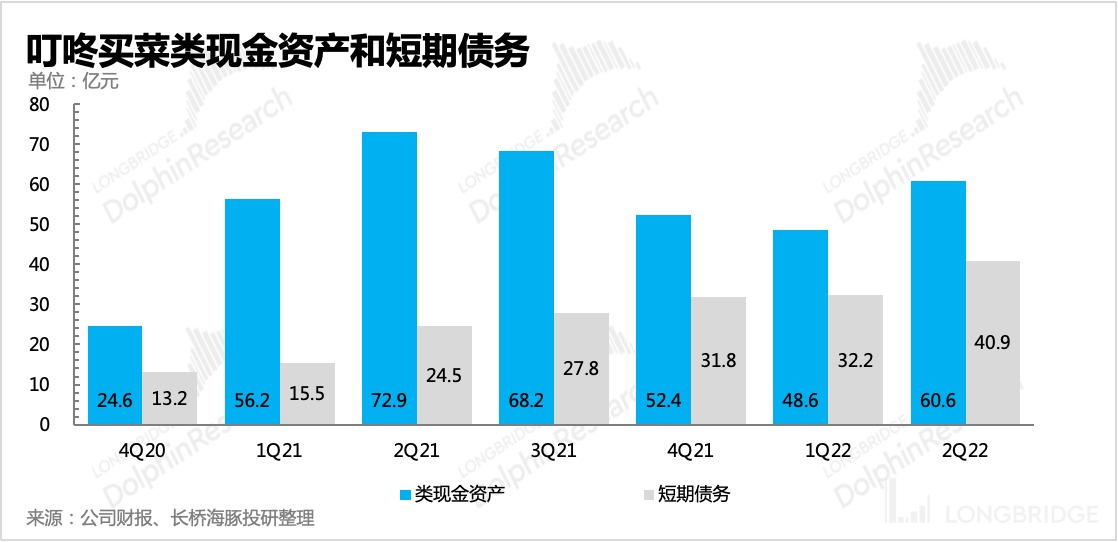

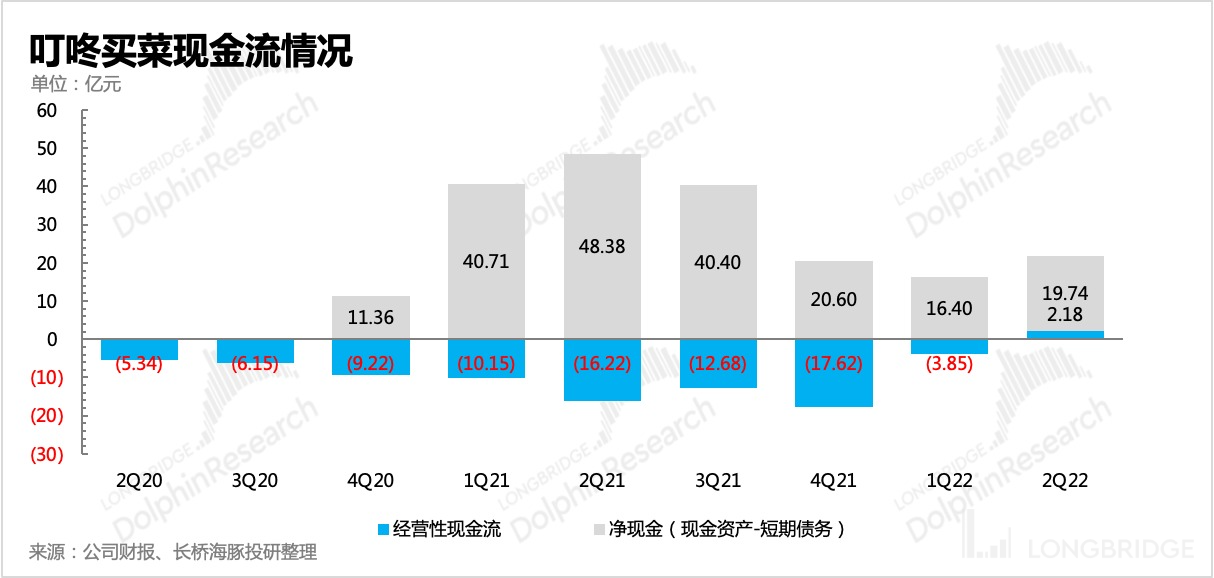

Looking at Dingdong Maicai's class of cash assets (cash + short-term investments) and short-term debt (short-term loans + part of the short-term repayment portion of long-term loans), after deducting class cash assets and short-term payable loans in the second quarter, the net cash remaining was nearly 2 billion. In the second quarter, Dingdong Maicai's operating cash flow has turned positive, even if all investment cash net outflow is added, it is only about 150 million yuan of capital outflow. Compared with the net cash of 2 billion yuan, there is still no need to be overly nervous about cash flow pressure.

Dolphin Research's Historical Reports on Dingdong Maicai:

In-depth

June 22, 2022 "Profit turning point is approaching, Dingdong Maicai is not that desperate" On July 15, 2021, "Dingdong Maicai (Part 2): Valuation Depends on Imagination, it's Not a Good Opportunity at Present | Dolphin Analyst" was published on Longbridgeapp.com.

On July 8, 2021, "Dingdong Maicai (Part 1): The Overlooked Gem of Pre-Warehouse? | Dolphin Analyst" was published on Longbridgeapp.com.

Risk Disclosure and Statement of this article: Dolphin Disclaimer and General Disclosure of Longbridge Investment