SMIC: Long-term belief, can't escape the "cycle curse" either

China Semiconductor International (0981.HK/688981.SH), on the evening of November 10th Beijing time, released its third-quarter financial report for 2022 (ending in September 2022) after the Longbridge Hong Kong stock market closed, with the following highlights:

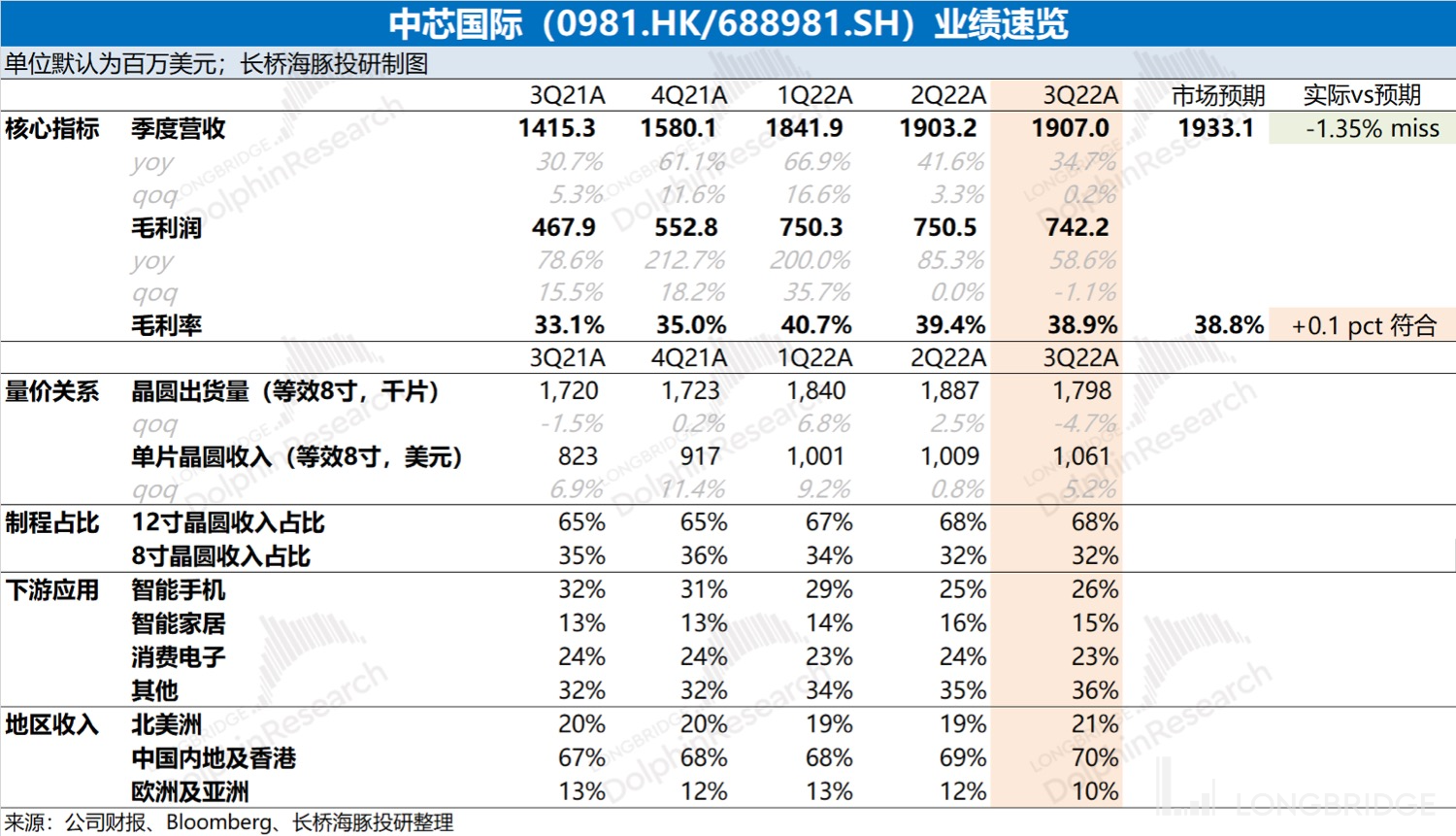

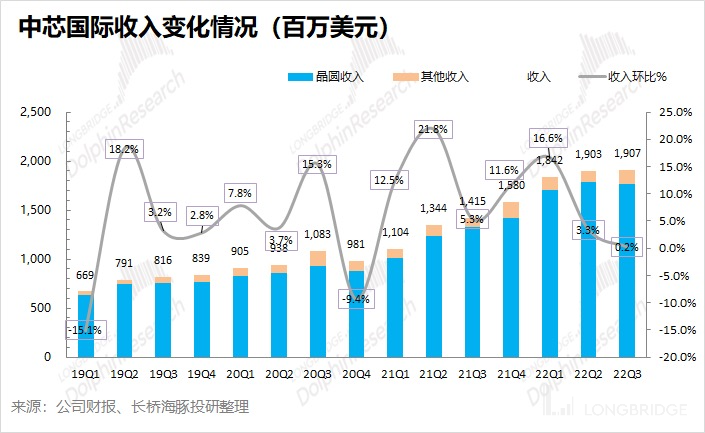

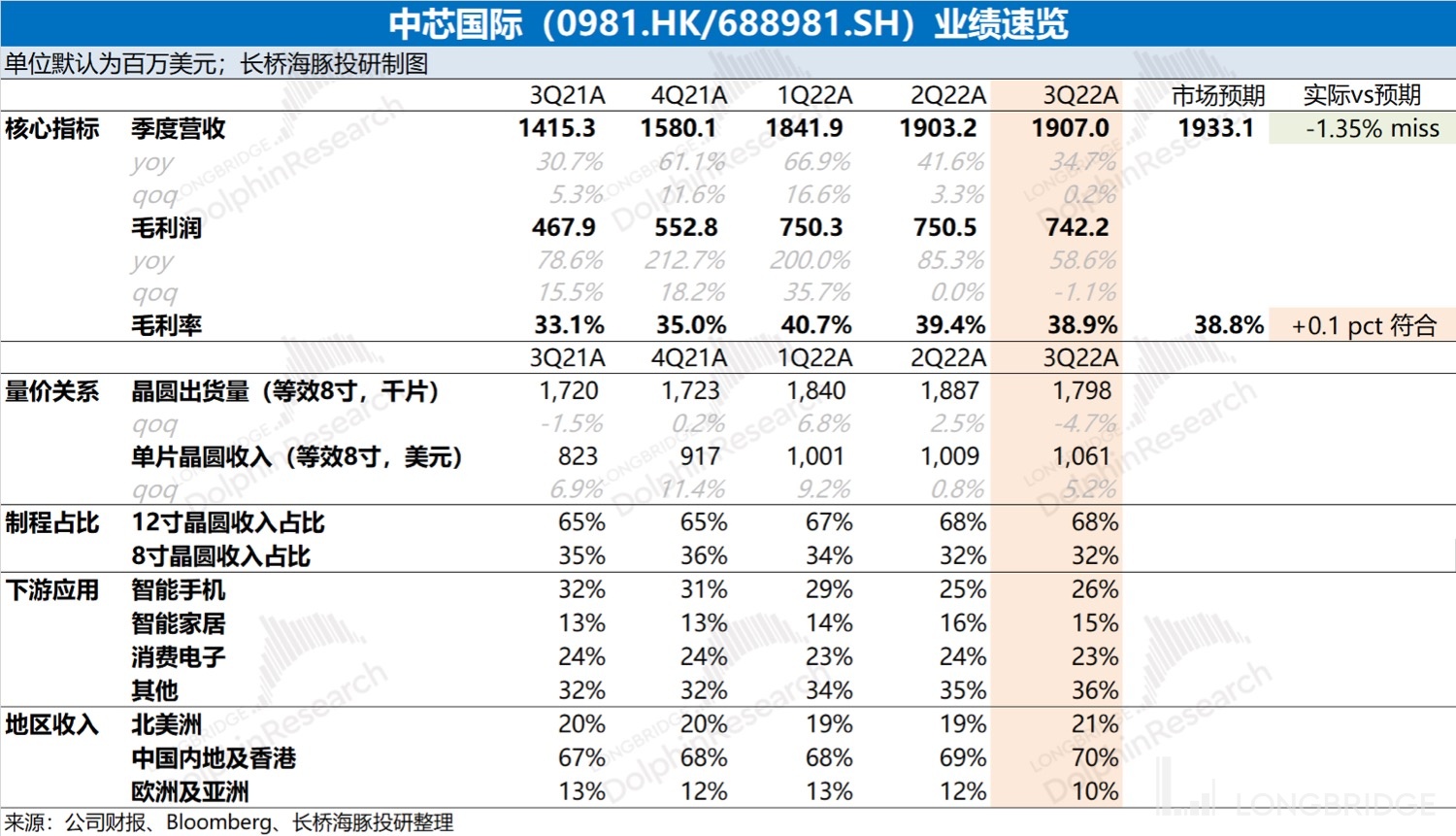

1. Overall performance: Revenue is lower than expected. China Semiconductor International (HK) achieved revenue of $1.907 billion this quarter, a quarter-on-quarter increase of 0.2%. The revenue barely met the lower limit of the guidance (0-2%), but was lower than the market expectation of $1.933 billion. The company's gross profit margin continued to decline to 38.9%, which meets the market expectation of 38.8%.

2. Observing three key indicators: revenue, gross profit margin, and capacity utilization rate. By breaking down the volume and price, the growth of China Semiconductor International's revenue this quarter mainly came from the increase in average shipping price, which was mainly influenced by the product structure. However, the quarter-on-quarter decline in wafer shipments also reflected the downward cycle of the semiconductor industry to some extent. With the downstream demand beginning to weaken, the company's inventory increased quarter by quarter. Therefore, the company also lowered the capacity utilization rate. The company's capacity utilization rate this quarter plummeted from 97% in the previous quarter to 92.4%, which directly dragged down the company's gross profit margin.

3. Business progress: Smartphones may have hit the bottom, and domestic substitution is still ongoing. This quarter, the proportion of smartphone business has rebounded, mainly due to the impact of the decline in smart home and consumer electronics business this quarter. In absolute terms, the smartphone business has stopped declining this quarter. Combining with the industrial chain situation, the Dolphin Analyst believes that although there is no sign of recovery in smartphones from all aspects, there are signs of hitting the bottom from the data of some supply chain manufacturers. With the impact of international semiconductor friction and other events, more and more domestic manufacturers will prioritize the production capacity of domestic semiconductors such as China Semiconductor International. The share of mainland and Hong Kong customers in China Semiconductor International's revenue is expected to continue to increase.

4. Guidance for the next quarter: China Semiconductor International (SH) expects that the revenue for the fourth quarter of 2022 will decrease by 13%-15% quarter-on-quarter (corresponding to US$1.62-1.66 billion), which is significantly lower than the market expectation of US$1.82 billion in revenue; the gross profit margin is 30-32%, lower than the market expectation of 33.6% gross profit margin.

Dolphin Analyst's overall view:

This financial report of China Semiconductor International is not very impressive. Although the gross profit margin has reached the market expectation, the revenue side has already missed the market expectation. Moreover, the guidance for the next quarter given by the company is even less optimistic than this quarter's performance.

As Dolphin Analyst mentioned in the previous financial report review, "The continuous increase in company inventory and stagnation in price growth all indicate the sign of the industry's peak." Analyzing SMIC's Latest Financial Report: Concerns in 5 Key Areas

1. Overall Performance vs. Market Expectations In the 3rd quarter of 2022, SMIC recorded revenue of US$1.907 billion, a 0.2% QoQ increase that fell short of market expectations ($1.933 billion). Given the downturn in the semiconductor industry, how does the company's performance compare to its peers?

2. Sources of Revenue Growth In terms of revenue growth, how much of it is attributable to volume versus price? How has the industry downturn impacted SMIC's shipment volumes and prices?

3. Drivers Behind Gross Margin Improvement Can SMIC achieve its projected gross margin for this quarter, and what factors are driving this? How have changes in prices and costs affected its gross margin? Are rising raw material costs still impacting SMIC?

4. State of Business Operations How is SMIC's downstream performance, and what progress has it made with domestic semiconductor customers in China?

5. Management Performance What has changed in SMIC's business operations this quarter? Are their inventory and accounts receivable levels adequate? How is their EBITDA performance?

Core Indicators for SMIC: Revenue, Gross Margin, and Utilization Rate

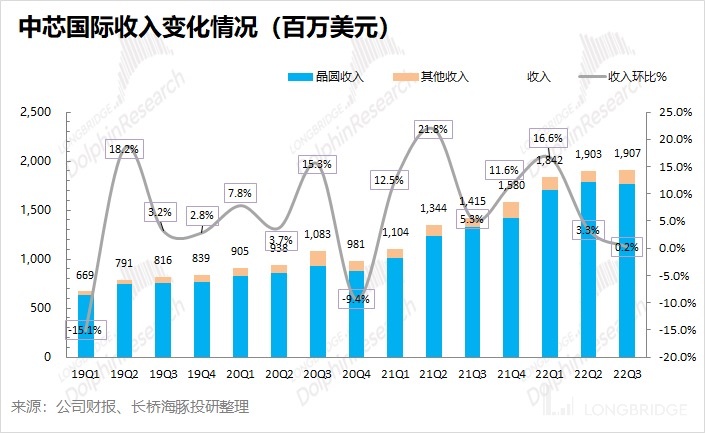

Core Indicator 1: Revenue In Q3 2022, SMIC generated $1.907 billion in revenue, an increase of 0.2% QoQ. The average selling price for this season continued to grow, while shipment volume began to decline. Company inventory continued to climb, indicating a downturn in downstream demand which may have affected its wafer shipments.

As an industry insider, I believe that after several quarters of decline, the high inventory levels of smartphones have largely dissipated. This indicates a sign of bottoming out. As self-sufficiency requirements continue to increase, domestic and Hong Kong customers will continue to account for a growing portion of SMIC's business, providing a certain level of order security for the company amid the downturn in the semiconductor industry. I still believe that SMIC has long-term value in the semiconductor sector, but the company's short-term performance will inevitably be affected by a downturn in the industry cycle.

Dolphin Analyst's focus for this financial report:

- The overall performance of SMIC vs. market expectations

- The sources of SMIC's revenue growth

- The drivers behind SMIC's gross margin improvement

- The state of SMIC's downstream business operations

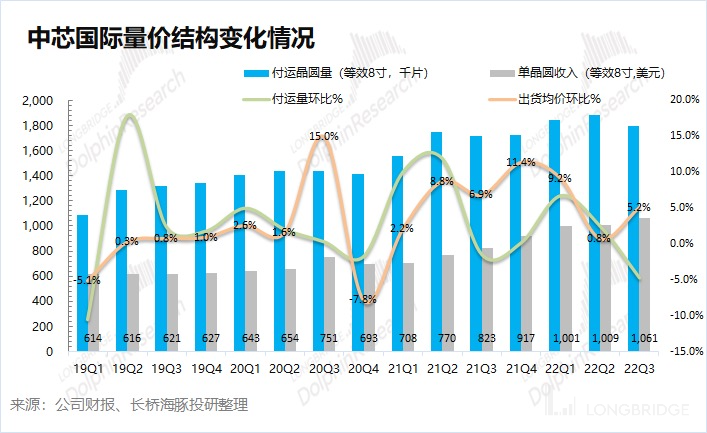

- SMIC's management performance From the perspective of volume and price, the main drivers of SMIC's revenue growth this quarter are:

-

From the perspective of volume, the equivalent 8-inch wafer shipment volume of SMIC this season reached 1,798 thousand pieces, a quarter-on-quarter decrease of 4.7%;

-

From the perspective of price, the revenue per single wafer of SMIC this season (equivalent to 8 inches) was USD 1,061, a quarter-on-quarter increase of 5.2%.

Looking at the breakdown of volume and price, the main driver of the company's revenue growth this quarter comes from the increase in the average selling price of wafers.

Considering SMIC's continuously increasing inventory in recent quarters, the decline in shipment volume this season was expected. The continuing increase in the average selling price of wafers is mainly due to the structural impact brought by the an increase in the proportion of high-priced product shipments.

Perhaps influenced by the industry's downward trend and high inventory levels, the company's capacity expansion slowed down this quarter. As of the end of the third quarter, SMIC's wafer capacity (equivalent to 8 inches) was 1,952 thousand pieces, a slight increase of 0.5% compared to the previous quarter. The company raised its capital expenditure for the full year by USD 1.6 billion this quarter, mainly for advance payment on equipment delivery.

Looking ahead to the fourth quarter, SMIC has given a quarter-on-quarter revenue decline guidance of 13-15%, corresponding to an expected revenue of USD 1.62-1.66 billion for the next quarter, far below the market's consensus expectations of USD 1.823 billion. Considering UMC's expectation for "price remaining unchanged from the previous quarter," Dolphin Analyst believes that the main reason for SMIC's decline in the fourth quarter is in terms of shipment volume.

Core Indicator 2: Gross Margin

SMIC's gross margin for the third quarter of 2022 was 38.9%, a quarter-on-quarter decrease of 0.5 percentage points, which is in line with the market's consensus expectations (38.8%).

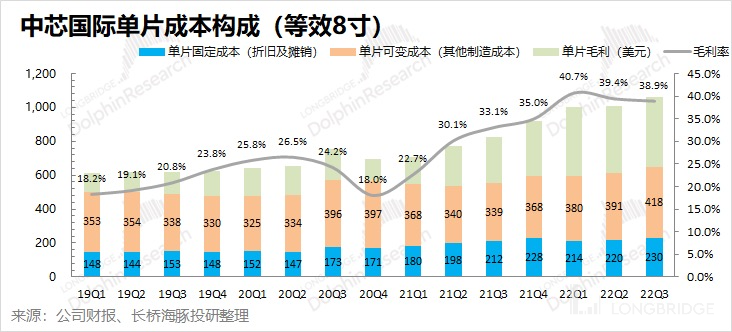

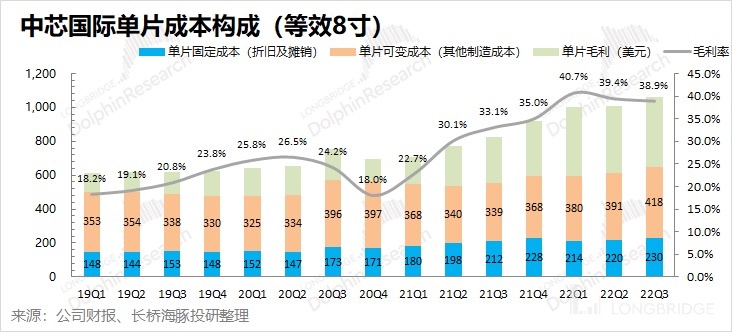

To analyze the source of the increase in SMIC's gross margin this season, the company's cost structure can be broken down as follows:

Single wafer gross profit = single wafer revenue - single wafer fixed cost - single wafer variable cost

-

Single wafer revenue: SMIC's revenue per single wafer this quarter (equivalent to 8 inches) was USD 1,061, an increase of USD 52/piece quarter-on-quarter.

-

Single wafer fixed cost (depreciation and amortization): This quarter's single wafer fixed cost (equivalent to 8 inches) was USD 230, an increase of USD 10/piece quarter-on-quarter.

-

Single wafer variable cost (other manufacturing costs): This quarter's single wafer variable cost (equivalent to 8 inches) was USD 418, an increase of USD 27/piece quarter-on-quarter.

-

Single wafer gross profit: SMIC's single wafer gross profit this season (equivalent to 8 inches) was USD 413, a quarter-on-quarter increase of USD 15/piece.

Through cost breakdown, it can be seen that SMIC's gross margin has decreased again this quarter. The decrease in gross margin is due to an increase in the company's single wafer variable cost and single wafer fixed cost, mainly caused by the decline in capacity utilization rate. The growth in the company's revenue and gross profit from the single wafer was mainly due to the increase in the proportion of high-priced products shipped, while the final decline in gross profit margin was mainly due to the increase in cost items directly caused by the decline in utilization rates of some production lines.

Looking ahead to the fourth quarter, SMIC (Semiconductor Manufacturing International Corporation) has given a quarterly guidance with a gross profit margin between 30-32%, which is lower than the market's consensus expectation of 33.59%. Combined with the gross margin decline guidance previously given by UMC (United Microelectronics Corporation), this also verifies the performance of the semiconductor cycle downturn in the financial reports of major chip factories. In combination with the continuing increase in the company's inventory this quarter, Dolphin Analyst predicts that the company's capacity utilization rate will be further lowered in the fourth quarter, thereby affecting the company's gross profit margin.

Core Indicator 3: Capacity Utilization Rate

Capacity utilization rate not only reflects SMIC's quarterly operating situation, but also reflects the trend of the entire wafer manufacturing industry. As the prosperity of the wafer manufacturing industry continues to rise, SMIC and many other manufacturers continued to exhibit full capacity. However, with the emergence of signs of semiconductor downturn today, adjustments in downstream orders will directly affect the capacity utilization rates of chip factories.

In the third quarter of 2022, SMIC's capacity utilization rate was 92.1%. The sharp decline in SMIC's capacity utilization rate this quarter was a new low for the company's capacity utilization rate in the past three years, which also means that the semiconductor up-cycle in recent years has come to a complete end. If the capacity utilization rate in the second quarter can be partially attributed to the epidemic, then such a large decline in the third quarter is a reflection of the overall industry's peak and downturn.

Looking ahead to the fourth quarter, although the capacity utilization rate in the third quarter hit a new low in recent years, due to the continued rise in inventory in the third quarter, there will still be no sign of improvement in the company's capacity utilization rate in the fourth quarter. In combination with the company's guidance of a significant decline in revenue and gross profit margin, Dolphin Analyst expects the company's capacity utilization rate in the fourth quarter to be even lower than that of the third quarter.

II. Business Perspective of SMIC

After looking at the three core indicators, Dolphin Analyst and everyone will take a comprehensive look at the quarterly business situation of SMIC:

2.1 Downstream Markets: Smartphones May Be Bottoming Out

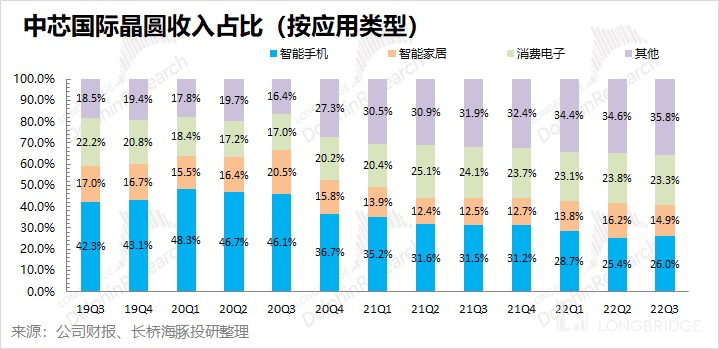

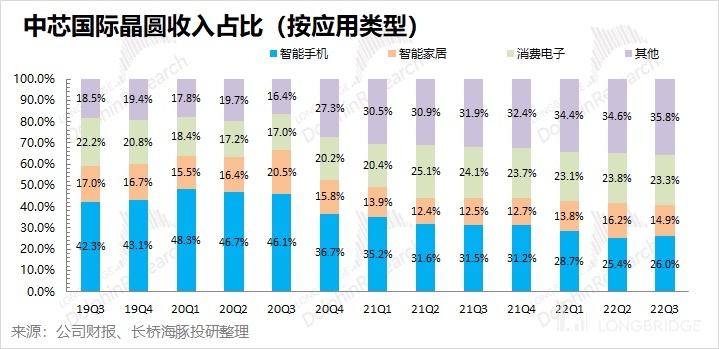

In this quarter, SMIC's revenue from the smartphone business accounted for 26%, mainly due to a certain decline in smart homes and consumer electronics this quarter. Among all the sectors, the revenue from other businesses continued to increase, reaching 35.8% this quarter. These other businesses mainly include the automotive, industrial and other application areas, mainly reflecting the demand driven by new energy and other fields.

Looking closely at the downstream situation of SMIC, the quarter-on-quarter decline in the smart home and consumer electronics business also reflects the signs of weakness in demand due to inflation and other factors. The previously declining smartphone business has shown signs of stabilizing this quarter. Although there is still no sign of improvement in smartphones from all aspects, Dolphin Analyst believes that signs of recovery have already begun to emerge from some supply chain manufacturers' data. In this quarter, SMIC's smartphone business no longer declined. Although the proportion of the business has been declining, the future smartphone business will still account for more than 20% of SMIC's business.

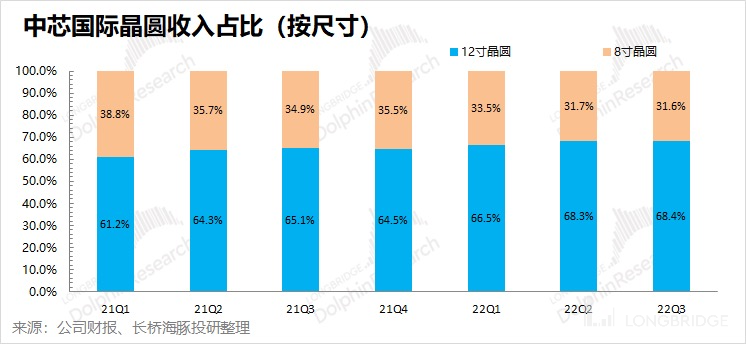

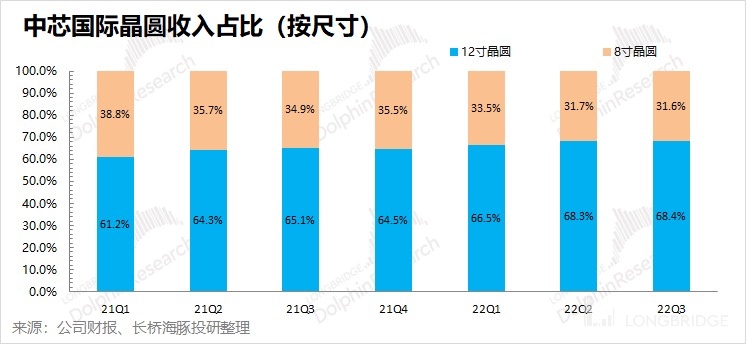

2.2 Wafer size: 12-inch wafer continues to rise

Starting from the first quarter of 2022, SMIC no longer discloses the revenue proportion of each process node, only the revenue proportion of 8-inch and 12-inch wafers. This makes it impossible to see the revenue changes of each node in detail.

In this quarter, the revenue proportion of 12-inch wafers at SMIC continued to increase to 68.4%. Judging from the trend of the increase in capacity proportion, the focus of SMIC's future is still on 12-inch wafers. The increase in the revenue proportion of 12-inch products is mainly due to the expansion of new capacity this quarter, which is mainly 12-inch.

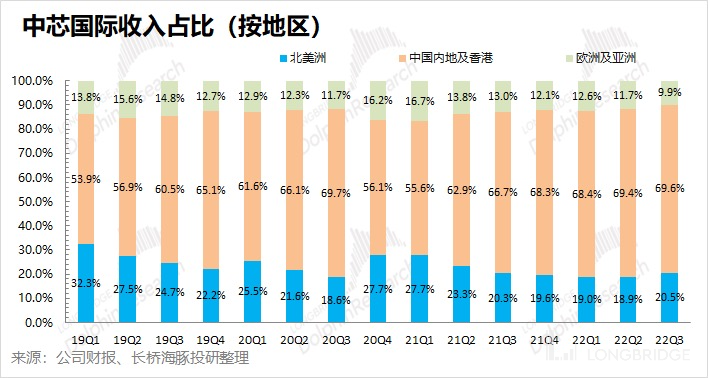

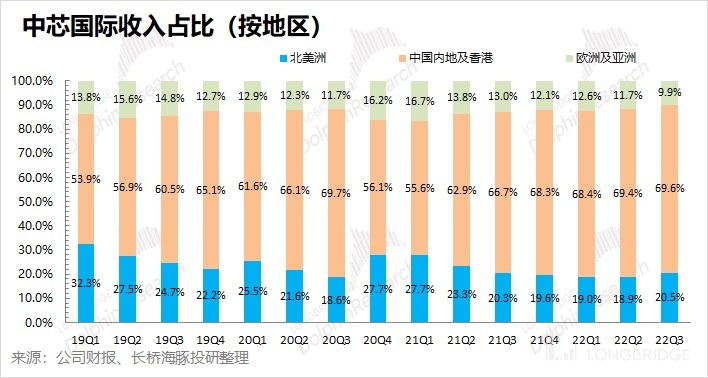

2.3 Regional distribution: Domestic substitutes continue to rise

The revenue proportion of SMIC's customers in Mainland China and Hong Kong has once again increased to a new high of 69.6% in this quarter. After H suppliers were restricted, the proportion of the Mainland China and Hong Kong regions once fell to around 55%. Now it has been close to 70% continuously. On the one hand, it indicates that SMIC's current customer structure is relatively stable, with domestic customers as the mainstay; on the other hand, it indicates that other domestic customers have filled the gap left by H suppliers and are still increasing.

Dolphin Analyst believes that with the impact of semiconductor friction and other events, more and more domestic manufacturers will prioritize domestic semiconductor capacity, such as SMIC, in order to ensure their own supply chain security. The revenue share of domestic Mainland China and Hong Kong customers at SMIC will continue to increase.

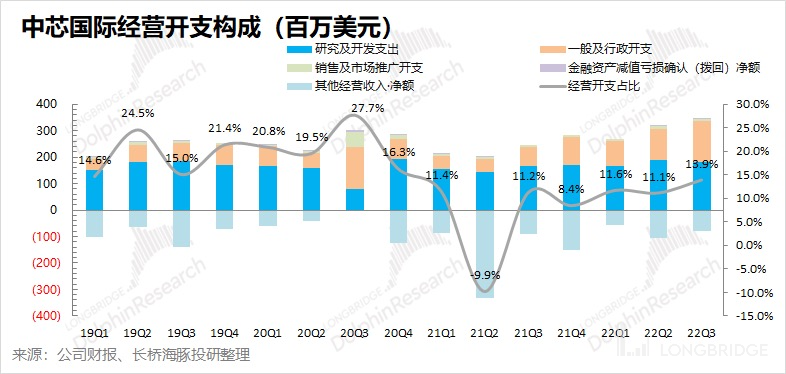

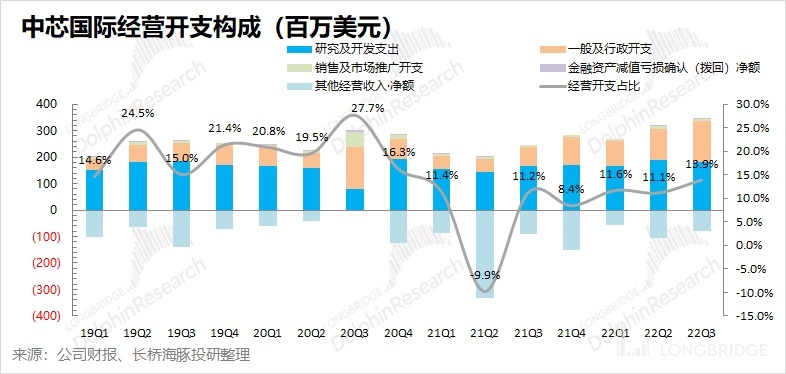

3.1 Operating expenses: New plant operations lead to increased expenses

From the perspective of operating expenses, SMIC's operating expenses this quarter were US$264 million, a slight increase from the previous quarter.

Breaking down the operating expenses of this quarter, R&D expenses were US$183 million, general and administrative expenses were US$153 million, and marketing expenses were US$0.7 million. R&D expenses are basically the same as the previous quarter, while general and administrative expenses have increased significantly. The increase in general and administrative expenses is mainly due to the increase in expenses related to the trial operation of the new plant in the third quarter. The increase in operating expenses this quarter mainly comes from the increase in general and administrative expenses brought by the trial operation of the new factory, while other expenses remain basically unchanged.

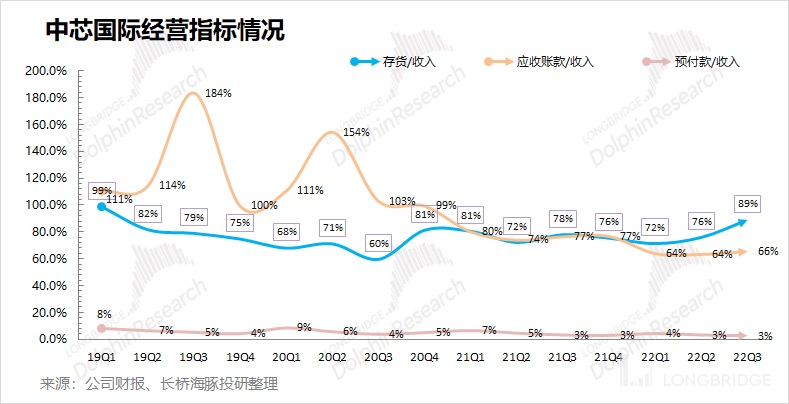

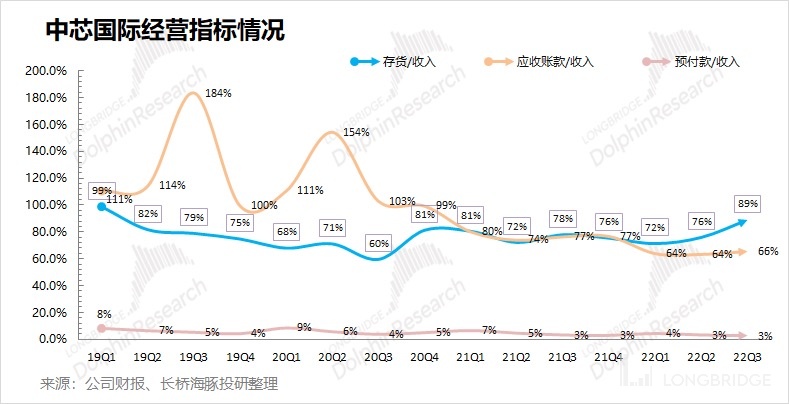

3.2 Operating Indicators: Inventory Indicators still not optimistic, approaching historical peak

From the perspective of operating indicators, the main observations are from the company's inventory and accounts receivable:

① SMIC's inventory this quarter was USD 1.698 billion, an increase of 17.2% sequentially;

② SMIC's accounts receivable this quarter was USD 1.255 billion, an increase of 3.7% sequentially.

③ Combined with the relationship between inventory/accounts receivable and revenue in the balance sheet, inventory/revenue and accounts receivable/revenue for this quarter were 89% and 66%, respectively. From the perspective of operating indicators, SMIC's inventory is still rising and the proportion of inventory is approaching historical highs.

Combining the company's inventory and capacity utilization data, the company's trends can be seen. The capacity utilization rate of the company was still close to full load in the first quarter of this year. With the continuous increase in the company's inventory since the first quarter, the capacity utilization rate of the company began to loosen from the second quarter. Therefore, based on the current inventory situation, Dolphin Analyst expects the capacity utilization rate for the fourth quarter to further decrease in order to prioritize the digestion of the company's existing inventory.

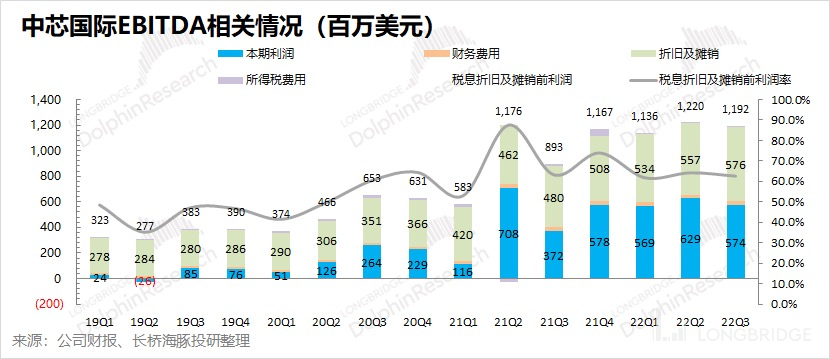

3.3 EBITDA Indicators: Profits and Depreciation each accounts for half

From the perspective of EBITDA, SMIC's Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) reached USD 1.192 billion in the third quarter, maintaining a high level.

Breaking down the indicators, the EBITDA of SMIC mainly comes from the release of operating profits and depreciation and amortization. The profit side has decreased this quarter while depreciation and amortization has continued to increase. The profit margin (before interest, taxes, depreciation and amortization) for this quarter was calculated to be 62.5%. Due to the heavy asset characteristics of the manufacturing industry, a portion of the company's profits were eroded by depreciation and amortization.

Financial Report Season

August 12, 2022 "Entering the Semiconductor Downturn Cycle, How Will SMIC Respond? (22Q2 Conference Call Summary)" 2022 August 11th Report: "[Price hike at a standstill, SMIC stands firm in the 'cyclic siege'] (https://longbridgeapp.com/topics/3297694)"

2022 May 13th Phone Conference: "Limited impact from pandemic, semiconductor continues to face structural shortages (Summary of SMIC's phone conference)"

2022 May 12th Financial Report Review: "Pandemic slump, market slump? SMIC's performance remains strong"

2022 February 11th Phone Conference: "[Alpha beyond industry price hikes; SMIC continues to expand production] (https://longbridgeapp.com/topics/1910418)"

2022 February 10th Financial Report Review: "SMIC: Unstoppable hike, continuous growth in performance | Financial Report Analysis"

2021 November 12th Phone Conference: "SMIC management communication following earnings surprise and sharp decline"

2021 November 11th Financial Report Review: "Don't question the market cycle top, SMIC stays strong!"

2021 August 6th Phone Conference: "How does senior management view SMIC's Q2 financial report?"

2021 August 5th Financial Report Review: "SMIC International: The rising force of China's semiconductor industry"

In-depth

2022 June 24th Industry Depth: "Canceling orders left and right, is the semiconductor industry really 'going through changes'?"

2021 July 16th Company Depth: "SMIC International (Part 2): The underestimated Chinese 'chip'"

2021 July 9th Company Depth: "SMIC International (Part 1): The strategy of the leading 'chip' attack"

Live broadcast

May 13, 2022: "SMIC (00981.HK) 2022 First Quarter Results Conference Call"

February 11, 2022: "SMIC (00981.HK) 2021 Fourth Quarter Results Conference Call"

November 12, 2021: "SMIC (00981.HK) 2021 Third Quarter Results Conference Call"

August 6, 2021: "SMIC (00981.HK) 2021 Second Quarter Results Conference Call"

May 14, 2021: "SMIC (00981.HK) 2021 First Quarter Results Conference Call"

Risk disclosure and statement for this article: Dolphin Analyst Disclaimer and General Disclosures