With the violent rise of Chinese assets, why are China and the US experiencing such vastly different outcomes? input: ====== 海豚君,我想了解一下长桥汽车(02333)的最新情况,能不能给我说一下?谢谢。 ====== output: Dolphin Analyst, could you please update me on the latest situation regarding Longbridge Automotive (02333)? Thank you.

Hello everyone, I am Dolphin Analyst. Last week was a week of mixed fortunes: due to the tech giants' disappointing earnings and next quarter's guidance, coupled with strong employment data suggesting the Fed is likely to stay firm on rate hikes, US stocks generally fell last week. However, Chinese assets witnessed an epic rebound, dispelling the gloom of several months of continuous decline and significantly improving market sentiment. So why did Chinese and American assets diverge? In the following text, I will explain it for everyone.

I. The employment market in the United States is really "difficult," when will it ease?

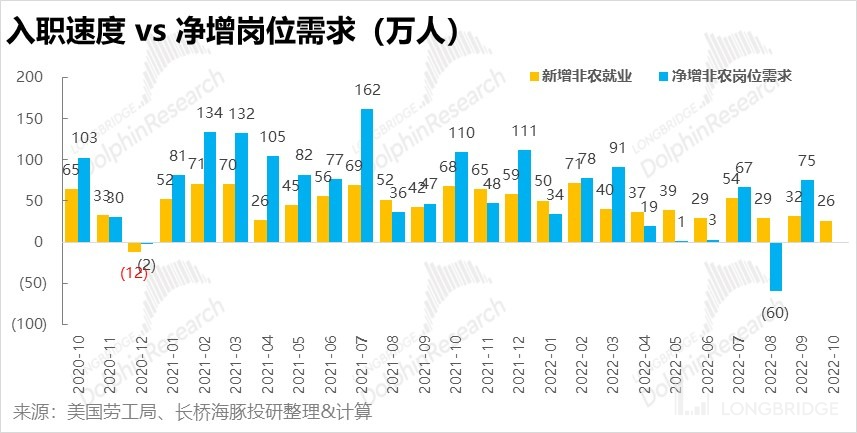

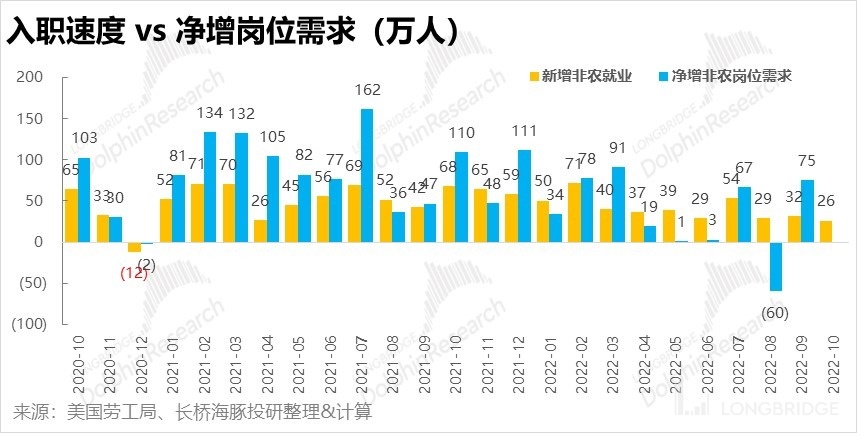

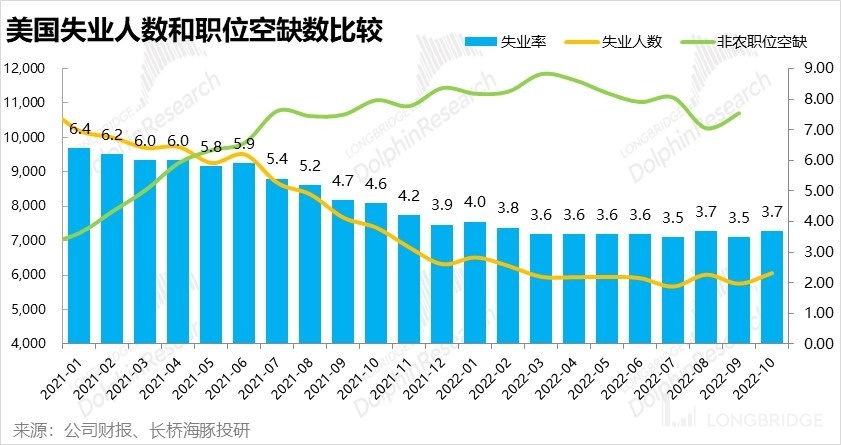

Last week, the US Bureau of Labor Statistics released the latest data on new jobs and job vacancies, showing that the US employment market is still tight, with no signs of easing. First, let's look at the "bad" news. In October, the US added about 260,000 non-farm jobs, slightly lower than the previous few months, but still far higher than the expected 200,000 new jobs, indicating that employment is still hot.

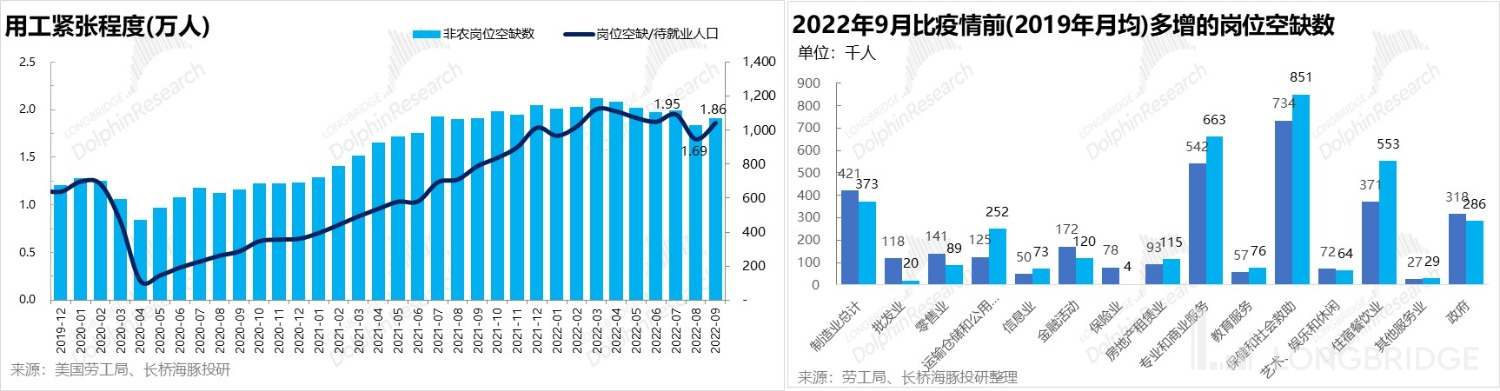

Moreover, the newly released non-farm job vacancy number has reversed the improving trend of August, with a net increase of 750,000 job vacancies in September, and the ratio of job vacancies to the unemployed also increased to 1.86, indicating an increased labor supply shortage. When it comes to industry breakdown, the gap in job vacancies for healthcare, food and accommodation, and professional services continued to widen in August.

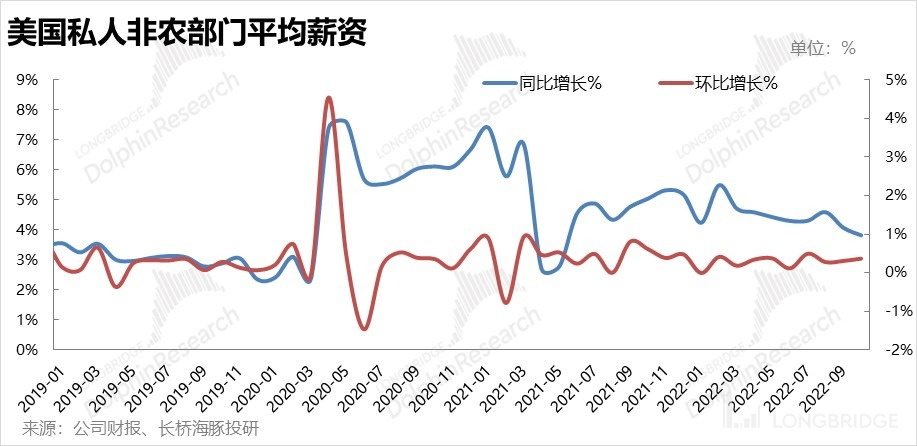

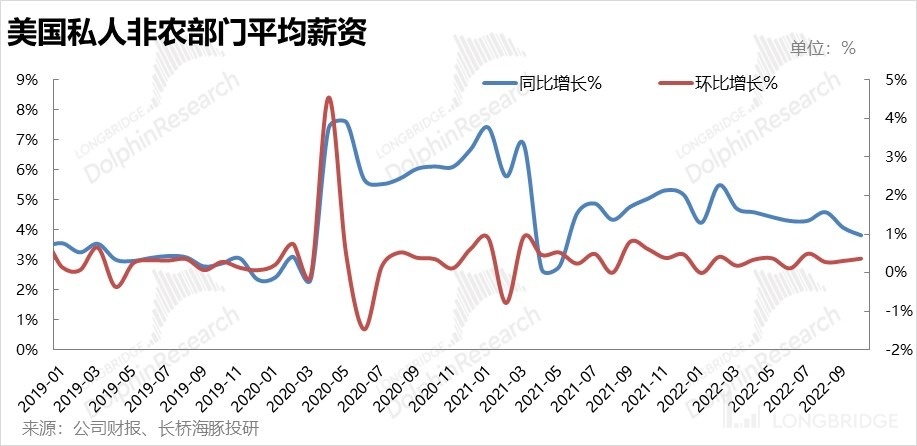

In addition, on the salary growth side, although the year-on-year growth rate has begun to decline due to the high base effect, if we exclude the base effect, the MoM growth rate that better reflects recent salary growth has slightly accelerated since August, from 0.28% to 0.37%. It can be seen that there is currently no substantive improvement in labor cost inflation caused by the tight labor market.

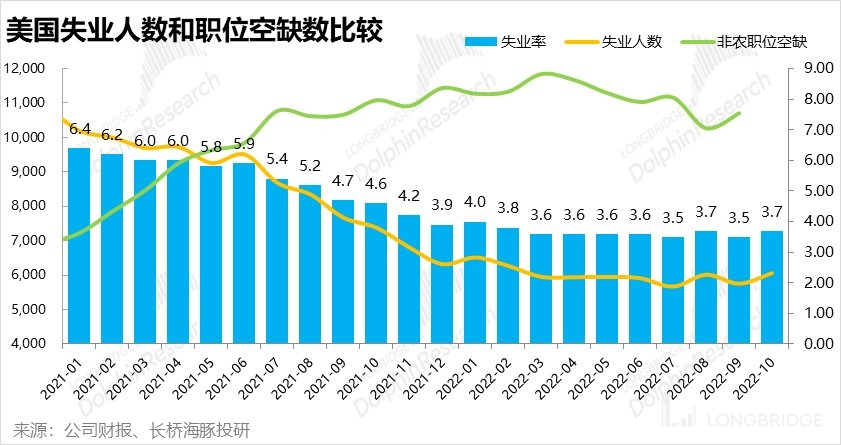

However, there are also signs of cooling in employment data. In October, the number of unemployed people increased by about 300,000, and the unemployment rate rose from its recent low of 3.5% to 3.7%. At the same time, the total labor force in October (including those employed and unemployed) remained stable. Therefore, the increase in the unemployment rate in October was indeed caused by the increase in the number of unemployed people, rather than a decrease in the labor force in the denominator.

Combining these factors, it can be concluded that some US employers may have started laying off workers based on pessimistic expectations, but overall (especially in the service industry), the strong employee demand has led to a tight labor market in the United States. It seems that substantial improvement in the employment market and salary increases will have to wait until the cooling of service industry demand.

2. Has the inflection point of the second derivative of interest rate increase been reached?

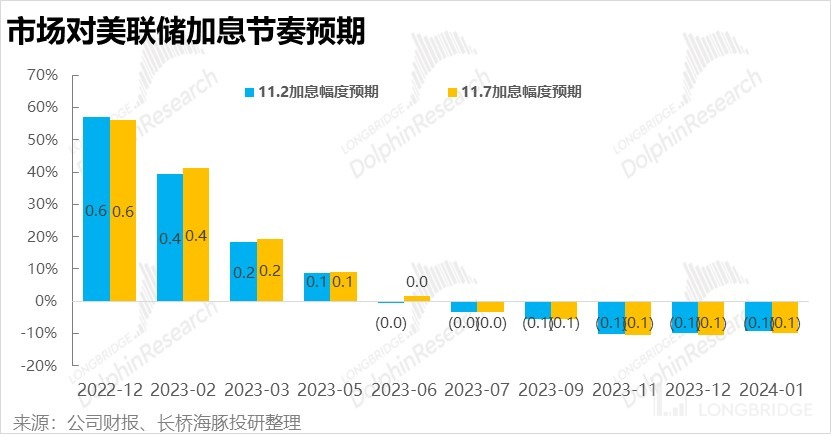

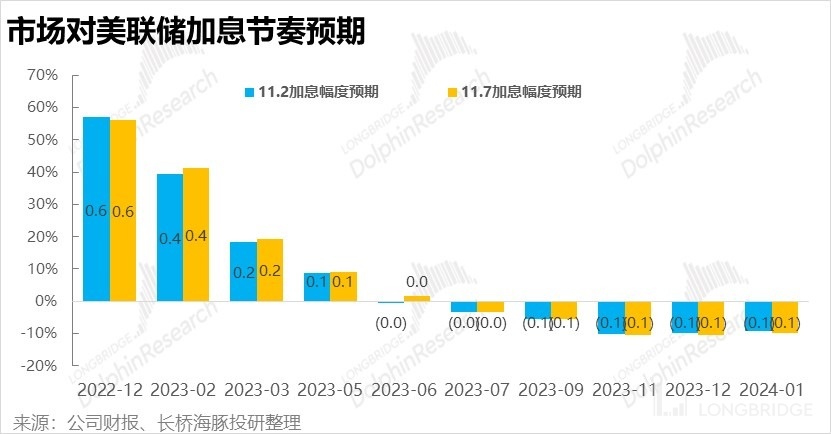

Last week, in addition to the employment data, the market was most concerned about the Federal Reserve's interest rate meeting. Although the result was not unexpected, the Fed decided to raise interest rates by 75 basis points to a range of 3.75%-4.0%. However, from the trend perspective, Dolphin Analyst believes that there are two points worth noting.

First, the second derivative of the interest rate increase (i.e. the magnitude of each interest rate increase) may reach an inflection point after this interest rate increase. Although the federal interest rate is highly likely to continue to rise in the future, the magnitude of each increase is expected to begin to slow down. Since June, the Fed has raised interest rates by 75 basis points at each of its four consecutive interest rate meetings. After this interest rate increase, the market's expectations for the magnitude of each subsequent interest rate increase are expected to decline on a month-on-month basis, meaning that the speed of future rate increases will continue to slow down.

It is also worth noting that in earlier interest rate meetings, the market would basically raise its expected interest rate increase after the meeting. However, before and after the meeting on November 2 and November 7, the market did not raise its expectations for the interest rate path. This indicates that the market currently does not see any factors that will push interest rates to rise more than expected.

However, from another perspective, although the pace of interest rate increases may not accelerate, it may further suppress valuations and risk preferences. The absolute value of interest rates will continue to rise and may remain at high levels for quite some time, and the impact on the economy and corporate profitability still needs time for the market to validate and digest.

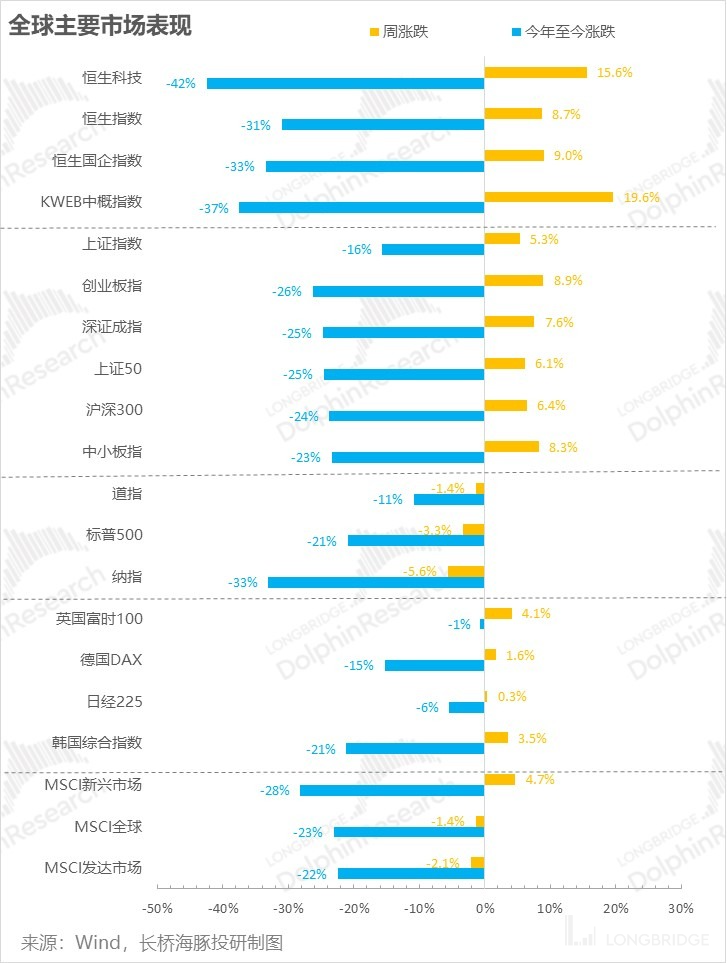

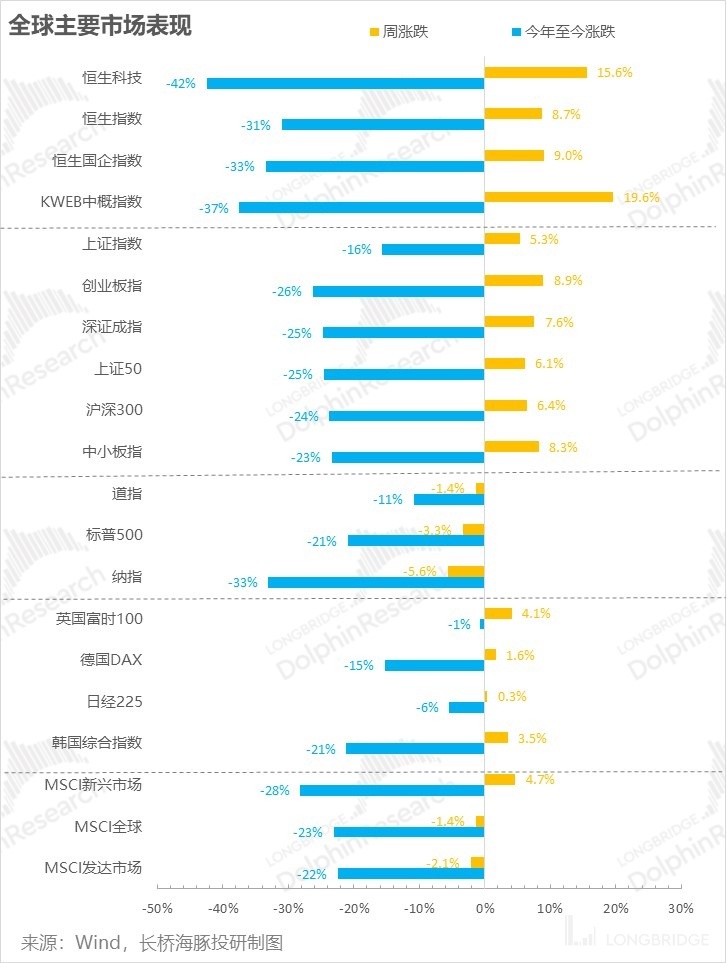

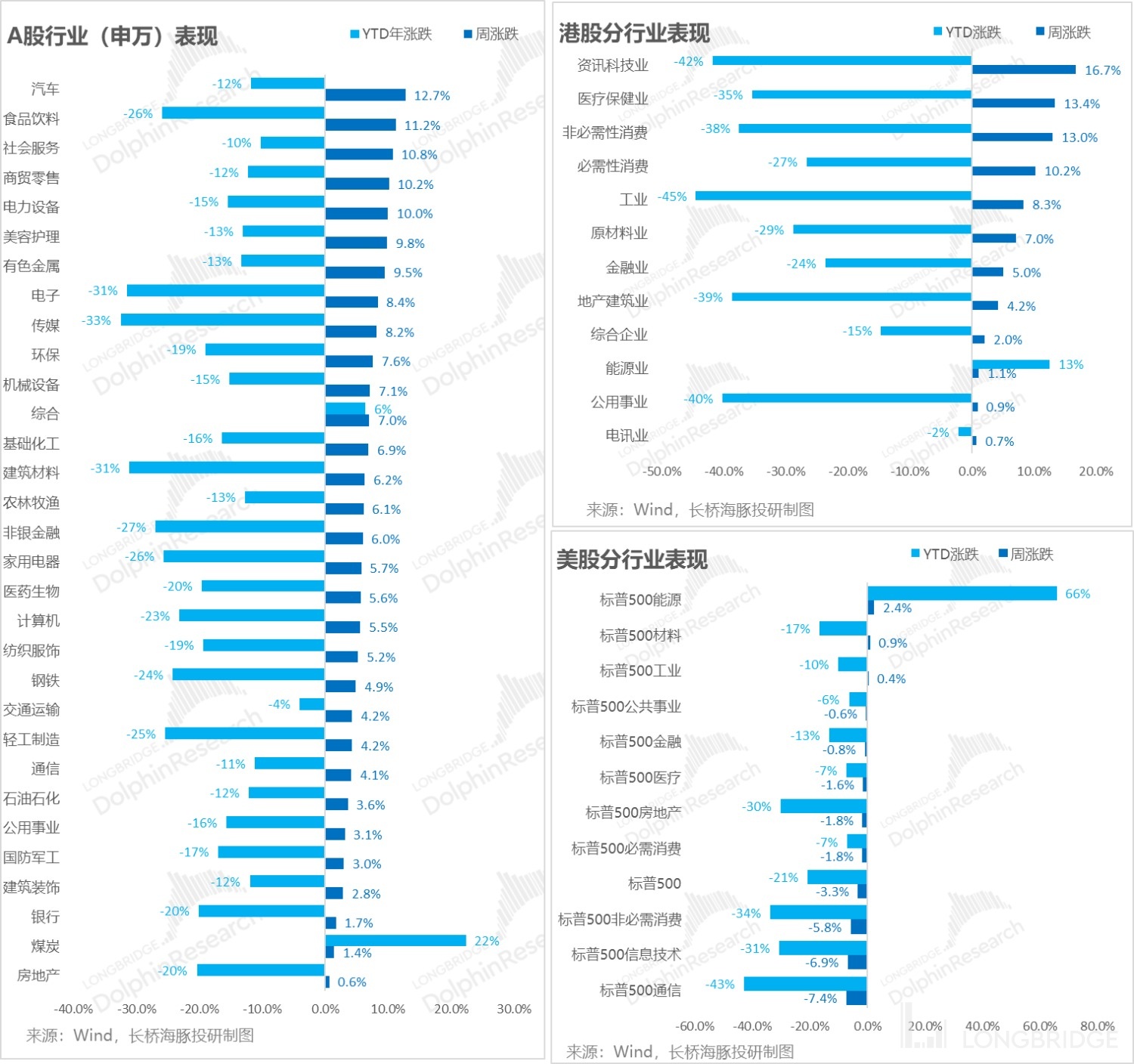

3. The two worlds of ice and fire: Strong rebound of Chinese assets

In terms of capital markets performance, there was again a divergence between China and the United States last week. The poor performance of technology giants' financial reports and widely pessimistic outlook for the fourth quarter led to growing concerns in the market about economic and corporate profit decline. Although the Fed's interest rate hike was in line with expectations, the actual impact of interest rates continuing to rise on the economy also needs time to absorb. As a result, the U.S. stock market generally fell last week under the logic of "recession + high interest rates". Also, according to the proportion of technology stocks (growth stocks), the Nasdaq fell the most, followed by the S&P 500 and the Dow Jones Industrial Average.

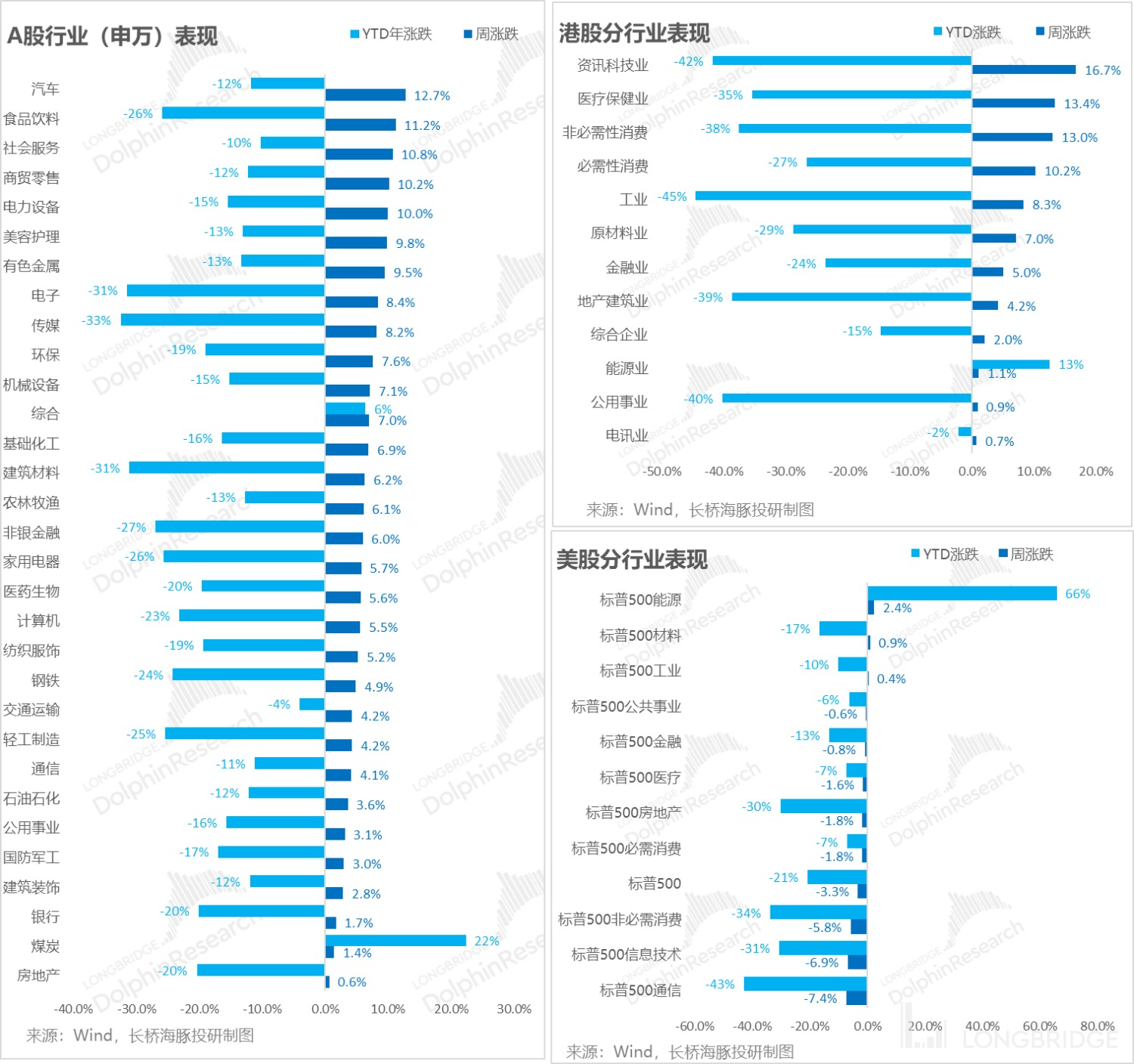

In contrast, after months of continuous decline, Chinese assets have seen a violent rebound that is not inferior to the "3.16 Miracle Day". Moreover, the rebound momentum in offshore assets is significantly stronger than that onshore. As shown in the figure below, the A-share index rose by a single digit percentage last week, while the China Concept Index and Hang Seng Tech both soared by more than 15%.

So why did Chinese assets rebound so strongly and independently in the "epic" rally when US stocks were generally falling? Dolphin Analyst believes there are three main reasons:

So why did Chinese assets rebound so strongly and independently in the "epic" rally when US stocks were generally falling? Dolphin Analyst believes there are three main reasons:

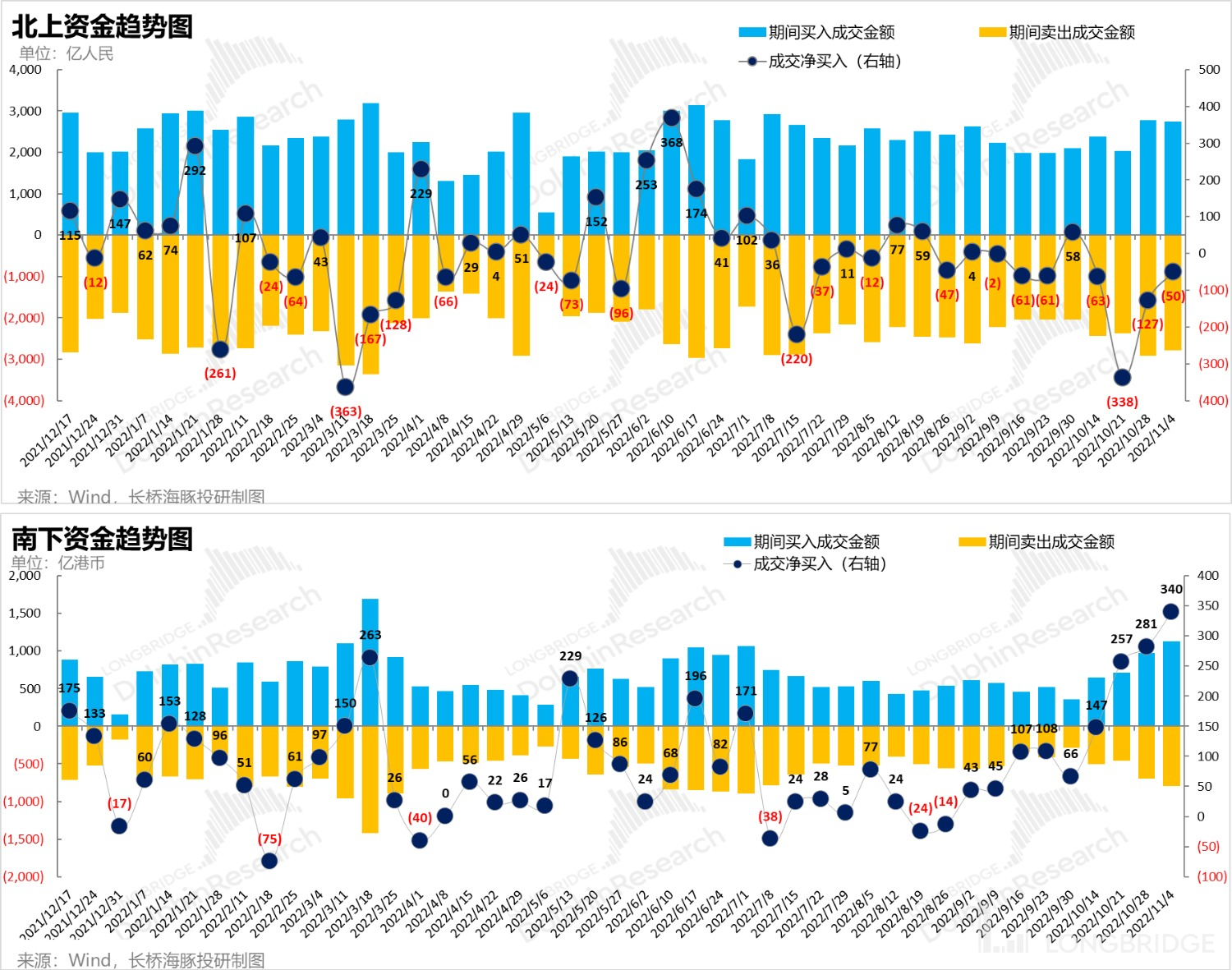

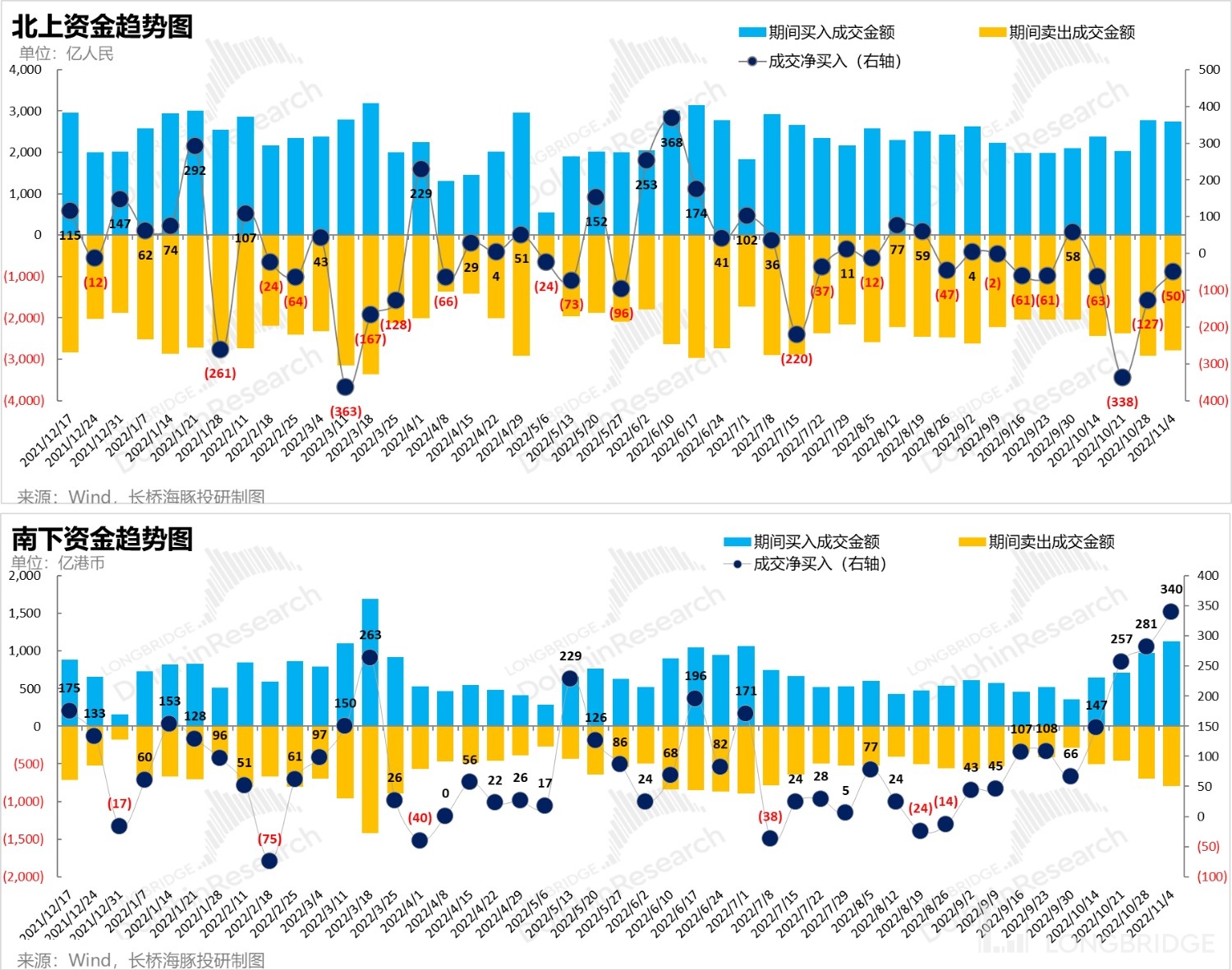

- The most important reason is that the funds (especially overseas funds) that previously fled Chinese assets have begun to return. As for domestic funds, since late October, southbound funds have accelerated their purchases of Hong Kong stocks, with net purchases exceeding billions of yuan every week, and even reaching as high as 34 billion yuan last week.

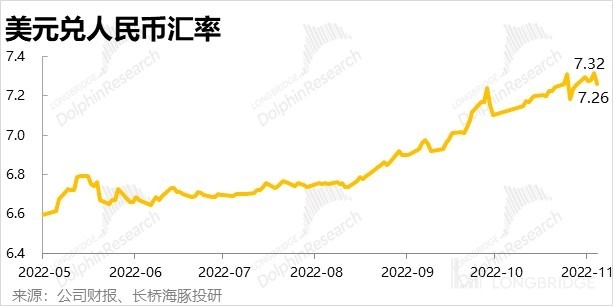

The reason why overseas funds originally continued to flee Chinese assets (especially offshore assets) is that apart from regulatory and economic pressure, the significant appreciation of the US dollar against the RMB, which has risen by more than 10% this year, is also an important factor. For overseas funds, even if the local currency price of Chinese assets remains unchanged, RMB depreciation can also cause the value of assets priced in US dollars to shrink by more than 10%.

Therefore, when the US dollar continues to rise and US bond yields continue to rise, overseas funds naturally have a tendency to flow back to the US. However, last week, as the Fed raised interest rates as expected and the market's expectations for the future pace of interest rate hikes slowed down, the speed of funds flowing back to the US also slowed down.

Just last Friday, the exchange rate between the US dollar and the RMB suddenly plunged by about 600 basis points, indicating that the market is reversing the behavior of selling RMB and buying dollars, and funds are starting to marginally flow back to China. For overseas funds, the stabilizing and rebounding of the RMB exchange rate further increases the return and attraction of Chinese assets.

- The market's expectations for a rebound in China's economic growth have begun to heat up recently, and there are various bullish news on various levels. Although most of the news cannot be confirmed, the effect of emotional reversal is obvious in an already extremely suppressed market sentiment. 3) Hong Kong stocks and Chinese concept assets had a huge decline recently, with some stocks even falling below the 3.15 mark. Valuations are already in a fairly pessimistic position, so there is a lot of room for upward rebound after marginal improvement.

Corresponding to the above logic, Hong Kong stocks and Chinese concept assets, which are more easily traded by overseas funds, have risen more in this round of rebound. From an industry perspective, sectors such as consumer, retail, automotive, and social services that are more benefited from economic recovery have also performed better.

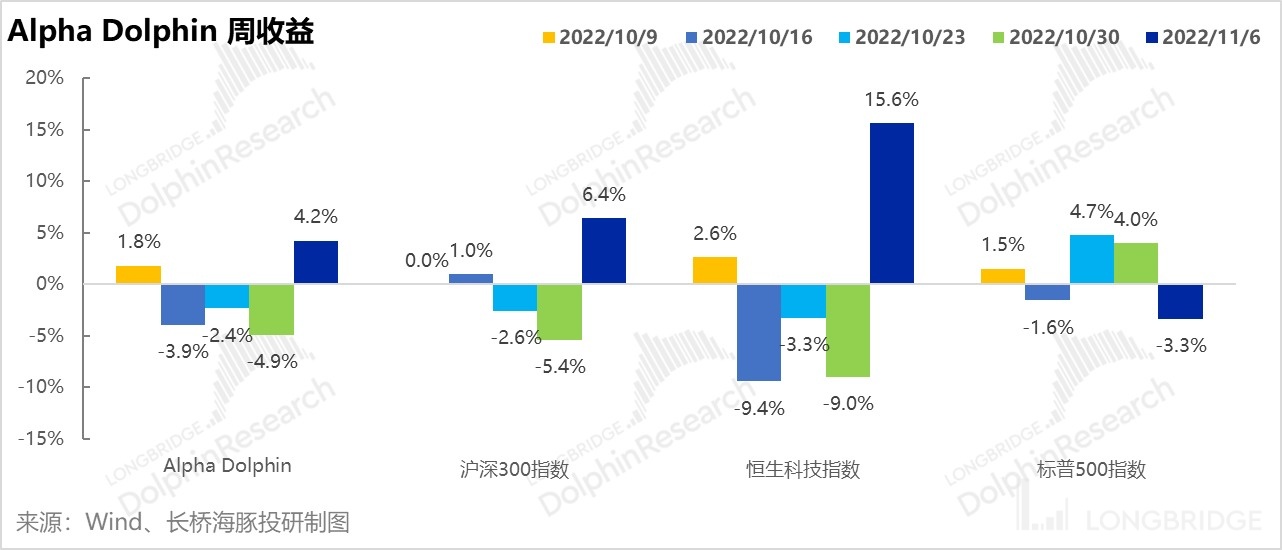

Fourth, Alpha Dolphin portfolio rebounded significantly

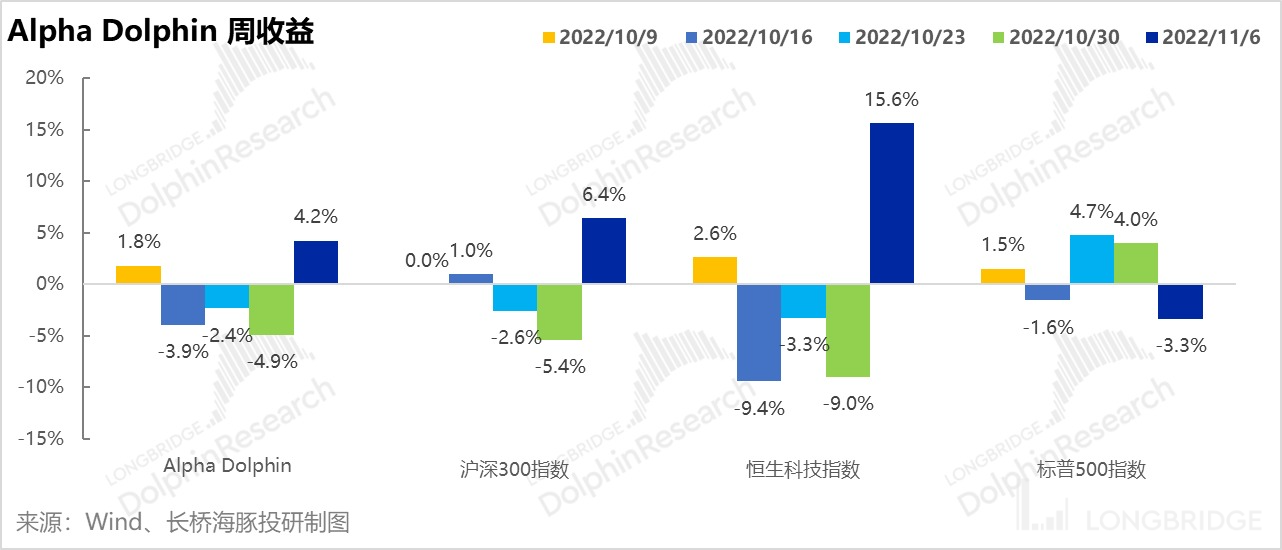

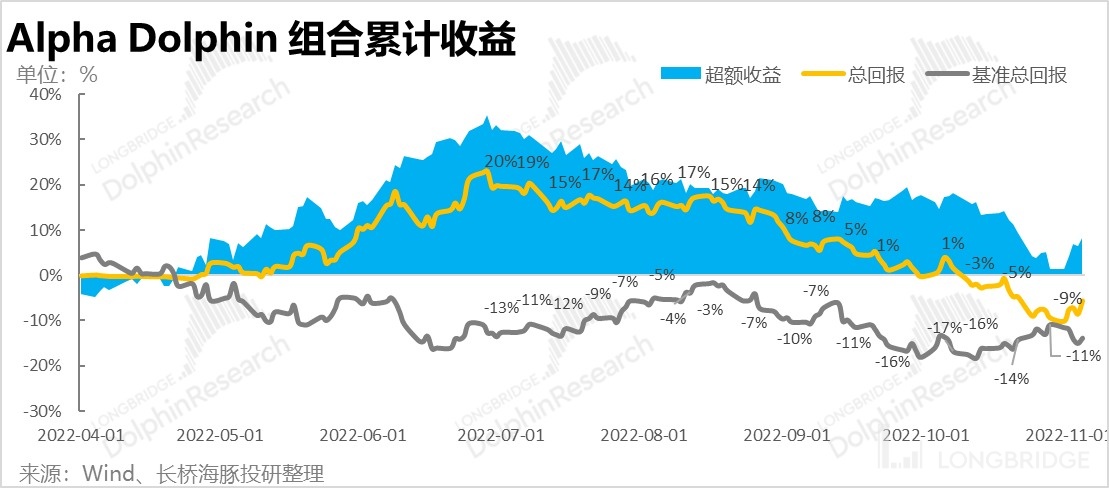

Due to the sharp rebound of Chinese assets last week, the Longbridge Alpha Dolphin portfolio also recovered some of the profits it had disgorged. However, due to the drag of the rising US stock market and the higher cash holdings in the Dolphin portfolio, the rebound of the portfolio was lower than that of the CSI 300 Index and the Hang Seng Tech Index. As of this week on 11/06, the Alpha Dolphin portfolio rose by 4.2%, significantly outperforming the S&P, but lagging behind the 15.6% rise in the Hang Seng Tech Index.

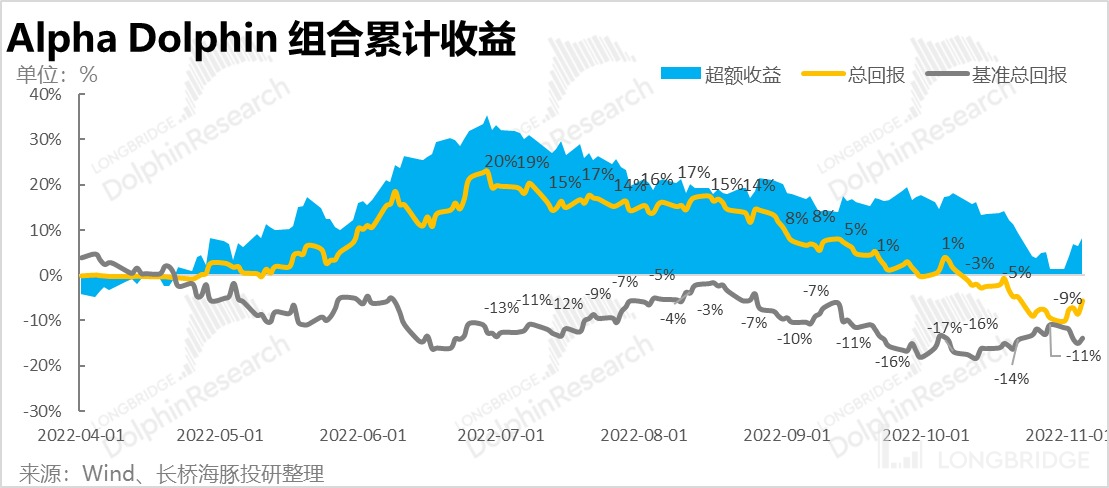

From the beginning of the self-organization test to last weekend, Dolphin's decline narrowed to 5.7%, and the excess return compared to the benchmark S&P 500 index also rebounded significantly to 8.1%, demonstrating the risk hedging effect of allocating Chinese assets to US stocks.

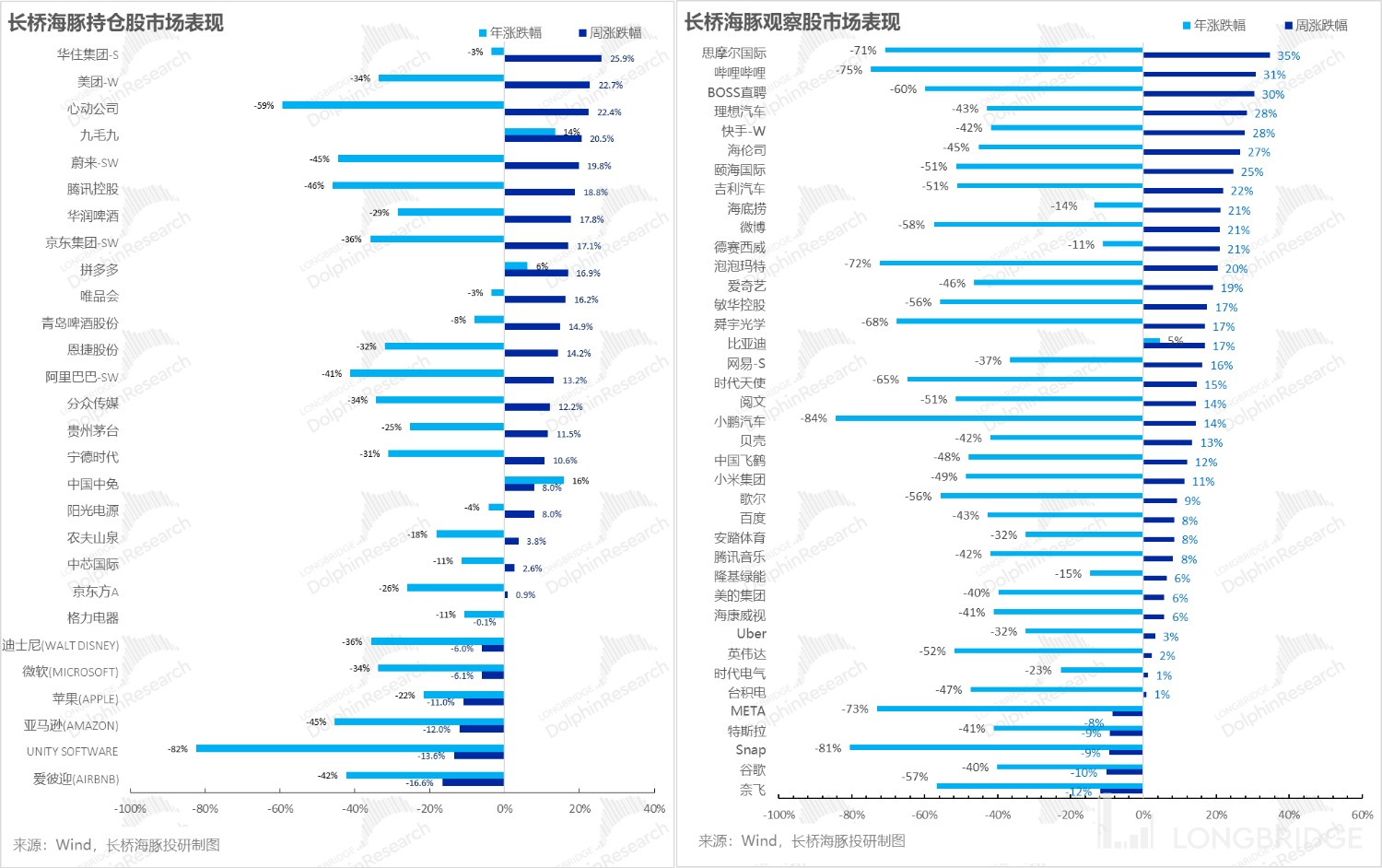

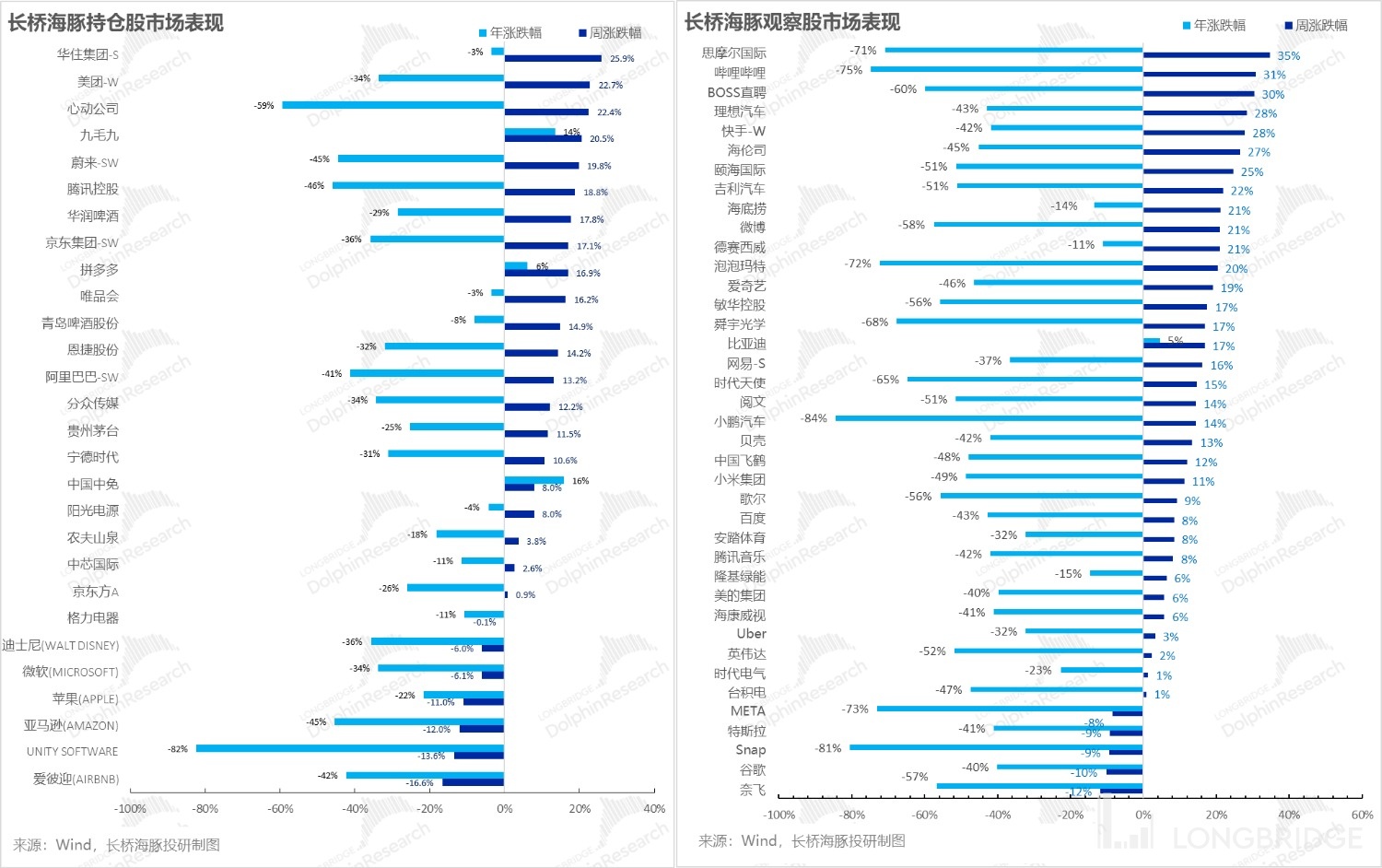

V. Individual Stock Performance: Macro Beta Shines

Last week, the performance of individual stocks largely depended on whether they were Chinese assets or pure US assets. Whether in the Dolphin combination or the observation warehouse, the stocks with the largest increase were all Hong Kong stocks or Chinese concept stocks. Those with the largest declines were all US stocks without exception.

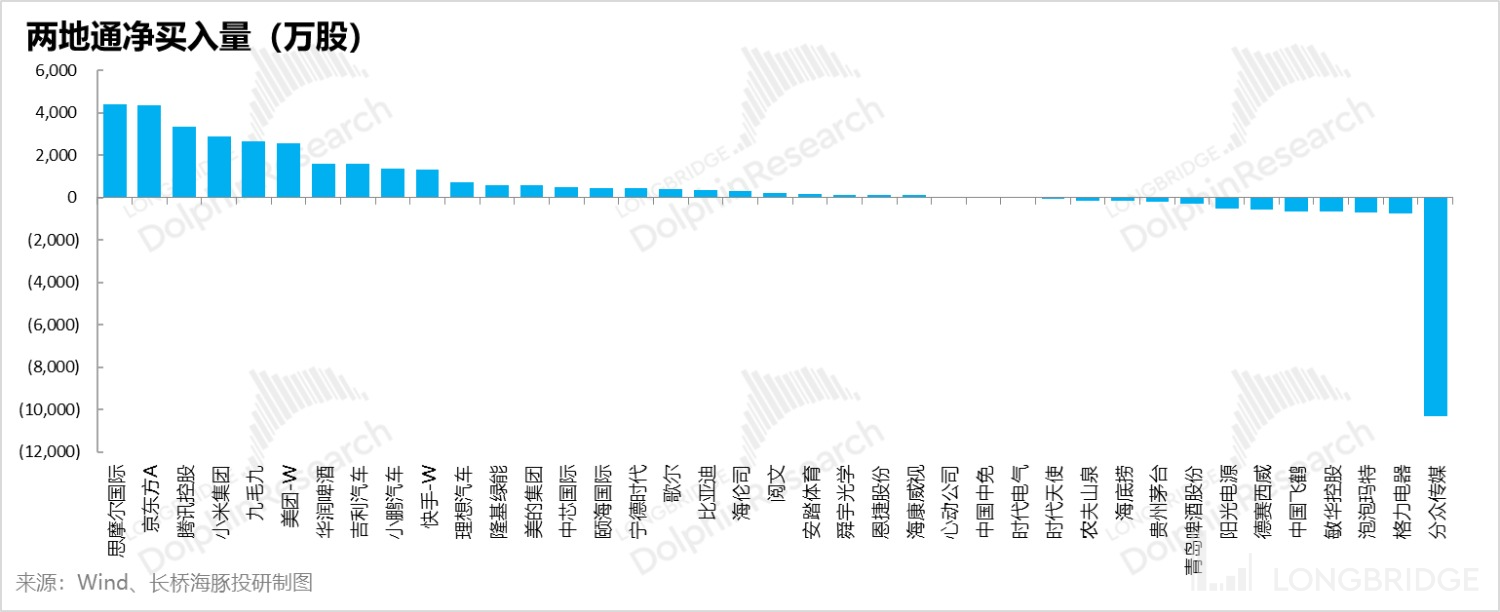

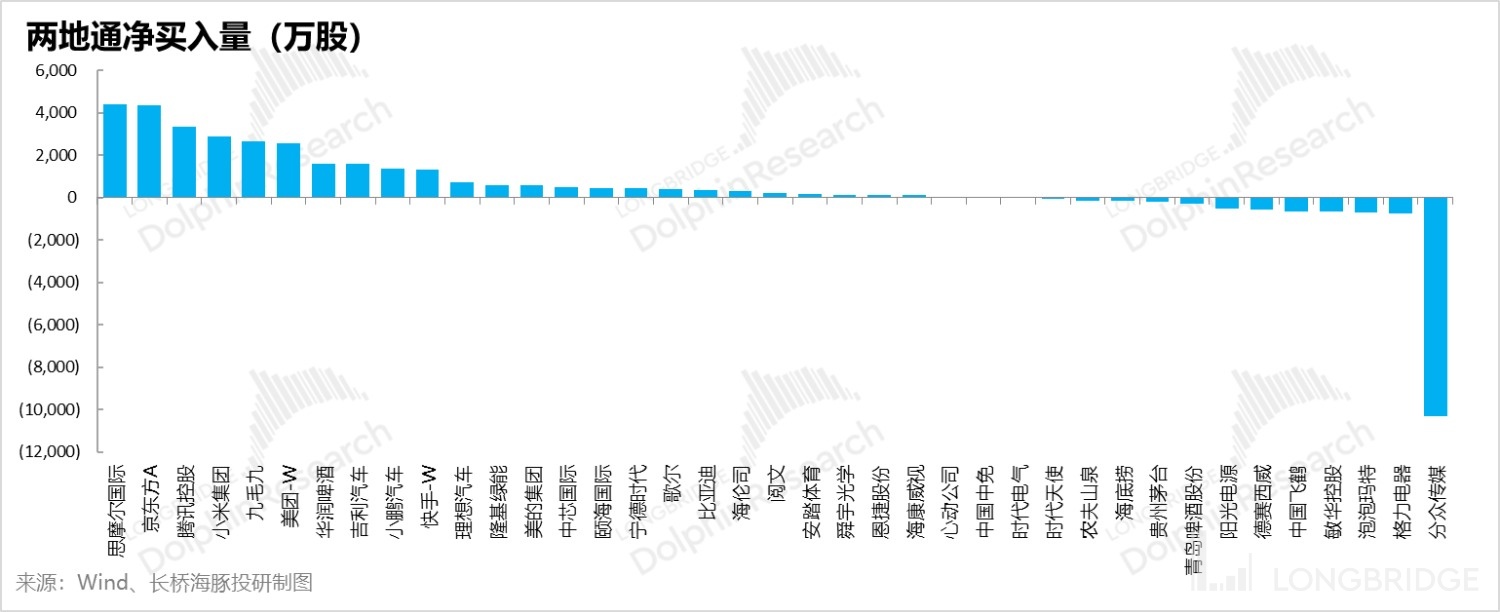

From the perspective of north-south fund flows, except for food and beverage retail such as Moutai and Tsingtao Beer, and high-valuation stocks such as Sungrow Power and Desay SV, most other individual stocks were net bought last week. Among them, transparent screen producers BOE and Xiaomi had the most net buying of undervalued stocks.

In addition, it is worth noting that, despite being undervalued targets and favored by foreign investors, iQiyi was sold off on a large scale last week. Not only did the poor third-quarter performance disappoint northbound funds that had continued to increase their holdings on the left side, but they also left.

For companies with large changes in stock prices, Dolphin Analyst has summarized the driving factors as follows for everyone's reference:

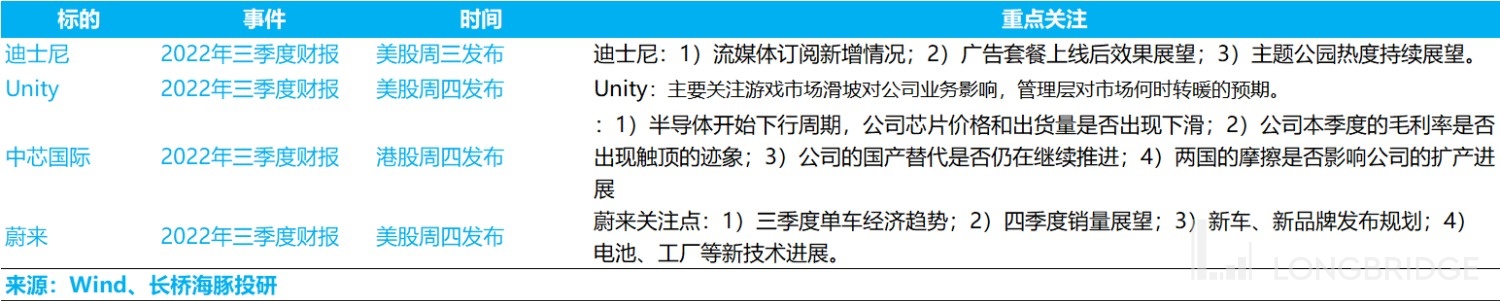

VI. Focus of the Week

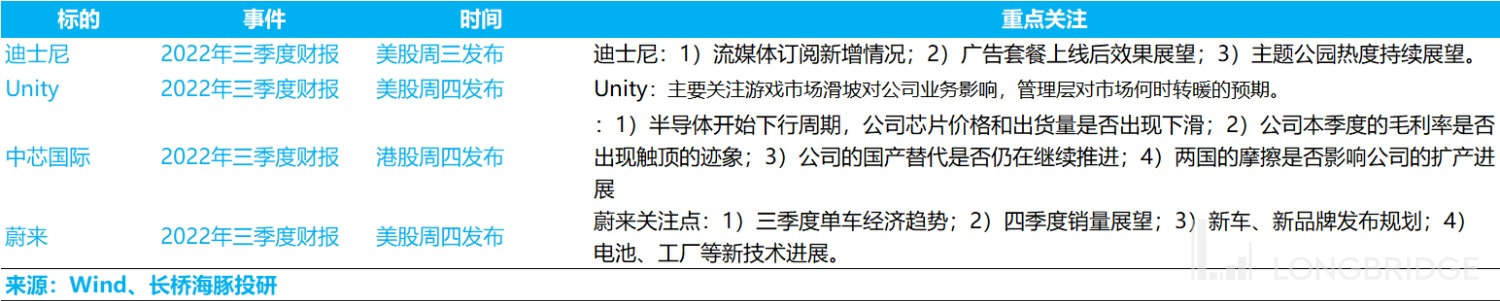

This week, both US and A-share markets have entered the intensive reporting season, with many companies to report. Companies that Dolphin Analyst is focusing on, including their reporting time and key areas of focus, are as follows:

VII. Portfolio Asset Allocation

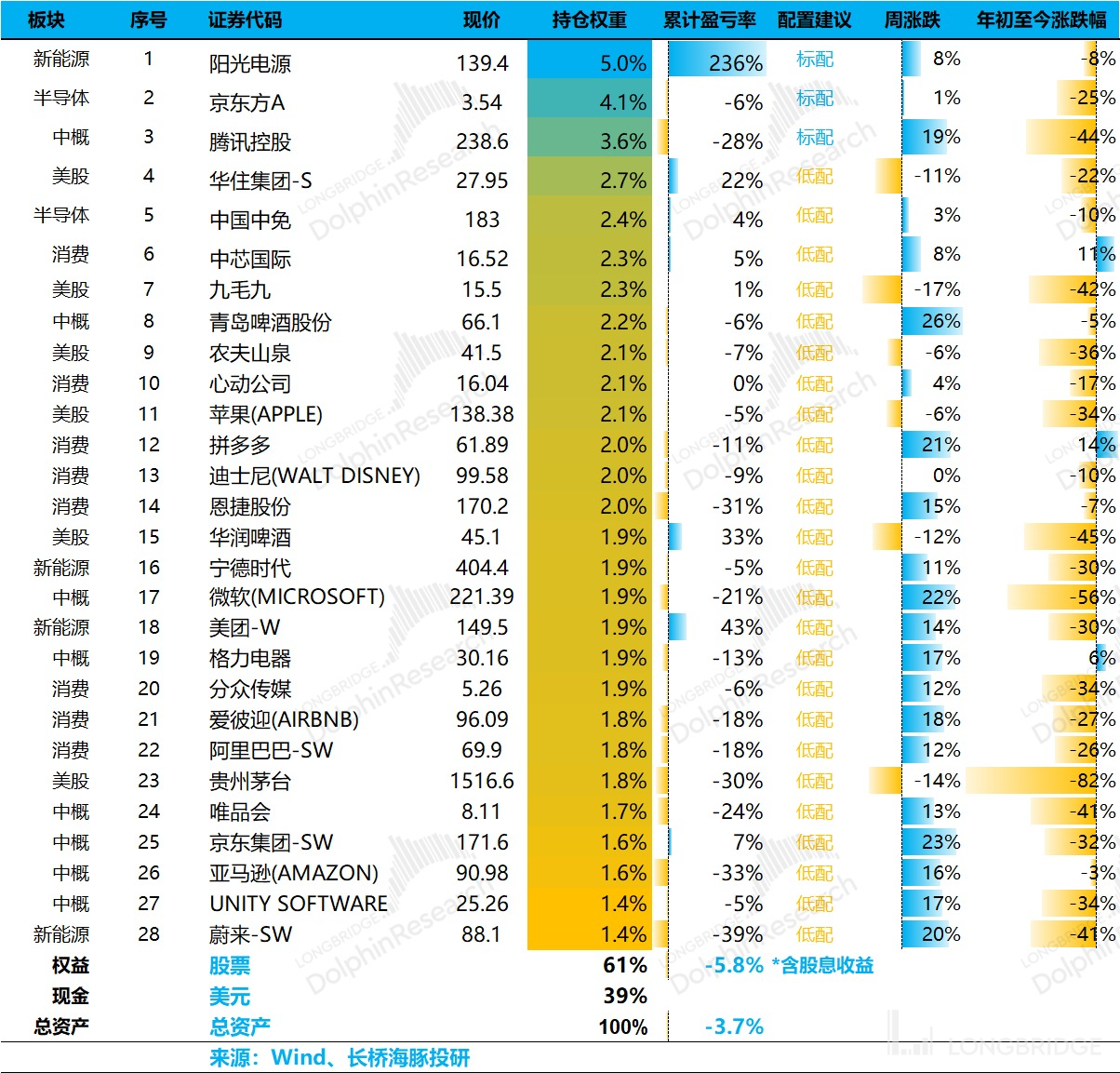

From March 1 testing until last week, Longbridge Alpha Dolphin portfolio's cumulative return was -0.1% (including dividend income), with stock asset returns of -1.6%.

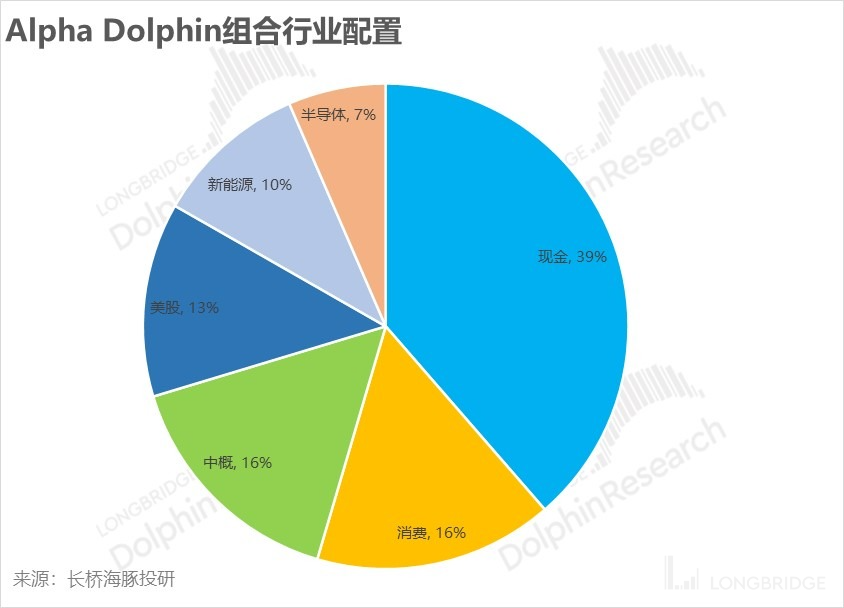

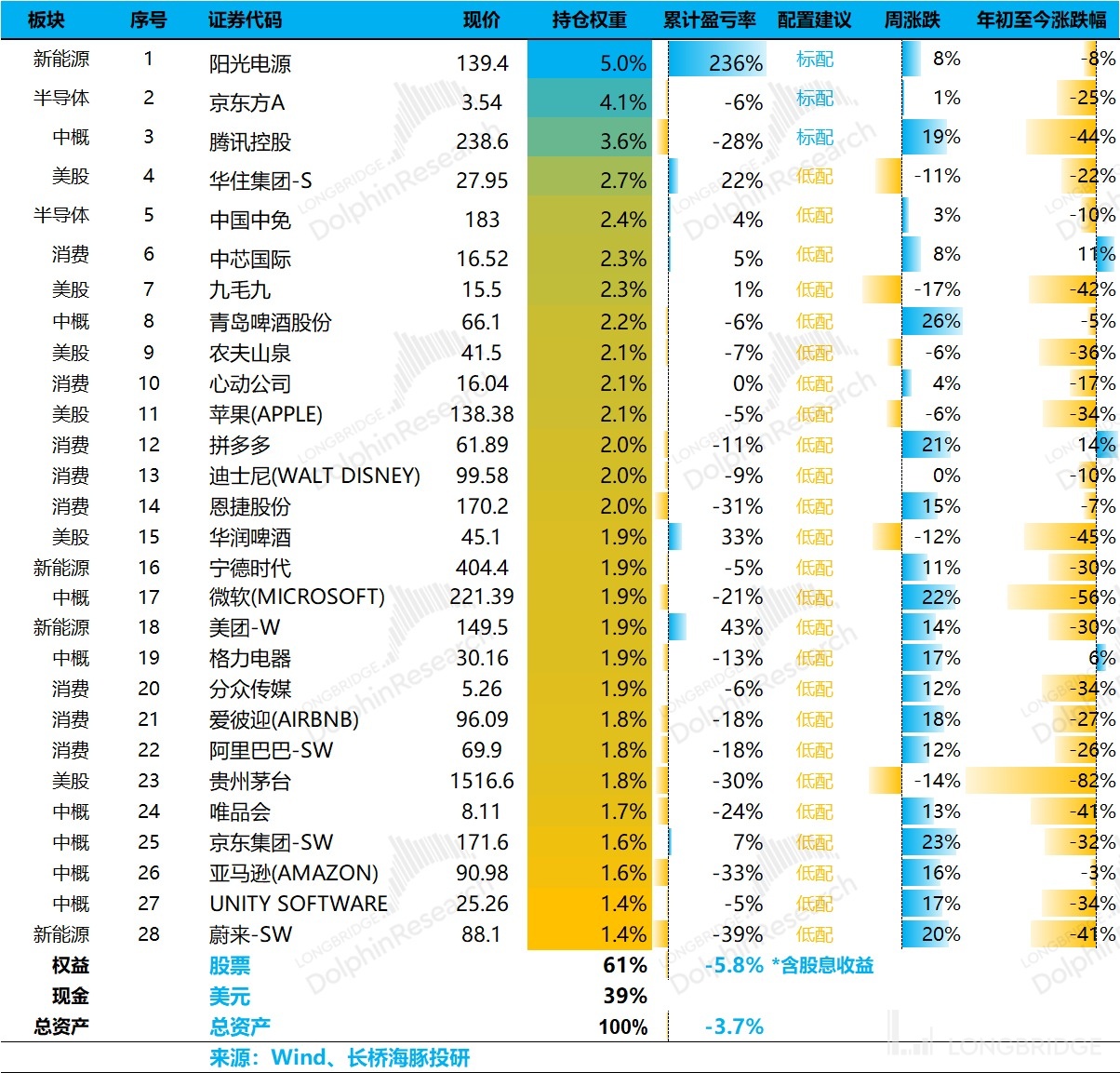

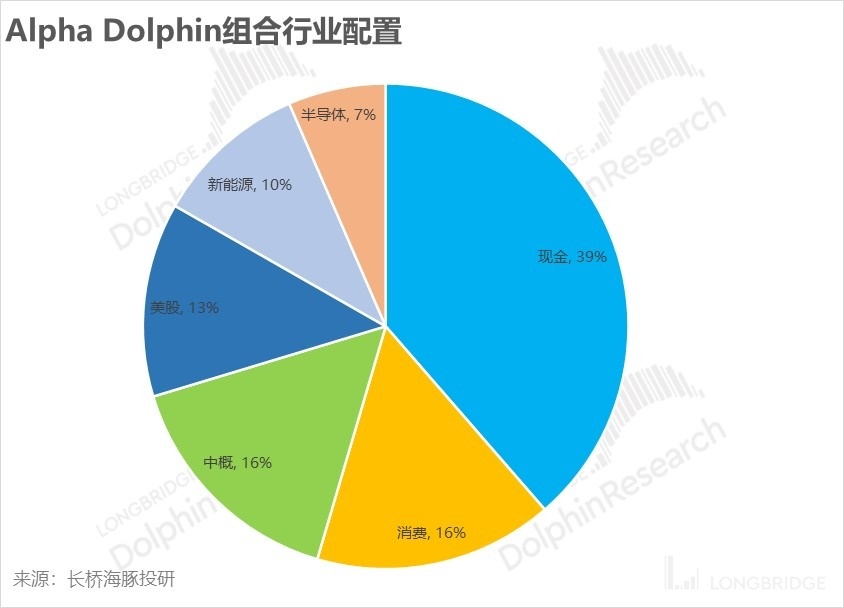

Currently, the Alpha Dolphin portfolio has allocated 28 stocks, including only 3 standard stocks and 25 low-loaded stocks. As of last weekend, the asset allocation and equity asset allocation of Alpha Dolphin were as follows:

Please refer to the recent weekly reports of Dolphin Analyst's investment research portfolio:

Behind the Policy Turnaround Expectation: The Unreliable "Strong Dollar Fund" GDP Growth?

Playing Catch-up in the South vs. Running Wild in the North, time to test one's resolve again

Slowing Down Rate Hikes? Dream Broken Again

Re-introduce a "Iron-blooded" Fed

Disappointing Second Quarter: "Hawkish" echoes, difficult to cross collectively

Falling into Doubt, Is There Hope for Reversal?

Violently Smash Inflation, Domestic Consumption Opportunities Arrive Instead?

Global Market Falls Significantly Again, US Labor Shortage is Root Cause

Fed Becomes Head Bear, Global Market Collapses ["One Rumor Leads to a Bloody Tragedy: Risks Have Never Been Eliminated, Folly Found in Glass Shards"]

["US Goes Left, China Goes Right, Price-to-Value Ratio Returns to US Assets"]

["Layoffs Aren't Fast Enough, Americans Can Only Continue to Decline"]

[["US Stock-Market Style Funerals: Recession is Good, Extreme Rate Hike is Bearish"]] (https://longbridgeapp.com/topics/3228451)

[["Rate Hike Enters Second Half, Earnings Disasters Begin"]] (https://longbridgeapp.com/topics/3140072?invite-code=032064)

[["Counterstrike of the Epidemic, US Decline, Capital Changes"]] (https://longbridgeapp.com/topics/3088846?channel=t3088846&invite-code=032064)

[["Current Chinese Assets: US Stocks' 'No News is Good News'"]] (https://longbridgeapp.com/topics/3035475?channel=t3035475&invite-code=032064)

[["Growth is Already Celebrating, But Will America Definitely Decline?"]] (https://longbridgeapp.com/topics/2986257?channel=t2986257&invite-code=032064)

[["In 2023 America, Will There be Decline or Stagnation?"]] (https://longbridgeapp.com/topics/2968618?channel=t2968618&invite-code=032064)

Disclosure and Disclaimer for this Article: Dolphin Analyst Disclosure and General Disclosure