NVIDIA: When will the turning point come as profits are reduced by 70%?

On the morning of November 17, Beijing time, Nvidia (NVDA.O) released its financial report for the third quarter of the 2023 fiscal year (ending in October 2022) after the US stock market closed:

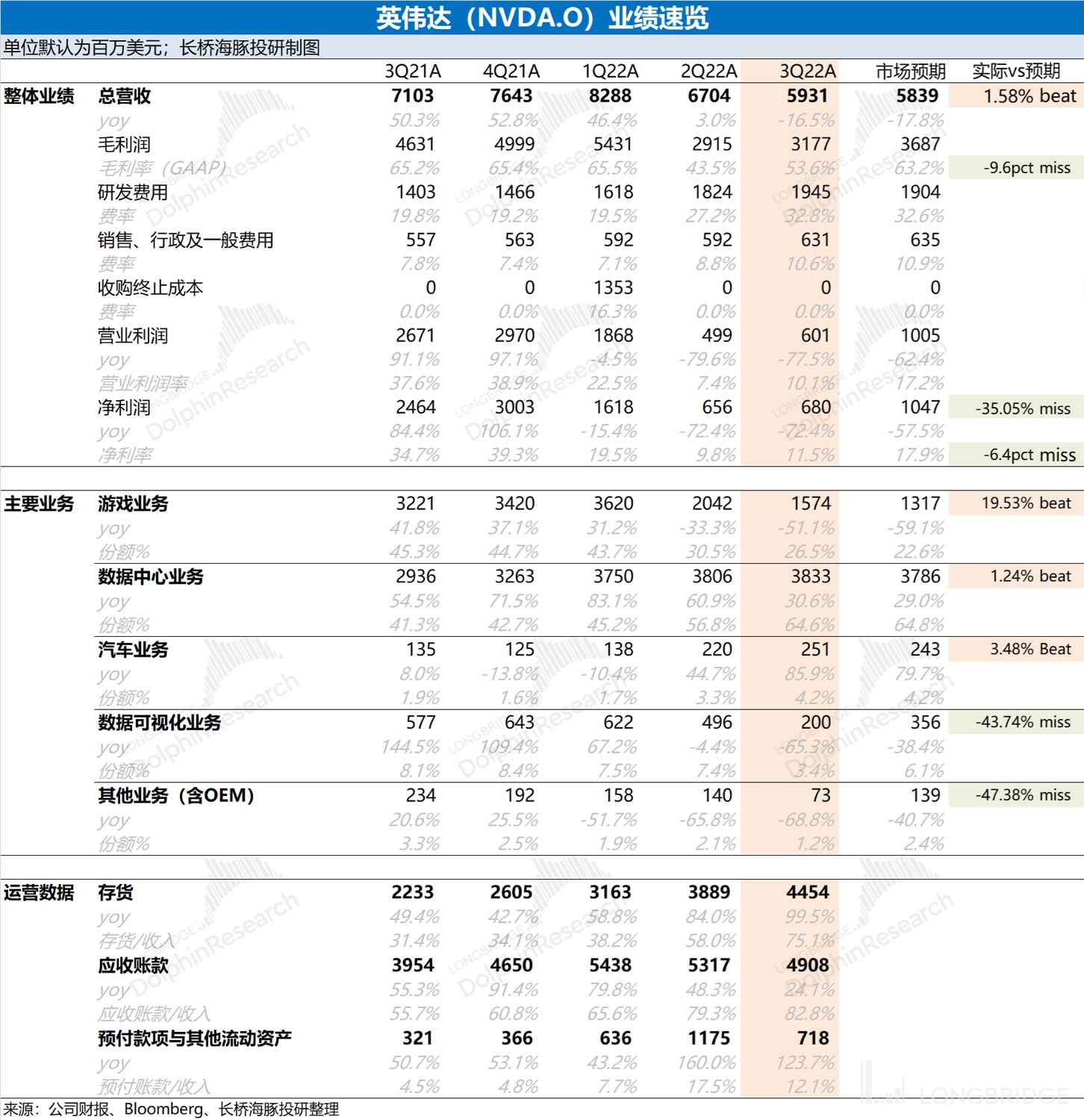

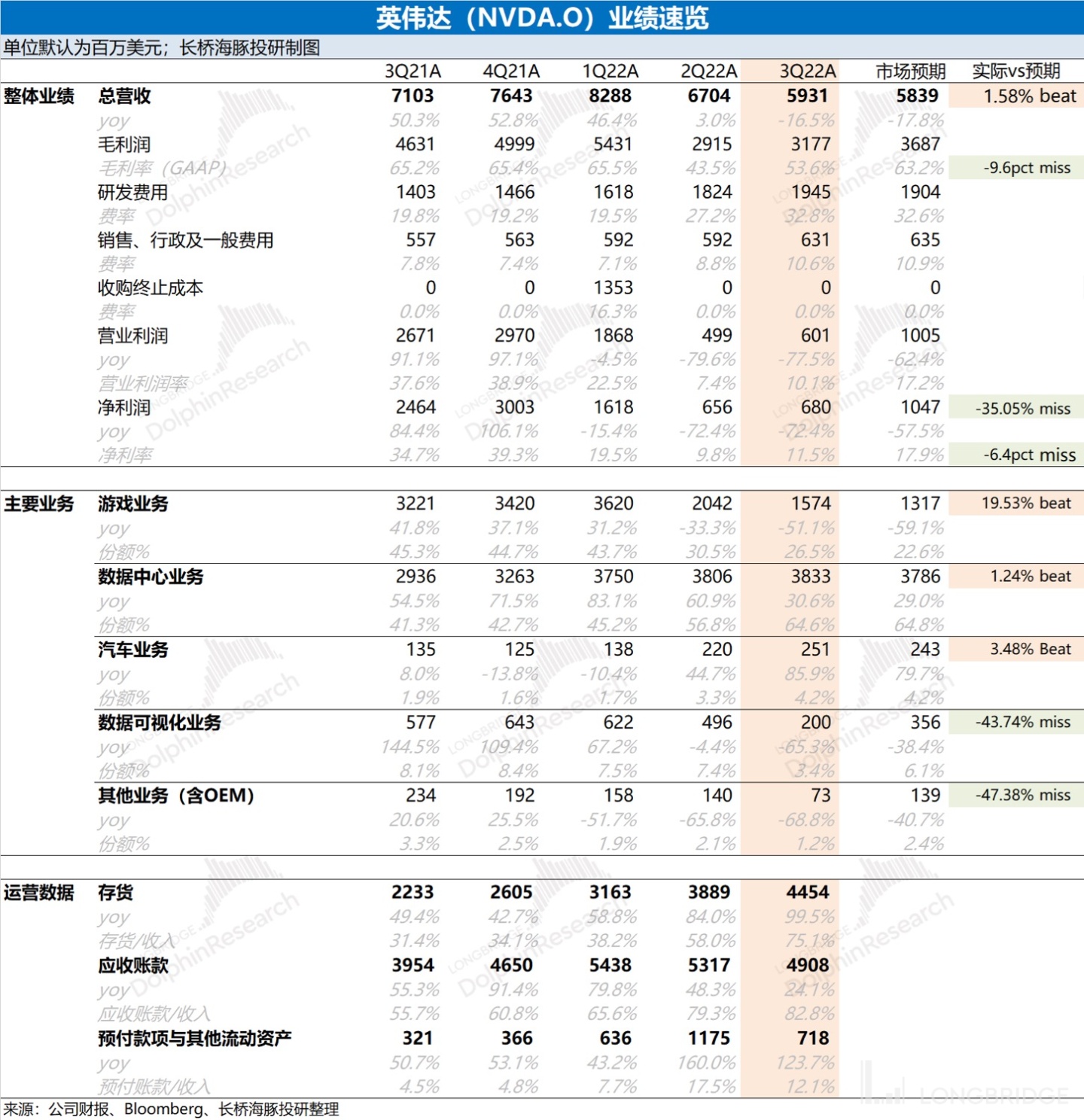

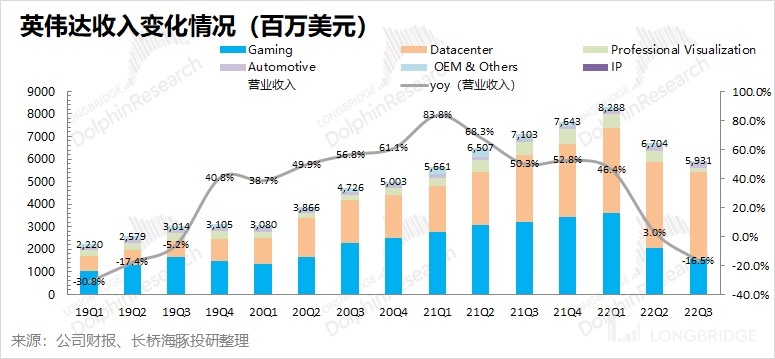

1. Overall performance: mediocre, with inventory being the main reason for the decline in gross margin. This quarter, Nvidia achieved revenues of $5.93 billion, down 16.5% year-on-year, which is in line with the company's previous guidance ($5.9 billion). The gross margin (GAAP) achieved by Nvidia this quarter was 53.6%, far lower than the expected guidance (62.4%), and the gross margin on the financial statement has not completely recovered from its low point. The main reason for the low gross margin is the reduction in inventory. The net profit in this financial report was only $680 million, down 72.4% year-on-year, which is much lower than the market's expectation of $1 billion, mainly due to the impact of lower-than-expected gross margin data.

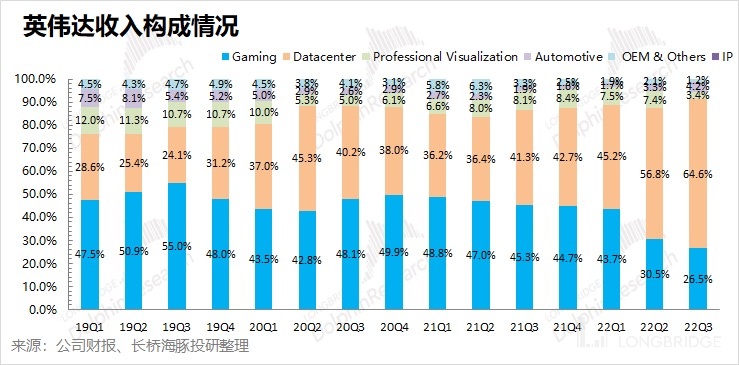

2. Core business situation: gaming business continues to decline, data center concerns gradually emerging. Gaming and data center businesses account for about 90% of the company's revenue, but both performed poorly this quarter.

1) The sharp decline in gaming business this quarter is the main reason for the weak performance. Dolphin Analyst believes that the main reasons for the continued downturn in gaming this quarter are: ① the global PC market is still sluggish in the third quarter and there is no sign of recovery; ② the continuous decline in virtual currency prices this year has weakened the demand for mining; ③ the dealer hoarding model directly affects the current pulling power.

2) The growth rate of the data center business in this quarter has begun to slow down significantly, and the impact of the macro economy on the cloud business has begun to emerge. As the large American tech companies begin to slow down their capital spending, the "hidden worries" of the company's data center business are gradually emerging.

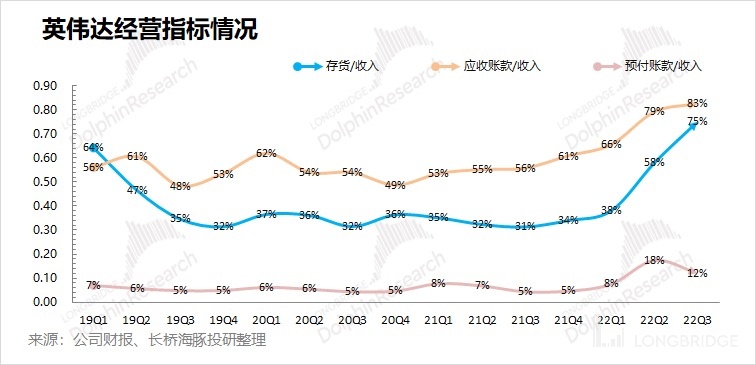

3. Major financial indicators: cost expenditures are showing rigidity, and inventory pressure continues to rise. Nvidia's operating expense ratio continued to rise this quarter, reaching over 40%. In absolute terms, research and development, sales, and administrative expenses are all growing. On the inventory side, there is still no sign of improvement. The company added $565 million in inventory this quarter, and inventory throughout the industry chain has risen due to sluggish downstream demand.

4. Guidance for next quarter: Nvidia expects revenue of $6 billion (+/-2%) and a year-on-year decline of 20% for the fourth quarter. The gross margin for the fourth quarter is expected to be 63.2%-66%, returning to the normal level.

Overall view: Nvidia's performance in the third quarter was mediocre. The revenue end of this quarter's performance is in line with the company's guidance and market expectations, while the gross margin end is far lower than the company's guidance and market expectations, mainly because the company has once again processed inventory worth $702 million this quarter. Excluding the impact of inventory processing, the company's gross margin will return to the normal level of over 60%.

Looking ahead to the next quarter, the company has given revenue guidance of $6 billion and gross margin guidance of over 63%. From the guidance, there are still no obvious signs of a rebound in the company's revenue end, but the gross margin guidance of 63% or higher seems to indicate a significant rebound. **However, based on the company's continued high inventory situation this quarter, Dolphin Analyst believes that the company may still conduct inventory processing in the next quarter, which will increase pressure on gross profit margin to return to above 63%.

In addition, Nvidia's continued high operating expenses this quarter will seriously erode the company's performance.** The last two quarters have seen a slowdown in the company's revenue, but expenses still exhibit rigid characteristics. This quarter, the company's operating expense ratio has reached over 40%. In other words, for every 100 yuan of product revenue, the company has to spend more than 40 yuan on operating expenses, which seriously erodes the company's net profit margin. Although the company has provided operating expense guidance of more than $2.5 billion for the next quarter, the operating expense ratio will still reach 42%. However, Dolphin Analyst believes that Nvidia may also initiate measures to control costs in the future.

Of course, as a growth stock, the market is most concerned about the company's business growth. As long as the company's business continues to grow rapidly, this will also be able to conceal the impact of expense spending and other aspects. In recent quarters' financial reports, revenue growth has slowed down and inventory continues to rise. Dolphin Analyst believes that Nvidia's gaming business is still in demand and the data center business is also affected by macroeconomic and large technology companies controlling costs. The constantly rising inventory not only indicates sluggish downstream demand but also puts continued pressure on the company's gross margin. The slowing increase in Fed rate hikes will have some impact on the company's stock performance, but there is still no clear sign of a rebound in the company's business.

For detailed content of this financial report, please refer to the following text:

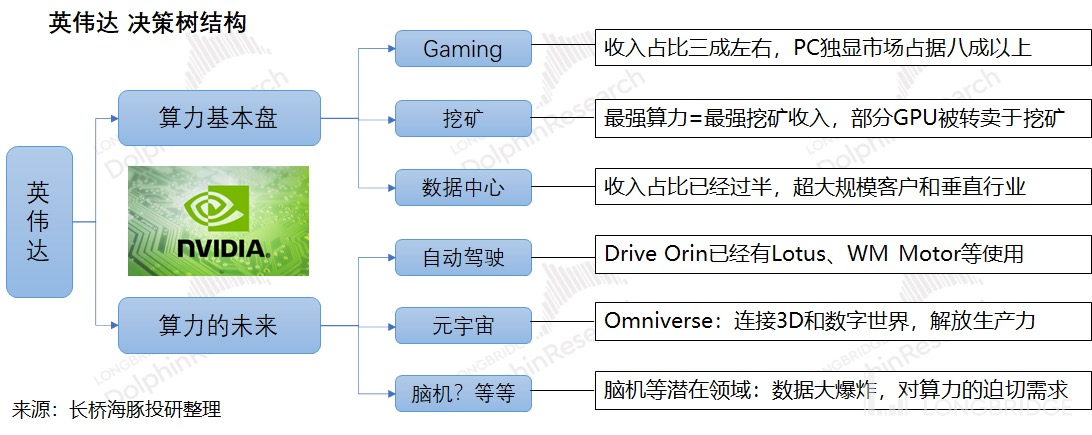

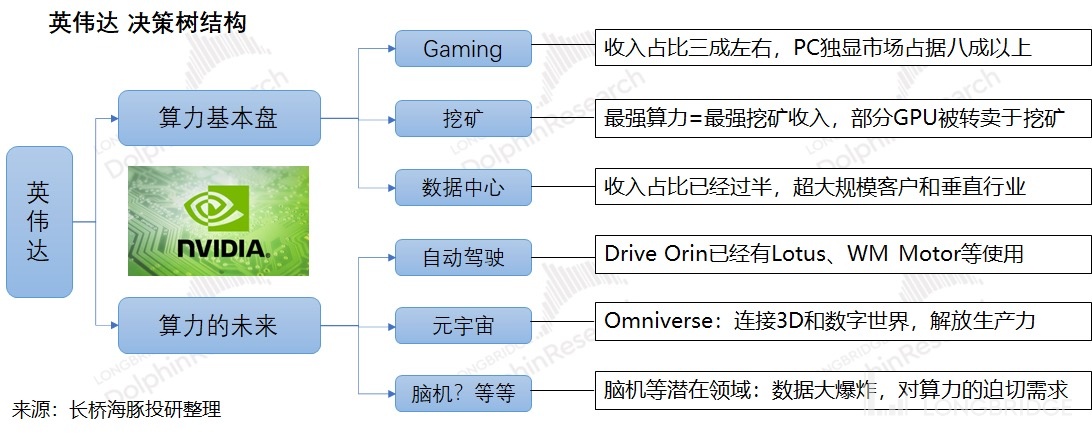

I. What do we need to know about Nvidia?

Nvidia is the world's leading computing chip company. The company's chips are not only used in traditional fields such as gaming and data centers but also in emerging fields such as autonomous driving and metaverse. Wherever there is a need for data computing, Nvidia can be seen.

In researching Nvidia, Dolphin Analyst started with two aspects: the "fundamental strength of computing power + the future of computing power." The "fundamental strength of computing power" is the company's main source of revenue now, while "the future of computing power" is the breakthrough Nvidia can make in emerging fields.

This quarter, Jensen Huang participated in the GTC keynote speech again, mainly introducing new cloud services and the next generation of GeForce RTX GPUs that support AI workflows, as well as various new systems, chips, and software.

1) Fundamental strength of computing power:

① Gaming Business: Nvidia has brought to market the highly anticipated new GeForce RTX 40 Series GPU this time, which utilizes TSMC's 4nm process. The performance of the new GeForce RTX 4090 will be four times that of the previous generation RTX 3090 Ti. ② Data Center: NVIDIA's H100 Tensor Core GPU and the new generation Transformer Engine of Hopper have been fully put into production. Grace Hopper combines the Arm-based NVIDIA Grace data center CPU with the Hopper GPU, whose fast memory capacity has increased by 7 times. This will bring a "huge leap" to recommendation systems.

2) The Future of Computing Power:

① Autonomous Driving: The brand new Thor super chip can provide 20 million trillion floating-point calculations per second, replacing Atlan in the DRIVE development roadmap. It can seamlessly connect with DRIVE Orin, which is currently used in mass-produced cars and can provide 2.54 million trillion floating-point calculations per second.

② Metaverse: Expanded through 3D technology, Omniverse is NVIDIA's platform for building and running metaverse applications. NVIDIA Omniverse Cloud is an infrastructure-as-a-service (IaaS) that connects Omniverse applications running in the cloud, locally, or on devices.

The GTC conference held smoothly this quarter has brought new products to the computing base and confidence to the future of computing power. So, can this quarter's financial report turn around the decline in last quarter's financial report?

II. Dolphin Analyst's detailed financial report analysis

I. Overall performance: Average, inventory is the main reason for gross margin decline

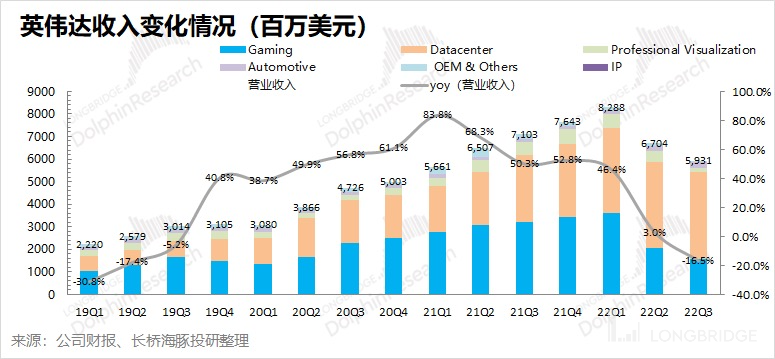

1.1 Revenue: In the third quarter of fiscal year 2023, NVIDIA achieved a revenue of 5.93 billion U.S. dollars, a year-on-year decrease of 16.5%, in line with the company's previous guidance (5.9 billion U.S. dollars). The company's revenue continued to decline this quarter, mainly due to the "computing base" business. ① The game business plummeted under the condition of weak demand. ② The growth rate of the data center business also slowed significantly due to the impact of export restrictions in some regions this quarter.

Looking ahead to the fourth quarter, the company's guidance is also difficult to improve. NVIDIA expects fourth-quarter revenue to be 6 billion U.S. dollars (plus or minus 2%), still a 20% year-on-year decline. Although the year-on-year decline is still significant, it has stabilized on a quarter-on-quarter basis.

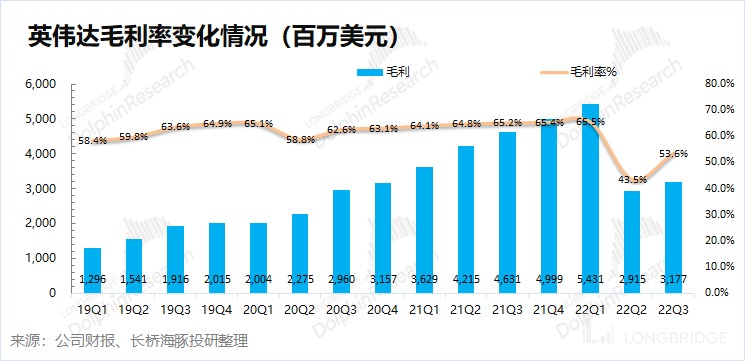

1.2 Gross margin (GAAP): In the third quarter of fiscal year 2023, NVIDIA's gross margin (GAAP) was 53.6%, far below the expected guidance (62.4%, plus or minus 0.5%). The gross margin on the quarterly report has not completely emerged from the low point.

The continued low gross margin this quarter is mainly due to weak downstream demand and high inventory in the industry chain. The company made an inventory provision of US$702 million this quarter. Compared with inventory changes of $1.22 billion in Q2, this quarter has decreased. Dolphin Analyst estimates that if the impact of the US$702 million inventory reduction is excluded, the company's gross margin in the third quarter will return to about 65%. However, due to the impact of the downturn in the semiconductor cycle and weak demand, the company has made some inventory adjustments.

NVIDIA expects gross margins for the fourth quarter to return to 63.2% to 66%. Whether the company can return to over 60% in the short term depends mainly on downstream demand recovering to digest inventory. If inventory remains high next quarter, the company will continue to work on inventory adjustments.

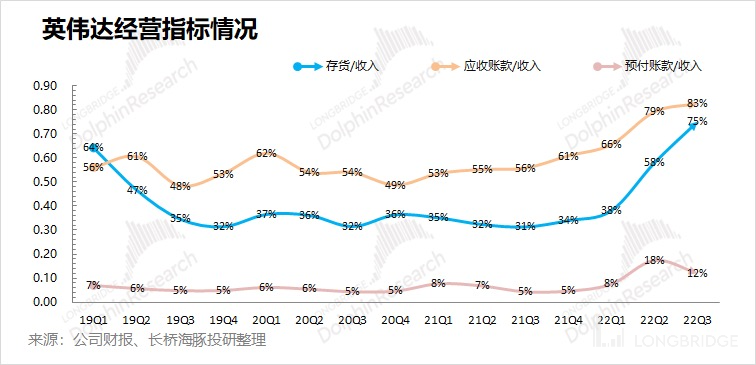

1.3 Operating indicators: inventory pressure is still increasing

1) Inventory/revenue: the ratio for this quarter is 75%, up 17 percentage points from the previous quarter. Weak revenue at the top end has pushed up the ratio. In absolute terms, inventory increased by $565 million this quarter, up from the previous quarter, and the company's inventory pressure is still increasing.

2) Accounts receivable/revenue: the ratio for this quarter is 83%, up 4 percentage points from the previous quarter. Weak revenue at the top end has pushed up the ratio. In absolute terms, accounts receivable decreased by $409 million this quarter from the previous quarter.

NVIDIA's high inventory mainly comes from insufficient demand in the gaming business, and its continuously high inventory also reflects that downstream areas have entered a downward channel. Combining the company's weak revenue guidance for next quarter, Dolphin Analyst believes that the company's inventory pressure will still be significant in the next quarter. At the same time, under the pressure of high inventory, NVIDIA may continue to work on inventory adjustments, thereby putting pressure on achieving gross margins of over 60% next quarter.**

II. Core Business Situation: Gaming Business Continues Decline, Data Center Hidden Risks Gradually Emerge

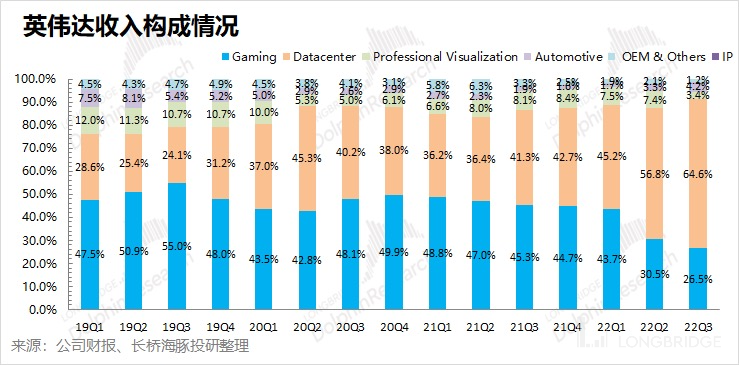

Due to the continued downturn in the gaming business, the revenue proportion of NVIDIA's data center business in 2023 Q3 continued to increase, exceeding 60%. The declining performance of the gaming market has reduced the share of the gaming business in the company's overall business to less than 30%.

Gaming and data center businesses are still the most critical businesses affecting the company's performance, and their total revenue accounts for about 90%.

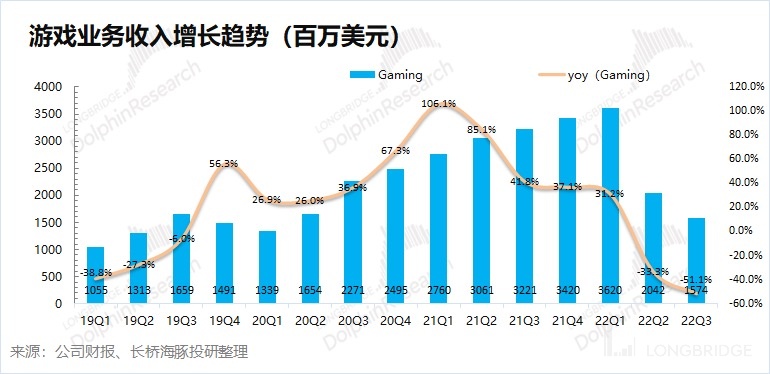

2.1 Gaming Business: NVIDIA's gaming business achieved revenue of $1.574 billion in Q3 2023, a year-on-year decline of 51.1%. The company believes that it is affected by macroeconomic conditions and the pandemic, as global desktop and laptop GPU sales have declined, directly affecting NVIDIA's gaming business. **

Dolphin Analyst believes that the main reason for the continued weakness of the gaming business is:

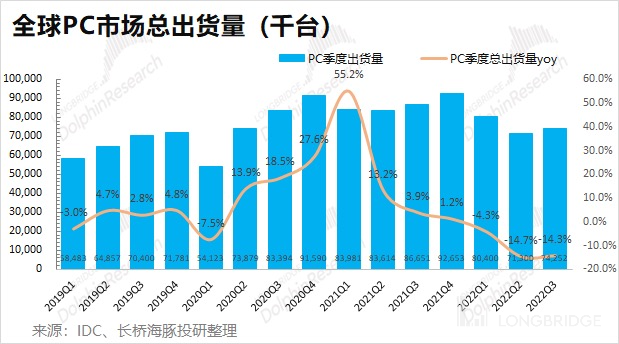

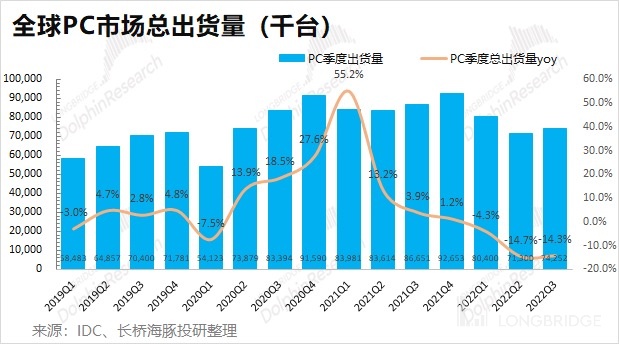

① The global PC market is still weak in the third quarter and there is no sign of recovery. According to the latest data from IDC, the global PC market in the third quarter of 2022 accelerated its decline, with only 74.25 million units shipped, a year-on-year decrease of 14.3%. As graphics cards are mainly used on the PC side in the game field, the demand for PC in the market has clearly declined during the post-epidemic period. At the same time, the impact of local epidemic control has weakened the demand for game graphics cards;

② The continuous decline in virtual currency prices this year has weakened the demand for mining. Like games, both mining and games have high computing power requirements, so some graphics cards are used for mining. Due to the continuous decline in virtual currency prices since the fourth quarter of last year, the demand for graphics cards in the "mining market" has been affected. Taking Bitcoin as an example, the price of Bitcoin has fallen below $20,000 from a high point of $69,000 in the second half of 2021.

Source: Wind, Dolphin Research

③ The dealer's hoarding model directly affects the current hauling power. As many game graphics cards are sold through dealerships, when dealers hoard goods at the beginning of a downturn cycle, hauling power is significantly reduced. It is transmitted to the company through the industrial chain, and the company's shipment situation has shown a significant decline, and inventory has continued to rise.

Dolphin Analyst believes that there are cycles in the industry, and in recent quarters, the game business of the company is similar to the downstream industry demand slump in 2018, which has led to high inventory levels and "thunderous" performance. NVIDIA's game business has returned to growth, and the stimulation of downstream demand requires the company to introduce new products and a rebound in virtual currency prices. However, from the company's weak guidance for the next quarter, the game business is still not optimistic.

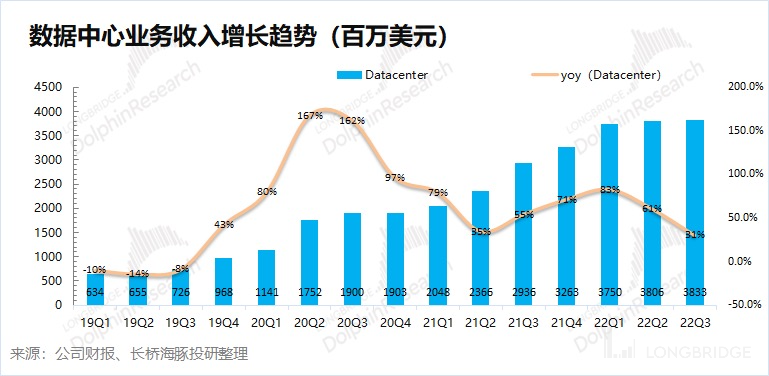

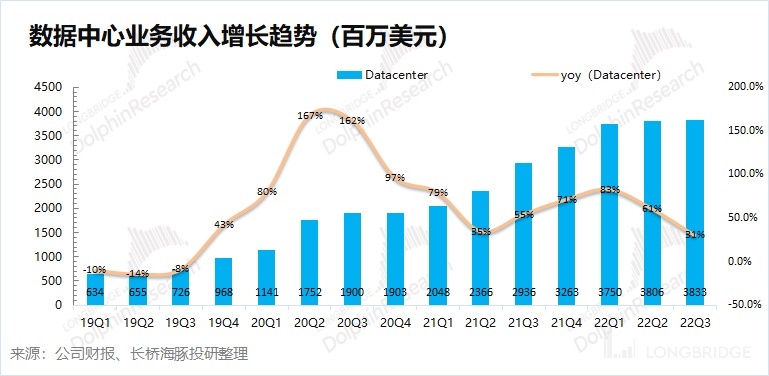

2.2 Data center business: In the third quarter of fiscal year 2023, NVIDIA's data center business achieved revenue of 3.83 billion U.S. dollars, a significant year-on-year growth slowdown of 31%, but a month-on-month growth of only 1%. The company explained that sales in North America's ultra-large-scale and cloud computing customers are still increasing, while sales in China are affected by economic conditions. The export of A100 and H100 has been restricted, which has been largely offset by replacement products in the third quarter.

Although the decline in performance of NVIDIA in this quarter is mainly due to the drag of the gaming business, the obvious slowdown in growth should not be ignored. Although data centers had a growth of 61% in the previous quarter's financial report, Dolphin Analyst also reminded that "growth risks cannot be ignored," and the growth of data centers has also slowed down significantly this quarter. Dolphin Analyst still believes that in the macro background of growth slowdown and inflation, the changes in revenue in a single region cannot be attributed, and at the same time, attention should also be paid to the layoffs and shrinking expenses of US technology giants such as Amazon and FB. Due to the impact of the downgrading of capital expenditures by large companies, there is a downtrend risk in the growth expectations of NVIDIA's data center business.

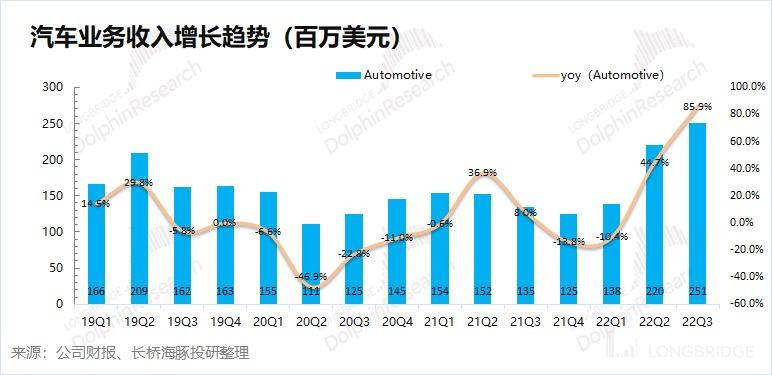

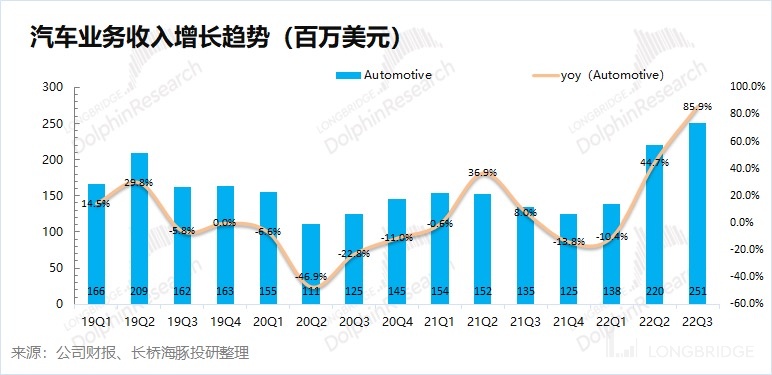

2.3 Automobile Business: NVIDIA's automobile business achieved revenue of 250 million US dollars in Q3 of fiscal year 2023, with a year-on-year growth of 85.9%, which mainly comes from the revenue of self-driving and AI driving cabin solutions.

With the promotion of new energy vehicles, the company's auto business has reached a historical high this quarter. As applications such as self-driving continue to penetrate, the auto business is expected to bring new growth to the company.

What cannot be ignored is that the contribution of the two hundred million-plus automobiles to revenue is still less than 5%, which is difficult to hold up the main performance. Dolphin Analyst will continue to pay attention to the progress of NVIDIA's automobile business.

III. Main Financial Indicators:

3.1 Operating Profit Margin: The growth of expenses is still increasing

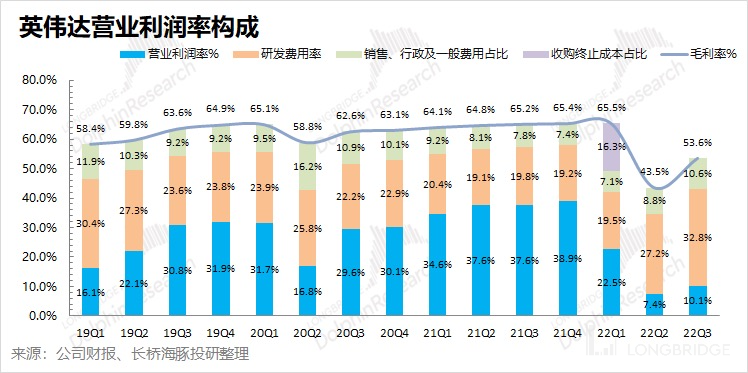

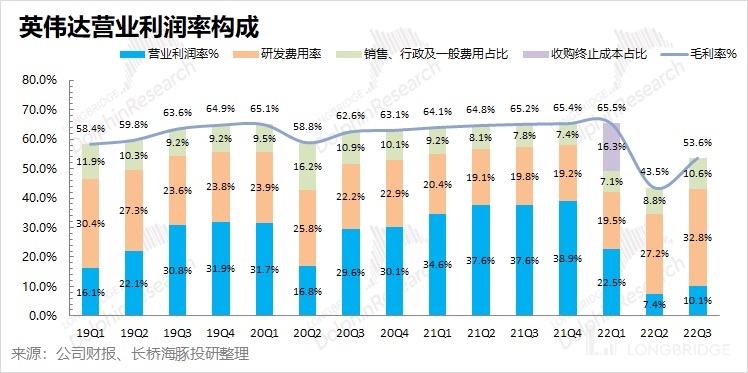

NVIDIA's operating profit margin rebounded to 10.1% in Q3 of fiscal year 2023, but is still at a low level. The rebound in operating profit margin this quarter is mainly due to the gross profit margin, but it can also be noted that the company's expenses are slightly rigid.

To analyze the composition of the operating profit margin, the specific changes are:

"Operating profit margin = Gross profit margin - research and development expense ratio - sales, administrative and other expense ratio"

-

Gross profit margin: 53.6% this quarter, down 9.6pct year-on-year, mainly affected by the weak gaming business and the reduction of inventory depreciation.

-

Research and development expense ratio: 32.8% this quarter, up 13pct year-on-year. This is mainly due to the relative rigidity of research and development expenses. Although the company's revenue is weak this quarter, the absolute value of research and development expenses will not have a significant decrease.

-

Sales, administrative, and other expense ratio: 10.6% this quarter, up 2.8pct year-on-year. There will be certain changes in sales expenses with revenue changes, and the rigid performance of administrative expenses has caused an overall increase in expense ratio.

NVIDIA's operating expense guidance for the fourth quarter is still as high as 2.56 billion US dollars. Although it has slightly decreased compared to the third quarter, in the face of weak revenue guidance, the operating expense ratio for the fourth quarter is still as high as 42%. Compared with the high expenses and weak performance guidance, NVIDIA will not rule out cost control measures in personnel and other areas in the future. **

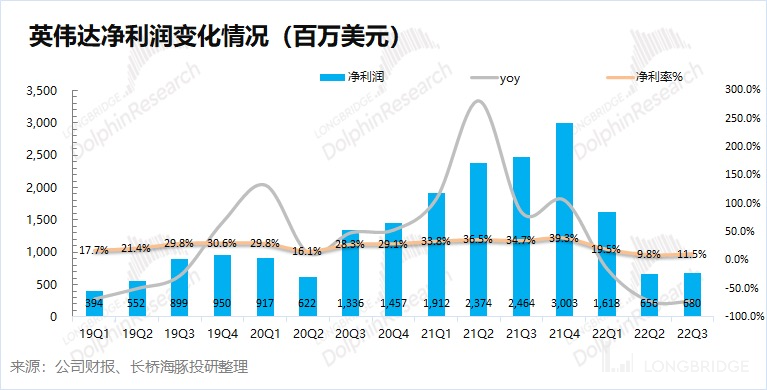

3.2 Net Profit (GAAP): Continues to stay at a low level

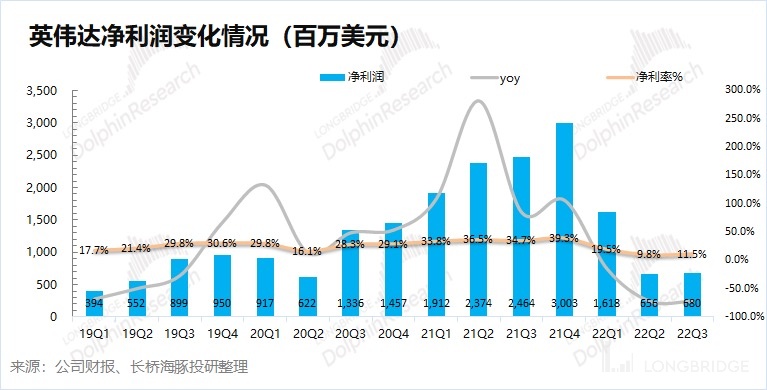

NVIDIA's net profit in Q3 FY2023 was 680 million US dollars, a year-on-year decrease of 72.4%. The net profit margin of this quarter has rebounded slightly to 11.5% compared to the previous quarter. The significant decline in profit this quarter is mainly due to the decrease in gross profit margin while the cost rate has been increasing under the continued weakness in revenue, ultimately squeezing the company's profit.

Dolphin NVIDIA historical articles:

In-depth

June 6, 2022, "Did the US stock market earthquake mistakenly target Apple, Tesla, and NVIDIA?"

February 28, 2022, "NVIDIA: High growth is not false, but the cost-effectiveness is still below average"

December 6, 2021, "NVIDIA: Valuations cannot be supported by imagination alone"

September 16, 2021, "NVIDIA (Part 1): How did this chip giant achieve a twenty-fold increase in five years?"

September 28, 2021, "NVIDIA (Part 2): The dual-wheel drive is no longer, will Davis strike again?"

Earnings season

August 25, 2022, Conference Call "How Does Management Explain the Collapse of Gross Margin? (NVIDIA FY2023 Q2 Conference Call)"

August 25, 2022, Earnings Review "Does NVIDIA have to follow the 2018 path again while stuck in the quagmire?"

August 8, 2022, Performance Preview Review "Thunder Rolling as NVIDIA's Performance Takes Freefall"

2022/05/26 Phone Conference "Epidemic and Lockdown Lead to Game Sales Drop, Dragging Down Q2 Performance (NVIDIA Earnings Call)"

2022/05/26 Financial Report Review "No More "Epidemic Bump", NVIDIA Performance Disappoints"

2022/02/17 Phone Conference "NVIDIA Focuses on Multi-Chip Promotion and Data Centers (Conference Call Summary)"

2022/02/17 Financial Report Review "Behind NVIDIA's Surprisingly Good Performance is a Hidden Vulnerability | Earnings Report Analysis"

2021/11/18 Phone Conference "How Does NVIDIA Build the Metaverse? Management Focuses on Omniverse (NVIDIA Conference Call)"

2021/11/18 Financial Report Review "With Computing Power and Metaverse Support, Will NVIDIA Always Be Bullish?"

Live Broadcasts

2022/05/26 "NVIDIA Corporation (NVDA.US) Q1 FY2023 Earnings Call"

2022/02/17 "NVIDIA Corporation (NVDA.US) Q4 FY2021 Earnings Call"

2021/11/18 "NVIDIA Corporation (NVDA.US) Q3 FY2022 Earnings Call"

Risk Disclosure and Statement: Dolphin Investor Disclaimer and General Disclosure.