The output cannot be provided as there is no text between the markers. Please provide valid input for translation.

On the evening of August 15th, Beijing time, Shunyu Optoelectronics Technology (2382.HK) released its 2022 first-half financial report (as of June 2022) after the Longbridge Hong Kong stock market closed, with the following highlights:

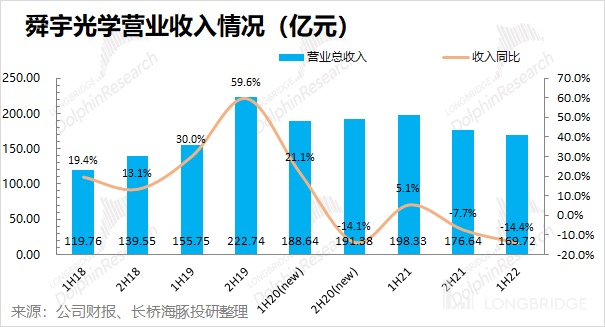

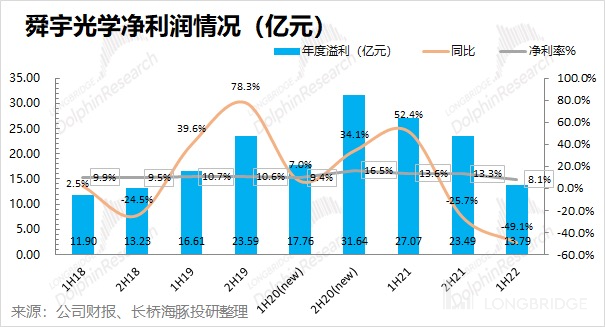

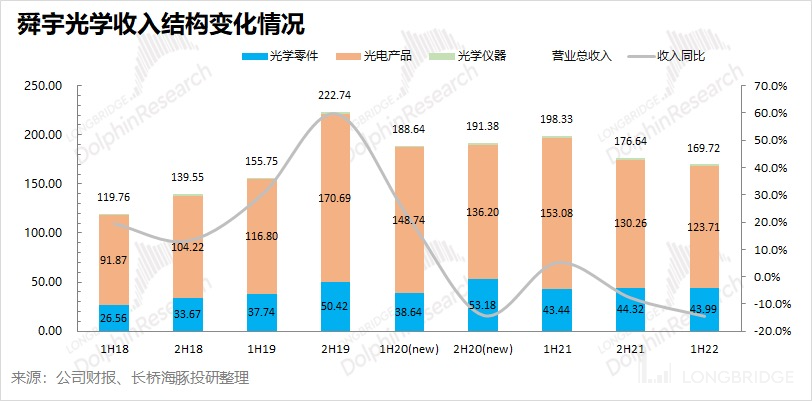

1. Overall performance: a tough first half-year for performance. In the first half-year, Shunyu Optoelectronics achieved revenue of RMB 16.972 billion, a year-on-year decrease of 14.4%, lower than the market expectation (RMB 17.619 billion); In the first half of the year, Shunyu Optoelectronics achieved a net profit of RMB 1.379 billion, a year-on-year decrease of 49.1%, which was close to the company's profit warning floor (RMB 1.344 billion to 1.478 billion). The company's poor performance in the first half of the year was mainly due to the impact of the sluggish demand in the mobile phone market. Decreased revenue, increasing expenses, ultimately resulting in "halved" profits.

2. Progress of downstream businesses: mobile phones are still weak, while cars are improving. Mobile phone business is still the largest source of revenue for Shunyu Optoelectronics Technology, and the drag on the company's performance in the first half of the year mainly came from the sluggish mobile phone market. The mobile phone business in the first half of the year fell by 19.5% year-on-year, continuing the previous downward trend, mainly affected by 1) the declining shipment volume of mobile phones; 2) The impact of the trend of reducing camera modules for mobile phones. The performance of the automotive business was significantly better than that of mobile phones, with a year-on-year growth of 9.6% in the first half of the year, and the share of the automotive business reached 10% for the first time. From the shipment of the company's products in July, the mobile phone business is still weak, while there are signs of improvement in the performance of the automotive business.

3. Shunyu's product revenue situation: the decline of the lens business is smaller than that of the camera module. Shunyu mainly divides its products into optical parts products with lenses as the main product, optoelectronic products with camera modules as the main product, and microscope products. The customers of the company's camera module products are mainly Android manufacturers, and the lens products include Apple. However, in the first half of the year, the pressure on Android customers was far greater than that on Apple, which resulted in a smaller decline in optical parts than in optoelectronic products.

Overall view: Shunyu Optoelectronics, the financial report for the first half of the year is really "tough". Since the company had previously issued a profit warning, the market had anticipated that the company's profit in the first half of the year would be halved. Although the profit of this financial report also reached the lower limit of the forecast, the market also reacted excessively. From this half-year report, the sluggish demand of the mobile phone market in the first half of the year and the increasing market competition ultimately led to the double killing of the company's revenue and gross margin.

As the company currently relies on the mobile phone market for 70-80% of its revenue, and as the mobile phone market tends to be stable and the trend of upgrading camera modules is no longer there, the risk of the company's business concentration has emerged. The development of the automotive and AR/VR businesses may be able to diversify the risks of business concentration for the company. The main focus of attention on the company's business out of the predicament and achieving incremental growth is still: 1) The mobile phone business continues to expand its share in Apple's market share and product penetration under the internal competition of Android; 2) The automotive business and AR/VR aspects continue to provide incremental growth.

Looking at the company's latest shipment volume in July, 1) the mobile phone business is still weak. The shipment volume of mobile phone lenses and modules continued to show a double-digit decline, indicating that the squeezed inventory in the Android/mobile phone market has not yet been digested; 2) The automotive business has shown highlights. Dolphin Analyst has come to the financial report to find answers to these questions:

1. Overall performance: "Disastrous" performance in the first half of the year

1.1 Revenue situation

In the first half of 2022, Sunny Optical achieved a revenue of RMB 16.972 billion, down 14.4% year-on-year, which was lower than the market expectation (RMB 17.619 billion). Sunny Optical's lower-than-expected performance in the first half of the year was mainly affected by the weak demand in the mobile phone market and the trend of reducing the specifications and configurations of cameras, which directly dragged down the overall revenue performance of the company.

1.2 Gross margin situation

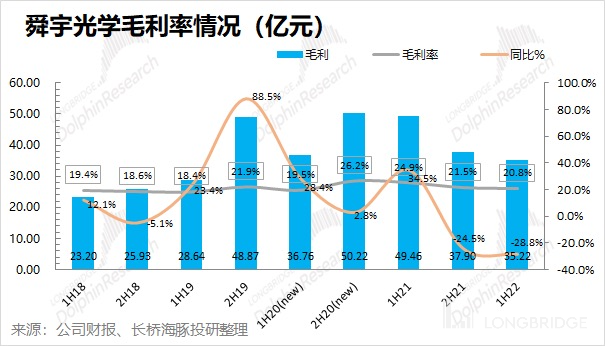

Sunny Optical achieved a gross profit of RMB 3.522 billion in the first half of 2022, a year-on-year decrease of 28.8%. The decline in the company's gross profit in this quarter was greater than that of revenue, mainly because the company's gross margin in the first half of the year also experienced a significant decline.

Sunny Optical's gross margin in the first half of the year slid to 20.8%, a year-on-year decrease of 4.1 percentage points, which was in line with market expectations (20.67%). This was mainly due to the pressure on the company's product prices and gross margins in the context of weak demand in the mobile phone business.

1.3 Core expense situation

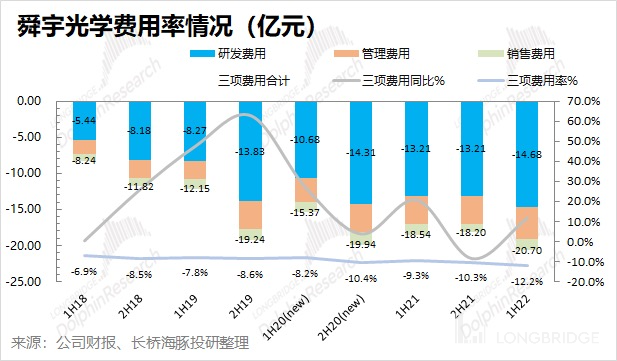

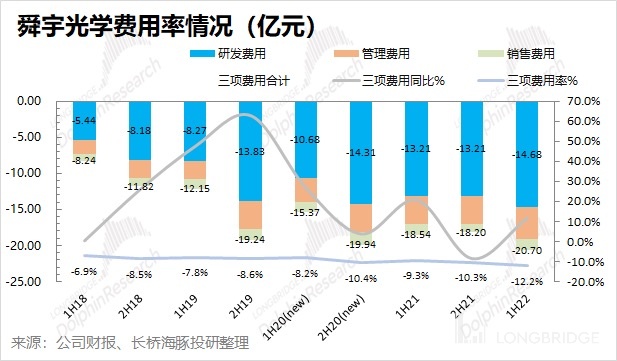

Sunny Optical's core expenses mainly include sales expenses, management expenses, and research and development expenses. The company's three core expenses totaled RMB 2.07 billion in the first half of 2022, a year-on-year increase of 11.7%. The three core expense ratio reached 12.2%. Sunny Optical's expenses in the first half of the year reached a new high, and the three expense ratios continued to rise.

1) Sales expenses: The company's sales expenses in the first half of the year were RMB 163 million, a year-on-year increase of 5.1%. The sales expense ratio in the first half of the year was 0.96%, a year-on-year increase of 0.18 percentage points. The sales expense ratio was relatively stable compared with the same period in history.

2) Management expenses: The company's management expenses in the first half of the year were RMB 438 million, a year-on-year increase of 16.1%, mainly due to the rise in the salaries of administrative staff, the issuance of restricted shares, and the increase in information technology construction expenses. The management expense ratio in the first half of the year was 2.58%, a year-on-year increase of 0.68 percentage points. 3) R&D Expenses: The company's R&D expenses in the first half of the year were RMB 1.468 billion, a year-on-year increase of 11.2%. The R&D expense ratio for the first half of the year was 8.65%, a year-on-year increase of 1.99pct. R&D expenses were the main source of increased expenses in the first half of the year. The increase in R&D expenditures this time was mainly focused on the automotive and ARVR fields.

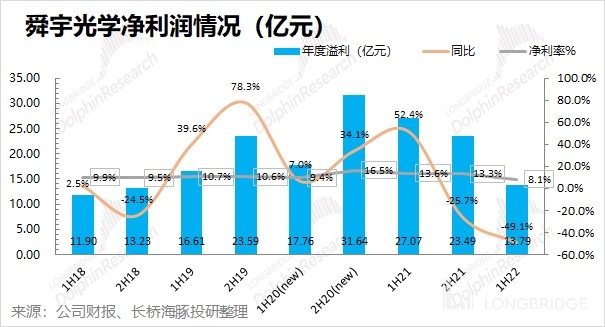

1.4 Net Profit Situation

In the first half of 2022, Sunny Optical achieved a net profit of RMB 1.379 billion, a year-on-year decrease of 49.1%, close to the company's previous profit warning threshold (RMB 1.344-1.478 billion). The company's net profit margin in the first half of the year was only 8.1%, a year-on-year decrease of 5.5pct. Income declined, but expenses continued to rise, ultimately resulting in a "bleak" net profit for the first half of the year.

II. Progress of Downstream Businesses: Mobile Still Weak, Automotive Improving

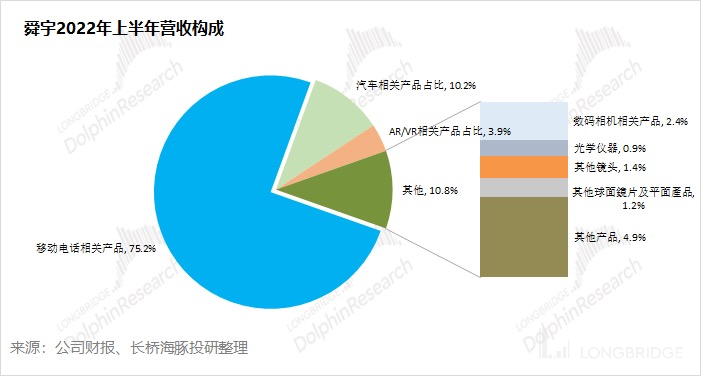

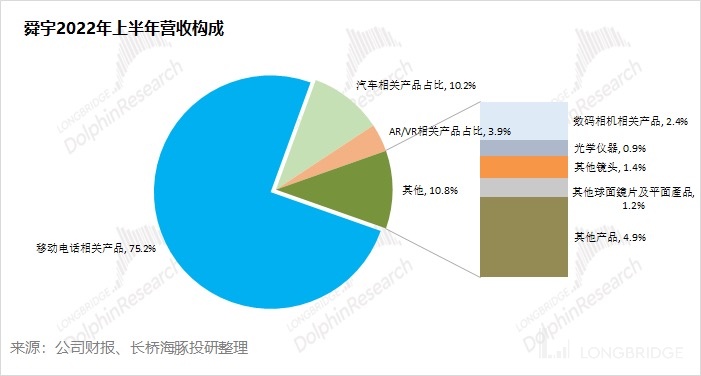

Looking at Sunny Optical's revenue in the first half of 2022, mobile business is still the company's largest source of revenue, but its proportion has dropped from over 80% in the past to 75% now. With the growth of the automotive and AR/VR businesses, the company started to separately disclose revenue from these two sectors in the past two years.

2.1 Mobile Business

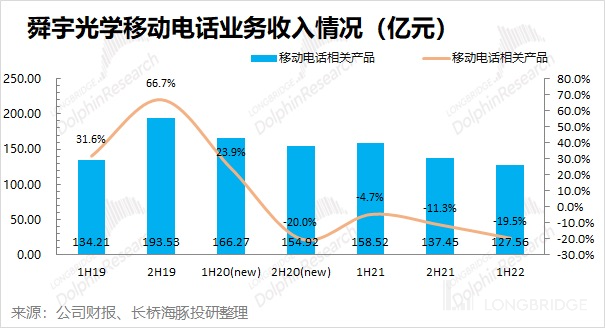

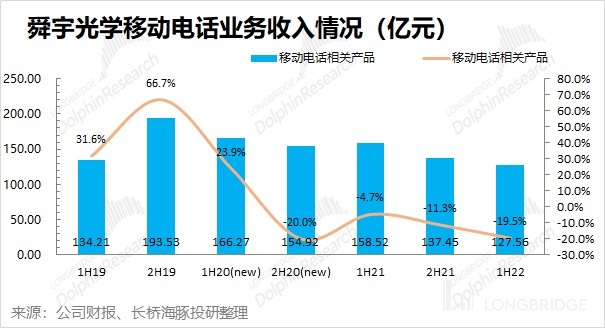

The mobile business achieved revenue of RMB 12.756 billion in the first half of 2022, a year-on-year decrease of 19.5% and a continuation of the previous downward trend. The decline in mobile business in the first half of the year was mainly due to① a decline in mobile shipments; and②the impact of the trend of reducing the quality of camera modules in smartphones.

Looking at Sunny Optical's revenue composition, the mobile business still accounts for the bulk of revenue. However, the global demand for mobile phones was weak in the first half of the year. According to IDC data, global mobile phone shipments in the first half of the year fell by nearly 10% year-on-year, which was the main reason for the company's overall revenue decline in double digits.

Sunny Optical's mobile business mainly includes two types of products: mobile lenses and smartphone camera modules. Both types of products have shown a downward trend and have not yet improved.

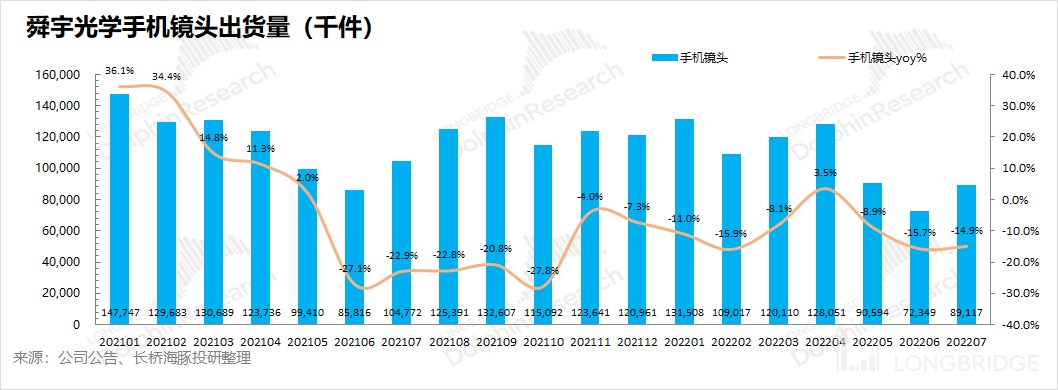

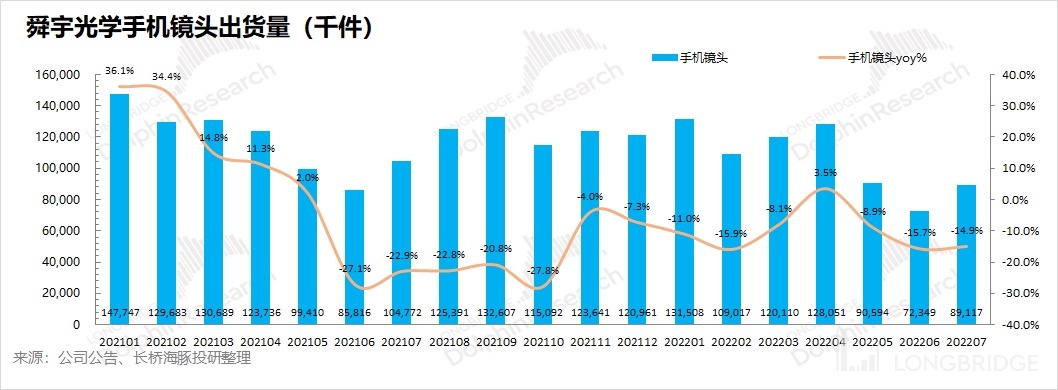

1) Mobile lenses: Sunny Optical's mobile lens shipments from January to July 2022 were 741 million, a year-on-year decrease of 9.9%;

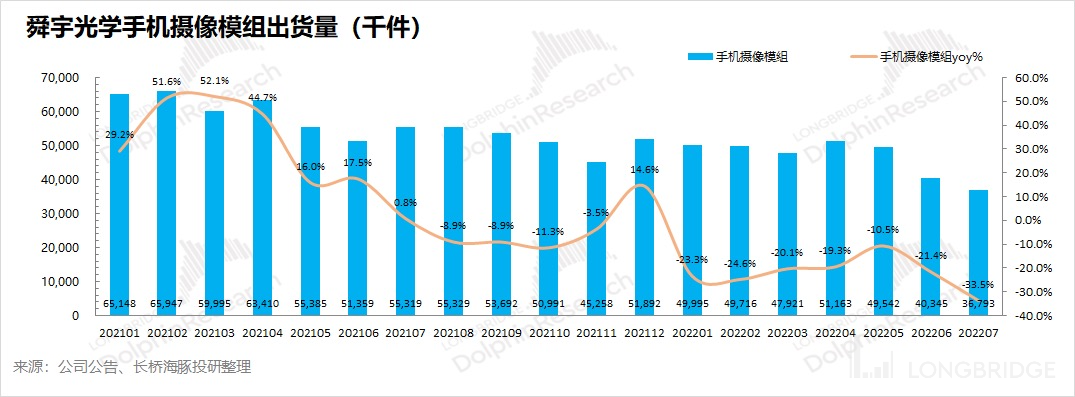

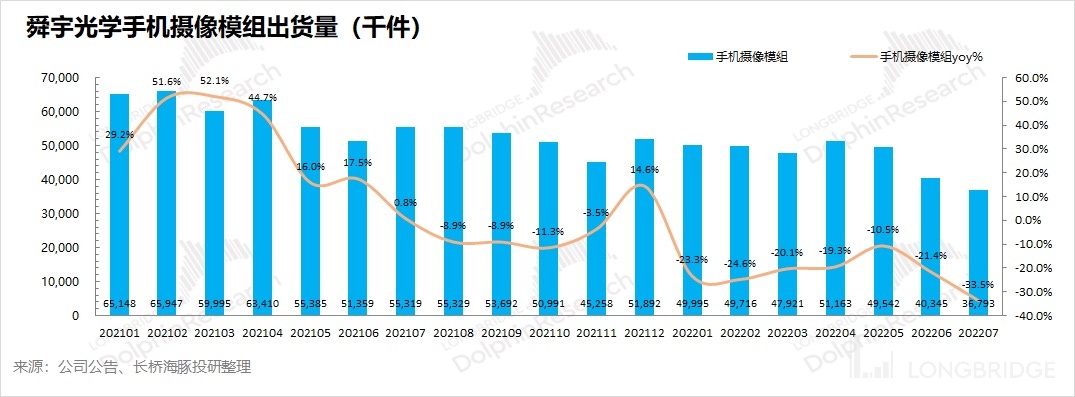

2) Mobile modules: Sunny Optical's mobile module shipments from January to July 2022 were 325 million, a year-on-year decrease of 21.9%.

From the shipment data for Sunny Optical's mobile business in the first seven months of the year, both lenses and modules have decreased by double digits. The decline of mobile modules was larger than that of lenses, mainly because the customers of mobile modules are mainly Android, while the customers of mobile lenses include not only Android, but also Apple.

In the first half of the year, the overall smartphone market declined, but Apple's smartphone shipments still grew, while Android's decline reached double digits. Due to the sluggish downstream demand, the inventory of Android customers rose sharply, directly affecting customer order shipments. This also caused Sunny Optical's mobile business to continue to decline in the first half of the year, and the decline of module products was even greater than that of lens products.

2.2 Emerging Businesses - Automotive Business, AR/VR Business

Since two years ago, Sunny Optical has disclosed its revenue from its automotive and AR/VR businesses, reflecting the company's focus on the future development of these two businesses. Due to the company's past heavy dependence on mobile business (as high as 80%), the performance and stock price of the company are seriously dependent on the cyclical performance of mobiles. The excessive concentration of business has reduced the overall risk resistance of the company.

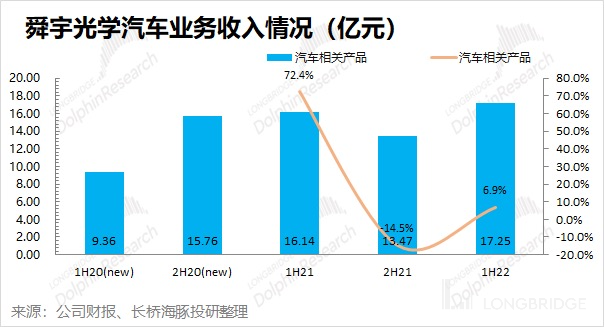

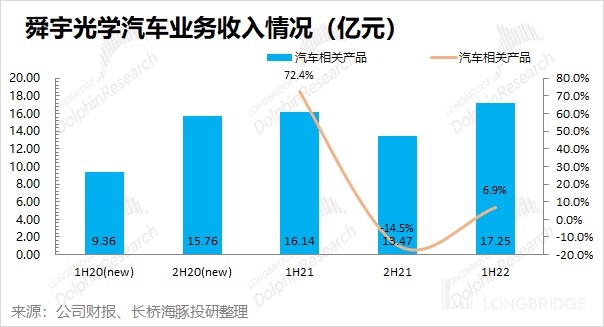

1) Automotive Business: Sunny Optical's automotive business achieved revenue of 1.725 billion yuan in the first half of 2022, a year-on-year increase of 6.9%. The revenue contribution of the automotive business reached 10% for the first time, becoming the second largest source of revenue outside of mobile phones. The growth of the automotive business was mainly due to the gradual easing of the automotive industry's supply chain chip shortage and the growth of the company in multiple brands of new energy.

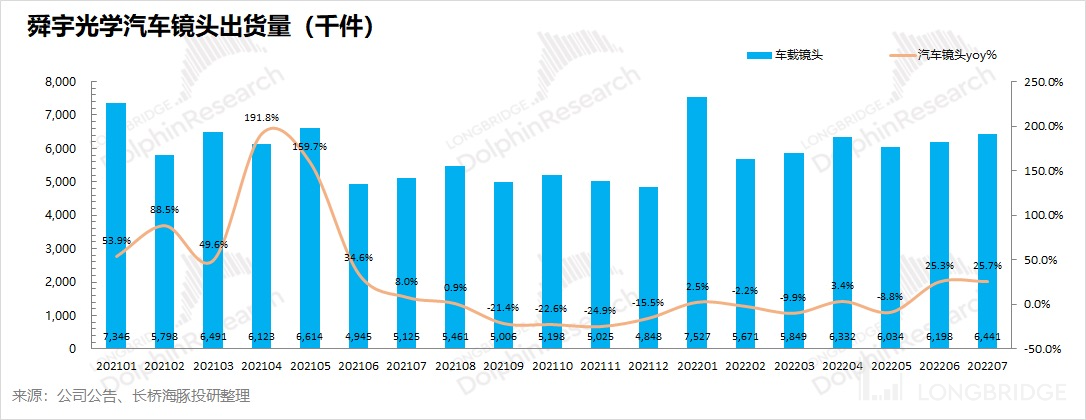

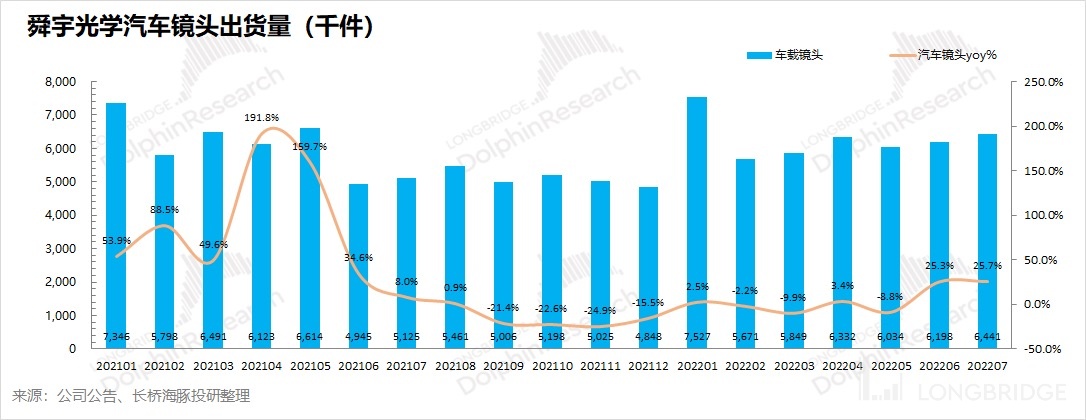

In the automotive lens market, Sunny Optical has been occupying a monopolistic position with a global market share of over 30%. Sunny Optical's automotive lens shipments from January to July 2022 reached 44.05 million, a year-on-year increase of 3.8%.

Looking at the monthly data for automotive lenses, there are signs of recovery. From June 2022, automotive lens shipments began to grow by more than 20% again, and monthly shipments stood firm at over six million units. Regarding the recovery of automotive lenses, the Dolphin Analyst believes that① downstream demand in the automotive market is better than that in the mobile market; ② the previous shortage of chips in the automotive industry chain has been basically alleviated.

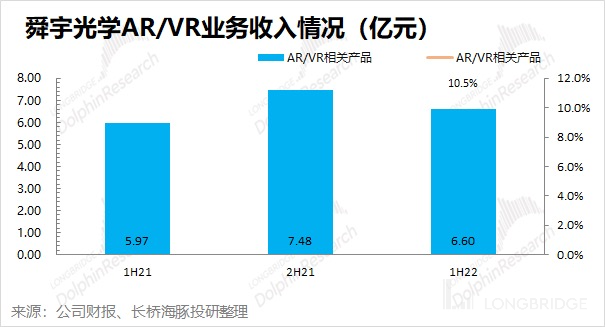

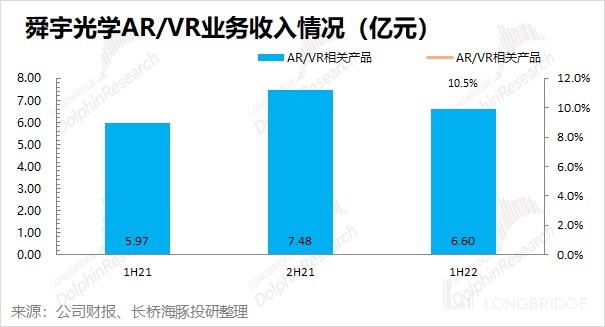

2) AR/VR Business: Shunyu Optical's AR/VR business achieved revenue of RMB 660 million in the first half of 2022, an increase of 10.5% year-on-year. Currently, the proportion of AR/VR business is still only 4%, but the company is optimistic that with downstream big players entering the market and new product releases, it is expected to open up future growth opportunities in AR/VR.

2) AR/VR Business: Shunyu Optical's AR/VR business achieved revenue of RMB 660 million in the first half of 2022, an increase of 10.5% year-on-year. Currently, the proportion of AR/VR business is still only 4%, but the company is optimistic that with downstream big players entering the market and new product releases, it is expected to open up future growth opportunities in AR/VR.

III. Shunyu's Product Revenue Situation: Lens Business Outperforms Camera Module

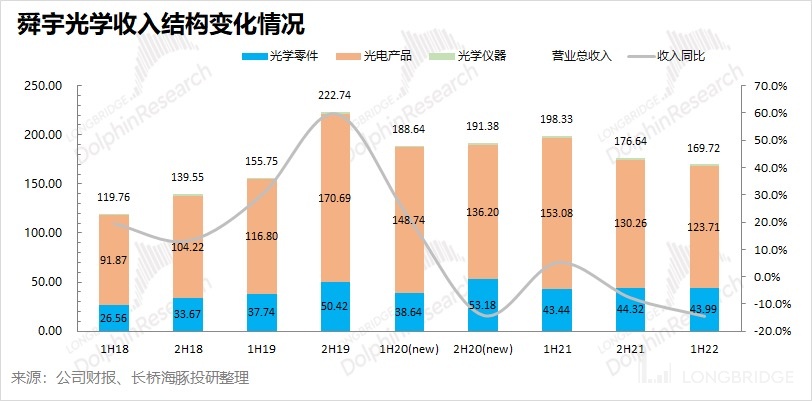

When Shunyu Optical discloses its financials, it usually divides the company's products into three categories: optical components, optoelectronic products, and optical instruments. The two largest categories are optical components and optoelectronic products.

3.1 Optical Components:

In the first half of 2022, the revenue of the optical components business was RMB 4.399 billion, an increase of 1.27% year-on-year. Optical components mainly include spherical lens, camera lens, car lens, and other lenses.

The data disclosed by the company here is the external sales. As there is a certain degree of synergy between the company's businesses, some of the optical components are sold internally. Due to RMB 1.163 billion of internal sales in 2022, the actual sales of the company's optical components in H1 were RMB 5.562 billion, a year-on-year decline of 8.1%.

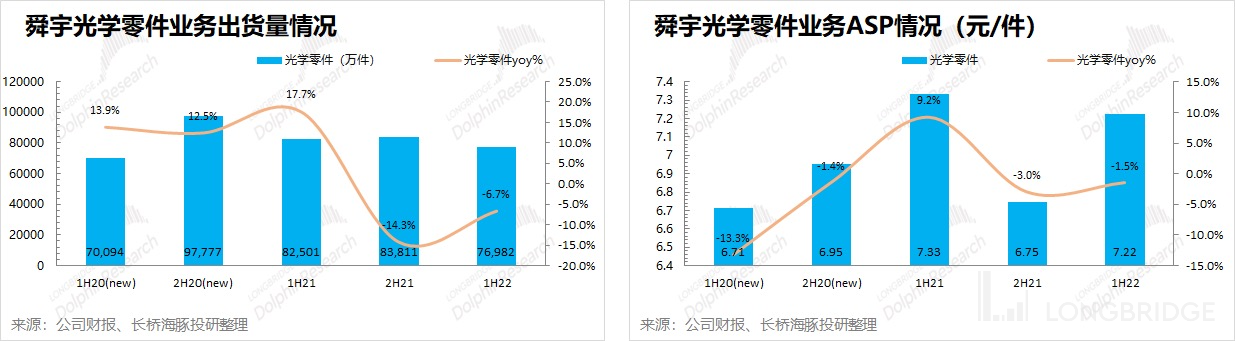

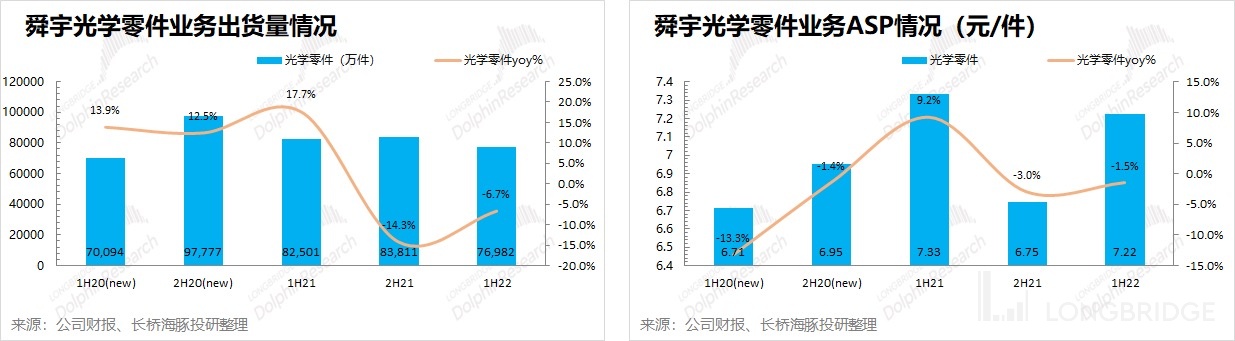

- Optical components business shipment volume: 770 million pieces in the first half of 2022, a year-on-year decrease of 6.7%;

- ASP of optical components business: RMB 7.22/piece in the first half of 2022, a year-on-year decrease of 1.5%;

Shunyu's car lens continued to grow in the first half of the year, while the decline in the optical components business was mainly due to the overall weakness of the smartphone market, which put pressure on shipment volume and prices of camera lens.

3.2 Optoelectronic Products:

In the first half of 2022, the revenue of the optoelectronic products business was RMB 12.371 billion, a year-on-year decrease of 19.19%. Optoelectronic products mainly include smartphone camera modules and other optoelectronic products.

The data disclosed by the company here is the external sales. As there is a certain degree of synergy between the company's businesses, some of the optoelectronic products are sold internally, while most of the internal sales of optical components are given to optoelectronic products. This is because the supply chain starts from the lens, then to the camera module, and finally to the sales of finished products. Due to RMB 2 million of domestic sales of optoelectronic products and RMB 1.163 billion of domestic sales of optical components in 2022. According to comprehensive calculations, the company's optoelectronic product sales in the first half of the year actually amounted to RMB 11.21 billion, a year-on-year decrease of 17.6%.

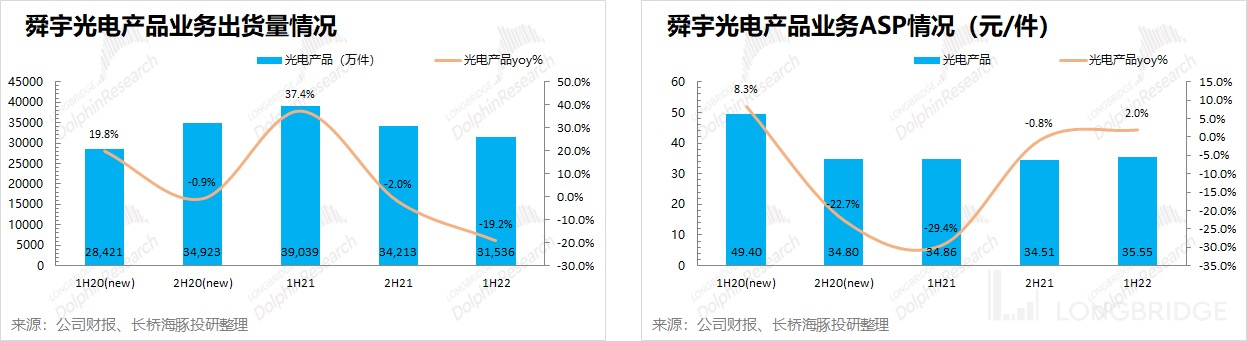

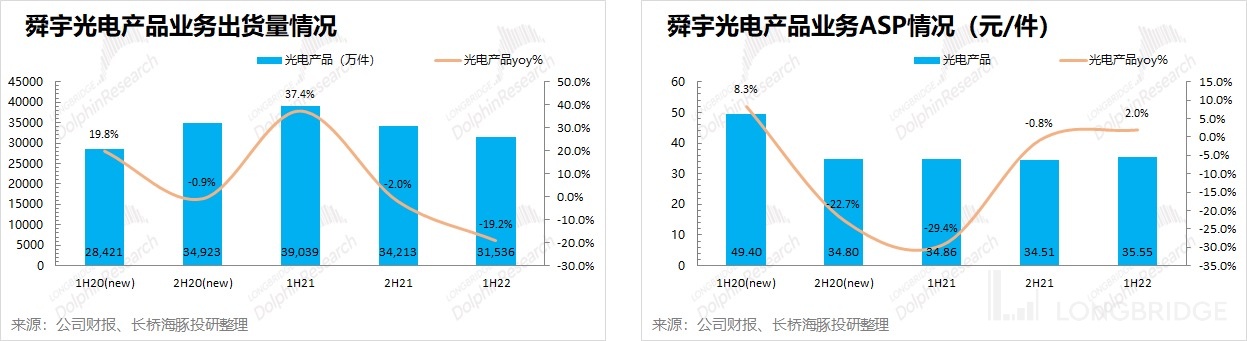

- Optoelectronic product shipment: 315 million units in the first half of 2022, a year-on-year decrease of 19.2%;

- Optoelectronic product ASP: average price of RMB 35.55 per unit in the first half of 2022, a year-on-year increase of 2%;

Sunlord's optoelectronic products are mainly camera module products. The shipment volume in the first half of the year fell by nearly 20%, mainly because the company's Android customer group reduced their demand due to sluggish sales and high inventory. In the case of significant pressure on smartphone camera modules, the ASP of optoelectronic products did not fall but increased, mainly due to the structural impact brought by the increased proportion of other high unit price optoelectronic products.

Dolphin Analyst's Research on Sunlord Optoelectronics

Depth

November 2, 2021 "Automotive Intelligence, Remaking Sunlord?"

October 13, 2021 "Ten years, a hundredfold growth stock, what did Sunlord do right?"