Baidu: Does advertising rely on luck, while reversing the future relies on the cloud?

After the Hong Kong stock market closed on August 30th Beijing time, Baidu (9888.HK;$Baidu.US) released its Q2 financial report, which was slightly better than expected as a whole, with resilient advertising display and improved gross margin. However, Q2 performance was largely within expectations. Given the recent recurring local outbreaks, the company may face a complex macro environment in the second half of the year. This is especially true since many of Baidu's advertising customers come from the travel industry and small and medium-sized businesses. As a result, the Dolphin Analyst is more concerned about the management's outlook on the second half of the year during the conference call.

The core highlights of this quarterly report are:

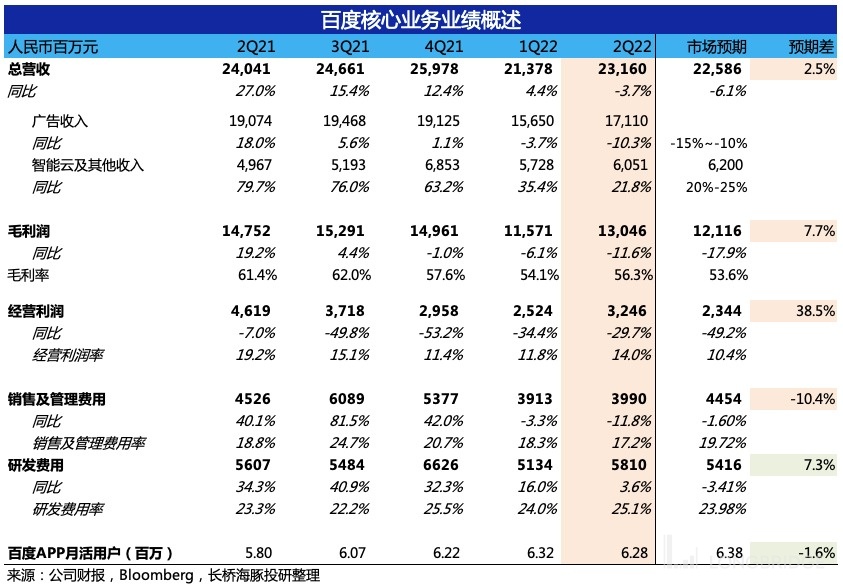

1) Baidu Group's Q2 revenue was RMB 29.6 billion, a YoY decrease of 5.4%, slightly higher than the market expectation (RMB 29.4 billion), but because iQiyi accounted for a sizable proportion of it at 23%, and because iQiyi has faced more industry regulations and external competition than Baidu itself in recent years, its short-term growth pressure is greater. It is therefore easy to drag down Baidu's performance when combined. In order to restore Baidu's own performance, we mainly focus on its core business performance.

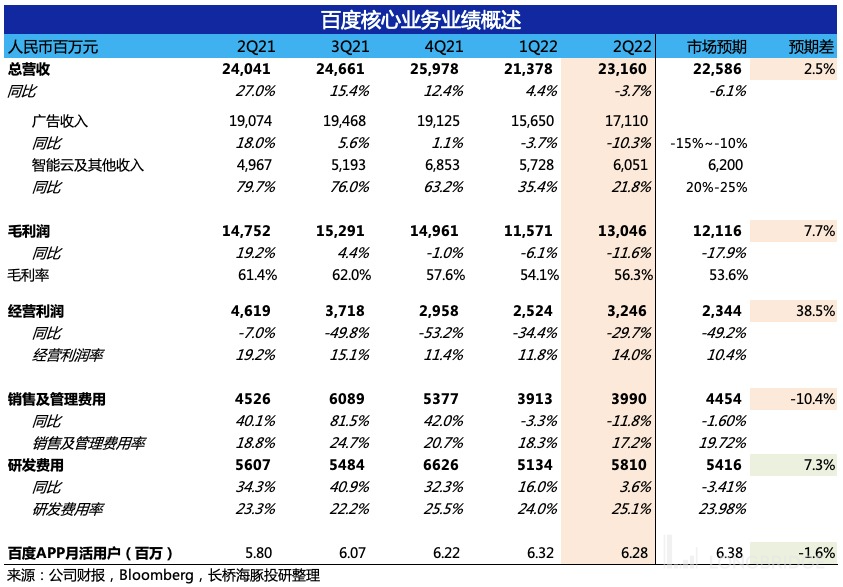

2) Excluding iQiyi, Baidu's core business revenue was RMB 23.2 billion, down 4% YoY, exceeding the market expectation (RMB 22.6 billion), with the main expectation gap coming from Baidu's advertising business during the pandemic. Its resilience in the face of headwinds was stronger than the market expected.

Further breakdown of Baidu's core businesses:

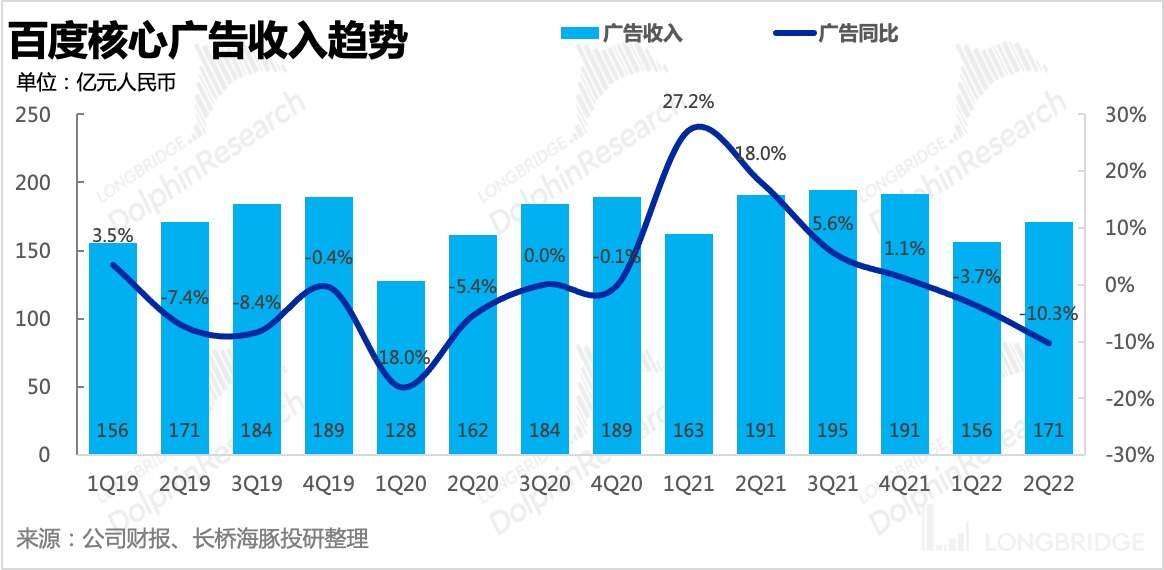

a. Core advertising revenue decreased by 10% YoY, and the expectations of top investment banks generally ranged from a 10-15% decline. Therefore, although advertising was under headwinds, it was not as bad as the market thought.

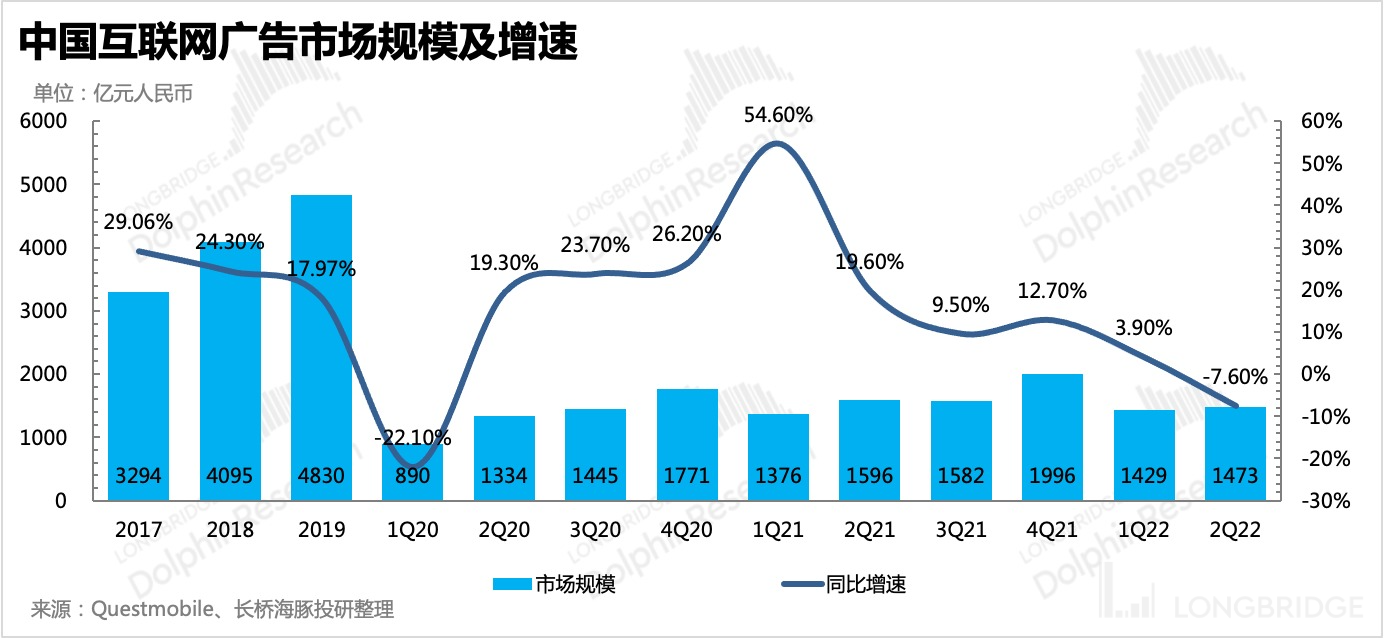

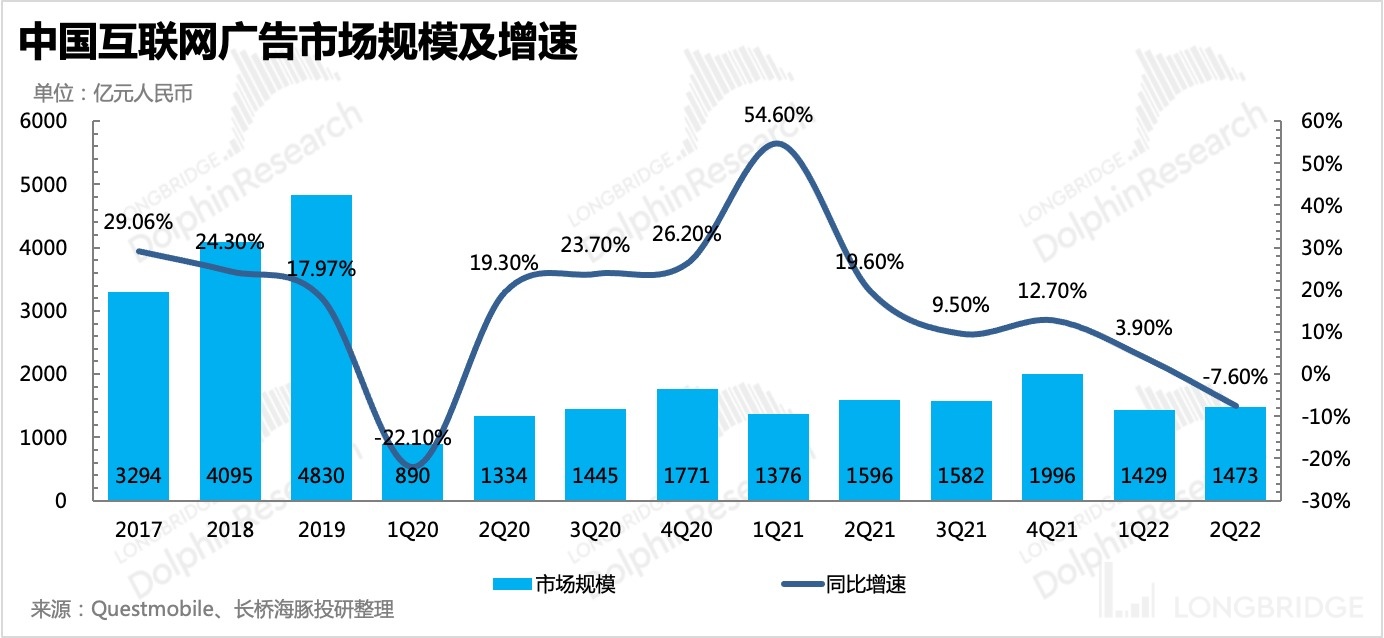

Baidu's Q2 advertising performance was slightly weaker than the industry average (an 8% decline), but the gap between Baidu and the industry was narrowed significantly from Q1. Although there are macro headwinds, Q2 still saw a 9% QoQ growth compared to Q1.

Compared to other mature platforms, especially traditional entertainment platforms that have been regulated or directly challenged by short videos, where declines of 20% to 30% occur easily, Baidu Advertising's performance has remained relatively stable.

The financial report revealed that managed page advertising revenue increased by 10% YoY in Q2, with a noticeable slowdown from the 37% growth in Q1. However, as an emerging growth pillar (accounting for half of Baidu's core advertising revenue) that Baidu Advertising has opened up in response to competition in recent years, maintaining double-digit growth in the difficult Q2 macro environment is not easy.

From a self-comparison and peer comparison perspective, it seems that the bottom of Baidu advertising is approaching. However, the Dolphin Analyst also reminds us that the proportion of small and medium-sized businesses in Baidu advertising is not small, and they are relatively more affected by the pandemic. The recent resurgence of the pandemic may also affect management's expectations and guidance.

b. Innovative businesses such as intelligent cloud continued to maintain a high growth trend, with some impact from the pandemic but overall with good momentum.

The intelligent cloud business, which accounts for the bulk of revenue, is expected to continue to outperform other peers in the short term due to its relative advantages in traditional clients.

c. The intelligent car business is a long-term story, so short-term contributions to performance are not a requirement, and business operations are steadily advancing. (3) Baidu's core business operating profit reached 3.2 billion, surpassing market expectations of 2.3 billion. This was mainly due to the improvement in gross margin brought about by the growth of advertising, while expenses for promotion, marketing, and channel buying were also shrinking.

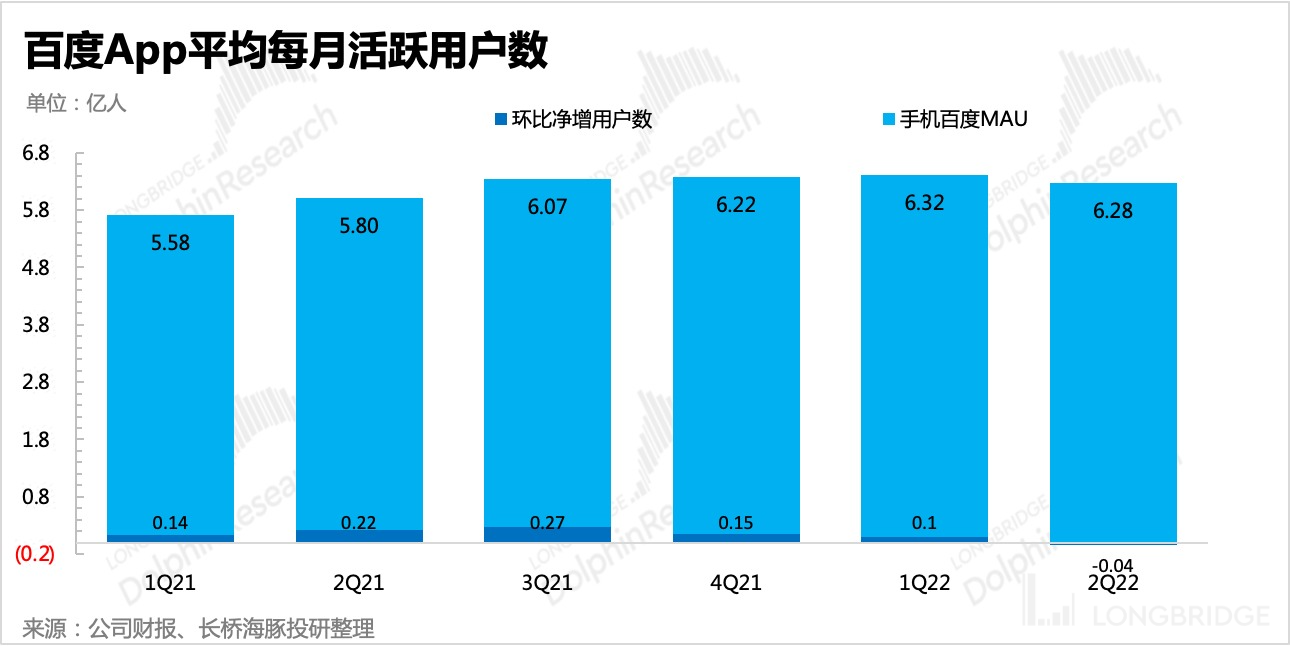

(4) Baidu app had a monthly active user base of 628 million, with a slight decrease compared to the previous period. The current traffic is crucial in judging whether the core advertising has bottomed out. It is recommended to pay attention to the interpretation of the management team during the conference call.

(5) As of the end of the second quarter, excluding iQiyi, Baidu held cash, short-term investments and other assets worth 184.5 billion yuan, accounting for more than 50% of the current market value of the company, and free cash flow was 5.5 billion.

Dolphin Analyst's Viewpoint

Due to the continuous migration and division of traffic by emerging platforms like short videos, and the long-standing strategic focus - the smart driving business - being too ambitious, Baidu's value has been continuously ignored by the market amidst a gradual cooling of capital.

With traffic migration, loss of advertising customers, and cash flow business crisis, emerging businesses have no money to burn. Based on this linear logic, the market has even begun to ignore Baidu's nearly $28 billion cash value (as of the end of the second quarter), with its valuation in the first half of the year hitting a low of $35 billion.

Dolphin Analyst believes that Baidu's advertising bottom may have been reached based on the fact that its ads have demonstrated higher resilience compared to its peers in the previous quarter. On the one hand, the steadily growing revenue from the paid search results page has gradually replaced traditional search ads as a performance support, breaking away from the industry's declining trend for search ads. On the other hand, the relatively positive dividend from the "demolish the wall action" across platforms further confirms our expectations regarding the performance of the second quarter's advertising revenue.

However, the fact that the second quarter exceeded expectations by not much means that whether advertising will rebound in the second half of the year depends on the epidemic situation. If the epidemic situation gradually stabilizes, there will be a relatively certain expectation for Baidu's performance recovery, especially for the recovery in profits. However, from the current on-going epidemic situation, the short-term guidance from the management may not be able to provide a relatively clear positive signal.

The smart cloud business may benefit passively from this wave of industry changes. The long-term story of smart cars is of no immediate benefit to its performance, but it still relies on the hope that it can catalyze more valuation imagination points under a market mood improvement in the future.

Due to recent fluctuations in the epidemic situation, the macro environment in the second half of the year may still be relatively complex. It is recommended to pay attention to the management team's conference call on the outlook and guidance for the future. Dolphin Analyst will first post the minutes of Baidu's conference call on the Longbridge app and user research group, and you can add WeChat "dolphinR123" if interested.

Detailed Analysis of this Quarter's Financial Report

Baidu is a relatively rare Internet company that has detailed business segments:

- Baidu Core: covering traditional advertising business (search/information flow ads) and innovative businesses (smart cloud/DuerOS, Xiaodu speakers, Apollo, etc.).

- iQIYI Business: Premium Membership, Advertising, and Copyright Authorization

The split of these two businesses is clear, and with iQIYI being an independent publicly traded company with detailed data, Dolphin analyst will also break down the two businesses in detail. As there are offset items of approximately 1% (between 200-400 million) for both businesses, Dolphin may have some differences in Baidu's core segmented data from the actual figures, but this does not affect the trend analysis.

This financial report review focuses on Baidu's core business performance. Dolphin will provide separate comments on iQIYI's performance, which will be released on the Longbridge app as soon as possible. If you are interested, you can download the app to read.

I. Resilience as Expected, Advertising May Have Reached the Bottom

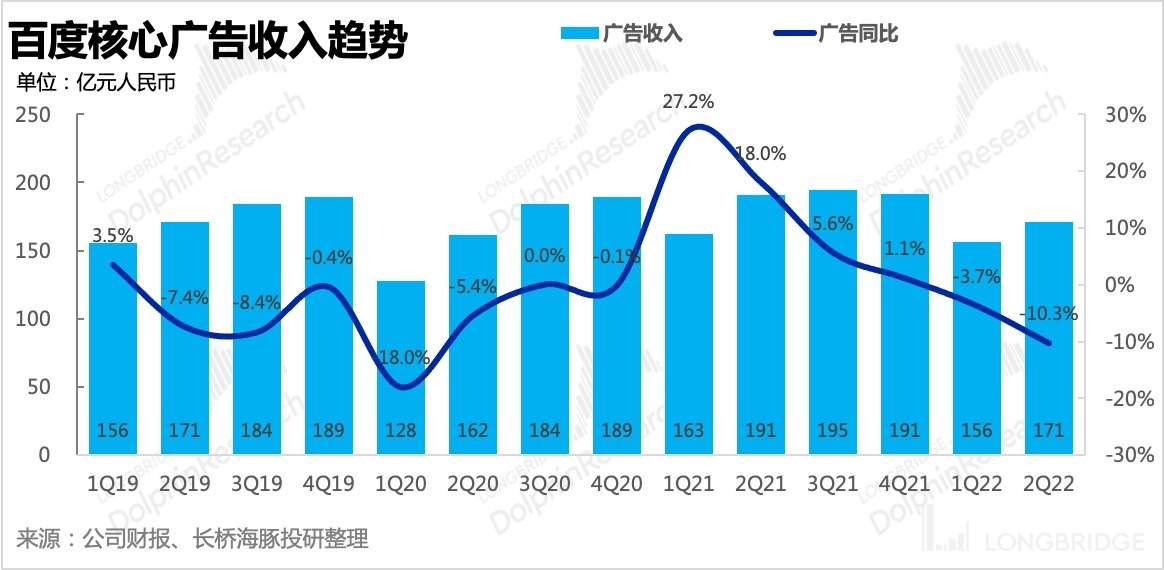

Unlike in the past where only innovative businesses such as intelligent cloud could be seen in the financial report data during advertising downturns, it's worth mentioning Baidu's advertising revenue this quarter.

Core advertising revenue this quarter was RMB 17.1 billion, a 10% YoY decline that exceeded the market's generally unoptimistic expectation. The second quarter was the period when the macro fundamentals were at their worst, and we could feel it in reports from companies such as Focus Media, Tencent, and Kuaishou. Regardless of online or offline, the advertising industry faced a comprehensive headwind, and businesses' wallets were being squeezed tight.

Platforms with traffic-related dividends such as Kuaishou can still maintain a significant MoM growth slowdown. Traditional platforms, such as Tencent's subsidiary platforms, have almost no defense. Overall, the online advertising industry showed a nearly 8% YoY decline in the second quarter.

Therefore, the market's expectations for advertising stocks are generally low. As a former king of traffic in the mobile internet era, Baidu's more pessimistic expectations may be due to its lack of social platforms, removal of entertainment content, and lack of short videos.

In order to increase the stickiness of advertisers and user experience, the "Marketing + Operations" type advertising SaaS solution launched in the second half of 2019, which is called the Agent Page Marketing, is a relatively positively growing form of advertisement among Baidu's declining advertising revenues.

As of the end of the second quarter, Agent Page Marketing revenue accounted for 49% of overall core advertising revenue, with a 10% YoY growth rate, although it slowed down from 37% in the first quarter, it is reasonable given the unfavorable macro environment.

Similar To B marketing and operations supporting business logic also applies to various leading platform mini-programs. But essentially, still relying on the platform's own ecosystem, keeping the traffic, for "upgraded versions" of marketing products, businesses will be willing to pay for them. Baidu App Monthly Active Users in Q2 are on the Decline

Baidu App had an average of 628 million monthly active users in Q2, a slight decline from the previous quarter. This may be a signal that it has reached its peak, but Q2 was a special business environment, so it's worth continuing to track its performance in Q3.

Overall, the market's attention on Baidu may have been focused on when its intelligent cloud and autonomous driving businesses would truly support Baidu's AI valuation story. However, while it's easy to tell a story when the wind is at your back, it's harder to deliver results when the wind is against you. Currently, Baidu's bottom line is more supported by advertising and cash, positioning it in the lower-end valuation zone. While Q2's advertising market held up, there weren't enough unexpected strengths to overcome the market's inherent negative impression of Baidu, especially with the halt in Q2 Baidu App user growth, which needs to be monitored further. Additionally, with the constantly recurring local outbreaks of COVID-19, the strength of the recovery in the second half of the year may also be affected.

Innovative Business Remains Strong Despite COVID-19

Other revenue streams in Baidu's core services (smart hardware and software, including intelligent cloud, intelligent speakers, and Apollo autonomous driving) currently have limited support for overall performance, especially profit, but serve more as upward options to boost Baidu's valuation when market sentiment is positive.

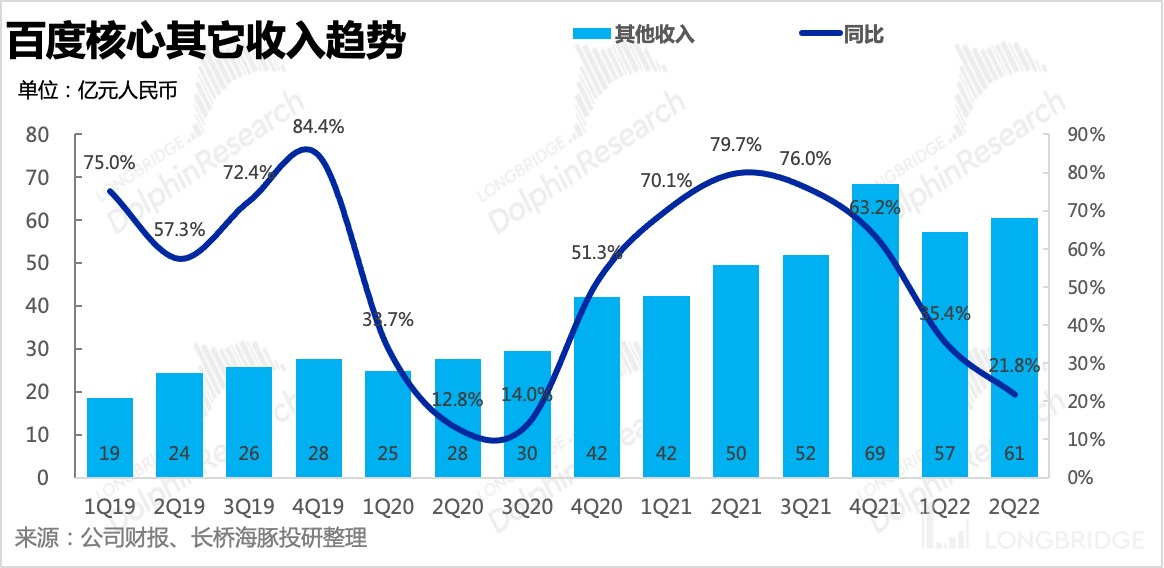

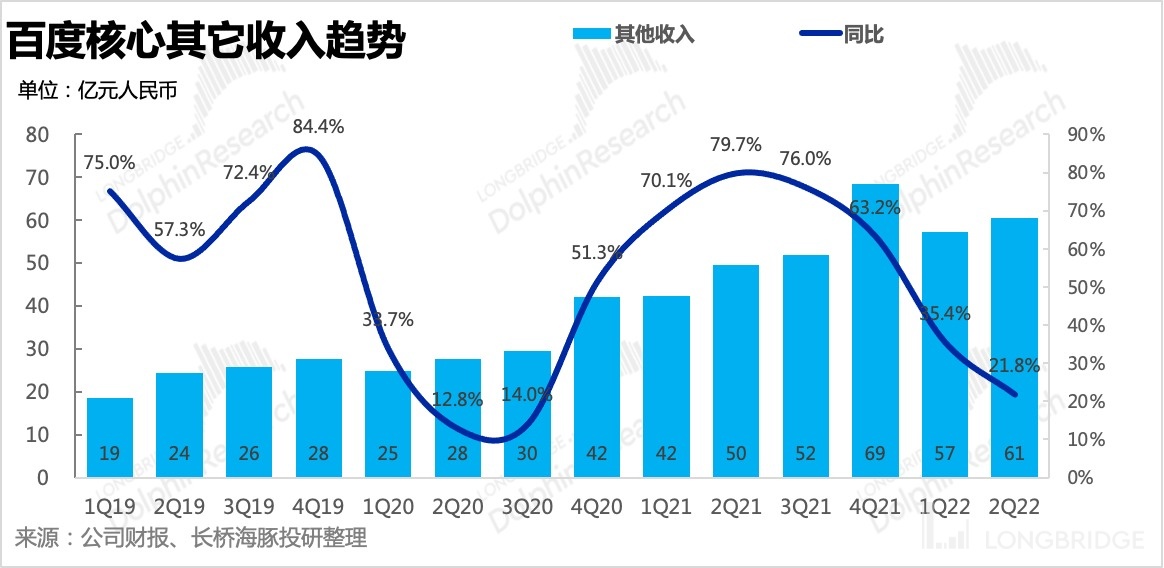

Q2's other revenue was CNY 6.1 billion, up nearly 22% YoY. Due to the impact of COVID-19 on customer acquisition and deployment, growth rate slowed down compared to the 35% in the previous quarter, but it still maintains a high-growth pattern and also falls within the expectations of investment banks.

1. Intelligent Cloud

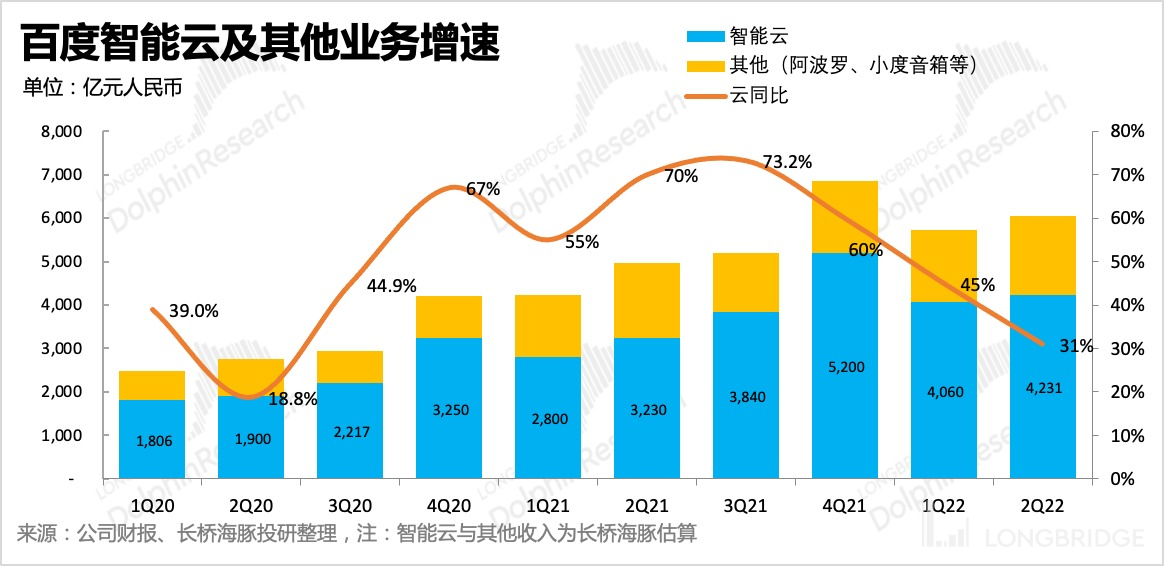

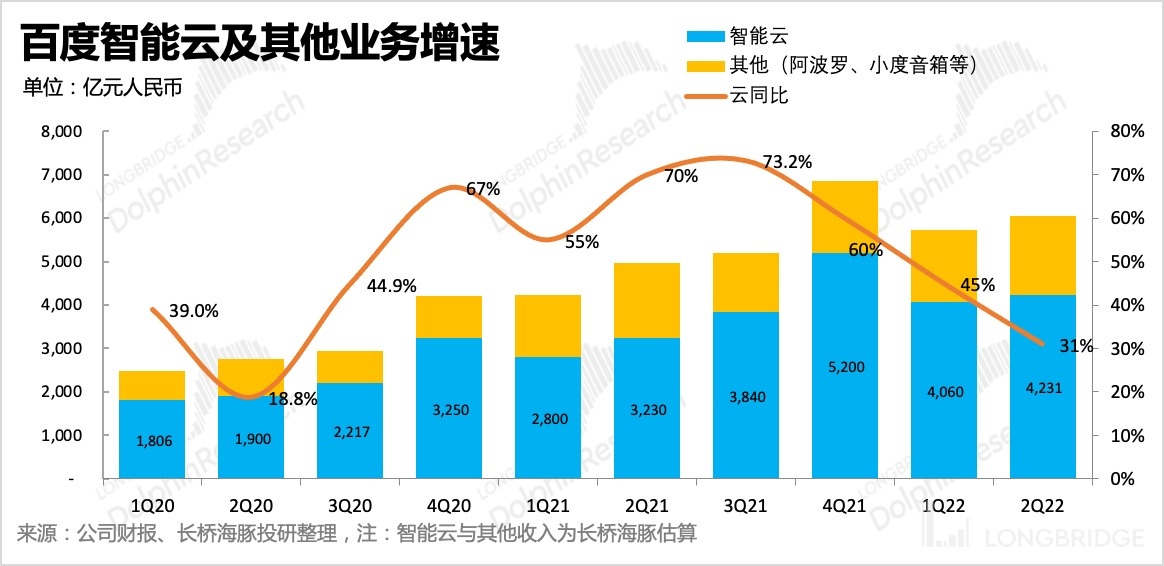

The majority of the smart cloud business YoY growth was 31%, which is still a significant increase even though it is less than the 45% seen in Q1. Compared to the two internet peers, Alibaba and Tencent, whose growth rates have fallen to single digits and negative growth, respectively, this may be associated with differences in customer structure. For example, Alibaba Cloud has more e-commerce customers, while Tencent Cloud has more entertainment related customers, overall leaning towards the internet industry.

With stronger internet supervision and the need for profits among the tech giants, there will inevitably be some challenges to business growth. However, Baidu's advantage is that it has many customers coming from traditional industries and faces relatively less regulatory pressure.

According to a recent earnings call, smart cloud revenue for the quarter was CNY 4.2 billion. This is much smaller than Alibaba's CNY 19 billion and Tencent's CNY 8 billion, but it shows a relatively stable growth momentum. According to an IDC report, Baidu Cloud has the largest domestic market share of AI cloud services.

2. Intelligent Car

2. Intelligent Car

Compared with cloud service, Baidu's intelligent car sector is still a long-term story that requires imagination. Although dreams are ambitious, it is more important to implement them step by step.

(1) Robo-Taxi (self-driving taxi): Similar to Google's Waymo, although the business valuation of this segment has experienced roller coasters from last year to this year, it has not hindered the continuous progress of the two search giants in China and the United States.

According to the financial report, the Robo-Taxi service provided 287,000 rides in the second quarter, and as of July 20, the Robo-Taxi has provided 1 million rides.

On July 20th, Robo-Taxi obtained the license to provide regular paid travel services in Beijing's Yizhuang.

From the end of July to the beginning of August, Robo-Taxi obtained trial licenses in cities such as Hefei, Chengdu, Chongqing, and Wuhan, becoming the first platform in China to provide self-driving paid travel services without safety personnel.

In addition, at Baidu World Conference in July, the 6th generation autonomous driving car Apollo RT6 was officially released. The biggest difference from the previous generations is that this model has no steering wheel and is basically designed for fully automated unmanned driving.

(2) Baidu ACE Intelligent Traffic Solution: As of the end of the second quarter, the ACE solution has been adopted by 51 cities nationwide, an increase of 10 cities compared to the previous quarter.

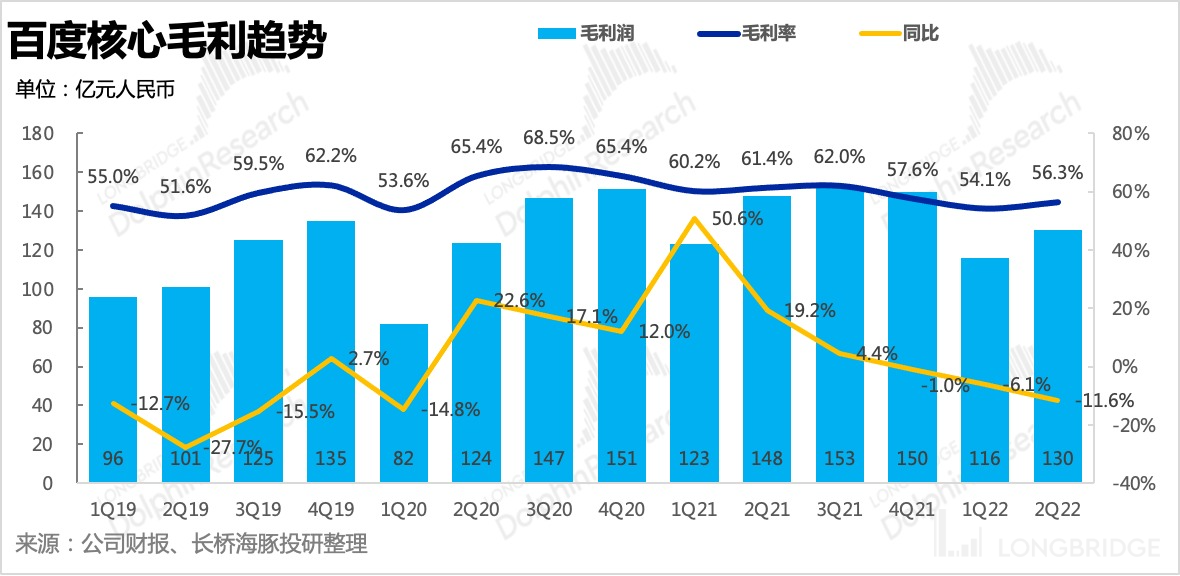

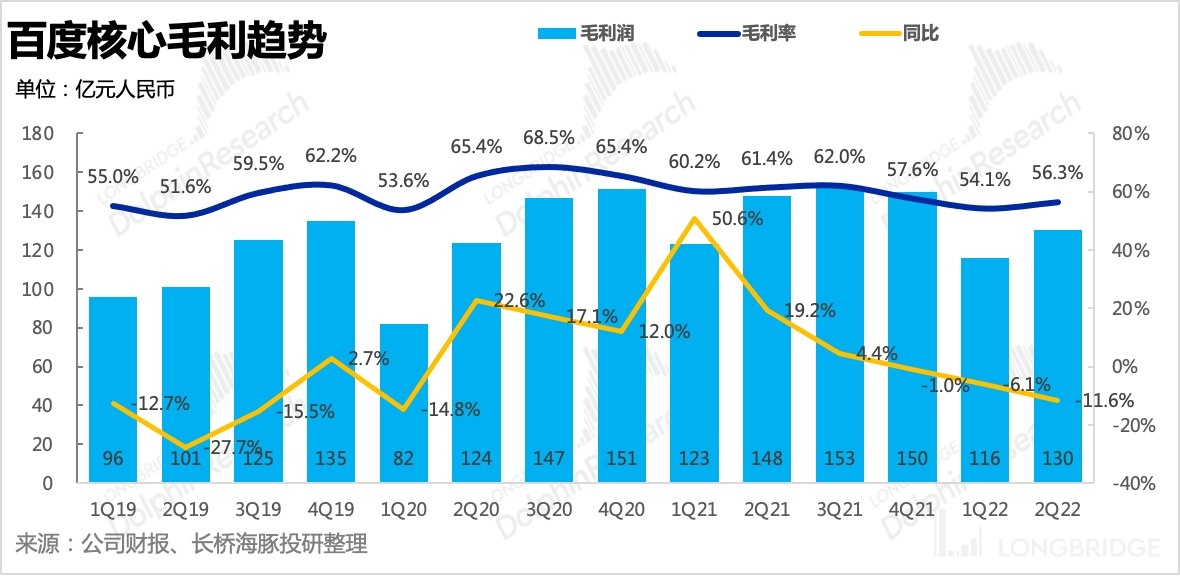

3. After advertising stability, the inflection point of gross profit margin has arrived

As innovative businesses are still in a loss-making state, Baidu's profits are mainly reliant on advertising. If the high gross margin of advertising revenue is stabilized, the deterioration of gross profit margin can also be stabilized.

Looking back at the past performance, Baidu's gross profit margin has continued to decline for more than a year, corresponding to a decrease in the contribution of advertising to overall performance. Although the core advertising revenue in the second quarter decreased year-on-year, it increased by 9% on a month-on-month basis, and other innovative businesses increased by 6%. Therefore, the support role of advertising has been restored, leading to an improvement in gross profit margin from 54% in the first quarter to 56% in the second quarter. With the overall advertising market rebounding in the second half of the year, Baidu's core business gross profit margin will continue to improve.

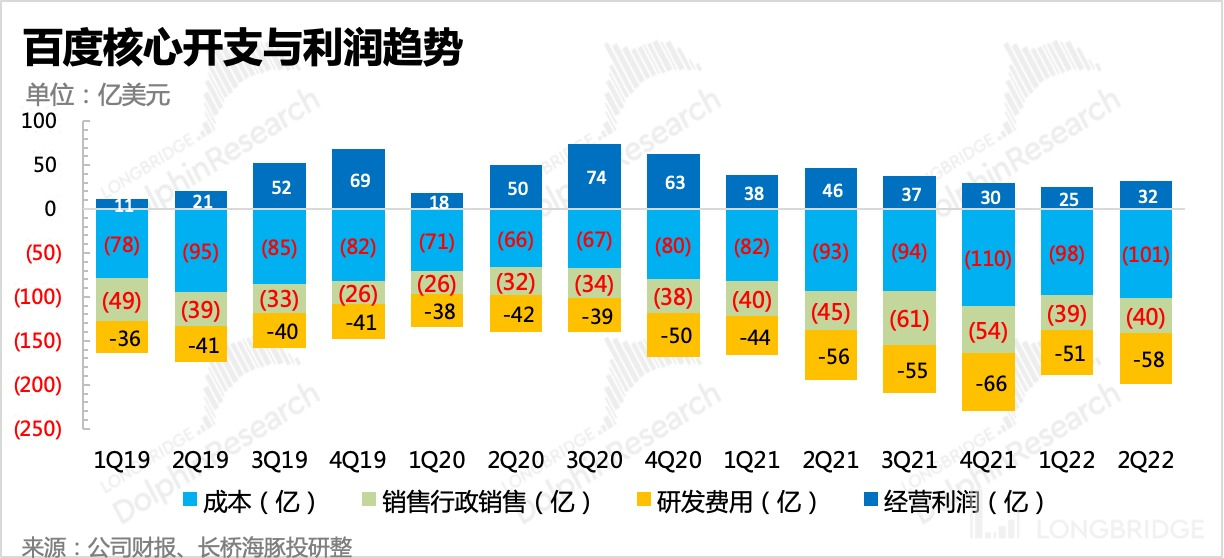

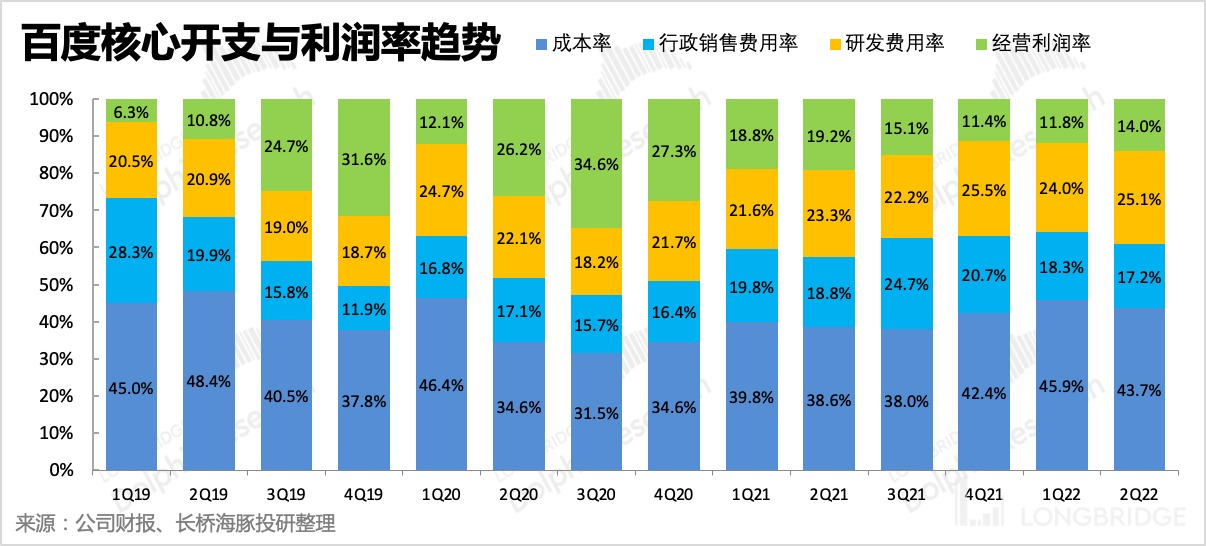

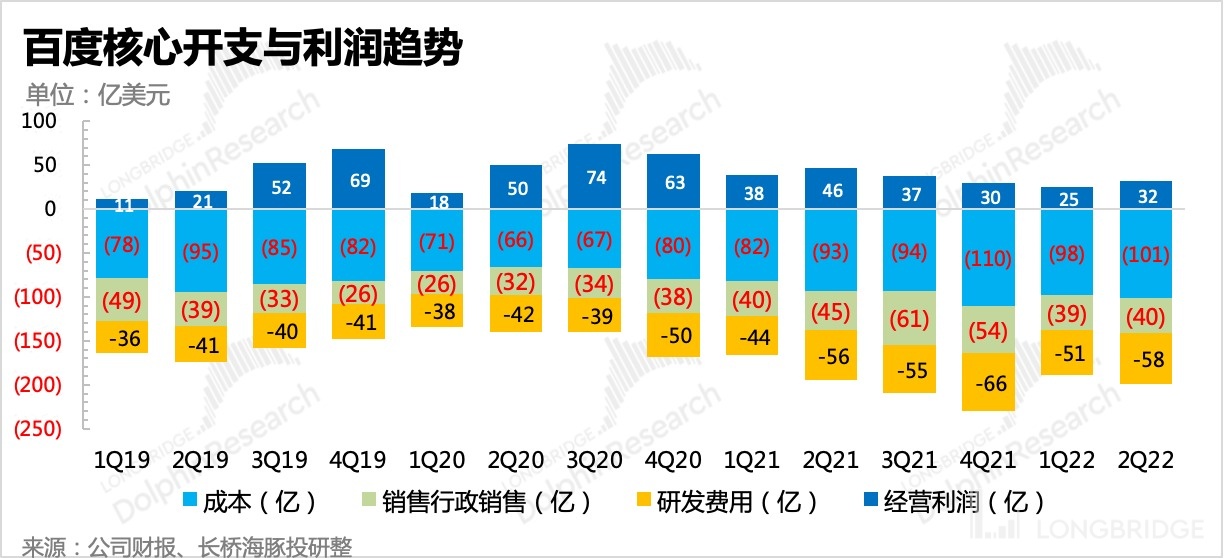

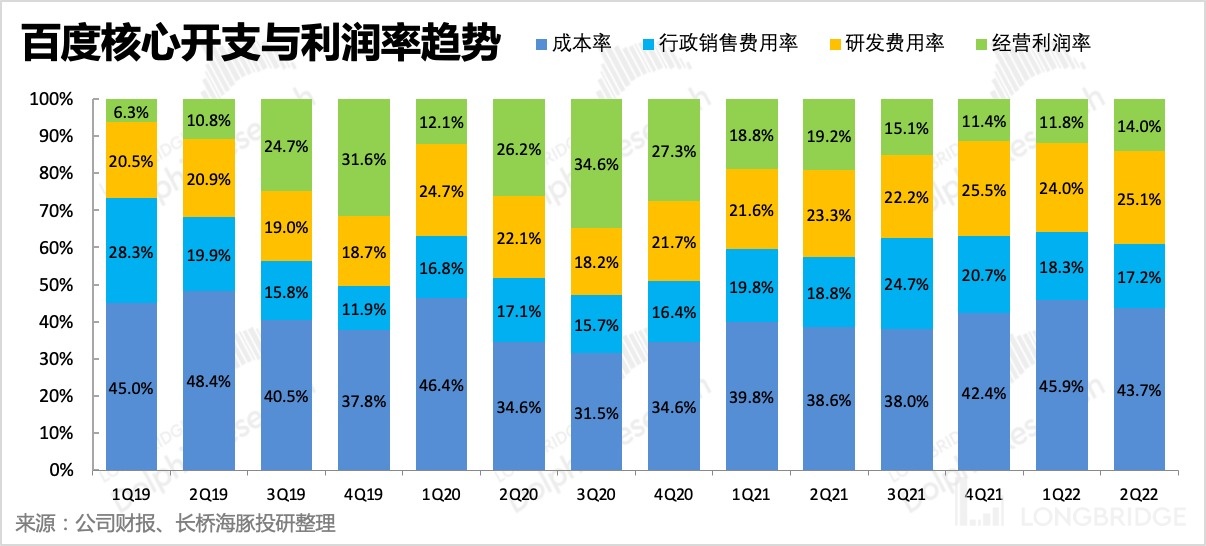

4. Unexpectedly tight cost controls lead to profit squeeze

In addition to the unexpectedly improved gross profit margin, expenses on marketing and promotion, and channel investment spending are more cost-effective than the market perception. In the second quarter, Baidu's sales and management expenses decreased by 12% year-on-year, and the expense ratio dropped to 17%, a more significant contraction compared to the previous quarter.

In terms of research and development expenses, since they are mainly used to support the development of strategic innovative businesses, they have not been reduced like sales expenses, and they are still growing. However, the growth rate has dropped significantly, which can be considered as a disguised "contraction."

**Finally, significant releases in profits, with second-quarter operating profit of core businesses reaching 3.2 billion, although it still decreased by nearly 30% year-on-year, from the perspective of the profit margin, it has improved significantly on a month-on-month basis, exceeding market expectations. **

Dolphin Analyst's historical articles on Baidu:

Earnings Season

May 26, 2022 Phone Meeting "Baidu's Intelligent Cloud and Self-Driving Business Return to the Market Focus (1Q22 Phone Meeting Minutes)"

May 26, 2022 Earnings Review "It's Darkest Before Dawn, and Baidu's Turnaround is Imminent?"

March 1, 2022 Phone Meeting "Advertising is Now Eating by Faith, Baidu's Crazy New Business Vision"

March 1, 2022 Earnings Review "Advertising is Still in Hell, but Baidu's "Change of Heart" May Work"

November 18, 2021 Phone Meeting "With Advertising Cooling, Baidu's Future Can Only Rely on "Self-Driving + Cloud" (Summary)"

November 18, 2021 Earnings Review "The Reality is Too Cruel and Dreams are Too Distant. Baidu is Too Hard"

August 13, 2021 Phone Meeting "Taxation, Supervision, Self-Driving... Baidu Phone Meeting is very "Substantial""

August 12, 2021 Earnings Review "Chasing Baidu's Financial Report Feeling: Storytelling is Not the Key Point, Landing is!"

May 18, 2021 Earnings Review "Baidu is Close to Being Halved? There is No Problem with the Fundamentals!"

On February 18, 2021, phone conference "Three in One Intelligent Driving, Apollo is Still a Good Choice - Baidu Conference" was held.

On February 18, 2021, financial report evaluation "Dolphin Research | From Advertising to AI Cloud + Driving, Baidu Gradually "Changes Heart"" was published.

In-depth

On March 17, 2021, "Carefully Scrutinize Baidu's Bottom Line: How Much Re-evaluation Space is Left for Baidu Listed in Hong Kong?" was published.

Risk Disclosure and Disclaimer in this Article: Dolphin Research Disclaimer and General Disclosure