How long can emerging markets bounce back as US stocks "revert to reality"?

Hello everyone, I am Dolphin Analyst.

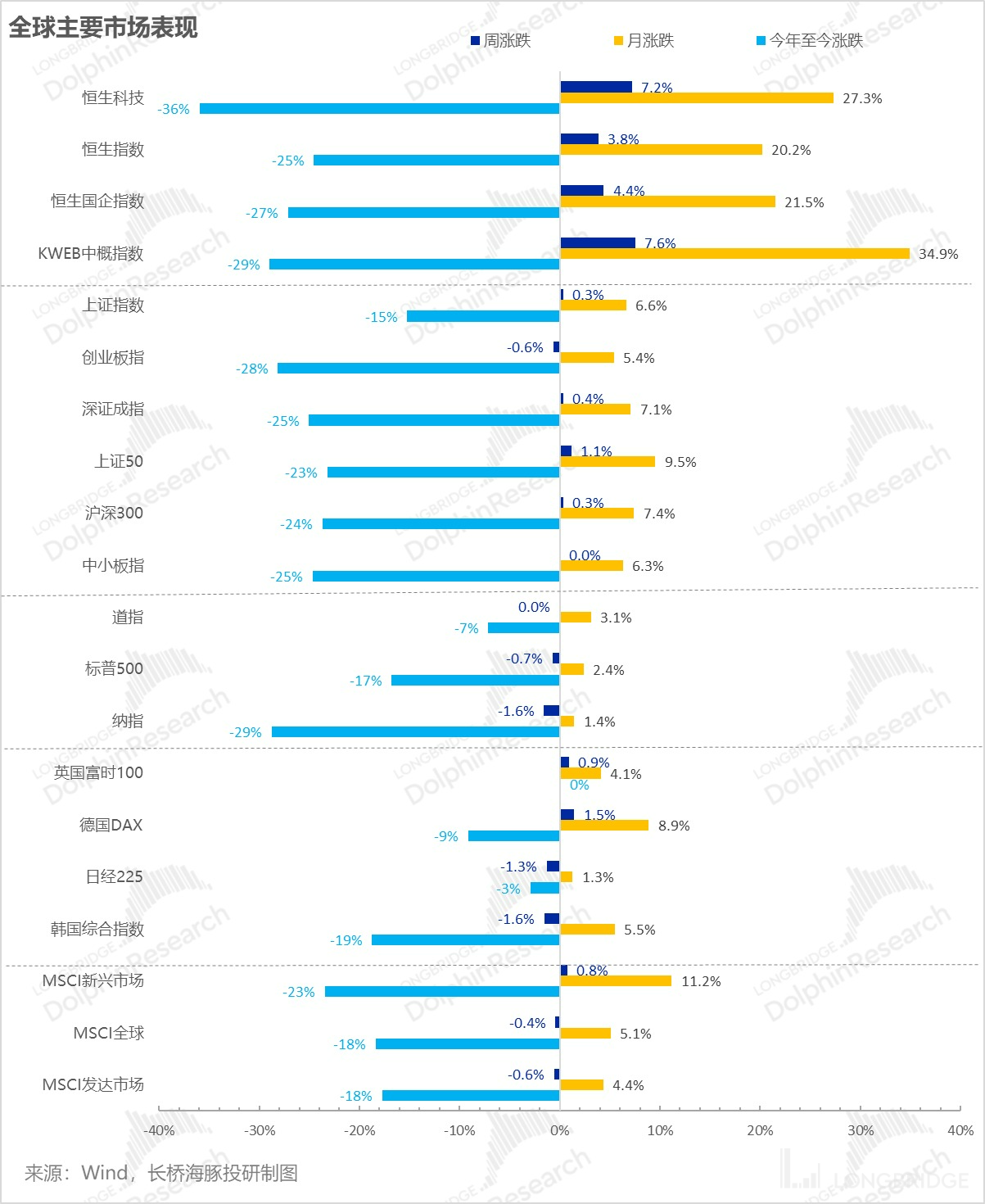

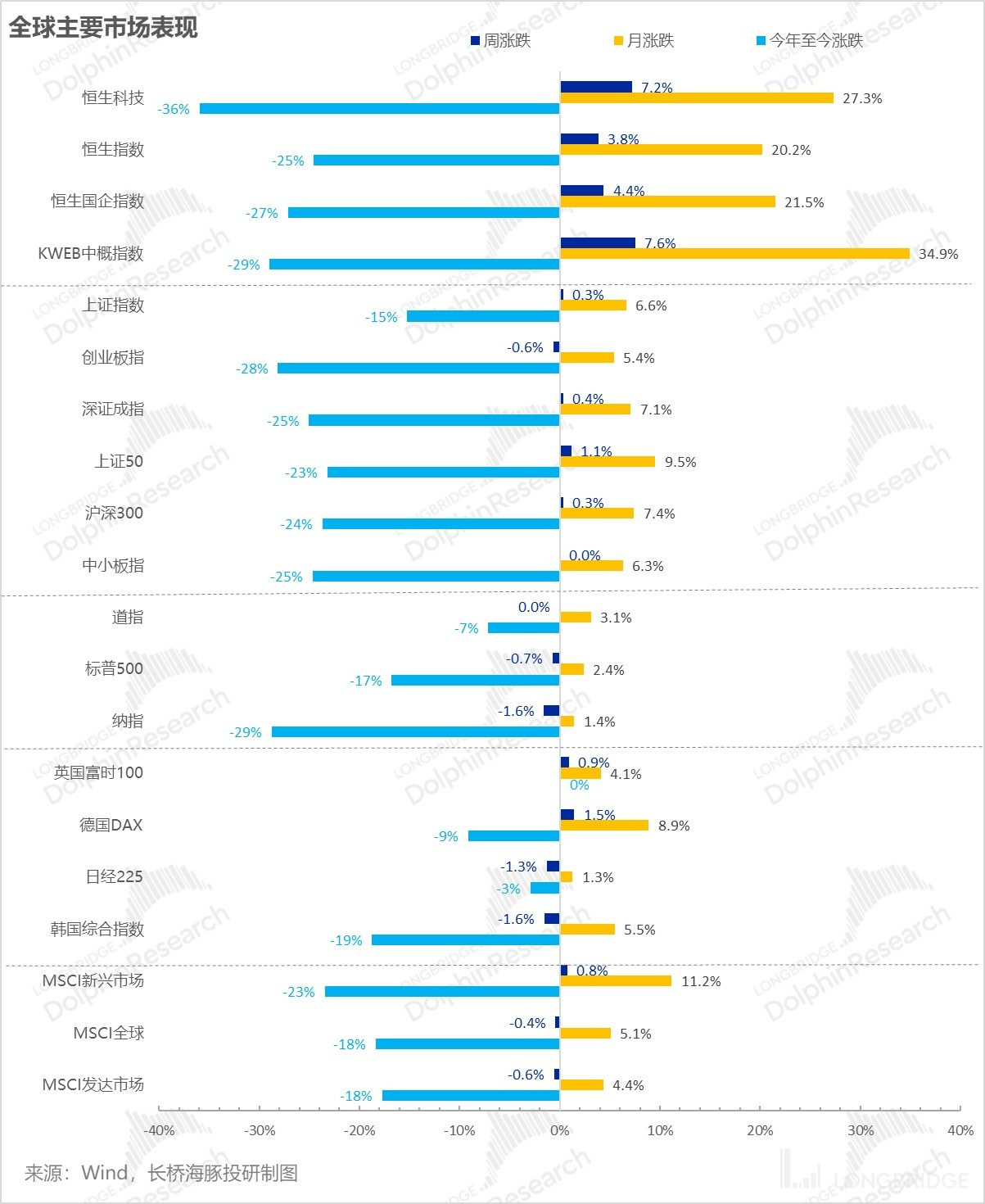

During this year's global market rebound, as the US labor market remains tight and interest rate hikes remain high, developed markets such as the US have fallen ahead of schedule.

In contrast, the dollar-peripheral market has rebounded after the expected interest rate peak, with a greater timing, duration, and extent of rebound than the US stock market. Looking at the monthly fluctuations, MSCI Emerging Markets has repaired by 11% in the past month, and has not fallen back last week.

Among emerging market assets, the repair of technology assets led by China's internet assets represented by the Hang Seng Technology and KWEB China Index is particularly noticeable. Last week still had a 7-8% increase, while the main indexes of US stocks have already entered the falling range.

This is basically consistent with Dolphin Analyst’s judgment in [“Amazon, Google, Microsoft stars fall?”] (https://longbridgeapp.com/topics/3625957?channel=t3625957&invite-code=276530) in early November that Hong Kong stocks are approaching opportunities.

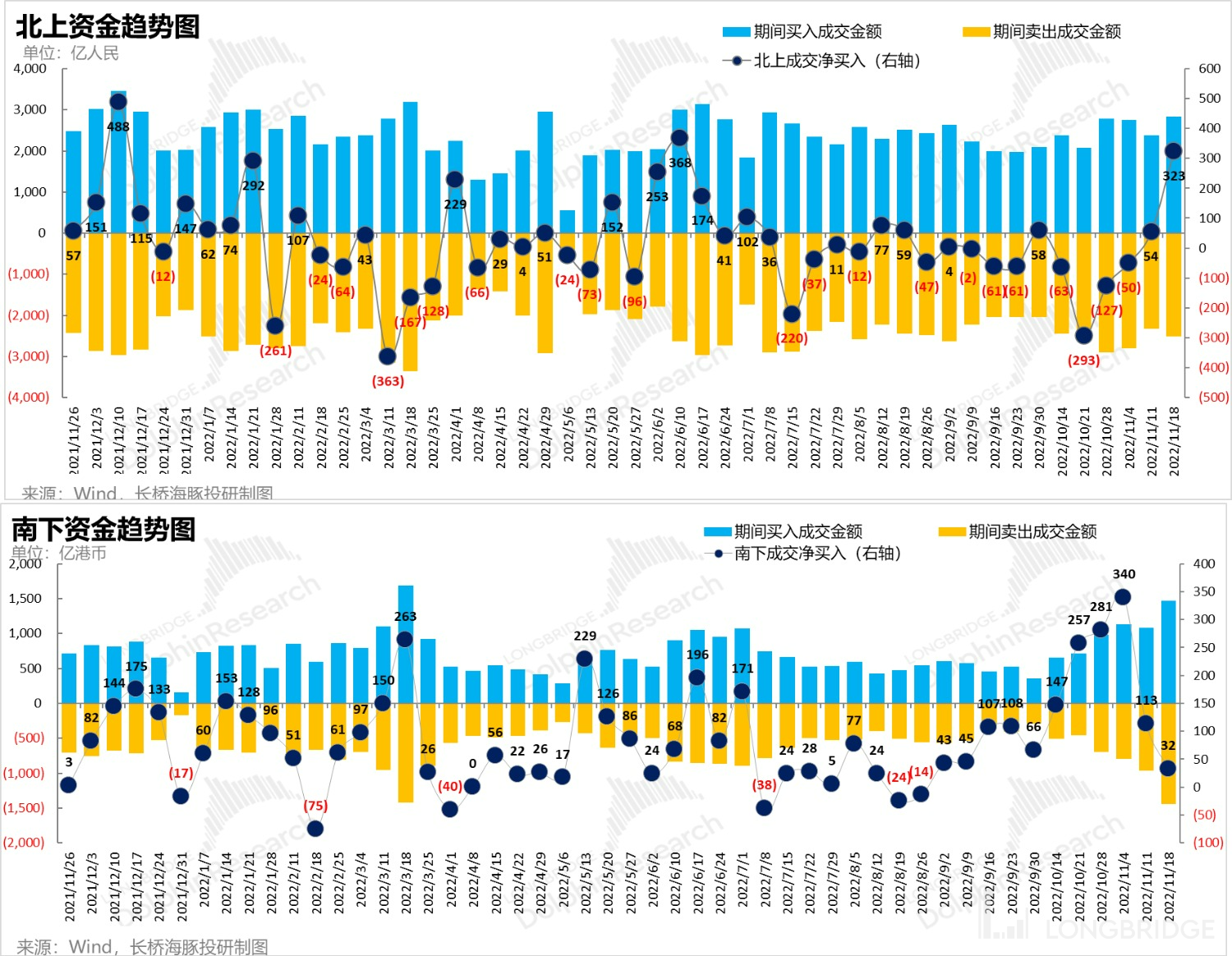

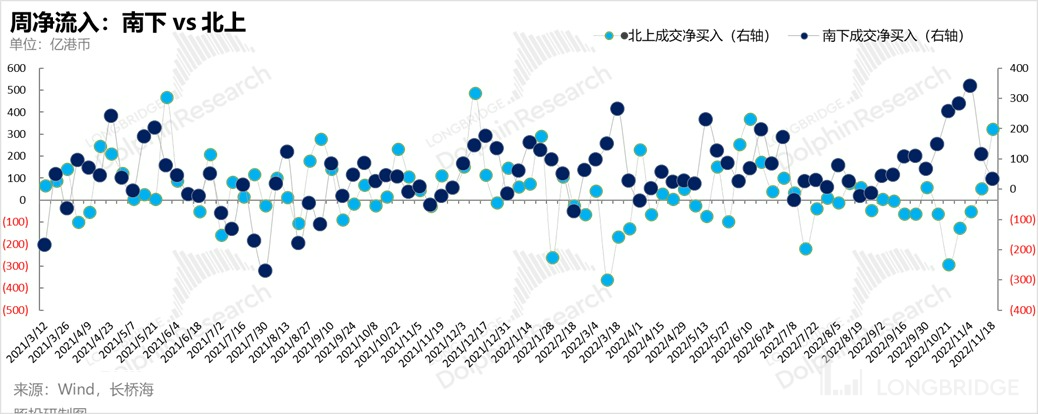

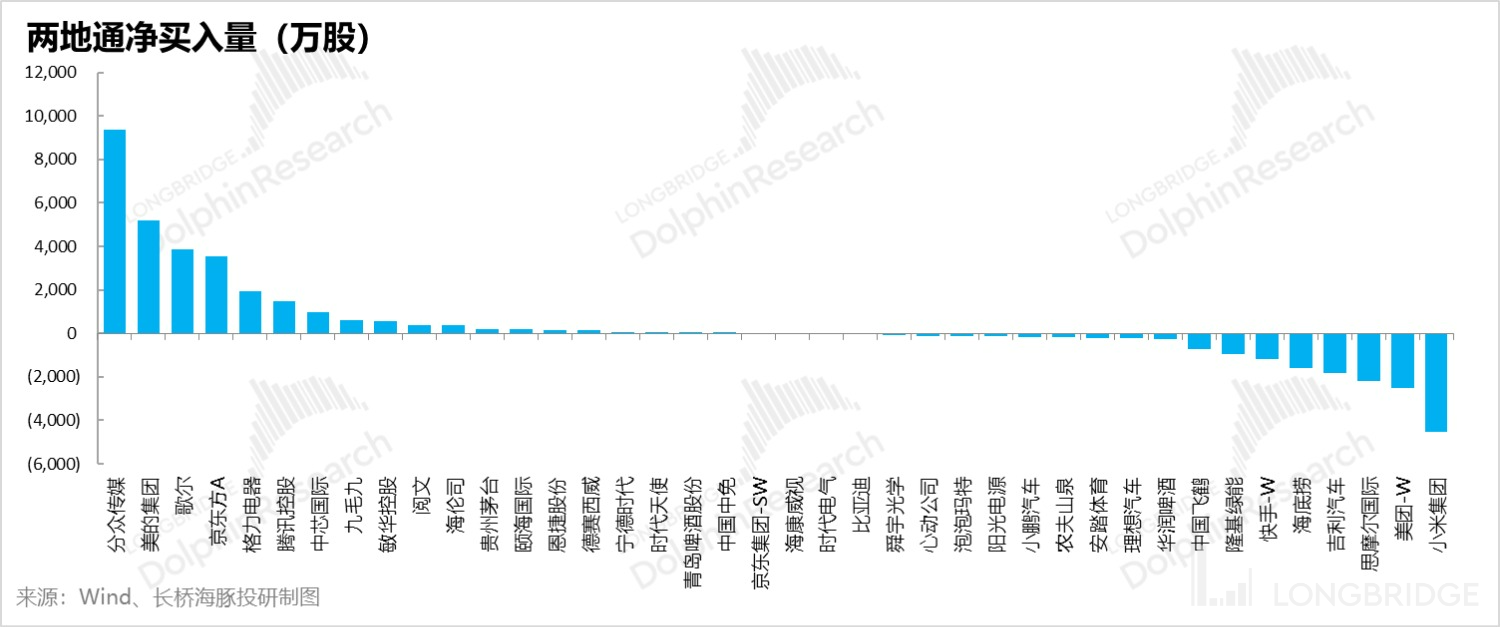

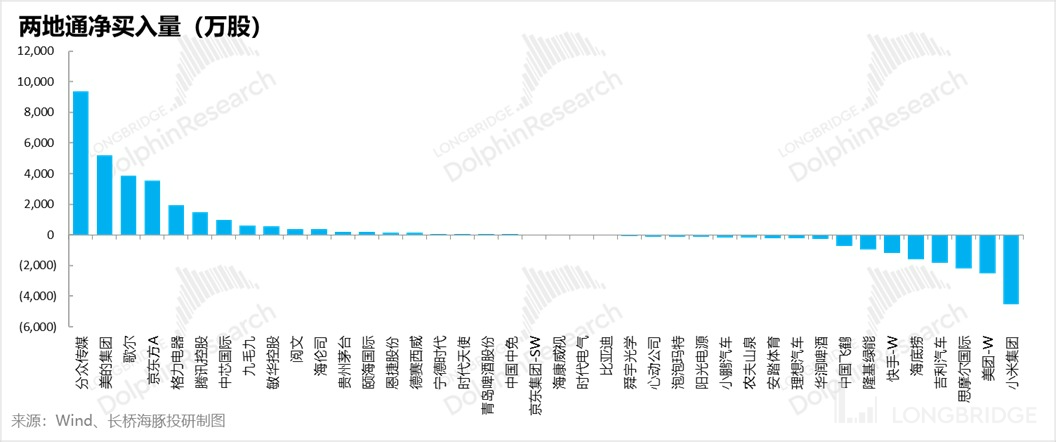

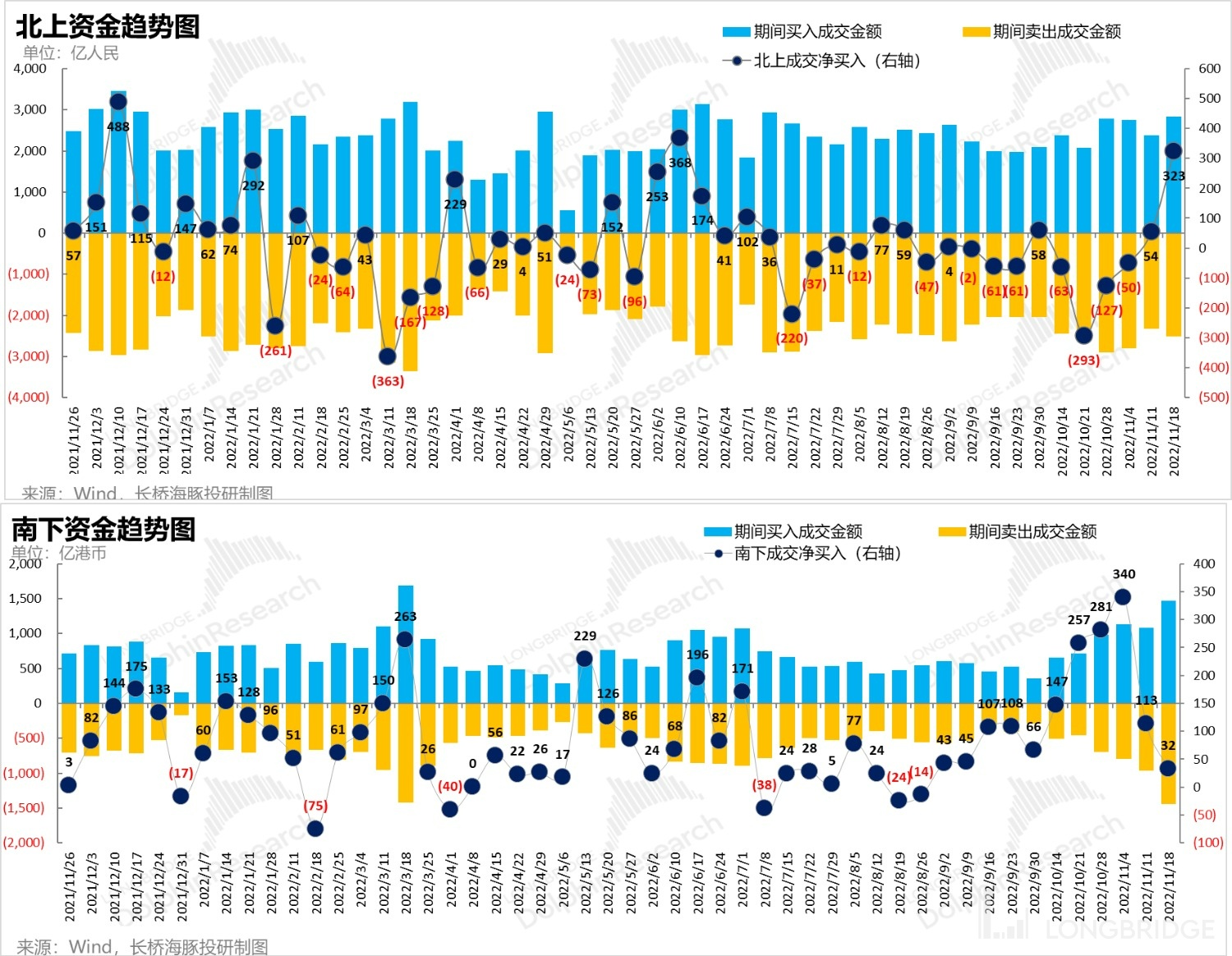

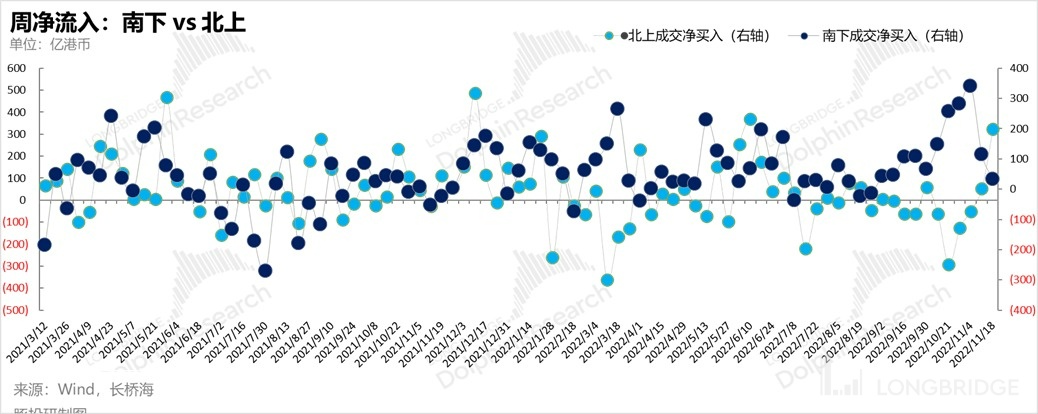

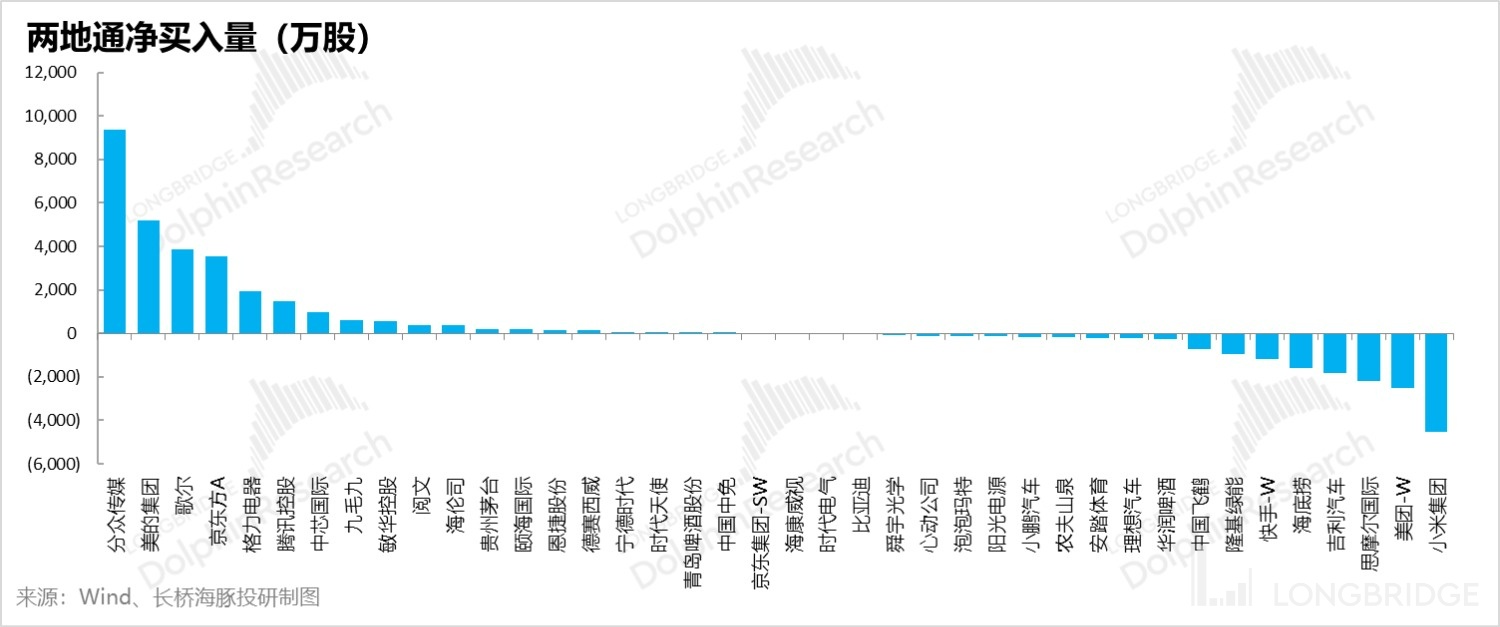

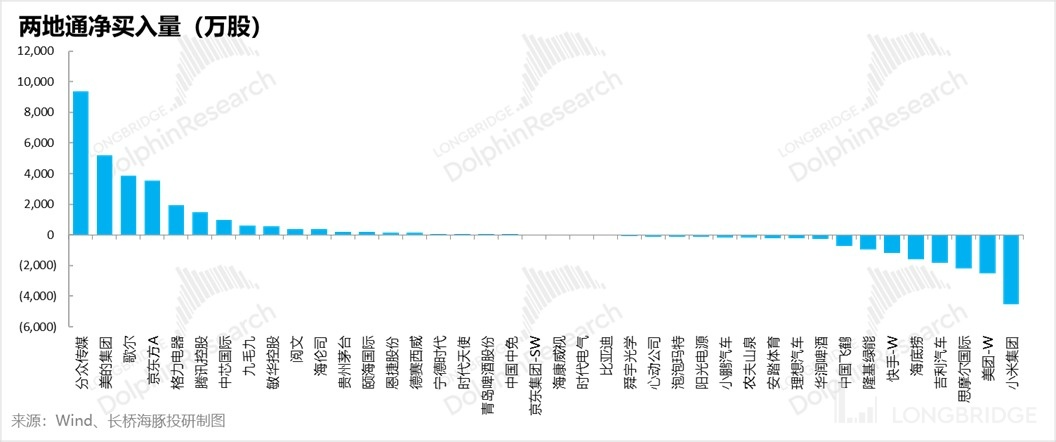

The acceleration of northern inflows and the obvious slowdown of southbound inflows can also be seen in the flow of funds:

In terms of reflecting speed, it seems that the reaction of Northbound capital is slower than that of Southbound capital. Judging from the net trading volume of funds, before (before March this year), the southbound and northbound fund operations were basically the same, but this wave of rebound, especially in March this year, the directions of the two funds were completely opposite. Northbound fled when Southbound was buying frantically, and when Southbound’s inflows slowed down, Northbound was crazy about putting in volume.

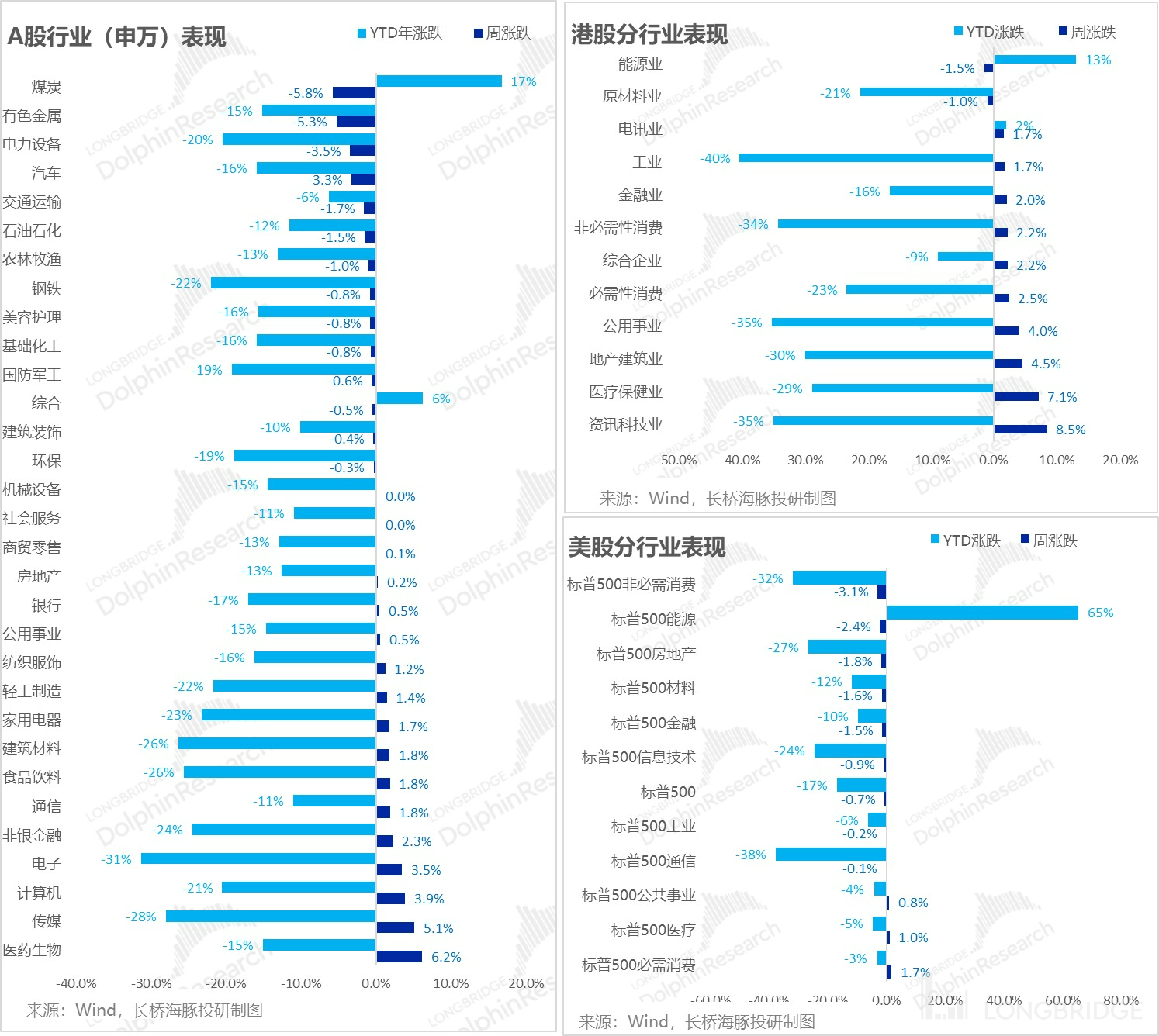

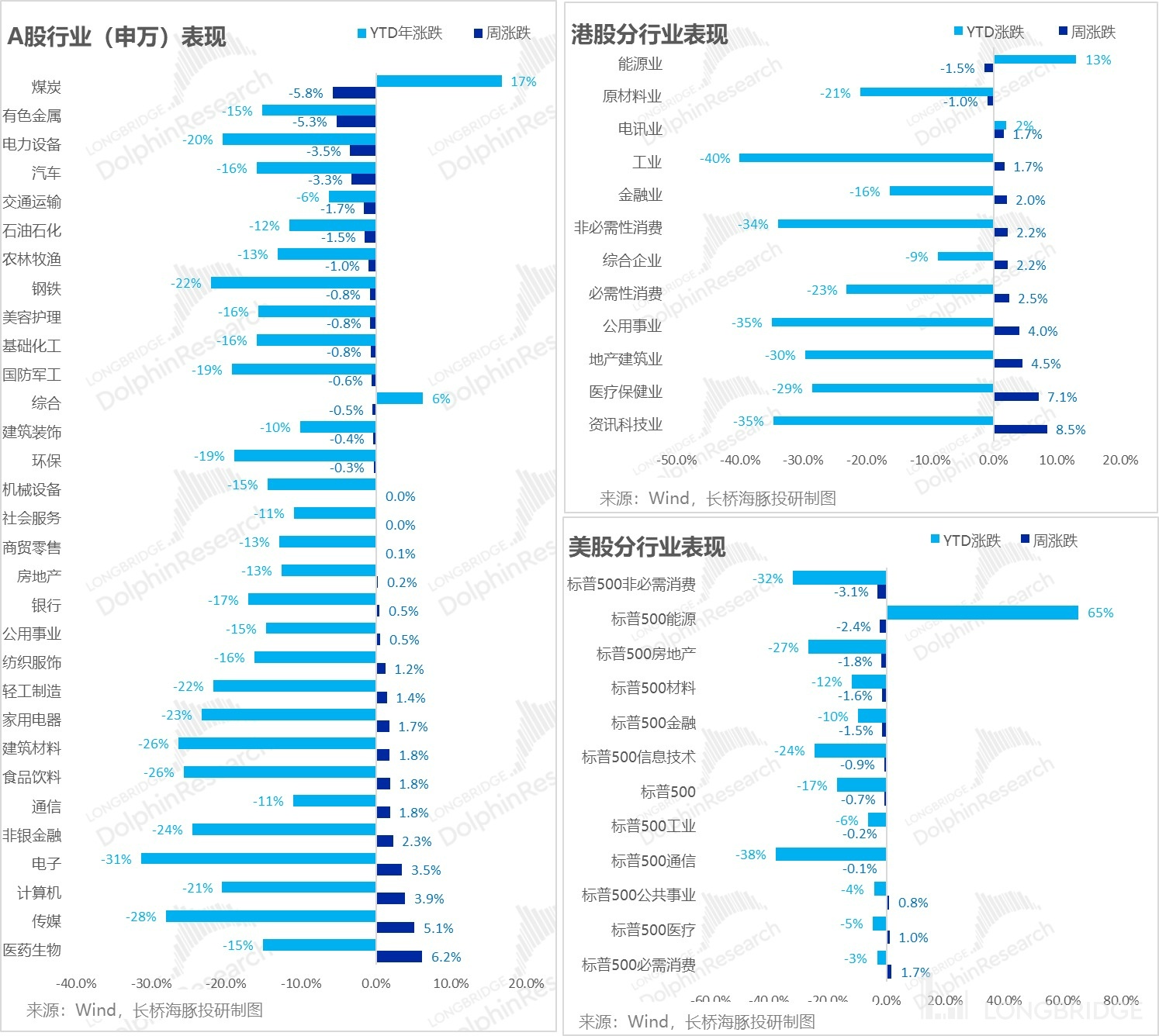

From the perspective of the three markets that Dolphin Analyst focuses on, A-shares and Hong Kong stocks are basically continuing to repair undervalued sectors under the support of real estate policies and the inflection point of peripheral market interest rate expectations, and REOPEN expectations. As for US stocks, various sectors have once again entered the recession logic under the high interest rate, and sectors such as optional consumption, energy, and real estate have fallen the most, which are suppressed by shrinking demand and high interest rates.

However, this rebound has already fallen in developed markets, and the rebound in emerging markets has basically entered the ending state. The subsequent issues such as poor fundamentals, delisting risks that cannot be cleared under the game, and the twists and turns of the REOPEN process still need to be faced. I. Chinese Concept Stocks: Unreliable Fundamentals

However, the current surge in Chinese concept stocks underestimates what one might call "high-quality" fundamentals. Looking at last week's financial reports from Alibaba, Tencent, and JD.com:

- The e-commerce sector as a whole has seen a collective decrease in competition, transitioning from rapidly increasing market share to a stage of "poor revenue, booming profits".

a. Lost growth: In light of the fact that the verdict has already been reached on Double Eleven, both eCommerce companies have given extremely pessimistic guidance. Alibaba has pointed out that the contraction in platform eCommerce revenue in the fourth quarter of 2021 may further decline; JD.com predicts that the growth rate of JD.com Retail will probably drop from 6-7% to low single digits in Q4. In addition, with JD.com claiming that its 2021 Double Eleven performance was better than the industry's growth rate, Alibaba's Double Eleven was equal to last year's performance, and the fact that daily sales growth is generally lower than during promotional periods, the guidance from both giants basically means that industry growth for eCommerce in the Q4 has no hope.

b. How to Interpret Strong Online Retail Performance in October? Dolphin Analyst saw in last week's ["Web Shopping As An Only Child, 'Sister' Offline Can Only Suffer"](https://longbridgeapp.com/topics/3650833?channel = t3650833&invite-code = 276530) that online retail seems to be performing exceptionally well, with a single month growth of about 15%, even taking into account the short-term downturn in online retail. However, there are some differences in timing for this year's Double-Eleven, resulting in a lack of complete comparability for year-over-year data:

JD.com’s 2021 and this year’s first instalment of payments for Double Eleven were both on the evening of October 31st, but Alibaba's first instalment began at 12:30 am on November 1st last year. This year both Alibaba and JD.com's payments were scheduled for the evening of October 31st, meaning that Alibaba's four-hour peak sales period for Double Eleven moved from November to October.

Combining media reports of Tmall's first-hour sales of 40 billion yuan during Double Eleven last year and the rough estimate of Tmall's trading volume being roughly the same in the past two years, there was roughly 100 billion yuan in sales on Tmall starting at 8 pm on October 31st. After deducting this 100 billion from the online retail revenue for October, the online retail growth rate for October is approximately between 5-6%, which isn't very good and is not fundamentally contradictory with this year's low-key Double Eleven performance data and Alibaba/JD.com's disappointing guidance for Q4.

c. Only profits remain: Dolphin's Analyst believes that the resilience of e-commerce lies in its profit elasticity; as long as you're willing, most e-commerce companies find it easy to release profits. By issuing fewer user coupons, especially in light of last year's widespread investment and competition for community group-buying, meeting expected profits for four consecutive quarters is not a problem. While most companies have managed to release profits after cutting costs, the problem lies in being unable to generate revenue. A "rare species" would be a company that can lower costs while maintaining a relatively stable income, rather than merely focusing on cutting corners. In terms of e-commerce, we can expect to see how Pinduoduo performs this quarter since it may be the only company capable of achieving both. However, the biggest risk lies in the degree to which cross-border e-commerce will drag down profits.

As for Tencent, the key to its gaming industry lies in improving official public opinion and accelerating the licensing process. Although Tencent's advertisement margins have not yet achieved a complete recovery as a whole, there will be a rise in ad revenue for WeChat Search and Video Account ads this year. Meanwhile, the payment business and the social retail industry have grown in sync, suggesting a REOPEN pattern.

From the Chinese concept stocks that received the most attention last week, we can see that companies in the pan-entertainment industry experienced a significant rebound following the improvement of regulatory conditions, while e-commerce companies achieved overall sectoral improvement in terms of profits. However, the recovery of advertising companies was not as noticeable in this wave.

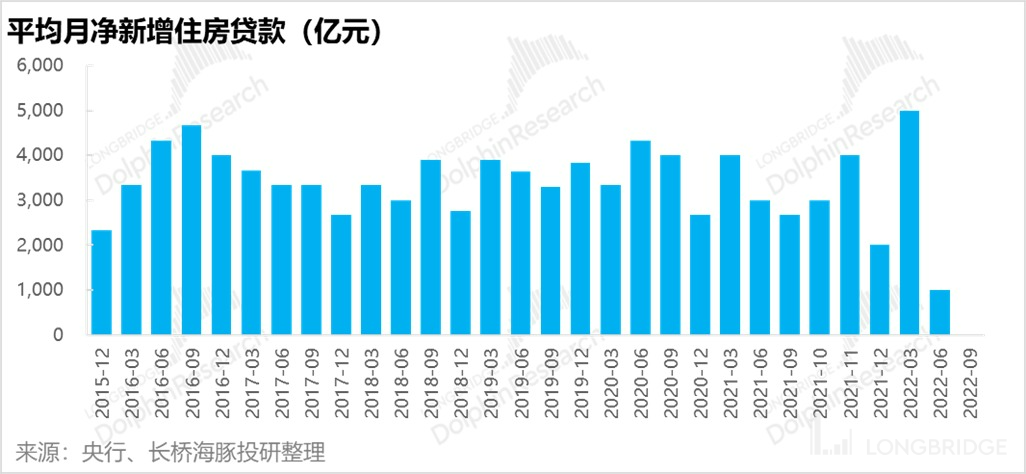

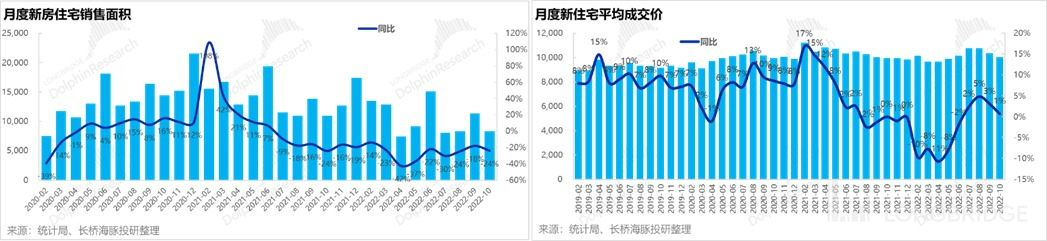

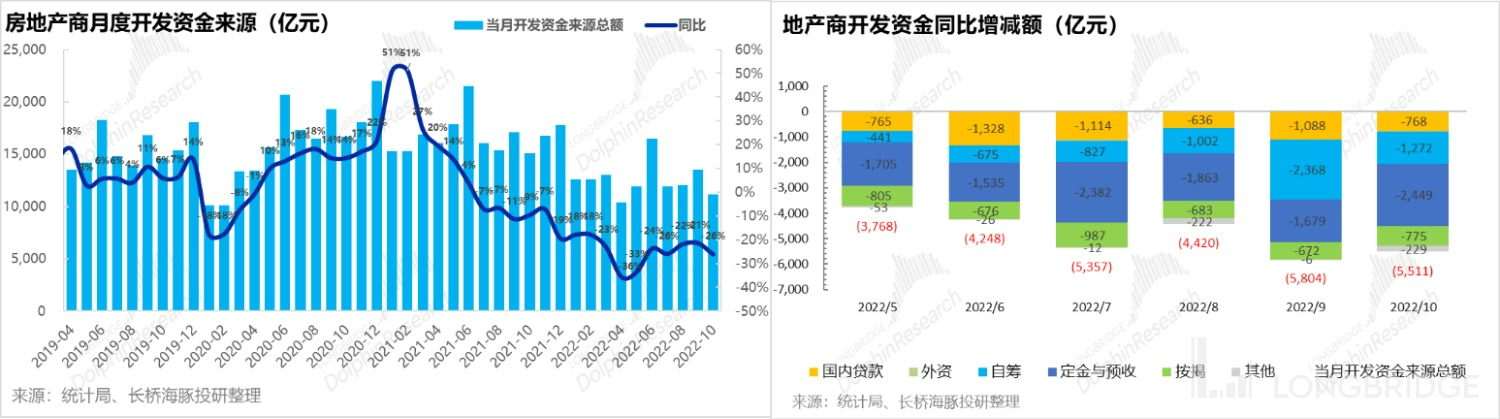

With the decrease in net long-term loans and increases in short-term debt, there seems to be a decline in property sales volume and prices. Furthermore, due to weak sales performance, deposits and advance receipts in real estate development have significantly decreased. However, the market still has some hope if these factors are laid out explicitly, and the situation worsens, as policy bailouts may come into play.

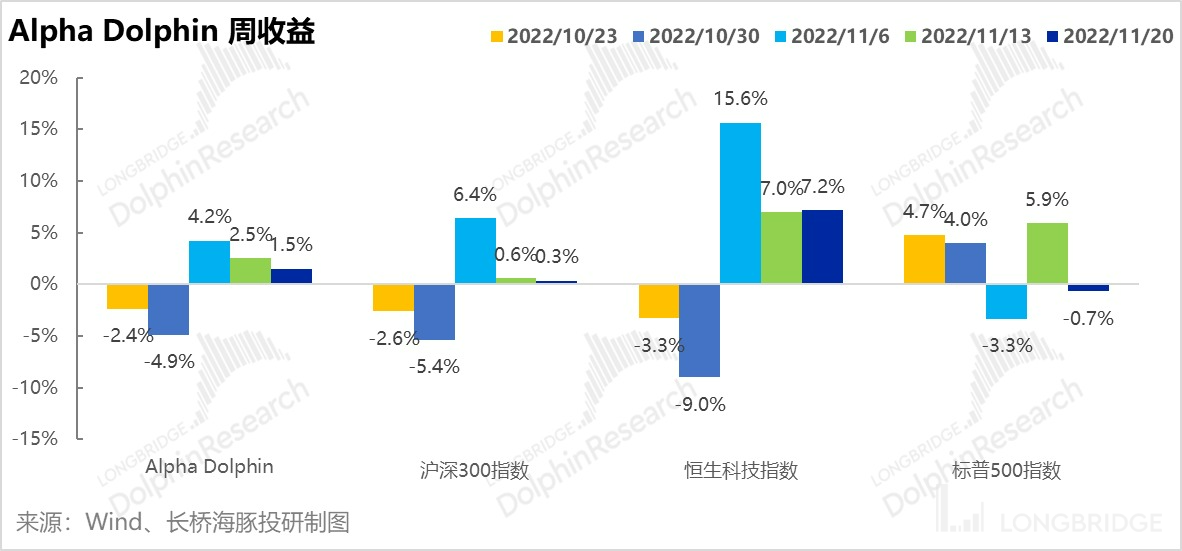

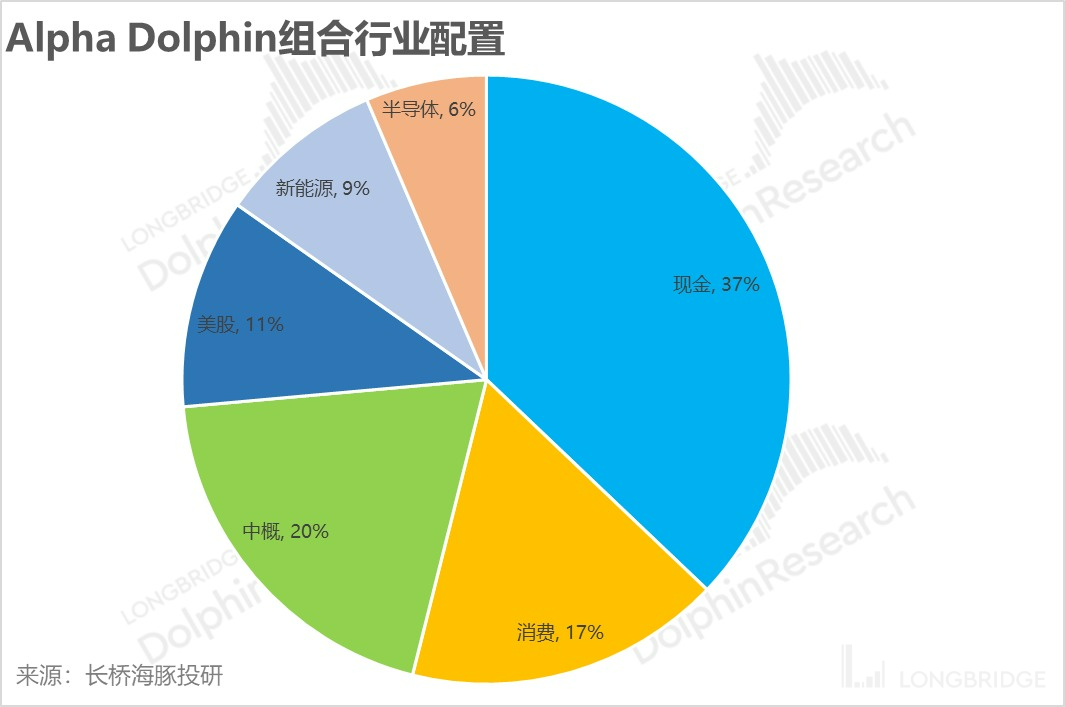

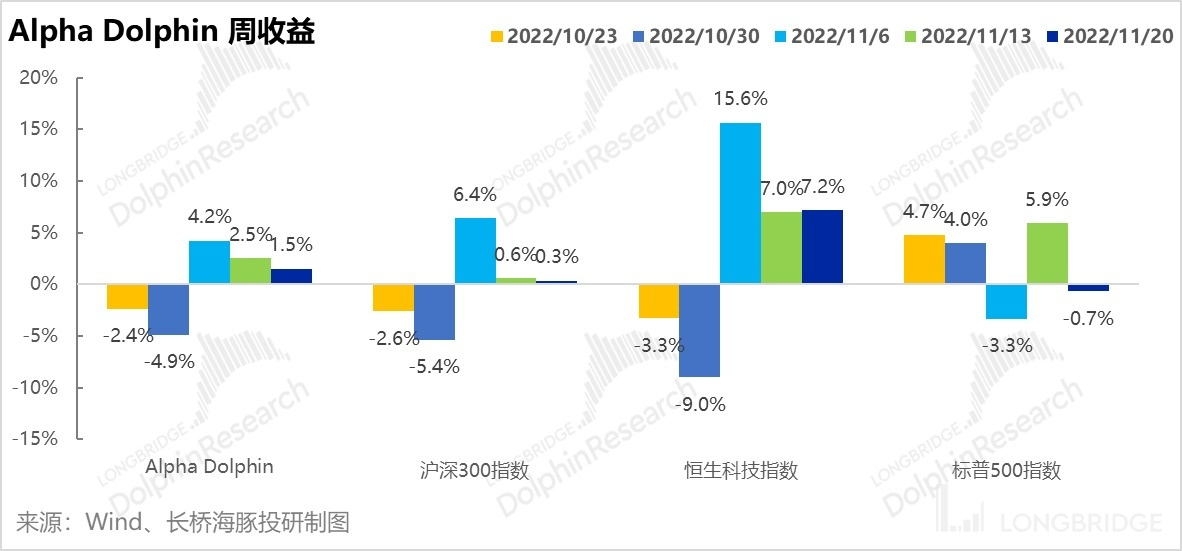

The Alpha Dolphin portfolio has been dragged down by the relatively high weighting of cash and relatively low weighting of new energy stocks. As of November 19th of this week, the Alpha Dolphin portfolio rose by 1.5% (equity rose by 2.5%), performing significantly better than the Shanghai and Shenzhen 300 (0.3%) and the S&P 500 (-0.7%), but significantly worse than the Hang Seng Tech Index (+7.2%). .

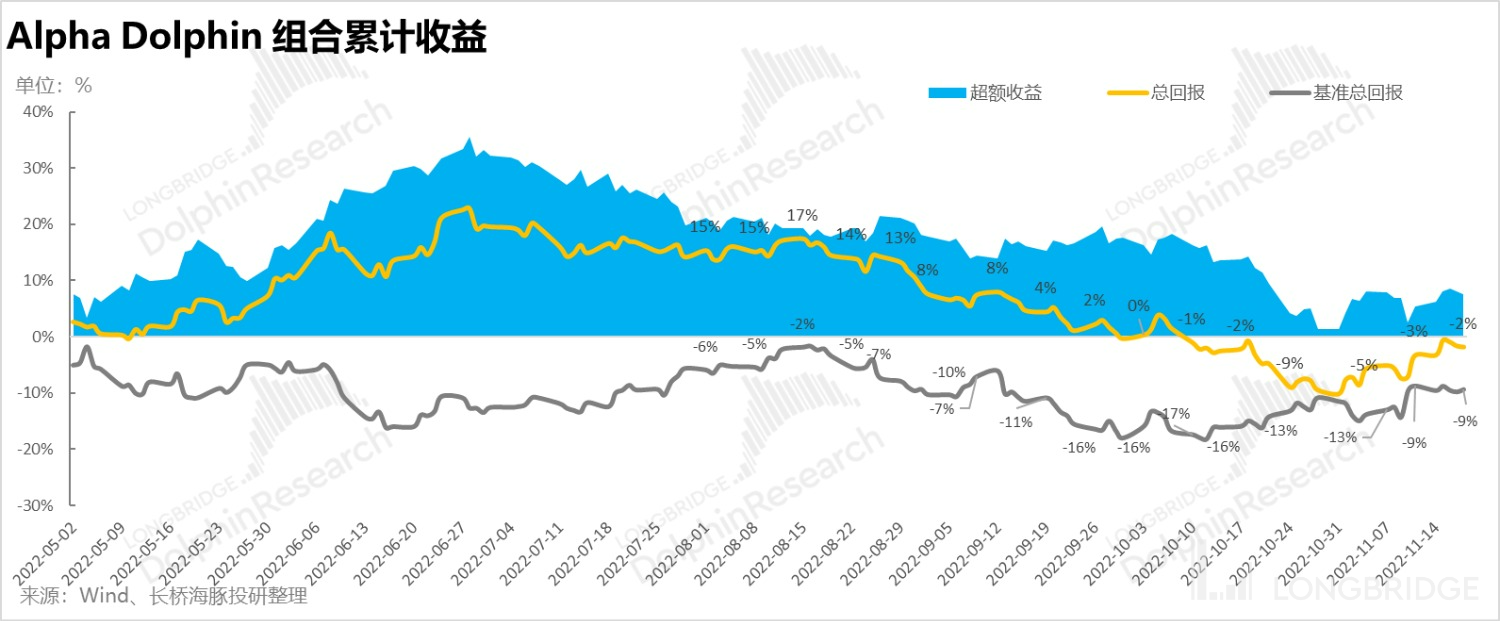

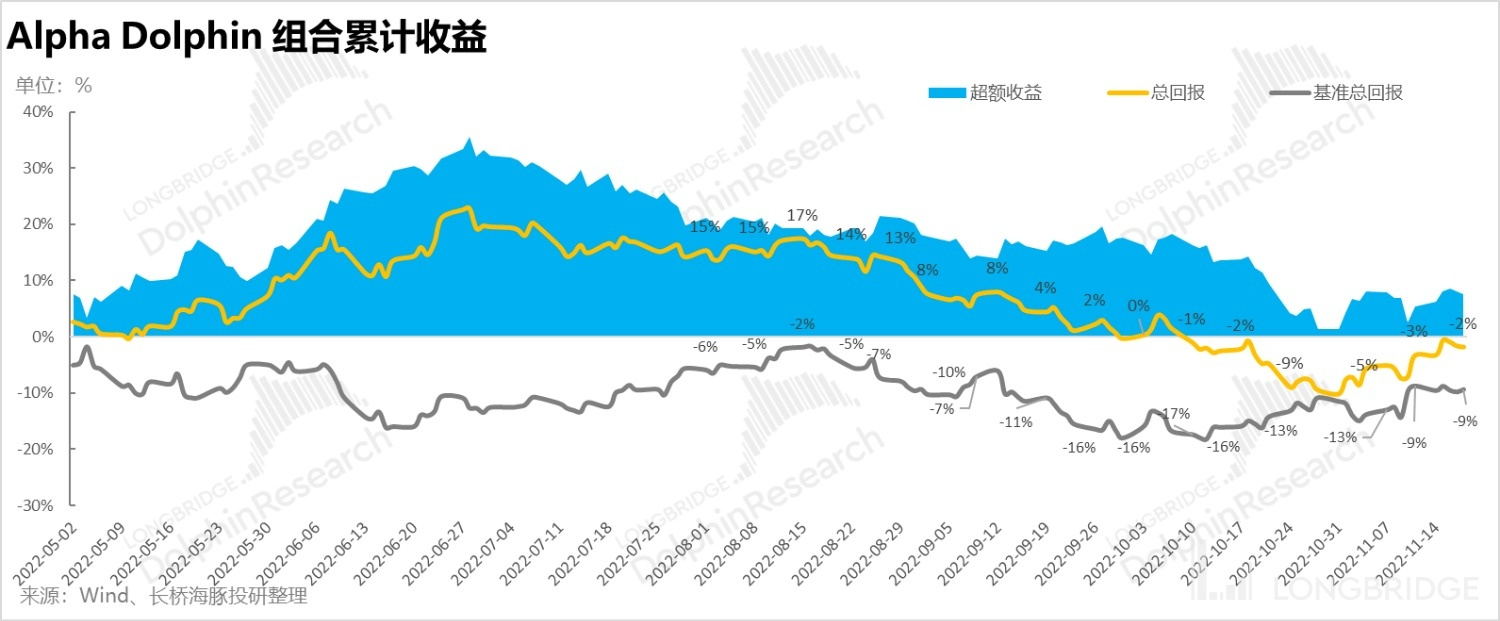

From the start of the self-organizing test to last weekend, the combination's absolute return was -1.8%, with excess returns compared to the benchmark S&P 500 index of 7.5%.

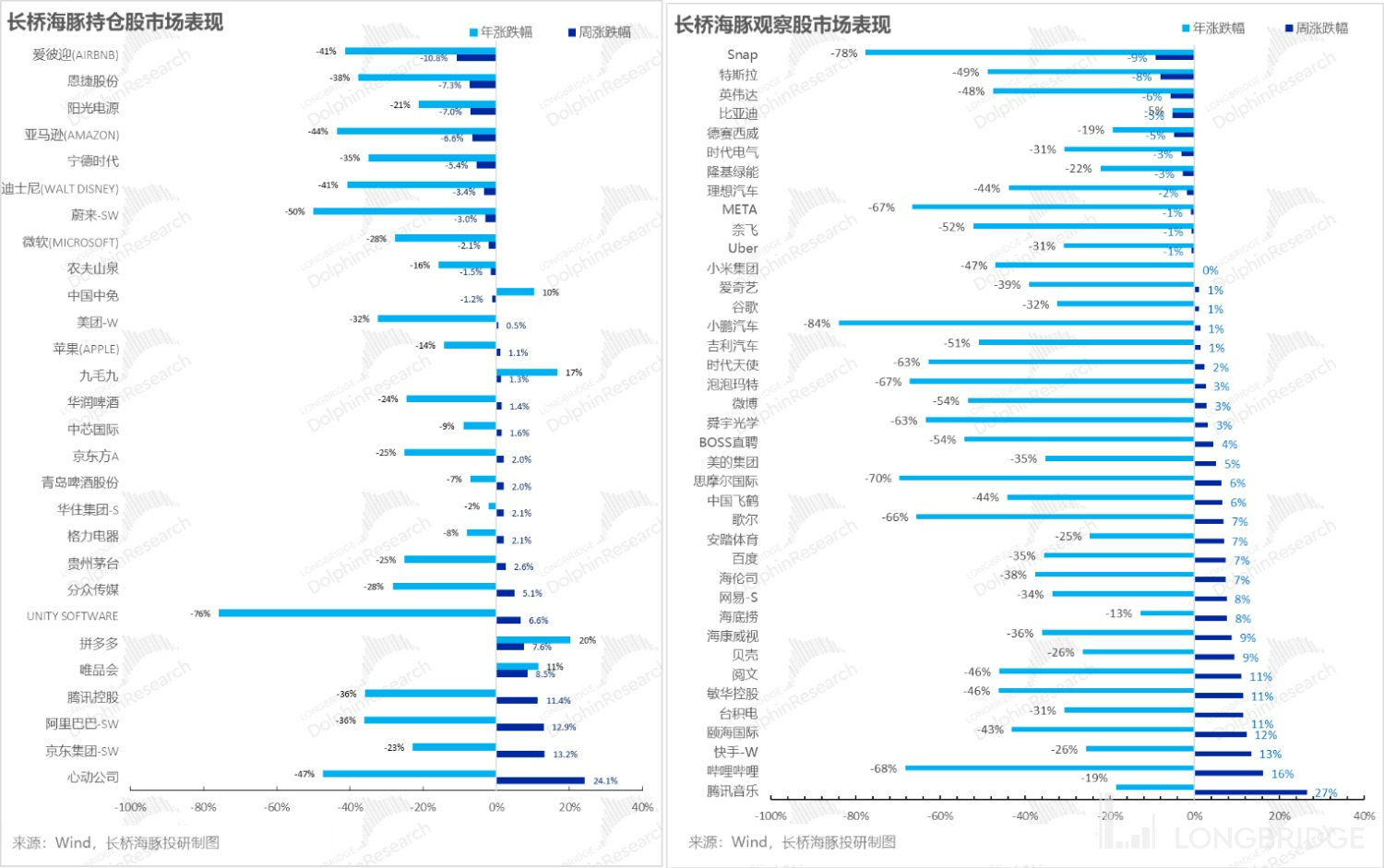

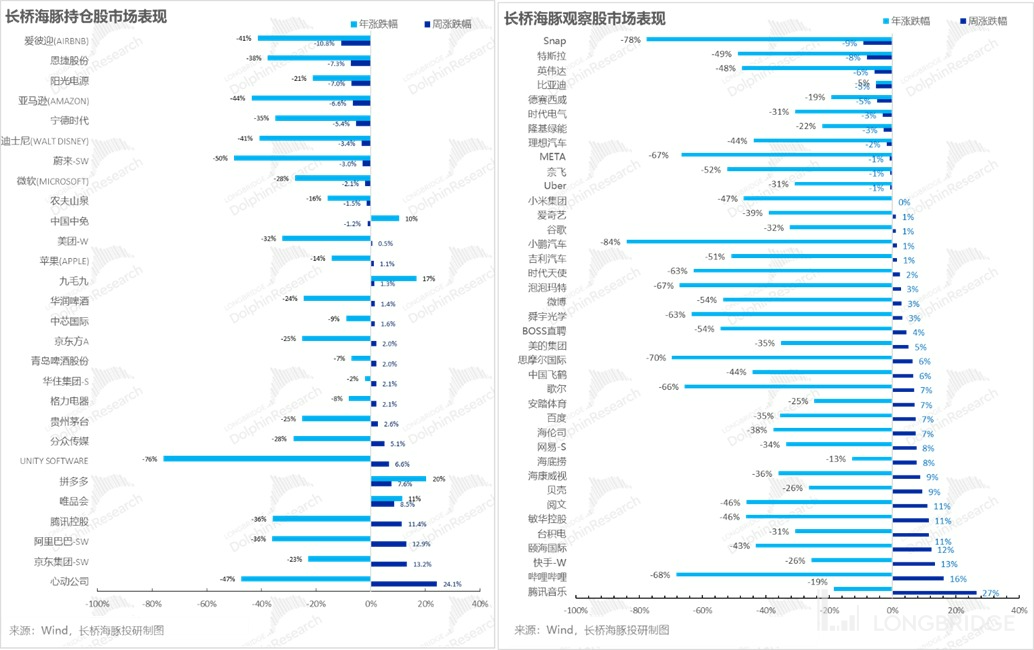

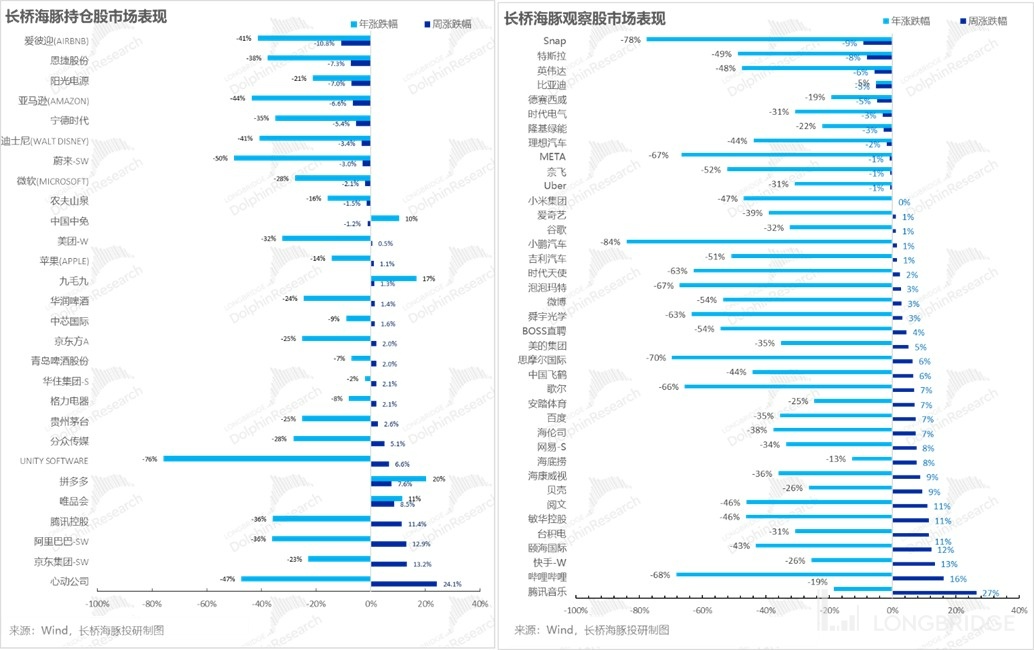

IV. Performance of individual stocks: Chinese concept stocks continue to rebound, new energy is still bleak, U.S. stock market turns back

Last week, the Dolphin Analyst's portfolio was mainly supported by Chinese internet and consumer assets. However, the cash position and new energy position affected the portfolio's ability to recover profits.

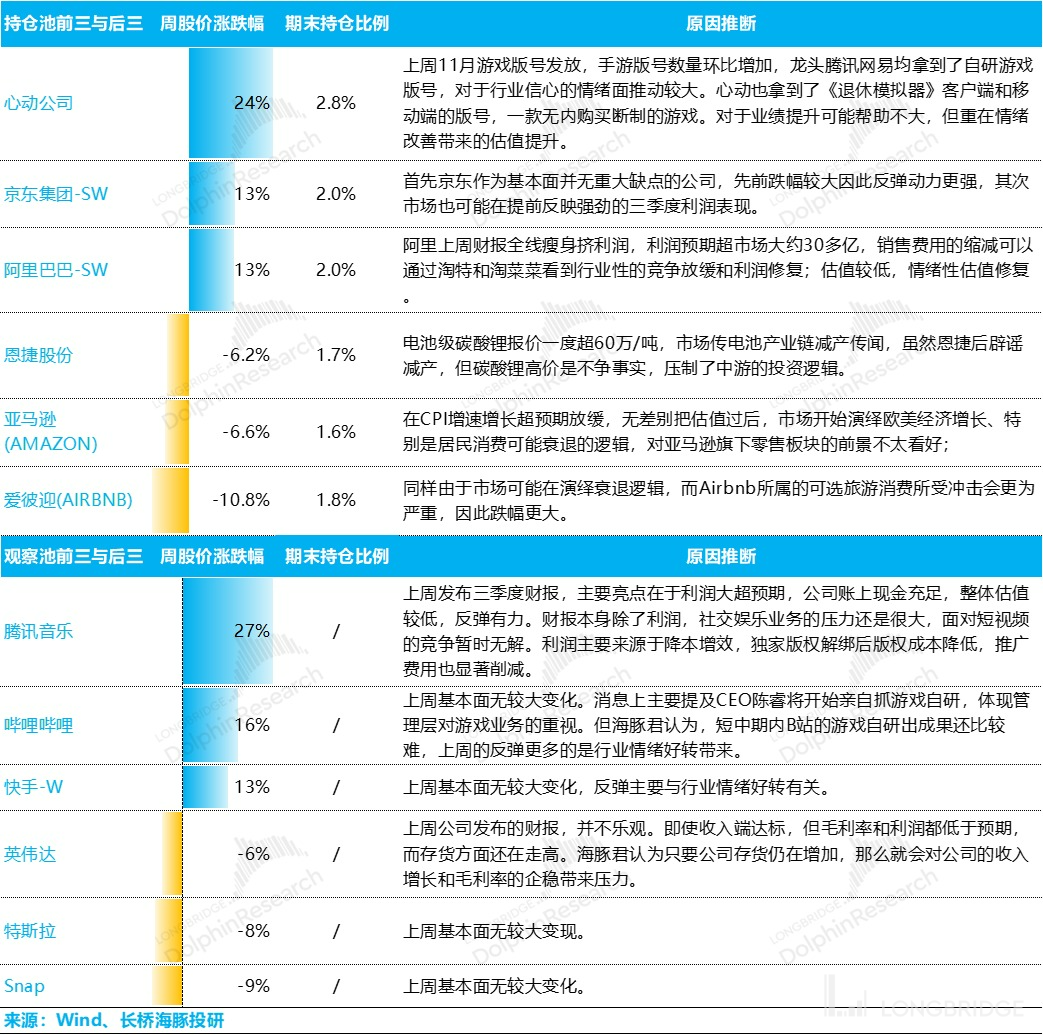

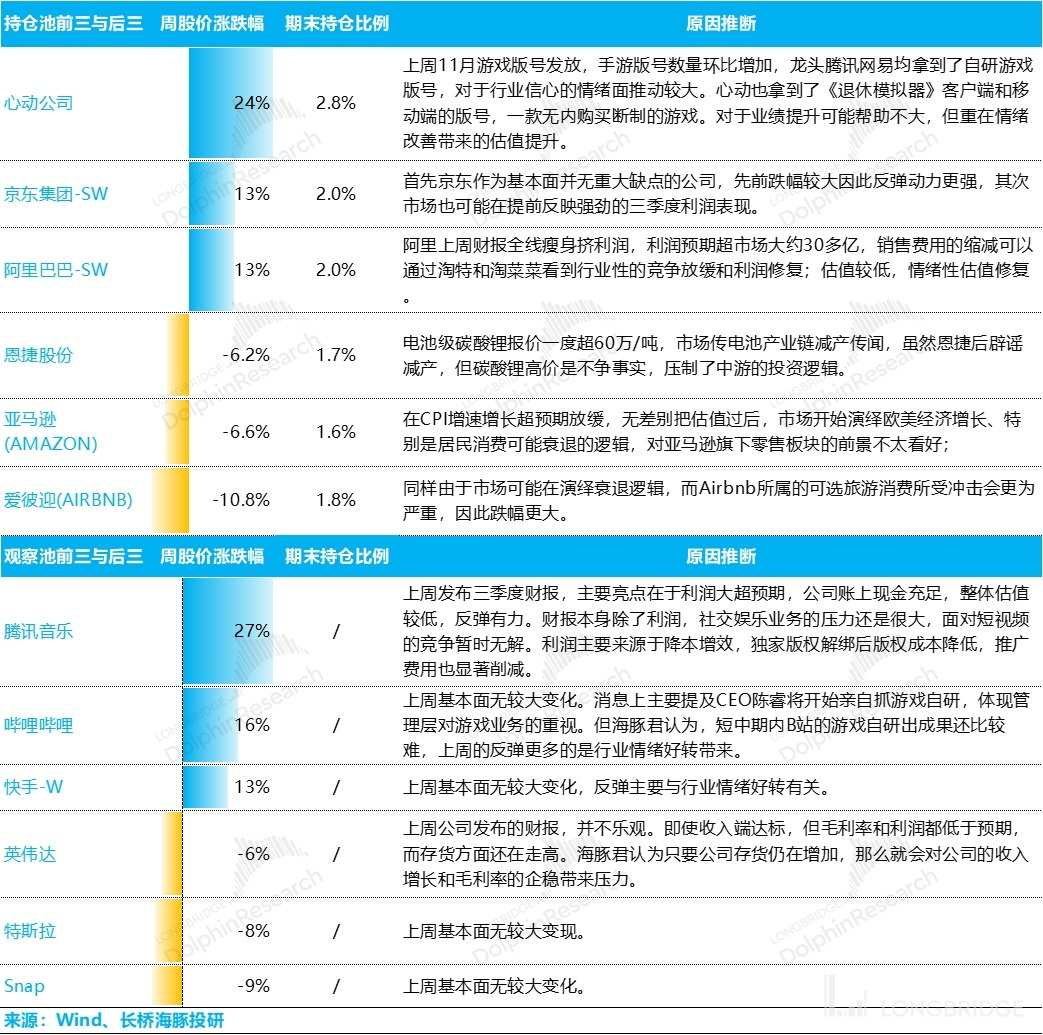

For companies with large fluctuations in stock prices, the Dolphin Analyst has compiled the driving reasons as follows for reference:

From the north-south fund flow of the Dolphin Analyst's stock pool, funds continue to flow into undervalued companies such as Midea, Gree, and Tencent, and the inflow of shares of Focus Media has increased significantly. After absorbing the product yield issue, funds are also flowing into GoerTek.

On the outflow side, the top of the list is clearly Kuaishou, Haidilao, SMOORE, Geely, and others who had previously gone south to bottom fish. Of particular note, in addition to Xiaomi, which has been sold continuously, and under the expectation of increased competition in local life, Meituan is also being sold heavily due to Tencent's "Sunshine Mentality Award" to shareholders.

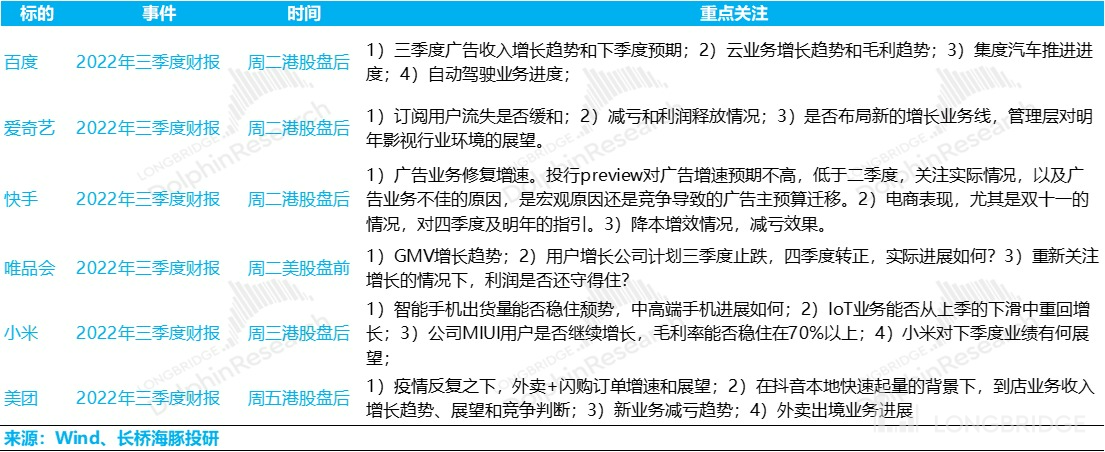

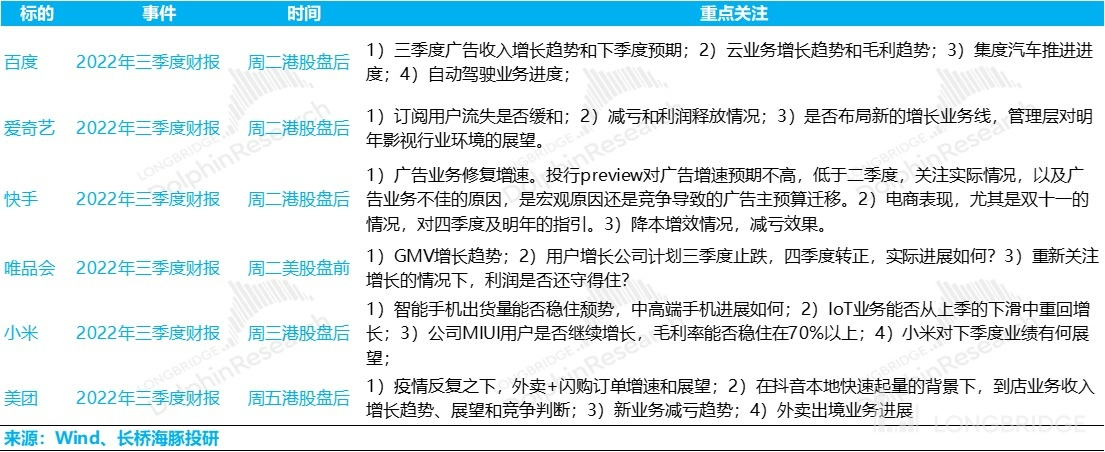

V. Key Focus this week

After Tencent, Ali, and JD.com's financial reports ended this week, the financial reports of companies such as Meituan, Xiaomi, Kuaishou, and Baidu are coming. The Dolphin Analyst's key focus on these companies is as follows:

VI. Asset Distribution of the Portfolio

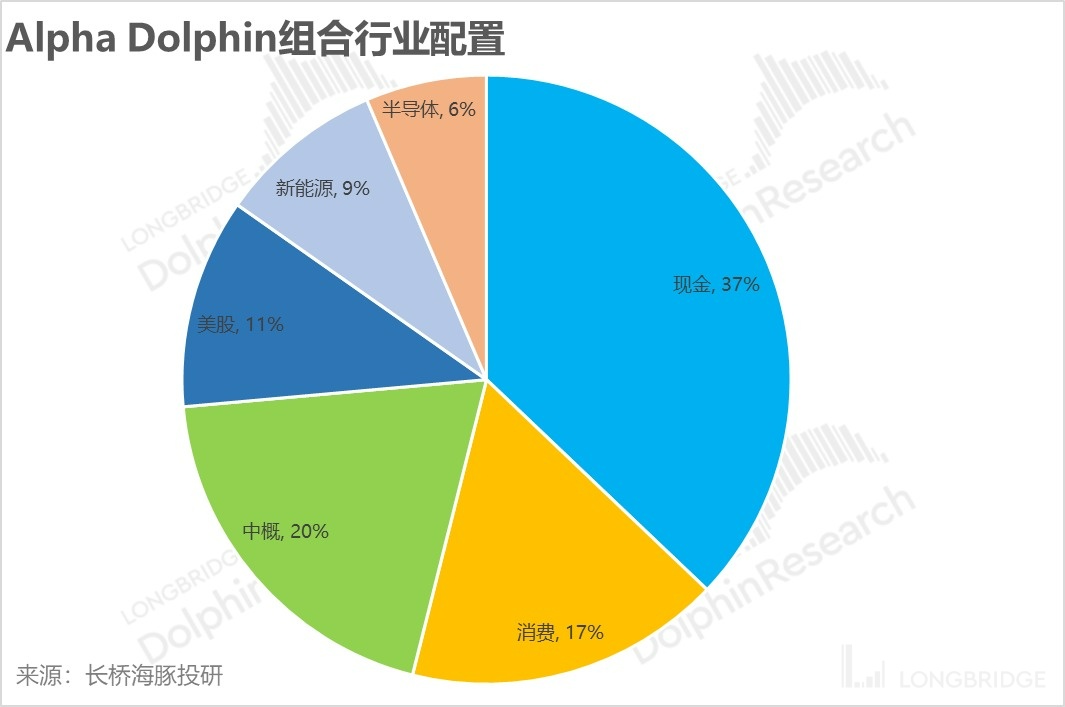

Last week, the Alpha Dolphin portfolio did not adjust its position: it still shared 28 stocks in total, of which only 3 were regular allocations, and the remaining 25 were low-allocated stocks.

However, given the situation of e-commerce competition - income is difficult to generate through profit release to drive performance, but Vipshop has turned back to growth. After the Vipshop share price has been repaired, the Dolphin Analyst plans to adjust the holding position in real-time this week. As of last weekend, Alpha Dolphin's asset allocation and equity holdings were as follows:

Please refer to the following articles in recent Dolphin Analyst weekly reports:

"Global Valuation Repair? Still A Check On Performance"

"The Violent Rise of Chinese Assets: Why The US and China Live In Different Worlds"

"Policy Change Expectations: An Unreliable "Strong US Dollar Fund" GDP Growth?"

"The Test of "Concentration" Time: Northbound vs. Southbound"

"The Dream of Slowing Down and Raising Interest Rates Is Shattered Again"

"Redefining the "Iron Blooded" Federal Reserve "

"Tragic Second Quarter: Can We Still Rebound From This Desperate Time?"

"Drowning In Doubt: Is There Any Hope For A Turnaround?"

"The Federal Reserve's Violent Hammering of Inflation: Has Domestic Consumer Opportunities Shifted?" 《Global Falls Again, US Labor Shortage is the Root of the Problem》

《The Federal Reserve is the Top Bear, and Global Markets are Falling Down》

《A Bloodbath Triggered by a Rumor: Risks Have Never Been Cleared, and Sugar is Found in the Broken Glass》

《The US is Moving Left, China is Moving Right, and the Cost Performance of US Assets is Back Again》

《Layoffs are Too Slow and Not Enough to Pick Up the Pieces. The US Must Continue to "Decline"》

《US Stocks Celebrate "Funeral" Style: Recession is Good News, and Raising Interest Rates the Most Fiercely is Called Negative》

《The Interest Rate Enters the Second Half, and the "Performance Thunder" Opens》

《The Epidemic Will Fight Back, the US Will Decline, and Funds Will Change》

《China's Assets Now: "No News is Good News" for US Stocks》

《Growth is Already in a Carnival, But Will the US Definitely Decline?》

《Will the US in 2023 Experience Recession or Stagnation?》 《US oil inflation, can China's new energy vehicles expand and become stronger?》

《As the Fed speeds up interest rate hikes, China's asset opportunities arise》

《US stock inflation hits the roof again, how far can the rebound go?》

《The most grounded portfolio, Dolphin Investment is launched》

Risk Disclosure and Statement of This Article: Dolphin Disclaimer and General Disclosure