Regarding the gross margin of "flash crash", how does management explain it? (Nvidia FY2023Q2 telephone conference call)

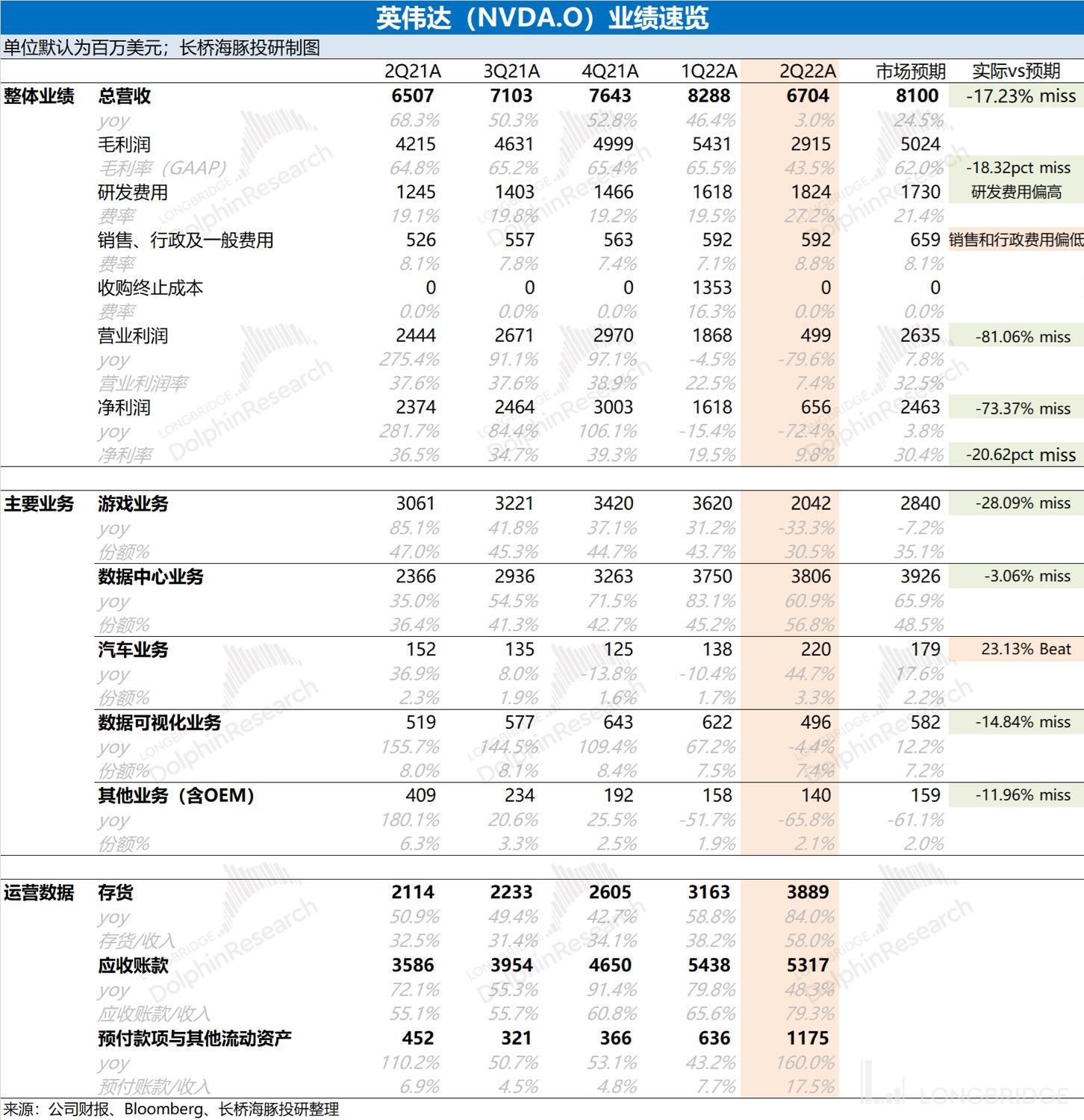

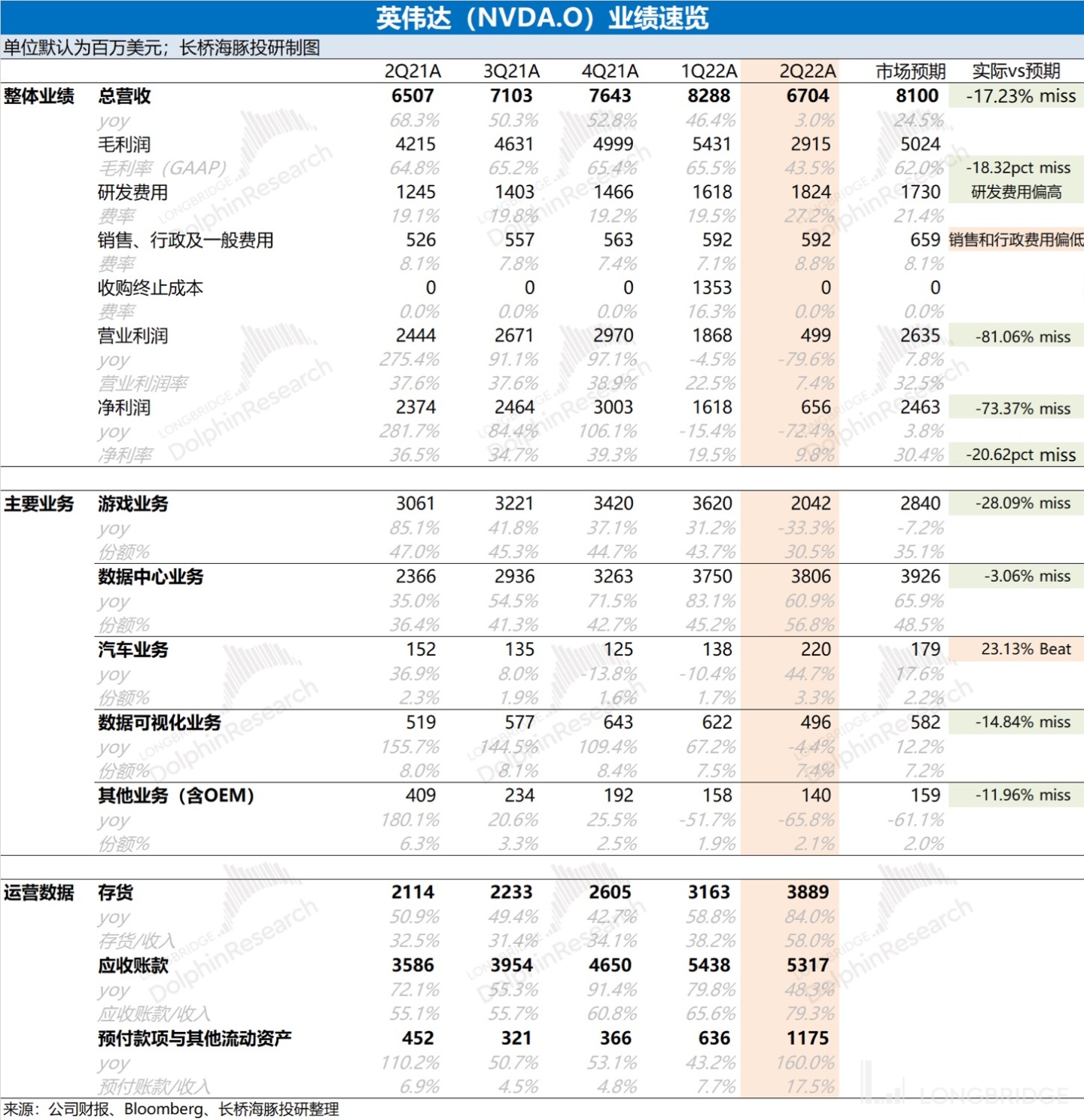

On the morning of August 25th, Beijing time, Nvidia (NVDA.O) released its financial report for the second quarter of fiscal year 2023 (ending July 2022) after the US stock market closed:

Highlights from the Quarterly Report vs Market Expectations:

-

Revenue: Nvidia achieved $6.7 billion in revenue for the quarter, up 3% year-on-year, but far below the company's previous guidance of $8.1 billion.

-

Gross Margin: The gross margin for the quarter was 43.5%, down 21.3% YoY, far below the expected margin (65.1%, +/- 0.5%).

-

Net Profit: Nvidia achieved $656 million in net profit for the quarter, down 72.4% YoY, far below market expectations ($2 billion).

-

Business Segments: ① Gaming Business: achieved revenue of $2.04 billion, down 33.3% YoY; ② Data Center Business: quarterly revenue of RMB 3.81 billion, up 61% YoY; ③ Automotive Business: quarterly revenue of RMB 220 million, up 45% YoY.

-

Outlook for the next quarter: ① Revenue is expected to be $5.9 billion (+/- 2%); ② GAAP and Non-GAAP gross margins are expected to be 62.4% and 65%, respectively, (+/-50 basis points); ③ GAAP operating expenses are expected to be approximately $2.59 billion, and Non-GAAP operating expenses are expected to be approximately $1.82 billion; ④ Capital expenditures are expected to be approximately $550 million to $600 million.

Dolphin Analyst will work with top YouTubers to provide more specific analysis of Nvidia's financial report in a video version to be shared later. Stay tuned!

This article is an original article from Dolphin Research, unauthorized reproduction is prohibited; If interested readers would like to join our investment group and exchange global investment perspectives, please add our WeChat account "dolphinR123".

- Telephone Conference Call Highlights:

-

Gaming business: It is estimated that the total sales or final demand for the second and third quarters will be approximately $5 billion. The company's strategy is to reduce sales in this or the next quarter, and adjust channel inventory.

-

Data Center Business: ① There are some issues with supply and delivery; ② Large-scale Chinese enterprises and Chinese Internet companies have slowed down their infrastructure investment this year, especially since the second quarter, they have been quite slow in construction. [3] Gross Profit Margin: The extremely low gross profit margin in Q2 was affected by inventory drawdown, but the gross profit margin guidance for Q3 will return to 60%. There was no mention of inventory provisions in Q3;

2. Telephone Conference Call Transcript:

2.1 Management Reporting

- Gaming business: Gaming revenue will continue to decline due to weak European consumption related to the Ukrainian war and the Chinese new crown pneumonia blockade. The decline in gaming GPU revenue is greater than expected due to lower sales and lower ASP.

- Professional visualization: The consecutive growth of mobile revenue is offset by the lower desktop revenue, especially in the high-end market. As macroeconomic headwinds intensify, enterprise demand slows down, and OEMs try to reduce inventory. We expect these trends to continue into Q3.

- Automotive business: With the winning sales of new energy vehicle designs, the advantage of automatic driving is particularly evident. We believe that Q2 is a turning point for our automotive business revenue due to the strong momentum of NVIDIA Orange. Looking ahead, we expect $11 billion in automotive design revenue growth.

- Data center: We were affected by supply chain disruptions, but revenue from hyper-scale customers almost doubled YoY. Sales to large-scale customers and cloud computing customers in North America increased, but were offset by the decline in sales to large-scale customers in China due to domestic economic conditions.

Guidance:

We expect that as OEMs and channel partners reduce inventory levels to meet current demand levels and prepare for our new product production, gaming and professional visualization revenue will decline in turn, and the continuous growth of data centers and automotive will partially offset this decline.

- Revenue is expected to be $5.9 billion, with a range of ± 2%.

- GAAP and non-GAAP gross margins are expected to be 62.4% and 65%, respectively, with a range of ± 50 basis points.

- GAAP operating expenses are expected to be approximately $2.59 billion, and non-GAAP operating expenses are expected to be approximately $1.82 billion.

- GAAP and non-GAAP other income and expenses are expected to be approximately $10 million, excluding gains and losses from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 9.5%, with a range of ± 1%.

- Capital expenditures are expected to be approximately $550 million to $600 million.

2.2 Analyst Q&A

Q: What is the normalized revenue of the gaming business, excluding the exaggerated part of cryptocurrencies? How do you view the cascading effects of the new product cycle? If gaming does not meet your new outlook, will you adjust inventory in the future?

A: In Q2 and Q3 of '23, our demand for terminal games was clearly insufficient. We expect the total sales or final demand in Q2 and Q3 to be approximately $5 billion. The inventory preparation and write-downs we have considered reflect some procurement more than a year ago when almost all of our products were in extreme supply shortages, which is an opportunity for us to adjust our scale. Our sales have declined from the high point at the beginning of the year, but are still stable. In fact, sales have grown by 70% since the beginning of the pandemic, so it is clear that the gaming market is stable. However, now that it has fallen from its peak and the macroeconomic situation has deteriorated sharply, our strategy is to reduce sales this quarter or next quarter and adjust channel inventory. We also have a plan to price and position our current products and prepare for the next generation of products. MPIR is the most popular GPU we have created. However, we do have an exciting new generation of products coming out that will build on top of this.

Q: Should we assume that game sales will remain at this level in the first or second quarter of next year, or will there be a turnaround after the release of new products?

A: The gaming demand in the terminal market is stable, but it was really high at the beginning of the year when it was at a high level, we now find ourselves with excess inventory. So our strategy is to give the channel an opportunity to adjust by selling below the current market sales level. We will take several quarters to do this. We believe that we will enter next year in good condition by the end of this year.

Q: The data center business is currently generating strong revenue, but some are concerned that capital expenditures for data centers may become the next area of adjustment in the semiconductor market. How do you think about the usage demand for your data center? What are the risks of data center business considering some of the macroeconomic concerns from some of the mega-enterprise customers?

A: In the data center terminal market, we have heard that the demand for GPU leasing far exceeds the current supply, partly because the number of use cases for GPUs in cloud computing has increased significantly. If you focus on a specific part of management—collecting and managing data, and using that data to train AI models, rebuilding HD maps—GPU usage in cloud computing has increased significantly. In addition, deep learning-based recommendation systems help Internet service providers increase engagement and click-through rates. Therefore, this special form of recommendation systems will truly drive a lot of data processing and machine learning in cloud computing. In recent years, a very important model called Transformer has been used in conversation chat, QA, summarization, text generation, and image generation. But it is very important that it is also used in life science to learn chemistry, to understand proteins, to understand DNA, so the impact of this area is very worth our attention. It is called a large language model. I remember Stanford University wrote a paper calling it the foundation model, which can be used to train various other types of AI. Therefore, we see a huge demand for GPUs in cloud computing.

This quarter, we are facing supply chain challenges because we are not just selling GPU chips, these systems are very complex, and there are a lot of chips in the system components we provide, such as HGX. All components must be combined together before we can deliver the final product. These data centers have been idle until the last piece of data is integrated. The last part includes extremely complex switches, very complex network cards, networks, and cables. Therefore, it is not particularly easy to establish these high-performance computing data centers for the whole world's cloud. Therefore, the challenges of the supply chain are somewhat disruptive. But the demand is there.

Q: Regarding data centers, you mentioned that you will bring revenue up to $200 million starting from October to the quarter of July, but there are also supply chain challenges, and some of the deliveries originally scheduled for July may be delayed until October. Can you share more information about this?

A: Our supply chain was really difficult and challenging this quarter. Our platforms, including HDX, network chips, cables, and switches, are critical to our customers. This is not just for selling GPU. Therefore, even if customers order components themselves, they will also look for our so-called suites, those suites that are compatible with GPU to support their data centers. We have also experienced internal supply disruptions in logistics and parts supply. Customers have also been affected by the critical third-party components that we did not provide, which slowed down their deployment speed. So the things we did in the second quarter's orders cannot be delivered in the third quarter, and some of the supply constraints must exist. We have supply in the second quarter where there is demand in the third quarter. So we work with customers to optimize supply and demand, which is what we disclose to you.

China's super-large-scale enterprises and Internet companies have really slowed down infrastructure investment this year, especially since the second quarter, they have been quite slow in construction, but this slowdown will not last forever. The number of new software technologies, the number of people using cloud computing, and the number of cloud services are all continuously increasing.

Q: Data center business, super-large-scale customers in the United States are stronger, and super-large-scale users in China are weaker. When do you think H-100 will start generating revenue?

A: Regarding Hopper, we are now in full production. It is together with our HGX, and there are multiple hoppers on a system tray. If you like, it is a supercomputer installed on a motherboard. Therefore, we have obtained a lot of resources from csp and ourselves around the world to obtain Hopper. We expect a large number of Hoppers to be shipped in the fourth quarter.

Q: About the inventory-related costs of $1.22 billion, inventory costs are related to the weak demand for data centers and games. The reasons for games are very clear. What happened to data centers? In the next few quarters, how to consider other factors related to data center demand? Is Intel's Sapphire Rapids latency expected to have a short-term impact on your business?

A: So our inventory cost, we not only need to thoroughly review the previous quarter and the quarters we guided, but also look at what demand we need in the long run, and then what supply we have. We made purchases earlier this year because we need to fulfill our existing supply contracts. Therefore, we have high expectations for data centers. We remain very bullish and stable on our growth expectations for the data center. We have written down some wafers and chips in consideration of macroeconomic conditions and preparations for future product launches, but some kits, services, and capacity have also been added to these writedowns in other driving factors.

Our Hopper supports the previous generation of CPUs. But the next generation GPUs, CPUs, Sapphire Rapids, Genoa, and Graviton need to be certified and tested for all CPUs because cloud service providers demand this. They plan to deploy NVIDIA accelerators, NVIDIA Hopper, on a large number of CPUs. This delay is disruptive, and many engineers have to take hasty action. If the next generation of CPUs can execute more perfectly, things will be much simpler. However, Hopper enters a CSPs environment where they connect our PCI Express connectors to older and current generation CPUs. No one likes delays. The next generation of CPUs will bring updates to infrastructure and new servers, and we will be able to fully leverage Hopper to support existing infrastructure in the market.

Q: Based on the guidance, the continuous decline in the gaming and professional visualization industries is over 30%, while the growth rate of data centers and the automotive industry may be low to mid-single digits. So, is this the right environment? With the full launch of Hopper, it sounds like in Q4, do you think data center growth will accelerate again as product cycles rotate?

A: We do expect gaming to decline, but not at the same rate as Q1 and Q2, with about three-quarters being gaming related. Professional visualization accounts for 1/4.

Our data center may grow like we just saw between Q1 and Q2. In terms of auto business, we expect growth to continue every quarter of this fiscal year. We believe Q2 is a turning point. So we will continue to grow into Q3, with hopes of further growth in Q4.

Our sales are far below market demand, and the reason for this is to allow inventory, channel inventory, and OEM inventory to be corrected. This prepares us for the next generation. Our next generation has Hopper for computation, but we also have next-generation computer vision, which is about to hit the market. Hopper's next generation is designed to execute a new AI model called Transformer. I am highly anticipating Hopper 2 being the next springboard for the company's future development.

Q: Can you talk about networking and computing? Were their supplies restricted in the July quarter? Did they continue to grow in the October quarter?

A: In our Q2 performance, we continued to improve our network supply. We were able to achieve very strong growth in networking, both sequentially and year-over-year. But there are other components in our computing supply, and we also provide CPUs. It's important that these components are combined, so supply to some extent is limited. Q: Why is this quarter's supply limitation having such a big impact on you? Or is this a problem brought about by Hopper? Is it related to other components? How long will it take to resolve these issues?

A: It's been quite a challenge for us to establish a complete data center for our customers and get it up and running. We're an integral part of setting up their data center, so the network's been in high demand ever since. Some of our CSPs have also encountered similar supply issues. So a few key products we need to ship are a bit delayed this quarter due to these factors, which caused some logistical and distribution chaos.

Q: Regarding inventory costs for the data center. Can you tell us how much the data center and gaming costs are? Can you talk about how your expectations for Hopper have changed? Or are there any changes related to inventory costs?

A: When it comes to our inventory costs, whether it's chips, components, or memory, remember that a lot of these things can be interchangeable. Also, the inventory value we have for data centers is vastly different from the value we have for gaming when it comes to overall cost perspective. We lump all these systems together as data centers. The demands for gaming and data centers are still steady, but we do need to make appropriate adjustments to the pace.

Hopper is designed for Transformers, and I don't think anyone could have predicted the impact of Transformers. A few years ago, language models were small, and the effectiveness of artificial intelligence was truly astonishing as it scaled hundreds of billions and got close to trillions of possible parameters. So I think the success of Hopper reflects the tremendous amount of work the team put into it and the suppressed demand for large-scale training systems, and I think Hopper's going to be hugely successful.

Q: Does the 65% non-GAAP number you're guiding include any additional inventory writeoffs? Your sales mix could potentially be margin-positive as the gaming industry declines significantly while data centers grow slightly. Are there any other offsetting factors?

A: So, aside from inventory costs in Q2 and Q3, our gross margins are actually related to our existing sales mix, and it's worth noting that our sales mix for GPUs going into Q3 isn't of high-end products. This has an impact on our gross margin going into Q3. We're hoping that data centers will help boost our gross margin, but we also have growth plans in the automotive sector. Automotive is below our company's average, so that's going to offset some of the upsides we're seeing in data centers. In our gross margin estimates, there may be minor other factors that come and go, so there aren't any major plans, but there may be some small factors each quarter, and these factors are already included in our gross margin.

Q: Did October's gross margin benefit from the write-down of inventory sold before? Can you give us a breakdown of the enterprise cloud business in data centers? Since it seems like this business shifted more towards enterprise in July, which may be viewed as a risk as enterprise growth slows down?

A: Q:

A: There was no discussion of inventory reserves for our call back in the third quarter. As for the division between our ultra-large-scale customers and data centers, it's 50/50. Ultra-large-scale users in China haven't been driving continuous growth here.

Q:

A: Our professional visualization business has been in short supply in such a short period of time. We've been accelerating the development of mobile and desktop devices for many industries. Last year, the scale of ProViz doubled. So now, automakers are all keeping an eye on their inventory levels. We need to make sure they can complete their inventory. But as we discussed earlier with games, there's still a stable demand in the market. Demand remains strong. We just need to adjust some inventory, but we still see opportunities for the market that will exist in the long term.

As for the second question, we don't know. Unlike our Workstation business, our ProViz business doesn't have an installation base. Most of our ProViz products are upgrades or replacements, and our installation base is 3, 4, or 5 years, regardless of their upgrade cycle. In the case of ProViz, if a company that purchased it upgrades ProViz, people can continue to use their existing systems. In our AI business, there's no real installation base. These are all new things that people are growing into. The productivity or cost savings benefits of using autonomous systems are quite far-reaching. So I think our AI business and ProViz business have very different characteristics. But what Colette said earlier about our ProViz business last quarter is absolutely correct, that OEMs realized that the end market is slowing down and seized the opportunity to correct inventory.

Q:

A: If there were no cryptocurrency factors, portfolio revenue would decline. However, from the long-term overall trend, ASP is gradually increasing. GeForce is essentially a game console in the PC. We've always believed that GeForce's ASP should approach the average selling price of game consoles, so it should be around $500. We also have GeForce in our cloud business. Because the cloud business's GeForce serves many players, it tends to become a more powerful GeForce, so our cloud games tend to have higher-end content. Of course, there are also design issues. Now, most designers and creators can use GeForce. They use their own PCs to create content, most of which will be used for electronic games, or they use electronic games to create their own artistic content. So, GeForce is not only designed for gaming, but also essentially serves as their creative workstation. Therefore, there are several factors contributing to the rise in GeForce's ASP, a trend we have seen for several years.

A Look Back at Dolphin Nvidia Historical Articles:

In-Depth Analysis

June 6, 2022 "Did the US Stock Market Tremble for No Reason? What About Apple, Tesla, and Nvidia?"

February 28, 2022 "Nvidia: High Growth is Real, But Cost-Effectiveness is Lagging"

December 6, 2021 "Nvidia: Valuation Cannot Rely Only on Imagination"

September 16, 2021 "Nvidia (Part I): How Did the Chip Expert Achieve Twentyfold Growth in Five Years?"

September 28, 2021 "Nvidia (Part II): Davis Finally Sells – Double Winning"

Earnings Season

August 8, 2022 Earnings Preview Review "Nvidia's Share Price Skydives as the Company Demonstrates Free-Falling Financial Performance"

May 26, 2022 Conference Call "Combined Effects of Lockdown and Epidemic Caused a Drop in Gaming, Pulling Down Second-Quarter Results (Nvidia Conference Call)"

May 26, 2022 Earnings Review "The End of the “Epidemic Fat Cow” Era Has Hurt Nvidia's Financial Results"

February 17, 2022 Conference Call "Nvidia: Multi-Chip Advancements, Data Centers Are Company Focus (Conference Call Summary)"

February 17, 2022 Earnings Review "The Hidden Concerns Behind Nvidia's Better-Than-Expected Results | Reading Financial Reports"

November 18, 2021 Conference Call "[How is Nvidia Building the Metaverse? Management Focuses on Omniverse (Nvidia Conference Call)](https://longbridgeapp.com/topics/1330657? invite-code=032064)》

On November 18th, 2021, the Dolphin Analyst reviewed the financial report of the first quarter of 2023 of Nvidia Corporation (NVDA.US) in a live broadcast. The analyst shared insights on the company's profits from mining and the potential growth from the Metaverse.

Also, you can find the recordings of past financial reports, including the earnings call of Q4 2021 and Q3 2022 of Nvidia Corporation, on Longbridge.

For more information and risk disclosure, please refer to Dolphin Analyst's Disclaimer and General Disclosure.