Meta: Another Plunge Nightmare? More Shocking Than Thrilling

Hello everyone, I am Dolphin Jun!

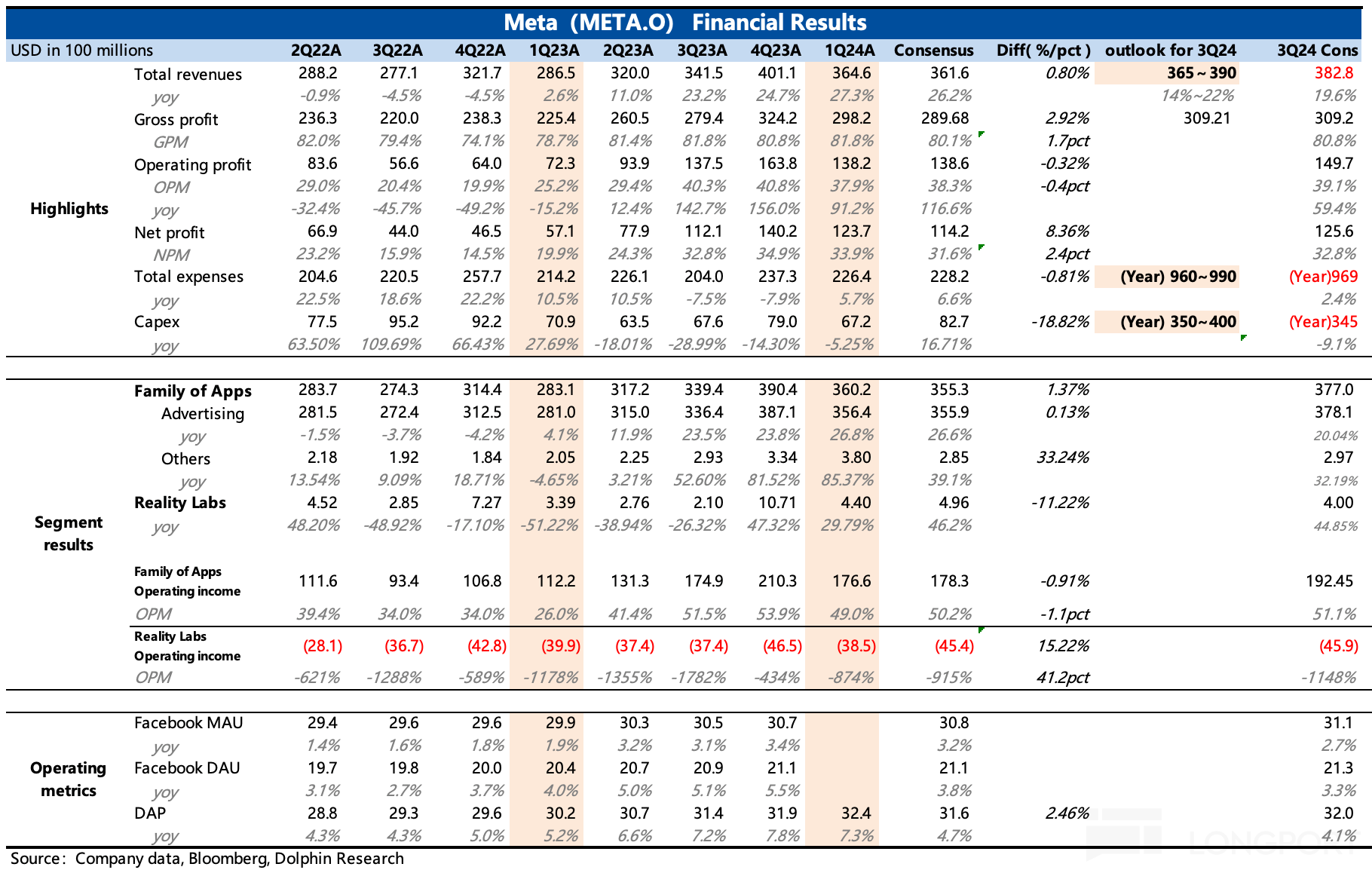

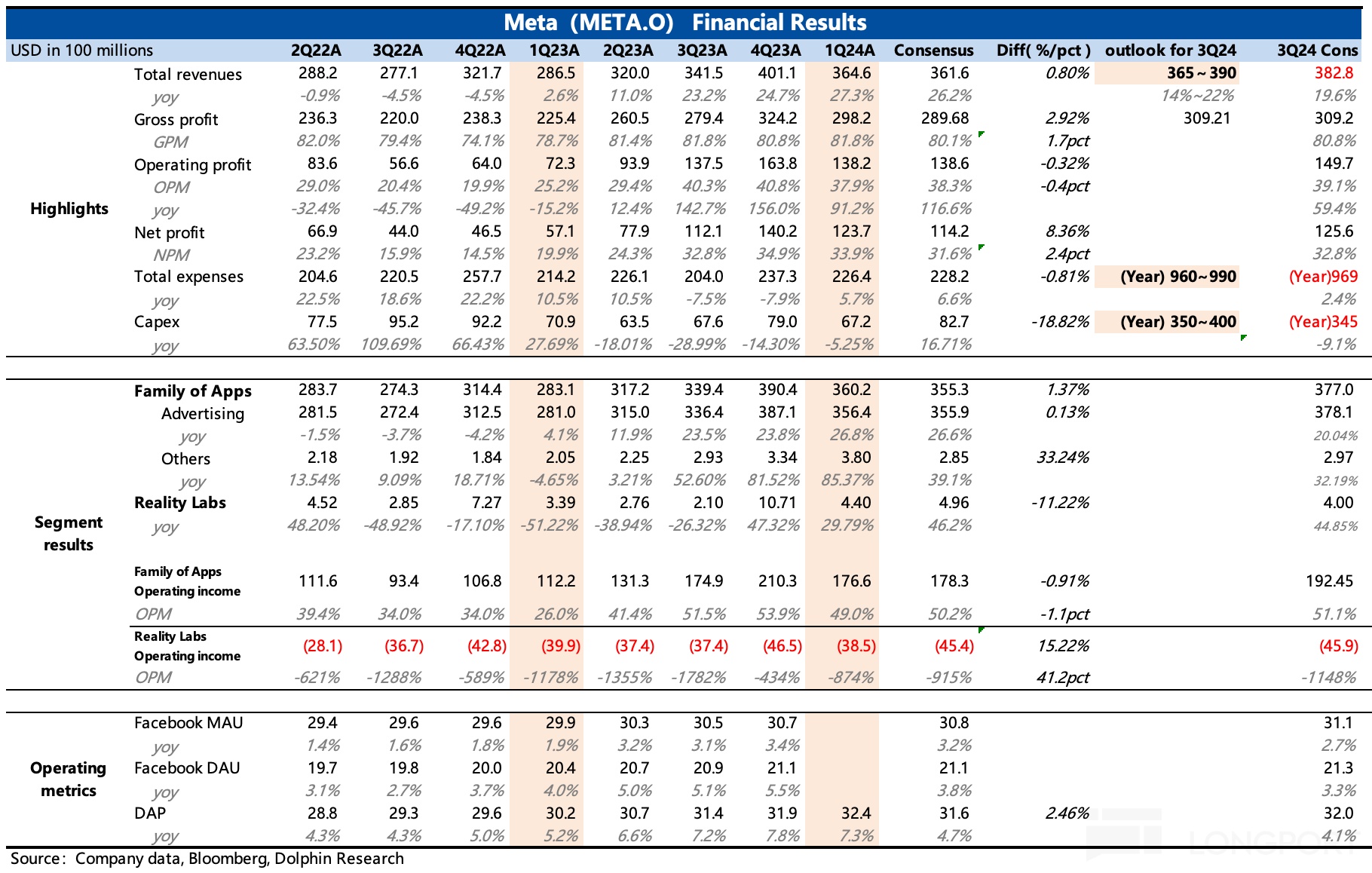

Meta Platforms released its first-quarter financial report for 2024 this morning (April 25th Beijing time). The biggest issue in the first quarter report is the low revenue guidance for Q2 + increased expenditure guidance, which compresses profits from both ends, weakening the market's expectation for the company's continuous improvement in profitability.

The significant post-market stock price fluctuations are more based on the previous quarter's high advertising prosperity, combined with the current market's full recognition of Meta's advantages, so the overall valuation is not considered low. The "expectation gap" caused by the first-quarter report makes it difficult to avoid a dual adjustment of Meta's EPS and valuation by the market.

Key points of the financial report:

- Another guidance thunder: Weak revenue + increased expenditure, whose responsibility is heavier?

Meta's first-quarter performance was good, confirming the high advertising prosperity in Q1, but the guidance hid some thunder. On one hand, the company's revenue guidance for the second quarter did not significantly exceed expectations like the previous quarter, with a median of 37.8 billion compared to the market's expectation of 38.3 billion, slightly weaker. On the other hand, Meta also raised the guidance range for annual operating expenses and capital expenditures, stating that the increased spending will mainly be used in AI, and revealed that Capex will continue to grow in 2025.

This seems a bit unfair. Firstly, Meta's capital expenditures are among the highest among the major tech giants, not matching the actual revenue scale. Secondly, just last quarter, the expenditure guidance was raised, and during the conference call, Mark Zuckerberg also emphasized that the computing power is sufficient. Raising the budget again just three months later appears relatively casual or extravagant in budget management.

So, which point does the market care more about, weak revenue or increased expenditure?

Dolphin Jun believes that although the continuously increasing expenditure is unpleasant, the market should be more concerned about the slightly weak revenue guidance for the second quarter. The current period belongs to a crucial stage of AI technological transformation, and it is also the moment when the giants are setting the stage, naturally implying a new round of investment cycle. Moreover, the impact of AI on Meta's platform user stickiness and optimization of advertising business has been confirmed in the first two quarters, with the recent release of Llama-3 receiving positive user feedback. Therefore, compared to the metaverse two years ago, the market's tolerance and credibility for investing in AI are evidently higher.

However, it is difficult to ignore the slightly weak revenue guidance. It is worth paying attention to the management's explanation during the conference call, whether it is related to the partial platform downtime at the end of March, significantly high advertising prices, and the reduction of marketing budgets for cross-border e-commerce and game developers in China. Market expectations for Meta's growth in 2024 are high, exceeding 17%, and if the second quarter is only 14%-22%, the growth pressure in the second half of the year with a high base will be even greater2. User disclosure adjustment: Overall growth remains stable

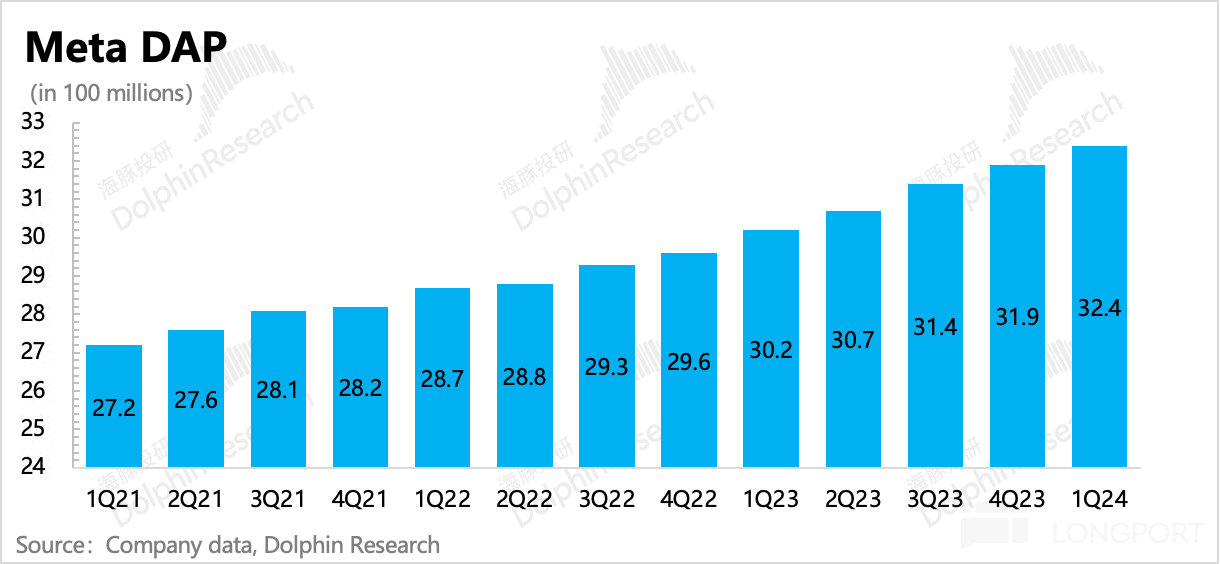

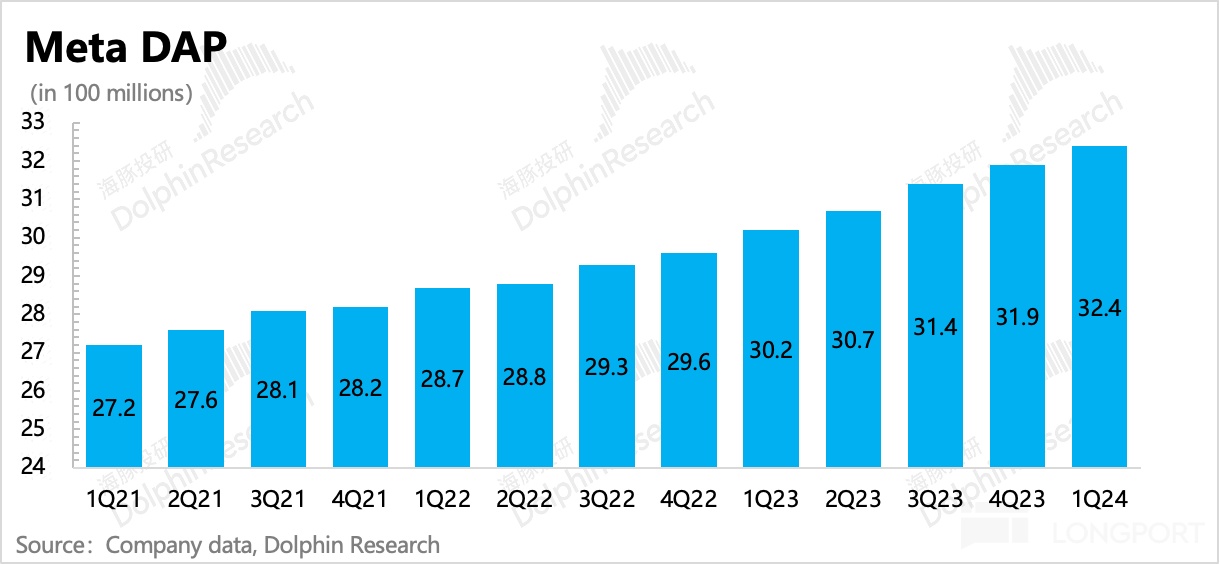

Another change in this financial report is that only the overall daily active users (DAU) of the platform ecosystem were disclosed, reaching 3.24 billion, a year-on-year increase of 7%, exceeding market expectations. The DAU and MAU situation by region and on the Facebook main site itself were not disclosed this quarter.

However, Meta supplemented the disclosure of advertising volume and price trends by region. From this, it can be roughly inferred that the daily active user situation by region is as follows: strong growth in the Asia-Pacific region, followed by North America, with Europe being the weakest. However, it is difficult to separate the user numbers of the Facebook main site itself.

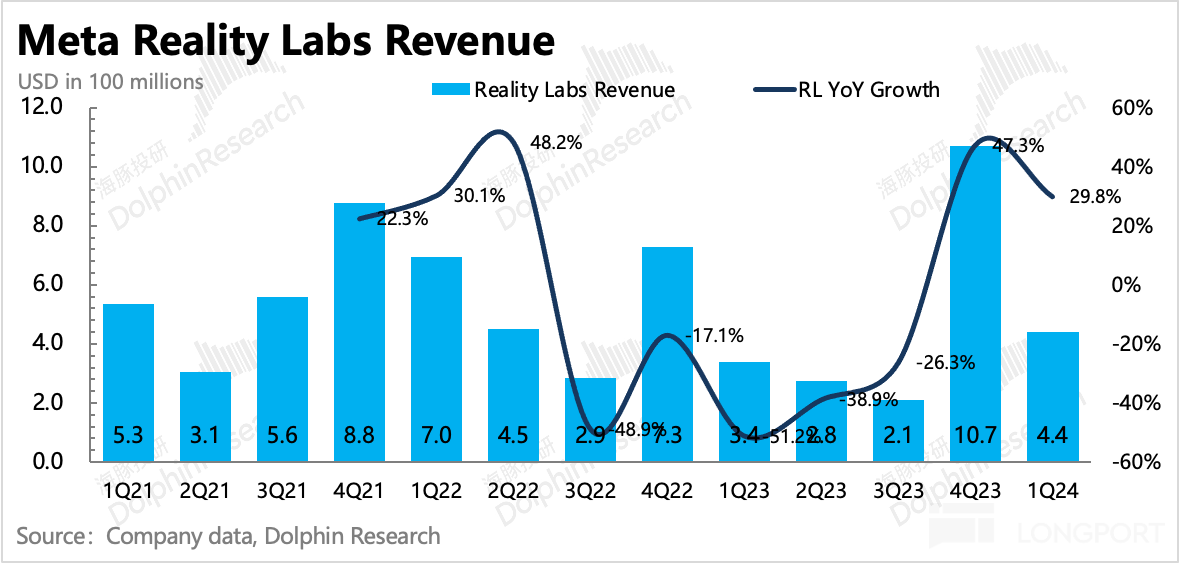

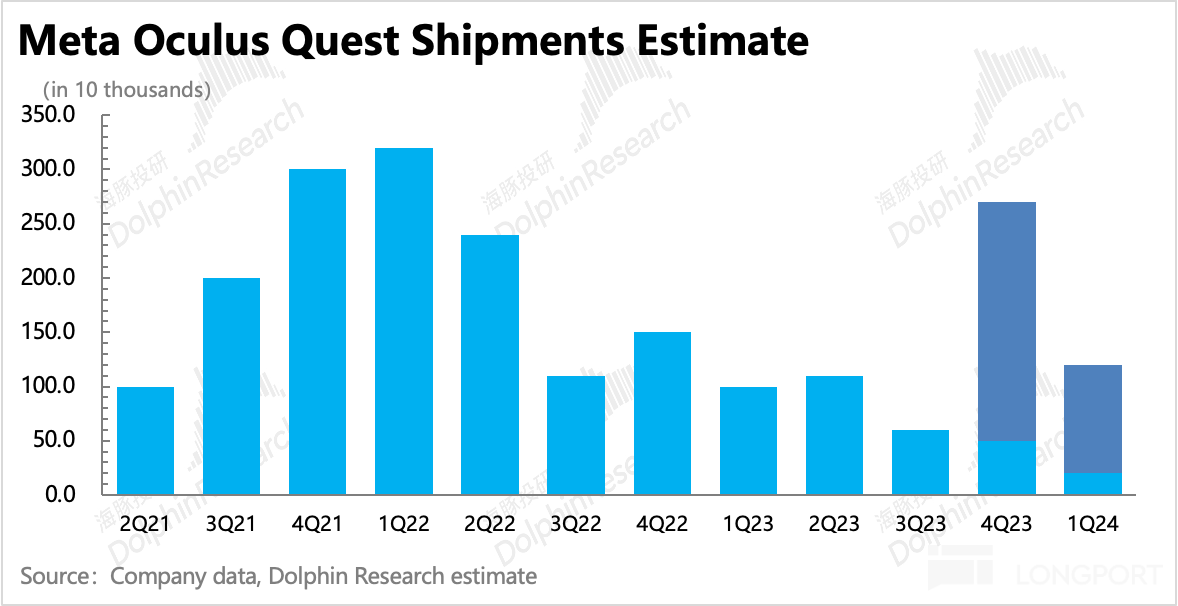

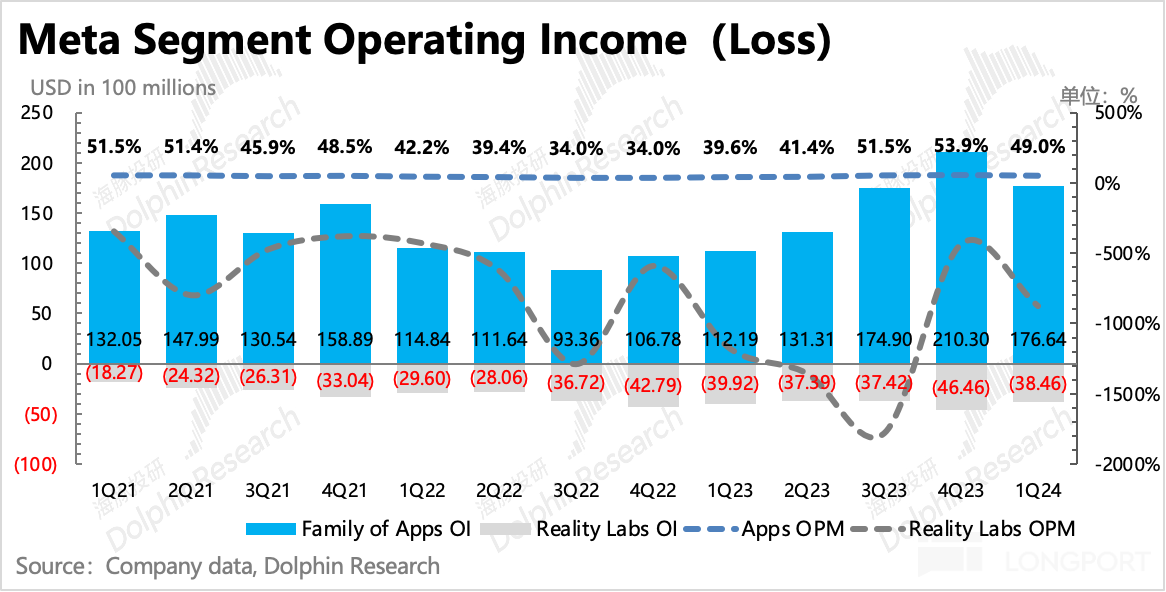

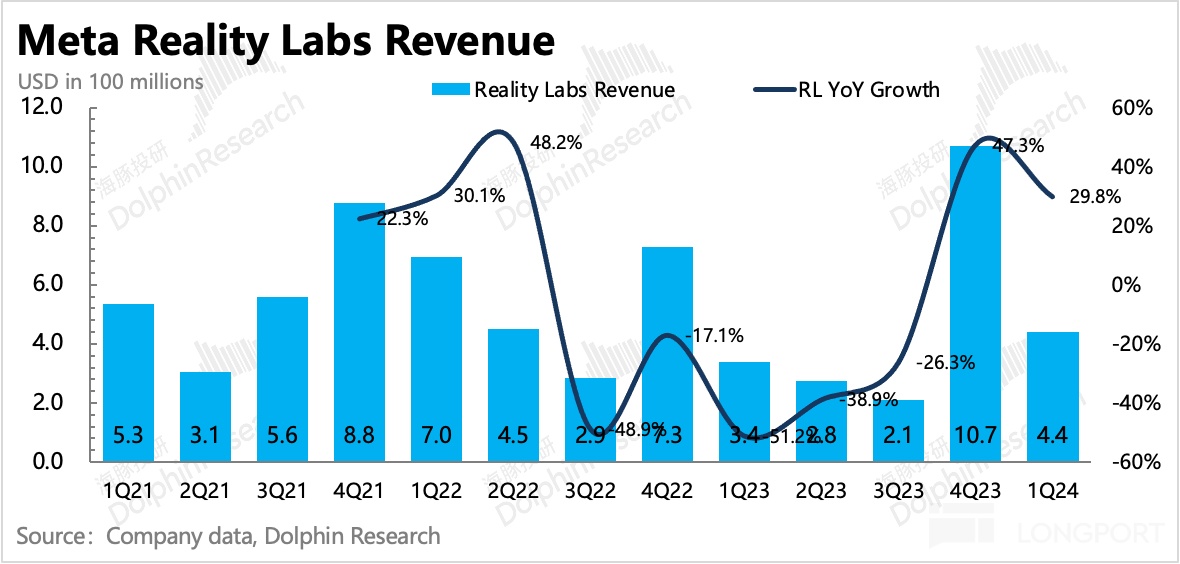

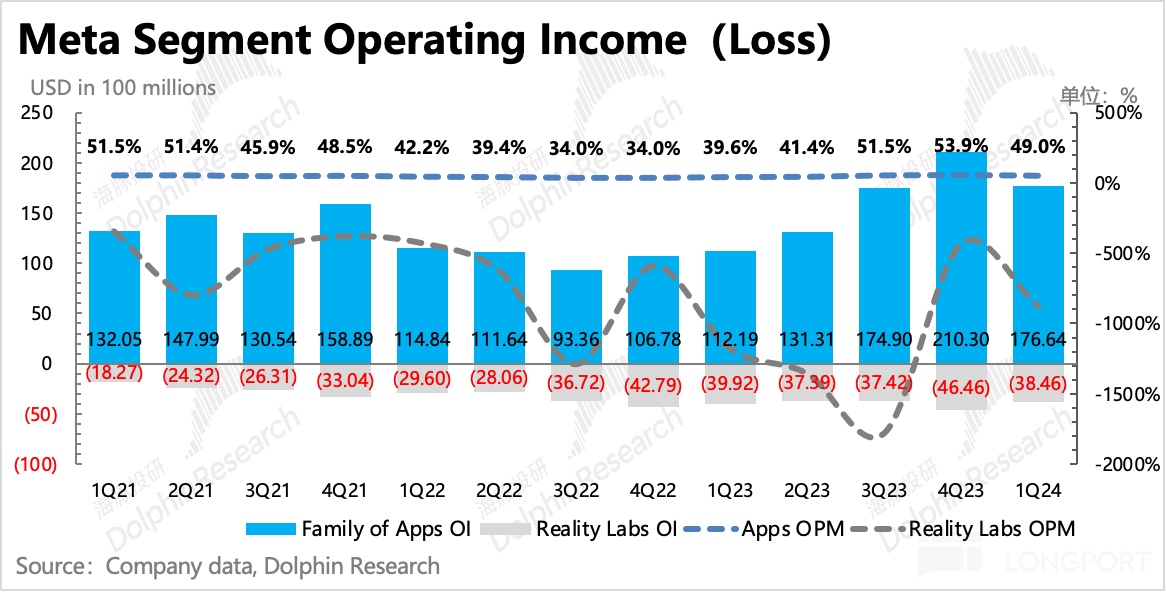

3. VR: Decline in new product popularity

Without the consumer atmosphere of the shopping peak season and the novelty of new products, the popularity of Quest 3 has significantly declined. The VR segment's revenue in the first quarter was 440 million, lower than the market's expected 496 million. At the same time, the operating loss rate has widened again, but it did not cause substantial negative impact as the market expectations were sufficient.

Recently, Meta has opened up the VR operating system Horizon OS, but it may not be seen in terminal volume effects so quickly. It might be worth observing for a while.

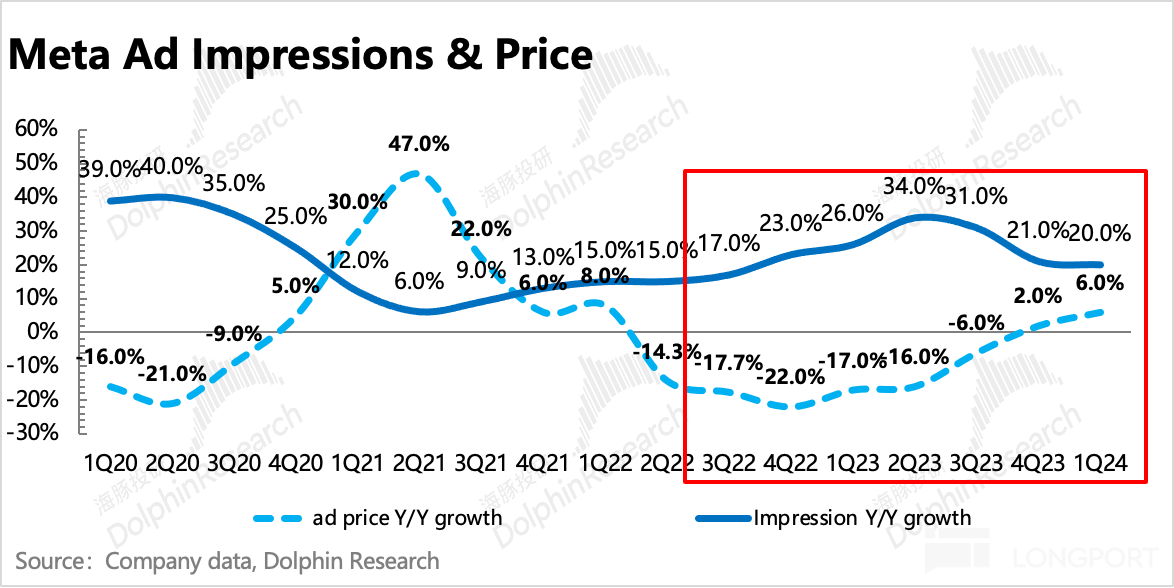

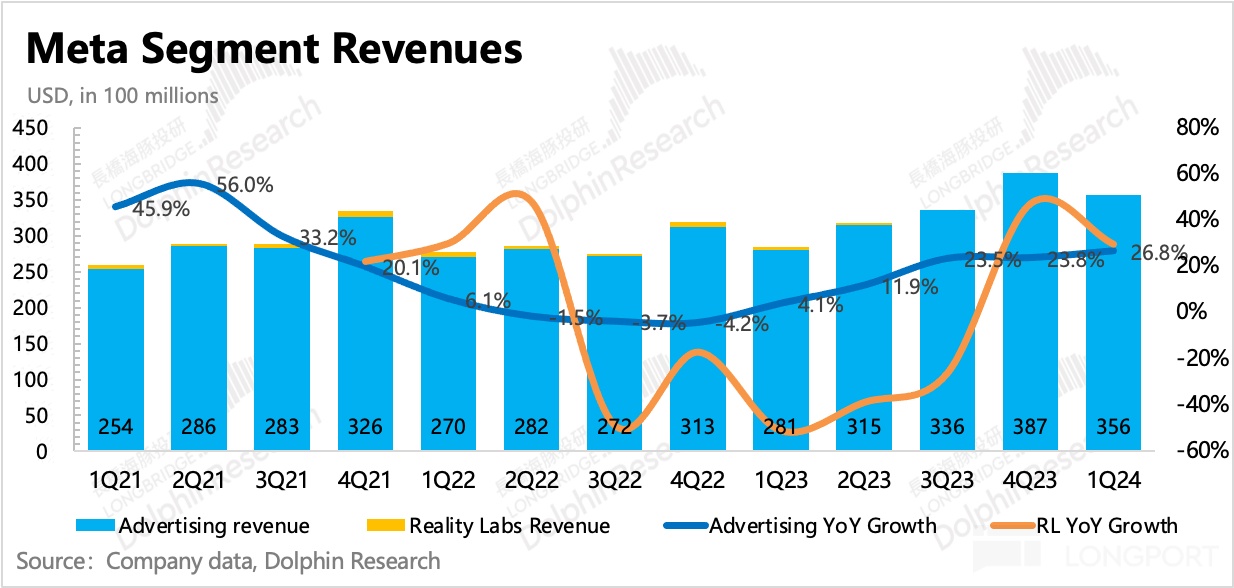

4. Advertising volume and price drive: Steady increase in unit price brings more marginal impact

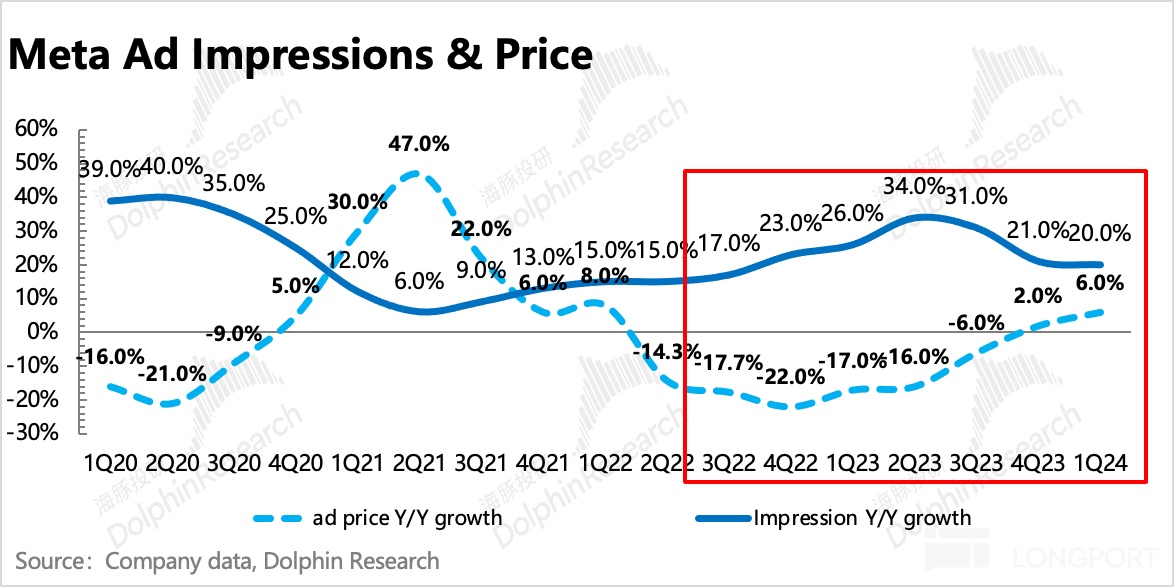

From the perspective of the relationship between advertising volume and price, the main driving force for strong advertising in the first quarter is still the increase in ad impressions, with a 20% year-on-year growth. However, in terms of marginal changes, the continuous increase in ad unit price has a greater impact on accelerating the growth rate of advertising revenue on a quarter-on-quarter basis.

The growth rate of advertising unit price in the first quarter increased from 2% in the previous quarter to 6%, which is related to strong macroeconomic conditions and Meta's own competitiveness. In addition, it also implies an increase in the advertising ROI of Reels, an increase in pricing competitiveness, and a corresponding reduction in the overall drag on the group.

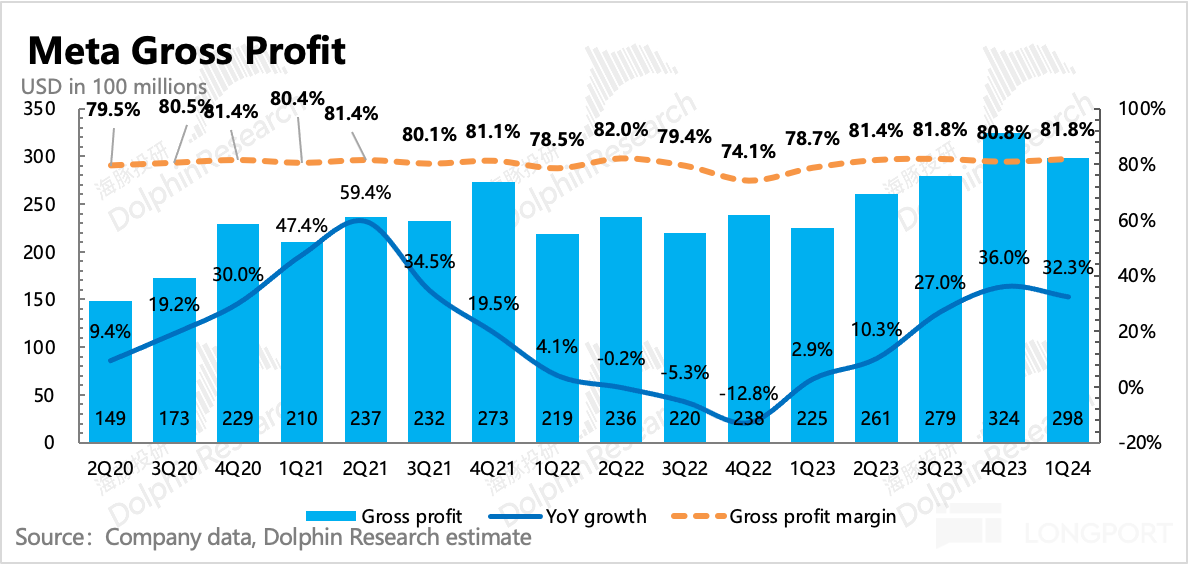

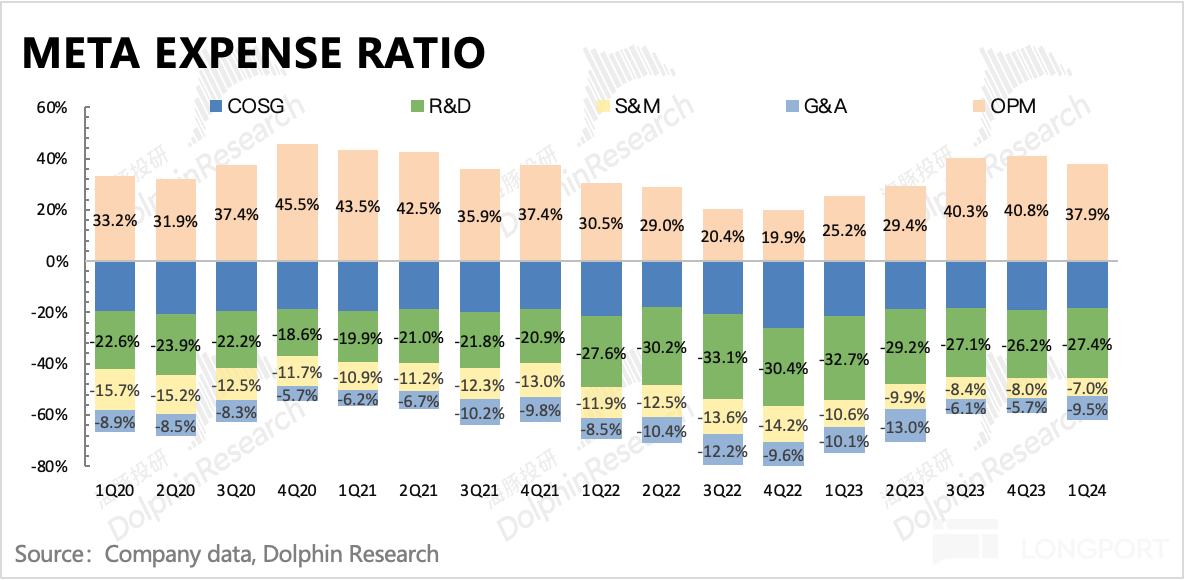

5. Profit: Record high gross profit margin, accelerated employee expansion

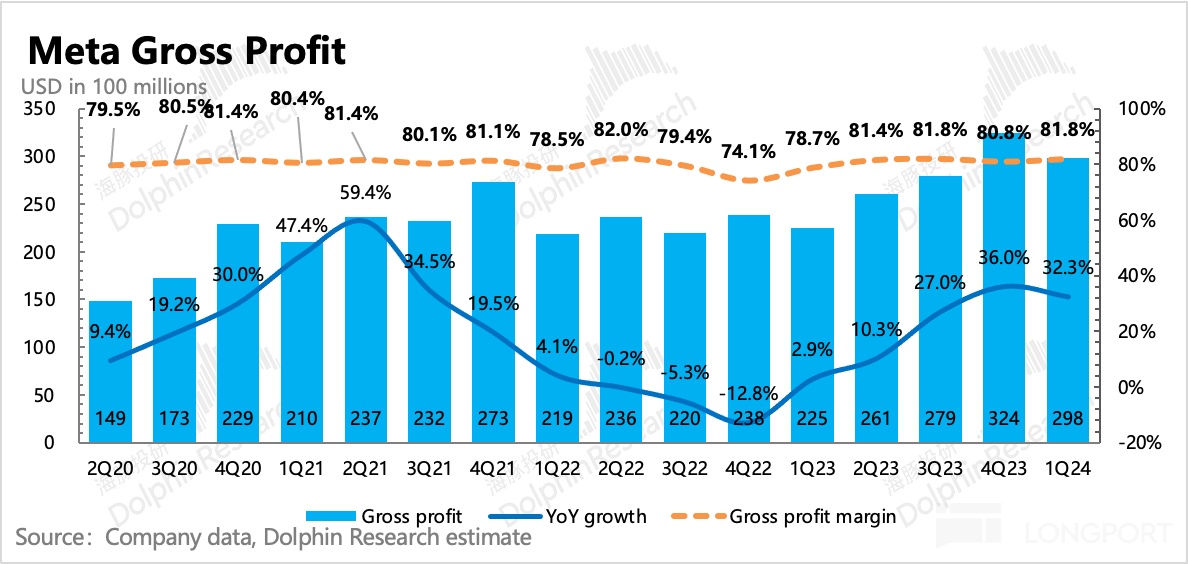

In the dividend period of improving platform ROI driven by AI video recommendations to increase user stickiness, Meta's gross profit margin further increased to 81.8% on a quarter-on-quarter basis, which is also a record high level for Q1 in previous years.

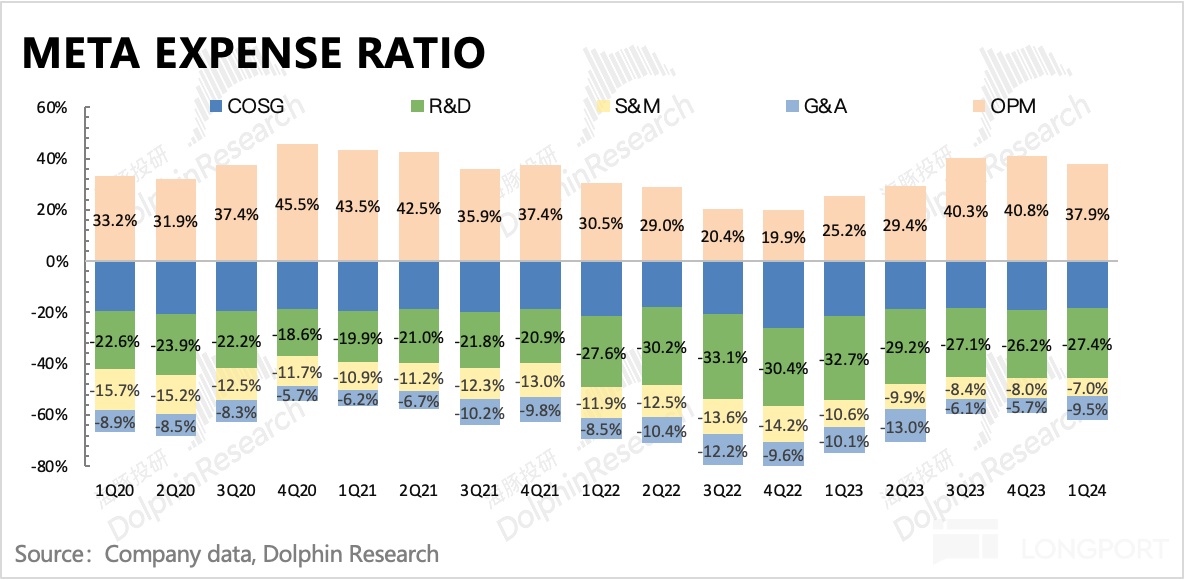

However, in terms of operating expenses, Q1 saw a return to growth, resulting in a final operating profit margin of 37.9%, slightly lower than market expectations. Although the 5% growth rate in operating expenses is not high, with a net addition of 2012 employees in Q1, showing a certain acceleration compared to the previous quarter, it is expected that expenses will continue to increase in the second half of the year. The efficiency improvement cycle brought about by the previous round of layoffs is nearing its end, with only a slight optimization space left for sales expenses.

Dolphin's Viewpoint

The biggest issue in the first quarter report is that while the Q2 revenue guidance is slightly below expectations, the company has also raised the guidance range for total spending and capital expenditures for the full year 2024, creating a situation similar to compressing profit expectations from both ends, reminiscent of the nightmare two years ago. Under this "expectation gap," it directly affects the market's judgment on the short-term profit improvement trend of the company. Therefore, with the stock price not being particularly low in valuation, the stock price is inevitably subject to significant fluctuations.Although it is inevitable to avoid the dual adjustments of full-year EPS and valuation in the short term (post-market capitalization corresponds to PE 20x/18x for 2024/2025, assuming a 10% downward adjustment in market earnings expectations for 2024, corresponding to PE 22x), objectively speaking, Dolphin believes that there may be an overreaction in the short term, and it is definitely not suitable to extrapolate the trend from two years ago.

Compared to the darkest moments starting now and in the second half of 2022, there are actually significant differences. On one hand, the Opex and Capex increases promised by the management are mainly used for AI, and the logic of AI driving business growth has been able to be demonstrated. It is possible that by 2025, it will further drive revenue growth rather than the expected decline. On the other hand, the competition deterioration issue that hurt logic the most last time, at least for Meta at the moment, does not exist, and instead, the recent issues of TikTok bans/divestitures have been repeatedly discussed.

Therefore, we believe that in the short term, the "pressure" beyond profit expectations is not the core issue. After squeezing out the valuation premium, changes in the macroeconomy and competitive landscape are the key factors affecting mid-term valuation.

As an advertising giant, the "expectation gap" issue for Meta's financial report tomorrow serves as a similar warning for Google, which will release its financial report. While adjusting advertising revenue expectations, capital expenditures are also expanding. However, Google also has a cloud business. Since the end of the Next conference in early April, due to the company's positive outlook on AI empowering Google Cloud, the market's growth expectations for the cloud business have increased compared to the beginning of the year, and it is expected to offset some of the potential gap caused by the "expectation gap" in advertising revenue.

Detailed interpretation below:

I. Another Warning Sign: Weak Revenue + Increased Expenses

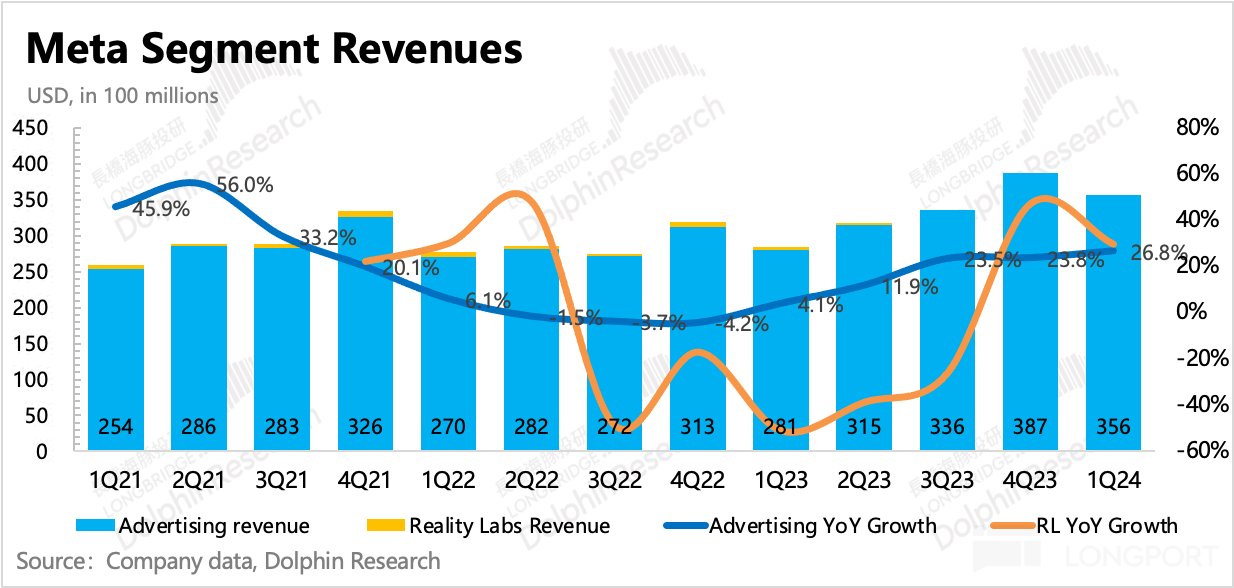

In the first quarter, Meta's revenue was 36.5 billion, a year-on-year increase of 27%. Although the base number has increased, the quarter-on-quarter growth is still accelerating. The main area that exceeded expectations is the advertising business, accounting for 98%, while VR revenue fell below expectations due to the cooling of Quest 3's popularity.

However, there are two hidden warnings in the guidance:

(1) Weak Revenue

Meta's management expects total revenue for 2Q24 to be in the range of 365-390 billion, corresponding to a year-on-year growth of 14%-22%, with the median slightly below market expectations. Although Meta's guidance style tends to be conservative and low-key, the upper end of the guidance range is only in line with the current market expectations, which is a stark contrast to the performance of the previous quarter.

At the end of March and early April, both Instagram and WhatsApp under Meta experienced nearly 2 hours of downtime, which may have also affected advertising conversions in the second quarter. Meanwhile, compared to higher and still growing ad prices among peers, some advertisers may consider weighing actual ROI. The combination of these two factors may also have a significant impact on short-term revenue growth in Q2.

1. Ad Volume and Price Rise Together

Looking at the driving factors behind the changes in ad volume and price, as well as their sustainability:

(1) Ad impressions continue to grow rapidly by 20%. Apart from the expansion of user base (ecosystem total daily active users DAP increased by 7% year-on-year), the average ad impressions per user have also increased.

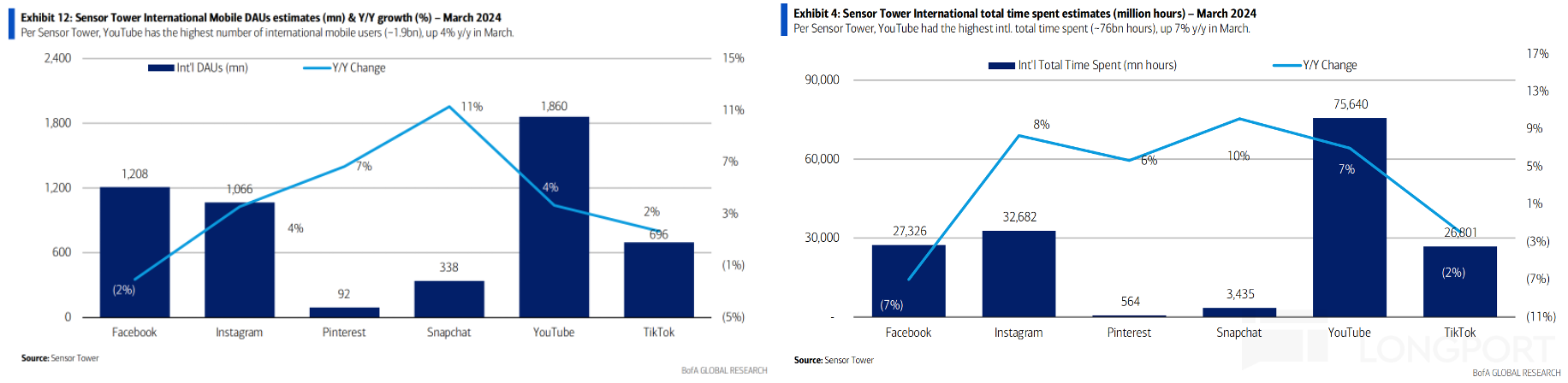

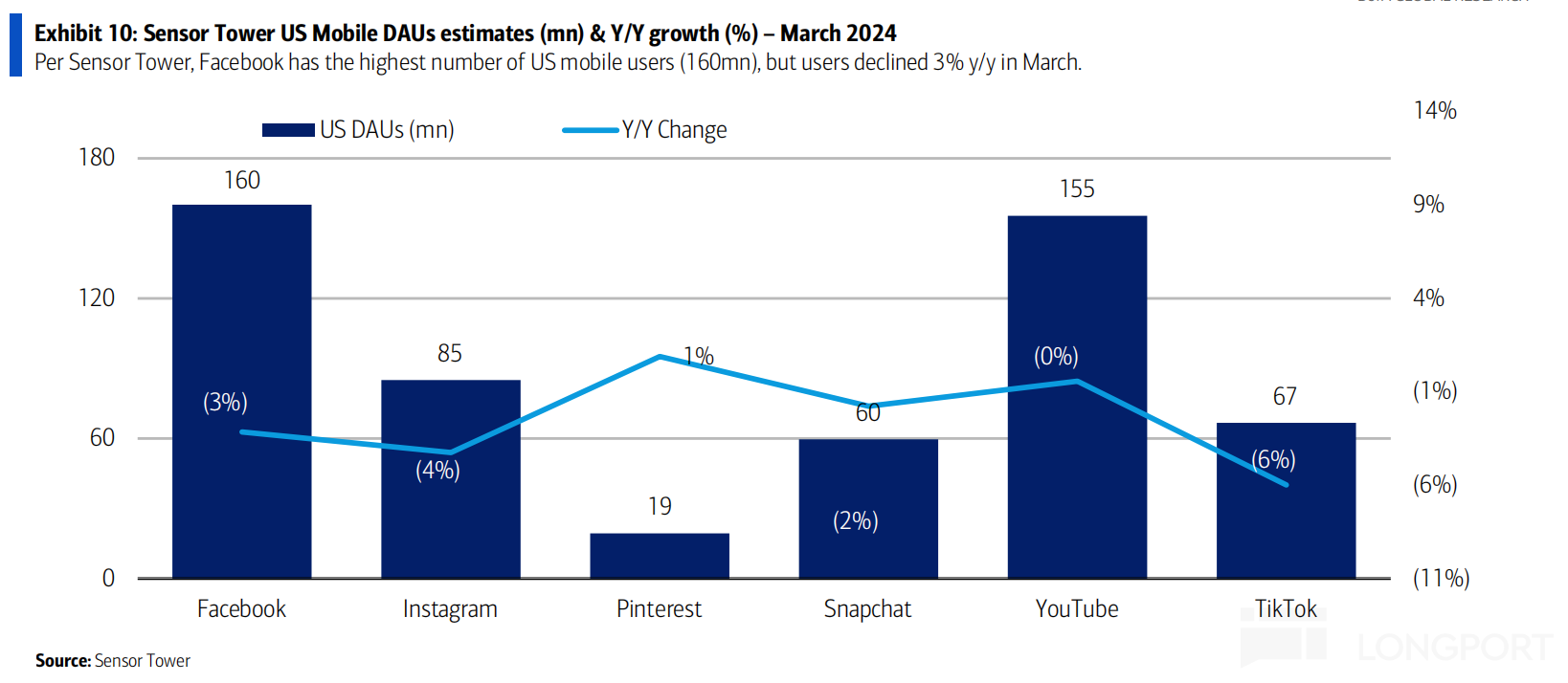

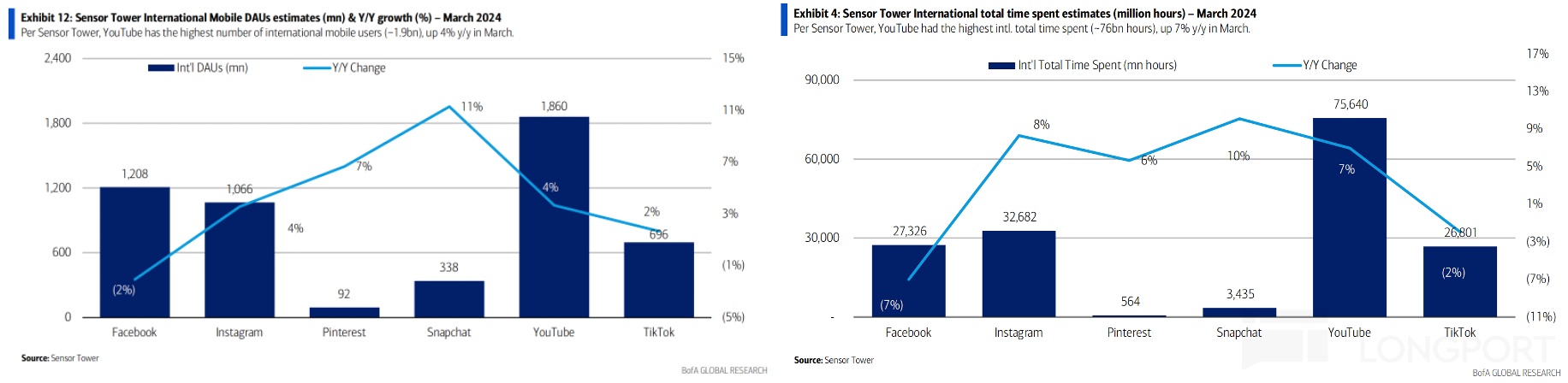

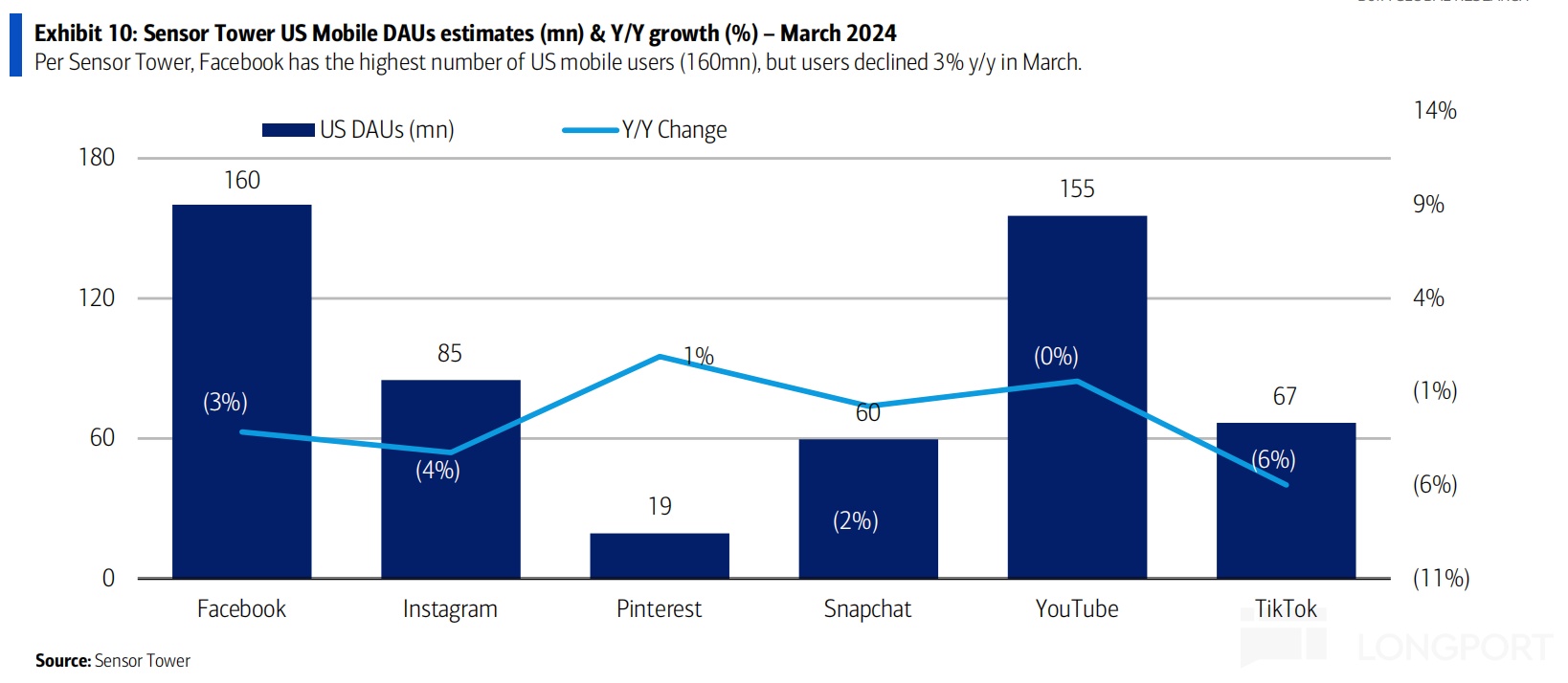

As Facebook's main site and ecosystem monthly active users were not disclosed this quarter, we can only rely on third-party data platforms. Regardless of Facebook or Instagram, user growth in North America is limited, mainly coming from international regions. Instagram continues to lead the growth, with international DAU increasing by 4% year-on-year, driving total watch time up by 8%, while Facebook's user base is declining year-on-year.

Tracking TikTok's performance as a direct competitor allows us to observe changes in the competitive landscape. In the first quarter, both TikTok and Meta faced the same issue - a decline in North American users, relying solely on international users for growth. Due to the repeated mentions of shutdowns and divestitures, TikTok's user loss in North America is even more severe.

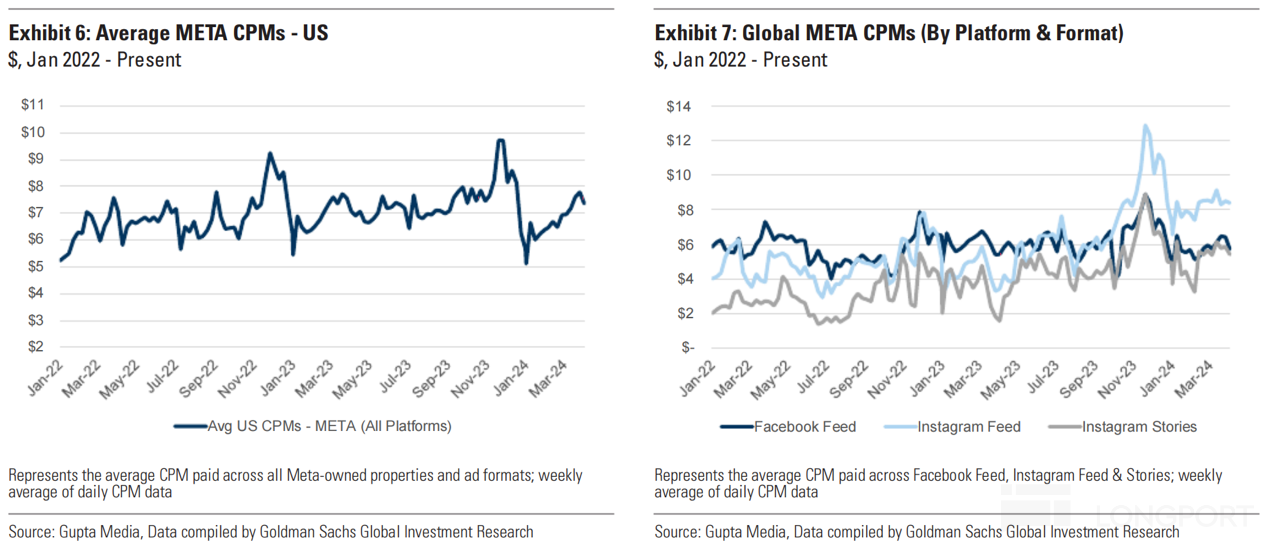

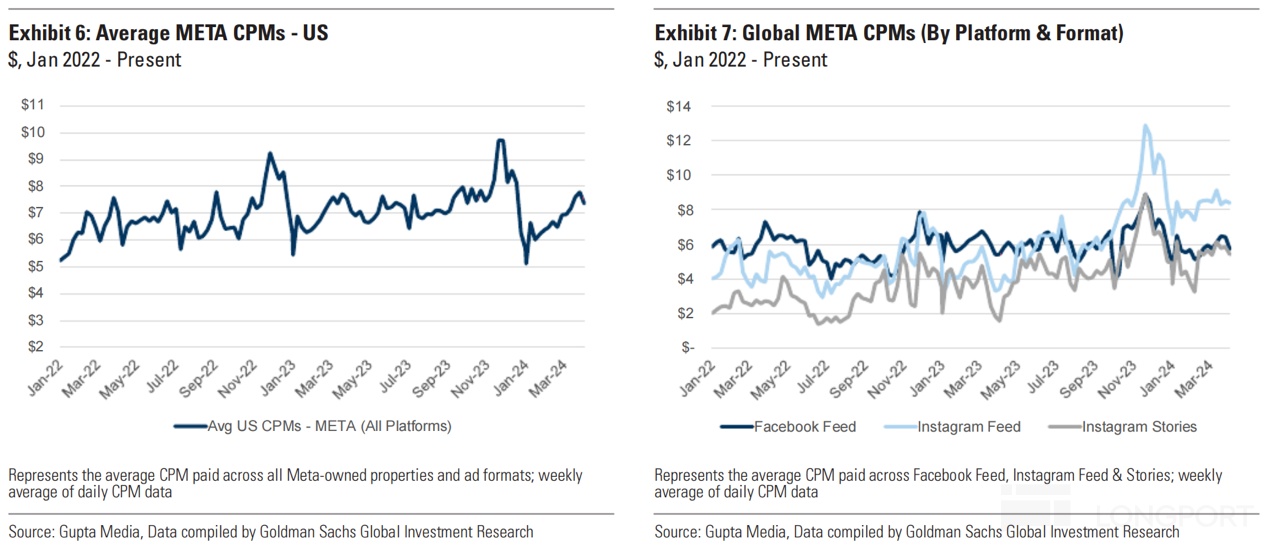

(2) Accelerated Growth in Ad Prices by 6%

As we mentioned before, ad prices are related to whether the economy is in an upswing cycle and whether the platform's competitive advantage has improved, but this is under the condition of stable traffic on the Meta platform.

In the past year, although Reels contributed new ad inventory after its launch, due to ROI issues, prices within the ecosystem remained relatively low. However, with the increase in AI video content recommendations (reaching 50% in 1Q24), ad precision and conversion rates have also improved. Coupled with a strong macro environment, industry-wide prices have remained high (initially falling at the beginning of the year, but gradually recovering in February and March), therefore Meta's ad price growth rate in the first quarter reached 6% (vs 2% in 4Q23).

2. Decline in Popularity of New VR Products

In the first quarter, VR revenue returned to calm, with a year-on-year growth of 30% on a low base, mainly due to the quick fading of the popularity of Quest 3.

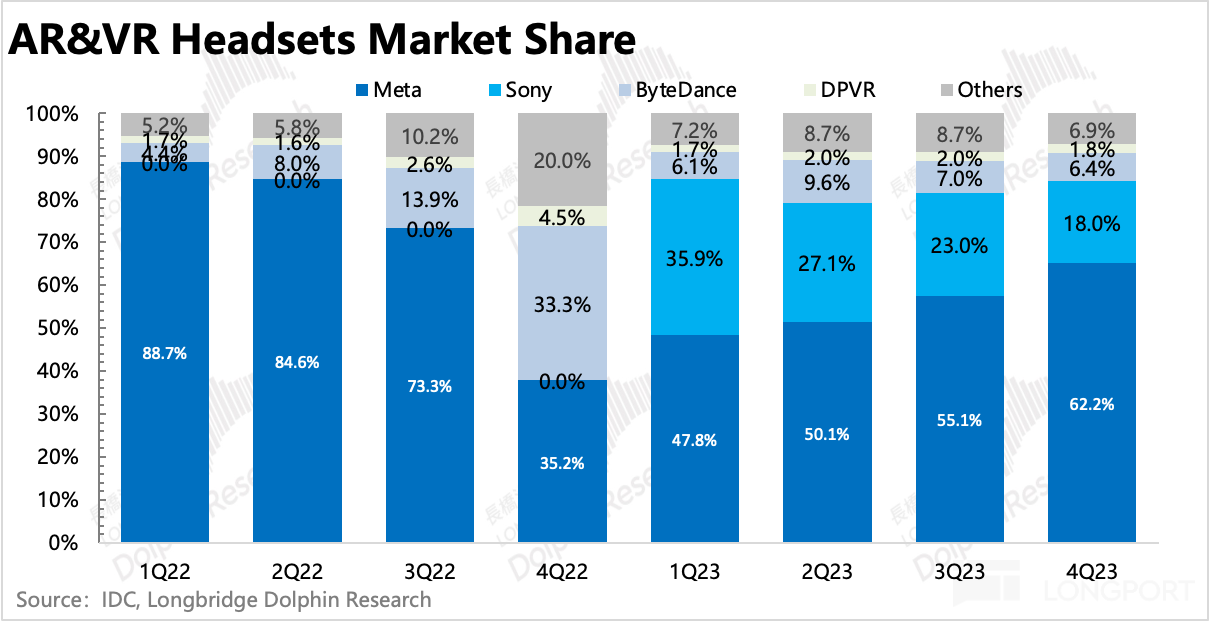

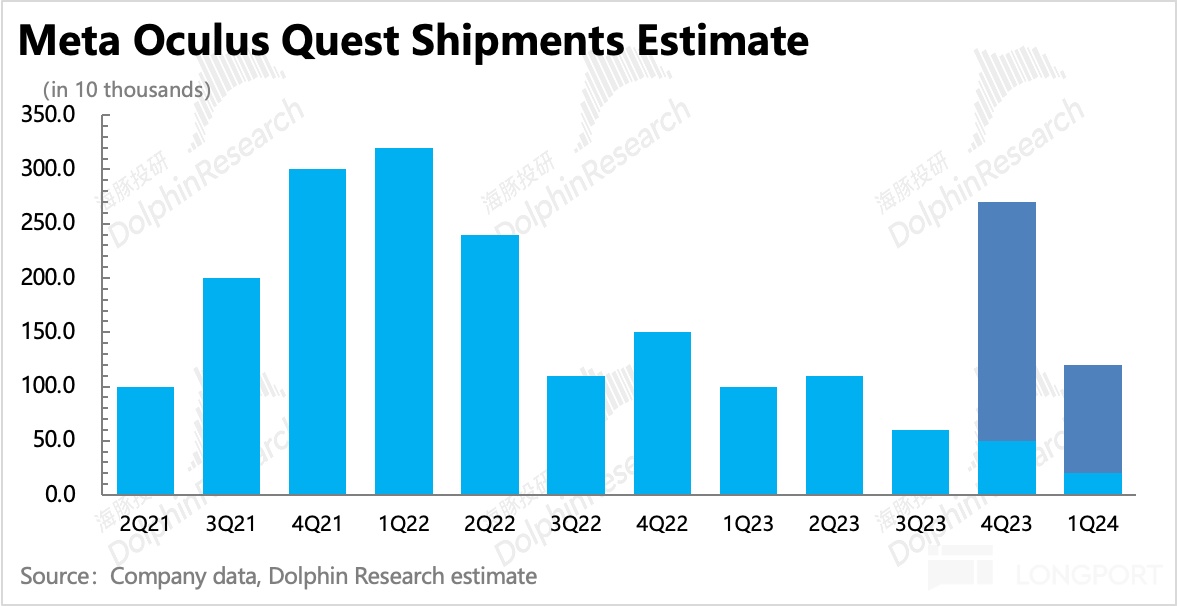

Combining IDC data and revenue calculations, Dolphin predicts that Oculus' overall sales volume in the fourth quarter will exceed 1 million units, a significant drop from the previous quarter. (All values are Dolphin's estimates, for trend reference only)

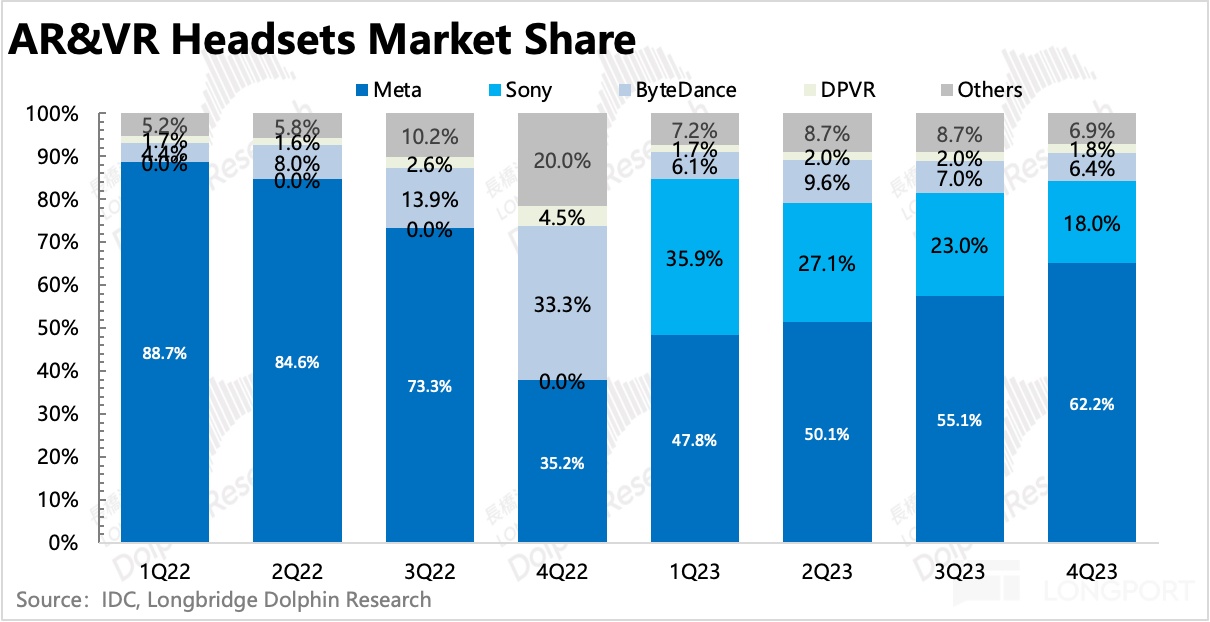

Last quarter, driven by the strong sales of Quest 3, Meta's market share also rose to 62.2%. IDC estimates that the shipment volume of VR/AR headsets will reach 9.7 million units this year, a 17% year-on-year increase. This is also expected to be a rebound driven by Apple's Visionpro, but the total shipment volume is still lower than in 2021.

Dolphin believes that Apple's Visionpro has a high purchase threshold, so there is no need to be too optimistic for now. Recently, Meta opened Horizon OS, which can be observed for actual feedback. Considering the development cycle of high-quality applications and hardware penetration rate, Dolphin still recommends observing before making any decisions in the short term.

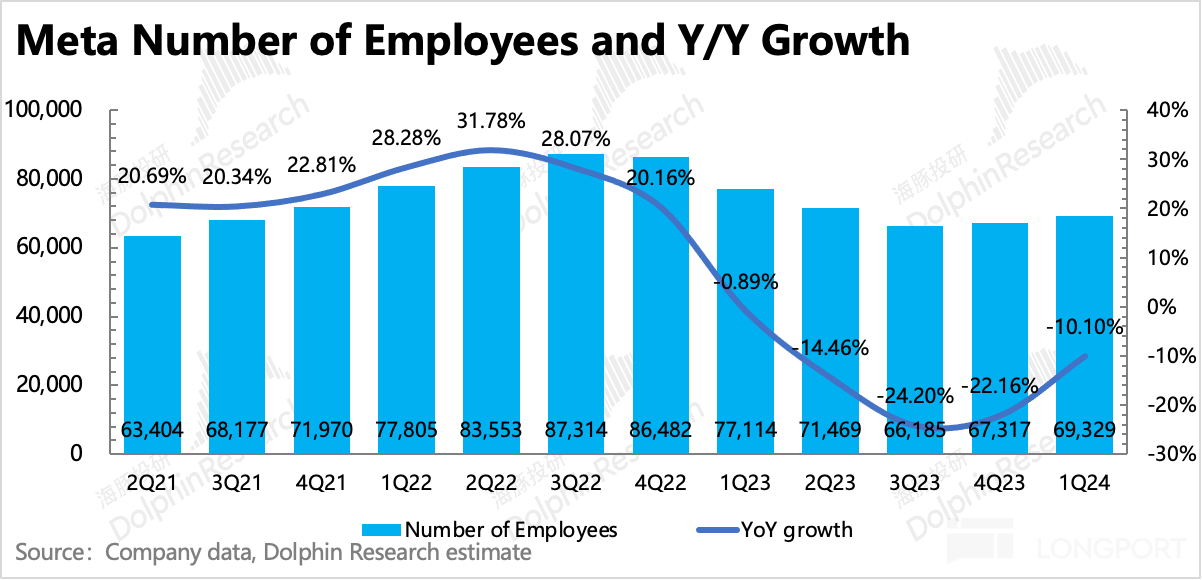

3. Increase in Expenses, Accelerated Net Expansion of Employees

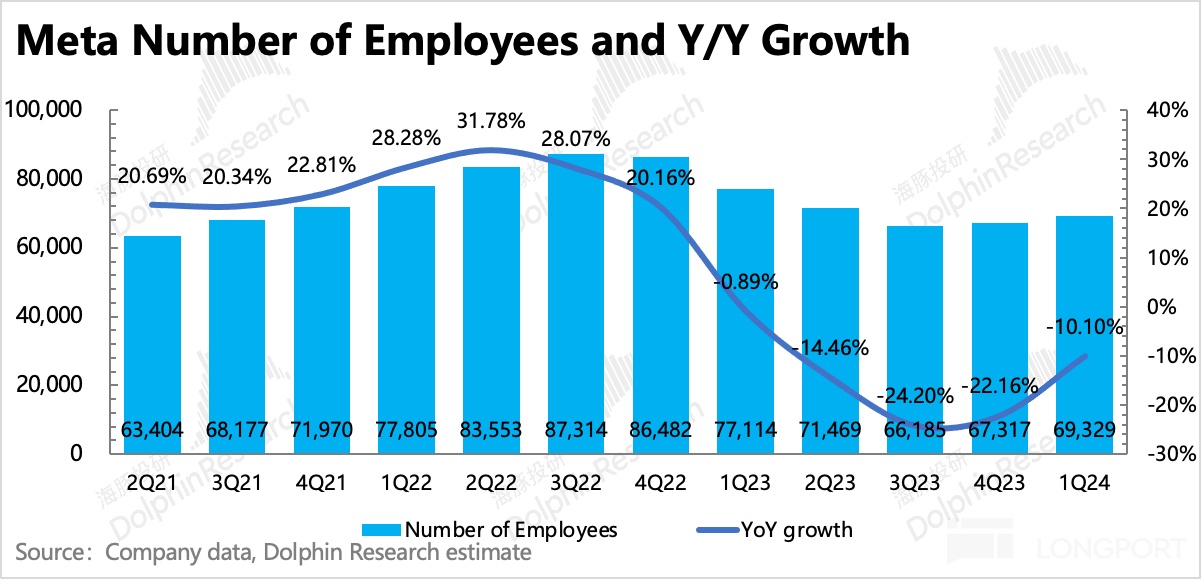

Meta has been reducing costs and increasing efficiency for a year, until the end of 2023. In 2023, Meta has reduced nearly 20,000 employees throughout the year, but in the fourth quarter, there was a net increase of 1,132 people. In the first quarter, the number of employees reached 69,329, with a net increase of 2,012 people compared to the previous quarter, indicating an acceleration in expansion, signaling the end of the dividend from the previous round of layoffs.

Although the increase in employee costs is not yet evident from the first-quarter expenses, if this expansion trend continues, it is expected that expenses will increase significantly in the second half of the year. The company has also raised its total expenditure (costs + expenses) guidance for this year from the original range of 94-99 billion to 96-99 billion.

Looking back at the gross profit margin, as Dolphin predicted last quarter, Meta's gross profit margin increased significantly by 3 percentage points year-on-year, reaching 82%, which has almost recovered compared to the previous difficulties. In the short term, with repeated increases in AI investment, further improvement is expected to be somewhat challengingThe Dolphin also believes that this is just a temporary recovery phase. In the medium to long term, as we pass through the mismatch period of AI investment and output, considering that AI can continue to optimize advertising ROI, expand monetization efficiency, help reduce internal company costs, and reduce losses in the RL segment, there is still room for improvement in gross profit margin.

In the end, Meta's operating profit margin in the first quarter was 38%. Although the gross profit margin continued to improve, the increase in operating expenses weakened the profit margin on a quarter-on-quarter basis. Looking at the two major businesses from the pack, the losses in the metaverse are still high, and management expects that the operating losses of Reality Labs will continue to increase. However, the VR business accounts for a small proportion, and management repeatedly emphasized that the market's expectations for losses are relatively sufficient.

Dolphin Research on Meta "Historical Articles":

Financial Report Season (Past Year)

February 2, 2024 Conference Call "Meta: Stable and Strong Advertising, Continuous Investment, Striving to be the Next Generation Computing Platform (4Q23 Conference Call Summary)"

February 2, 2024 Financial Report Review "Meta: China's Overseas Expansion Explodes, Mark Zuckerberg Generously "Gives Gifts""

October 26, 2023 Conference Call "Meta: Chinese Advertisers Contribute More to Investment (3Q23 Performance Conference Call Summary)"

October 26, 2023 Financial Report Review "Meta: Strong Return of Advertising, Why Doesn't the Market Buy It?"

July 27, 2023 Conference Call "Meta: Focusing on AI Empowerment, Not Just Commercialization Alone (2Q23 Performance Conference Call Summary)"Financial report review on July 27, 2023: "TikTok in decline, Meta completely reborn"

Telephone conference on April 27, 2023: "The 'Efficiency Year' shows good results, Reels making a big impact (Meta 1Q23 conference call summary)"

Financial report review on April 27, 2023: "Meta: Rebirth after crossing the calamity, fully resurrected"

Telephone conference on February 2, 2023: "Full of 'efficiency', Little Zha has learned to be 'obedient' (Meta 4Q22 performance conference call summary)"

Financial report review on February 2, 2023: "Good news stacking up, Meta turning gorgeously?"

Telephone conference on October 27, 2022: "Despite being questioned under 'siege', Little Zha still insists on betting on the metaverse (Meta 3Q22 conference call summary)"

Financial report review on October 27, 2022: "Meta, stubbornly betting on the 'metaverse' despite severe losses"

Telephone conference on July 28, 2022: "Macro, Apple ATT, facing multiple headwinds in competition, management's short-term outlook is very conservative (Meta conference call)"

Financial report review on July 28, 2022: "Without a 'Google-style' reversal in expectations, Meta's decline is hard to conceal"

Telephone conference on April 28, 2022: "To cope with competition, no rush to commercialize Reels (Meta conference call summary)"2022 年 4 月 28 日财报点评"Surge in Belief? Meta's Turning Point Has Not Yet Arrived" at longbridgeapp.com

2022 年 2 月 3 日电话会"Can We Expect Reels to Reactivate Meta User Growth Like Stories Did 3 Years Ago? (Conference Call Summary)" at longbridgeapp.com

2022 年 2 月 3 日财报点评"More Troubles After the Change, Facebook Turns into a 'Declining God' After Renaming to Meta" at longbridgeapp.com

In-depth

2023 年 12 月 8 日"Meta's 'Love-Hate Relationship' with Chinese Concepts Going Global: TikTok Competes, Temu Delivers" at longportapp.cn

2023 年 6 月 27 日"TikTok Falls, Meta Feasts" at longportapp.com

2023 年 2 月 21 日"US Stock Market Advertising: After TikTok, Will ChatGPT Spark a New 'Revolution'?" at longportapp.com

2022 年 7 月 1 日"TikTok Wants to Teach 'Big Brothers' How to Work, Google and Meta Are About to Change" at longbridgeapp.com

2022 年 2 月 17 日"Internet Advertising Overview - Meta: Low Combat Power is the Original Sin" at longbridgeapp.com

2021 年 9 月 24 日"Apple Draws First Blood, Is Facebook the First 'Big Brother' to Feel the Pain?" at longbridgeapp.com

2021 年 8 月 6 日"Facebook: Digging Deep into the 'Business Value' of the World's Top Internet User Harvesting Machine" at longbridgeapp.comOn November 23, 2021, "Facebook: Heavy Investment Shifts to 'Meta', Turning Point Not Far After Double Pressure" was published.

Risk Disclosure and Statement of this Article: Dolphin Investment Research Disclaimer and General Disclosure