The Dream of Slowing Down and Raising Interest Rates is Shattered Again

Hi everyone, I am Dolphin Analyst! After the National Day vacation, the Dolphin's weekly report is back.

I. Strong Employment Data Crushes the Market's Illusion of "Slowing and Raising"

Since the Fed's "Iron-blooded" raised interest rates by 75 basis points on September 21, the global market has surrendered and fell for two consecutive weeks. However, on October 4, the Reserve Bank of Australia unexpectedly announced a rate hike of only 25 basis points, which was lower than the market's expected 50 basis points. On the same day, the United Nations Conference on Trade and Development (UNCTAD) also released a report stating that if developed economies continue to adopt contractionary monetary and fiscal policies, the global economy may fall into recession and long-term economic stagnation.

One of the major monetary policies in the world unexpectedly turned dovish, and the UN official organization also strongly called for a slowing down of interest rate hikes after market's "good wishes" for the Fed to slow down its hikes once again returned, and global stock markets also responded with a sharp rise. On October 4, the S&P 500 index rose sharply by 3%, and the Hong Kong Stock Hang Seng Index rose by an astonishing 5.9% the next day.

However, the strong employment data released last Friday was quite robust, reinforcing the need for the Fed to raise rates, and extinguishing the market's "good illusion" of slowing down interest rate hikes, causing the US stock market to fall again on Friday.

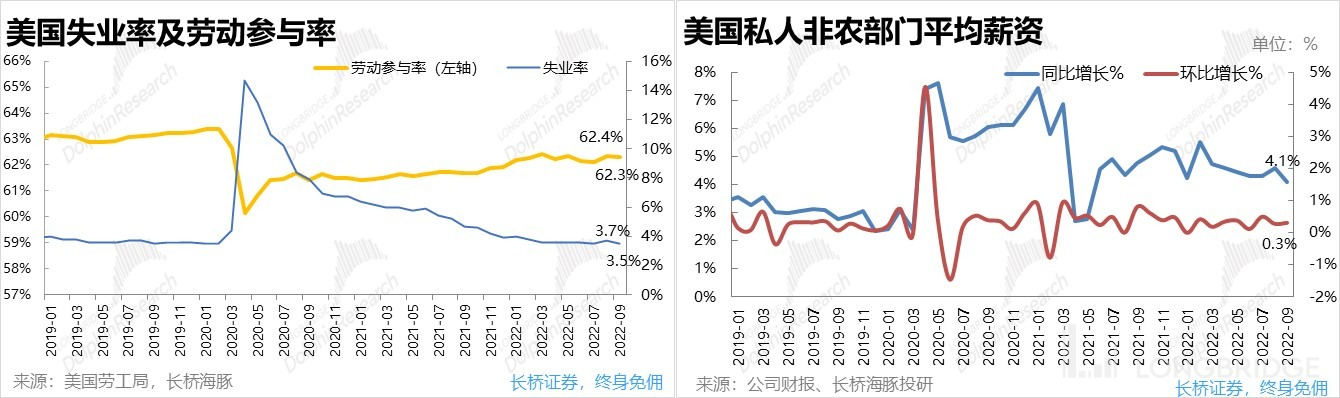

Specifically, the US unemployment rate in September was 3.5%, a decrease of 0.2% from the previous month, and the labor force participation rate was 62.3%, a 0.1% decrease from the previous month; while the private sector's average weekly salary year-on-year growth rate has slowed slightly, it still reached 4.1%, far higher than the pre-pandemic 2-3% steady-state growth rate. On a month-on-month basis, the average weekly salary still increased by 0.3% compared to the previous month, indicating that the momentum of wage increases has not reversed.

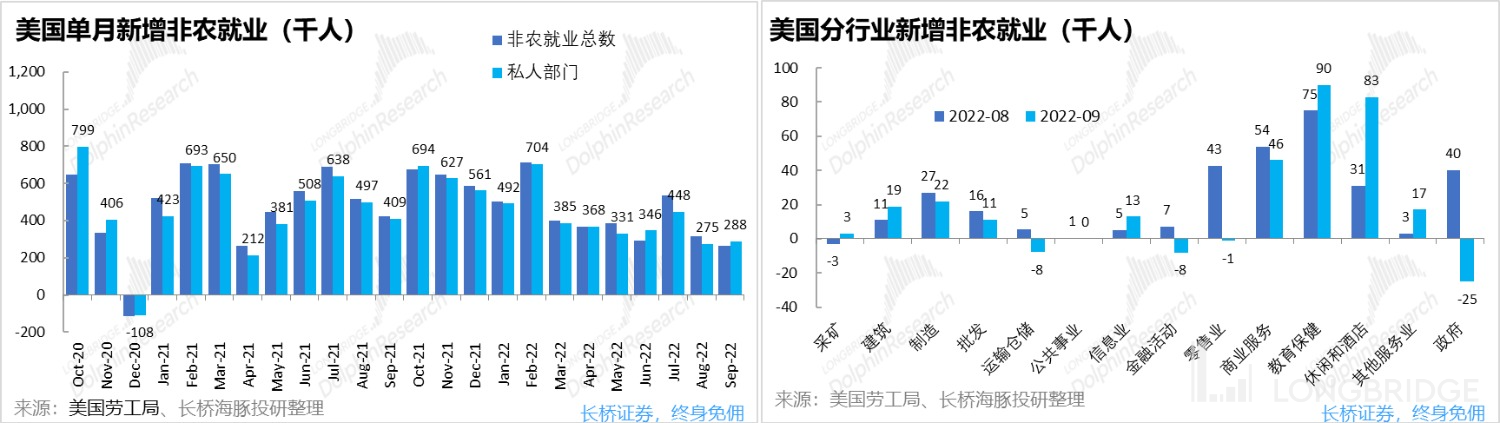

In addition, the US added 263,000 non-farm jobs in September, although it has declined from the previous months, it still exceeded the expected 255,000 jobs. Moreover, at the end of September, the total non-farm employment in the United States reached 153 million, which is 500,000 more than the pre-pandemic level. Under the condition of full employment, the new employment in September was even more robust.

By industry, excluding government layoffs, the actual number of private sector new jobs was 288,000. Among them, the growth in employment in the manufacturing industry has clearly slowed down, but the service industry (education, healthcare, leisure, catering, and accommodation) still maintains robust growth in new employment.

Overall, the US job market is still hot, and US residents have no trouble finding jobs, and wages are also increasing rapidly. With stable employment and income growth, residents' demand for consumption will continue to be strong. Since private consumption accounts for more than 70% of the US GDP, as long as consumption remains strong, the overall US economy is difficult to cool down, and inflation is difficult to rapidly fall back, so the Fed is also difficult to slow down interest rate hikes. ** 二、Is the shortage of personnel seeing the dawn?

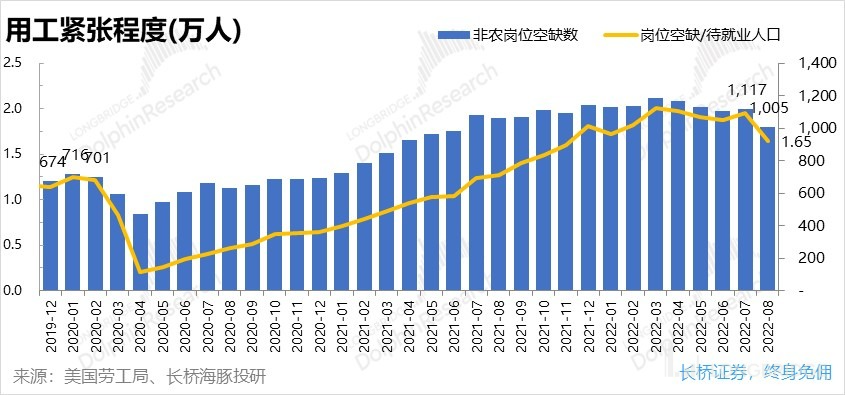

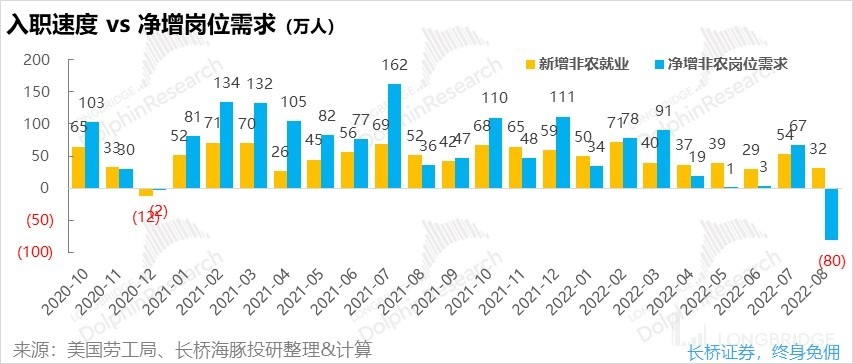

However, while the US job market is still hot and the labor shortage is still severe, there are signs of improvement. The latest release of non-farm job vacancies for August showed a decrease of nearly 1.12 million people compared to the previous month, of which about 315,000 were filled by new non-farm employment in that month. Simple calculations show that US companies cancelled about 800,000 job vacancies in the month of August. The ratio of job vacancies to job seekers also decreased from 1.95 in July to 1.65, so while the US job market is still "more jobs than people," there are signs of improvement in labor shortages.

But the current job gap is still 3 million more than before the pandemic, and looking back throughout history since 2000, such a large-scale job reduction has only occurred continuously during the 2008 financial crisis, and never during normal economic conditions. Therefore, it is feared that it will take more than one recession to fill the 3 million job gap.

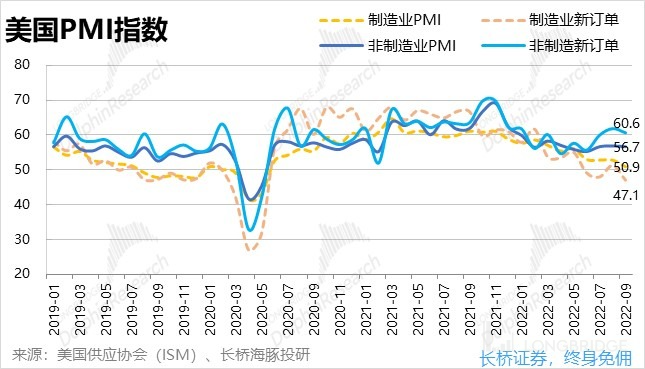

At the same time, the PMI index, an economic leading indicator, also declined in September, reflecting a weak manufacturing sector that was aligns with job data. However, the service industry is still quite strong. Among them, the new order index for manufacturing PMI fell to 47.1, indicating a recession. However, the new order index for the service industry PMI, which has a higher economic weight, reached 60.6 in September, still in the high prosperity range.

Overall, although the US economy has shown signs of slowing down, it is still quite strong overall, and the hot and scarce job market is still a long way from cooling down. Therefore, in Dolphin Analyst's view, it is still impractical to expect the Fed to temporarily defer rate hikes or even restart rate cuts in the short to medium term.

** 三、Will frequent supportive policies lead to an upturn in China's real estate industry?**

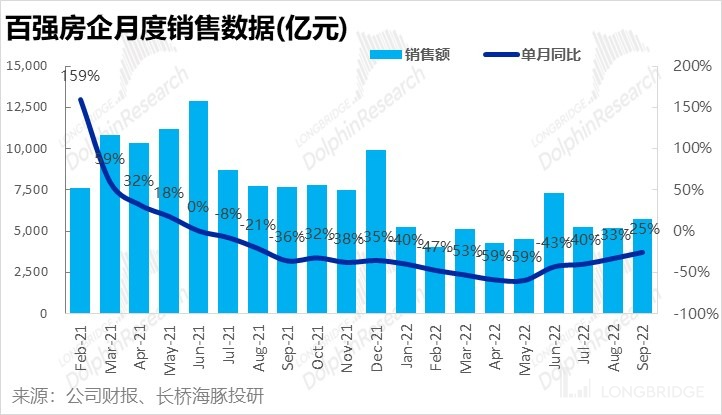

As the core pillar of the domestic economy, the real estate industry's explosive cold from the second half of last year until now is also one of the biggest factors affecting domestic demand. Although this year, many places have implemented a lot of stimulative policies under the general principle of "implementing policies according to the circumstances of individual cities," the monthly sales of China's top 100 real estate enterprises as of September are still at a low level and have not significantly rebounded. However, on the eve of National Day, the central government issued three rare real estate support policies, including: (1) further relaxing the minimum interest rate for home loans in cities that meet certain conditions, (2) buyers who sell their existing homes to purchase new ones can have their personal income tax refunded, and (3) lowering the interest rate of provident fund loans.

Unlike mostly regional support policies issued by local governments in the past, the central government has always maintained the stance of "housing is for living in, not for speculation", but these policies are all national policies, covering a wider range. The fact that three policies were issued within two days indicates significant support, and the fact that they were directly enacted by the central authority may suggest the first top-down shift in domestic real estate policy.

1. Further Relaxing the Minimum Interest Rate for Home Loans

According to the policy, cities in which the sales prices of newly-built commodity homes have continuously declined month-on-month and year-on-year from June to August 2022 can loosen the interest rates for first-time homebuyers. Local governments can decide the lower limit of the loan interest rate independently. Compared with the 20bp reduction in the lower limit of the interest rate in May this year, the strength and flexibility of this policy are obviously greater.

According to the house price data for 70 cities published by the National Bureau of Statistics, 23 cities meet the necessary requirements for interest rate reduction (all second and third-tier cities). Most of the other small and medium-sized cities outside the range of 70 cities should also meet the requirements for interest rate reduction.

2. Refund of Personal Income Tax for Replacing Homes

Those who sell their own houses and repurchase homes in the same city within one year after selling their current homes can apply for a refund of the personal income tax paid for their current homes sold, which is equivalent to lowering the cash flow pressure of buyers when paying down payment.

3. Lowering the Interest Rate of Provident Fund Loans

The interest rate of the first-person housing provident fund loan has been lowered by 0.15 percentage point, and the interest rate for a period of not more than five years (including five years) and for more than five years has been adjusted to 2.6% and 3.1%, respectively. The policy for the interest rate of the second-person housing provident fund loan remains unchanged.

Overall, this is one of the most supportive policies since the downturn in the real estate industry, and is expected to promote the recovery of the real estate chain and domestic demand to some extent. However, in the current context of weak economic environment and confidence, the possibility of significant recovery for the real estate industry and domestic demand is not very high. Therefore, it is still necessary to pay attention to whether the government will continue to introduce economic stimulus policies during the conference and the actual recovery of the real estate industry.

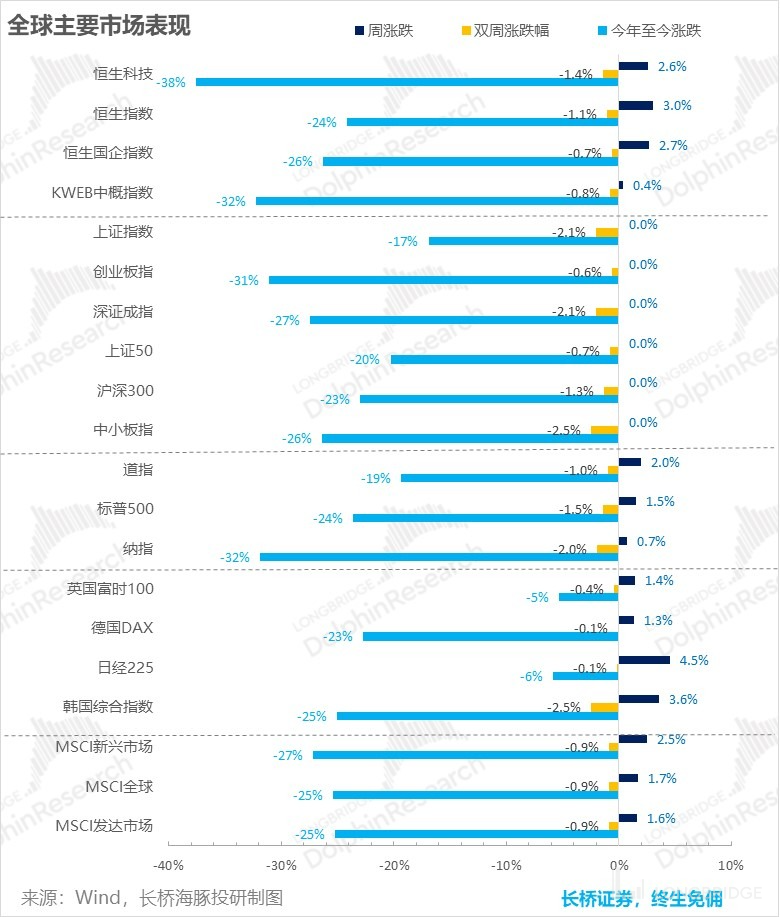

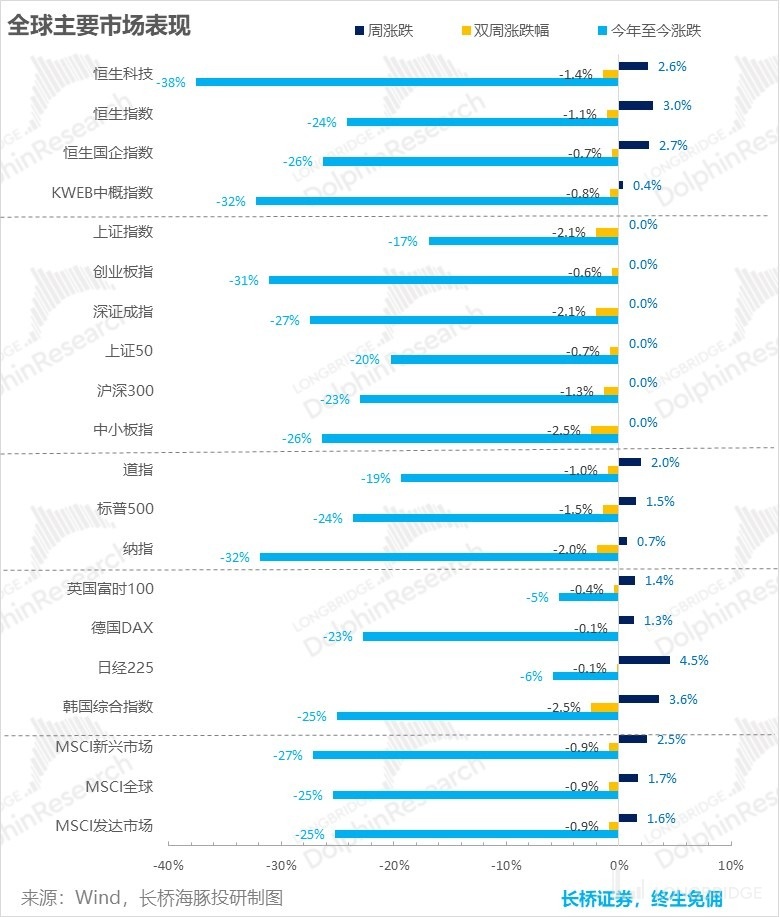

4. Failed Rush to Rise: The Stock Market Rose and Then Fell

Just as the market's attitude towards interest rate increases has shifted from pessimism to optimism, then back to pessimism, in the two weeks from September 26 to National Day, global market trends have basically fallen first then risen and fallen. In the last week of September, the global market continued its downward trend after the Federal Reserve raised interest rates. However, during the 11 days when the A-shares market was closed for the National Day holiday, overseas markets once again "raced" ahead of the game against the Federal Reserve's slowing interest rate increases, with overseas markets and Hong Kong stocks soaring violently on October 3-4. But under the pressure of strong US employment data on the 7th, foreign markets plummeted again. Overall, the rebound during the National Day holiday was not as strong as the decline at the end of September, so overall, global markets still fell in the past two weeks.

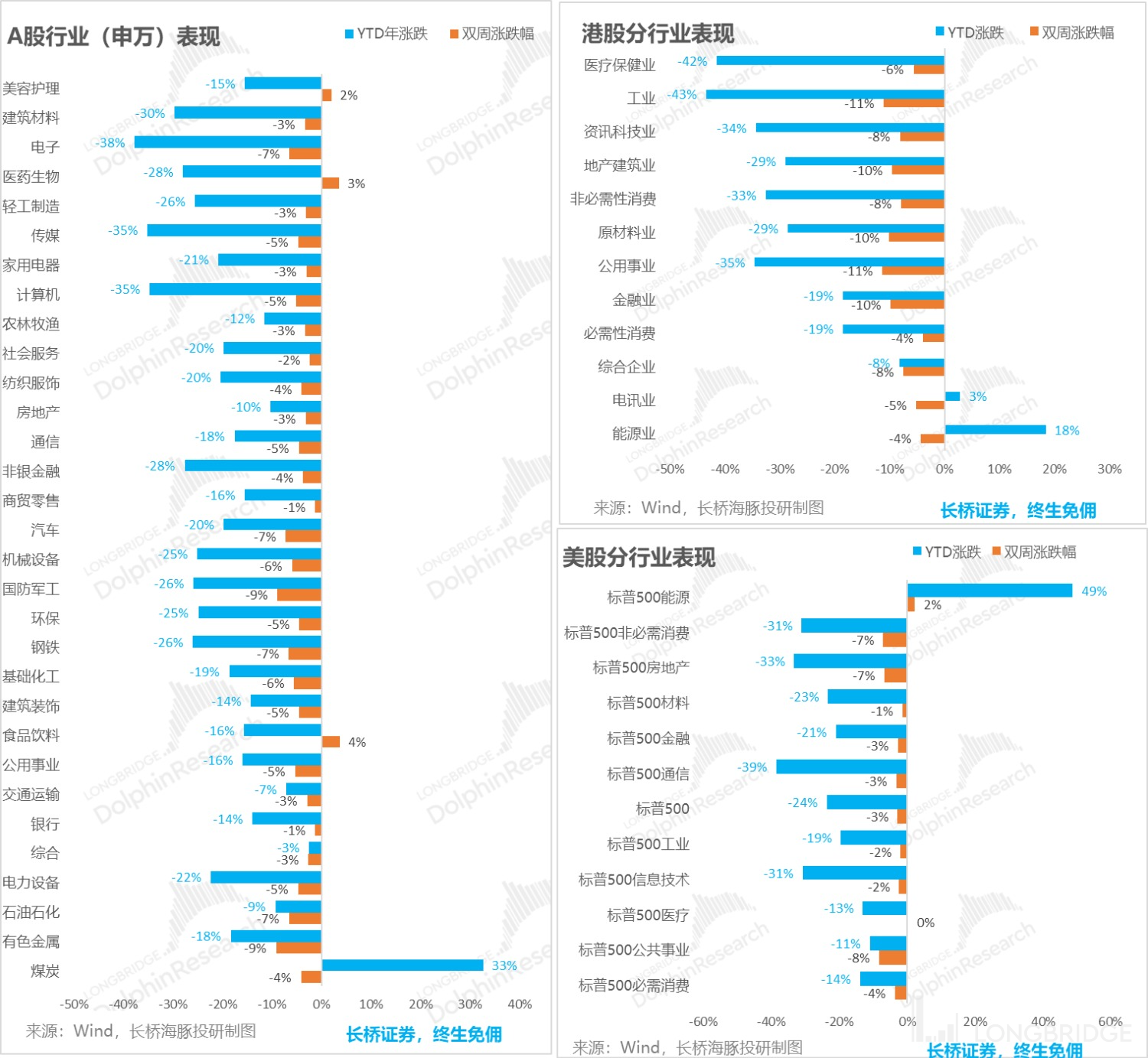

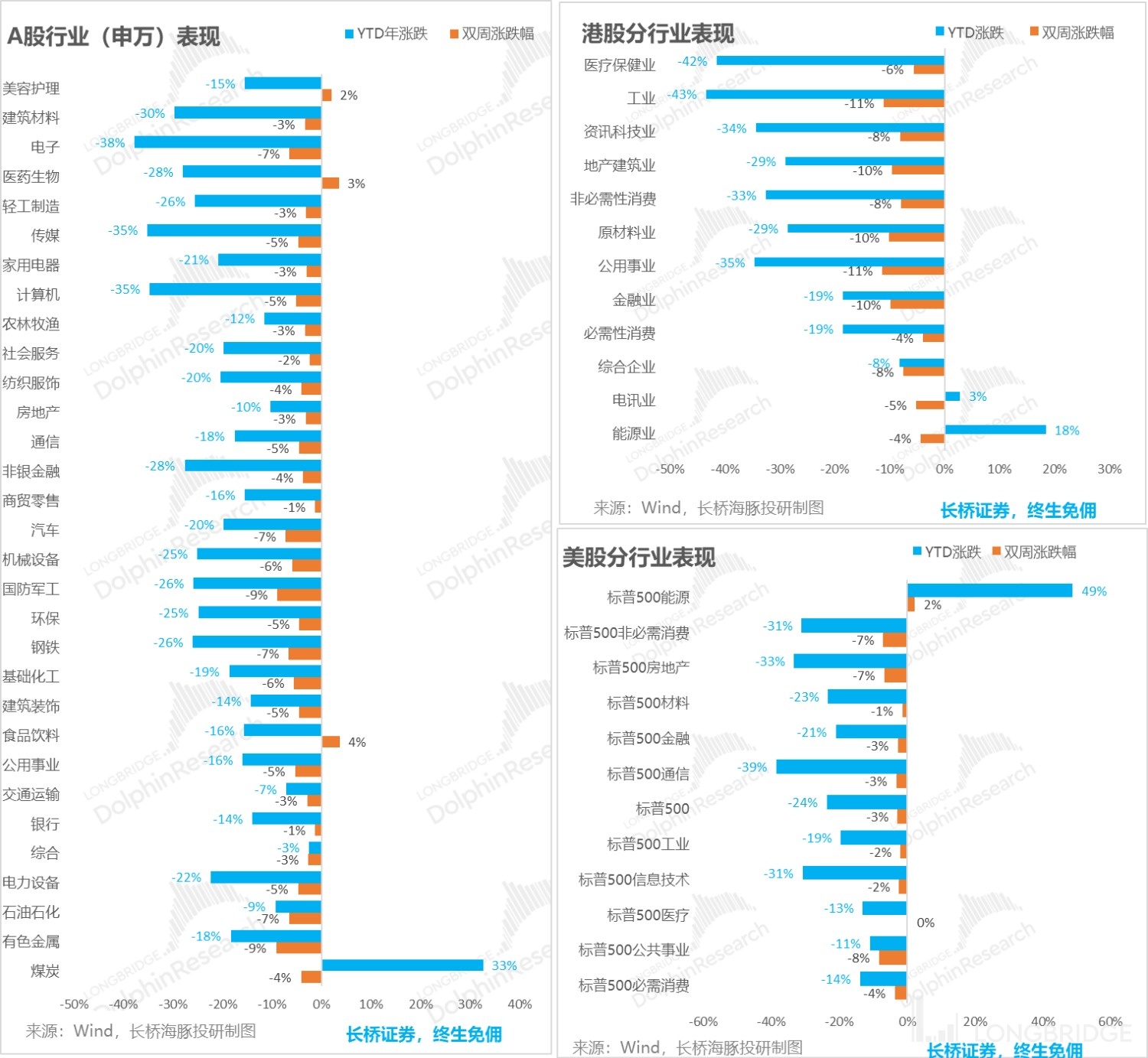

Looking at it by industry, energy, healthcare, and essential consumer goods are the best performing sectors in A-shares, H-shares, and US stocks. Among them, the energy industry is a beneficiary logic under inflation, while essential consumption is a relatively resilient defensive logic under economic weakness.

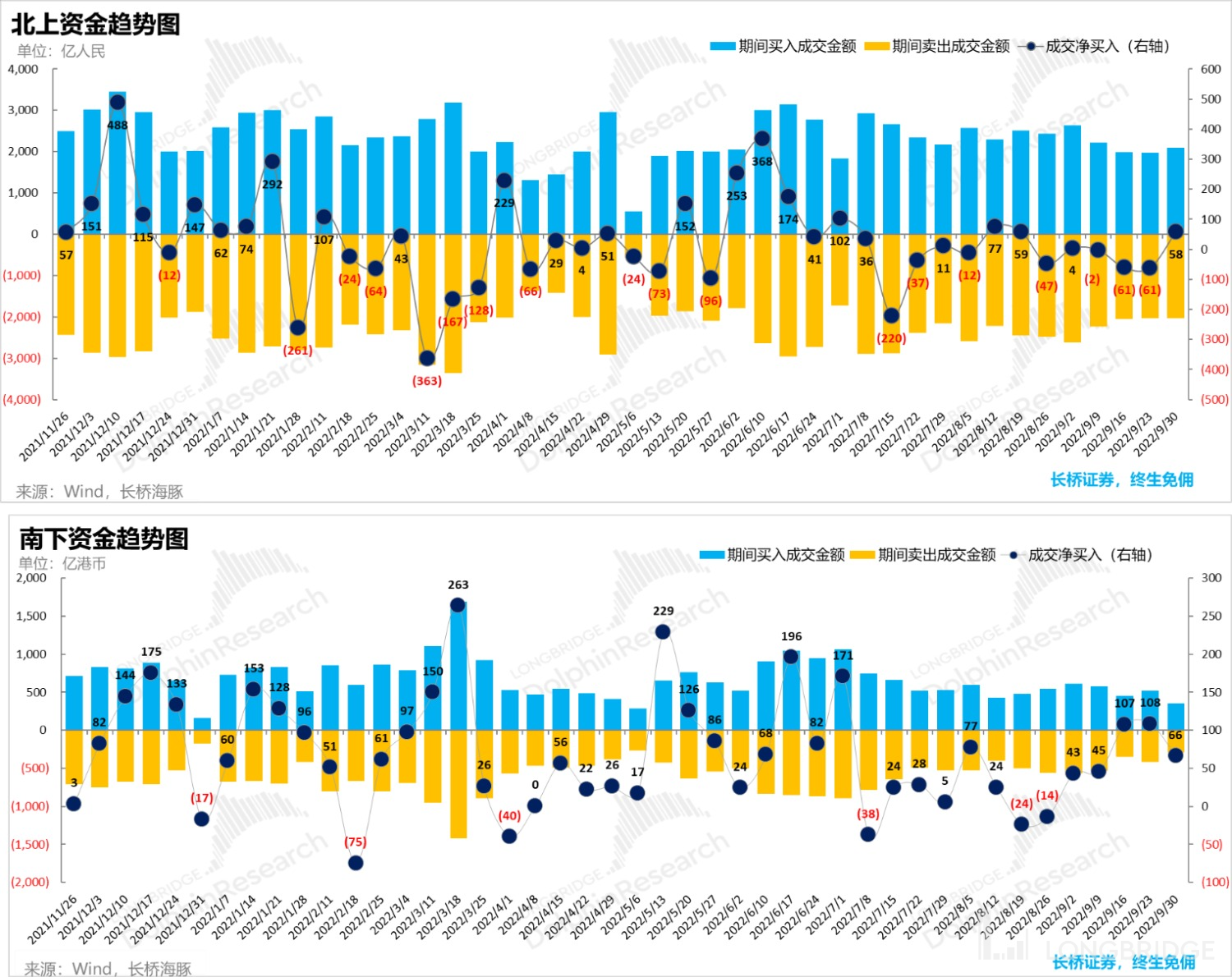

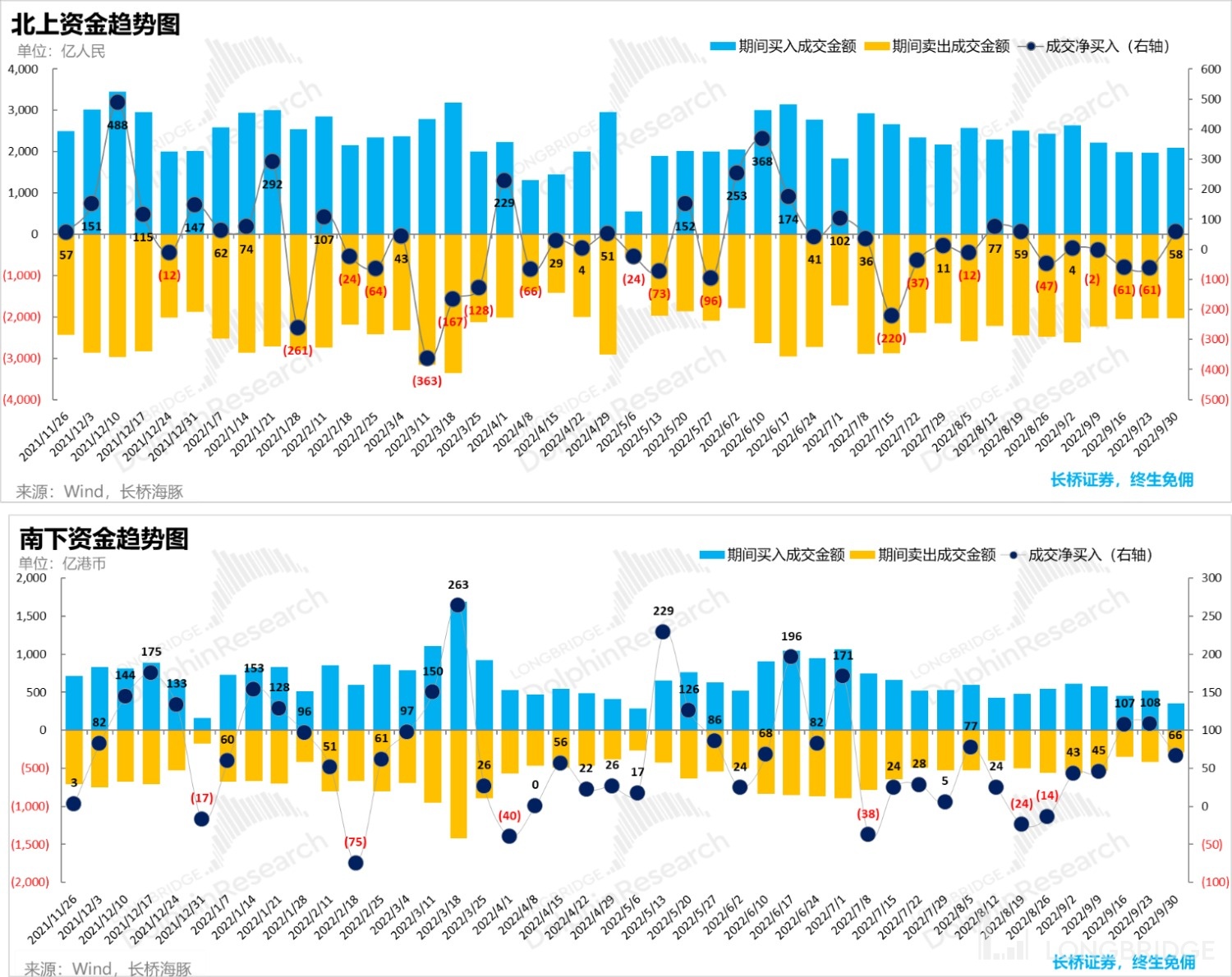

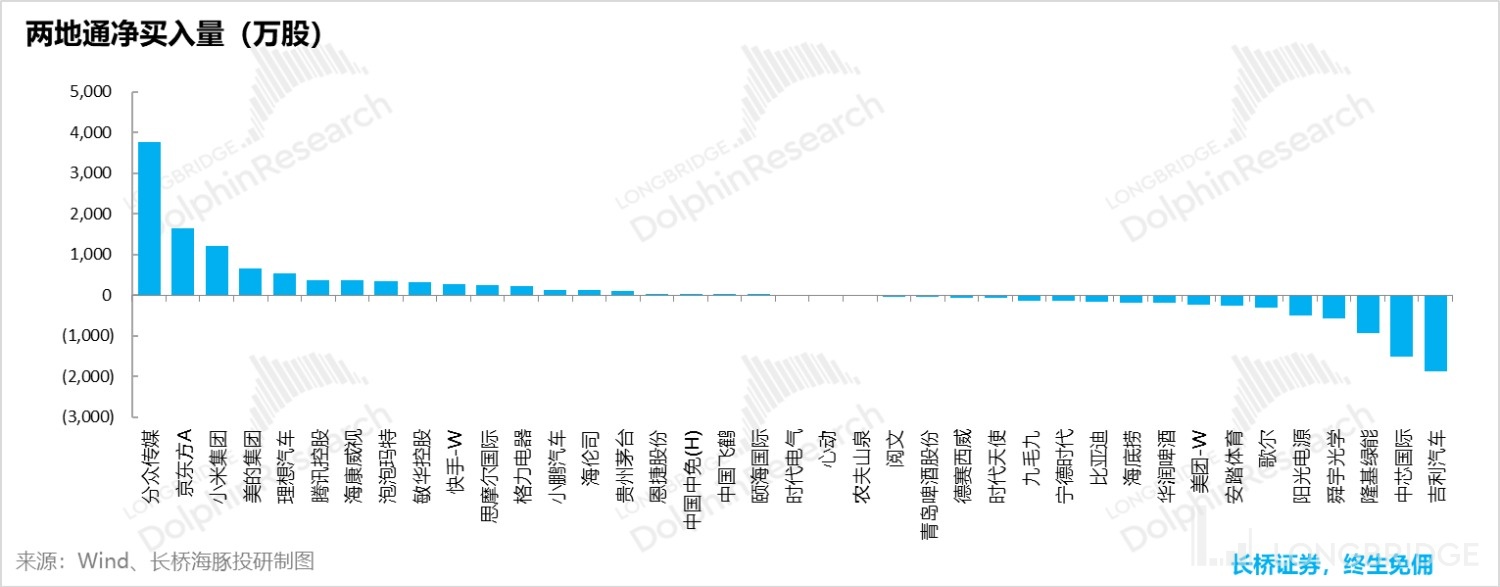

From the perspective of funds flowing into and out of the Hong Kong and Shanghai stock markets, prior to the National Day holiday, when there was a small wave of momentum in essential consumption such as food and beverage, northbound funds took the opportunity to increase their net holdings of A-shares. However, strict epidemic control measures during the National Day holiday and the expected decline in consumption data led to a general drop in the consumption industry on the first trading day after the holiday, basically erasing the pre-holiday gains.

While Hong Kong stocks have been at an all-time low due to the continuous interest rate hikes in the United States and the return of funds from around the world to the US, southbound funds have been net inflows for five consecutive weeks, continuously bottom fishing beaten-down valuations in the Hong Kong stock market.

IV. Alpha Dolphin Portfolio Returns

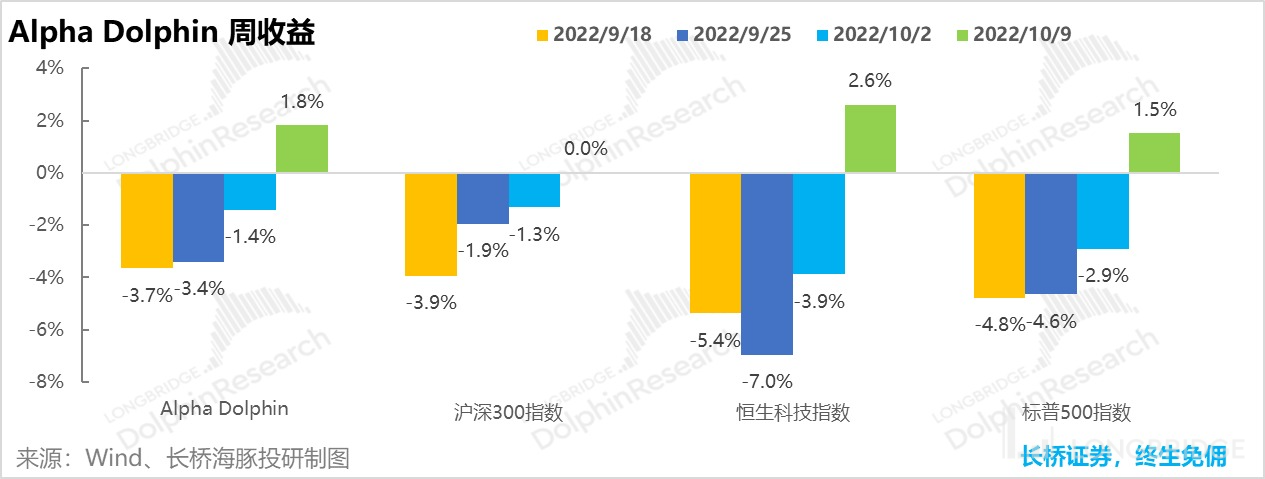

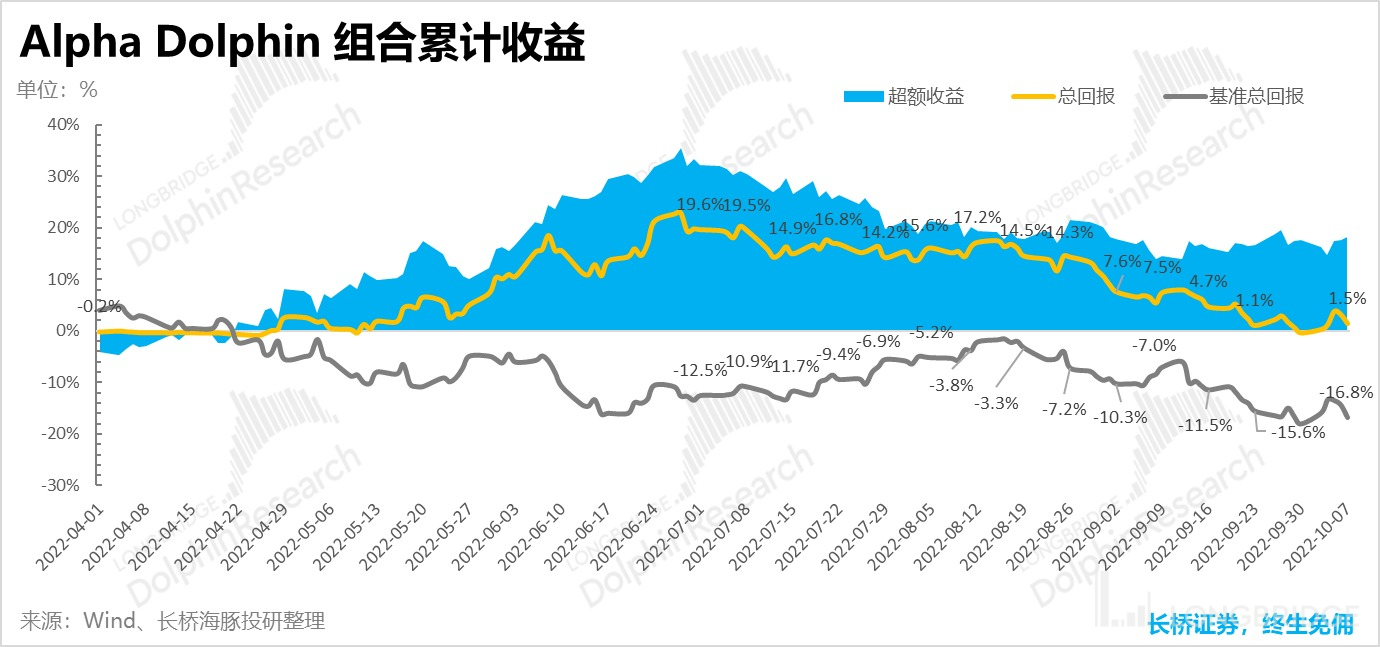

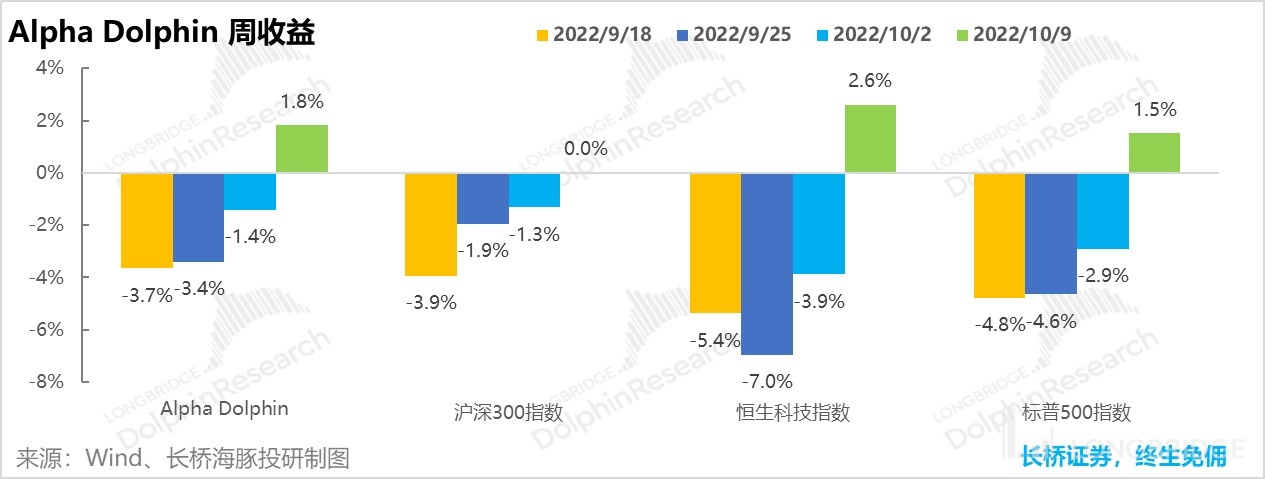

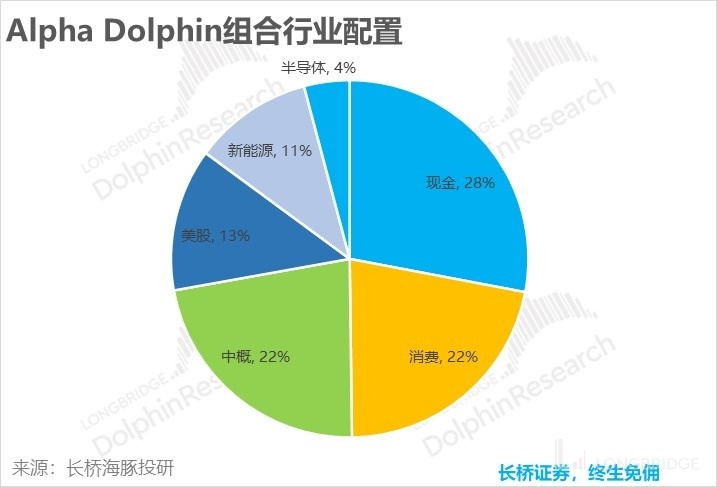

During the period of the US interest rate hike cycle, the global market is generally in a downward trajectory. However, the Dolphin Analyst has already reduced the stock position in advance and increased the proportion of cash; in terms of sector allocation, the proportion of US stocks has been reduced and domestic consumption stocks have been added. Therefore, the volatility of the Alpha Dolphin portfolio is relatively small, and overall performance is better than the benchmark S&P 500 index. As of this week ending October 2nd, the Alpha Dolphin Portfolio fell by (1.4%), which is less than the S&P 500's (2.9%); as of October 9th, the portfolio's increase was 1.8%, larger than the S&P 500's 1.5%.

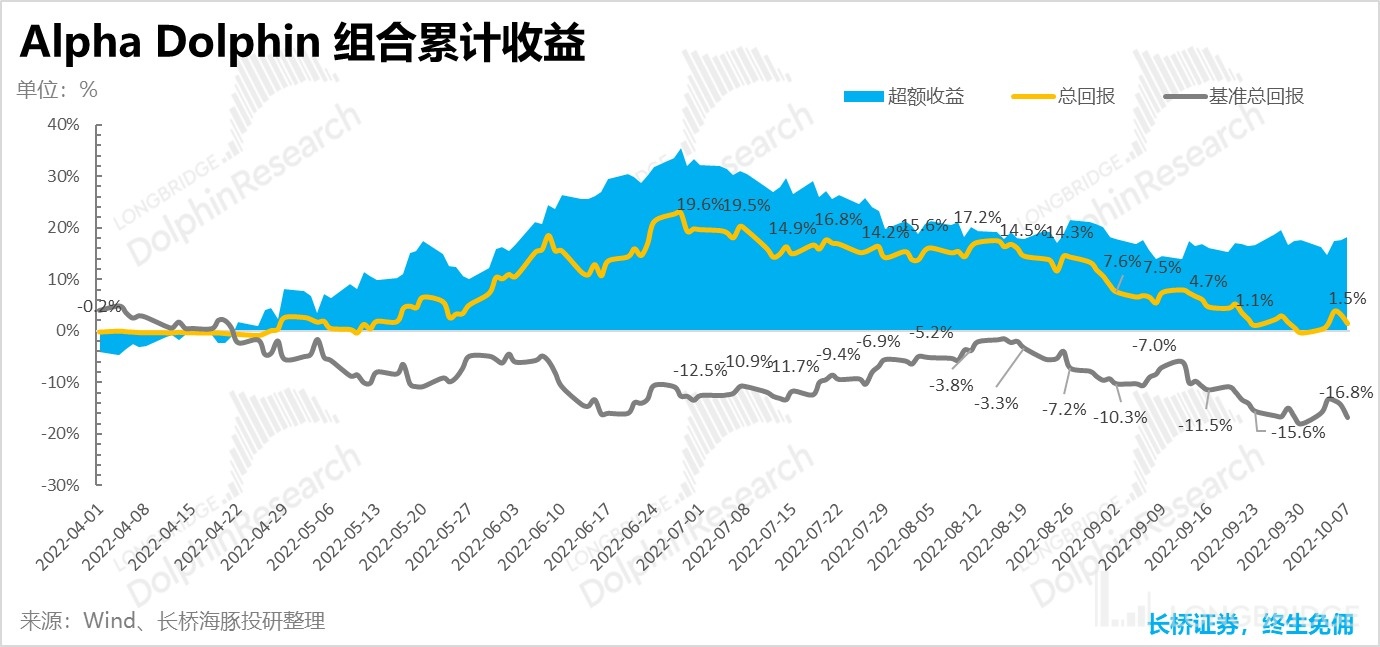

From the start of testing the portfolio to last weekend, the absolute return of the portfolio is 1.5%, and the excess return with respect to the benchmark S&P 500 index is 18.3%.

V. Stock Performance: Essential Consumer Goods Sector Leads the Way

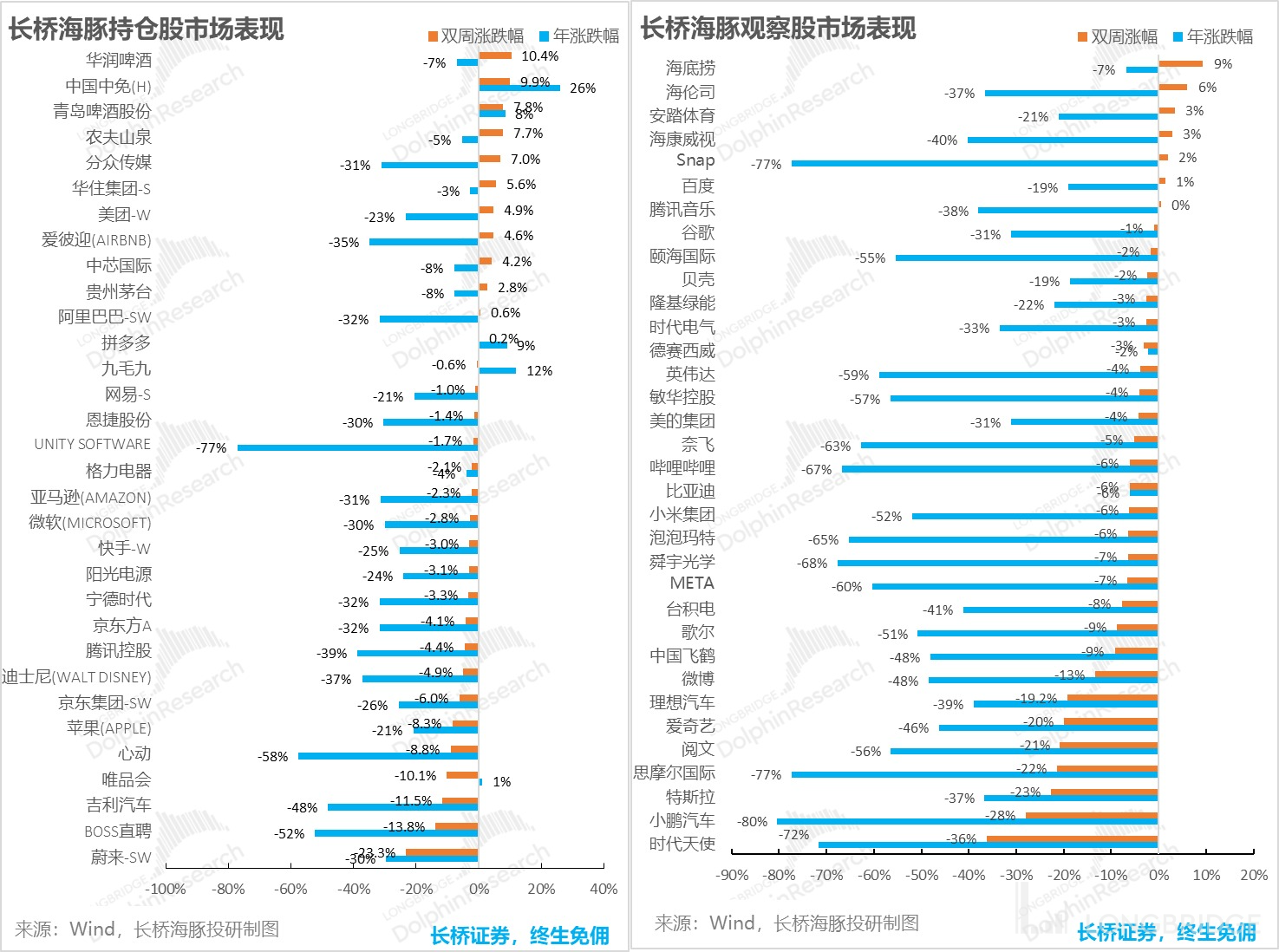

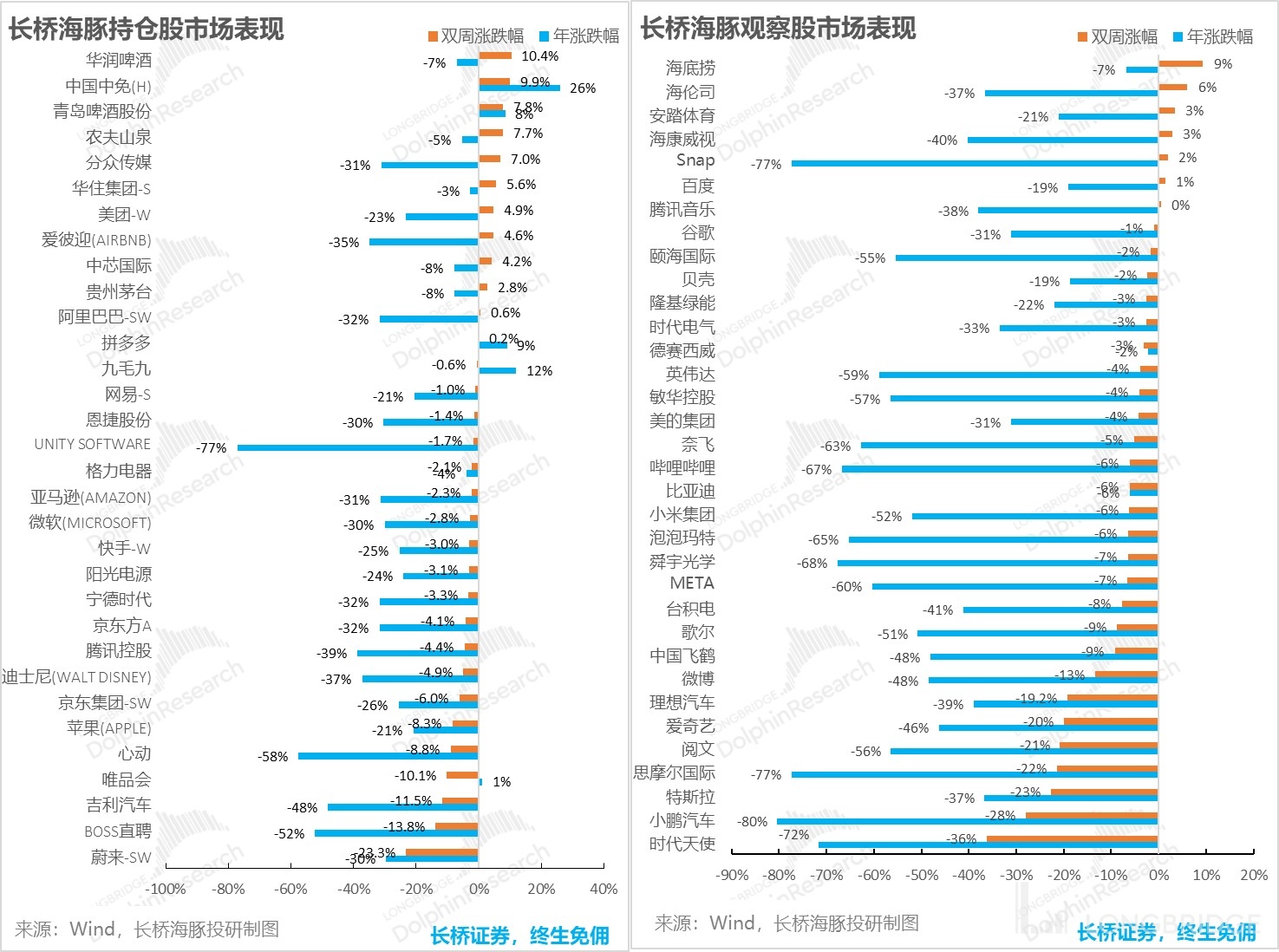

Last week, new energy vehicle manufacturers saw huge declines, with Weilai and Tesla both down by about 20%, making them the worst-performing sector among the Dolphin Analyst’s coverage targets. Due to the overuse of domestic demand for new energy vehicles, the market is concerned that the growth rate of sales will slow down significantly next year. And the competition pattern of new energy vehicles has deteriorated with the launch of large numbers of new models by various new and old forces, so funds have begun to flow out of the overvalued electric vehicle sector.

The defensive consumer sector has become a new "favorite" for funds. In the past two weeks, among the consumer targets covered by Dolphin Analyst, beer, Nongfu Spring, China Duty Free and Helenspur have performed the best.

For companies with significant changes in the past two weeks, the driving reasons summarized by Dolphin Analyst are as follows for reference:

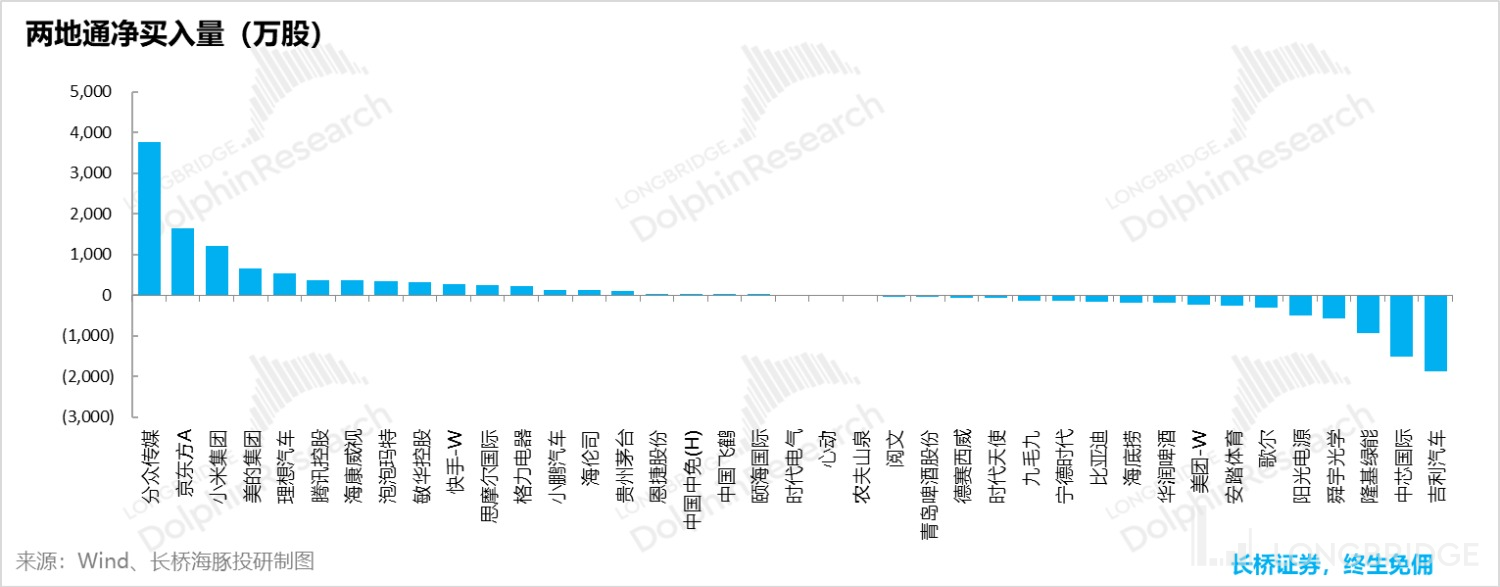

From the perspective of north-south fund flows of individual stocks, buying undervalued and top-tier companies in difficulty seems to have become the consensus of the market. Stocks with extremely low valuations such as Focus Media, BOE, Xiaomi, and Midea have been heavily bought by funds, while sectors such as the electric vehicle market and the mobile phone industry chain that are experiencing a downturn in the business cycle have been heavily sold by north-south funds.

VI. Combination adjustment and key focus

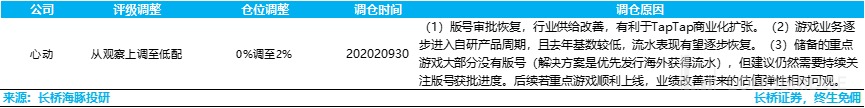

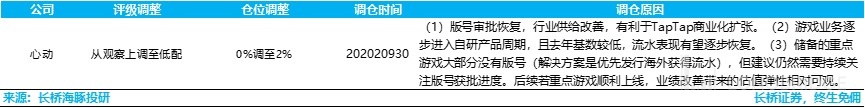

In addition, on September 30th, based on the previously released report "After Seeking a Way Out, Tencent, Kuaishou, and B Station Have Different Destinies", Dolphin Analyst adjusted the Alpha Dolphin combination and incorporated Xindong as a low weight (2%) holding. The adjustment logic is shown in the following table:

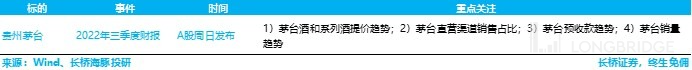

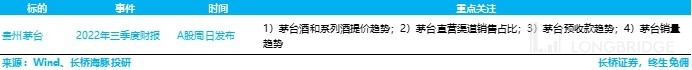

This Sunday, A-share leader Guizhou Maotai will also be the first to release its third-quarter financial report on this Sunday (10.16). Dolphin Analyst believes the following dynamic should be the key focus of this report:

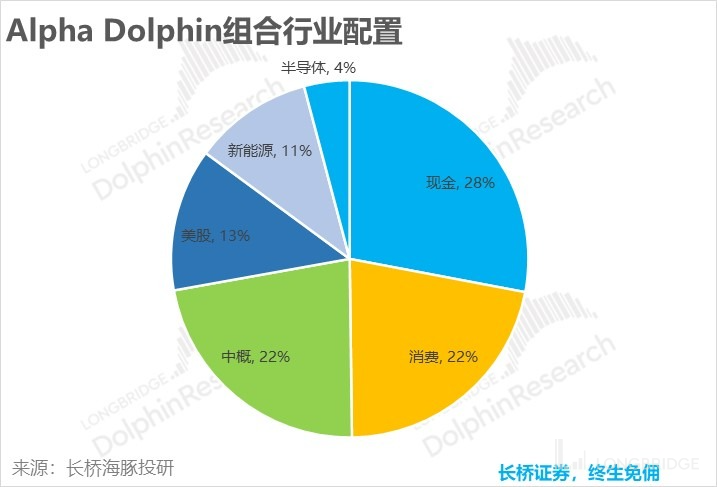

VII. Combination asset distribution

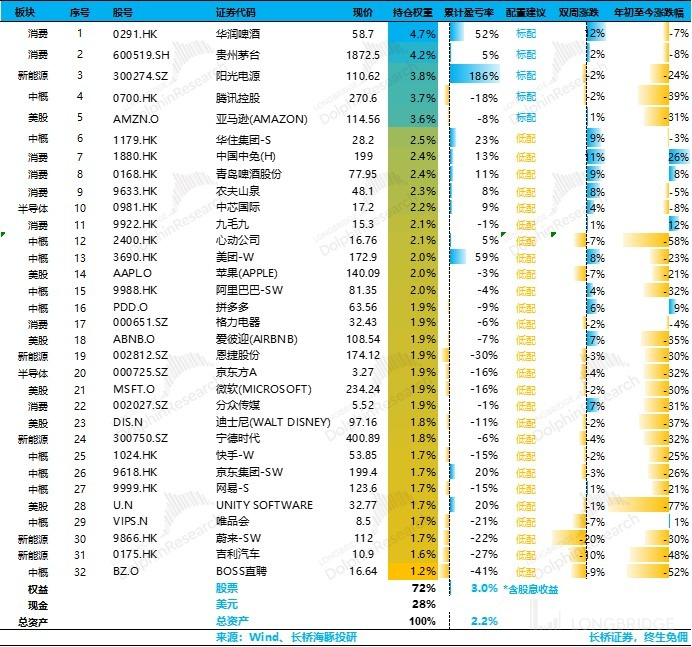

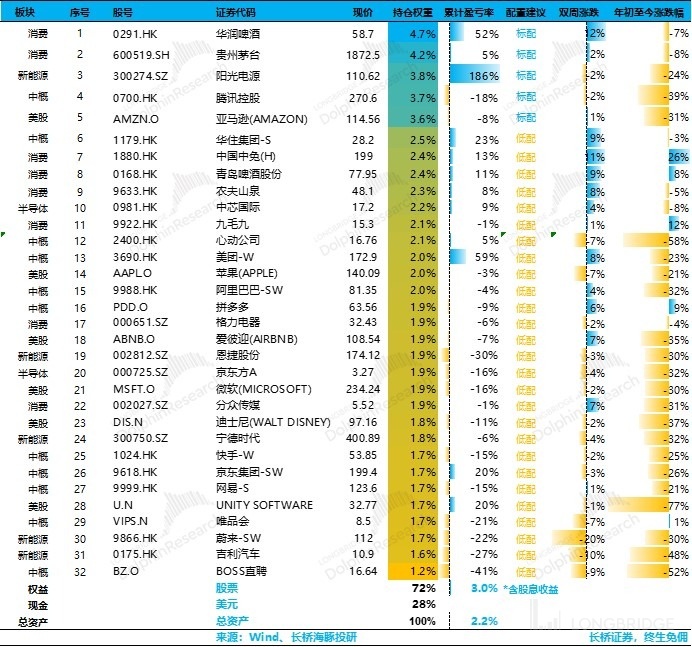

From the start of testing on March 1st to last week, the overall return of the Longbridge Alpha Dolphin combination was 2.2% (including dividend income), and the stock asset return was close to 3%.

Currently, the Alpha Dolphin portfolio comprises 32 stocks, of which only five are standard and 27 are low weight. As of the end of last week, the asset allocation distribution and equity asset holding weight of Alpha Dolphin were as follows:

Please refer to the recent weekly reports of Dolphin Analyst:

"Getting to know a 'Iron-blooded' Federal Reserve again."

"Sad second quarter: 'Hawkish' voices are loud, collective crossing is difficult"

"Is there still hope for a turnaround when you fall into despair?"

"Violent hammering of inflation by the Federal Reserve, but opportunities arise in domestic consumption?"

"Global falls sharply again, US labor shortage is the root of the problem "

"The Federal Reserve becomes the number one bear, and the global market falls to its knees"

"A massacre caused by a rumor: risks have never been cleared, finding sugar in broken glass"

"US turns left, China turns right- the cost-effectiveness of US assets has returned "

"Layoffs are too slow to pick up, and the US still has to continue to 'decline' "

Interest rate hikes enter the second half, and the "performance thunder" opens.

Current Chinese assets: "No news is good news" for US stocks.

Has growth already gone crazy, but will the United States always be in recession?

Will the United States experience a recession or a stagnation in 2023?

US oil inflation, can China's new energy vehicles grow and strengthen?

As the Federal Reserve increases interest rates, opportunities in Chinese assets have emerged.

The US stock market's inflation has once again exploded, how far can the expected rebound go?

This is the most grounded way, the Dolphin investment portfolio is launched.

Risk disclosure and statement of this article: Dolphin Analyst Disclaimer and General Disclosure