Will Nvidia, mired in a quagmire, have to retrace its steps to 2018?

On the early morning of August 25th, Beijing time, the US stock market released the financial report of the second quarter of the fiscal year 2023 (as of July 2022) after trading hours:

-

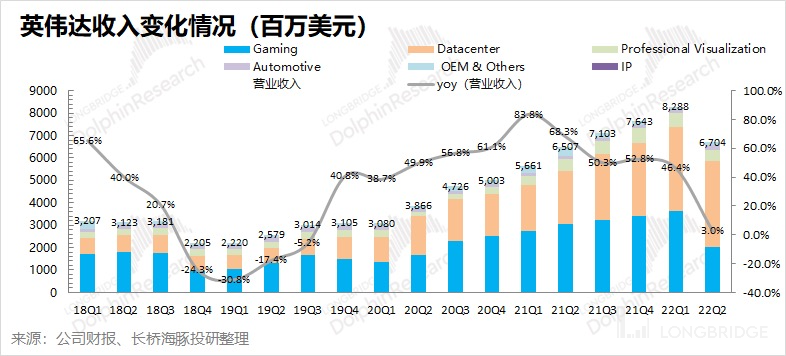

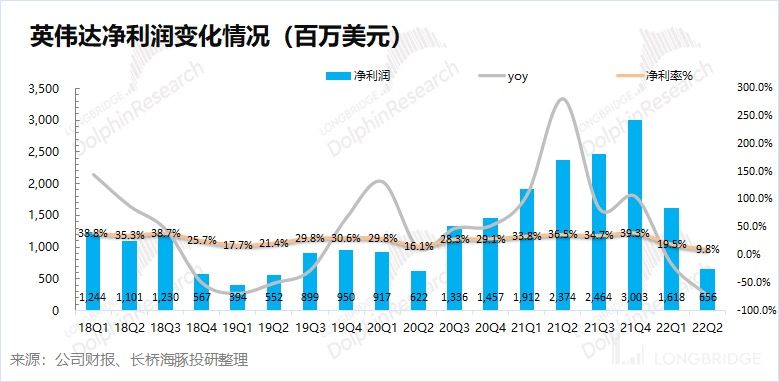

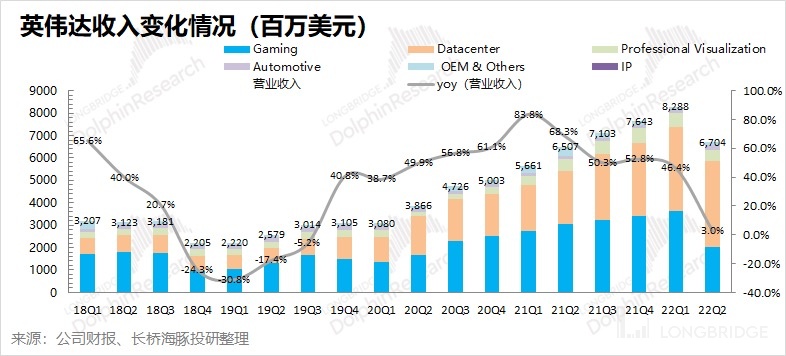

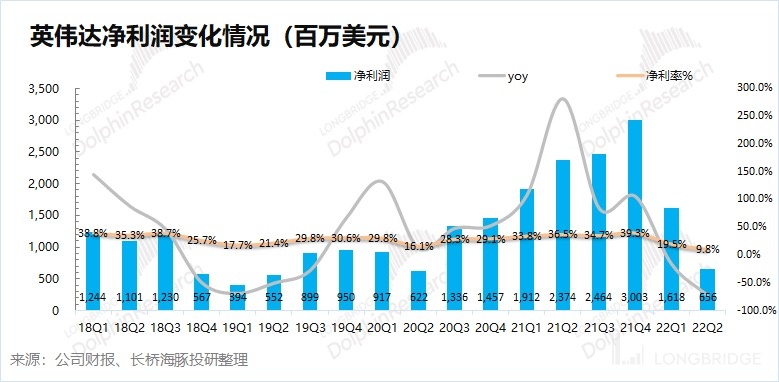

Overall performance: entering the declining period. Nvidia (NVDA.US) realized a revenue of 6.7 billion US dollars this quarter, an increase of 3% year-on-year, far lower than the company's previous guide (8.1 billion US dollars). The expected gross profit margin (GAAP) this quarter is 43.5%, far lower than the expected guide (65.1%, plus or minus 0.5%). The revenue and gross profit margin announced in this financial report are basically similar to the expected results, which have been digested by the market. However, the net profit in this financial report is only 656 million US dollars, a year-on-year decrease of 72.4%, and far lower than the market's expected 2 billion US dollars.

-

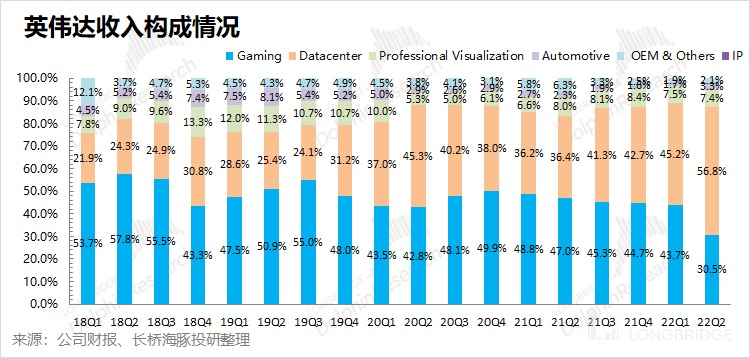

Core business situation: game business disappointing, and data center harbors hidden dangers. Gaming and data center businesses account for more than 80% of the company's revenue, and both performed poorly this quarter.

(1) The game business collapsed this quarter, which is the main reason for poor performance. Dolphin Analyst believes that the main reasons for the significant decline of the game business this quarter are: ① The global PC market saw a significant decline in the second quarter, which weakened the demand for the gaming market; ② The prices of virtual currencies have continued to fall this year, which has weakened the relevant demand for mining; ③ Dealers’ inventories were high, which directly affected the current shipping power.

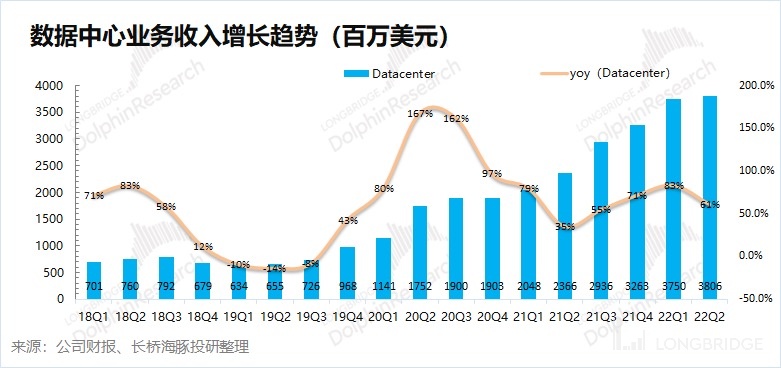

(2) The growth rate of the data center business also slowed down this quarter, with only a 1% increase month-on-month. As US technology giants begin to slow down their capital spending, the company's data center business also has "hidden dangers."

-

Main financial indicators: Profitability plummeted, and inventory remained high. Nvidia's gross profit margin plummeted this quarter, while operating expenses climbed to more than 35%, resulting in a net profit margin of less than 10%. On the inventory side, the outlook is still not optimistic. The company's inventory increased by 726 million US dollars this quarter, and the lack of downstream business demand has led to a comprehensive increase in industry chain inventories.

-

Guidance for the next quarter: Nvidia expects revenue of $5.9 billion (plus or minus 2%) in the third quarter, a year-on-year decrease of 17%; the gross profit margin of the third quarter is 62.4% (plus or minus 0.5%), a year-on-year decrease of 2.8 percentage points. Gaming and professional visualization business will continue to drag down next quarter, and the gross profit margin still has a certain degree of continuity.

Overall view: Nvidia's performance in the second quarter was surprising. As Nvidia previously issued a performance warning, the two core indicators - "revenue and gross profit margin" of this financial report have already been digested by the market. The focus of this financial report is mainly on the expense ratio and the guidance for next quarter.

The company's operating expenses are mainly composed of research and development expenses and sales and administrative expenses, and from this quarter's perspective, operating expenses have a certain degree of rigidity. Although revenue has declined this quarter, operating expenses are still rising. Looking ahead to next quarter's guidance, the operating expenses of $2.59 billion will continue to rise, which will continue to squeeze the final profit of next quarter.

And for the company's revenue and gross profit margin guidance, the revenue end only gave a revenue guidance of $5.9 billion for the next quarter. Therefore, Nvidia will directly face a double-digit year-on-year decline next quarter, which also indicates that after experiencing the low ebb of the second quarter, the company still cannot get out of the dilemma of its gaming business. As for gross profit margin, it gave the expected guidance of returning to 60%, indicating that the company's gross profit margin still has some sustainability, but also shows a downward trend.

Dolphin Analyst believes that Nvidia's gaming business is still stuck in the quagmire of weak demand, and the macroeconomic impact on data center business and big companies reducing cost is causing the company's overall operations to face significant challenges, and there is no sign of a bottoming out and improvement.

For the detailed content of this financial report, please see the following:

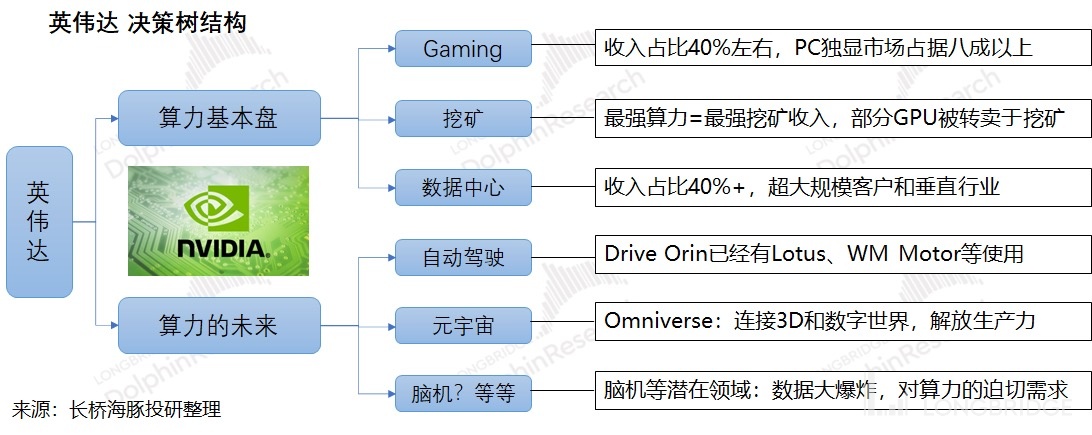

I. What should we know about Nvidia?

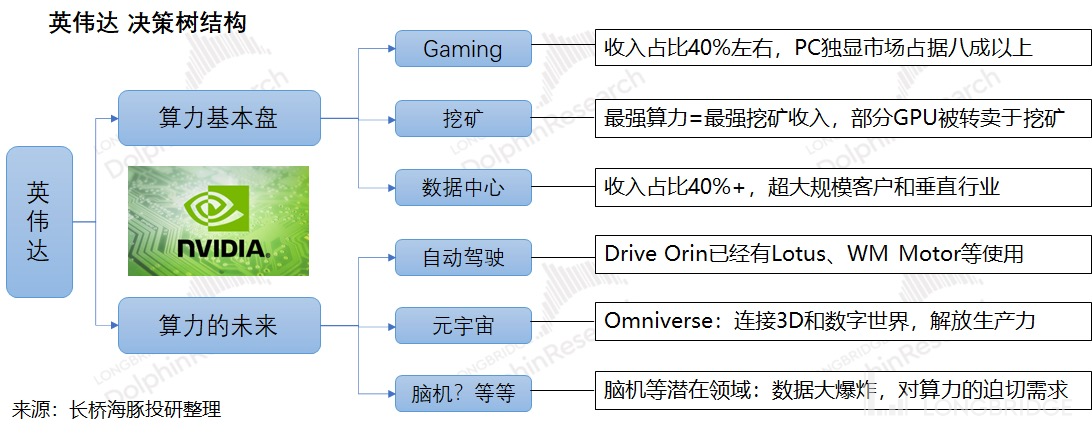

Nvidia is the world's leading computing chip company. The company's chips can be used not only in traditional fields such as gaming and data centers, but also in emerging fields such as autonomous driving and metaverse. As long as there is a need for data computing, Nvidia can be seen.

Regarding Nvidia research, Dolphin Analyst starts with two aspects of "computing basic plate + computing future". The "computing basic plate" is the company's main source of income at present and is the main source of the company's performance, accounting for more than 80% of the company's revenue. In recent years, the development of data center business has mainly benefited from the acceleration of cloud infrastructure and the increase of vertical industry demand, while gaming business is mainly GPU-based and has always been the company's traditional business, mainly downstream used in the discrete graphics field of PC. At the same time, due to the company's advantage in computing power on GPU, with the rise of virtual currencies such as Bitcoin, some GPUs have been used for mining and other new fields of demand.

"Computing Future": Future potential growth points, but currently account for a relatively small proportion. This is mainly due to the new demand for computing power in the era of big data, including emerging fields such as autonomous driving, metaverse, and brain-computer interfaces.

II. Here is a detailed analysis of Dolphin's financial report on Longbridge:

I. Overall Performance: Entering the Decline Period, Q3 Revenue is Even "Worse"

1.1 Operating Revenue: In the second quarter of fiscal year 2023, Nvidia's revenue was $6.7 billion, a year-on-year increase of 3%, far lower than the company's previous guidance ($8.1 billion). The continuous eight quarters of quarter-on-quarter growth was interrupted, and the income side showed "cliff-like" performance. Mainly because the "computing basic plate", the main source of the company's revenue, has been weak, the gaming business has exploded and plummeted, and the data center business has also shown signs of slowing down in growth this quarter.

Looking ahead to the third quarter, the company's guidance is also not optimistic. Nvidia expects third-quarter revenue of $5.9 billion (+/-2%), a year-on-year decline of 17%. The continued decline in quarterly revenue is still mainly due to the decline in gaming and professional visualization revenue.

II. Here is a detailed analysis of Dolphin's financial report on Longbridge:

I. Overall Performance: Entering the Decline Period, Q3 Revenue is Even "Worse"

1.1 Operating Revenue: In the second quarter of fiscal year 2023, Nvidia's revenue was $6.7 billion, a year-on-year increase of 3%, far lower than the company's previous guidance ($8.1 billion). The continuous eight quarters of quarter-on-quarter growth was interrupted, and the income side showed "cliff-like" performance. Mainly because the "computing basic plate", the main source of the company's revenue, has been weak, the gaming business has exploded and plummeted, and the data center business has also shown signs of slowing down in growth this quarter.

Looking ahead to the third quarter, the company's guidance is also not optimistic. Nvidia expects third-quarter revenue of $5.9 billion (+/-2%), a year-on-year decline of 17%. The continued decline in quarterly revenue is still mainly due to the decline in gaming and professional visualization revenue.

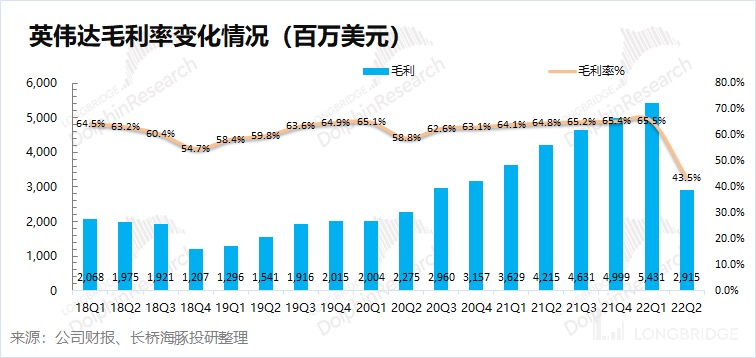

1.2 Gross profit margin (GAAP): Nvidia expects a gross profit margin (GAAP) of 43.5% for the second quarter of fiscal year 2023, far below the expected guidance (65.1%, +/-0.5%), almost a free fall, and 10 percentage points lower than the previous trough.

The significant decline in gross profit margin this quarter is mainly due to weak demand and high industry chain inventory, and the company has made a $1.22 billion inventory impairment. Dolphin Analyst estimates that if the impact of the $1.22 billion inventory changes is excluded, the company's gross profit margin for the second quarter of this year would still be 61.7%.

Nvidia expects the gross profit margin for the third quarter to return to 62.4% (+/-0.5%), and to return to above 60% in the short term, indicating that the sharp drop in gross profit margin in the second quarter is a short-term performance, mainly due to inventory impairment. The company's high gross profit margin has some sustainability, but overall it is showing a downward trend.

II. Core Business Situation: Gaming Business Underperforms, Data Center Hides Risks

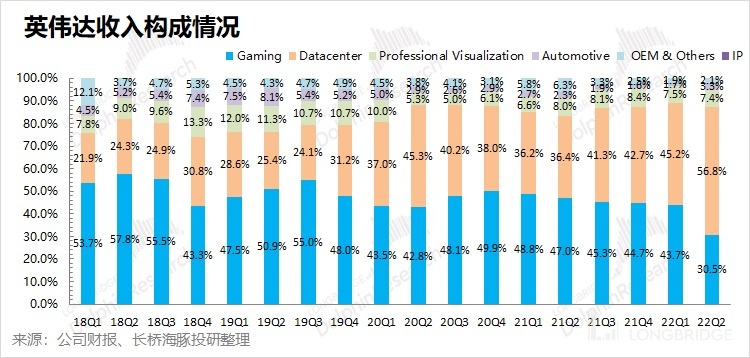

Due to underperformance of the gaming business, the revenue ratio of Nvidia's data center business exceeded half for the first time in the second quarter of fiscal year 2023, becoming the company's largest source of revenue. The share of the gaming business in the company's various businesses in this quarter dropped to 30%.

Gaming and data center businesses are the most core businesses that affect the company's performance, with their combined revenue accounting for more than 80%.

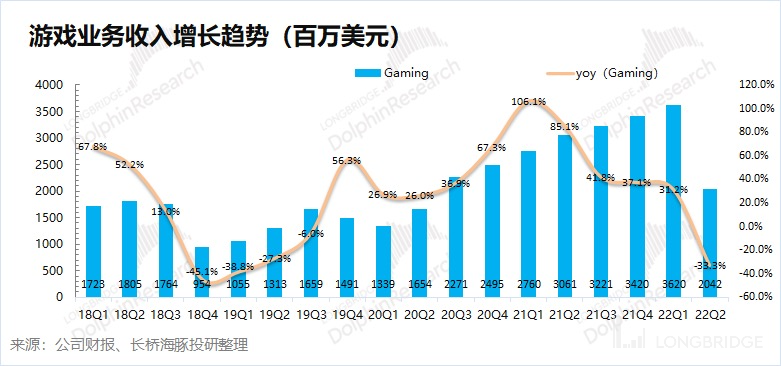

2.1 Gaming Business: Nvidia's gaming business achieved revenue of $2.04 billion in the second quarter of fiscal year 2023, a year-on-year decrease of 33.3%. In this quarter, the gaming business no longer uses "slower growth" to cover up its embarrassment, but directly plummeted by more than 30%. The company attributes the decline to the macroeconomic headwinds and the decrease in sales of gaming products.

And Dolphin Analyst believes that the main reasons for the catastrophic failure of the gaming business this quarter are:

And Dolphin Analyst believes that the main reasons for the catastrophic failure of the gaming business this quarter are:

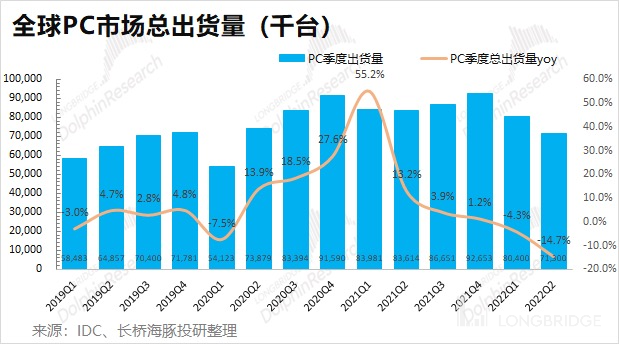

1) The global PC market showed a significant decline in the second quarter, weakening demand for the gaming sector. According to the latest data from IDC, the global PC market shipment accelerated by 14.7%, to only 71.3 million units in the second quarter of 2022. As graphics cards are primarily used in the gaming field on the PC side, the market demand for gaming graphics cards also declined due to the significant decline in demand for PCs in the post-epidemic market.

2) The continuous decline in virtual currency prices this year has weakened demand for mining-related needs. Like gaming, mining also has high computing power requirements, so some graphics cards are used in mining. However, due to the continuing decline in virtual currency prices since the fourth quarter of last year, the "mining market" is impacted, thereby weakening demand for graphics cards. Taking Bitcoin as an example, its price fell below $20,000 after reaching a high of $69,000 in the second half of 2021.

Source: Wind, Dolphin Research

3) The high inventory of distributors directly affected the current pulling force. The distributor hoarding sale model accelerated the "catastrophic failure" of this quarter. Driven by the booming demand for the PC market and virtual currency mining demand during the epidemic last year, the retail price of the RTX3070 series graphics cards, priced around 4,000 yuan, was once driven up to more than 10,000 yuan.

However, since the second half of last year, the shrinking demand in the PC market and the virtual currency market has directly affected the retail prices of distributors. Since 2022, the price of many products in the graphics card market has fallen by more than 50%, and many products have fallen below their recommended retail prices. The decline in demand for graphics cards and the slide in prices have squeezed the profit margins of distributors. The decline in the pulling force of distributors has been passed down to the company's significant decline in shipment this quarter.

In the June report "Cut, cut, cut. Is the semiconductor industry really "changing"?", Dolphin Analyst also mentioned that "Due to the decline in PC market sales, inventories of companies such as Dell/Lenovo have been rising, and Nvidia's inventory has also tended to rise." Looking back at the company's 2018, the downstream industry demand was sluggish, which also led to the company's high inventory and resulted in the company's catastrophic results. Dolphin Analyst believes that the growth of Nvidia's gaming business requires an increase in new product launches and a rise in virtual currency prices to stimulate downstream demand recovery. However, judging from the weak guidance for the next quarter, the gaming business still faces significant decline.

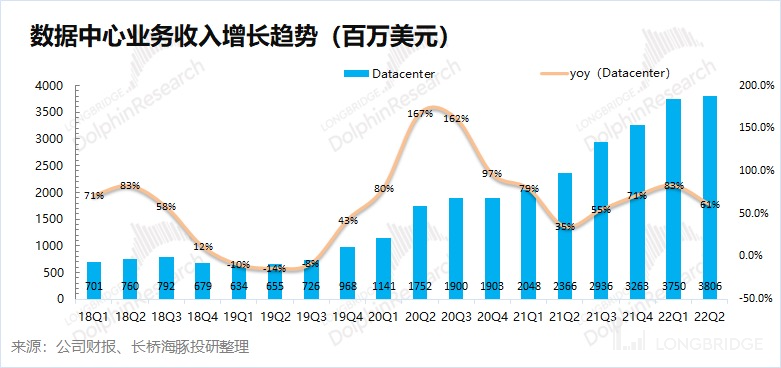

2.2 Data Center Business: In the second quarter of fiscal year 2023, Nvidia's star business, the data center, achieved revenue of 3.81 billion U.S. dollars, with an incredibly impressive year-on-year growth rate of 61%, but a meager 1% compared to the previous quarter. The company explains that the increase was due to the sales growth of extensive-scale and cloud computing customers in North America, while revenue in China declined due to economic conditions.

Dolphin Analyst believes that although Nvidia's performance this quarter was mainly dragged down by its gaming business, the data center business, which has hidden growth risks, cannot be ignored either. Against the backdrop of slowing growth and inflation on a macro level, Amazon, Facebook, and other large U.S. tech companies are beginning to downsize and cut expenses. Affected by the adjustment in capital expenditure made by these companies, Nvidia's expected growth in data center business may also face a downturn risk.

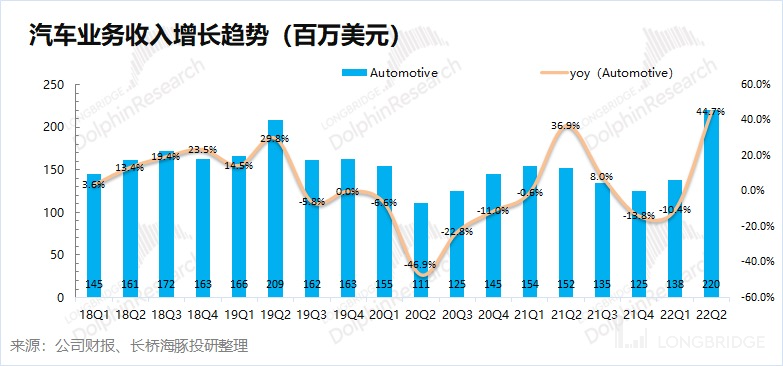

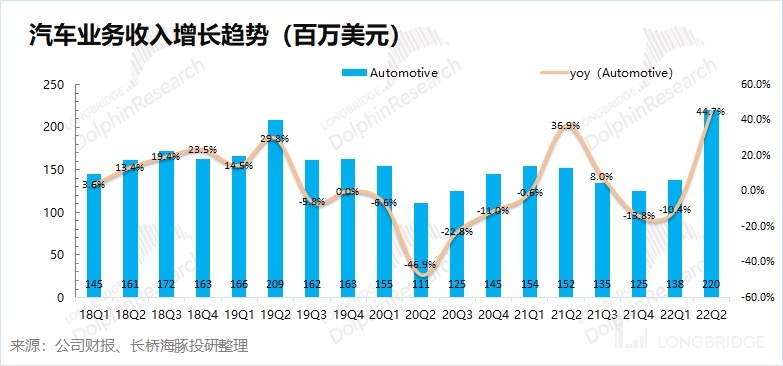

2.3 Automotive Business: Nvidia's automotive business achieved revenue of 220 million U.S. dollars in the second quarter of fiscal year 2023, with a year-on-year growth rate of 44.7%. These increases were mainly driven by revenue from autonomous and AI driving cockpit solutions.

The automotive business achieved unexpected growth in this quarter, reaching a historical high. With the continuous penetration of applications such as autonomous driving, the automotive business is expected to bring new growth to the company.

However, the revenue contribution of over two billion dollars from the automotive business is currently only around 3%, making it difficult to prop up performance. Dolphin Analyst will continue to keep track of the progress of Nvidia's automotive business.

III. Major Financial Indicators: Profits Plummet and Inventories Remain High

3.1 Operating Profitability: The Root Cause of the Sharp Decline is in Gross Profit Margin

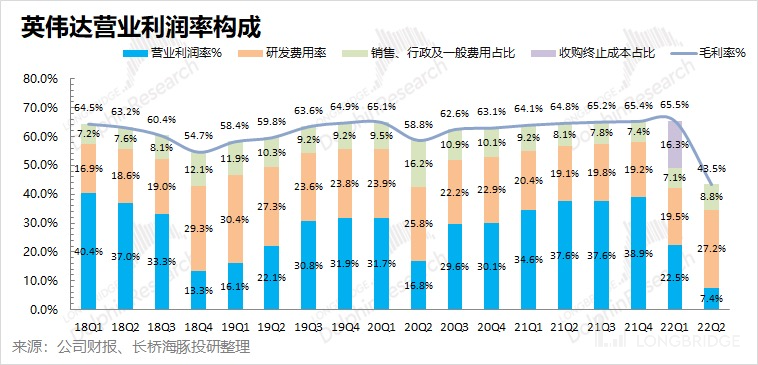

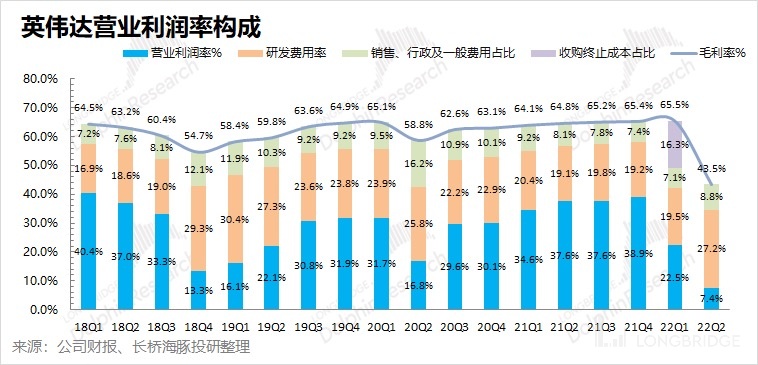

Nvidia's operating profitability continues to decline to 7.4% in the second quarter of fiscal year 2023. The sudden drop in operating profitability in this quarter is due to the decline in gross profit margin and the increase in expense ratio. The decline in product profitability coincides with cost growth, resulting in an "avalanche-like" drop in operating profitability.

Analyzing the components of operating profitability, specific changes are as follows:

"Operating Profitability = Gross Profit Margin - R&D Expense Ratio - Sales, Administrative, and Other Expense Ratio"

1) Gross Profit Margin: 43.5% in this quarter, a year-on-year decrease of 21.3 percentage points, mainly due to weak gaming business and product pricing adjustments;

2) R&D expense ratio: 27.2% in this quarter, a year-on-year increase of 8.1 percentage points. This is mainly due to the relative rigidity of R&D expenses. Although the company's revenue was weak this quarter, the absolute value of R&D expenses will not decrease significantly as a result. 3) Proportion of sales, administrative and other expenses: 8.8% this quarter, up 0.7pct YoY. Sales expenses vary with revenue, while the rigid nature of administrative expenses has led to an overall increase in the expense ratio.

The company's third-quarter operating expenses guidance is still as high as $2.59 billion, and faced with weak revenue guidance, operating expenses in the third quarter may continue to rise to around 44%. The increased expense ratio will continue to put pressure on the company's profits.

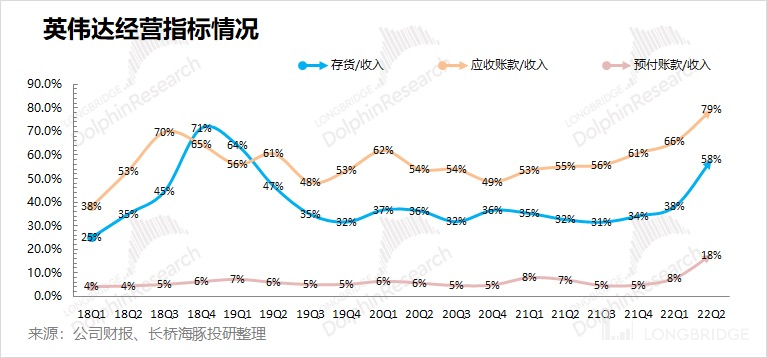

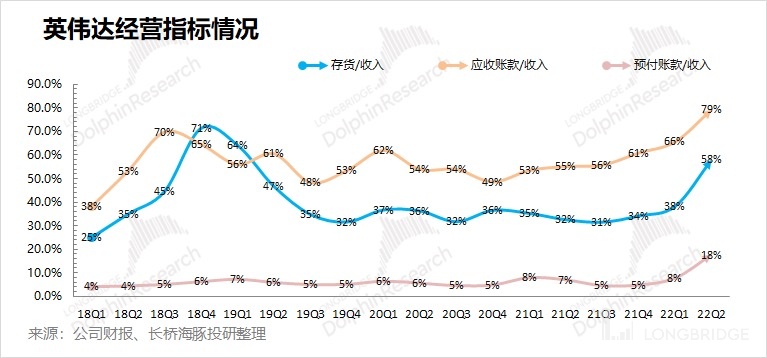

3.2 Business indicators: Increasing inventory pressure

1) Inventory/revenue: The ratio for this quarter is 58%, up 20pct QoQ. The sharp drop in revenue directly led to an increase in the ratio. In absolute terms, inventory increased by $726 million QoQ this quarter, and the company's inventory pressure continued to increase.

2) Accounts receivable/revenue: The ratio for this quarter is 79%, up 11pct QoQ. The sharp drop in revenue directly led to an increase in the ratio. In absolute terms, accounts receivable decreased by $121 million QoQ this quarter.

The main reason for Nvidia's high inventory is the lack of demand in the gaming business, and the constantly high inventory also reflects that the downstream field has entered a downward channel. Given the company's weak revenue guidance for next quarter, Dolphin Analyst believes that the company's inventory pressure will remain significant next quarter.

3.3 Net profit (GAAP): The main reason for the steep decline is the gross profit margin

In the second quarter of fiscal year 2023, Nvidia's net profit was $656 million, a YoY decrease of 72.4%, and this quarter's net profit margin fell to a historic low of 9.8%. The significant decline in profits this quarter is mainly due to the sharp drop in the gross profit margin and the significant increase in the expense ratio in the context of weak revenue, which ultimately squeezed the company's profits.

Dolphin's historical articles on Nvidia:

Depth June 6, 2022 "Did the US stock giant tremble? Was Apple, Tesla, and Nvidia wrongly killed?"

February 28, 2022 "Nvidia: High Growth is True, but Cost-Effectiveness Is Still Not Quite There" #####2021 年 12 月 6 日《NVIDIA: Valuation Should Not Rely Solely On Imagination》

#####2021 年 9 月 16 日《NVIDIA (1): How Did The Chip Giant Grow 20 Times In Five Years?》

#####2021 年 9 月 28 日《NVIDIA (2): No Longer Driven By Dual Wheels, Will Davis Strike Back?》

Earnings Season

#####2022 年 8 月 8 日 Performance Preview《Falling Downhill: NVIDIA's Free-fall Performance》

#####2022 年 5 月 26 日 Telephone Conference Call《Epidemic-Induced Lockdown and Gaming Decline Drag Down Q2 Performance (NVIDIA Conference Call)》

#####2022 年 5 月 26 日 Report Review《"Epidemic Fattening" Is Gone, NVIDIA's Performance Looks Miserable》

#####2022 年 2 月 17 日 Telephone Conference Call《NVIDIA: Multi-chip Advancement, Data Center Become Company's Focus (Conference Call Summary)》

#####2022 年 2 月 17 日 Report Review《NVIDIA: Hidden Worries Behind Surprise-performance |Reading Financial Reports》

#####2021 年 11 月 18 日 Telephone Conference Call《How Does NVIDIA Build The Metaverse? Management: Focus On Omniverse (NVIDIA Conference Call)》

#####2021 年 11 月 18 日 Report Review《Can Nvidia Continue To Be Bullish With Computing And Metaverse Boosts?》

Live Broadcast

#####2022 年 5 月 26 日《NVIDIA Inc. (NVDA.US) 1Q FY2023 Earnings Call》 On February 17, 2022, the Q4 2021 Earnings Conference Call of NVIDIA Corporation (NVDA.US) was held, for more details please refer to Longbridge. On November 18, 2021, the Q3 2022 Earnings Conference Call of NVIDIA Corporation (NVDA.US) was held, for more details please refer to Longbridge.

Risk disclosure and statement of this article: Disclaimer and General Disclosure of Dolphin Research