Disney: Theme Park "Fever" Not Dispelled, Streaming Services Expand Quickly

Hi everyone, I'm Dolphin Analyst!

Disney released its Q3 2022 results after the US stock market closed on August 10th, US Eastern Time.

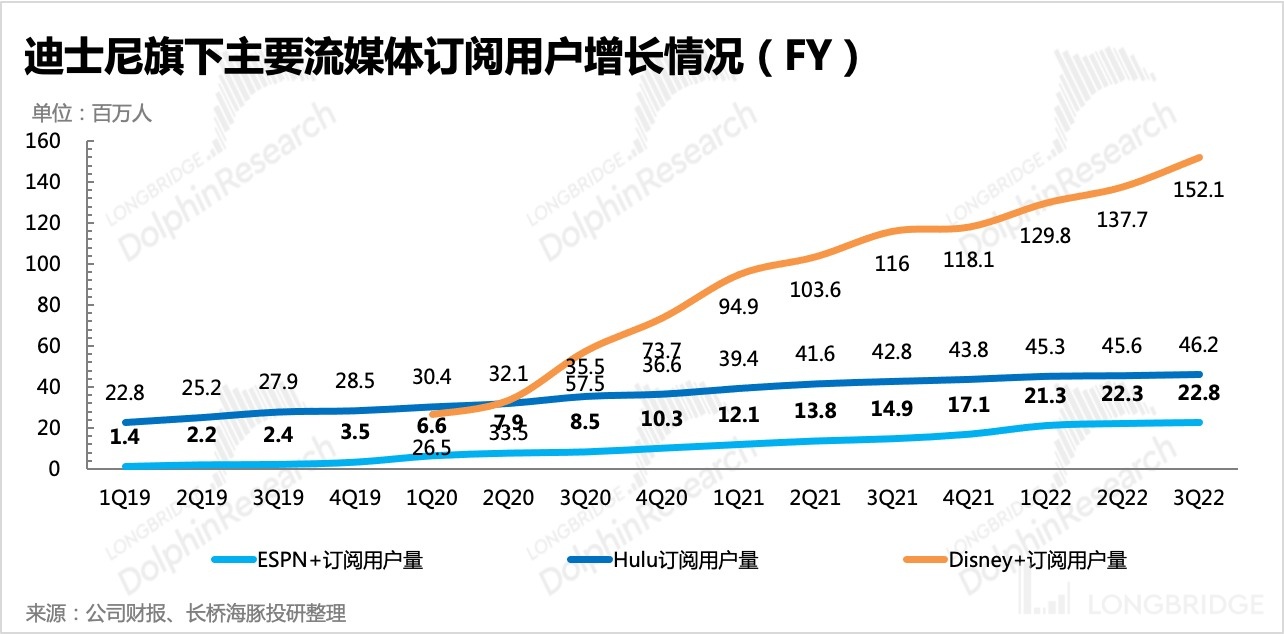

In this quarter, traditional businesses still contribute significantly to revenue and profit growth, especially in the theme park business, where visitor numbers are rapidly recovering, and per capita spending is still increasing. The streaming business still loses money, but net user growth is much higher than expected, and Disney+ global users surge to 152 million. Boosted by the better-than-expected performance, Disney soared by nearly 7% after-hours.

Here are some specific highlights:

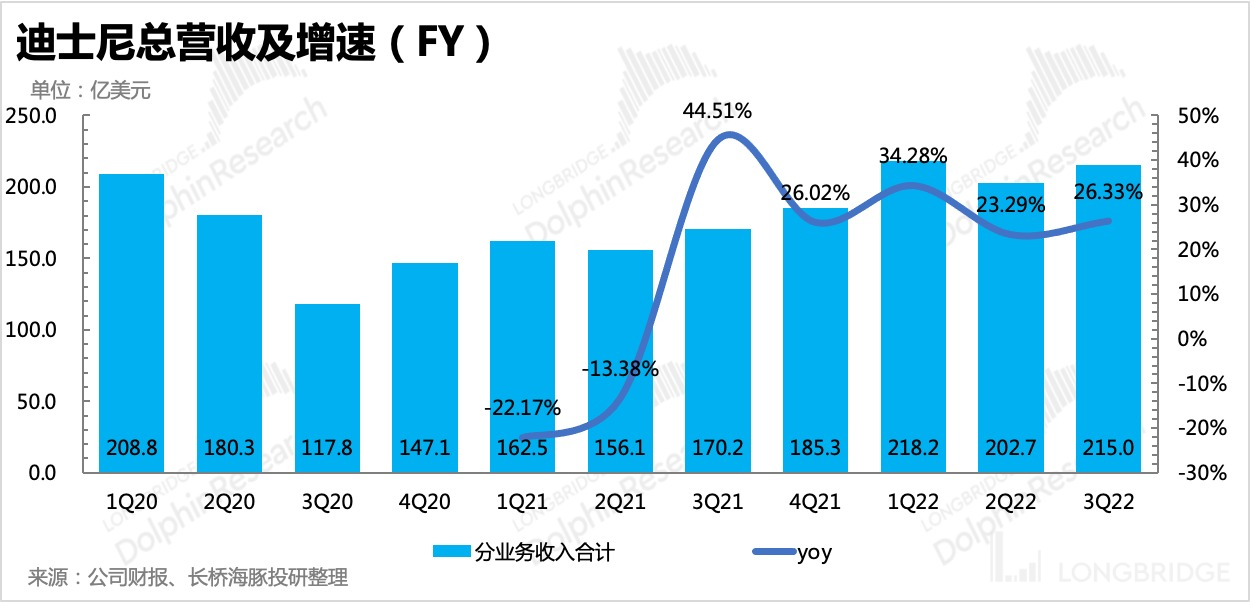

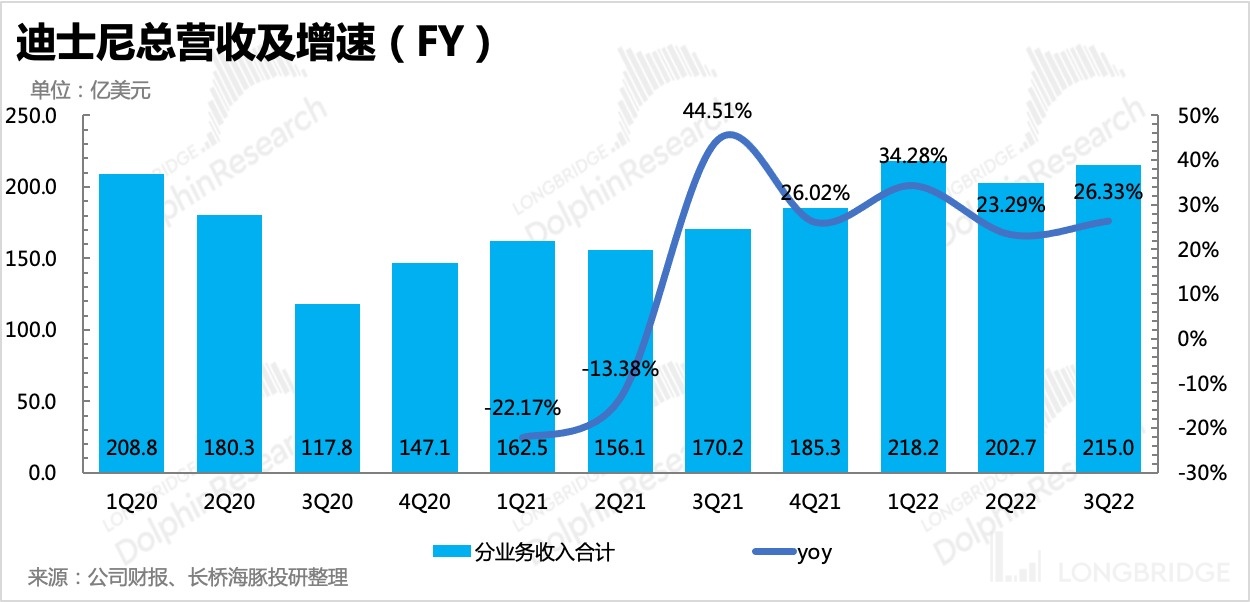

- Total revenue was $21.5 billion, up 26% YoY, exceeding market expectations. The theme park business continued to enjoy the benefits of volume and price driving, maintaining high-speed growth and being the main driving force behind the increase in total revenue.

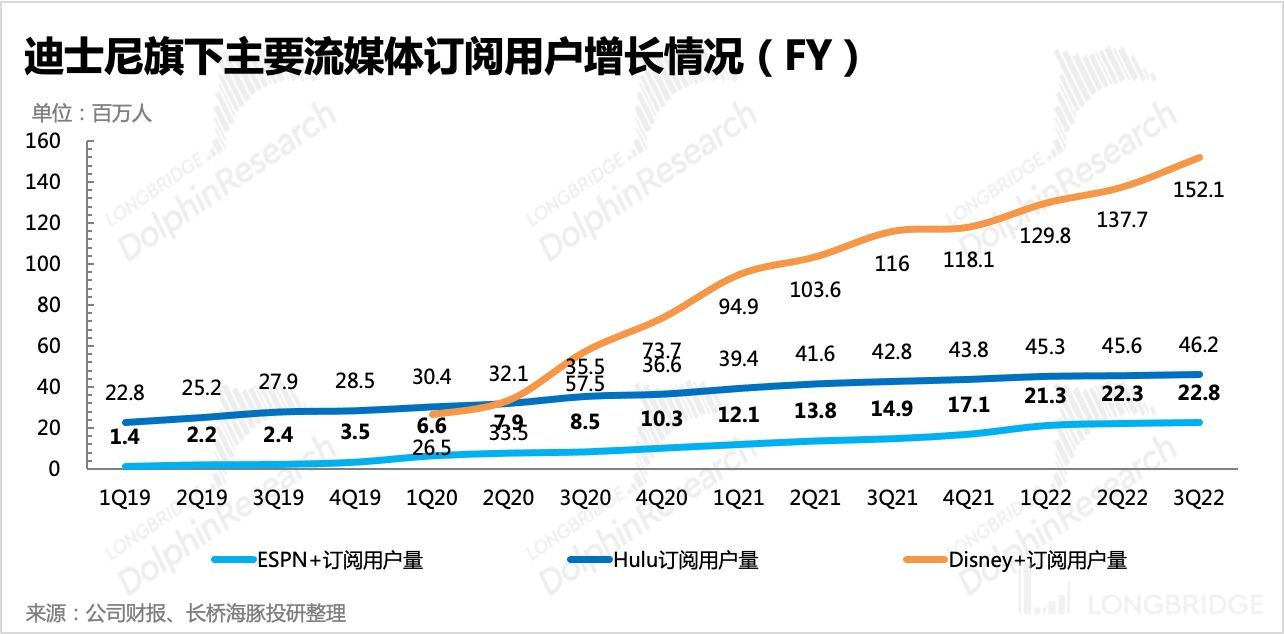

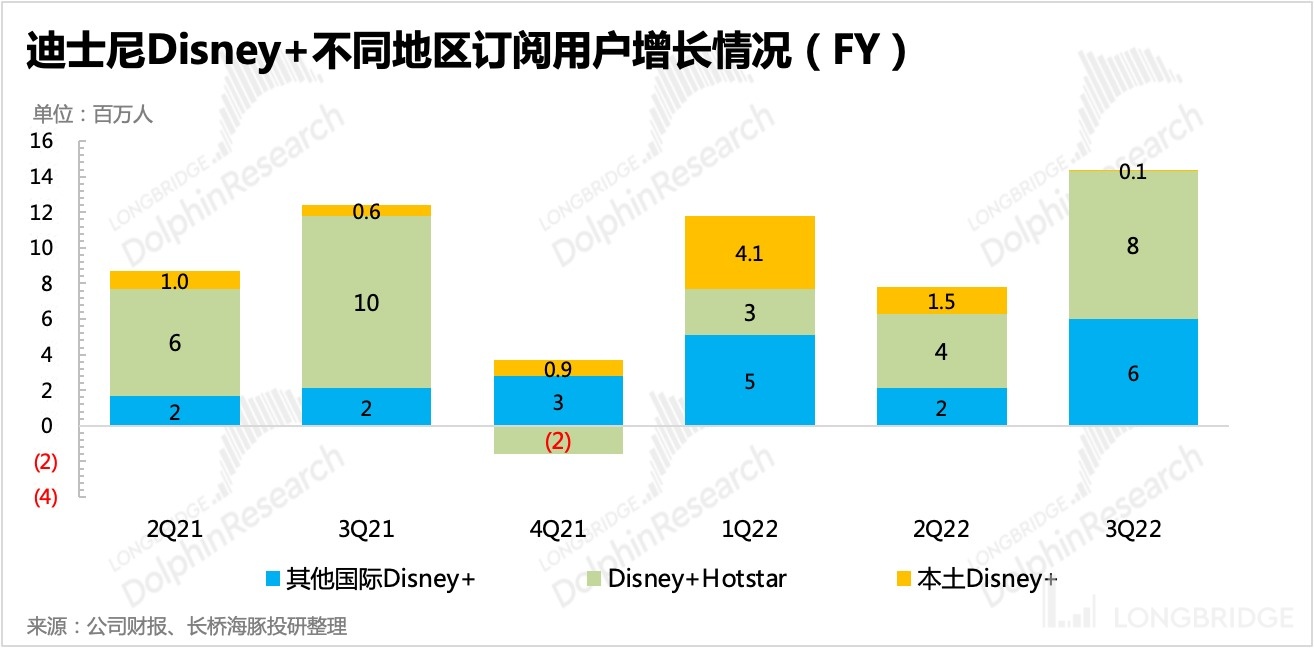

2. Disney+ streaming service added 14.4 million net subscribers, accelerating from 7.9 million in the previous quarter, which is inspiring. However, among them, 8.3 million new subscribers were from India, and another 6 million from other international regions, with only 100,000 added in North America.

Looking at the single user value, 8.3 million Indian users' value is significantly lower. Although Disney+'s prices are still considerable compared to industry peers, on the other hand, the fact that Disney lost the right to the Indian Premier League for the next five years may affect the overall user growth target. This requires attention and further explanation from management during the conference call. (Add "dolphinR123" to get the conference call summary.)

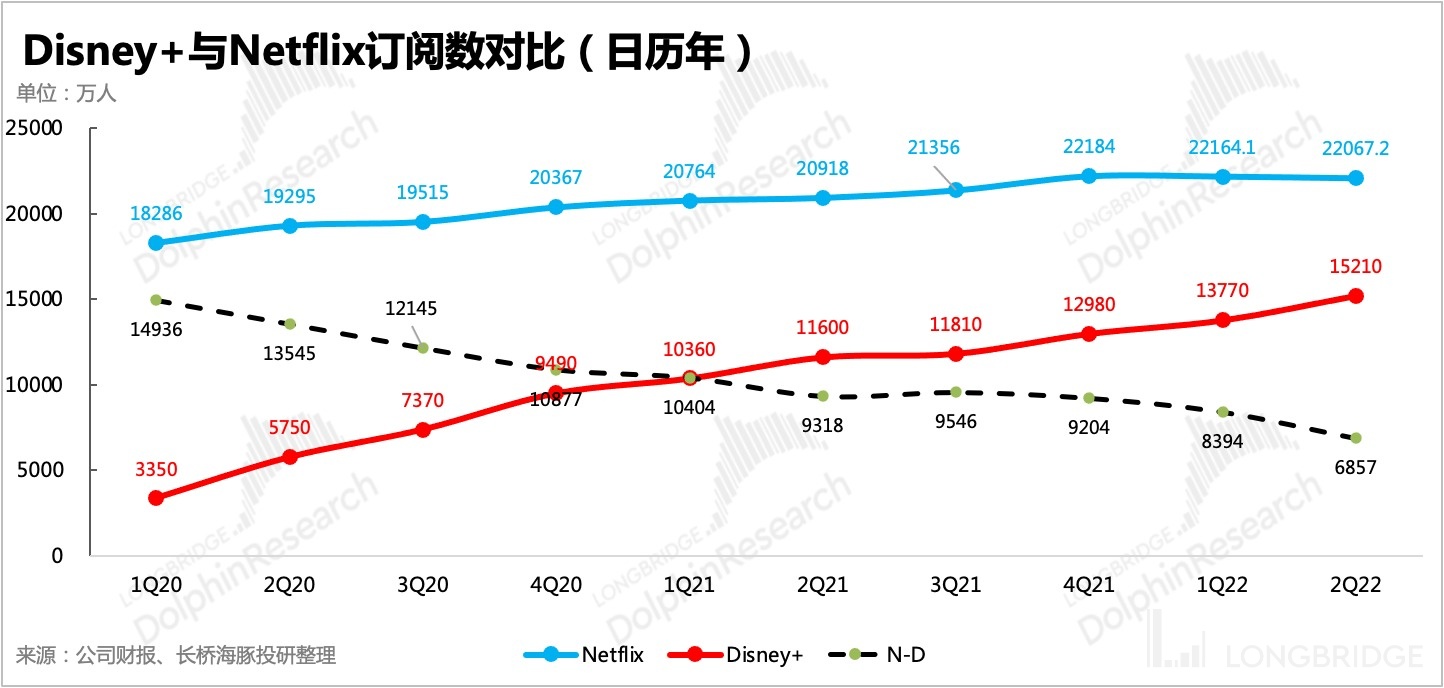

Other streaming platforms' user growth is slow, mainly through price increases to supplement income. As of the end of this quarter, Disney's total user base across all platforms reached 221 million, with Disney+ reaching 152 million, further narrowing the gap with the leader Netflix.

In addition, the company expects to launch a Disney+ advertising package in December this year.

-

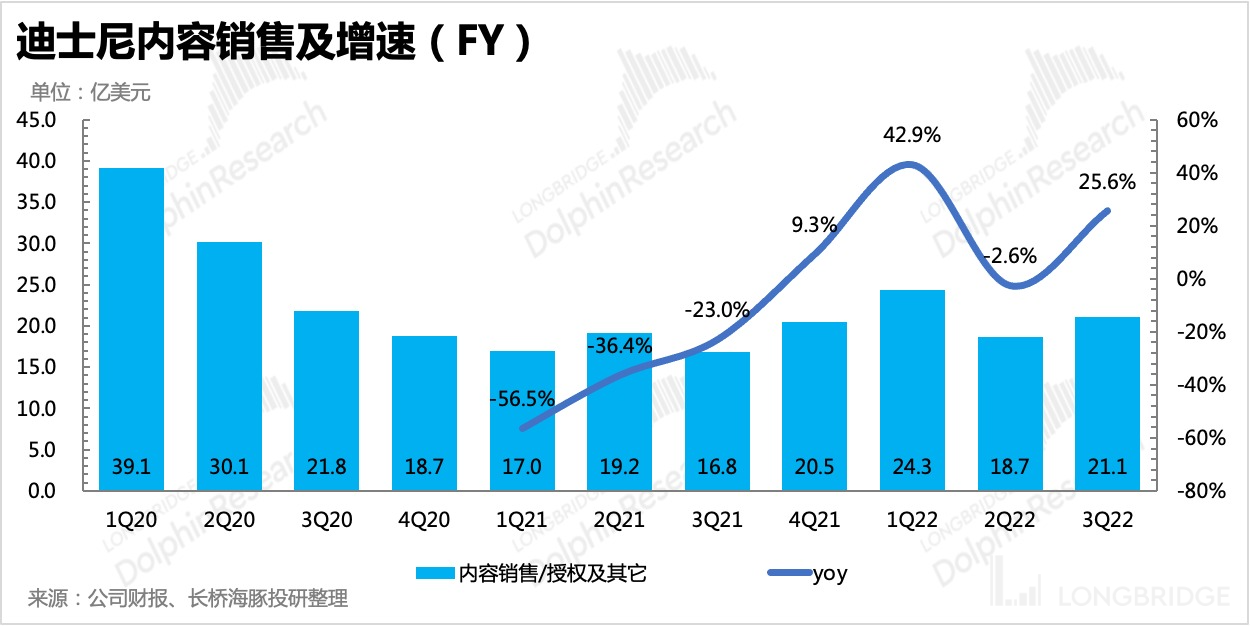

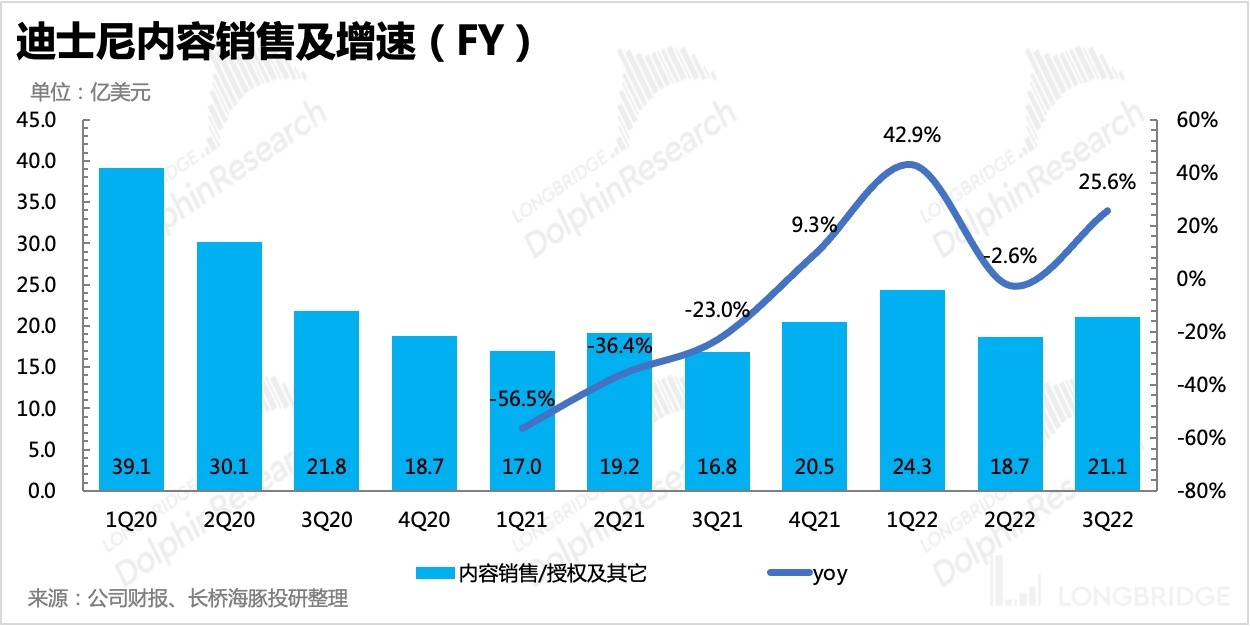

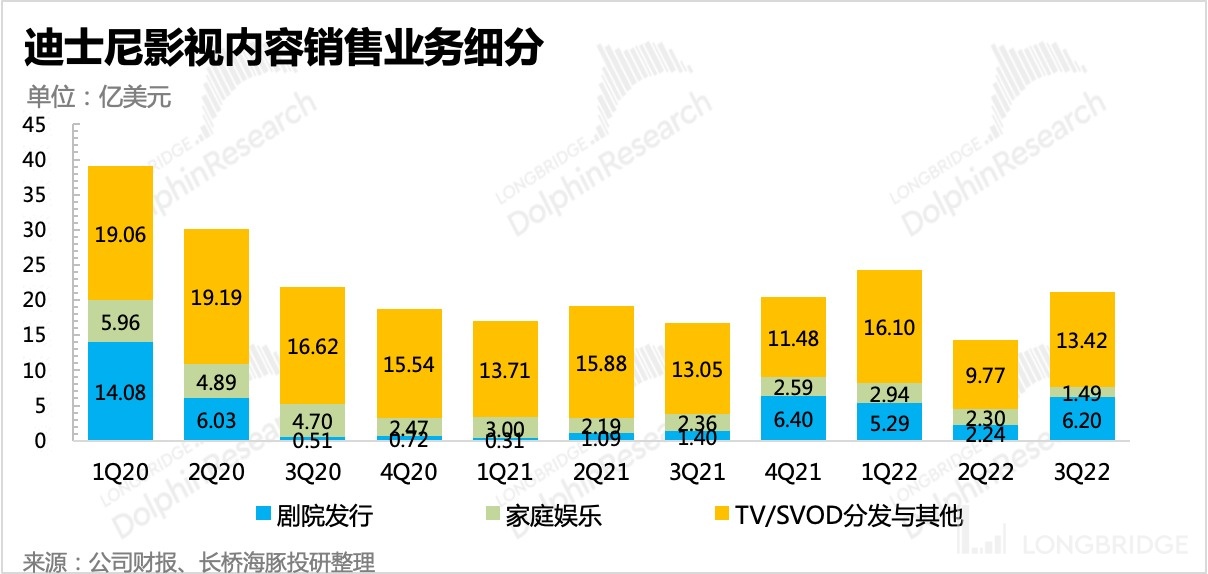

The film and television content business achieved revenue growth of 25.6% due to the heat of the movie "Doctor Strange 3" and other factors, which recovered significantly from the previous quarter. Although the release of pandemic restrictions and the recovery of cinema consumption are factors, fundamentally, this business is still mainly affected by the company's own content cycle.

-

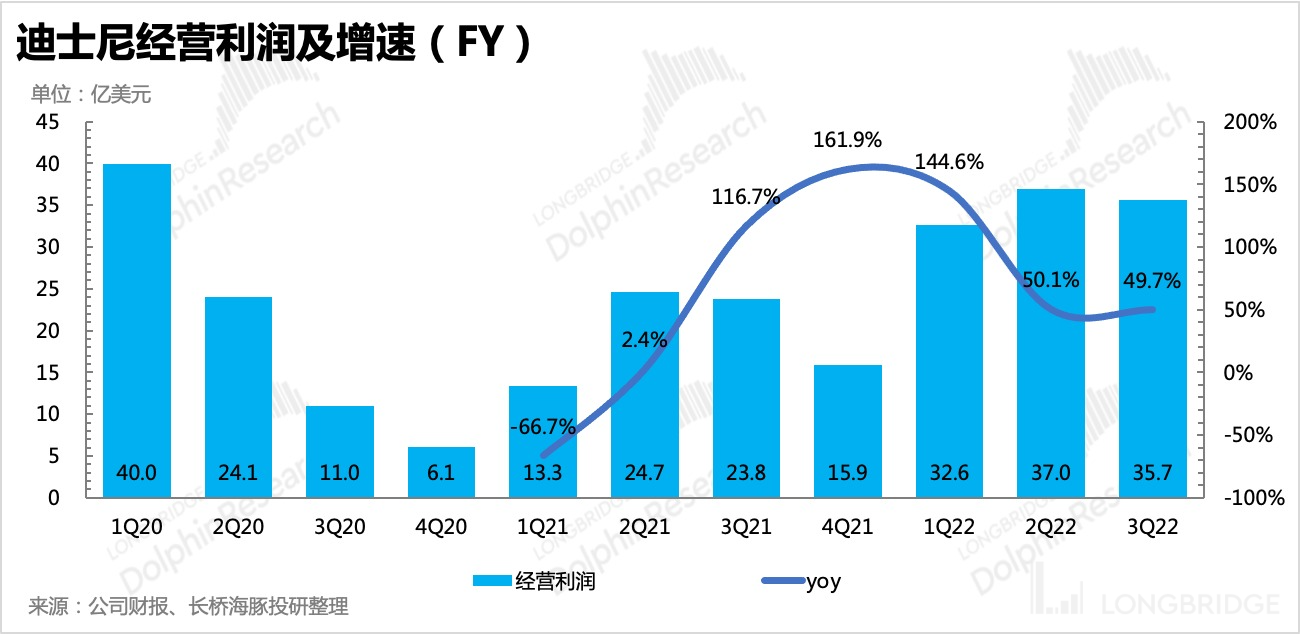

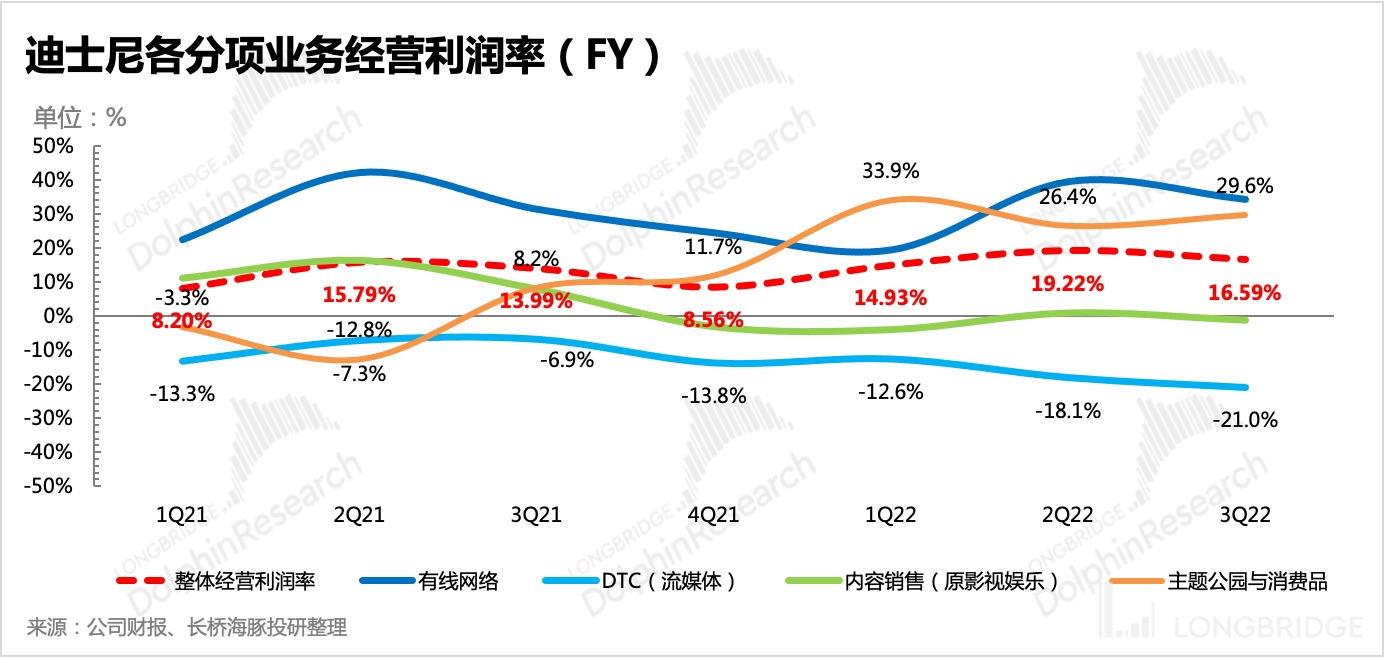

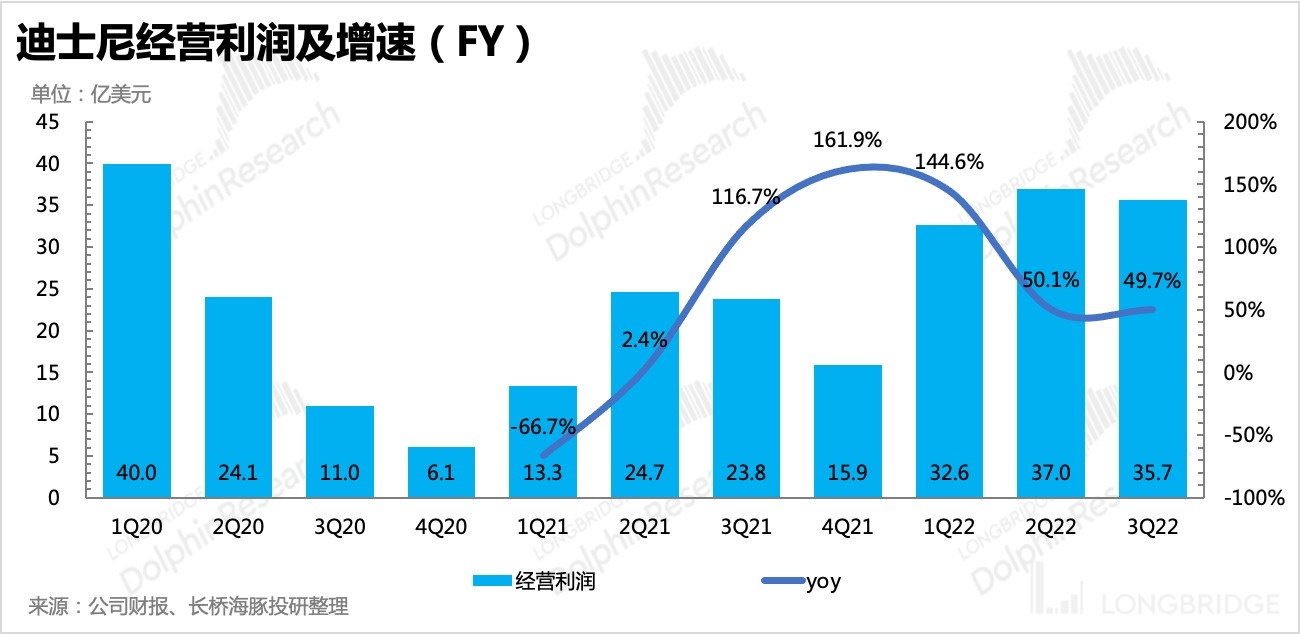

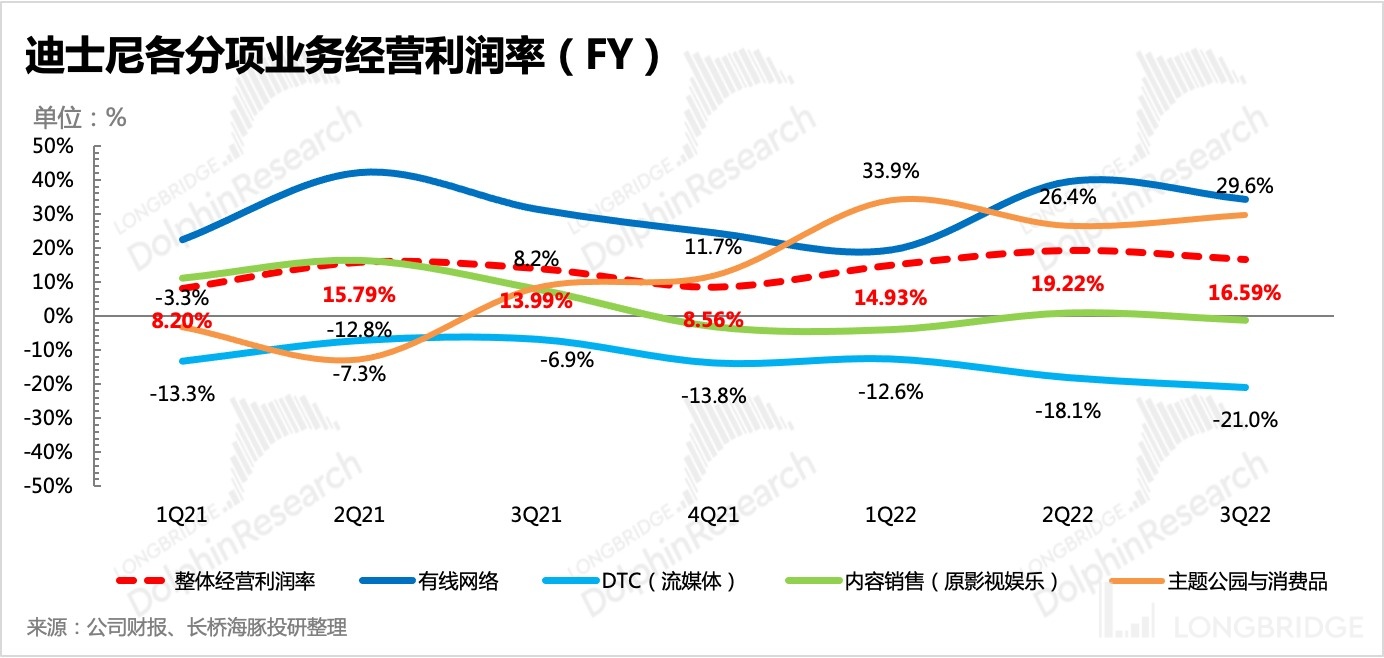

The operating profit in this quarter was 3.6 billion yuan, with a profit margin of 17%, down slightly from the previous quarter, except for the theme park business and the other three main businesses (cable TV, film and television content, streaming) have all weakened significantly in operating profit margin, mainly due to the increase in content production and procurement costs.

-

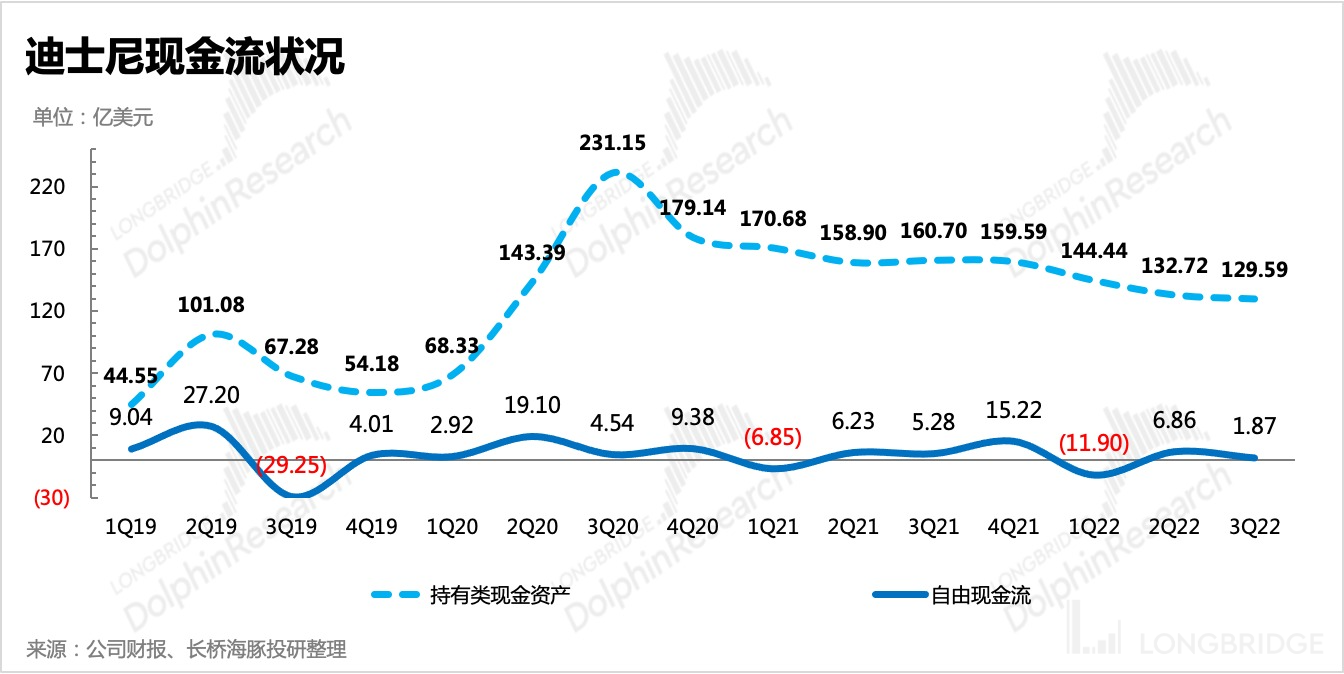

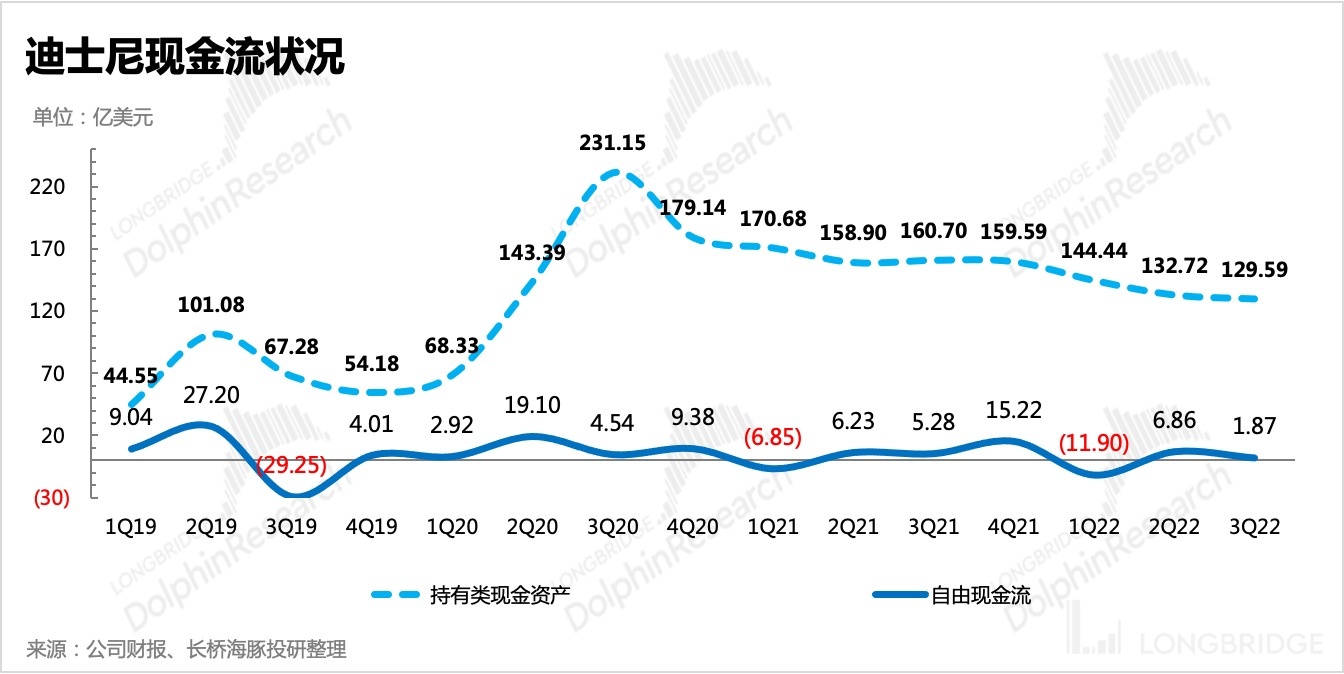

Disney's cash flow is stable, and this quarter's free cash flow was $187 million, holding $13 billion in cash. In terms of content investment, based on the investment target given at the beginning of the year, there is still a remaining investment budget of $10 billion for this fiscal year. However, due to macro environmental pressures, investment may slow down to maintain a healthy cash flow and profitability level.

Dolphin Analyst will share the minutes of the conference call with Dolphin users through the Longbridge App and interested users are welcome to add the WeChat account "dolphinR123" to join the Dolphin investment research group and get the minutes of the conference call as soon as possible.

Dolphin Analyst's perspective

The earnings report of Disney is overall not bad in Dolphin's view, which fully reflects the current logic and focus of investing in Disney.

In the short term, Disney is still in a content cycle. The expansion of streaming media is also being achieved by constantly developing new countries and regions and adding more content. The popularity of theme parks has not yet shown a clear decline. Therefore, Dolphin thinks that, compared to Disney, more attention needs to be paid to macroeconomic risks, especially whether there are signs of a contraction in consumer demand.

In the long-term logical sense, content and channels are the two main business lines of Disney. Pursuing high-quality content and capturing the trend of user channel migration are the keys for Disney to maintain long-term standing.

For investors, we focus on profit (EPS) and growth (PE). Although streaming media has no profit at present, the profitability in the future may not be as good as that of theme parks with high demand. However, streaming media represents the business growth of Disney.

Disney without streaming media might be a "cyclical value stock" highly influenced by macroeconomic and its own content cycles. Streaming media is the consumer direction chosen by the users, which binds most users' attention in the future. Although Disney's film sales and theme parks are of high quality, they need to attract more users through channels to expand their influence.

And the content investment with an annual scale of billions of dollars, for Disney, the content produced is not only used for streaming media, but also for repeat monetization in forms such as cinemas and theme parks, which can multiply the benefits.

This is also why Dolphin still focuses on Disney when the commercial model of streaming media has not yet been explored successfully.

Detailed interpretation of this quarter's financial report

I. Disney's main business structure

As a century-old entertainment kingdom, Disney's business structure has also undergone many adjustments. Dolphin has introduced it in detail in Disney: The "Botox" of the Hundred-Year-Old Princess to help investors understand the latest business structure before reading the financial report.

-

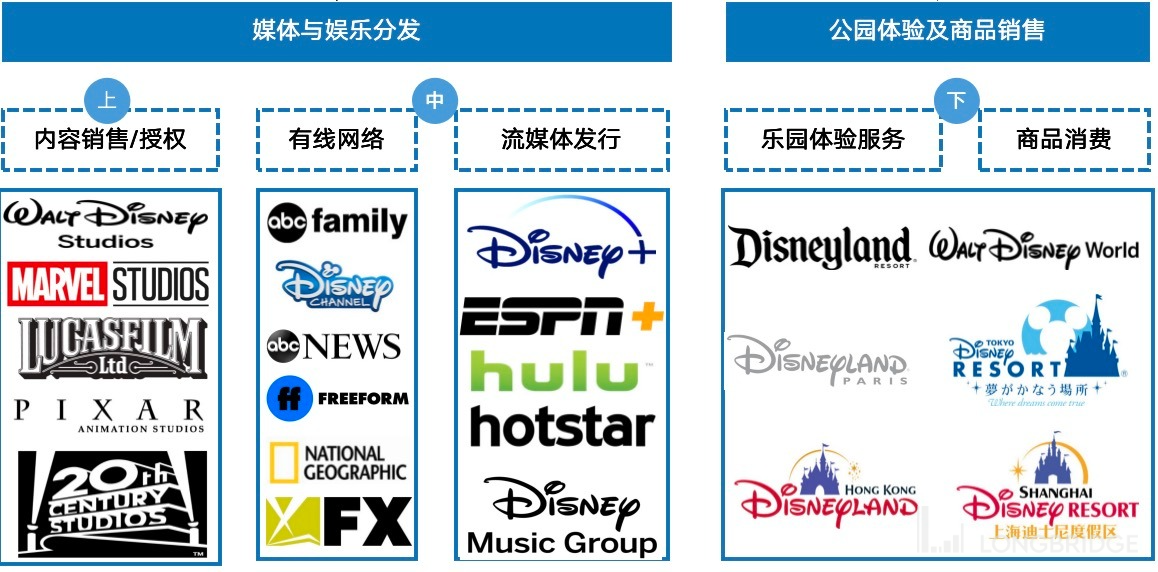

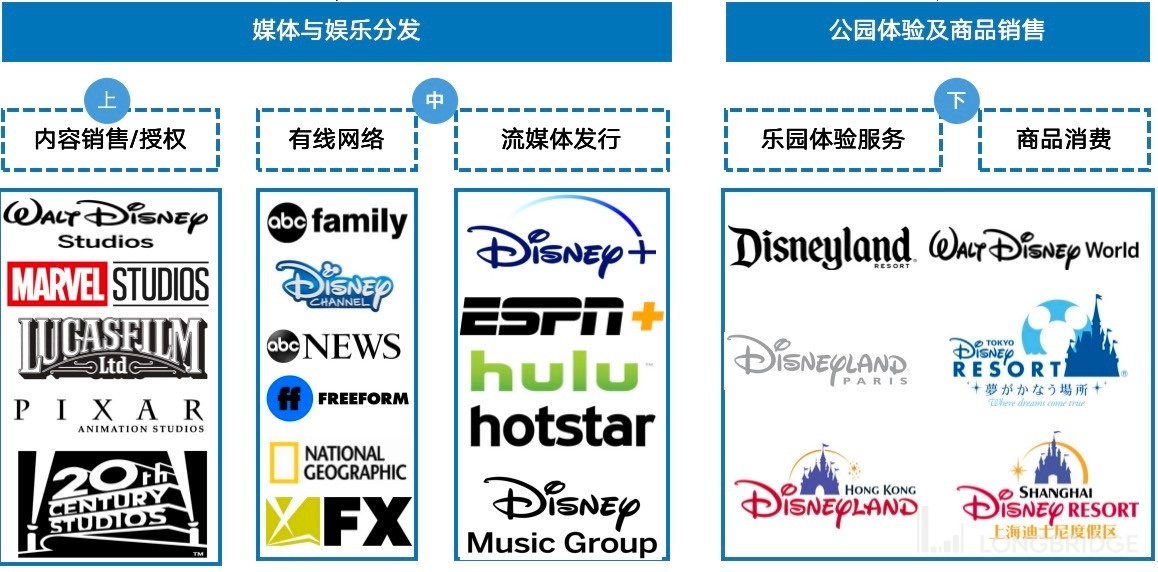

Disney's business structure mainly includes four parts: film and television entertainment, cable television, streaming media, and theme parks and retail.

-

Theme parks and retail have developed for many years and have become more mature with the support of the first IP reserve. Disney's leading position in theme park business is stable and is greatly influenced by the overall consumption. In normal times, it can be regarded as a stable cash flow.

-

[Movie and Television Entertainment], [Cable TV], [Streaming Media] are essentially engaged in the production and distribution of Disney films, so revenue changes are mainly related to Disney's film arrangement and overall film market consumption.

Source: Disney Financial Report, Dolphin Research and Illustration

2. Revenue side: Traditional business is still the main growth pillar

In this quarter, Disney achieved a total revenue of USD 21.5 billion, a year-on-year increase of 26%, which exceeded market expectations (~USD 21 billion). Apart from the consistently strong revenue performance of theme parks since the second half of last year, this quarter's sales revenue of movies and TV series also quickly recovered due to the gathering of hot movies (Doctor Strange and the Multiverse of Madness, Lightyear).

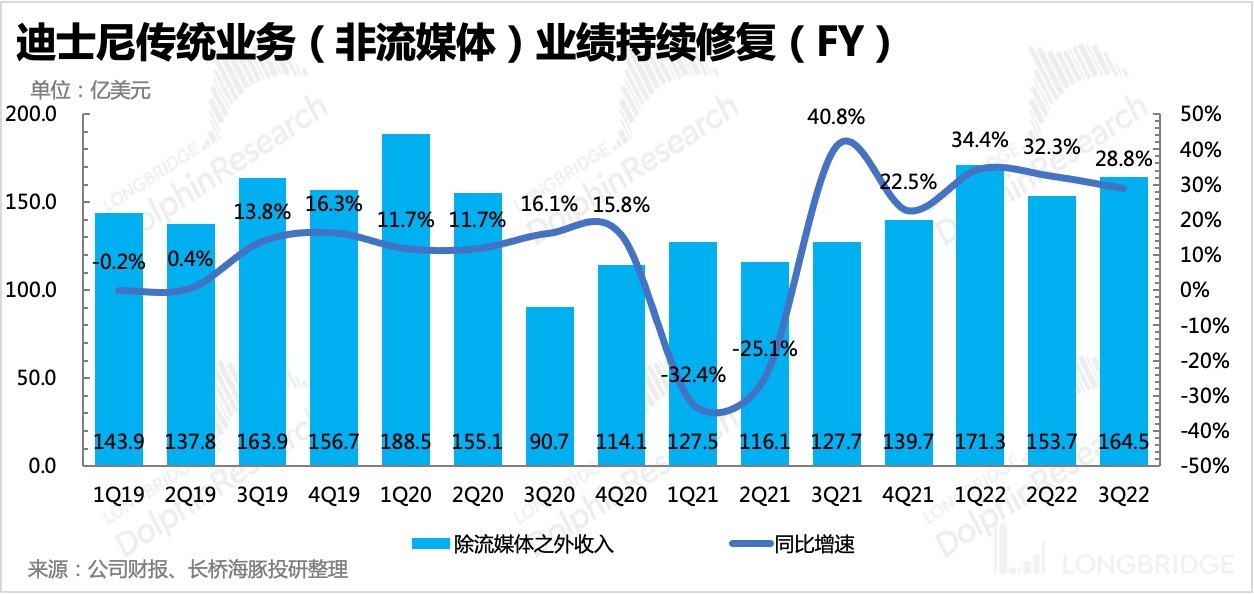

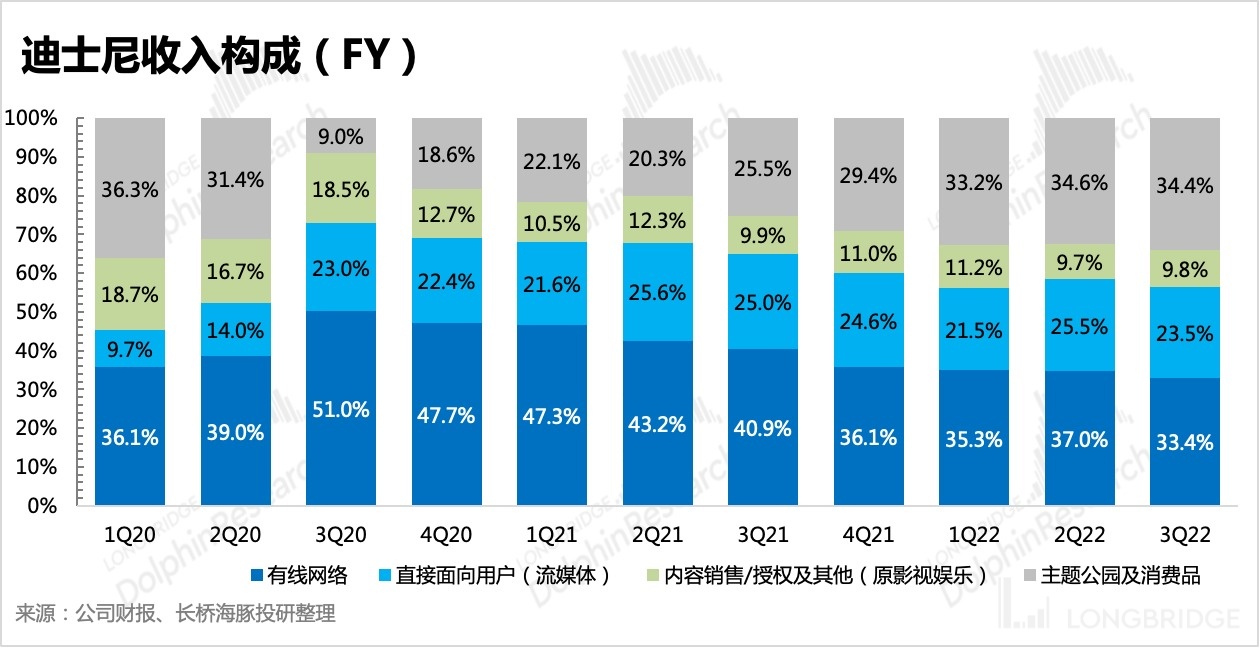

From the perspective of revenue growth contribution, traditional business repair logic still prevails this quarter. As competition in the streaming media business remains intense, the motivation for revenue growth mainly lies in increasing user penetration, while a significant increase in prices is not feasible.

Let's take a closer look at specific business situations:

1. Streaming media business (DTC)

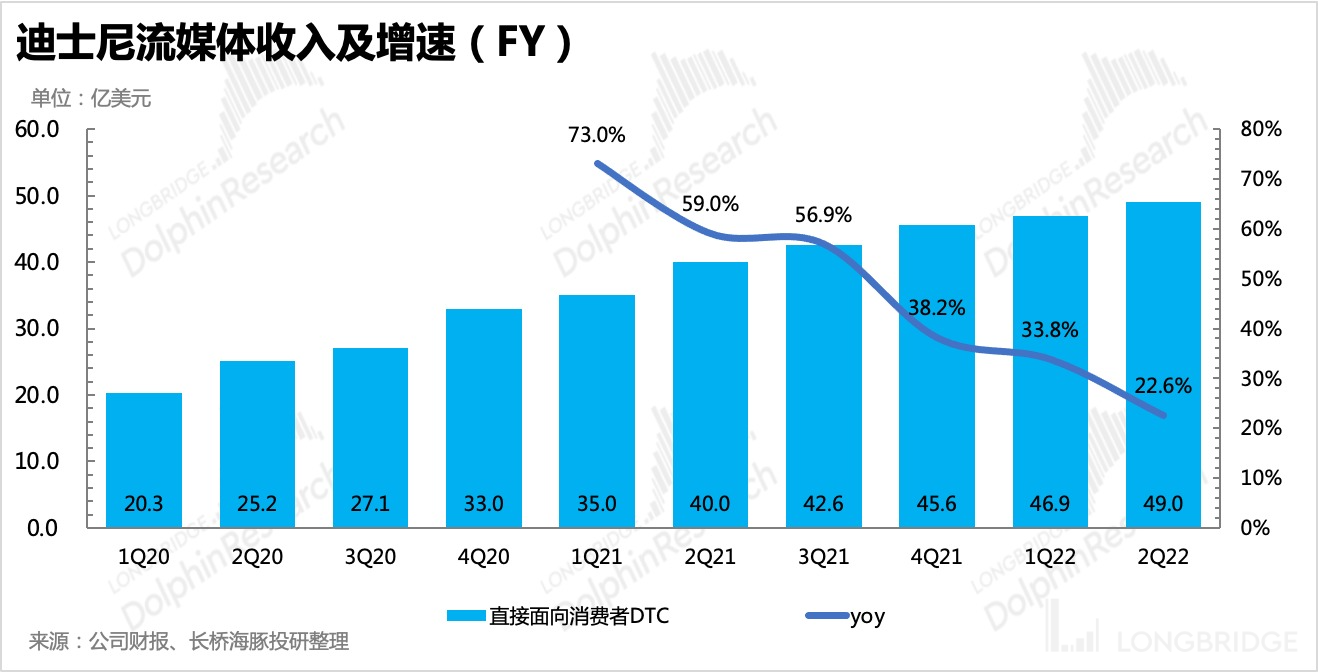

Although it currently does not contribute significantly to the company's revenue and profits, the streaming media business is indeed the main logic supporting the company's growth and is the main driving force of the market's upward valuation of Disney's future.

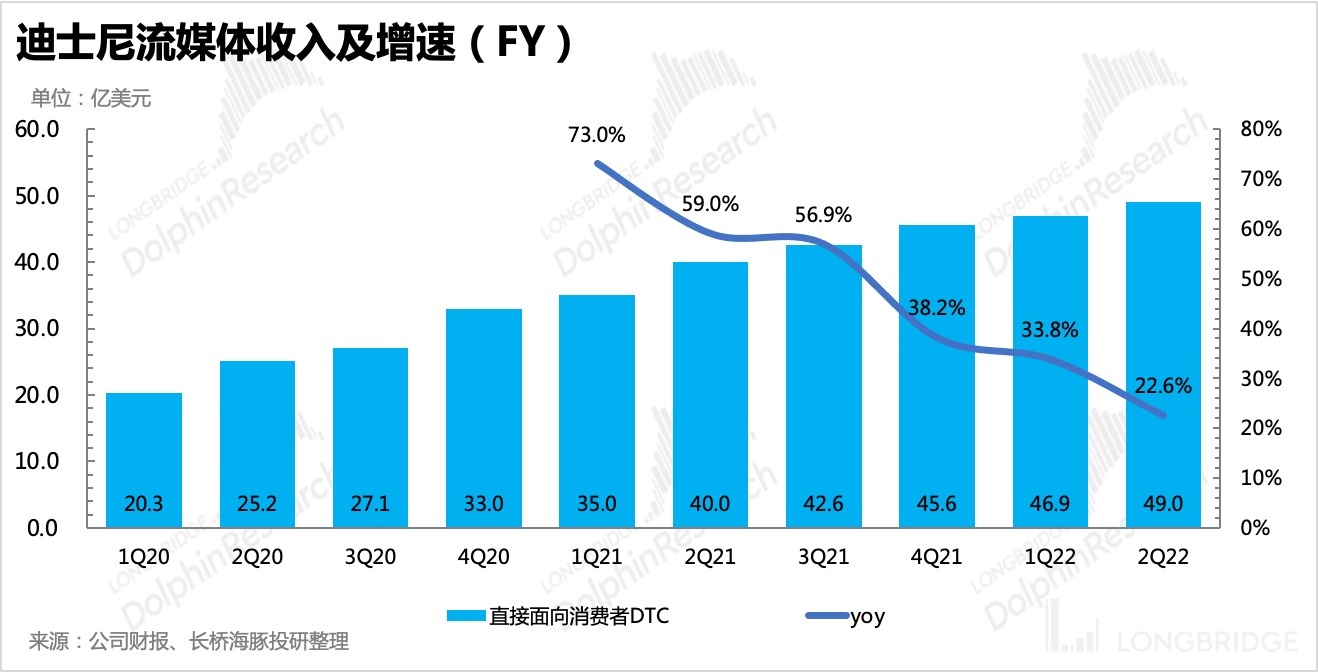

In this quarter, it achieved revenue of CNY 5.058 billion, a year-on-year increase of 18.8%, which cannot be said to be a poor performance, but it is indeed average compared to other traditional businesses. Looking at price and quantity separately, the main growth driver comes from the rapid expansion of the subscription user scale.

This quarter, the net increase in subscription users for the company's promoted streaming media Disney+ reached 14.4 million, accelerating from 7.9 million in the previous quarter, mainly from the growth of international users such as India. Although there is war friction in some European regions that expanded in this quarter, its impact does not seem to be as significant as expected.

That is to say, the increase in user scale relies on countries and regions with lower single user value. However, achievements are measurable, and if we compare the user surges of Netflix and Disney+, the latter seems more impressive.

That is to say, the increase in user scale relies on countries and regions with lower single user value. However, achievements are measurable, and if we compare the user surges of Netflix and Disney+, the latter seems more impressive.

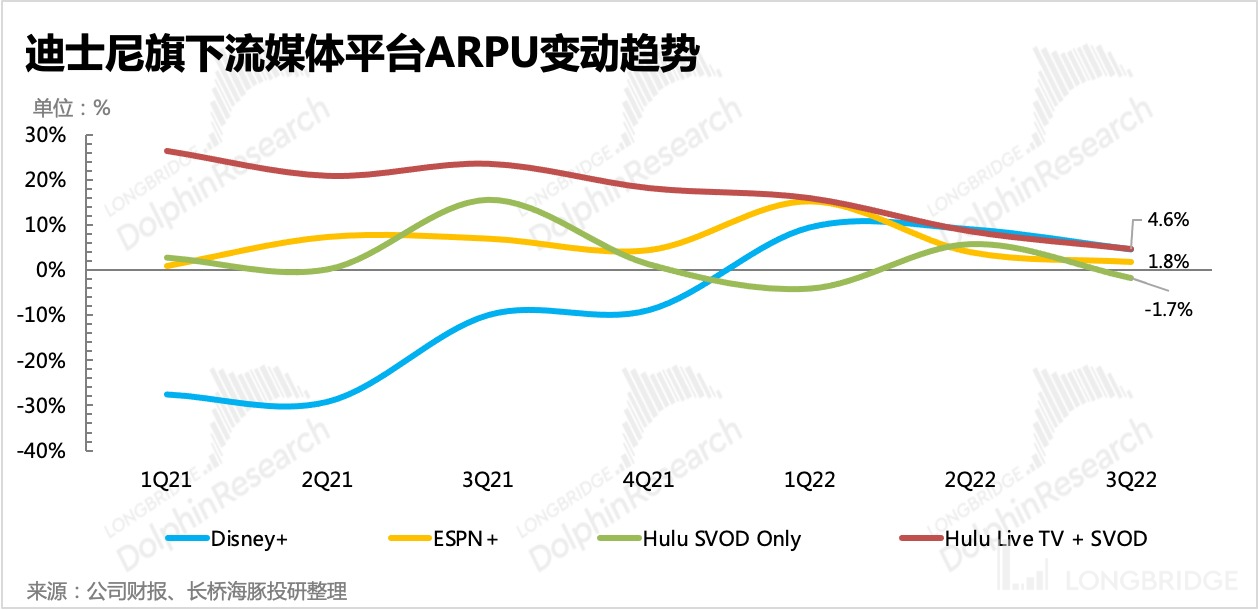

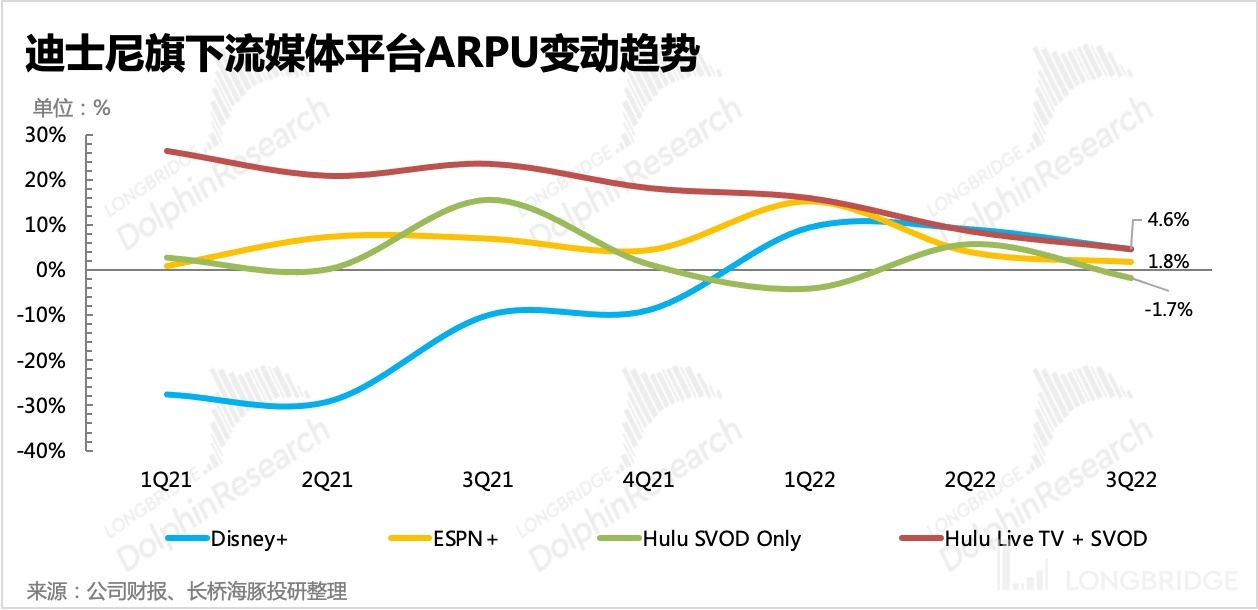

Although the overall single-user price ARPU is also increasing, except for the significant increase (53.8%) of Disney+Hotstar for the Indian market, the profitable North American market calculates the payment price per Disney+ user separately, which is down by 5.3% compared to the same period previously because more users have chosen bundled packages. Other international markets have also seen an increase in single-user payments, and their user value is not low. However, the Indian market has the most potential for growth. This quarter, the monthly payment just exceeded $1, a significant difference compared to peers.

Other streaming platforms under Disney are relatively mature in development, especially when the contents on the platforms are gradually being transplanted to Disney's bundled package. The appeal of individual subscriptions has declined, and user growth is relatively weak compared to Disney+. They are currently relying mainly on exclusive platform content and gradually harvesting existing users by raising prices in rotations.

For example, Hulu raised its prices at the end of last year, and this quarter is also digesting the side effects of the price increase. While recently, ESPN+ announced in mid-July that its prices would increase by nearly 50% (standard monthly fee rose from $6.99 to $9.99). This will be reflected in the performance next quarter.

However, it is worth mentioning that for Dolphin Analyst, the rights to the Indian IPL event, which is highly regarded by him, were not successfully obtained by Disney after the expiration this year. In the financial report review last quarter, the Dolphin Analyst expressed his regret that the copyright fees after the IPL was snatched away once again reached exorbitant levels. Originally, it was thought that with the influence of HotStar's past five years of cooperation relationships, and Disney could easily obtain the copyright for the next five years, the only obstacle would be the higher cost.

IPL is a sports event in India with national-level influence. Over the past two years, every time IPL events aired, the streaming subscriptions of Disney+HotStar increased significantly. After losing the copyright for the next five years, it will inevitably have a certain impact on the global user growth of Disney+. Will the guidance provided by management for a subscription scale of 230-260 million users in 2024 be adjusted? Investors are advised to pay attention to the management's answers to this issue during the conference call. The failed high-priced auction of the IPL copyright further confirms the industry trend of content premium enhancement and competition intensification. In terms of various media platforms, this translates to higher costs and lower profit expectations. Whether viewed from the perspective of Chinese gamers' endgame or the business model itself, long videos are not a very good business, especially when compared to the money-making ability of traditional businesses with high barriers to entry like Disney.

However, in the current context of increasingly fierce streaming media competition, American giants are unwilling to give up and withdraw, so the content arms race will inevitably continue, and the situation of increasingly heavy film and television content will continue for a while. At this point, it depends on which giant has a unique insight and can efficiently release one after another drama that is both well received and sold to users.

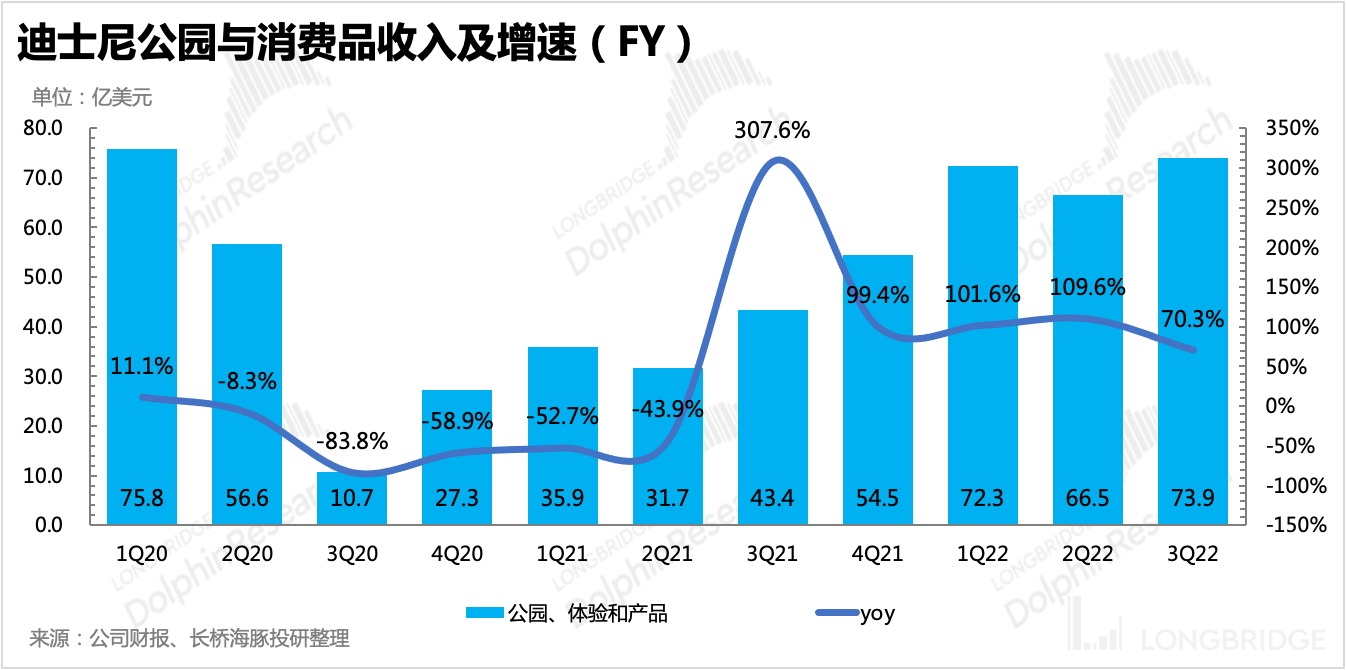

Theme parks and consumer goods - this quarter, the theme park continues to be the strong performer of the company's performance, with further improved profitability under high revenue growth, even significantly exceeding the profit margin level of the stable period before the epidemic.

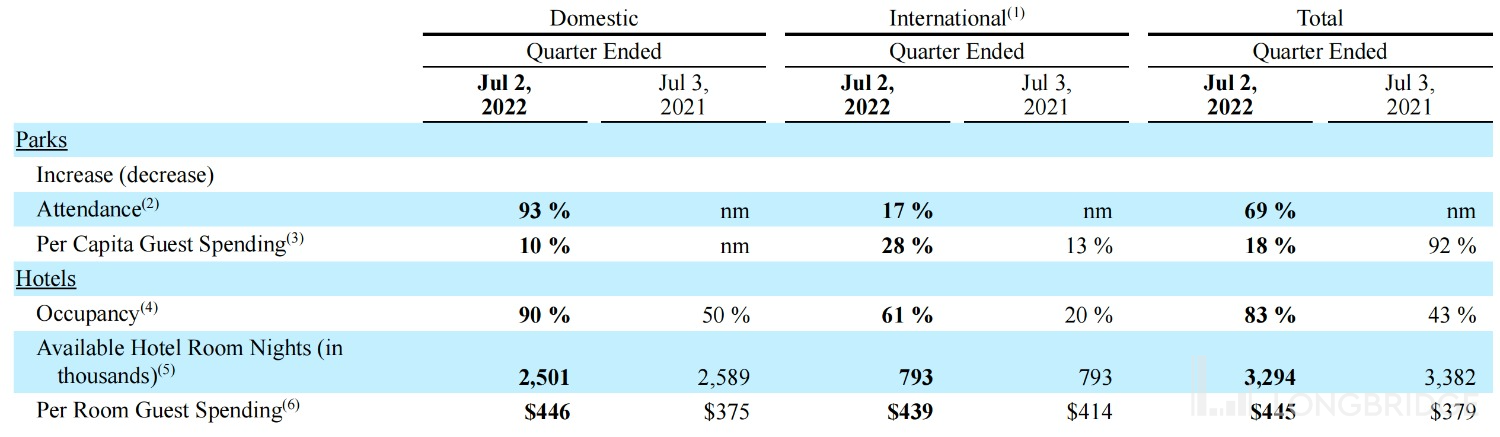

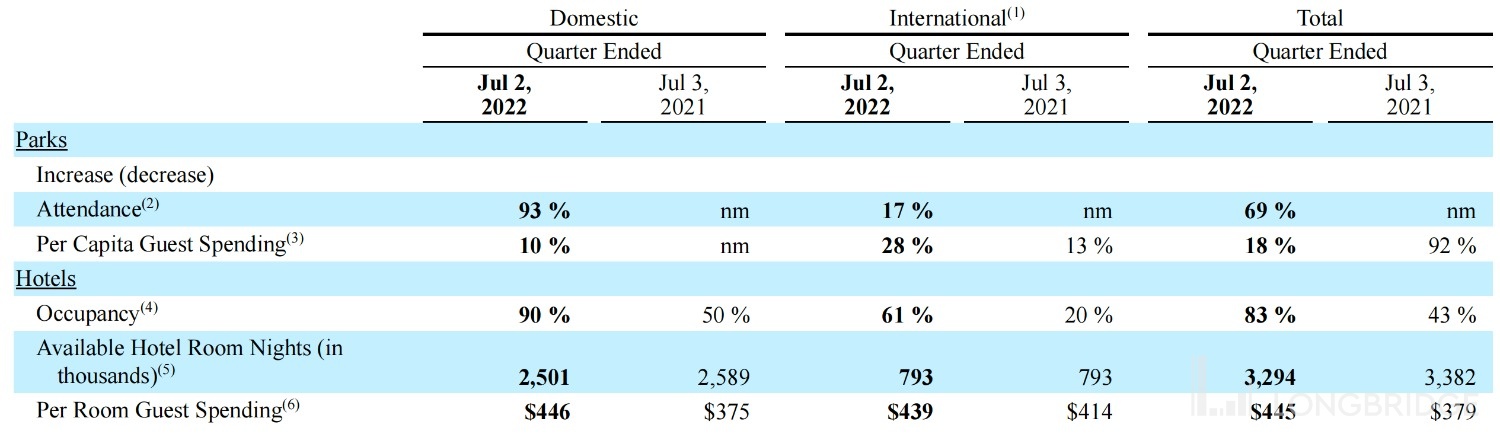

This quarter achieved a revenue of 7.394 billion US dollars, a year-on-year increase of 70%, of which the theme park revenue was 6.2 billion, a year-on-year growth rate of 95%, significantly higher than market expectations. Although the growth rate has slowed down compared to the previous quarter, the overall demand is still strong.

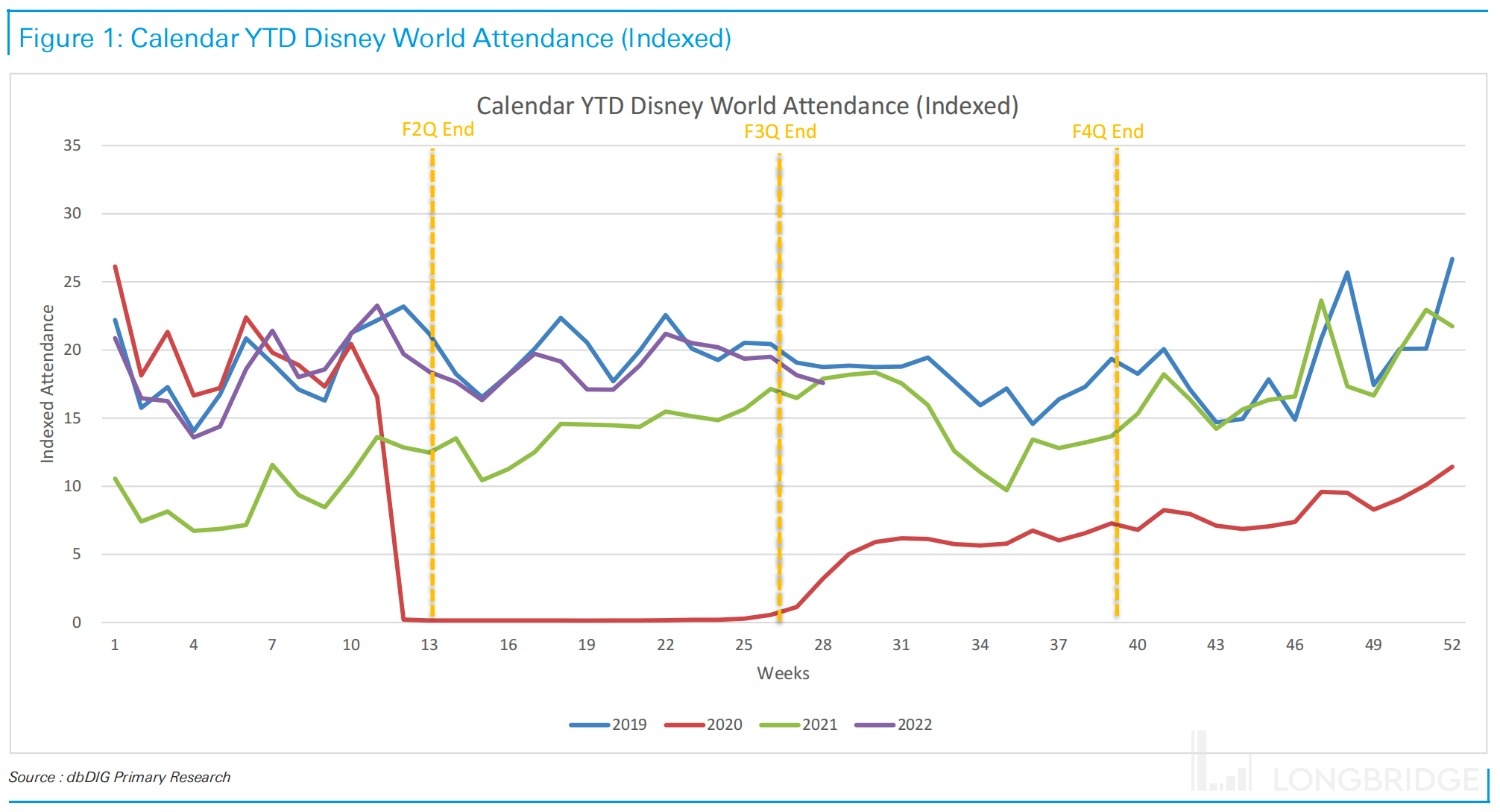

Although the epidemic is still sporadic, the world is basically in a relaxed state. This quarter, except for the closure of Shanghai Disney due to the epidemic, other parks are open as usual, but there are still certain restrictions on the peak daily traffic in areas with relatively severe epidemics, such as Disney World in Florida.

In the conference call last quarter, the management expected that the closure of Asian theme parks would lead to a potential loss of nearly 350 million. If this loss is added, it means that the revenue-generating ability of the original international park will surpass the pre-epidemic level, with higher elasticity in year-on-year growth.

Behind the high growth of theme parks for several quarters, in addition to the natural repair after the relaxation of the epidemic, the 50th anniversary of Florida Disney and the 30th anniversary of Paris Disney Celebration also brought enthusiasm. Price increases in hotels and other consumer goods, timely introduction of value-added services and products by the company also stimulate user consumption. In addition, this quarter, Disney Cruise is open as usual after being completely closed last year.

Overall, the reason why the revenue growth rate of theme parks remained high this quarter is mainly due to the driving force of the recovery of people flow after the epidemic was relaxed, and under the retaliatory consumption psychology of tourists, all price increases and additional value-added services and products are accepted. **

(For more historical admission and occupancy rate data, download the Longbridge app and go to the "In-Depth Data" section of the Disney stock page.)

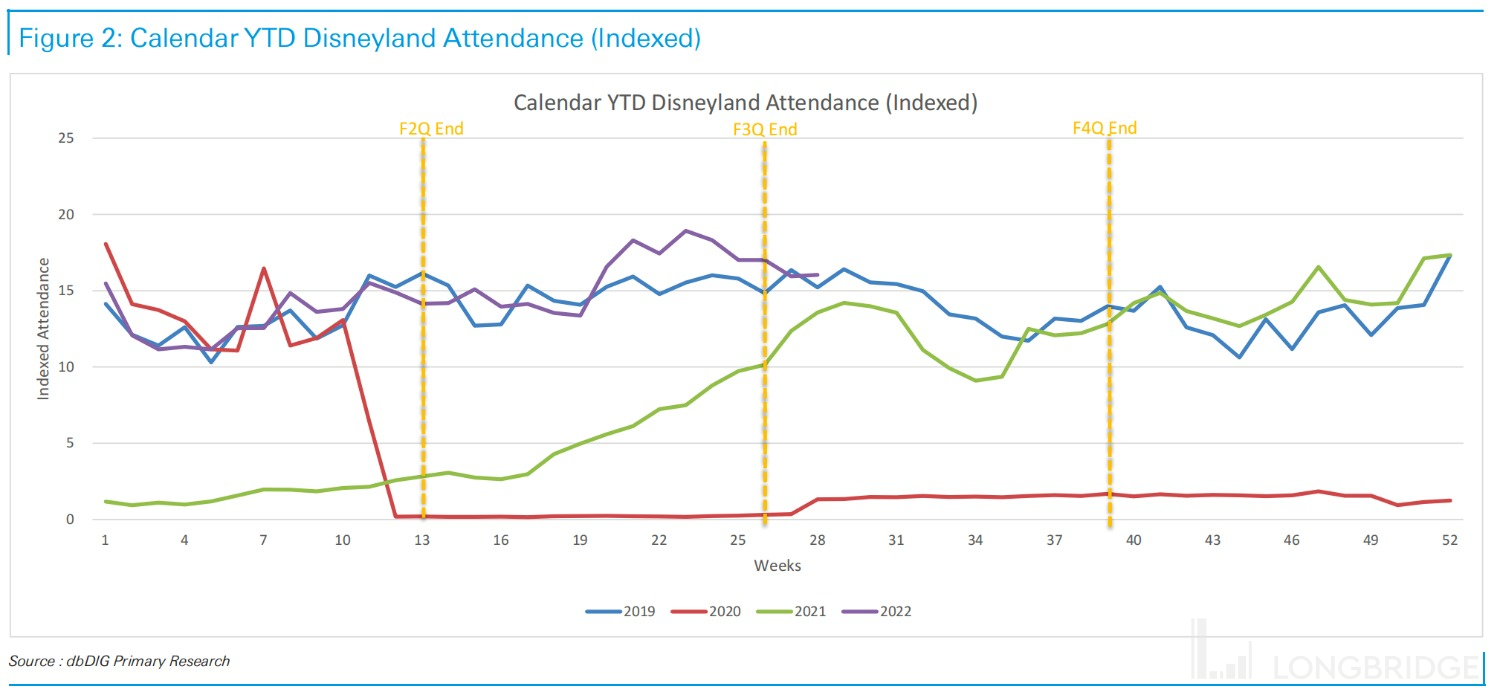

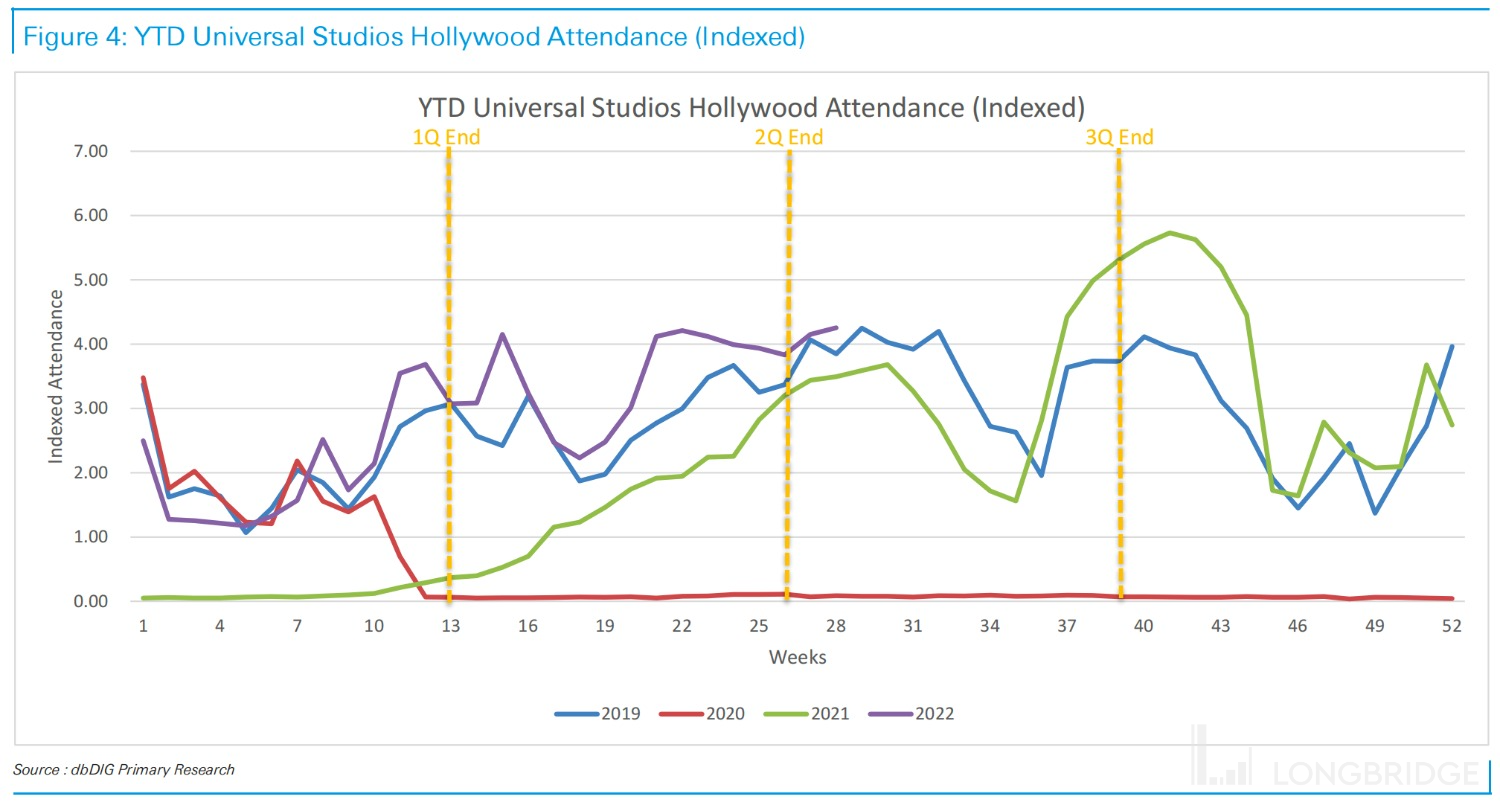

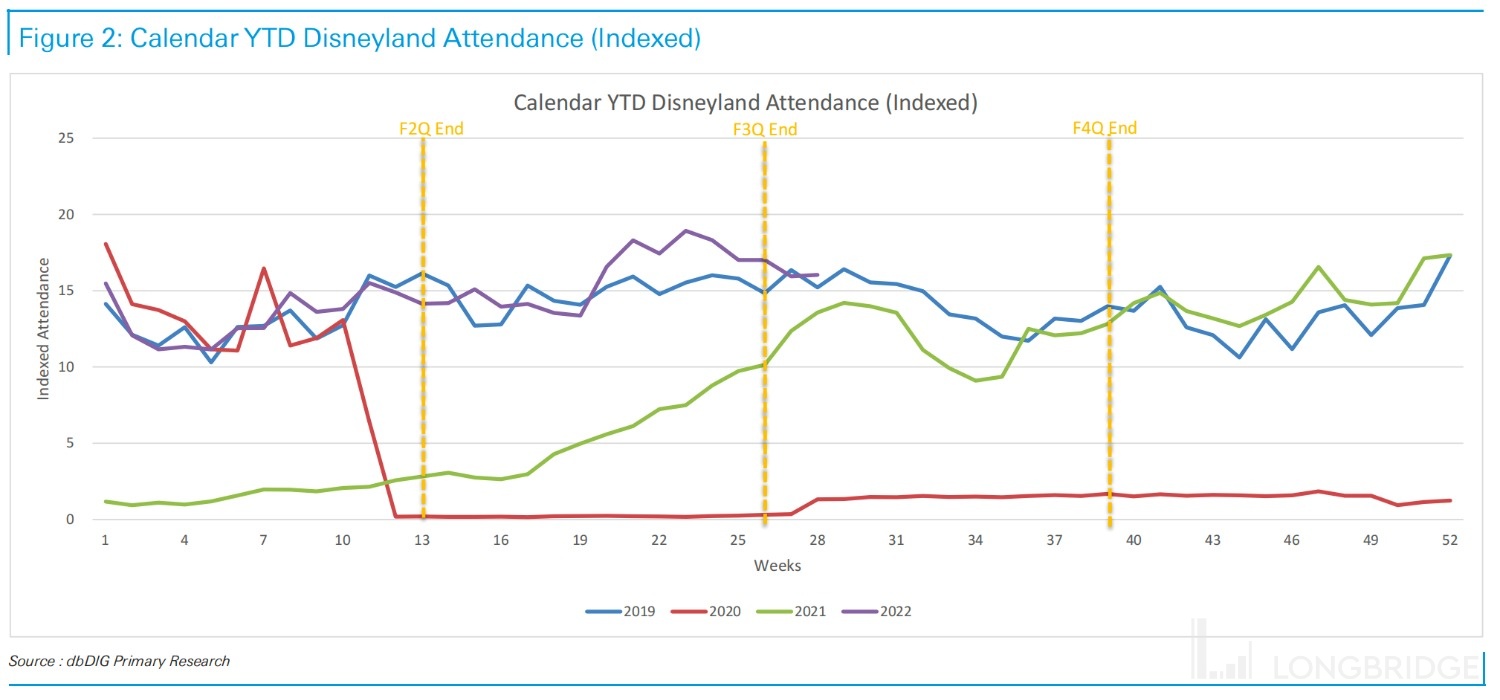

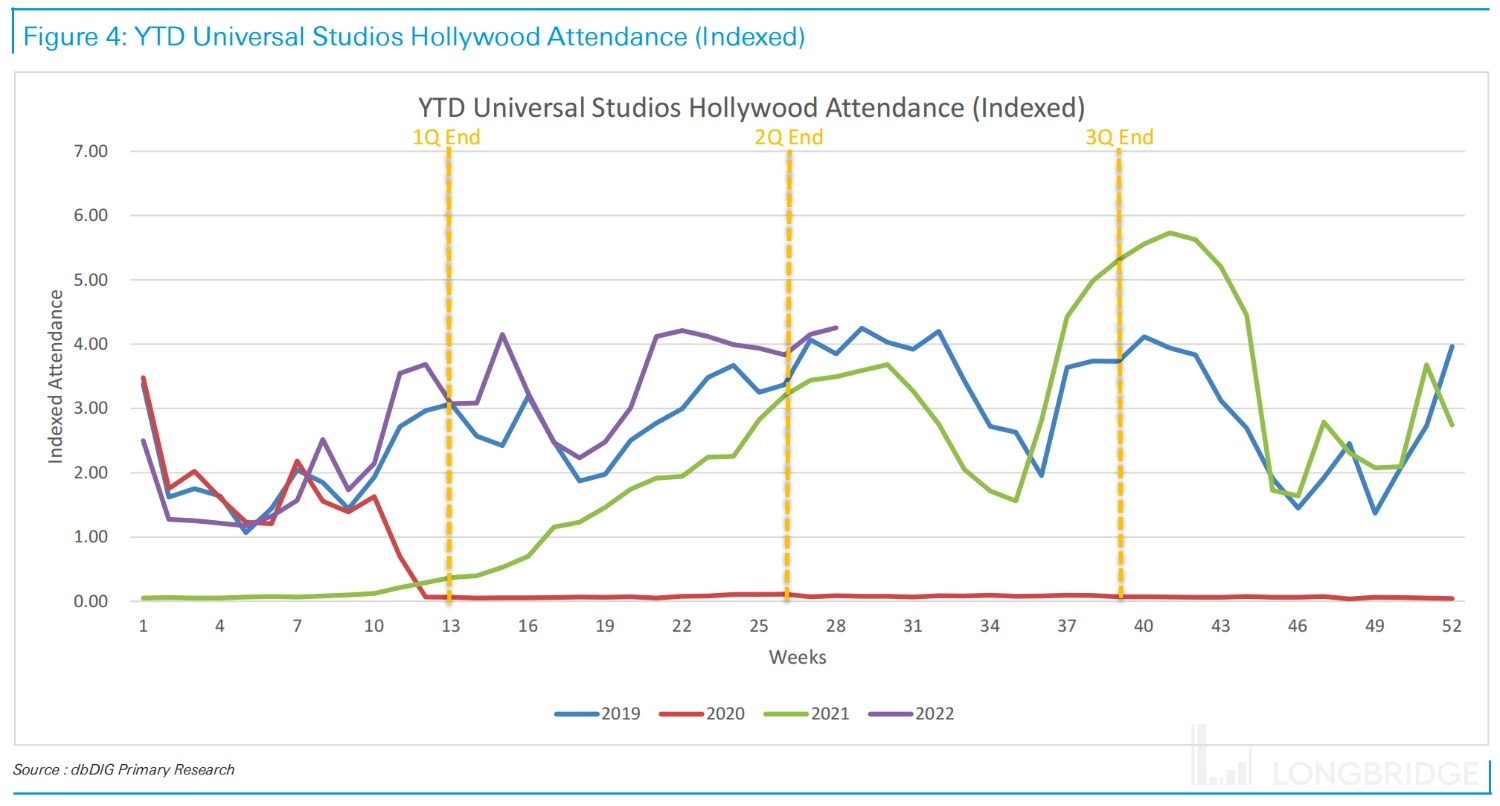

Deutsche Bank's alternative tracking data also shows strong demand for offline parks, with California Disneyland's admission rate surpassing 2019 levels and Florida Disney World still below 2019 levels due to pandemic restrictions and opposition to gender education bills.

The same trend is evident at Universal Studios' theme parks, so the strong demand at present is more industry-driven. People who have been held back by the pandemic for two years are still in the retaliatory consumption phase after the formal reopening this quarter.

3. Sales of film and television content

Content sales revenue is mainly related to the theatrical performance of current Disney releases, as well as the distribution and licensing of other television programs and the payment of home television on-demand services. In the current quarter, Disney released Marvel's "Doctor Strange 3," which has performed well in global box office revenue, surpassing $960 million to date. In addition, the popular Pixar animated film "Lightyear" has also grossed $220 million in revenue.

However, on a sub-item basis, on-demand revenue from households has shown a significant year-on-year decline, and SVOD revenue has rebounded slightly from a cold start last quarter, remaining broadly the same as last year. However, from a strategic management perspective, the future trend is to prioritize content on streaming platforms. Therefore, there is no growth point for home entertainment and SVOD in the future.

In the next quarter of the fiscal year, "Thor 4" has been in theaters for a month, grossing $700 million globally to date. Although there has been some negative feedback, there is no need to worry too much about the box office revenue of Marvel's films. The next big movie may have to wait until the end of this year, the new fiscal year. FY2023 will see another small peak in blockbusters, especially with the release of "Avatar 2," which is worth looking forward to.

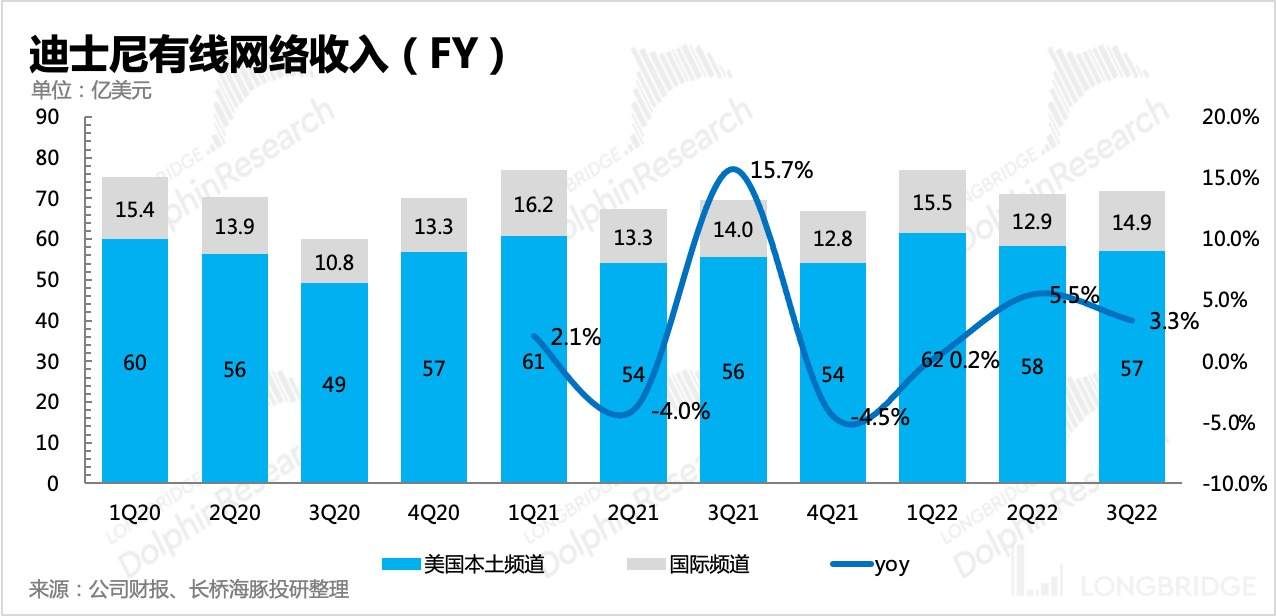

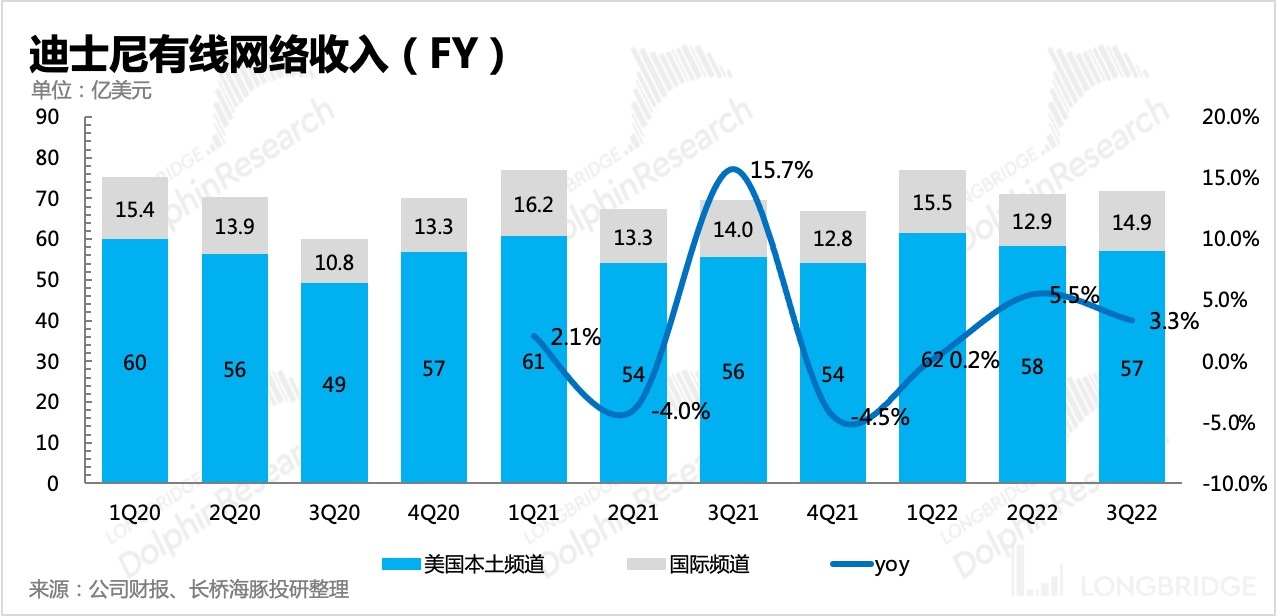

4. Wired Networks

During this quarter, traditional broadcast television media saw an increase in advertising revenue due to the NBA Finals, bringing in a total of 7.189 billion USD in revenue, a year-on-year increase of 3.3%. However, the baseline from last year was also high, and there was a delay in the broadcast of the 2020 European Cup Football Match due to the pandemic, so the growth rate appears to be low. But in fact, it’s already difficult for wired television to maintain stability under the high-speed development of new emerging channels such as streaming media and CTV. The trend of cord-cutters migration makes it difficult to see any significant growth opportunities, only occasional favorable timing for stimulation.

3. Profit End: Theme Park Profit Margin Increases, Streaming Media Losses Increase

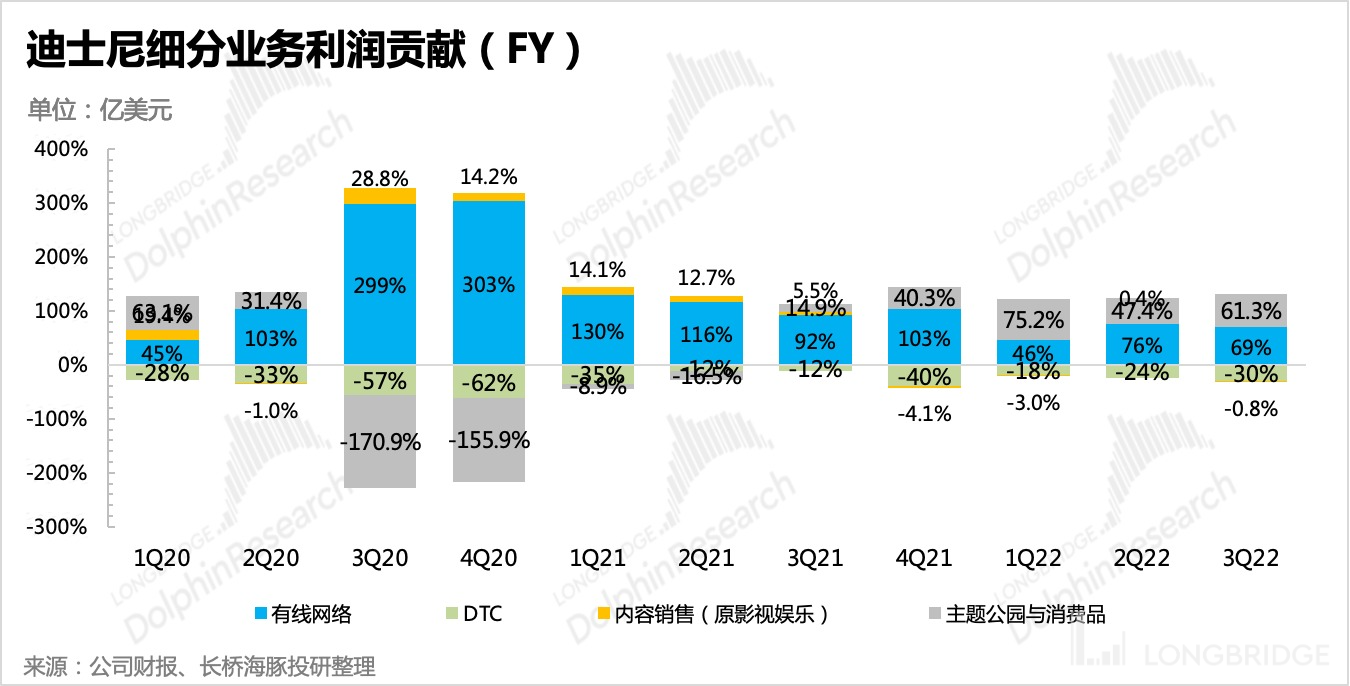

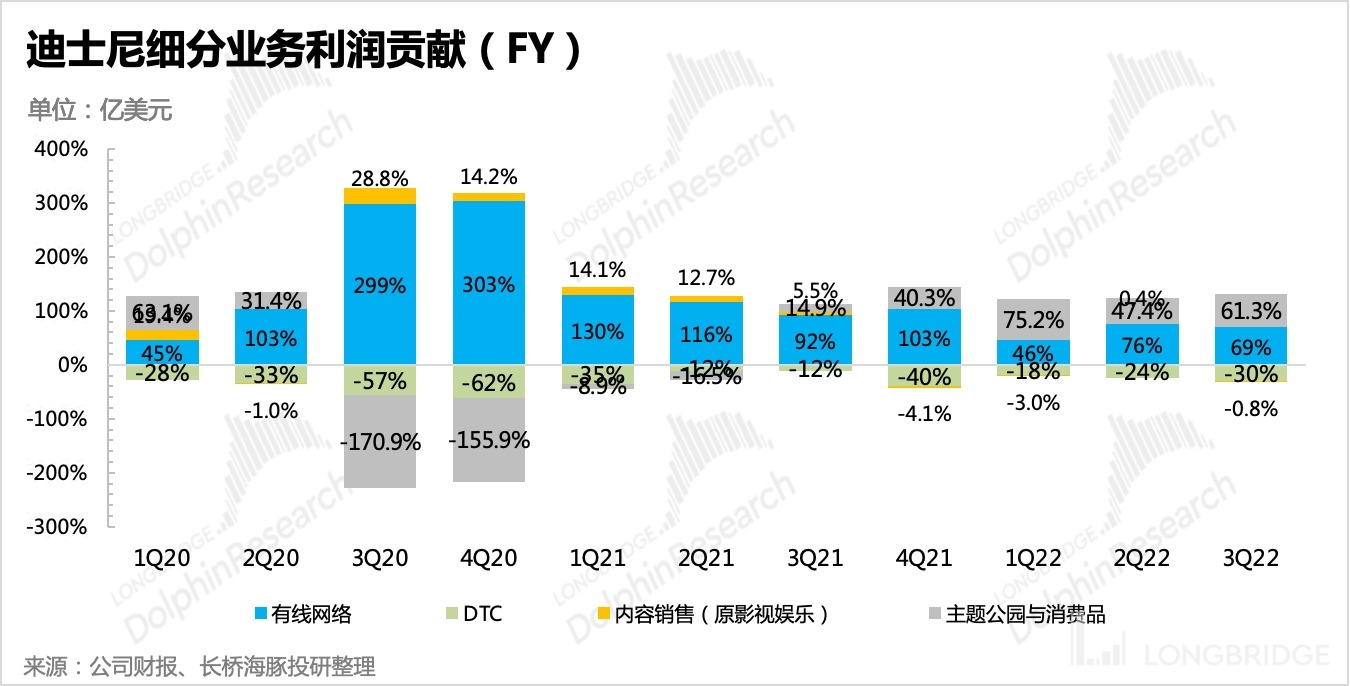

During this quarter, the four major business segments achieved a total operating profit of 3.567 billion USD, a growth rate of 49.7% compared to the previous quarter, though mainly due to the release of traditional business profits. The loss of streaming media has been increasing and there has been no improvement in loss rate.

A breakdown shows that the profit contribution of traditional businesses is still continuing to rise. Streaming media is still under cost pressures, generating upstream content premium force by intense competition, as well as rising production costs in their own studio. However, current streaming media platforms are fighting both content wars and price wars to acquire users. By constantly doing promotions when their inventory is low, they exert pressure on peers, and counteract each other. As a result, it may be difficult to tell who the winner is.

This is the awkwardness of streaming media business logic. Users are loyal to content, not the channel. Unless they continuously produce smash hits, it is hard to maintain dominance. Netflix used to be the absolute monarch, but as more and more strong competitors continue to emerge, it is almost impossible to maintain the continuity of that absolute dominance.

Therefore, what we can expect is only when the competition pattern is stable, and giants stop bombarding with funds, the entire industry's benefits gradually rise together so as to enable long video’s profit model to work.

IV. Cash Flow Situation: Relatively Stable, Focus on Adjusting Short-term Investment Goals

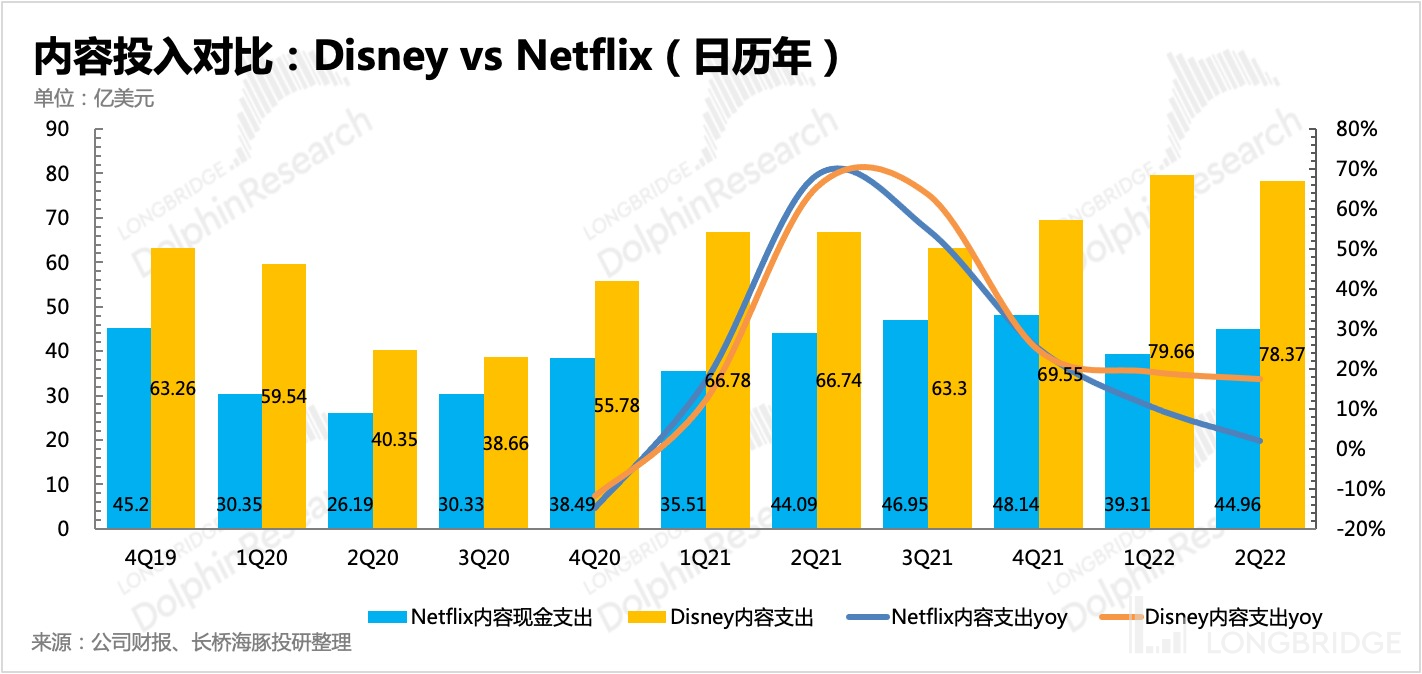

As of the third quarter of FY2022, Disney has spent nearly USD 22.8 billion on content production and procurement, leaving nearly USD 10 billion of investment quota, compared to its previous target of USD 32 billion (which was adjusted from USD 33 billion in the previous phone call of last quarter).

However, Disney has never had a content investment of up to USD 10 billion in any quarter in the past, and considering that most global giants are slowing down Capex and even relying on layoffs to achieve cost reduction and efficiency improvement, Dolphin Analyst predicts that the investment plan for the whole year may still need adjustment.

In the eyes of Dolphin Analyst, under foreseeable macro risk pressure, slowing down short-term investment in a planned way is a responsible and reliable operation for shareholders. Disney previously had negative free cash flow due to aggressive content investment. In times of economic recovery or prosperity and loose financing environment, the market tends to interpret it in an optimistic and positive direction. Conversely, the market prefers to see healthy cash flow and real profits.

Looking at the cash flow situation of this quarter, although Disney's free cash flow has slipped compared to the previous quarter (due to a significant increase in investment in theme parks in this quarter), it still maintains a net inflow status. There is still nearly USD 13 billion in cash on the account and there is no cash flow pressure for the time being.

Dolphin Analyst's "Disney" Past Reports

Earnings season:

-

May 12, 2022 Phone Call: "Disney: Strong Content in the Second Half of the Year, Continued Prosperity of Parks, Reducing Content Licensing and Closing Asian Parks Are Negative Factors (2Q22 Phone Call Summary)"

-

May 12, 2022 Earnings Review: "Disney: Accelerating Profit Release in Traditional Business and Working Hard to Inject Blood for Streaming Media"

-

February 10, 2022 Phone Call: "Gradually Entering the Content Cycle, Management is Confident in Growth Goals (Disney Phone Call Summary)"

-

February 10, 2022 Earnings Review: "Disney: Streaming Media Growth Regains Glory, with Theme Parks Being Even More Gorgeous"

-

November 11, 2021 Phone Call: "Disrupted by the Epidemic, 2022 Content Cycle of Disney will Wait Until the Second Half of the Year (Phone Call Summary)" 2021 November 11th Financial Report Review "Streaming Media Growth Slack, Disney's Long Path of Transformation Is Difficult?"

Depth

June 1st, 2022 "Disney: The Streaming Media Bubble Has Burst, Returning to the Theme Park Origin"

October 10th, 2021 "Disney: Centenarian Princess's "Rejuvenation Formula""

October 15th, 2021 "Can Disney, Which Continuously "Creates Dreams," Have "Magical Valuation"?"