Is Pinduoduo's performance exploding again, will it be limitless?

On the evening of November 28th Beijing time, before the US stock market opened, Pinduoduo (PDD.US) released its Q3 2022 financial report. Overall, both revenue and profit performance were "explosively good" again, making it the strongest faith in the e-commerce sector. The financial highlights are as follows:

1. Nobody but us, revenue growth again "explosively good"

Although JD.com and Alibaba disclosed lower-than-expected Q3 revenue growth and even more pessimistic Q4 guidance, the independent Pinduoduo once again proved to be the "only faith" in the e-commerce sector.

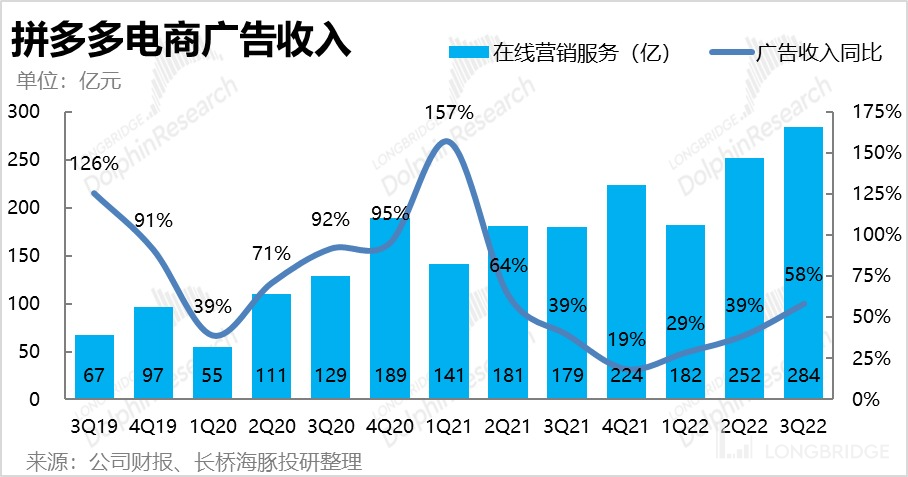

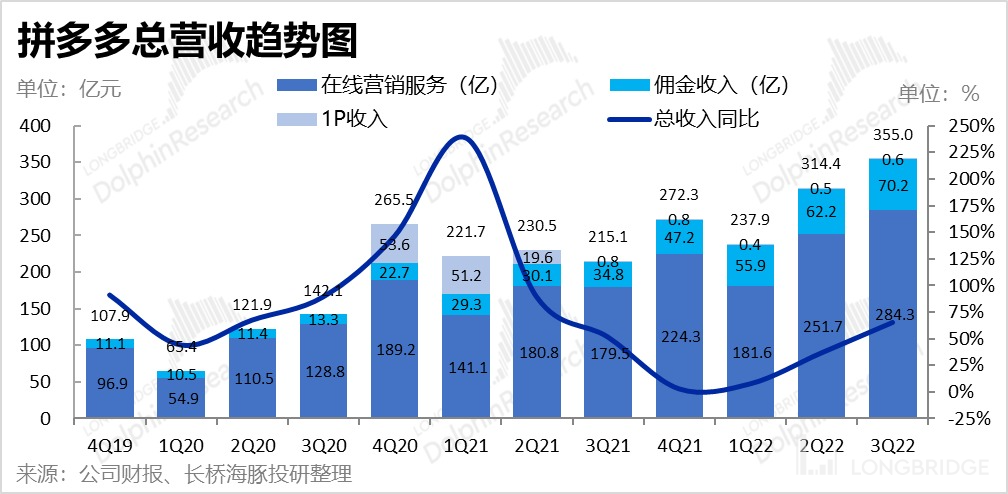

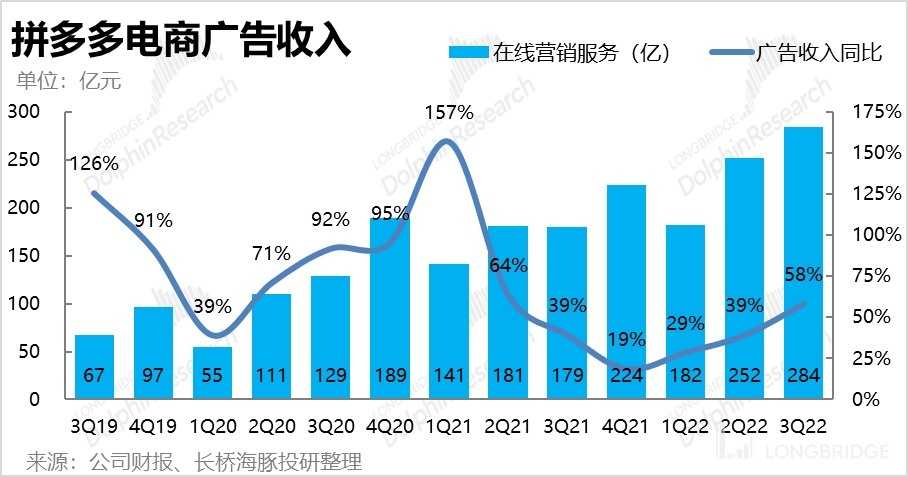

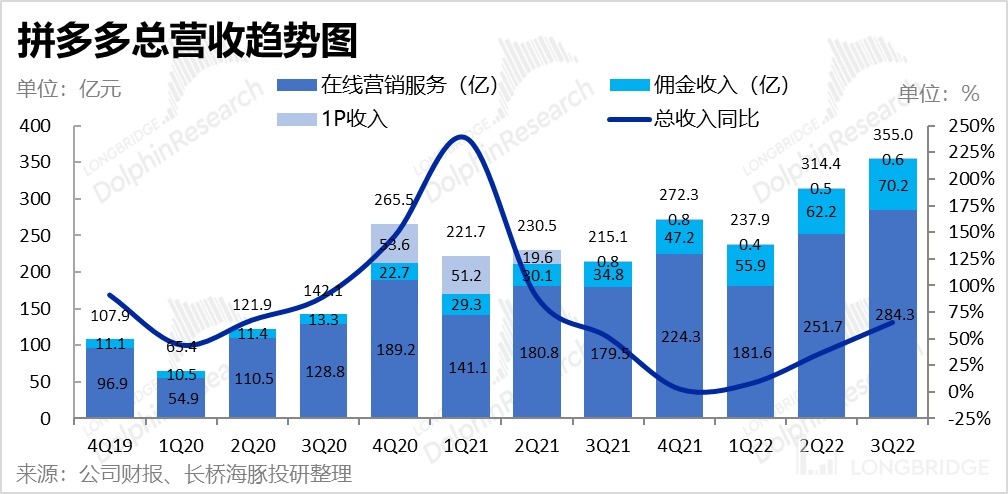

Pinduoduo's total revenue for this quarter was 35.5 billion yuan, with a year-on-year growth rate rising sharply to 66%, again significantly higher than the market's expected 30.9 billion yuan: E-commerce advertising generated revenue of 28.4 billion yuan this quarter, with a year-on-year growth rate of up to 58%. While sellers generally expected growth rate to decline month-on-month, it actually increased for four consecutive quarters. In addition to the consumption downgrade and inventory reduction logic that began last quarter, the recent claim by some brokerages that the proportion of branded sellers has increased may be another reason for the acceleration of advertising revenue.

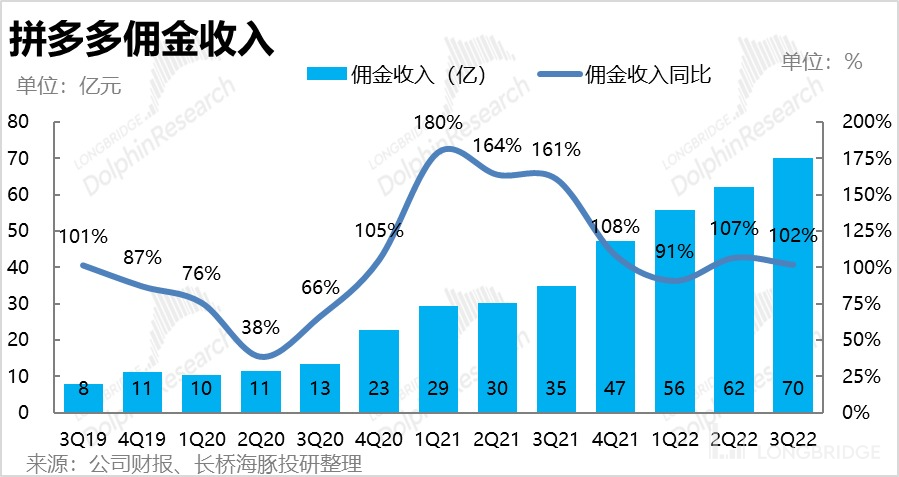

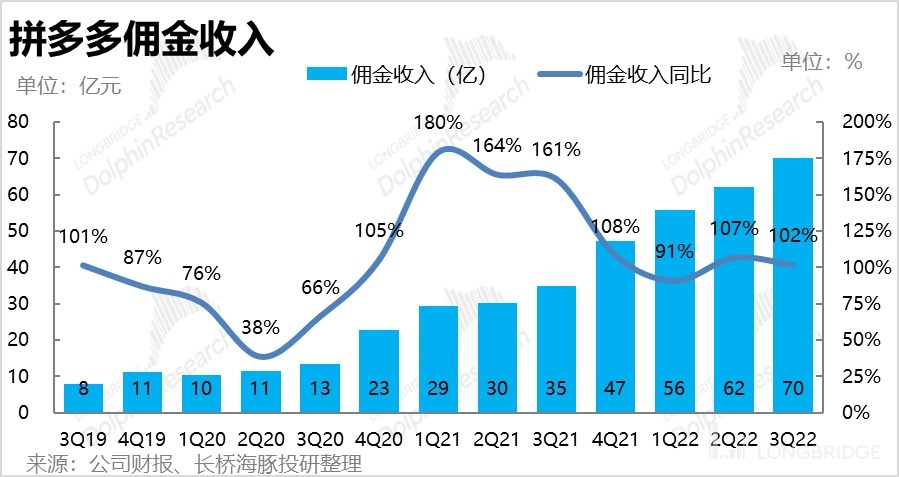

The commission income (including payment handling fees, Duo Duo Mai Cai and e-commerce commission income) had revenue of 7 billion yuan this quarter, with a year-on-year growth rate of 102%, basically the same as the previous quarter. Dolphin Analyst believes that after Duo Duo Mai Cai officially confirmed its position as the top in terms of scale and unit efficiency (UE) in the community group buying field last quarter, it continued to lead the industry this quarter.

2. Unafraid of increased investment, profit hits a new historical high again

Although the company's expenditure has increased again ahead of its peers this quarter, the total profit of Pinduoduo still hit a new historical high amid a significant increase in gross profit margin.

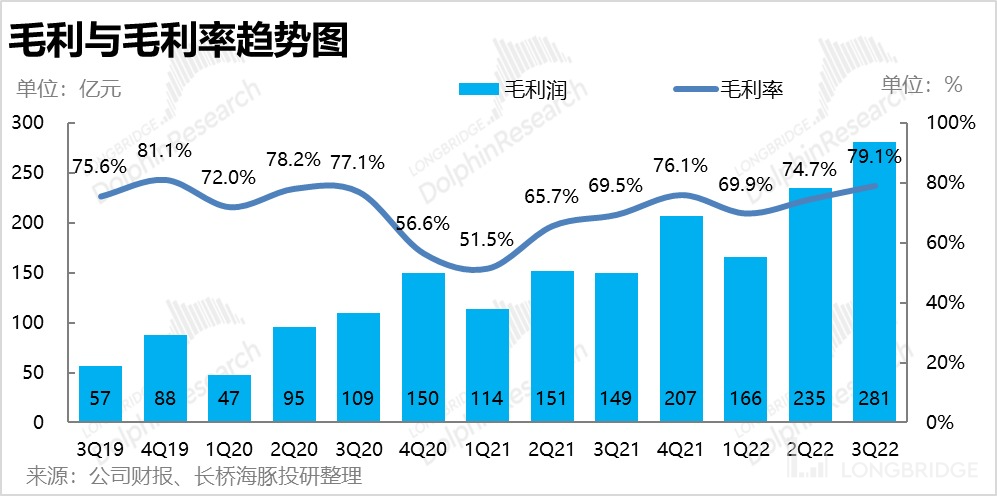

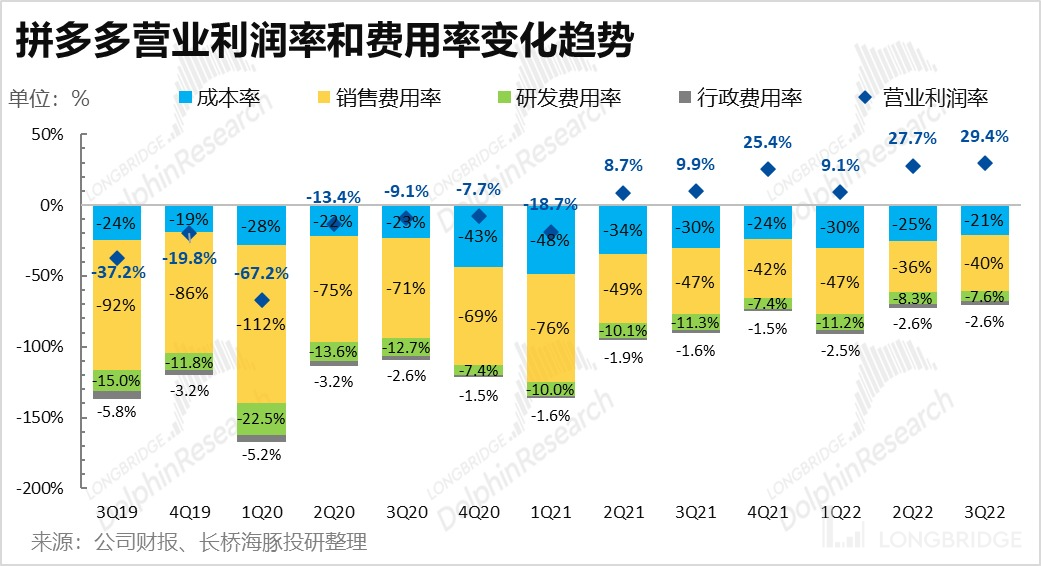

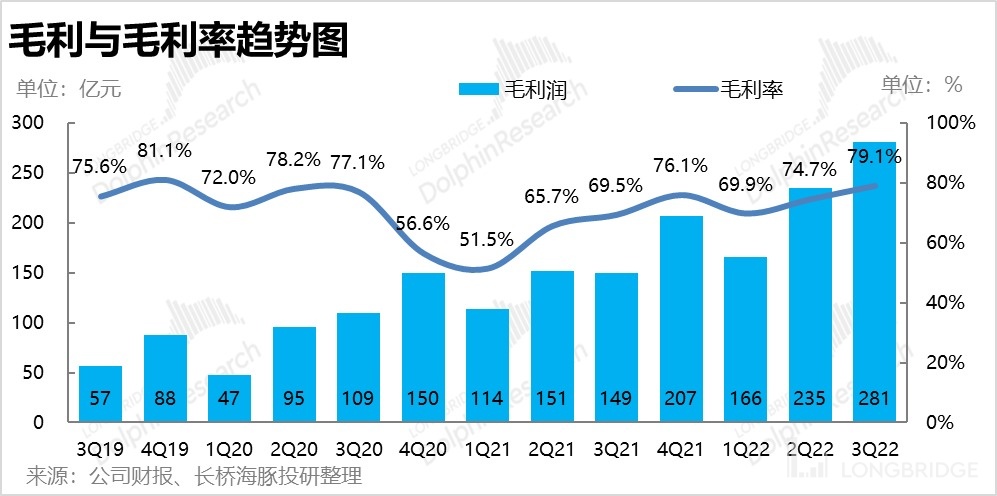

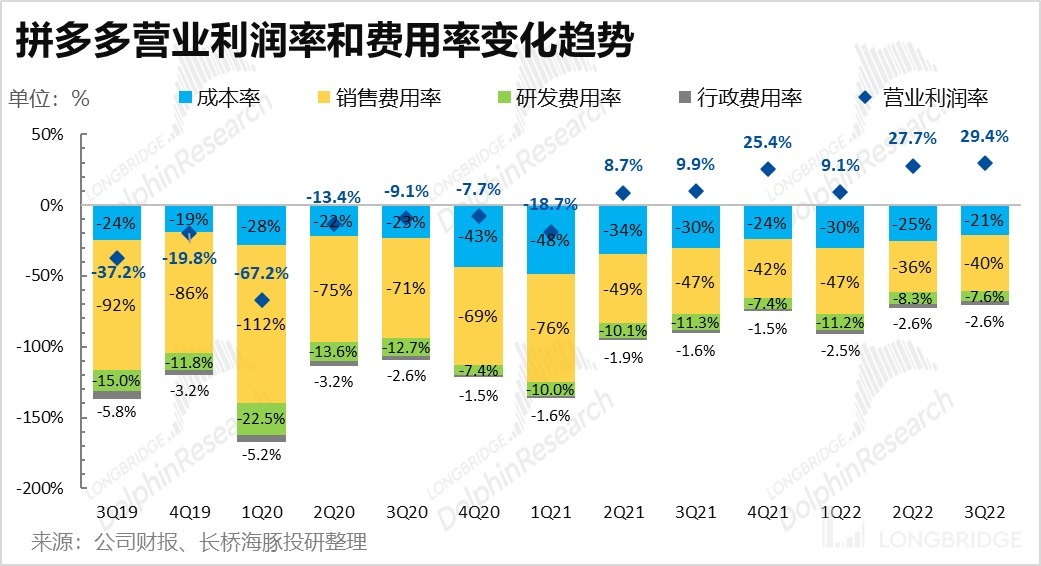

①The company achieved a gross profit margin of 28.1 billion yuan this quarter, far exceeding seller expectations of 22.5 billion yuan. The gross profit margin also surprisingly increased by 4.4 percentage points month-on-month to 79%. Although the management has always claimed that the improvement in gross margin is a one-time positive factor, Dolphin Analyst believes that from the company's operational perspective, the continuous over-performance of advertising revenue indicates that the monetization rate continues to improve. The growth of monetization rate does not bring much additional cost, which is one of the main drivers of the continuous improvement of gross profit margin. In addition, the continued loss reduction in the grocery business should be the second reason for the continuous improvement in gross profit.

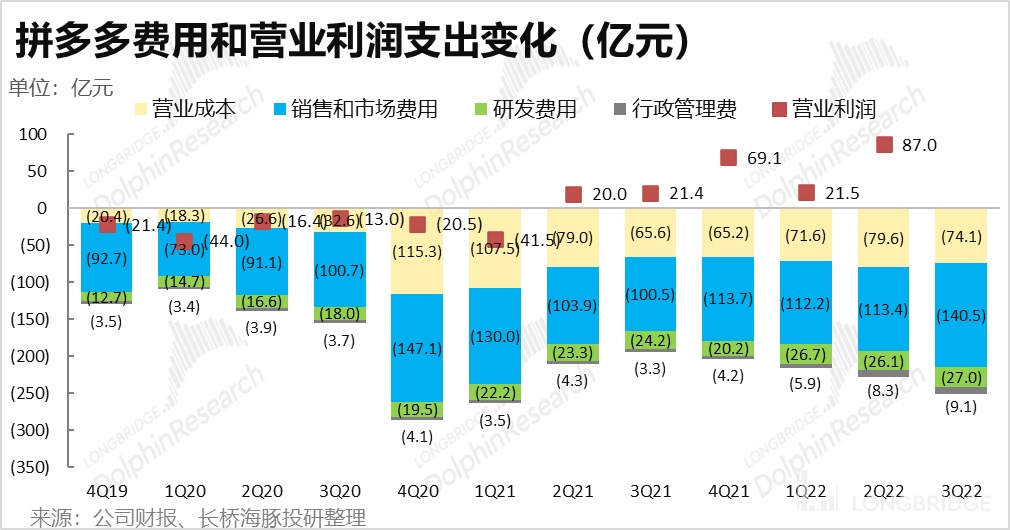

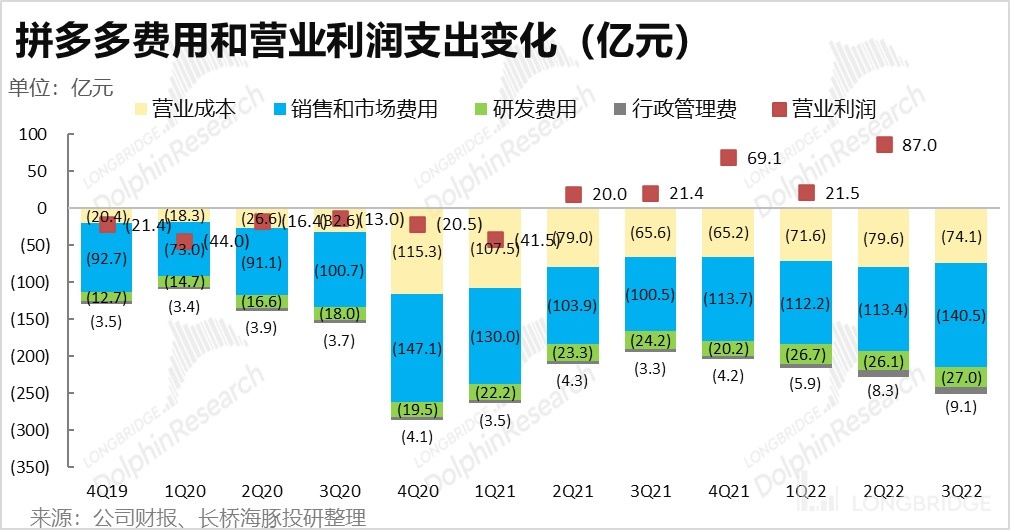

② With the obvious improvement in competitive landscape and the continuous over-performance of the company's operations, it is rational for Pinduoduo to increase the cost input and continue to seize market share. First of all, marketing expenses reached 14.1 billion yuan, significantly higher than the expenditure of about 11 billion yuan in the previous quarter and the same period last year. The cross-border e-commerce platform Temu that was launched in September should also be one of the reasons for the cost growth.

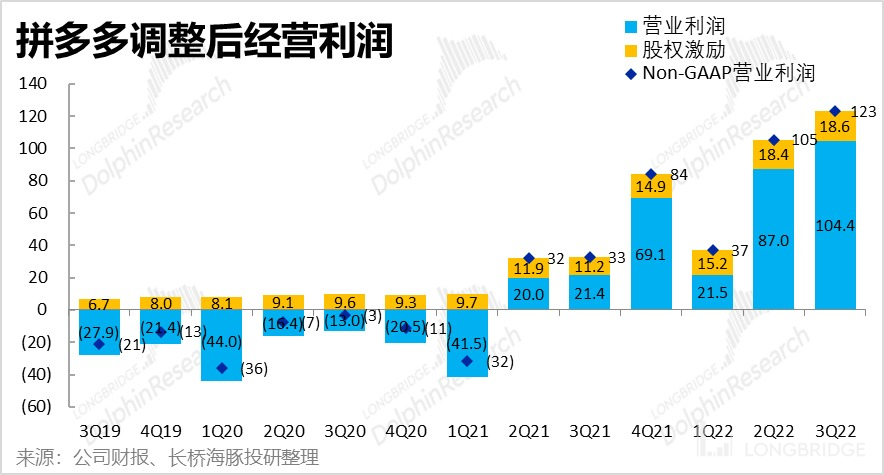

Due to the continuous explosive performance, the incentives and management expenses given to employees have also skyrocketed, increasing by 10% month-on-month (over 170% year-on-year). As for R&D expenses, they remained stable, with a YoY growth rate of 11%, the same as the previous quarter. Overall, the total expenditure of operating three expenses was 17.6 billion yuan, actually higher than the seller's expected 16.6 billion yuan.③Finally, although the cost investment was higher than expected, the company's operating profit margin this quarter was as high as 29.4%, far exceeding the market's expected 18.4%. In the end, the company achieved an operating profit of RMB 10.4 billion, breaking a new historical record, and far exceeding the seller's expected 5.7 billion.

Dolphin Analyst Opinion:

The performance of this quarter is once again impeccable, with revenue and profits both exceeding market expectations. Although the market was mentally prepared for the profits to exceed expectations, the key point is that when the seller was considering how much the revenue growth rate would slow down from last quarter, the actual increase rate was about 19% higher than the previous quarter. Therefore, amidst an industry where exceeding expectations on profits is common, Pinduoduo's ability to significantly exceed revenue growth expectations is even more valuable and scarce.

In addition, the improvement in the company's profit this quarter is not just talk, but rather a real improvement in operations and gross profit margin. In terms of both revenue and profit, Pinduoduo's exceeding of market expectations is of good quality.

From a business perspective, in addition to the previously confirmed logic of user consumption downgrading and merchants de-stocking from last quarter, this quarter the market once again sees progress in Pinduoduo's brand upward trend (still awaiting confirmation of end-of-year customer unit price data). Furthermore, in a competitive environment, at the best time for profit release, Pinduoduo has increased investment and launched a cross-border e-commerce platform, giving it further advantages to maintain leadership in the mid-term.

The Dolphin Analyst confirms what was stated in the previous industry review: Pinduoduo is the most beneficial and best-performing target in the e-commerce sector during the current cycle, and is officially crowned as the newest "faith stock" in the pan-retail sector. (Please refer to the link for a detailed explanation of why we believe Pinduoduo is a great investment during this cycle.)

Dolphin Analyst will share the conference call summary with Longbridge App users through a group call. Interested users are welcome to add the WeChat ID "dolphinR123" to join the Dolphin Investment Research Group and get the conference call summary as soon as possible.

Detailed Interpretation of this quarter's Financial Report:

I. Exploding Revenue Growth, No One Can Compare

As Alibaba and JD's third-quarter e-commerce revenue reports have already been released and were slightly below market expectations, their fourth-quarter guidance is generally worse than the third quarter, so the market's sentiments toward the domestic e-commerce industry are overall cautious and pessimistic. However, Pinduoduo's "explosive" revenue growth this quarter once again proves its uniqueness and distinctiveness in the e-commerce sector.

The core e-commerce ad business achieved 28.4 billion yuan in revenue this quarter, with a YoY growth rate of a shocking 58%, and the consecutive four quarters experienced accelerating growth. Meanwhile, seller performance forecasts were generally discussing how much Pinduoduo's revenue growth rate would slow down from the last quarter. Therefore, Pinduoduo's actual performance far exceeded the seller's expected 24.3 billion yuan revenue and 39% growth rate.Dolphin Analyst believes that the possible reasons for the revenue growth rate to once again exceed expectations are:

In the 3Q e-commerce market, the growth rate accelerated from 3% in 2Q to 7%, and the industry growth is still increasing under the acceleration. The seller's prediction of a decline in 3Q advertising revenue may be slightly conservative (Dolphin Analyst's own predicted revenue is over 27 billion yuan, but the company's actual performance is even better).

Since the last quarter, there has been a trend of "downgrading" in consumer spending, while the demand for inventory reduction by merchants has increased. Therefore, the logic of the platform's cost-effectiveness continuation for Pinduoduo has become more favored.

In addition, according to research by some securities firms, Pinduoduo's attractiveness to brand merchants has increased, thereby promoting the company's brand advertising revenue and customer unit price. However, as the company only discloses customer unit price data in the annual report, whether this trend is true still needs to be verified over time.

In addition, the company's commission income (including payment processing fee income, Duoduo MaiCai income, and e-commerce commission income) had a revenue of 7 billion yuan this quarter, with a year-on-year growth rate of 102%, although the growth rate has slowed slightly on a month-on-month basis. The actual figure was significantly higher than the market's expected revenue of 6.5 billion yuan. Moreover, in the case of maintaining triple-digit growth, there is no "slowing down" at all.

In Dolphin Analyst's previously published article "Pinduoduo vs. Vipshop: Are Your "Poor Days" Their "Good Days"?" It has been shown that Duoduo MaiCai has successfully achieved overall leadership in the community group buying field in terms of total order volume, GMV, and unit economic profit. Therefore, the performance of commission income this quarter, which is similar to last quarter, indicates that Duoduo MaiCai has continued its trend of leading the industry after confirming itself as the industry leader in the second quarter.

Due to the continued significant outperformance of the core 3P business, and the end of the impact of 1P business revenue being zero, Pinduoduo's total revenue for the quarter was 35.5 billion yuan, with a year-on-year growth rate of 66%, again significantly higher than the market's expected 30.9 billion yuan. It is truly exciting to see what other surprises Pinduoduo can bring to the market in the future.

Secondly, even with an increase in investment, profits have once again hit a new high. Along with the violent growth in revenue, Pinduoduo's profit release has once again significantly exceeded market expectations. In fact, despite the company continuing to invest heavily on the expense side (while its peers are still cutting costs) after the competitive landscape has clearly improved and the company's performance has consistently exceeded expectations, the company's operating profit margin has still increased significantly due to the continuous and significant increase in gross profit margin.**

First of all, from the perspective of gross profit, the company achieved a gross profit of RMB 28.1 billion this quarter, far exceeding the seller's expected RMB 22.5 billion. The gross margin for this quarter also unexpectedly increased by 4.4pct to 79% compared to the previous quarter. Although the company has always claimed that the high gross profit in the previous quarter was a one-time high point caused by the epidemic, the market expected the gross profit to decrease sequentially this quarter. However, the actual gross profit not only did not decrease, but increased significantly, even exceeding the previous temporary high point caused by the return of Tencent Cloud server costs in the fourth quarter of last year.

After exceeding expectations multiple times in a row, Dolphin Analyst believes that the improvement in gross profit is not simply a one-time benefit as claimed by the management, but rather a trend improvement. Dolphin Analyst believes that the sustained increase in advertising revenue which continues to exceed expectations should be attributed to the sustained improvement in monetization rate. The growth of monetization rate will not bring much additional costs, which should be one of the main drivers of sustained gross profit improvement. In addition, the continued reduction in losses from the grocery business should also be the second reason for the sustained improvement in gross profit.

However, from the perspective of costs, "winning is hard" Pinduoduo has actually begun to increase investment

Firstly, unlike Alibaba and JD.com, who are still reducing marketing expenses and continuously expanding market share, Pinduoduo, which has released unprecedented profit margins, has already begun to increase marketing investment. This quarter's marketing expenses amounted to RMB 14.1 billion, while both the previous quarter and the same period last year exceeded RMB 11 billion, and the growth is still significant. In addition, the cross-border e-commerce platform Temu was launched in September, which is also one of the reasons for increased investment in this area.

Investment in research and development costs has remained stable, with a YoY growth of 11% this quarter, the same as the previous quarter. However, under the dilution of revenue growth, the proportion of research and development costs to revenue continued to decline to 7.6%.

In the case of the company's continued explosive performance, management expenses continued to rise, with an increase of 10% compared to the previous quarter. The main reason for this was equity incentive expenses of RMB 680 million, while it was only RMB 160 million in the same period last year. It is reasonable to give employees more equity incentives for good performance. In addition, the newly launched Temu business will also drive the increase in management expenses.

Overall, the company's total operating expenses amounted to RMB 17.6 billion, which is actually higher than the seller's expected RMB 16.6 billion.

Therefore, although the actual investment in expenses is higher than expected, the company's operating profit margin for this quarter still reached a high of 29.4%, far exceeding the market's expected 18.4%. In the end, the company achieved an operating profit of RMB 10.4 billion, a historic high and far exceeding the seller's expected RMB 5.7 billion.

**After removing share-based compensation expenses, the company's adjusted operating profit for a single quarter reached 12.3 billion yuan. Regardless of revenue or profit, Pinduoduo's performance can only be described as even more impressive than that of the bulls, far exceeding market expectations.

Three, how is Temu's cross-border business progressing?

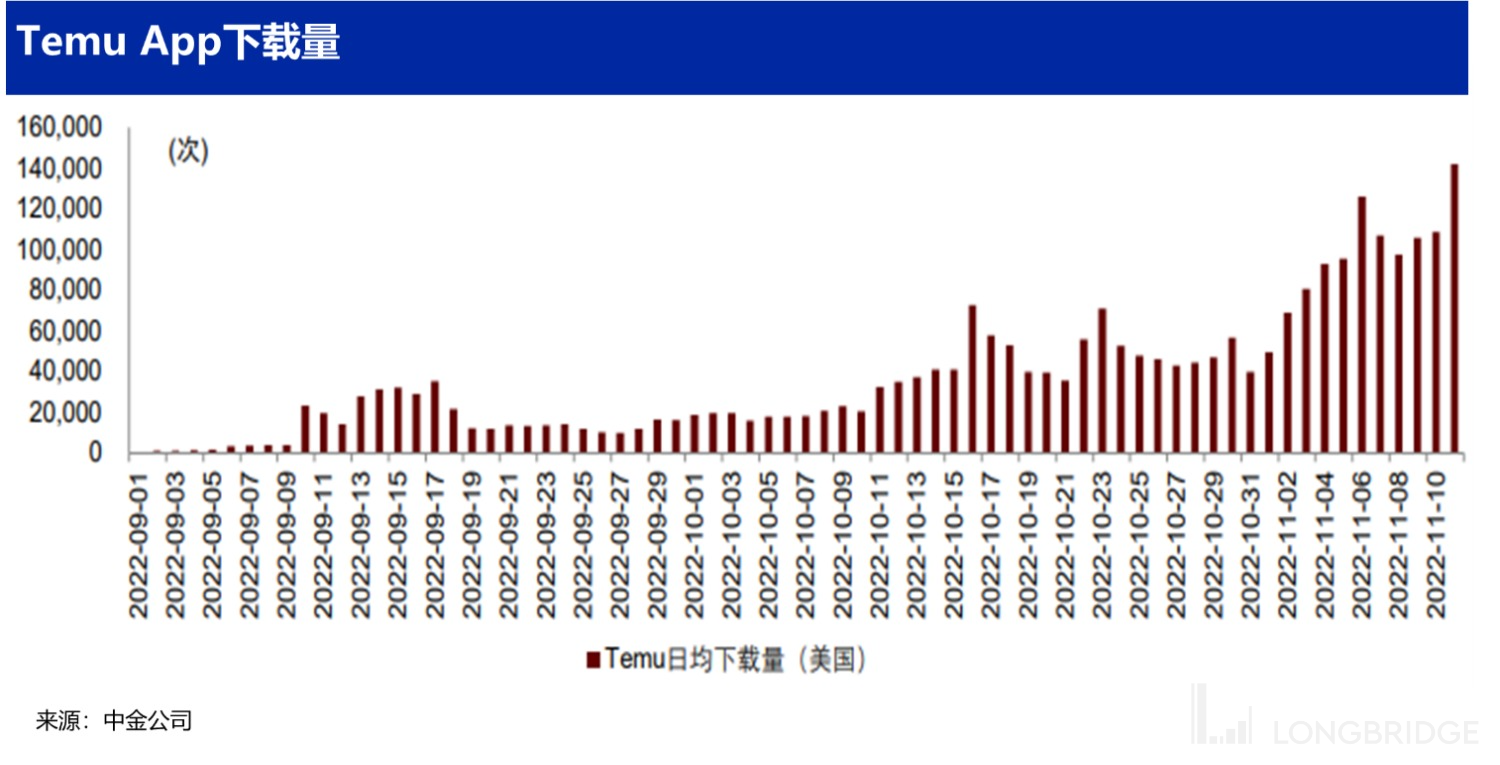

As Pinduoduo's main site's profitability continues to be proven, contributing nearly 10 billion yuan in profit per quarter, and with its grocery business achieving the industry's best in terms of scale and unit economics, Pinduoduo is at the optimal time to begin developing Temu, the company's new growth curve in cross-border e-commerce platforms. The core focus of the market's attention on this new business, according to the Dolphin Analyst, is simply, "1) How quickly Temu's scale reaches volume (mainly user scale and transaction volume, which will not generate much revenue in the early stages), and 2) How much Temu's investment will drag down Pinduoduo's overall profit."

Regarding the first point of the speed of scaling, Temu's download rate has already reached first place among shopping apps in the US. As seen in the chart below, Temu's daily download volume has been over 100,000 since November. According to news media reports, Temu’s daily GMV scale has reached nearly $1.5 million. A simple calculation shows that Temu's GMV scale in the fourth quarter will most likely be above $100 million.

However, just like Pinduoduo's main site, Temu's tagline is also extreme cost-effectiveness. According to Zhongjin's statistics, the average commodity price on the Temu platform is less than $1, and the price of all single products is basically not more than $10. Therefore, the average commodity price on the Temu platform is most likely only a single digit $. After deducting the cost of goods, discounts, or freight subsidies given to users, the company's final net income is most likely almost zero, or even negative at this time.

Therefore, let's assume that Temu's net income contribution in the fourth quarter is zero. As for the critical logistics costs in cross-border e-commerce, according to our reference from Shein, the logistics cost of a single item is approximately $2. Based on our rough estimate of Temu's GMV and average commodity price, Temu's logistics cost in the fourth quarter should be roughly around 40-50 million US dollars. Furthermore, including customer acquisition costs and Temu's brand promotion expenses on various channels, according to the seller's calculations, Temu will need at least a few million US dollars, so Temu's drag on Pinduoduo's overall profitability in the fourth quarter could be at least a few billion RMB.But perhaps investing in companies that make over 10 billion in quarterly profits is no longer a problem.

Of course, the above speculation is only a rough estimate of the level of impact Temu has on profits. For a detailed analysis and prediction, please stay tuned for Dolphin Analyst's future articles.

End of Article

Dolphin Pinduoduo Research Reports:

Earnings Call

August 29, 2022, Phone Meeting: "Increase investment in the future, Pinduoduo is determined to continue to innovate (phone meeting notes)"

August 29, 2022, Financial Report Review: "Explosive earnings! "Roll King" Pinduoduo is the true king behind it all"

May 27, 2022, Phone Meeting: "R&D investment will increase, and future profitability may fluctuate (Pinduoduo 1Q22 phone meeting notes)"

May 27, 2022, Financial Report Review: "The return of disappearing magic, Pinduoduo "kills" its competition!"

March 21, 2022, Phone Meeting: "The "lying-flat" strategy is only temporary. Will Pinduoduo return to investment and growth? (Phone meeting notes)"

March 21, 2022, Financial Report Review: "Half heaven and half hell, Pinduoduo is "splitting" again"

Deep Dive

September 30, 2022, "Pinduoduo vs. Vipshop: Your "poor days" are their "good days"?"

April 27, 2022, "Alibaba vs. Pinduoduo: After the bloodbath, only coexistence remains?"

September 22, 2021, "Has the e-commerce traffic battle between crazed Alibaba, Meituan and Pinduoduo led to true barriers to entry?"

Risk Disclosure and Statement for this Article: Dolphin Investment Research Disclaimer and General Disclosure